Blockchain and Decentralized Finance:

A 2024 Primer

Presenter: Andreas Park

Agenda

- Background:

- Vocabulary & Evolution

- What's DeFi and what's different to TradFi?

- Explain some key DeFi applications

- Understanding tokens

- asset-linked tokenization

- stablecoins

- crypto-tokens and their role

- Getting your hands dirty!

What is a Cryptocurrency?

Conceptually, what is a blockchain?

What our financial infrastructure looks like

payments

stocks, bonds, and options

swaps, CDS, MBS, CDOs

insurance contracts

payments

stocks, bonds, and options

swaps, CDS, MBS, CDOs

insurance contracts

\(\Rightarrow\) a single common resource

- easy value management

- straightforward transfers & ownership accounting

- new types of contracts and usage of assets

- \(\ldots\)

What would the most efficient financial infrastructure look like?

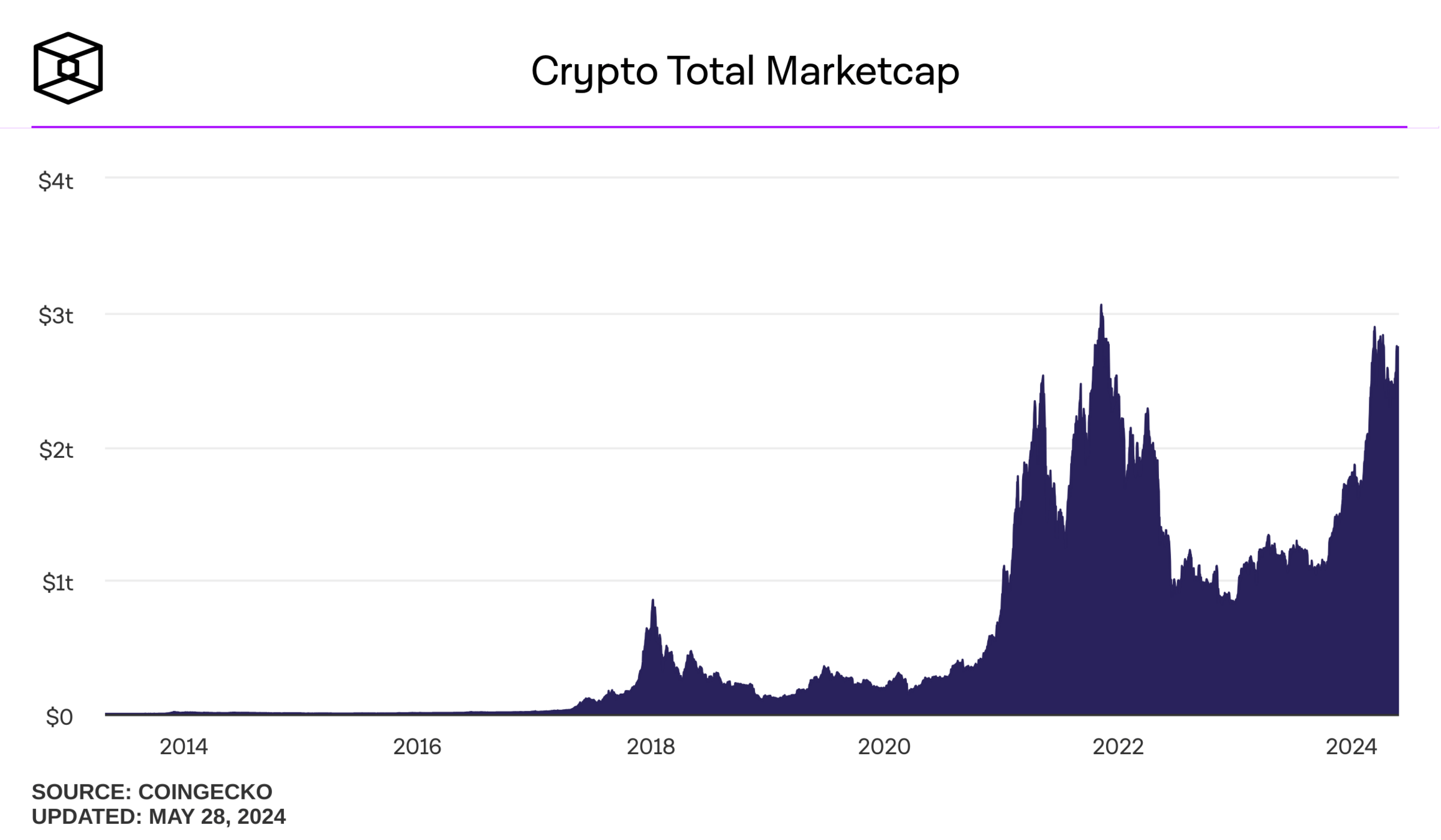

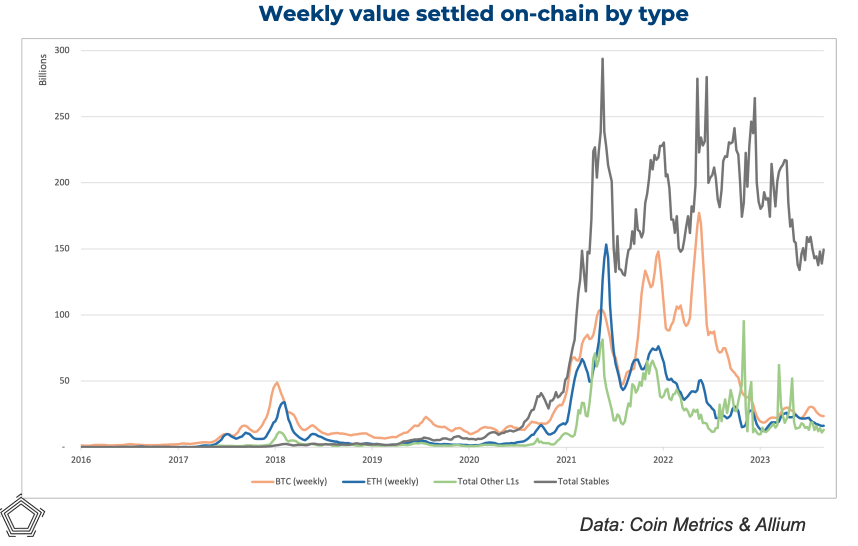

\(\approx\) 50% is bitcoin (but used to be 70%)

How do you own a blockchain asset? Addresses, Accounts, Wallets, and Public/Private Keys

Smart contract accounts

- controlled by code

- decentralized applications

- tokens

Externally owned accounts

controlled by private keys

private

key

public

key

seed phrase

public

address

wallet = software to keep and use private keys

- Self-custody of assets

- Access to financial infrastructure

- Value management layer = common resource

- Platform approach to commerce

What makes blockchain-based finance different from TradFi?

Decentralized Trading

Trading Infrastructure

payments network

Stock Exchange

Clearing House

custodian

custodian

beneficial ownership record

seller

buyer

Broker

Broker

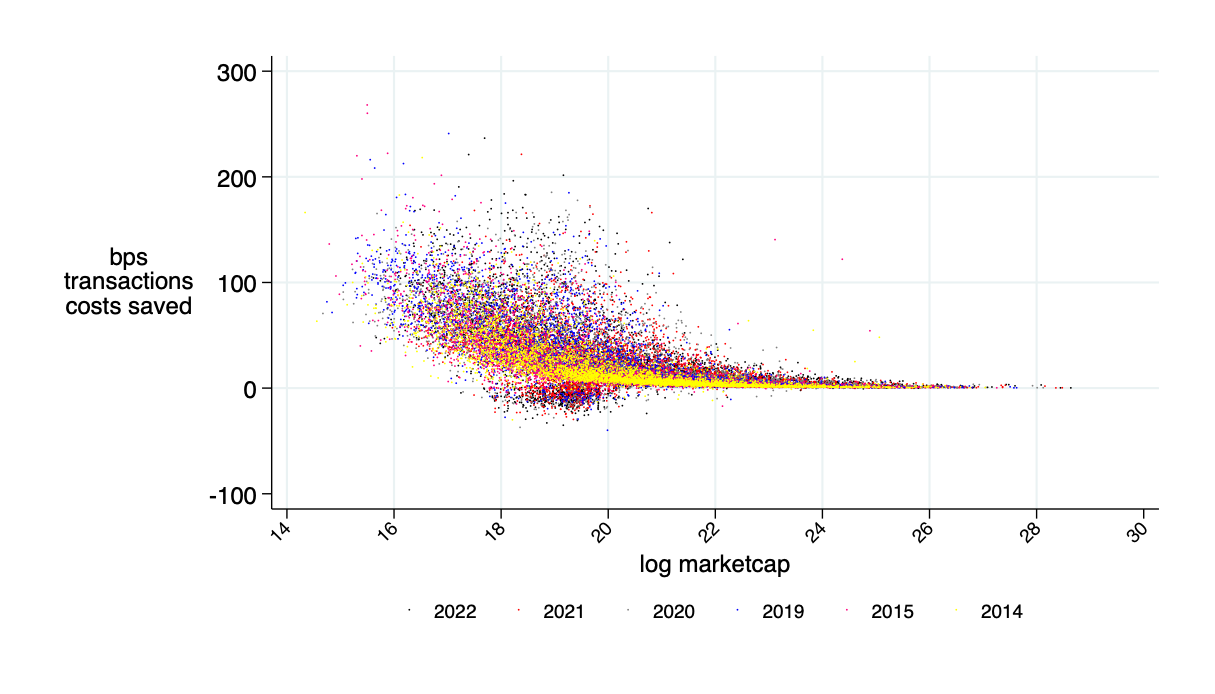

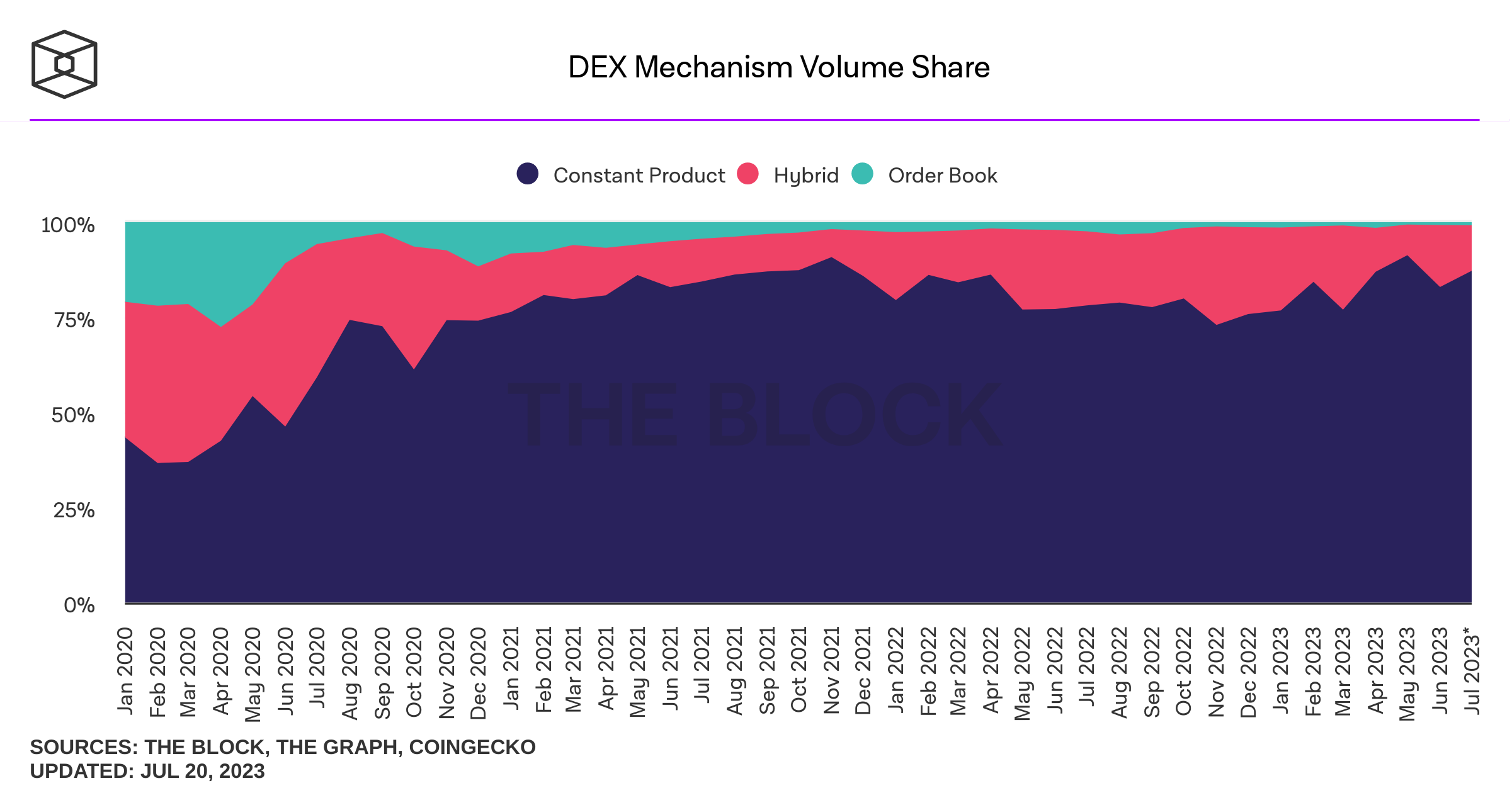

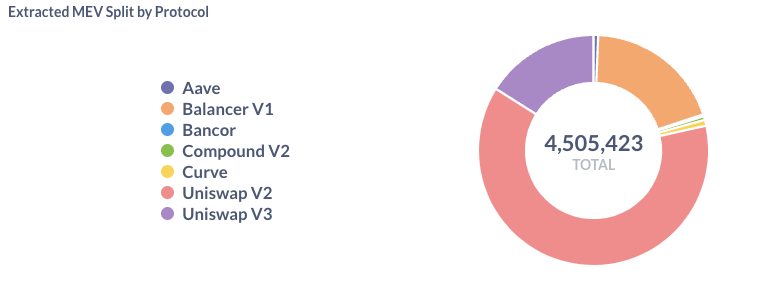

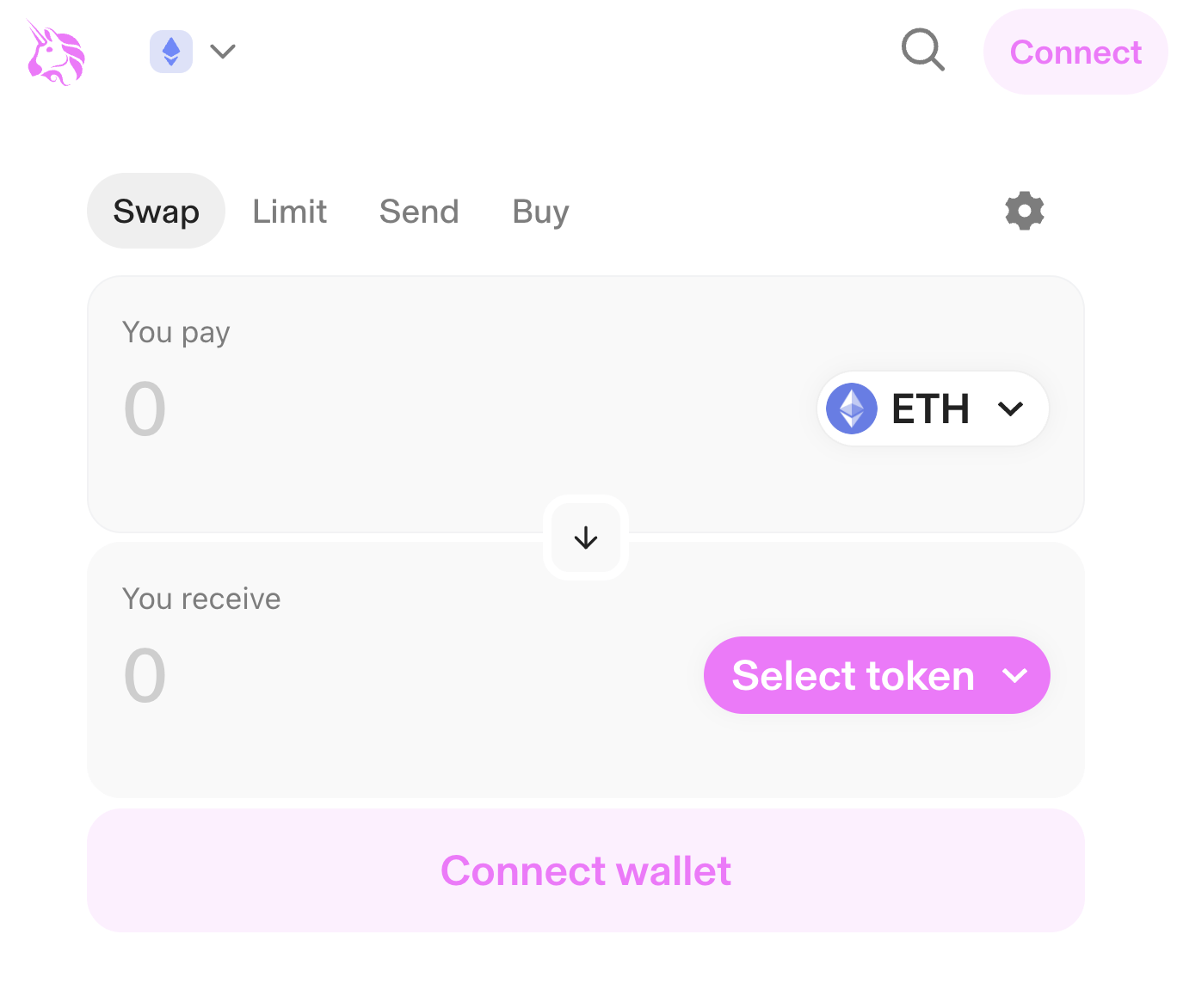

Application: decentralized trading with automated market makers

Source of savings:

- better risk sharing among liquidity providers

- better use of capital

Possible transaction cost savings when applied to equity trading: \(\approx\) 30%

Source: "Learning from DeFi: Would Automated Market Makers Improve Equity Trading?" working paper, Malinova & Park 2023

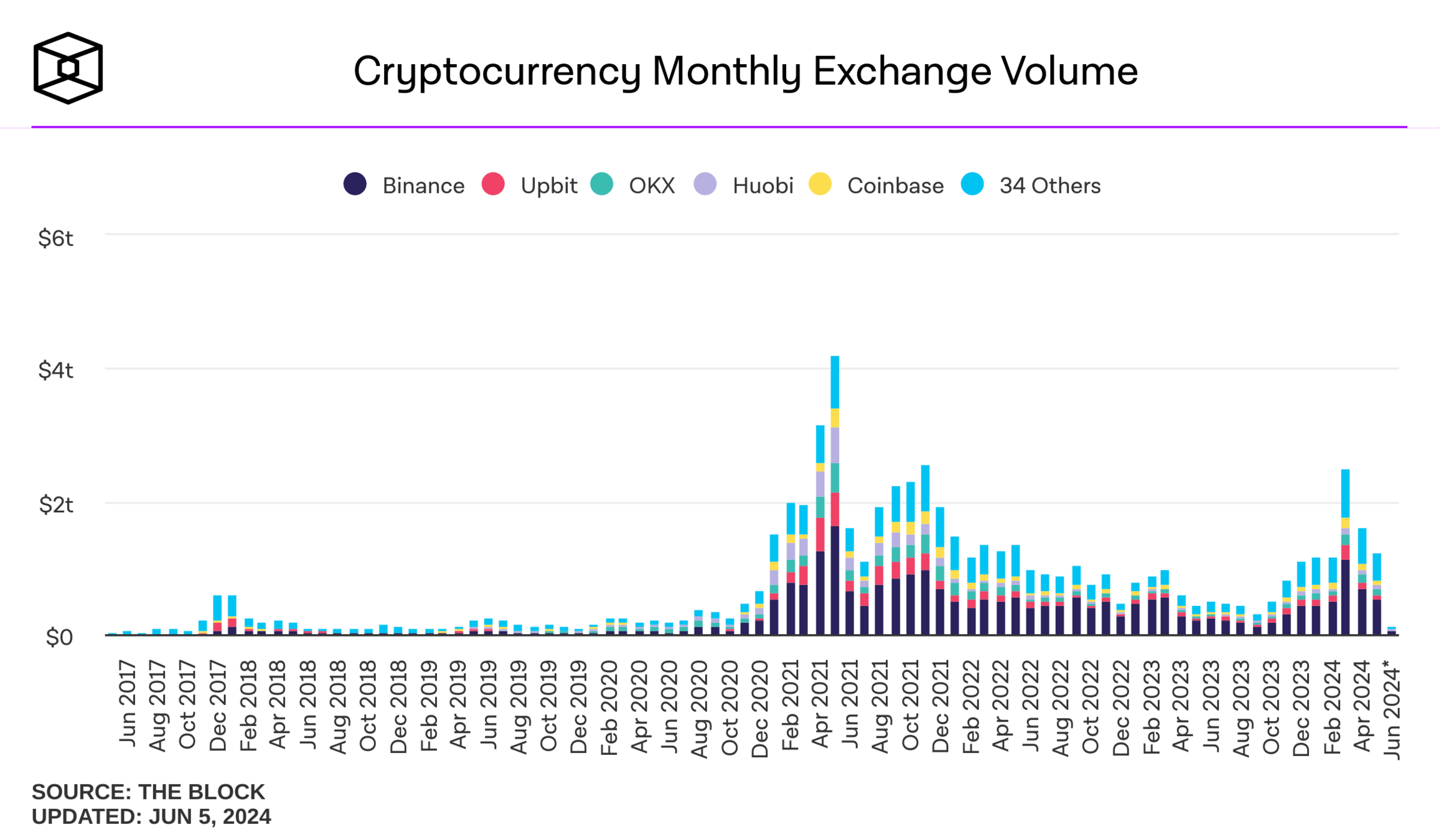

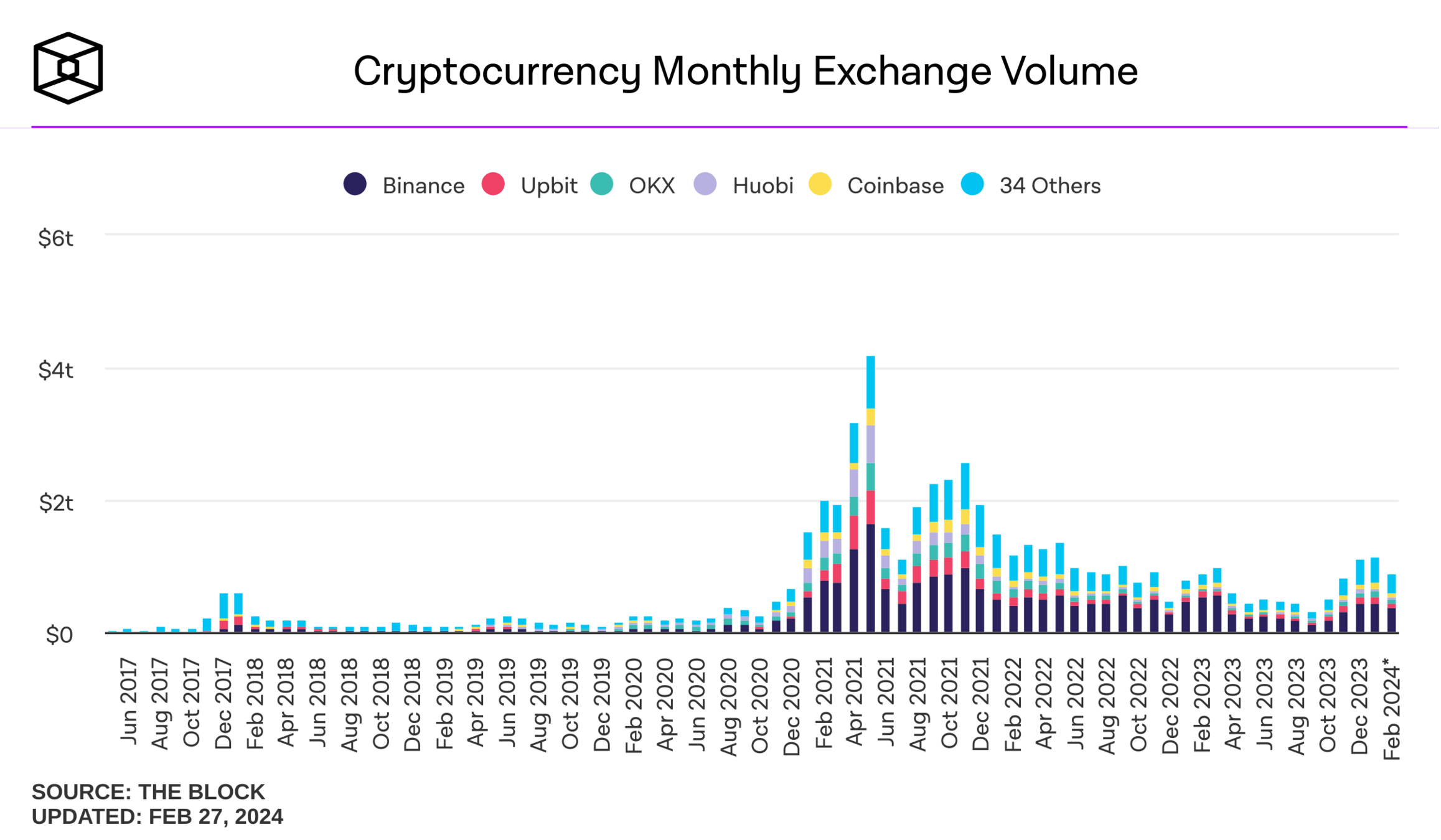

Let's look at some stylized facts

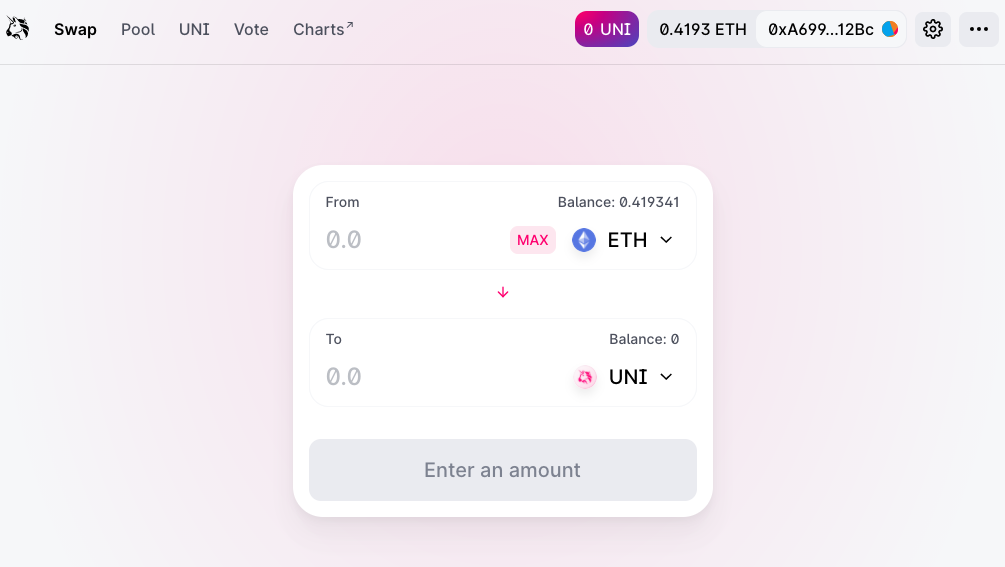

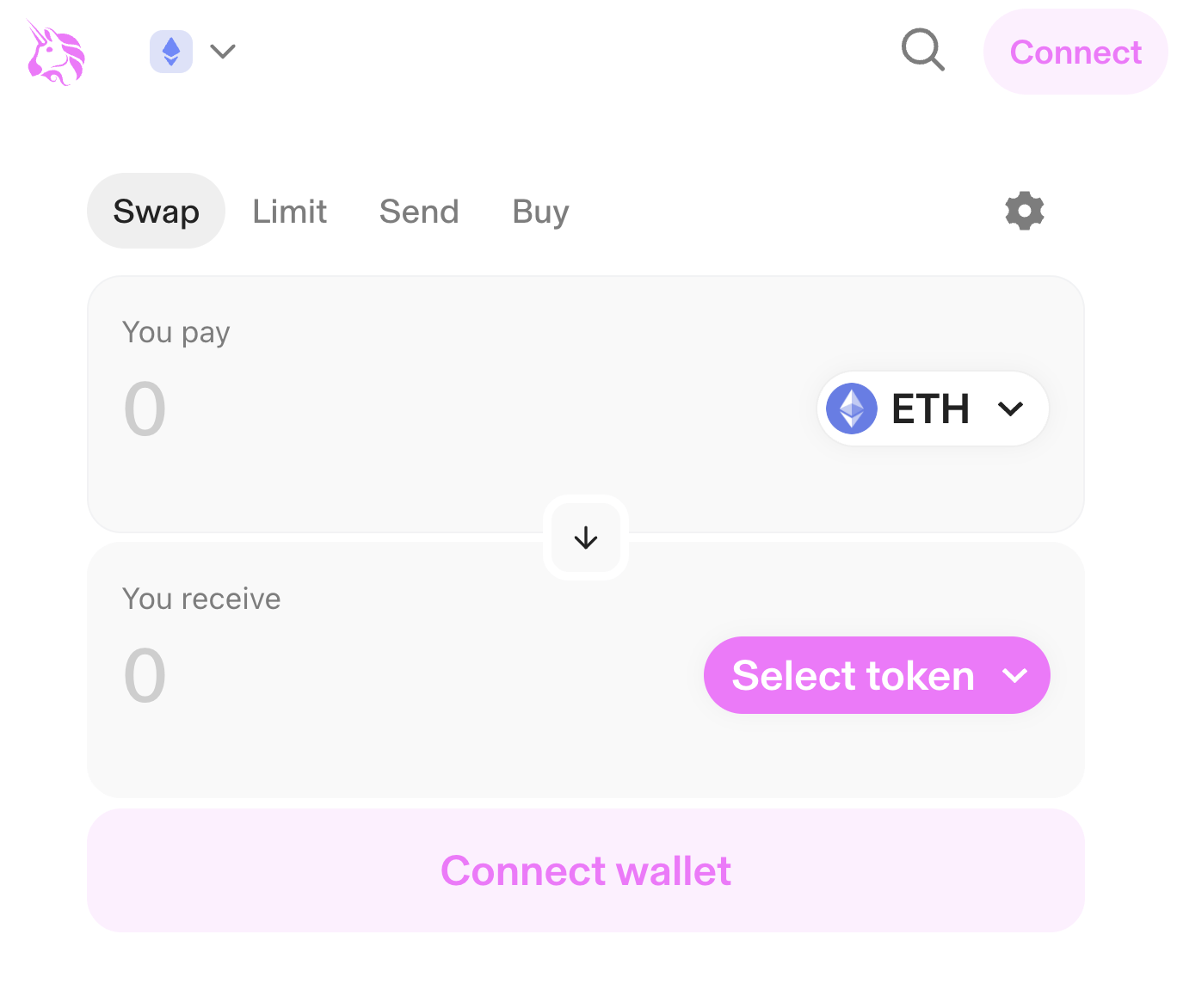

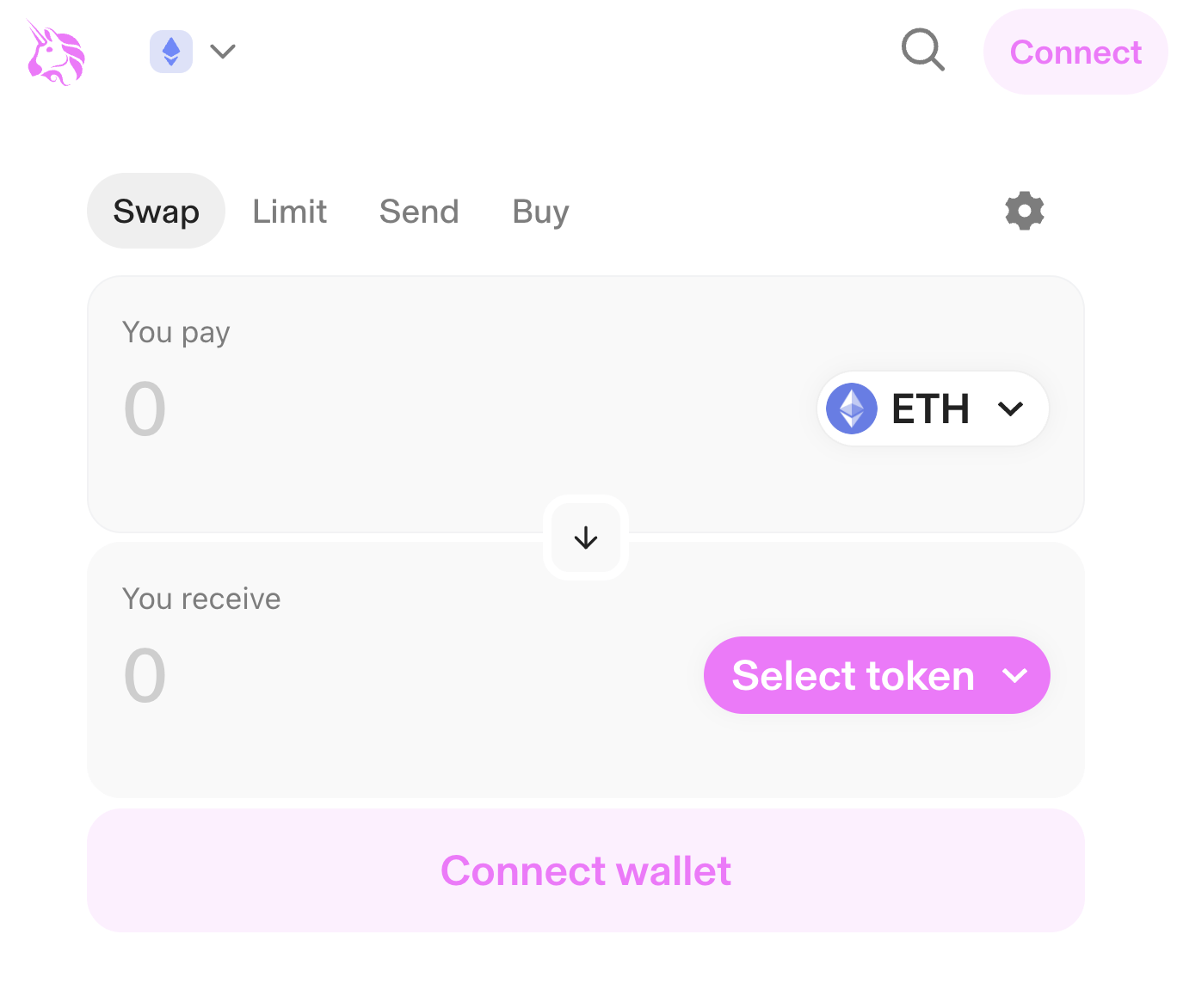

\(\to\) simply connect with MetaMask (or similar wallet)

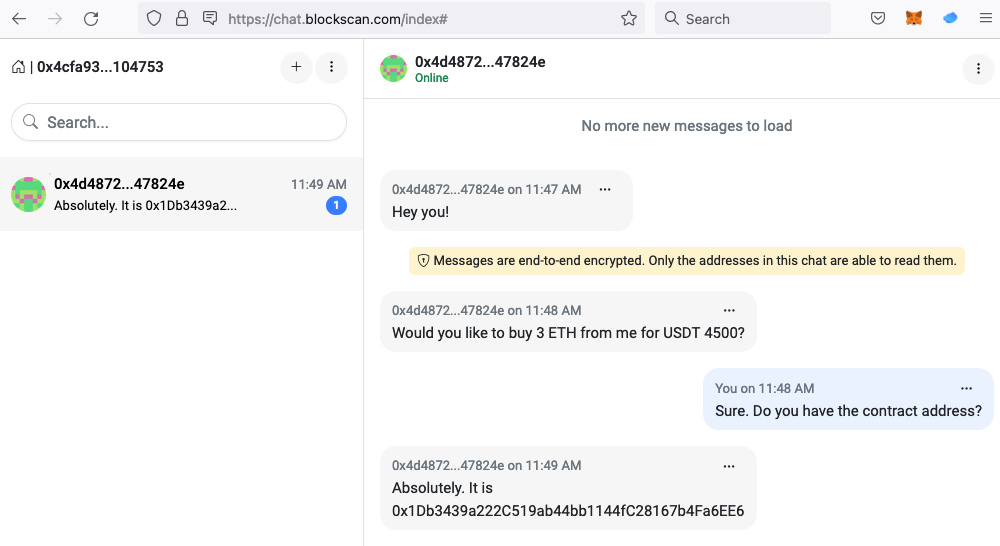

How does this look in practice?

Broker

Exchange

Internalizer

Wholeseller

Darkpool

Venue

Settlement

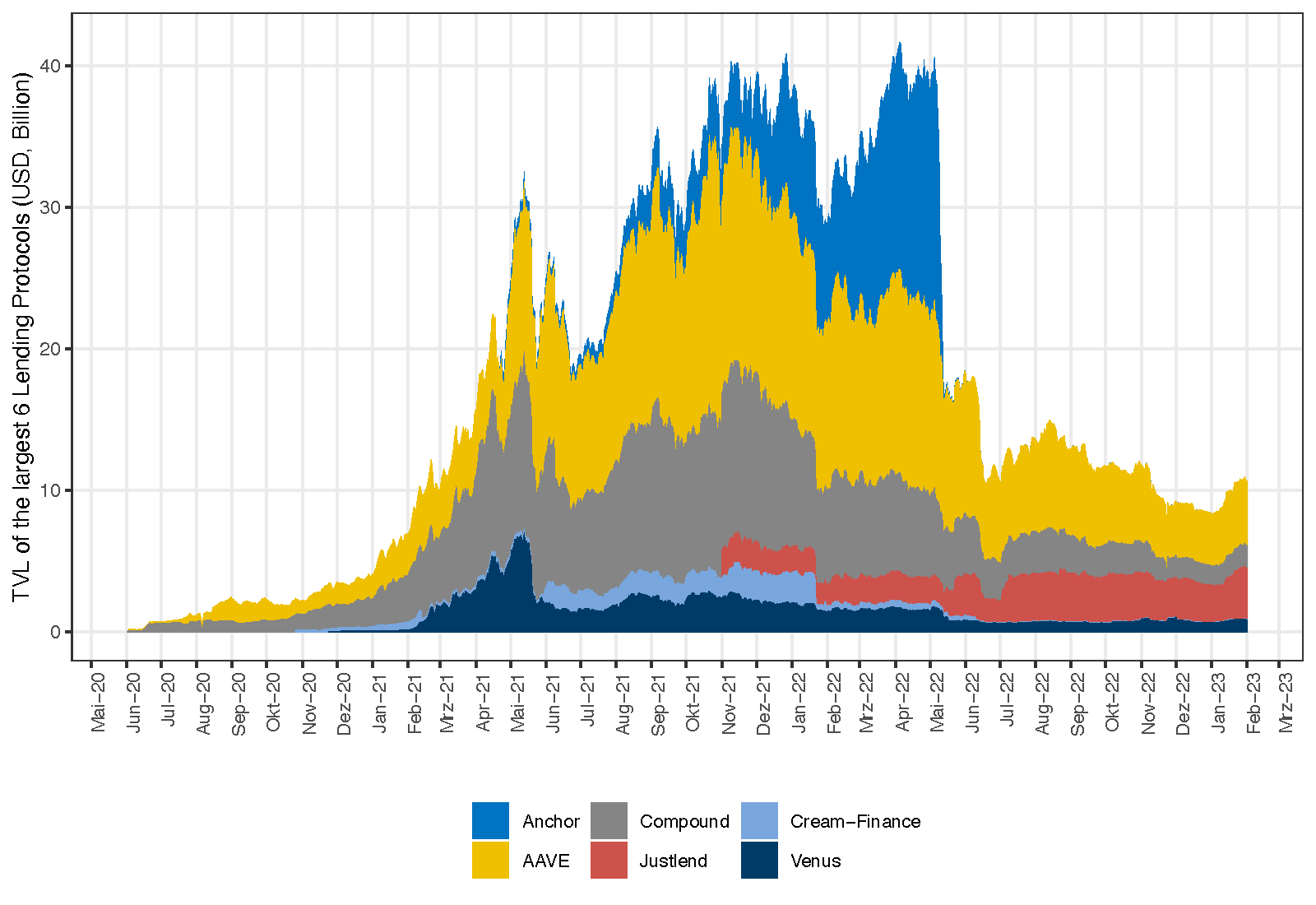

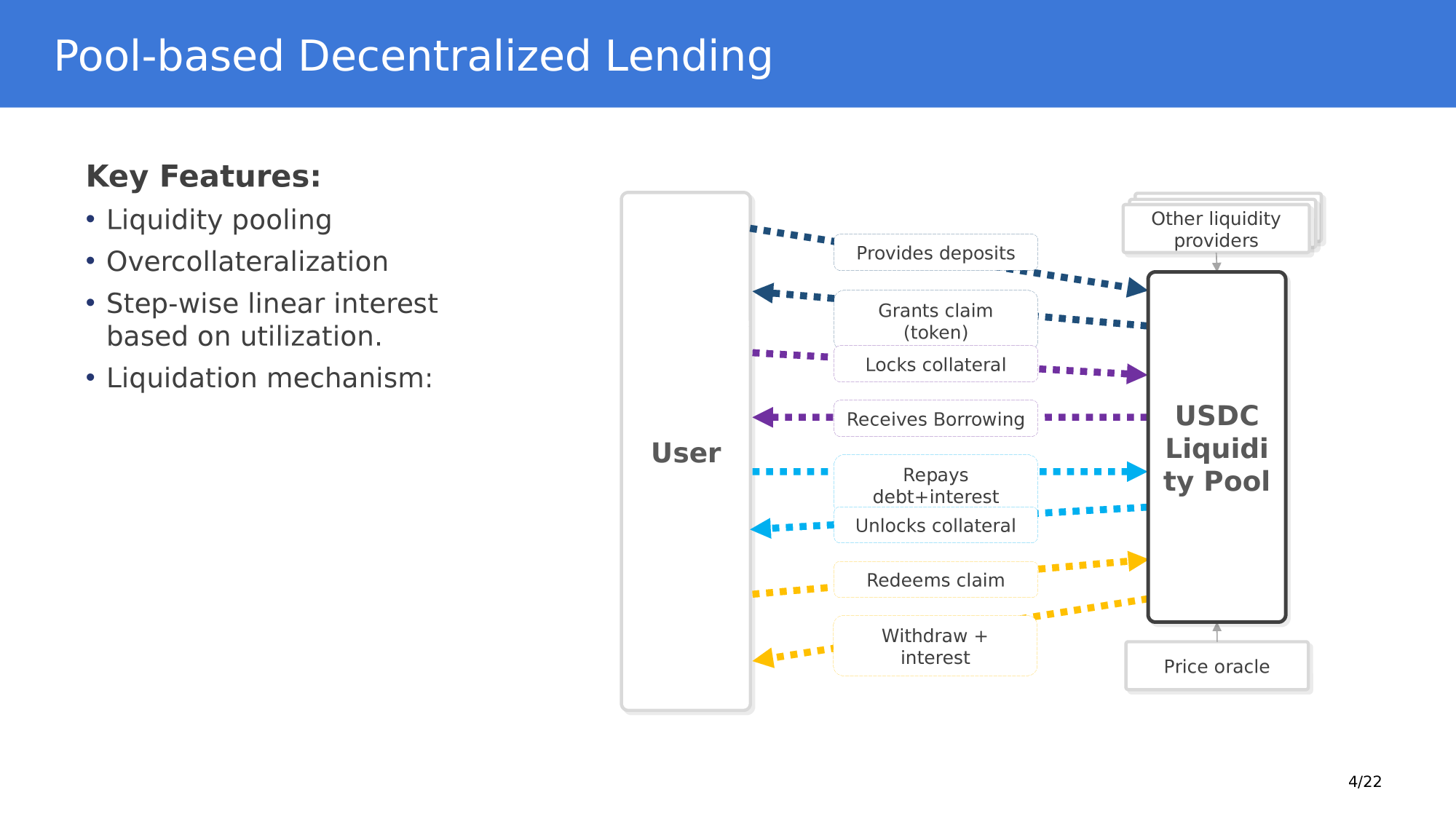

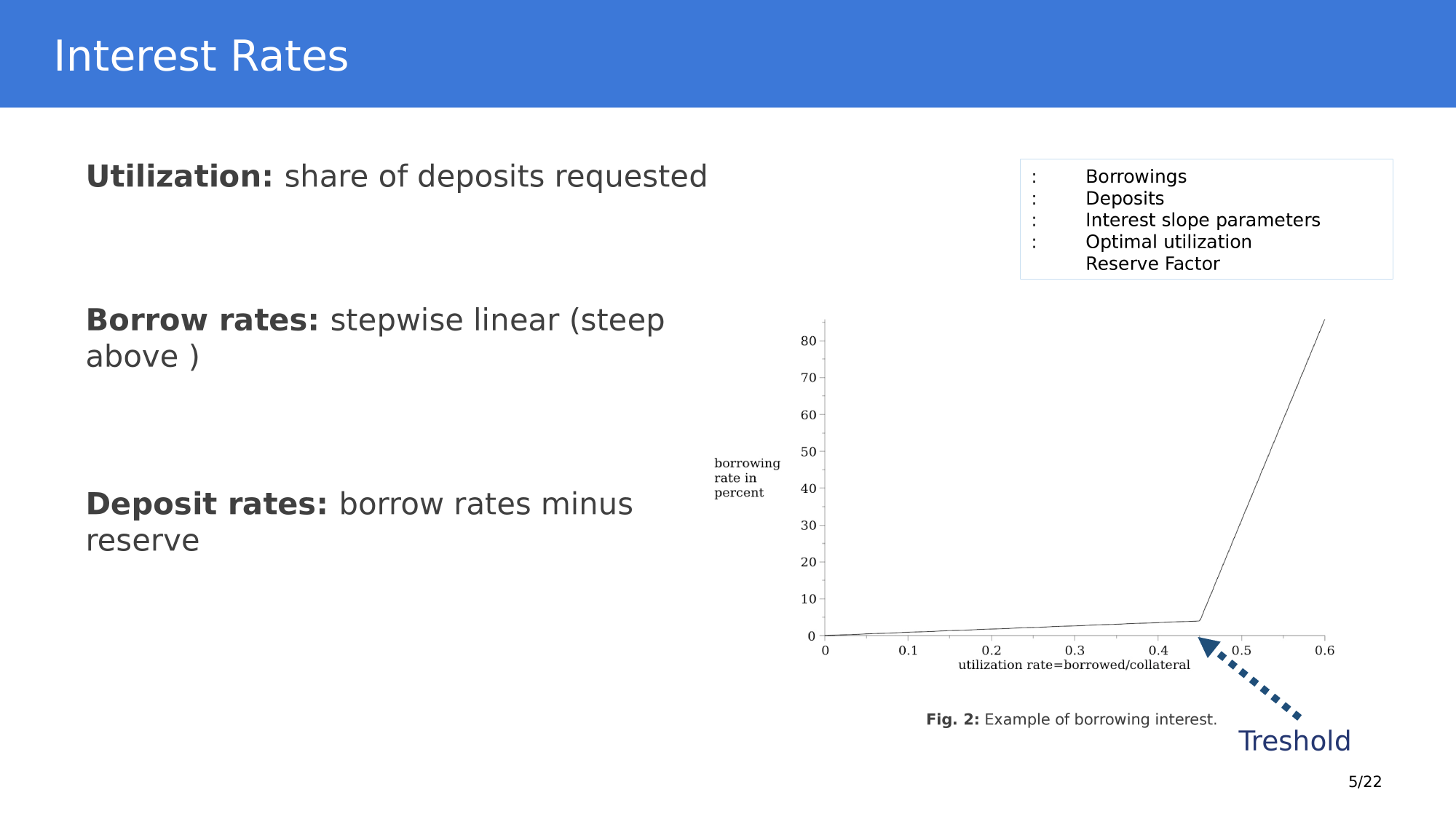

Pool-based lending principles

borrow

provide collateral

Application: Pool-based borrowing and lending

Application: Decentralized Borrowing & Lending

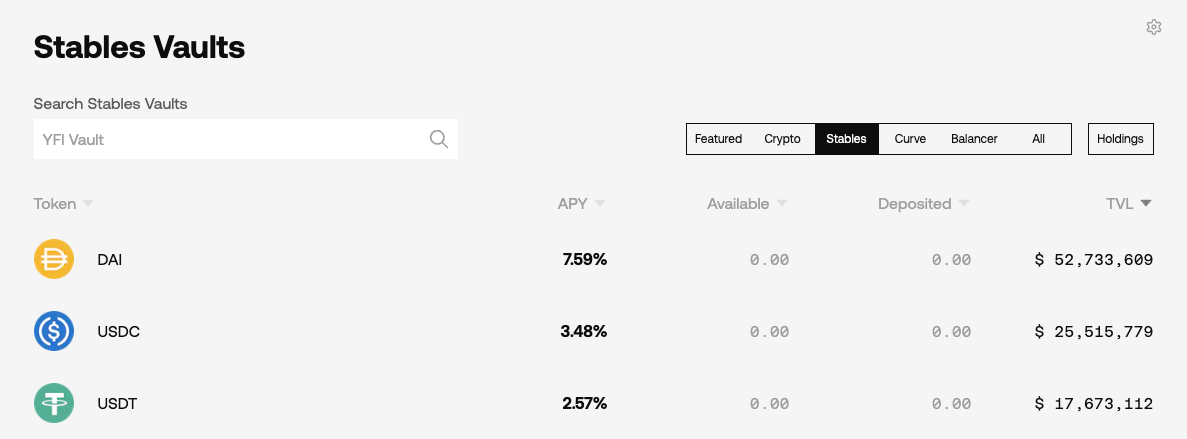

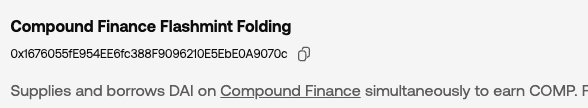

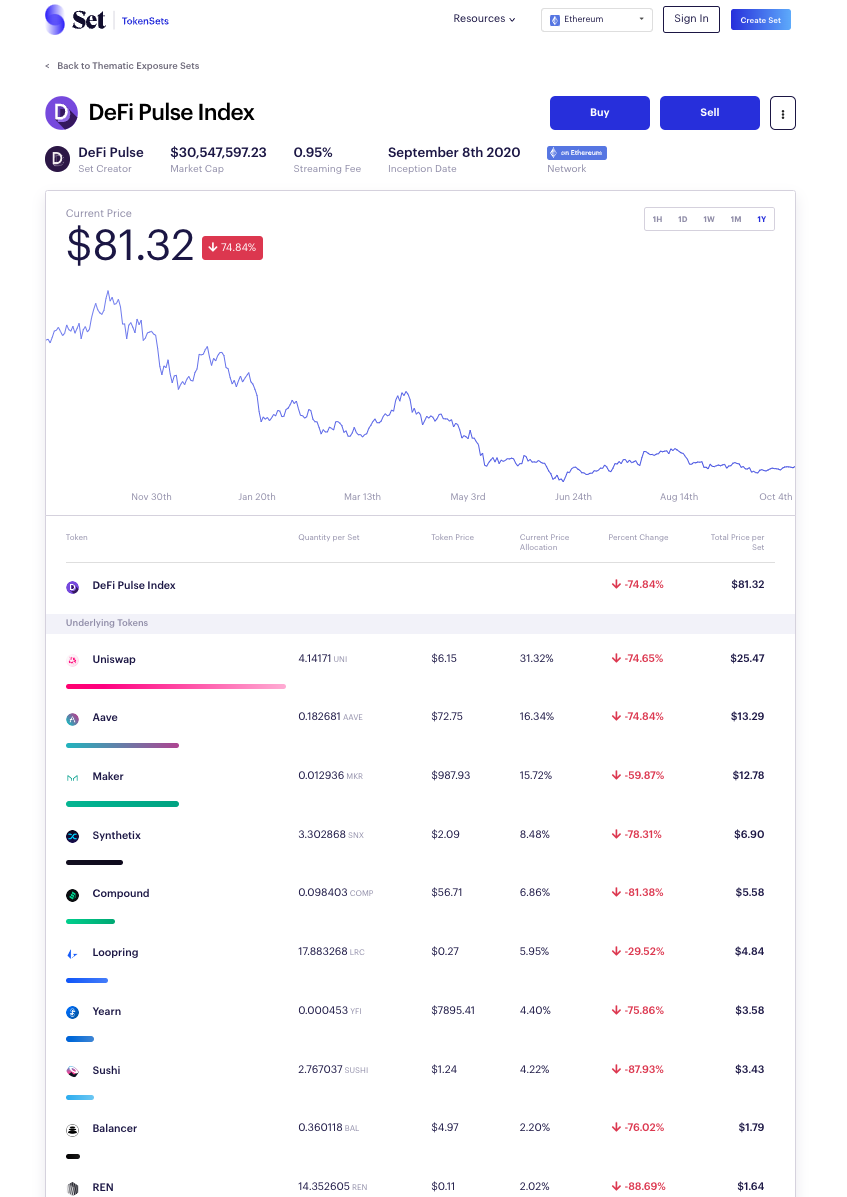

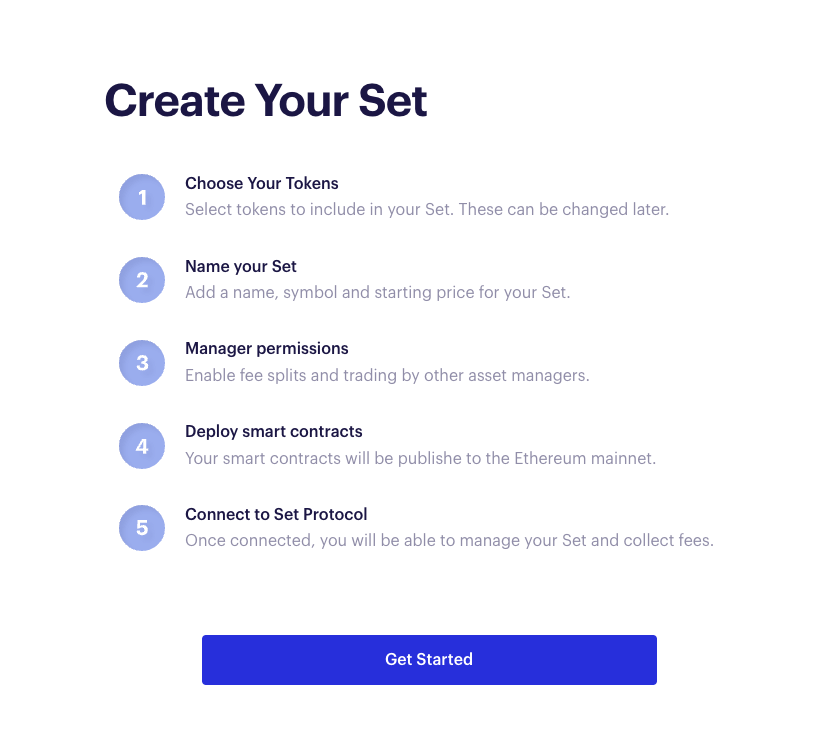

Obvious Smart Contract Application: Automate Investment Strategies

idea: create new mutual fund like asset

"yield aggregator:" push capital where rate of return is highest

Flash Loans

5. repay DAI

for loan

with health factor <1

liquidation

opportunity

1. flash-borrow DAI

2. repay loan

with DAI

3. claim

collateral ETH

4. convert ETH to DAI

What roles do tokens play?

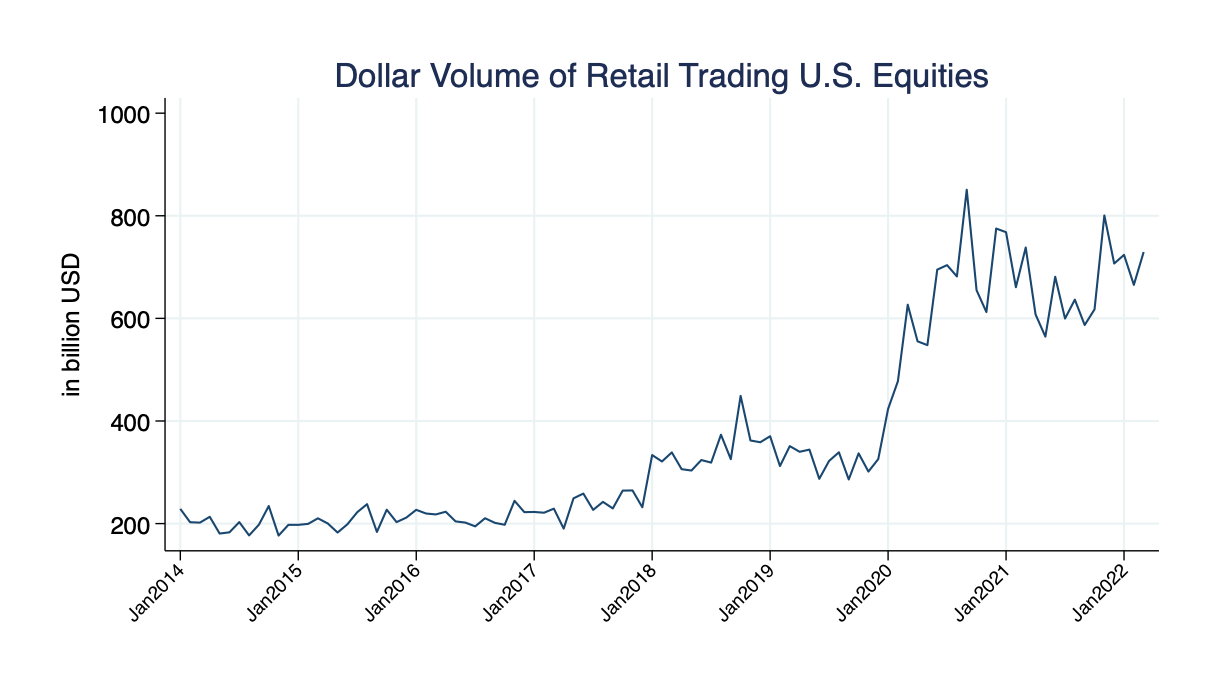

- People clearly treat tokens and cryptocurrencies as objects of speculation

- data: authors calculations from TAQ (up to March 2023)

- crypto volume worldwide is larger by factor >4

- Self-custody of assets

- Access to financial infrastructure

- Value management layer = common resource

- Platform approach to commerce

What roles do tokens play?

recall the differences

\(\to\) key feature: no necessary intermediaries

Application 1: decentralized trading with automated market makers

Problems:

- How to get liquidity?

- How do you attract traders?

lesser problem because

- tokens trade elsewhere

- arbitrage creates activity

Common solution: create a reward token! Here's how this works

Step 4: users receive a reward token based on the time that they lock up the "receipt" token

Step 3: users lock up the "receipt" token in a smart contract

Step 2: users contribute liquidity and get a "receipt" token

Step 1: create reward tokens and deposit into a smart contract

borrow

provide collateral

Application: Pool-based borrowing and lending

Application 2: decentralized Borrowing and Lending

Same problems as with trading:

- How to get liquidity?

- How do you attract borrowers?

But: in contrast to trading, here you need both!

liquidity \(\nearrow\)

volume \(\nearrow\)

protocol fees \(\nearrow\)

token value \(\nearrow\)

Platform economics is tricky:

- What's the product?

- How do you get it started?

- How do you get people to contribute?

- How do you earn money?

Without intermediaries:

platform economics!

incentives for both?

What value do these tokens have?

- Functionality:

- fee levels for AMMs

- decision to deploy on other chains

- key threshold values for lending

- Monetary value

- implicit claims on "protocol" income

- implicit claim on reserve pools

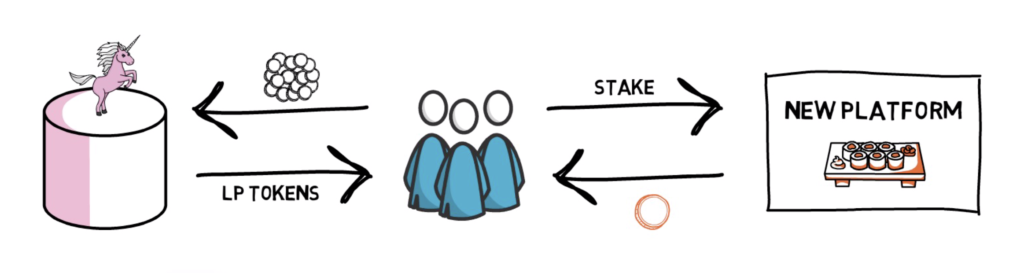

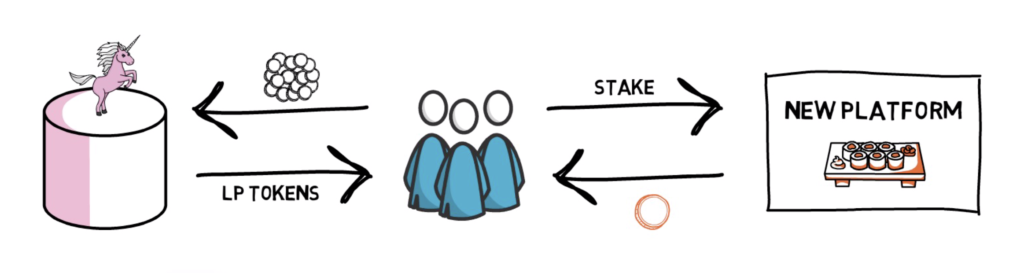

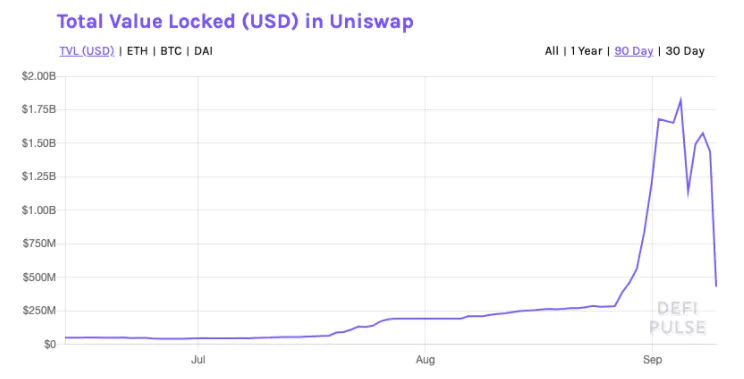

Vampire Attacks and Other Shenanigans

Source: https://finematics.com/vampire-attack-sushiswap-explained/

- Vampire Attack:

- syphon liquidity from a different protocol

- using your own token!!!

- Mechanism:

- deposit in UniSwap, receive LP token

- deposit LP token to Sushi, receive rewards

- liquidate LP token and migrate original liquidity to Sushi = "suck out the blood from UniSwap"

another common trick:

- pump the price of the reward tokens

- \(\Rightarrow\) "yields" often exceed 500%

Application 3: Oracle Nodes Ecosystems

Chainlink

https://market.link/overview

- Function 1: Payment

- payment from decentralized applications for oracle function

- Function 2: enforcement of uptime and honesty

- providers must stake token to participate

- deposit stakes can be slashed

- \(\to\) deposit signal of commitment

A Taxonomy of Tokens

- tokens are a re-imagination of value, ownership, use, rewards

-

tokens live on a single infrastructure and can interact with other tokens

- tokens are immediately transferable & immediately usable in DeFi

- token can be programmed to have many features and have many different uses

- tokens can assign ownership to "things" that could not be owned before

- tokens are often important for the functioning and incentives of platforms

What's a crypto-token and what's special about it?

Tokens by use

payments:

- you use them strictly to pay for something

- example: native cryptocurrencies

utility

- you use them to access a specific service of function

- example: filecoin

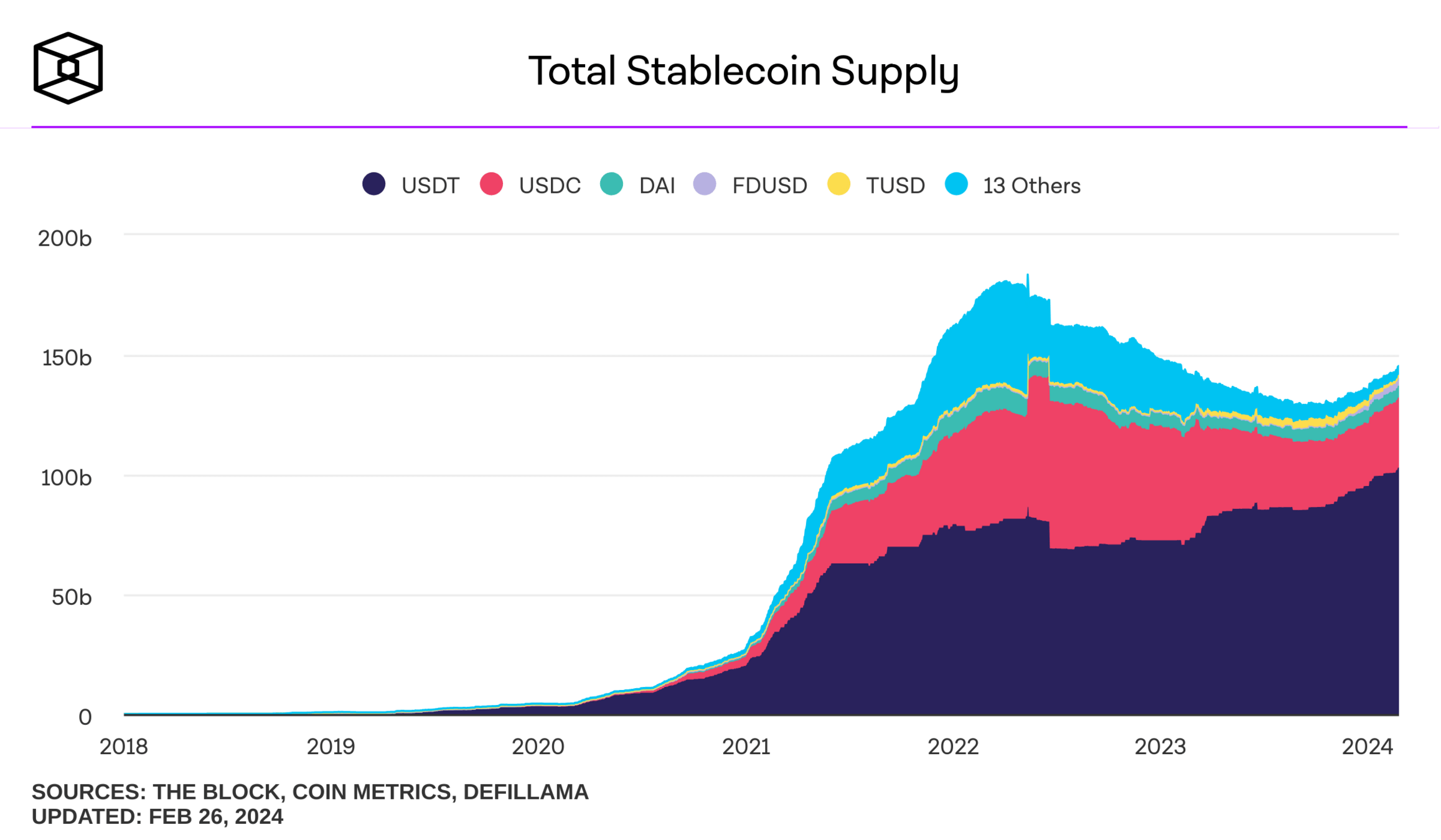

stablecoins

- digital representation of fiat money

- centralized/ decentralized

- examples: DAI, USDC, USDT

governance

- voting rights to determine parameters of a project

- example: UNI, Compound etc

asset

- representation of ownership

- pool claims, digital items

- example: receipts from UniSwap, Compound, NFTs

derivatives

- tokens based on other tokens & functions

- Example: tokensets

Disclaimer: this list in non-exhaustive, new ideas and concepts come up every day!

Asset Tokenization or

"The Creation of Asset-Linked Tokens"

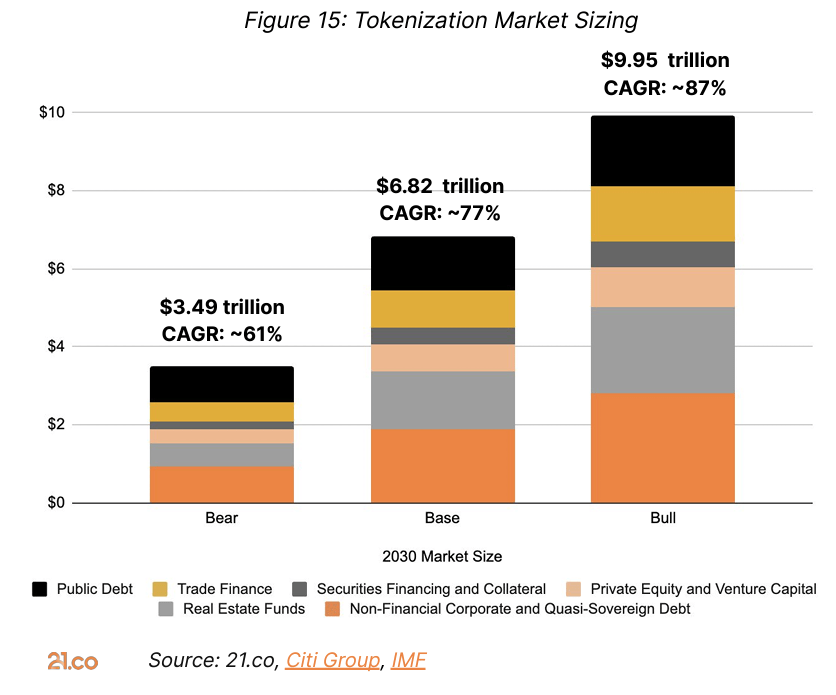

Tokenization is coming

- this list contains mostly "neglected" assets

- what about very "busy" assets aka equities

- what challenges apply to tokenization?

- what problem are you trying to solve vis-a-vis traditional markets?

- what do we have to worry about with a defi implementation?

- what are the opportunities?

Tokenization of stocks is nothing new: American Depository Receipts

foreign investor/

issuer

domestic bank with foreign representation

ADR issuing bank handles

- shareholder communications

- dividend payments

- other recording-keeping

Is this a workable model for blockchain- tokenization of existing assets?

foreign representation of domestic bank/ its custodian

domestic depository bank

S.E.C.

registration with form F-4

domestic broker

issues and cancels ADRs

domestic investor

lets investors own and trade ADRs

domestic

market

deposits shares

Blockchain Tokenization has many options

existing investor/

issuer

token issuance platform

investor

wallet

instruct to create tokens

deposits shares

custodian bank

deposits shares

creates tokens and sells to investors

centralized or decentralized

market

S.E.C.

registration

Tokenization & DeFi Solutions

- stock=ownership rights

- rights to dividends

- rights to shareholder votes

- How can you retain them in a world where

- tokens can be held indirectly by smart contracts

- ownership attribution is pseudonymous

- Li, Park, Singh, Veneris (2024)

- off-chain registry of accounts

- on-chain data collection

- rights redemption contract

- some of this may require legal and regulatory changes

DEX Accounting is complicated

- issuer whitelist must include NFT position manager account for CL DEX

- \(+\) factory contract (to lookup pools by pairs & fee).

- knowledge of the pool’s invariant functions

- shareholders must report corresponding tokenIds of any CL pool where they hold positions

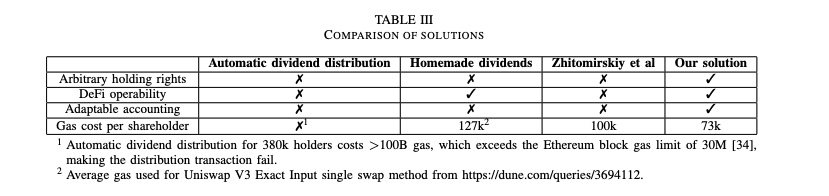

Some solutions exist

- automated dividend distribution

- will likely exceed gas limits

- homemade dividends (=buy back schemes)

- can't handle other holding rights

- Zhitomirskiy, Schmid, and Walther (Dec 2023)

- can't handle other rights and is not defi-compatible

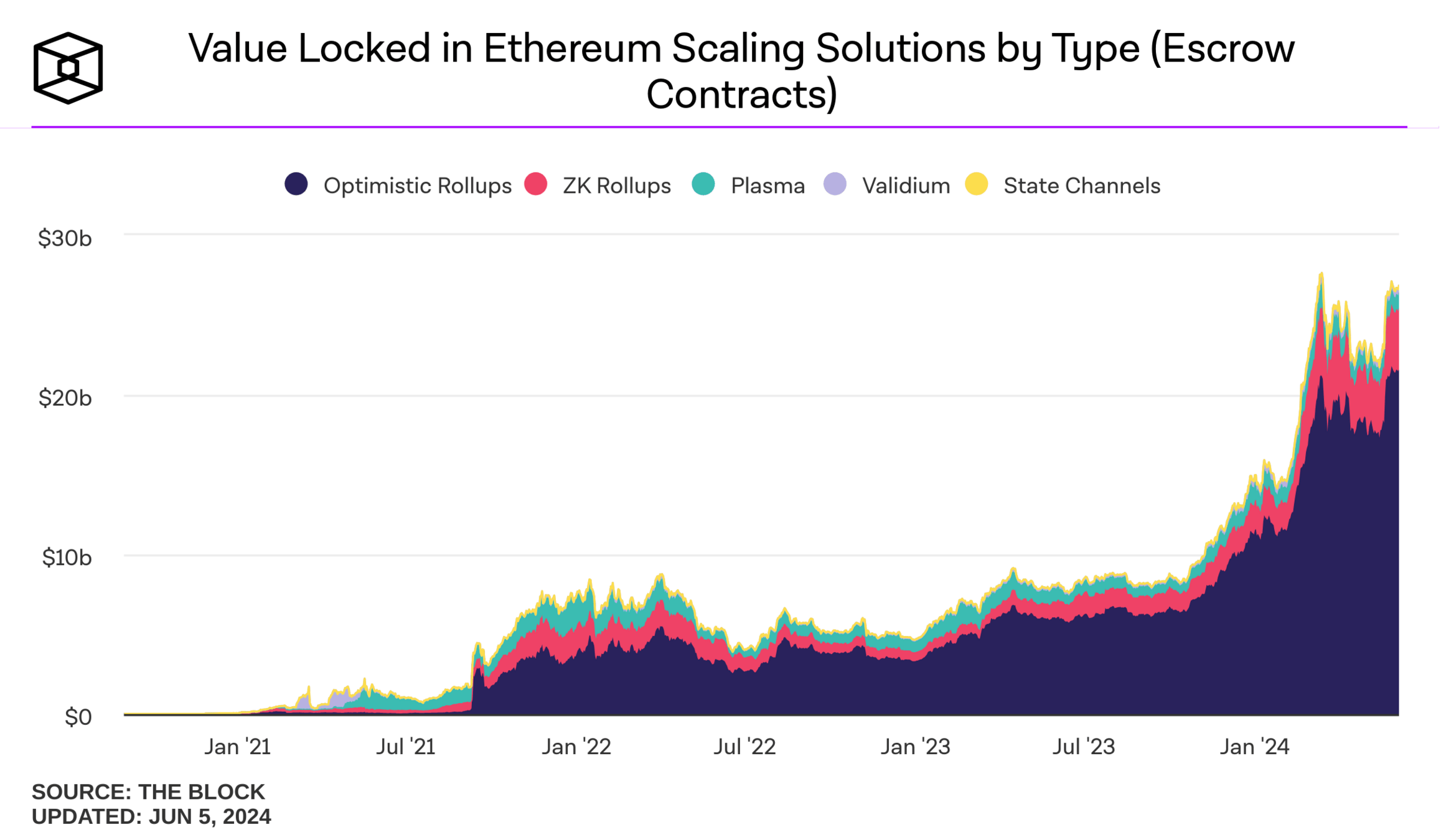

Tokenization FAQs

- Can we do KYC and restrict transfers?

- Yes one can create whitelists.

- But why? That kills all advantages of defi

- Can we have tradfi involved, defi & KYC?

- Yes. Can use a rollup.

- Case: tokenized gold

- issued on rollup

- allows defi applications and free use within rollup

- asset cannot "leave" the rollup

What is a stablecoin?

digital representation of a unit of a fiat currency on a blockchain

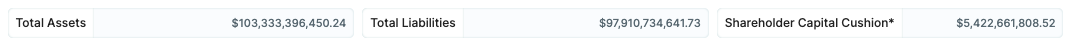

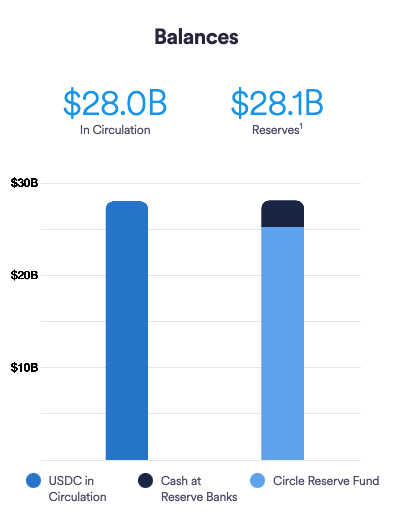

Collateral Backed Stablecoins: USDT & USDC

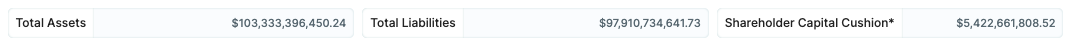

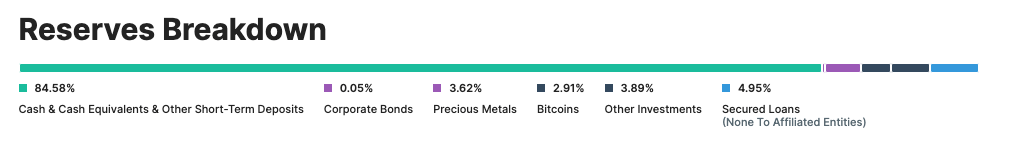

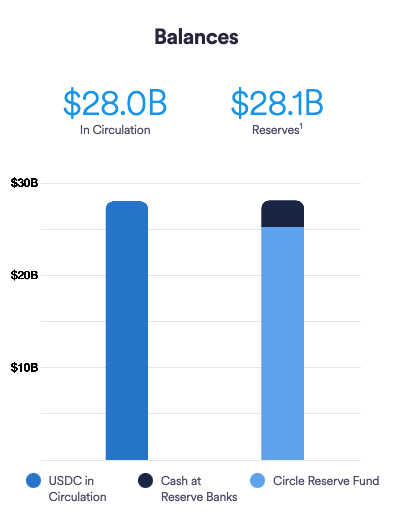

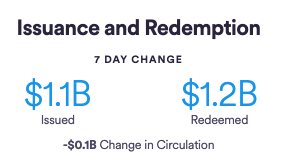

\(\Rightarrow\) 5% over-collateralized

primary market acces: 6 entities only

Collateral Backed Stablecoins: USDT & USDC

- "Cash at Reserve Banks" once was SVB

- Reserve fund = short-date US treasuries & overnight repos

primary market acces: 560+ entities

pulled from Nick Carter's talk on "Will stablecoins serve or subvert U.S. interests?"

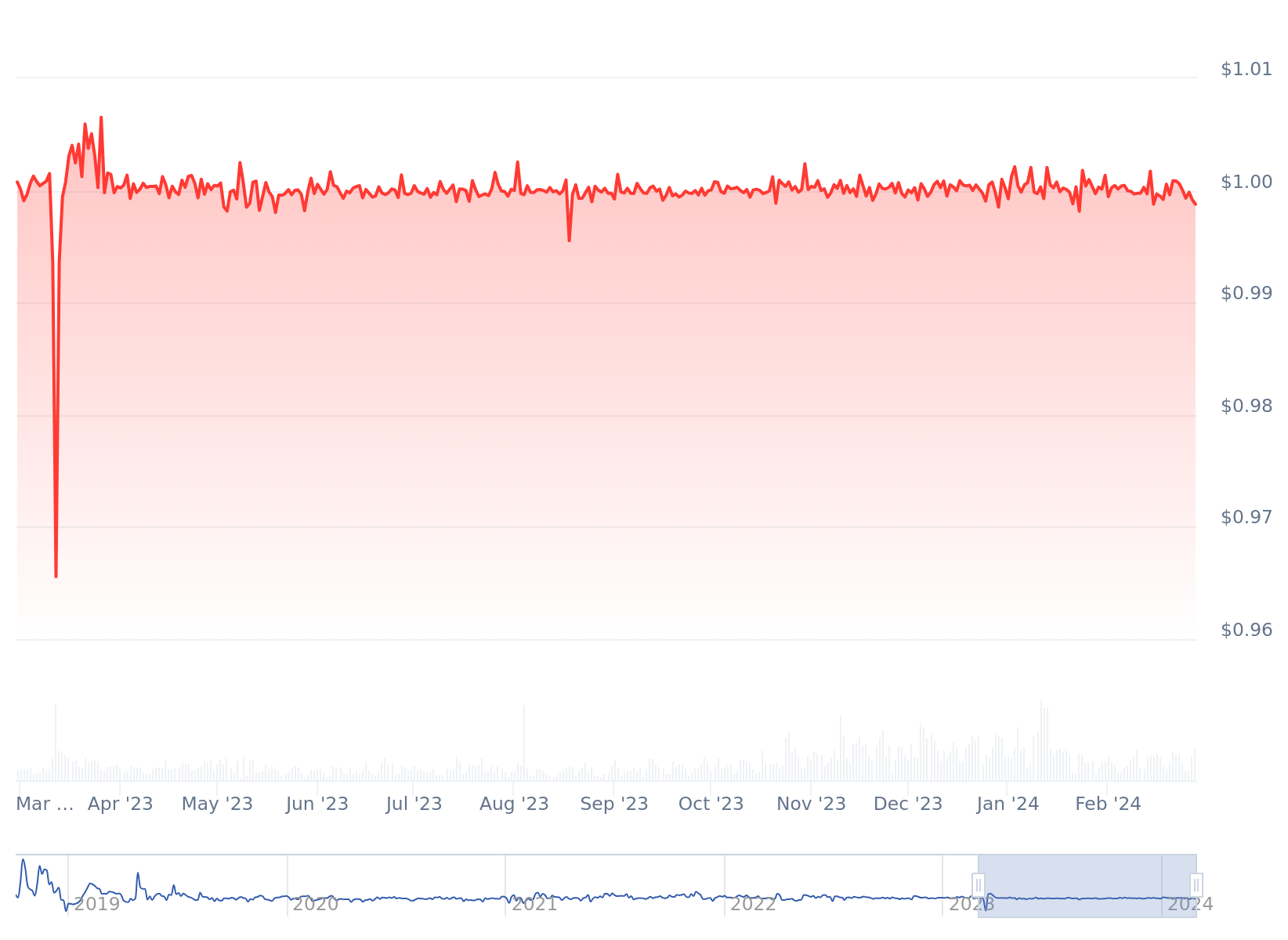

What makes a Stablecoin stable?

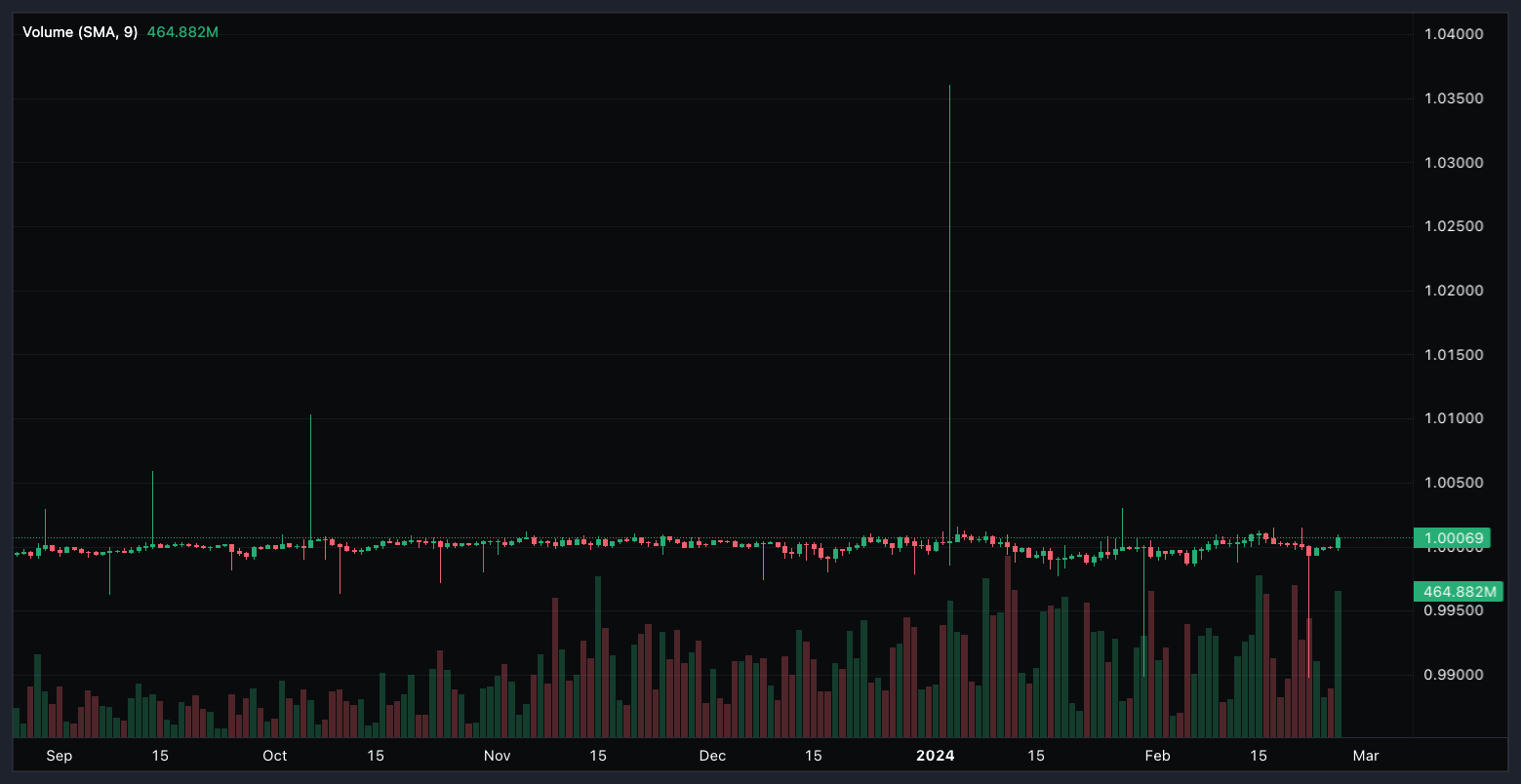

USD-USDT (6 months)

\(\Rightarrow\) need a primary/reference market mechanism to allow for forces of arbitrage to align prices

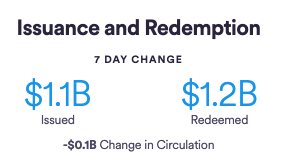

- stablecoins are issued

- by a single entity or

- a blockchain-based algorithm (smart contract)

- they trade in a secondary market

- on crypto-exchanges against fiat

- on crypto-exchanges against cryptos

- on-chain against other tokens

- \(\Rightarrow\) stablecoin price fluctuates

Arbitrage when price(stablecoin)>$1

collateralized stablecoin

arbitrageur

issuer/ primary market

secondary market

collateralized stablecoin

arbitrageur

Arbitrage when price(stablecoin)<$1

issuer/ primary market

secondary market

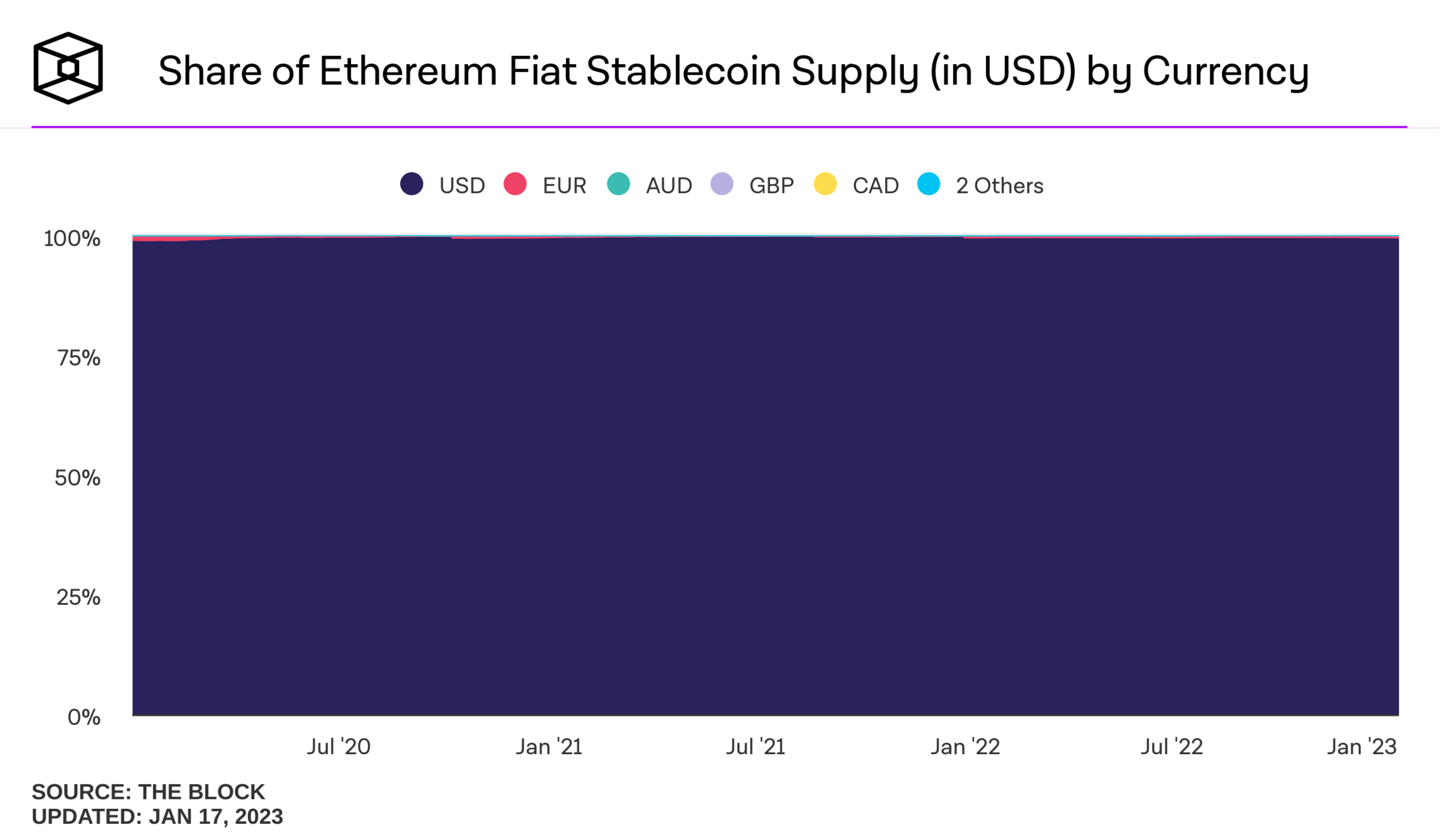

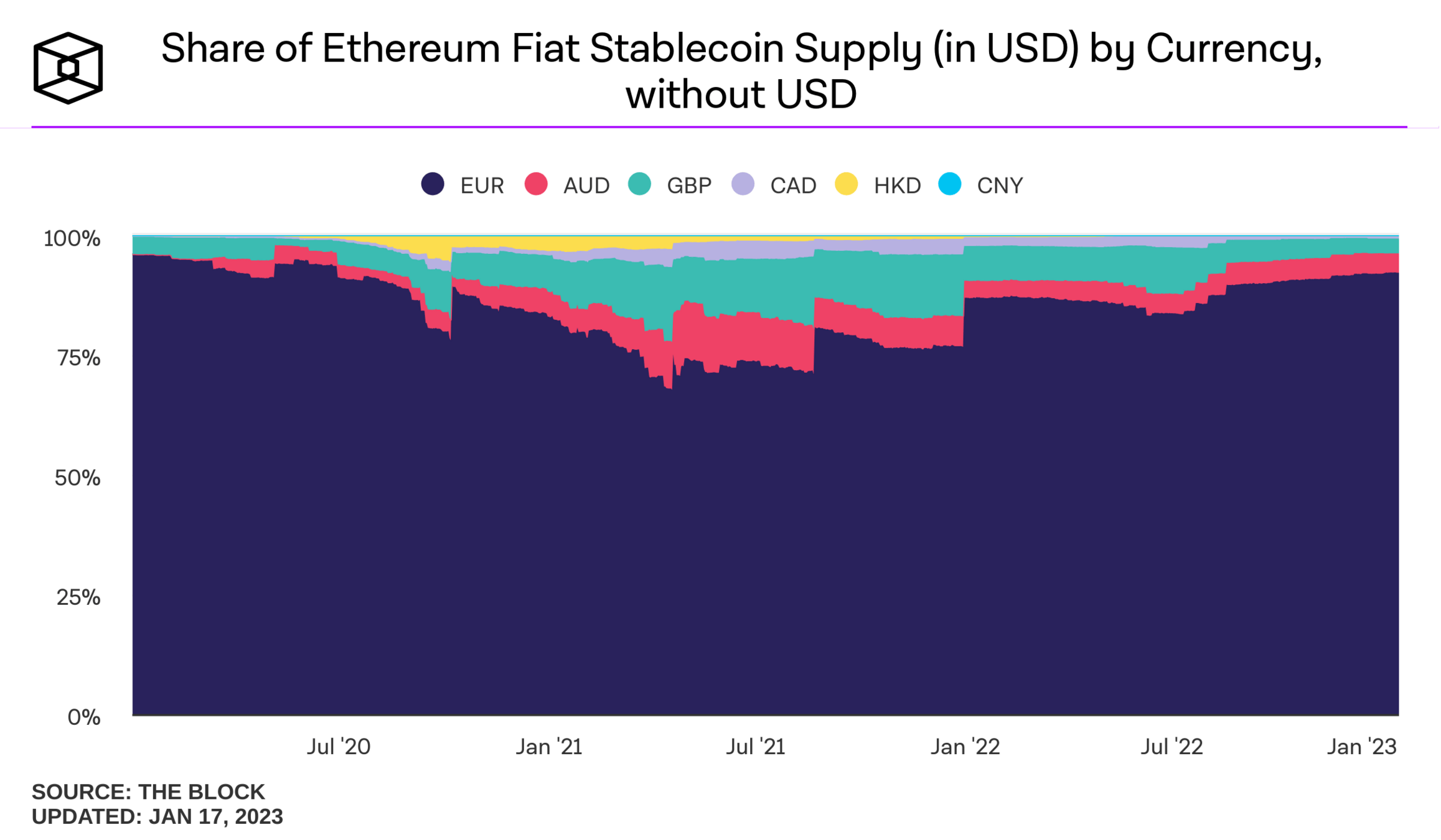

Stablecoin use cases

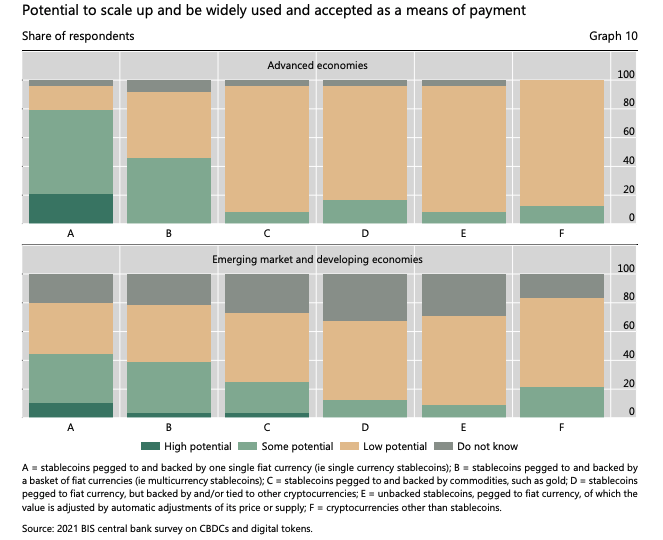

What do central bankers think about stablecoins?

BIS Survey of Central Banks:

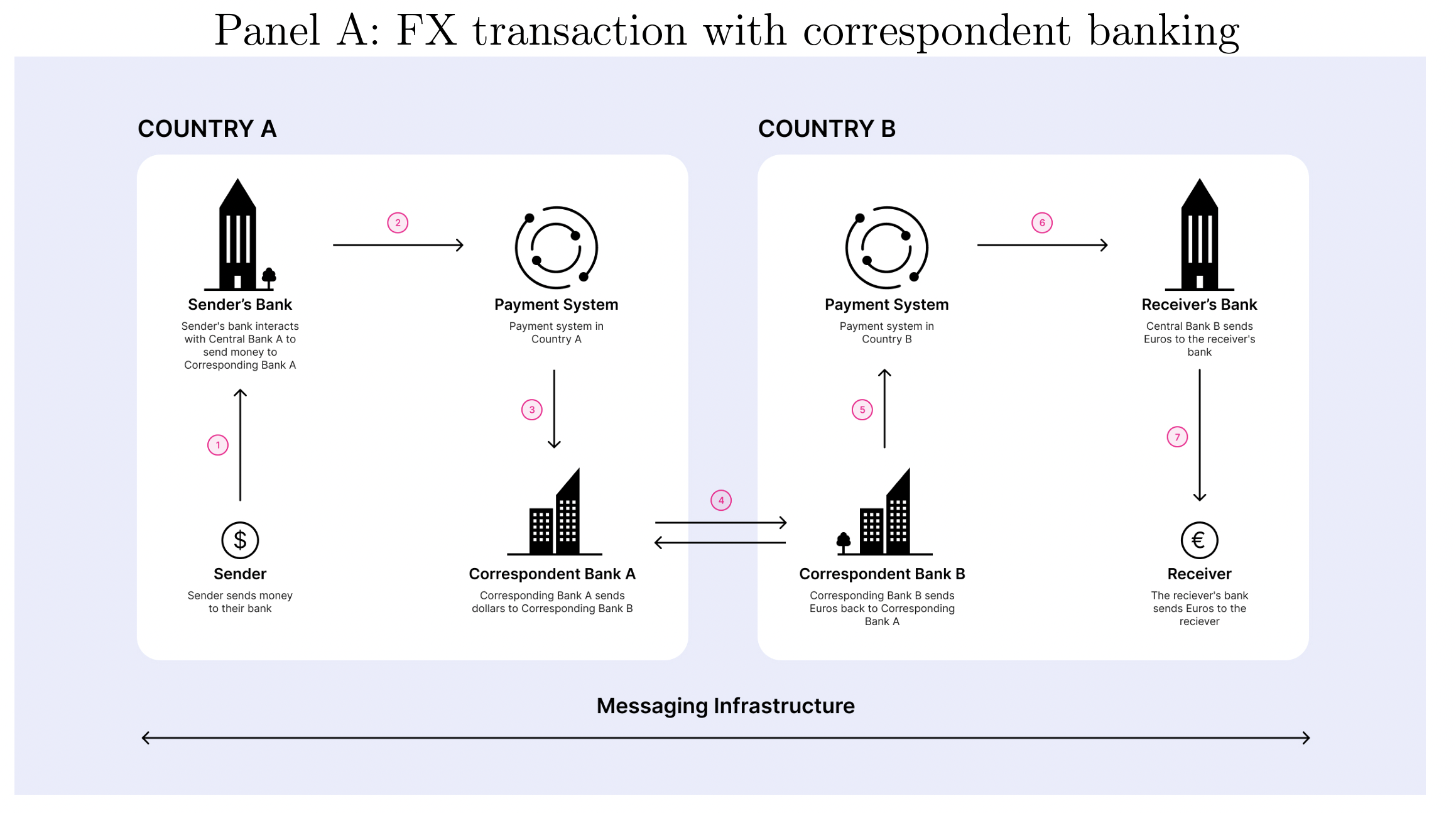

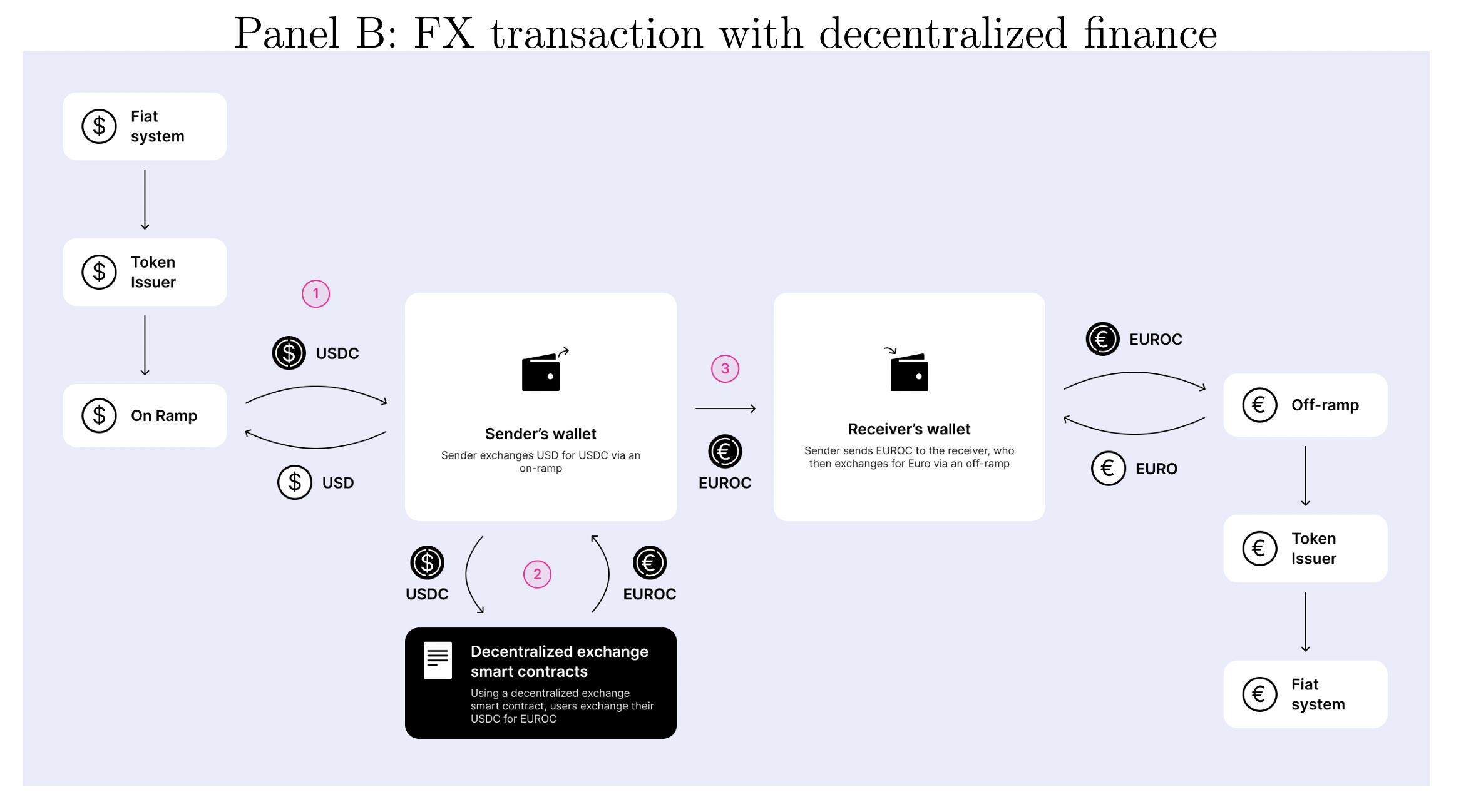

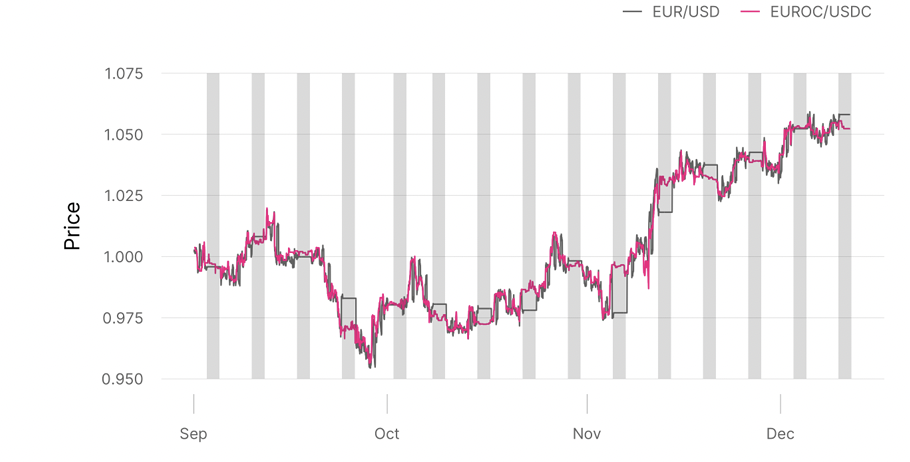

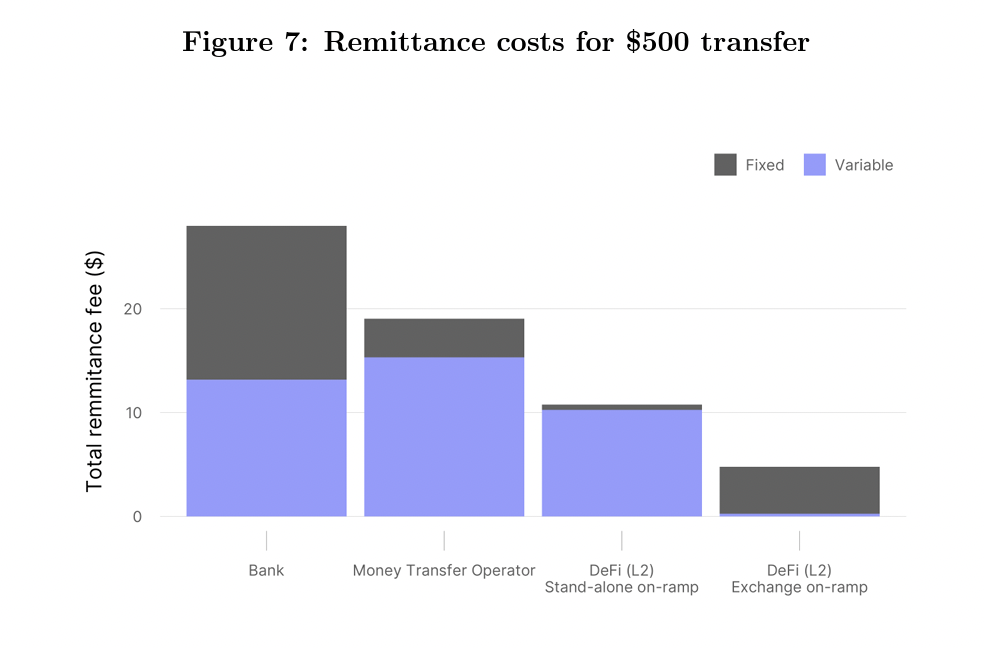

Source: On-chain Foreign Exchange and Cross-border Payments by Austin Adams, Mary-Catherine Lader, Gordon Liao, David Puth, Xin Wan (2023) [team from UniSwap Labs]

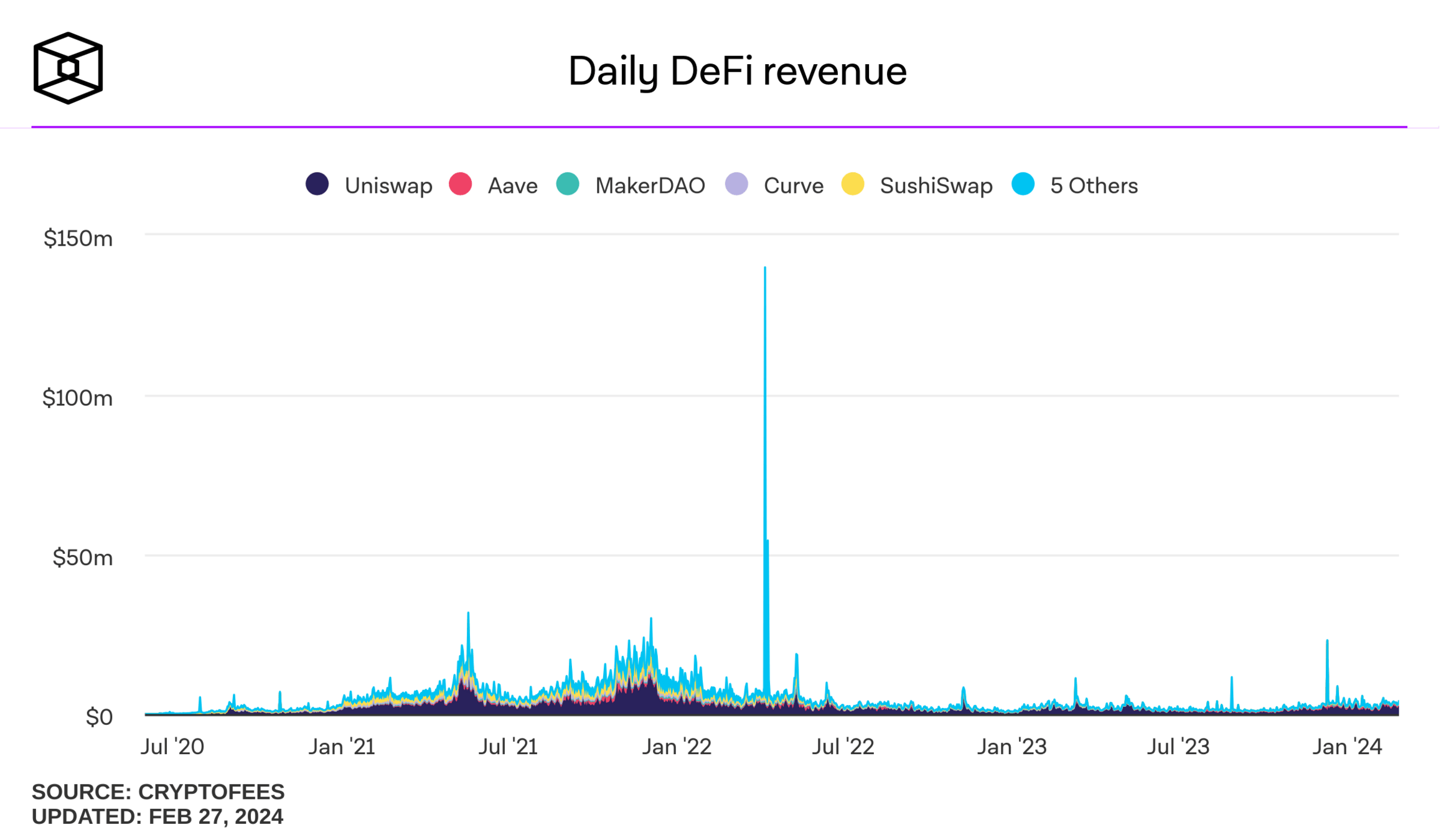

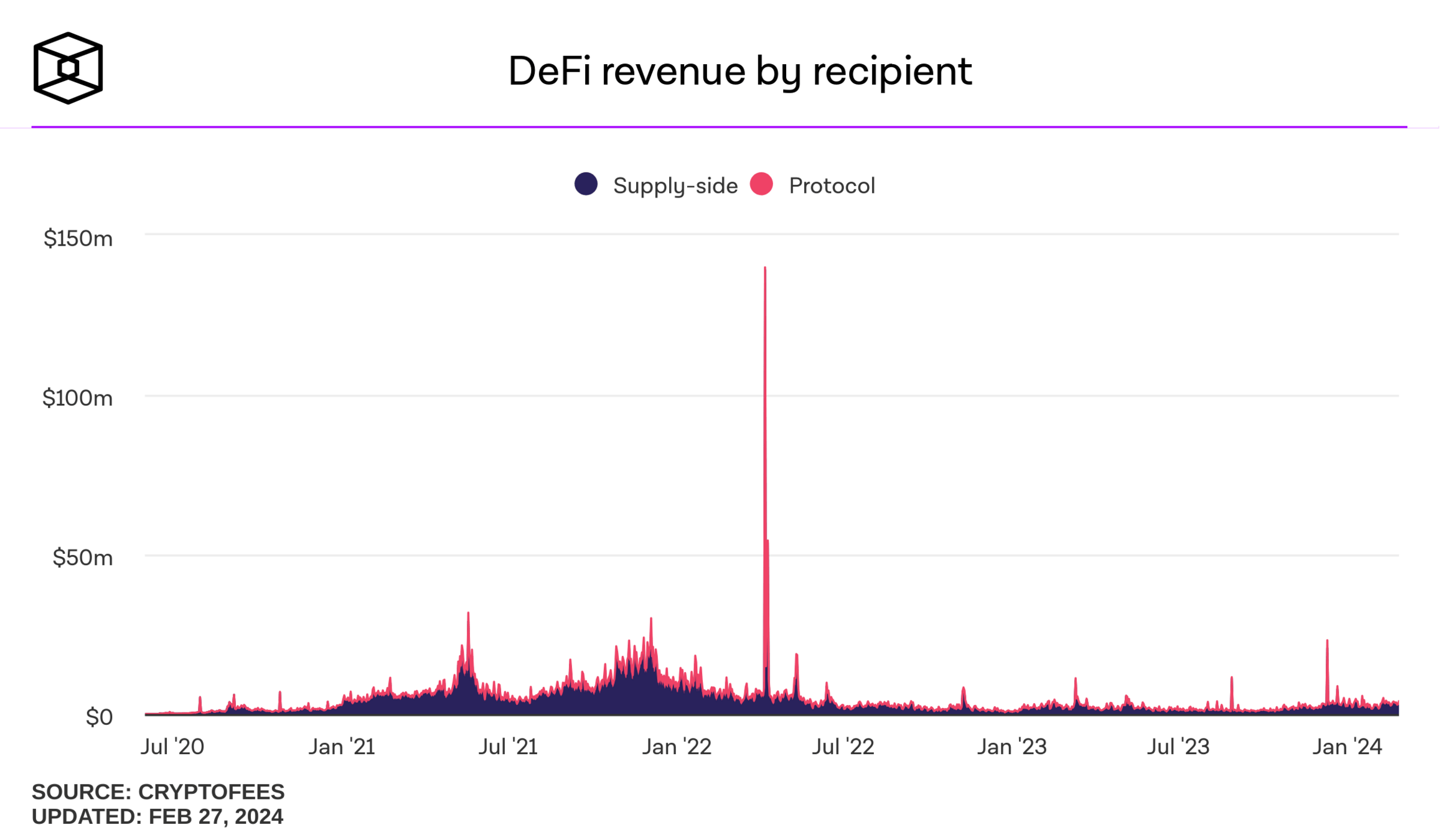

DeFi fees:

- fiat to crypto on ramp: 0%-1%

- exchange fees 1-5bps

- network fee: $0.001-5$

- off-ramp fee: 0%-1%

- total: from close to 0 to 2%+$5

Run Risks

Stablecoin Run Risks

- Scenario:

- concern about stablecoin backing

\(\to\) mass-redemptions - stablecoin issuer liquidates backing assets

- liquidity crisis in backing assets

- \(\to\) contagion to traditional finance

- concern about stablecoin backing

- Secondary effects

- disruptions would spread across applications, wallets, and functions

- \(\to\) stablecoin failure would disrupt every aspect of digital commerce

- Is this plausibe? The Case of USDC

- backing assets are in the most liquid assets and banks

- limited number of arbitrageurs allows side deals

- but: scale is still very small

The "U.S. President's Working Group on Stablecoins" would essentially make issuers narrow banks (deposits largely backed only by reserves)

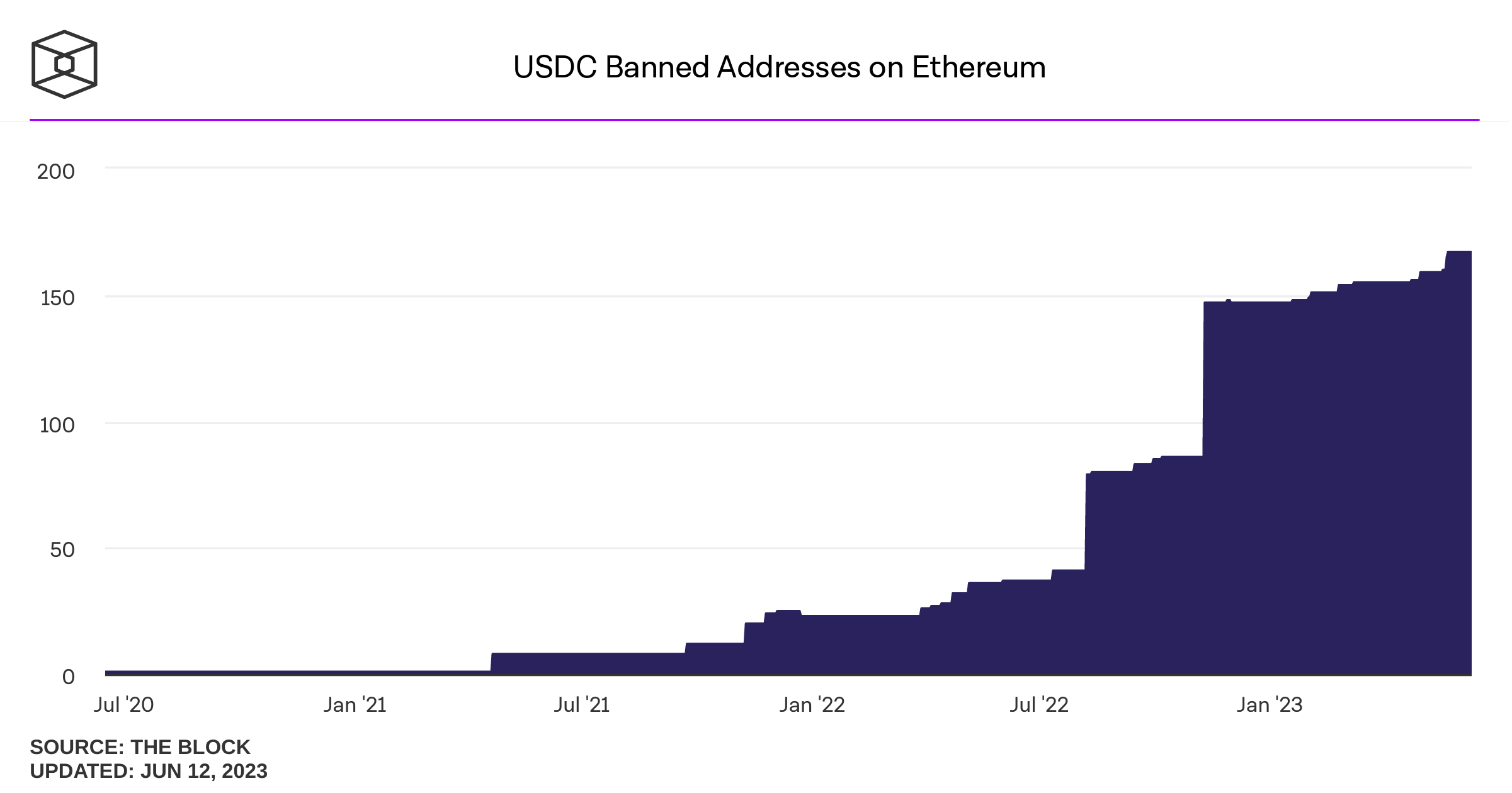

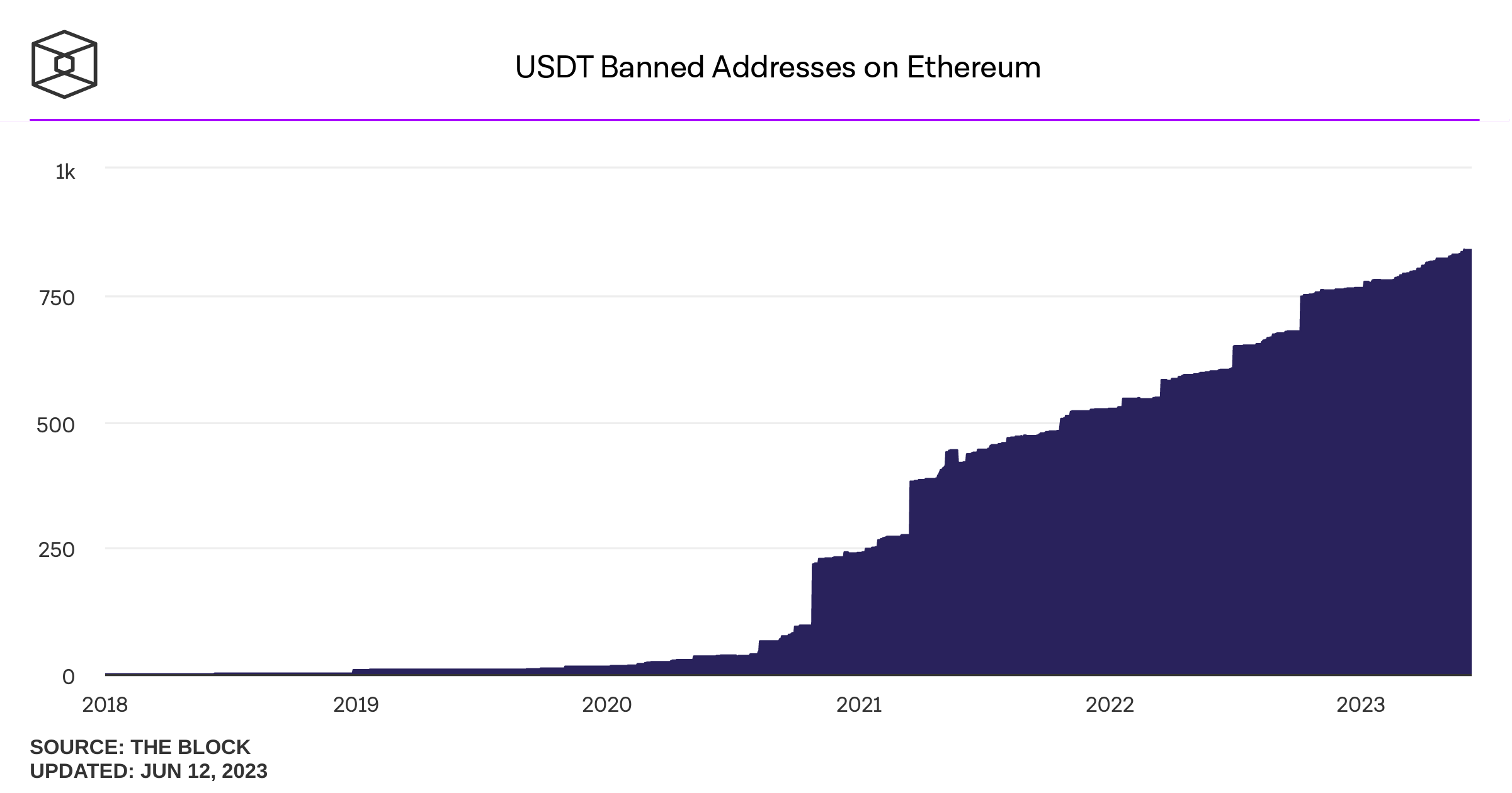

Money Laundering and Crime

- Does it provide scale?

- Does it enable new criminal activity?

- Is there substitution from super-visable means? Is it easier and safer to use for criminals than traditional means?

What's special about crypto-crime?

Banned addresses (usually by OFAC order)

criminals don't use USDC - why are we so worried?

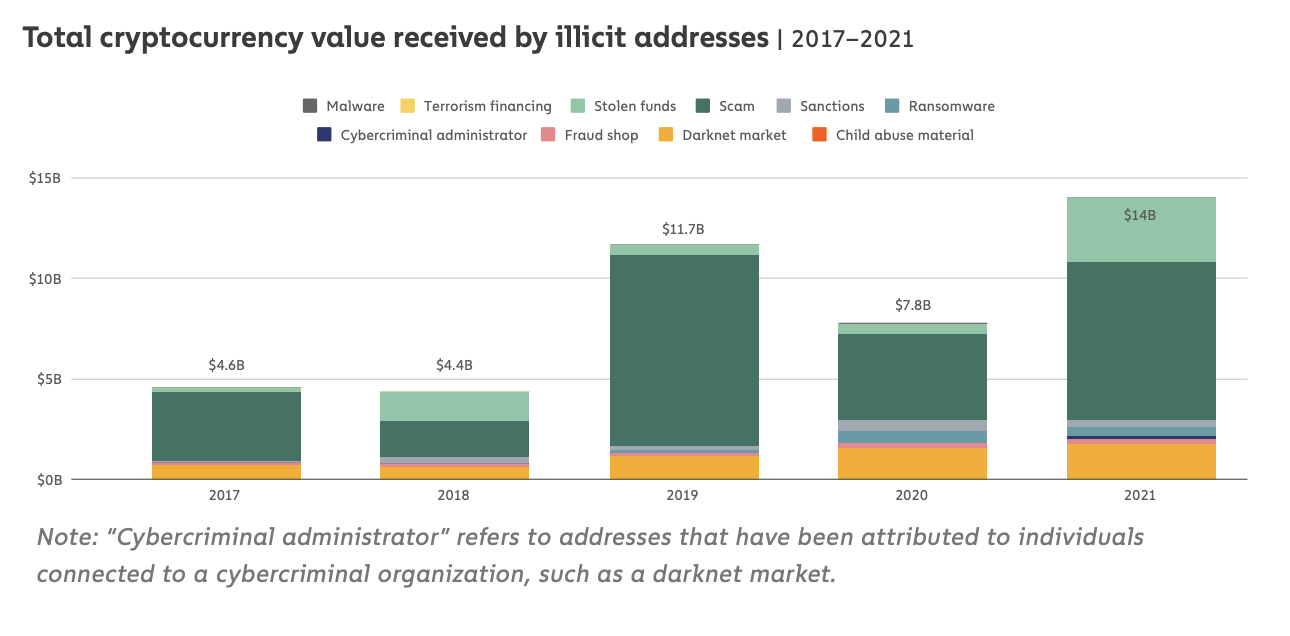

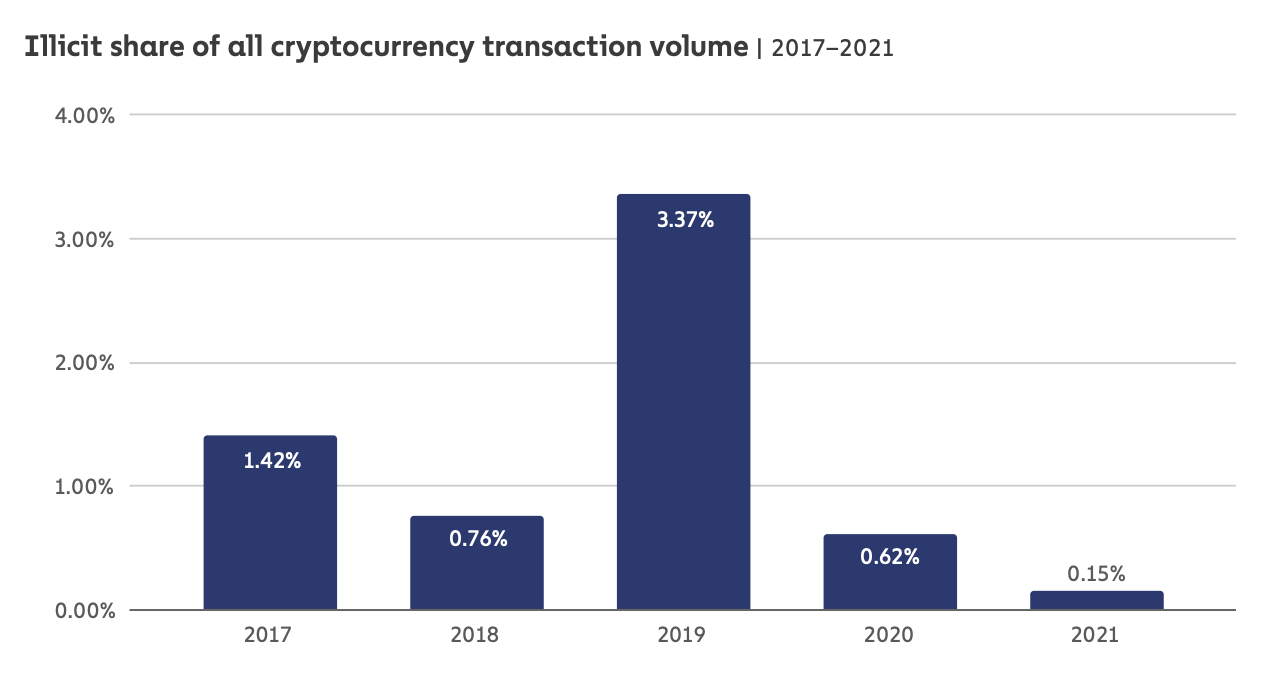

Chainalysis Crime Report

extra info:

- 2019: PlusToken Ponzi scheme

- numbers depend on known addresses, e.g., 2021 report listed ~.3% for 2020 and upped to .65 now

The Common View

The Reality

- no evidence that Hamas has received significant volumes of crypto donations.

- full understanding of blockchain analysis and context is needed

- Elliptic: Wall Street Journal [must] correct misinterpretations of the level of crypto fundraising by Hamas.

- in discussions with Senator Warren to ensure parties have a proper appreciation of the complexities and nuances of analyzing these wallets.

"The approximate amounts in USD received by wallets on the TRON blockchain associated with terrorist entities:

- Hamas: $2.3M

- DUBAI Co. for Exchange: $29M

- Palestinian Islamic Jihad: $87M

- Hezbollah: $2.364B"

Source: https://inca.digital/intelligence/crypto-intelligence-alert-tron/inca_digital_crypto_intelligence_alert-TRON.pdf

Reality Part 2: The Stinky Stuff

Central Bank-Issued Digital Currencies

Evolution

2008

2014/5

2019

2020

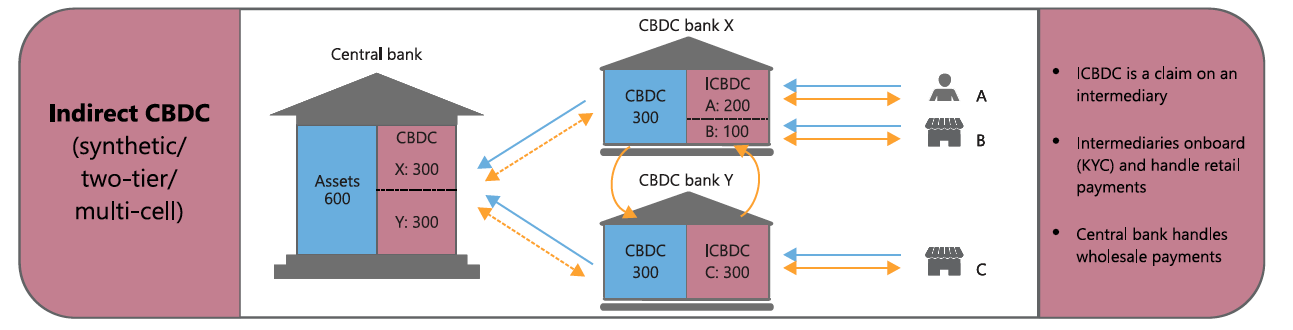

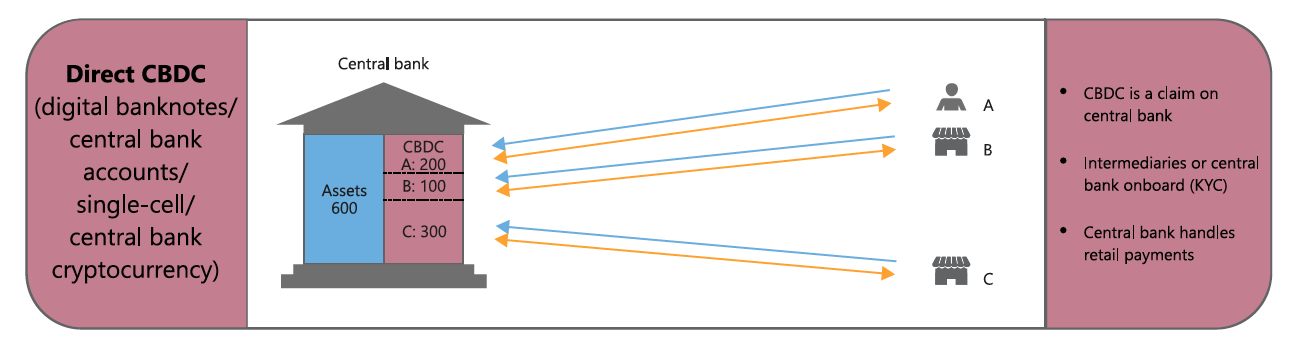

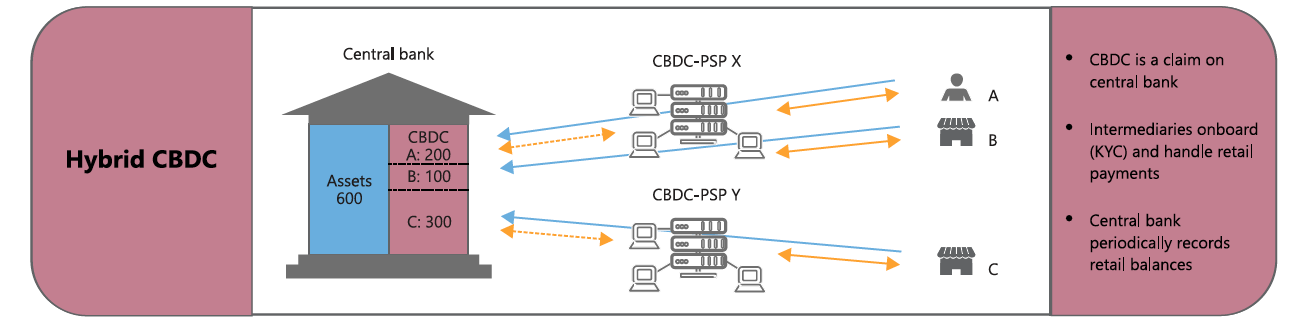

Possible CBDC architectures

Source: BIS Quarterly Review, March 2020

How will you introduce and run it? Concerns

- first CBDC (Finland, early 90s) failed for the tiniest of reasons

- you have only one shot to get it right

- are you prepared to be customer-facing (in Canada: 40M+)?

- can you do it?

- what more than money are you offering?

- you bring the government very close to people with AML supervision

go alone

and do self

partner with banks \(=\)

use them for distribution and operation

- why would they support a competitor to their highly profitable payments?

- what does a CBDC do that fast payments cannot? (case may be different in Europe)

The Year is 2008: what the Toronto a la cart program teaches us about CBDCs

Cautionary tales for central bank innovation

- Finland:

- Avant card failed

- China:

- people are unimpressed with the e-Yuan

- trust AliPay/WeChatPay vs. CCP

- Mexico:

- QR code pay uptake <5%

(not CBDC)

- QR code pay uptake <5%

what people want

what we got

- a program designed by city departments

- no regard for business owners or customers

- burdensome regulation

- a truck ("cart") designed by committee that did not work

- program essentially died after 2 years

Features of Digital Money

- instantaneous 24/7 payments

- digital = borderless

- money that is compatible with digital applications, digital finance, internet of things etc

- privacy protection

- peer to peer transfers

- transfers of money without the involvement of a commercially interested third party

- non-fee digital payments

fast money

CBDC run by

Central Bank

CBDC on new communually run system

bank-issued stablecoin on public blockchain

|

What? |

||||

|---|---|---|---|---|

| 24/7 instantaneous | ||||

| borderless | ||||

| programmable | ||||

| privacy | ||||

| p2p | ||||

| no commercial 3rd party | ||||

| nominal fee |

Taking a step back

- balance sheet: $3T

- cash: $>60B

Option 1a (existing cash):

- lock up cash in an escrow

- \(\to\) stablecoin is claim on cash

Option 1b (convert cash to digital):

- issue stablecoin in exchange for new cash

- lock up new cash in an escrow

- \(\to\) stablecoin is claim on cash

Option 2 (overcollateralized):

- lock up existing shares in an escrow

- \(\to\) issue stablecoin as a claim on stocks

- over-collateralize

Option 3 (exotic):

- issue stablecoins in exchange for shares

- guarantee fixed conversion of shares against stables at dollar market price

What are Apple's options?

Thought experiment: Apple Inc. wants to issue a stablecoin

Options 1 a&b: Collateral Backed Stablecoins \(\to\) USDC

- "Cash at Reserve Banks" once was SVB

- Reserve fund = short-date US treasuries & overnight repos

primary market acces: 560+ entities

\(\vdots\)

formally: this smart contract is a collateralized debt position (CDP)

- create fiat money on chain with borrowing

- a collateralized loan with ETH in escrow

The User's Perspective for a DAI Loan

Option 2 (reminder): Assets converted to cash: MakerDAO

Case 1:

stablecoin \(>\$1\)

arbitrageur

issuer

for fully decentralized algo/smart contract stablecoin: there is no dollar to give!

The Case of Luna-Terra

exchange LUNA for newly minted UST tokens at the prevailing $ market rate

secondary market

LUNA secondary market

Option 3: Algorithmic Stablecoin like UST on Terra

arbitrageur

issuer

exchange UST for newly minted LUNA tokens at the prevailing $ market rate

market

LUNA market

Case 2:

stablecoin \(<\$1\)

Option 3: Algorithmic Stablecoin like UST on Terra

Sadly, we know how this has always ended

UST Stablecoin

LUNA (cryptocurrency of the TERRA network)

But: there is no theoretical result that shows that collapse is inevitable

BTC, ETH

HQLA: USD, EUR

asset (gold)

fee-backed

Seigniorage

Crypto

Traditional

Algorithmic

Collateral-Backed

Taxonomy of Stablecoins

DEPOSITS

other assets

JPM coin

USDC

USDT

UST, Basis, Neutrino

DAI, FEI

Final Thoughts

Some Final Thoughts

- this presentation only scratches at the surface, there are tens of thousands of people working on blockchain ideas

-

this is not (only) garage band work -- university research plays a key role

- blockchain tech won't get uninvented.

- the space is still trying to figure things out, including tech and economic challenges

- great progress has been made, but things will and do still go wrong

- a common resource can have huge economic benefits

- I'd like to see more thinking and discussion about paths to unlock the benefits

@financeUTM

andreas.park@rotman.utoronto.ca

slides.com/ap248

sites.google.com/site/parkandreas/

youtube.com/user/andreaspark2812/

Why are Blockchains challenging for current regulation?

UniSwap Lab supports development

a website app accesses the code

token holders control contact features

don't own the code

operation = decentral

control = decentral

anyone can use the baseline code

core code runs on the blockchain

tokens used as rewards

Illustration of the Challenges: The UniSwap Token

Questions around Regulation & Compliance

- Are regulations as they are because of existing institutional arrangements or

- are institutional arrangements the way they are because of regulations?

- compliance in a borderless world

- efficacy?

- flight to offshore?

- is compliance even possible?

- cost-benefit of compliance for regulators and the regulated

- What is the goal of regulation?

- compliance?

- disappearance?

- investor protection?

- issuer protection?

present vs future

- moving and evolving space: fighting the last war?

- unintended consequences of "future proofing"

Challenge 1: How do you get data onto a blockchain?

The Oracle Problem

<standings: 7,3,8,4,2,1,6,5> + digital signatures

Disagreement?

Majority Vote

1 ETH = $4780

1 ETH = $4789

1 ETH = $4781

DEXes can be used as on-chain price oracles

Time-Weighted Average Price (TWAP)

The Oracle Problem

- Participation incentives?

- rewards, payments...

Oracle nodes form their own ecosystem

- Incentives for honest reporting?

- penalties, collateral...

- Reputation?

- Uptime, correctness, penalty history, collateral amount....

- Fee collection from dAPPs

- Nodes stake LINK

- More LINK staked more jobs taken

staked LINK can be slashed

Chainlink

Same follow-on challenge for builders: how can you fit staking, rewards, and inevitable speculation into securities law?

Challenge 2: the settlement layer has a mind of its own

a

b

c

d

e

f

g

Problem: Public Mempools allow Sandwich (MEV) Attacks

Solutions and Remedies

- Flashbots protocol

- encrypted transactions

- FHE Protocol

A brief look under the hood: the workflow

liquidity pool

blockchain

user

website

router

liquidity pool

blockchain

user

A brief look under the hood: the workflow

aggregator protocol

router

pool 1

blockchain

user

pool 2

multiple

pools

A brief look under the hood: the workflow

back to UniSwap

pool 1

blockchain

user

pool 2

A brief look under the hood: the workflow

back to UniSwap

pool 1

blockchain

user

pool 2

just-in-time

liquidity bots

A brief look under the hood: the workflow

back to UniSwap

pool 1

blockchain

user

pool 2

just-in-time

liquidity bots

in the settlement layer ("MEV")

Are Tokens Securities and What Safeguards Should There Be?

- People want(ed) crypto assets and they will get their hands on them

- US style differentiation of securities vs commodities etc is neither helpful nor useful

- There is no such thing as "technology-neutral" regulation.

- Some rules from securities regulation simply cannot be implemented with blockchain tech

- Just because someone buys something with an investment motive doesn't mean that they should get all securities protections

Provocative Thoughts

- End of Theory -

Some Developments

- Soulbound tokens, digital ID, privacy zero-knowledge proofs

- improved user experience, e.g., SIM cards with blockchain wallets

- invisible blockchains (used in China for AliPay NFT storage)

Blockchain Infrastructure

seller

buyer

What is a Blockchain?

The Premise of the

Internet & Blockchain

Peer to Peer Communication

Peer to Peer Value

!

?

?

Sidebar: What is digitize-able value?

- money

- digitally native assets

- claims on resources and property

- identity, personal data

The challenge: how do you ensure digital scarcity?

- traditional approach: unique record-keeper

- problem:

- intermediary necessary for record keeping

- tight supervision of custodian

- no peer-to-peer

- What is the equivalent of TCP/IP for value?