Crypto Trading:

Centralized Platforms

Instructor: Andreas Park

Broker

Exchange

Internalizer

Wholeseller

Darkpool

Venue

Settlement

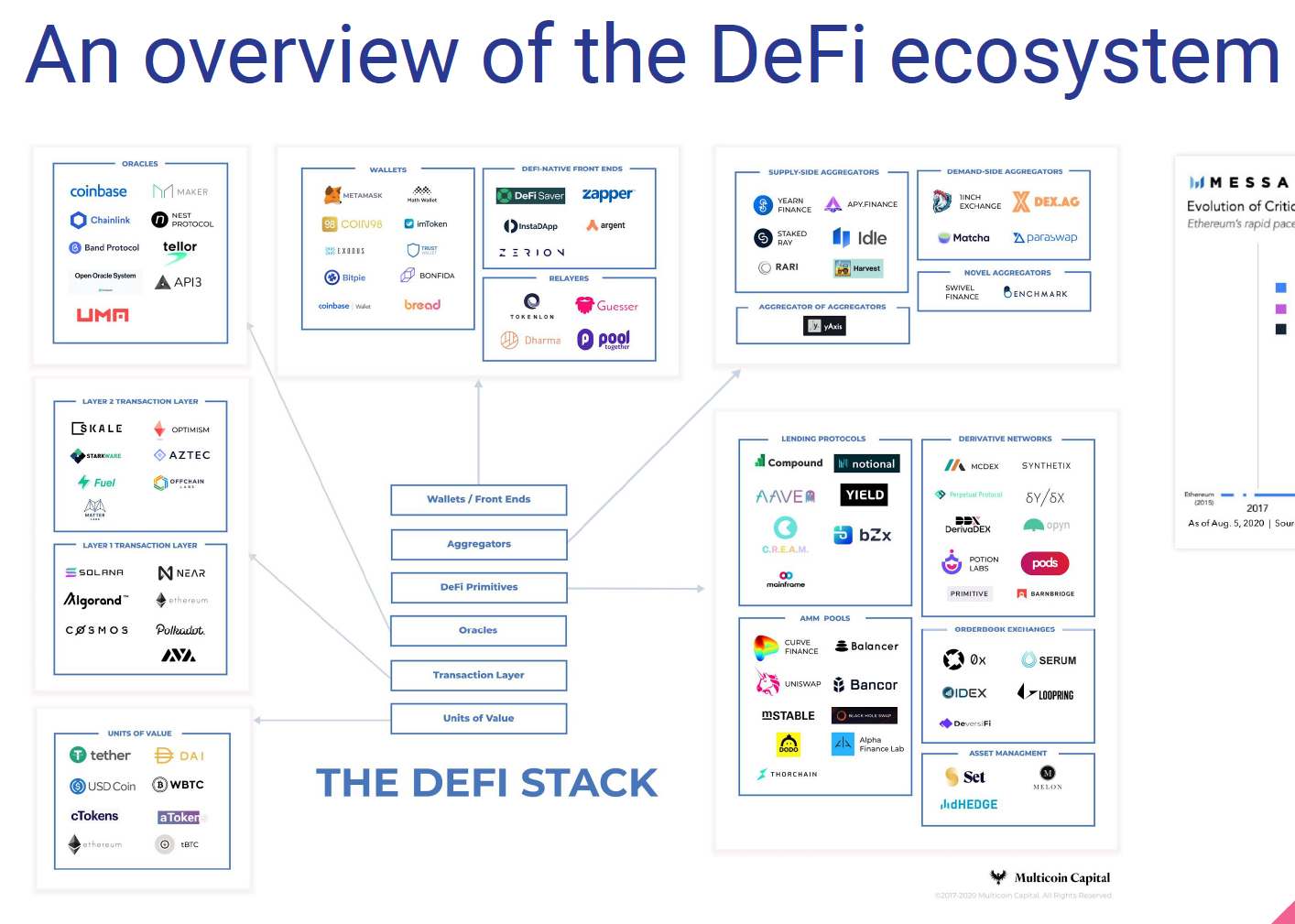

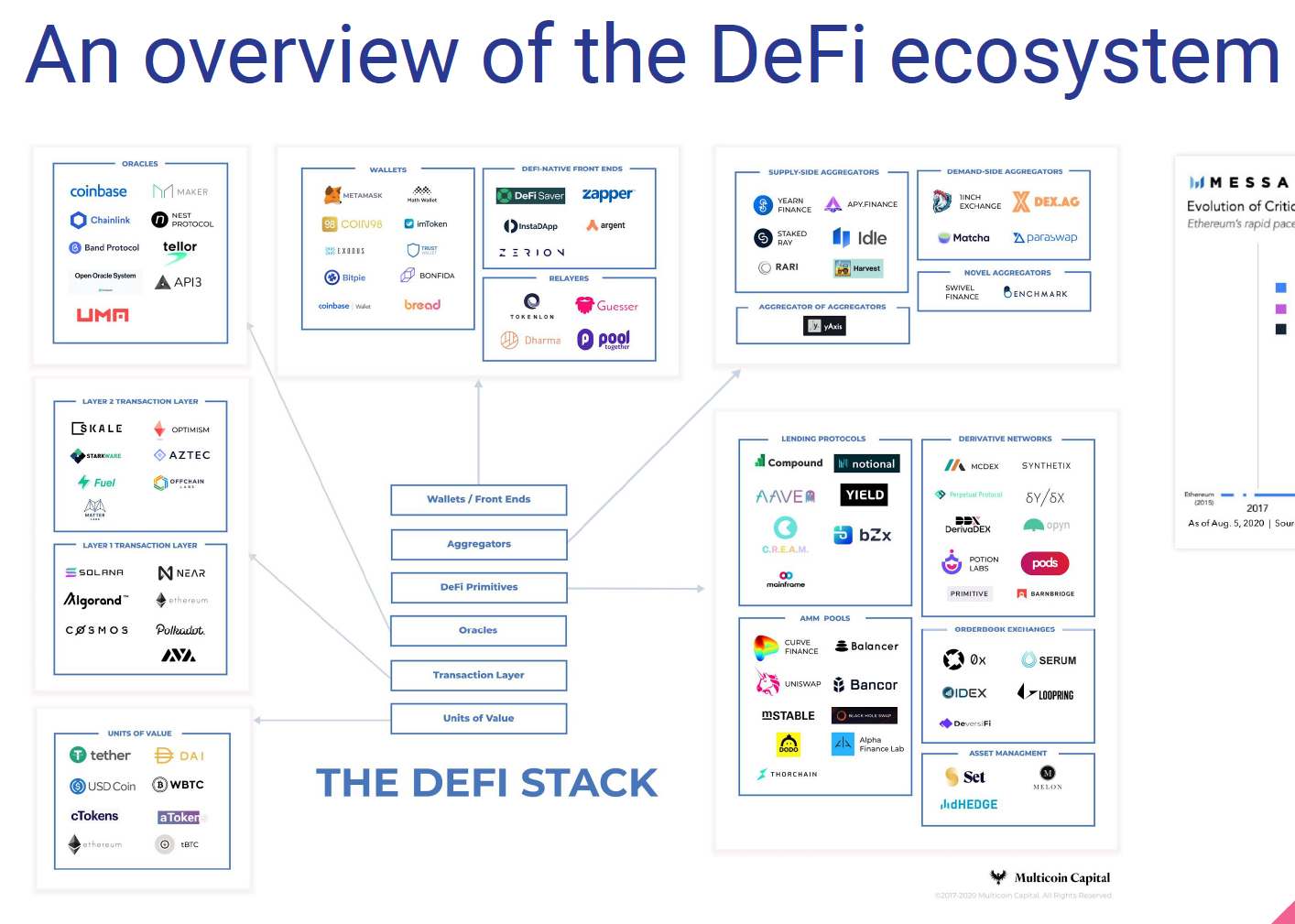

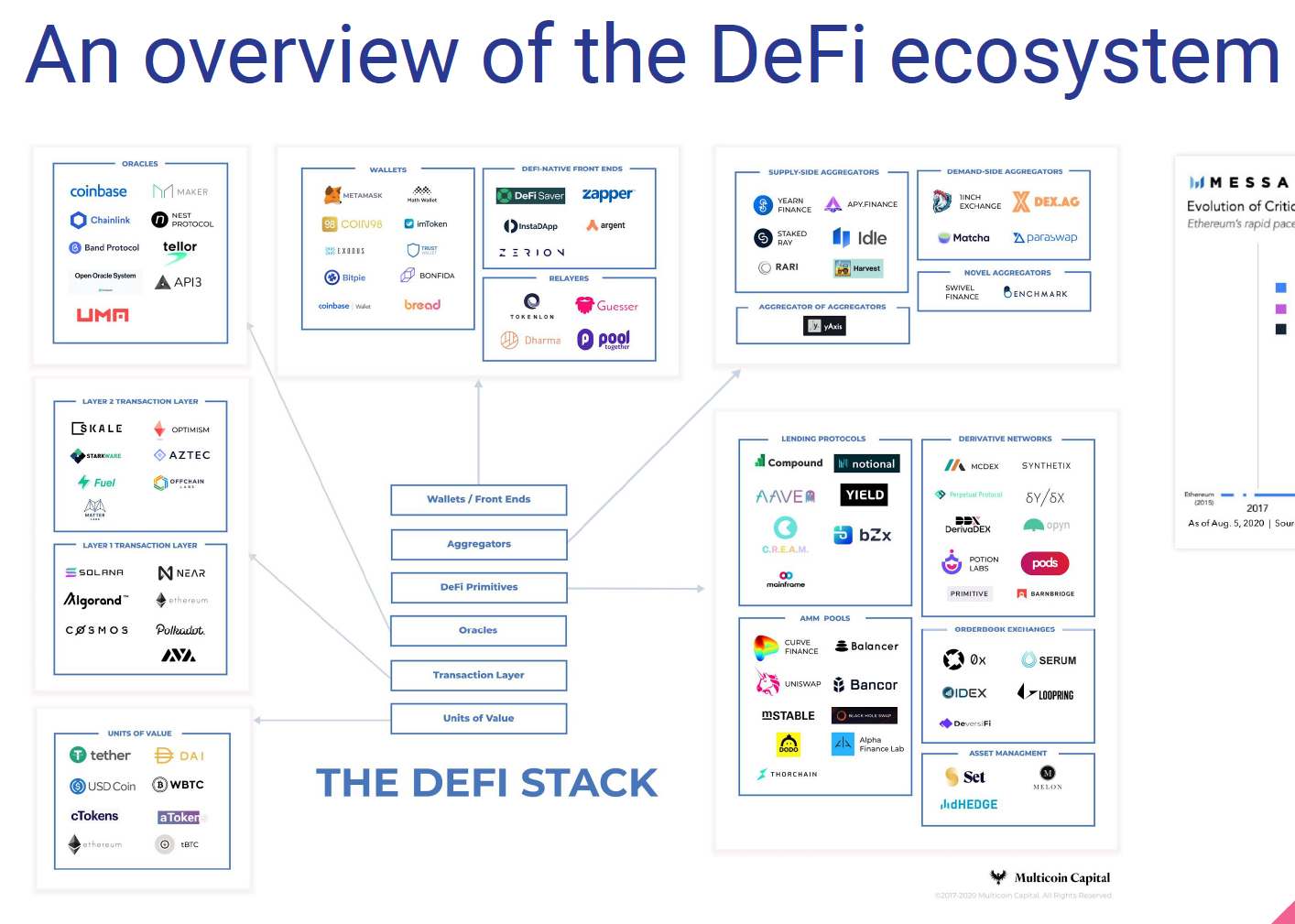

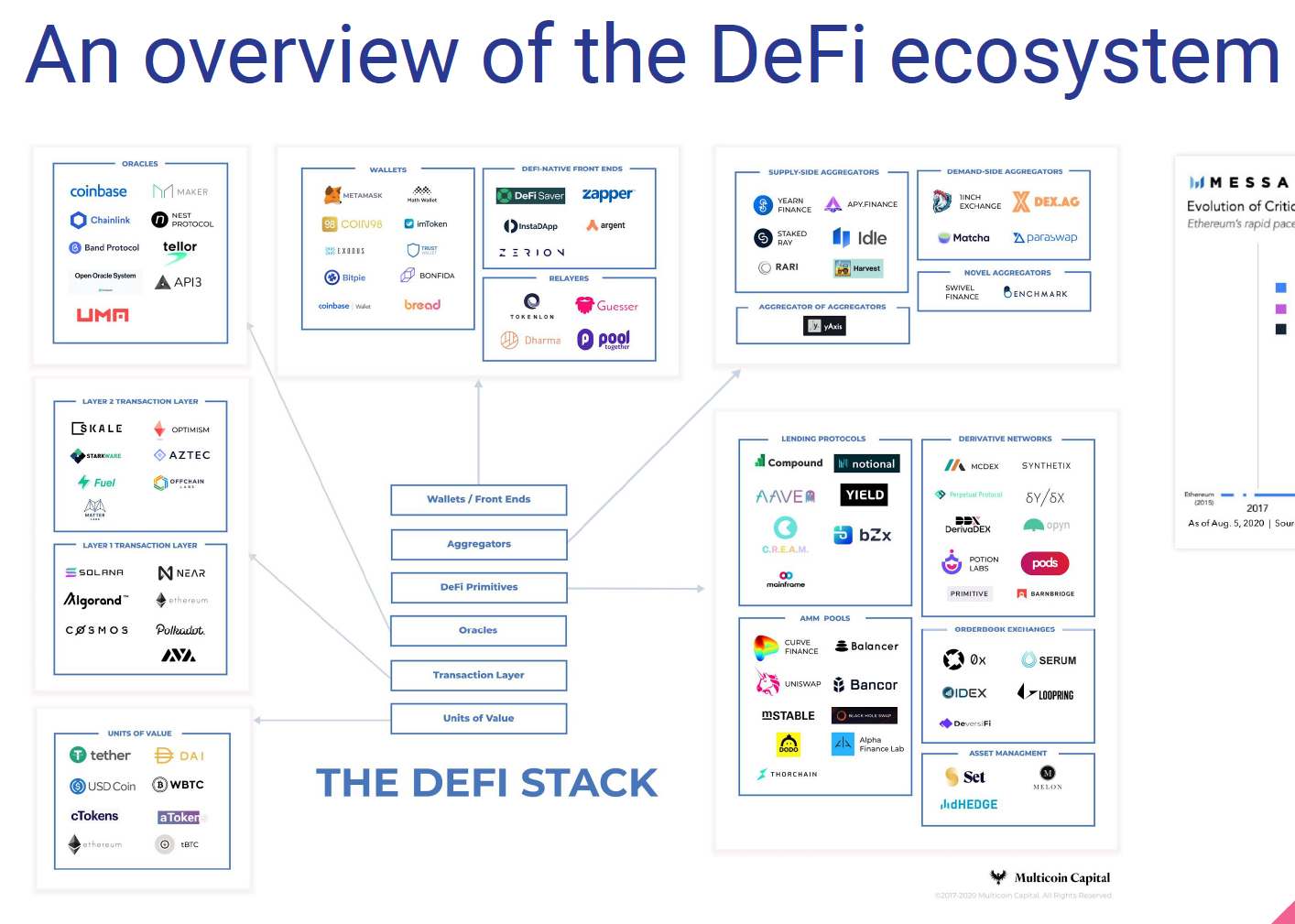

DeFi Overview

Overview of Traditional Trading

trading Infrastructure

payments network

Stock Exchange

Clearing House

custodian

custodian

beneficial ownership record

seller

buyer

Broker

Broker

Types of traders

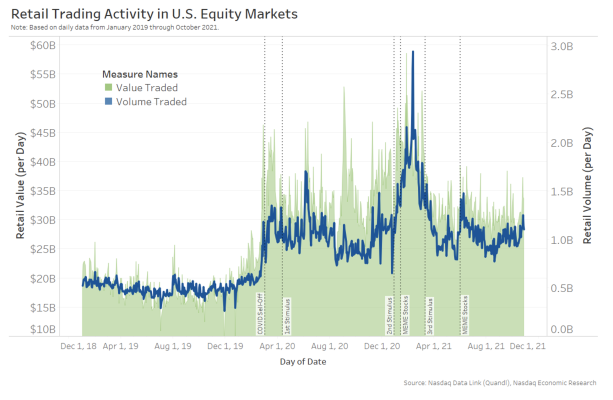

Trading in Equity Markets today

Retail

Institutional

Pro-Traders

high volume securities

low volume securities

50%

50-60%

0%

30-40%

40-50%

10-20%

Summary of workflow

Exchange

Traditional

Internalizer

Wholeseller

Darkpool

Investor

Venue

Broker

Settlement

Exchanges

Wholesellers

Dark pools

Broker Internalizations

Where does trading occur?

Trading in Equity Markets today

Exchanges

Wholesellers

Dark pools

Broker Internalizations

How does trading work?

Trading in Equity Markets today

(

(

How to access the market?

Trading in Equity Markets today

Retail

Institutional

Pro-Traders

Retail: Canada

Trading in Equity Markets today

Rule: must send to exchange with best price

Retail: U.S.A.

Trading in Equity Markets today

Exchange

Wholeseller

market order

limit order

In Europe: no best price obligation

Institutions: U.S.A.

Trading in Equity Markets today

Exchange

Dark pools

Pro Traders

Trading in Equity Markets today

Type 2: "borrow" broker-dealer system

Type 1: licenced broker-dealer

risk control

Big Message

Trading in Equity Markets today

-

You commonly don't access the market directly.

-

Brokers take many decisions but they are bound by regulations.

-

Critical: markets are formally linked by best-price rules.

Crypto Trading Overview

Three Fallacies for Crypto Economics

crypto assets = traditional equities

crypto trading = traditional trading

crypto entities = traditional firms

Types of traders

Trading in Equity Markets today

Retail

Institutional

Pro-Traders

high volume securities

low volume securities

50%

50-60%

0%

30-40%

40-50%

10-20%

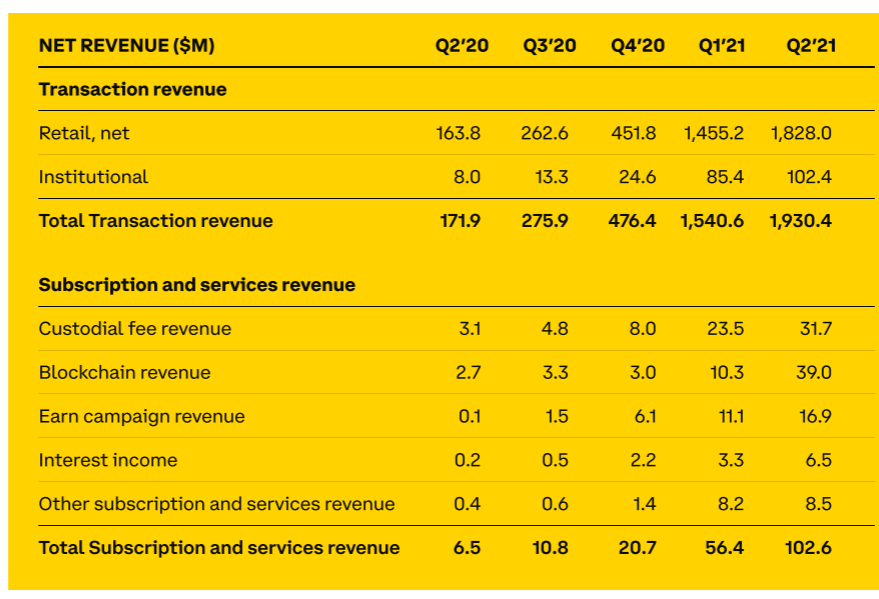

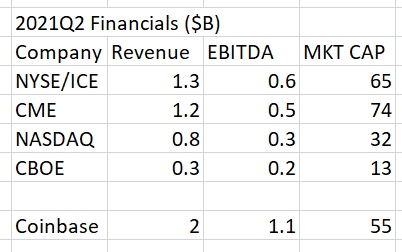

Coinbase's recent numbers

Coinbase's recent numbers

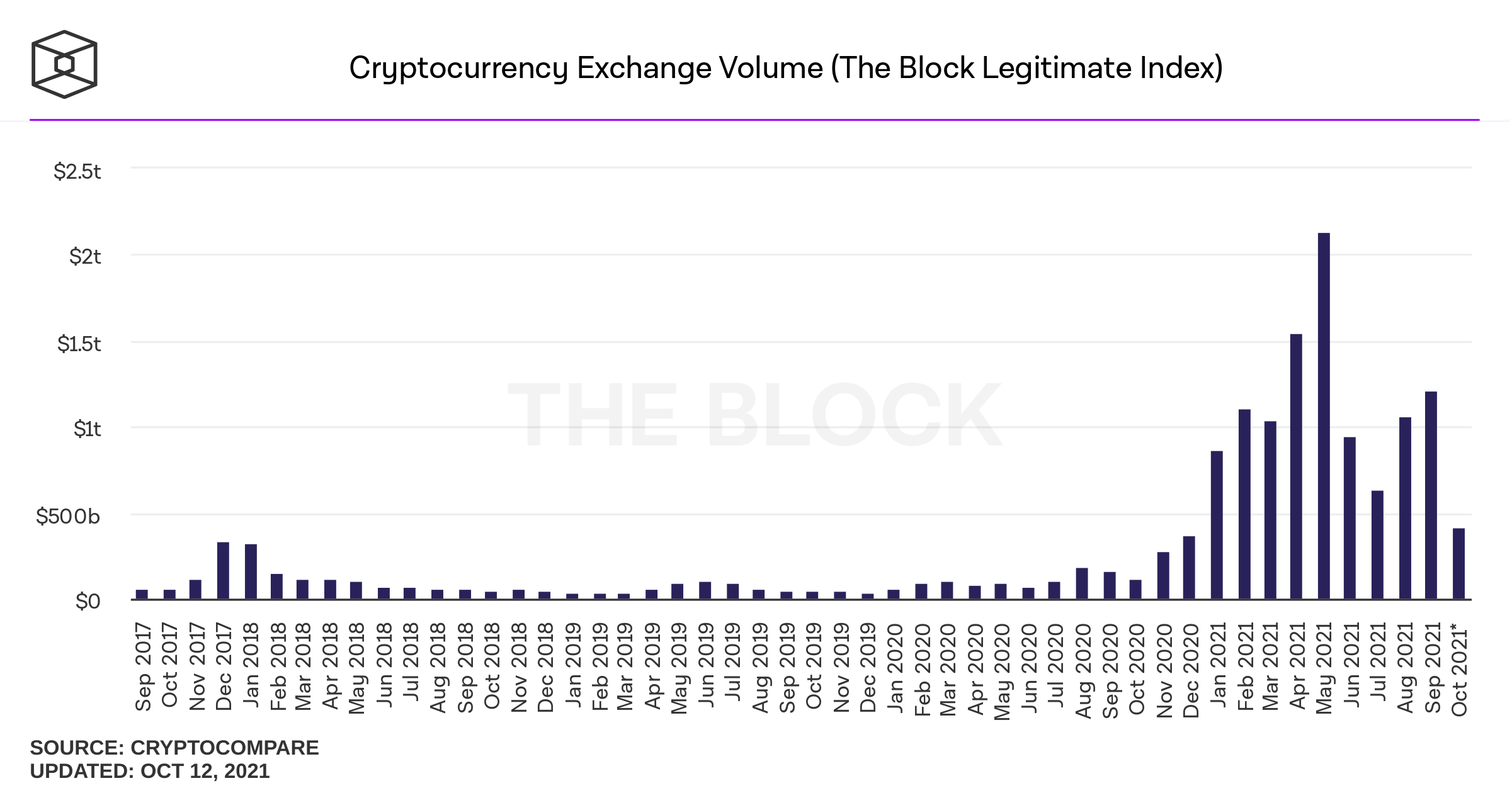

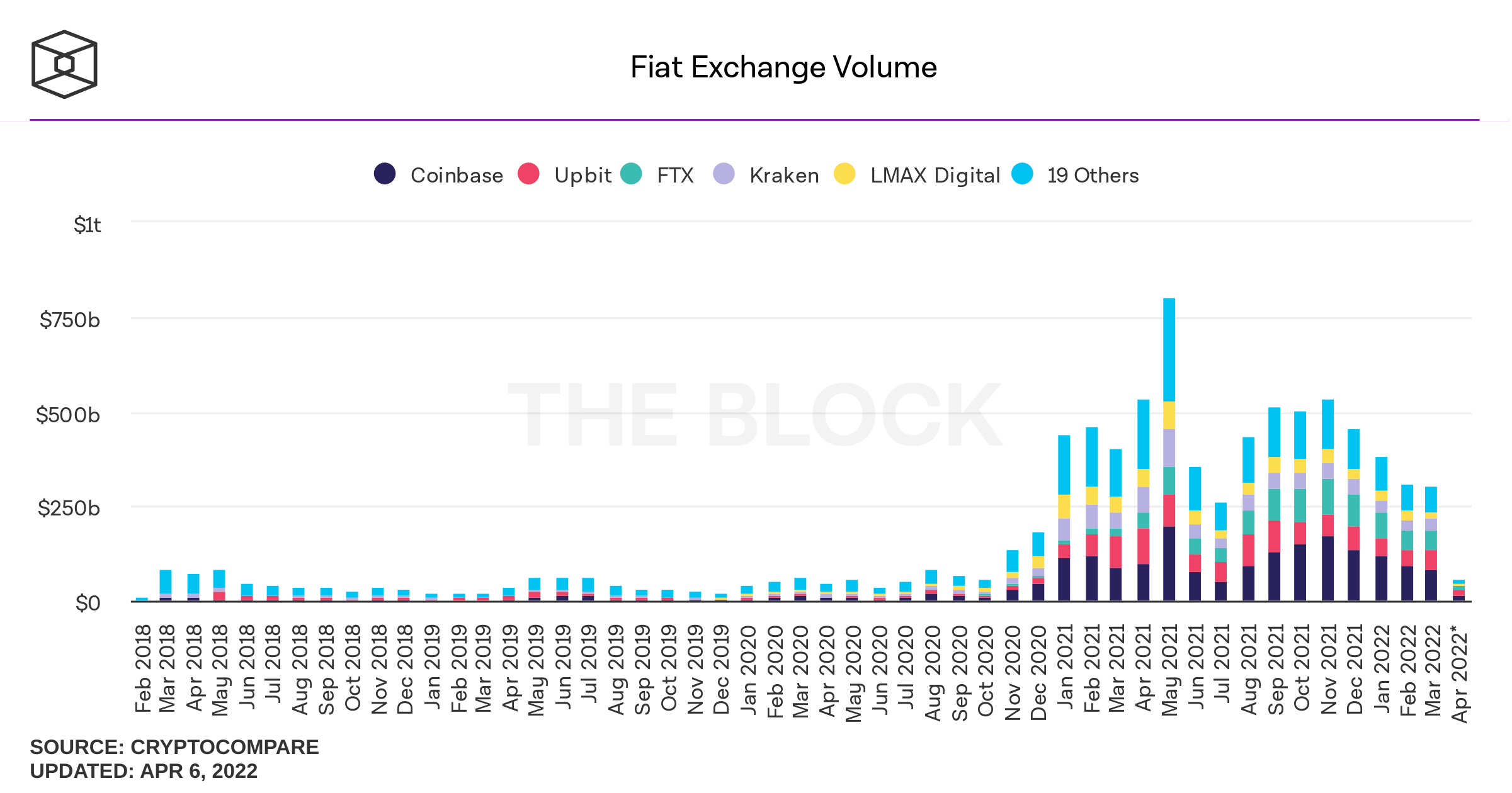

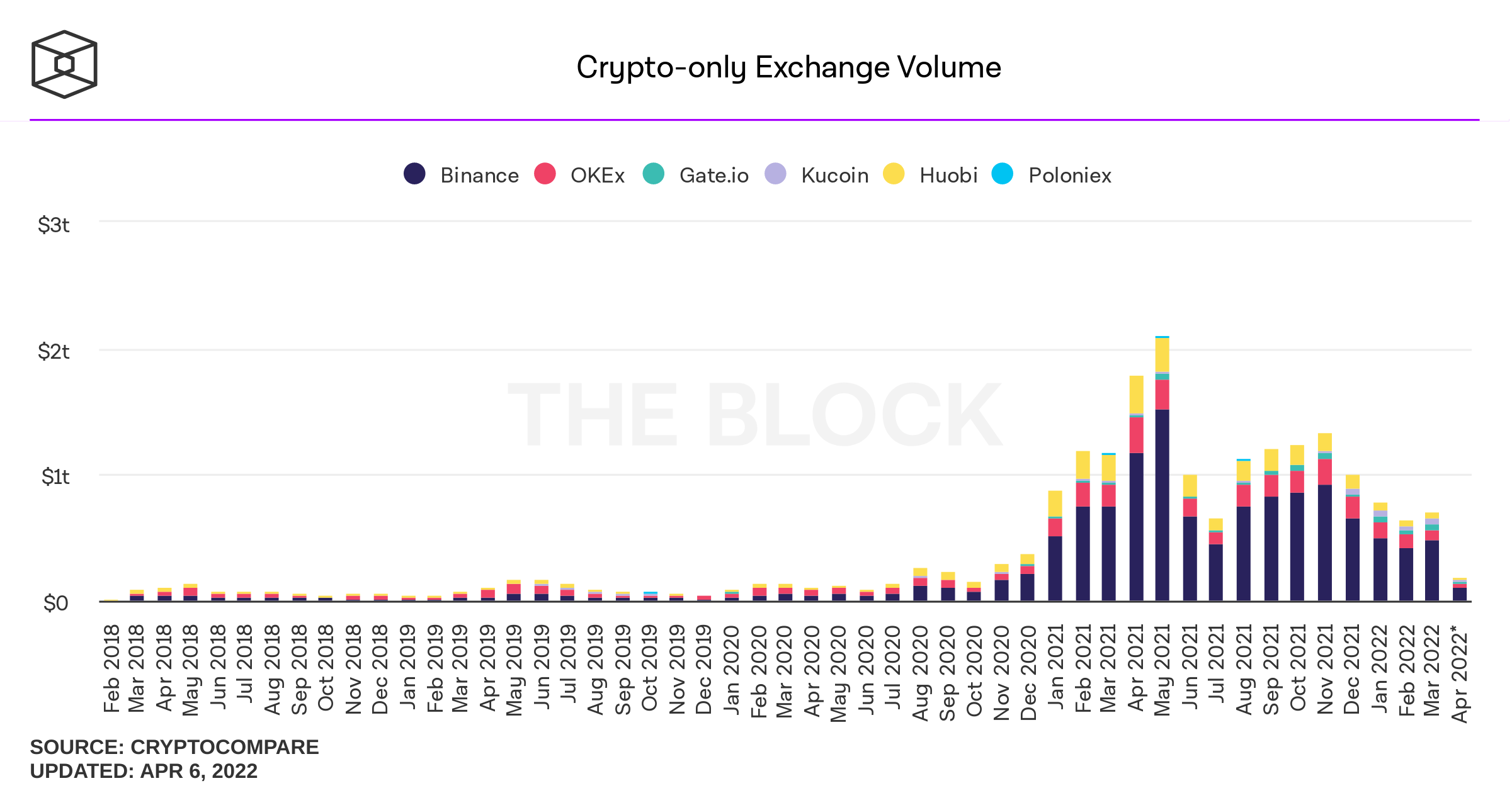

Some Stylized Facts on Crypto Trading

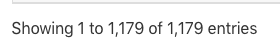

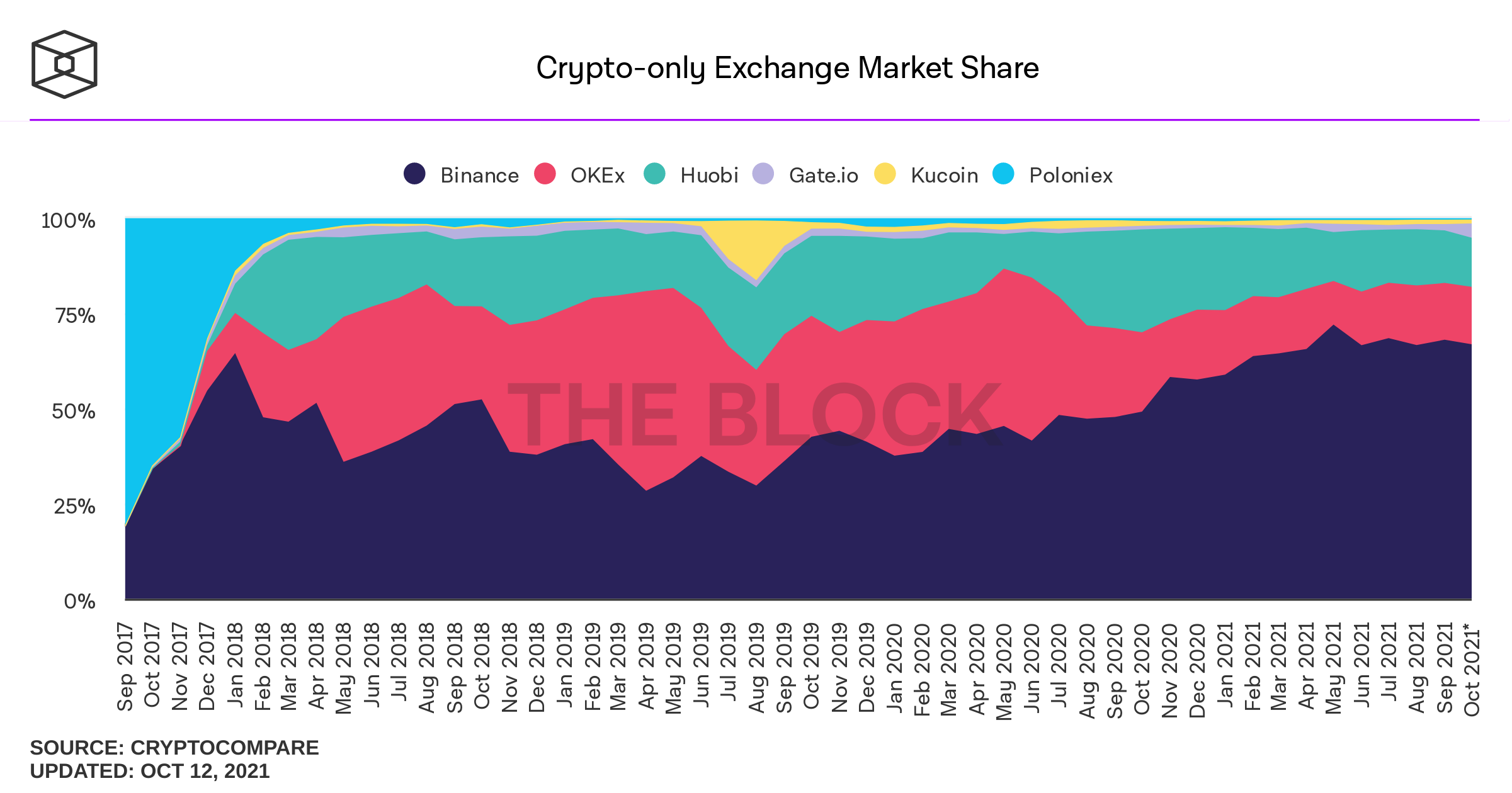

How many CEXes are there?

(307 CEX, rest DEX)

What are the differences?

What do they trade?

Link to traditional finance?

- spot trading

- derivatives

- crypto-only

- "fiat" linked

- regulation

- cryptos traded

- accessibility

- privacy

- credibility

approx:

400B p.m.

approx:

700B p.m.

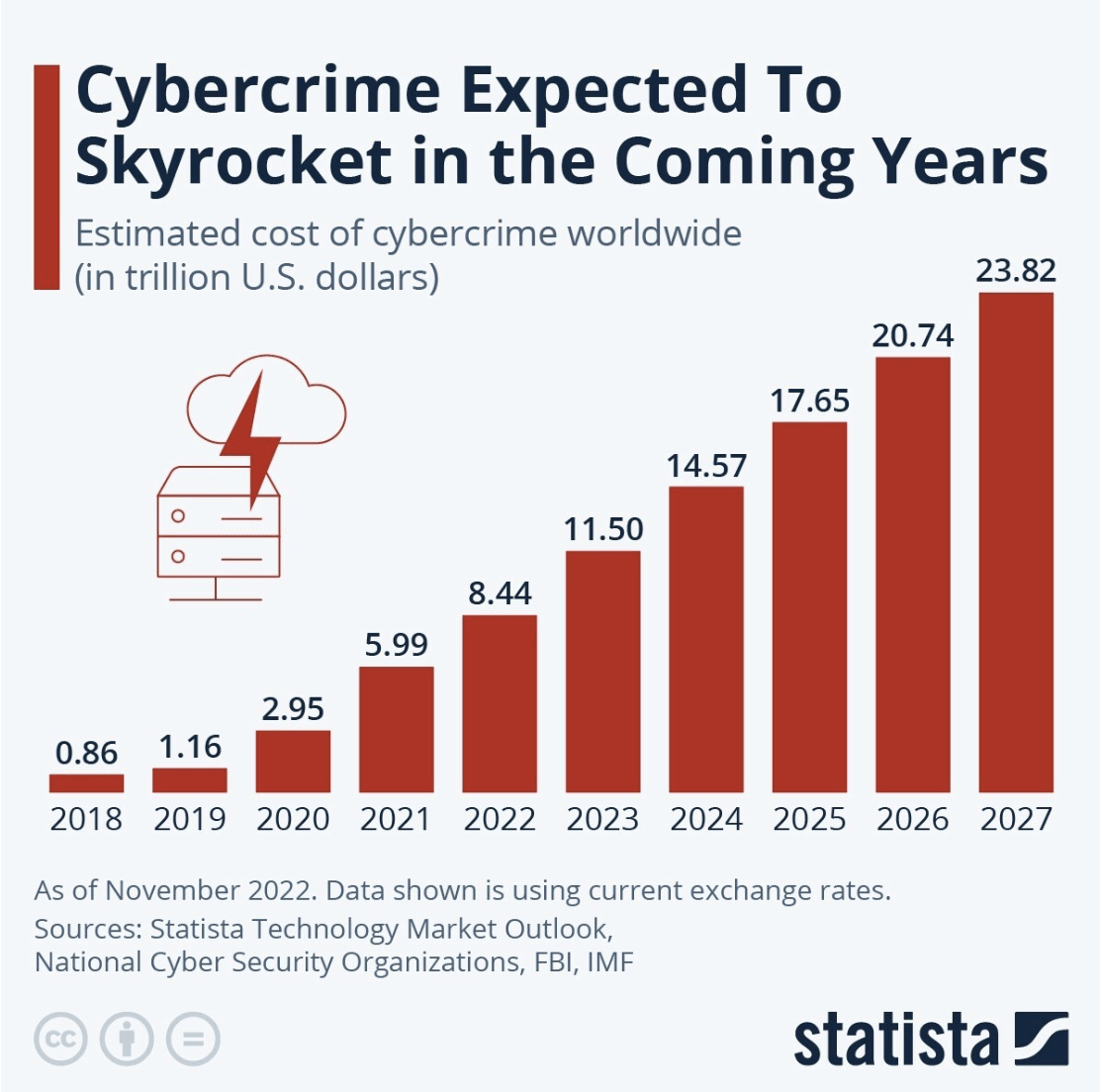

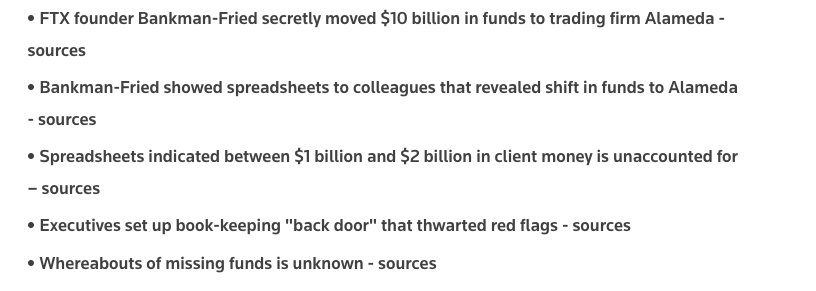

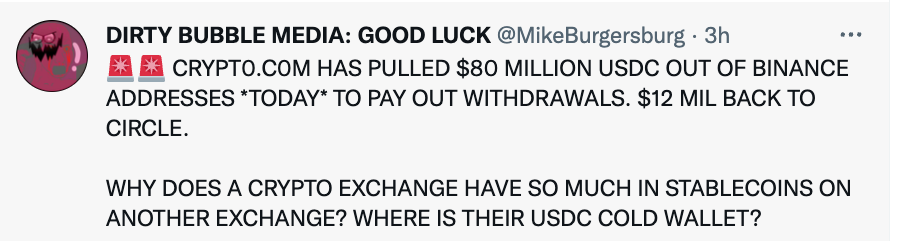

Concerns with CEX-Trading

CEX = Offramps for criminals

More broadly: cybercrime costs: in trillions!

World Economic Forum:

- growing cyber inequity

- the highest barrier to cyber resilience is transforming legacy technology and processes.

Role for blockchain?

Costs vs benefits of decentralization?

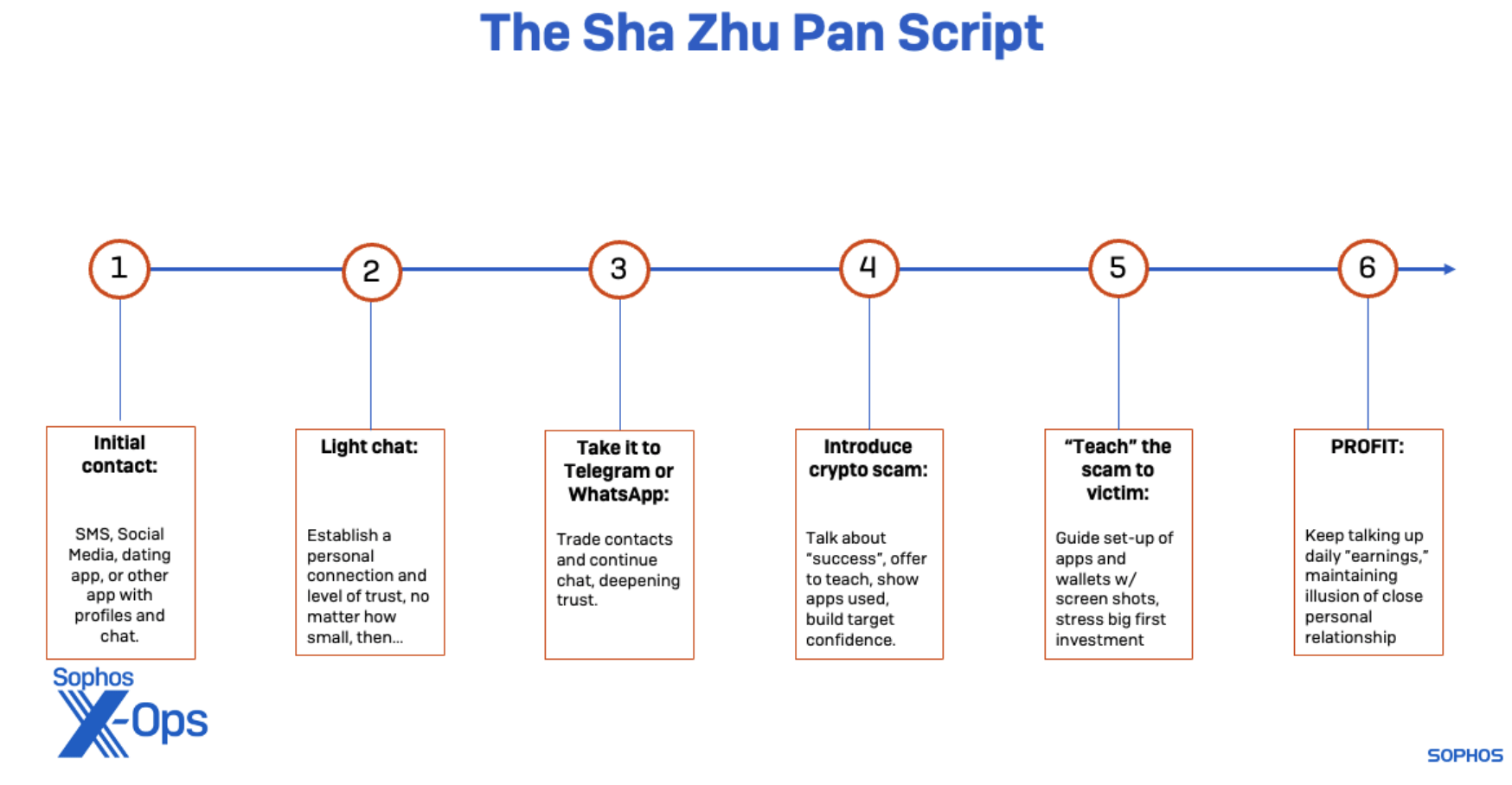

The Sha Zhu Pan (Pig Butchering) Script

UN REPORT 2023:

- \(\ge\) 120,000 people in Myanmar & \(\ge\) 100,000 in Cambodia

- “may be held in situations where they are forced to carry out online scams.”

- “may be held in situations where they are forced to carry out online scams.”

- scam industry in one (unnamed) Mekong nation alone “may be generating $7.5 to $12.5 billion”

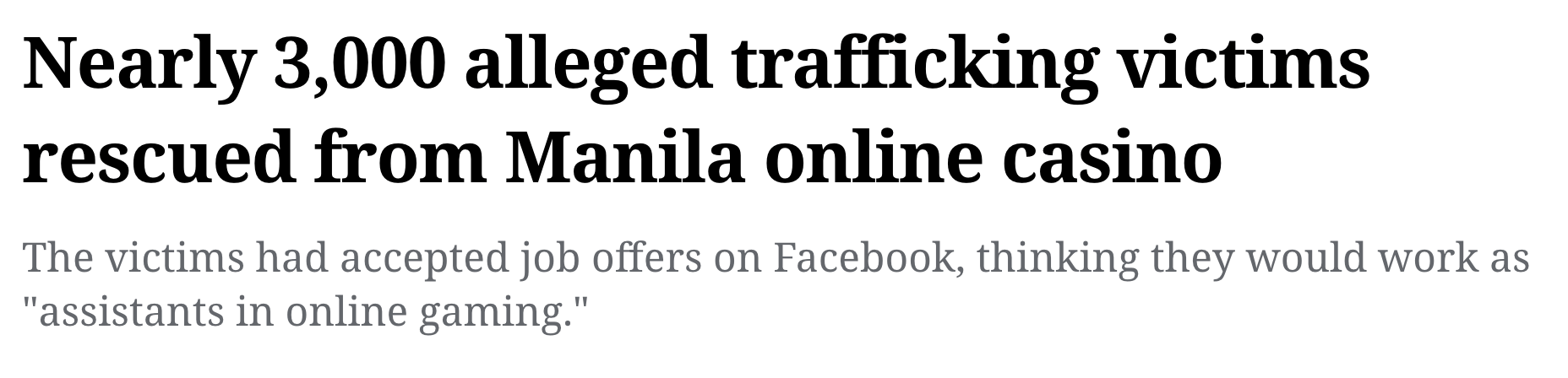

What does it have to do with slavery?

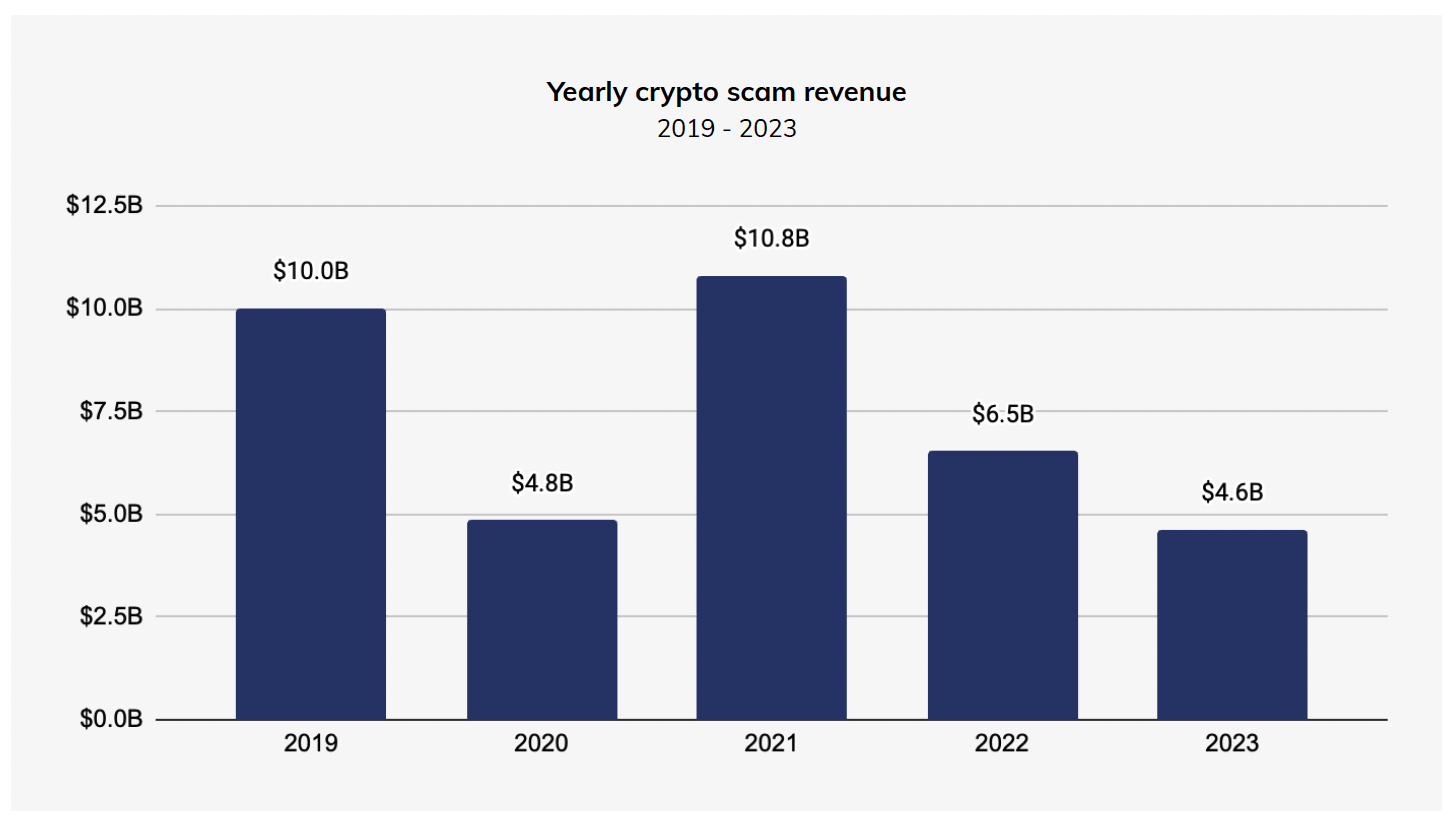

How Do Crypto Flows Finance Slavery? The Economics of Pig Butchering => $75B (!!) lost to pig-butchering scams

Text

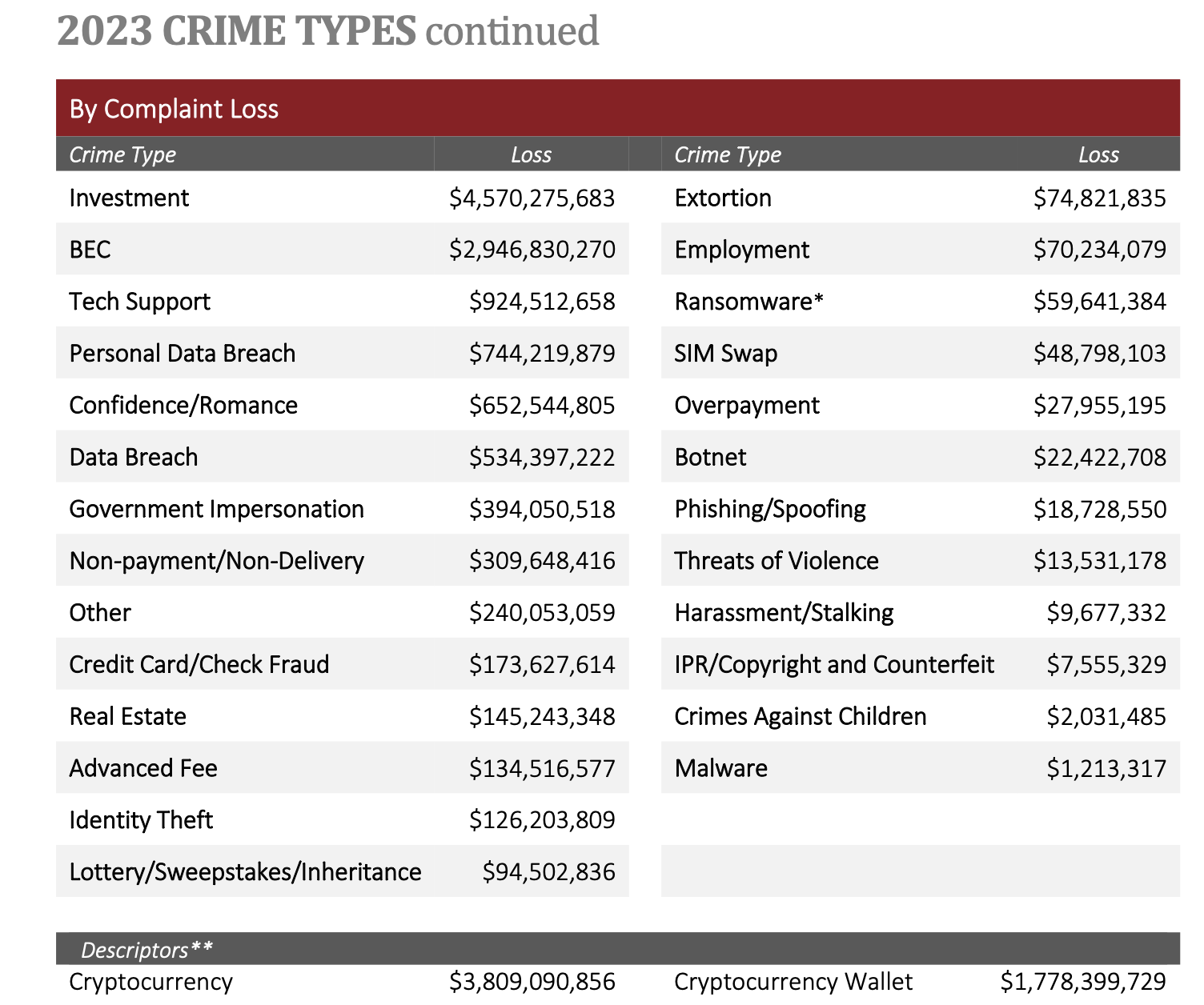

The $75.3 billion number

FBI Internet Crime Complaint Center Report (IC3)

Investment: $4.57B

Business Email Compromise: $3B

...

Confidence/Romance: $0.65B

Crypto-related totals: $5.6B

The $75.3 billion number

$26B Total Crypto Scam Revenue in 2020-2023

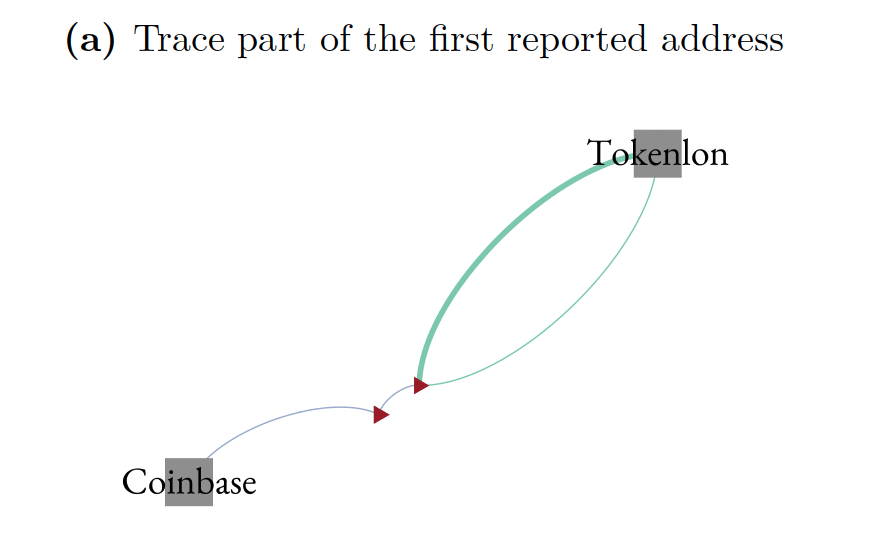

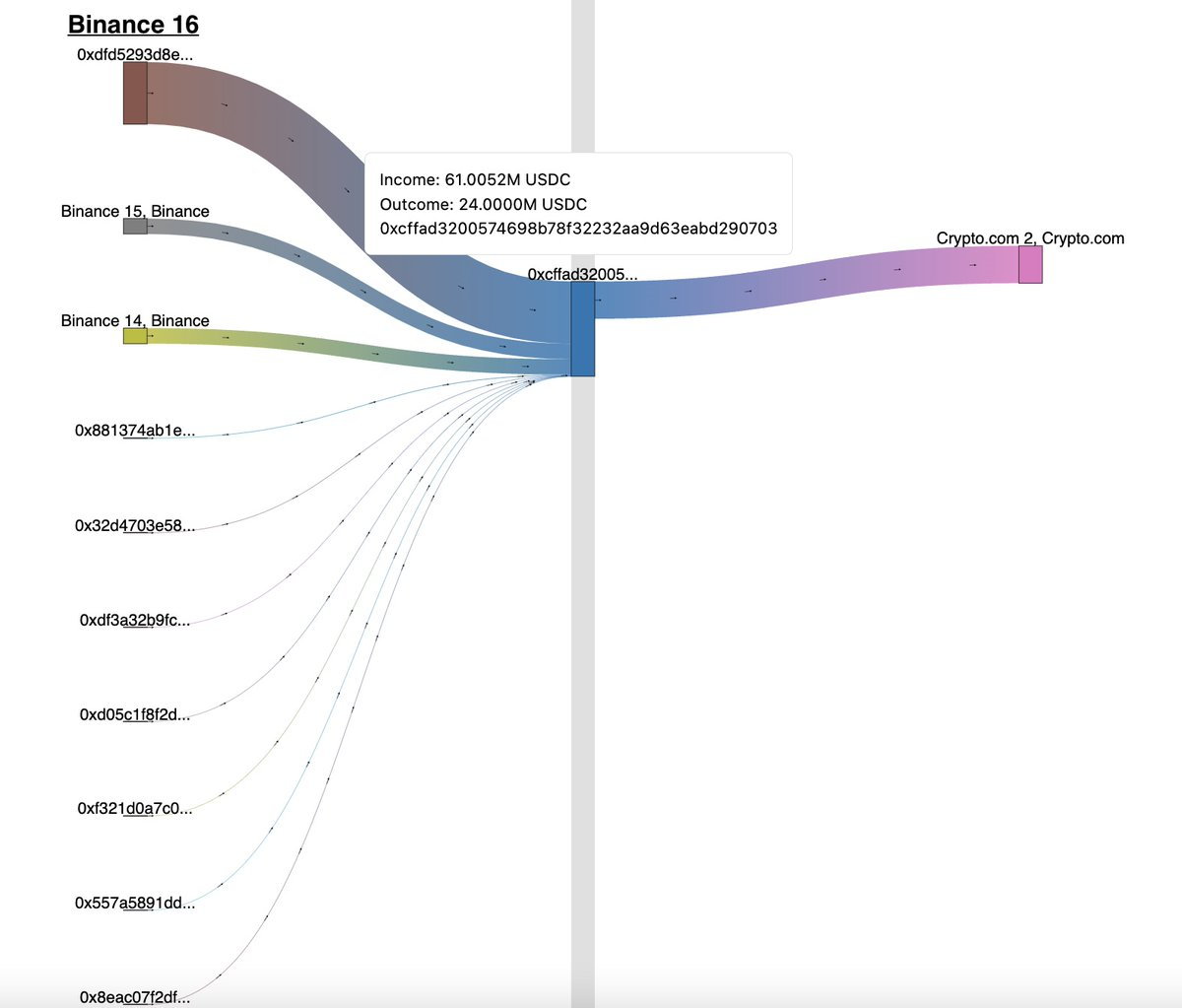

The $75.3 billion number: Tracing

Reported Scammer Address

focus on Ethereum paths that start from exchange wallets sending funds

to scammer addresses and end at user deposit addresses

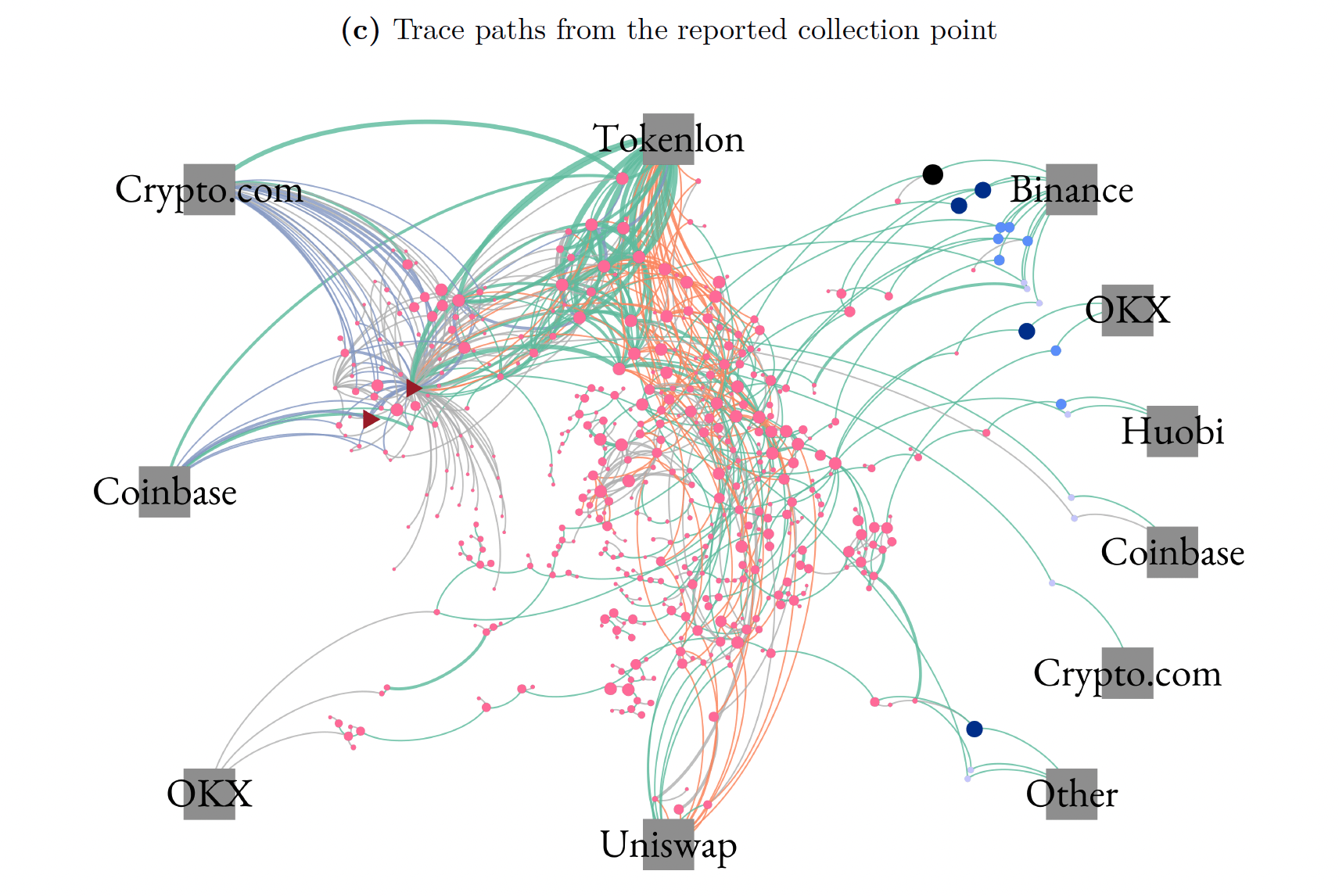

The $75.3 billion number

Reported Scammer Address

"Deposit Addresses"

at Exchanges

Concern 1: "tool includes proprietary

criteria to terminate a trace path if funds reach an address that is unlikely to be a scammer"

"Deposit Addresses"

at Exchanges

Deposit Addresses

at Exchanges

"sum all inflows to these addresses and find $75.3 billion"

Concern/Question 2: addresses may belong to entities that service other (illicit?) activities?

- Illegal gambling?

- Avoiding China Capital Controls?

Question 3: How much money EXIT the exchanges?

Comment/Concern 1B:

- collect 1,065 addresses

- the United States

Institute of Peace (USIP) shared a large set of additional addresses - "apply screens"

- \(\to\) 4,728 addresses

Comment/Question 4:

- The scam tactics have evolved

- No longer "send money to the [scammer] address"

Concerns

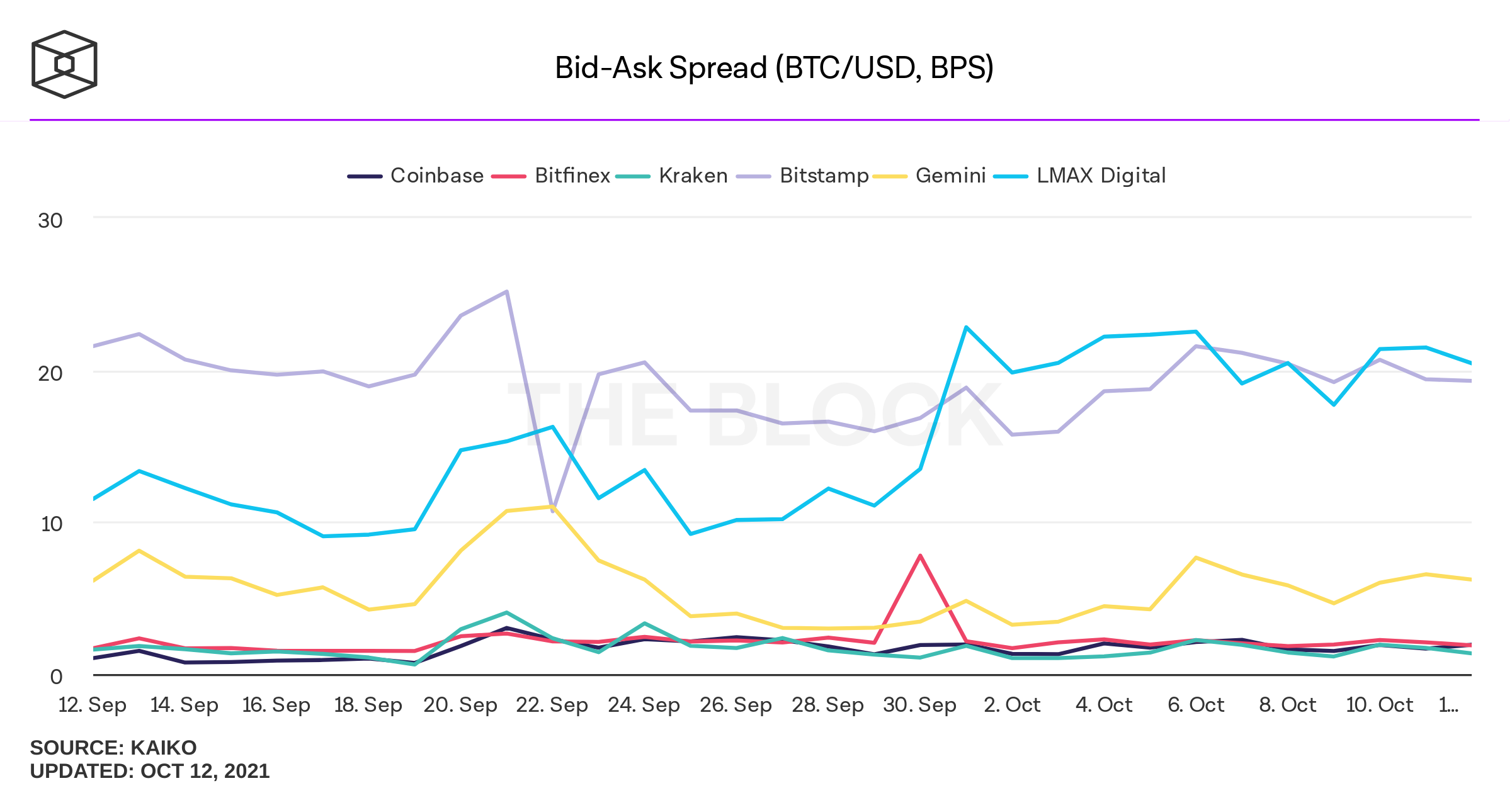

arbitrage is either not possible or requires large capital commitment => expensive

exchanges = brokers? => single point of failure

decentralized: totally anonymous => easy price manipulation (e.g. wash trades)

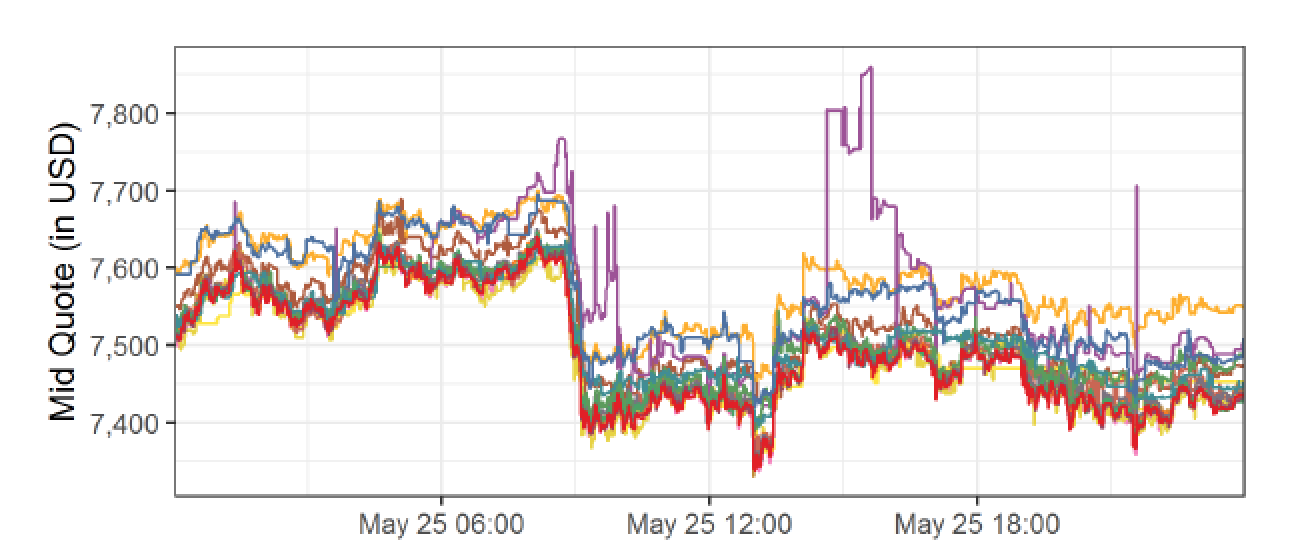

Bitcoin prices in USD, May 25 2018, 17 exchanges

Arbitrage?

Pre-req for Trading on a Crypto Exchange

trade

Settle on the blockchain for digital "assets"

Wire transfer for fiat

Arbitrage on a Crypto Exchange

BTC/USD

ask: 7,600

bid: 7,550

BTC/USD

ask: 7,500

bid: 7,450

buy low

sell high

Arbitrage on a Crypto Exchange

BTC/USD

ask: 7,600

bid: 7,550

BTC/USD

ask: 7,500

bid: 7,450

buy BTC

sell BTC

move BTC to Kraken

=> arbitrage = commit capital on multiple exchanges

Arbitrage on a Crypto Exchange

Wire: free*; 1-5 days

Credit card: 3.5%

trading fee: 10-25 bps

flat fee in BTC \(\approx\) $4-8

\(\approx\) 10-60 minutes

trading fee: 0-26 bps

35 USD + 0.125%

($5 if >$50,000)

1-3 business days;

possible other fees/delays

Some exchanges allow short selling

Crypto Wash Trading, Lin William Cong, Xi Li, Ke Tang, Yang Yang

- systematic tests:

- robust statistical and behavioral patterns in trading to detect fake transactions on 29 cryptocurrency exchanges.

- Regulated exchanges are OK

- unregulated exchanges: rampant manipulations

- wash trading on each unregulated exchange:

- on average over 70% of the reported volume

- improve exchange ranking

- temporarily distort prices

Volume Manipulation on Crypto Exchanges

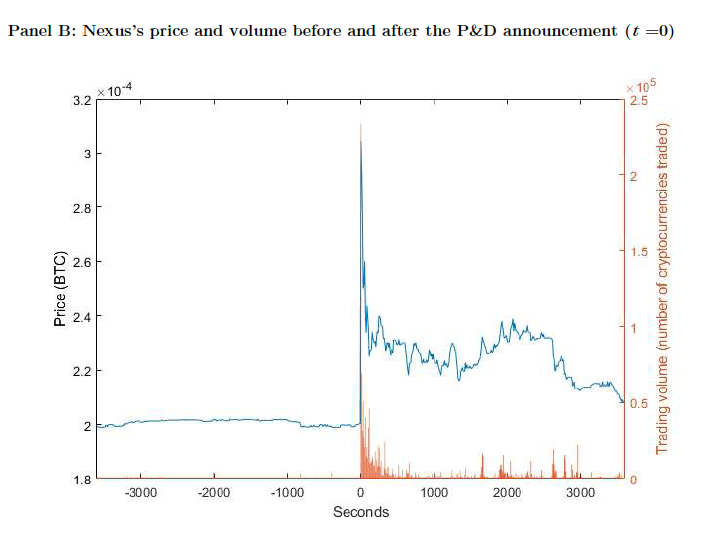

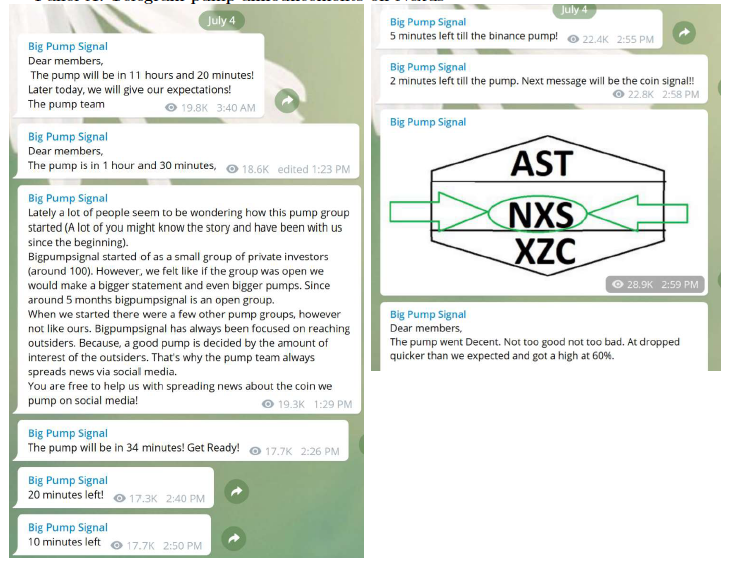

Cryptocurrency Pump-and-Dump Schemes

Tao Li, Donghwa Shin, and Baolian Wang, 2020

What is pump and dump?

arranged via Telegram Channels

Price Manipulation on Crypto Exchanges

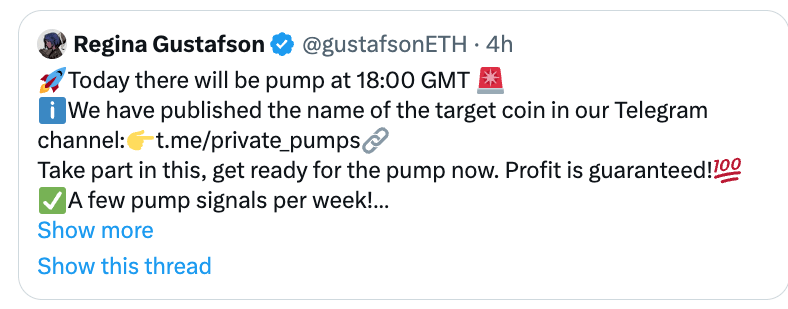

Still going strong -

this one is from Nov 25, 2023

- prices of pumped cryptocurrencies begin rising five minutes before a P&D starts.

- some pump group organizers offer premium memberships to allow certain investors to receive pump signals before others do (\(\to\) insiders)

- Average P&D insiders make one Bitcoin (about $10,000) in profit

- only investors who buy in the first 20 seconds after a P&D begins make a profit

Other Tidbits of Information

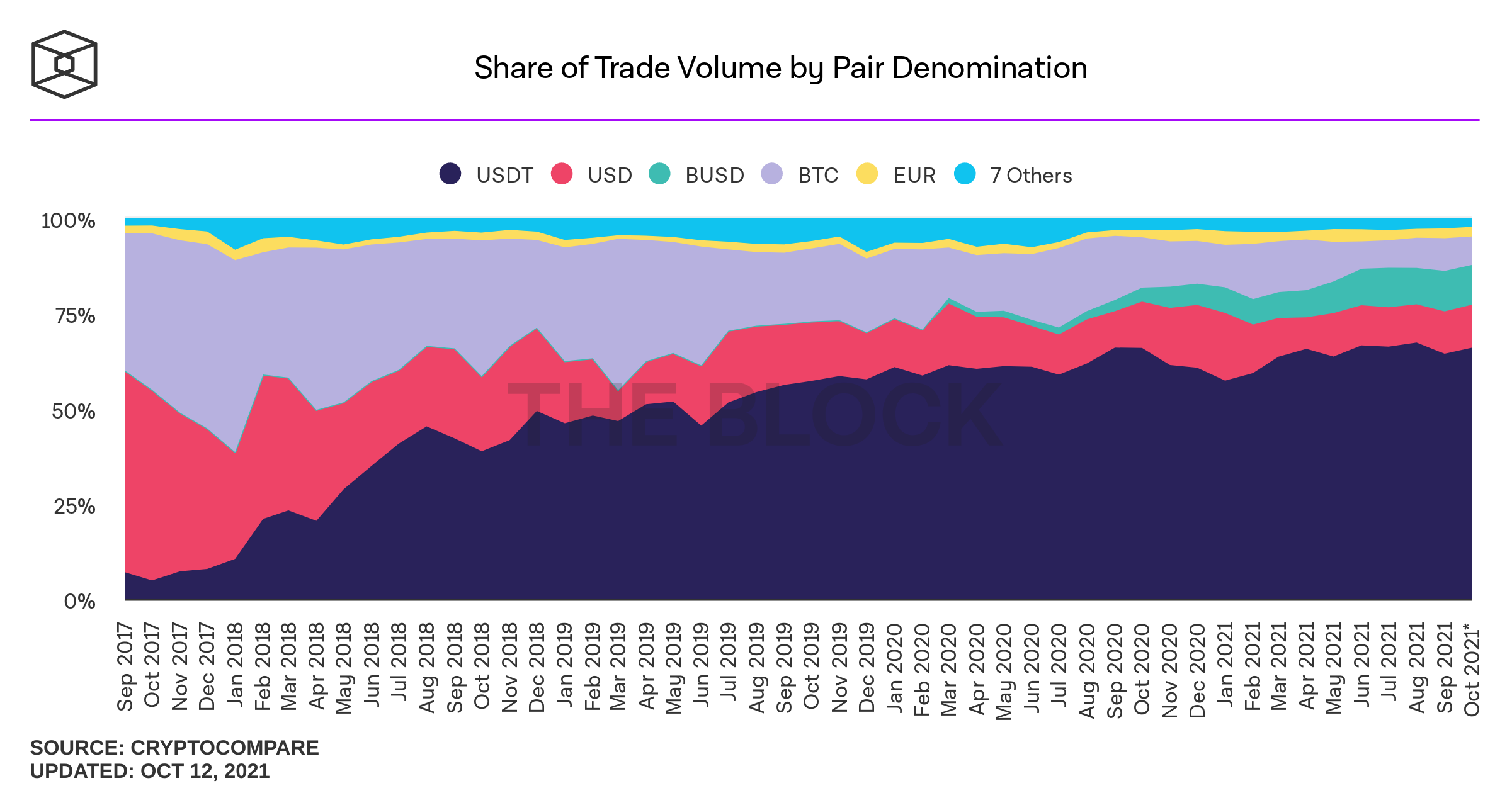

IS BITCOIN REALLY UN-TETHERED? JOHN M. GRIFFIN and AMIN SHAMS

Journal of Finance 2020

- basic idea: USDT is issued unbacked to trade Bitcoin and to inflate its price

- more on the next slides...

Price Manipulation on Crypto Exchanges

What's the result?

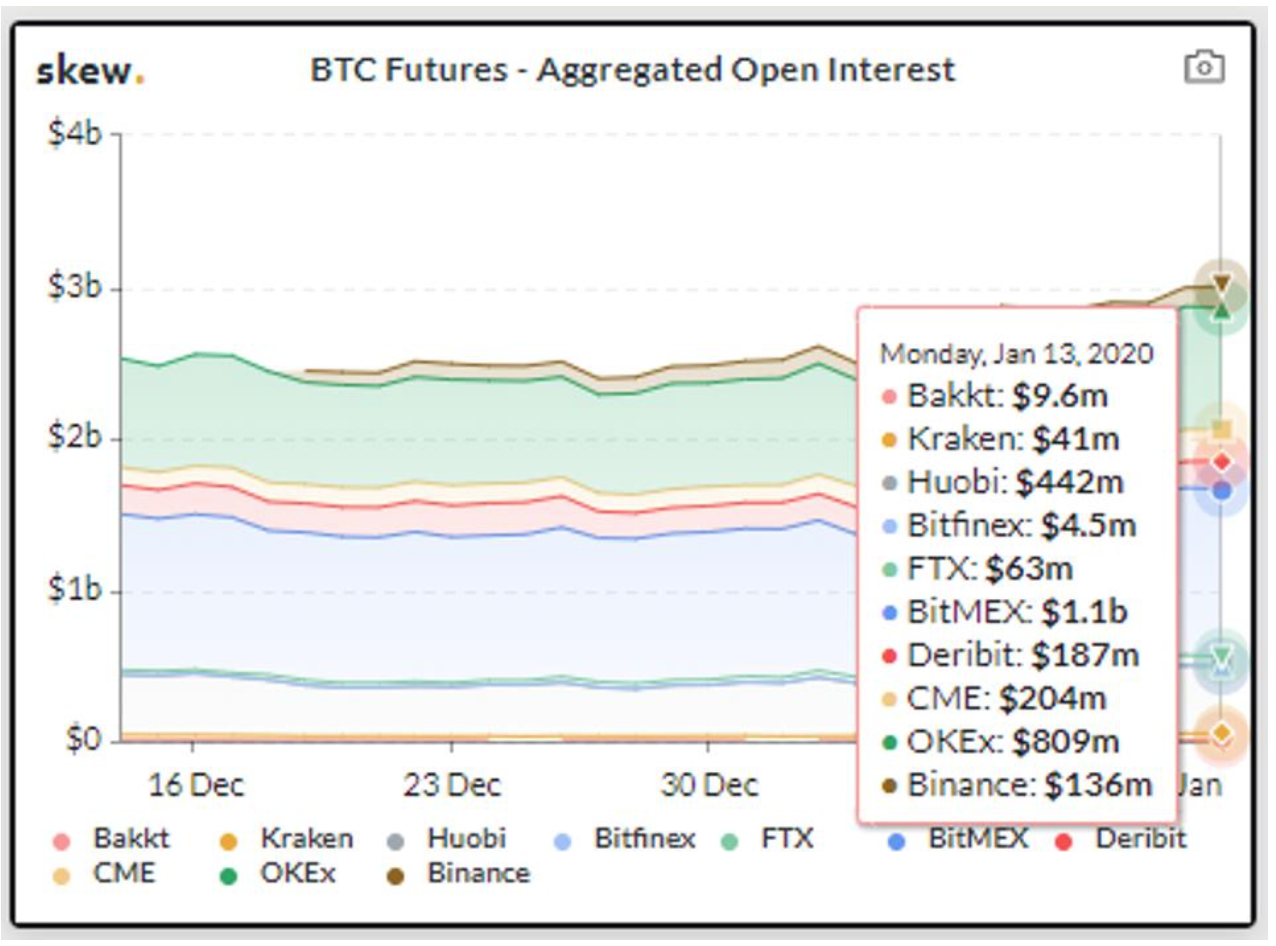

Regulated Exchanges

Derivatives trade mostly offshore! Unregulated(?!)

- on April 30, 2019: Tether does not have cash reserves equal to 100% of the outstanding Tethers.

- May 15, 2019 court hearing: Tether did invest in instruments beyond cash, including Bitcoin

Historically: “Tether Platform currencies are 100% backed by actual fiat currency

assets in our reserve account.”

Today: "The Tether Platform is fully reserved when the sum of all tethers in circulation is less than or equal to the value of our reserves."

IS BITCOIN REALLY UN-TETHERED?

JOHN M. GRIFFIN and AMIN SHAMS

Journal of Finance 2020

vs.

Why does that matter?

- Tether = ‘pushed’

- print an unbacked digital dollar to purchase Bitcoin.

- \(\to\) additional supply of Tether creates unwarranted inflation in Bitcoin price

Text

IS BITCOIN REALLY UN-TETHERED?

JOHN M. GRIFFIN and AMIN SHAMS

Journal of Finance 2020

vs.

- Tether = ‘pulled’

- driven by legitimate demand from investors who use Tether as a medium of exchange

- \(\to\) the price impact of Tether reflects natural market demand

Text

IS BITCOIN REALLY UN-TETHERED?

JOHN M. GRIFFIN and AMIN SHAMS

Journal of Finance 2020

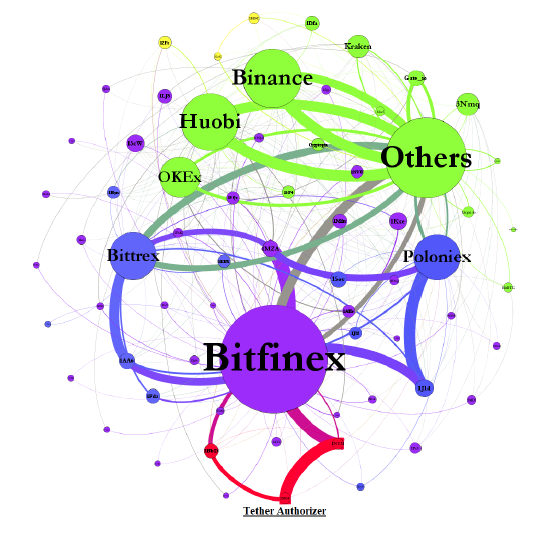

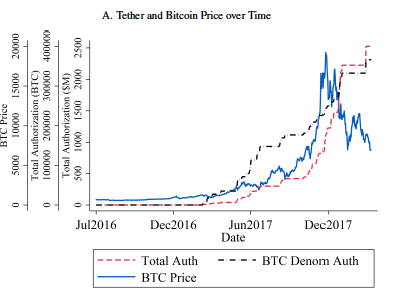

Flow of events

- Tether is authorized

- moved to Bitfinex

- then slowly distributed to other Tether-based exchanges (Poloniex and Bittrex)

- \(\to\) almost no Tether returns to the Tether issuer to be redeemed

- Kraken (major exchange for Tether\(\to\) USD) accounts for only a small proportion of transactions

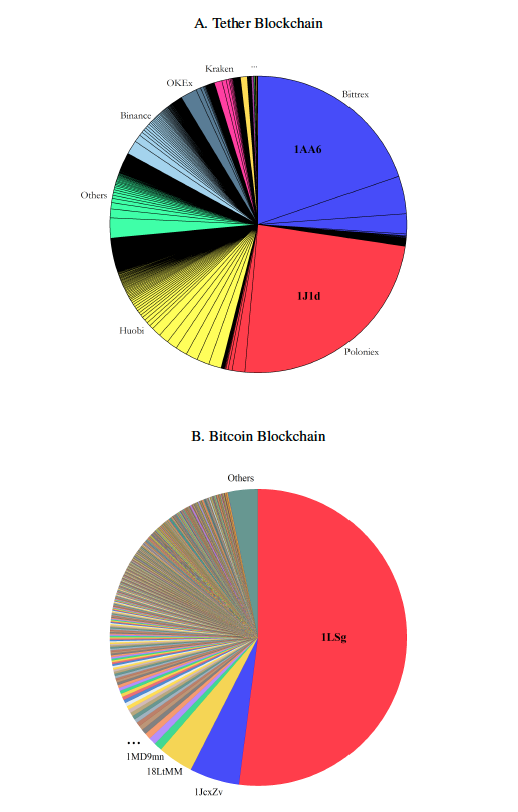

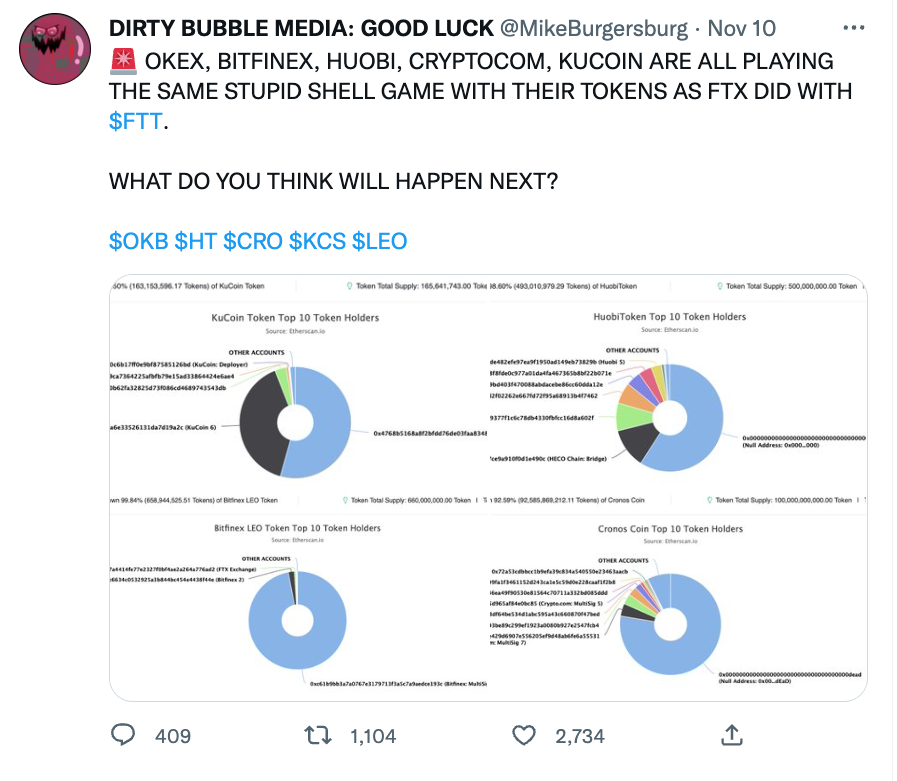

Figure 1. Aggregate Flow of Tether between Major Addresses

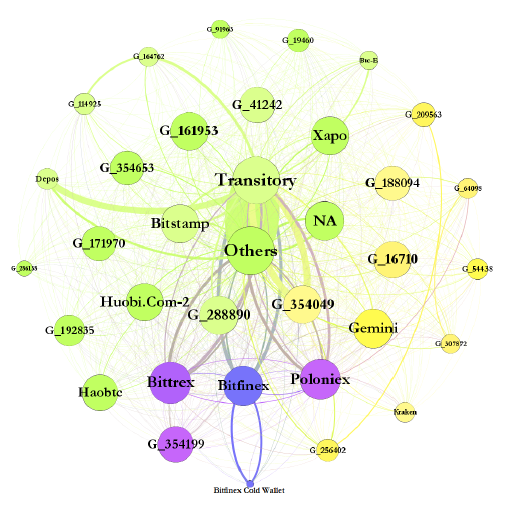

Figure 3. Aggregate Flow of Bitcoin between Major Addresses.

Top Accounts Associated with the Flow of Tether from and Bitcoin to Bitfinex

- three main Tether exchanges, Bitfinex, Poloniex, and Bittrex, have considerable cross-exchange Bitcoin flows

- cross-exchange Bitcoin flows on Bitcoin closely match Tether flows

- one large player has >50% of the exchange of Tether for

- Bitcoin at Bitfinex

- \(\to\) distribution of Tether into market from ONE large player and not many different investors

If Tether is printed independently

of demand and pushed onto the market then ...

- \(\nearrow\) money supply in crypto

- \(\nearrow\) cryptocurrency prices through artificial demand

- if traded strategically, Tether can further impact and manipulate Bitcoin prices

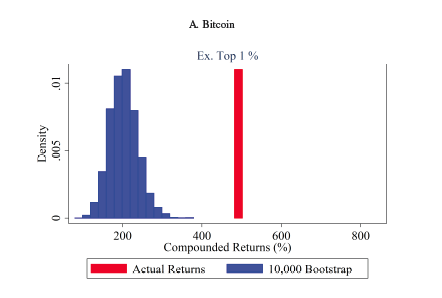

the 1% of hours with the strongest lagged Tether flow are associated with 58.8% of the Bitcoin buy-and-hold return over the period.

Is the Price Effect Economically Important?

the "normal-times" returns

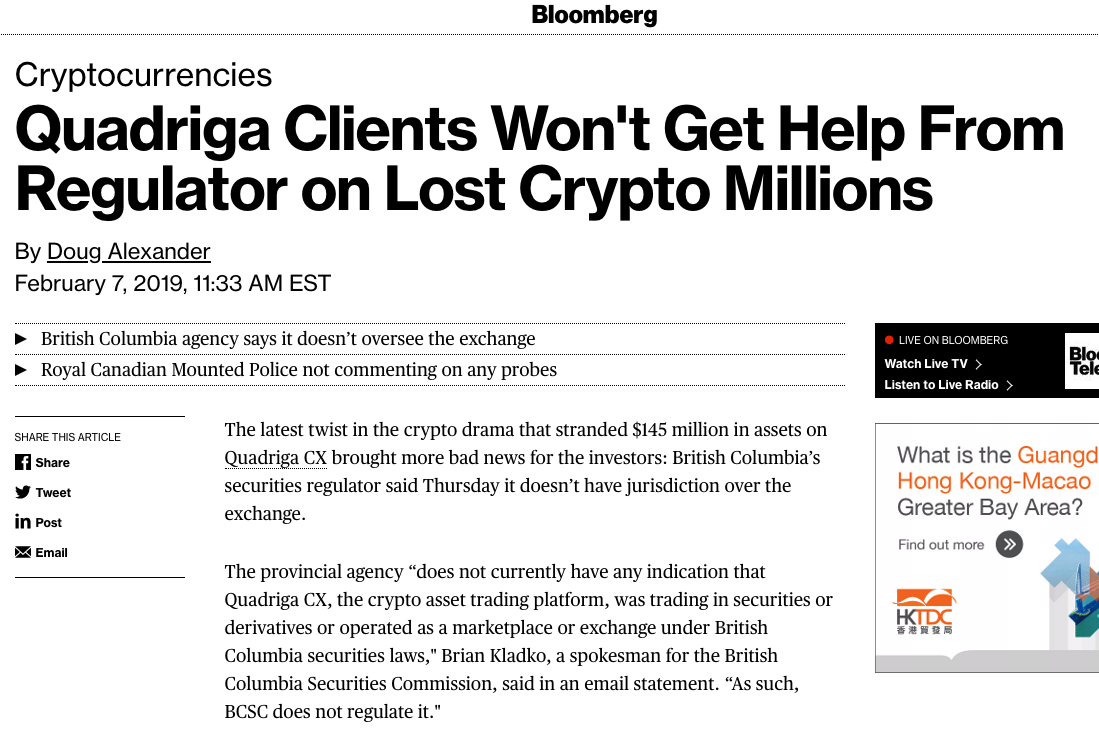

Crypto exchanges are a security risk

August 2016

Crypto exchanges are a security risk

By yours truly, Dec 2017: "What really concerns me about the current craziness is the role of the cryptocurrency exchange platforms, such as Coinbase, Quadriga, or Bitfinex, which most people use to buy Bitcoins. These are like banks that hold deposits. For cryptocurrencies to succeed it is critical that these interfaces with the real world are financially robust. Are they? Do they have all the Bitcoins they sell? Can they always satisfy depositors’ demands?"

Crypto exchanges are a security risk

https://www.forbes.com/sites/jasonbrett/2019/12/19/congress-considers-federal-crypto-regulators-in-new-cryptocurrency-act-of-2020/#7ddcdfd65fcd

Crypto exchanges are a security risk

https://www.osc.ca/en/news-events/news/osc-working-ensure-crypto-asset-trading-platforms-comply-securities-law

SEC denies Bitcoin ETF

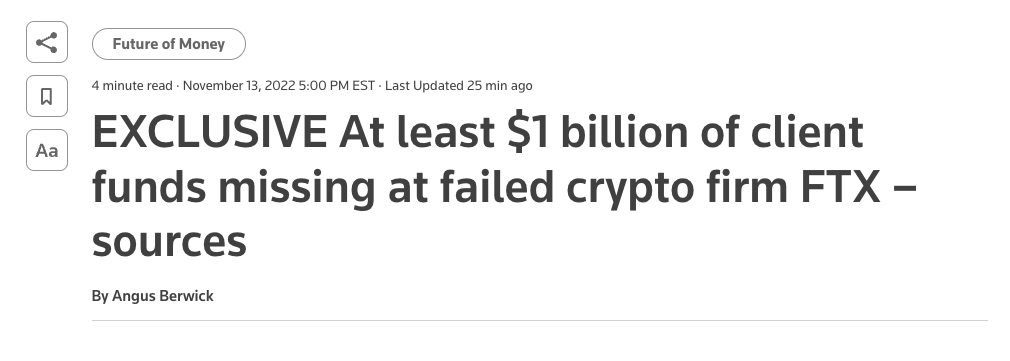

The FTX Collapse

The Terra Implosion

UST Stablecoin

LUNA (cryptocurrency of the TERRA network)

A timeline

May 7: selling pressure on UST from Curve withdrawals

May 12: LUNA and UST at $0.01

June 27: Three Arrows Capital ordered to liquidate

June 12: Celsius Network suspends withdrawals

July 13: Celsius files for Chapter 11

July 6: Voyager Digital files for Chapter 11

July 4: Vault suspends withdrawals

Three Arrows Capital lost >60% of value and faces numerous margin calls that they did not react to

partially saved by \(\ldots\) FTX

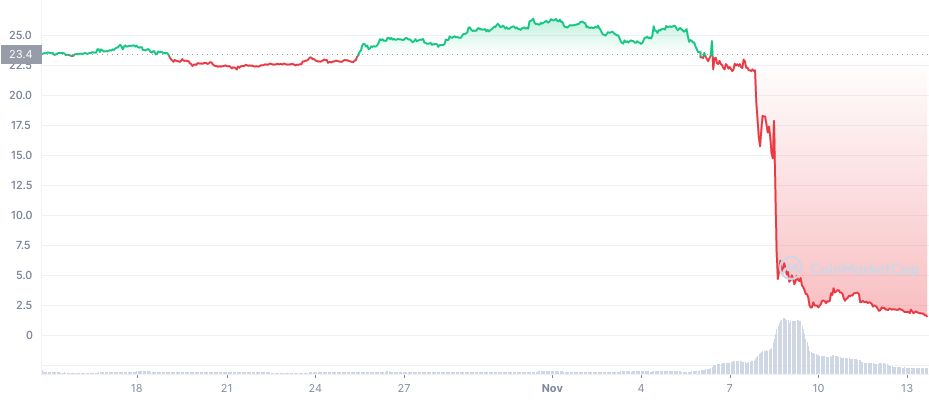

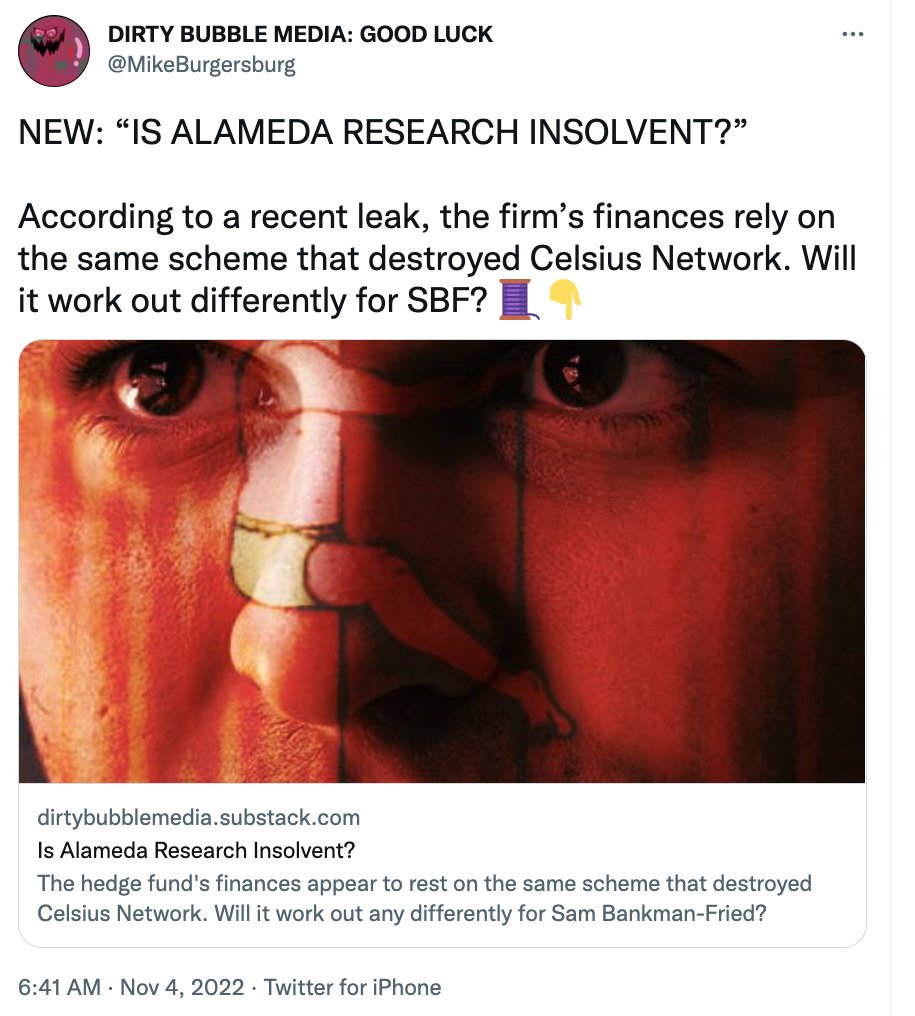

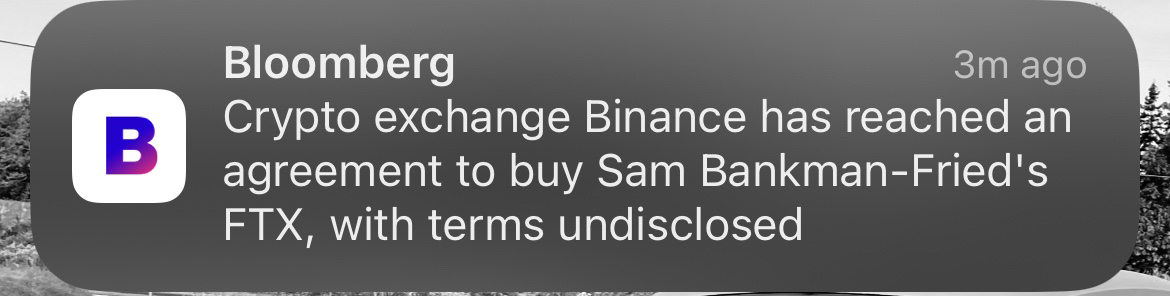

The FTX Implosion

A timeline

Nov 8

What's next?

DEX vs CEX Tradeoffs

|

Option |

Exchange-side risk |

User-side risk |

|

Custodial exchange (eg.Coinbase today) |

User funds may be lost if there is a problem on the exchange side |

Exchange can help recover account |

|

Non-custodial exchange (e.g.Uniswap or dydx today) |

User can withdraw even if exchange acts maliciously |

User funds may be lost if userscrews up |

Source: https://vitalik.ca/general/2022/11/19/proof_of_solvency.html

Core problem with QuadrigaCX:

- Gerry Cotton sold people crypto he did not have.

Core problem FTX

- used customer funds to prop up their market maker Alameida

- => they gave Alameida customer assets

In finance terms

- call it unhedged "leverage"

- hedge means that you have an off-setting position

Possible solution

- prove your aggregate positions:

- prove your assets & liabilities

- if asset = liabilities \(\Rightarrow\) solvency

Source: https://vitalik.ca/general/2022/11/19/proof_of_solvency.html

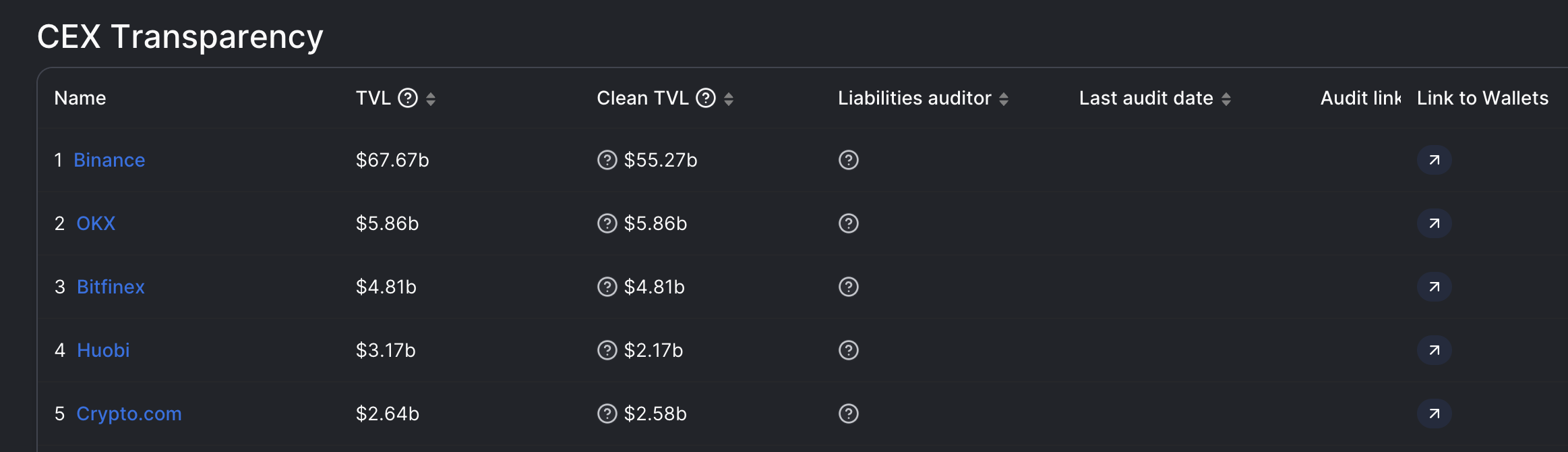

Core Problems with CEXes

-

Assets: cash in bank accounts and crypto assets in exchange wallets

-

Liabilities: crypto and cash deposits made by customers

-

Proof of cash assets

-

requires an auditor report

-

-

Proof of crypto asset

-

publish all exchange wallets

-

problem: cold storage

-

proof of control: shift assets from one address to another at a pre-determined time

-

-

Proof of liabilities

-

public customer balances - customer can check

-

own holding

-

positive customer balances

-

sums to assets

-

-

-

Problem: privacy

-

Solutions:

-

hash of customer

-

Merkle tree-type organization

-

zero-knowledge proofs

-

-

Proof of assets & liabilities

Core Problems with CEXes

The Regulator's View

Canadian View

- Heavily influenced by QuadrigaCX debacle

- Custody questions paramount (how stored, how accessible, what risks)

- Custody = crypto trading platform (CTP) offers a security (irrespective of the underlying)

- Requirement on due diligence when listing

- Current $50K limit for new purchases

- CTP must register with IIROC (which has no process)

- Only BitBuy is compliant, some are in "Sandbox"

Summary

Main differences

Trading in Equity vs Crypto

- regulated environment

- firm trading rules

- listing requirements

- multi-step process

- complicated settlement

- many intermediaries

Equity Market

Crypto Market

- emerging regulatory environment

- 500+ CEXes worldwide

- use of intermediaries is a choice

- crypto exchange are closer to brokerages than equity exchanges

- settlement a choice and straightforward

- fully decentralized trading is possible and most exiting innovation

- much work remains to be done