Welcome to Econ 51

Intertemporal Consumption

Christopher Makler

Stanford University Department of Economics

Econ 51: Lecture 1

Today's Agenda

Part 1: Course Overview

Part 2: Intertemporal Choice

Quick overview - read the syllabus!

Intertemporal budget line

Preferences over time

Optimal choice of saving and borrowing

Present value of multiple time periods

Introductions

Econ Department Peer Advising

Other Resources

VPTL Peer Tutoring

Three Central Themes

-

Time

-

Information

-

Equity and Efficiency

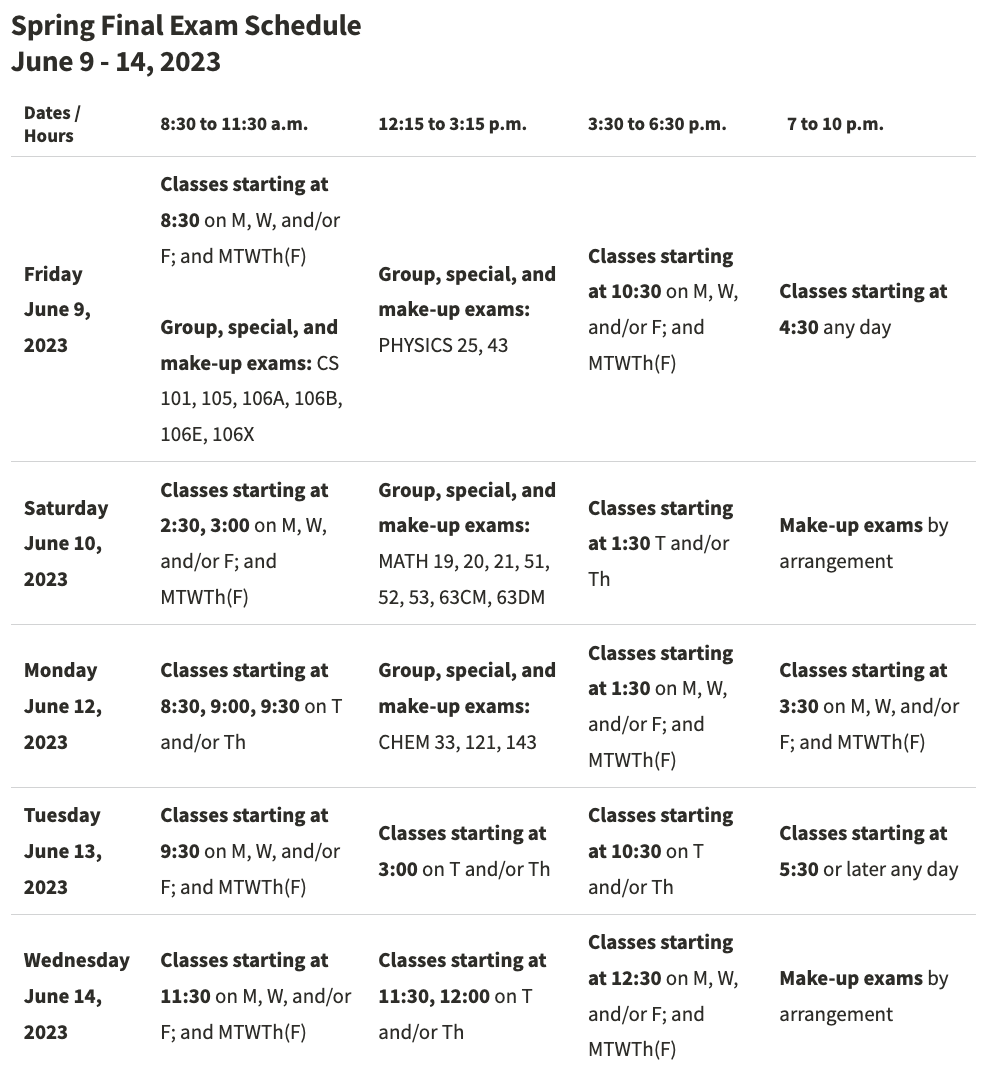

There's no way I'm going to ask you all to stay on campus until June 14.

And there's only one class in Week 10.

SO: We're just going to have the last test in that class of Week 10.

Online tests are terrible and invite cheating.

Weeks 1-3

Game Theory and Imperfect Competition

Tuesday 5/16

Exam on Unit II

Weeks 7-9

Efficiency and Equity

Quarter Rhythm

Weeks 4-6

The Economics of Information

Tuesday 4/25

Exam on Unit I

Tuesday 6/6

Exam on Unit III

Missing Exams

-

Exams are worth 65% of your grade. Due to multiple honor code violations during COVID, we are not giving students exams to take in isolation: if you miss an exam, for whatever reason, you miss the exam. We are having 3 exams to make it so that missing one exam is less of a big deal.

-

If you take all 3 exams:

-

lower midterm score is 15% of your grade

-

other two count for 25% of your grade

-

-

If you miss one of the midterms, we will re-weight the other two appropriately

-

If you miss more than one test, but have otherwise completed all the coursework, you will be given an Incomplete and will need to take any tests you missed in a future quarter.

Don't do this.

Tuesady, May 16

Exam 2

Tuesday, April 25

Exam 1

Tuesday, June 6

Exam 3

THESE ARE THE EXAM DATES.

DO NOT SCHEDULE VOLUNTARY TRAVEL THAT FORCES YOU TO MISS AN EXAM!!!

PUT THEM IN YOUR CALENDAR.

Course Web Sites

All content is posted/linked within Canvas.

Each lecture has its own module with everything you need to know about that lecture.

Please use Ed Discussions to ask questions (not email).

Please upload your homework to Gradescope by 8am the morning after it's due.

The Small Print

- Names and pronouns

- Students with documented disabilities

- Stanford University Honor Code

- Econ Department syllabus

- Humor gone wrong

Important?

Explained by Econ 50?

Time

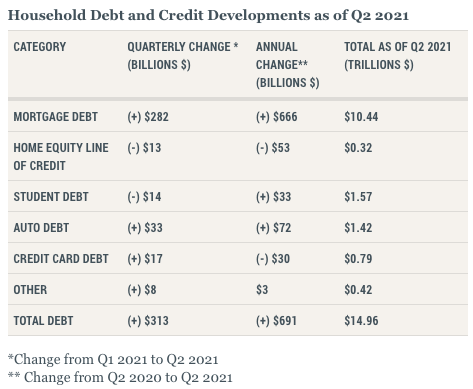

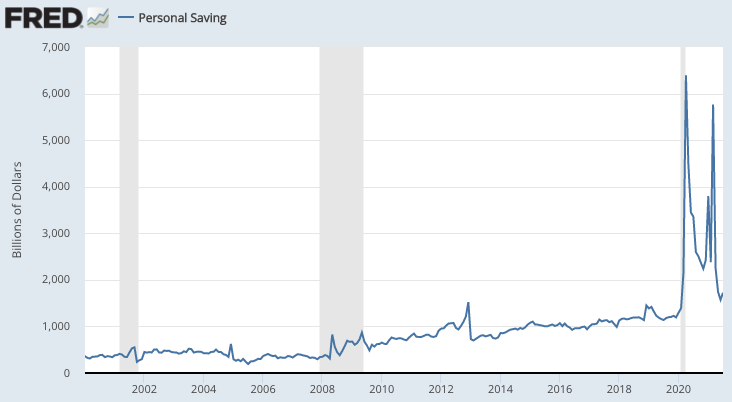

Saving and borrowing is a huge part of the U.S. economy.

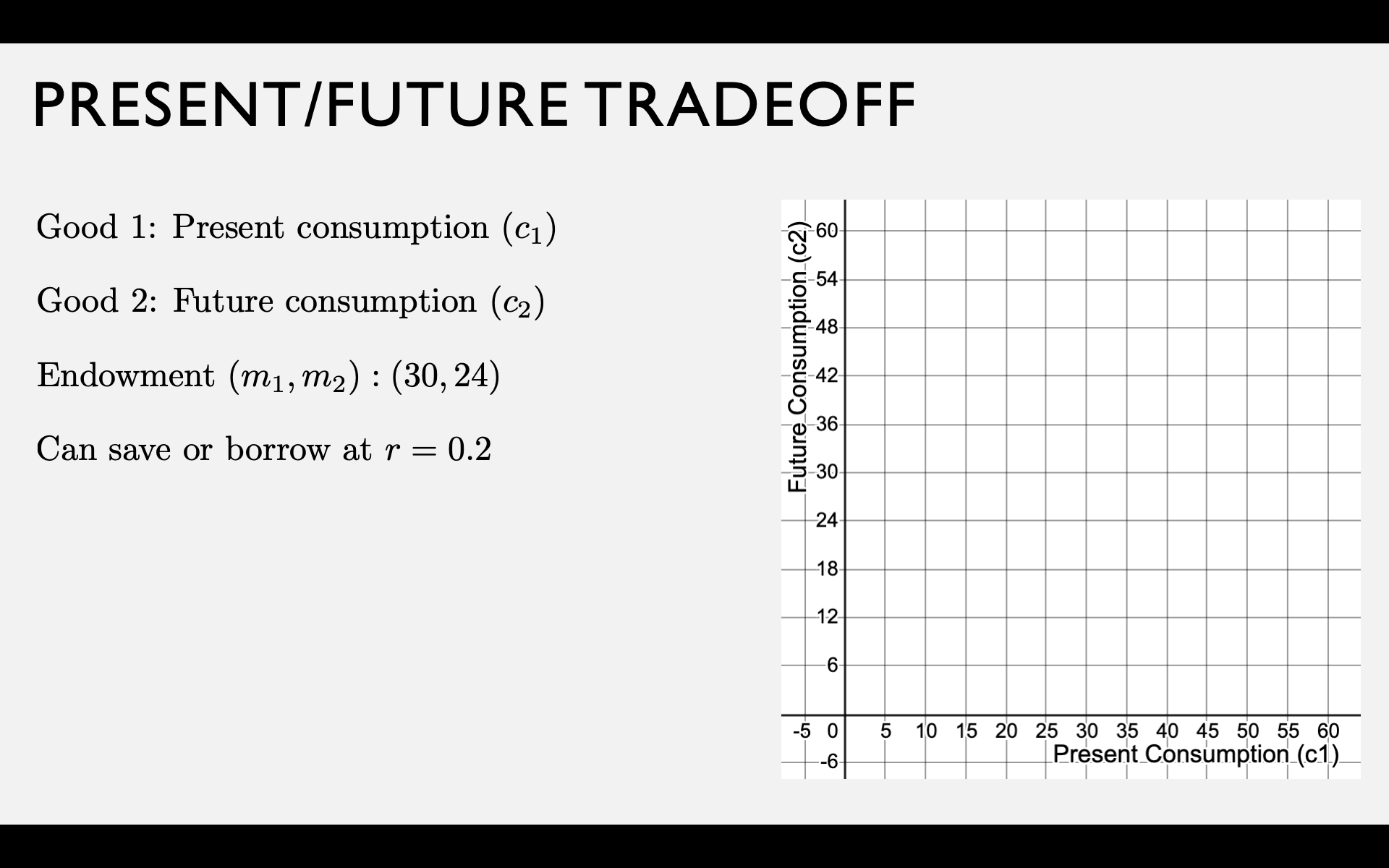

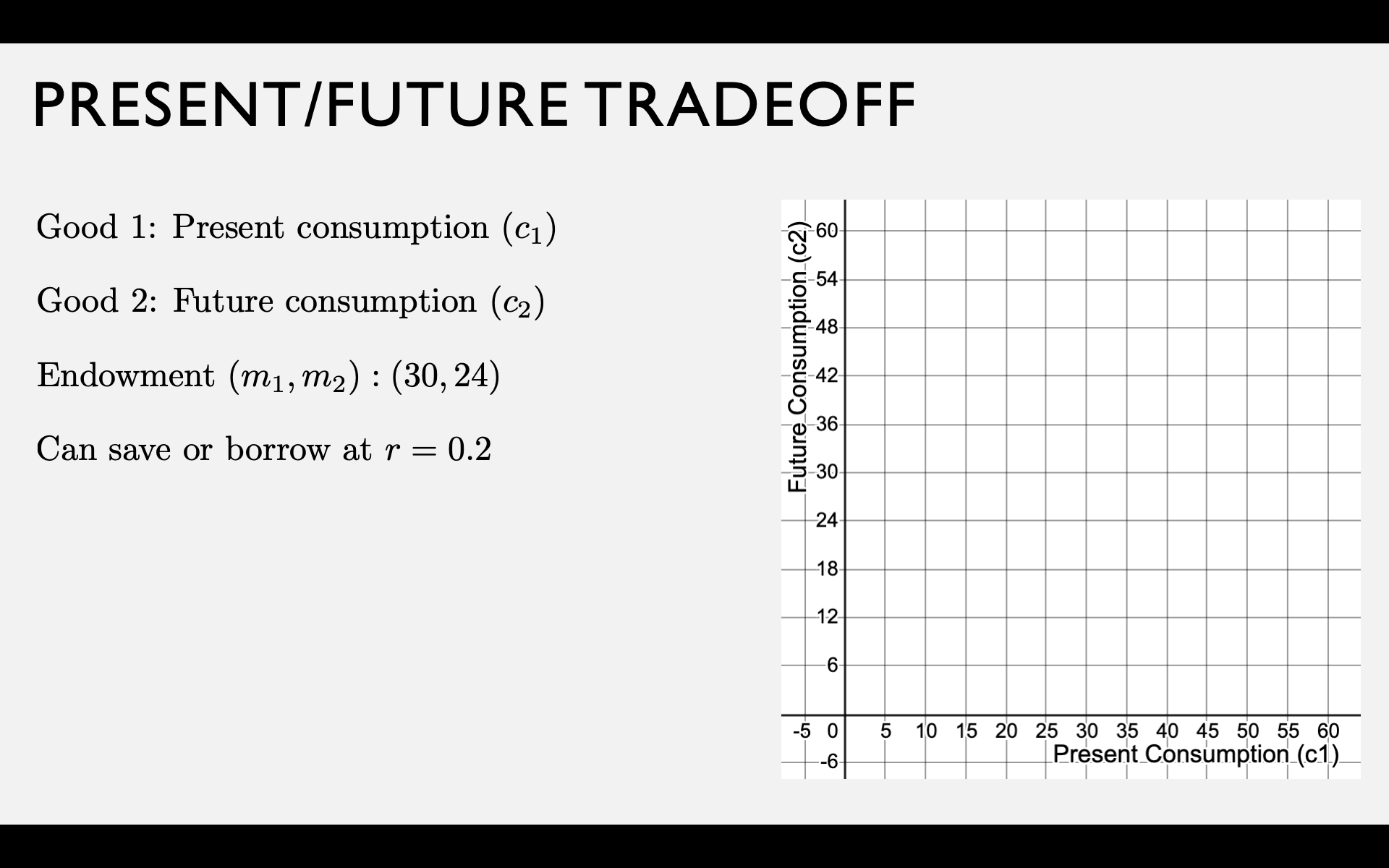

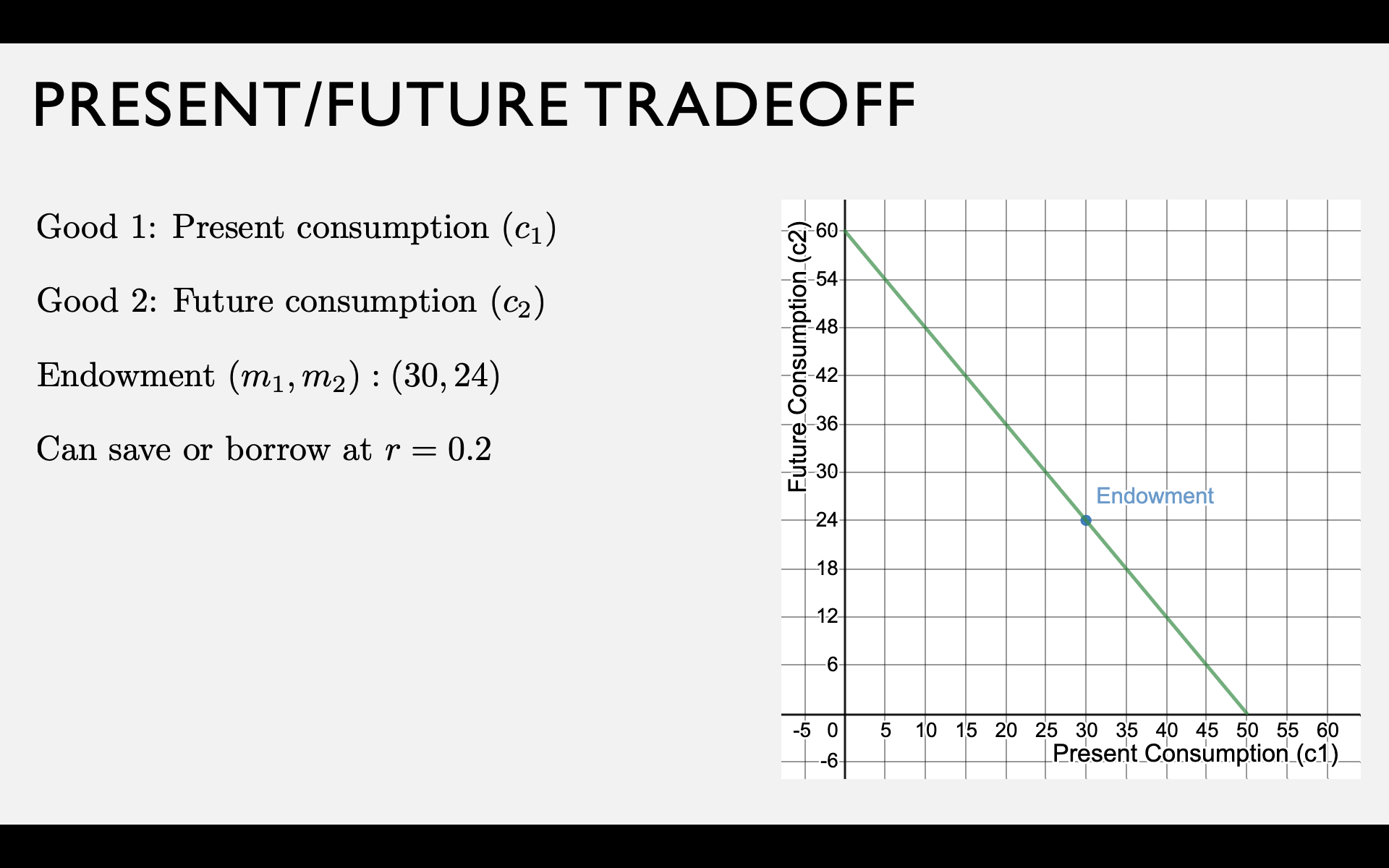

Present-Future Tradeoff

Your endowment is an income stream of \(m_1\) dollars now and \(m_2\) dollars in the future.

What happens if you don't consume all \(m_1\) of your present income?

Two "goods" are present consumption \(c_1\) and future consumption \(c_2\).

Let \(s = m_1 - c_1\) be the amount you save.

Saving and Borrowing with Interest

If you save at interest rate \(r\),

for each dollar you save today,

you get \(1 + r\) dollars in the future.

You can either save some of your current income, or borrow against your future income.

If you borrow at interest rate \(r\),

for each dollar you borrow today,

you have to repay \(1 + r\) dollars in the future.

"Future Value"

"Present Value"

Preferences over Time

Examples:

When to borrow and save?

Save if MRS at endowment < \(1 + r\)

Borrow if MRS at endowment > \(1 + r\)

(high interest rates or low MRS)

(low interest rates or high MRS)

If we assume \(v(c)\) exhibits diminishing marginal utility:

MRS is higher if you have less money today (\(m_1\) is low)

and/or more money tomorrow (\(m_2\) is high)

MRS is lower if you are more patient (\(\beta\) is high)

Borrow or Save?

Optimal Bundle

Tangency condition:

Budget line:

Supply of Savings and

Demand for Borrowing

At low interest rates, you'll "demand" funds for borrowing:

At high interest rates, you'll

"supply" funds for saving:

Different Interest Rates

BORROW

SAVE

What if the interest rate is different for borrowing and saving?

Inflation and Real Interest Rates

Suppose there is inflation,

so that each dollar saved can only buy

\(1/(1 + \pi)\) of what it originally could:

Up to now, we've been just looking at

dollar amounts in both periods

We call \(r\) the "nominal interest rate" and \(\rho\) the "real interest rate"

For low values of \(r\) and \(\pi\), \(\rho \approx r - \pi\)

"Present Value" for two periods

Beyond Two Periods

If you save \(s\) now, you get \(x = s(1 + r)\) next period.

The amount you have to save in order to get \(x\) one period in the future is

Remember how we got this...

If you save \(s\) now, you get \(x = s(1 + r)\) next period.

The amount you have to save in order to get \(x\) one period in the future is

If you save for two periods, it grows at interest rate \(r\) again, so \(x_2 = (1+r)(1+r)s = (1+r)^2s\)

Therefore, the amount you have to save in order to get \(x_2\) two periods in the future is

If you save for two periods, it grows at interest rate \(r\) again, so \(x_2 = (1+r)(1+r)s = (1+r)^2s\)

Therefore, the amount you have to save in order to get \(x_2\) two periods in the future is

If you save for \(t\) periods, it grows at interest rate \(r\) each period, so \(x_t = (1+r)^ts\)

Therefore, the amount you have to save in order to get \(x_t\), \(t\) periods in the future, is

Therefore, the amount you have to save in order to get \(x_t\), \(t\) periods in the future, is

We call this the present value of a payoff of \(x_t\)

The present value of an income stream is the sum of the present values in each period:

Evaluating Infinite Payoffs

The present value of a stream of payoffs

(\(\pi_0\) now, \(\pi_1\) in the next period, \(\pi_2\) two periods from now, etc)

may be given by the sum

The present value of a stream of payoffs of \(x\) in every period is

Value of getting payoff \(x\) forever, starting now:

Value of getting payoff \(z\) forever, starting next period:

Value of getting payoff \(y\) now and then payoff \(z\) forever after:

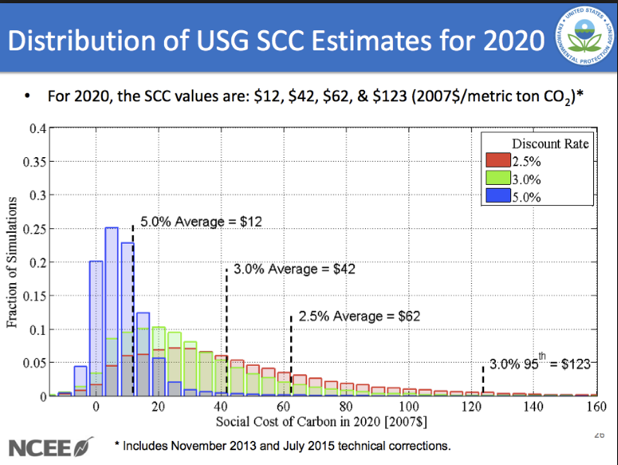

Application: Social Cost of Carbon

Obama Admin: $45

Uses a 3% discount rate; includes global costs

Trump Admin: less than $6

Uses a 7% discount rate; only includes American costs

PV of $1 Trillion in 2100:

$86B for Obama, $4B for Trump

To Do Before Next Class

Be sure you've filled out the section survey.

Read chapters 1-5 of Watson and do the quiz!