F741: Intro to Fintech

Professor Katya Malinova

What is FinTech?

Why now?

Lecture 1:

Today

- Course Logistics

- Why FinTech and why now? (And what is it?)

- Which areas?

Course Logistics

- Learn from each other in class

- do ask and answer (!) questions

- Grading: assignments, quizzes, term test, class participation

- Groups: self-selected, 4 people, sign up on A2L

- Quizzes: short, limited time once started, 24+-hour window to complete

- posted on Thursdays, closes on Saturday 11:59pm

- keeping track of topics

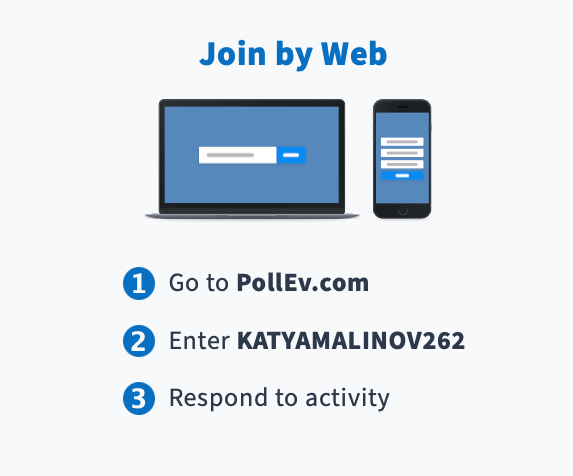

We will occasionally use Polls Everywhere in Class

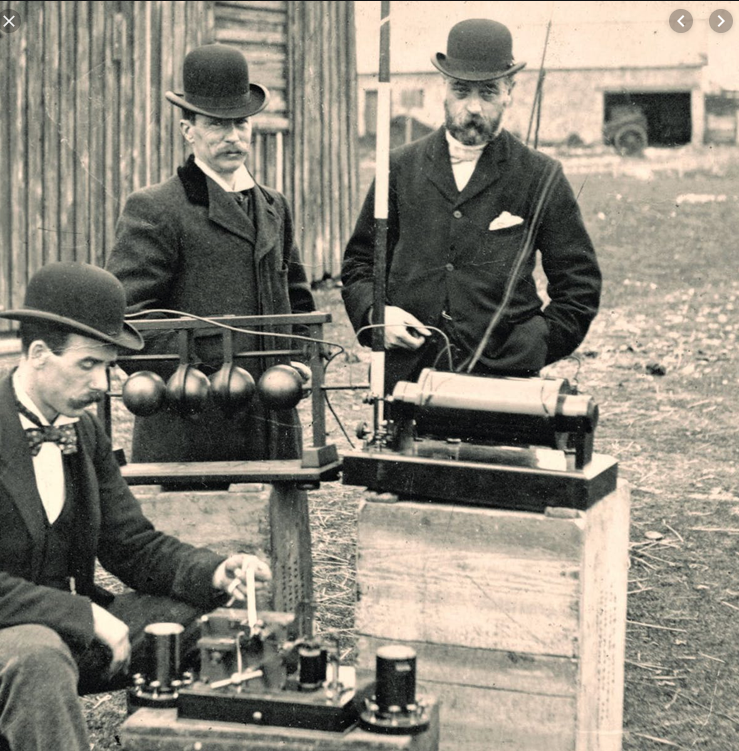

Technological Innovation has always affected trading ....

Old days of trading: highly specialized humans

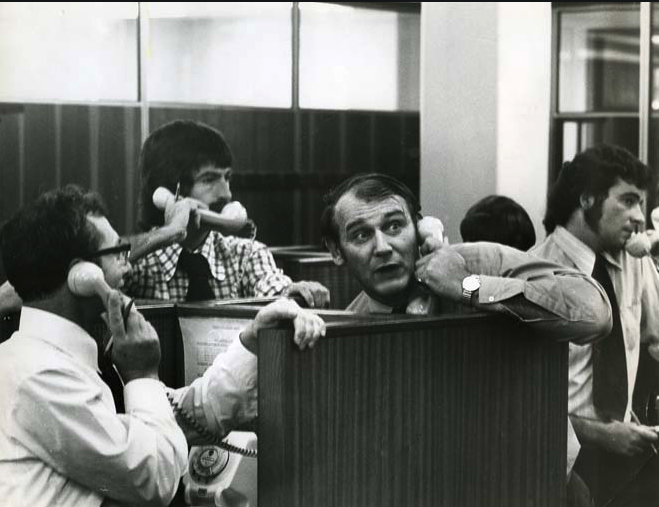

Modern Day Trading

Autonomous Algorithms run the show

Modern Day Trading

Trading floors are more suited for parties and journalists

Modern Day Trading

And the former heart of Wall Street is now in a faceless & glamourless suburb of Mawah, NJ

What drove this change of Wall Street (and the demise of the NYSE as we knew it)?

Why? The machines ...

- Many trading strategies are more-or-less mechanical/probabilistic

- computers are

- faster,

- cheaper, and

- more reliable

- Computer algos allow much wider scope

Source: Bloomberg News, Feb 20, 2015

Note: The biggest disruptors (the HFTs) came from the outside of the traditional system (kinda).

Why? The HR ...

- Old skill-set of an equity trader

- good and fast with numbers

- brash

- strong vocab in profanities

- gender

- New skill set

- programming

- stats/data

- econometrics

- ....

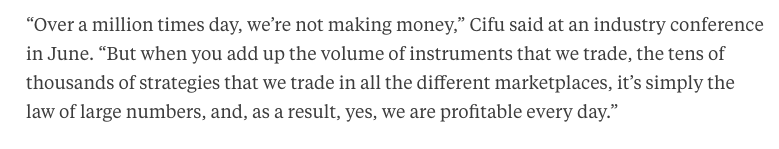

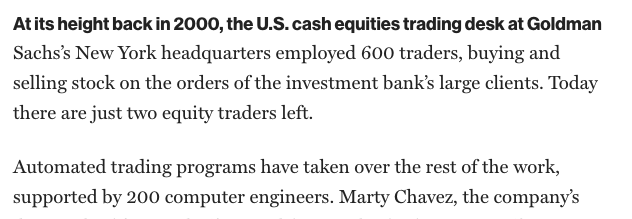

The result?

entire career streams disappear

MIT Technology Review, Feb 07, 2017

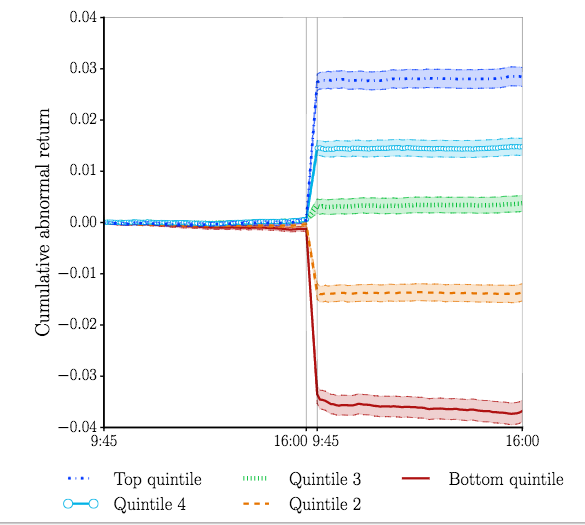

Markets get better: the post earnings announcement drift had been a long-standing puzzle in finance. ... It's gone.

What's the impact?

Source: Martineau (UofT) (WP2017; Critical Finance Review 2022)

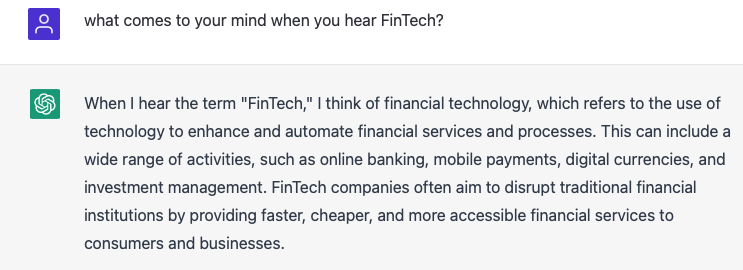

What comes to your mind when you hear "FinTech"?

Fall 2023:

When I hear the term "fintech," several thoughts come to mind:

Overall, when I think of fintech, I see a dynamic and transformative sector that is reshaping the way people manage and interact with their finances.

The world of Finance as we know it is over

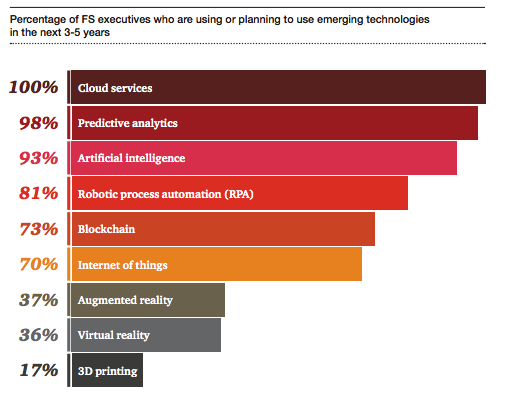

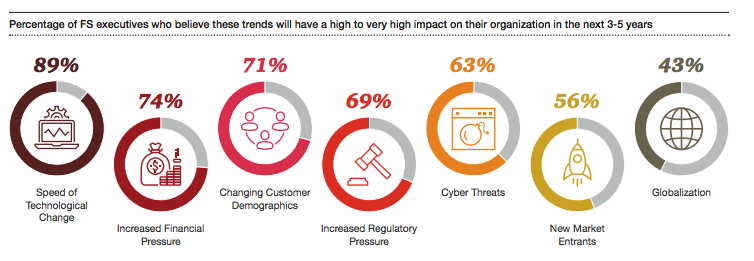

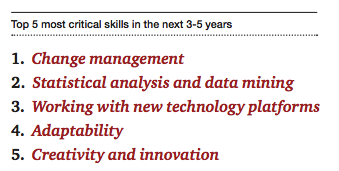

2018 TFSA study on the Future of the Financial Industry

GTA: 800,000 (?) jobs in FI

(other numbers (Invest Ontario) say "400K")

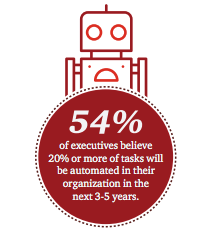

50% of executives believe that 40% or more of these jobs will change fundamentally over the next 3-5 years

Source: "Unlocking the human opportunity: Future-proof skills to move financial services forward"; PwC report for the Toronto Financial Services Alliance, April 2018

$82 billion (4%) of GDP

https://www.investontario.ca

TFSA study on the Future of the Financial Industry

TFSA study on the Future of the Financial Industry

TFSA study on the Future of the Financial Industry

TFSA study on the Future of the Financial Industry

(Or is it?)

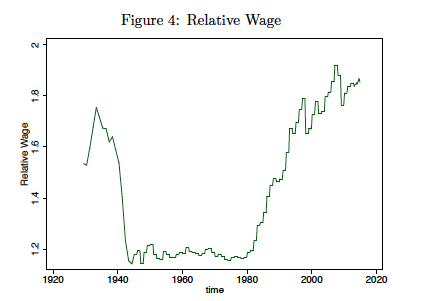

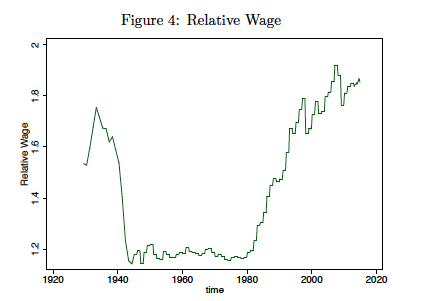

Why was/is it inevitable that finance would get disrupted?

in a nutshell: why people choose to work in finance

relative wage=avg wage in finance/avg rest of economy

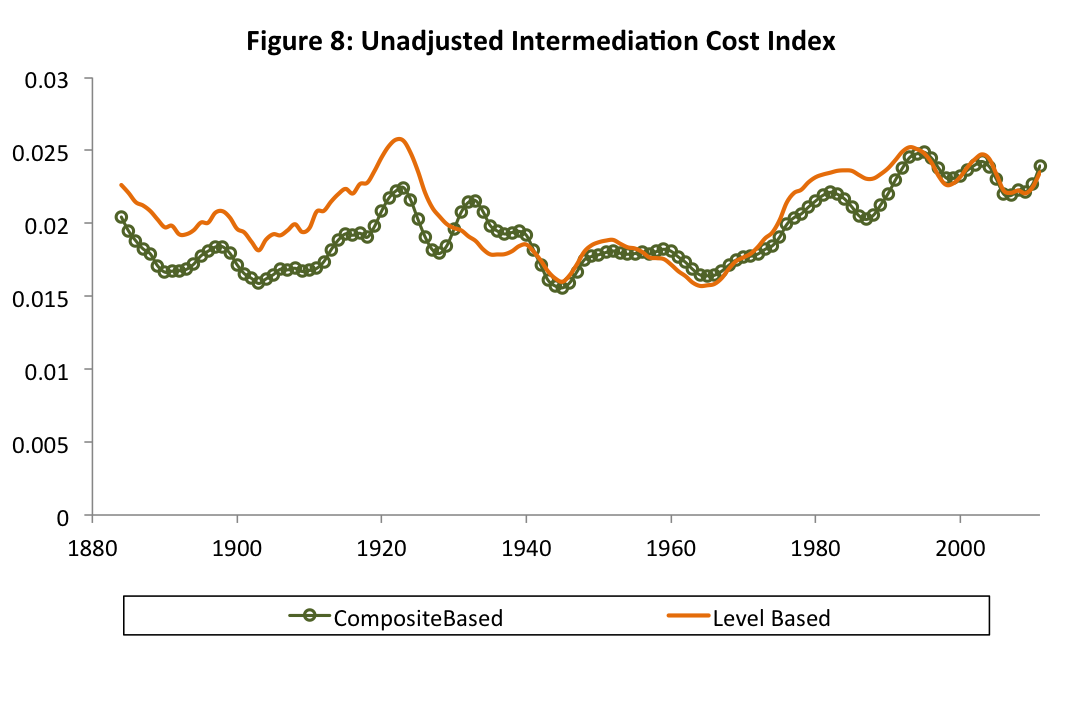

Source: Philippon (AER 2015) "Has the U.S. Finance Industry Become Less Efficient?"

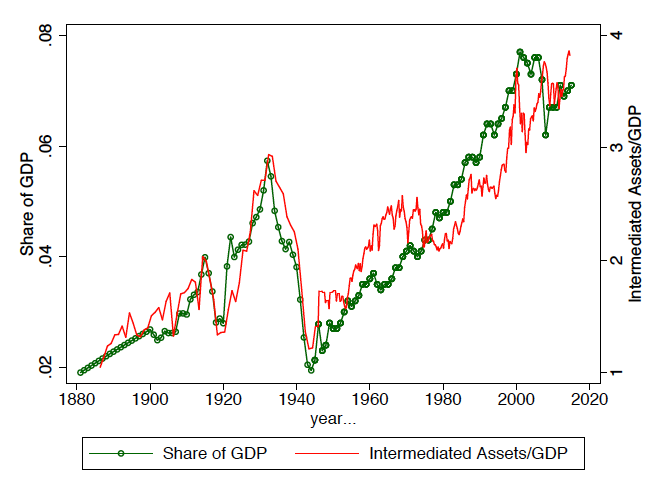

The Growth of Finance as % of GDP

Source: Philippon (AER 2015) "Has the U.S. Finance Industry Become Less Efficient?"

... and unit costs are flat!

Source: Philippon (AER 2015) "Has the U.S. Finance Industry Become Less Efficient?"

Ratio of the income of financial intermediaries to the quantity of intermediated assets

Workers in the Finance Industry benefit greatly from growth of finance

- Philippon and Reshef (QJE 2012):

- 1980: wage financial services=wage other industries

- 2006: financial services=170% x other

-

Goldin & Katz (AER 2008)

- 1969-74: 6% of Harvard grads went to Fin Industry

- 2006: 28%

-

Oyer (JF 2008):

-

wages Stanford GSB grads in finance industry

- 300% of wages in non-finance

-

wages Stanford GSB grads in finance industry

What explains high wages?

- High quality?

- Bai, Philippon, Savov (JFE 2013): No, markets haven't become any better/more informative.

- Better allocative efficiency?

- Aguiar and Bils (AER 2015): no improvement in risk sharing.

- No evidence that allocative efficiency has improved (typically measured by "total factor productivity" (TFP)).

- There is a dispute whether growth in finance has actually brought benefit to society ...

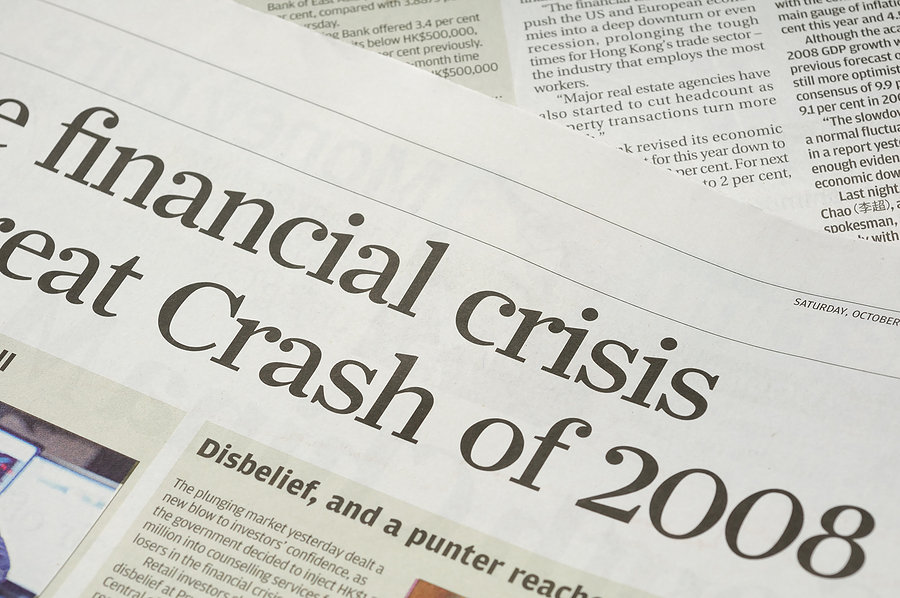

And then there's this:

which led to ...

High cost industries with high rents?

\(\Rightarrow\) Disruptive entry is bound to take place!

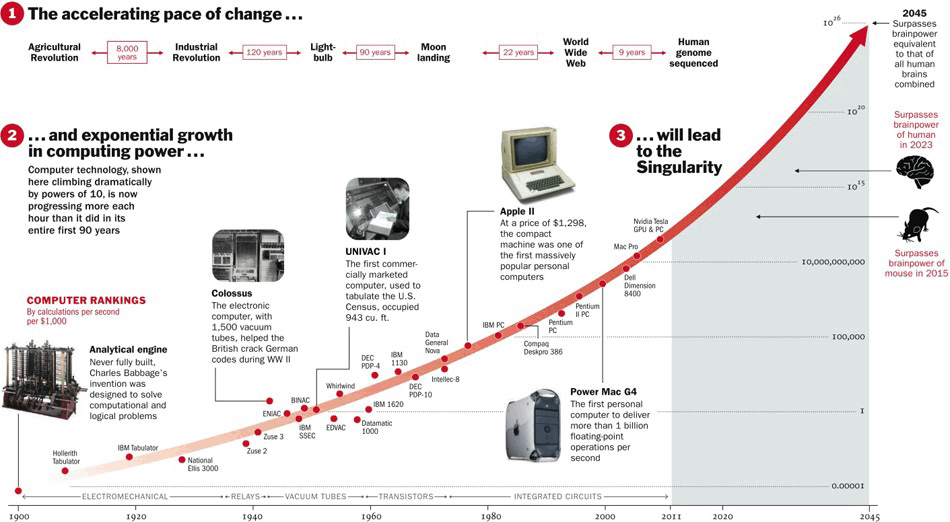

Key drivers?

But why "now" (after 2008)?

Main structural changes?

Main Structural Change

Main Structural Change

Main Structural Change

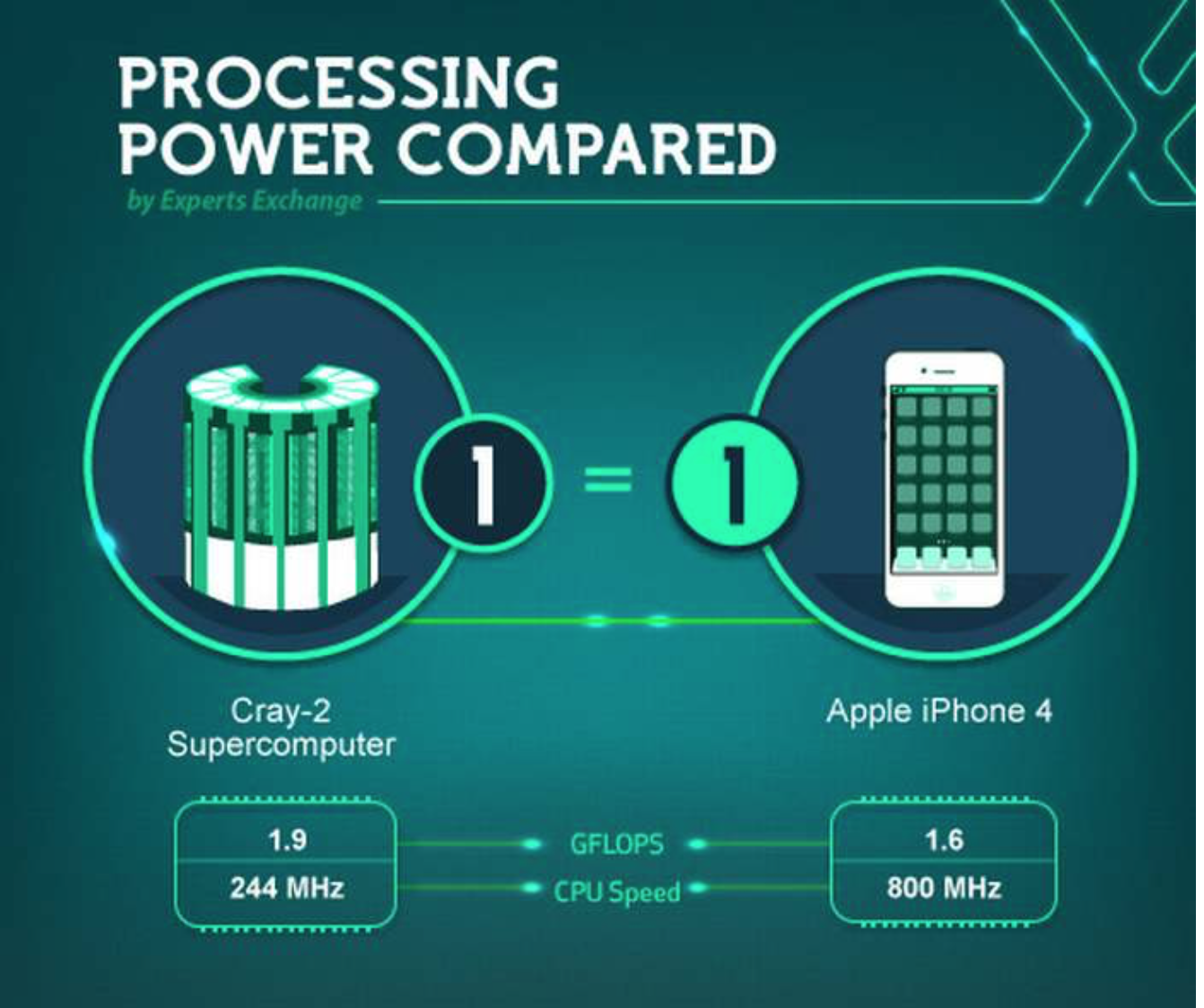

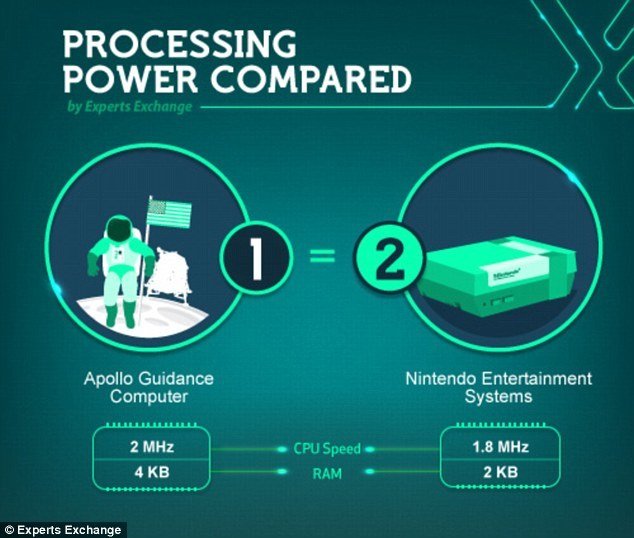

Fastest Computer in 1985!

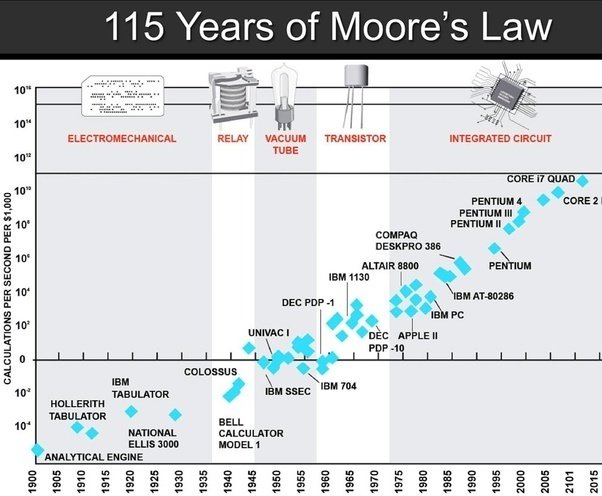

Main Structural Change

Moore's Law

"the number of transistors per square inch on integrated circuits had doubled every year since their invention."

(& the cost halved)

What is FinTech?

Key features

- focus on positive customer experience

- Willingness to apply technology in novel ways.

Approach: Propositions that are

- simpler, seamless

- more convenient,

- more transparent and

- more readily personalized.

based on EY 2017 FinTech report

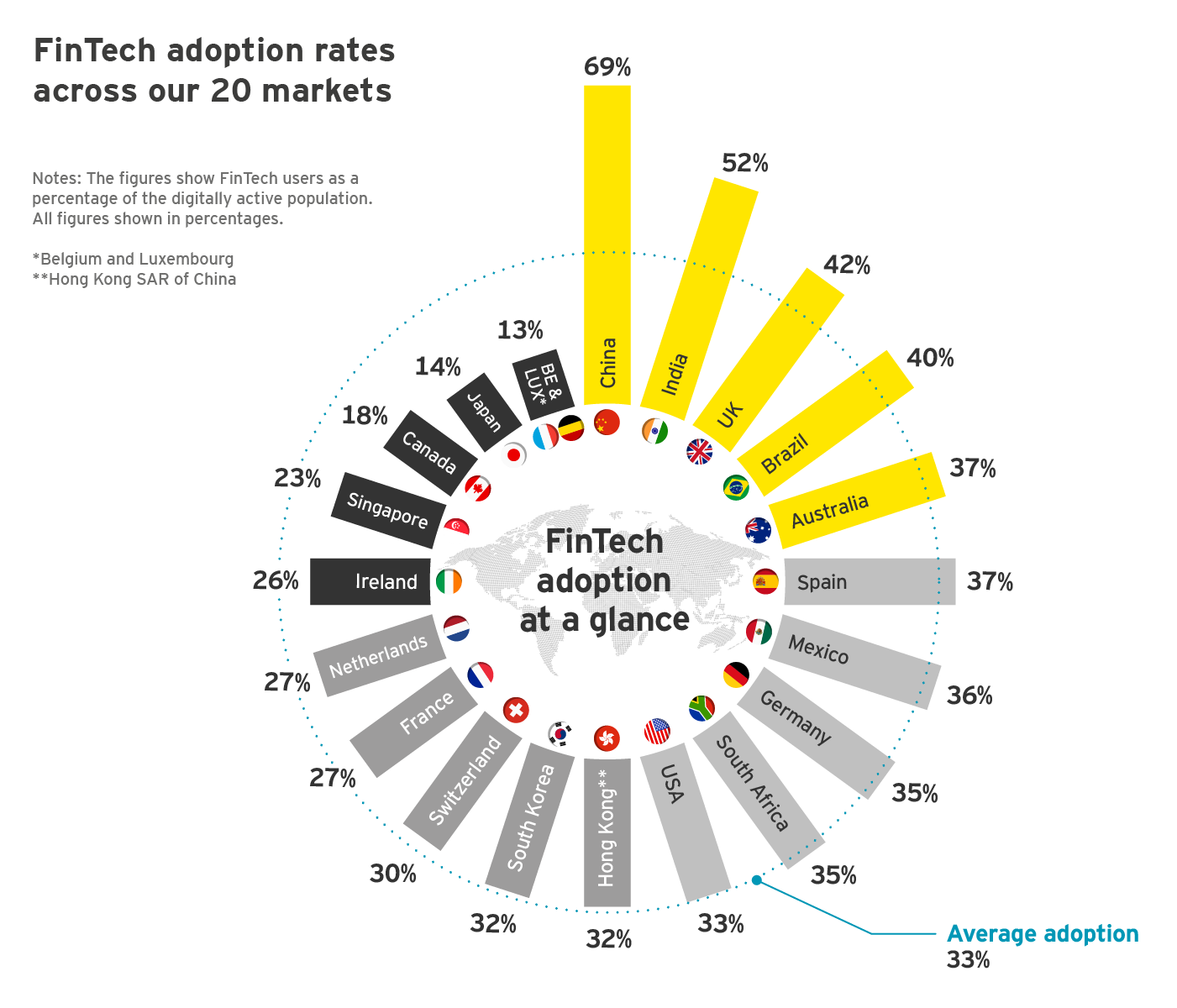

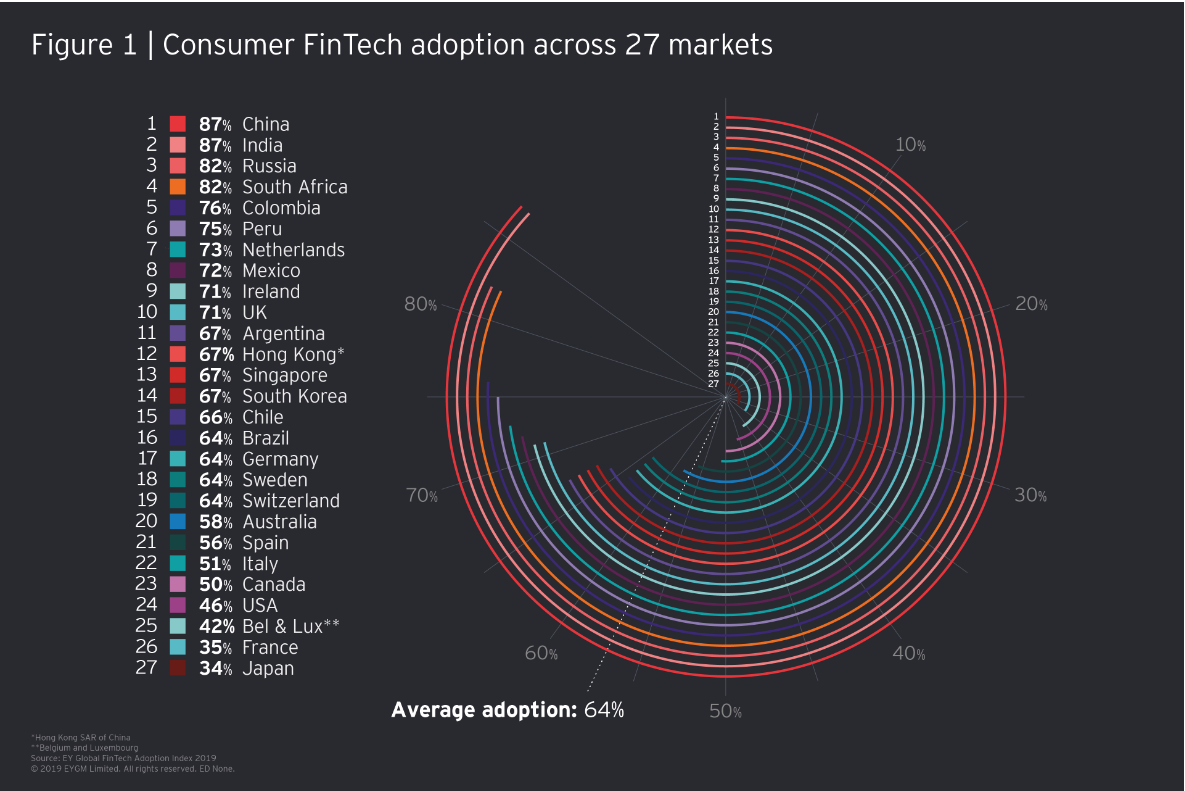

5-6 years ago many haven't heard of it!

Source: EY FinTech Adoption Index 2017

18%

Source: EY Aug 2020

Things are changing ...

- non-integrated IT systems

Things are changing ...

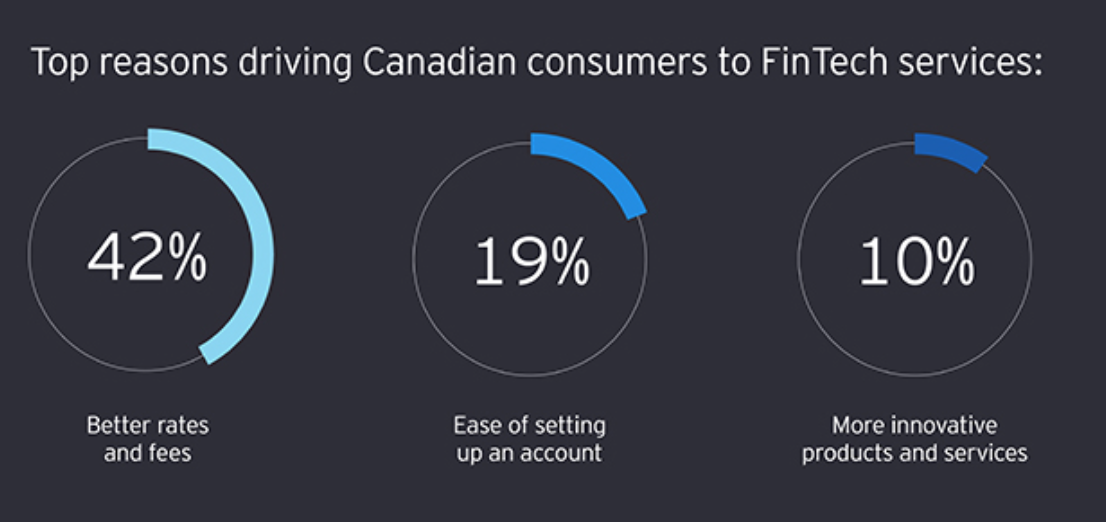

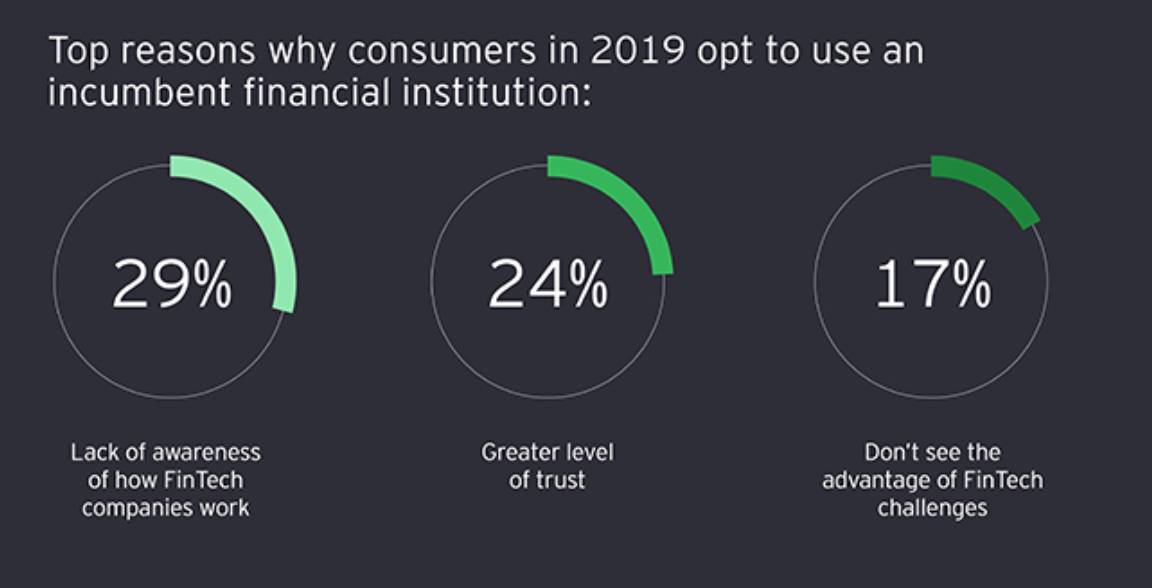

Why do people opt for traditional Financial institutions?

Why do people opt for FinTechs?

Things are changing ...

Obstacles

Source: Philippon (2017)

- non-integrated IT systems

Why disruption from outside?

Why disruption from outside?

- Financial Industry is self-contained

- for many years, hired a "certain" type of person

- "fixed" set of tech vendors

- Technological advances have the capacity to break into the industry

- but outside disruption is still difficult!

- access to financial infrastructure essential

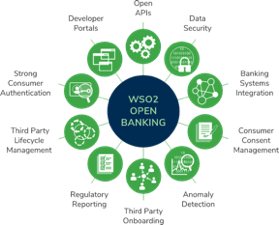

Example of a catalyst for the change:

https://liberal.ca/our-platform/a-fairer-financial-system/

- Was expected in Canada by Jan 2023 (even as of spring 2022)

- This would already have been 5 years after the UK

Source: Financial Post, Sept 9, 2021

Obstacles

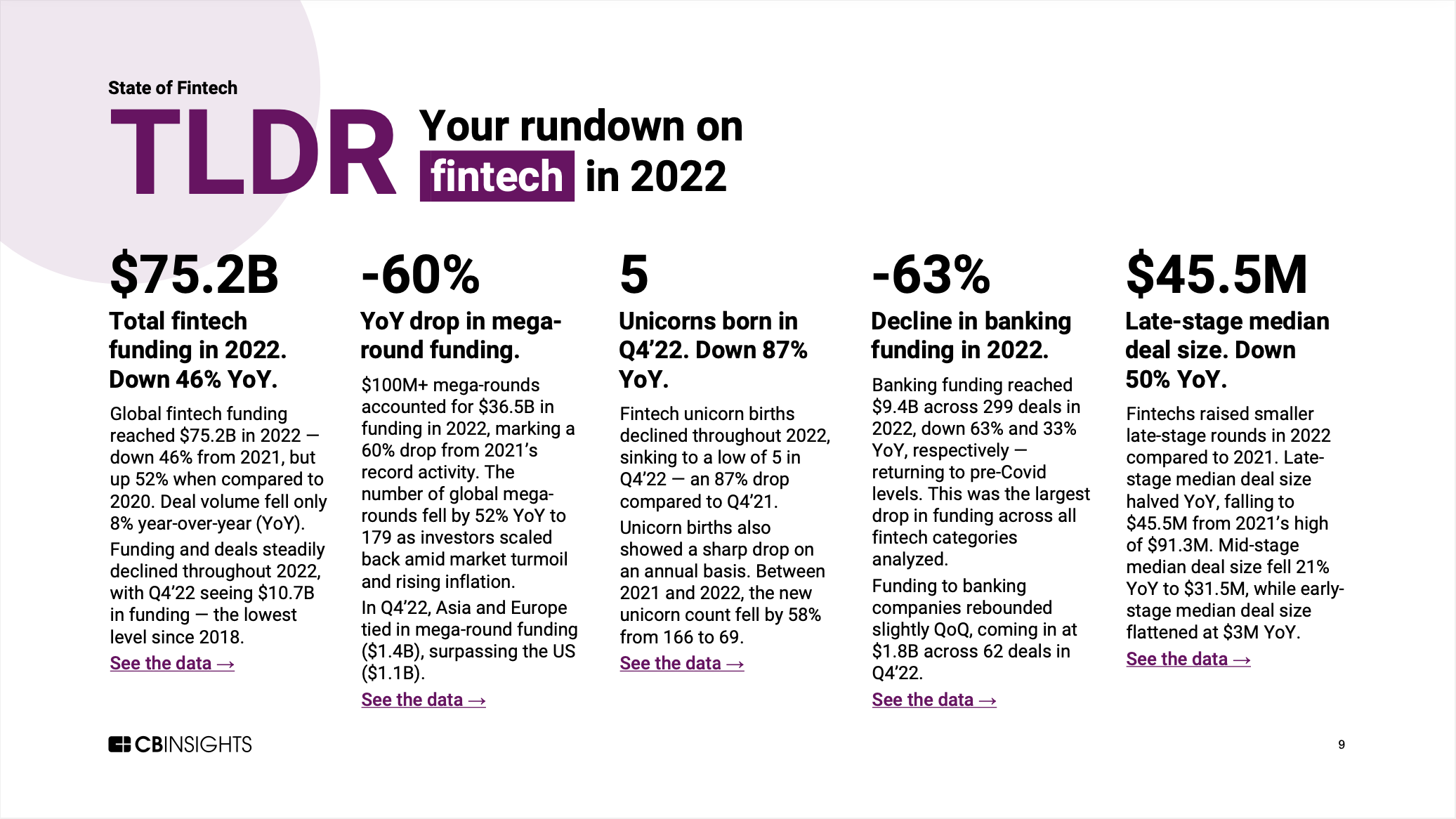

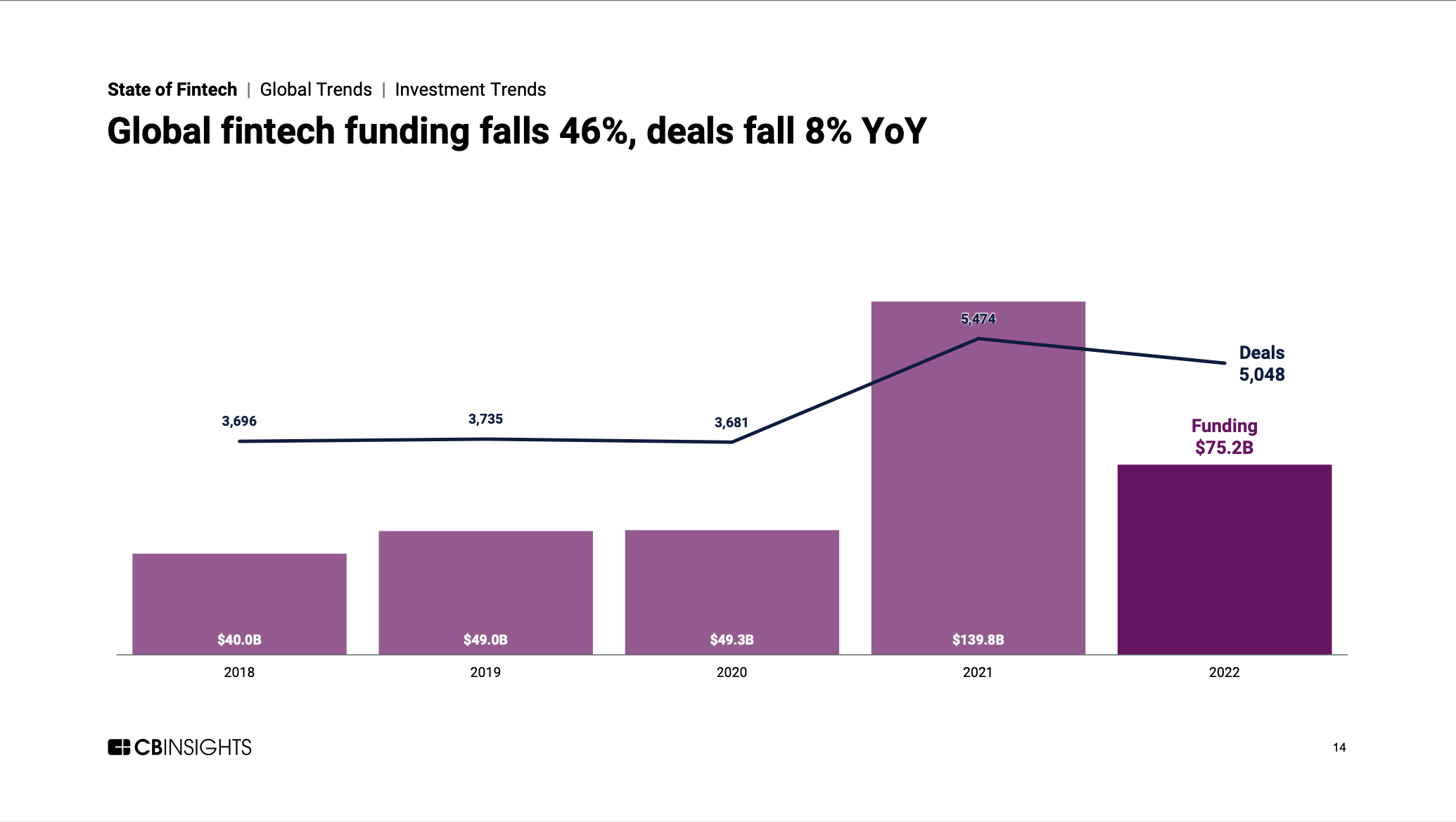

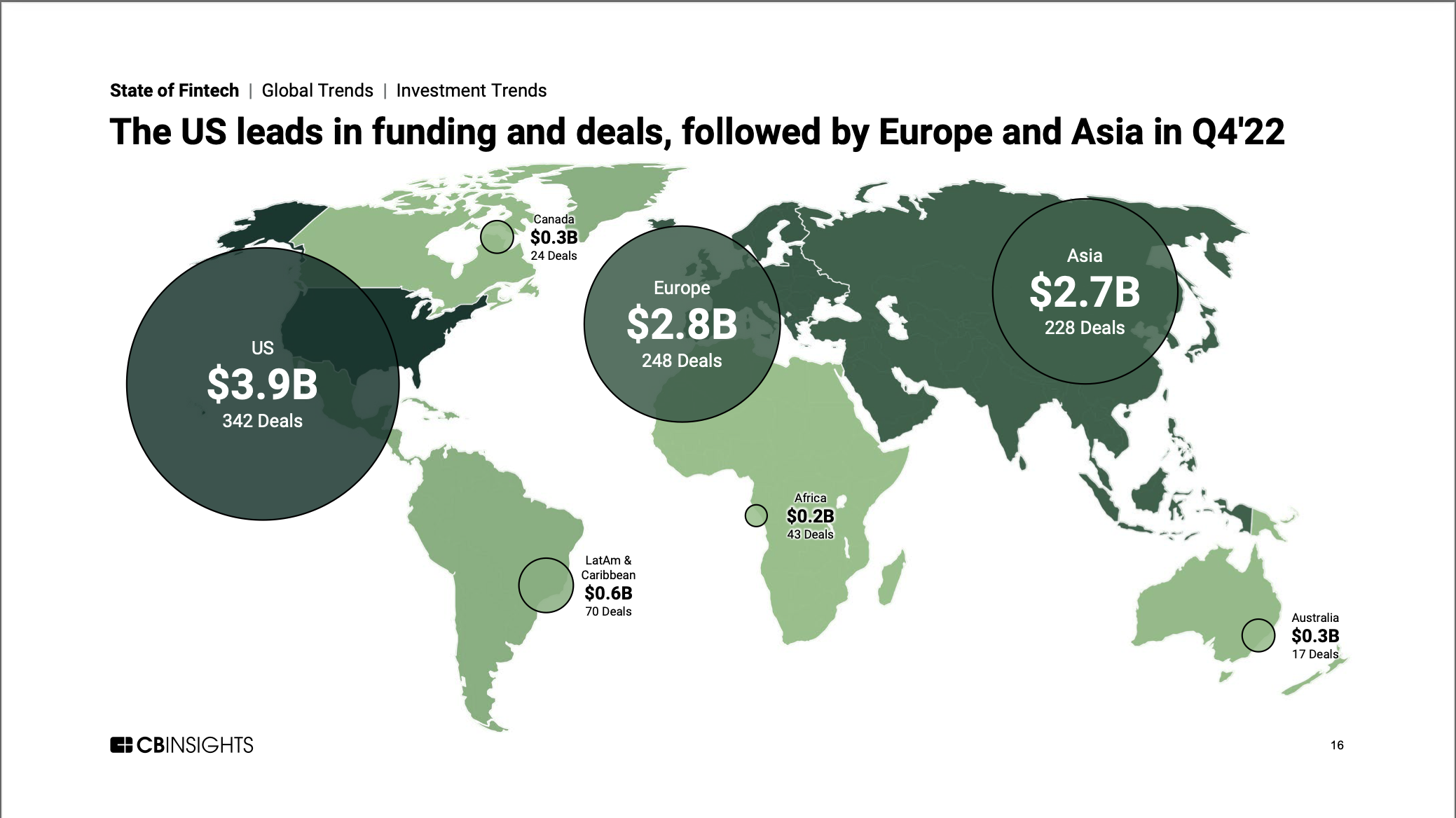

Current state of FinTech?

A few instructive examples and tales from the past ...

Let's look at a Big Bank: What does it do?

loans/credit

deposits

consumer

business

consumer

business

securitization

trading

clients

market making/prop

investment banking

M&A

securities issuance (debt/equity)

credit cards

insurance

investment advice

payments

Let's look at a Big Bank: What does it do?

Main role: Intermediation

- time intermediation

- people have and need money at different times

- size intermediation

- many small deposits but firms need big loans

- risk intermediation

- aggregate and then spread idiosyncratic risk

Traditionally: banks have been necessary for the financial system

- gigantic infrastructure

- people need accounts to store money etc.

What are their roles in the future?

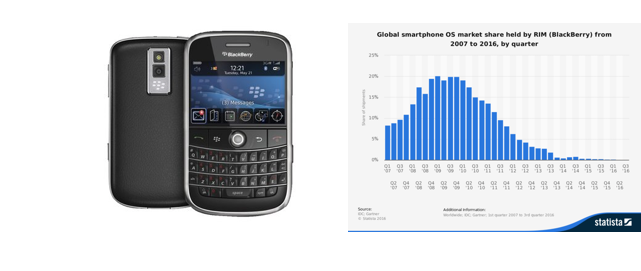

Nokia's market shares for devices:

- 2007: 49.4%

- 2012: 3%

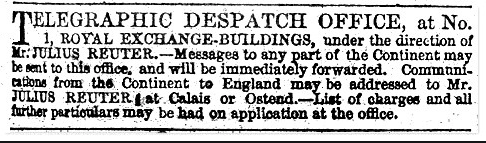

Little bit of history ....

- Keyboard

- Security

- Being businessy

- Cool and cutting edge

- Being Canadian

- Independence from desk

What did they pay for?

What do people value?

- Mobile email

- Brand name

- Easy access to branch

- Great product range

- Fair prices

- Great advice

- Latest tech

- Friendly tellers

- Safe-keeping of assets

- Moving money around

As banks move data into "the cloud," why do we need banks?

Blackberry vs. a Generic Bank

Key Insight: Open Platforms provide value

What took the place of Blackberry?

App stores

Future of banking?

A glimpse of a stock trade today

Alice wants to sell ABX

Bob wants to buy ABX

sell order

buy order

Clearing House

Stock Exchange

Broker

Broker

3rd party tech

custodian

custodian

record beneficial ownership

central bank/payment network

Would we design market this way if we were to start "from scratch" today?

"joint ,single system"

"silos" &

painful

transaction

reconciliation

A Tale of Railroads

US Standard railroad gauge (distance between the rails) is 4 feet, 8 1/2 inches

Because that's the way they built them in England

that's the gauge used for pre-railroad tramways

the same jigs and tools that they used for building wagons, which used that wheel spacing

other wheels would break on old roads. Because that's the spacing of the old wheel ruts

The first long distance roads in Europe were built by Imperial Rome

Regulation & innovation

IOSCO (International Organization of Securities Commission): Policy recommendations for Decentralized Finance (DeFi). Sept 2023.

“same activity, same risk, same regulatory outcome” [..] regardless of the technology

To facilitate a level-playing field between crypto-asset markets and traditional financial markets

regulatory frameworks for DeFi [..] should seek to achieve regulatory outcomes for investor protection and market integrity that are the same as, or consistent with, those required in traditional financial markets

products and services offered in the DeFi markets [..] do not materially differ from [..] traditional financial markets, [..] the same risks, along with additional risks

Economic Insights for Regulation?

Economic Insights for Regulation?

- Ultimately: new risks

- Functions and entities that create market failures change or disappear:

- fewer intermediaries \(\to\) fewer agency conflicts

- But: new entities hold deposits

- QuadrigaCX, FTX

- smart contracts \(\to\)real-time view of transactions

- But: only as "smart" as their source code (code audit?)

- fewer intermediaries \(\to\) fewer agency conflicts

- Moving to open systems requires international cooperation

How to FinTech?

- non-integrated IT systems

Clayton Christensen: customers don’t buy products; instead, they hire a solution to help them complete a specific job at a specific time.

https://youtu.be/sfGtw2C95Ms

Consequence of FinTech

Impact on incumbents: struggle to deliver the seamless and personalized user experience.

Consequence: ripple effect

-

consumers expect convenience for all financial products and from all service providers

- retail banking,

- wealth management or

- insurance.

based on EY 2017 FinTech report

Problem for incumbents

- FIs focus on their needs and wants

- => are not customer-centric

Three types of FinTechs (?) - very loosely

- Those that start outside of FIs and would like to collaborate with FIs.

- Those that started outside of FIs and now collaborate FIs.

4. Big Tech Firms

3. Those that work to replace or change the financial system as we know it.

We will leave the rest of this deck for when we cover the relevant topics!

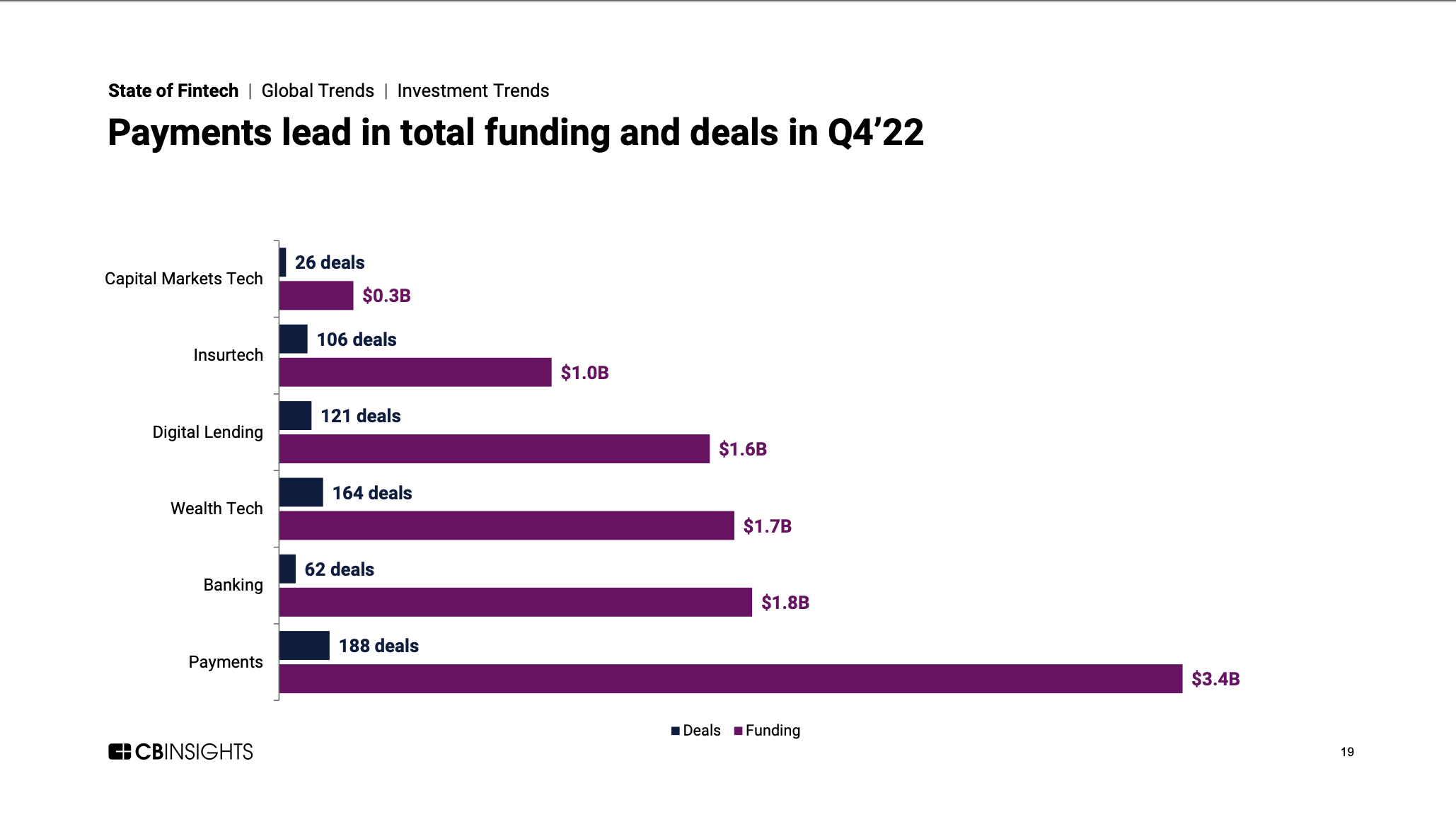

Which areas do we expect/see disruption to occur in?

Some Core Functions of Financial Institutions/Banks affected by FinTechs

Lending and Borrowing

Wealth Management

Payments

Investment Banking Services

Payments

5% to cab firm and 10-day delay

International remittances: $600B (U.S.) p.a.

all in: 10% fees

Payments

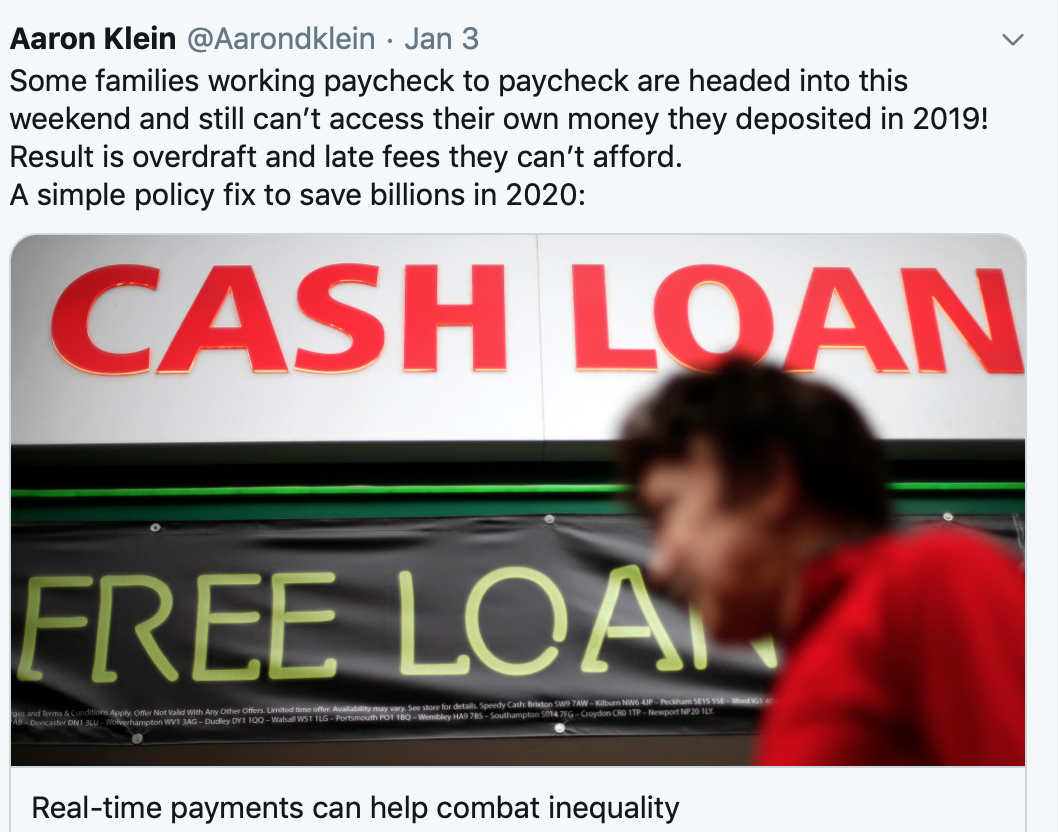

https://www.brookings.edu/opinions/real-time-payments-can-help-combat-inequality/

Importance of Real-Time Payments

https://www.brookings.edu/opinions/real-time-payments-can-help-combat-inequality/

Payments

500M users in India

free international transfers at Interbank rates

used by >60% of total population in Denmark

- 1 billion WeChat users

- >150K in Greater Toronto

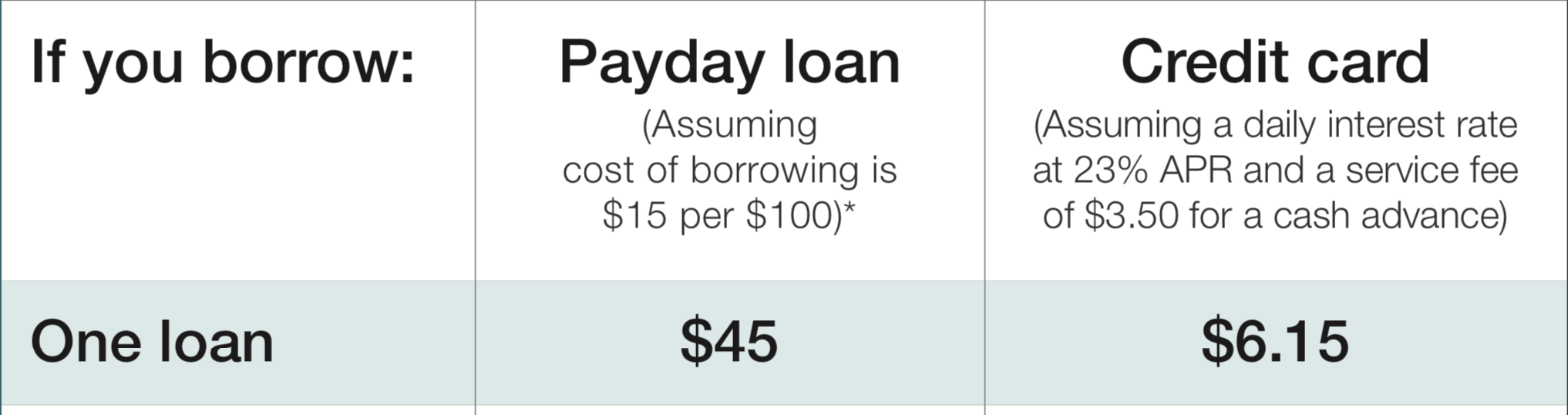

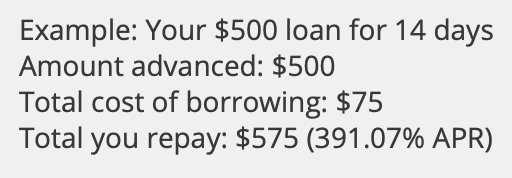

Lending and Borrowing

price for loan

effort required to get loan

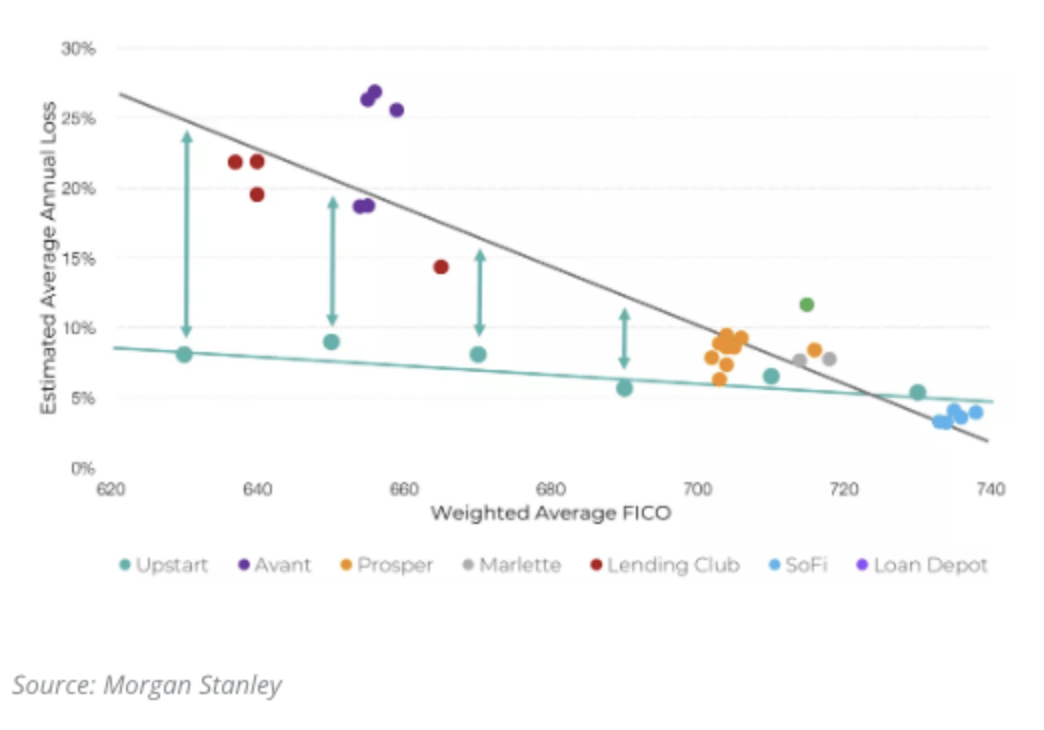

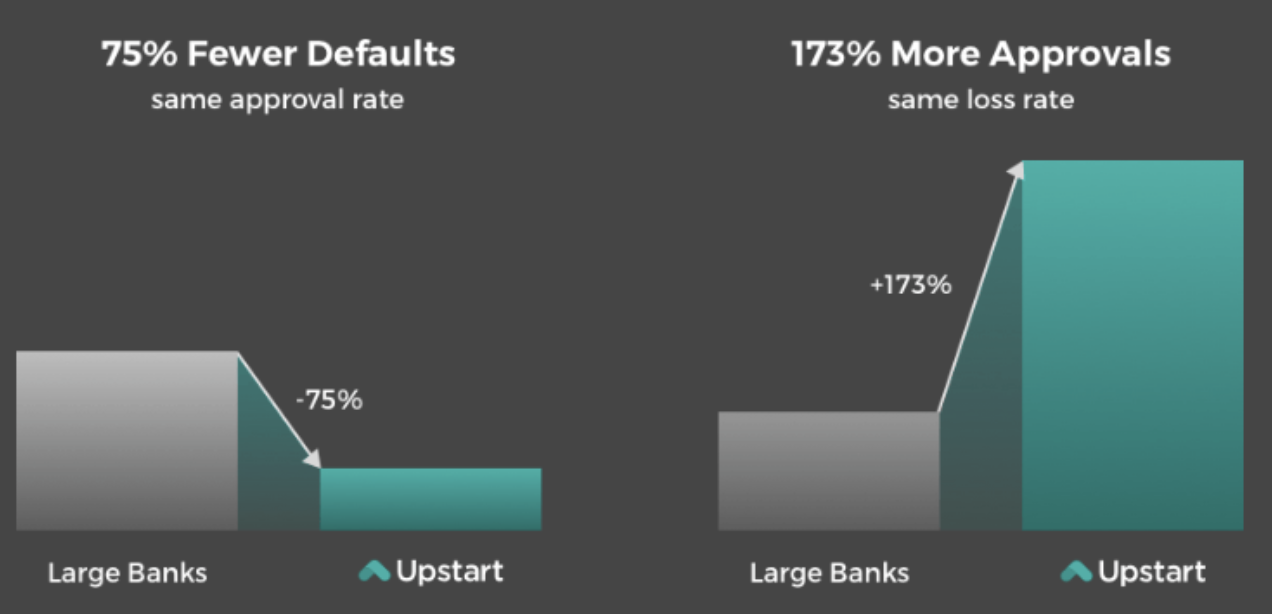

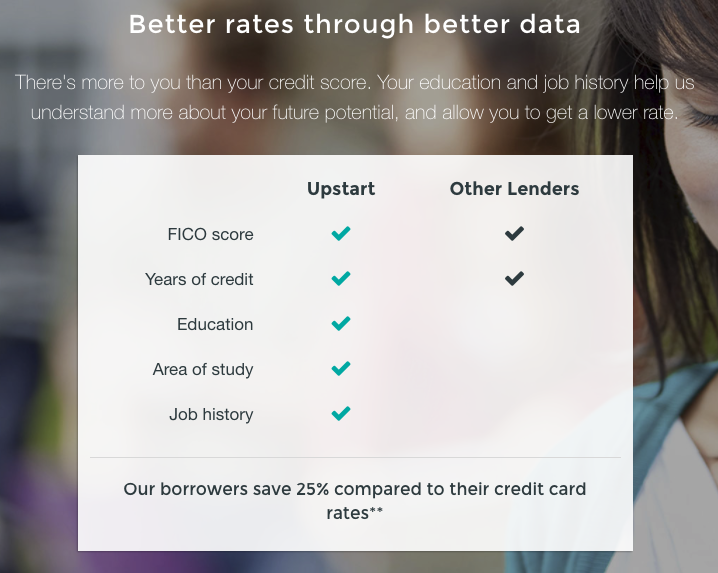

Lower losses than competitors

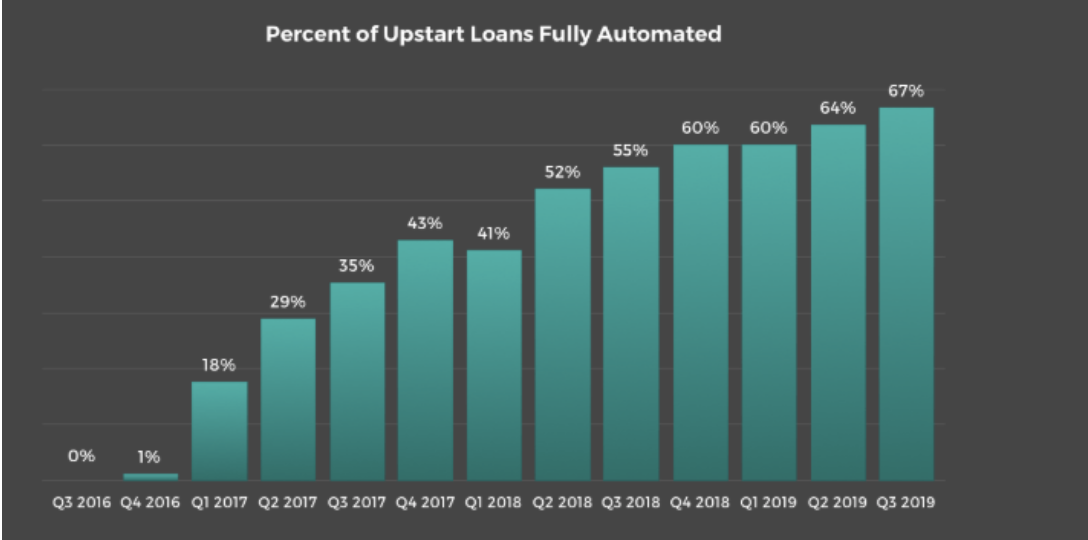

Example: Upstart

Tools?

AI& Machine Learning

Example: Lending Club

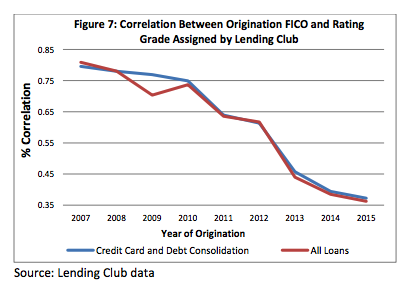

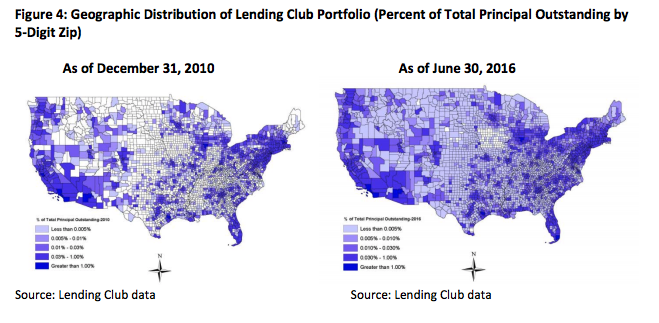

Source: Jagtiani & Lemieux, 2017, Philly Fed Working Paper 17-17

Future: Scalability

Source: Jagtiani & Lemieux, 2017, Philly Fed Working Paper 17-17

WealthTech

- availability of investment products

- fee transparency

- regulatory changes

- mobile savvy users

some key changes in recent years:

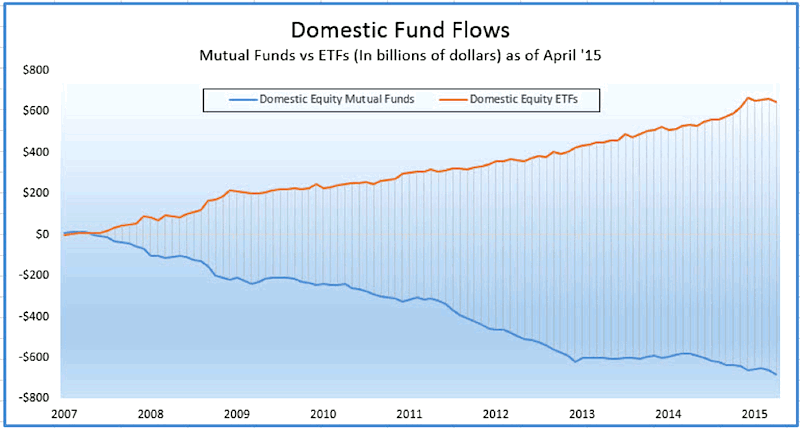

New, low-cost Investment Products: Exchange Traded Funds (ETFs)

US data: https://www.seeitmarket.com/what-are-etf-and-mutual-fund-flows-trends-telling-investors-now-14449/

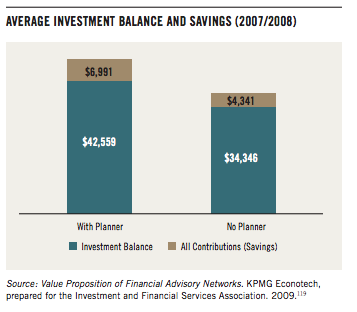

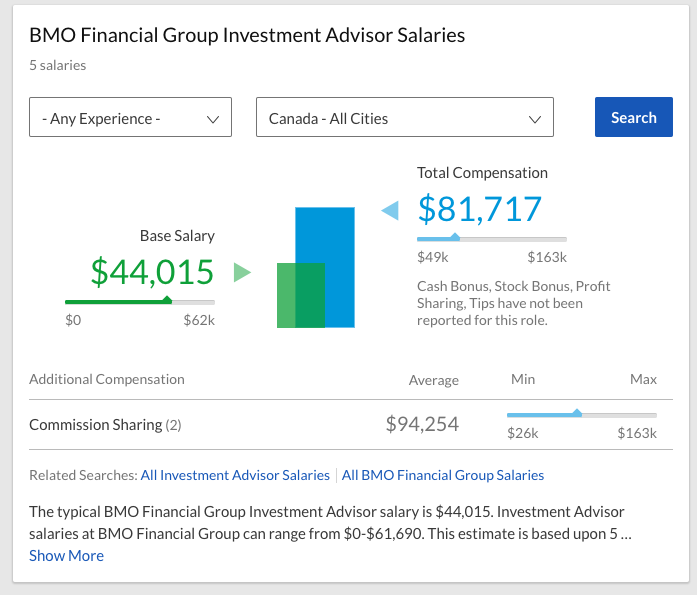

Help from financial advisors is useful for the average investor but ...

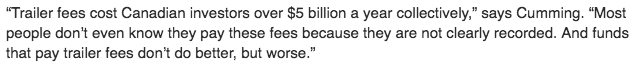

... all evidence points to severe conflict of interest

Regulatory changes force structural changes in fund management

- ban on [some] trailing fees

- for funds: separation of research fees and commissions

- best interest vs suitability

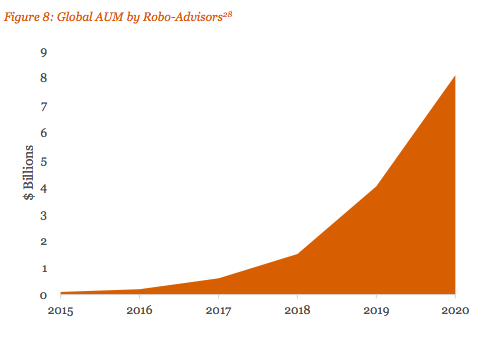

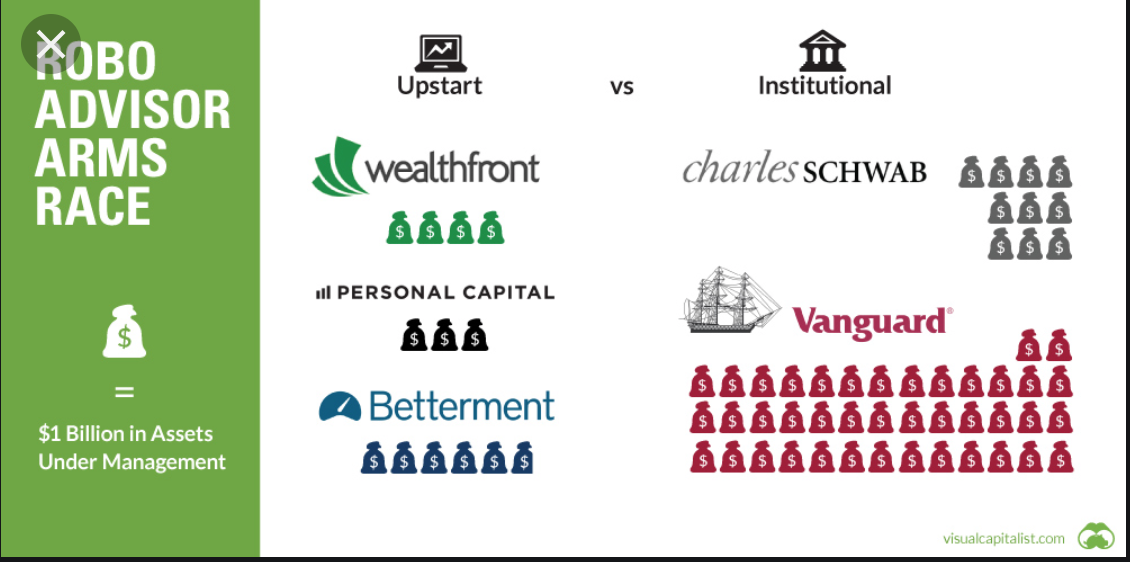

=> automation = Robo Advisors!

Older projections

Evolution IS CRITICAL for success!

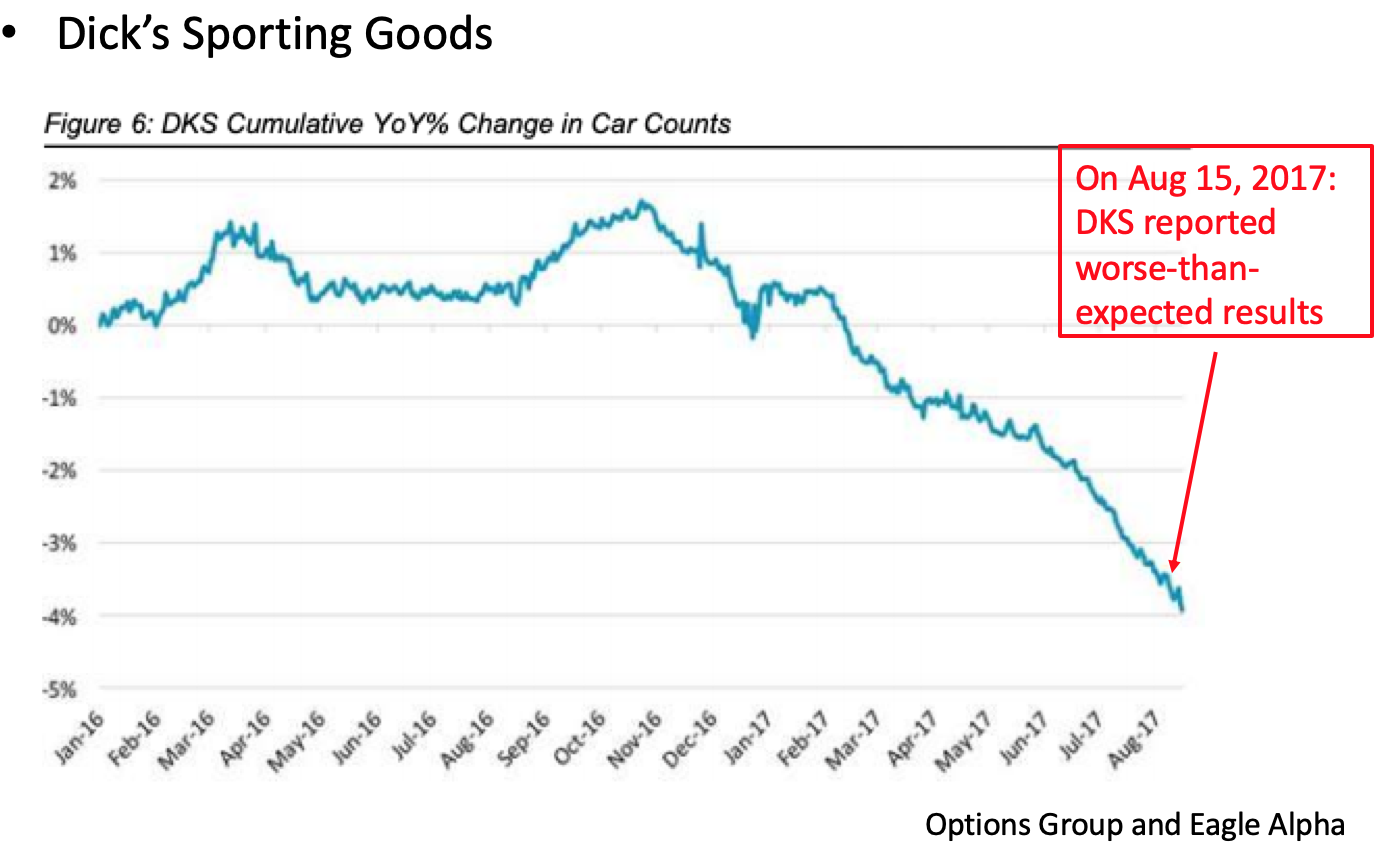

Big Data, Machine Learning, AI

Big Data, Machine Learning, AI

- Data is valuable

- Alternative data:

- Better Governance Mechanism (Zhu (2019))

- Too much of "low quality" info may discourage long-term info acquisition (Dugast and Foucault (2018))

- Concerns?

- Privacy?

- Discrimination?

- Opacity of algos!

Big Data, Machine Learning, AI

- Useful tools for prediction

- Outperform standard forecasting models (Gu, Kelly, Xiu (2019))

- ML/AI is an "umbrella term"

- Many, many, many different tools!

- Not a "magic wand"

Big Data, Machine Learning, AI

- MIND: Horizons ACTIVE A.I. GLOBAL EQUITY ETF

- "The ETF allocates its equity index exposure using a proprietary artificial intelligence selection process that extracts patterns from analyzing data"

MIND

MSCI World Index

"Part of its underperformance [relative to the MSCI Index] was because the artificial intelligence behind the ETF didn’t include currency hedging" (Horizons ETFs Canada CEO Steve Hawkins)

Type 3: Those that want(-ed?) to "blow up the banks"*

*= disintermediate

everything

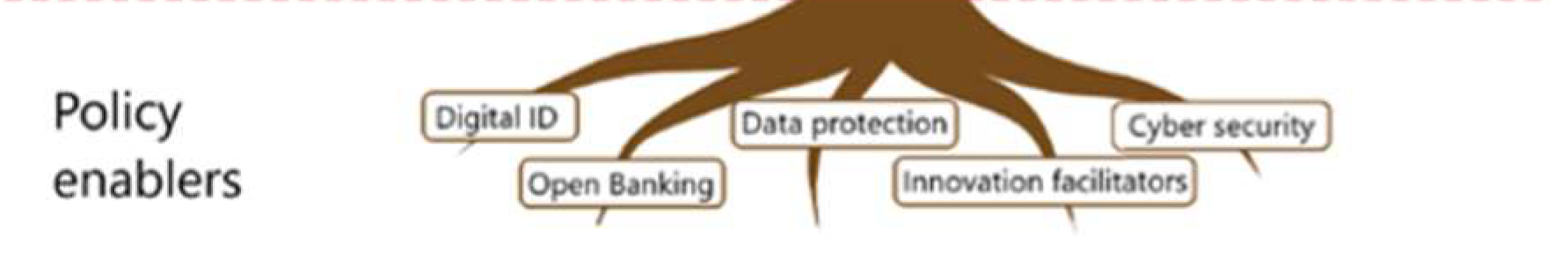

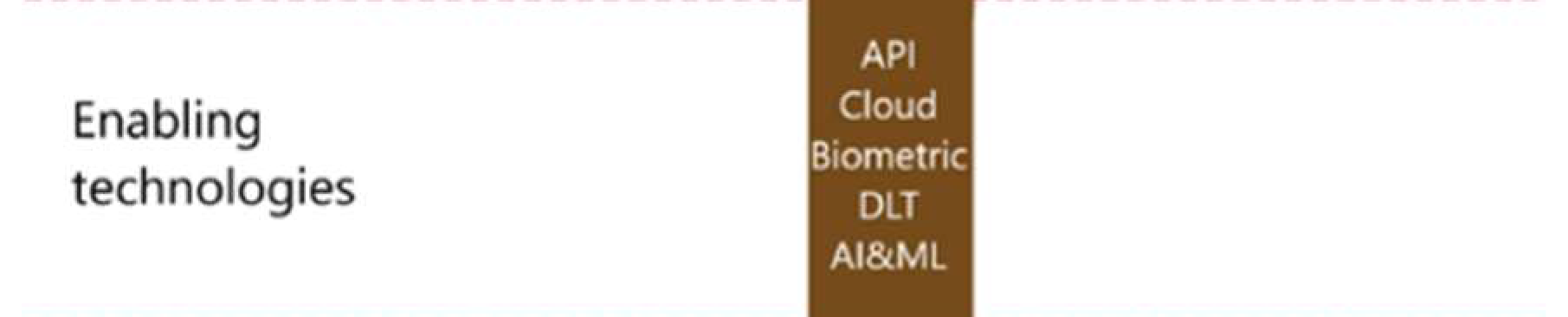

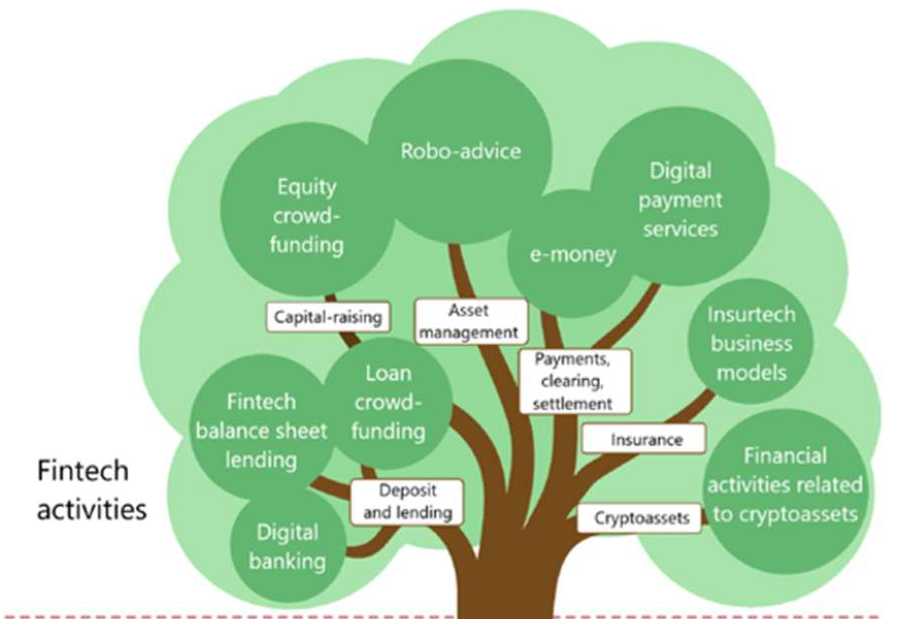

The FinTech Tree

Source: Leckow & Frost, BIS Aug 2021

@katyamalinova

malinovk@mcmaster.ca

slides.com/kmalinova

https://sites.google.com/site/katyamalinova/

Taxonomy of the FinTech Ecosystem

RegTech

Compliance

Security

Crowdfunding

Payments

Lending and Borrowing

Digital Wealth

Personal Finance

Platforms & Open Banking

Data and Analytics

AI&ML

InsurTech

Blockchain, DLT

Cryptocurrencies

Stablecoins

FinTech

What I hope you'll get out of the course

- solid understanding of FinTech ecosystem

- basic understanding of critical tools

- ML/AI + big data analytics

- blockchain tech

- idea generation: find your business creativity!