Trading from an Endowment

Christopher Makler

Stanford University Department of Economics

Econ 51: Lecture 12

Today's Agenda

Part 1: Exchange Optimization

Part 2: Comparative Statics

The endowment budget line

Optimal choice with a constant price

Different prices for buying and selling

Optimization at general prices

Gross demand and net demand

Net demand and net supply

Applications: Labor Supply, Intertemporal Choice, Risk and Uncertainty

Econ 50

Consumer starts with money,

can buy a bundle of goods.

Econ 51

Consumer starts with a bundle,

can trade one good for another

Straight trade/barter

Sell some of one good for money,

use the money to buy the other good

Trading from an Endowment

Good 1

Good 2

Note: lots of different notation for the endowment bundle!

Varian uses \(\omega\), some other people use \(x_1^E\)

Suppose you'd like to move from that endowment to some other bundle X

You start out with some endowment E

This involves trading some of your good 1 to get some more good 2

Buying and Selling

Good 1

Good 2

If you can't find someone to trade good 1 for good 2 directly, you could sell some of your good 1 and use the money to buy good 2.

Suppose you sell \(\Delta x_1\) of good 1 at price \(p_1\). How much money would you get?

What is the amount of good 2 you could buy with the proceeds, \(\Delta x_2\), at price \(p_2\)?

Buying and Selling

Good 1

Good 2

The amount you spend must be the amount you get, so:

The amount you spend must be the amount you get, so:

"value of the endowment at market prices"

Endowment Budget Line

Good 1

Good 2

If you sell all your good 1 for \(p_1\),

how much good 2 can you consume?

If you sell all your good 2 for \(p_2\),

how much good 1 can you consume?

Endowment Budget Line

Divide both sides by \(p_2\):

Divide both sides by \(p_1\):

If \(x_1 = 0\):

If \(x_2 = 0\):

The budget line only depends on the price ratio \(p_1/p_2\), not the individual prices.

pollev.com/chrismakler

Bob has an endowment of (8,8) and can buy and sell goods 1 and 2. What happens to his endowment budget line if the price of good 1 decreases? You may select more than one answer.

Effect of a Change in Prices

What happens if the price of good 1 doubles?

What happens if both prices double?

Optimization

Optimization problem with money

Optimization problem with an endowment

Procedure is exactly the same - we just have a different equation for the budget constraint.

pollev.com/chrismakler

Bob has the endowment (8,8) and the utility function $$u(x_1,x_2)=x_1x_2$$If he faces prices \(p_1 = 10\) and \(p_2 = 5\), what is his optimal choice?

Optimization: Income vs. Endowment

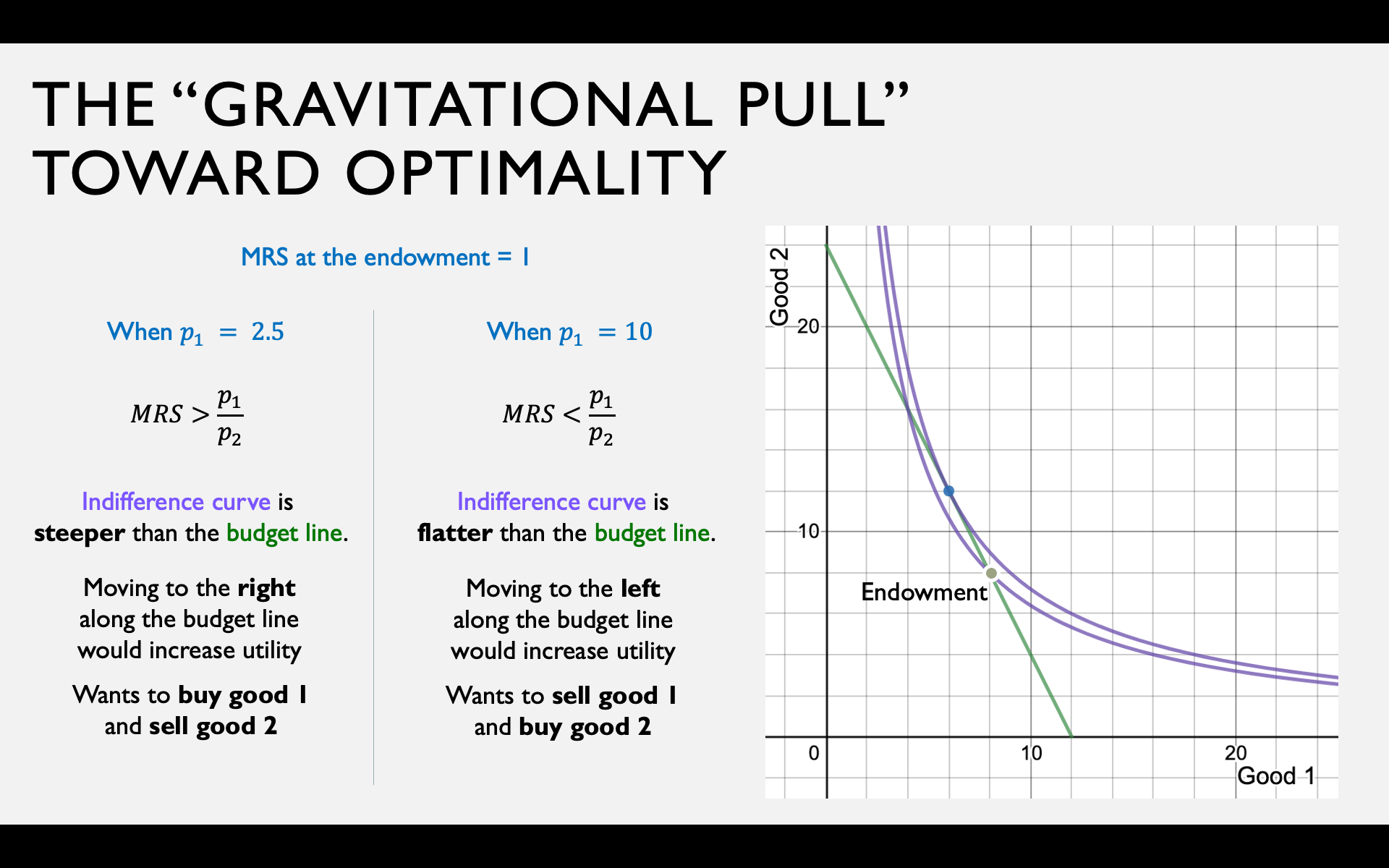

Recall: The “Gravitational Pull" Argument

Indifference curve is steeper

than the budget constraint

Can increase utility by

moving to the right

along the budget constraint

Indifference curve is flatter

than the budget constraint

Can increase utility by

moving to the left

along the budget constraint

Good 1

Good 2

pollev.com/chrismakler

Suppose Alison has the endowment (12,2) and the utility function $$u(x_1,x_2)=x_1x_2$$ If the price of good 2 is 6, for what price of good 1 will she be willing to sell some of her good 1?

Different Prices for Buying and Selling

Tickets

Money

If you sell all your tickets,

how much money will you have?

If you spend all your money on additional tickets, how many tickets will you have?

Suppose you have 40 tickets and $1200; you can sell tickets for $25 each,

or buy additional tickets for $60 each.

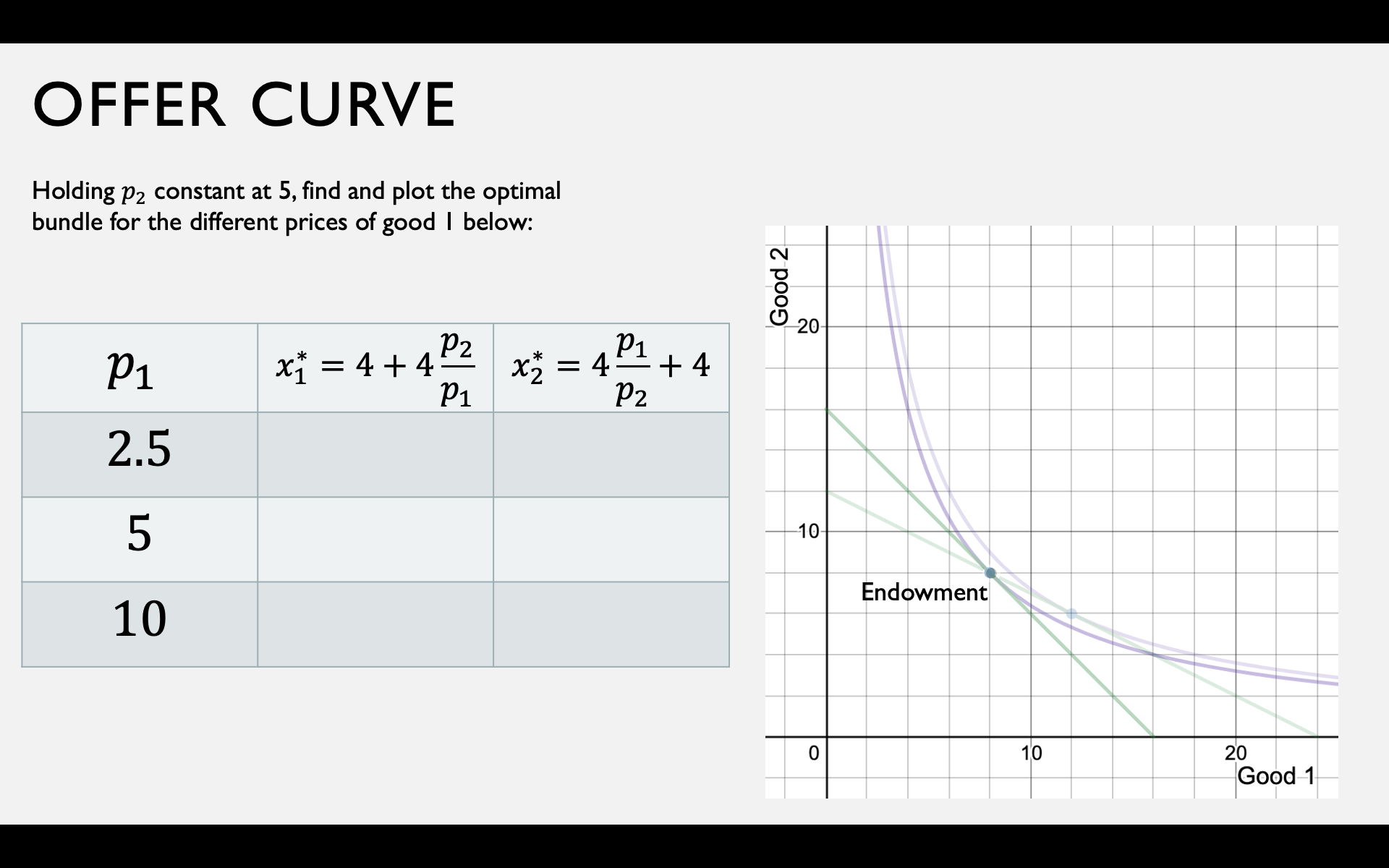

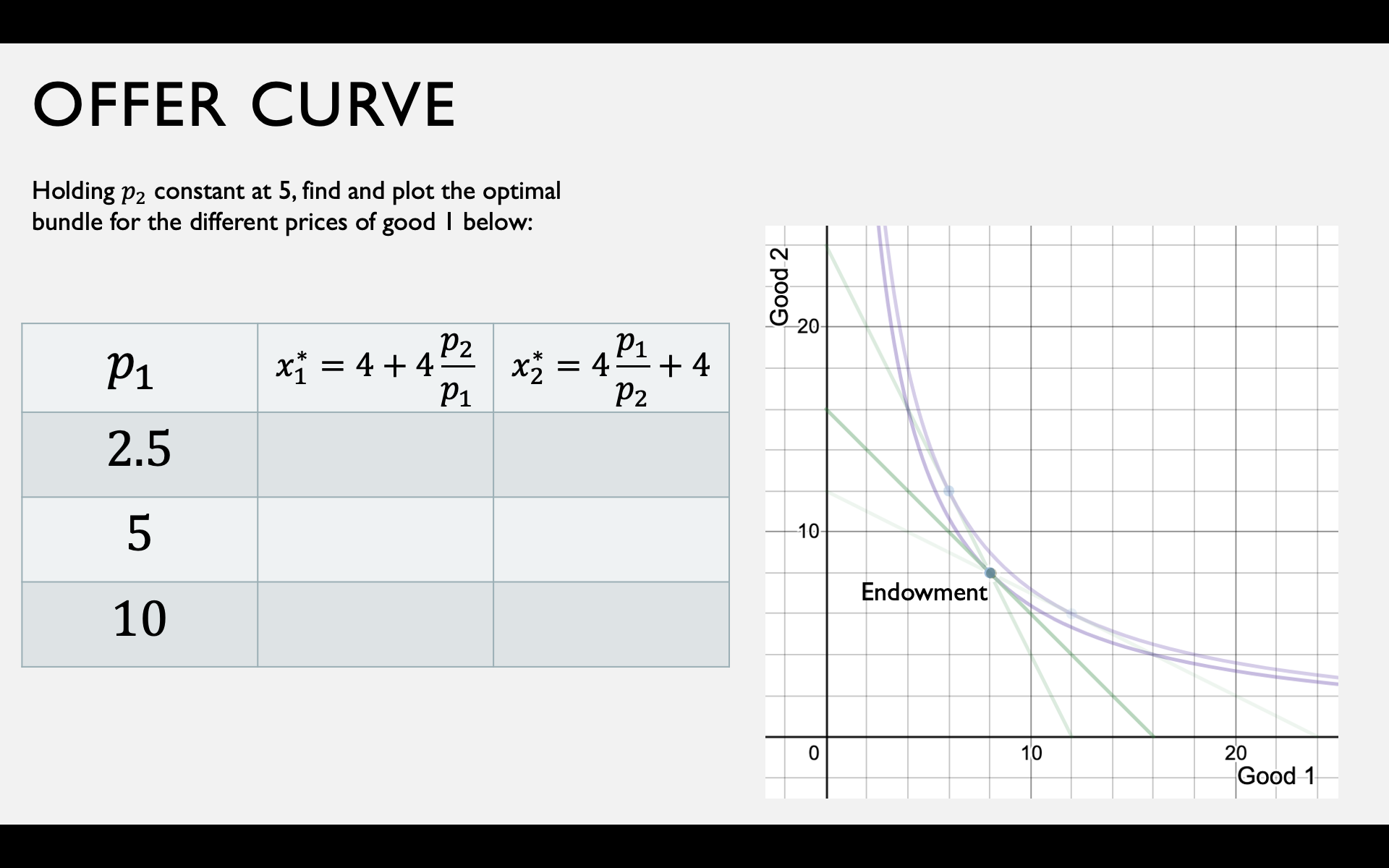

Part II: Comparative Statics

Gross Demands and Net Demands

The total quantity of a good

you want to consume (i.e. end up with)

at different prices.

Gross Demand

The transaction you want to engage in

(the amount you want to buy or sell)

at different prices.

Net Demand

Is this positive or negative?

Positive: you are a net demander of good 1.

Negative: you are a net supplier of good 1.

Most Important Takeaways

The endowment budget line depends only on the price ratio, not on individual prices.

Whether you're a net demander or supplier depends on the relationship between the price ratio and the MRS at the endowment.

Applications

Labor supply

"Good 1" = time

"Good 2" = money

Working: selling time for money

Intertemporal Choice

"Good 1" = money in the present

"Good 2" = money in the future

Saving: selling current money to

get more money in the future

Borrowing: selling future money to get more money in the present

"Goods" =

money in different

"states of the world"

Trading: betting, investing, insurance

Uncertainty and Risk

Application 1:

Labor Supply

Leisure-Consumption Tradeoff

Leisure (R)

Consumption (C)

You trade \(L\) hours of labor for some amount of consumption, \(\Delta C\).

You start with 24 hours of leisure and \(M\) dollars.

You end up consuming \(R = 24 - L\) hours of leisure,

and \(C = M + \Delta C\) dollars worth of consumption.

Selling Labor at a Constant Wage

Leisure (R)

Consumption (C)

You sell \(L\) hours of labor at wage rate \(w\).

You start with 24 hours of leisure and \(M\) dollars.

You earn \(\Delta C = wL\) dollars in addition to the \(M\) you had.

...and you consume \(R = 24 - L\) hours of leisure.

Budget Line Equation

Leisure (R)

Consumption (C)

This is just an endowment budget line

Optimal Supply of Labor

Preferences are over the two "good" things: leisure and consumption

We've just derived the budget constraint in terms of leisure and consumption as well:

Maximize utility as usual, with one caveat:

you can only sell your leisure time, not buy it.

When will labor supply be zero?

Remember: you only want to sell good 1 (in this case, your time) if

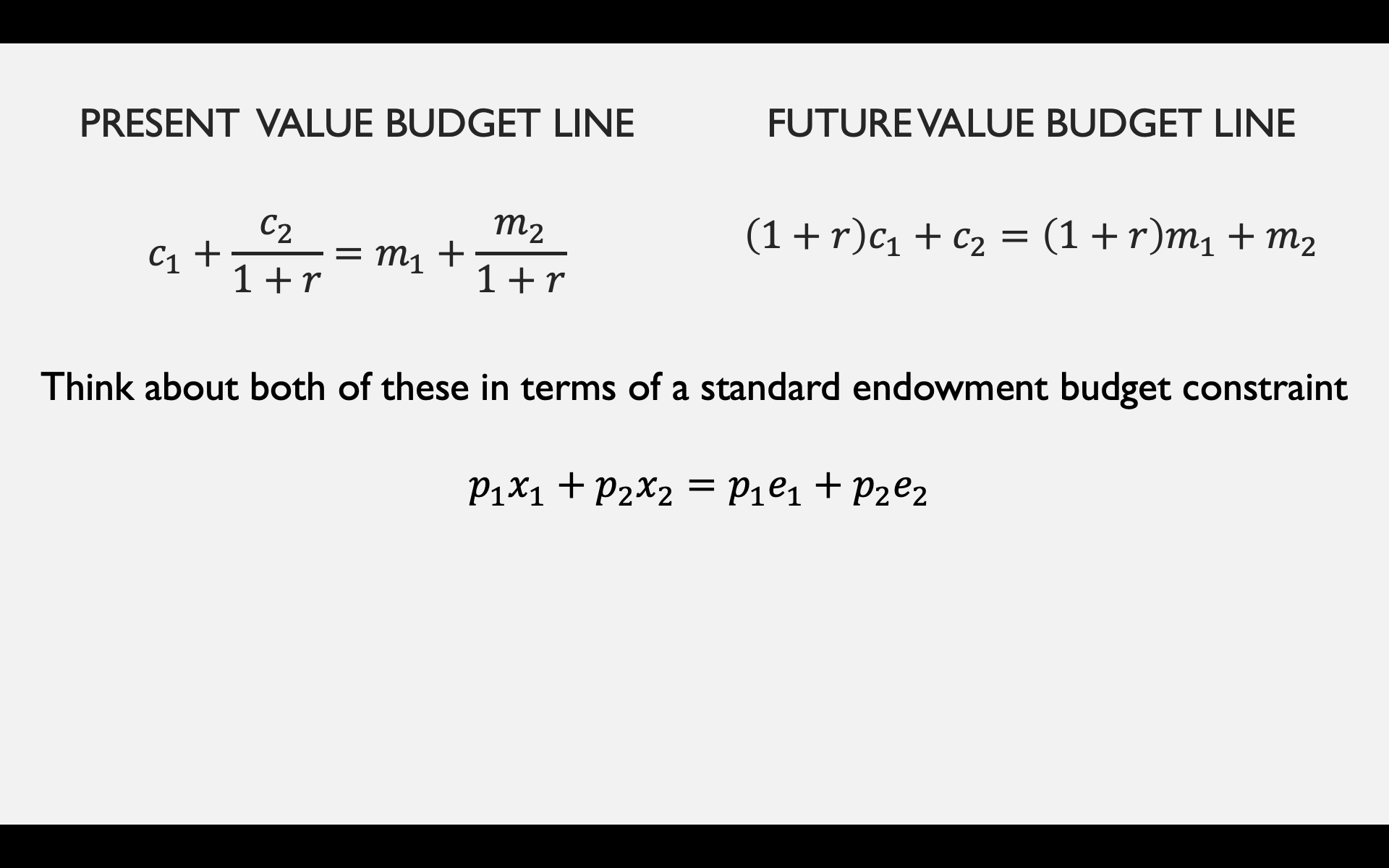

Application 2:

Intertemporal Choice

Present-Future Tradeoff

Your endowment is an income stream of \(m_1\) dollars now and \(m_2\) dollars in the future.

If you save at interest rate \(r\),

for each dollar you save today,

you get \(1 + r\) dollars in the future.

You can either save some of your current income, or borrow against your future income.

If you borrow at interest rate \(r\),

for each dollar you borrow today,

you have to repay \(1 + r\) dollars in the future.

Two "goods" are present consumption \(c_1\) and future consumption \(c_2\).

Application 3:

Uncertainty and Risk

Money in good state

Money in bad state

35,000

25,000

Suppose you have $35,000. Life's good.

If you get into a car accident, you'd lose $10,000, leaving you with $25,000.

You might want to insure against this loss by buying a contingent contract that pays you $K in the case of a car accident.

Money in good state

Money in bad state

35,000

25,000

You want to insure against this loss by buying a contingent contract that pays you $K in the case of a car accident. Suppose this costs $P.

Now in the good state, you have $35,000 - P.

In the bad state, you have $25,000 - P + K.

35,000 - P

25,000 + K - P

Budget line