So you want a CBDC: how will you do it?

by Andreas Park

Based on:

Central Bank Digital Loonie: Canadian Cash for a New Global Economy

(Model X Competition Final Report)

by Veneris, Park, Long and Puri, 2021

Workshop on Future of Money, Paris , June 2022

Design of a Digital Loonie

- Bank of Canada: extensive research on CBDCs in particular on wholesale CBDCs (Project Jasper)

- June 2020: Model X Competition

- Invite several dozen universities to compete to develop a CBDC design proposal

- Targeted business school & engineering/CS to collaborate

- Specific focus on blockchain research background

- Three winning teams were invited to submit full CBDC design proposal in early 2021.

Background

BoC will consider issuing CBDC if:

- cash becomes unusable, and/or

- an alternative digital money starts taking over

The BoC Contingency Plan

What does this mean in practice?

- cash unusable

- only commercial digital payment solutions remain

- ability to pay = public good \(\to\) BoC needs to build a public alternative

- Philosophy:

- digital payments without a commercially interested third party

- protection of citizen's privacy

- \(\Rightarrow\) new, digital payment rail

- alternative digital money

- possible scenarios

- a foreign public money, e.g. digital USD, e-CNY

- a private money on a private infrastructure

- a private money on a public infrastructure

(aka stablecoin on a blockchain)

- \(\Rightarrow\) a new digital infrastructure

- possible scenarios

Our Design of a Digital

CBDC = infrastructure that covers all scenarios

- works as a new payments rail and

- has broader use cases: common resource for general value transfers

Our Approach and Thinking

Driving view

- do not repeat the feet-dragging of the "Payments Modernization Initiative" (ongoing since pre-2012)

Required Components

- multi-entry onboarding & KYC

- AML compliant transactions

- connection to legacy infrastructure & autonomous setup

Features & Goals

- privacy protection

- no direct interaction with customers/digital-only

- innovation & competition in payments

- competitive product

- universal access

Synopsis of our CBDL proposal

Phase 1:

- Centralized platform

- e-KYC through existing resources

- Fully controlled by the BoC via new payments entity

Phase 2:

- Expansion to enterprise-level blockchain \(\to\) common resource

- Open APIs, programmable, open source

- Phase 2 open to FIs as validators and FinTechs

Other Key CBDL Proposal Features

- Detailed architecture for offline CBDL

- AML/CFT compliant

- Regulatory guidance

- Cost-effective

user obtains wallet

registers wallet address via e-KYC

- authenticator adds the public key to whitelist

- mapping person \(\leftrightarrow\) wallet stays with authenticator

transactions processing among whitelisted wallets quasi-anonymously

Phase 1: e-Know-Your-Customer

LVTS/

Lynx

consumers can initiate EFTs from chequing account at commercial bank to CBDL wallet at NB

existing payments system facilitates transfers to CBDL system

NB has reserve account at BoC to link with commercial banks

NB handles all

CBDL payments

How our system fits with the legacy system

issues transaction instructions

- signs transaction

- sends authentication request

- sends transaction instructions

checks

- signature

- whitelist

- balance

( )

( )

initiates wallet transfer

record keeping and AML/CFT processing

Phase 1: Anatomy of CBDL Transfer

Phase 2: DLT

overnight house- keeping

*

service example: internal payment-reward system

service example: small business bookkeeping

NB transitions into a validator node

a

b

c

d

e

f

g

blockchain network with validators and nodes

Any concerns?

-

Disintermediation:

- BoC report 2020-15 (Garcia, Lands, Liu and Slive)

- Minor concern but Banks' financing costs will increase

- payments income will decline

-

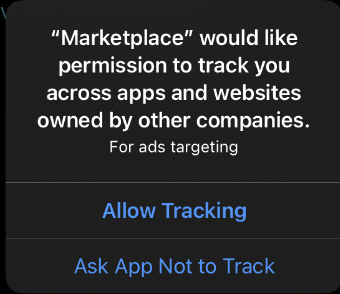

Privacy: Payments are central to anything we do - how much privacy do grant?

- Great restraint \(\to\) privacy by design? Wire-tapping-like hurdles? or

- Ongoing monitoring/surveillance? \(\to\) affects user uptake

-

Ongoing technological innovation: Will a public sector solution be suitable for private sector innovation?

- Canada's bad track record of public sector tech innovation (IBM-Phoenix, Ontario e-Health)

- what are genuine use cases vs. bureaucratic, arbitrary design

Summary

build a new infrastructure based on solid foundation:

- use open source, versatile language

- use easy access, scalable and expandable system

avoid building by committee and just do it:

- Kickstart with a simple solution that use existing resources

- enable private sector innovation

Law allows the BoC to do it, but an open, broad discussion is critical.

@financeUTM

andreas.park@rotman.utoronto.ca

slides.com/ap248

sites.google.com/site/parkandreas/

youtube.com/user/andreaspark2812/

Contingency applies when:

- Canadian FIs convinced Canadians to ditch cash OR

- Canadians adopted "another" money

Implementation: Strategic Considerations

Contingency happen, now what?

Too late & risky to involve FIs

- FIs did convince Canadians to ditch cash

- Legacy FIs winners \(\to\) why establish a competitor?

- Canadians adopted "another" e-fiat (Diem, e-USD, e-RMB)

- Legacy FIs losers \(\to\) why would consumers want them now?

CBDL distribution by FIs vs competition in payments

- FIs/Card issuers have little interest to cannibalize existing lucrative payment's income

No "Design by Committee" with conflicting interests

- Danish MobilePay (Danske Bank went alone)

- Payments "Modernization" (ongoing since 2011)

- Brazilian PIX (live since Nov. 2020): built in 9 months

AML/CFT Compliance and Other Legal Considerations

Changes to Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations Act and associated rules:

- Amend the definition of “financial entity” to include NB

- Provide exceptions to permit NB rely on identity verification completed by approved 3rd party authenticators

- Ensure all e-wallet providers are subject to FINTRAC oversight and outline the expectations for CBDL service-wallet provider compliance programs

- Apply the current AML/CFT rules with respect to e-KYC, imposing different e-KYC requirements depending on transaction size

Other Considerations:

-

Changes to Canada Deposit Insurance Corporation Act

-

do CBDL wallet require deposit insurance?

-

Our insight says "no" but our design is flexible

-

-

Consumer Protection Initiatives

-

Privacy Considerations

-

Tax Considerations

-

Service provider's wallet licensing

Regulation and oversight of CBDL wallets

Four regulatory options:

- Regulate the NB and Suppliers as banks under the Bank Act

- Regulate the NB and Suppliers as crypto-asset exchange platforms under provincial securities laws and IIROC rules

- Develop a customized regulatory regime under the Canadian Payments Act and the Payment Clearing and Settlement Act

- Develop a novel regulatory framework under the Department of Finance’s recently proposed retail payments oversight framework

Our Recommendation:

- Option #3- Develop customized regulatory regime under the Canadian Payments Act and the Payment Clearing and Settlement Act; this would make NB and suppliers subject to an experienced regulatory framework and would allow the BoC significant oversight and control

Optimal regulatory system:

- Our recommendation: a single regulatory body for all CBDL network participants

Executive Summary: CBDL - A 30,000 ft. view

Central Bank Digital Loonie (CBDL) would be programmable money with high privacy protection that powers a new financial infrastructure

Phase 2 Extend Phase 1 to a

- shared-resource infrastructure for

- programmable digital fiat platform

- to enable private sector innovation

Digital "fiat" is already here: Diem, DCEP, Stablecoins, Digital USD & EUR

Phase 1 BoC goes alone to establish CBDLs as new digital payment means

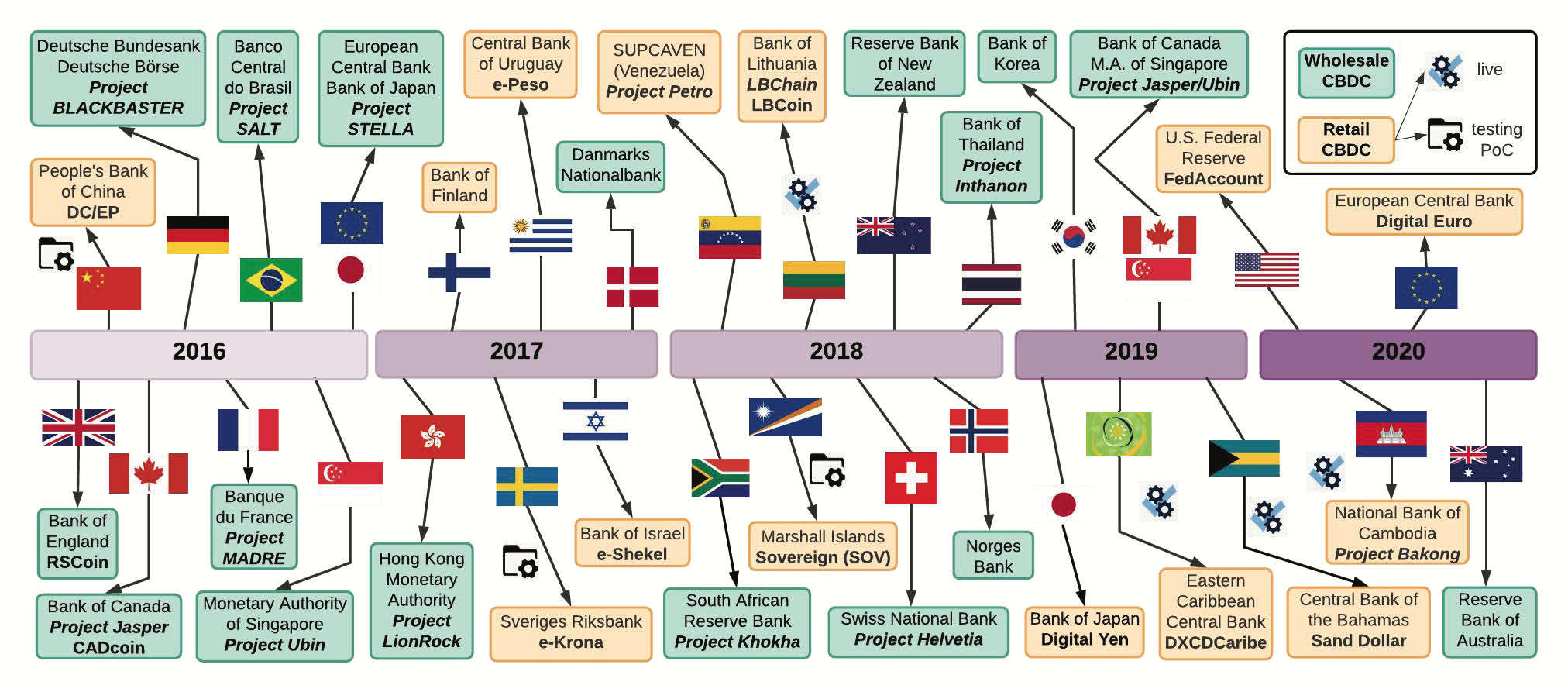

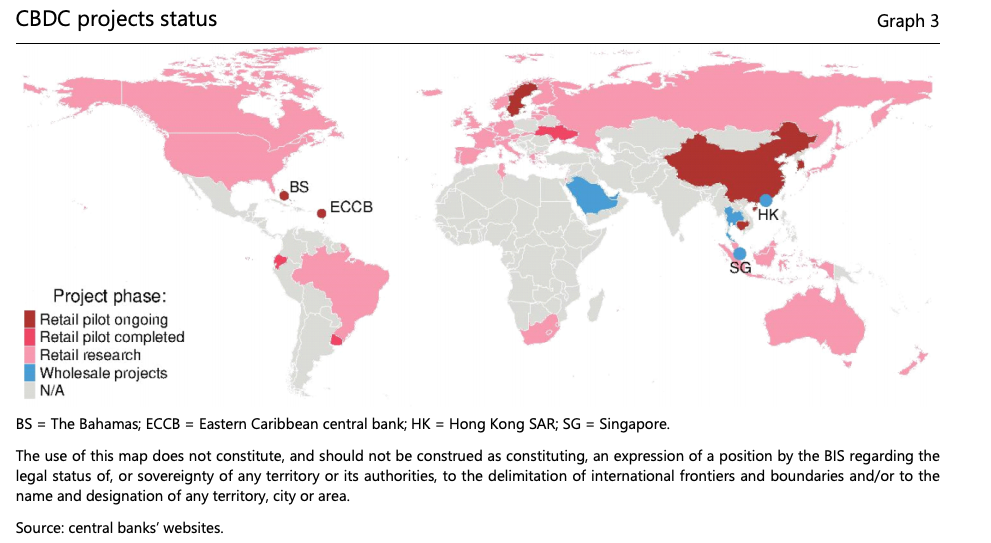

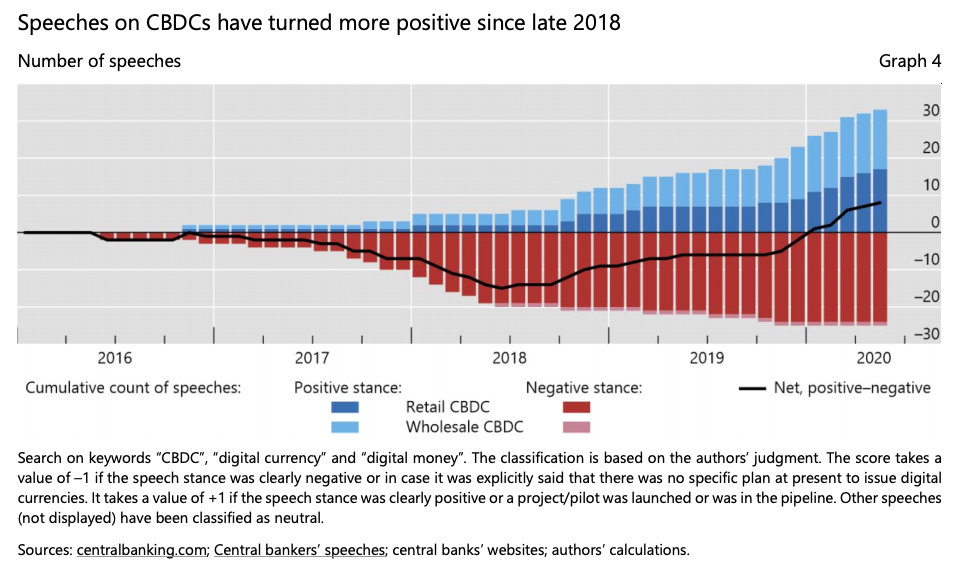

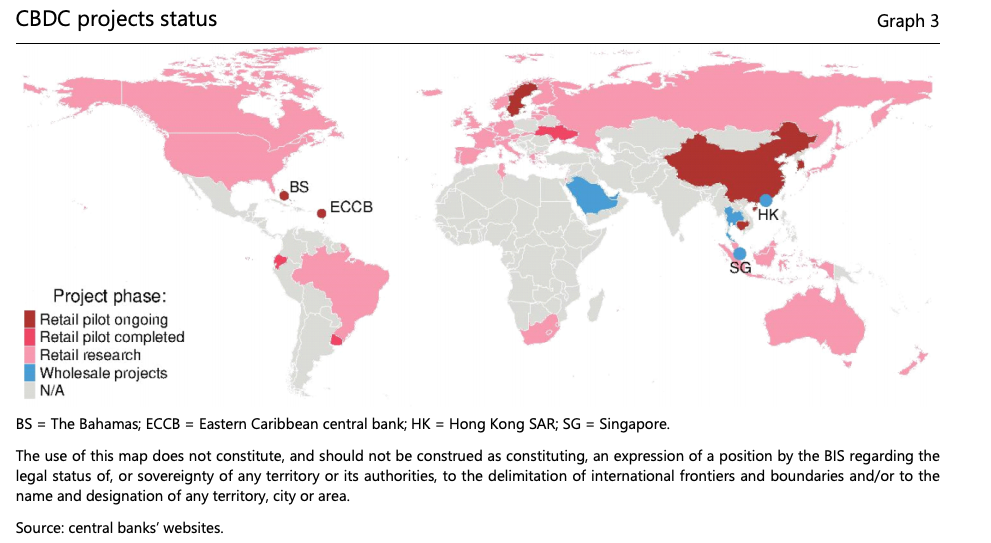

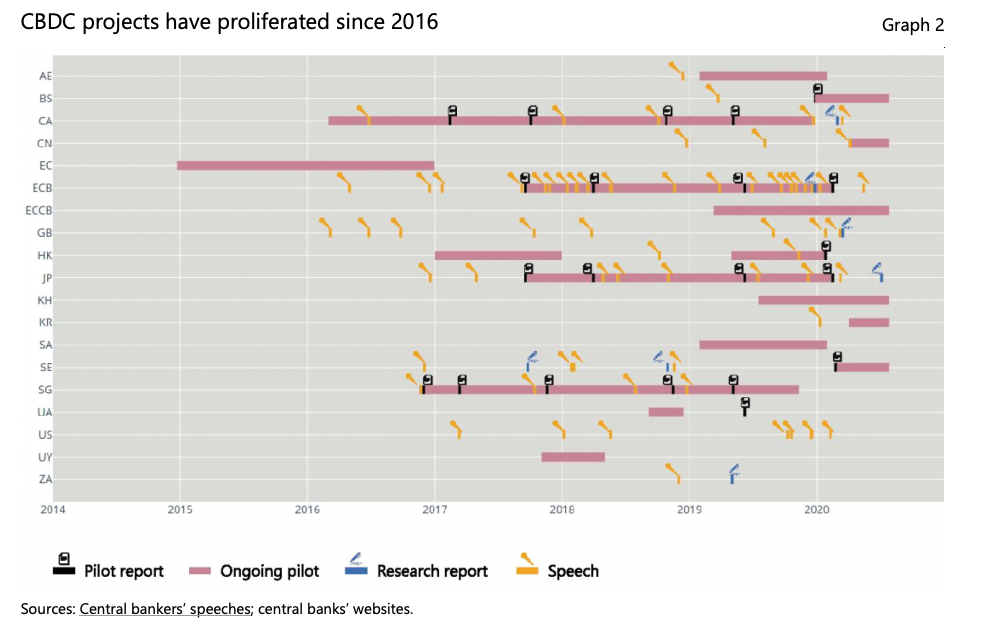

Executive Summary: A timeline of CBDC projects

Source: BIS Working Papers No 880 "Rise of the central bank digital currencies: drivers, approaches and technologies" by Raphael Auer, Giulio Cornelli and Jon Frost

CBDC History - Where are we at?

Offline CBDL-cash-cards

Scenario 1: CBLD-cash-card to Online Merchant

- RF signal from terminal "powers up" the card initiating the CBDL direct transfer

- CBDLs removed from card and credited to the merchant online wallet

Scenario 2: CBDL-cash-card to Offline Merchant

- Merchant terminal still "powers up" card with RF

- Merchant transfer to wallet delayed till merchant terminal comes online

- Entails some limited risk to merchant (similar to this of cash)

Scenario 3: CBDL-cash-card to CBDL-cash-card

- Needs an external source to "power up" cards (e.g., RF-flashlights)

- Sync-in/sync-our is eponymous but passing the card around is fully anonymous

each offline card is linked to a KYC-ed user/e-wallet

NB transfers CBDL with serial numbers to the card

user pays offline

user pays offline

user pays offline

user pays offline

Anatomy of an Offline CBDL Transfer

user initiates transfer from card to e-wallet

user initiates transfer from e-wallet to card

The Model X Challenge

Executive Summary

CBDL System Architecture

The Business Plan

Legal & Regulation

Summary

Offline CBDL Transactions

The Model X Challenge

Executive Summary

CBDL System Architecture

The Business Plan

Legal & Regulation

Summary

Offline CBDL Transactions

Why now?!

- Can all Canadians access the digital economy TODAY?

- Is there competition in payment systems?

- Right to participate in the digital economy without commercially interested third parties harvesting their data?

- Lack of FinTech innovation - where is Canada's Fintech sector relative to other countries (AUS, UK, SG, China)?

- Threat of Diem/DCEP/Digital USD

Authority to issue CBDLs - can the BoC do it?

Bank Act

- The BoC can accept deposits from a bank licensed entity under the Bank Act, or in a manner authorized by an Act of the Parliament.

- We recommend ensuring that the NB fits within one of these categories, incl. through possible amendments to the Bank Act, to ensure it can both accept deposits and issue CBDLs to the NB

Bank of Canada Act

- Grants the BoC the sole authority to issue "notes"

- While "note" is legislated as "notes intended for circulation in Canada", Sec. 25(3) and (4) of the Act also asks that they are "printed"

- We recommend BoC Act is updated to explicitly grant the BoC authority issue “digital currency”

Royal Canadian Mint Act

- Defines a "circulation coin" as a coin "composed of base metal"

- We recommend amending the definition to include a digital coin

Payment Clearing and Settlement Act

- When setting out the BoC’s authority to oversee payments and other clearing and settlement systems in Canada, the preamble specifically references "Canadian dollar payments"

- We recommend an amendment to explicitly mention "digital Canadian dollars"

The BoC Contingency Plan (2/20) & Model X Challenge (4/20)

Model X System Requirements:

- Privacy

- Regulatory compliant (AML/CFT)

- Universal access (inclusive)

- Secure

- Resilient/continuously operable

- Performant/scalable

BoC will consider issuing CBDC if:

- cash becomes unusable, and/or

- an alternative digital money starts taking over

Notable Model X Considerations:

- cash with digital features

- system-critical infrastructure with multi-decade life span

- high-level business model and system architecture

Model X: Desired System Functionalities

Features & Outcomes

- no BoC contact with end-user

- products and services of highest quality

- high system efficiency

- maybe: distribution through major FIs

- enhanced competition in payments market

Minimum functions

- onboarding

- linking to bank accounts

- paying in physical stores and online

- p2p online & offline transfers

The Model X Challenge

Executive Summary

CBDL System Architecture

The Business Plan

Legal & Regulation

Summary

Offline CBDL Transactions

Phase 1: The CBDL Transactions Processor

Narrow Bank (NB) - a public utility:

-

Separate legal entity

-

Entirely digital (no physical locations)

- Operates under the BoC auspices

- Processes CBDL transactions in real time

- AML/CFT compliant

- ISO20022 compliant

- Access to RTR and Lynx

- Reserve account with the BoC

- ... it does resemble a "narrow bank"

Why linking to LVTS/RTR?

- Convertibility between reserves, commercial money, and CBDLs

- Enables CBDLs for monetary policy

- Circumvent FIs

How?

- Use the Canadian Payments Act

- Gives Payments Canada legislative mandate to establish & operate national systems for the clearing and settlement of payments

Phase 2: Business Innovation by Design

- A permissioned "pseudo" blockchain acting as a common resource where:

- NB/BoC takes sole control at rare systemic crisis (i.e., degenerates to Phase 1)

- Private sector pays all system costs, in exchange ...

- ... for lucrative new global AI/5G/ML market opportunities

- Quasi-anonymous transactions: guards citizen data, trade-offs for perks

- Key Players in Phase 2:

- NB: a validating node, AML/CFT overnight, sole validator in systemic crisis

- Validators: likely a few FIs (entities with experience handling private data)

- Service providers: Tim Hortons et al. for perks, service dapps, etc

-

CBDL Users: e-KYCed Canadians that may exchange data for perks/services

-

CBDLs: programmable money with dapps by approved entities (i.e., Google Store)

- BoC opportunity: lead standardization within G20/CBDC int'l forums

The Model X Challenge

Executive Summary

CBDL System Architecture

The Business Plan

Legal & Regulation

Summary

Offline CBDL Transactions

Offline CBDL-cash-cards

- Offline payments: an inherent security vs. cost trade off

- Goal is to emulate physical cash yet contain its deficiencies

- Goal is to emulate physical cash yet contain its deficiencies

- Introducing a quasi-token CBDL-cash-cards:

- Transfers happen via NFC/QR using RF power sources

- Cards/smart-phones with Trusted Execution Environments (TEEs)

- Limited by a cap amount (e.g., $200 CBDLs)

- Sync-in and sync-out with e-KYCed CBDL wallet only when wallet is online

- More prone to AML/CFT than today's "invisible" banknotes

- Lost cards are reported/replaced but their CBDLs are lost (aka physical cash)

- Promotes inclusion (aka food stamps, etc)

- Accommodate tourists, business travelers, etc (via a passport e-KYC)

The Model X Challenge

Executive Summary

CBDL System Architecture

The Business Plan

Legal & Regulation

Summary

Offline CBDL Transactions

Authority to issue CBDLs: statutory changes

Bank Act

- The BoC can accept deposits from a bank licensed entity under the Bank Act, or in a manner authorized by an Act of the Parliament.

- We recommend ensuring that the NB fits within one of these categories, incl. through possible amendments to the Bank Act, to ensure it can both accept deposits and issue CBDLs to the NB

Bank of Canada Act

- Grants the BoC the sole authority to issue "notes"

- While "note" is legislated as "notes intended for circulation in Canada", Sec. 25(3) and (4) of the Act also asks that they are "printed"

- We recommend BoC Act is updated to explicitly grant the BoC authority issue “digital currency”

Royal Canadian Mint Act

- Defines a "circulation coin" as a coin "composed of base metal"

- We recommend amending the definition to include a digital coin

Payment Clearing and Settlement Act

- When setting out the BoC’s authority to oversee payments and other clearing and settlement systems in Canada, the preamble specifically references "Canadian dollar payments"

- We recommend an amendment to explicitly mention "digital Canadian dollars"

Regulation and oversight of CBDL wallets

Four regulatory options:

- Regulate the NB and Suppliers as banks under the Bank Act

- Regulate the NB and Suppliers as crypto-asset exchange platforms under provincial securities laws and IIROC rules

- Develop a customized regulatory regime under the Canadian Payments Act and the Payment Clearing and Settlement Act

- Develop a novel regulatory framework under the Department of Finance’s recently proposed retail payments oversight framework

Our Recommendation:

- Option #3- Develop customized regulatory regime under the Canadian Payments Act and the Payment Clearing and Settlement Act; this would make NB and suppliers subject to an experienced regulatory framework and would allow the BoC significant oversight and control

Optimal regulatory system:

- Our recommendation: a single regulatory body for all CBDL network participants

AML/CFT Compliance and Other Legal Considerations

Changes to Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations Act and associated rules:

- Amend the definition of “financial entity” to include NB

- Provide exceptions to permit NB rely on identity verification completed by approved 3rd party authenticators

- Ensure all e-wallet providers are subject to FINTRAC oversight and outline the expectations for CBDL service-wallet provider compliance programs

- Apply the current AML/CFT rules with respect to e-KYC, imposing different e-KYC requirements depending on transaction size

Other Considerations:

-

Changes to Canada Deposit Insurance Corporation Act

-

do CBDL wallet require deposit insurance?

-

Our insight says "no" but our design is flexible

-

-

Consumer Protection Initiatives

-

Privacy Considerations

-

Tax Considerations

-

Service provider's wallet licensing

The Model X Challenge

Executive Summary

CBDL System Architecture

The Business Plan

Legal & Regulation

Summary

Offline CBDL Transactions

Contingency applies when:

- Canadian FIs convinced Canadians to ditch cash OR

- Canadians adopted "another" money

Critical Business Strategy Considerations

Contingency conditions triggered, now what?

It is too late & too risky to involve FIs assist build CBDLs

- Canadian FIs did already convince Canadians to ditch the physical loonie

- Legacy FIs are already winners \(\to\) why establish CBDC as a competitor?

- Canadians have already adopted "another" e-fiat form (Diem, e-USD, e-RMB)

- Legacy FIs are already losers \(\to\) why would consumers want them now?

CBDL distribution by FIs vs competition in Payments

- FIs/Card issuers have little interest to cannibalize existing lucrative payment's income

Avoid a "Design by Committee" plan with Conflicting Interests

- Danish MobilePay (Danske Bank went alone)

- Payments Modernization (ongoing since pre 2015)

- Brazilian PIX payment platform (live since Nov. 2020): it was built in just 9 months

Private sector partner incentives

-

Phase 1:

- branding of wallets

- discounted reserves to dampen balance sheet impact and any fears of disintermediation

-

Phase 2:

- validators: chance to view payments activities

- branding of CBDL access/services

- innovative fintech/data services, reward programs/applications, IoT services, data analytics

- spillover effects for legacy payments

- fees from export of services to second-mover markets (i.e., to domestic/int'l service providers)

Business Plan Considerations

System Costs

- System development, NB, e-KYC, AML monitoring

- Consumer onboarding

- Transactions processing capacity << 11M trans/day

- less than small Canadian stock exchanges today

- Others: Point-of-Sale costs

BoC Revenue

- A nominal cost recovery processing fee, e.g.,

- 11M cash trans/day today - assume 50% as CBDL in future with a fee of 1c per transaction

- This is a $20M revenue p.a.

- licensing and access fees (Phase 2)

- seigniorage

Alignment with Model X Challenge

Model X System Requirements:

- Privacy

- Regulatory compliance (AML/CFT)

- Universal access (inclusive)

- Secure

- Resilient/continuously operable

- Performance & scalable

Notable Model X descriptions for our team:

- cash with digital features

- system-critical infrastructure with multi-decade life span

- sound high level business model and system architectures

Features & Outcomes

- no end-user contact

- highest quality products and services

- high efficiency

- enhanced competition in payments market

Minimum functions

- onboarding

- linking to bank accounts

- paying in physical stores and online

- p2p online & offline transfers

The Model X Challenge

Executive Summary

CBDL System Architecture

The Business Plan

Legal

Summary

Offline Transactions

Executive Summary

The Model X Challenge

Executive Summary

CBDL System Architecture

The Business Plan

Legal

Summary

Other items

AML/CFT Compliance

Necessary changes to Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations Act and associated rules:

- Amend the definition of “financial entity” to ensure it includes the NB

- Provide exceptions to permit the NB to rely on identity verification completed by third party approved authenticators

- Ensure all e-wallet providers are subject to FINTRAC oversight and outline the expectations for CBDL service-wallet provider compliance programs

- Apply the current AML/CFT rules with respect to e-KYC, imposing different e-KYC requirements depending on transaction size

Other Legal Considerations

-

Changes to Canada Deposit Insurance Corporation Act

-

do CBDL wallet require deposit insurance?

-

Our insight answers "no" but our design remains flexible

-

-

Consumer Protection Initiatives

-

Privacy Considerations

-

Tax Considerations

-

Service provider's wallet licensing

Risks

- NB is outward-facing

- Cyber-security

- Fraud and fraud resolution

- Being outsmarted by abuse of programmability

- Disintermediation, reduced deposit funding and systemic risk? (Garcia, Lands, Liu & Slive say no) (consumer deposits make up at most 10% of banks' funding sources)

Alternative Solutions

- CBDLs distributed and processed by legacy banks

-

CBDLs distributed and processed via all-equal permissioned DLT

- CBDLs issued on a public blockchain

Legal: Can you do it?

In closing

What is a CBDC and what's the rest of the world doing?

What's the business plan?

Other approaches

- The Bank has been doing research on general-purpose CBDCs for years.

- To dot the i's and cross the t's they sought external ideas from universities: the Model X Challenge/Competition.

- Three proposals were selected. This presentation is about ours.

The Bank of Canada Model X Challenge

Disclaimer: the Bank of Canada has no current plans to issue a CBDC

- the use of bank notes were to continue to decline to a point where Canadians no longer had the option of using them for a wide range of transactions; or

- one or more alternative digital currencies—likely issued by private sector entities—were to become widely used as an alternative to the Canadian dollar as a method of payment, store of value and unit of account.

The Bank of Canada has thought about this for years

Contingency Planning for a Central Bank Digital Currency February 2020

The BoC will consider issuing a CBDC if:

When \(\not=\) How!

Disclaimer: the Bank of Canada has no current plans to issue a CBDC

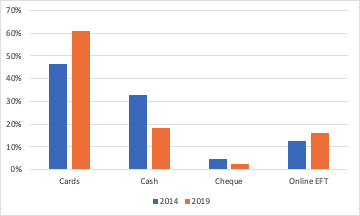

The usage of cash is declining

So what?

- 99% of adult Canadians have a bank account \(\to\) access to electronic payments

- cash is dirty \(\to\) COVID risk

- cash is risky for businesses and can be stolen

- cash requires a detour via an ATM

\(-38\%\)

But then \(\ldots\)

- If they have access to cards, why use cash?

- CBA: 70% pay off credit card each month \(\to\) 30% have an expensive balance

- Cash helps to curb spending.

- Cash helps to avoid fees.

- People live in remote communities.

- Cash allows you to do commerce without a third party.

- Cash is anonymous.

- Cash is universally available and accepted.

Canadians continue to have a preference for cash

What's on the horizon?

- Digitization of the economy

- Micro (sub-penny) payments?

- How can cash users participate?

- Tracking is everywhere

- How can users avoid retain privacy of how they pay for things?

- New types of money

- Displacement of the loonie?

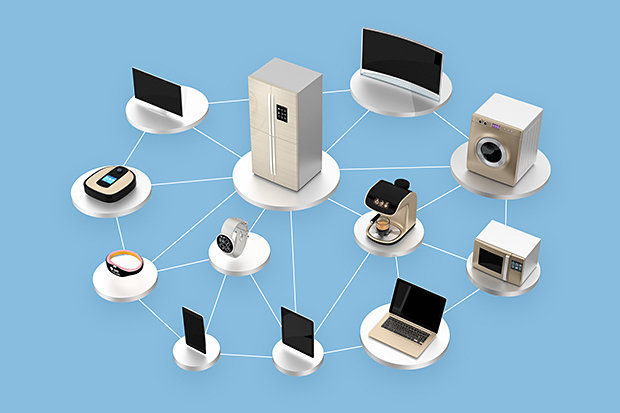

The Internet of Things

There is a strong case to give Canadians the means to participate in the digital economy with cash-like privacy

Contingency applies when:

- Canadian FIs convinced Canadians to ditch cash OR

- Canadians adopted "another" money

The Business Plan

Contingency applies when:

- Canadian FIs convinced Canadians to ditch cash OR

- Banks are winners \(\to\) why establish CBDC as a competitor?

- Banks are winners \(\to\) why establish CBDC as a competitor?

- Canadians adopted "another" money

- Banks are losers \(\to\) why would consumers want them now?

- Banks are losers \(\to\) why would consumers want them now?

Our recommendation:

- Establish the system by yourself.

- Invite private sector later

- authority to issue CBDLs

- regulation and oversight of CBDL wallets

- operating of transactions processing

- AML/CFT compliance

Legal: Can you do it? Short Answer: Yes.

The system needs

\(\Rightarrow\)

placeholder

Proposal Synopsis

Phase 1: centralized ledger

- e-KYC with public services and existing private sector solutions

-

Narrow Bank (NB): a new entity that processes CBDL transactions

- Offline quasi-token CBDL-cash-cards

Phase 2: expand into blockchain

- public resource to enable innovation

- Phase 1 tech as backbone that the private sector can leverage

- NB as "special power node" that can system can collapse to

key attributes

- efficient use of existing resources in e-KYC

- protects privacy yet AML/CFT compliant

- achieves objectives of universal access, privacy, competition

What is a Central Bank-issued Digital Currency ?

"normal" liability on central banks balance sheets

Two types:

General Purpose/Retail

Wholesale/InterBank

digital representation of fiat money

General Purpose/Retail

Alignment with Model X Challenge

Model X System Requirements:

- Privacy

- regulatory compliant (AML/CFT)

- Universal access (inclusive)

- Secure

- Resilient/continuously operable

- Performant/scalable

Notable Model X descriptions for our team:

- cash with digital features

- system-critical infrastructure with multi-decade life span

- high level business model and system architecture

Features & Outcomes

- no end-user contact

- highest quality products and services

- high efficiency

- enhanced competition in payments market

Minimum functions

- onboarding

- linking to bank accounts

- paying in physical stores and online

- p2p online & offline transfers

Critical Business Strategy Considerations

Competition in Payments vs Partnering in Distribution with FIs

- Card issuers are the main beneficiaries of payments income

- Card issuers are the legacy FIs

- What interests do FIs have in enhanced competition in payments?

Model X: System Functions that drive our thinking

Features & Outcomes

- no end-user contact

-

highest quality products and services

- high efficiency & security

- maybe: distribution through major FIs

- enhanced competition in payments market

Minimum functions

- onboarding/KYC

- linking to bank accounts

- paying in physical stores and online

- p2p online & offline transfers

- high privacy

- regulatory compliant

-

Legacy FIs benefit from their tight control of current payments market

-

Our design is set up explicitly so that FIs are not essential.

Model X: Desired System Functions

Features & Outcomes

- no end-user contact

-

highest quality products and services

- high efficiency

- maybe: distribution through major FIs

- enhanced competition in payments market

Minimum functions

- onboarding

- linking to bank accounts

- paying in physical stores and online

- p2p online & offline transfers

Does this align with requirements and objectives

System Requirements

- Privacy

- regulatory compliant (AML/CFT)

- Universal access

- cash with digital features

- system-critical infrastructure

\(\Leftarrow\) Centralized system/Boss-Node gives strong control

Does this align with functionality & constraints

Minimum set of functions

- onboarding of consumers & merchants

- link to commercial bank accounts

- buy and sell CBDC for cash

- pay for goods and services in physical stores and on-line

- transfer CBDC from person to person on-line or off-line

\(\Leftarrow\) Likely a Phase 2 solution but could be provided by merchants directly

\(\Leftarrow\) new utility, using existing KYC processes

\(\Leftarrow\) NB provides a seamless link

- ideally no end-user functions & services

- maybe baseline service to end-users

- distribution through major FIs or not?

-

highest standard products and services

- high efficiency (operation & cost)

- seigniorage income from CBDC

- enhanced competition in payments market

Does this align with functionality & constraints

X

strategically bad idea

tech not design choice

- cash becomes unusable

- alternative digital currencies take over

The Bank of Canada Contingency Plan

The BoC will consider issuing a CBDC if:

- Can all Canadians access the digital economy TODAY?

- What competition/viable alternative are there to banks' payments?

- Do people have the right to participate in the digital economy without commercially interested third party?

- No payments, no FinTech - where is Canada's Fintech sector relative to other countries (AUS, UK, SG, China)?

- When Diem/DCEP/Digital USD have a foothold, is a Digital Loonie still viable?

Why wait?

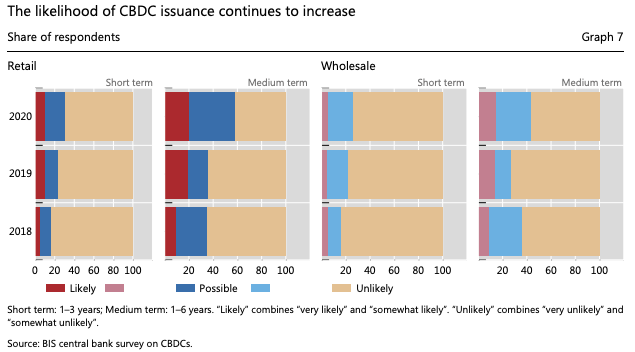

Source: BIS Working Papers No 880 "Rise of the central bank digital currencies: drivers, approaches and technologies" by Raphael Auer, Giulio Cornelli and Jon Frost

CBDC History - Where are we at?

-

BIS Jan 2019: "Proceed with caution"

-

BIS Jan 2020: "Impeding Arrival"

-

BIS Jan 2021: "Ready-steady-go?"

Will they come?

Go it alone for Phase 1

- Case 1: FI entirely lack incentives to participate

- Case 2: they have been hugely unsuccessful

- not clear why consumers would switch to the loser's new proposition

- but may speed up Phase 2

- not clear why consumers would switch to the loser's new proposition

Our recommendation

- MobilePay in Denmark: started "by committee" but eventually Danske Bank charged ahead

- Banco do Brazil build Pix in 9 months

- "payments modernization" is ongoing since before 2015

- For KYC:

- Public service agencies (provincial & federal)

- Private e-KYC tools (e.g., Verified-Me)

-

For NB (payments processor)

-

Payments Canada

-

Payments Canada

- CBDL cash card development

- Merchant payment tools

Partnerships

Costs

- System development:

- Wallets

- NB

- e-KYC

- AML monitoring

- Consumer onboarding

- Transactions processing

- Capacity requirement: 50 million p.d. \(\to\) less than what small stock exchanges in Canada process

- Others:

- PoS

Cost and Revenues

Revenue

- nominal cost recovery processing fee, e.g

- 2.2B cash transactions today

- 50% as CBDL in future

- fee: $0.01

- \(\Rightarrow\) $20M revenue p.a.

- licensing and access fees (Phase 2)

- seigniorage