pollev.com/chrismakler

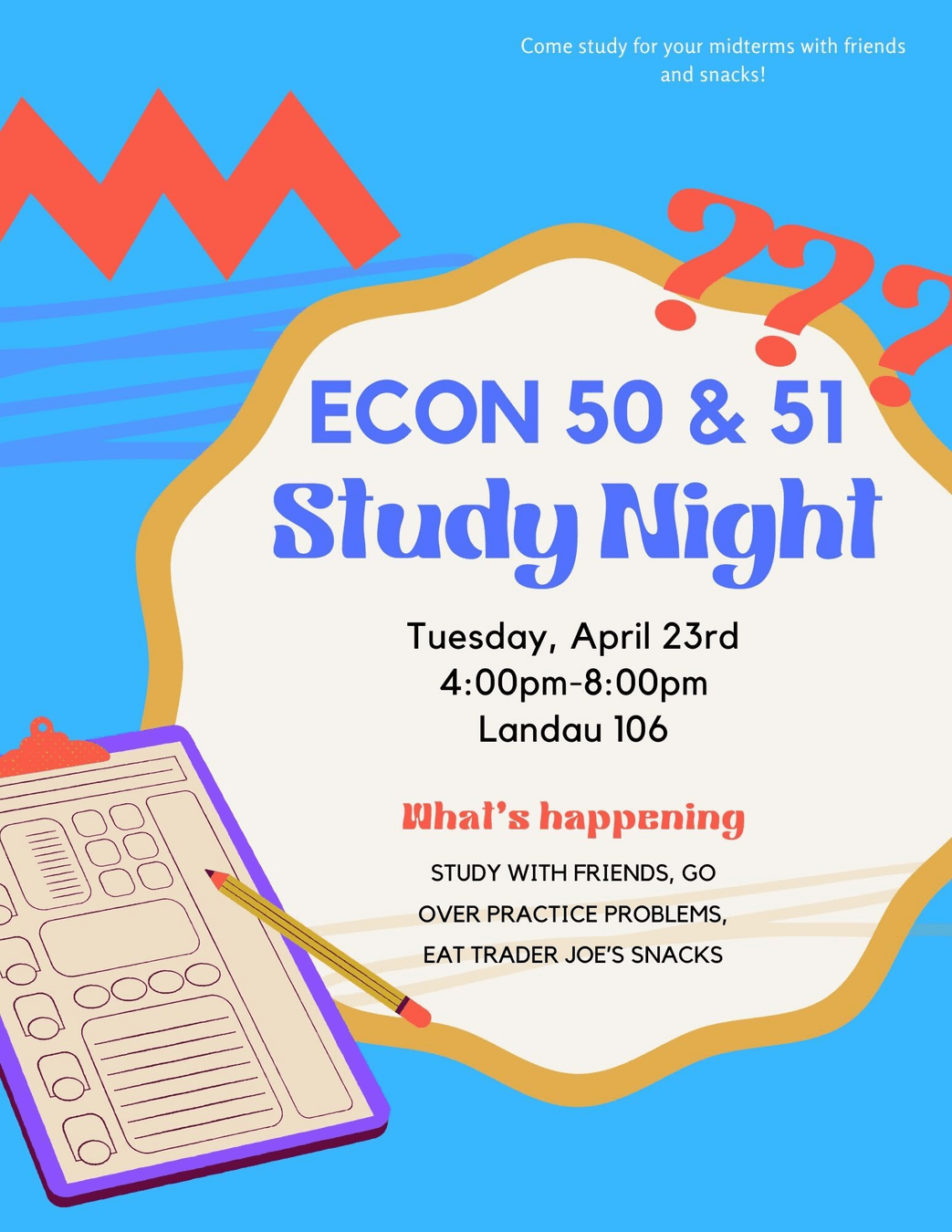

Eric office hours at the SEA Study Night tonight!

Pete office hours Wednesday 3:30

(place TBD)

Makler office hour/review session on zoom Wednesday night

No section or homework this week!

Externalities

Christopher Makler

Stanford University Department of Economics

Econ 51: Lecture 15

Climate Change

Inequality

COVID-19

Externalities

- Situations in which the actions of agents affect the payoffs of others

- Often caused by "missing markets"

- Markets (or more generally, everyone acting in their own self interest) will not generally solve the problems — equilibria are inefficient or inequitable

Externalities

- One agent affecting another:

- Edgeworth Box

- Steel Mill and Fishery

- Many agents affecting each other:

- Market externalities

- Tragedy of the Commons

Externalities

- One agent affecting another:

- Edgeworth Box

- Steel Mill and Fishery

- Many agents affecting each other:

- Market externalities

- Tragedy of the Commons

Not as much a "one size fits all" model,

but more of an approach:

- identify a "social welfare function" that tell us what the "socially optimal" outcome is

- model the incentives agents face, and understand why the "market equilibrium" outcome differs from the "socially optimal" one.

- try to find a way to adjust the incentives to achieve the socially optimal outcome

- usually involves getting the agents to internalize the externality they are causing others

Classic Example: Smoking

Two roommates, Ken and Chris.

Ken is a smoker who can smoke up to 10 hours per day.

Chris is a non-smoker and dislikes Ken's smoking.

Preferences

Each have preferences over how much Ken smokes (good 1) and money (good 2).

Preferences

Each have preferences over how much Ken smokes (good 1) and money (good 2).

Suppose we define property rights over smoking.

This is like an endowment:

Let's assume Chris and Ken each start with $100.

Equilibrium

If we allow them to trade from their endowment, they'll end up on the contract curve — at an efficient allocation!

Coase Theorem

Under certain circumstances, the efficient amount of externality is independent of the original assignment of property rights.

Steel Mill and Fishery

Base Model: Profit Maximization

Extension: Production choices affect other's profit

Conflict: Steel mill only takes into account its own cost,

not impact on the fishery.

Solution: assign property rights and allow bargaining, or merge.

Market Externalities

- Individuals solving their own optimization problem

disregard the external effects they have on others - Social marginal cost (SMC) = private marginal cost (PMC) + marginal external cost (MEC)

- Market equilibrium will occur where MB = PMC

- Social optimum is where MB = SMC

Pigovian tax:

Internalize the externality so that private marginal cost equals social marginal cost.

Competitive equilibrium:

consumers set \(P = MB\),

producers set \(P = PMC \Rightarrow MB = PMC\)

With a tax: consumers set \(P = MB\),

producers set \(P - t = PMC\)

Q: Makler, what do you think about taxes?

A:

It depends. What model are we in?

Tragedy of the Commons

- Each individual, acting in their own best interest, overuses the common resource

- Possible solutions: regulation (issue permits); taxation (charge for use); privatization (avoid problem by making them not a commons at all)

Tragedy of the Commons

Village of 35 people who can choose to fish or hunt.

Each fish is worth $10; each deer is worth $100. Every hunter gets one deer.

If \(L\) people fish, (and \(35 - L\) people hunt), total fish caught: \(f(L) = 40L - L^2\)

Total revenue from fishing:

Total revenue from hunting:

Average revenue per fisher:

Average revenue per hunter:

Marginal revenue from additional fish:

Marginal cost of having that person not hunt:

What's the effect of an increase in \(L\)?

Fees

Suppose you needed to buy a fishing permit for a fee F.

What value of F would result in the optimal L*?

Taxes

Suppose the village levied a tax of t per fish caught.

What value of t would result in the optimal L*?

Externalities

Efficiency in the Edgeworth box comes from everyone

equating their own private marginal benefits and costs.

In the presence of externalities, personal decisions affect others.

If everyone just balances their own personal marginal benefits and costs,

it can have a negative (or positive) external effect on others.

Markets will not, in general, result in a Pareto efficient outcome on their own — there is a role for government intervention.

Game Theory

For the rest of this course, we're going to derive

a general framework for analyzing situations in which

everyone's payoffs are a result of everyone's actions.