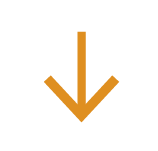

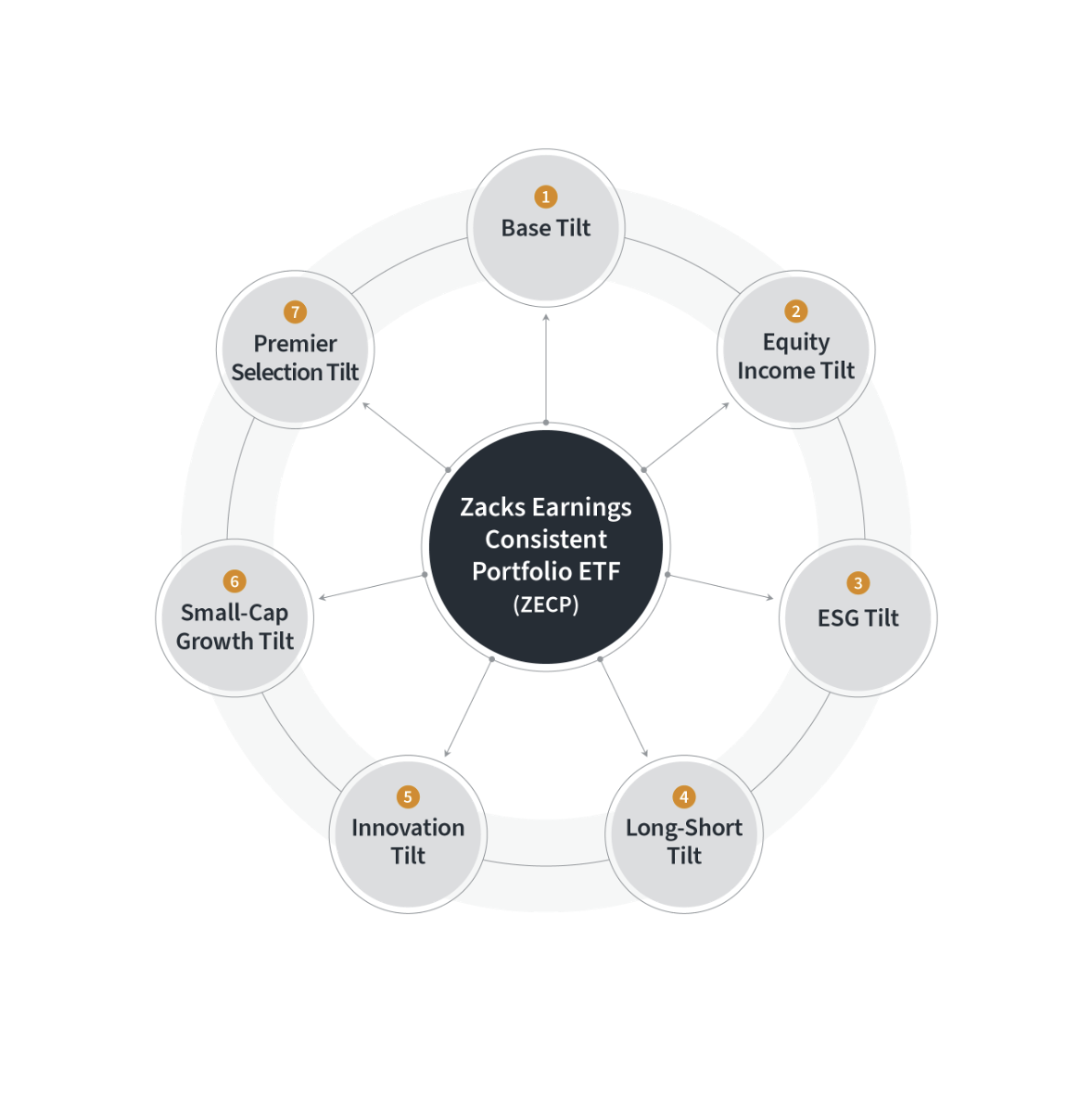

A Customizable Solution Built on the Zacks Earnings Consistent Portfolio ETF

Introducing the ZECP+

ZECP+

Now you can tilt ZECP in your client’s favor.

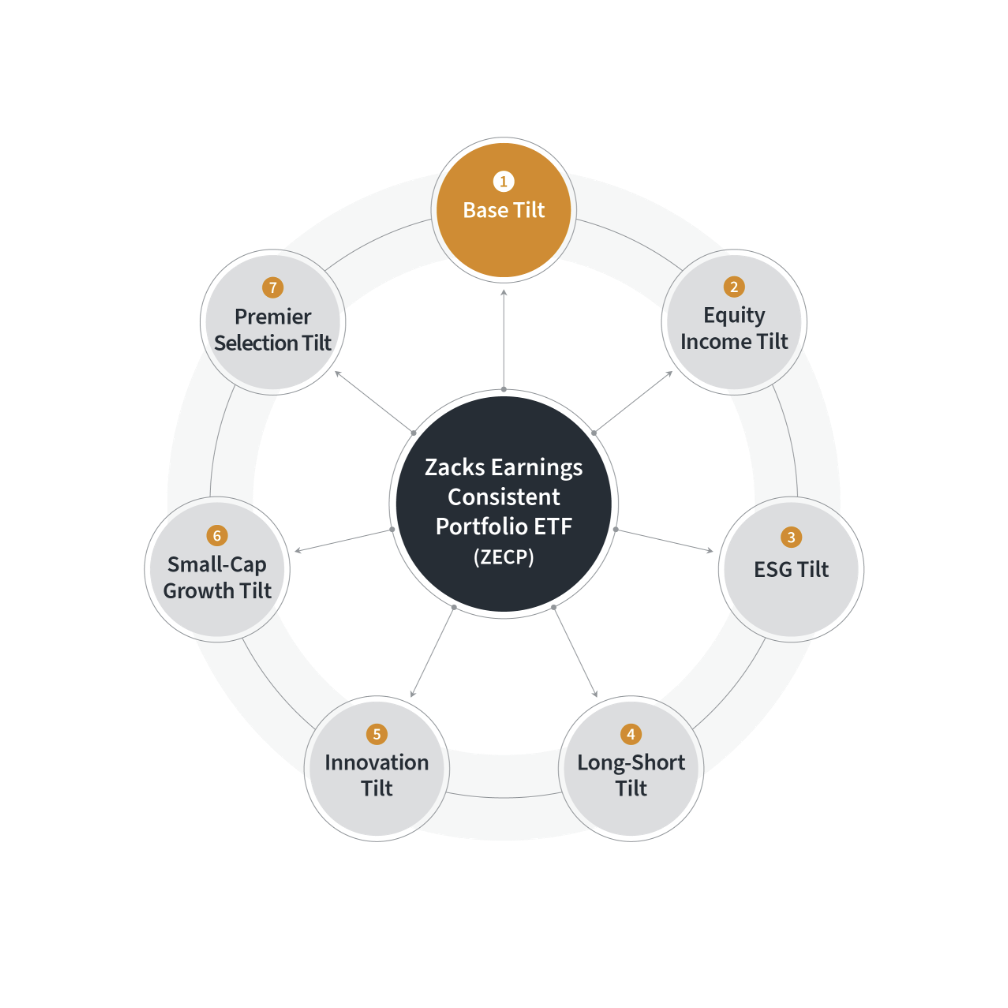

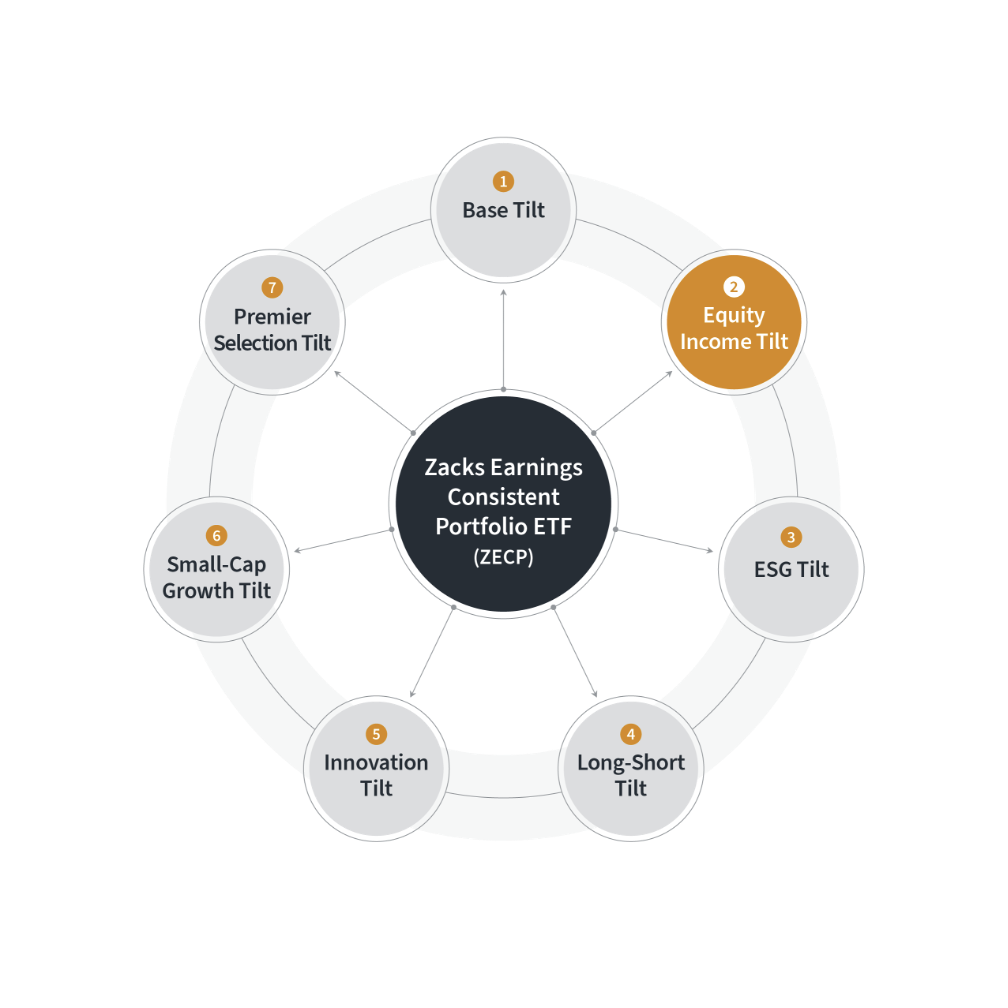

Zacks Earnings Consistent Portfolio (ZECP) and Strategy Tilts offer financial professionals an opportunity to take the power of the Zacks Earnings Consistent Portfolio ETF and combine it with distinct satellite portfolios according to the needs of their clients.

Offered through separately managed accounts, the unique core-satellite structure offers a flexible vehicle that can be tilted toward seven of the most popular investment themes. This means investors can allocate across and move among a variety of SMA tilts according to their market outlooks and exposure needs—without layering additional fees.

As an independent, research-based asset management firm, Zacks Investment Management provides customizable solutions rooted in a disciplined, time-tested investment process.

ZECP and SMA Tilts

Zacks Earnings Consistent Portfolio ETF (ZECP)

The Zacks Earnings Consistent Portfolio ETF (the “Fund”) seeks to provide long-term total returns and minimize capital loss. The Fund pursues its investment objective by constructing a portfolio of companies that exhibit a track record of moving through adverse market conditions with little to minimal impact on aggregate earnings growth relative to the overall equity market.

OBJECTIVE

SMA (Separately Managed Account)

Base Tilt

1

The primary investment objective of the Base Tilt is capital appreciation.

OBJECTIVE

SMA (Separately Managed Account)

Base Tilt Features

1

The Base Tilt provides access to small and mid-cap stocks that we believe are poised to outperform their respective benchmarks, according to Zacks’ proprietary ranking models.

The strategy is designed to utilize Zacks’ decades of earnings research and ranking model to guide our investment selection. The portfolio is diversified across market capitalization and sectors.

Our process seeks to identify stocks that have received revised upward earnings estimates—before the price has moved higher.

The Base Tilt may be appropriate for investors seeking capital appreciation through a diversified stock portfolio.

Small and medium capitalization companies may involve greater volatility and risk than investing in larger and more established companies.

SMA (Separately Managed Account)

Equity Income Tilt

2

The objective of Equity Income Tilt is to generate a relatively high dividend yield.

OBJECTIVE

SMA (Separately Managed Account)

Equity Income Tilt Features

2

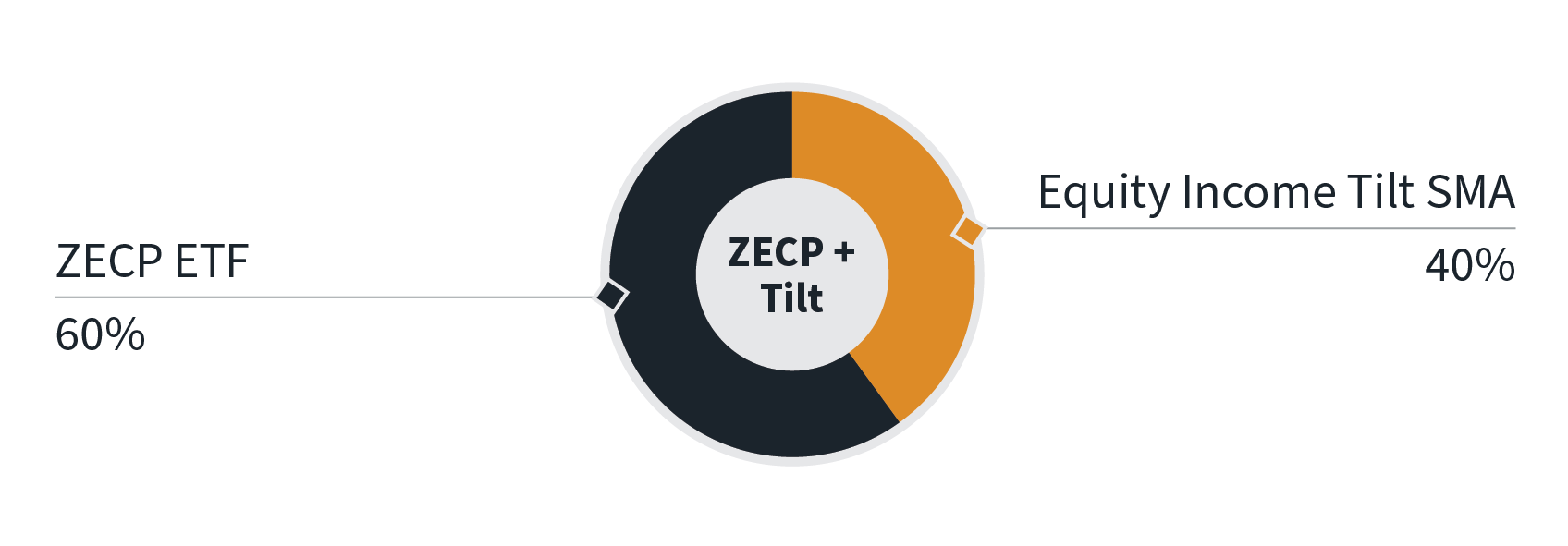

The Equity Income Tilt combines the ZECP ETF with leading dividend-paying stocks.

The selection process seeks to identify stocks with a consistent history of dividends distribution, while raising dividends consistently.

The stocks that we identify have a history of maintaining dividend distributions, which can aid the portfolio in markets that are experiencing downward pressure.

The Equity Income Tilt may be appropriate for investors who are interested in dividend-paying stocks to seek yield and increase stability.

High yielding stocks are often speculative, high-risk investments. These companies can be paying out more than they can support and may reduce their dividends or stop paying dividends at any time, which could have a material adverse effect on the stock price of these companies and the Fund’s performance.

SMA (Separately Managed Account)

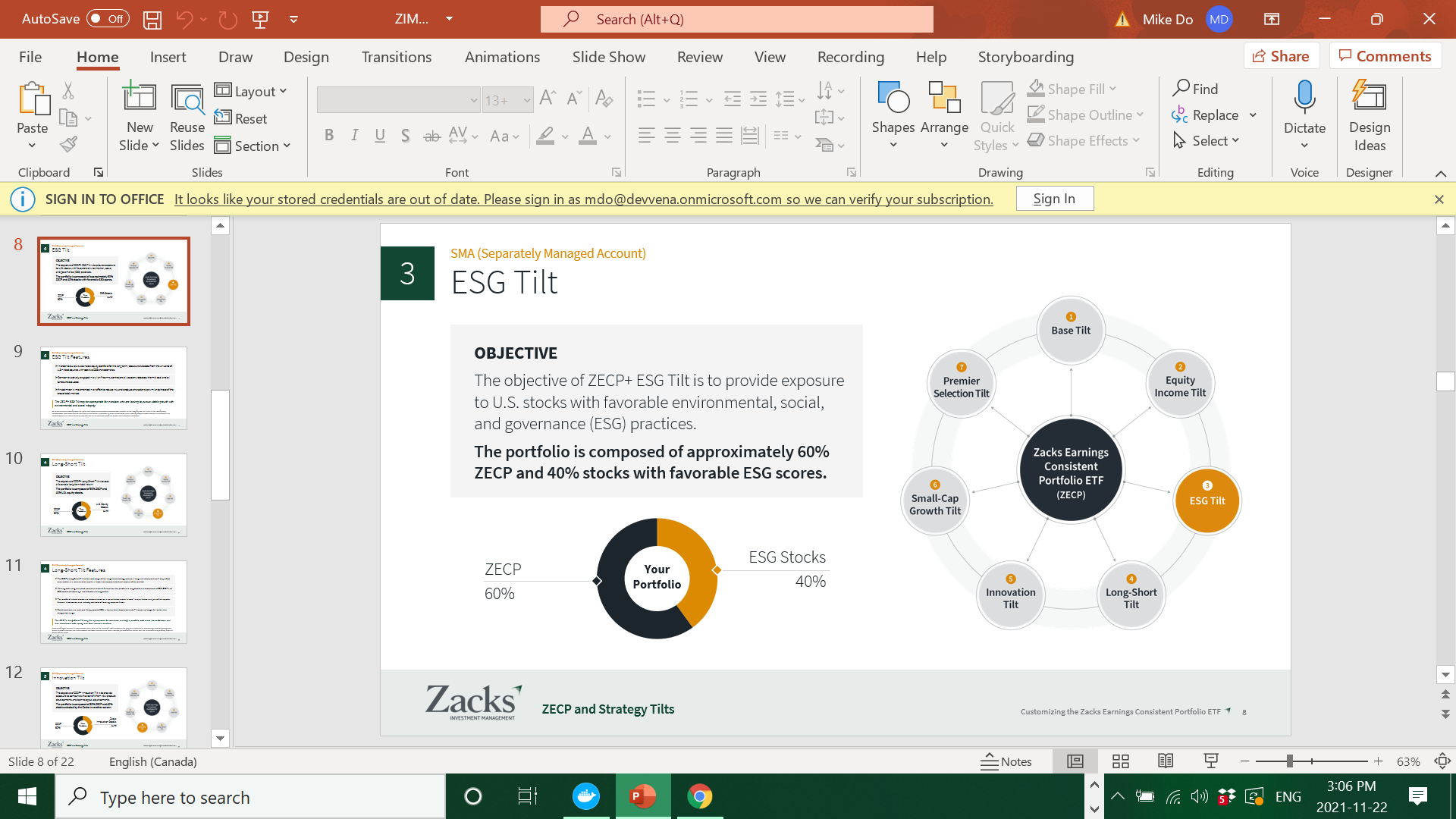

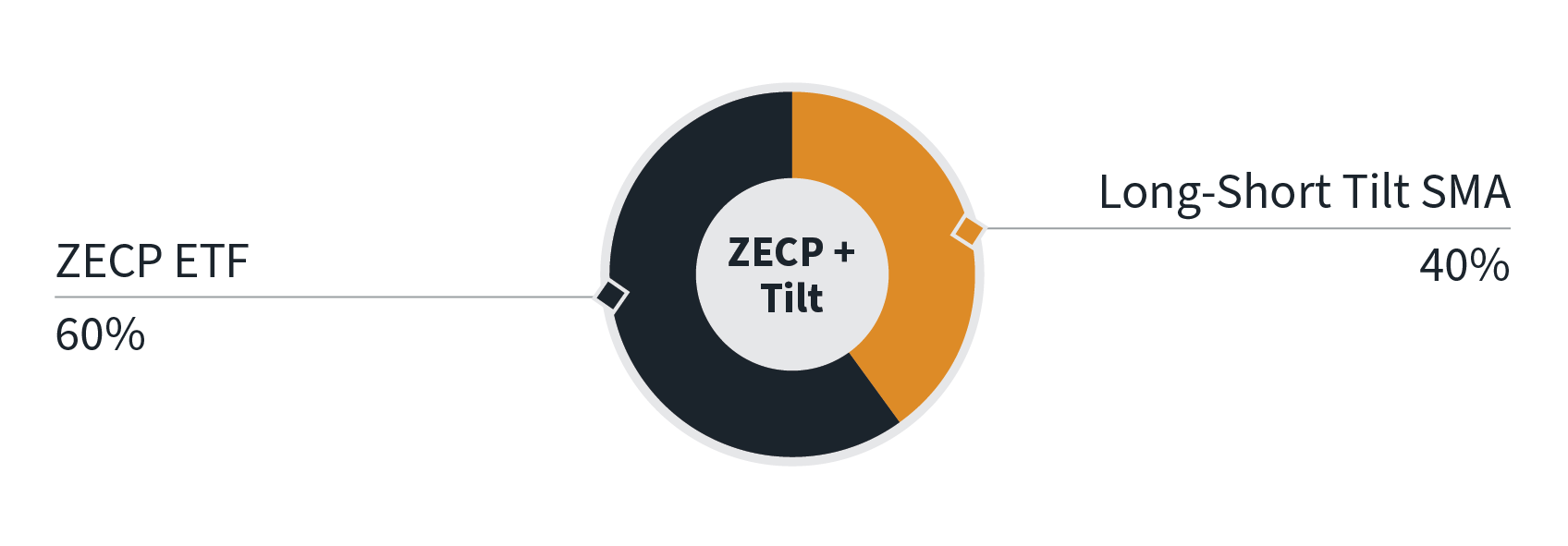

ESG Tilt

3

The objective of ESG Tilt is to provide exposure to U.S. stocks with favorable environmental, social, and governance (ESG) practices.

OBJECTIVE

SMA (Separately Managed Account)

ESG Tilt Features

3

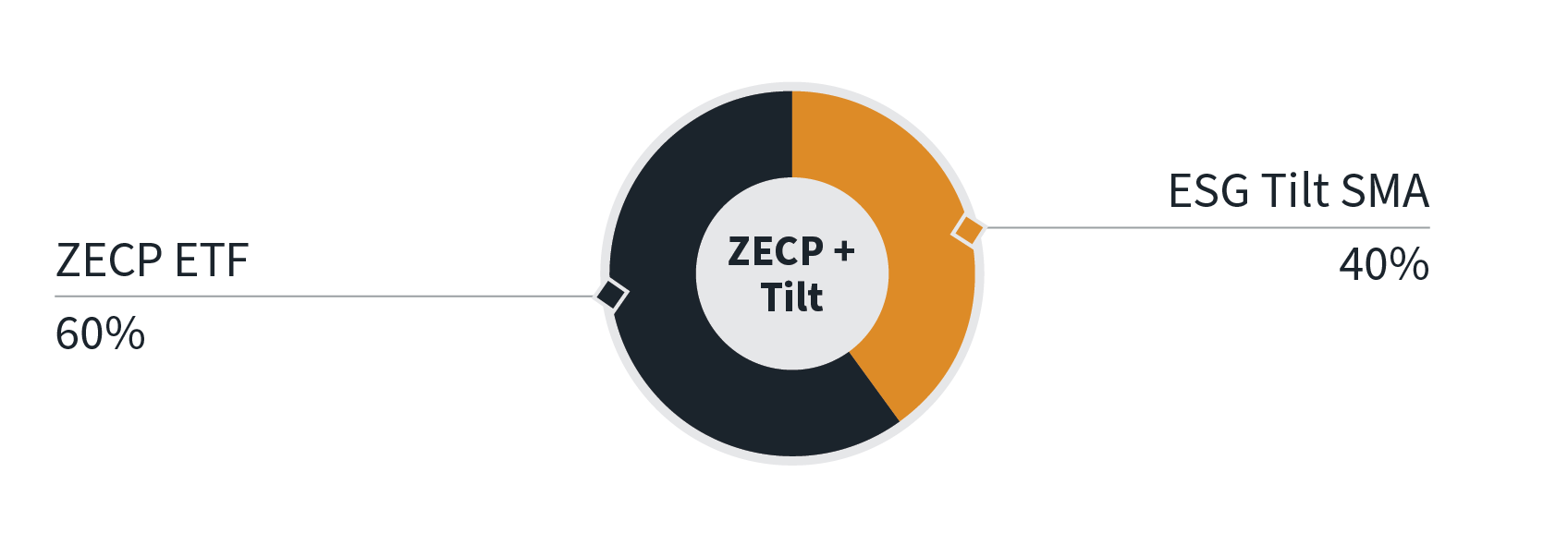

In order to build a sustainable equity portfolio for the long term, stocks are selected from the universe of U.S.–listed equities with positive ESG characteristics.

Companies actively engaged in civilian firearms, controversial weapons, tobacco, thermal coal and oil sands are excluded.

An optimizer is implemented in an effort to reduce risk and produce characteristics similar to those of the broad stock market.

The ESG Tilt may be appropriate for investors who are looking to pursue stable growth with environmental and social integrity.

An ESG investment strategy limits the types and number of investment opportunities available to the strategy and, as a result, the strategy may underperform other funds that do not have an ESG focus. Companies selected for inclusion in the strategy may not exhibit positive or favorable ESG characteristics at all times and may shift into and out of favor depending on market and economic conditions.

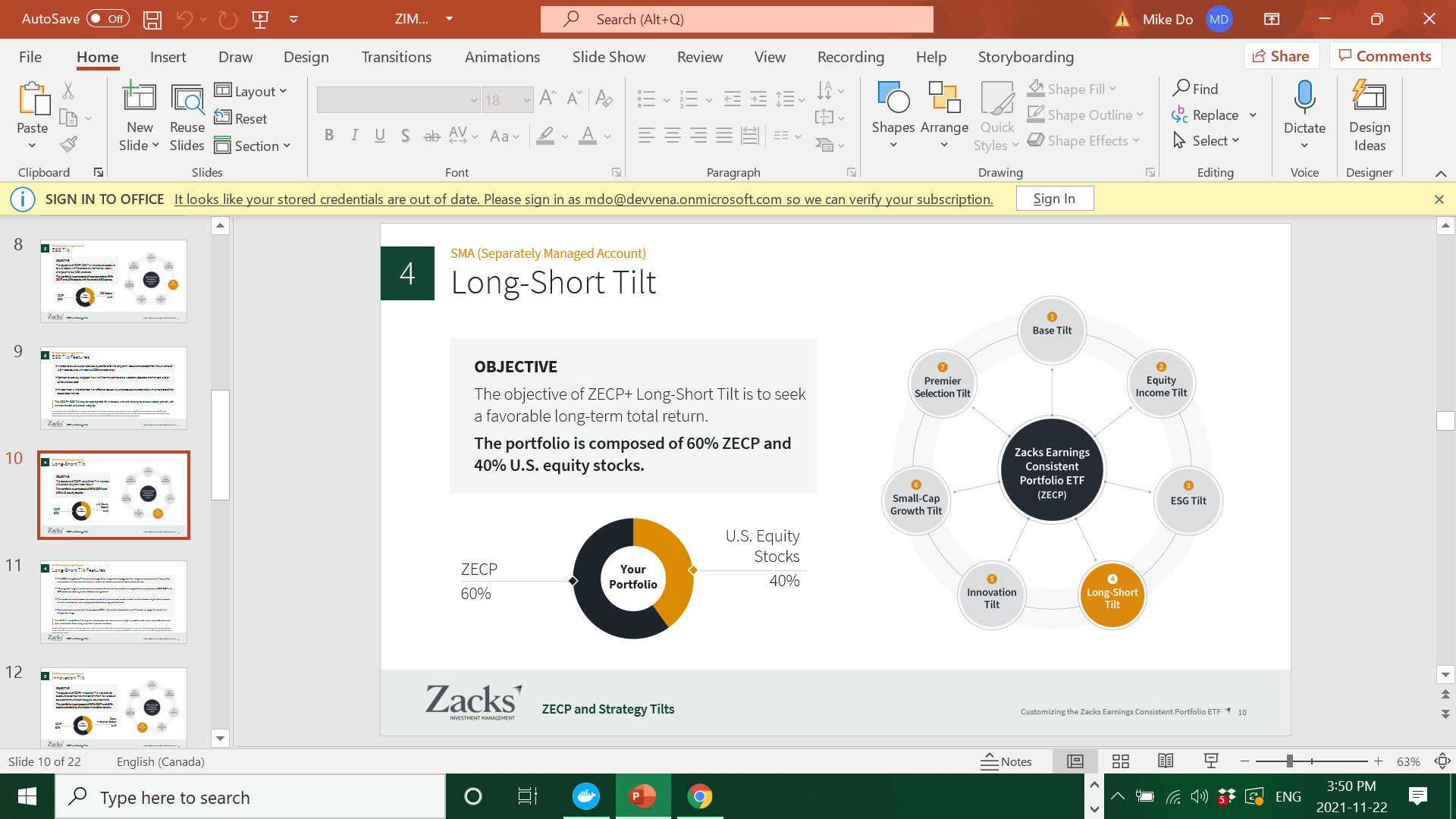

SMA (Separately Managed Account)

Long-Short Tilt

4

The objective of Long-Short Tilt is to seek a favorable long-term total return.

OBJECTIVE

SMA (Separately Managed Account)

Long-Short Tilt Features

4

The Long-Short Tilt takes advantage of the long-short strategy, wherein long and short positions* may offset one another in a manner that results in lower net exposure to the direction of the market.

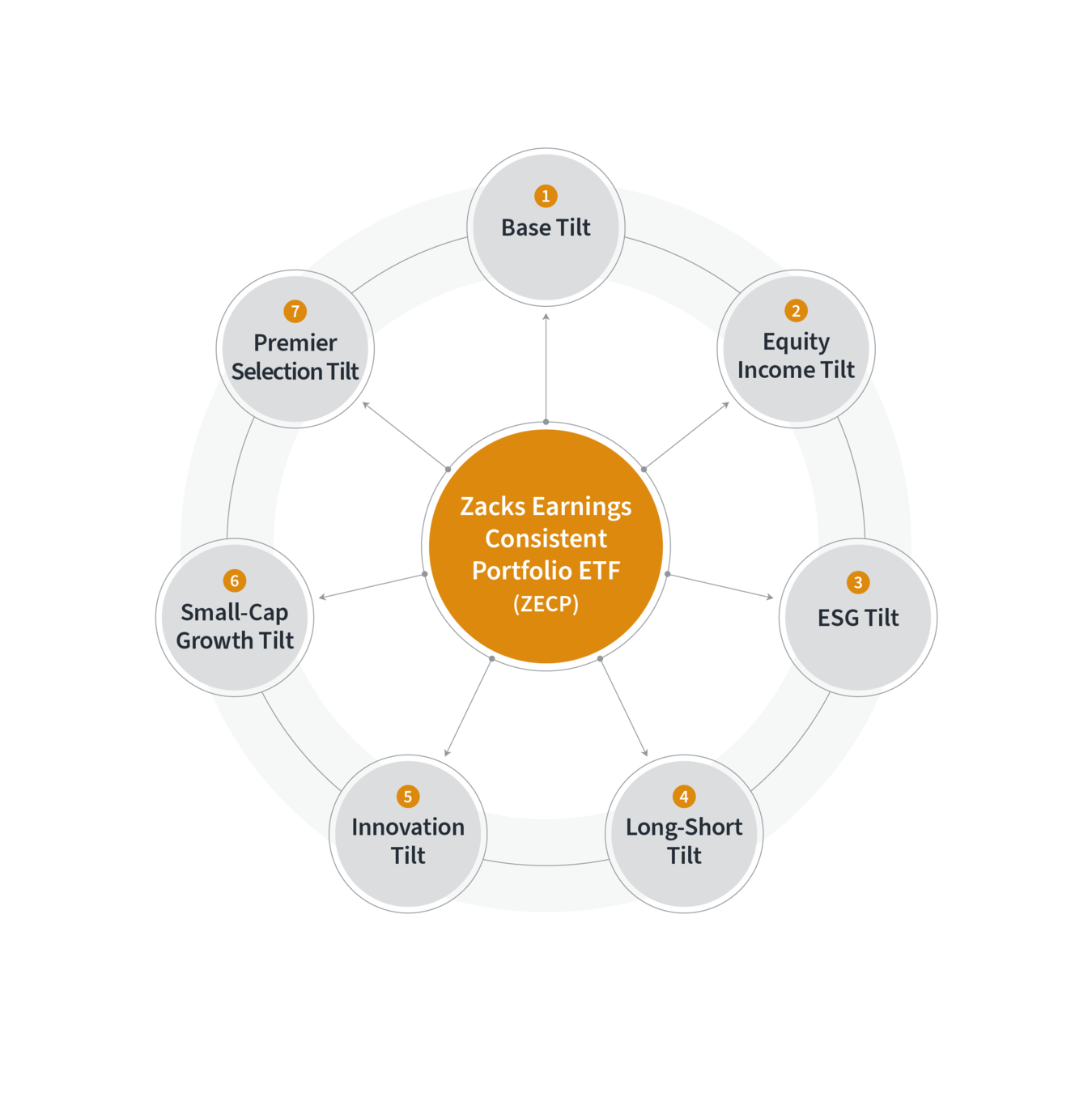

Holding both long and short positions across U.S. equities, the portfolio’s long stocks are composed of 60% ZECP and 40% stocks selected by a multi-factor ranking model.

The portfolio’s short shocks are chosen based on a quantitative model, as well as qualitative analysis of the reports, financial disclosures, and industry outlooks of leading research firms.

The Long-Short Tilt may be appropriate for investors seeking a portfolio with more diversification and less correlation with equity and fixed income markets.

Short Selling Risk: Because a short position loses value as the security’s price increases, the loss on a short sale is theoretically unlimited. Short sales involve leverage because the Fund borrows securities and then sells them, effectively leveraging its assets. The use of leverage may magnify gains or losses for the Fund.

Short positions are replaced if they exceed 30% in loss or their downside alpha** scores no longer fall within the designated range.

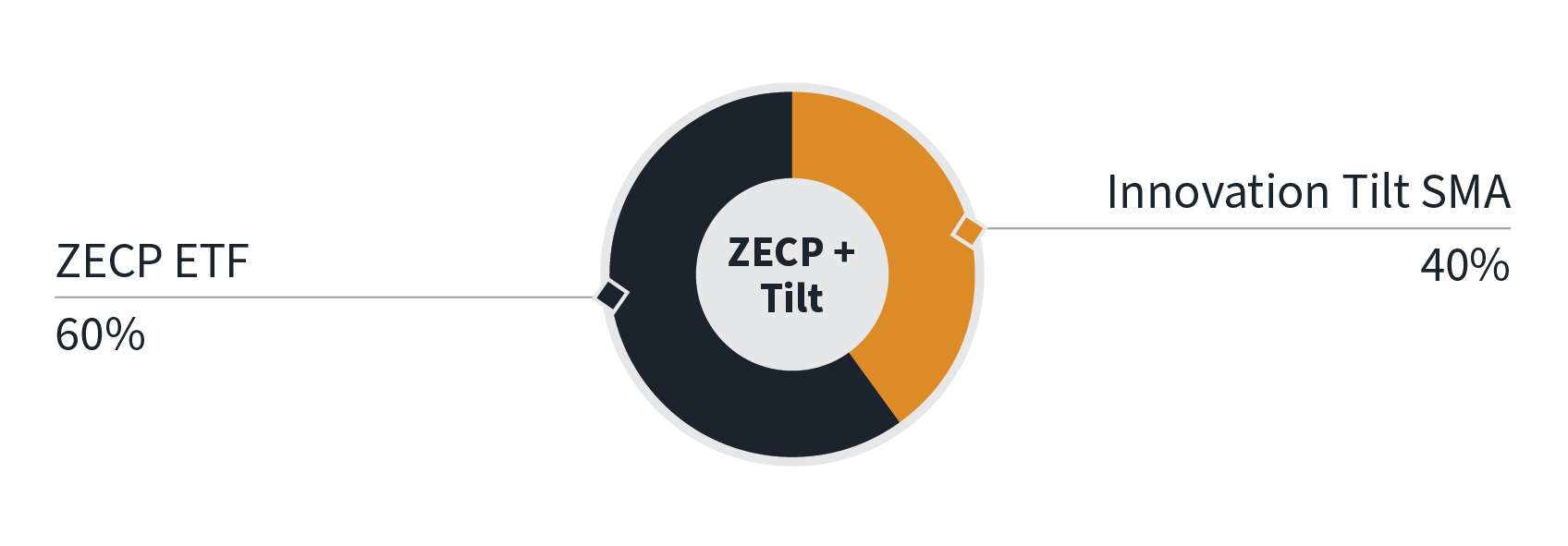

SMA (Separately Managed Account)

Innovation Tilt

5

The objective of Innovation Tilt is to provide exposure to companies that benefit from new product developments and technological advancements.

OBJECTIVE

SMA (Separately Managed Account)

Innovation Tilt Features

5

The Innovation Tilt provides exposure to the growth potential of companies generating or affected by the development of new products or services, technological improvements, or advancements in scientific research.

The Zacks Innovation Screen is primarily focused on the R&D expense, which evaluates revenue versus research and development.

In the stock selection process, we may consider other factors including innovation correlation or the number of patents a company files.

The Innovation Tilt may be appropriate for investors seeking long-term capital appreciation through disruptive technology breakthroughs.

Innovative Company Risk: Companies that the Adviser believes are capitalizing on disruptive innovation and developing technologies to displace older technologies or create new markets may not in fact do so. Companies that initially develop a novel technology may not be able to capitalize on the technology. These new and novel technologies may be exposed to greater risk than established companies.

SMA (Separately Managed Account)

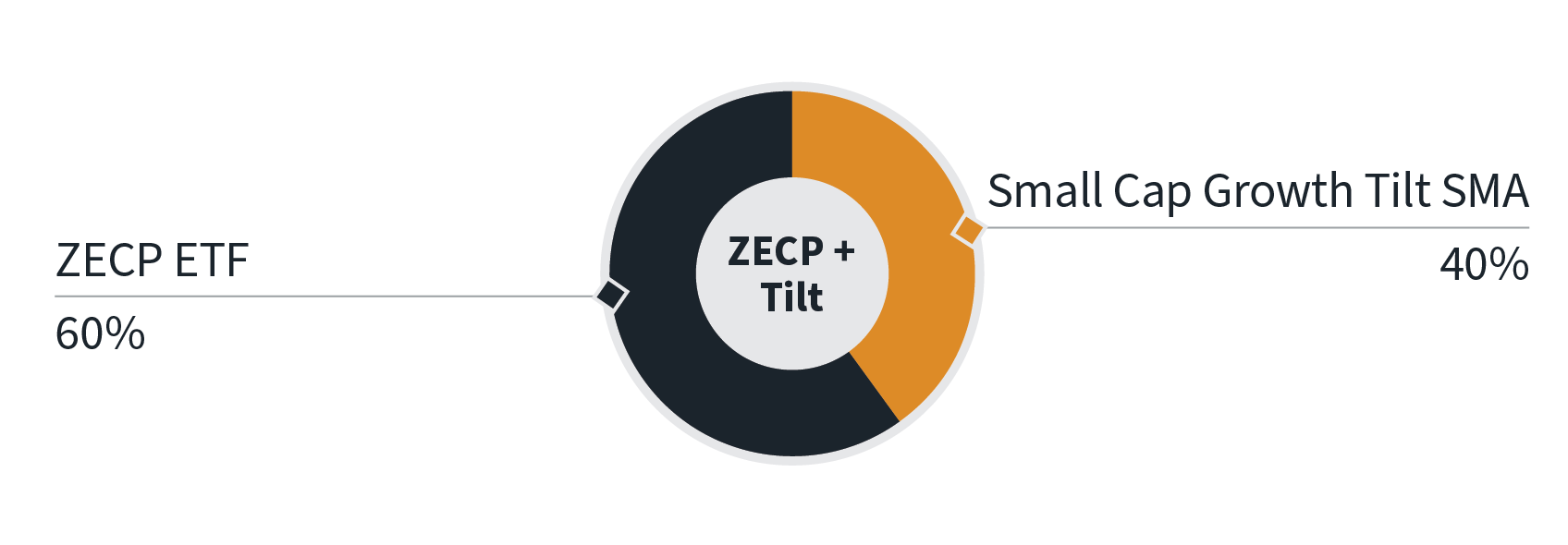

Small-Cap Growth Tilt

6

The objective of Small-Cap Growth Tilt is to provide exposure to small-cap stocks with a growth orientation.

OBJECTIVE

SMA (Separately Managed Account)

Small-Cap Growth Tilt Features

6

The Small Cap Growth Tilt provides the opportunity to achieve outperformance with the expectation of robust economic acceleration driven by a vaccine-led reopening, accommodative monetary policy and fiscal stimulus.

Each company within the small-cap growth universe is ranked based on the multi-factor model and a weighted average score is assigned to each individual stock.

An optimizer is used in portfolio construction to help control risk and portfolio managers conduct a qualitative review before trade execution.

The Small Cap Growth Tilt may be appropriate for investors with optimistic views of small-cap stocks.

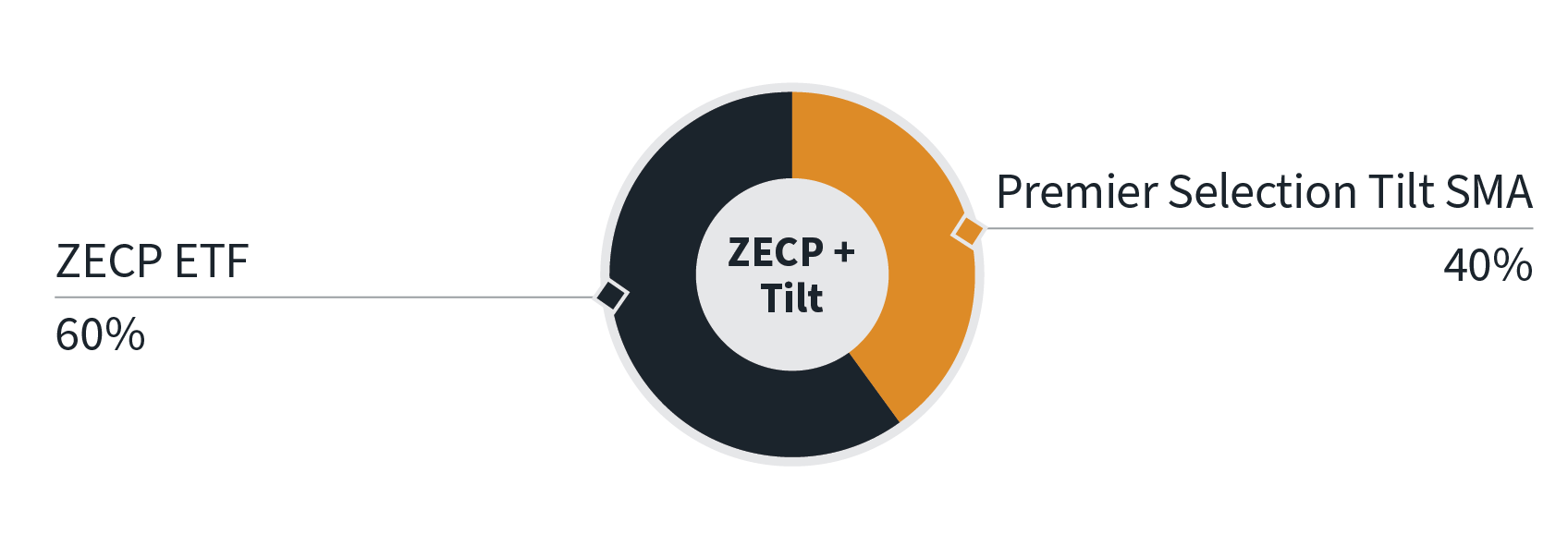

SMA (Separately Managed Account)

Premier Selection Tilt

7

The objective of Premier Selection Tilt is to outperform the broad market benchmark.

OBJECTIVE

SMA (Separately Managed Account)

Premier Selection Tilt Features

7

The Premier Selection Tilt is our “best idea” tilt, which is designed to pursue competitive returns by investing in companies with productive assets and positive earnings estimate revisions.

The Premier Selection portfolio is composed of 10 positions screened by quantitative models and qualitative oversight.

An initial screen focuses on each stock’s proprietary Zacks Performance Rank score, and a second screen focuses on each stock’s Growth Profitability score.

The Premier Selection Tilt may be appropriate for investors with an above-average risk appetite who are seeking competitive returns.

Firm Overview and History

In 1978, after receiving his doctorate from MIT, Len Zacks was the first to document the value of earnings estimate revisions within the stock selection process.

The Origins of Zacks Investment Research

As time went on, his seminal article proved to be both accurate and influential. Zacks estimate revisions studies have become the most powerful indicator in forecasting material changes in earnings, and earnings have continued to be the most important fundamental factor affecting stock prices. Zacks Investment Management became synonymous with earnings estimate revisions analysis, and began originating concepts and innovations such as:

Earnings per share (EPS) surprise, now widely used in the investment industry

The Zacks Performance Rank, a proprietary stock-ranking model and the core of the Zacks Investment Philosophy

Numerous proprietary quantitative models

Zacks History and Legacy

To trace the history of Zacks is to draw a through-line from one of one of today’s largest independent equity research providers, through 40 years of pioneering studies, to Wall Street’s original think tank.

Zacks Investment Research is now one of the largest providers of independent research in the U.S., with a litany of Ph.D.s and other analysts involved in developing and refining models, assessing data and conducting research in order to form new insights into the investment process.

In 1992, Zacks Investment Management was established as a wholly owned subsidiary of Zacks Investment Research. As a boutique wealth management firm, we apply the time-tested insights of our parent company to create models like the Zacks Dividend Strategy.

Zacks Investment Management:

Born on Research

Since our inception, Zacks Investment Management has been dedicated to delivering results for our clients by seeking excess returns over standard benchmarks within a risk-controlled framework.

Ultimately, our active management approach and bottom-up fundamental stock selection process were built upon the very discoveries that changed the industry over 40 years ago, and have generated exceptional results ever since. Within the Zacks Dividend Strategy, we will continue to adhere to this discipline in all market cycles.

“The Zacks legacy was born on research and it has been proven through history. We’re an independent family business and to this day we’re proud to share the fruits of our expert insights for the benefit of our clients.”

Mitch Zacks

Principal and Senior Portfolio Manager

227 W. Monroe, Suite 4350, Chicago, IL 60606

Toll free. (888) 775-8351 | wholesale@zacks.com

Zacks Investment Management