Using Deep Learning in Trading

The next ten years in quantitative portfolio management will be about applying Deep Learning

This is for educational purposes only. Please view important disclosures at the end of the presentation.

Outline of the presentation

-

Who am I?

-

What do I know anyway?

-

-

The next ten years in trading is going to be about Deep Learning. Why is that?

-

How is it different from how quant funds make trading strategies today?

-

Why do we need GPUs?

-

Why do we need cloud infrastructure and not Physics PhDs?

-

-

What is the end goal? What are we working towards?

Who am I

- Highest revenue trading strategy at Tower Research

- Co-Founder global high-frequency trading firm

- Co-Founder qplum - AI driven asset management firm

High Frequency Trading is ...

-

Short-term prediction of price changes

-

Detecting demand-supply imbalances

-

Avoiding overcrowding of trades

-

Being very sensitive to losing pennies

High Frequency Trading is ...

High Frequency Trading is ...

-

very costly

-

low capacity

-

not enough to make money anymore

-

ignoring long-term signals

-

first success of ML in trading, more to come

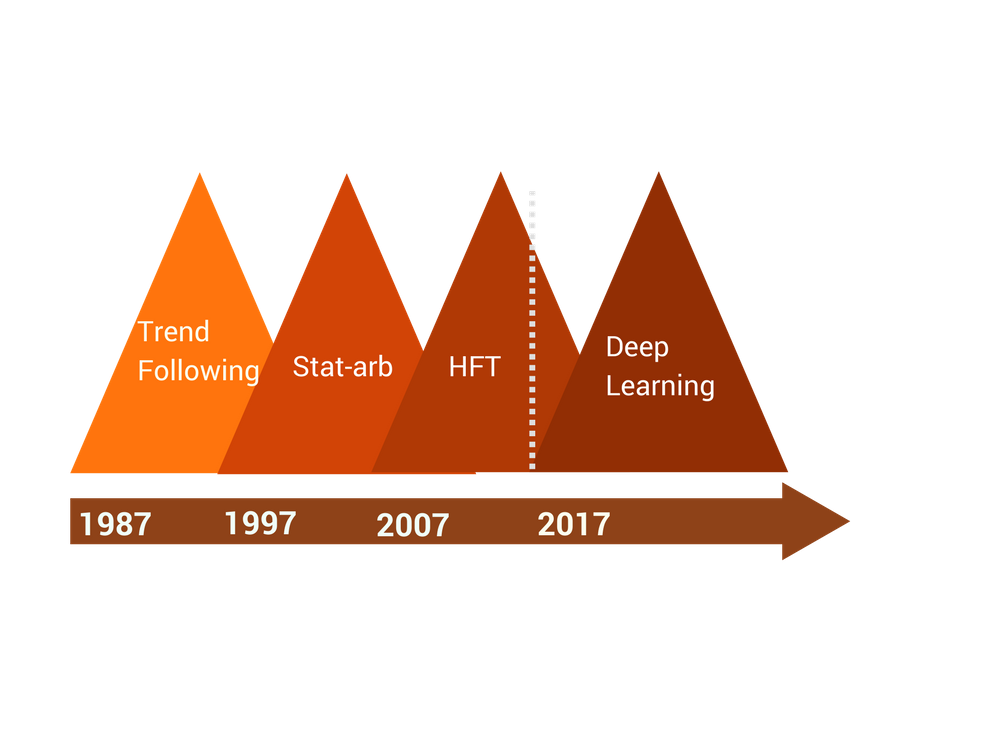

1987, 1997, 2007, 2017?

qplum.co

Using AI and ML for portfolio management

What's new?

Business drivers?

Examples

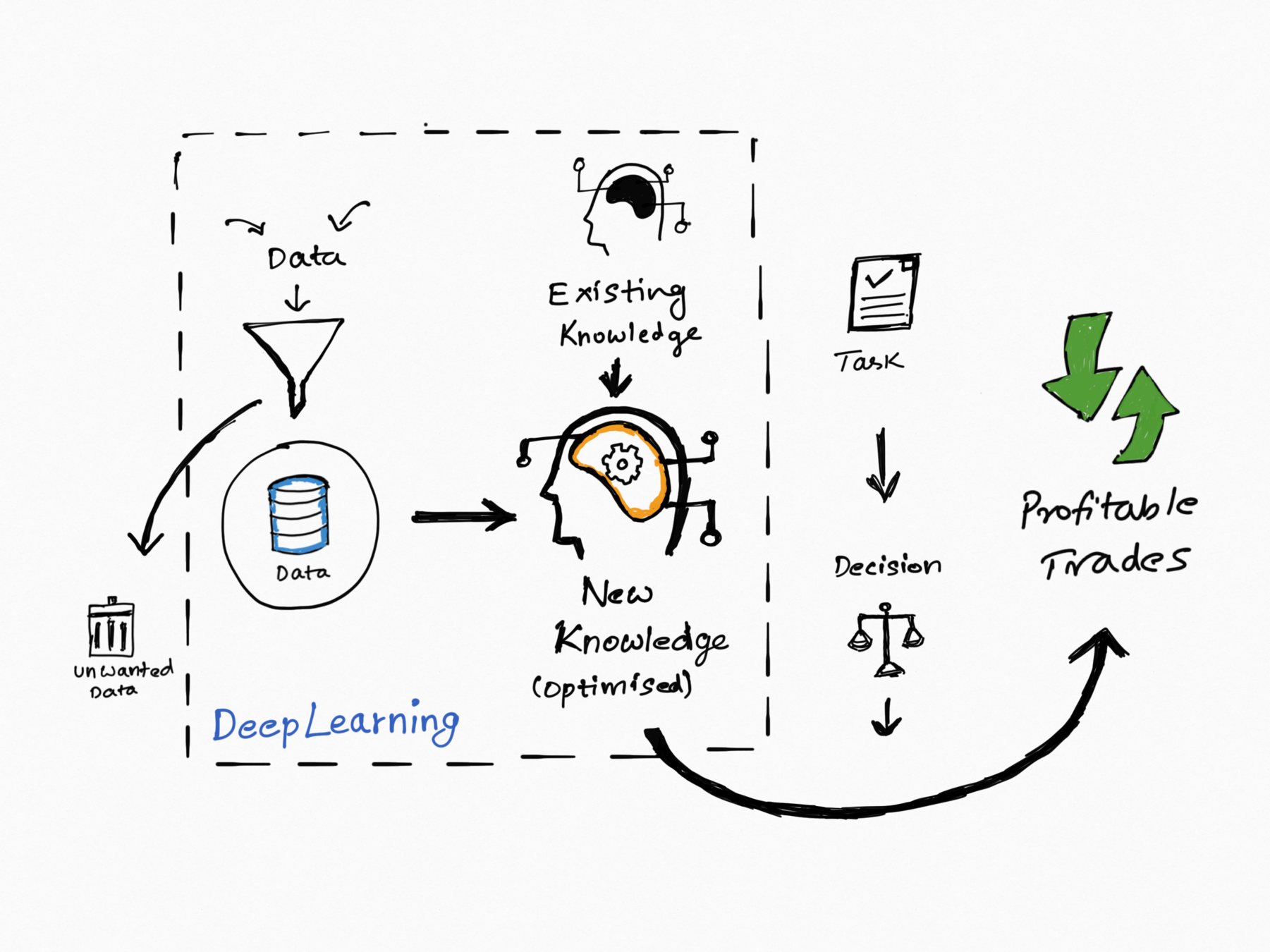

Using Deep Learning / AI in Trading

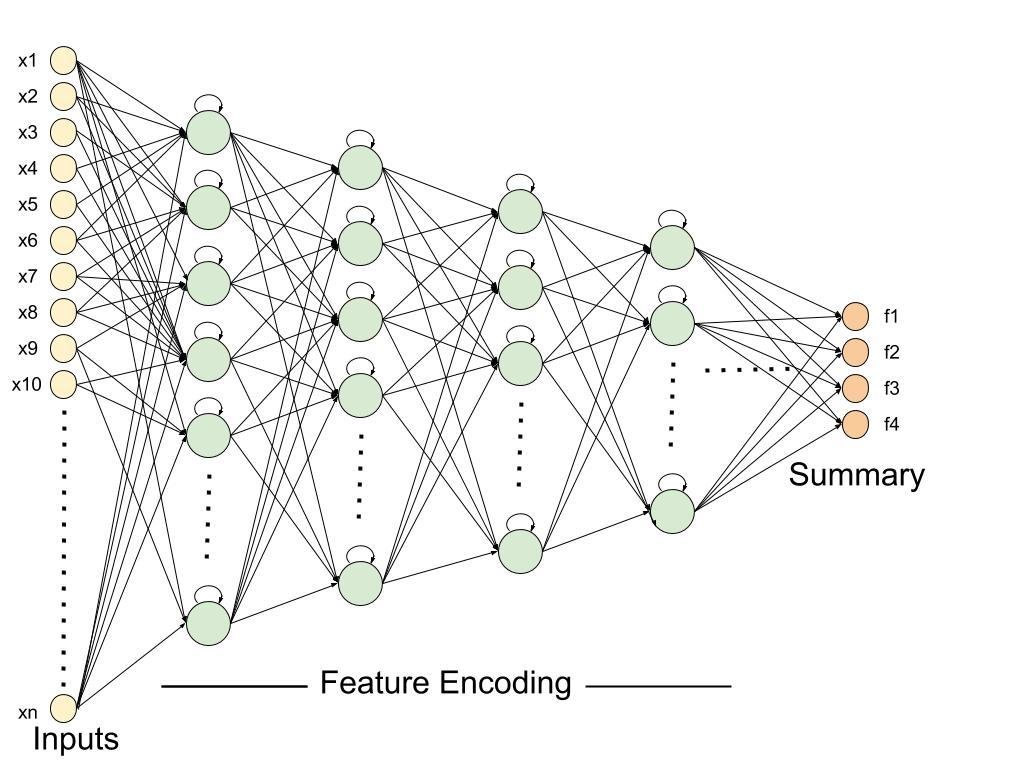

USP: Finding summaries

Business drivers of AI in asset management

New technology - Deep Learning

Lots of data

Cloud + GPUs

Better at building tech companies

more important than all of these ...

See appendix for details

AI, Machine Learning is better than traders

-

A shift in power from star traders to complex systems.

-

Five years ago, no serious money manager would let us touch their money with DL

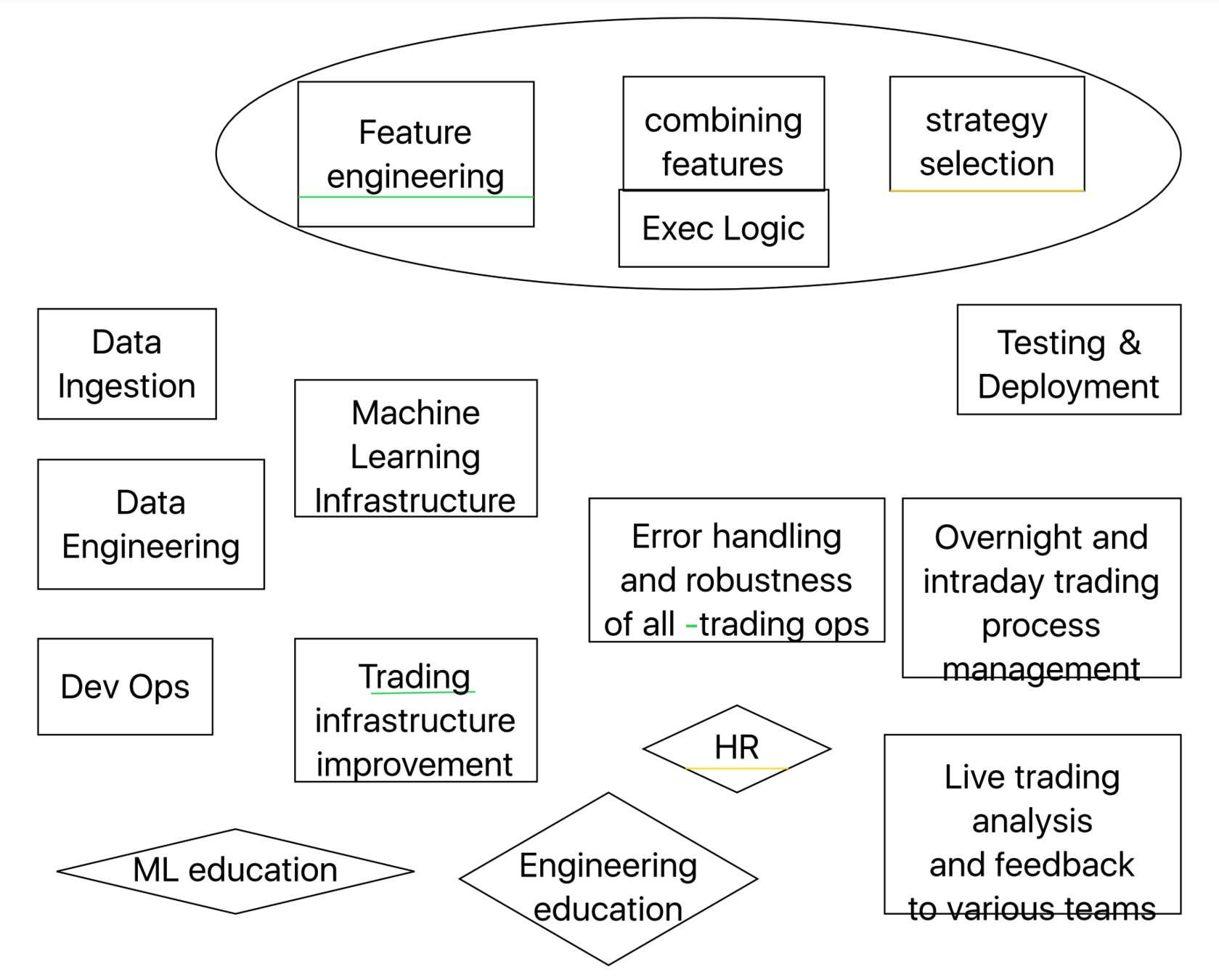

Asset management as a tech company

What's the end goal? What are we working towards?

qplum.co

Investing can be a science

Not a game

Not a competition

but an inclusive process where decision making is truly data-driven.

qplum.co

Investing can be a science, if we all work towards it.

Email: contact@qplum.co Ph: 1-888-QPLUM 4U

| qplum LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance. |

Appendix

Why now? - Lots of data

-

High Frequency trading and systematic trading, in general, has led to a lot of data. We are generating more data in one day now than we were in the entire decade of 1990s.

-

The traditional quant approach does not spend as much time in discarding noise.

qplum .co

Why now? - GPUs and TensorFlow

-

GPUs and customized hardware that allows us to solve problems in hours that would have taken weeks a year or two ago.

-

There is a lot of innovation into machine learning of social sciences led by technology companies like Google and Facebook.

-

Software like Tensorflow/PyTorch and MapReduce make all of this cheap enough for small companies to innovate with.

qplum.co

Secret sauce!

How we use Deep Learning in Trading

How we use Deep Learning at qplum

How is it different from the traditional quant approach?

qplum.co

The traditional quant approach

-

Hire lots of quants.

-

They all think of trading strategies.

-

They backtest them

-

The firm invests in the strategies that have the best returns.

qplum.co

Problem: Too much data at every step

-

This requires hiring a lot of quants

-

They will then make millions and billions of features.

-

Challenge then is to pick the needle in a haystack of trading strategies, with very little data.

qplum.co

Clean formulas don't make money

-

The workflow for a good quant is to make an integrable mathematical formula.

-

But that's not real-world.

-

Case in point is Modern Portfolio Theory. The "optimal" trading strategy is easily outperformed by rebalancing.