Investing is (can be) a science

if we all work towards making it one

Outline of the presentation

-

Introduction: Who am I, what am I good at, and what I am not good at, what is my mission?

-

The three sources of alpha: The three main trades by which people make money.

-

There are no simple trades any more.

-

What is the new landscape of trading?

-

An illustration of a new method that is really not so new.

-

An ideal investment manager today

-

How to watch out for bad quants?

Quiz 1

Suppose there is an island with 32 monks.

Each day in the morning they tell me if it's going to rain or not.

I have to decide whether it will rain or not after hearing their answers.

I am also told that at least one of the monks is always right.

Now my job is to come up with a strategy to answer each day if it will rain or not, in a way that I make the least number of mistakes.

What should be my strategy?

Who am I

- Bachelors in Computer Science in IIT Kanpur, the first technological institute setup in India with collaboration with the U.S.

- Rank 1 and 100% (full score) in the GATE exam in India (Subject GRE equivalent exam for Computer Science).

- A transformative course "Financial applications of Machine Learning" by Dr. Michael Steele at Wharton.

- Joined a systematic trading firm, Tower Research Capital in 2005. I was given 10k and a computer. Within eighteen months I made partner and we accounted for 50% of firm revenue. Our strategies have made more than a billion dollars since then.

- I quit to start my own global trading firm in 2010. Moved on to start qplum in 2015 with Mansi Singhal.

Who am I (contd)

My education in a nutshell: "Financial applications of machine learning"

My work in a nutshell: "Building complex trading systems that traded all over the world interacting with many different providers and without any errors!"

What drives me: "I want to help people with a problem they face using what I know"

Quiz 2

What is the hardest part of making a formula-one car?

- (A) Making it go faster? A faster acceleration

- (B) Better braking

better deceleration - (C) Making it easy for the driver to use it

The three sources of alpha

Short Term

Medium Term

Long Term

Information

Stat-Arb / Options based trade structuring

Prediction or market view

The three sources of alpha

|

Information Speed Short term |

These trades work most of the time. They make a little bit of money, when they do |

|

Structuring Stat-Arb Lead/Lag Medium term |

Works a fair bit of the time. Works particularly well when volatility and risk in the market is low. Reasonable scale, about 3% to 5% of annual alpha. |

|

Prediction View-based Long term |

These trades are typically very few, but when they work, they are very big winners. This is where deep neural networks and combining multiple alphas is most critical. |

Is trading a service?

- What is the service we are performing?

- Who are we providing the service to?

- What is the stack of service providers between us and the eventual risk taker?

- What is work and what is research? Let's make sure we don't get lost in the endless pursuit of questions that no one cares about.

- A culture that prioritizes foolproof processes and not brilliance.

Reference: Blackrock fires a 6bn PM. Costs/Returns?

As a trader or an investment manager, we need to understand:

No simple trades any more

Beta based investing is very tough right now:

Stocks and bonds are both in over-extended uptrends

Macro Trading:

Based on the economic data, will markets end up or down for the year?

Pairs Trading:

If stock X goes up, will stock Y go up too?

Technical Patterns:

Are there visual patterns that repeat in a price series over time?

No simple trades any more

It's not that simple trades don't work.

They work a small fraction of the time.

Quiz 3

Rank these roles in financial services industry by number of job openings (highest to lowest)?

- Compliance Officer

- Teller

- Financial Analyst

The new landscape of Trading

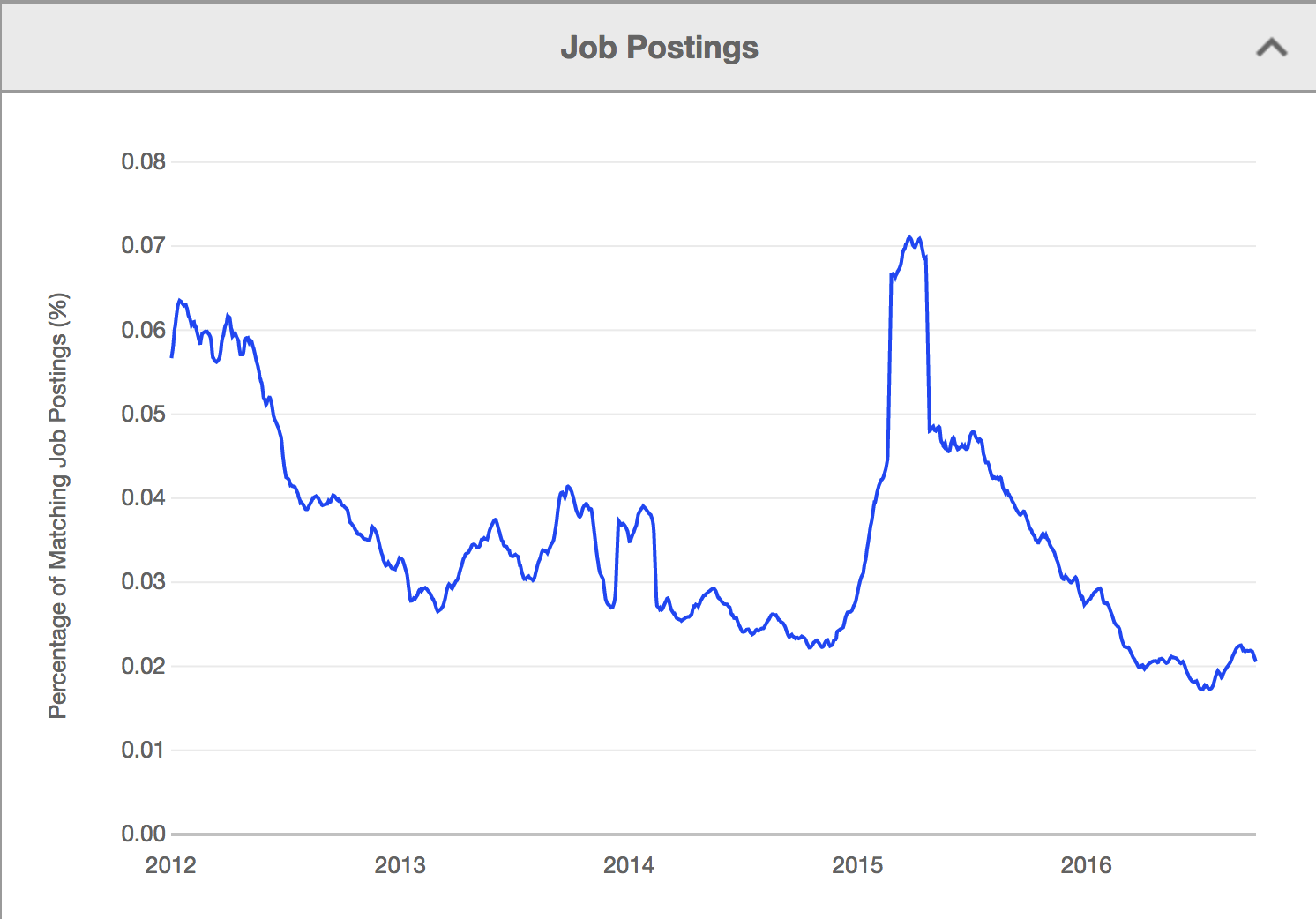

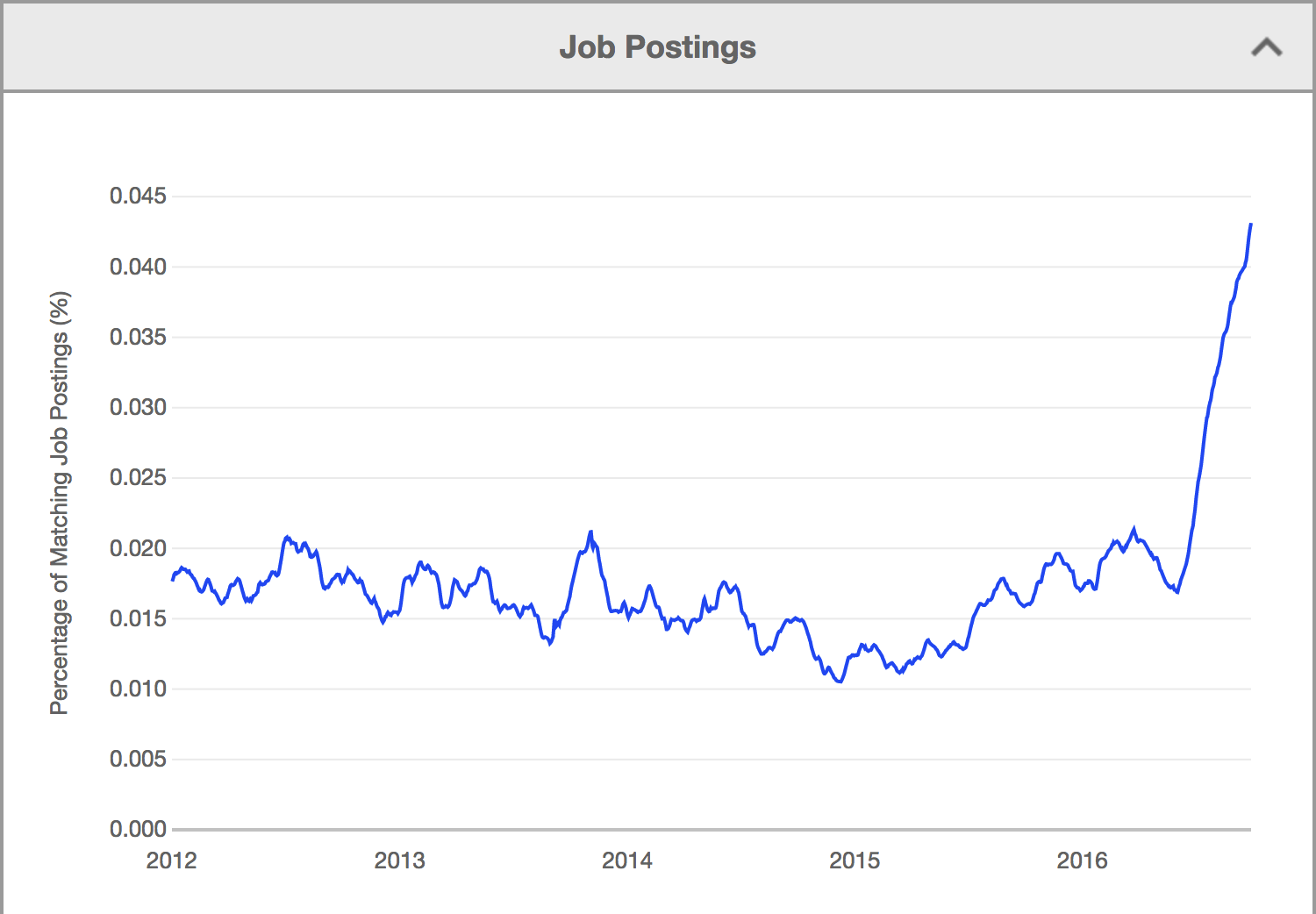

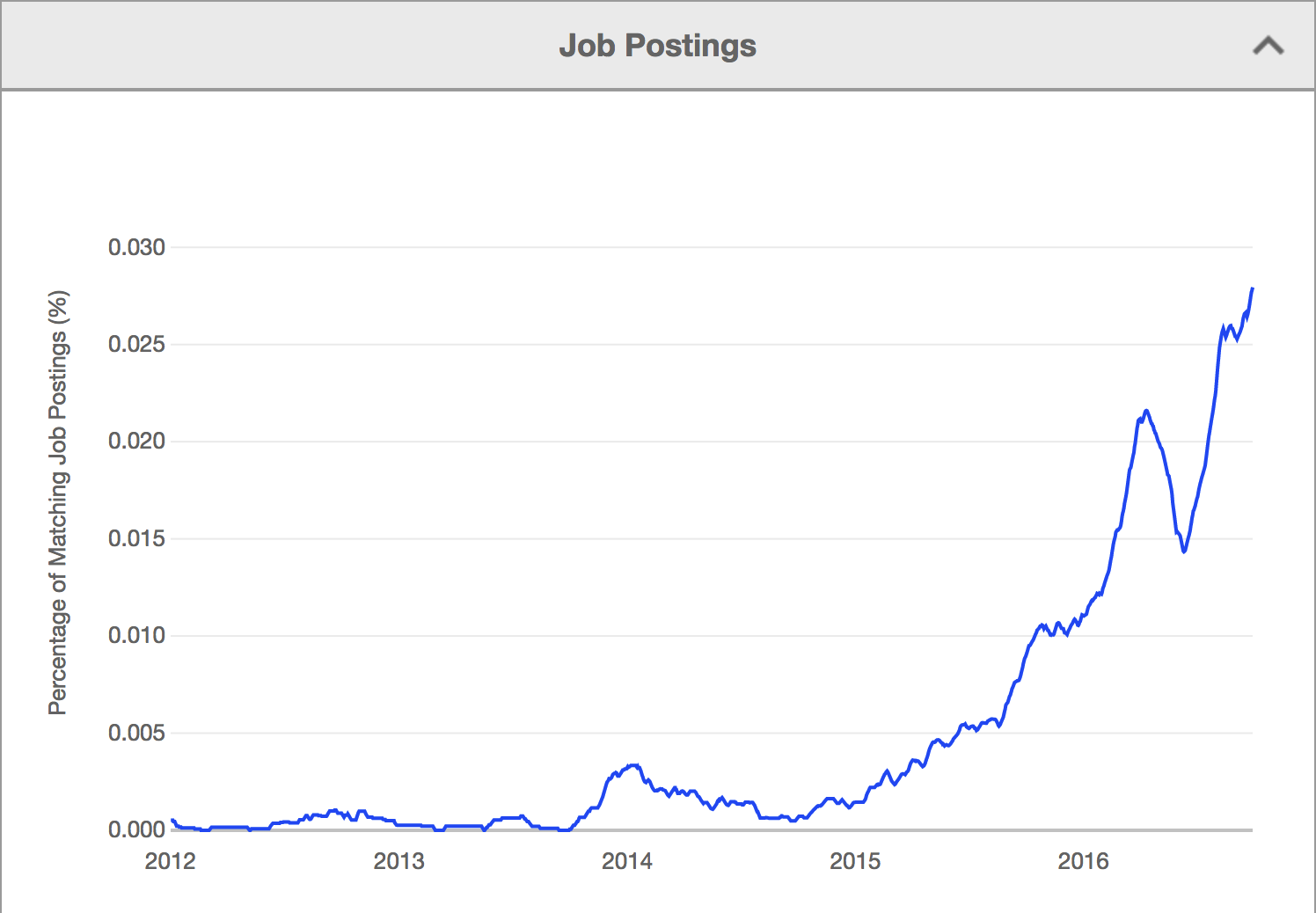

Nobody wants traders

Nationwide job postings of traders

The new landscape of Trading

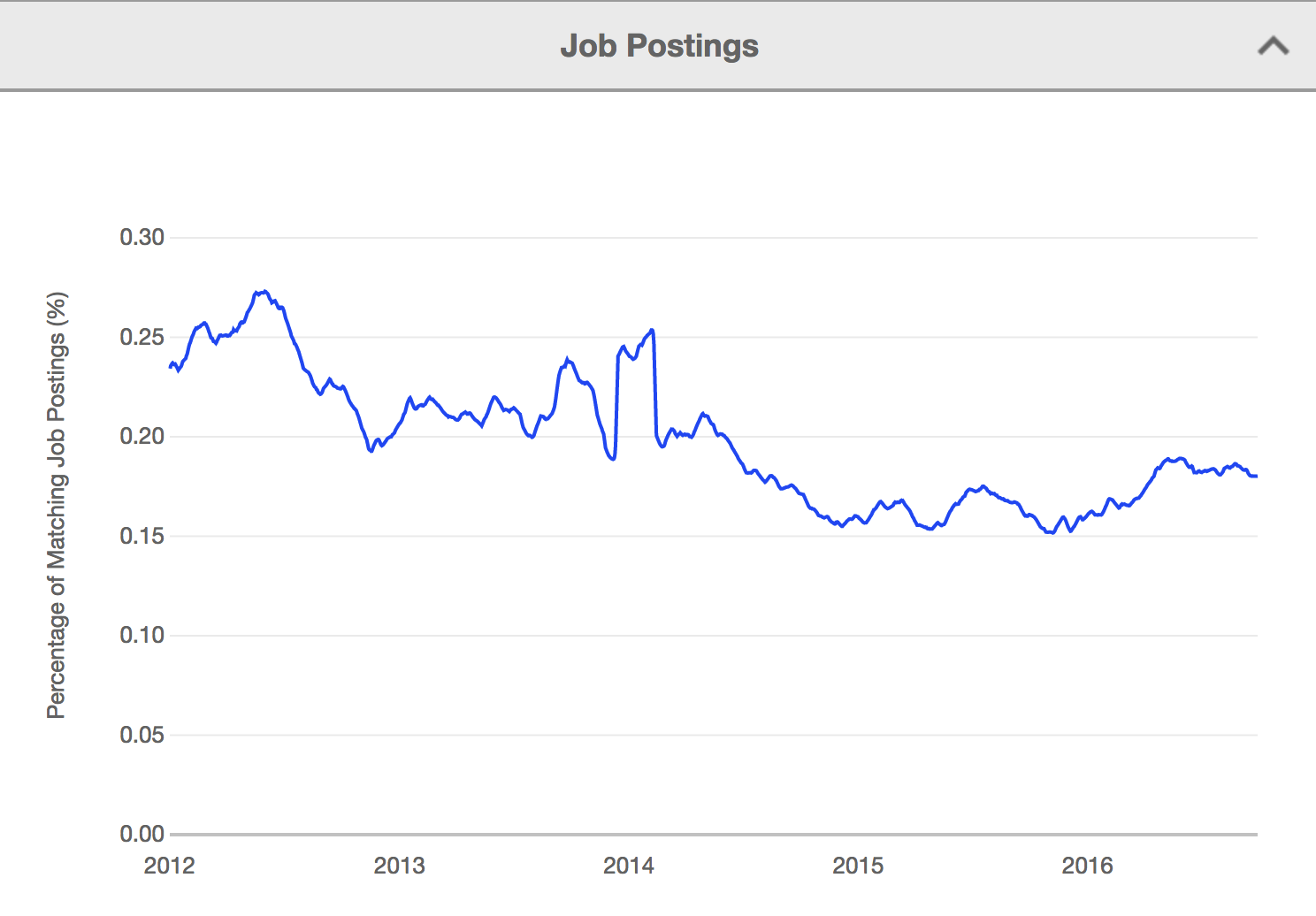

(Almost) nobody wants quants

Nationwide job postings of quantitative analysts

The new landscape of Trading

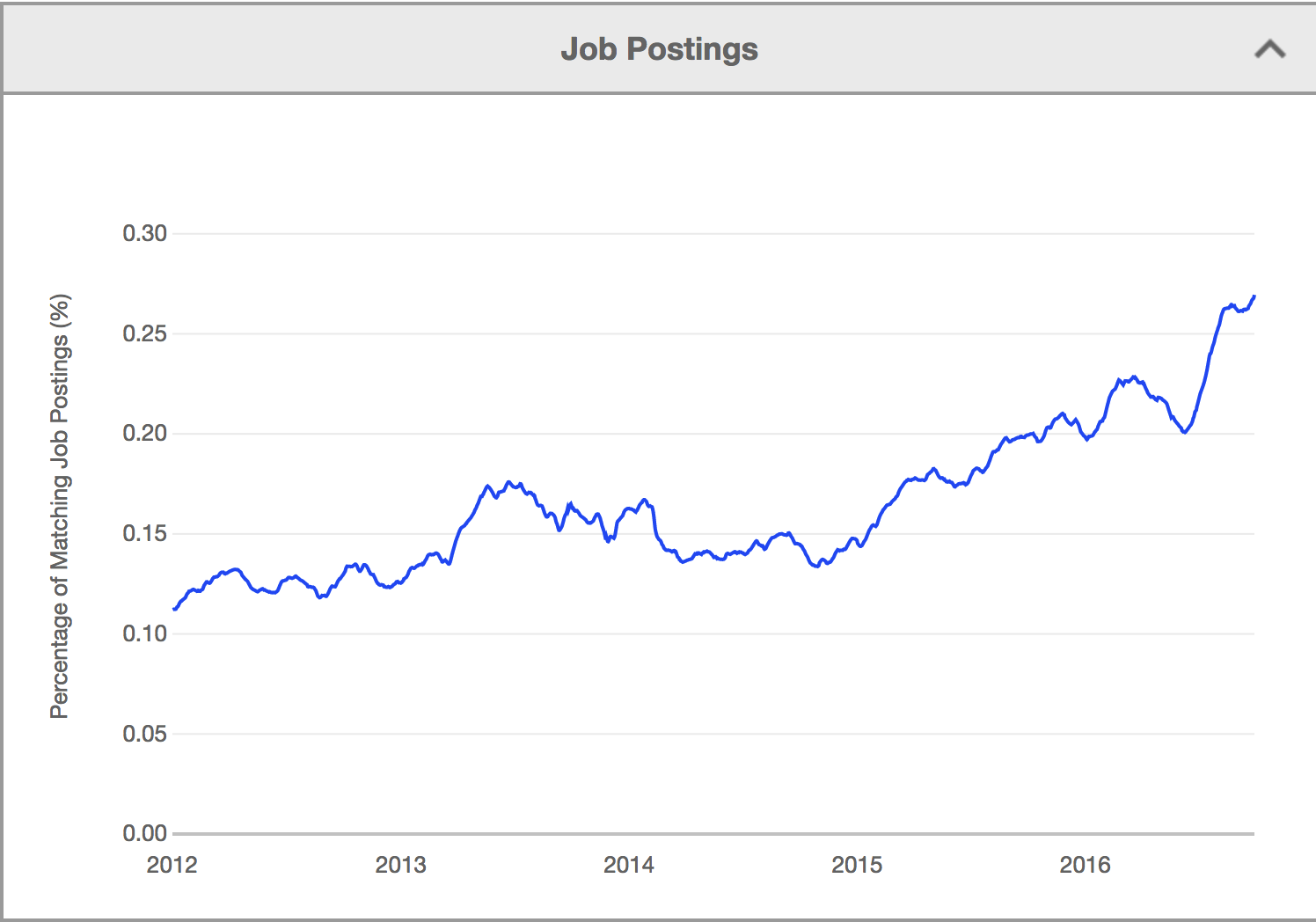

Machine Learning is booming

Nationwide postings of Machine Learning jobs

The new landscape of Trading

Artificial Intelligence is sky-rocketing

Nationwide postings of AI jobs

The new landscape of Trading

FinTech is the new Finance

Nationwide postings of FinTech jobs

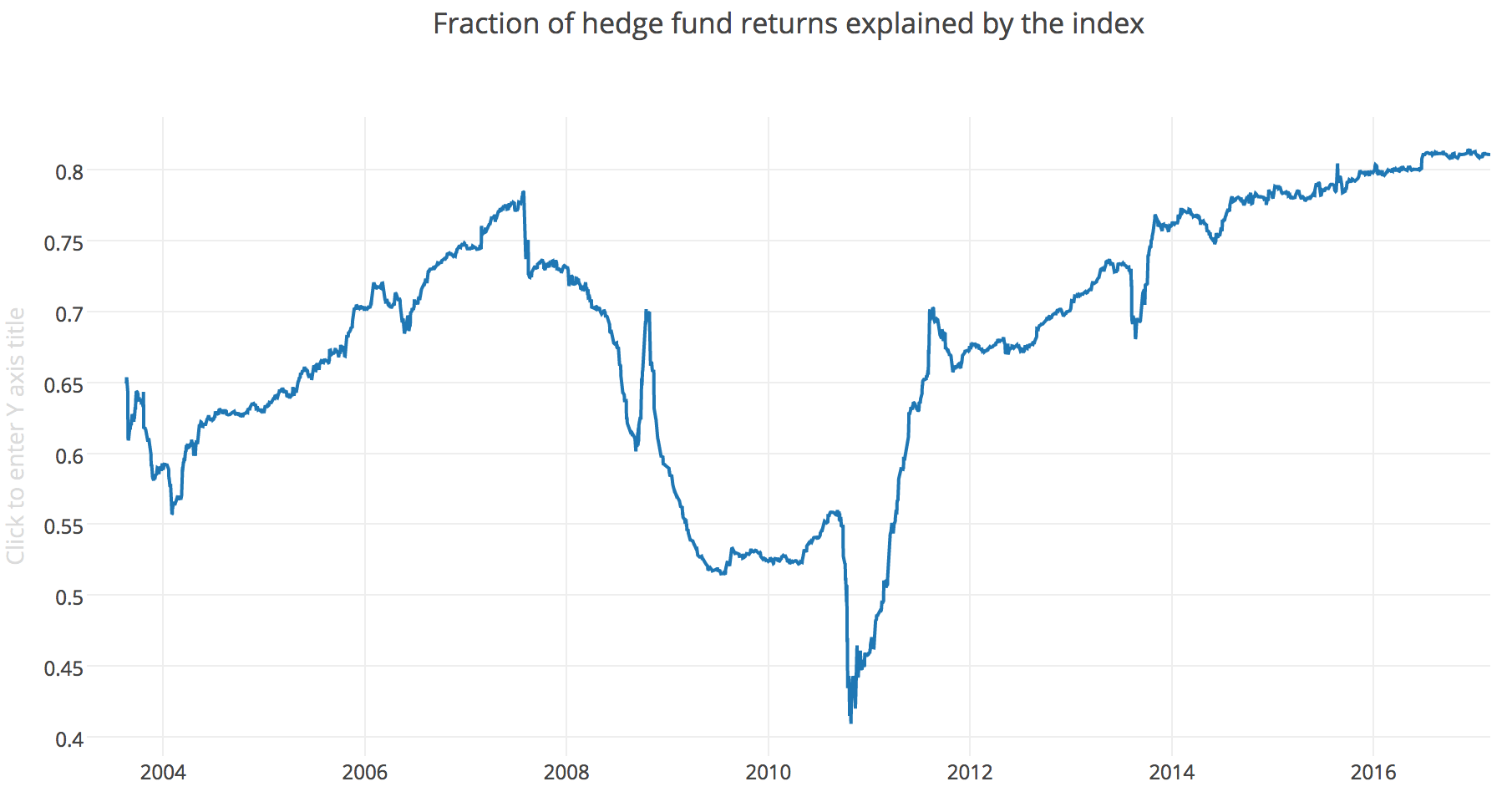

Prop Trading is dying

- HFT firms like Teza have been making losses and shut down

- Shareholders in HFT firms have been losing money since 2014 (Ref: stock prices of KCG, VIRT)

- Large Global Macro funds have shut down or are on the verge of shutting down. (e.g. Blackrock, Tudor, Brevan, Bain Capital, Fortress )

- Hedge fund correlation with the stock market has never been higher.

Where are people trying new ideas?

Who will pay me to come up with the next goldmine?

What's new?

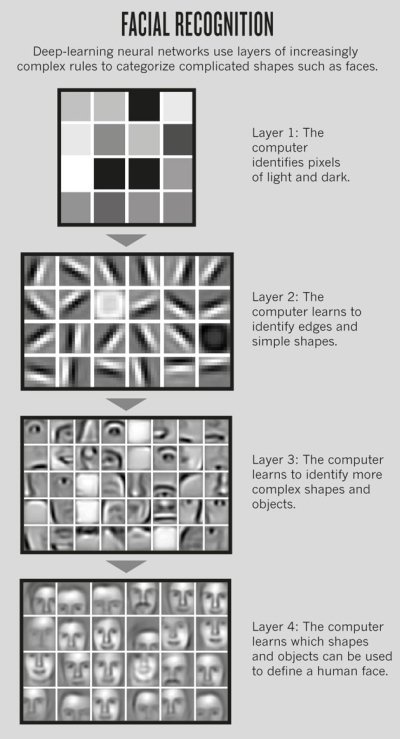

1. Deep Learning

Deep Learning is a cool new branch of Artificial Intelligence (AI) with which researchers are breaking previous records in how much we can learn from data.

2. Scaleable and cheap computation

An upstart trading firm competing with the likes of Goldman Sachs can now run at the same scale without hiring a single in-house person to manage the machines or the network.

3. Lots of data

What is Deep Learning?

Deep Learning refers to using a multi-layered neural network for prediction.

Earlier we used to make models by trying to think of better indicators and improving the correlation.

In a Deep Learning approach, we learn the features of the data in a hierarchical fashion, exactly similar to what humans do.

Deep Learning in Trading

Imagine being asked to make a single value summary of everything that happened in the stock market on a day.

What would that be?

Now if we ask ourselves that normally when that summary is what it is today then what should have happened to each stock?

This is the direction Stat-Arb is going in.

Deep Learning is about learning the perfect representation of markets on which to make predictive models.

Quiz 4

What is the average correlation of hedge funds to the stock market?

- Not sure exactly, but it should be negative. Hedge funds are focused on downside protection.

- It should be around 0. Hedge funds generally target "total return". They should be trying to make money in all market seasons.

- I would say as high as positive 70%. Hedge funds are probably all just closet indexers.

An ideal investment manager

Thorough

- "Look under every rock" for alpha

- Strategy diversification

- Data cleaning

- Data infrastructure

When we search on Google, we expect it to search every web-page on the web to find the information we are seeking. We will stop using Google if they don't search thoroughly.

Similarly, an investment manager needs to look into every source of data and every trading strategy to deliver a complete investing experience.

An ideal investment manager

Efficient

- Costs have to be under 1% today. Expected returns are much lower, both for beta and alpha. Net costs of more than 1% don't make sense.

- Integration with other systems

- Technology to reduce overall costs without compromising quality.

To be low-cost and yet to maintain and increase our commitment to research and data science, we need to find efficiencies in other aspects of our work. We need to use technology to reduce costs for our clients by bringing efficiency in our trading operations and back office processes.

An ideal investment manager

Transparent

We need to remember that we are just a service provider in an investment stack with the investor taking the real risks.

We need to explain to others above us in the stack the experience they will get by investing with us. Otherwise, it just does not makes sense for the investor or their representatives to consider us.

Our thought leadership

Three laws of quant trading

-

As investors, we care about future results and not past results.

-

The portfolio manager only has past data to work with.

-

Not all aspects of past data re equally applicable to future data.

What makes a good quant strategy?

- The strategy is able to achieve the results it advertises.

- The results have not been over-fitted to past data to make them look better than the competition.

- The strategy should work in a number of different market conditions and it should not be very difficult to stay invested in it.

- The strategy should adapt as markets change.

Summary : make sure we don't overfit

Answers to quizzes

1. Choose Rain on a day if the majority of the currently eligible monks say that it will rain.

Remove the monks that make a mistake from the set of eligible monks for the next day.

2. Brakes, and pressure required for braking.

3. Teller,

Financial Analyst,

Compliance Officer

Note that even in an age of "FinTech",

we need more bank tellers.

Answers to quizzes

4. The average correlation is positive. It is as high as 70%.

It seems like hedge fund returns can be broadly explained as 70% market returns with trend-following contributing the remaining 30%.

Let's keep learning

Benjamin Graham published an article on 1945 about "Toward a science of security analysis". Somehow we seem to have forgotten it.

Let's keep dreaming

The promise of fairness, the promise of progress, the promise of not being short changed for an honest day's work.

Talk to us

www.qplum.co

contact@qplum.co

1-888-QPLUM 4U

| qplum LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance. |