The Microstructure of

Crypto-Asset Trading

Andreas Park

Traditional Markets

What is Market Microstructure?

- How do trading institutions affect market outcomes, e.g.

- trading costs

- information efficiency

- allocative efficiency

- A lot of tricky issues

- no one model can do it all

- complex theoretical problems (e.g., infinite regress)

- large datasets

Broker

Exchange

Internalizer

Wholeseller

Darkpool

Venue

Settlement

Traditional Institutions

Investors

Trading Arrangements

central limit order book

complexity

price impact of trades

anonymity

price discovery

centralized auction

bilateral

negotiation

Request

for Quote

open

outcry

Broker

Exchange

Internalizer

Wholeseller

Darkpool

Venue

Settlement

Investor

Who trades?

- Most of the time there is no "coincidence of wants"

- \(\Rightarrow\) Need intermediating liquidity providers!

- What's there first?

- trader's order \(\equiv\) liquidity provision

- trader's order \(\to\) liquidity provision

- liquidity provision \(\to\) trader's orders

- Deeply affects models and modelling choices

Key question for liquidity provision

- Why is there trading?

- diversification/liquidity shocks

- private information

- arbitrage

Seminal papers

- trader's order \(\equiv\) liquidity provision

- trader's order \(\to\) liquidity provision

- liquidity provision \(\to\) trader's orders

What's there first? Orders or Liquidity?

Seminal papers

- trader's order \(\equiv\) liquidity provision

- Grossman & Stiglitz (AER 1980)

- trader's order \(\to\) liquidity provision

- Kyle (ECTA 1985)

- Grossman & Miller (JF 1988)

- liquidity provision \(\to\) trader's orders

- Glosten & Milgrom (JFE 1986)

- Foucault (JFM 1999)

- people "buy" noisy information

- demand = supply

- price reveals information

- marginal value of info = cost of info

- competitive liquidity provider receives order flow and sets zero-profit price

- noise trader order flow

- monopolist informed trader cautiously trades over time to conceal info

- slope of the price curve measures liquidity

- risk-averse market makers require compensation for risk-taking (position risk)

- liquidity-motivated traders submits order

- what determines the price slope?

- informed and uninformed arrive in random sequence at the market

- market maker posts bid and ask prices that account for info-driven loss

- what determines the spread?

- submit market vs limit order?

- post limit order = trading option for others

- fundamental may change and may not be able to adjust limit order

- gives rise to price slope and spread

Basics of liquidity provision under value uncertainty

- fundamental value up

- \(\Rightarrow\) price up

- \(\Rightarrow\) sell the asset for less than its worth

- \(\Rightarrow\) price up

- fundamental value down

- \(\Rightarrow\) price up

- \(\Rightarrow\) buy the asset for more than its worth

- \(\Rightarrow\) price up

Questions:

- What are the fees/cash sources of income?

- When does/did the value change?

- When do I assess the positional gain/loss?

- liquidity provision = accept a risk

- risk = fundamental value may change (or may have already changed and you don't know it)

every model has some form of structure like

\[\text{trading income (fees, spreads, etc)} +\underbrace{\text{what I sold it for}-\text{value of net position}}_{\text{positional gain/loss}} \ge \text{outside option} \]

Example 1: Grossman/Miller

- Any position is a risk \(\to\) cost

- always over-price the trade to compensate for risk

Example 2: Kyle or Glosten-Milgrom

- trade with informed:

- receive too little/pay too much

- trade with uninformed:

- pay too little/receive too much

- trade-by-trade view

- can either trade on "other" market

- hold asset to maturity

Example 3: Limit order market (a la Glosten 1994)

- trade with uninformed:

- overprice small orders

- trade with informed:

- underprice small orders

Centralized Trading

Issues and concerns with CEX trading

- No shortage of drama!

- A short list of issues

- expensive arbitrage

- price manipulation

- volume manipulation

- security risk

- Google "Lazarus Group"

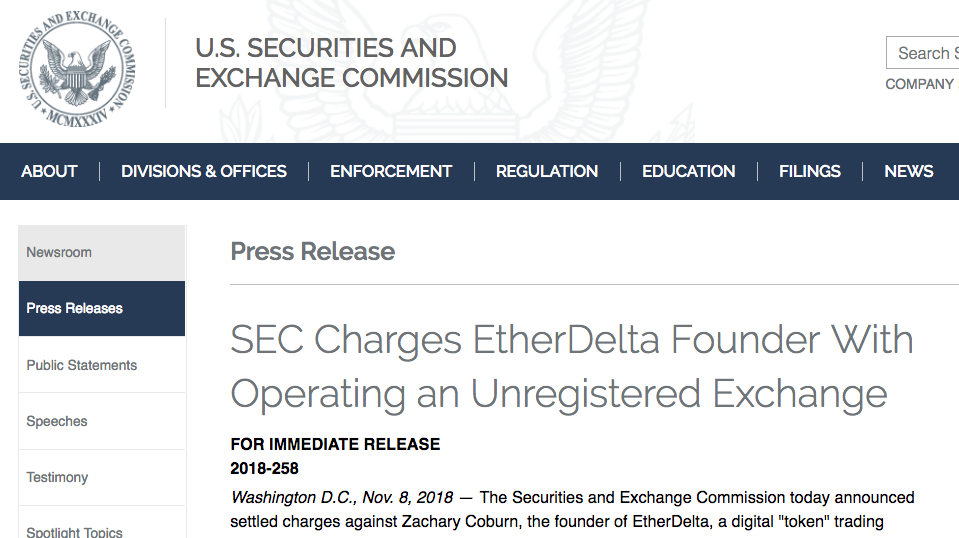

- Are they unlicensed securities exchanges?

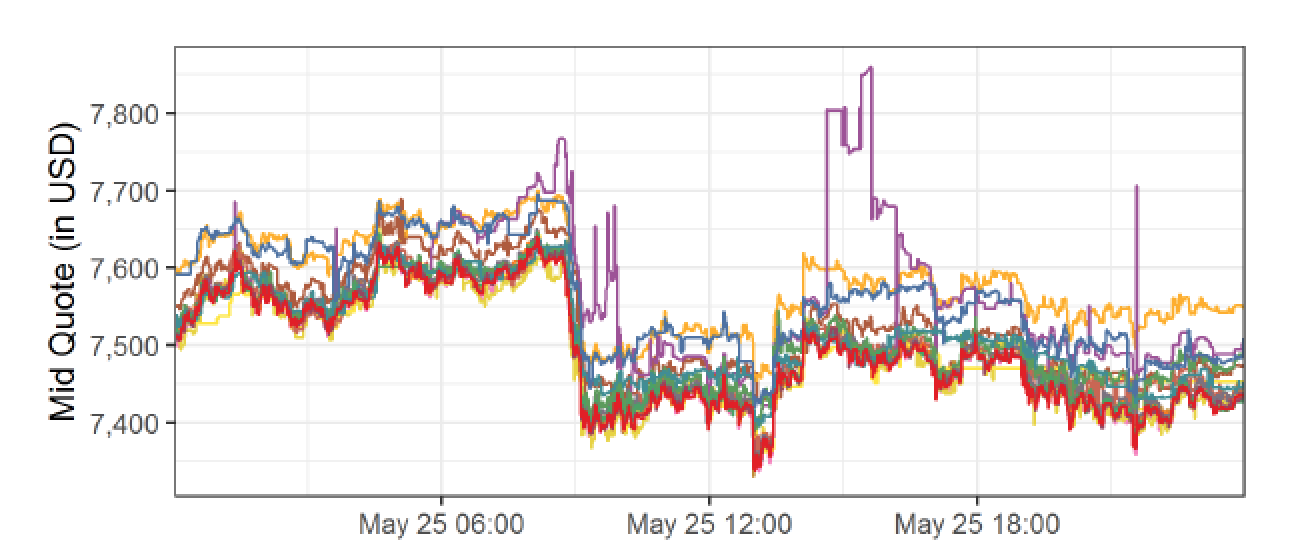

Costly Arbitrage

BTC/USD

ask: 7,600

bid: 7,550

BTC/USD

ask: 7,500

bid: 7,450

buy BTC

sell BTC

move BTC to Kraken

=> arbitrage = commit capital on multiple exchanges

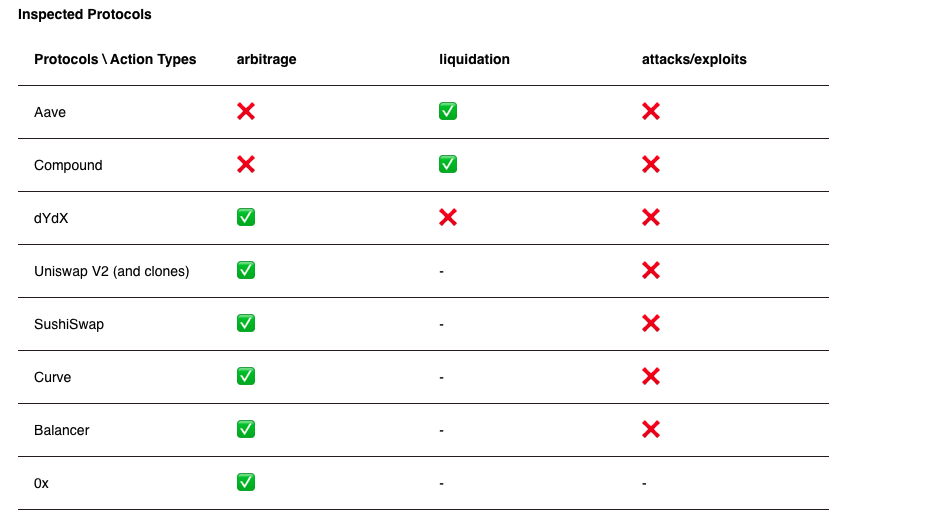

Crypto Wash Trading, Lin William Cong, Xi Li, Ke Tang, Yang Yang

- systematic tests:

- robust statistical and behavioral patterns in trading to detect fake transactions on 29 cryptocurrency exchanges.

- Regulated exchanges are OK

- unregulated exchanges: rampant manipulations

- wash trading on each unregulated exchange:

- on average over 70% of the reported volume

- improve exchange ranking

- temporarily distort prices

Volume Manipulation

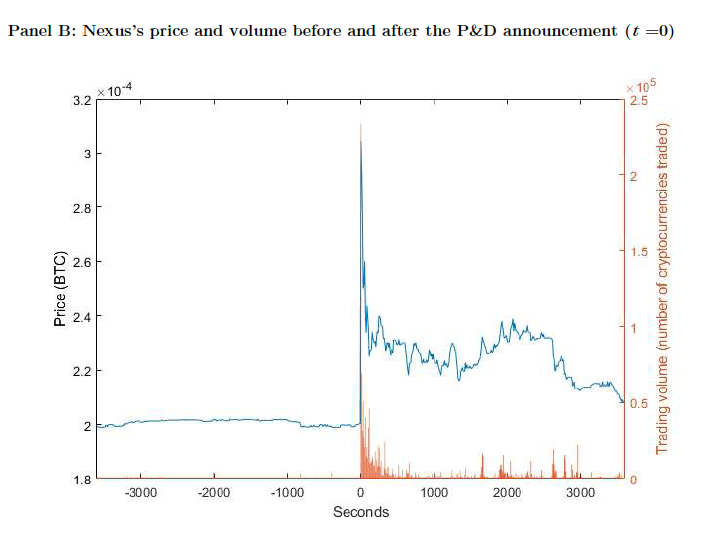

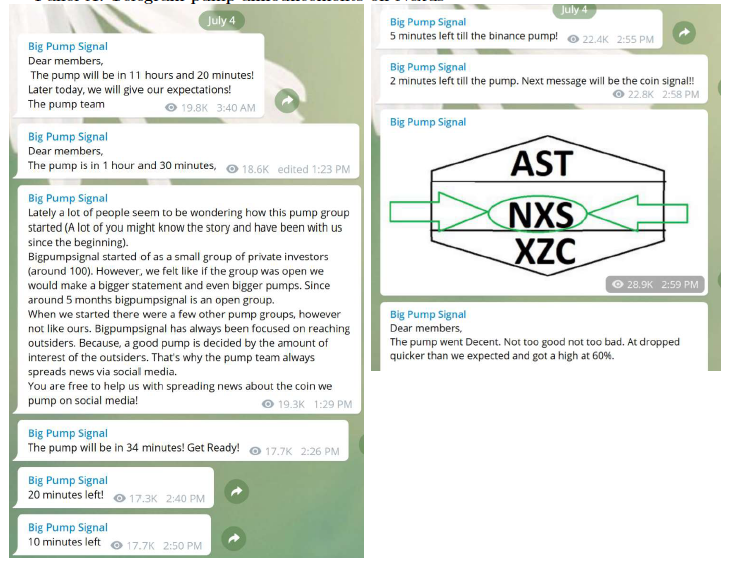

Cryptocurrency Pump-and-Dump Schemes

Tao Li, Donghwa Shin, and Baolian Wang, 2020

What is pump and dump?

arranged via Telegram Channels

Price Manipulation: Pump & Dump

August 2016

Security Risk

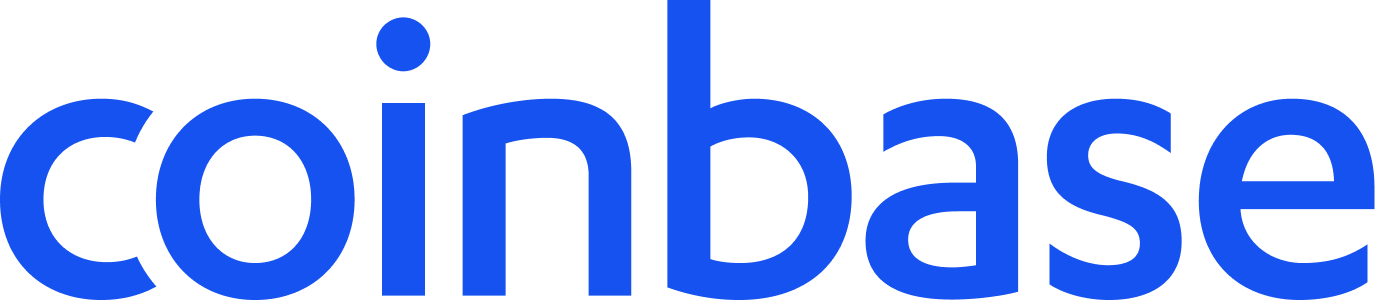

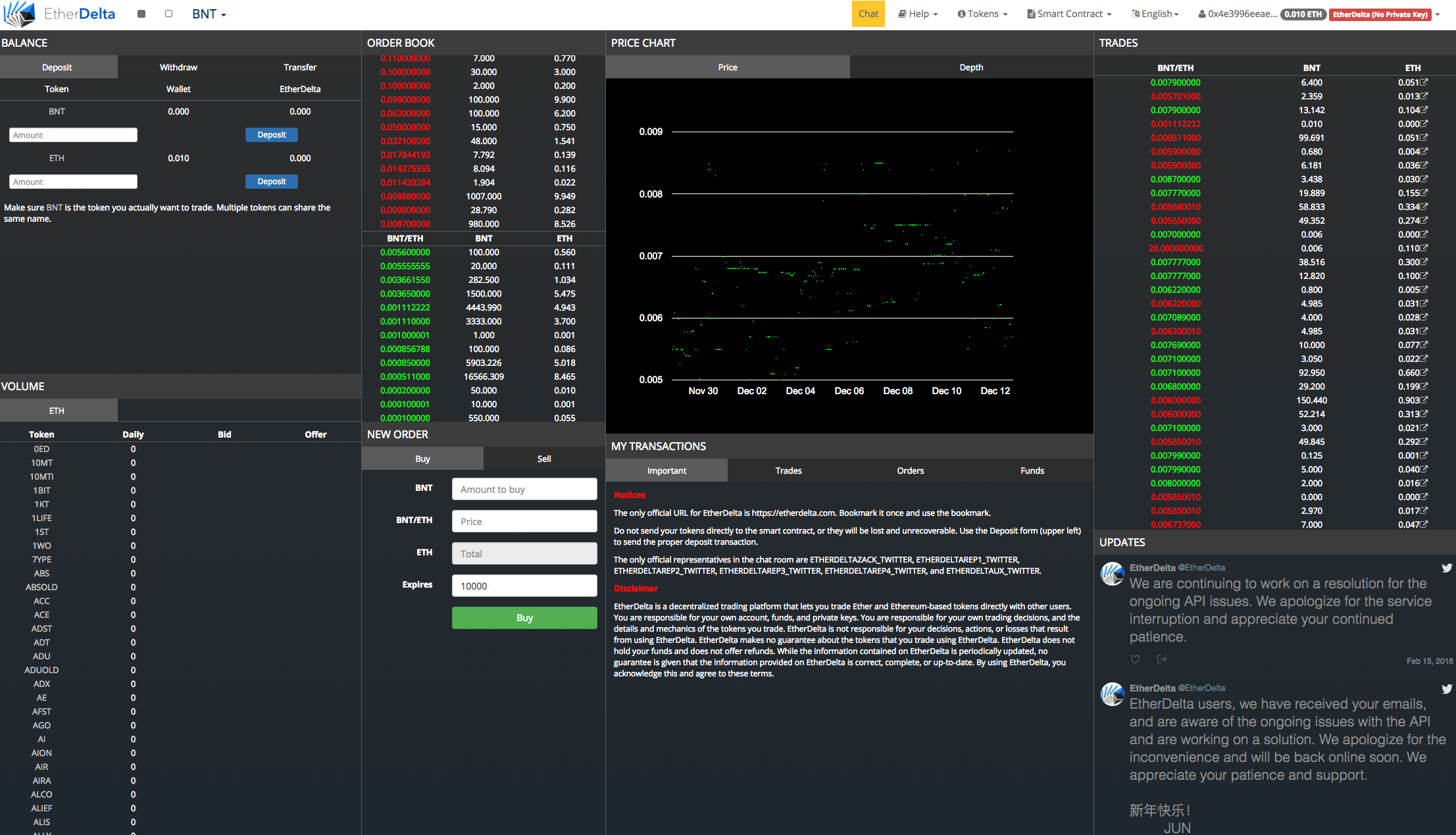

Decentralized Trading

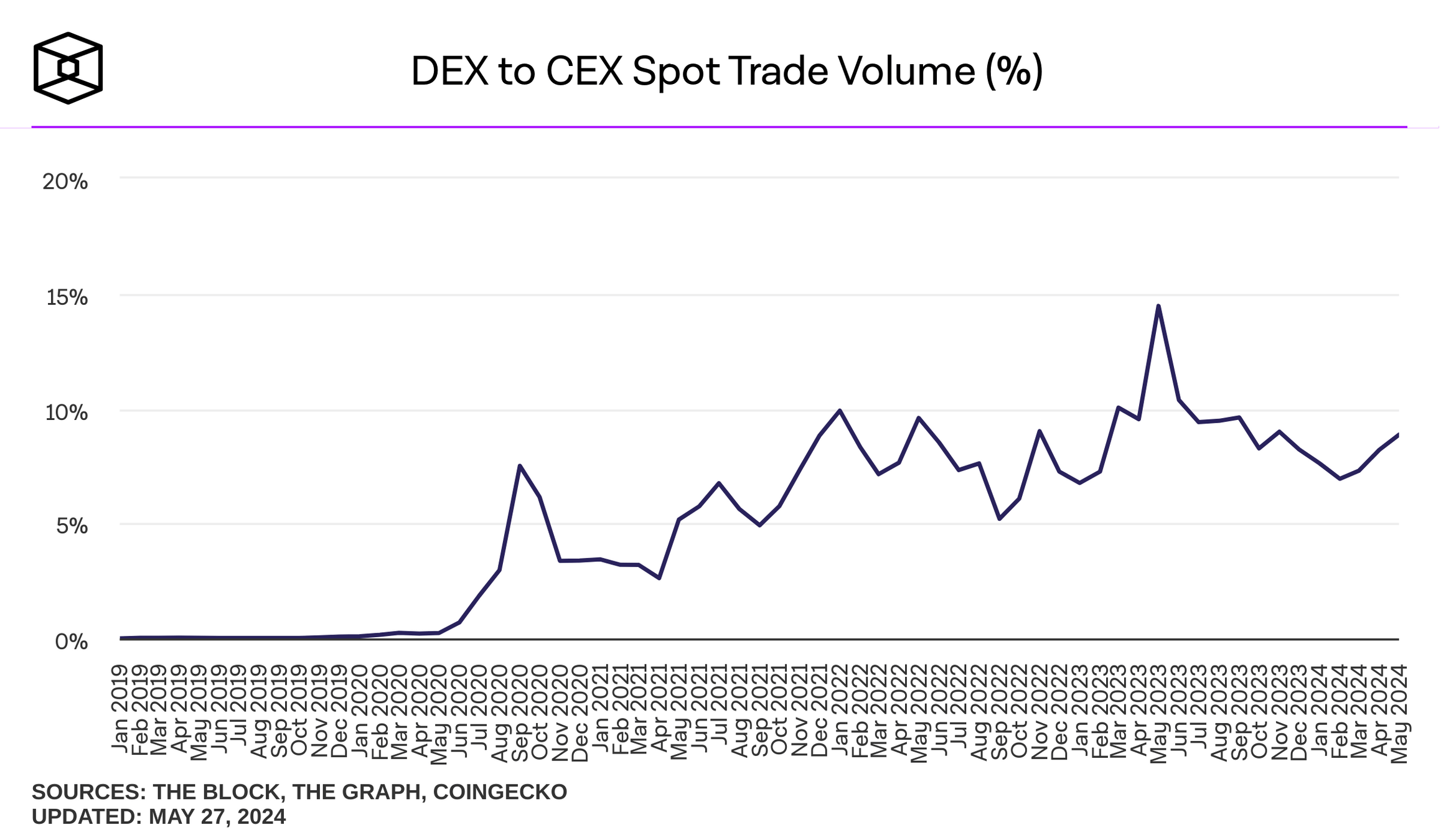

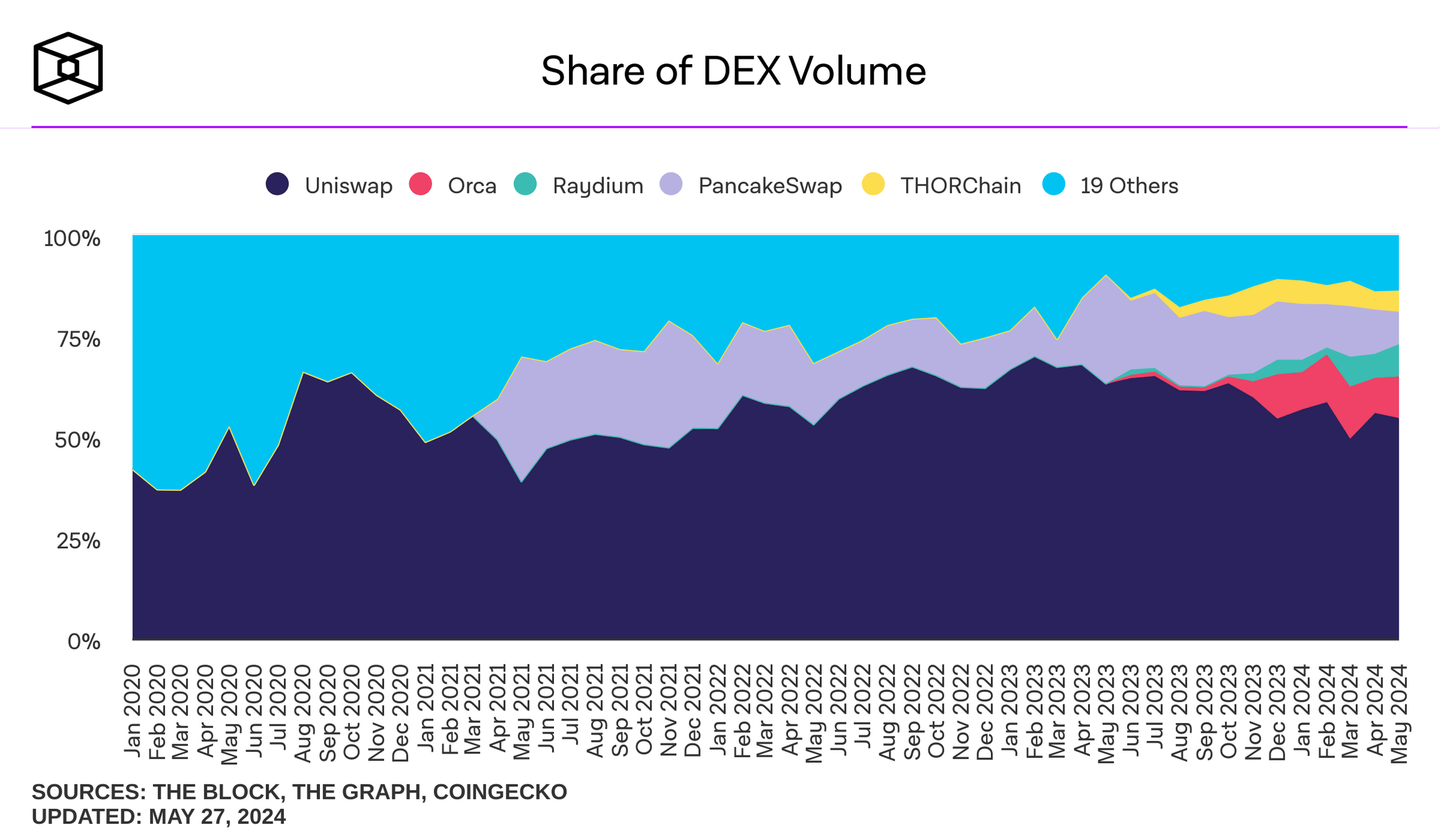

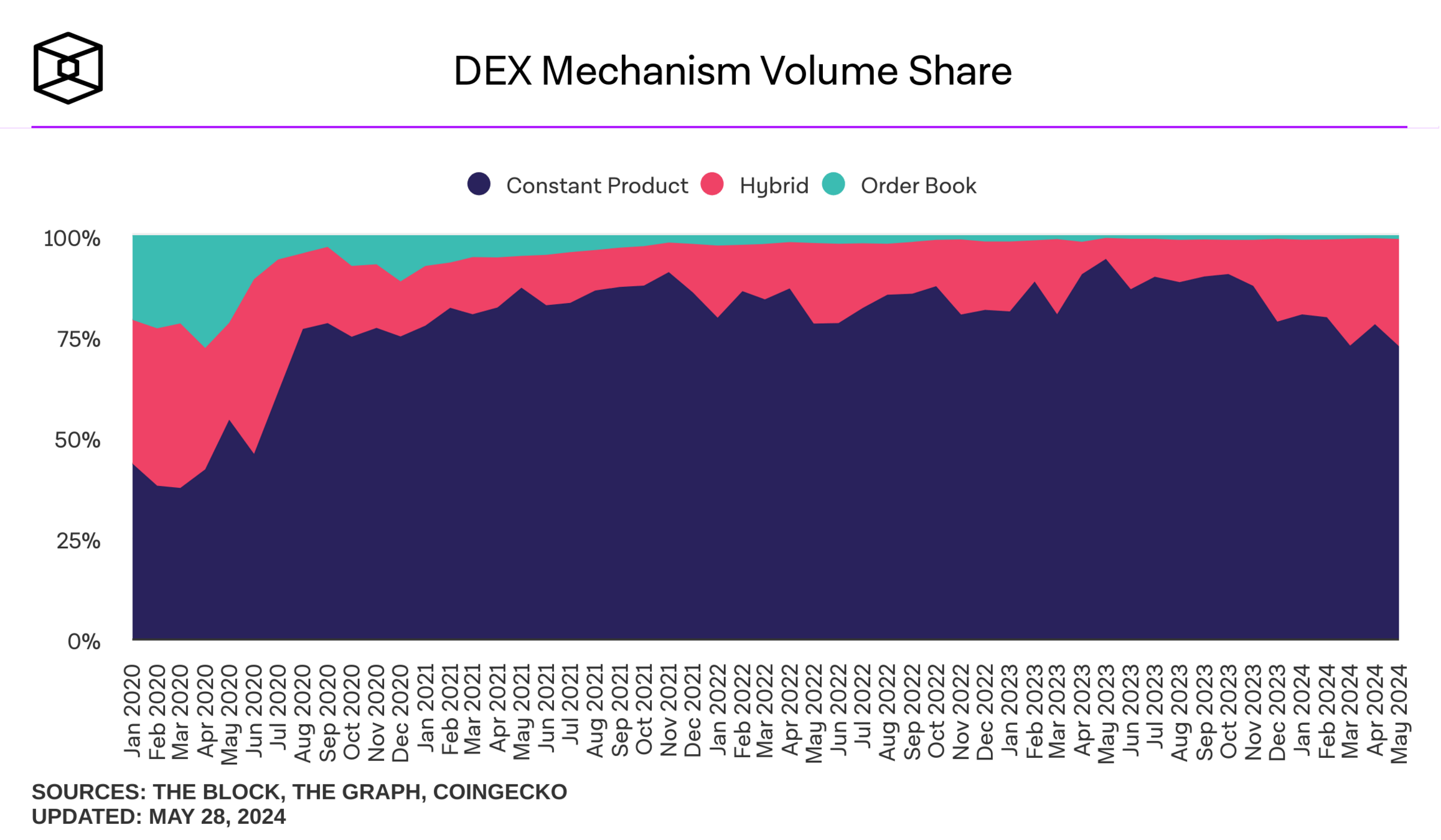

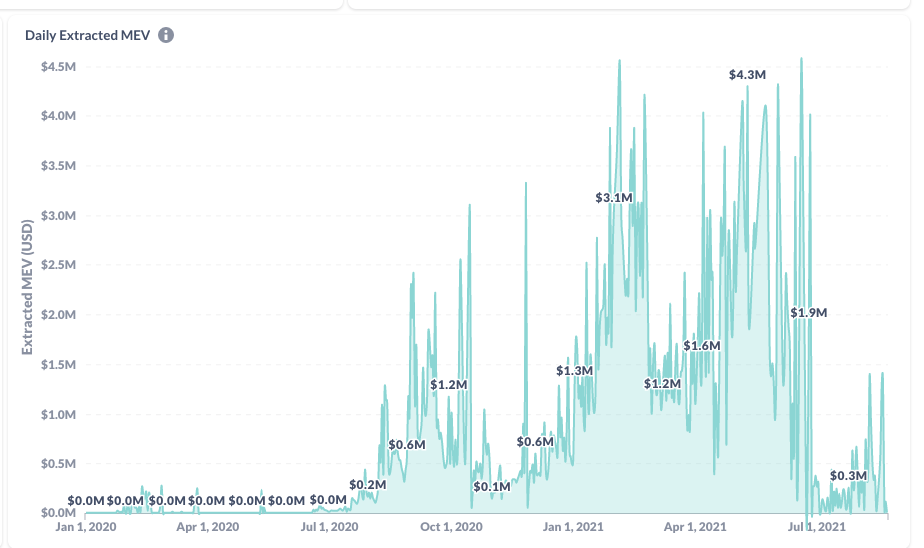

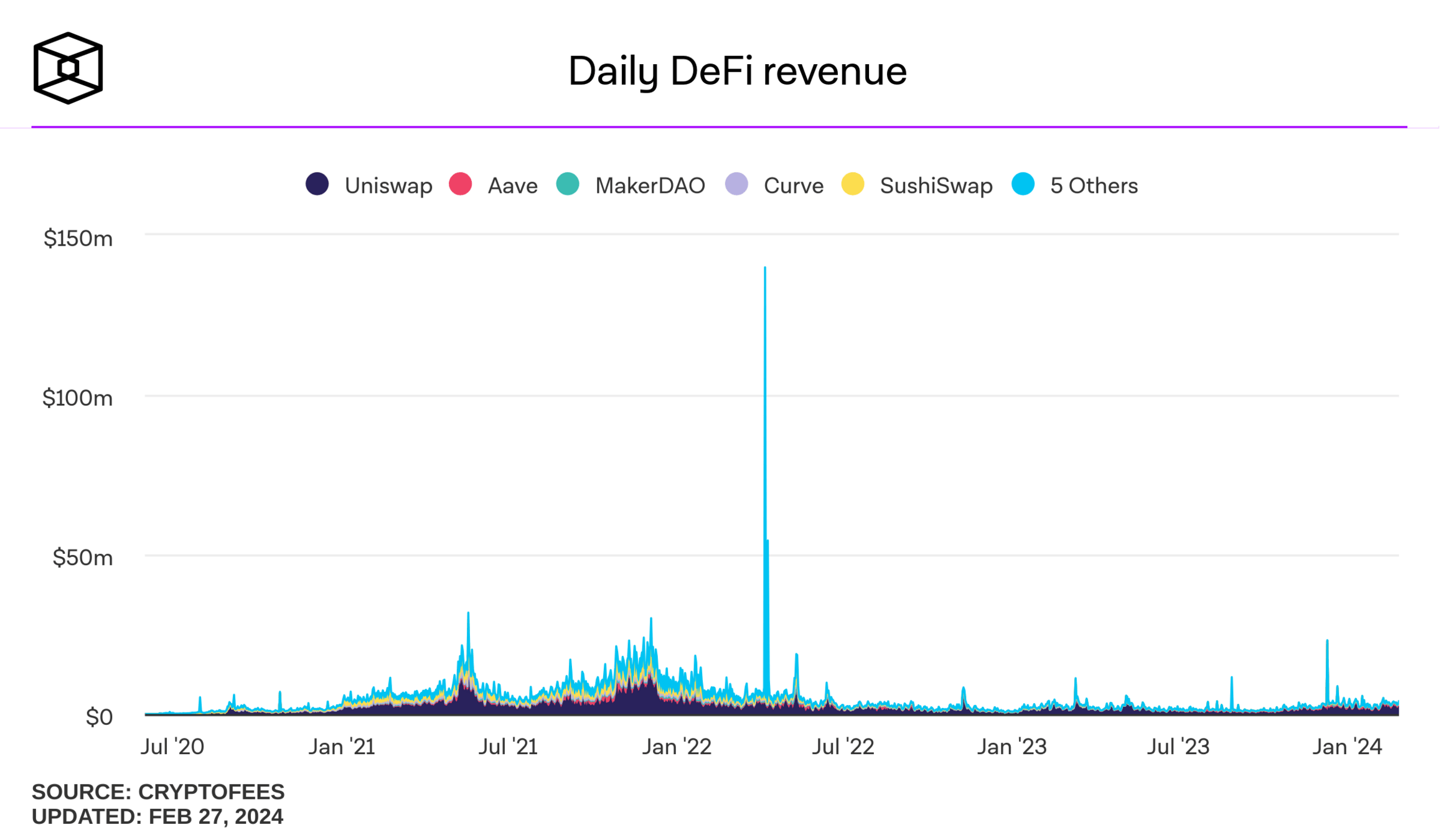

where do I find these plots? theblock.co/data/

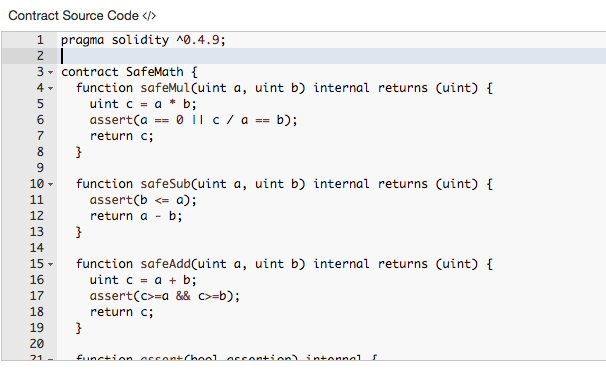

... 300 lines of code ...

Can we run a limit order book directly on the blockchain? Yes, but ...

- for reference: NASDAQ creates several peta-bytes worth of data each month!

- \(\to\) on-chain order book is a really bad idea!

- \(\to\) Data-intensive, computation intensive, costly, inefficient

How do people trade on-chain?

Decentralized trading using automated market makers (AMM)

Liquidity providers

Liquidity demander

Liquidity Pool

AMM pricing is mechanical:

- determined by the amounts of deposits

- most common:

- constant product

- #USDC \(\times\) #ETH = const

No effect on the marginal price

| limit order book | periodic auctions | AMM | |

|---|---|---|---|

| continuous trading |

|||

| price discovery with orders | |||

| risk sharing |

|||

| passive liquidity provision | |||

| price continuity |

|||

| continuous liquidity | |||

| sniping prevented |

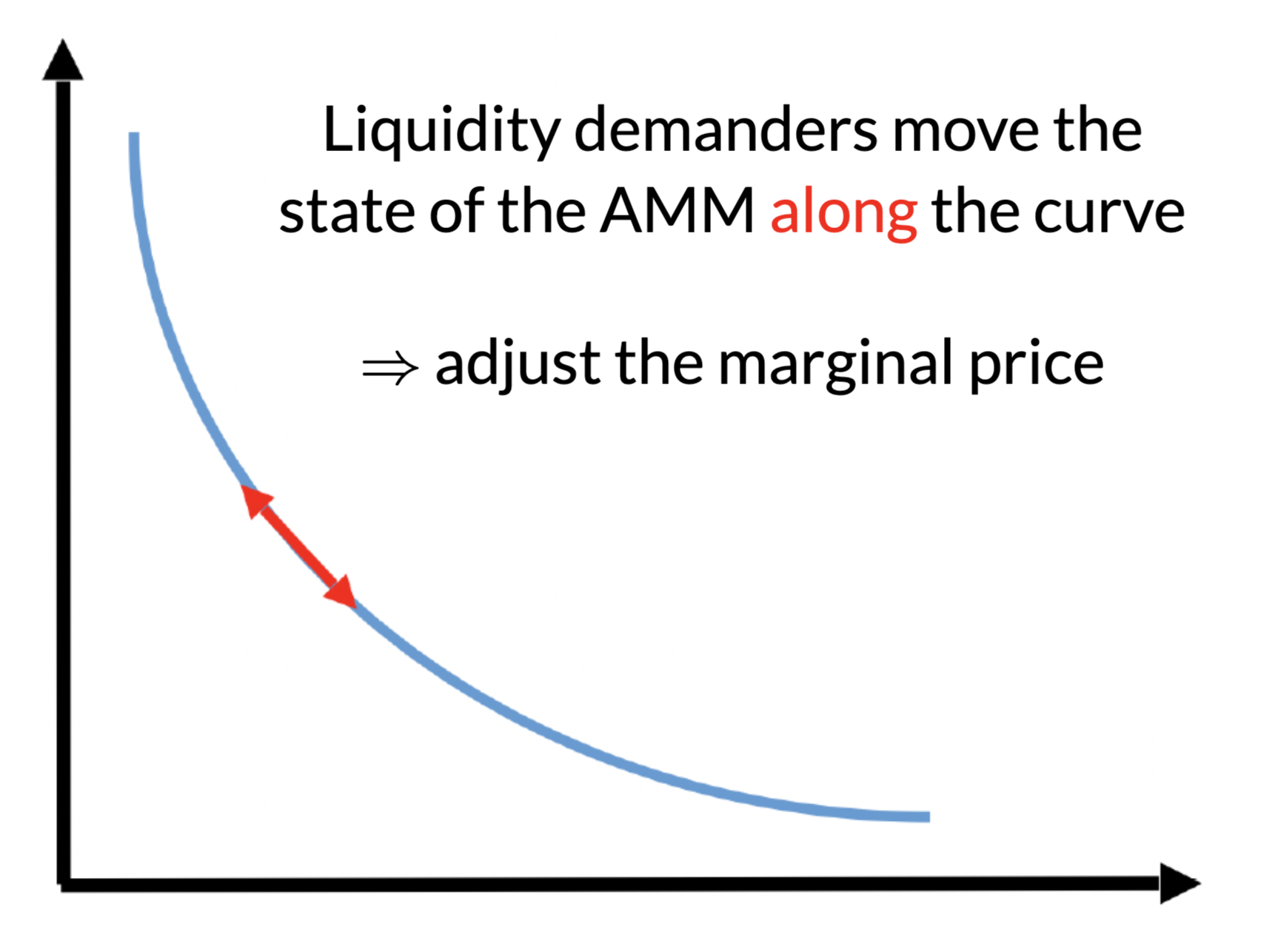

AMM Theory: The Price Function

Basic Requirements

- Two assets:

- cash and an asset

- deposits in pool of \(c\) cash and \(a\) asset

- AMMs should be self-contained: pricing rule based on

- deposits \(a,c\) and

- liquidity demanded \(q\)

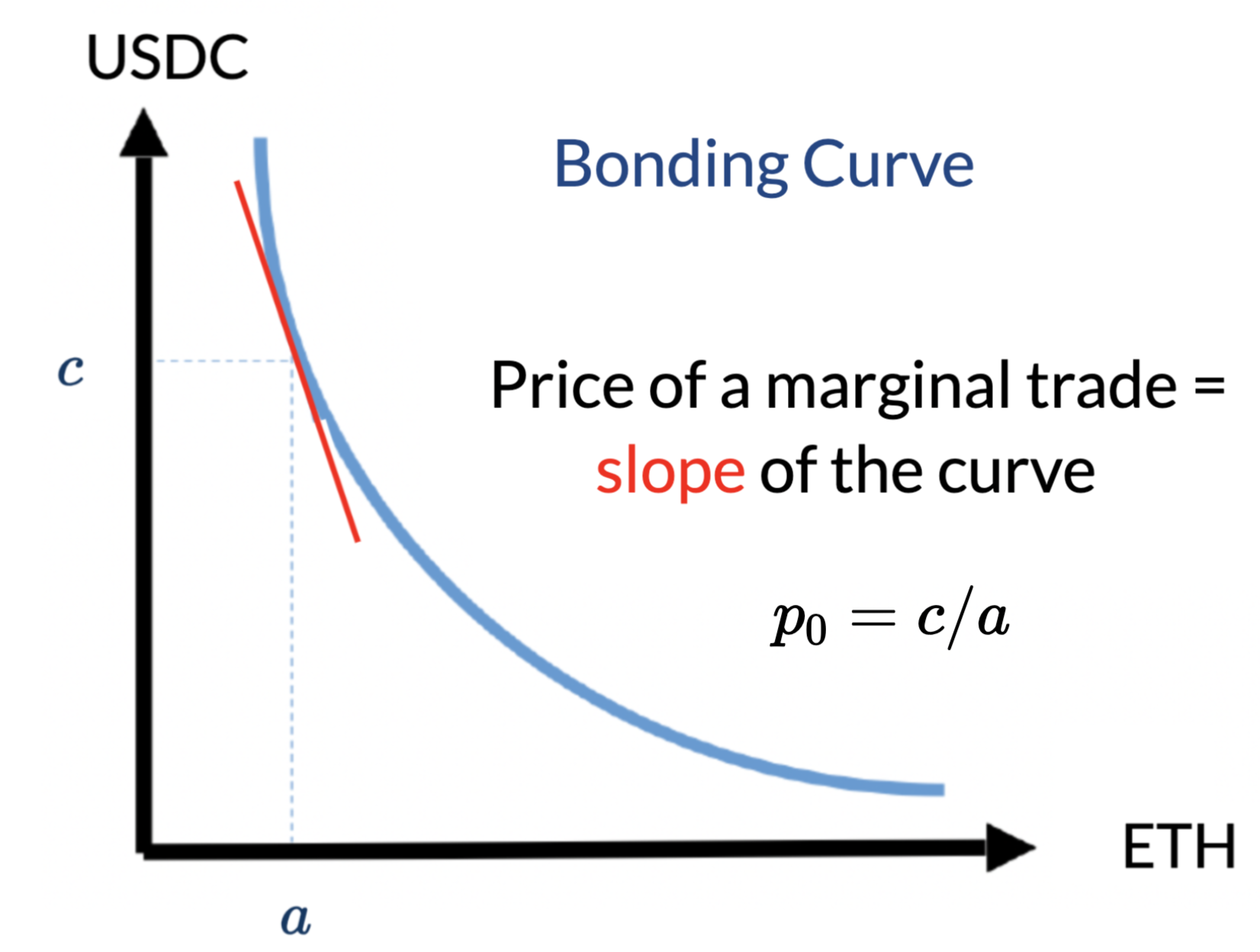

- implied value of the asset at deposit: \[p=\frac{c}{a}.\]

- marginal price: an infinitesimal unit should cost \[p^m=p\]

What does an AMM need?

- trades create linear changes:

- a trade of \(q\in(-\infty,a),\) will cost \(\Delta c(q)\in(-c,\infty)\)

- liquidity changes

- \(a\) \(\to\) \(a-q\)

- \(c\) \(\to\) \(c+\Delta c(q)\)

- \(\to\) marginal price after trade of \(q\) is

\[p^m(0)=\frac{c}{a}~~\to~~p^m(q)=\frac{c+\Delta c(q)}{a-q}.\]

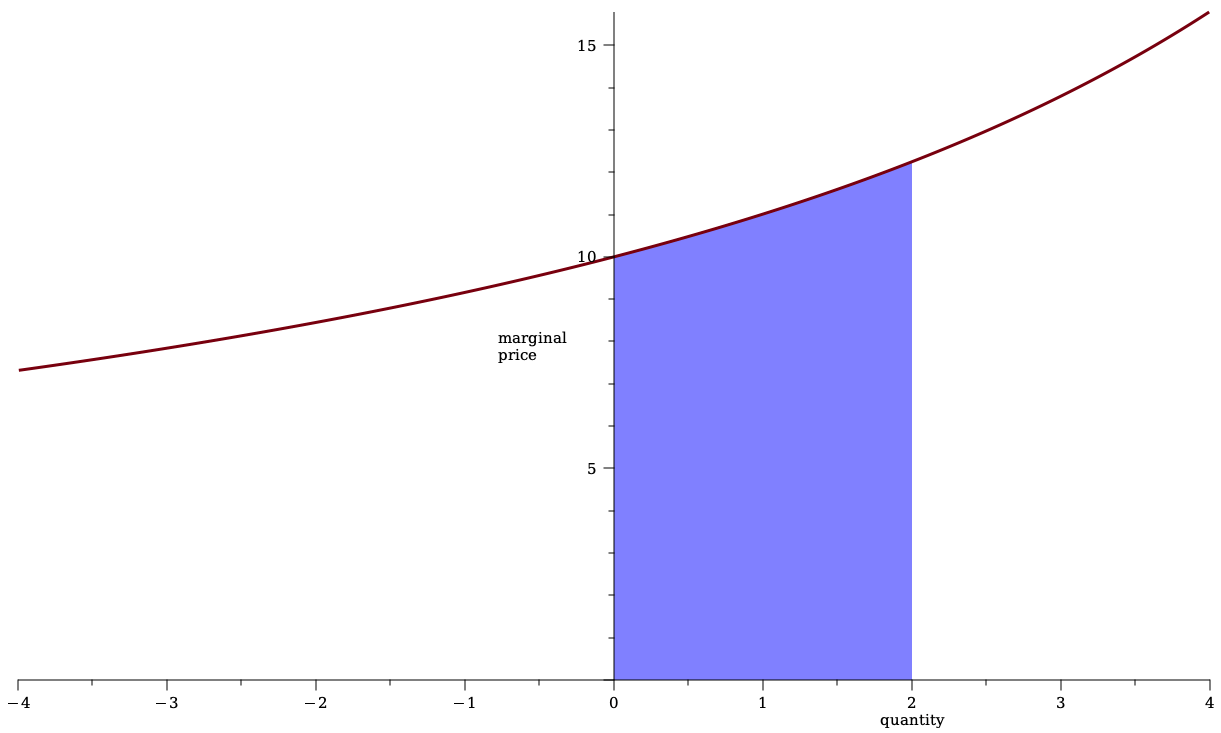

quantity

price

\(q\)

\(p^m(q)\)

\(\Delta c(q)(Q)=p(q)^m\times q\)

Traditional pricing: auctions/open outcry/RFQ: uniform price

idea: cost of \(q=\) price\(\times\) quantity

Some Pricing Rules from Traditional Markets: Uniform Price

- assume cost is price \(\times\) quantity: \[\Delta c(q)=q\cdot p(q)\]

- plus assume average price \(=\) marginal price after trade

\[p(q)=\frac{c+q\cdot p(q)}{a-q}~~\Leftrightarrow~~p(q)=\frac{c}{a-2q}.\]

- formalized and analyzed by Canidio and Fritsch (2023) and implemented in COW-Swap

- theoretical/implementation problem: splitting an order into smaller units is profitable!

\(q=2\)

\(\Delta c(q)= q\times p^m(q)=2\times 15.5\)

Main pricing rule in stock exchanges: limit order book

quantity

price

\(q\)

\(p^m(q)\)

\(\Delta c(q)=\int_0^qp^m(s)~ds\)

Some Pricing Rules from Traditional Markets: Limit Order Book

- For AMM: assume continuity \(\to\) price of "final" marginal unit coincides with price of "first" marginal unit of next trade \[\Delta c(q)=\int_0^q \rho(s) ds~\to~\Delta c'(q)=\rho(q)=p(q).\]

- Also "first" unit costs nothing \(\Delta c(0)=0\)

- This brings differential equation

\[p(q)=\frac{c+\int_0^q \rho(s) ds}{a-q}~~\Leftrightarrow~~\Delta c'(q)=\frac{c+\Delta c(q)}{a-q},\] - with solution \[\Delta c(q)=q\cdot\frac{c}{a-q}.\]

- Or, we can write \[\Delta c(q)=\int\limits_0^q p(s)ds=\int\limits_0^q\frac{ac}{(a-q)^2}ds=\frac{cq}{a-q}.\]

- Idea of pricing: liquidity before trade \(=\) after trade

\[L(a,c)=L(a-q,c+\Delta c)\]

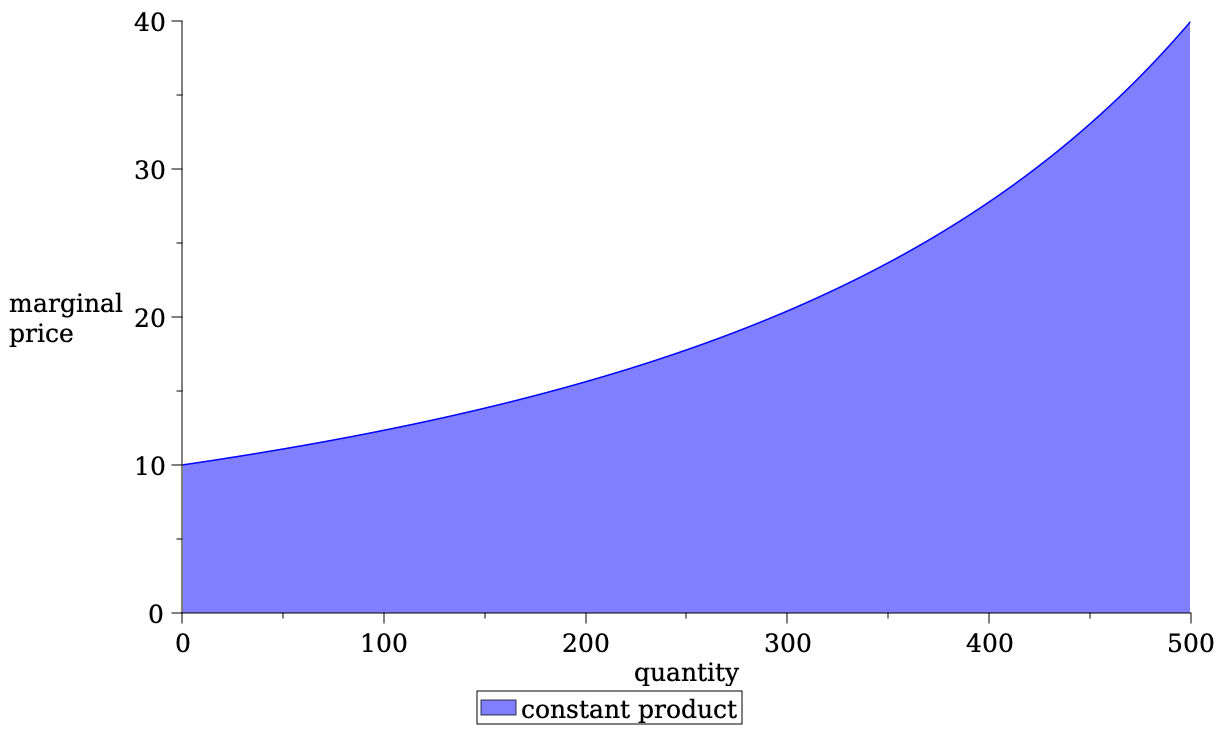

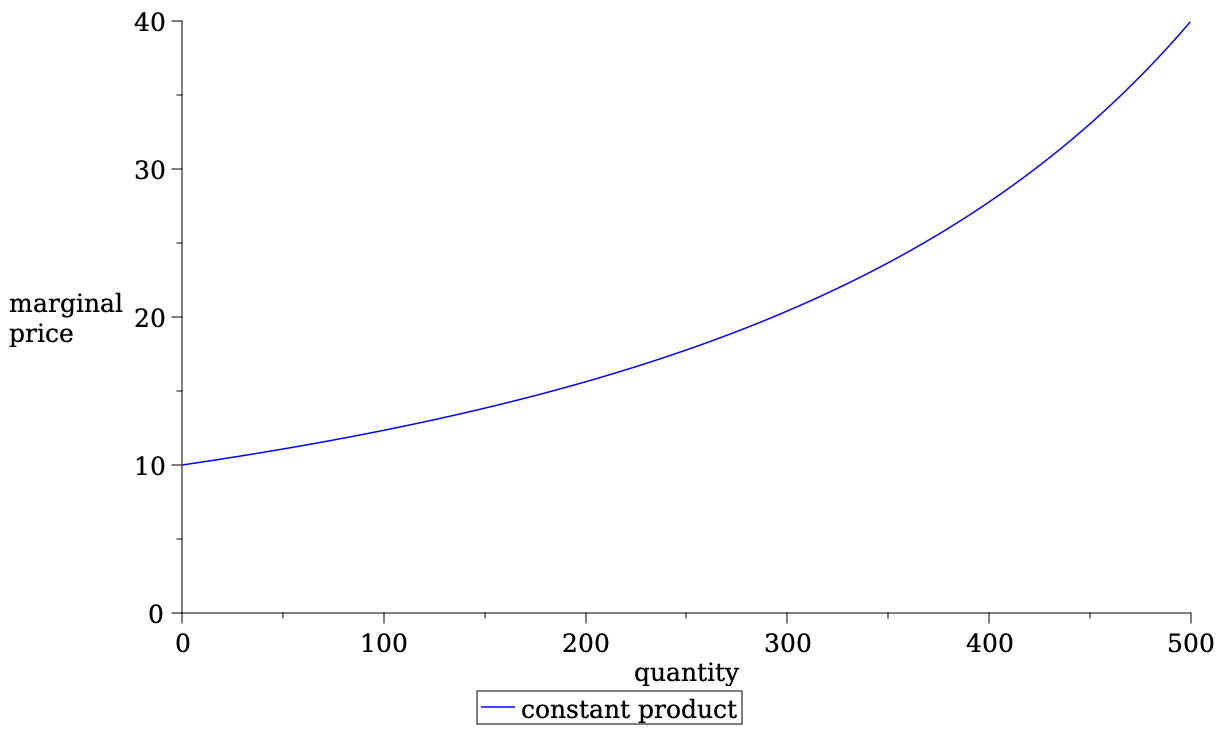

Most Common Pricing Rule in DeFi: Constant Product

Most Common Pricing Rule in DeFi: Constant Product

- With \[a\cdot c= (a-q) (c+\Delta c(q))\]

- we compute cost \[\Delta c(q)=q\cdot \frac{c}{a-q},\]

- average price \[p(q)=\frac{c}{a-q}\]

- and marginal price \[p^m(q)=\frac{c+\frac{cq}{a-q}}{a-q}=\frac{ac}{(a-q)^2}.\]

Insight: AMM pricing function is the same as a limit order book when we require

- that prices are continuous and

- that prices are determined by liquidity deposits only

- price \(\times\) quantity: \[p(q)=\frac{c}{a-2q}\]

- limit order book: \[p(q)=\frac{c}{a-q}.\]

- constant product: \[p(q)=\frac{c}{a-q}.\]

Some insights on pricing functions

- Price \(\times\) quantity

- nice feature:

- regret-free price: if price move is due to information, you have no positional loss

- poor feature:

- you can always save by order-splitting

- limit price for splitting = limit order book price

- nice feature:

- LOB/CP

- nice feature:

- order splitting doesn't pay

- poor feature:

- prices not regret-free: if price move is due to information, you always lose

- nice feature:

The Pricing Function

- Most common form of AMM liquidity rule is Constant Product Pricing

\[L(a,c)=a\cdot c~\Rightarrow~a\cdot c= (a-q)\cdot (c+\Delta c).\] - Total cost of trading \(q\) \[\Delta c=\frac{cq}{a-q}.\]

- Price per unit \[p(q)=\frac{c}{a-q}.\]

- Average spread paid\[\frac{p(q)}{p(0)}-1=\frac{q}{a-q}.\]

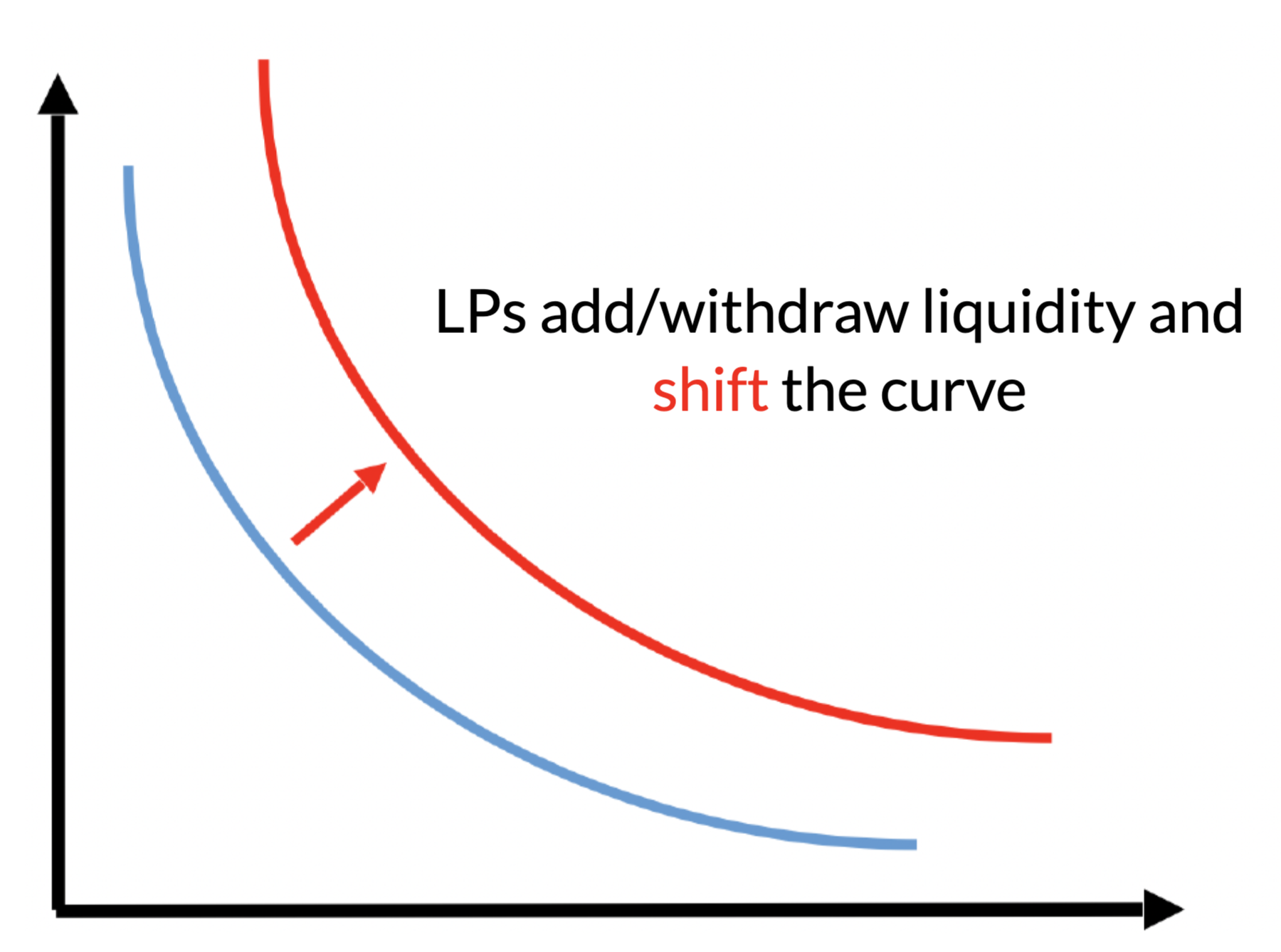

- liquidity provider makes asset and cash deposit

- more deposits flatten price curve

- may attract more volume

- but larger "positional" dollar loss when prices move

- larger liquidity deposits \(a\) \(\Rightarrow\)

- lower costs (price impact) for liquidity demanders

Liquidity Supply and Demand in an Automated Market Maker

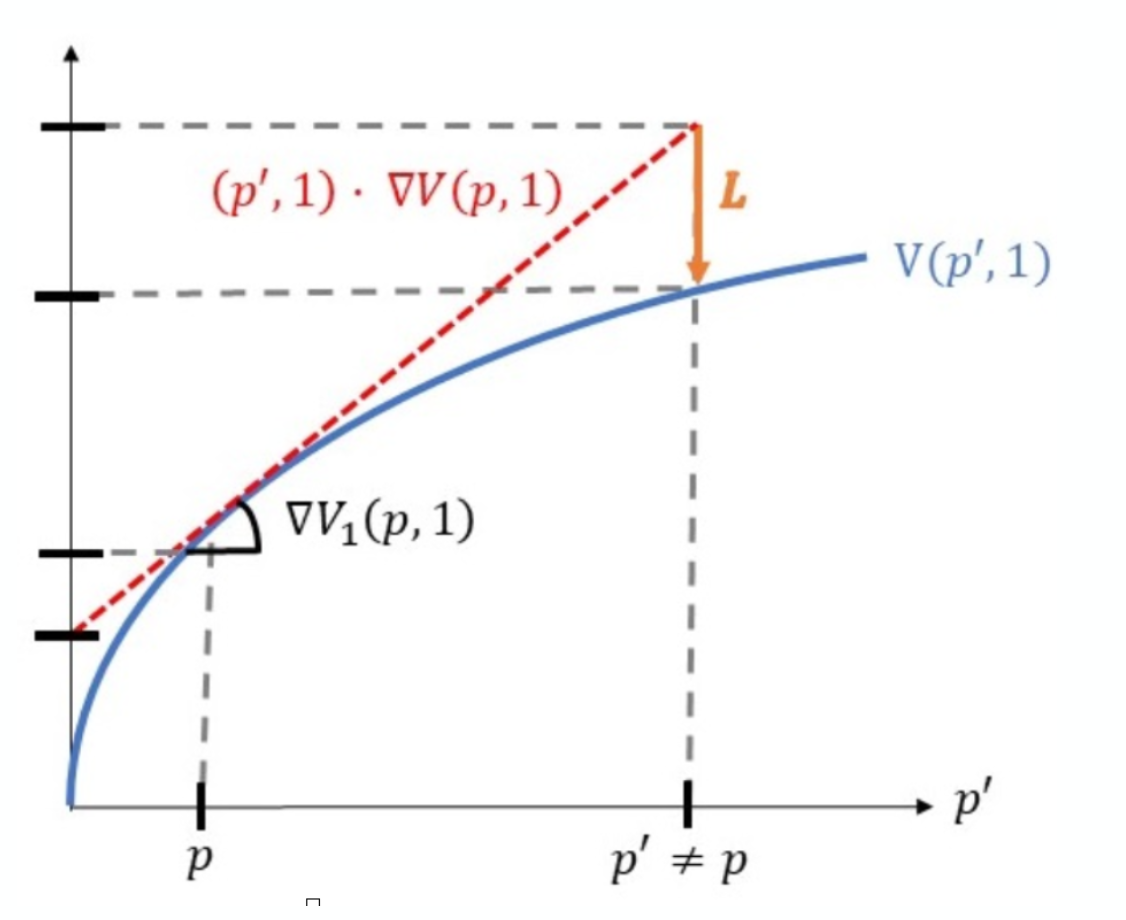

Liquidity providers: positional losses

- Deposit asset & cash when the asset price is \(p\)

- Withdraw at price \(p'\ne p\)

Buy and hold

Provided liquidity

in the pool

- Why?

- adverse selection losses

- arbitrageurs trade to rebalance the pool

- \(\to\) always positional loss relative to a "buy-and-hold"

Two views

- You may trade with uninformed or informed.

- you may have a position gain (against uninformed) or loss (against informed)

- example: Aoyagi and Ito (2021) "Coexisting Exchange Platforms: Limit Order Books and Automated Market Makers", Cartea, Drissi, Monga (2023)

- You trade over time with informed and uninformed

- you always lose but get compensated over time

- examples: Lehar and Parlour (2021), Hasbrouck, Riviera, Saleh (2023), Park (2021), Malinova and Park (2023)

- Lehar and Parlour (2021) assume that every uninformed trade is off-set by an arbitrageur \(\to\) more fee income

- between deposit and withdrawal, asset value changes from \(V_0\to V_t\) and price \(p_0\to p_t\)

- efficient pricing: \(p_t=V_t\)

- gross return \(R=p_t/p_0\)

- in AMM, only trades move price

- between deposit and withdrawal, trade with informed and uninformed

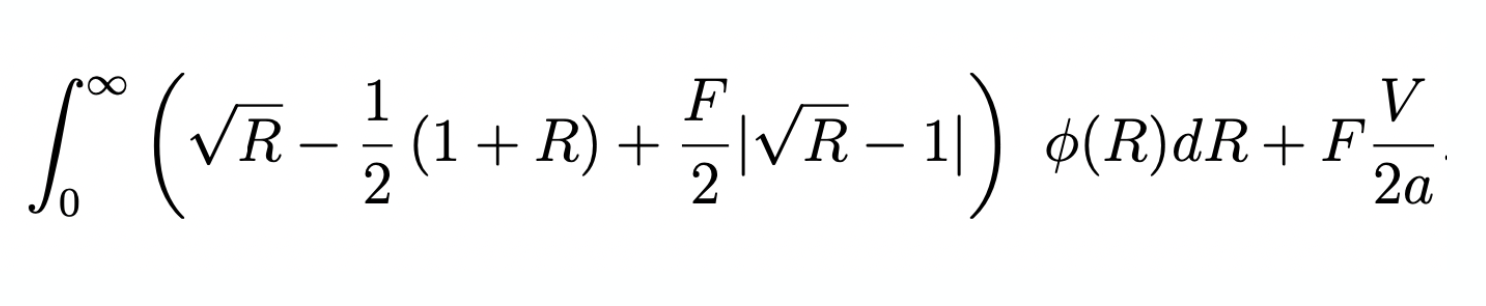

Basics of Liquidity Provision

\[\underbrace{F \int DV \mu(DV) }_{\text{fees earned on}\atop \text{balanced flow}}+\int_0^\infty\underbrace{(\Delta c(q^*)-q^*p_t(R)}_{\text{adverse selection loss} \atop \text{when the return is {\it R}}} +\underbrace{F \cdot \Delta c(q^*))}_{\text{fees earned}\atop \text{from arbitrageurs}}~\phi(R)dR \ge 0.\]

\(q^* \) is what arbitrageurs trade to move the price to reflect \(R\)

Basic idea of liquidity provision: earn more on balanced flow than what you lose on price movement

\[\text{fee income} +\underbrace{\text{what I sold it for}-\text{value of net position}}_{\text{adverse selection loss}} \ge \text{cost of capital} \]

in AMMs:

protocol fee

in tradFi: bid-ask spread

- in Malinova & Park (2023): express equation with returns

- single variable decision problem as fraction of shares outstanding

- allows calibration to any market

Theory Literature on AMM

- Lehar & Parlour (JF 2024): compares LOB with CP for theory and empirics

- Barbon & Ranaldo (2022): empirics on trading costs; closed form solution to loss

- Milionis, Moallemi, Roughgarden, and Zhang (2022) have dynamic analysis of impermanent loss (or, rather, "loss vs rebalancing" (LVR))

- Hasbrouck, Riviera, Saleh (2023): optimal trading fee \(\not=\) 0

- Park (2023): analysis of price functions properties

- Malinova & Park (2023): calibrate AMM to equity markets

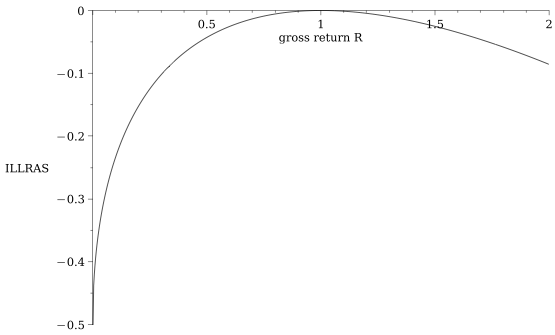

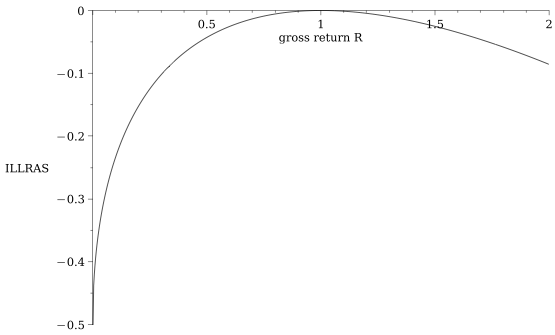

Sidebar: we can quantify how much a PASSIVE LP loses when the price moves by \(R\)

for orientation:

- If the stock price drops by 10% the incremental loss for liquidity providers is 13 basis points on their deposit

- \(\to\) total loss=-10.13%

- If the stock price rises by 10%, the liquidity provider gains 12 basis points less on the deposit

- \(\to\) total gain =9.88%

\[\frac{\text{adverse selection loss when the return is \(R\)}}{\text{initial deposit}}=\sqrt{R}-\frac{1}{2}(R+1)\]

see Barbon & Ranaldo (2022)

Liquidity Demander's Decision & (optimal) AMM Fees

- Two opposing forces in equilibrium for fee \(F\nearrow\)

- more liquidity provision

\(\to\) lower price impact - more fees to pay

- more liquidity provision

Result:

competitive liq provision\(\to\) there exists an optimal (min trading costs) fee \(>0\)

- \(\to\) derive closed form solution for competitive liquidity provision

- depends on return distribution, balanced volume, quantity demanded

Similar to Lehar&Parlour (2023) and Hasbrouck, Riviera, Saleh (2023)

- For trading of a fixed quantity:

\[\text{LD cost}=\text{AMM price impact} +\text{AMM fee} .\]

\[F^\pi=\frac{1}{E[|\sqrt{R}-1|/2]+V}\left(-2q\ E[\text{position loss}]+ \sqrt{-2qV\ E[\text{position loss}]}\right).\]

assume: liquidity providers add liquidity until they break even in expectation

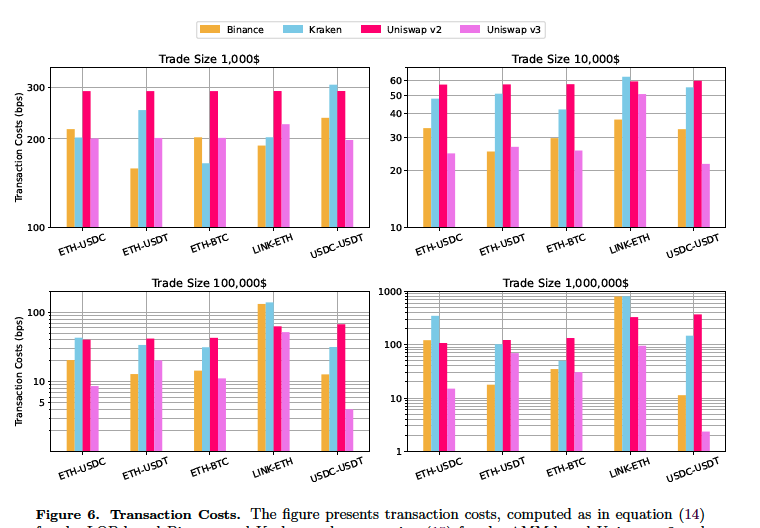

Empirical Work

Lehar and Parlour (2021)

Barbon & Ranaldo (2023)

Other notables:

- Lehar, Parlour, Zoican (2022):

- study and document fragmentation of liquidity across different fee levels

- most intense provision-withdrawal activity for low fees \(\to\) UniSwap v3 starts mimicking tradfi

- Capponi & Jia (2022) study impact of curvature of pricing function

- Theory: curvature of optimal pricing curve \(\nearrow\) volatility

- Empirics: cost volatility is 60% lower for stable-coin pairs

- corr(deposit inflows ,volatility)<0

corr(deposit inflows ,volume)>0

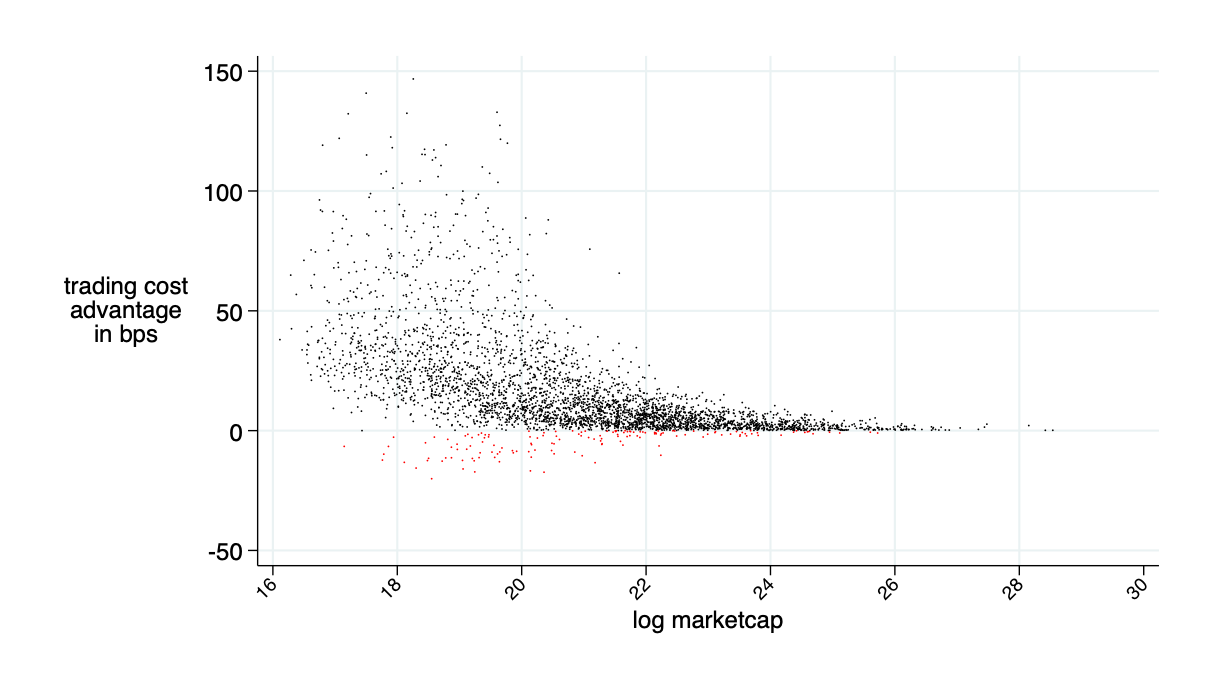

Malinova & Park (2023): AMM applied to equities would reduce trading costs by 30%

UniSwap v3

UniSwap v3 has "concentrated liquidity provision"

- liquidity provision choice in v2:

- submit \(a,c\) at the marginal \(p_0=\frac{c}{a}\)

- \(\to\) for given \(p_0\), there is ONE degree of freedom

- provide liquidity

- for all prices \(p\in(0,\infty)\)

- all asset amounts \(q\in(0,a)\)

- all cash amounts \(\Delta c\in (0,c)\)

- liquidity provision choice in v3:

- submit \(u,\Delta c (d)\)

- choose price range \([p_d,p_u]\)

- provide liquidity

- for all prices \(p\in[p_d,p_u]\)

- all asset amounts \(q\in(-\infty,u)\)

- all cash amounts \(\Delta c\in (-\Delta c(d),\infty)\)

Just a little more institutional details

-

users submit liquidity positions \((u,d,p_u,p_d)\) and receive an ERC-721 (=NFT) token as a receipt

-

the code segments liquidity into discrete exponential intervals \([p_k,p_{k+1}]\) with \[p_k=(1+\delta)^k. ~~~(\text{numerically: }p(k)=1.0001^k)\]

-

it aggregates liquidity over these intervals

-

the pricing curve for each interval is determined by the constant product rule

-

intervals may be "empty"

How the price is determined

- In v2, for given \(p_0=\frac{c}{a}\), users have ONE degree of freedom.

- for instance, when you pick prices \(p_u,p_d\) and the quantity \(u\) that you are willing to supply, then the amount of cash that you have to contribute is pre-determined.

- You can pick \(p_d=p_0\) so that \(\Delta c(d)=0\)

- In v3, for given \(p_0\), users have THREE degree of freedom.

How the price is determined

- some more facts

- if the marginal price \(p_u\) is reached, you will sell \(u\) units of the asset

- the price is still using constant product

- but we use the term "virtual" liquidity

- its the v2 liquidity that would pertain if you'd supply liquidity on the entire interval of prices

\(p_d\)

\(p_u\)

\(p_0\)

we know this curve has functional form \[p^m(q)=\frac{\tilde{a}c}{(\tilde{a}-c)^2}\]

where \(\tilde{a}\) is the virtual liquidity

quick disclaimer: what follows is not how UniSwap is explained on its website etc. But the resulting maths are the same

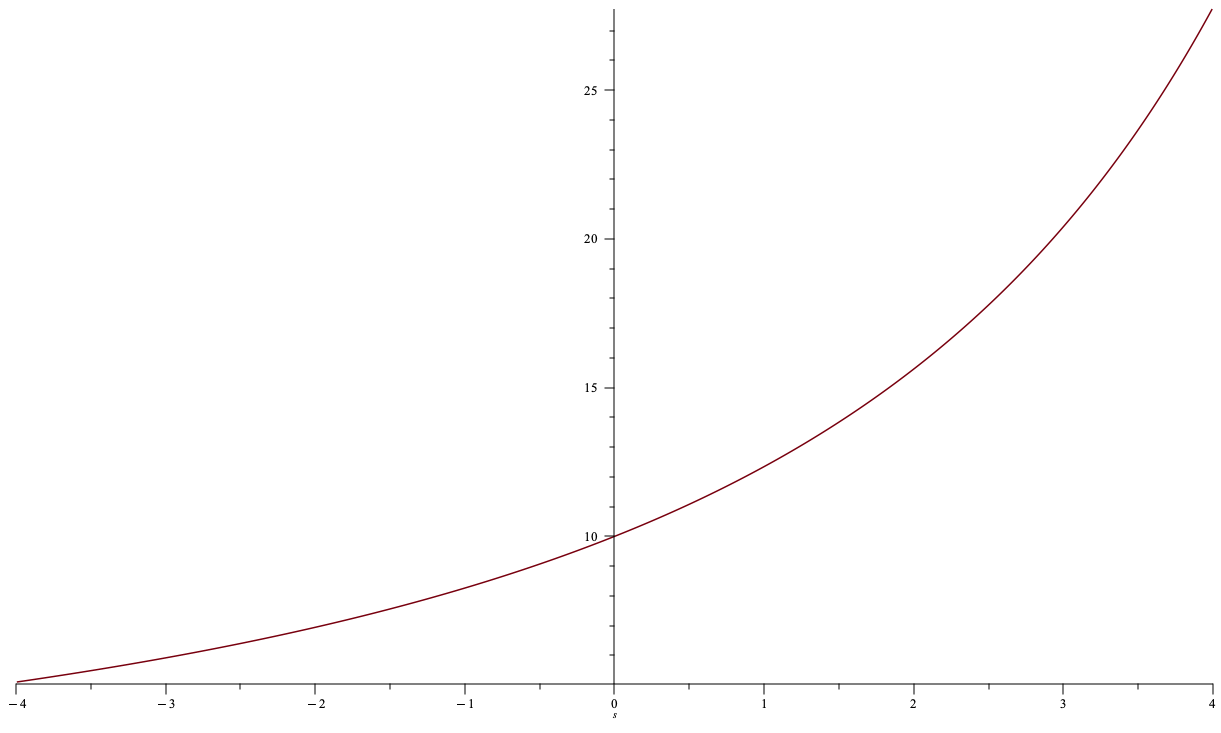

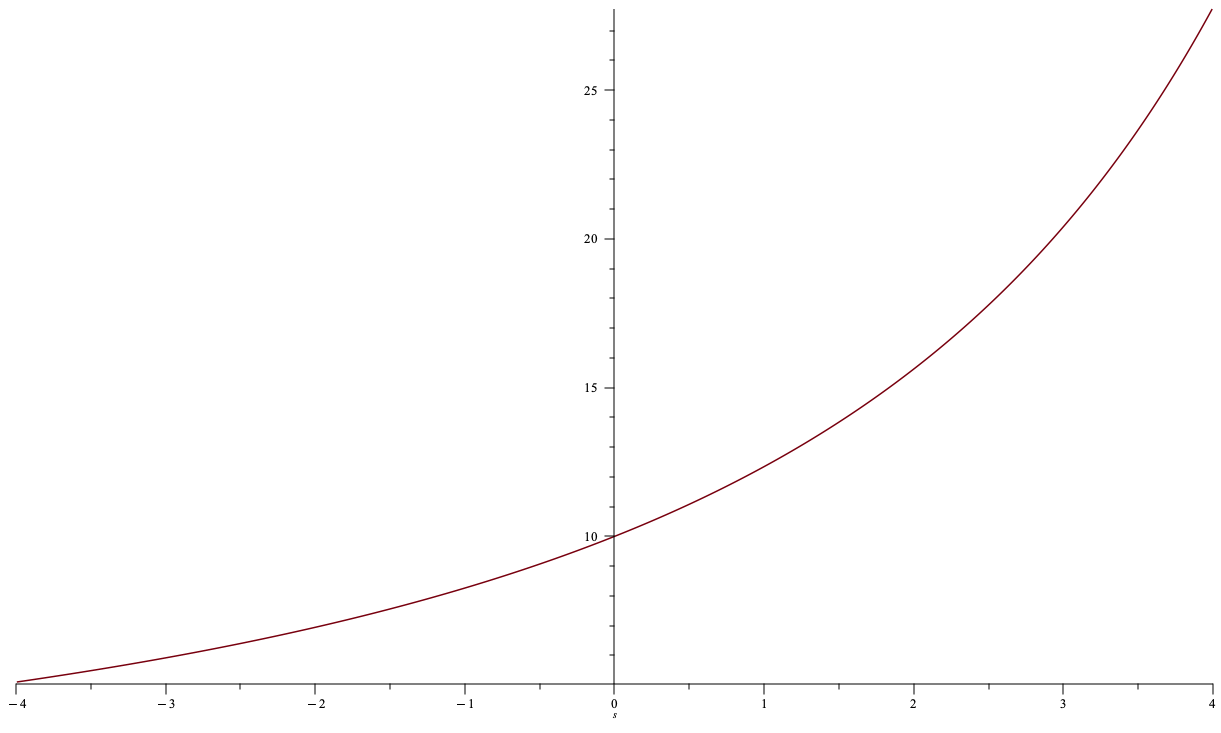

More on UniSwap v3

marginal "limit order book" price

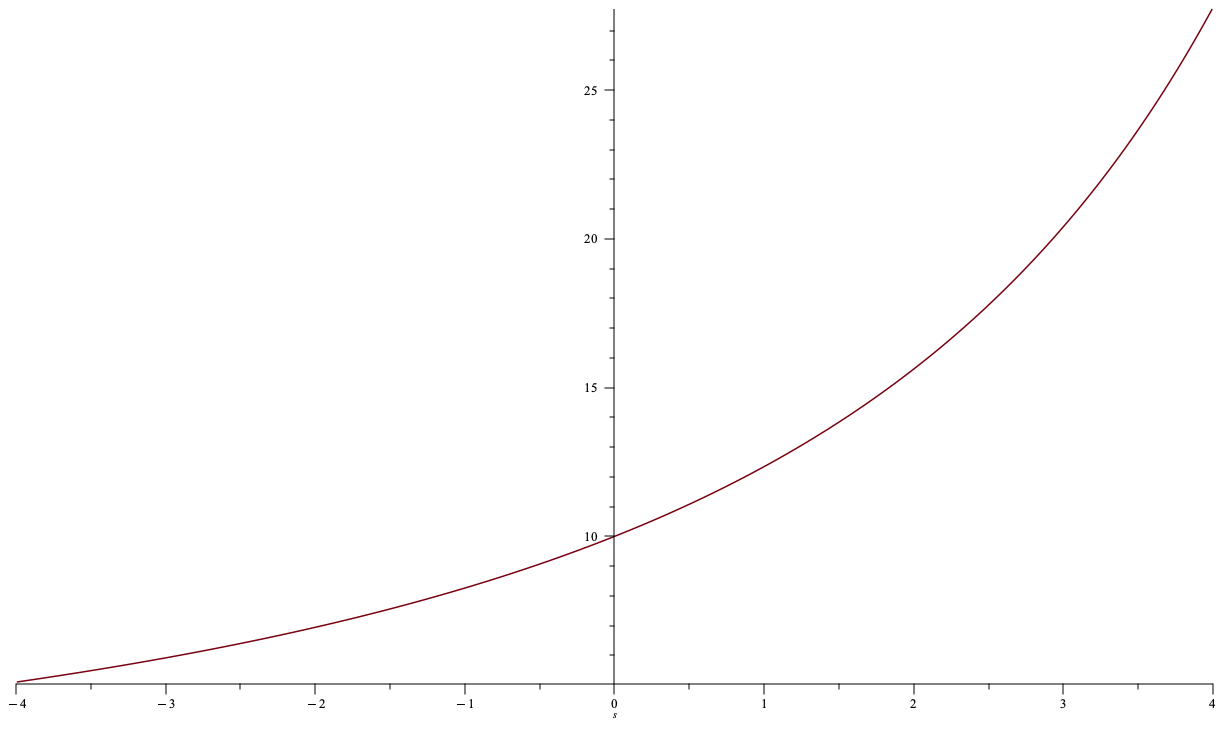

\[\gamma(s)=\frac{ac}{(a-s)^2}\]

\(p_u=15\)

\(p_d=7\)

\(u=2\)

\(p_0=10\) (that's exogenous, not a choice)

Finding virtual liquidity factor \(\tilde{a}\)

marginal "limit order book" price

\[\gamma(s)=\frac{ac}{(a-s)^2}\]

\(p_u=15\)

\(p_d=7\)

\(u=2\)

\(p_0=10\) (that's exogenous, not a choice)

= find the right curve

= find the right "\(\tilde{a}\)"

Finding the fourth parameter \(\Delta c(d)\)

marginal "limit order book" price

\[\gamma(s)=\frac{ac}{(a-s)^2}\]

\(p_u=15\)

\(p_d=7\)

\(u=2\)

\(d=?\)

required cash deposit \(\Delta c(d)=\) the amount that I pay for \(d\)

Solutions

- virtual liquidity factor: \[\tilde{a}=\frac{u}{1-\sqrt{p_0/p_u}}=u\cdot \frac{\sqrt{p_u}}{\sqrt{p_u}-\sqrt{p_0}}.\]

- required quantity to reach \(p_d\) \[\rho(-\tilde{d})=\frac{\tilde{a}\tilde{c}}{(\tilde{a}+\tilde{d})^2}=p_d.~~\Leftrightarrow~~d^*=-\tilde{a}(1-\sqrt{p_0/p_d})\]

- required cash deposit \[\Delta c(\tilde{d})=-\tilde{a}(1 - \sqrt{p_0/p_d})\sqrt{p_0p_d}=-u\sqrt{p_0p_d}\frac{1 - \sqrt{p_0/p_d}}{1 - \sqrt{p_0/p_u}}\]

- marginal pricing function \[\tilde{\gamma}(q)=\frac{\tilde{a}^2p_0}{(\tilde{a}-q)^2}=\frac{u^2p_0p_u}{((u-q)\sqrt{p_u}+q\sqrt{p_0})^2}.\]

Numerical example

- Suppose \(p_0=\$10\).

- LP is willing to sell up to \(u=100\)

- v2 liquidity:

- Required cash deposit: \(c=100\times 10=1000\)

- liquidity \(c\cdot a=100\times 1,000\)

- For v3: suppose willing to supply liquidity in \([\$9,\$11]\)

- v3 liquidity:

- virtual liquidity factor: \(\tilde{a}\approx 2,150\)

- required cash \(c^*=\$1,100\)

- consider a buy order of \(q=10\)

- cost per unit

- v2: \(\frac{1000}{100-10}=11.11\)

- v3: \(\frac{21,500}{2,150-10}=10.05\)

Want to read more?

- A Primer on UniSwap v3 Math: As Easy as 1,2, v3 https://blog.uniswap.org/uniswap-v3-math-primer

- Elts 2012: Liquidity Math in UniSwap v3

- Hasbrouck, Riviera, Saleh (2023):

- UniSwap Liquidity Provision is like a covered call,

- whereas a standard market (Copeland & Galai JF 1983) is a short strangle (call at the ask, put at the bid)

Concerns around Automated Market Makers

a

b

c

d

e

f

g

Problem 1: Public Mempools allow sandwich (MEV) attacks

related paper: “Maximal Extractable Value and Allocative Inefficiencies in Public Blockchains”. A. Capponi, R. Jia, and Y. Wang (2023)

Problem 2: Just-In-Time Liquidity (single trade cream skimming)

X-Router

Liquidity pool

OTC

Problem 2: Just-In-Time Liquidity (at the MEV level)

X-Router

Liquidity pool

searcher/builder

balanced orders

add as much liquidity as possible

withdraw liquidity

unbalanced orders

- the issue:

- order flow segmentation increases adverse selection

- JIT: not enough fees from balanced order flow

related paper: Capponi, Jia, and Zhu (2024) "The Paradox of Just-in-Time Liquidity in Decentralized Exchanges: More Providers Can Lead to Less Liquidity"

From Vitalik Buterin's post on the topic:

https://ethresear.ch/t/improving-front-running-resistance-of-x-y-k-market-makers/1281

- February 2022: UniSwap (V2), ETH-USDC

- 38,100 ETH

- 118M USDC

- \(p=\$3,097\)

- Buy: 100 ETH

- pay approximately $3,105 per ETH. accoridng to bonding curve

- 100 ETH MEV sandwich attack

- Initial trade cost: $3,105 per ETH

- reversing yields $3,121 per ETH

- total profit of $1,639 \(=\) value extracted from original trader.

- 1,000 ETH MEV attack

- profit/loss \(=\) $17K

- 10,000 ETH MEV attack

- profit/loss \(=\) $261K.

Theorem (Park 2023):

- Constant product pricing and linear limit order book pricing allows unlimited MEV losses

- Uniform pricing has limited MEV losses but profitable splitting

Hypothetical example

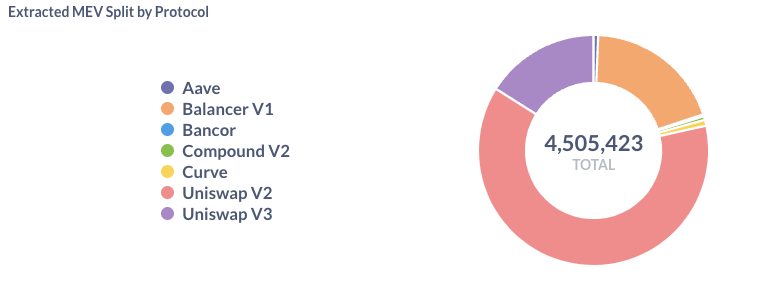

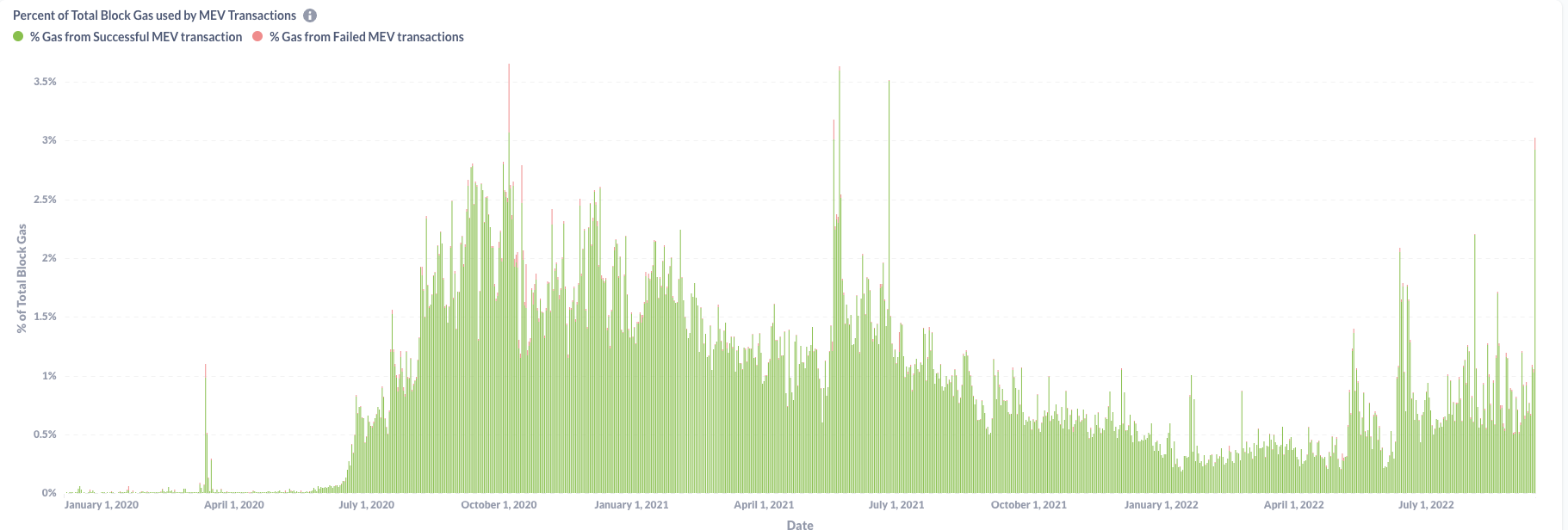

The Bigger Picture: MEV Extraction

- MEV extraction is a reality and almost inevitable

- imposes negative externalities as e=bots bid up gas prices

- "Flashbots" protocol "democratizes" exploits

- protocols became better at preventing sandwich attacks with better functionality

read more at: "Battle of the Bots: Flash Loans, Miner Extractable Value and Efficient Settlement", Lehar & Parlour, 2023

The Bigger Picture and Last Words

Last Words

- here: blockchain \(\approx\) value management infrastructure

- can combine asset custody, orders, trading, clearing, and settlement

- allows different IO of markets and market services

- AMMs are a genuinely new market institution

- evolving space, new ideas come up all the time:

- UniSwap v4 is on its way

- may be embedded in many applications and processes

- lots to learn

@financeUTM

andreas.park@rotman.utoronto.ca

slides.com/ap248

sites.google.com/site/parkandreas/

youtube.com/user/andreaspark2812/

Literature

AMM Literature: a booming field

- Theory

-

Lehar and Parlour (2021): for many parametric configurations, investors prefer AMMs over the limit order market.

-

Aoyagi and Ito (2021): co-existence of a centralized exchange and an automated market maker; informed traders react non-monotonically to changes in the risky asset’s volatility

-

Capponi and Jia (2021): price volatility \(\to\) welfare of AMM LPs; conditions for a breakdown of liquidity supply in the automated system; more convex pricing \(\to\) lower arbitrage rents & less trading.

-

Capponi, Jia, and Wang (2022): decision problems of validators, traders, and MEV bots under the Flashbots protocol.

-

Park (2021): properties and conceptual challenges for AMM pricing functions

-

Milionis, Moallemi, Roughgarden, and Zhang (2022): dynamic impermanent loss analysis for under constant product pricing.

-

Hasbrouck, Rivera, and Saleh (2022): higher fee \(\Rightarrow\) higher volume

-

-

Empirics:

-

Lehar and Parlour (2021): price discovery better on AMMs

-

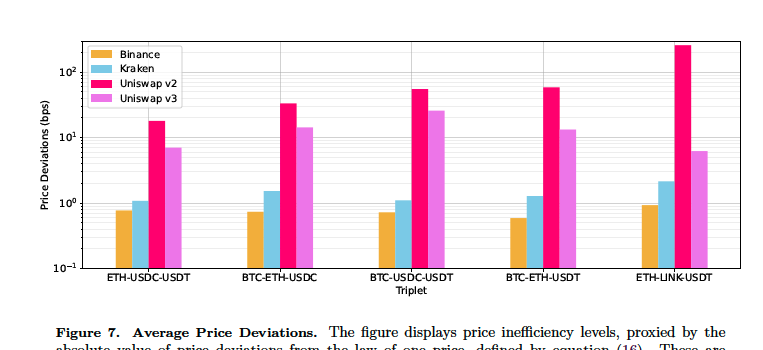

Barbon and Ranaldo (2022): compare the liquidity CEX and DEX; argue that DEX prices are less efficient.

-

-

Math Literature: large number of papers that study AMMs in applied maths

- e.g. Cartea, Drissi, Monga (2023): closed form solution to IPL and optimizing strategy

Trading Infrastructure

payments network

Stock Exchange

Clearing House

custodian

custodian

beneficial ownership record

seller

buyer

Broker

Broker

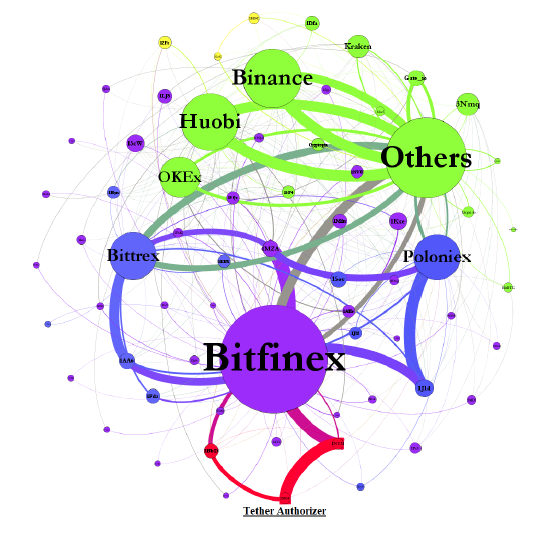

IS BITCOIN REALLY UN-TETHERED? JOHN M. GRIFFIN and AMIN SHAMS

Journal of Finance 2020

- Tether = ‘pushed’

- print an unbacked digital dollar to purchase Bitcoin.

- \(\to\) additional supply of Tether creates unwarranted inflation in Bitcoin price

vs.

- Tether = ‘pulled’

- driven by legitimate demand from investors who use Tether as a medium of exchange

- \(\to\) the price impact of Tether reflects natural market demand

Price Manipulation: Pumping Bitcoin

Price Manipulation: Pumping Bitcoin

Figure 1. Aggregate Flow of Tether between Major Addresses

marginal pricing function

quantity \(q\)

price \(p^m(q)\)

Illustration of pricing

Some Pricing Rules from Traditional Markets: Limit Order Book

- Liquidity providers submit sell orders \(s_1(p_1,q_1),\ldots,s(p_n,q_n)\)

- Matching engine sorts order increasing by price

-

someone who wants to buy quantity

\[q\in\left(\sum_{i=1}^{m-1} q_i,\sum_{i=1}^{m} q_i\right]~~~\text{pays}~~\Delta c(q)=\sum_{i=1}^mq_i\cdot p_i.\]

- For a simpler exposition, assume that the price-quantity curve can be expressed by a continuous marginal price function \(\rho(s)\) so that

\[\Delta c(q)=\int_0^q\rho(s) ds.\]

Returns to Liquidity Provision

For fixed balanced volume \(V\) and fee \(F\)

- Larger pool \(\to\) smaller share of fees

- \(\to\) LP expected return \(\searrow\) pool size

Competitive liquidity provision

- \(\Rightarrow\) upper bound on pool size above which LPs lose money

- Here: characterize this amount by the asset's market cap to be deposited to the pool (notation: \(\overline{\alpha}\))

Basics of Liquidity Provision

\[\text{LP payoff}=\text{what I sold it for}-\text{value of net position}+\text{fee income}\]

- \(R\) = asset return

- F = trading fee

- V = balanced volume

- a = size of the liquidity pool

see Lehar and Parlour (2023), Barbon & Ranaldo (2022).

(incremental) adverse selection loss when the return is \(R\)

fees earned

on informed

fees earned

on balanced flow

for reference:

- If the asset price drops by 10% the incremental loss for liquidity providers is 13 basis points on their deposit

- \(\to\) total loss=-10.13%

- If the asset price rises by 10%, the liquidity provider gains 12 basis points less on the deposit

- \(\to\) total gain =9.88%

positional loss

Basics of Liquidity Provision

\[\frac{1}{\text{initial deposit}}\int_0^\infty(\Delta c(q^*)-q^*p_t(R)+F \cdot \Delta c(q^*))~\phi(R)dR +\frac{F p_0 V}{\text{initial deposit}}\ge 0\]

\[\int_0^\infty\left(\frac{\Delta c(q^*)-q^*p_t(R)}{\text{initial deposit}} +F \cdot \frac{\Delta c(q^*)}{\text{initial deposit}}\right)~\phi(R)dR +\frac{F p_0 V}{\text{initial deposit}}\ge 0\]

closed form functions of \(R\) only

(see Barbon & Ranaldo (2022))

\[\underbrace{F \int DV \mu(DV) }_{\text{fees earned on}\atop \text{balanced flow}}+\int_0^\infty\underbrace{(\Delta c(q^*)-q^*p_t(R)}_{\text{adverse selection loss} \atop \text{when the return is {\it R}}} +\underbrace{F \cdot \Delta c(q^*))}_{\text{fees earned}\atop \text{from arbitrageurs}}~\phi(R)dR \ge 0.\]

Basics of Liquidity Provision

\(\Rightarrow\) \(\Delta c(q^*)-q^*p_t(R)\) is also referred to as the "impermanent loss" or "divergence loss"

\(\Delta c(q^*)-q^*p_t(R)=\underbrace{p_t(R)\times(a-q^*) +c+\Delta c(q^*)}_{\text{value of liquidity deposit}}-\underbrace{(p_t(R)a+c)}_{\text{value of buy-} \atop \text{and-hold position}}\)

see Milionis, Moallemi, Roughgarden, and Zhang (2022) for a dynamic analysis of impermanent loss

Basics of Liquidity Provision

Liquidity provision measured as "collective" deposit \(\alpha\) of token's market cap as function of

- balanced volume

- return distribution

(some authors use explicit functions so they can relate it to asset volatility) - fee

\[E[\text{DL}(R)]+F\cdot E[\text{another function of }R]+F\cdot \frac{\text{E[dollar volume]}}{\text{initial deposit}}\ge 0.\]

\[\text{what I sold it for}-\text{value of net position}+\text{fee income} \ge 0 \]

The Decision of the Liquidity Demander

- Wants to trade some quantity \(q\) at cost

\[\text{AMM price impact} +\text{AMM fee}.\]

- two opposing forces for \(F\nearrow\) for liquidity demand

- more liquidity provision

\(\to\) lower price impact - more fees to pay

- more liquidity provision

- Finding: There is a minimal cost fee:

\[F^\pi=\frac{1}{E[|\sqrt{R}-1|/2]+E[DV]}\left(-2q\ E[\text{DL}]+ \sqrt{-2qE[DV]\ E[\text{DL}]}\right).\]

this is from Malinova and Park (2023); similar result is in Hasbrouk, Riviera, Saleh (2023)

Model Summary

- Have: equilibrium choice for liquidity provision.

Useful feature: can express liquidity by % market cap of token/asset

- Can measure cost for liquidity demanders to use AMM.

- Know: fee that maximizes liquidity demander benefit (\(\not=0\))

The Pricing Function

Liquidity Deposit \(\Rightarrow\) slope of the price curve

- Most common form of AMM liquidity rule is Constant Product Pricing

\[L(a,c)=a\cdot c~\Rightarrow~a\cdot c= (a-q)\cdot (c+\Delta c).\] - Total cost of trading \(q\) \[\Delta c=\frac{cq}{a-q}.\]

- Price per unit \[p(q)=\frac{c}{a-q}.\]

- Average spread paid\[\frac{p(q)}{p(0)}-1=\frac{q}{a-q}.\]

- makes asset and cash deposit

- more deposits flatter price curve

- attracts more volume

- but larger "positional" loss when prices move

The Pricing Function (just a little more)

- A limit order book has a marginal price function \(\rho(q)\) so that \[\Delta c(q)=\int_0^q\rho(s) ds.\]

- We can do that here, too: for

\[\rho(q)=\frac{ac}{(a - q)^2},\]

we have \[\int_0^q \frac{ac}{(a - s)^2}ds=\frac{cq}{a-q}.\] - \(\to\) Constant Product = special case of a limit order book.

The Pricing Function (almost done, just one more thing)

- Suppose we start with a price \(P\) and end with a price \(P'=R\cdot P\).

- We know by definition

\[P=\frac{c}{a},~P'=\frac{c'}{a'},~L=\sqrt{ac},~L=\sqrt{a'c'}.\]

- Then it holds that \[a=\frac{L}{\sqrt{P}},~c=L\sqrt{P},~a'=\frac{L}{\sqrt{P'}},~c'=L\sqrt{P'}.\]

- For the price to move from \(P\) to \(P'\), quantities \(q,\Delta c\) change hands.

- Therefore \(a'=a-q,~c'=c+\Delta c\)

- Combine with the above \[a-q=\frac{L}{\sqrt{P'}}~\Leftrightarrow~q=L\left(\frac{1}{\sqrt{P}}-\frac{1}{\sqrt{P'}}\right).\]

- do the same for \(\Delta c\) \[\Delta c= L\left(\sqrt{P'}-\sqrt{P}\right).\]

- the per unit price for the trade of \(\Delta x\) is \[\frac{\Delta c}{q}=\sqrt{PP'}=P\sqrt{R}.\]

- \(\to\) avg price is the geometric mean of the prices

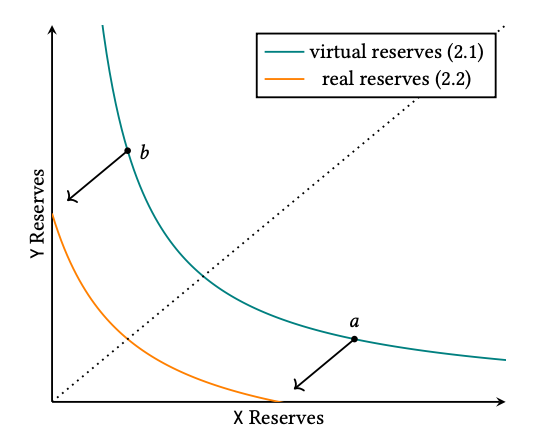

AMMs continue to evolve: UniSwap v3

Basic idea:

- allow different fees (let's ignore)

- don't supply liquidity for entire price range \((0,\infty)\) but only \([p_a,p_b]\)

- idea: project the iso-liquidity curve back to the axes

- price in this range is determined by constant product rule

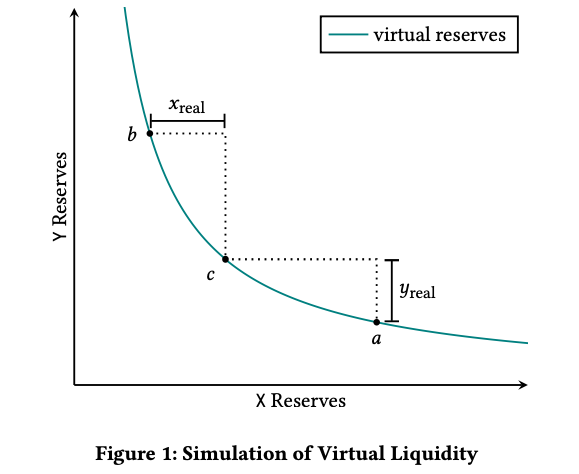

Source:" Uniswap v3 Core," Adams, Zinsmeister, Salem, Keefer, Robinson (2021)

- current price at point \(c\): \(p_c\)

- \(x_{\text{real}}=\) max of \(X\) you buy

- \(y_{\text{real}}=\) max of \(Y\) you buy

- pricing effectively occurs on a grid

- it's not straightforward to describe the pricing function without lots of new notation

Some UniSwap v3 maths (Barbon & Ranaldo 2023)

Source: Elsts (2021) "Liquidity Math in UniSwap v3"

- We are interested in "virtual limit orders"

- for selling known \(x\Rightarrow y=0\) (only sell) have known \(P,x,y,p_a\):

- what is the (ask) price \(p_b\)?

- for selling up to price \(p_b\) \(\Rightarrow y=0\) (only sell) have known \(P,y,p_a,p_b\):

- what is the quantity \(x\)?

- for selling known \(x\Rightarrow y=0\) (only sell) have known \(P,x,y,p_a\):

- When the price is in interior of \((p_a,p_b)\) liquidity provided "to the left" of the price must coincide with liquidity provided to the right.

- We can derive conditions \[x=L\ \frac{\sqrt{p_b}-\sqrt{P}}{\sqrt{p_b}\sqrt{P}}\]

\[y=L\ (\sqrt{P}-\sqrt{p_a})\]

- \(\tilde{x},\tilde{y}\) the "real" reserves, \(x,y\) the virtual reserves

- \(P\) the price of "\(x\)" (asset) in "\(y\)" (cash), with \(P\in[p_a,p_b]\)

- \(L\) the liquidity

- Constant product function: \(L=\sqrt{xy}\)

- And then \[L^2=\left(\tilde{x}+\frac{L}{\sqrt{p_b}}\right)\left(\tilde{y}+L\sqrt{p_a}\right).\]

- At the price bounds, the real amounts are either \(x=0\) or \(y=0\). We can derive conditions \[x=L\ \frac{\sqrt{p_b}-\sqrt{p_a}}{\sqrt{p_b}\sqrt{p_b}}\]

\[y=L\ (\sqrt{p_b}-\sqrt{p_a})\]

Problem: MEMPOOL Frontrunning is intrinsically profitable

\(X\)

\(Y\)

normal trade: sell \(x\) \(\to\) get \(y'\)

\(Y-y'\)

\(X+x\)

front-running:

- front-runner: sells \(x\) \(\to\) gets \(y'\)

- front-run: sells \(x\) \(\to\) gets \(y''\)

- front-runner: buys \(x\) \(\to\) pays \(y''\)

\(Y-y'-y''\)

\(X+2x\)

\(y'>y''~\Rightarrow\)

front-running is intrinsically profitable

Disclaimer:

- this problem is well-known

- fees can mitigate it

- several protocols such as the latest iteration by Balancer try to combat it

Dark side of DEx trading: Miner extractable value

Application 1: decentralized trading with automated market makers

Problems:

- How to get liquidity?

- How do you attract traders?

lesser problem because

- tokens trade elsewhere

- arbitrage creates activity

Common solution: create a reward token! Here's how this works

Step 4: users receive a reward token based on the time that they lock up the "receipt" token

Step 3: users lock up the "receipt" token in a smart contract

Step 2: users contribute liquidity and get a "receipt" token

Step 1: create reward tokens and deposit into a smart contract

borrow

provide collateral

Application: Pool-based borrowing and lending

Application 2: decentralized Borrowing and Lending

Same problems as with trading:

- How to get liquidity?

- How do you attract borrowers?

But: in contrast to trading, here you need both!

liquidity \(\nearrow\)

volume \(\nearrow\)

protocol fees \(\nearrow\)

token value \(\nearrow\)

Platform economics is tricky:

- What's the product?

- How do you get it started?

- How do you get people to contribute?

- How do you earn money?

Without intermediaries:

platform economics!

incentives for both?

What value do these tokens have?

- Functionality:

- fee levels for AMMs

- decision to deploy on other chains

- key threshold values for lending

- Monetary value

- implicit claims on "protocol" income

- implicit claim on reserve pools

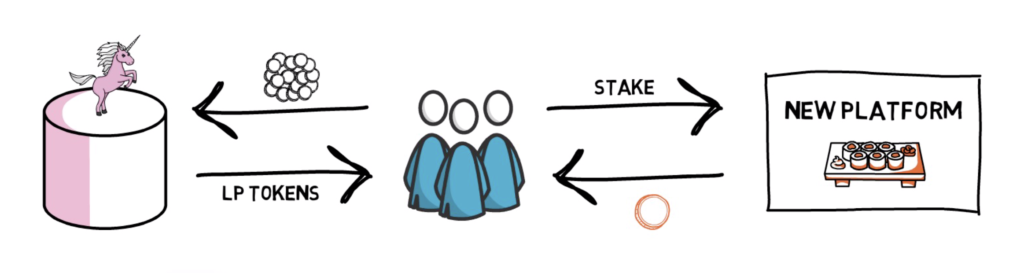

Vampire Attacks and Other Shenanigans

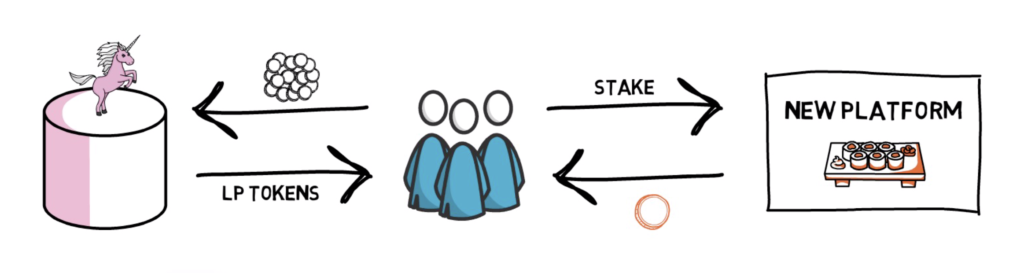

Source: https://finematics.com/vampire-attack-sushiswap-explained/

- Vampire Attack:

- syphon liquidity from a different protocol

- using your own token!!!

- Mechanism:

- deposit in UniSwap, receive LP token

- deposit LP token to Sushi, receive rewards

- liquidate LP token and migrate original liquidity to Sushi = "suck out the blood from UniSwap"

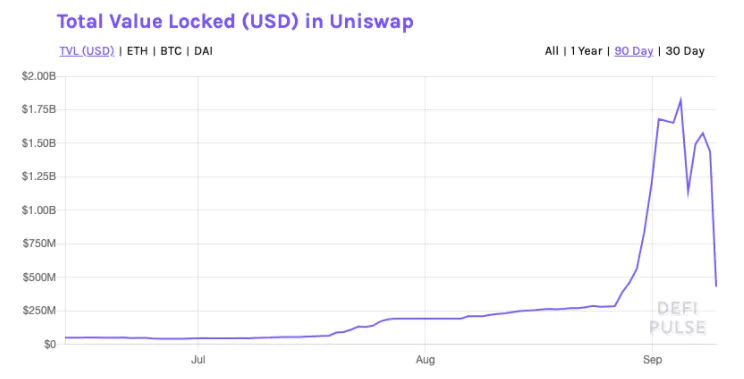

another common trick:

- pump the price of the reward tokens

- \(\Rightarrow\) "yields" often exceed 500%