The Adoption of Blockchain-based Decentralized Exchanges

Ruizhe Jia & Agostino Capponi

Discussion by Katya Malinova

DeGroote School of Business

McMaster University

NFA 2021 (virtual)

- asset class

- common resource

Decentralized finance (DeFi): why exciting?

DeFi: provision of financial services without the necessary involvement of a traditional financial intermediary

blockchain

Decentralized Exchanges

Idea:

- use blockchain to exchange items

- fully decentralized

- no single controlling entity, nor location,

- everything runs with smart contracts

How?

Decentralized Exchanges

Basic idea: (great!)

- share the common resource:

- pool the liquidity!

- liq. providers:

- deposit funds on both sides (e.g., and ) to a liquidity pool

- share gains & losses, don't compete with each other

- liq. demanders:

- trade against these funds

- e.g., send to the pool and get from the pool

Question:

- how to set the price/exchange rate?

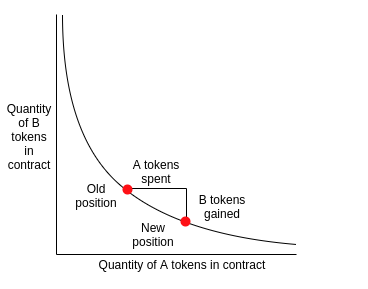

pricing mechanism:

- \(A=\) contract balance of token A

- \(B=\) contract balance of token B

- \(k=\) invariance factor

- key relation \(k=A\times B\ \) (constant product rule)

- (Other \(F(A,B) = k\) possible)

Automated Market Maker

- send \(\Delta_A=5\) of tokens A

- \(\to\) receive \(\Delta_B\) of token B s.t.

- \(k =10\times 10=(10+5)\times(10-\Delta_B)\)

- \(\to\) get 3.33 tokens B

Does/can this pricing function work?

10

10

15

6.67

- This paper (see also Lehar & Parlour (2021) -- next in this session!):

"Unbundle" liquidity provision & price discovery- \(\to\) possible exploitable arbitrage opportunities = losses to liq. providers

- \(\to\) "liquidity freezes" when exchange rates are too volatile

- AMM best for "stable" pairs and/or those with high private value trading vol

- a combo of linear & constant product pricing mitigates -- but doesn't eliminate -- this problem

- \(\to\) possible exploitable arbitrage opportunities = losses to liq. providers

- Park (2021) (tomorrow at the NFA): Mechanical pricing + "tech details" \(\to\) possibilities for malicious behaviour (= losses/costs to investors)

- The price computed using contract balances at settlement

- \(\to\) opportunities for profitable "front-running" while in mempool (between "send the transaction in" and "settle")

- proposes a different, pricing function, drawing on insights from microstructure

- The price computed using contract balances at settlement

Possible issues?

Very interesting paper: cleanly & clearly drills down to the economics of swap exchanges

- participants incentives

- \(\to\) sources, persistence (and consequences!) of arbitrage opportunities

- mitigating these consequences ...

- when/where the pricing works

- effects on/externalities for the shared resource (gas fees)

Bottom line

- (Minor) too many "moving parts" & notation?

- Closer related to microstructure than the paper suggests ...

- liquidity (and lack of thereof) is HUGE in microstructure ...

- \(\to\) possible insights into DEX organization?

- Empirics:

- Cool stylized facts! Support model's predictions, though not causal (?)

- Trading volume: theory predictions are on "investor" volume (\(\to\)fraction of "noise/non-strategic trading") but doesn't your empirical volume measure include arbitrage trades?

Three sets of comments

- Liquidity Providers (LP)

- no pricing decisions

This paper's model vs "traditional" microstructure

- Liquidity Providers (LP)

- Investors

- private values

- incur "slippage"/price impact cost

- + pay a preset % trading fee

- Noise traders (?)

- the bid-ask-spread cost

- LP earns the bid-ask spread

- noise trader loss = LP gain

- LP unable to gain the "spread" (can't liquidate the new (better than original) position for free)

- Arbitrageur: brings the contract reserves back, gains the "spread" but pays exactly that in gas fees \(\to\) earns zero profit

- Miners (outside the model) earn the "spread"

- LPs earn (twice) the trading fees

- Liquidity Providers (LP)

- earn trading fees, no gains from temp. "noise" price/position dislocations

This paper's model vs "traditional" microstructure

- Exchange rate shock

- the swap (reserve-quantity-based) exchange rate is stale \(\to\) any trade = loss to LP

- Shock to the fundamental \(\to\) quotes become stale \(\to\) loss to LP

- Adverse selection in limit order books b/c of public information:

- Foucault (JFM 1999);

- Budish, Cramton, Shim (QJE 2015)

- Adverse selection in limit order books b/c of public information:

- Equilibrium bid-ask spread increases in prob. of informed trading/prob. of shocks to fundamental

- Lose more on info \(\to\) extract more from noise traders ....

- Severe adverse selection (large or very likely exchange rate shock)

- \(\to\) fixed trading fees are insufficient to compensate LPs

- \(\to\) do not supply liquidity \(\to\) liq. freeze

- Liquidity Providers (LP)

- earn bid-ask spread

- Is there ever a benefit for the LP to match the gas fee submitted by the arbitrageur in race to withdraw? (No for this model (?).)

- Indirectly: alternate shapes of the pricing function [this paper & Park (2021)]

- Affects noise trader incentives vs. arbitrageur incentives

- \(\to\) possible to reduce losses to LPs

Mitigating liquidity freezes?

- Involve an Oracle in pricing?

- e.g., adjust contract reserves (\(\to\) swap exchange rate) based on external data?

- (not that simple ....)

- Any way for LPs to benefit directly from favourable contract reserve changes (i.e., better than "fair" swap exchange rates) -- akin earning the bid-ask spread?

- Variable trading fees?

- Role of the reserves size in the liquidity pools?

@katyamalinova

malinovk@mcmaster.ca

slides.com/kmalinova

https://sites.google.com/site/katyamalinova/