Coexisting Exchange Platforms: Limit Order

Books and Automated Market Makers

Jun Aoyagi & Yuki Ito

Discussion by Katya Malinova

DeGroote School of Business

McMaster University

CBER Conference

May 2022, Boston

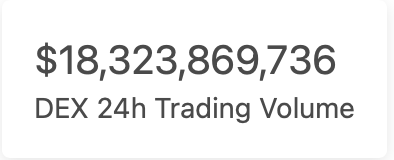

Decentralized Exchanges: Why Important?

- Blockchain: infrastructure for value exchange

- \(\to \) trading?!

- But infrastructure \(\ne\) market

- How do you organize a marketplace on-chain?

- Limit order book?

- Very challenging

- monitor & re-quote \(\to\) gas fees to change orders, all nodes have to update, ...

- Very challenging

- Centralized market \(\to\) off-chain, missing out on the infrastructure

- Limit order book?

- Decentralized exchanges & AMM!!

- Pool liquidity, automate pricing

- HUGE!

A genuinely novel market institution: how does it interact with the existing ones?

Multiple markets & their co-existence

- A long-standing issue in finance

- Different markets/pricing structures co-exist in practice

- Yet, theoretically, co-existence is less obvious

- Pagano (1989, QJE) "Trading Volume and Asset Liquidity"

- co-existence is either a knife-edge, or heavily relies on trader conjectures

- "clustering" by size

- Glosten (1994, JF) "Is the Electronic Open Limit Order Book Inevitable?"

- Back & Baruch (2007, JF) "Working orders in limit order markets and floor exchanges"

- "Equivalent" equilibria under the two different pricing structures

- Zhu (2014, RFS) "“Do dark pools harm price discovery?"

- Informed concentrate on lit exchanges (and only trade on lit for low volatility)

- Pagano (1989, QJE) "Trading Volume and Asset Liquidity"

Co-existence of DEX & CEX: very exciting topic!

- Traditionally:

- different markets = markets with different pricing structures

- DEX vs. CEX

- different pricing structures

- different custody arrangements

- possibly different use value to trading/holding a token on DEX vs CEX

- different settlement arrangements & a whole new set of players (validators)

- possible attacks on pending transactions

- \(\to\) next paper in this session!

Several papers on AMM

- Capponi and Jia (2021)

- welfare of the liquidity providers on the DEX

- conditions for the liquidity breakdowns

- Lehar & Parlour (2021)

- compare the two markets "in isolation" + empirics on UniSwap

- when is the DEX superior?

- Park (2021)

- compares different pricing functions & the desired properties

- do (and which) pricing functions give rise to attacks on pending transactions & MEV?

- This paper:

- examine co-existence of DEX and CEX

- Focus on the novel pricing on DEX

- Search for an equilibrium where a DEX co-exists with a limit order book

- \(\to\) it exists and stable

- Empirical predictions

- Buy vs. sell asymmetry of the price impact on DEX

- \(\to\) informed buyers vs sellers differ in DEX vs CEX preferences \(\to\) asymmetry in buy vs sell order info

- Complementarities in DEX & CEX liquidity

- Buy vs. sell asymmetry of the price impact on DEX

This paper

- Relate the results to existing theoretical literature on co-existence

- Are the issues identified in existing literature surface here?

- And if not, what is key to robust co-existence here?

General Comments & Questions

- Are there equilibria where trading concentrates on a single market?

- Focus on a particular parameter for an interior solution

- How large is this parameter region?

- Are the pricing diffs + info the main ingredients to understand DEX vs. CEX?

- The role of other differences?

- Model-wise, the limit order book on CEX is very stylized: how critical is it?

- Price discovery?

- Period 1: Liquidity providers ("market makers")

- post quotes on CEX & provide liquidity on DEX

- Period 2:

- Change in the fundamental \(\to\) Informed liquidity demanders

- All trade in the same direction

- Continuum of them \(\to\) trading fully reveals the info

- No change in the fundamental \(\to\) "Noise" liquidity demanders

- A continuum of them

- Buy demand = sell demand \(\to\) no imbalance

- Change in the fundamental \(\to\) Informed liquidity demanders

- Period 3 (if there was a change in the fundamental):

- Arbitrageurs on DEX

- Liquidity providers re-quote on CEX

Model Recap: Who and When?

Model Recap: Where & How?

DEX

- "Limit order book"

- but not discriminatory

- Liquidity demanders enter sequentially but:

- all pay the same ask

- \(\to\) no price impact cost from "earlier"/faster entrants on later ones

- no "walking the book", no MM re-quoting

- Costs:

- informed & noise pay the same bid-ask spread

CEX

- Bonding curve \(\to\) price

- "discriminatory"

- Liquidity demanders enter sequentially and:

- "later" buyers pay more b/c of the price impact from "earlier"/faster entrants

- Costs:

- informed face the price impact cost

- all pay transaction cost

- in terms of "asset" \(\to\) depends on trader's asset valuation

Model Recap: informed trader costs & choices

DEX

CEX

bid-ask spread cost (flat)

trans cost (flat)

+

marginal price (increases as informed trade on the same side)

\(\Rightarrow\) trade on DEX until the marginal price there = the "flat" ask (bid) on CEX

\(\Rightarrow\) informed trade on both exchanges

Model Recap & Comments: noise trader costs & choices

DEX

CEX

bid-ask spread cost (flat)

trans cost (increases in the noise trader asset valuation)

+

marginal price (flat = fundamental)

\(\Rightarrow\) trade on DEX if the private asset valuation is sufficiently low (\(\to\) perceive the trans fee to be "low") & on CEX otherwise

\(\Rightarrow\) noise trade on both exchanges

- This assumption seems key, yet unclear where heterogeneity in private valuations comes from

- Explore motives for trading on CEX vs DEX?

- Differences in aspects other than the price?

- E.g., custody?

- \(\to\) trade exclusively on DEX because need tokens to use them in DeFi applications

- arguably these are "noise"

- \(\to\) (?) expect more "noise" on DEX?

Model Recap & Comments: liquidity providers

DEX

CEX

Set the bid-ask spread to "break-even"

- zero profits in expectation on CEX

- there exists a liquidity pool size on DEX \(\to\) zero profits

- lose on the informed, profit from the "noise"

A knife-edge case?

Why only one level of the book?

- The further in the queue, the more likely to trade against single-sided flow (informed)

- Also, say, measure 1 of noise in total

- \(\to\) if the queue position >0.5, you only get to trade against the informed!

- \(\to\) must quote at the "new" fundamental

How critical is the non-discriminatory, no re-quoting LOB?

Comments on the Empirical Implications

informed trade on DEX until the marginal price = the ("fixed") ask/bid on CEX

- Larger liquidity pool on DEX \(\to\) smaller price impact \(\to\) more informed on DEX \(\to\) better liquidity on CEX

- Empirical implication #1 from the paper: adding a DEX improves CEX liquidity

-

Need a more detailed explanation here:

- why wouldn't noise migrate from CEX to DEX after its intro (zero price impact on the DEX!)

- larger size isn't the same as going from "CEX only" to "CEX & DEX"

@katyamalinova

malinovk@mcmaster.ca

slides.com/kmalinova

https://sites.google.com/site/katyamalinova/