Blockchain and Decentralized Finance:

A 2023 Primer

Presenter: Andreas Park

Agenda

- Getting our hands dirty!

- Background:

- Vocabulary & Evolution

- What's DeFi and what's different to TradFi?

- Explain some key DeFi applications

- What do we know about tokens?

- What happened with FTX & Terra and what's the S.E.C. doing?

- Outlook

What is a Blockchain?

What is a Cryptocurrency?

Why is this idea powerful?

payments

stocks, bonds, and options

swaps, CDS, MBS, CDOs

insurance contracts

A blockchain is a

- general purpose

- open access

- value management

- infrastructure

- that is communally run

- create & manage assets

- transfer value

- contingent contracts

- guaranteed execution of sets of commands

- applications

What makes DeFi different from TradFi

decentralized finance =

provision of financial service functionality without the necessary involvement of a traditional financial intermediary like a bank or broker-dealer*

digital media =

provision of information service functionality without the necessary involvement of a traditional information intermediary like a publisher, library, or newagency

*my take: applies to only commoditizable services

trading Infrastructure

payments network

Stock Exchange

Clearing House

custodian

custodian

beneficial ownership record

seller

buyer

Broker

Broker

Application: decentralized trading with automated market makers

AMM Pricing

- Purchase \(q\) of asset

- Deposit cash \(\Delta c (q)\) into liquidity pool, extract \(q\) of shares

- liquidity before trade \(=\) after trade

\[L(a,c)=L(a-q,c+\Delta c)\]

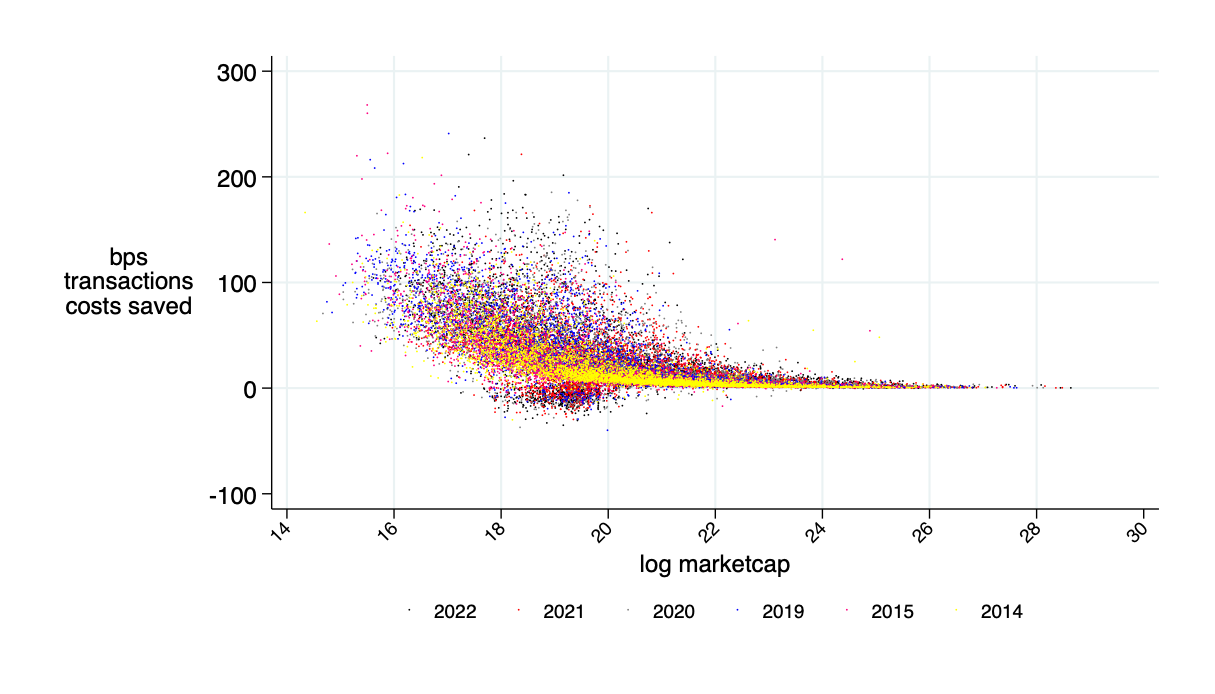

Source of savings:

- better risk sharing among liquidity providers

- better use of capital

Possible transaction cost savings when applied to equity trading: \(\approx\) 30%

Source: "Learning from DeFi: Would Automated Market Makers Improve Equity Trading?" working paper, Malinova & Park 2023

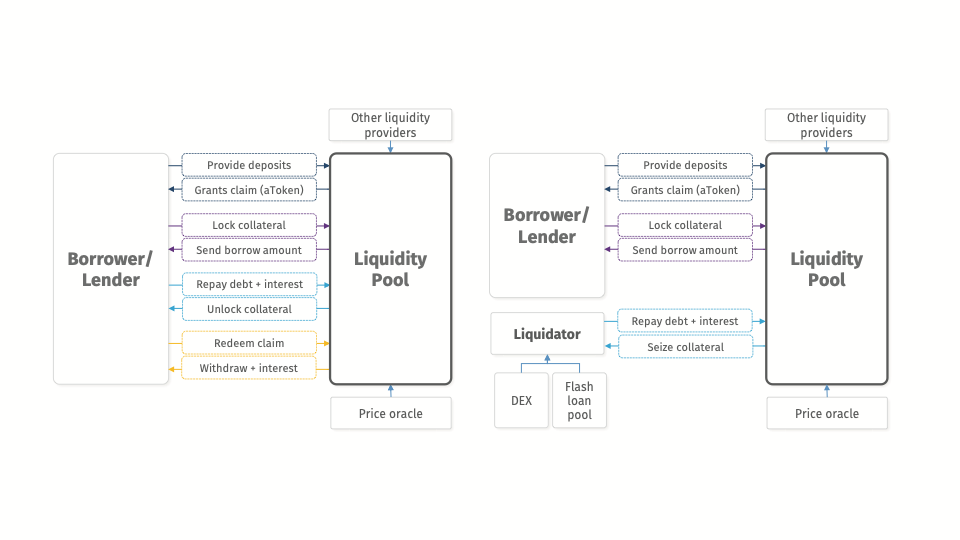

Application: Decentralized Borrowing & Lending

borrow

provide collateral

The Flow of Event: Normal Times

The Flow of Event: Collateral Liquidation

Dapp composability ("DeFi LEGOS") & Flash loans

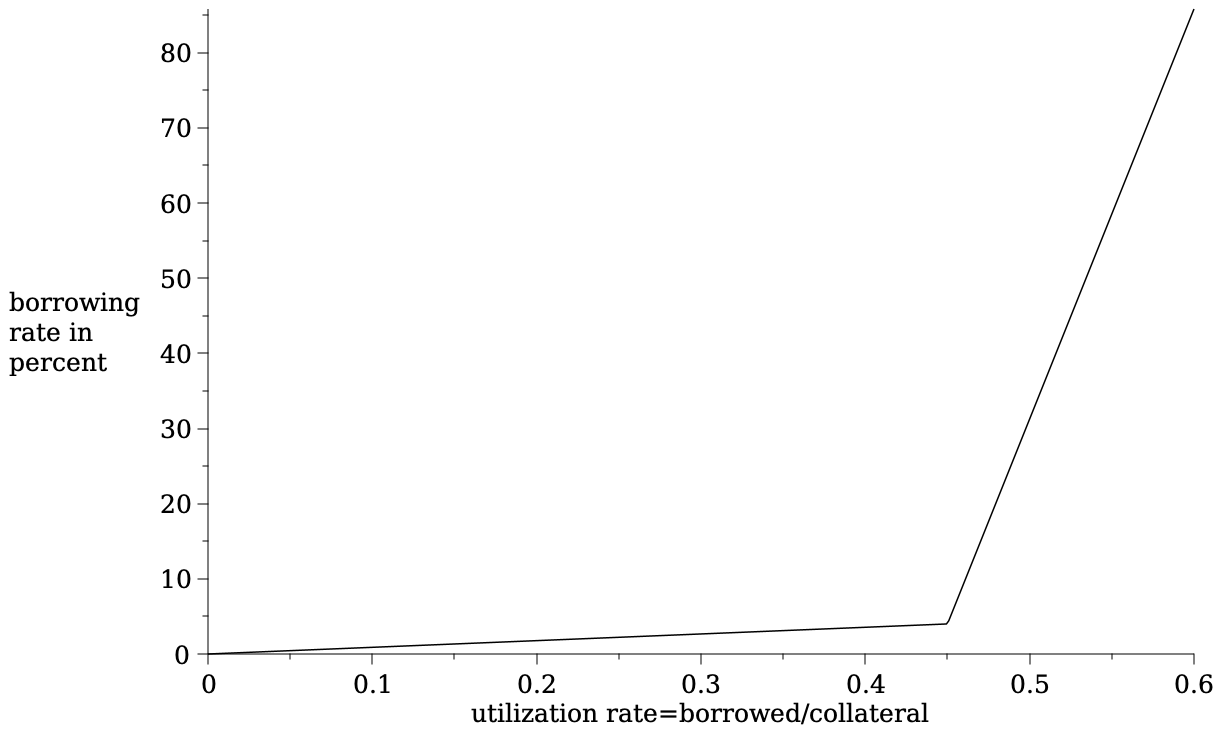

Interest rates: a function of pool usage

threshold usage rate

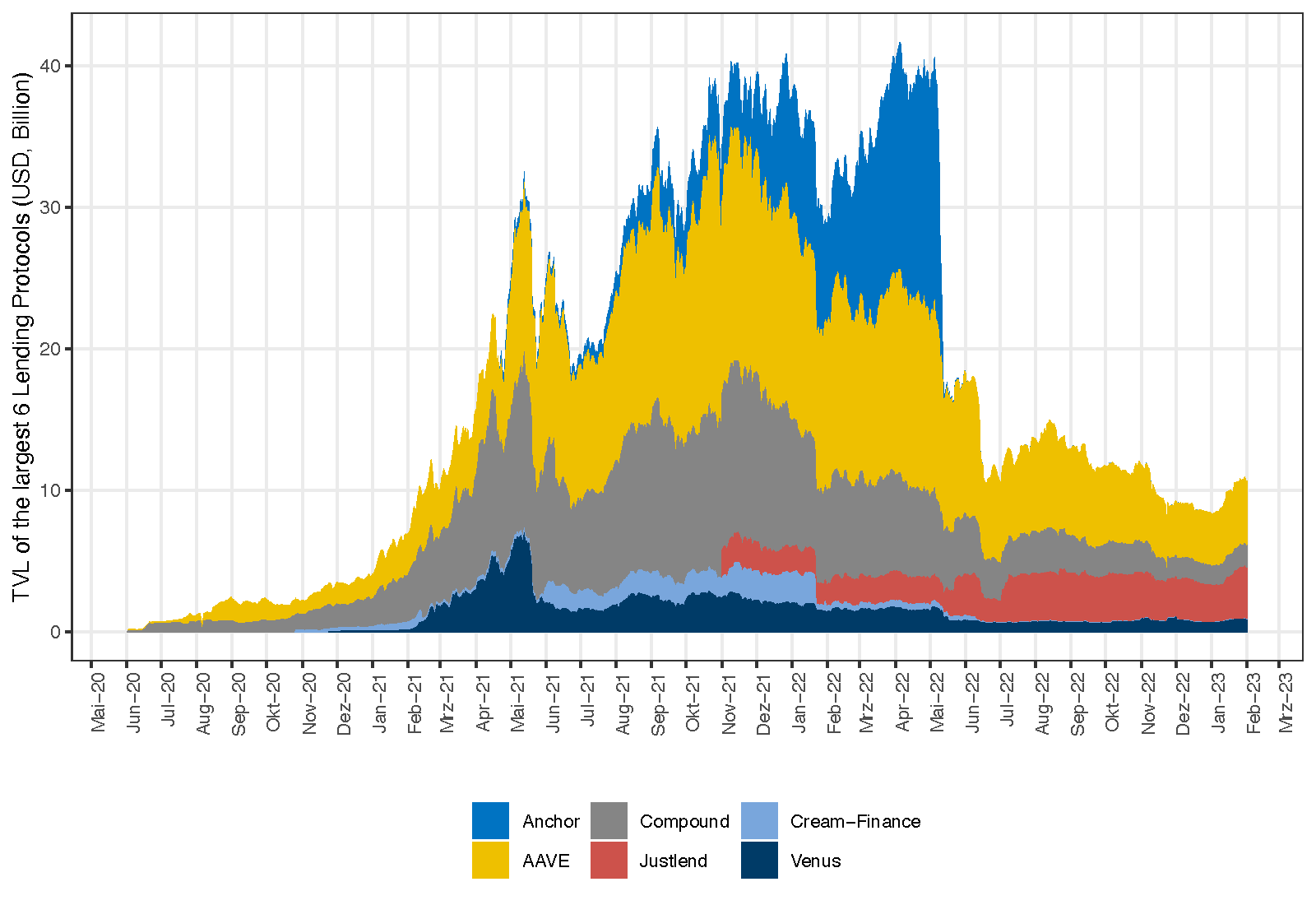

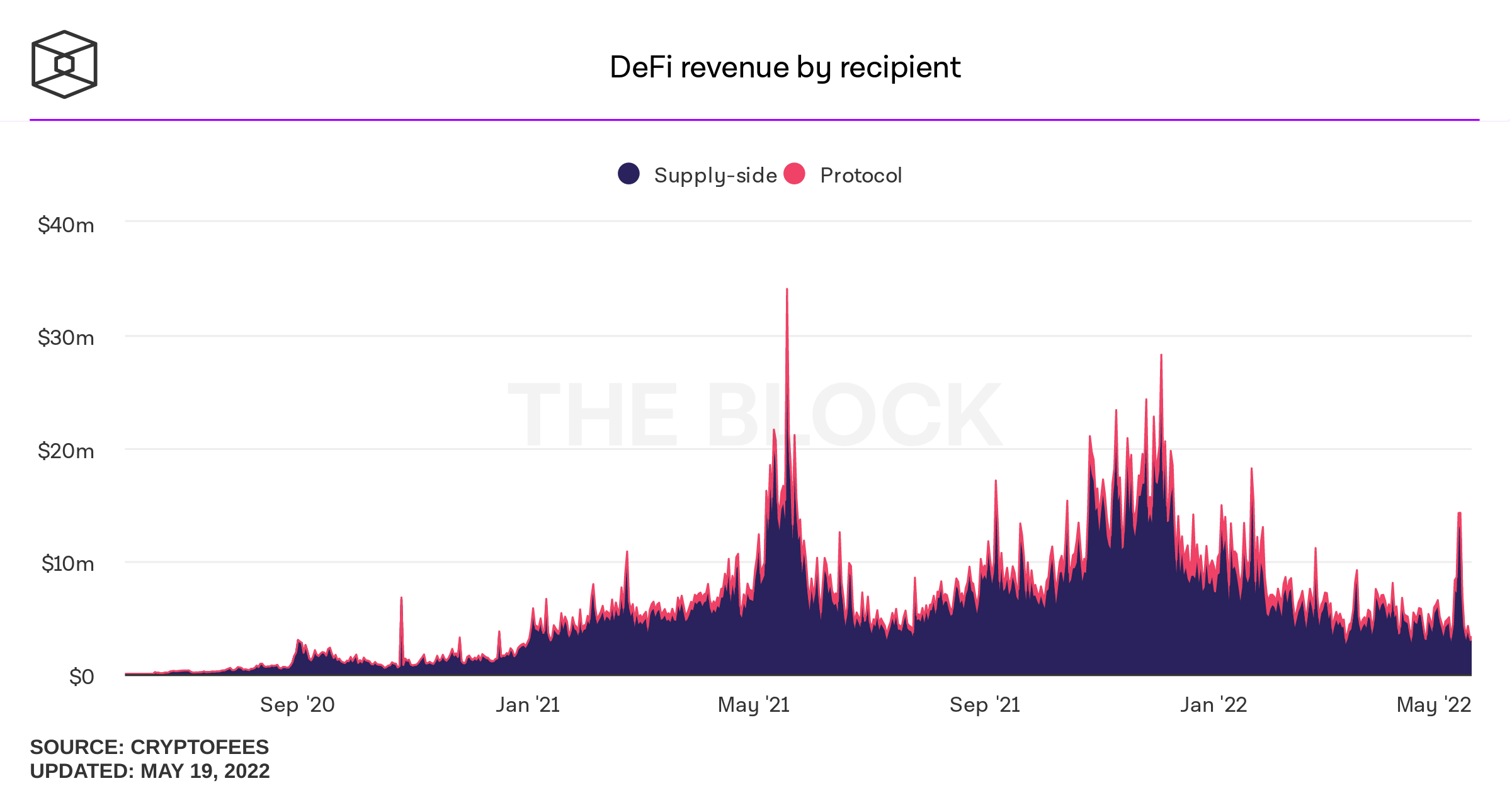

Some Data

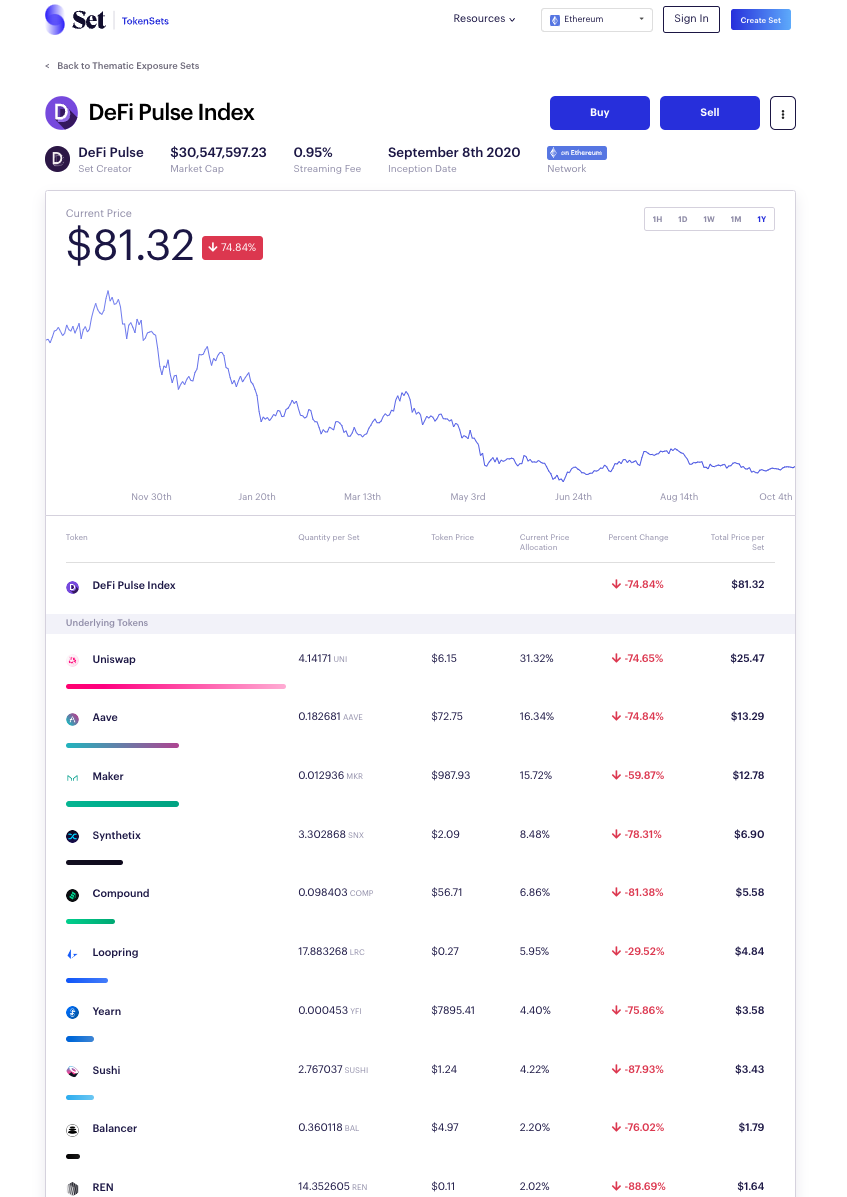

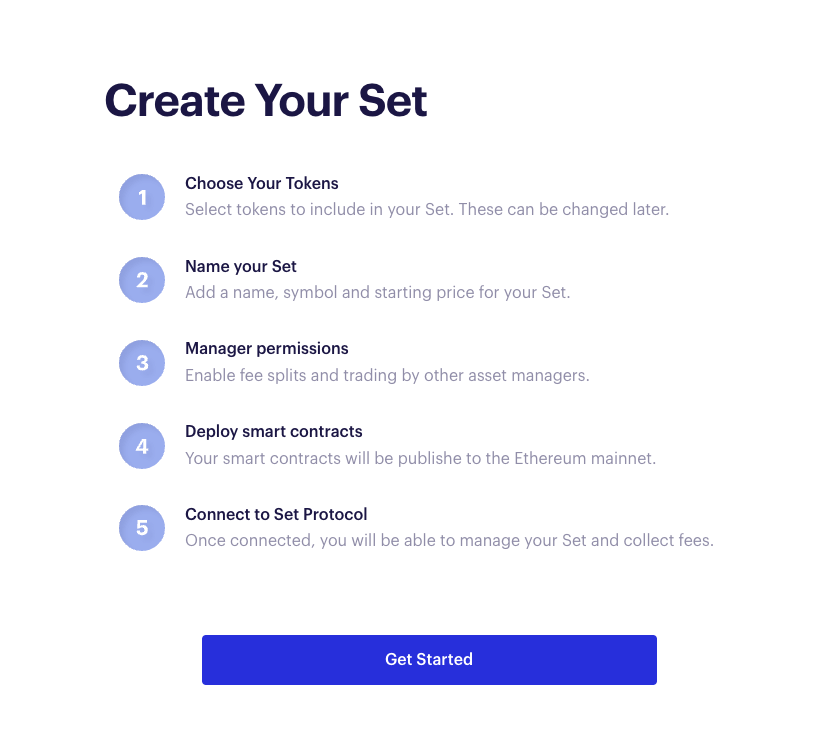

Securities Creation: Tokensets

idea: create new mutual fund like asset

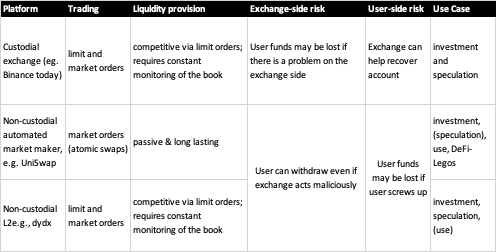

Platforms, Peer-to-Peer, and Decentralization

Philosophy of Peer-to-peer

Traditional Market

two-sided with fixed roles

- consumers \(\leftrightarrow\) producers

- consumers \(\leftrightarrow\) intermediaries \(\leftrightarrow\) producers

Decentralized Market?

value management protocol \(\not=\) market

- blockchain \(=\) application execution \(=\) intermediary

- blockchain-native \(\Rightarrow\) requires platform thinking

- consumers \(=\) producers

Peer-to-peer \(\Rightarrow\) Platforms

liquidity \(\nearrow\)

volume \(\nearrow\)

protocol fees \(\nearrow\)

token value \(\nearrow\)

Platform economics is tricky:

- What's the product?

- How do you get it started?

- How do you get people to contribute?

- How do you earn money?

it works!

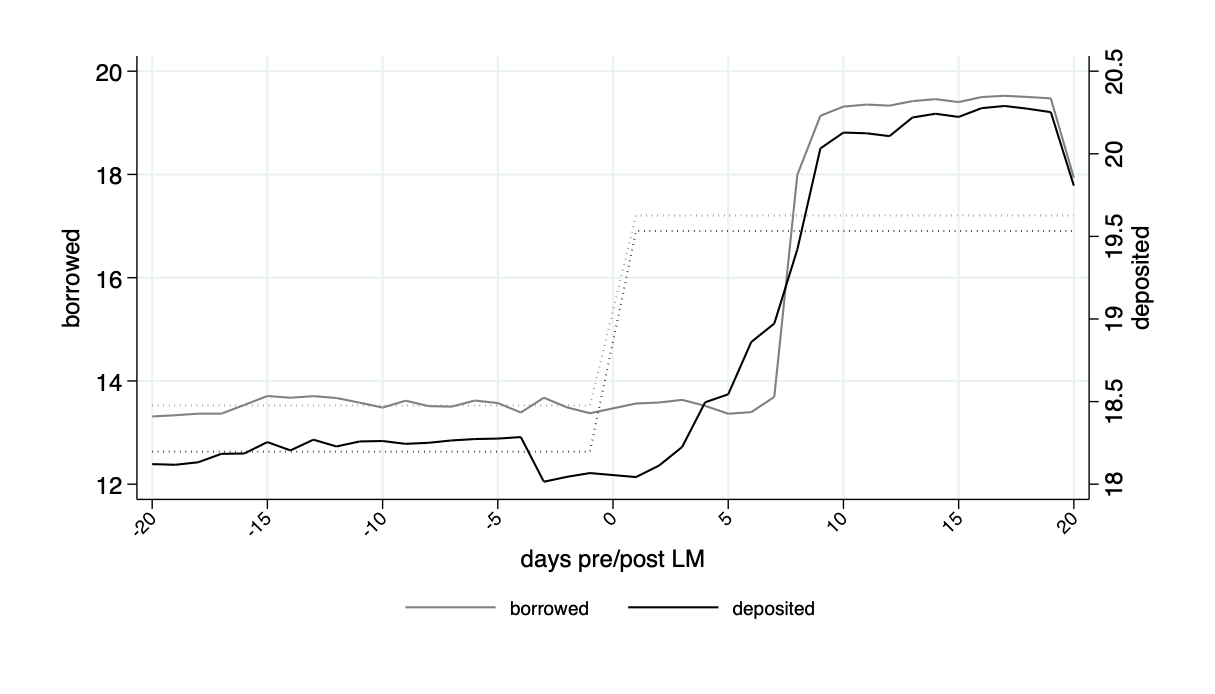

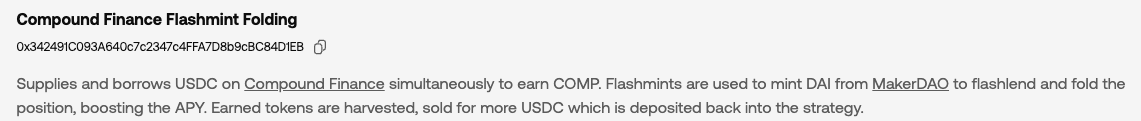

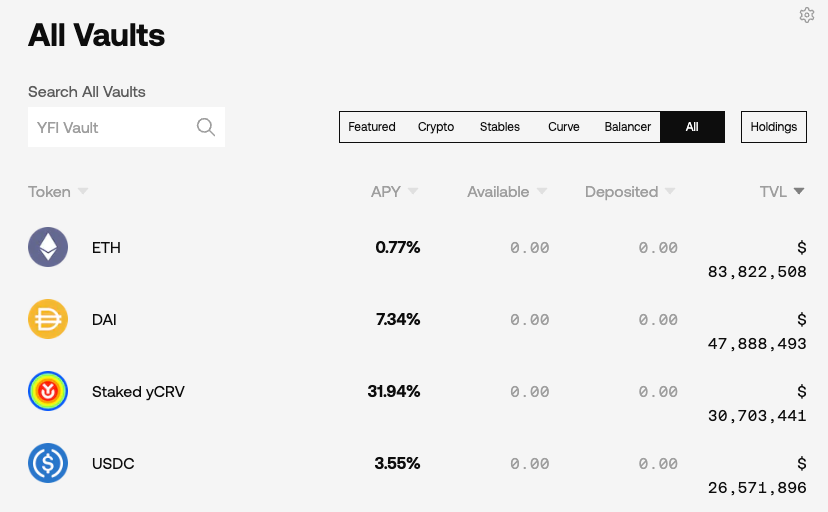

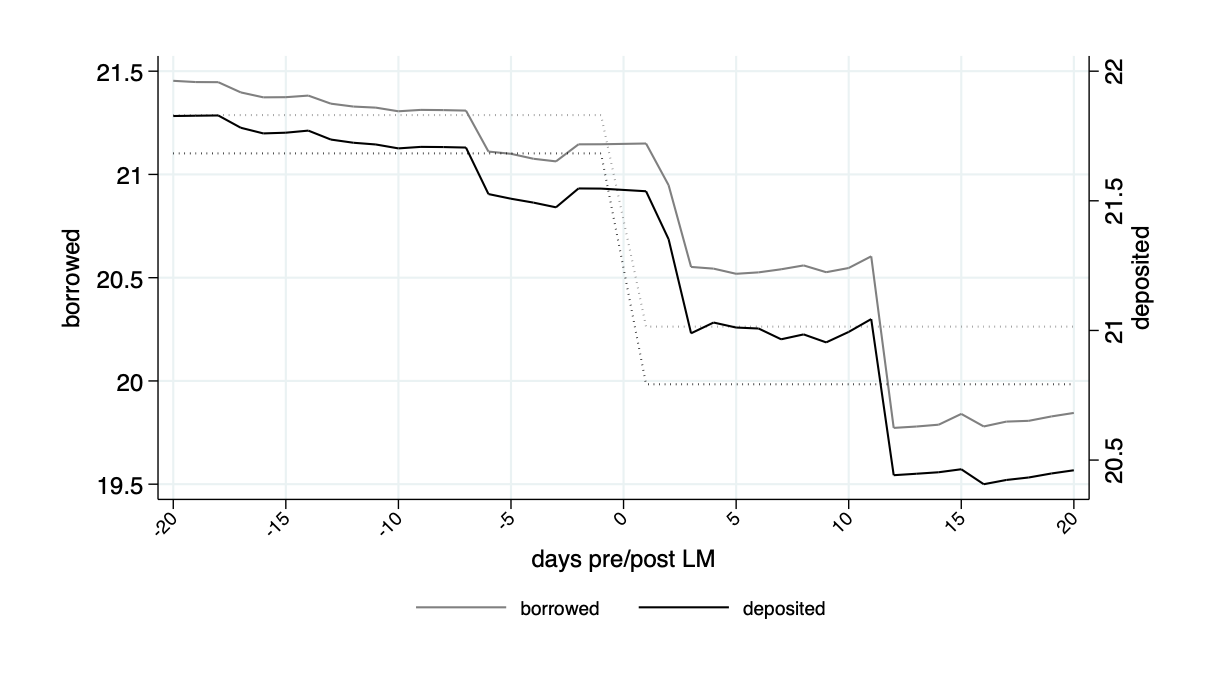

A Consequence of Liquidity Mining: Yield Aggregators

Idea:

- strategy to systematically take advantage of token issuance (liquidity mining) programs

- like pooling funds to take advantage of banks deposit incentives

- liquidity flees quickly

- "mirage" effect: yield aggregators borrow what they deposit

Who controls the Projects? Decentralized Autonomous organizations

UniSwap Lab supports development

a website app accesses the code

token holders control contact features

don't own the code

operation = decentral

control = decentral

anyone can use the baseline code

core code runs on the blockchain

tokens used as rewards

A Taxonomy of Tokens

- tokens are a re-imagination of value, ownership, use, rewards

-

tokens live on a single infrastructure and can interact with other tokens

- tokens are immediately transferable & immediately usable in DeFi

- token can be programmed to have many features and have many different uses

- tokens can assign ownership to "things" that could not be owned before

- tokens are often important for the functioning and incentives of platforms

What's a crypto-token and what's special about it?

- a blockchain is a protocol in which

- users have direct control and responsibility over their assets

- users can create codes at will

- \(\rightarrow\) any user can create tokens and applications

Tokens by use

payments:

- you use them strictly to pay for something

- example: native cryptocurrencies

utility

- you use them to access a specific service of function

- example: filecoin

stablecoins

- digital representation of fiat money

- centralized/ decentralized

- examples: DAI, USDC, USDT

governance

- voting rights to determine parameters of a project

- example: UNI, Compound etc

asset

- representation of ownership

- pool claims, digital items

- example: receipts from UniSwap, Compound, NFTs

derivatives

- tokens based on other tokens & functions

- Example: tokensets

Disclaimer: this list in non-exhaustive, new ideas and concepts come up every day!

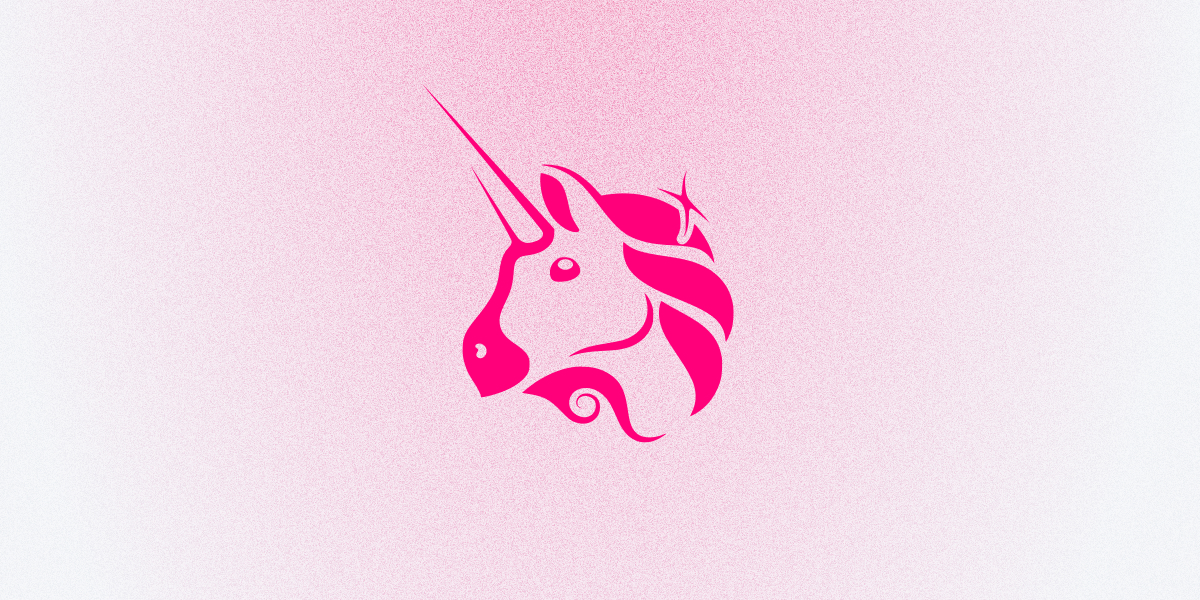

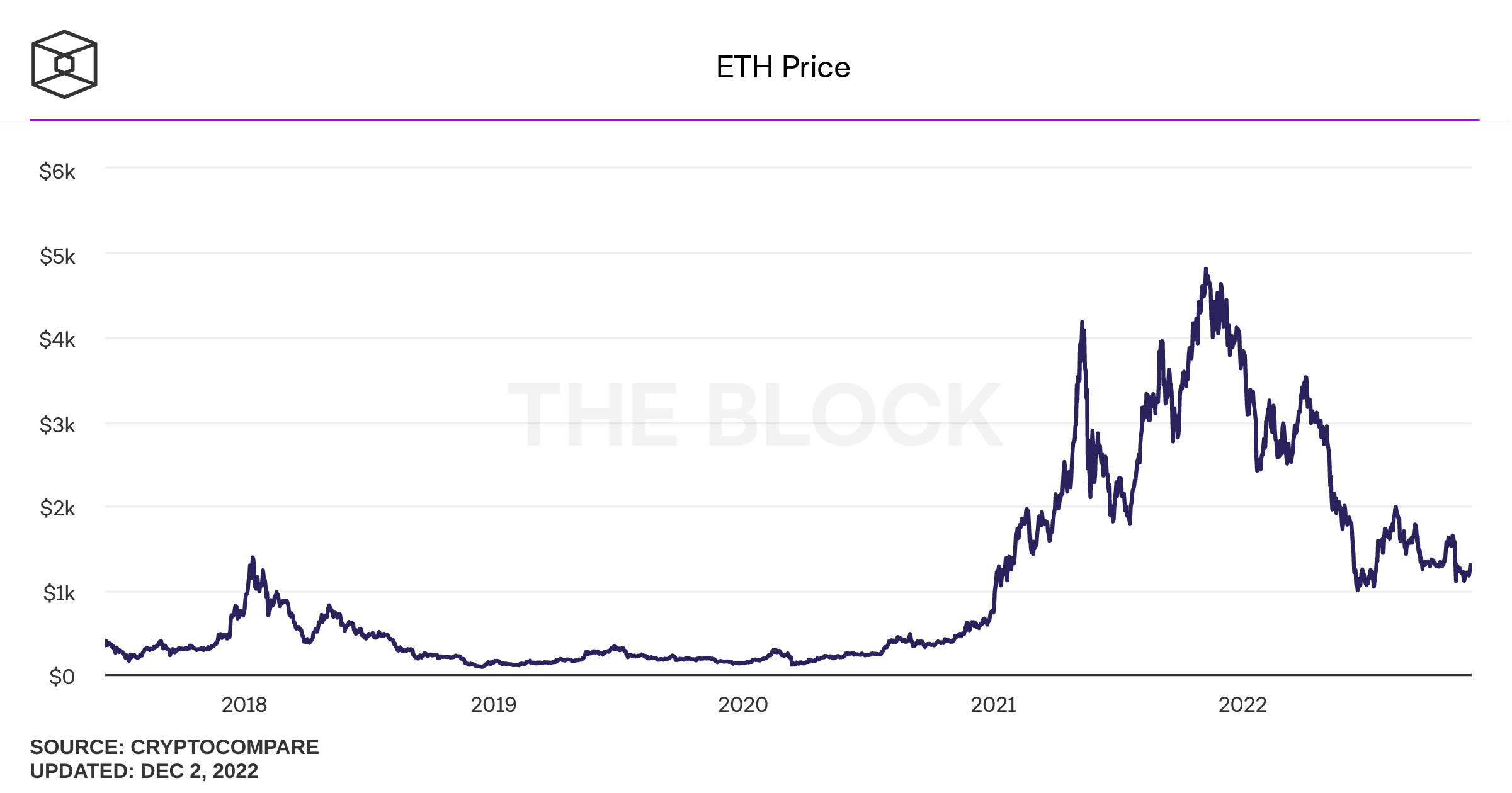

An ugly 9 months

From a slow slide to a thorough crash

-75%

-75%

!

The Terra Implosion

UST Stablecoin

LUNA (cryptocurrency of the TERRA network)

A timeline

May 7: selling pressure on UST from Curve withdrawals

May 12: LUNA and UST at $0.01

June 27: Three Arrows Capital ordered to liquidate

June 12: Celsius Network suspends withdrawals

July 13: Celsius files for Chapter 11

July 6: Voyager Digital files for Chapter 11

July 4: Vault suspends withdrawals

Three Arrows Capital lost >60% of value and faces numerous margin calls that they did not react to

partially "saved" by \(\ldots\) FTX

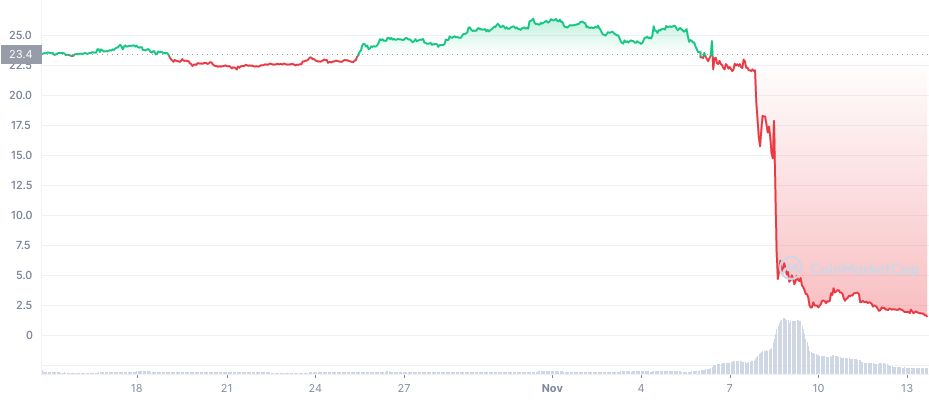

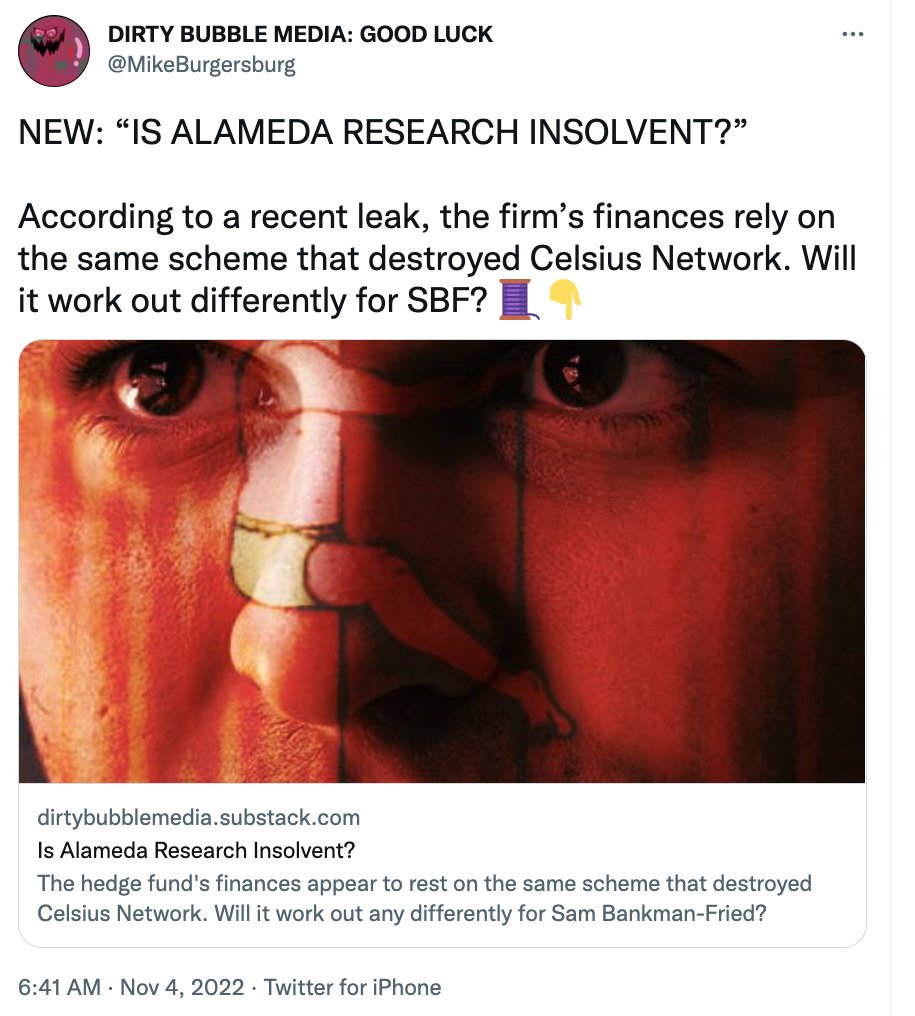

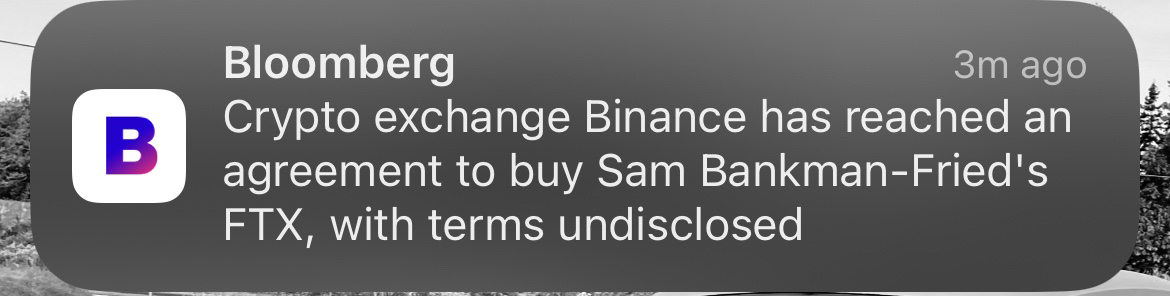

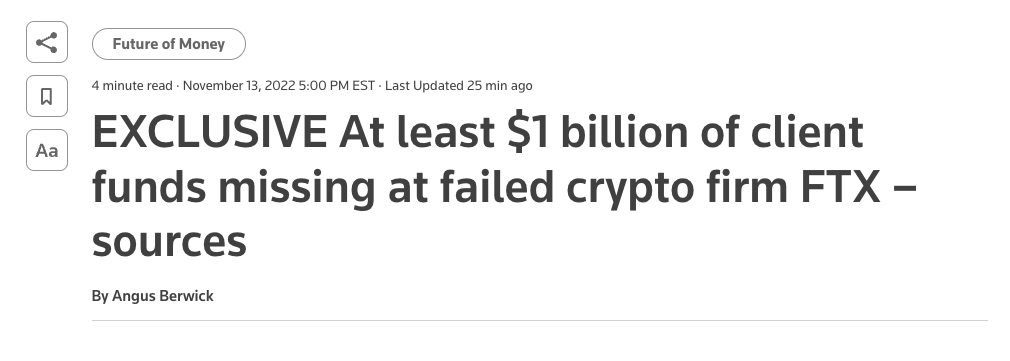

The FTX Implosion

A timeline

Nov 8

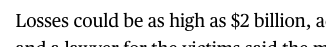

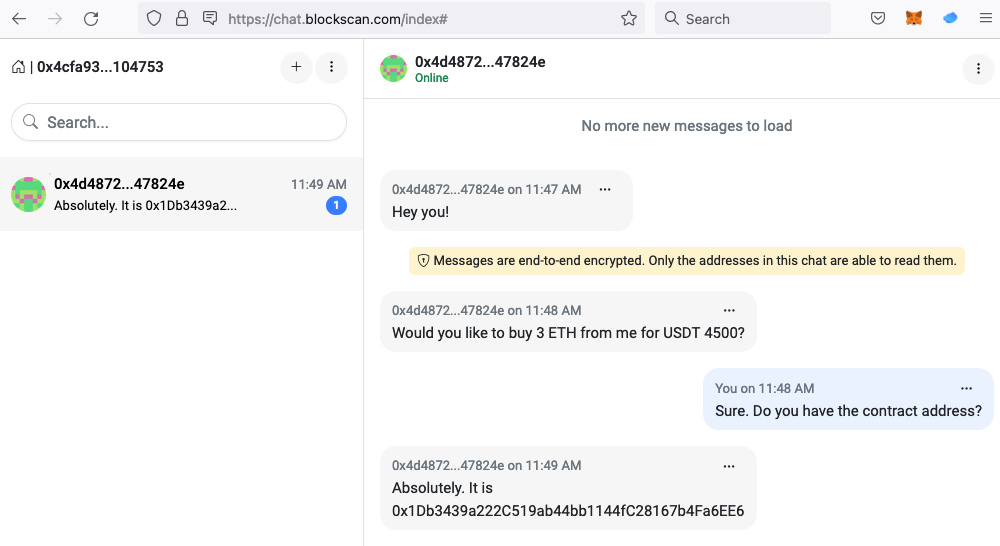

Recurring Core problem QuadrigaCX:

- QuadrigaCX:

- Gerry Cotton sold people crypto he did not have

- FTX:

- auto-execution of margin calls for all except Alameda

- SBF used customer funds to hide "short" market maker Alameda

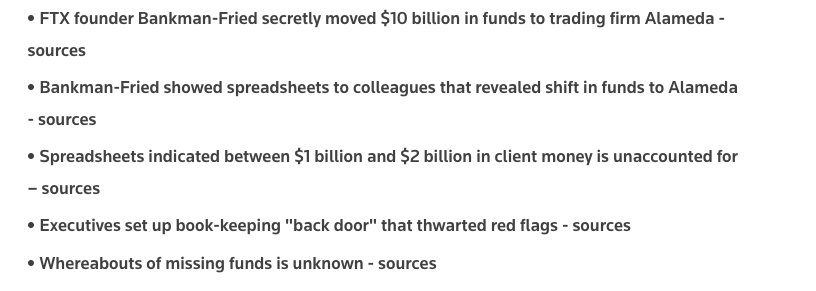

Fundamental Problems: Solution sans Regulators?

IN FINANCE TERMS

- hedge = off-setting position

-

here: unhedged/"leverage"

Solution

- prove aggregate positions

- prove assets & liabilities

- asset = liabilities \(\Rightarrow\) solvency

New trend: data providers check assets

-

Assets: cash in bank accounts and crypto assets in exchange wallets

-

Liabilities: customers' crypto and cash deposits

-

Proof of crypto assets

-

publish all exchange wallets

-

proof of control: shift assets from one address to another at a pre-determined time

-

-

Proof of crypto liabilities

-

public customer balances - customer can check

-

own holding

-

sum of all

-

-

-

Problem: privacy (adequate solutions exist)

Proof of Assets & Liabilities

A timeline

May 7: selling pressure on UST from Curve withdrawals

May 12: LUNA and UST at $0.01

June 27: Three Arrows Capital ordered to liquidate

June 12: Celsius Network suspends withdrawals

July 13: Celsius files for Chapter 11

July 6: Voyager Digital files for Chapter 11

July 4: Vault suspends withdrawals

Three Arrows Capital lost >60% of value and faces numerous margin calls that they did not react to

partially "saved" by \(\ldots\) FTX

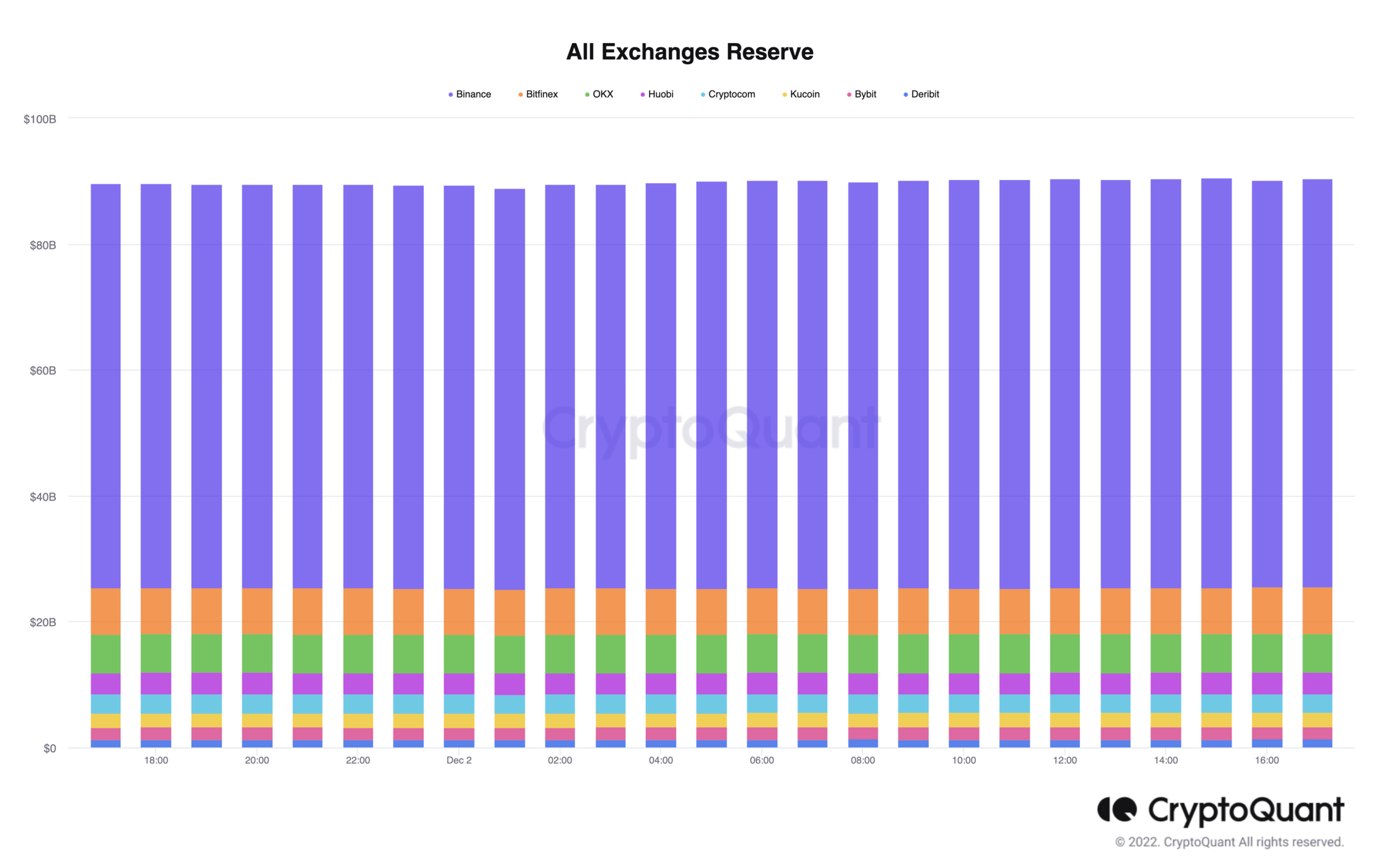

all centralized!

Centralized vs Decentralized?

Why are Blockchains challenging for current regulation?

What is blockchain=crypto? Some basic facts

anyone can use it

a open, general-purpose

digital value management tool

that maintains digital scarcity

ownership & control is direct and not intermediated

it's a protocol, not a thing

it does not belong to anyone

practically impossible to prevent the creation of code

borderless and digital

does not require high tech, a laptop is enough

requires use of tokens

What is blockchain=crypto? Some basic facts

anyone can use it

a open, general-purpose

digital value management tool

that maintains digital scarcity

ownership & control is direct and not intermediated

it's a protocol, not a thing

it does not belong to anyone

practically impossible to prevent the creation of code

borderless and digital

does not require high tech, a laptop is enough

requires use of tokens

The Investment Process

issuers

investors

- funding

- record-keeping

- instruments

- custody

- advice

- trading

services

needed & provided

- takes care of custody and allows self-custody

- allows instrument creation

- enables record-keeping

- allows circumvention of existing institutions

A general purpose value management infrastructure:

intermediaries

separate institutions

- asset custodians

- broker-dealers

- trading platforms

The blockchain reality:

new institutions

emerged that do all three

tokens are often not intended to be investments!

... and that brought us ...

- wash trading

- pump-and-dump schemes

- Bitfinex-Tether price manipulations

- cyber hacks

- epic thefts, "rug pulls," and fraud

- crypto trading platforms and custody risk

- quibble with CFTC on jurisdiction

- enforcement actions

- "almost all crypto-assets are securities"

Regulators' Focus

MiCA

- whitepaper rule

- platforms as money services businesses

current look: almost all branches of the US government work to make it "go away"

The Regulator's Dilemma

The Regulator's Dilemma

benign

crypto-assets

non-benign crypto-assets or crypto-assets that look like securities but are unregistered

crypto-assets that look like securities and are registered

crypto-assets that regulators feel comfortable to be traded on a platform under their supervision

The Regulator's Dilemma

The Reality of Markets

benign

crypto-assets

non-benign crypto-assets or crypto-assets that look like securities but are unregistered

crypto-assets that look like securities and are registered

crypto-assets that you feel comfortable to be traded on a platform under your supervision

The Dilemma

- blockchain as an idea will not become uninvented

- there is continuous research & development, including by universities

- when another hype starts, people will want to get their hands on the assets

- blockchains are borderless by design

- "tough" regulation pushes firms outside of jurisdictions

- no regulation can prevent the bankruptcy of an offshore entity

- willing issuers want clear guidance

- but issuers of crypto assets cannot comply with current rules

Final Thoughts

Some Final Thoughts

- blockchain tech won't get uninvented.

- young people and universities keep working on blockchain ideas

- the space is still trying to figure things out, including tech and economic challenges

- great progress has been made, but things will and do still go wrong

- a common resource can have huge economic benefits

- I'd like to see more thinking and discussion about paths to unlock the benefits

@financeUTM

andreas.park@rotman.utoronto.ca

slides.com/ap248

sites.google.com/site/parkandreas/

youtube.com/user/andreaspark2812/

Are Tokens Securities and What Safeguards Should There Be?

- People want(ed) crypto assets and they will get their hands on them

- US style differentiation of securities vs commodities etc is neither helpful nor useful

- There is no such thing as "technology-neutral" regulation.

- Some rules from securities regulation simply cannot be implemented with blockchain tech

- Just because someone buys something with an investment motive doesn't mean that they should get all securities protections

Provocative Thoughts

- End of Theory -

Some Developments

- Soulbound tokens, digital ID, privacy zero-knowledge proofs

- improved user experience, e.g., SIM cards with blockchain wallets

- invisible blockchains (used in China for AliPay NFT storage)

Blockchain Infrastructure

seller

buyer

What is a Blockchain?

The Premise of the

Internet & Blockchain

Peer to Peer Communication

Peer to Peer Value

!

?

?

Sidebar: What is digitize-able value?

- money

- digitally native assets

- claims on resources and property

- identity, personal data

The challenge: how do you ensure digital scarcity?

- traditional approach: unique record-keeper

- problem:

- intermediary necessary for record keeping

- tight supervision of custodian

- no peer-to-peer

- What is the equivalent of TCP/IP for value?