Risk and Credit

Brandon Williams

Development Economics

October 10, 2024

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

- Information asymmetry is bad

- Hidden information - characteristics that are unobservable (so things that add to risk of default but can't be measured)

- Hidden action (Moral Hazard) - damaging actions that are costly to the agent cannot be observed by the principal

- Separating these two is hard! People with different risk select in at different interest rates (hidden info) and those with different rates have different incentives to default (hidden action)

- South African micro-lender giving cash loans with high interest (11.75% monthly rate = 200%+ APR) and short terms (4 months)

- Solicited to former borrowers (what would be the effect if mass solicited?)

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

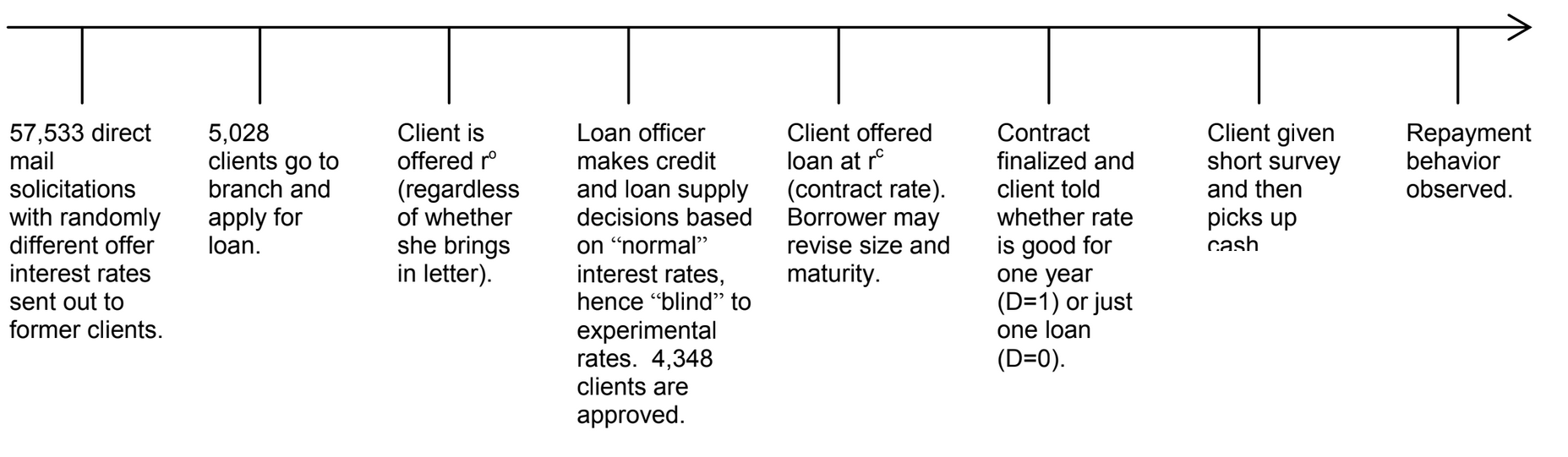

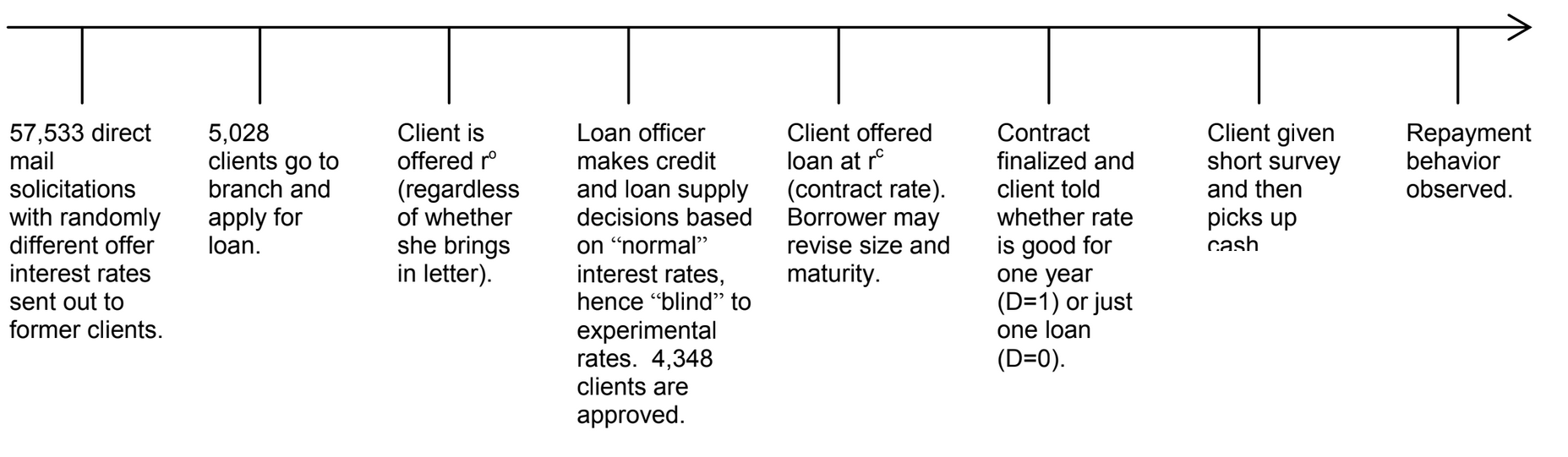

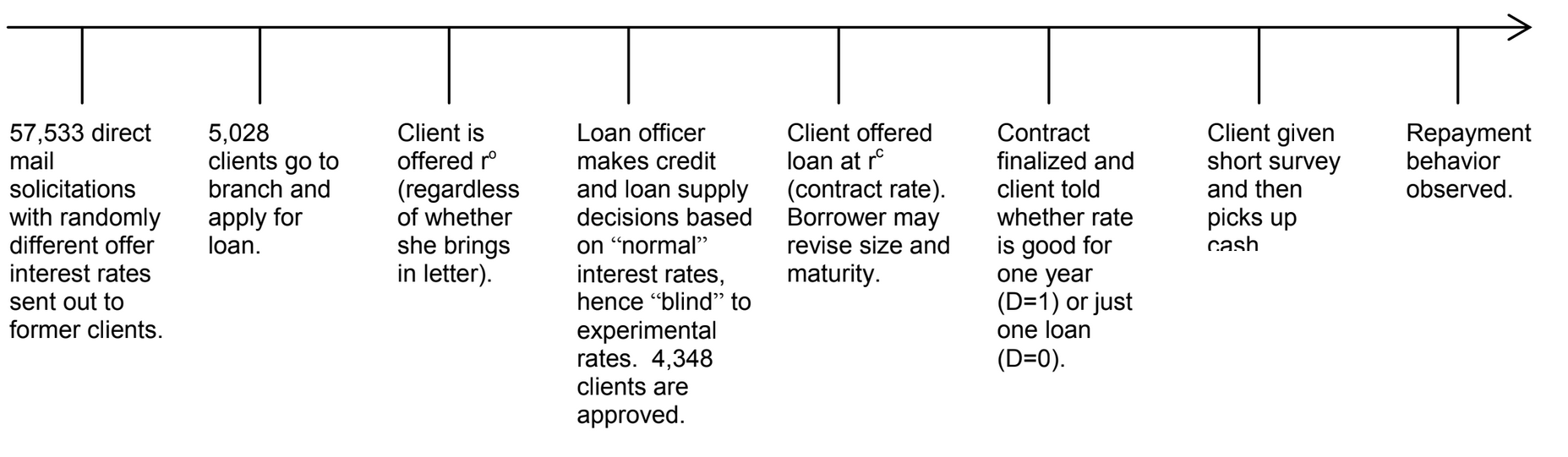

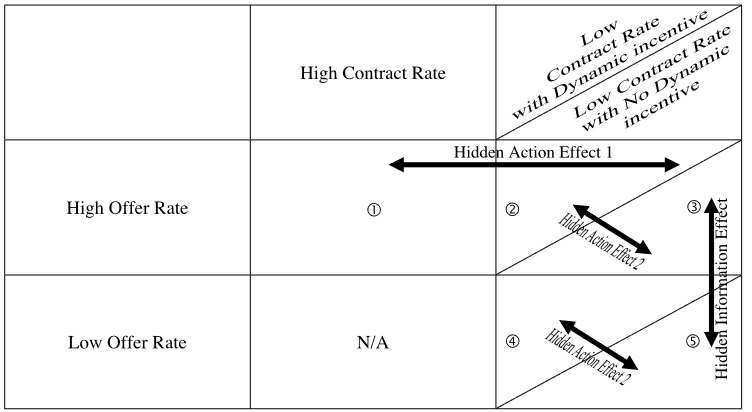

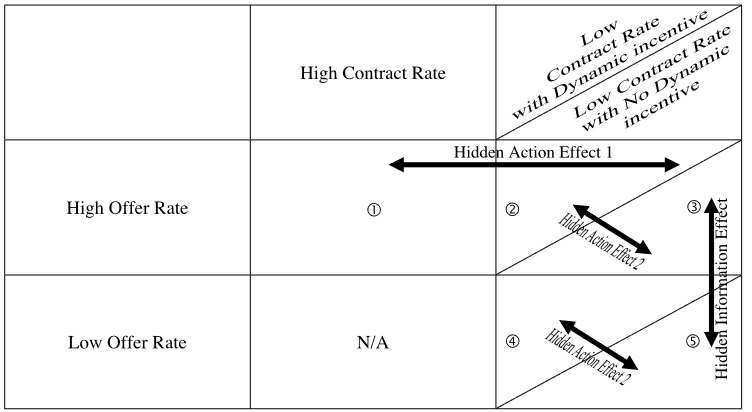

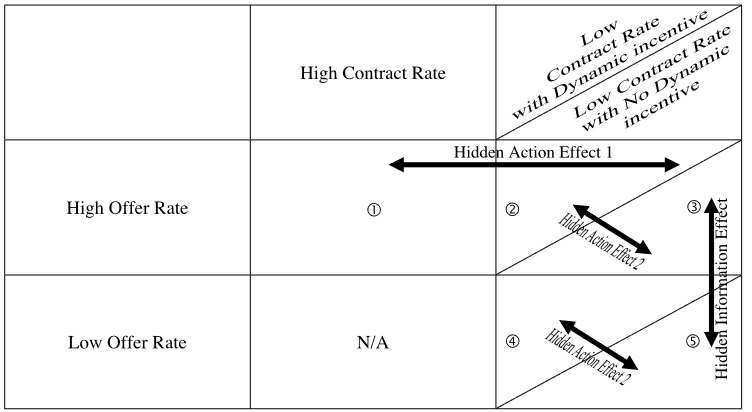

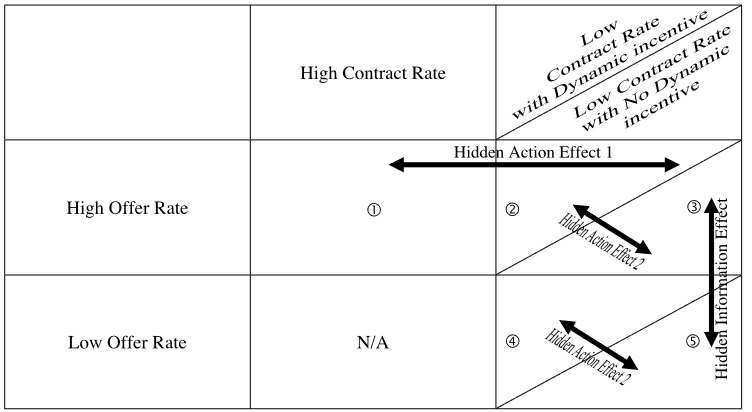

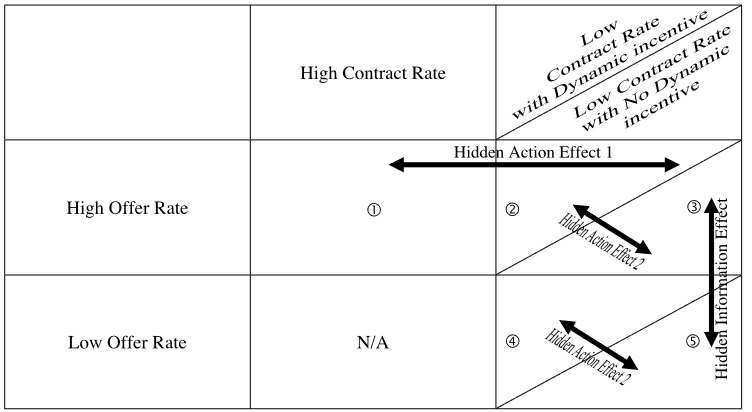

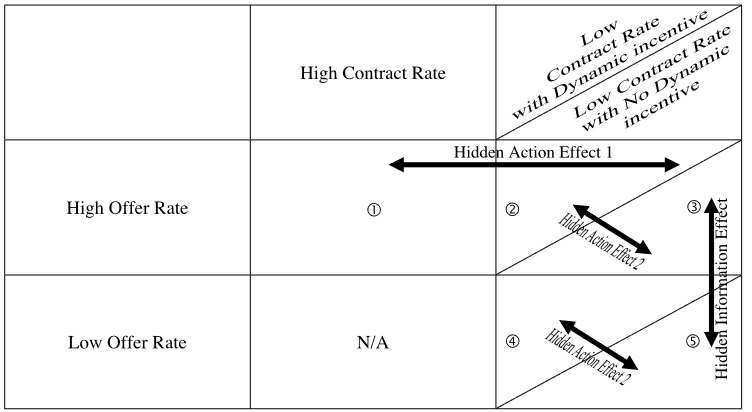

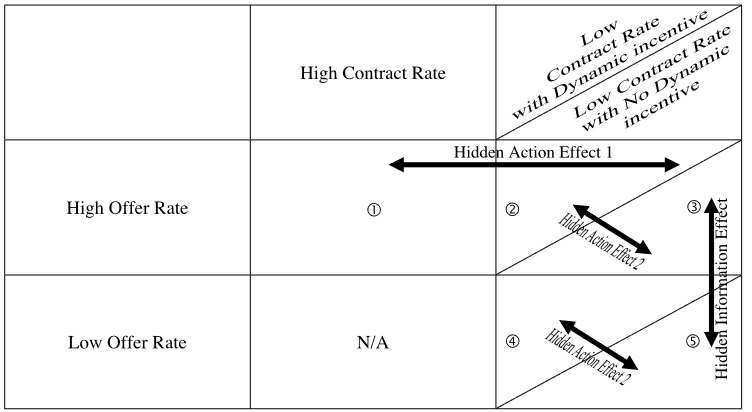

- Randomize experiment with three dimensions:

- Interest rate offered in a direct mail solicitation

- The actual interest rate on the loan contract

- The interest rate offered on future loans

- Disentangles borrowers who select in at identical rates and then face different repayment incentives going forward; and borrowers who select in at different rates and then face identical repayment incentives. Why?

- Distinguishes hidden information and hidden action

- Crucial for policy remedies:

- Hidden information: loan guarantees, information coordination and screening

- Hidden action: liability, garnishment, and contracting

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

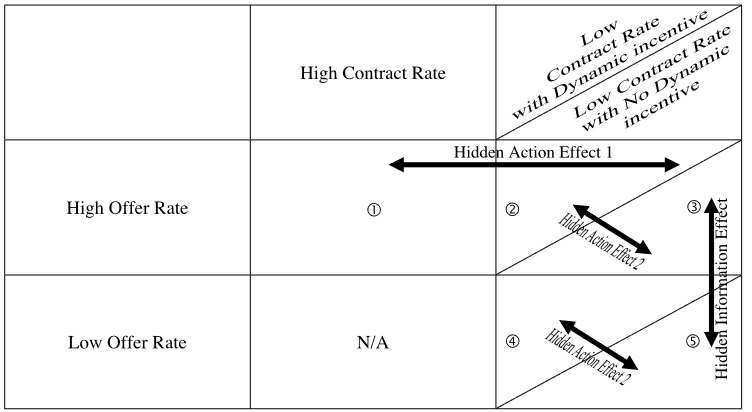

Nobody receives a higher rate than they were solicited

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

Some are given the same rate

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

And some are surprised with a lower rate (but importantly selected in with a high rate)

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

Or given the lower rate at which they selected in

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

If we are concerned about selection in on asymmetric information (unobservables), we have now eliminated that gap because they selected in at variable rates but ultimately received a low rate

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

These borrowers selected in identically (at high rates), but ultimately received different rates, now we can identify moral hazard (effort) induced by ending up with a different rate!

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

Moreover, we can identify any moral hazard that arises from future rates that are conditional on paying back the current loan (which increases the value of the current loan repayment)

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

probability of

success

project returns

choose effort

contingent on type

cost of default

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

compare to outside option

solve for optimal effort

implicit function theorem

higher cutoff leads

to riskier types

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

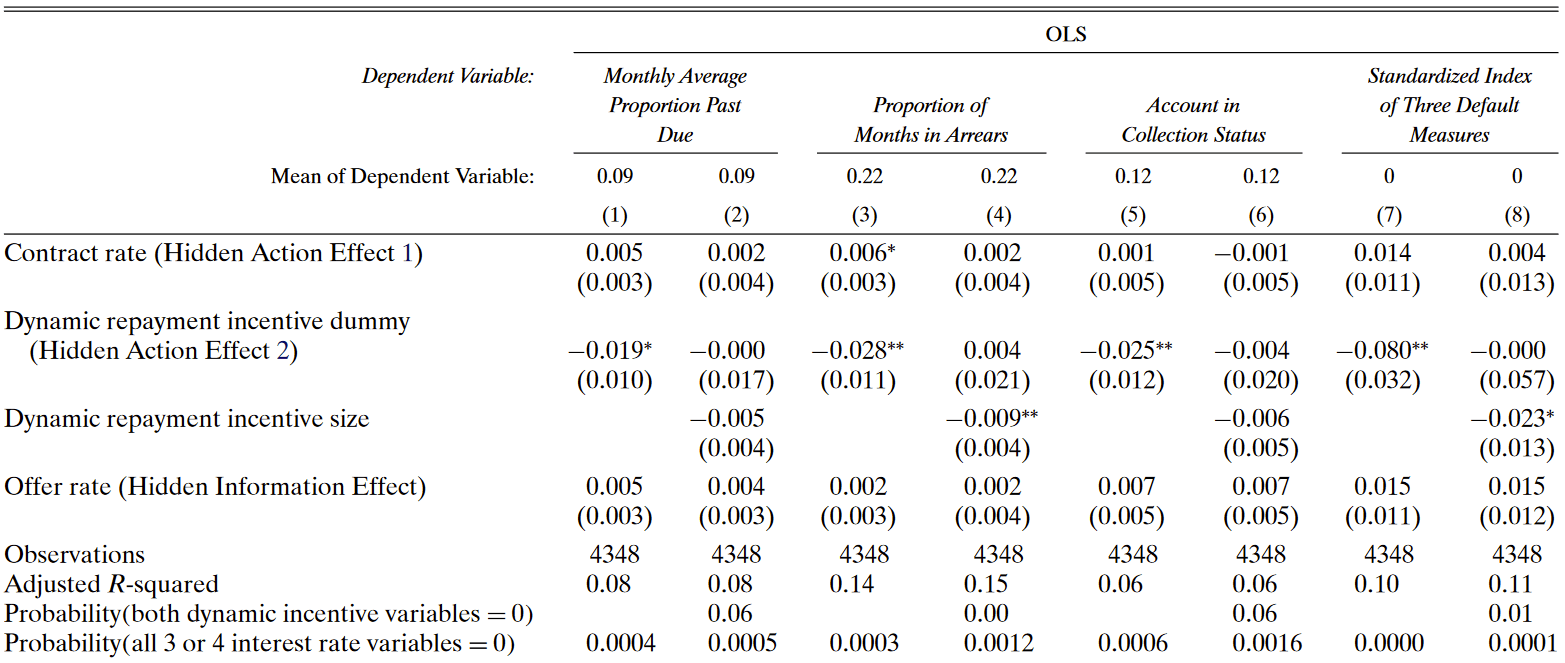

- Effort is decreasing in interest rates (hidden action effect 1)

- Effort decreases in decreasing cost of default (hidden action effect 2)

- A higher interest rate leads to lower repayment (hidden information effect)

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

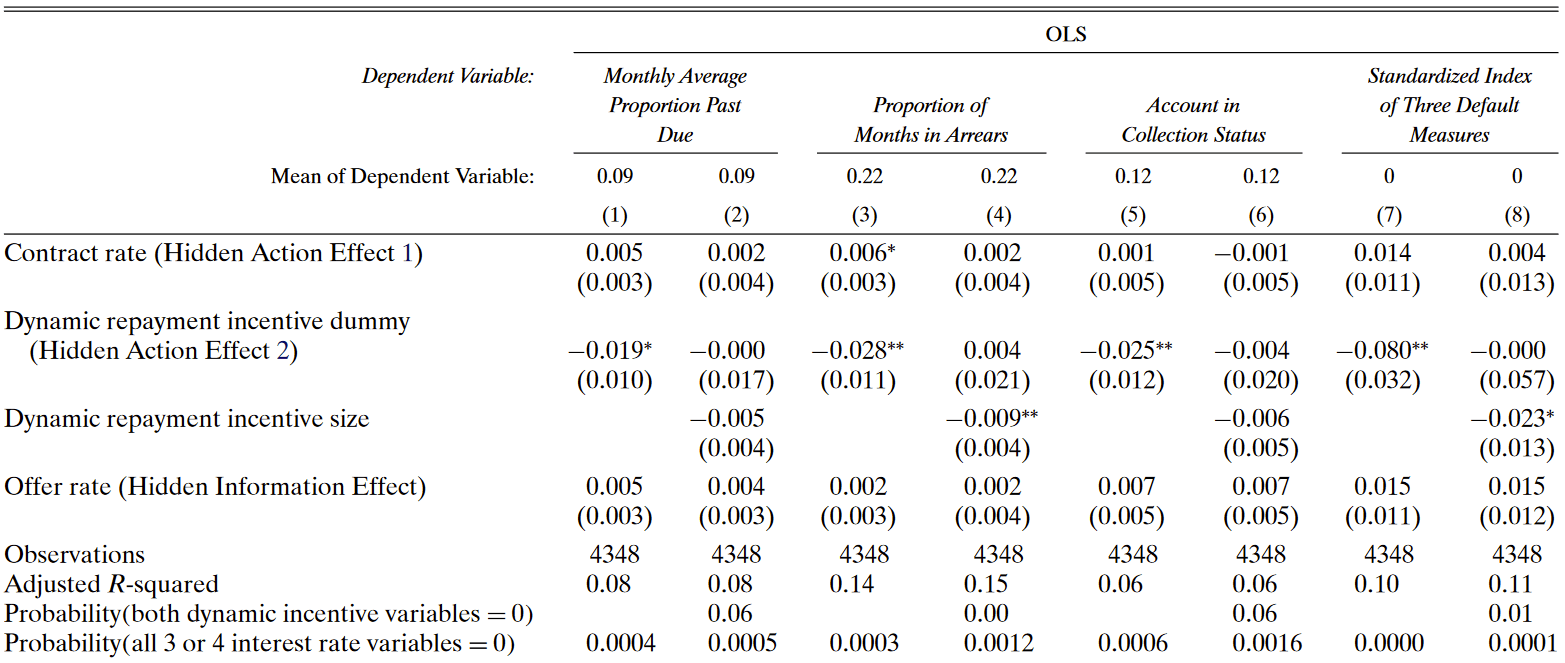

Stronger evidence of moral hazard as giving more incentive drives up repayment

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

Stronger evidence of moral hazard as giving more incentive drives up repayment

Weaker evidence of adverse selection, but they argue these are still economically significant

Risk and Credit

Development Economics

October 10, 2024

Observing Unobservables (2009)

The recent literature on insurance markets is characterized by the constant interaction between theory and empirical studies that is the hallmark of scientific research..."

- The Economics of Contracts, 2005