Understandable Artificial Intelligence

Overview

©2018 Economic Data Sciences

EDS was given a sample portfolio. The pension advisor who created it was looking to improve it as they did not have a good strategy to market it

As we have often seen from clients, the list of funds included comprised of a broad range: global equities, U.S. large cap value, international equities etc.

EDS goal was to find a better allocation within the wider client universe to meet the implicit goals this portfolio was attempting to accomplish

Overview - Goals

©2018 Economic Data Sciences

- The key goal for every EDS-run optimization is to increase return for every single unit of risk

- We did not know the portfolio preferences and were only given asset weights

Understanding Preferences

©2018 Economic Data Sciences

-

By 'balance' we mean the allocation shows a moderate preference for diversification and medium absolute/relative risk

- Likely a bucket-by-bucket approach was taken

- Alpha is a focus but not pursued in an aggresive fashion

-

This understanding of preferences could be very beneficial in servicing your clients' needs

- Which funds are the most valuable to individual clients

-

Our A.I. can provide deeper insight into preferences through simultaneous evaluation

- What is balance? How do we measure it?

One unique and powerful aspect of our A.I. is the ability to understand preferences. In this example we find that the allocation preferences could best be described as focused on balance

Metrics For Balance - 1

©2018 Economic Data Sciences

-

Total Factor Sensitivity

- Units of risk received from each factor, adjusted for the correlation between factors

- We argue that this is one of the best possible measures of balance

-

In essence, the total factor sensitivity of a portfolio tells you how much you are being 'paid' for each factor exposure in the portfolio

- It represents the risk in the portfolio attributable from factors

-

Total Factor Sensitivity Ratio

- Similar to Sharpe Ratio

- Specific to factor risk

Due to our A.I.'s ability to simultaneously compute so many factors at once we are able to compute a Total Factor Sensitivity for a portfolio -- This is unique to our tool

Metrics For Balance - 2

©2018 Economic Data Sciences

-

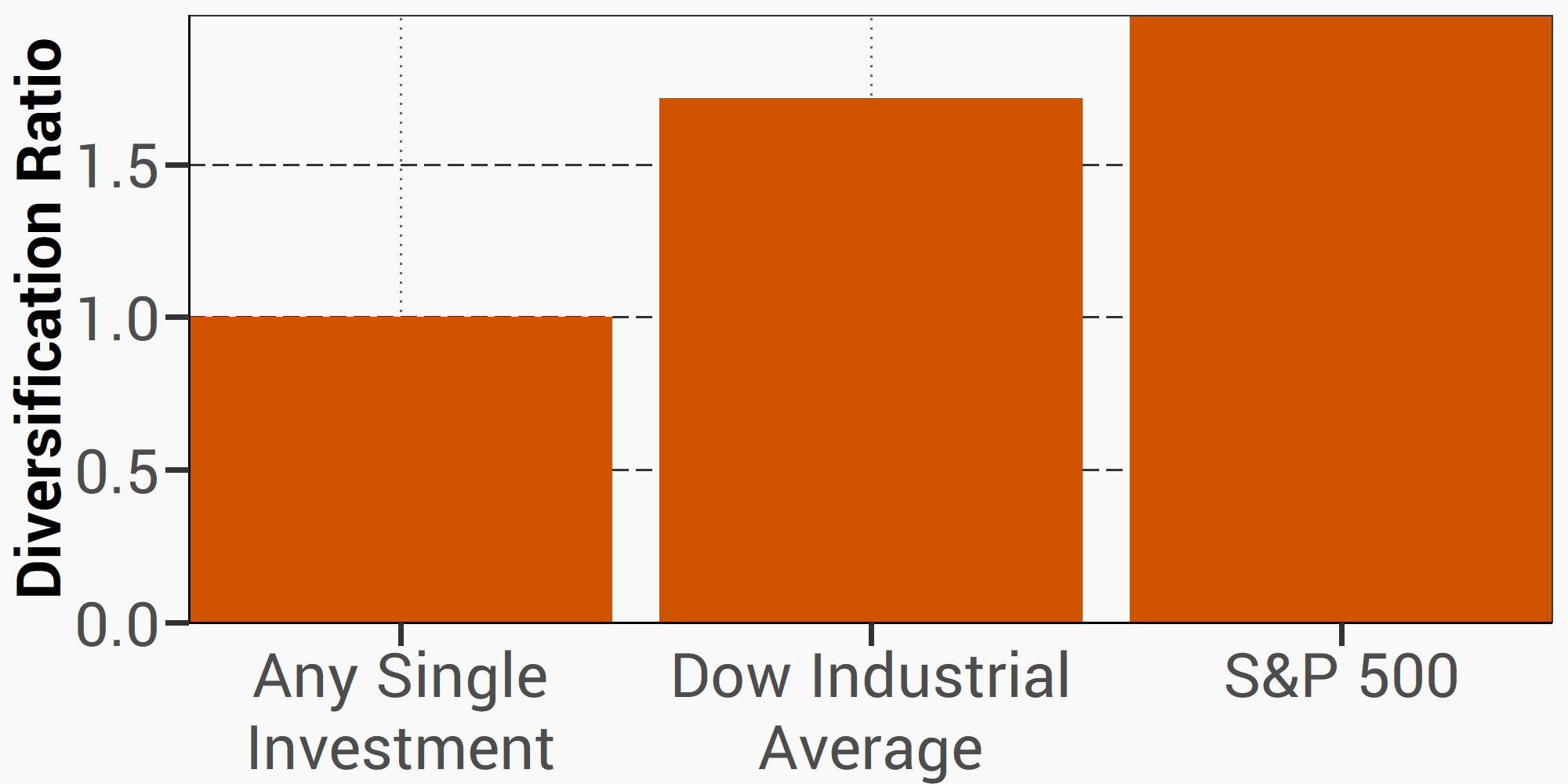

Diversification Ratio

- Defined in the paper Towards Maximum Diversification

- We apply this ratio to both standard deviation and factor risk

- In essence this is an 'Index of Diversification'

Another common metric for diversification is the Diversification Ratio. Because our A.I. can simultaneously compute so much, it can find the best trade-off in this metric and others.

*Data from EDS & Bloomberg, courtesy of London Business School

A.I. Analysis

Re-allocated, Expanded, Re-defined

Re-Allocate: Metrics Review

©2018 Economic Data Sciences

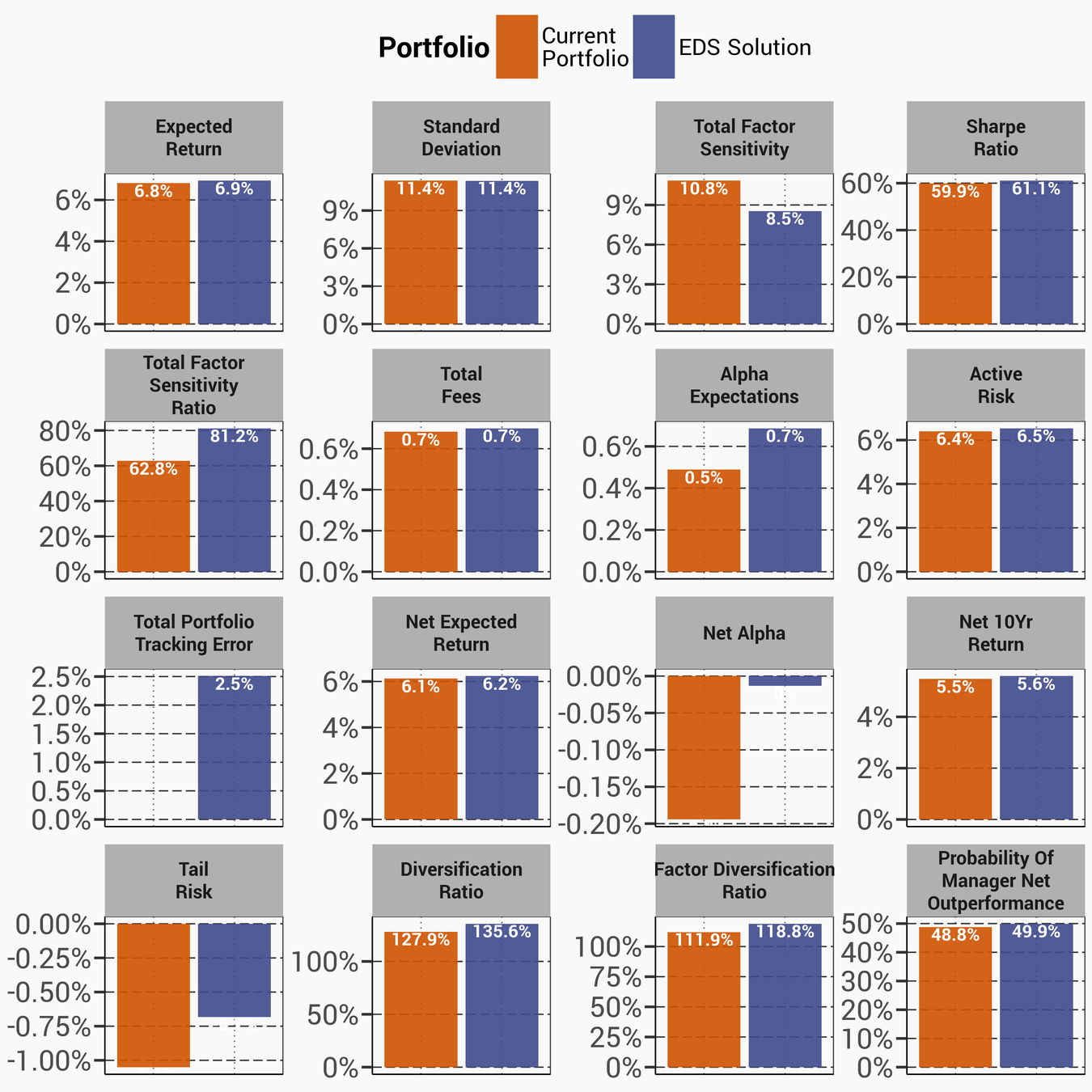

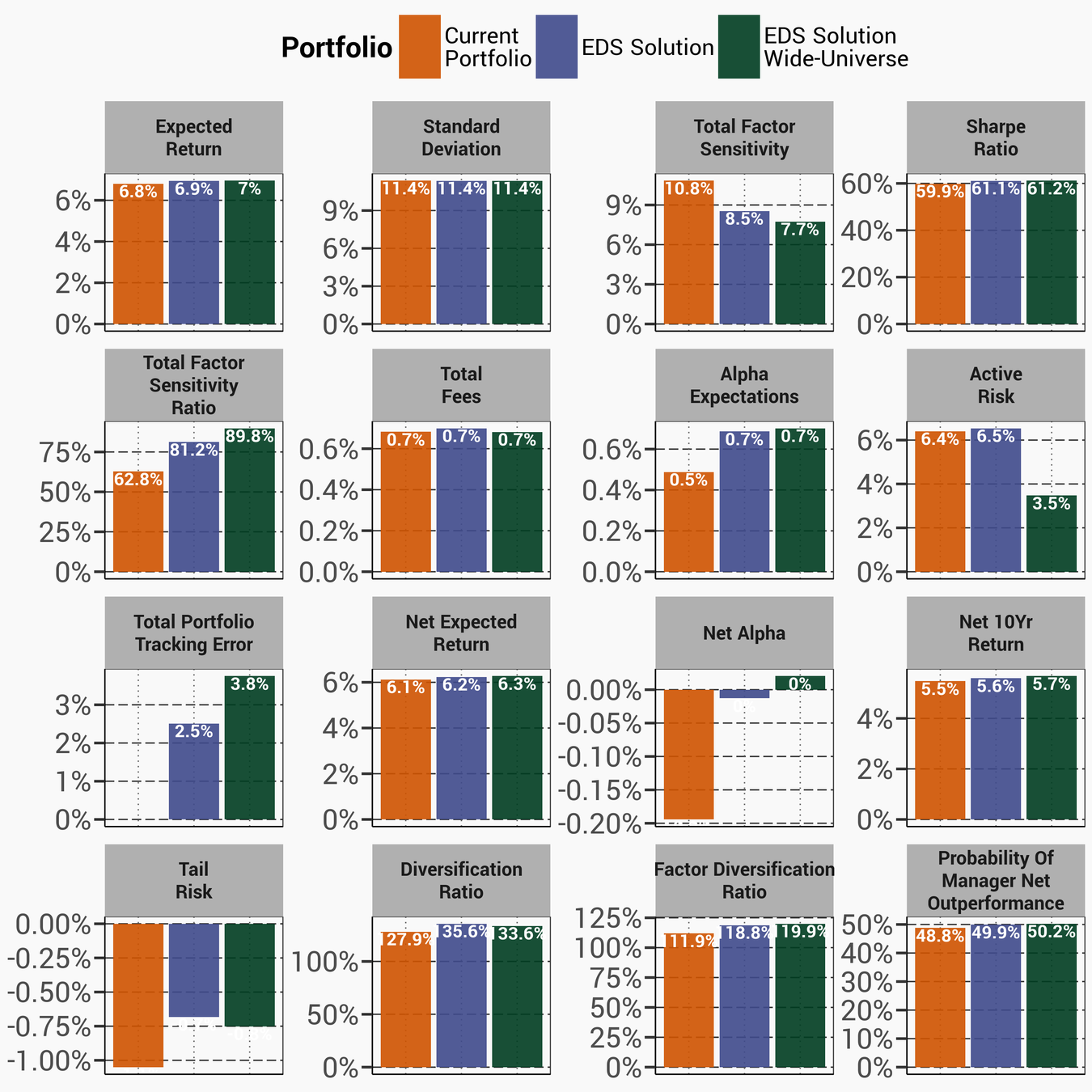

- Unsurprisingly, the available benefits in this example are small

- A focus on diversification and delivering alpha is maintained

- Interestingly, we can provide significant improvement in factor effeciency via Total Factor Sensitivity

-

Conclusion:

- Small improvements with small changes

- Preferences better expressed?

In this first step we use only the funds already included in the portfolio and allow the A.I. to re-allocate based only on its understanding of preferences, we hope this is a better expression

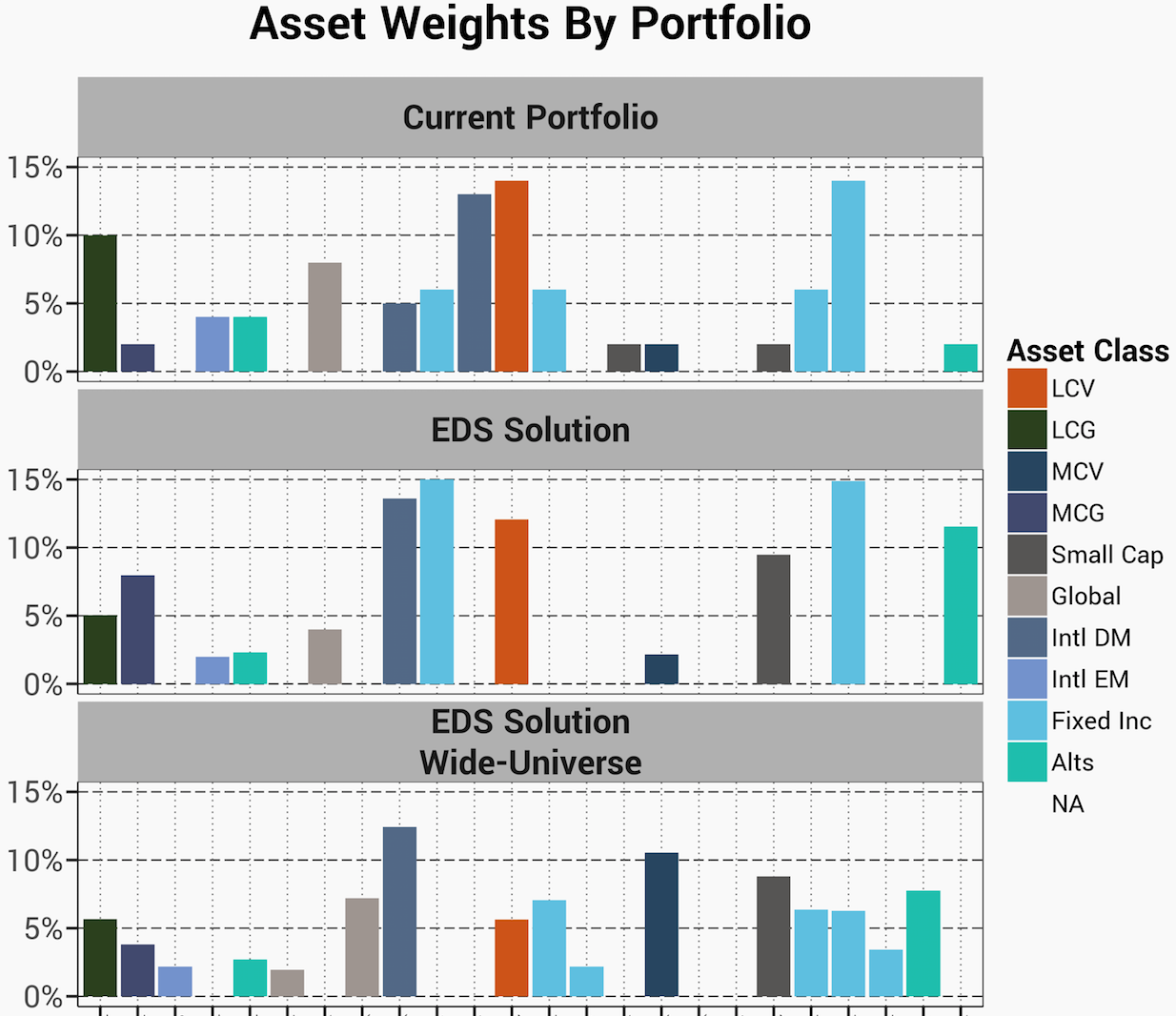

Re-Allocate: Funds List and Weights

©2018 Economic Data Sciences

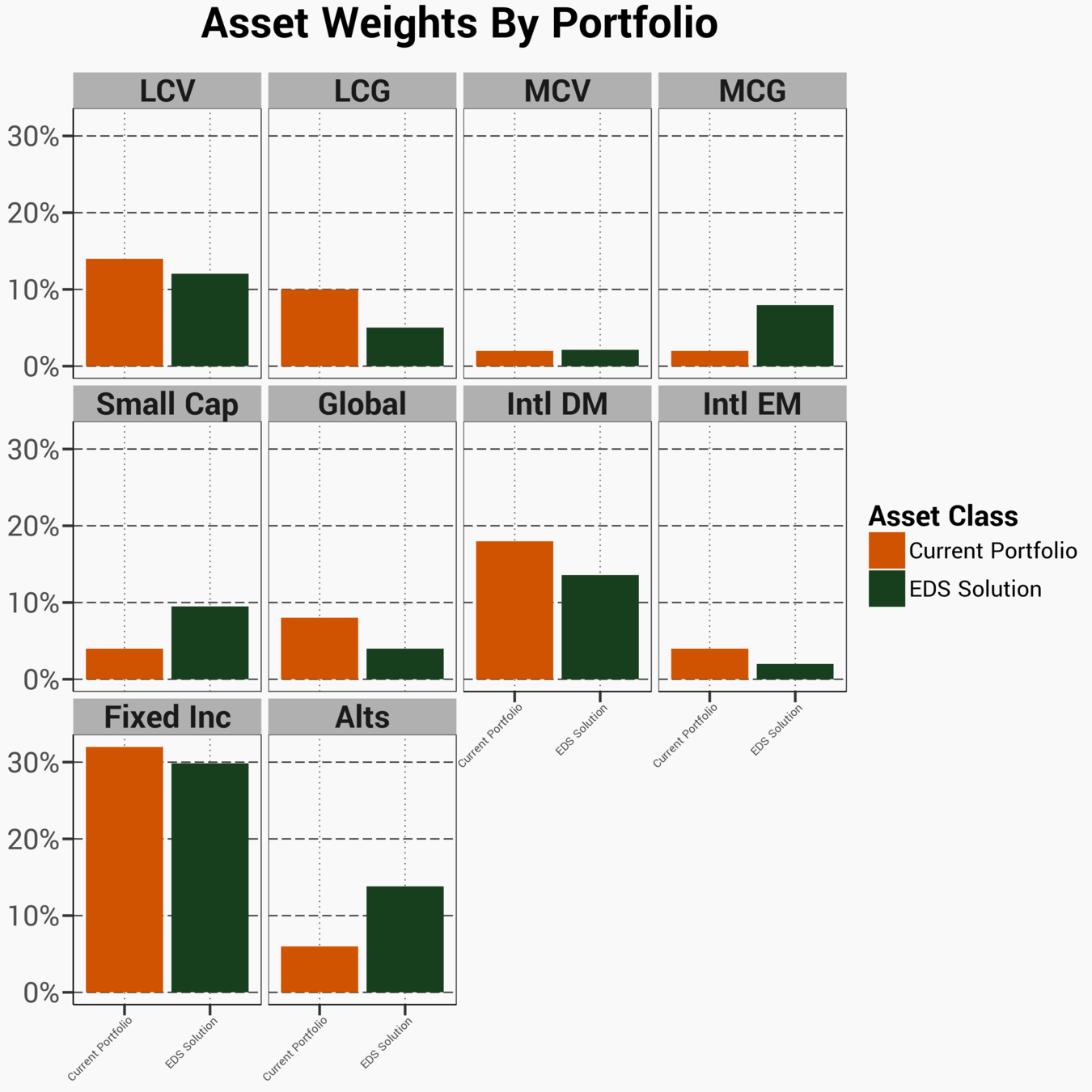

The construction of the original portfolio was likely a 'bucket-by-bucket' approach. We keep this in mind during our analysis

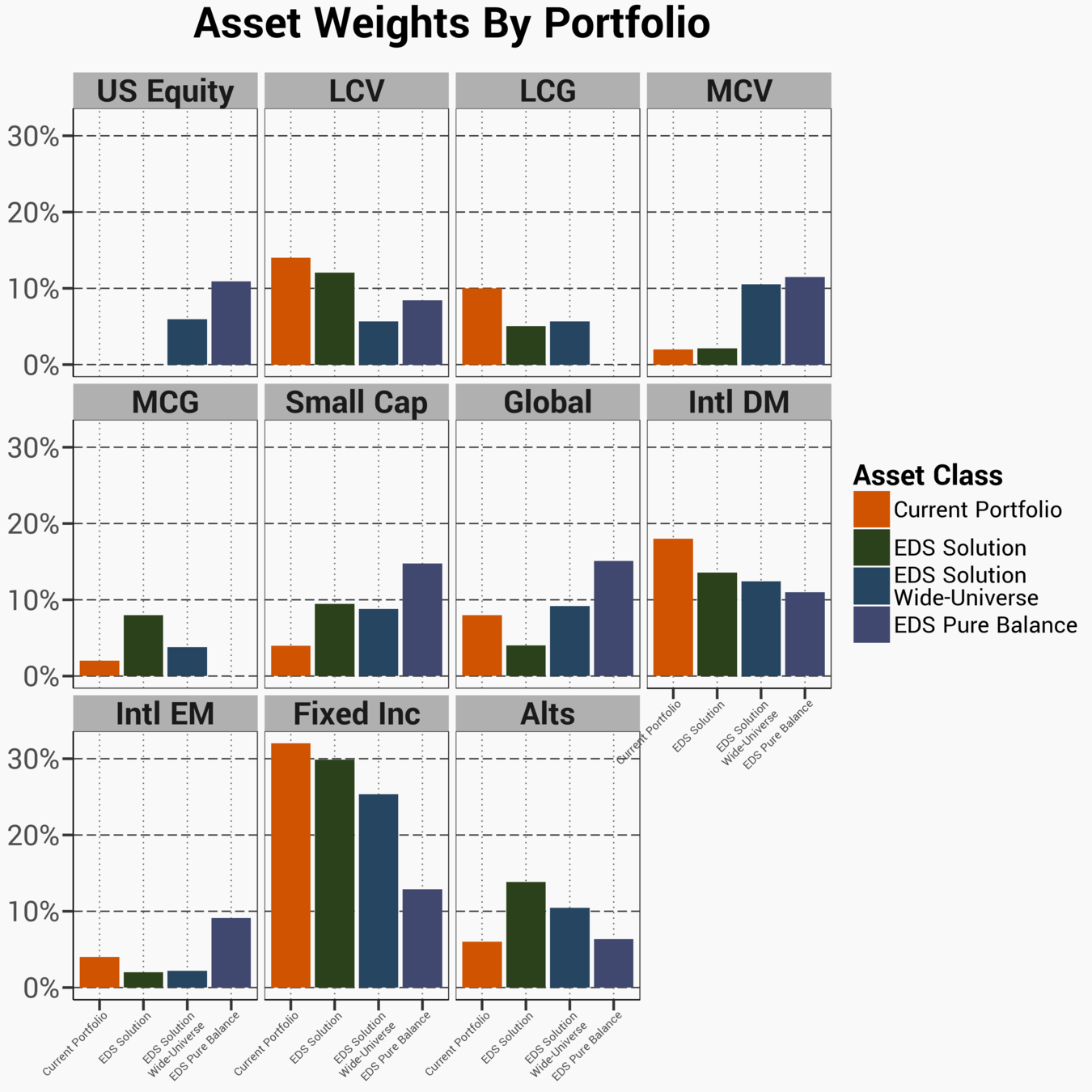

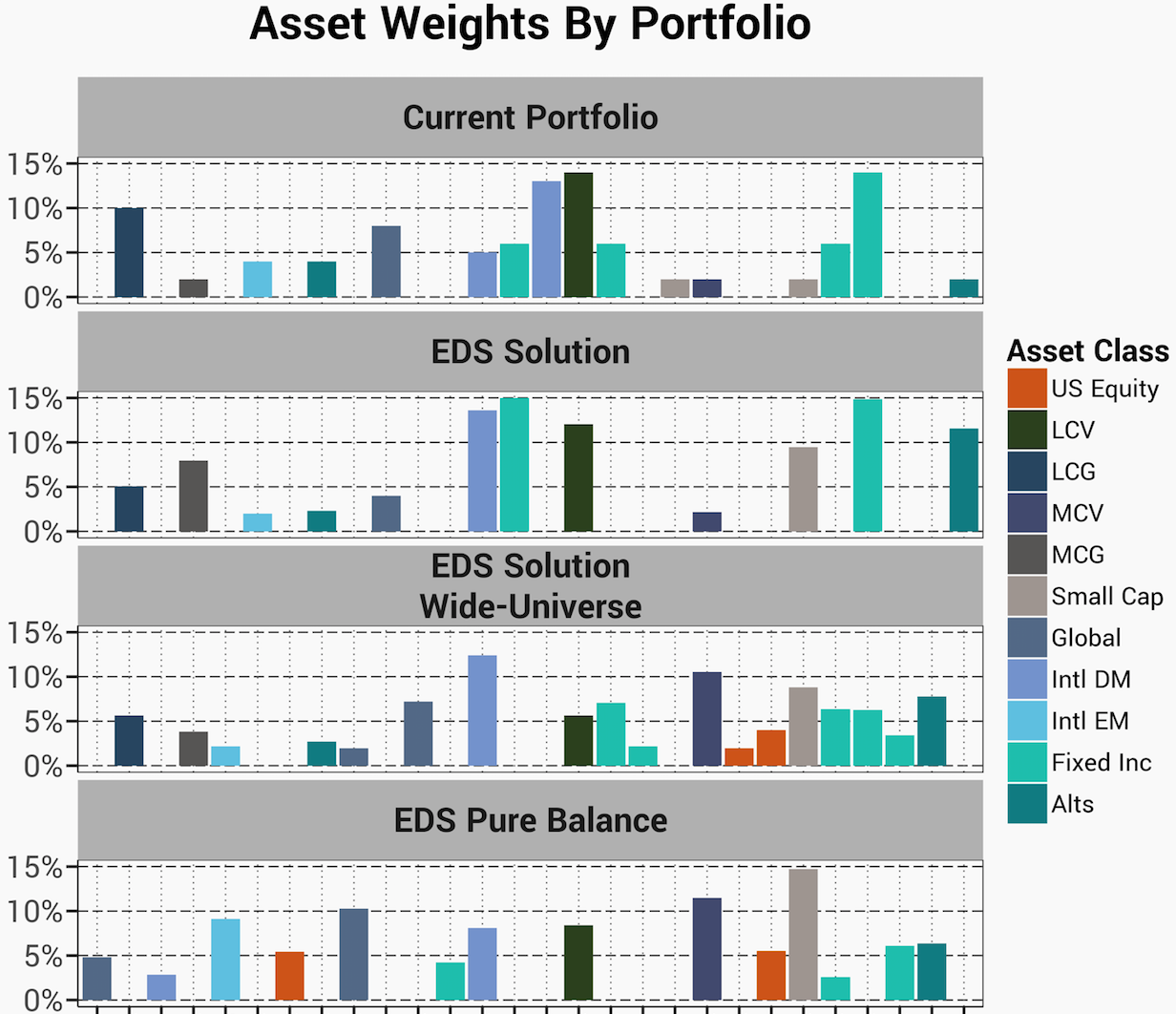

An explanation of the short-hand of each asset class can be found in the back

*Data from EDS, Oppenheimer, & Bloomberg, courtesy of London Business School

Expand: Other Internal Funds

©2018 Economic Data Sciences

- Increase universe to all approved client funds

- Diversification and efficient alpha delivery remain a focus

- Keep target return at a similar level

This part of the analysis is trying to answer a simple question: Can further improvements be made if the wider client universe is examined?

Expand: Metrics Overview

©2018 Economic Data Sciences

- Higher diversification ratio

- Lower active risk

- Higher Alpha expectations

- Lower total factor sensitivity

At this point we feel the A.I. has a good understanding of preferences and seeks to make further improvements by searching the broader client universe of funds

In this example several significant improvements can be found:

Expand: Asset Weights

©2018 Economic Data Sciences

-

Simultaneous evaluation leads to more informed and holistic decisions

- Removes overlaps

- Favors efficient delivery of factor exposures

In this example we keep the overall bucket weights fairly similar but search through a wider set of client funds

*Data from EDS, Oppenhiemer, & Bloomberg, courtesy of London Business School

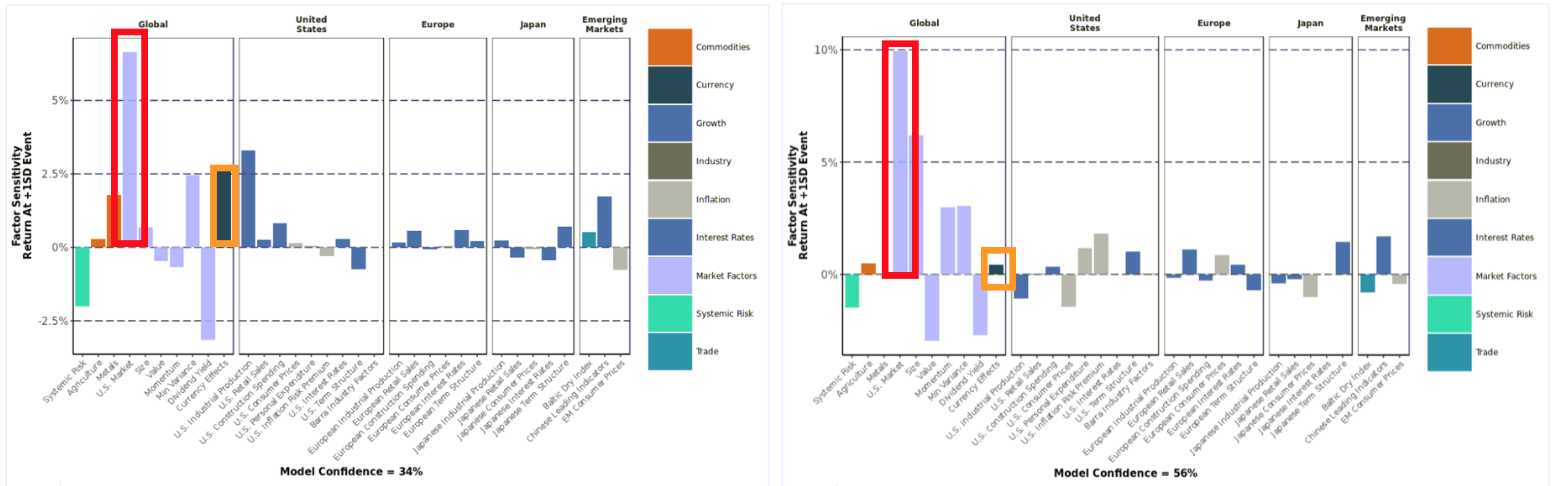

Expand: Why These Funds?

©2018 Economic Data Sciences

-

Efficient Delivery and Avoiding Unwanted Exposures

- Dollar for dollar, more factor return is delivered from that exposure

- Avoid unwanted factor risk and inefficient cancelling out of factors

Simultaneous evaluation leads to a better/deeper perspective of the factors that drive returns. When allocating the A.I. suggests funds that deliver factor exposure efficient and won't erode other factor exposures across the portfolio

*Data from EDS & Bloomberg, courtesy of London Business School

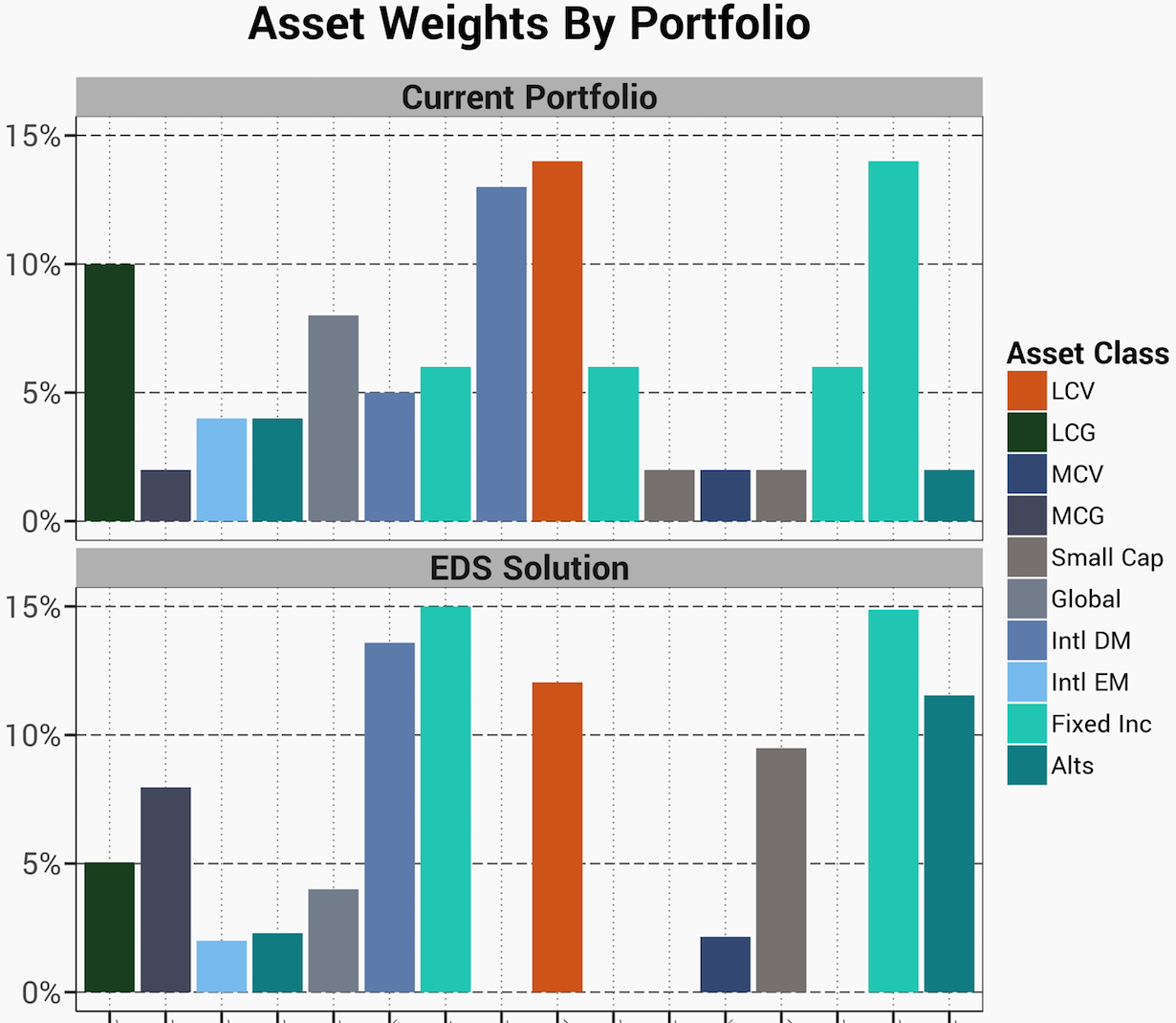

Re-Define: Pure Balance

©2018 Economic Data Sciences

-

In this example we are purely led by preferences

- A bucket approach is like a constraint and can confirm existing biases

- For example, a constrained Facebook feed is an echo chamber that confirms biases

-

Using similar preferences as before, we allow the A.I. more freedom to make allocation decisions

- Again, focused on diversification and delivering alpha consistently

In this example we allow the A.I. to purely express our preferences without regard to the traditional buckets which contain overlap of factor exposure leading to sub-optimal outcomes

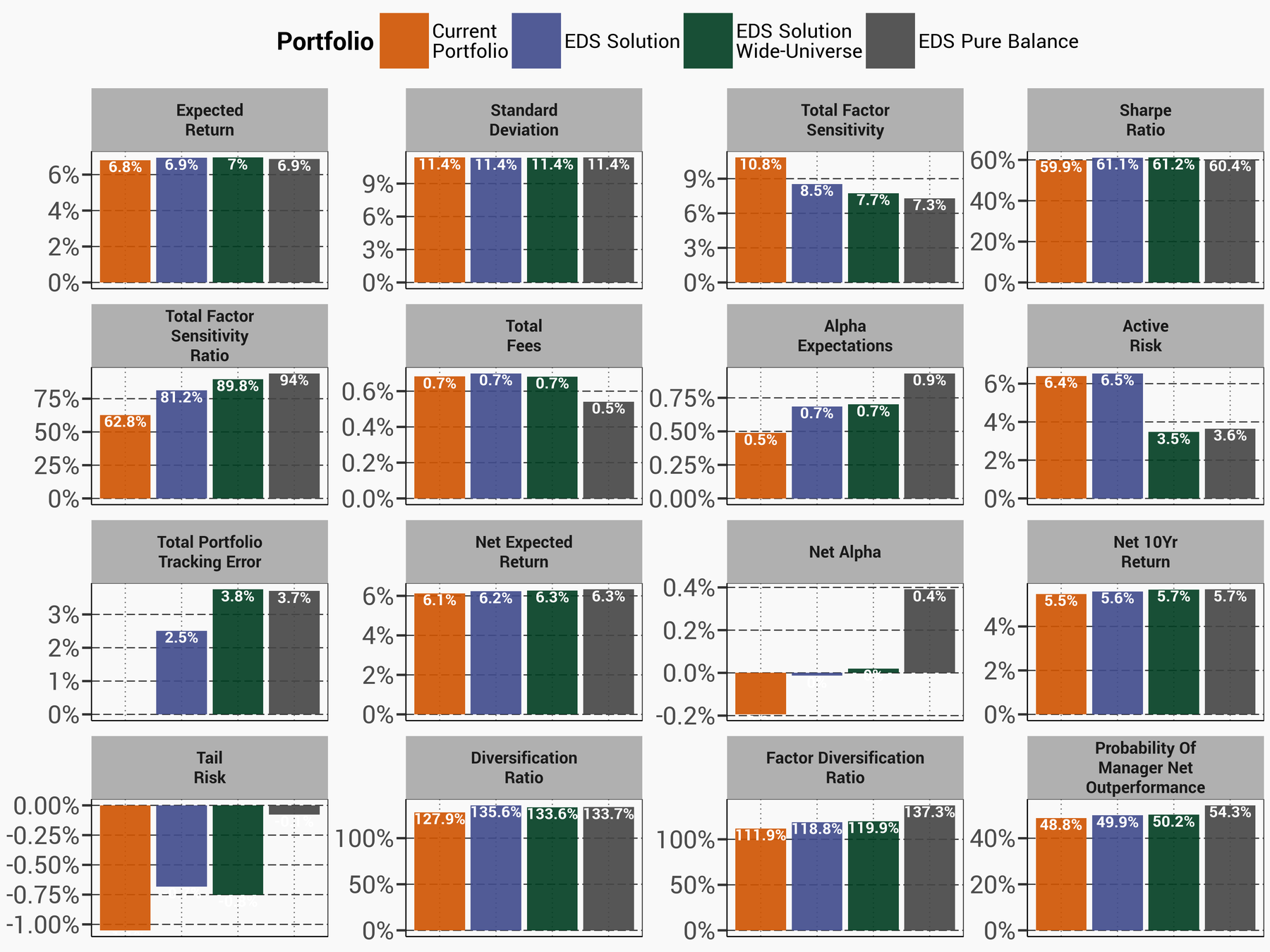

Re-Define: Metrics Overview

©2018 Economic Data Sciences

Removing the constraints improves the desired goal, using conservative forward- looking estimates

- Highest expected Alpha with low active risk

- Best probability of net outperformance

- Highest factor diversification ratio

- Lowset Tail-Risk and Factor Sensitivity

Re-Define: Asset Weights

©2018 Economic Data Sciences

'Pure Balance' is an attempt to purely implement invesment preferences

- Final allocation is not widely different

- Takes an opportunistic and unconstrained approach

- Understaning preferences can inform where and what types of new funds are most valuable to the investor

Re-Define: Fund Allocation

©2018 Economic Data Sciences

-

Largest added funds:

- E/M LOC DB

- Global ESG Revenue

-

Largest removals:

- Capital Appreciation

- International Diversified

- Prefences can be further refined, but making unbiased decisions leads to significant improvements

This holistic approach removes overlap that erodes efficiency and makes decisions without bias

*Data from EDS, Oppenheimer, & Bloomberg, courtesy of London Business School

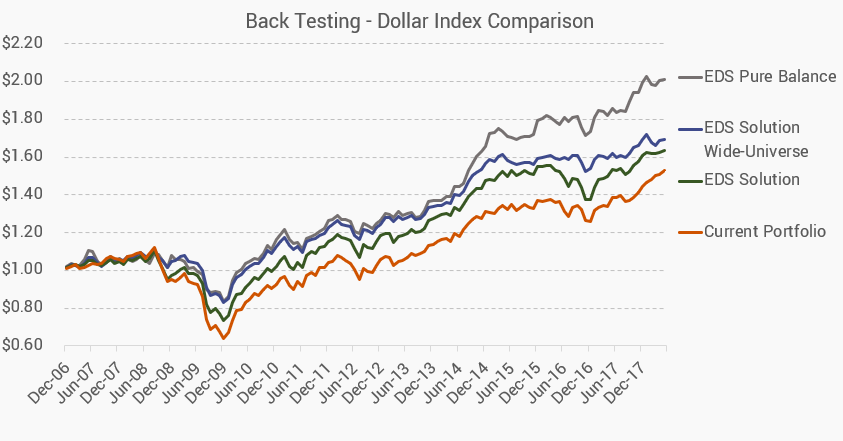

Back Testing Solution

©2018 Economic Data Sciences

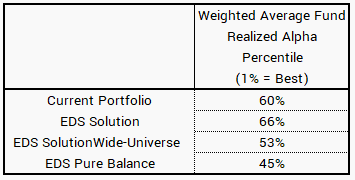

All of our estimates thus far were forward -looking, however it is often informative to test the solution in history

- The Pure Balance solution performs consistently well due to its ability to get more from each factor it is exposed to → i.e. being more balanced

*Data from EDS & Bloomberg, courtesy of London Business School

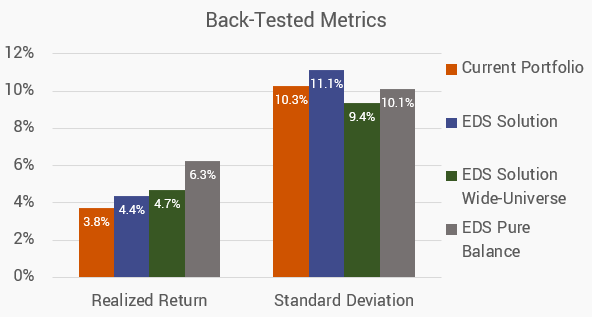

Back Testing - Return and Std Dev

©2018 Economic Data Sciences

The metrics from this test show a significant realized historical improvement. Beyond just performance we also see that the managers/funds selected beat their benchmarks more often

Conclusion

©2018 Economic Data Sciences

-

Main goal: Balanced fund

- Focus on exposure across multiple areas

- High return is not the objective

-

Unconstrained EDS solution generates a more complete portfolio

- Higher projected Alpha with lower active risk

- Higher diversification factor

Using our A.I. tool to enhance your existing methods can lead to significant improvements not just in performance but other important metrics like diversification and alpha. Furthermore, we believe the marketing advantages of an A.I. approach are also a positive in today's environment

Fund Names Shorthand

©2018 Economic Data Sciences

- LCV - U.S. Large Cap Equity Value

- LCG - U.S. Large Cap Equity Growth

- MCV - U.S. Mid Cap Equity Value

- MCG - U.S. Mid Cap Equity Growth

- Small Cap - U.S. Small Cap Equity

- Global - Global Equities

- International DM - Developed Markets Equities

- International EM - Emerging Markets Equities

Disclaimers

©2018 Economic Data Sciences

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this presentation, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for an individual's portfolio.

Our projections are based on current market conditions which can vary over the coming months and weeks. Additionally, our projections are based on historical market behavior which may vary unexpectedly. Using Machine Learning, our tool should adjust to new market fluctuations but we might not be able to avoid short term volatility.

Get In Touch

©2018 Economic Data Sciences

info@EconomicDataSciences.com

info@EconomicDataSciences.com