Blockchain Technology in Finance: Wrapping Up

Instructor: Katya Malinova

Course : F741 Fall 2023 (October 11 & October 18)

Goals for this set of slides

- Wrapping up the topic of blockchain

- Some "key" vocab and challenges

- "Other topics" that are fun but that we don't have the time to cover

- Mostly "headlines"

recall the key concepts

blockchain=

an infrastructure for digital resource transfers

cryptocurrency =

internal payment mechanism to pay for operation of a blockchain

A Taxonomy of Tokens

- tokens are a re-imagination of value, ownership, use, rewards

-

tokens live on a single infrastructure and can interact with other tokens

- tokens are immediately transferable & immediately usable in DeFi

- token can be programmed to have many features and have many different uses

- tokens can assign ownership to "things" that could not be owned before

What's a crypto-token and what's special (and positive) about it?

- a blockchain is a protocol in which

- users have direct control and responsibility over their assets

- users can create codes at will

- \(\rightarrow\) any user can create tokens and applications

Tokens by use

payments:

- you use them strictly to pay for something

- example: native cryptocurrencies

utility

- you use them to access a specific service of function

- example: filecoin

asset

- representation of ownership

- pool claims, digital items

- example: receipts from UniSwap, Compound, NFTs

Disclaimer: this list in non-exhaustive, new ideas and concepts come up every day!

Tokens by use

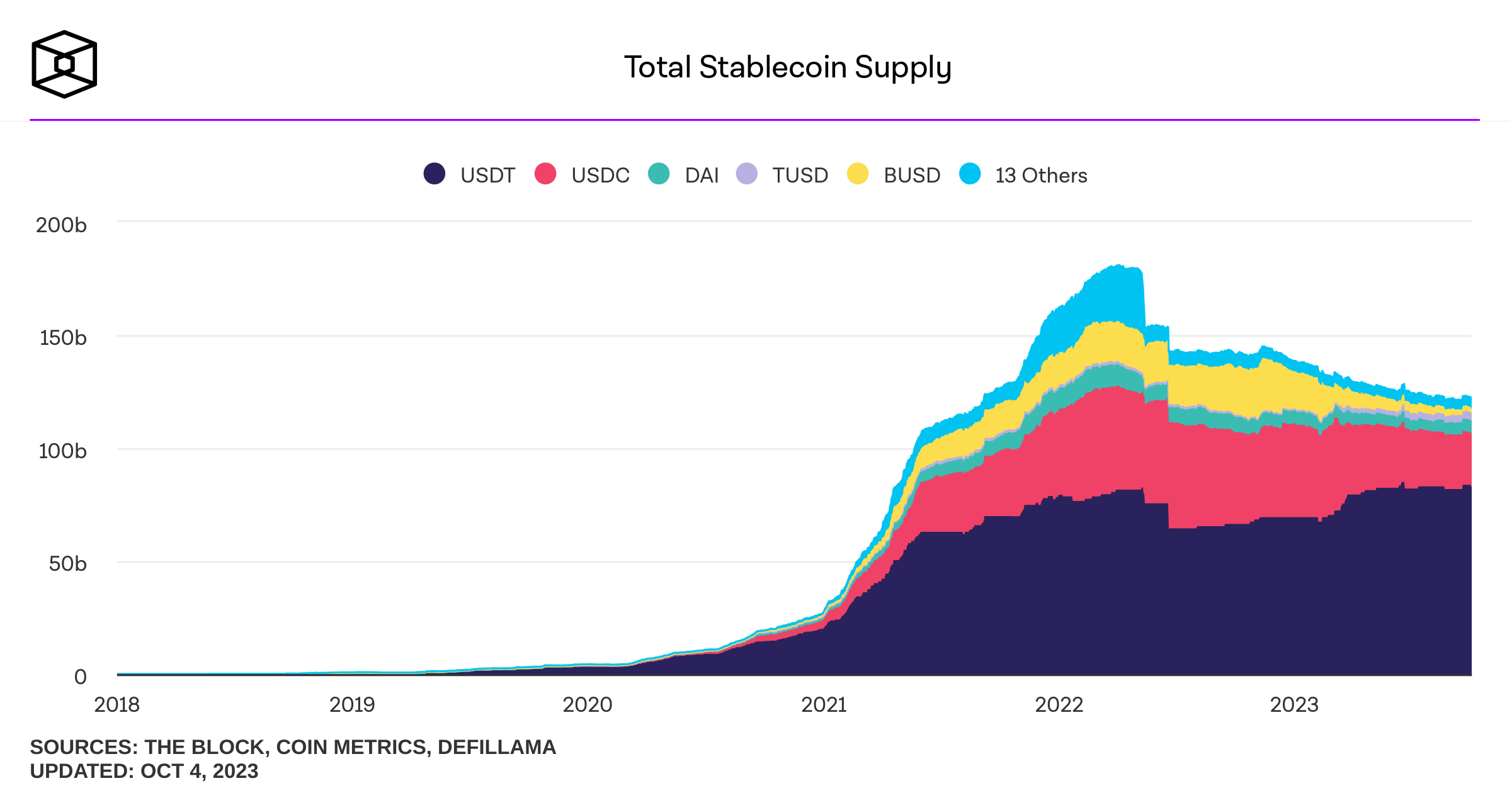

stablecoins

- digital representation of fiat money

- centralized/ decentralized

- examples: DAI, USDC, USDT

governance

- voting rights to determine parameters of a project

- example: UNI, Compound etc

derivatives

- tokens based on other tokens & functions

- Example: Synthetix, dYdX

Disclaimer: this list in non-exhaustive, new ideas and concepts come up every day!

Why are Blockchains challenging for current regulation?

The Investment Process

issuers

investors

- funding

- record-keeping

- instruments

- custody

- advice

- trading

services

needed & provided

- takes care of custody and allows self-custody

- allows instrument creation

- enables record-keeping

- allows circumvention of existing institutions

A general purpose value management infrastructure:

intermediaries

separate institutions

- asset custodians

- broker-dealers

- trading platforms

The blockchain reality:

new institutions

emerged that do all three

tokens are often not intended to be investments!

Regulatory issues: U.S. test for whether it's an investment contact (security)

Similar regulation in Canada: look up the Pacific Coast Coin test

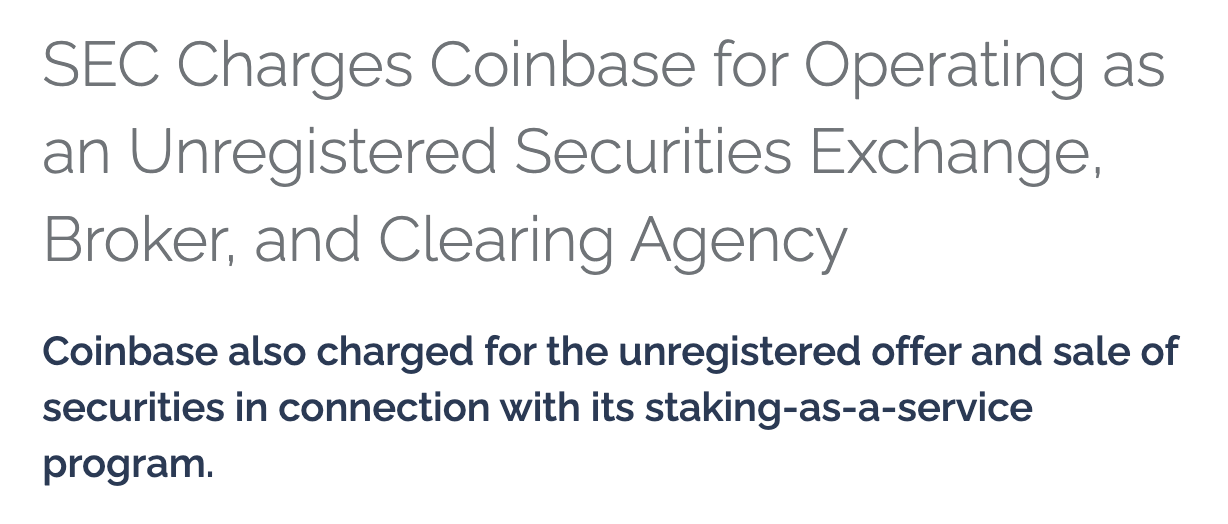

Examples of regulatory actions & controversies

the SEC vs. Ripple (ongoing)

Ripple Labs: appeared in 2012.

- promise to provide financial institutions with low-cost and speedy clearance of cross-border money transfers.

- the RippleNet network, cryprocurrency XRP, settled & cleared in real time

- XRP was used to raise funds in 2013.

- Dec 21, 2020: SEC files a lawsuit: Ripple broke securities laws.

- Dec 28, 2020: Coinbase delists XRP.

July 13, 2023: Judge Analisa Torres rules:

- Ripple did not break the law when XRP was sold on public exchanges

- XRP is not a security per se!

- But: Ripple did break the securities laws when it sold XRP directly to hedge funds and other institutional buyers.

the SEC vs. Terraform Labs

Terra-Luna (more later: UST "stablecoin" crashed, wiped $42 Bln in May 2022):

-

Terraform Labs and its founder Do Kwon

-

charged with "with orchestrating a multi-billion dollar crypto asset securities fraud" Feb 2023

-

moved to dismiss the case

-

July 31, 2023: Judge Jed Rakoff:

- denied Terraform Labs' motion to dismiss an SEC lawsuit.

- rejected the use of a ruling from Judge Torres who ruled that Ripple did not violate securities law in selling XRP to retail investors through an exchange intermediary.

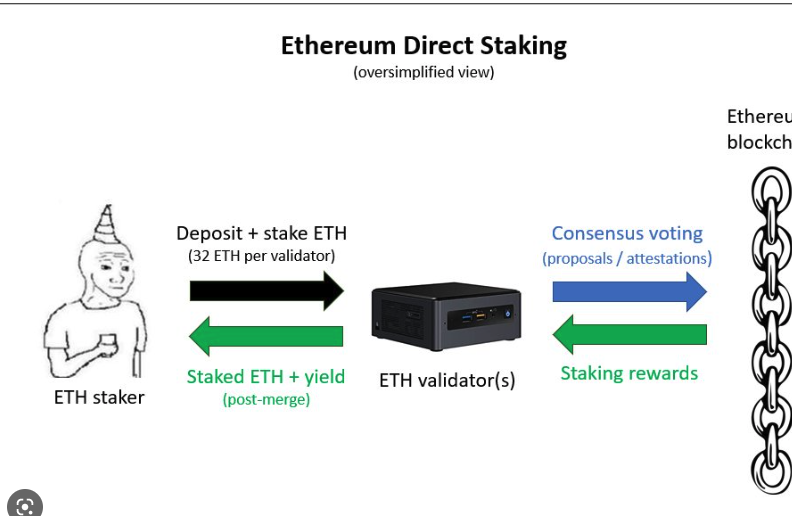

Staking: One word, multiple meanings

Very loosely: locking in the funds

Staking as a Validator

June 06, 2023

Ongoing:

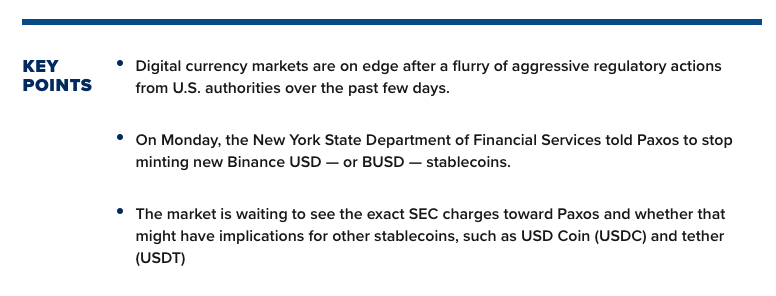

Stablecoins

BTC, ETH

fiat: USD, EUR

assets (e.g., gold)

not convinced

Crypto

Traditional

Algorithmic

Collateral-Backed

Taxonomy of Stablecoins

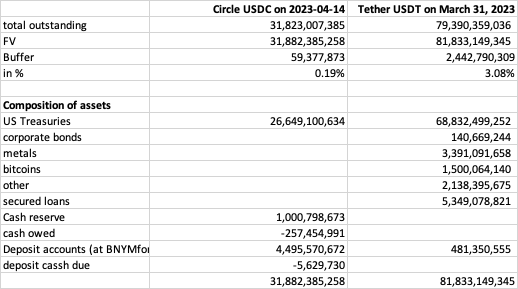

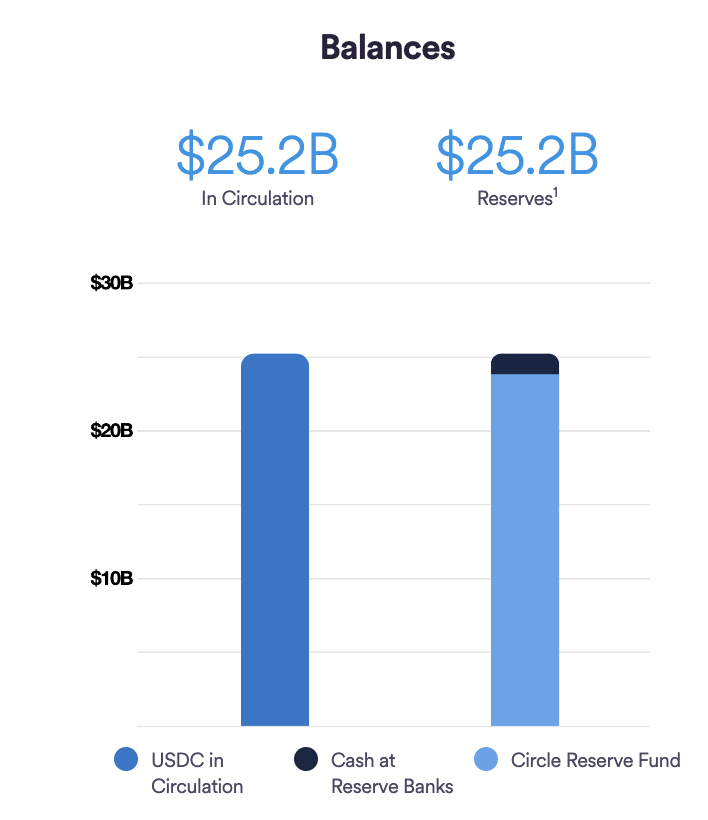

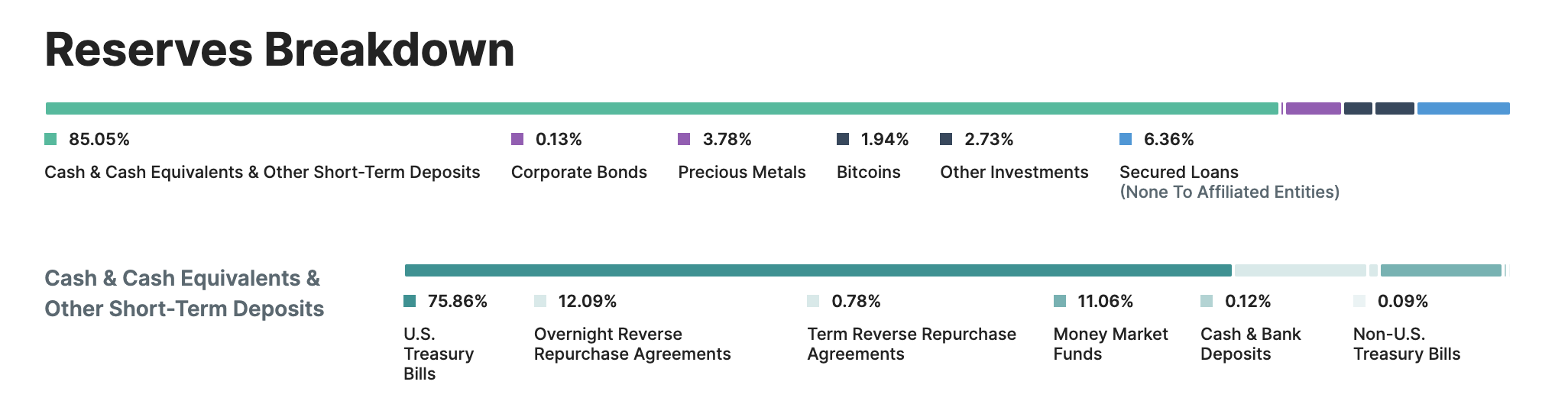

Asset-Backed stablecoins: USDT & USDC

USDC

Stablecoins: Digital Representations of the USD

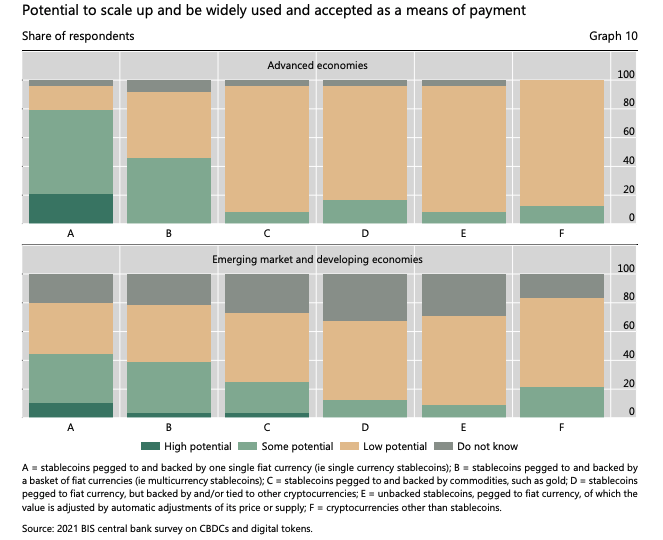

BIS Survey of Central Banks:

Caution: the Terra Implosion

UST Stablecoin

LUNA (cryptocurrency of the TERRA network)

"Algorithmic stablecoin", arguably based on "voodoo economics" to begin with

Odd Lots podcast has an excellent episode on this collapse

How did UST work?

- "algorithmic stablecoin" UST

- network token LUNA

- \(\to\) a utility token/cryptocurrency for the TERRA blockchain

- \(\to\) has value if people value the network

- When 1UST > 1USD

- \(\to\) print more tokens

- \(\to\) inflation

- \(\to\) price UST \(\searrow\)

- When UST < 1USD

- \(\to\) exchange 1 UST for $1 of LUNA

- \(\to\) receive $1 worth of something that cost < $1

- \(\to\) demand for UST \(\nearrow\)

- \(\to\) price for UST \(\nearrow\)

- What is the problem?

- conversion leads to inflation of LUNA

- \(\to\) large conversions lead to inflation \(\to\) price drops in LUNA

- \(\to\) conversion takes time and price may drop too fast

- \(\to\) wrecks the arbitrage mechanism

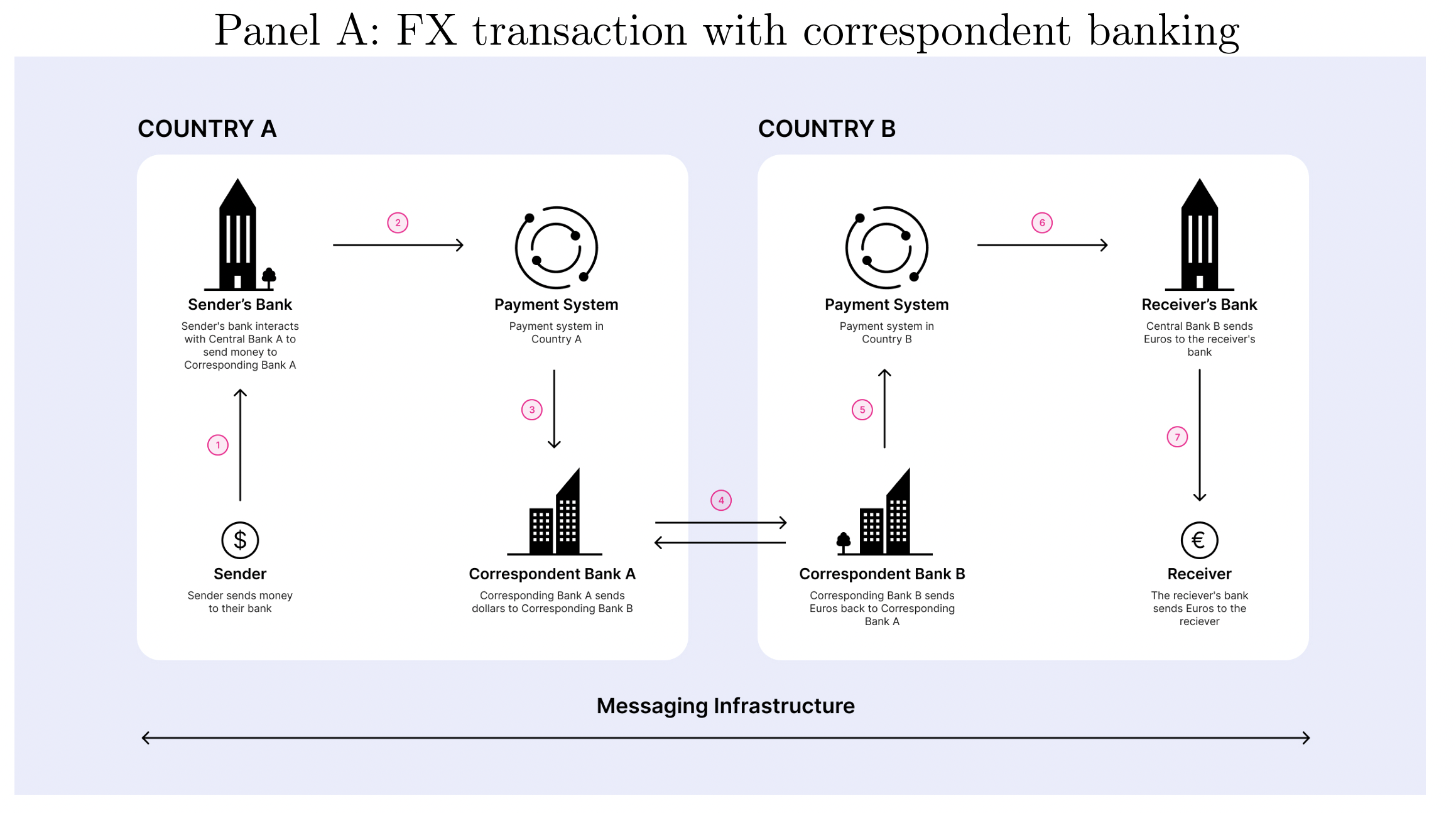

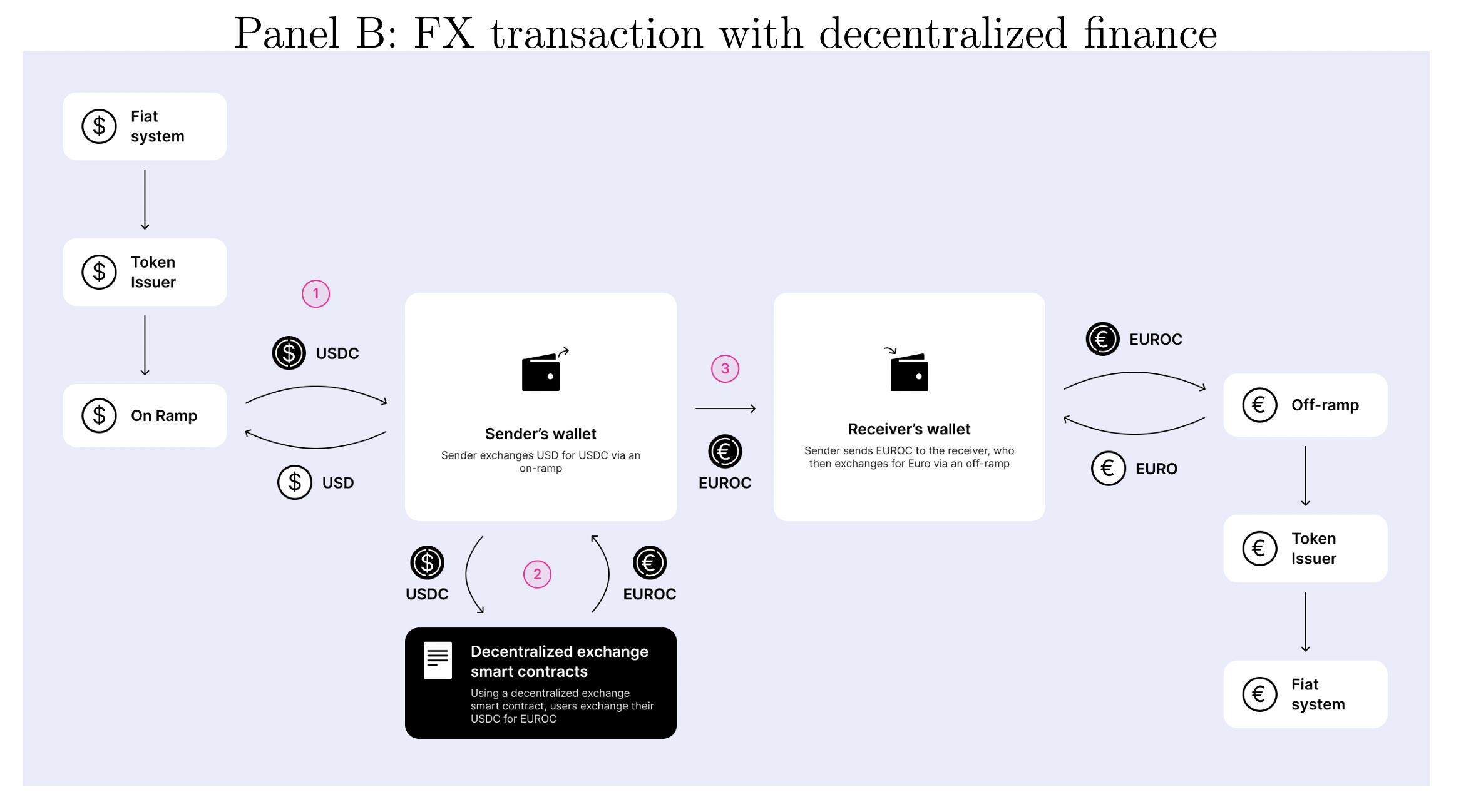

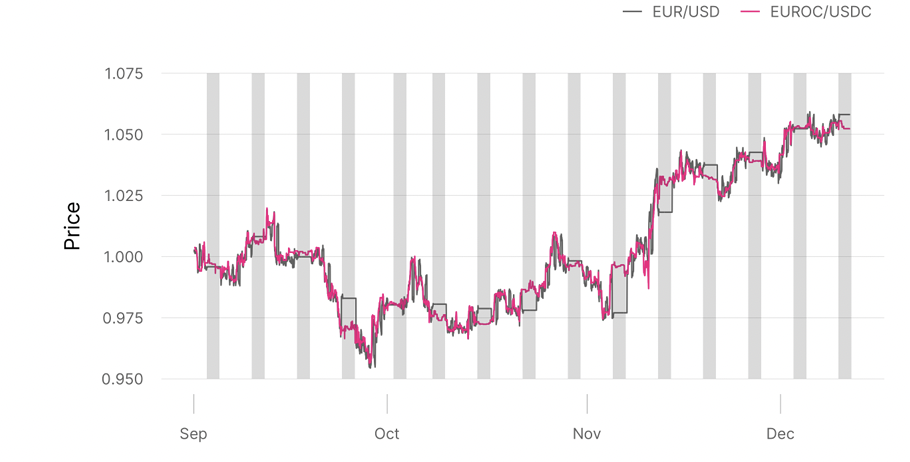

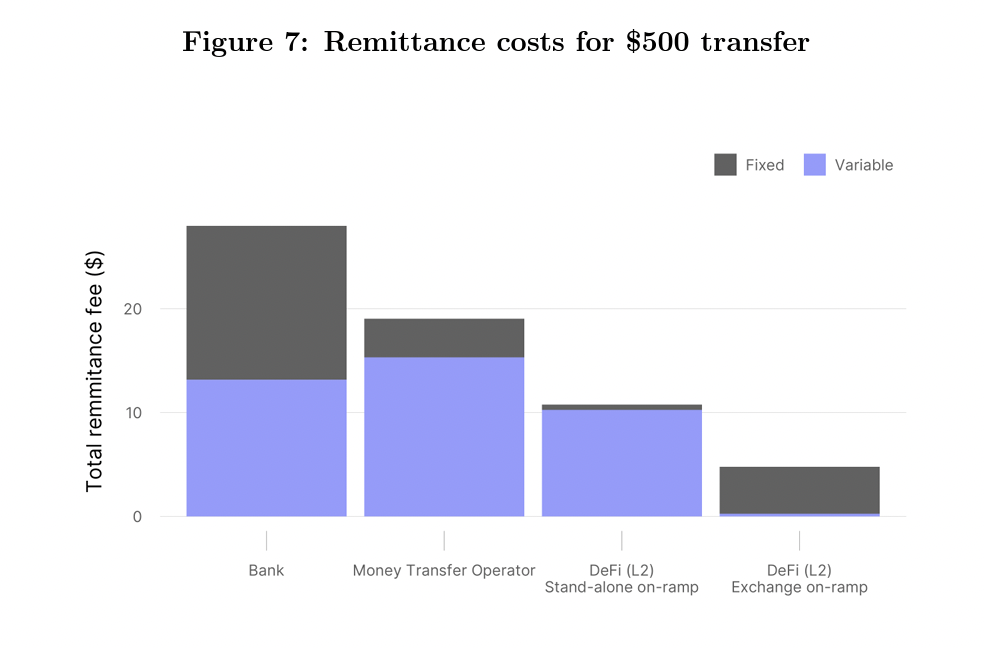

Stablecoins have many uses.

E.g., FX.

Source: On-chain Foreign Exchange and Cross-border Payments by Austin Adams, Mary-Catherine Lader, Gordon Liao, David Puth, Xin Wan (2023) [team from UniSwap Labs]

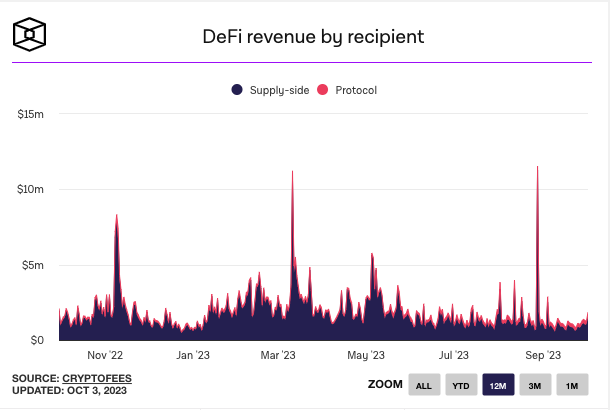

DeFi fees:

- fiat to crypto on ramp: 0%-1%

- exchange fees 1-5bps

- network fee: $0.001-5$

- off-ramp fee: 0%-1%

- total: from close to 0 to 2%+$5

- Canada has 800,000 international students

- admits around 300,000-400,000 annually

- Government of Canada: "We estimate that in 2017 and 2018 respectively, international students in Canada spent $18.4 billion and $22.3 billion on tuition, accommodation, and discretionary spending."

- Most of these funds are transferred from foreign countries to Canada in large sums.

- Students regularly get harrassed by tellers/banks about the source of their funds.

Canada is a country of international students

- To get admitted & get a visa you need to

- make a sizeable deposit

- prove that you have funds for tuition and sustaining your life

- How??? \(\to\) expensive brokers and other shady arrangements

- securities regulation is very broad and covers (and is meant to cover) almost everything

- But: crypto-assets and investment contracts are often separated.

- tokens can have many purposes - which one reigns supreme?

Example: ETH- payment token for usage of the network = money or coupon

- can be used for staking income = income generating

- staking is an economic activity

- staking as a service is an investment contract

Some thoughts about crypto-assets as securities

How do you comply?

- crypto-entities have no address or geographic location

- cryptos can be held in self-custody and be used in contracts

- How would an issuer know who owns them?

- How do you get prospectuses to "investors"?

- Smart contracts issue tokens - who would do the reporting?

- Who does the reporting for generally decentral entities?

DeFi for "Real Finance" & Stablecoins

Let me postpone this until after the "other headlines"

Stablecoins and Deposits

- DeFi applications for "real" finance

- DeFi Lending?

- Lending club on blockchain? (incl. personal loans etc)

- pools would be mostly stablecoin-based

- DEX trading?

- tokenized stocks require cash and stock deposits

- on chain FX require stablecoins in multiple currencies

- DeFi Lending?

huge demand for continuously available "high quality" money

\(\to\) stablecoins

Stablecoins \(\to\) Financial stability concerns

- currently

- borrowing and lending is balance sheet based

- bank deposits are "stable," long-term

- Central Bank and Risk Regulators (e.g. OSFI and OCC) effectively ensure fungibility of bank money

- private stablecoins

- would spread across applications, wallets, and functions

- stablecoin failure would disrupt every aspect of commerce

Stablecoins & Stability

- Circle

- issued $338B

- redeemed $302B

- supported >T$10 transaction volume

- prior to SVB held 20% in deposits

- \(\to\) high movements that are beyond the control of issuer

- \(\to\) not everyone can redeem

- during the SVB crash (on March 9) Circle requested the transfer of about $5B away from SVB

Source: Jeremy Allaire testimony to the U.S. Congress , June 14, 2023 https://www.circle.com/executiveinsights/payment-stablecoins-support-the-dollar-and-u.s.-economic-competitiveness

Very mobile liquidity!

Also:

- automated strategies (eg yield aggregators)

- or deliberate attacks

Stablecoins & Alternatives

- Best backing for a stablecoin?

- \(\to\) reserves!?

- \(\to\) makes a stablecoin issuer a "narrow bank"

- Can this be supported?

- Is CBDC an viable alternative?

- Privacy?

- What rights do you have?

Other topics & vocabulary (will pick and choose, time-permitting, may revisit on Oct 18)

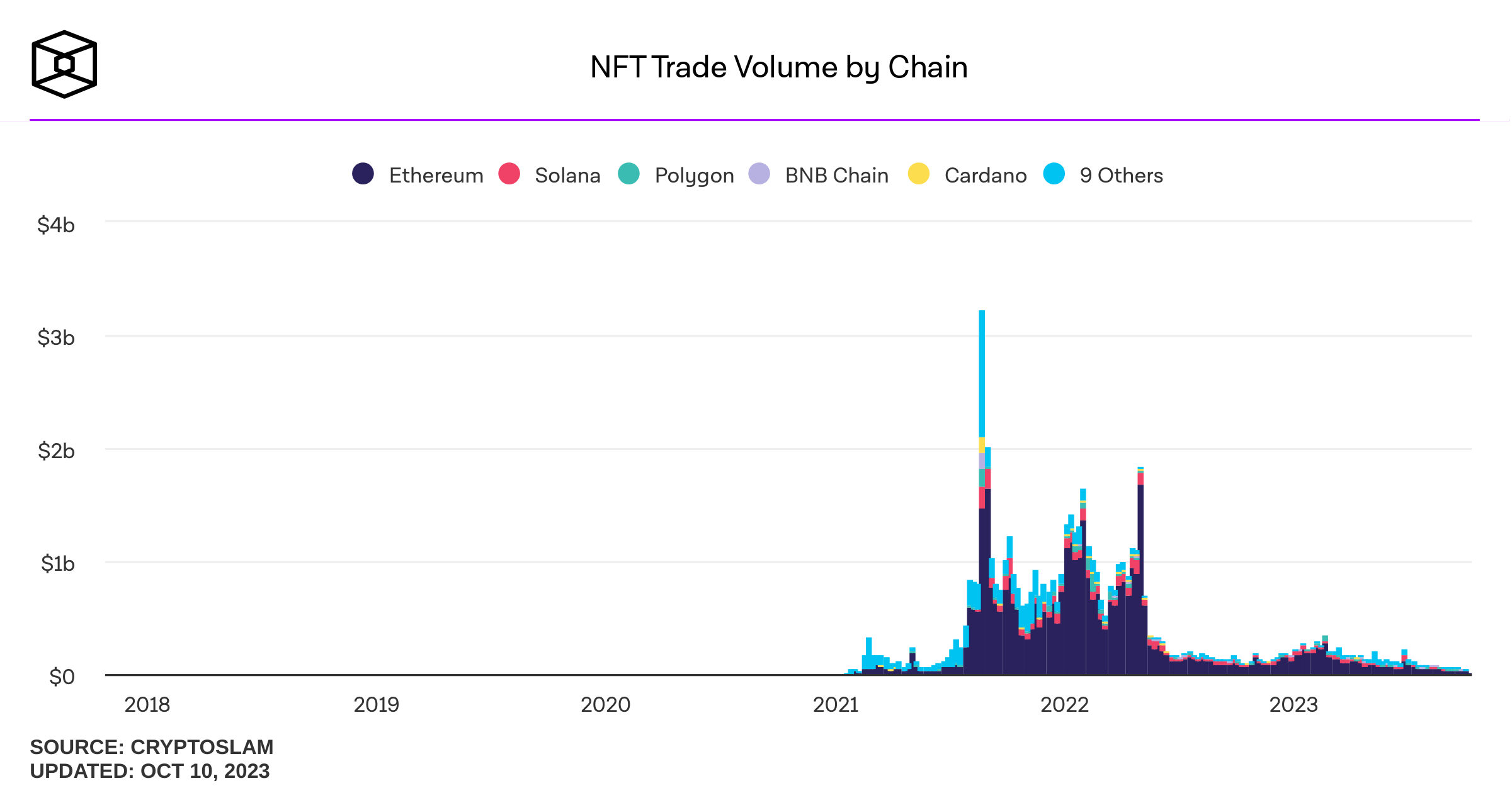

NFTs

What's an NFT?

The NFT Boom

The NFT Boom & Crash

The NFT Boom

The NFT Boom & Crash

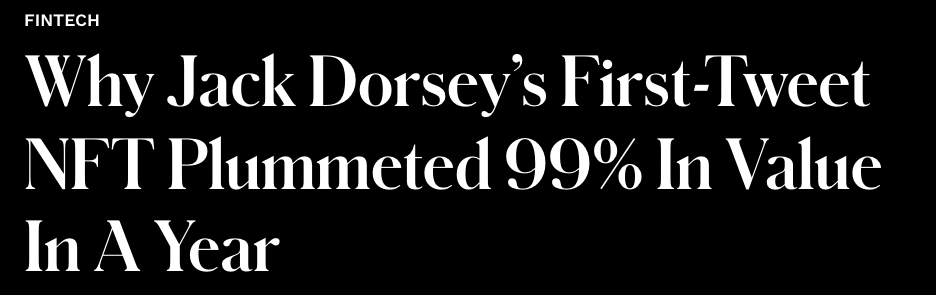

In December 2020, Jack Dorsey created a non-fungible token (NFT) out of his first-ever Twitter post. He turned a static image into a digital file stored on a blockchain, and voila, an NFT was born. A few months later, the image sold for $2.9 million.

Sina Estavi put it up for auction in April 2022, for $50 mln but no one bid more than $280.

- "what is the real value proposition here? [...] probably nothing.”

- "[...] a lot of people have grown weary of cash-grab tactics.”

The NFT Boom & Crash

That said ....

Any ideas on what NFTs can be useful for?

Staking More Broadly & Yield Farming

- "Staking" : commonly used in decentralized finance (DeFi) protocols.

- DeFi staking often refers to locking up tokens within a protocol to achieve a specific goal or result.

- Could be considered a misnomer but it is a common phrase.

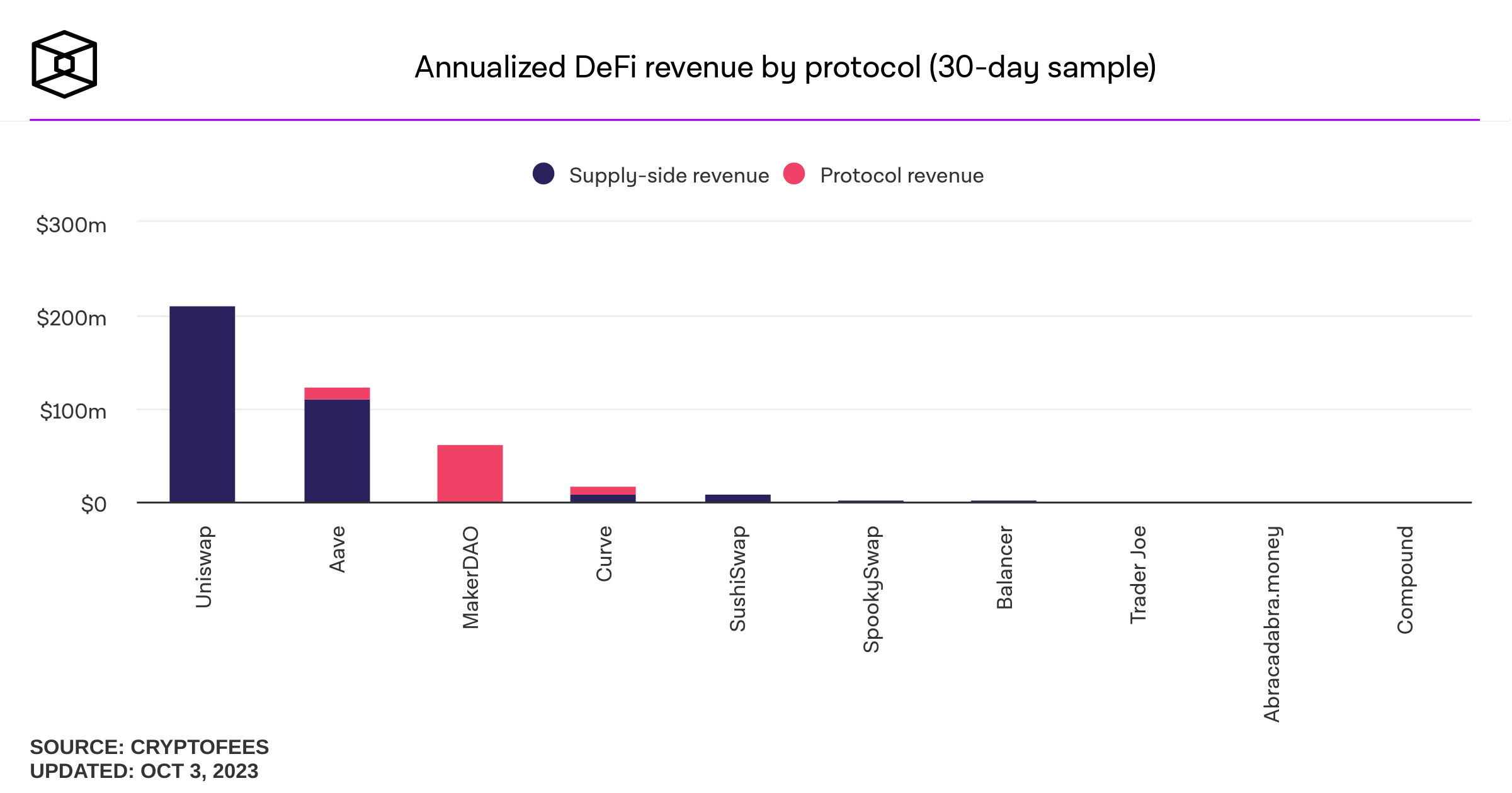

- Typically receive: a portion of the protocol fees. Examples:

- trading fees (Uniswap)

- protocol-issued tokens (e.g., governance tokens)

- liquidity mining fees (rewards for providing liquidity on the platform)

Staking in DeFi

- Protocol Insurance (liquidity to be used as a backstop)

- Governance (e.g., Curve) -- only have this right if the tokens are staked

- Liquidity Provision

- Synthetix: staking as a way to supply collateral for the creation of synthetic assets

- Token distribution

- only get rewards ("dividends" in tradfi) when/if your tokens are staked -- e.g., because the ownership is easily defined (and also as a reward for facilitating the protocol)

Staking in DeFi: Why?

- Very broadly and very loosely:

- Yield farming refers to any effort to put crypto assets to work to generate the highest returns possible on those assets.

- E.g.,

- staking

- lending in a DeFi lending protocol

- supplying liquidity on a decentralized exchange

"Yield farming"

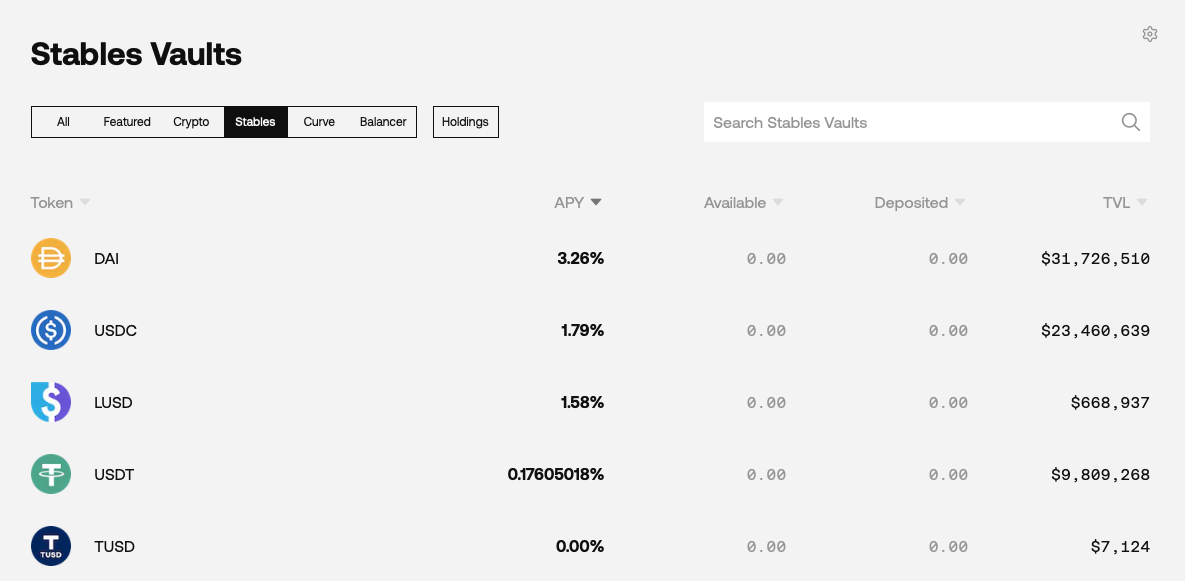

Obvious Smart Contract Application: Automate Investment Strategies

"yield aggregator:" push capital where rate of return is highest

Caution: "yield farming" has its risks ....

Odd Lots: SBF and Matt Levine on How to Make Money in Crypto (podcast, April 25, 2022)

If too pressed for time to listen, start at minute 21:17, or check out:

And yet: staking, lending, and supplying liquidity on DEXes - at least in theory - allows (non-expert) investors to passivley participate in and benefit from the promise/growth of cryptoassets

For a more rigorous analysis (not for F741), see Augustin, Chen-Zhang, and Shin, Donghwa, "Reaching for Yield in Decentralized Financial Markets"

https://ssrn.com/abstract=4063228

"investors chase farms with high yields and that [...] farms with the highest headline rates record the most negative risk-adjusted returns"

Platforms, Peer-to-Peer, and Decentralization

Peer-to-peer \(\Rightarrow\) Platforms

liquidity \(\nearrow\)

volume \(\nearrow\)

protocol fees \(\nearrow\)

token value \(\nearrow\)

Platform economics is tricky:

- What's the product?

- How do you get it started?

- How do you get people to contribute?

- How do you earn money?

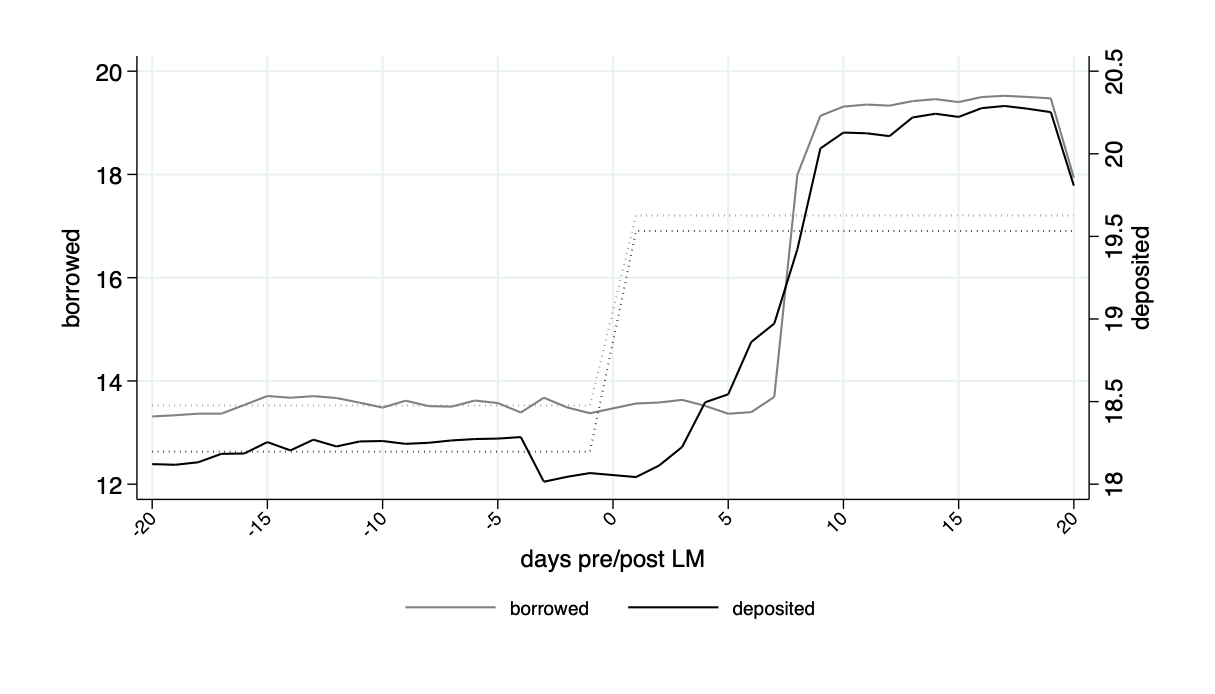

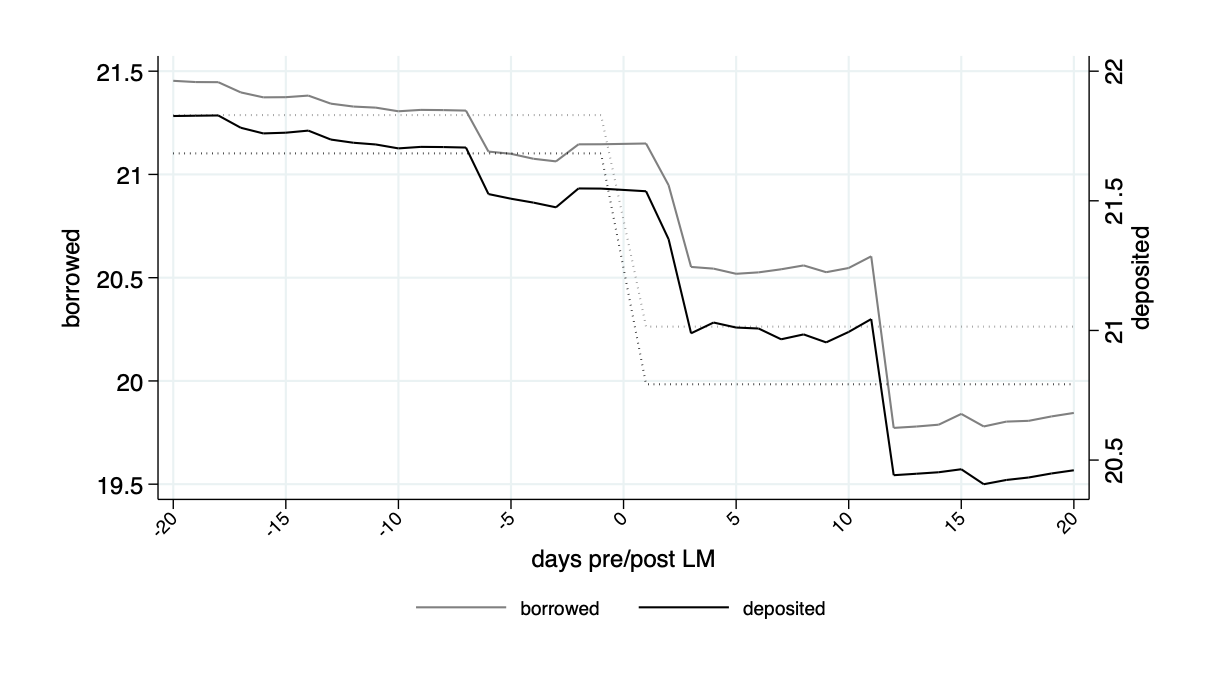

liquidity mining (LM) = rewards for providing liquidity - worked (?) for Compound

Liquidity Mining & Yield Aggregators

Yield aggregators:

- develop strategies to systematically take advantage of token issuance (liquidity mining) programs

- like pooling funds to take advantage of banks deposit incentives

- liquidity flees quickly after liquidity mining programs end

- "mirage" effect: yield aggregators borrow what they deposit

Decentralized Governance

idea: blockchain-based = democracy

Problems to solve:

- What level and what decisions?

- Who gets to vote?

- What institutions?

- Majority rule vs minority rights?

- What's a majority?

- Why democracy?

Firms

- autocracy: CEO takes most decisions with minor restraints

- central body

- Investor = transactional relationship

A Landsgemeinde in the canton of Glarus on 7 May 2006, Switzerland (Wiki)

"The DAO hack" & decentralized (?) governance

"The DAO":

- Decentralized autonomous organization launched in 2016 on the Ethereum blockchain.

- Raised $150 million USD worth of ether (ETH) through a token sale

- intended to act as an investor-directed venture capital firm

- contained roughly 14% of all ETH in circulation

- Hacked due to vulnerabilities in its code, $60 million of ETH drained

- The Ethereum blockchain was hard forked to restore the stolen funds

- not all parties agreed with this decision

- \(\to\) the network splitting into two distinct blockchains:

- Ethereum

- Ethereum Classic.

Oracles

What is "off-chain" reality?

Want to learn more? Look up "Chainlink"

Smart contracts need data

- Decentralized exchanges

- Token programming/management

- Lending/Derivatives

- Prediction markets

- Insurance

- Betting

- NFTs

How do we feed external data to smart contracts?

- Trust a third party to write the data

- Goes against decentralization

- Natural failures

- link goes down

- website goes down

- API fails etc.

- Malicious

- betting outcome manipulation

- insurance fraud

- DeFi pool exploits

The Oracle Problem

- Do it in a way that respects decentralization and is failure-resistant

Disagreement?

Majority Vote

The Oracle Problem

- Do it in a way that respects decentralization and is failure-resistant

Multiple Values?

Report Median

1 ETH = $4780

1 ETH = $4789

1 ETH = $4781

The Oracle Problem

- Do it in a way that respects decentralization and is failure-resistant

1 ETH = $4780

1 ETH = $4789

1 ETH = $4781

DEXes can be used as on-chain price oracles

Time-Weighted Average Price (TWAP)

Challenges

- Participation incentives?

- rewards, payments...

Economic Questions around the oracle node ecosystem

- Incentives for honest reporting?

- penalties, collateral...

- Reputation?

- Uptime, correctness, penalty history, collateral amount....

- Does an oracle system need its own token?

- Control over tokenomics, development funding etc

- Integration/Interoperability with multiple blockchains

Oracle Economics

Further non-regulatory challenges for blockchain

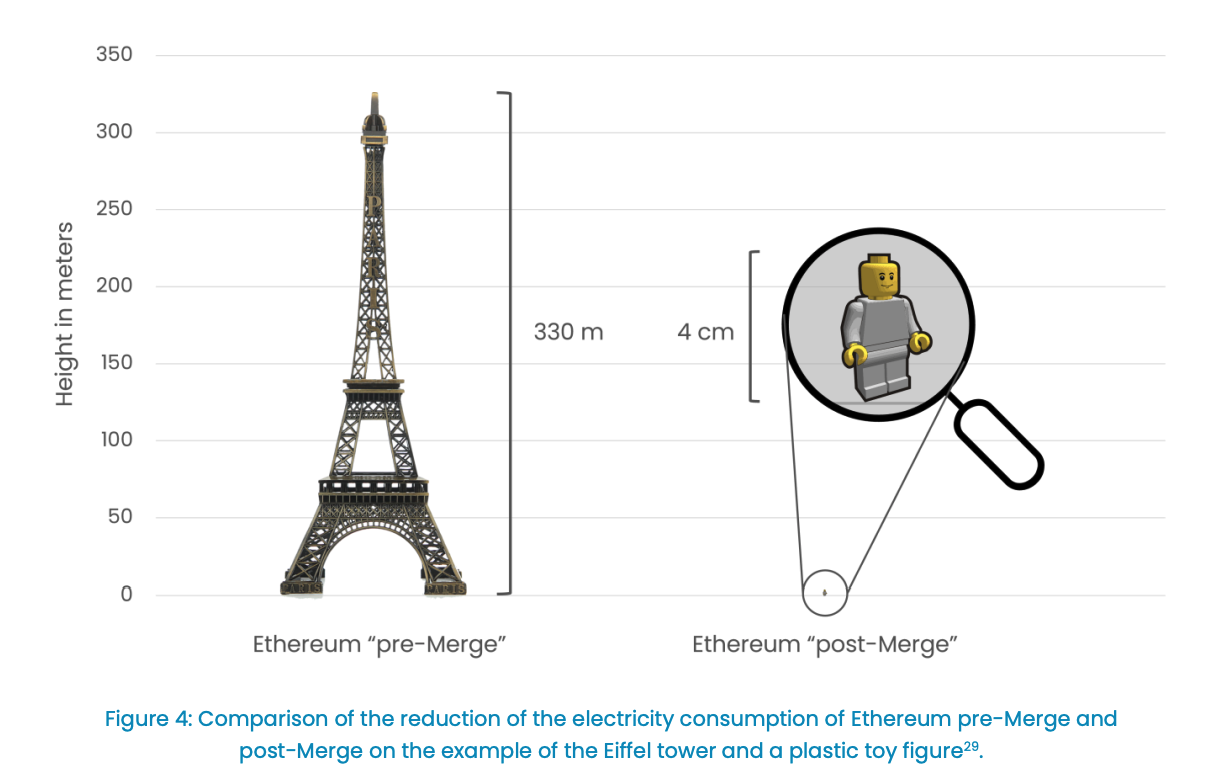

Challenge #1 (?): Environment

Again: most cited problem are for the proof-of-work consensus protocol

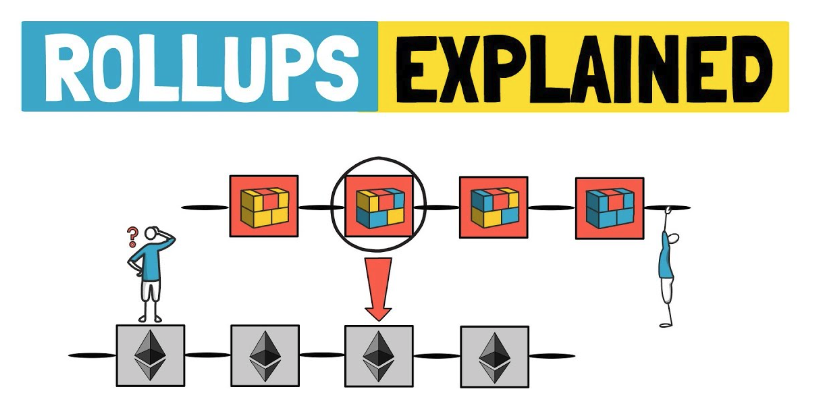

Challenge 2: Throughput

Active on-going work on solutions:

Sharding

Optimistic Rollups

ZK Rollups

Sidechains

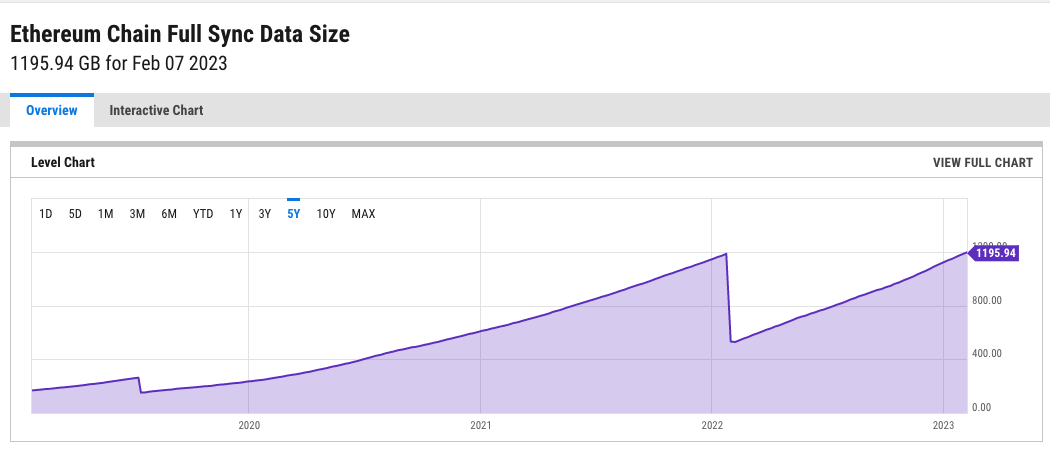

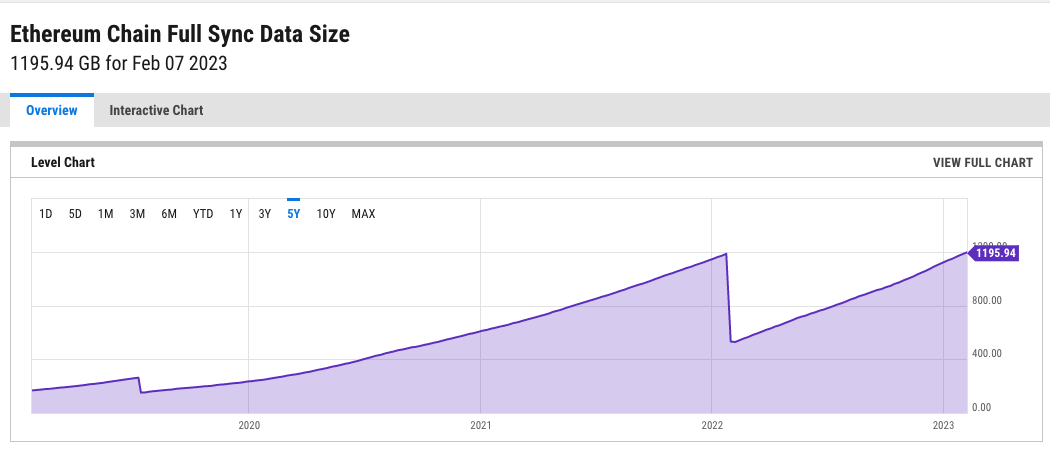

Ethereum Challenge 3: State Size

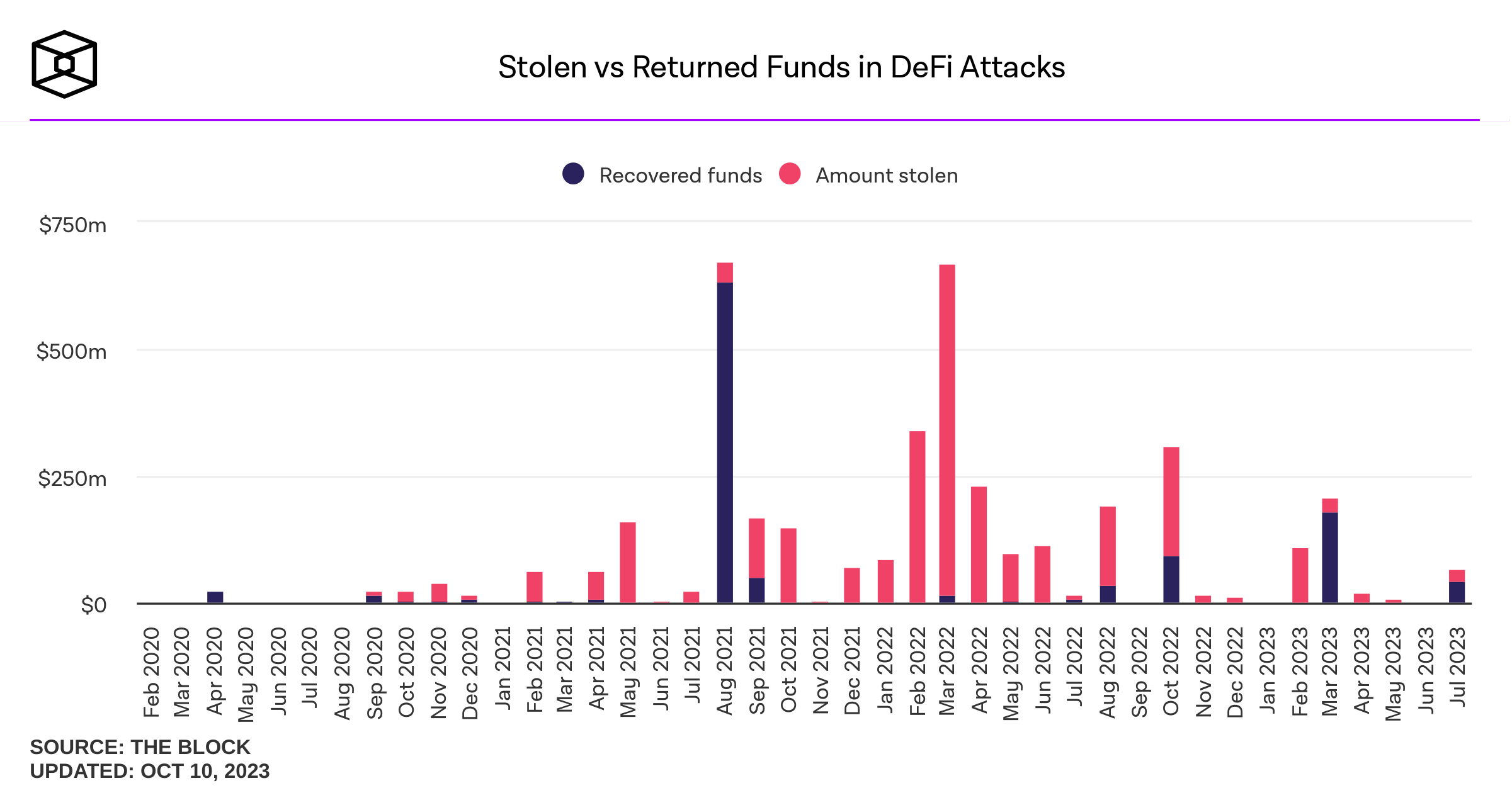

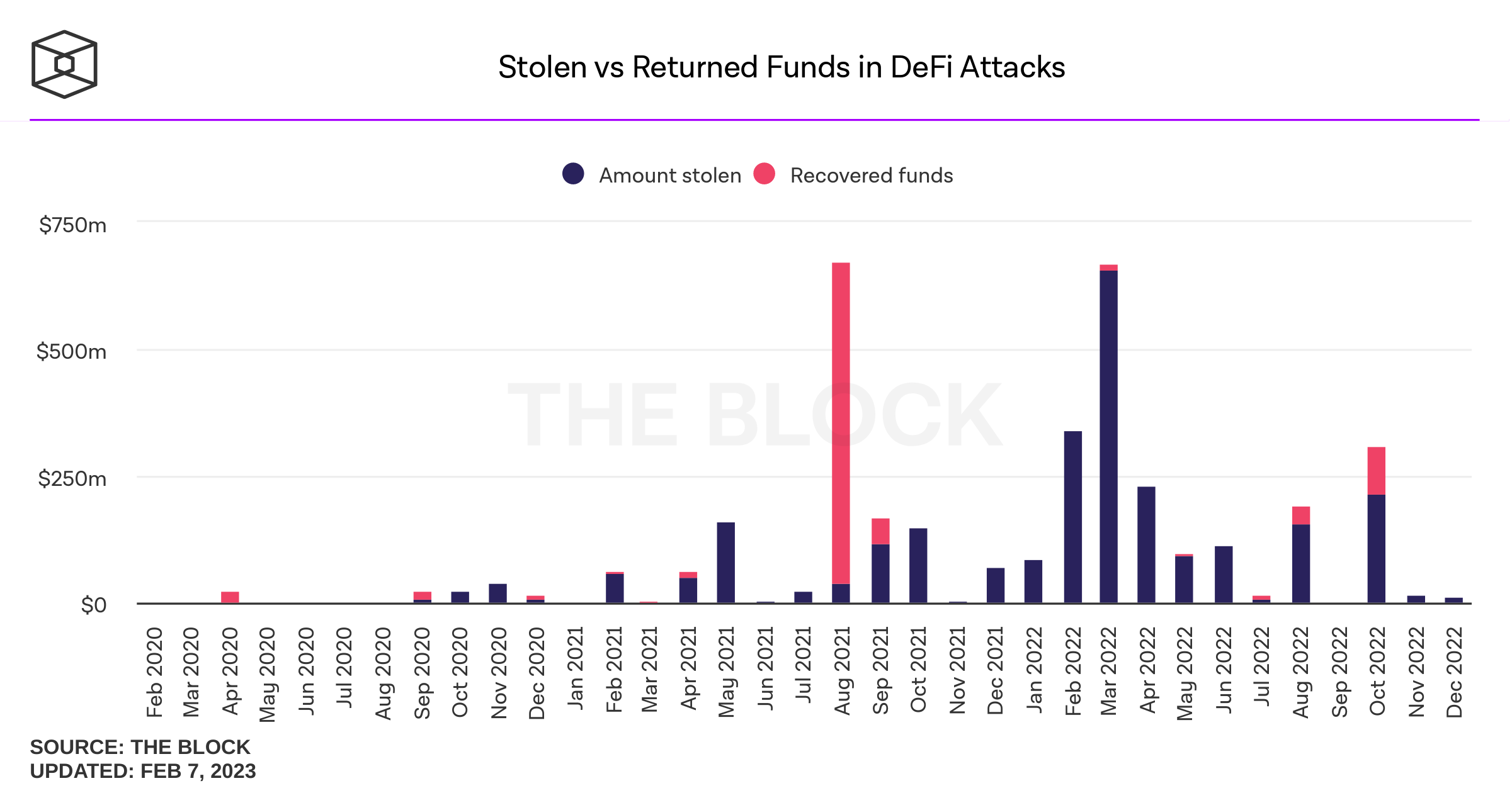

Challenge #4: Hacks, Thefts, and Exploits in DeFi

Common Reasons: hacks, faulty code, tricking a protocol

Challenge #0: UX

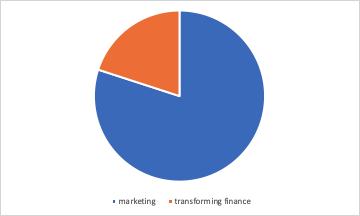

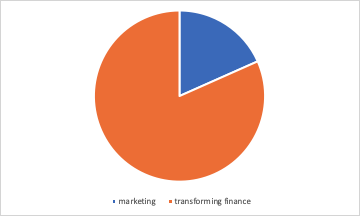

FinTech

DeFi

- more user-friendly

- more customer-oriented

- less squeezing/rent-extraction

- more competitive services

- more innovative services

- currently: horribly user-unfriendly

- "blowing up the banks"

- fundamental re-thinking of financial services

- lots of scams, cowboy-attitude towards laws

innovation vs. salesmanship

main focus

Final Thoughts

Some Final Thoughts

- blockchain tech won't get uninvented.

- young people and universities keep working on blockchain ideas

- the space is still trying to figure things out, including tech and economic challenges

- great progress has been made, but things will and do still go wrong

- a common resource can have huge economic benefits

- would like to see more thinking and discussion about paths to unlock the benefits

@katyamalinova

malinovk@mcmaster.ca

slides.com/kmalinova

https://sites.google.com/site/katyamalinova/

Just in: regulators

Non-regulatory challenges

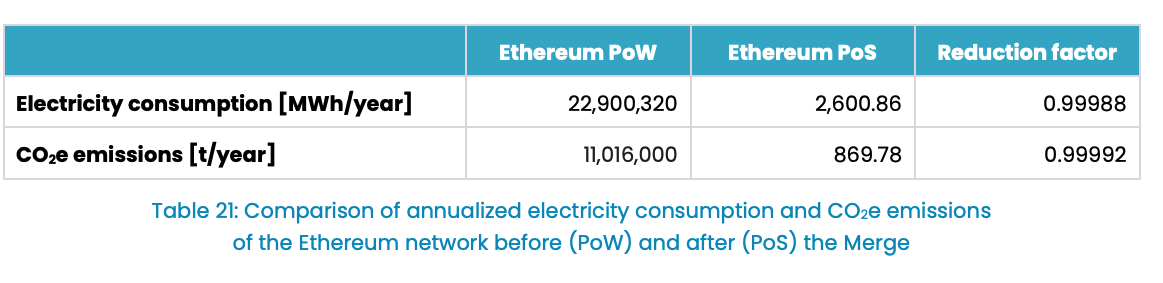

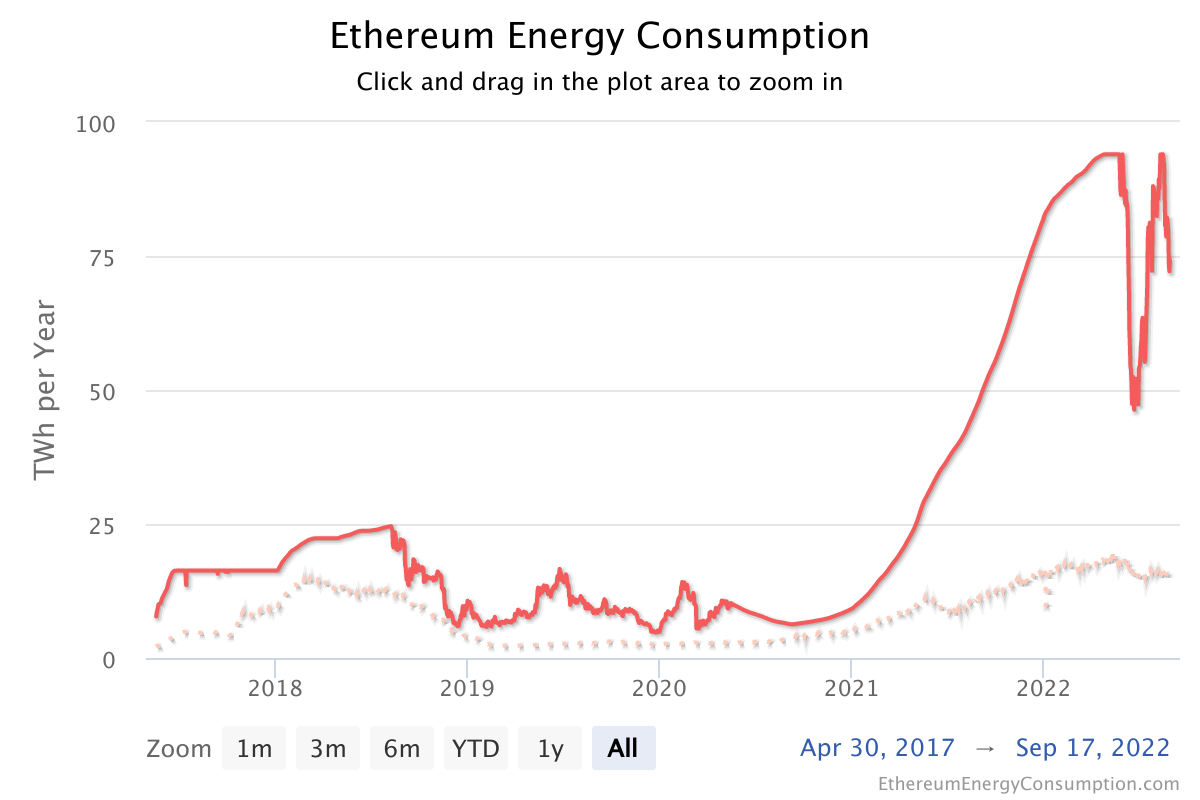

Challenge #1 (?): Environment

Most cited problem are for the proof-of-work consensus protocol

Usage

| Network | DApps | Dollarvolume |

|---|---|---|

| Ethereum | 3,500 | $40-50B |

| Solana | 100 | $2.5B |

| Binance Smart Chain | 250 | $3B |

| Avalanche | 400 | <$.5B |

| EOS | 300 | <$100M |

| Algorand | 12 | <$20M |

Ethereum Challenge 1: Environment

- Carbon footprint of Switzerland

- Power consumption of Austria

| transactions per second | T per 12 hours (business day) | |

|---|---|---|

| Bitcoin | 7 | 302,400 |

| Ethereum | 30 | 1,296,000 |

| Algorand | 2000 | 86,400,000 |

| Conflux | 4000 | 172,800,000 |

| Athereum | 5000 | 216,000,000 |

| Payments Canada ACSS | 648 | 28,000,000 |

| US retail | 7639 | 330,000,000 |

| Canada number of equity trades | 46 | 2,000,000 |

| Orders on Canadian equity markets | 3588 | 155,000,000 |

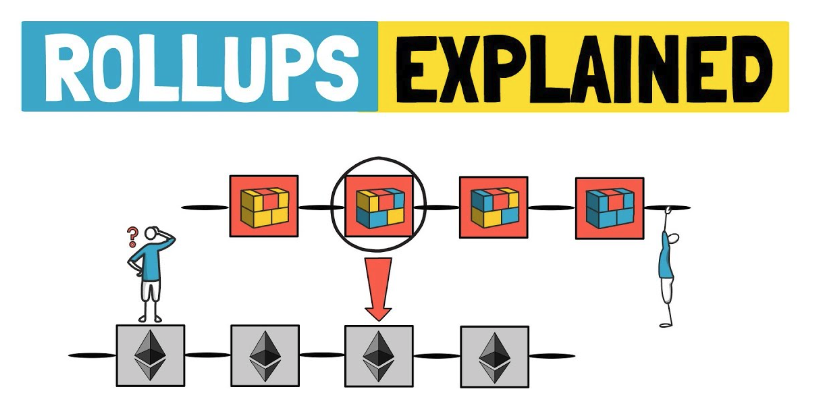

Challenge 2: Throughput

Challenge 2: Throughput

Active on-going work on solutions:

Sharding

Optimistic Rollups

ZK Rollups

Sidechains

| transactions per second | T per 12 hours (business day) | |

|---|---|---|

| Bitcoin | 7 | 302,400 |

| Ethereum | 30 | 1,296,000 |

| Algorand | 2000 | 86,400,000 |

| Conflux | 4000 | 172,800,000 |

| Athereum | 5000 | 216,000,000 |

| Payments Canada ACSS | 648 | 28,000,000 |

| US retail | 7639 | 330,000,000 |

| Canada number of equity trades | 46 | 2,000,000 |

| Orders on Canadian equity markets | 3588 | 155,000,000 |

-

Tweaks: lighting network (BTC) or side chains, SegWit, blocksize possible, but there are limits

-

microtransactions, IoT, and other smart contract use cases place very high demands

Challenge 2: Throughput

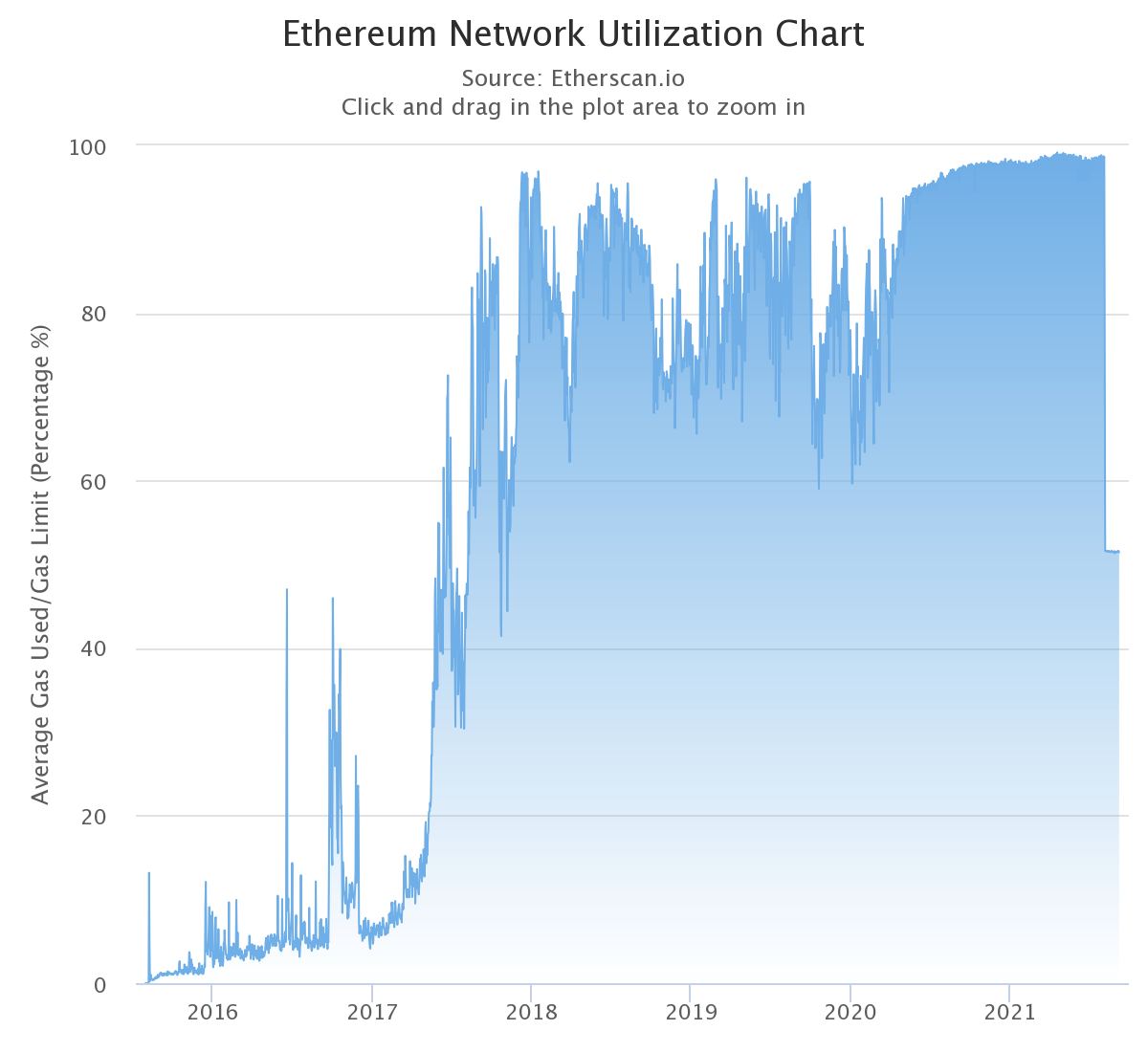

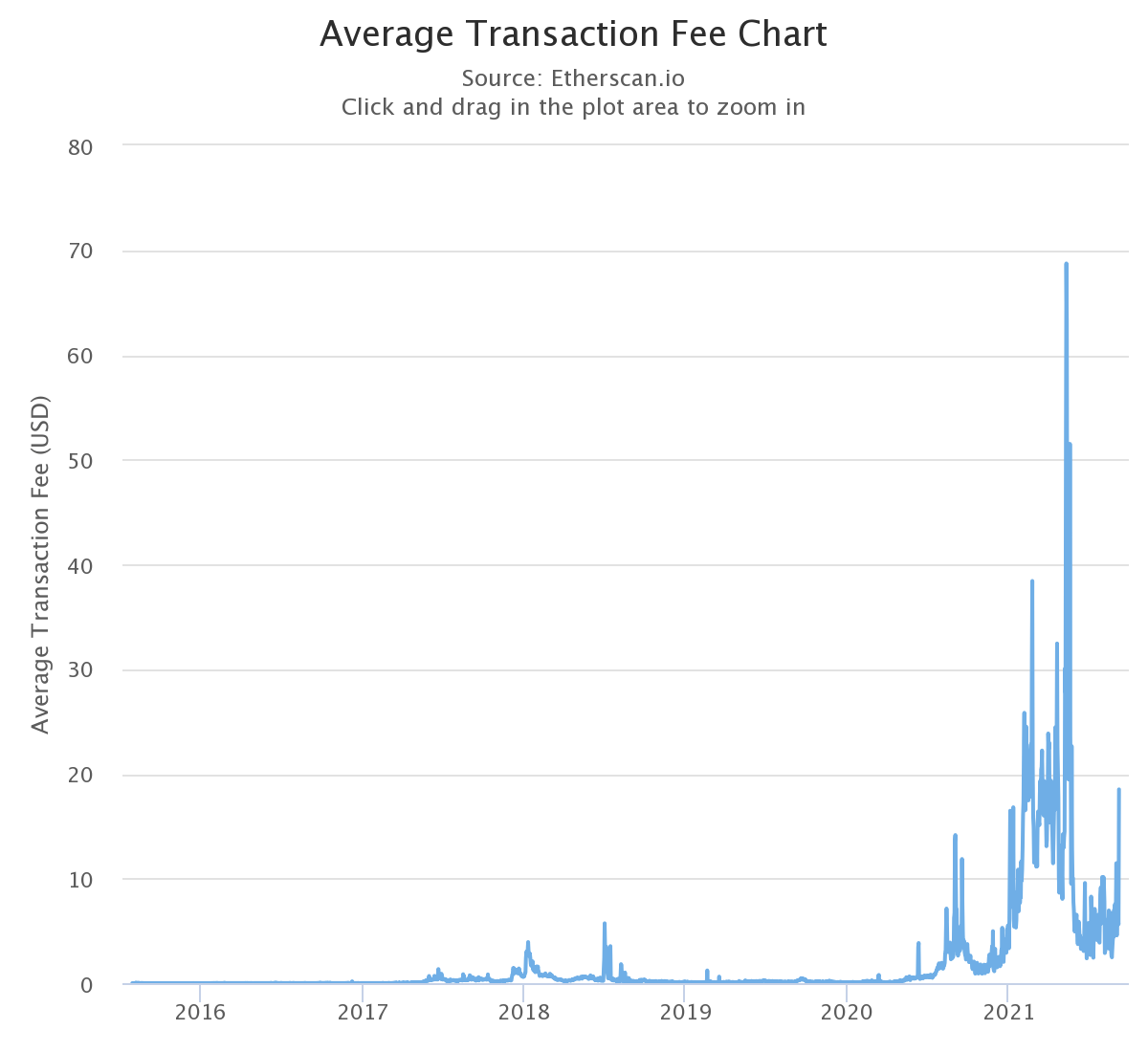

Ethereum Challenge 2: Throughput

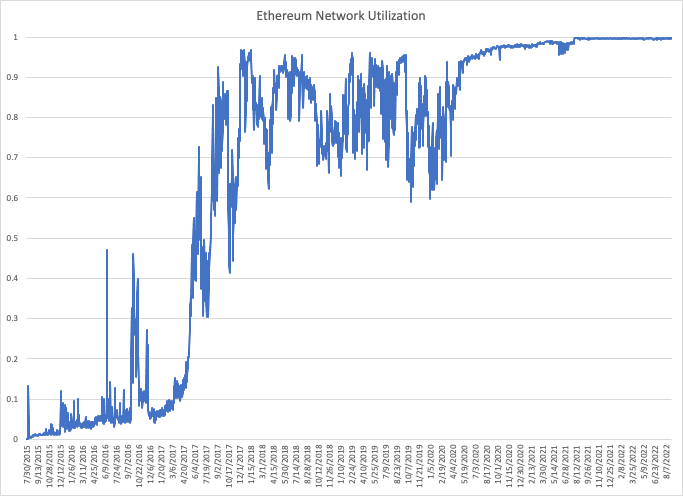

Source: Etherscan w re-scaling

Ethereum Challenge 3: State Size

Challenge #4: Hacks, Thefts, and Exploits in DeFi

Common Reasons: hacks, faulty code, tricking a protocol

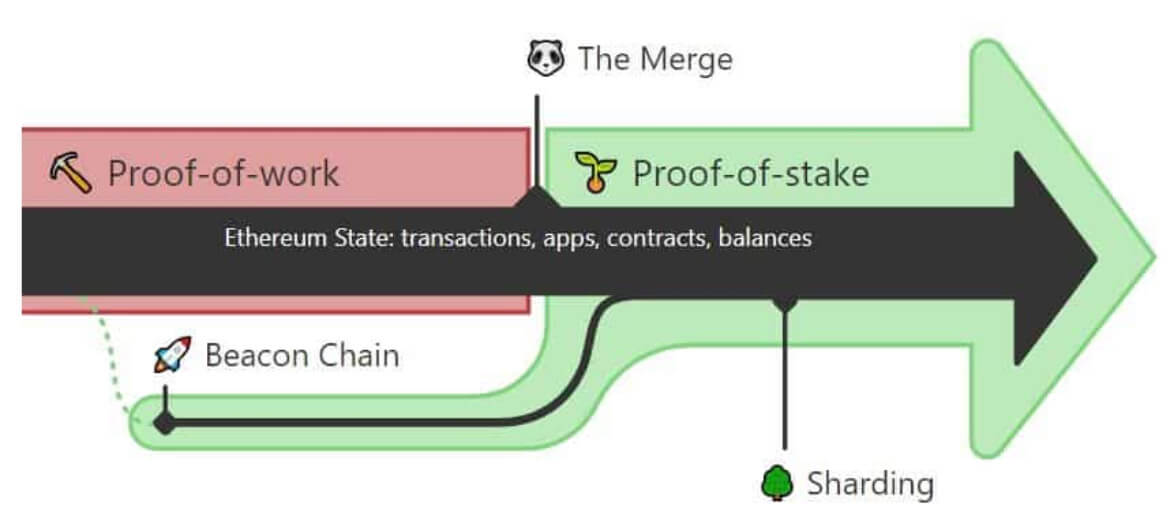

Major Ethereum Tech Upgrade: The Merge

scheduled date: September 13

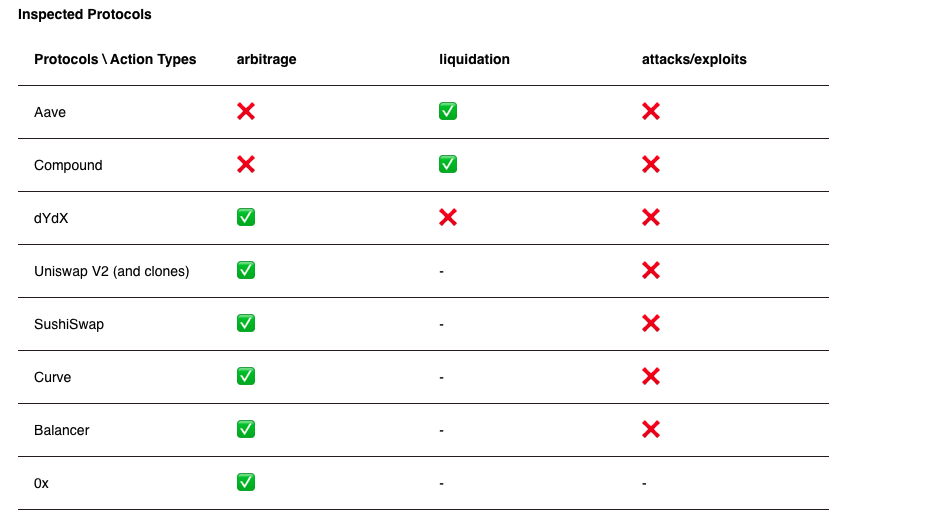

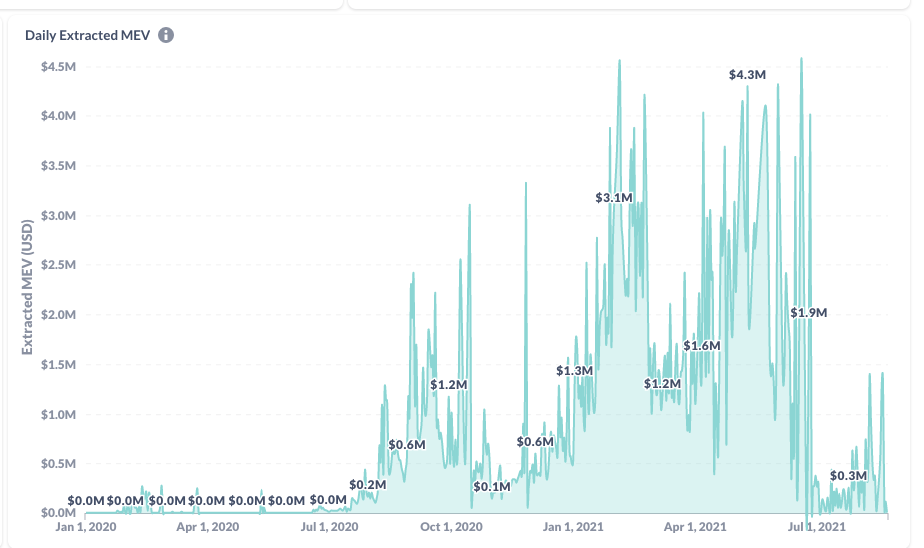

Miner extractable value and High Priority Gas Auctions

Challenge #0: UX

FinTech

DeFi

- more user-friendly

- more customer-oriented

- less squeezing/rent-extraction

- more competitive services

- more innovative services

- currently: horribly user-unfriendly

- "blowing up the banks"

- fundamental re-thinking of financial services

- lots of scams, cowboy-attitude towards laws

innovation vs. salesmanship

main focus

Turn to history for a solution? Public Education?

1990s education drive on the Internet

kids' guide:

Three Scenarios for the Next Five Years

borderless digital economy \(\to\) blockchain-integrated

mass tokenizations \(\to\) likely originates from non-Western world

blockchains \(\to\) stay niche (gaming)