How to maximize your post tax returns

Passive investing can outperform active!

Taxes can take a huge bite from the returns of an active investing strategy

Based on our studies, an active investing strategy like a statistical arbitrage strategy with similar 9% returns as US stocks can end up a with a post-tax returns of under 3% for taxable accounts!

When we are comparing two investing strategies for taxable accounts, we should look at how much money would we get if we were to sell all positions at the end and convert to cash.

How bad can taxes be for your portfolio?

Buy and hold in a tax free account

Growth of $100 invested for 20 years in a 60-40 stocks-bonds portfolio

Buy and hold in taxable account

Actively managed in a taxable account

$416

$291

$242

Taxes can make a bigger impact on the returns of a strategy, than the strategy itself

Even a passive buy-and-hold strategy that doesn't trade at all will lose about ~30% to taxes

Active management will result in an even less favourable tax treatment

But it is much better at managing risk, and minimising the impact of long lasting bear markets

30% lower

Okay, so what's the plan? ->

What's the plan then?

- Invest in a fashion that does not book any gains.

- Guess correctly what will beat the market over the next thirty years.

- Don't sell winners!

What's the problem with this plan?

- It takes a lot of algorithmic work to painstakingly book losses and defer gains.

- It is hard to guess what will work the next day, let alone thirty years.

- Don't sell winners! Yup this part is easy. The hard part is to come up with winners.

A more realistic plan of action ->

What should an investor do?

Have you exceeded your IRA limit?

Max out your IRA investments first, as the capital gains on them are tax exempt

Yes

No

Yes

No

Pure passive portfolios are tax efficient, but we could be completely wrong in our guess of what to hold. Invest in a mix of market allocation and a strategic allocation that aims at highest post tax gains in long term e.g. qplum's flagship strategy

Do you mind locking in your investments for 5-7 years?

Long term gains and short term gains are treated differently

Taxes have to be paid only on gains, and losses can offset gains

Loss Harvesting

Tax optimized responsive investing

Lot Matching

Markets might tank, so make sure that your portfolio is designed to ride out a business cycle without going into deep losses. The strategies should be cognizant of tax laws too. e.g. qplum's lotus portfolio.

Gain Deferment

Deferring the booking of gains can help them turn long term

You can minimize your tax liability by choosing the right lots to sell

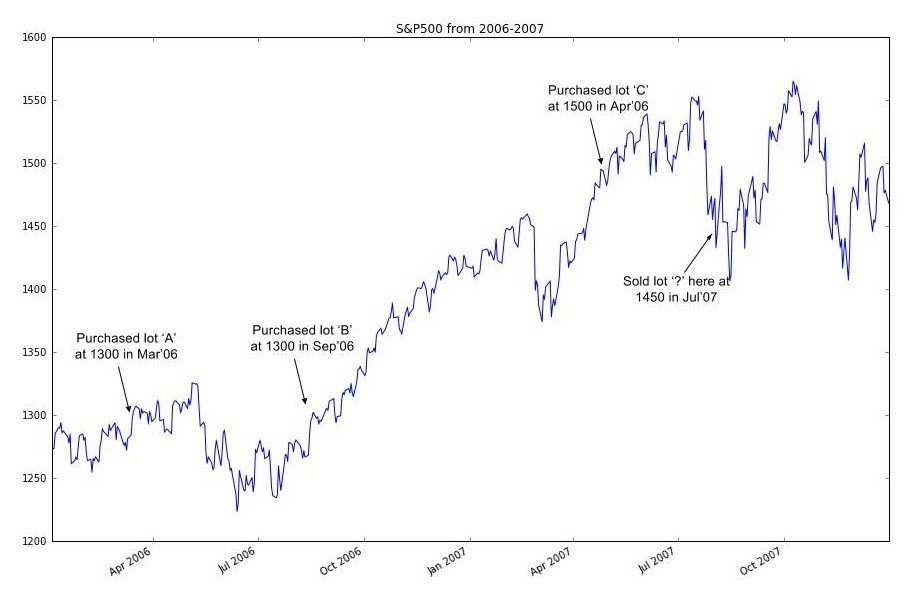

For the exact same trade you want to place, you could have multiple lots to choose from

Depending on which lot you sell, you can book a gain or a loss, which can be long term or short term. And this makes all the difference.

In this particular case:

selling A - long term gain of $150

selling B - short term gain of $150

selling C - short term loss of $50

The clear winner is C!!

Booking losses before gains lowers your immediate tax liability. It also allows the existing gains to turn long term.

Book your losses now, so that you effectively need to pay less taxes later

To summarize, we should try to book losses whenever we can, so that they can be used to offset gains later

Year 1

Year 2

Gain

$100

Loss

($80)

Tax

($50)

Year 1

Year 2

PNL

($30)

Loss

($80)

Gain

$100

Tax

$40

PNL

$50

Tax

$40)

Tax

($50)

PNL

$10

vs

To illustrate the power of tax loss harvesting, we compare two cases where our portfolio sees a gain and a loss of $100 and $80 respectively in consecutive years, but in a different order

In both the cases, we have tax liabilities of -$50 (for $100 gain) in one year and +$40 (for $80 loss) in the other

But while in case 1, the $40 tax break goes waste (or has to wait till the next year), in case 2 we could use it to offset the tax liability of $50. As a result the final PNL in case 2 is higher by $40

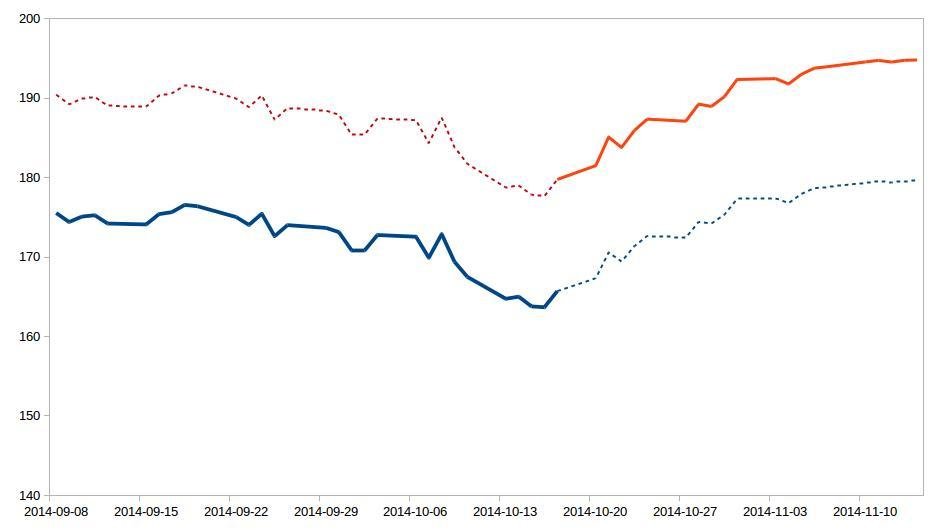

But how can you book losses without diverging from the portfolio mandate?

Buy SPY

Sell VOO

Use of alternate securities like 'VOO' and 'SPY' can help us bypass the wash sale rule as harvesting one's losses by replacing it with the other won't change the portfolio mandate

In order to restore the portfolio allocation we must buy the same securities again

But buying 'same' or 'significantly similar' securities within 31 days of the loss causing sale (order notwithstanding) can lead to violation of wash sale rule

Per the wash sale rule, this transaction doesn't stand. The cost of the newly purchased securities are adjusted to reflect this loss, but we will not be able to use this loss for offsetting the gains.

We at qplum make further efforts for tax optimizing your portfolios

Security grouping

Tax Sensitive Trading

Tax Efficient Account Transfer

To ensure that active strategies (satellite) of the portfolio don't end up negatively impacting the passive strategies (core), we keep separate sets of products for each.

Reacting to the market noise can result in excess trading, and hence taxes. We therefore trade only when portfolio diverges from the mandate by more than a threshold, and the trades won't result in huge tax liabilities

In case of account transfers from other brokers, we avoid selling the positions which have short term gains. We try to slowly move towards the intended allocation, in a tax efficient manner.

Investing can be a science if we all work towards it.

Email: contact@qplum.co Ph: 1-888-QPLUM 4U

qplum LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.