The Crypto Eco-System &

Regulation in 2022

Presenter: Andreas Park

Why are Blockchains challenging for current regulation?

What is blockchain=crypto? Some basic facts

anyone can use it

a open, general-purpose

digital value management tool

that maintains digital scarcity

ownership & control is direct and not intermediated

it's a protocol, not a thing

it does not belong to anyone

practically impossible to prevent the creation of code

borderless and digital

does not require high tech, a laptop is enough

requires use of tokens

What is blockchain=crypto? Some basic facts

anyone can use it

a open, general-purpose

digital value management tool

that maintains digital scarcity

ownership & control is direct and not intermediated

it's a protocol, not a thing

it does not belong to anyone

practically impossible to prevent the creation of code

borderless and digital

does not require high tech, a laptop is enough

requires use of tokens

Blockchain and Investment Contracts

The Investment Process

issuers

investors

- funding

- record-keeping

- instruments

- custody

- advice

- trading

services

needed & provided

- takes care of custody and allows self-custody

- allows instrument creation

- enables record-keeping

- allows circumvention of existing institutions

A general purpose value management infrastructure:

intermediaries

separate institutions

- asset custodians

- broker-dealers

- trading platforms

The blockchain reality:

new institutions

emerged that do all three

tokens are often not intended to be investments!

... and that brought us ...

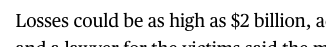

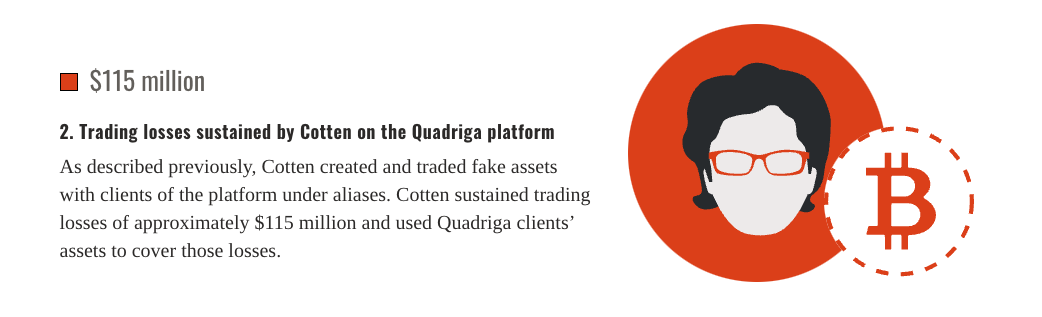

- wash trading

- pump-and-dump schemes

- Bitfinex-Tether price manipulations

- cyber hacks

- epic thefts, "rug pulls," and fraud

The Work of Regulators on Blockchain

- crypto trading platforms and custody risk

- quibble with CFTC on jurisdiction

- enforcement actions

- "almost all crypto-assets are securities"

Regulators' Focus

MiCA

- whitepaper rule

- platforms as money services businesses

The Regulator's Dilemma

The Regulator's Dilemma

benign

crypto-assets

non-benign crypto-assets or crypto-assets that look like securities but are unregistered

crypto-assets that look like securities and are registered

crypto-assets that regulators feel comfortable to be traded on a platform under their supervision

The Regulator's Dilemma

The Reality of Markets

benign

crypto-assets

non-benign crypto-assets or crypto-assets that look like securities but are unregistered

crypto-assets that look like securities and are registered

crypto-assets that you feel comfortable to be traded on a platform under your supervision

The Regulator's Dilemma

Regulator's Dilemma

save custody onshore and save assets only

unsave custody offshore and unsave assets

save custody onshore and unsafe assets

???

Given what people do, what is the bigger evil?

- tokens are a re-imagination of value, ownership, use, rewards, and can assign ownership to "things" that could not be owned before

-

tokens live on a single infrastructure and can interact with other tokens

- tokens are immediately transferable & immediately usable in applications

- token can be programmed to have many features and have many different uses

- tokens are a very useful and often necessary for network externality-based applications

Crypto Asset: Form and Function

- a blockchain is a protocol in which

- users have direct control and responsibility over their assets

- users can create codes at will

- \(\rightarrow\) any user can create tokens and applications

- a creator need not be a business or single person

Concluding Thoughts

Last Words, The Path Forward, And My Wishlist for Santa

- blockchain as an idea will not become uninvented

- there is continuous research & development, including by universities

- when another hype starts, people will want to get their hands on the assets

- blockchains are borderless by design

- "tough" regulation pushes firms outside of jurisdictions

- no regulation can prevent the bankruptcy of an offshore entity

- jurisdictional battles among regulators have to end

- allow risk but prosecute clear fraud

- create checklists for decentralized token issuers

- force crypto trading platforms into transparency:

- focus on leverage

- publish assets and liabilities in real-time

- enable safe onramps and encourage use of on-chain platforms

- backed-stablecoin supervision

Three Scenarios for the Next Five Years

borderless digital economy \(\to\) blockchain-integrated

blockchains \(\to\) stay niche (gaming)

mass tokenizations \(\to\) likely originates from non-Western world