ECF5560

Winter term, 2023

Lecture 3: Primary market valuation

Cost benefit analysis & economic decision making

Dr. Emilia Tjernstrom

1. CBA steps

2. Micro review (as relevant to CBA)

3. Opportunity costs

1. CBA steps

Steps of a CBA

-

Specify the set of alternative projects

-

Decide who counts (standing/referent group)

-

Identify impact categories & select indicators

-

Predict impacts over life of project

-

Monetize all impacts

-

Discount benefits & costs to get present values

-

Compute NPV of each alternative from (1)

-

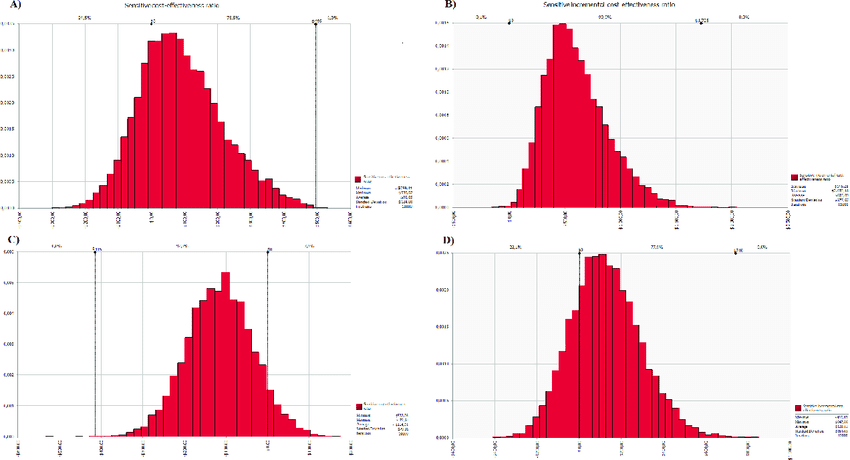

Conduct sensitivity analysis

-

Make recommendation

Limiting the number of alternatives can be a challenge

Steps of a CBA

-

Specify the set of alternative projects

-

Decide who counts (standing/referent group)

-

Identify impact categories & select indicators

-

Predict impacts over life of project

-

Monetize all impacts

-

Discount benefits & costs to get present values

-

Compute NPV of each alternative from (1)

-

Conduct sensitivity analysis

-

Make recommendation

Limiting the number of alternatives can be a challenge

Steps of a CBA

-

Specify the set of alternative projects

-

Decide who counts (standing/referent group)

-

Identify impact categories & select indicators

-

Predict impacts over life of project

-

Monetize all impacts

-

Discount benefits & costs to get present values

-

Compute NPV of each alternative from (1)

-

Conduct sensitivity analysis

-

Make recommendation

Limiting the number of alternatives can be a challenge

Steps of a CBA

-

Specify the set of alternative projects

-

Decide who counts (standing/referent group)

-

Identify impact categories & select indicators

-

Predict impacts over life of project

-

Monetize all impacts

-

Discount benefits & costs to get present values

-

Compute NPV of each alternative from (1)

-

Conduct sensitivity analysis

-

Make recommendation

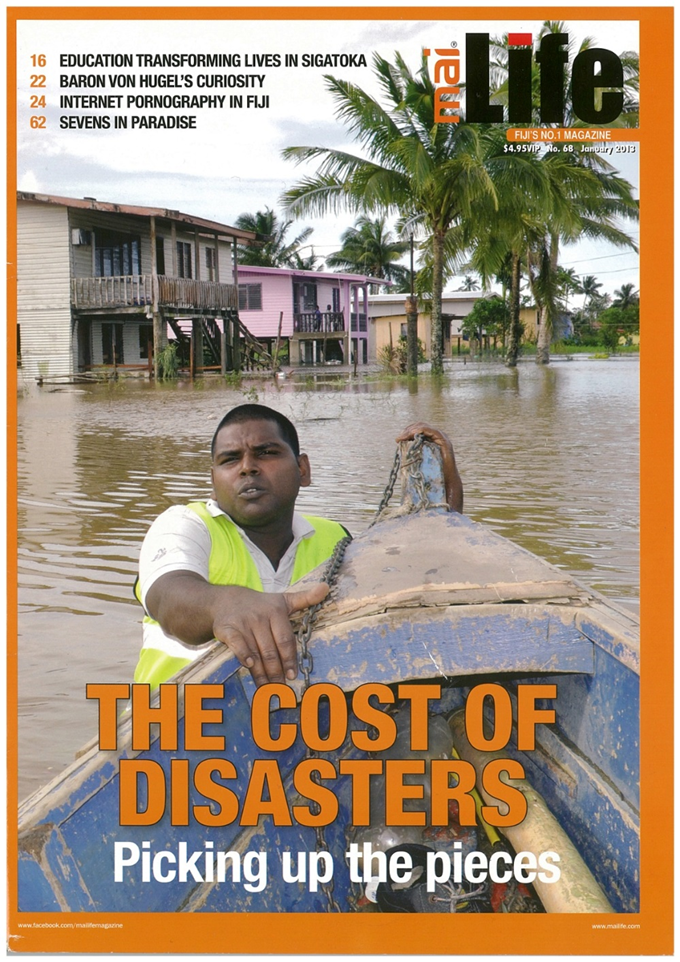

Tricky when things are valued differently by different groups

Steps of a CBA

-

Specify the set of alternative projects

-

Decide who counts (standing/referent group)

-

Identify impact categories & select indicators

-

Predict impacts over life of project

-

Monetize all impacts

-

Discount benefits & costs to get present values

-

Compute NPV of each alternative from (1)

-

Conduct sensitivity analysis

-

Make recommendation

Tricky when things are valued differently by different groups

Where the rubber hits the road

Need to estimate C & B in each time period

We don't know the true supply & demand curves

- correlation vs. causation

- unintended consequences

Harder...

- the longer the time horizon

- the more different variables interact

Steps of a CBA

-

Specify the set of alternative projects

-

Decide who counts (standing/referent group)

-

Identify impact categories & select indicators

-

Predict impacts over life of project

-

Monetize all impacts

-

Discount benefits & costs to get present values

-

Compute NPV of each alternative from (1)

-

Conduct sensitivity analysis

-

Make recommendation

Need to estimate C & B in each time period

We don't know the true supply & demand curves

- correlation vs. causation

- unintended consequences

Harder...

- the longer the time horizon

- the more different variables interact

Harder to obtain value / WTP...

- if goods aren’t traded in markets

- if markets are incomplete / functioning poorly

Steps of a CBA

-

Specify the set of alternative projects

-

Decide who counts (standing/referent group)

-

Identify impact categories & select indicators

-

Predict impacts over life of project

-

Monetize all impacts

-

Discount benefits & costs to get present values

-

Compute NPV of each alternative from (1)

-

Conduct sensitivity analysis

-

Make recommendation

- What $-amount do we attach to lives saved?

- What is the value of a person-hour?

- Reduced scenic beauty along expanded highway = how many $?

Harder to obtain value / WTP...

- if goods aren’t traded in markets

- if markets are incomplete / functioning poorly

Steps of a CBA

-

Specify the set of alternative projects

-

Decide who counts (standing/referent group)

-

Identify impact categories & select indicators

-

Predict impacts over life of project

-

Monetize all impacts

-

Discount benefits & costs to get present values

-

Compute NPV of each alternative from (1)

-

Conduct sensitivity analysis

-

Make recommendation

Harder to obtain value / WTP...

- if goods aren’t traded in markets

- if markets are incomplete / functioning poorly

- What $-amount do we attach to lives saved?

- What is the value of a person-hour?

- Reduced scenic beauty along expanded highway = how many $?

Steps of a CBA

-

Specify the set of alternative projects

-

Decide who counts (standing/referent group)

-

Identify impact categories & select indicators

-

Predict impacts over life of project

-

Monetize all impacts

-

Discount benefits & costs to get present values

-

Compute NPV of each alternative from (1)

-

Conduct sensitivity analysis

-

Make recommendation

Steps of a CBA

-

Specify the set of alternative projects

-

Decide who counts (standing/referent group)

-

Identify impact categories & select indicators

-

Predict impacts over life of project

-

Monetize all impacts

-

Discount benefits & costs to get present values

-

Compute NPV of each alternative from (1)

-

Conduct sensitivity analysis

-

Make recommendation

Steps of a CBA

-

Specify the set of alternative projects

-

Decide who counts (standing/referent group)

-

Identify impact categories & select indicators

-

Predict impacts over life of project

-

Monetize all impacts

-

Discount benefits & costs to get present values

-

Compute NPV of each alternative from (1)

-

Conduct sensitivity analysis

-

Make recommendation

Steps of a CBA

-

Specify the set of alternative projects

-

Decide who counts (standing/referent group)

-

Identify impact categories & select indicators

-

Predict impacts over life of project

-

Monetize all impacts

-

Discount benefits & costs to get present values

-

Compute NPV of each alternative from (1)

-

Conduct sensitivity analysis

-

Make recommendation

If comparing with the status quo,

decision rule:

If multiple projects, the largest NPV represents most efficient allocation of resources

Steps of a CBA

-

Specify the set of alternative projects

-

Decide who counts (standing/referent group)

-

Identify impact categories & select indicators

-

Predict impacts over life of project

-

Monetize all impacts

-

Discount benefits & costs to get present values

-

Compute NPV of each alternative from (1)

-

Conduct sensitivity analysis

-

Make recommendation

Steps of a CBA

-

Specify the set of alternative projects

-

Decide who counts (standing/referent group)

-

Identify impact categories & select indicators

-

Predict impacts over life of project

-

Monetize all impacts

-

Discount benefits & costs to get present values

-

Compute NPV of each alternative from (1)

-

Conduct sensitivity analysis

-

Make recommendation

2. Micro review

Allocative efficiency

Pareto efficiency

CBA is a framework for measuring efficiency

What do we know about maximizing efficiency?

Do we know a system or principle that maximizes social welfare?

In reality, no market is perfect

Real world markets rarely achieve the ideal of “perfect competition”

Still, models of PC can give us insights about real-world markets

Approximately correct in some situations

Informative about what happens when key assumptions are relaxed

Perfect competition is our benchmark

All market participants are price takers, i.e.,

can’t influence price at which they buy/sell

Perfect competition: assumptions

- many buyers & sellers

- no barriers to entry/exit

- homogeneous goods

- perfect information

- zero transaction costs

- no externalities

All market participants are price takers, i.e.,

can’t influence price at which they buy/sell

Perfect competition: assumptions

- many buyers & sellers

- no barriers to entry/exit

- homogeneous goods

- perfect information

- zero transaction costs

- no externalities

smooth D curves + no market power

price driven to MC by new entrants (ex?)

perfect substitutes; chars don't vary

perfect knowledge of price, utility, quality

no 'wedge' between selling & buying price

private C & B = social C & B

If there is a market failure, government intervention can improve efficiency & increase social welfare

If there is current regulation / "interference" in a market without clear market failures, then "less policy" could enhance welfare

Perfect competition: why is this relevant?

Remember that government policies that distort otherwise well-functioning markets do two things:

1. transfer surplus

2. create DWL

Perfect competition: why is this relevant?

Remember that government policies that distort otherwise well-functioning markets do two things:

1. transfer surplus

2. create DWL

-

Specify the set of alternative projects

-

Decide who counts (standing/referent group)

-

Identify impact categories & select indicators

-

Predict impacts over life of project

-

Monetize all impacts

-

Discount benefits & costs to get present values

-

Compute NPV of each alternative from (1)

-

Conduct sensitivity analysis

-

Make recommendation

Perfect competition: why is this relevant?

Remember that government policies that distort otherwise well-functioning markets do two things:

1. transfer surplus

2. create DWL

-

Specify the set of alternative projects

-

Decide who counts (standing/referent group)

-

Identify impact categories & select indicators

-

Predict impacts over life of project

-

Monetize all impacts

-

Discount benefits & costs to get present values

-

Compute NPV of each alternative from (1)

-

Conduct sensitivity analysis

-

Make recommendation

👉🏻

Demand curves measure benefits

Demand curves as measures of benefits

P

Q

We measure the benefit of a good / service using WTP

therefore the (inverse) demand curve measures benefits

Total Benefits (TB) from consuming a given quantity

= area under the demand curve

Demand curves as measures of benefits

P

Q

q*

Total Benefits (TB) from consuming a given quantity

= area under the demand curve

Consumers are willing to pay TB

but pay only

Demand curves as measures of benefits

P

Q

q*

Consumers are willing to pay TB

but pay only

Total Benefits (TB) from consuming a given quantity

= area under the demand curve

Consumer Surplus

P

Q

q*

Consumers are willing to pay TB

but pay only

This means consumers get a surplus of benefits

hence Consumer Surplus (CS)

Consumer Surplus

P

Q

q*

Many policies / interventions / proposals

can be thought of as either:

a) changing prices, i.e. movement along D curve

b) shifting the D curve

Usually, changes in CS

approximate changes in WTP

Changes in Consumer Surplus

P

Q

q*

Many policies / interventions / proposals

can be thought of as either:

a) changing prices, i.e. movement along D curve

b) shifting the D curve

Usually, changes in CS

approximate changes in WTP

Changes in Consumer Surplus

P

Q

q*

Many policies / interventions / proposals

can be thought of as either:

a) changing prices, i.e. movement along D curve

b) shifting the D curve

Usually, changes in CS

approximate changes in WTP

and are approximated with linearity assumptions

Changes in Consumer Surplus

P

Q

q*

Usually, changes in CS

approximate changes in WTP

and are approximated with linearity assumptions

Changes in Consumer Surplus: elasticities

P

Q

q*

Usually, changes in CS

approximate changes in WTP

and are approximated with linearity assumptions

...assuming we know the demand curve!

(usually we don't)

this is where elasticities come in

Price elasticity of demand:

a measure of how responsive demand is to price changes

Changes in Consumer Surplus: demand shifters

P

Q

q*

What are some things

that "shift" demand?

changes in income

changes in expectations

changes in tastes

changes in prices of substitutes/ complements

Supply curves measure costs

Producer surplus

P

Q

q*

Just like the impact of policy changes can be measured by changes in CS, we can value impact on producers using PS

Producer surplus + Consumer surplus = TS

P

Q

q*

Ignoring the government for now,

we can compute total surplus (TS) as the sum of CS & PS

In well-functioning perfect competition market, total surplus (and hence net benefits)

are maximized

Gross Social Surplus vs Net

P

Q

q*

Government surplus = Net government revenue

For example, if the government gives a good away for free, some of that good is transferred to consumers as consumer surplus

That is not a "loss" but a transfer

It is important to separate transfers from losses:

Gross Social Surplus vs Net

P

Q

q*

TS = CS + PS + GS

Supply curves measure benefits

Opportunity costs

Opportunity costs

In calculating net benefits, don’t ignore the opportunity costs of resources

- somebody (maybe society) bears the cost of implementation

- opportunity cost = value of resources in their best alternative use

Opportunity cost of factors used to 'produce' or deliver a program: area under the supply curve!

Thinking in terms of opportunity costs helps clarify why economists

(correctly) ignore sunk costs

Opportunity costs

In calculating net benefits, don’t ignore the opportunity costs of resources

How closely do government expenditures measure opportunity cost for…

jurors’ time in a criminal justice reform program that would increase the number of trials?

Opportunity costs

In calculating net benefits, don’t ignore the opportunity costs of resources

How closely do government expenditures measure opportunity cost for…

land on which a nuclear waste storage facility will be installed

- the land is owned by the government

- the land is located on a military base

Opportunity costs

In calculating net benefits, don’t ignore the opportunity costs of resources

How closely do government expenditures measure opportunity cost for…

labour for a reforestation program in a small rural community with high unemployment?

- the land is owned by the government

- the land is located on a military base

Opportunity costs

In calculating net benefits, don’t ignore the opportunity costs of resources

How closely do government expenditures measure opportunity cost for…

labor of current gvt employees needed to administer a new program?

assume that these employees are already on the gvt payroll, so diverting their time to admin involves no additional expenditure

Review of micro

-

Goal of CBA: improve allocative efficiency

(i.e. ensure that resources are used in their most productive capacity) -

Kaldor-Hicks Efficiency vs. Pareto Efficiency

-

We need some theory to correctly evaluate whether a proposed policy will increase efficiency

-

In a perfectly competitive market, allocative efficiency happens on its own

-

Shortage and surplus are quickly resolved through price adjustments

-

No efficiency grounds for intervention

-

-

Typical justification for intervention is a market failure