Output Supply

and Labor Demand

Christopher Makler

Stanford University Department of Economics

Econ 50 | Lecture 19

Optimization

What is an agent's optimal behavior for a fixed set of circumstances?

Utility-maximizing bundle for a consumer

Profit-maximizing quantity for a firm

Profit-maximizing input choice for a firm

Comparative Statics

How does an agent's optimal behavior change when circumstances change?

Utility-maximizing bundle for a consumer

Profit-maximizing quantity for a firm

Profit-maximizing input choice for a firm

Assumptions

We will be analyzing a

competitive (price-taking) firm

in the short run

- output price \(p\)

- wage rate \(w\)

Today's Agenda

1. Choosing the \(q^*\) and \(L^*\) for a fixed \(p\) and \(w\)

4. Edge Cases

2a. Deriving output supply

as a function of \(p\),

holding \(w\) constant

2a. Deriving labor demand

as a function of \(w\),

holding \(p\) constant

3a. Analyzing how a change in \(w\)

shifts the supply curve

3b. Analyzing how a change in \(p\)

shifts the labor demand curve

[ MOVEMENT

ALONG CURVES]

[ SHIFTS OF

CURVES]

We'll stick with our same function

1. Optimization with Fixed Price and Wage Rate

Profit as a function of quantity

Profit as a function of labor

1. Costs and Revenues

2. Profit = total revenues minus total costs

3. Take derivative of profit function, set =0

1. Costs and revenues

2. Profit = total revenues minus total costs

3. Take derivative of profit function, set =0

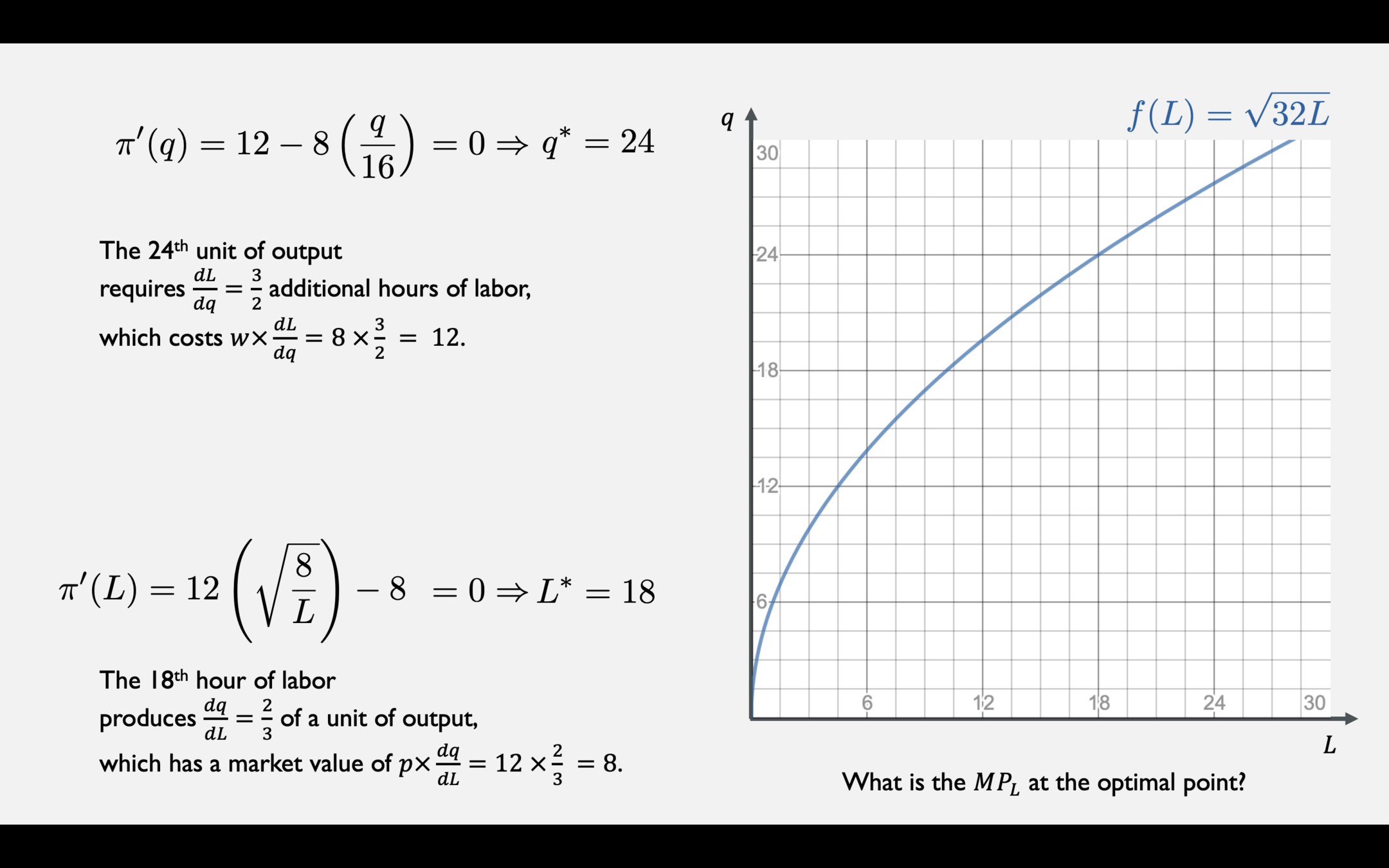

Profit two ways when \(p = 12\), \(w = 8\), \(r = 2\), and \(\overline K = 32\)

2a. Output Supply as a Function of \(p\) with Fixed \(w\)

When price is fixed at 12

For a general price

1. Costs and Revenues

2. Profit = total revenues minus total costs

3. Take derivative of profit function, set =0

Profit-Maximizing Output Choice when \(w = 8\), \(r = 2\), and \(\overline K = 32\)

NUMBER

FUNCTION

TR

TC

MR

MC

Take derivative and set = 0:

Solve for \(q^*\):

SUPPLY FUNCTION

When \(p = 4\), this function says that the firm should produce \(q = 8\).

If it does this...

pollev.com/chrismakler

We just showed that for a firm with the cost function 𝑐(𝑞)=64+14𝑞2c(q)=64+41q2, the profit-maximizing choice when 𝑝=4p=4 is to produce 𝑞=8q=8. If the firm does this:

Text

2b. Labor Demand as a Function of \(w\) with Fixed \(p\)

When wage is fixed at 8

For a general wage

1. Costs and Revenues

2. Profit = total revenues minus total costs

3. Take derivative of profit function, set =0

Profit-Maximizing Labor Choice when \(p = 12\), \(r = 2\), and \(\overline K = 32\)

NUMBER

FUNCTION

TR

TC

MRPL

MC

Take derivative and set = 0:

Solve for \(L^*\):

LABOR DEMAND FUNCTION

(over to powerpoint for a moment)

Profit as a function of output \(q\)

Profit as a function of labor \(L\)

1. Costs for general \(w\) and revenue for general \(p\)

2. Profit = total revenues minus total costs

3. Take derivative of profit function, set =0

[cost of labor required for \(q\) units of output]

[revenue of output produced by \(L\) hours of labor]

MARGINAL COST (MC)

MARGINAL REVENUE PRODUCT OF LABOR (MRPL)

"Keep producing output as long as the marginal revenue from the last unit produced is at least as great as the marginal cost of producing it."

"Keep hiring workers as long as the marginal revenue from the output of the last worker is at least as great as the cost of hiring them."

Profit as a function of output \(q\)

Profit as a function of labor \(L\)

LABOR DEMAND FUNCTION

LABOR DEMAND FUNCTION

SUPPLY FUNCTION

the conditional labor demand

for the profit-maximizing supply:

The profit-maximizing labor demand is

Edge Cases

Edge Case 1:

Multiple quantities where P = MC

Edge Case 2:

Corner solution at \(q = 0\)

"The supply curve is the portion of the MC curve above minimum average variable cost"

Other Edge Cases to

Watch Out for On Exams

- Discontinuities

- Capacity constraints

- Quantities produced with capital

- Don't just trust formulas —

perform a gut check!

Summary

A competitive firm takes input prices \(w\) and \(r\), and the output price \(p\), as given.

We can therefore characterize its optimal choices of inputs and outputs

as functions of those prices: the supply of output \(q^*(p\ |\ w)\),

and the demand for inputs (e.g. \(L^*(w\ |\ p)\)).

We can find the optimal input-output combination either by finding the optimal quantity of output and determining the inputs required to produce it, or to find the profit-maximizing inputs and determine the resulting output. These two methods are equivalent.

Profit is increasing when marginal revenue is greater than marginal cost, and vice versa.

In most cases, the profit-maximizing choice occurs where \(MR = MC\).

If \(p\) is below the minimum value of AVC, the profit-maximizing choice is \(q = 0\).

In which MR or MC is discontinuous, logic must be applied. (There is an old exam question on the homework that explores this...and this kind of thing often shows up on exams...)