Blockchain Technolgy in Finance: DeFi Intro and Crypto Trading

Instructor: Katya Malinova

Course : F741 Fall 2023

A quick recap

blockchain=

an infrastructure for digital resource transfers

software protocols that allow multiple parties to operate under shared assumptions and data

without trusting each other.

Updates are packaged into “blocks” and are “chained” together cryptographically to allow an audit of the prior history

cryptocurrency =

internal payment mechanism to pay for operation of a blockchain

Consensus Protocol =

a set of rules that determine what kinds of blocks can become part of the chain and become the “truth”.

Transaction

Execution

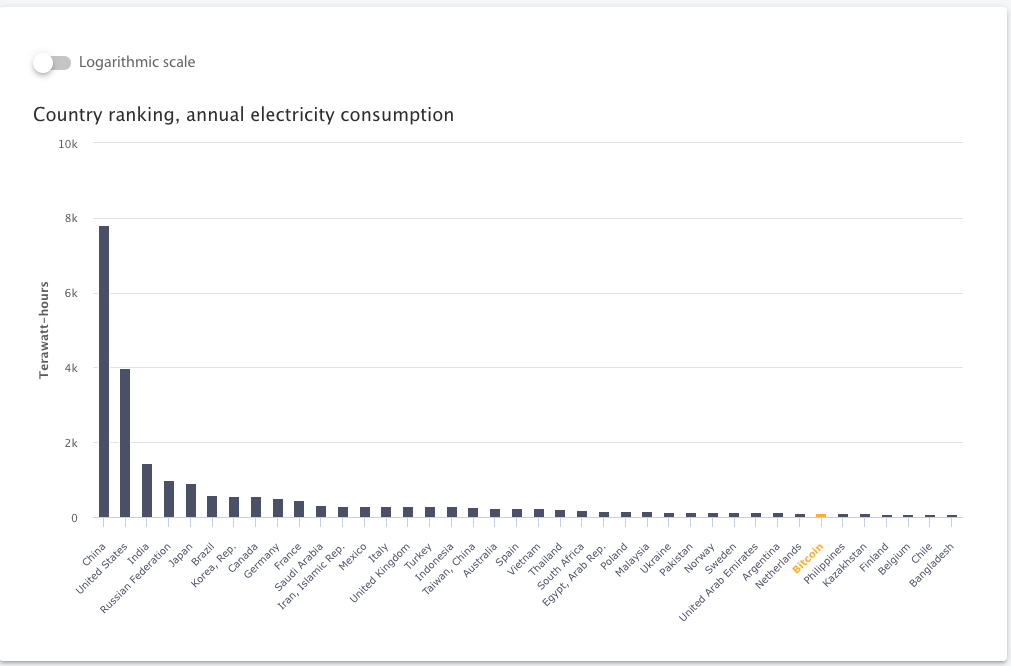

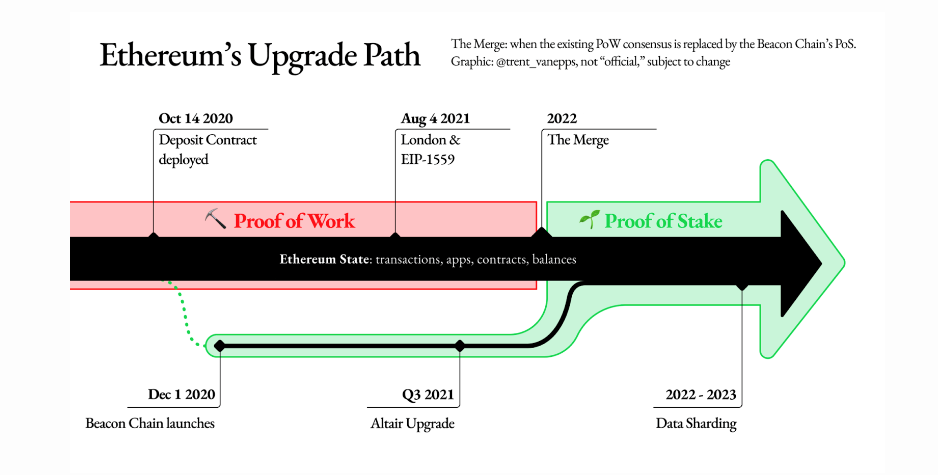

Source: Cambridge Bitcoin Energy Consumption Index https://cbeci.org/

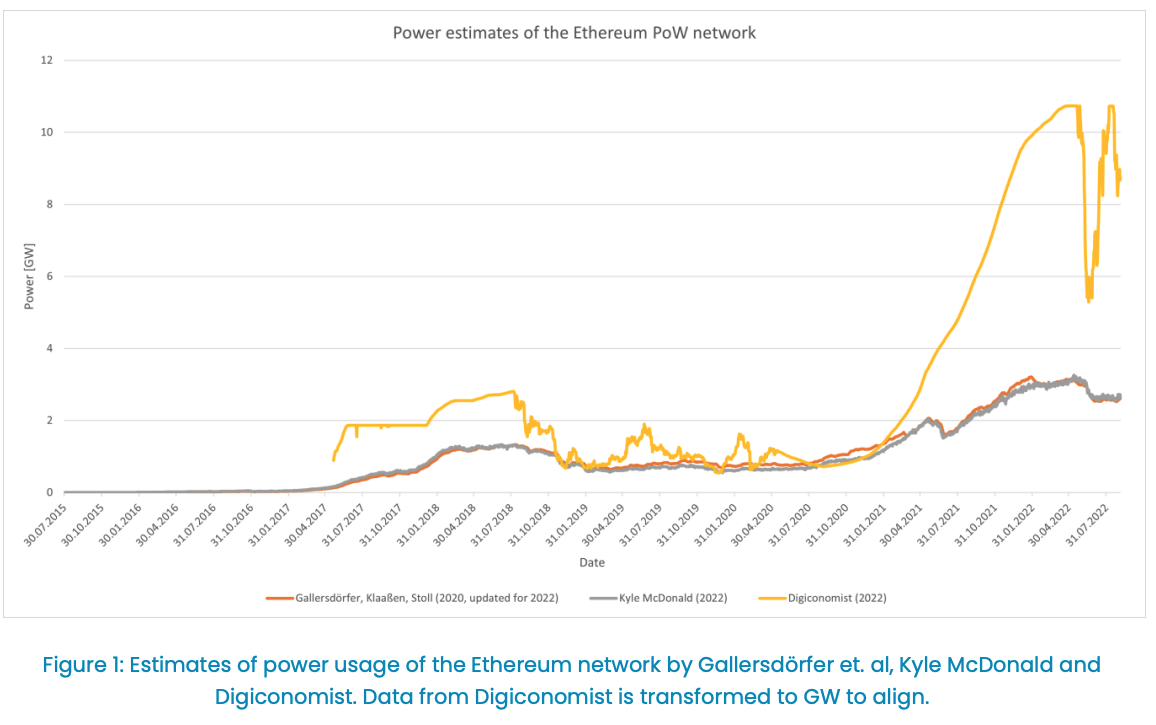

Proof of work protocol: unsustainable amount of energy

Ethereum power usage before the Sept 15, 2022 Merge

Why is this idea powerful?

payments

stocks, bonds, and options

swaps, CDS, MBS, CDOs

insurance contracts

A blockchain is a

- general purpose

- open access

- value management

- infrastructure

- that is communally run

What makes DeFi different from TradFi

decentralized finance =

provision of financial service functionality without the necessary involvement of a traditional financial intermediary like a bank or broker-dealer*

digital media =

provision of information service functionality without the necessary involvement of a traditional information intermediary like a publisher, library, or newagency

*my take: applies to only commoditizable services

trading Infrastructure

payments network

Stock Exchange

Clearing House

custodian

custodian

beneficial ownership record

seller

buyer

Broker

Broker

Application: decentralized trading with automated market makers

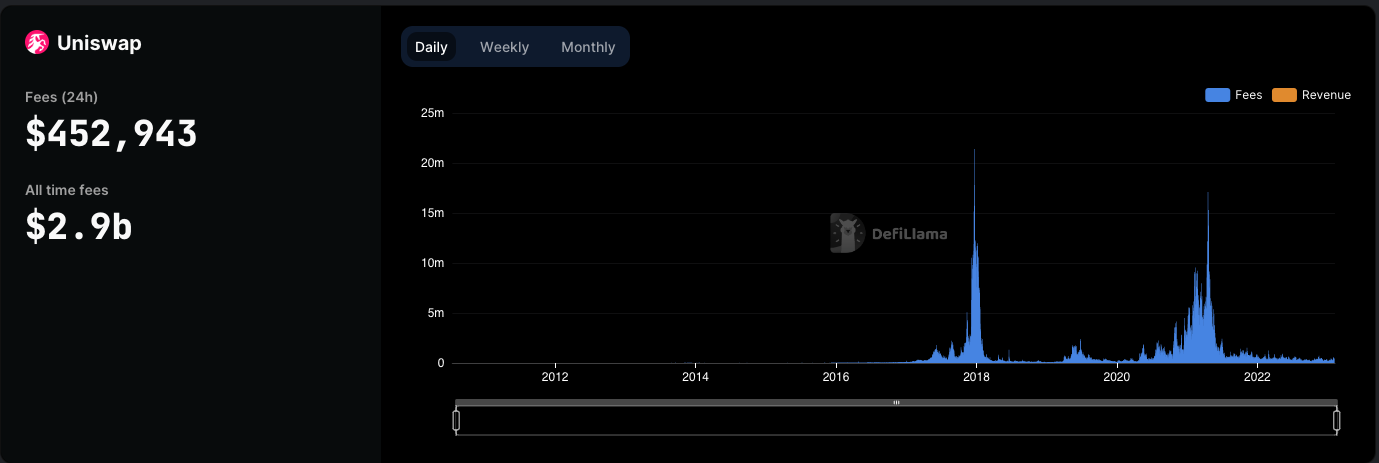

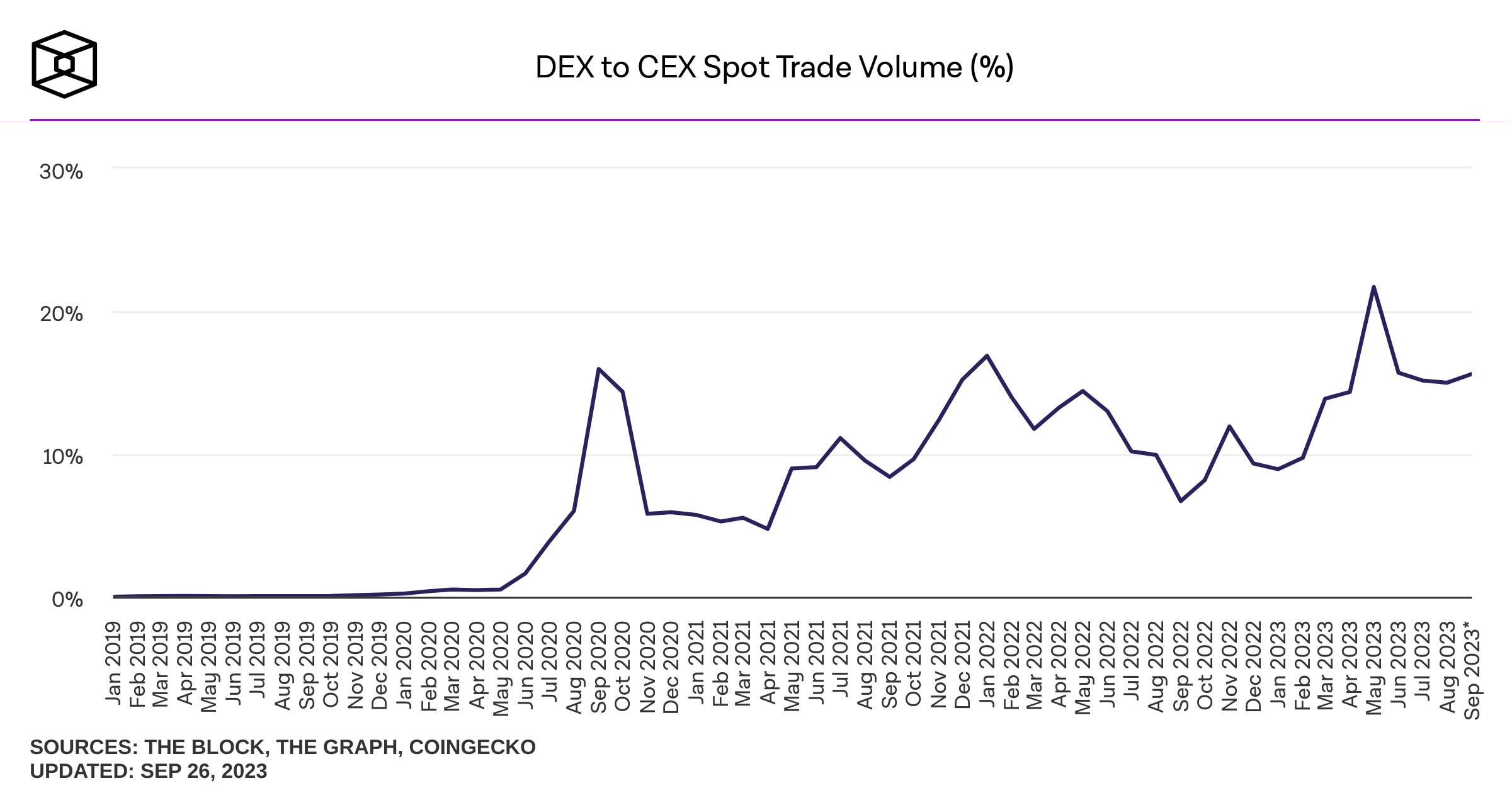

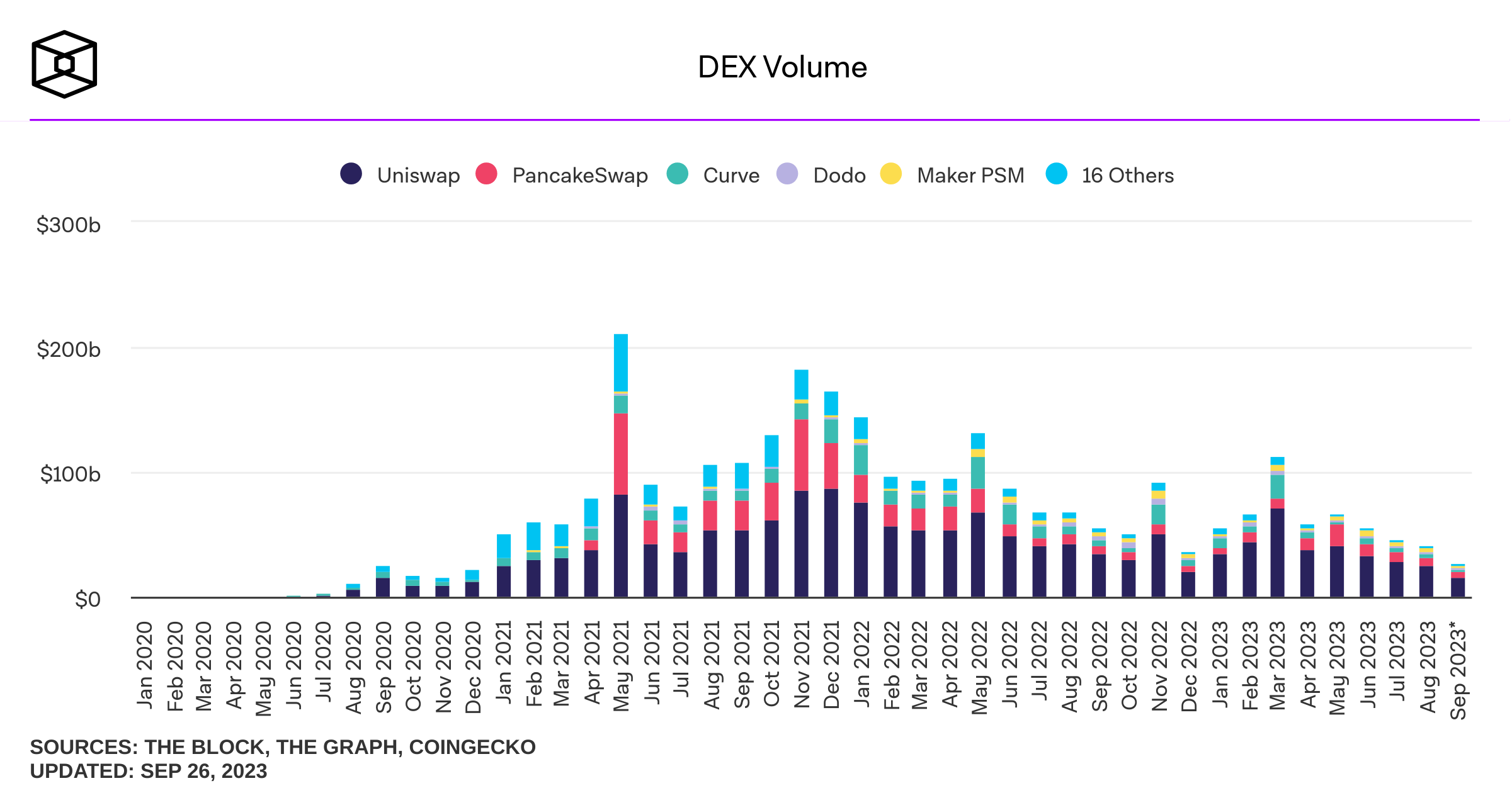

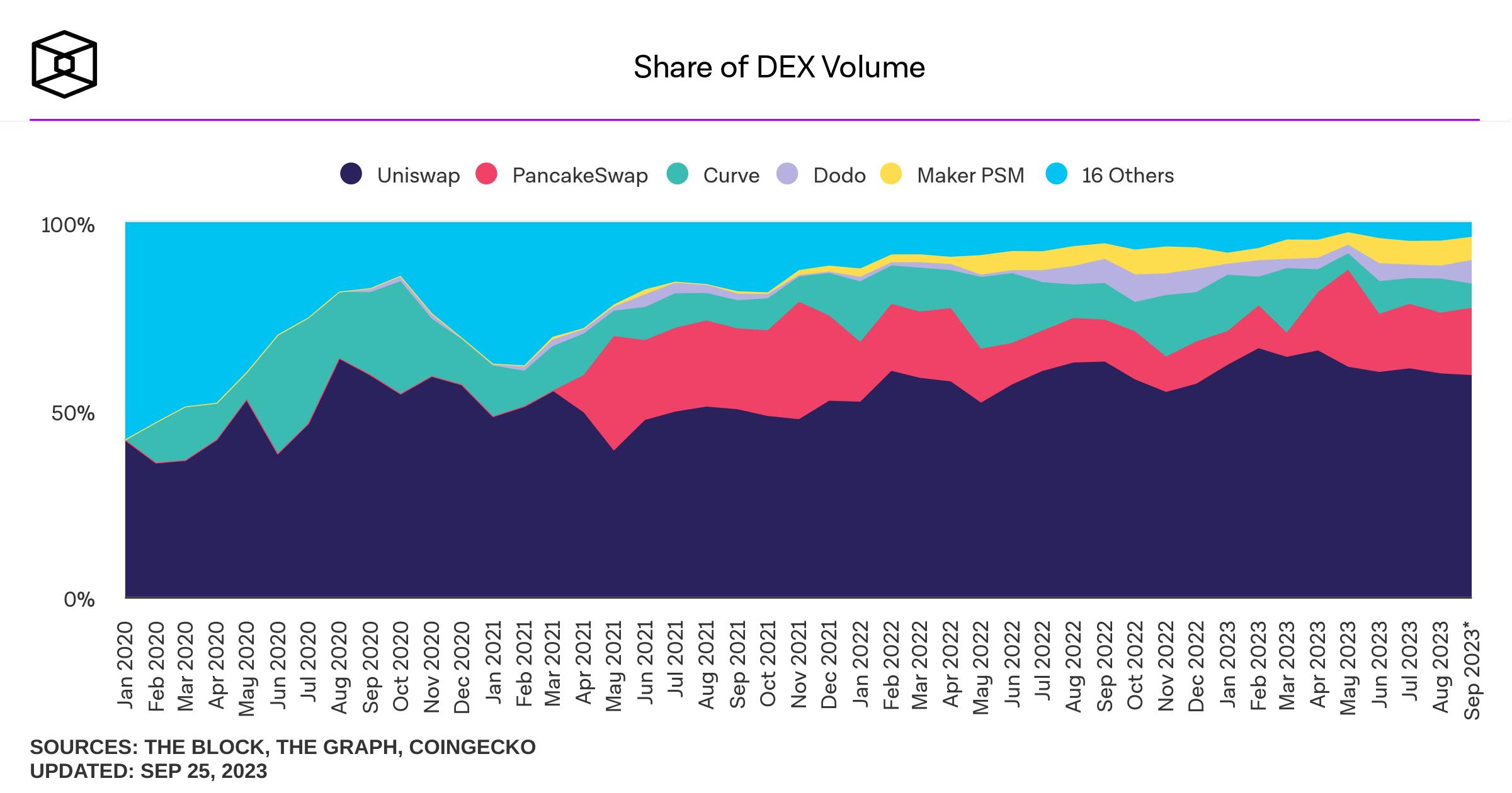

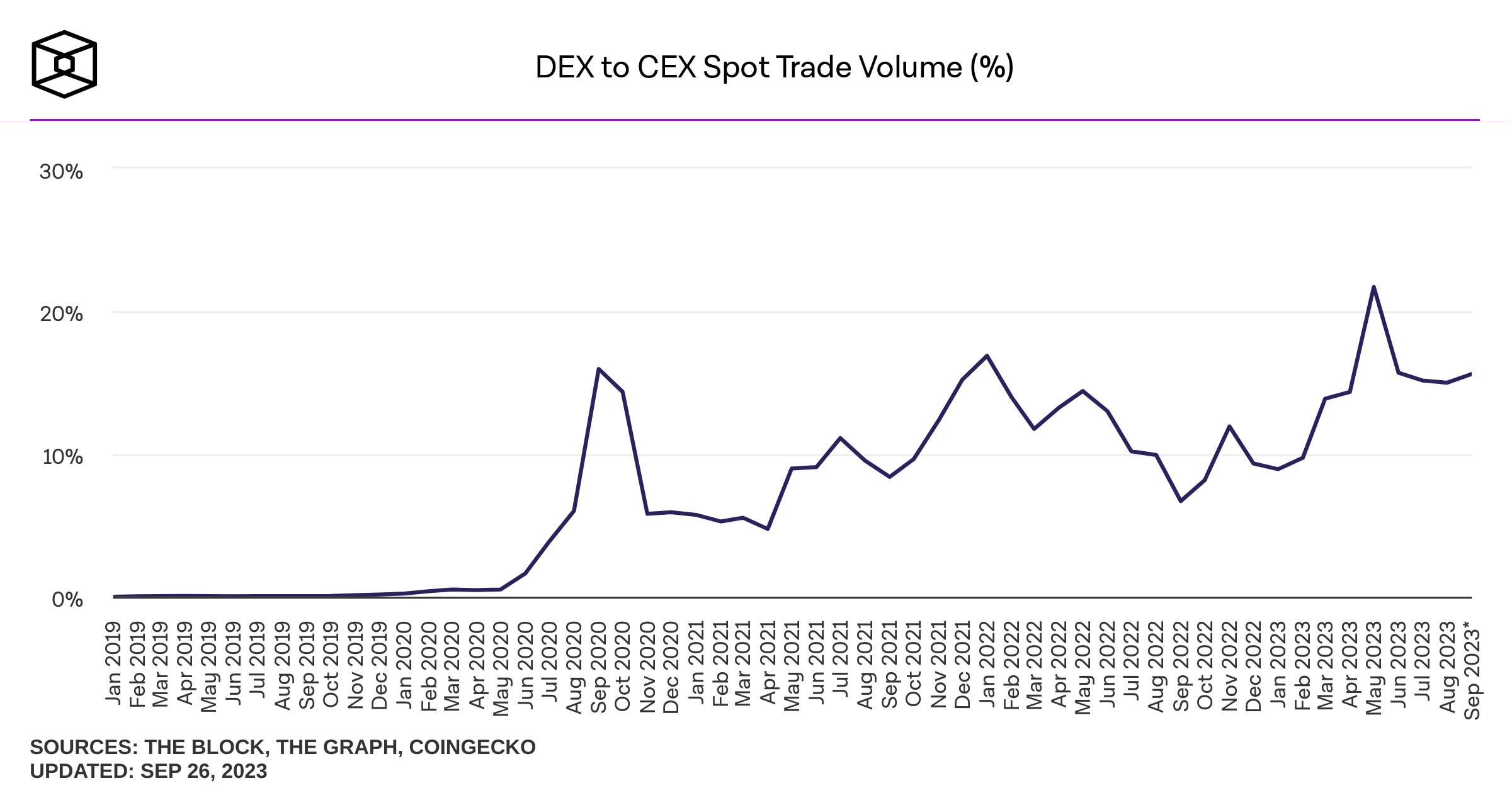

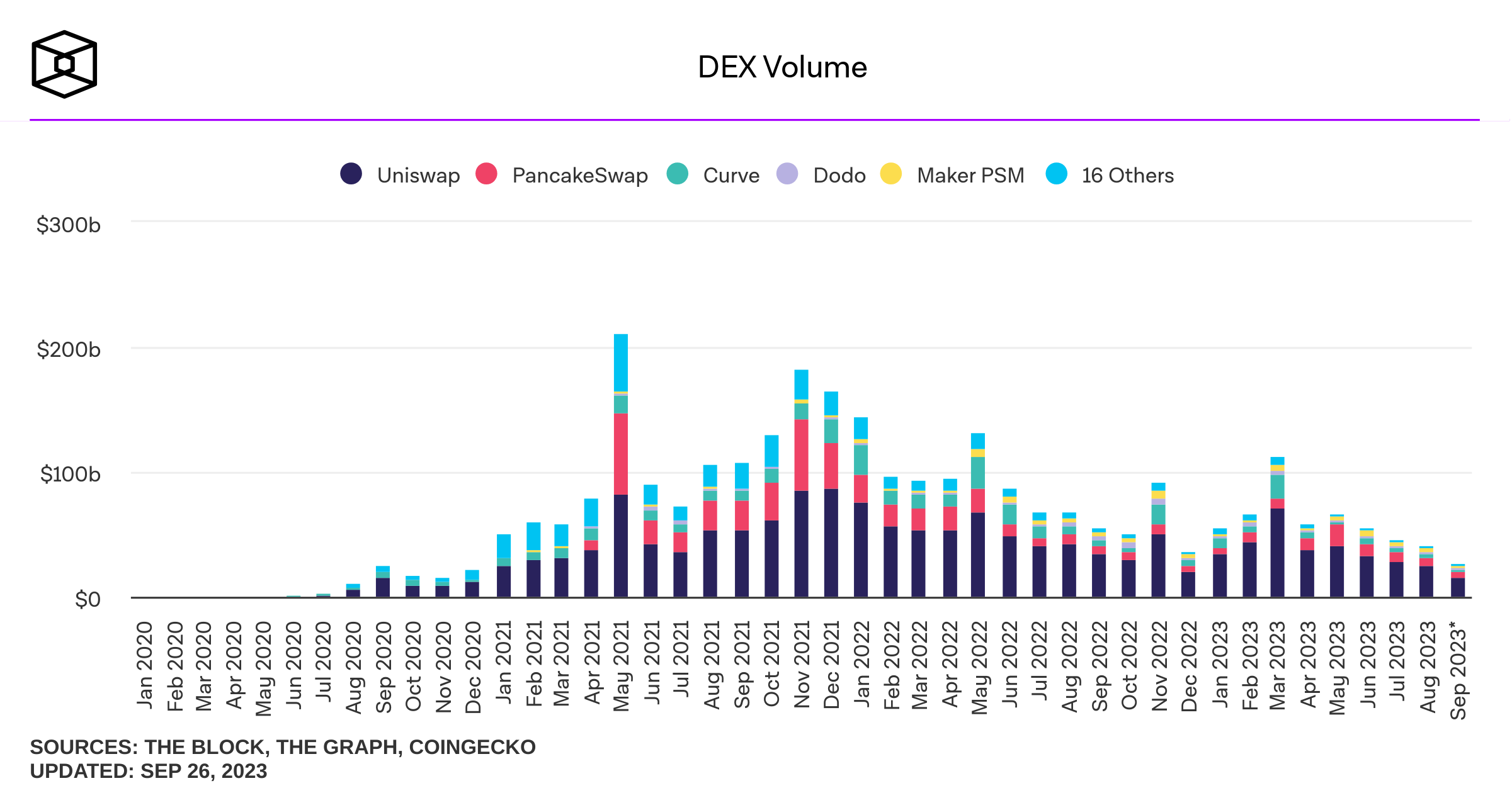

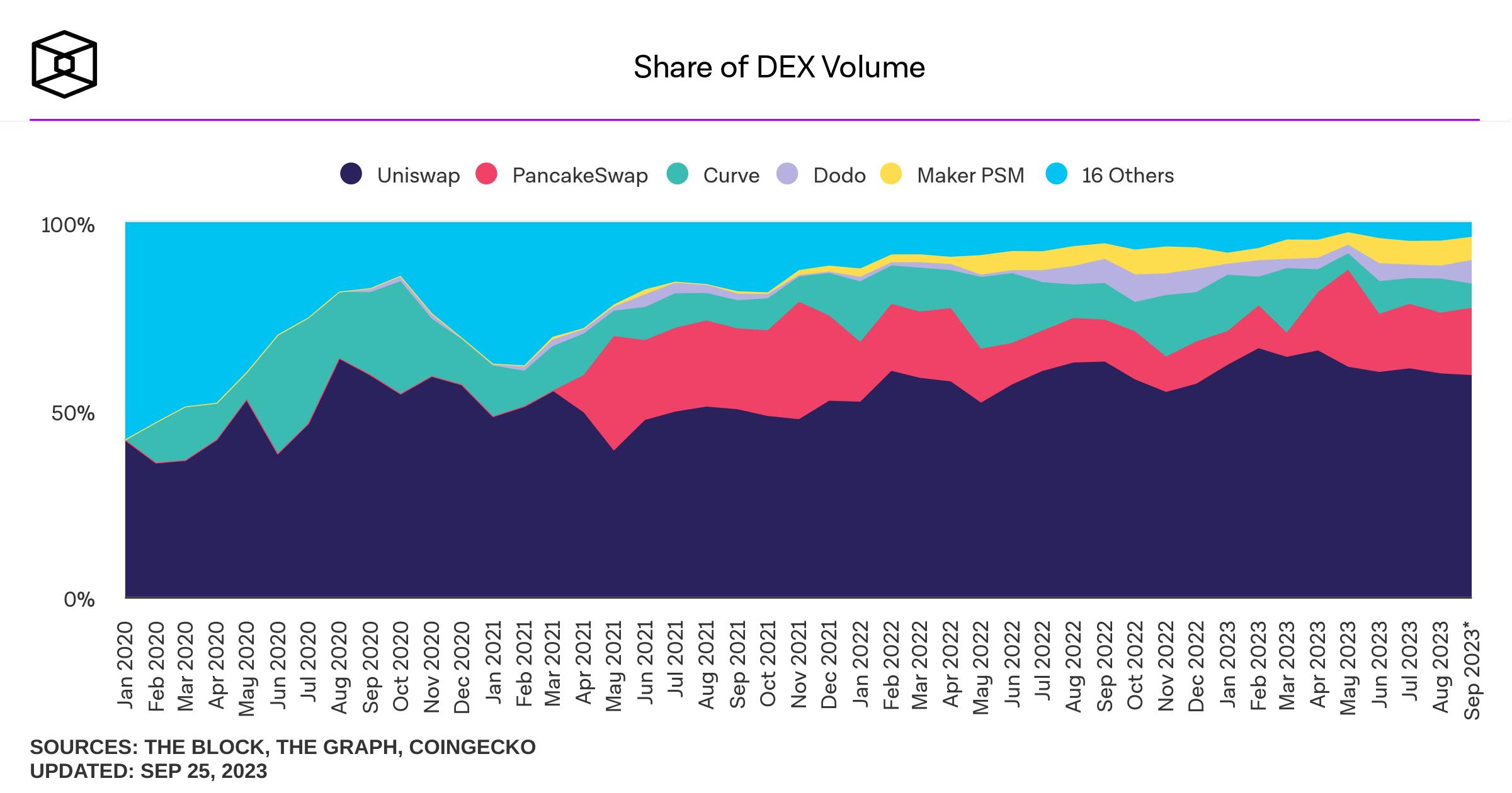

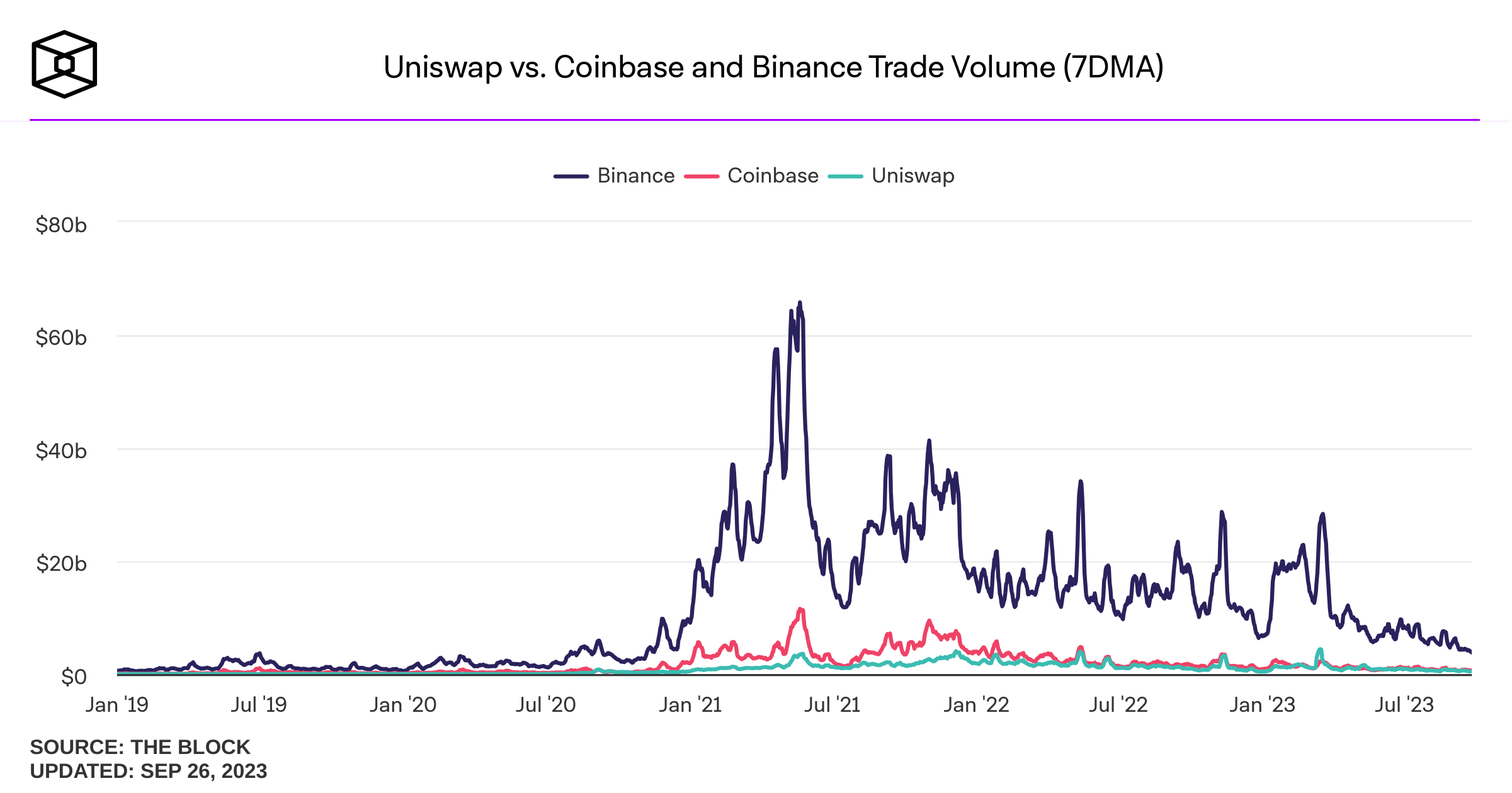

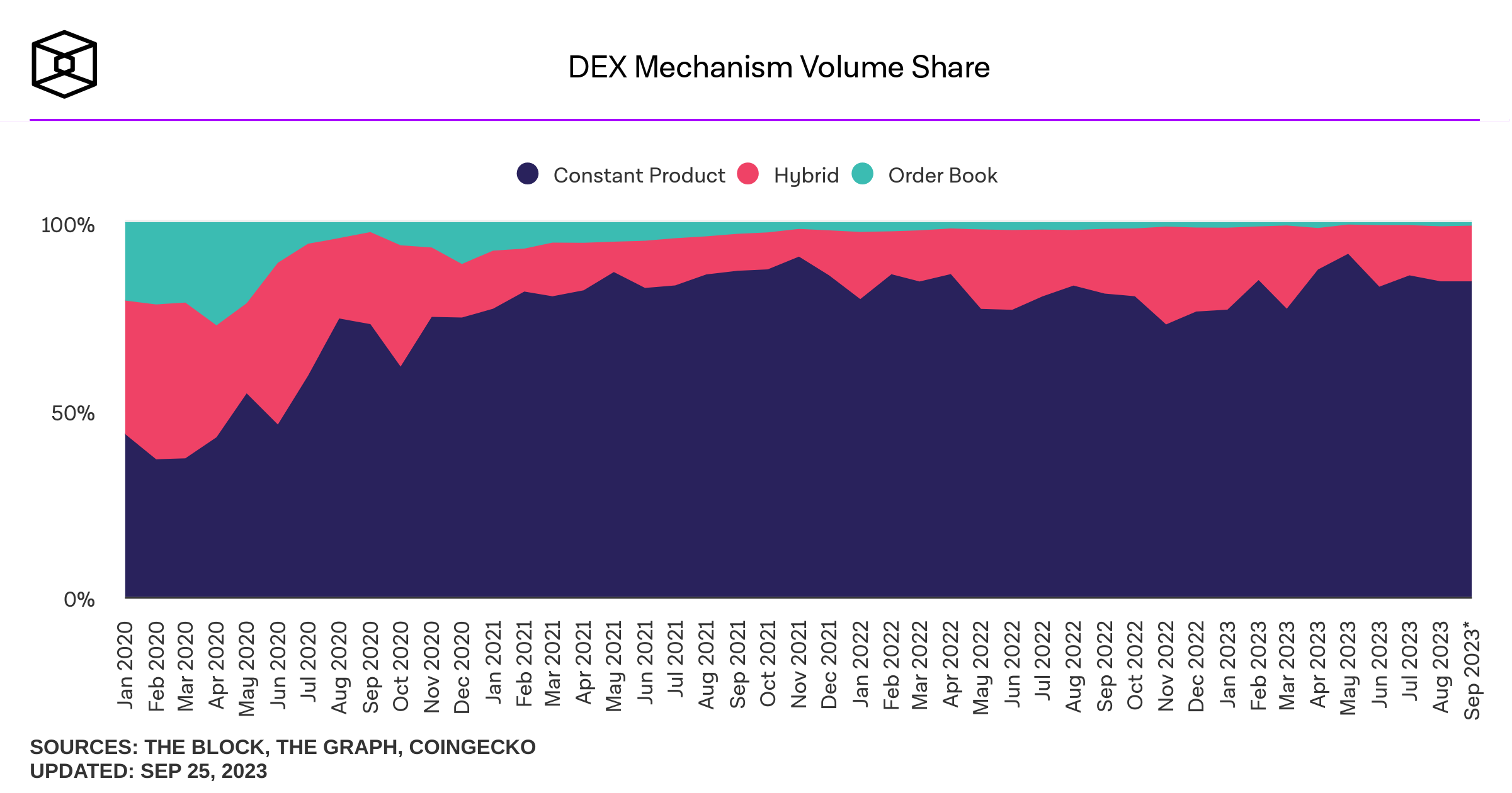

Some background stats on DEcentralized Exchanges (DEX)

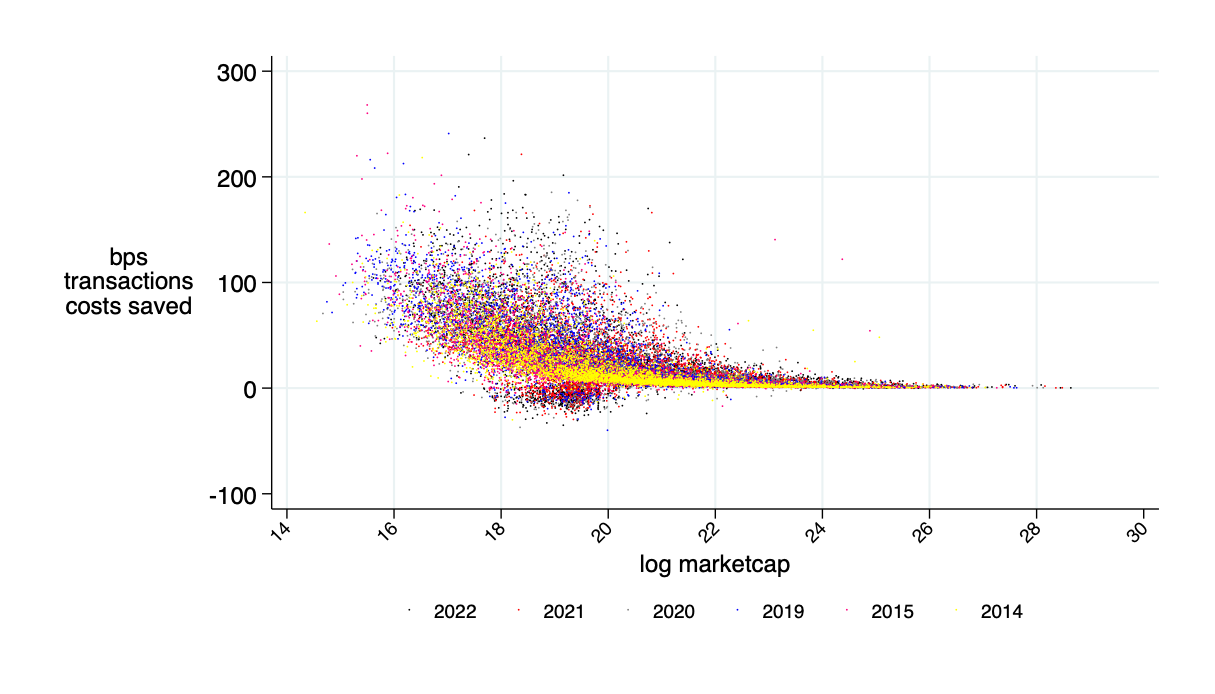

Sources of savings:

- better risk sharing among liquidity providers

- better use of capital

Possible transaction cost savings in cash equities: \(\approx\) 30%

Source: "Learning from DeFi: Would Automated Market Makers Improve Equity Trading?" working paper, Malinova & Park 2023

Who controls the Projects? Decentralized Autonomous organizations

UniSwap Lab supports development

a website app accesses the code

token holders control contact features

don't own the code

operation = decentral

control = decentral

anyone can use the baseline code

core code runs on the blockchain

tokens used as rewards

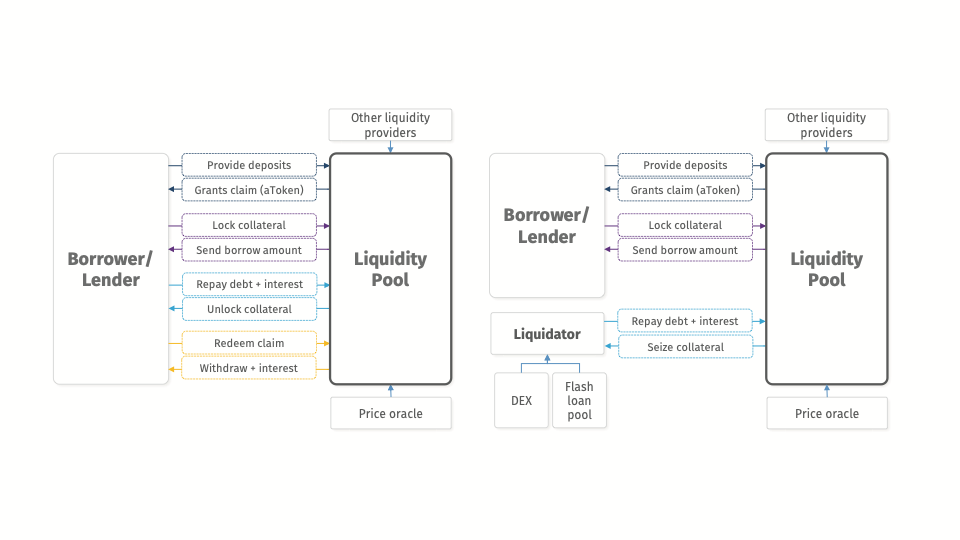

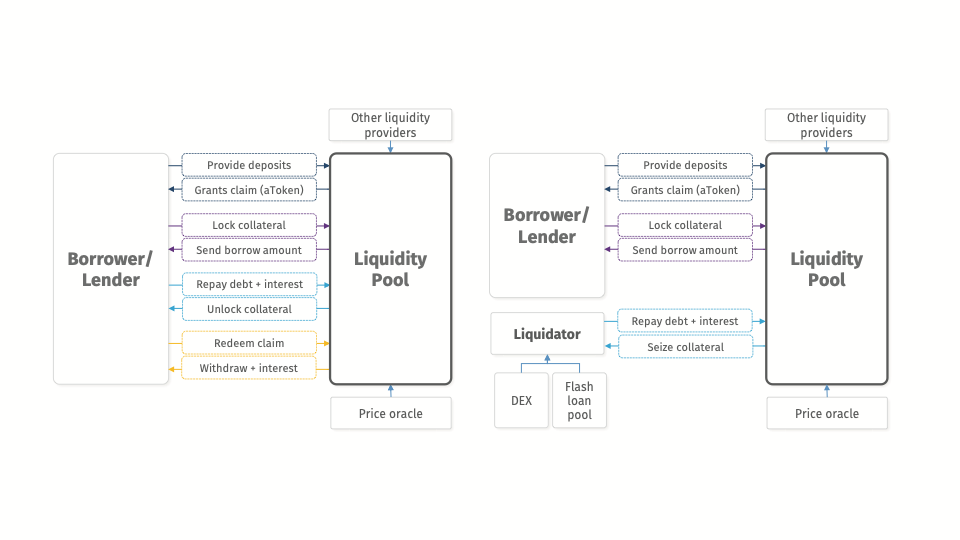

Application: Decentralized Borrowing & Lending

borrow

provide collateral

The Flow of Event: Normal Times

The Flow of Event: Collateral Liquidation

Dapp composability & Flash loans

1. flash-borrow DAI

5. repay DAI

3. receive the collateral (ETH) at a discount

4. convert ETH to DAI

2. liquidate ETH-collaterilized loan with DAI

Loan liquidation opportunity

New tools: flash loan

- either all of these execute or none -> arbitrage!

- can be used more traditionally -- e.g. to refinance a loan at a better rate

UNI governance token holders: control rights, but no cash flows

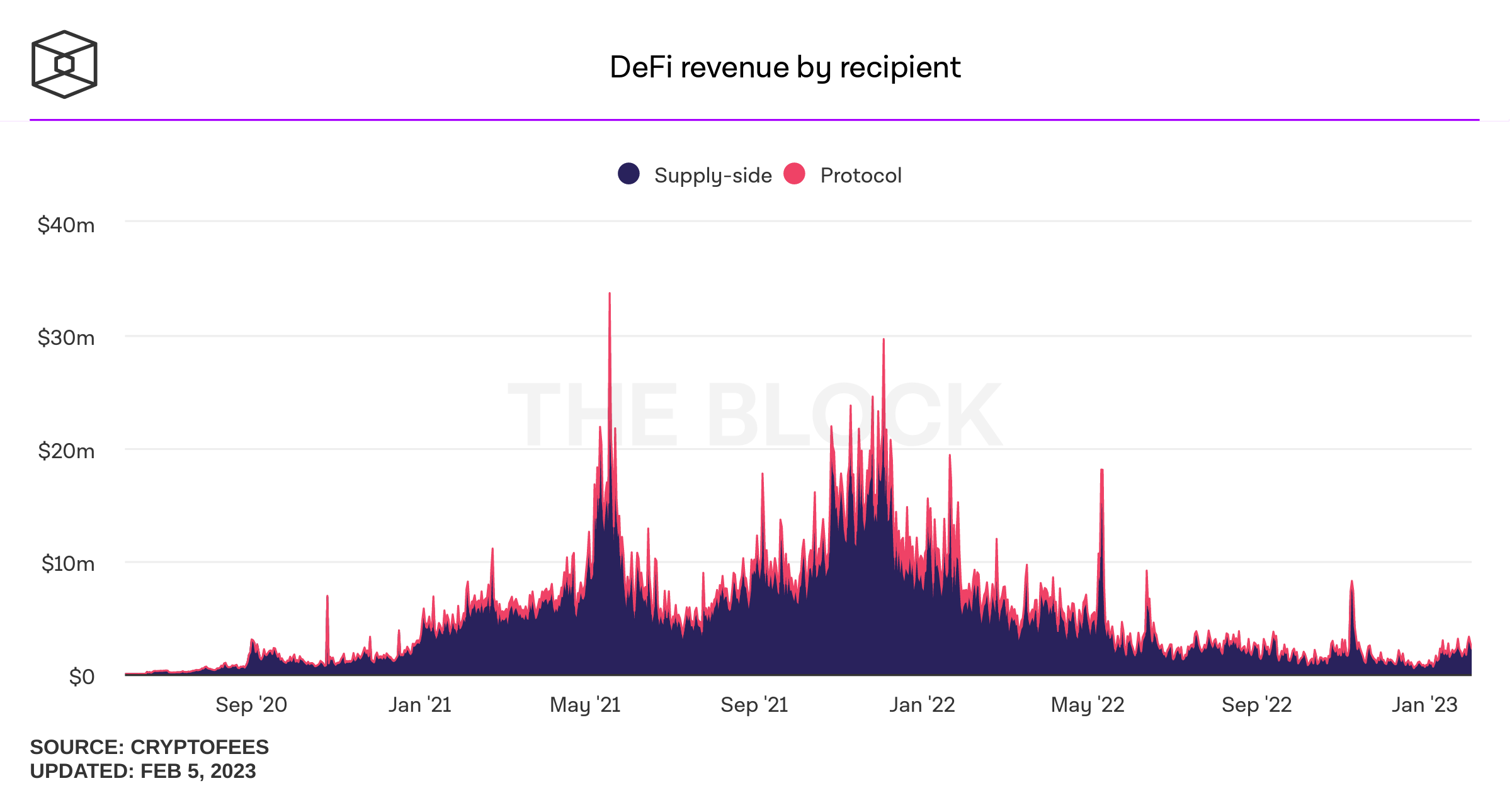

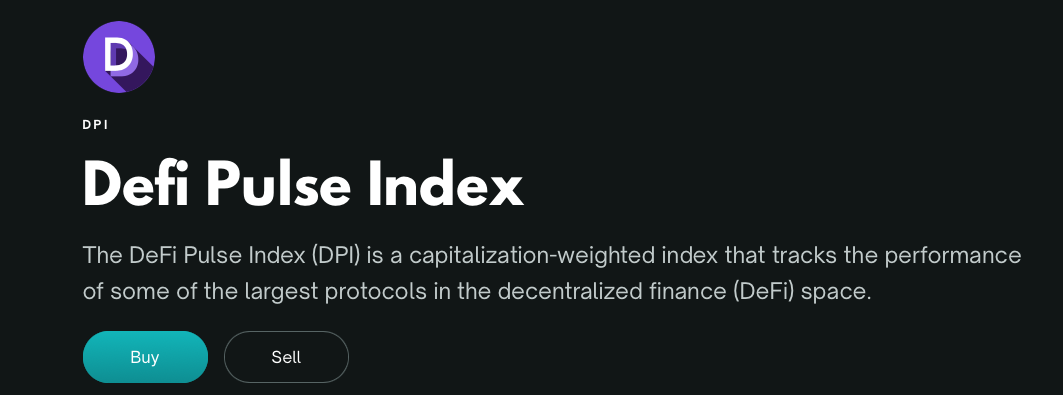

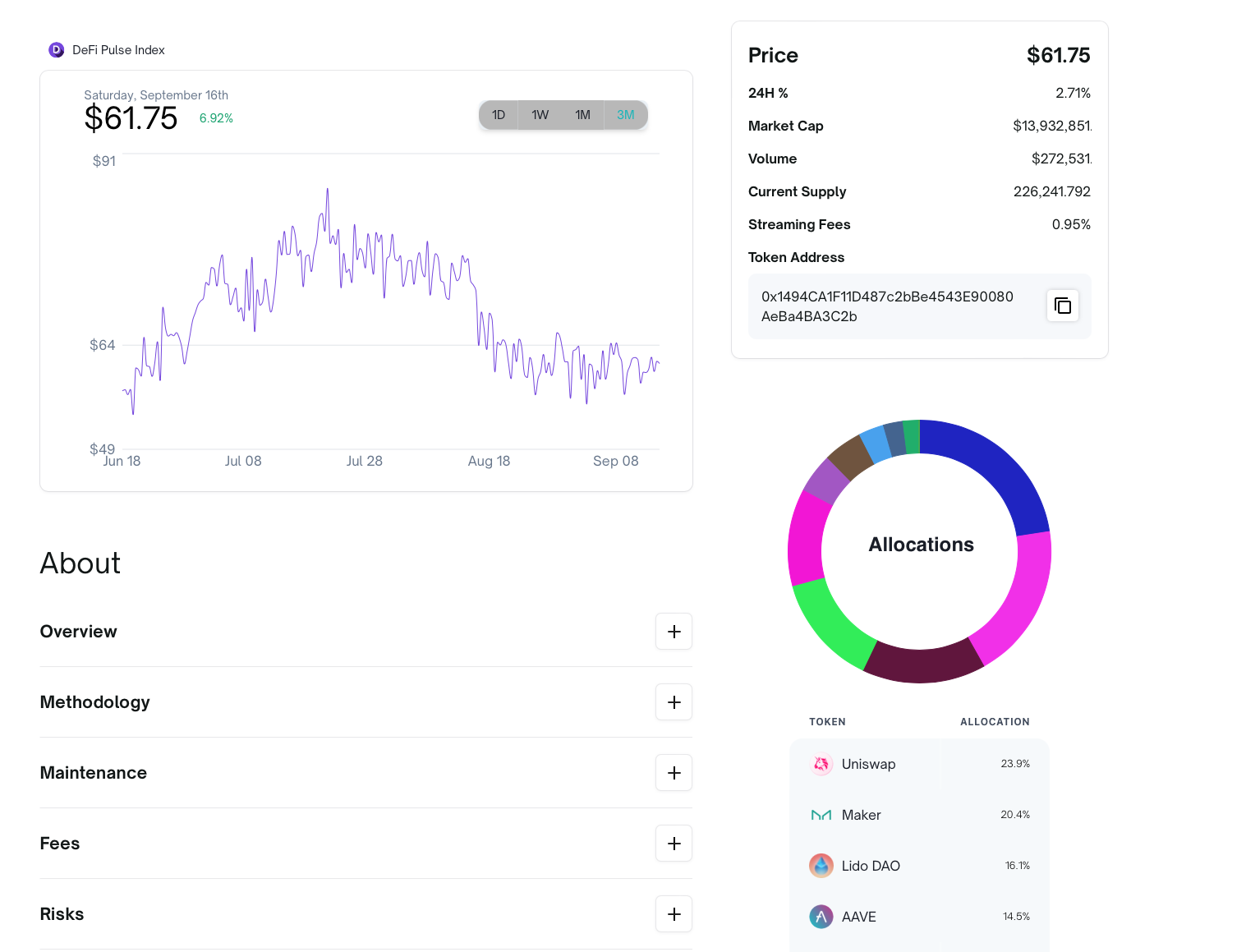

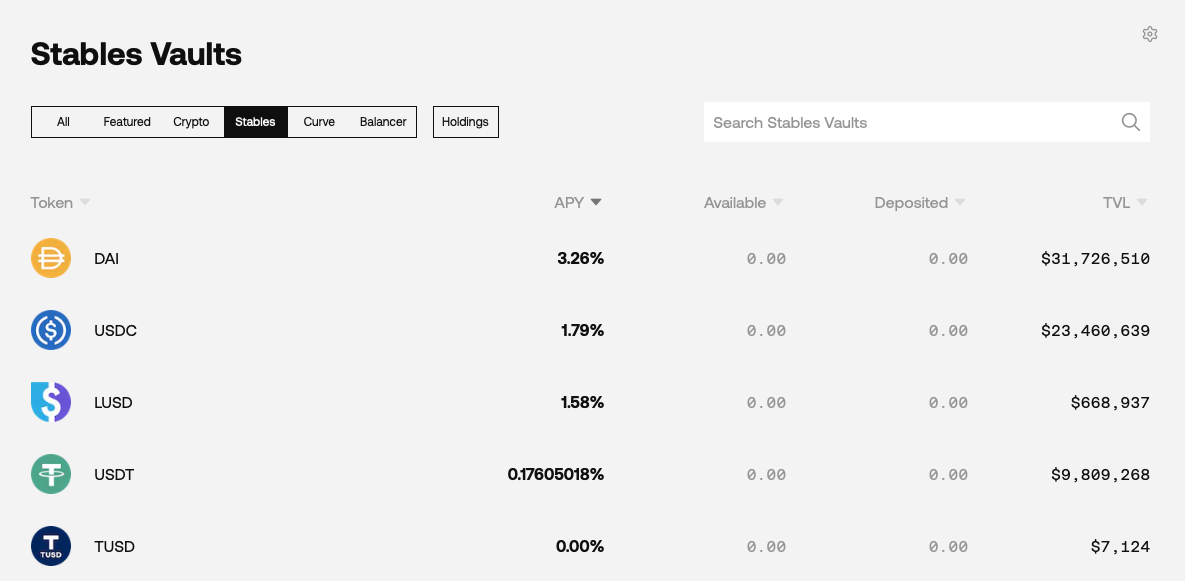

Many automated DeFi products are emerging

Obvious Smart Contract Application: Automate Investment Strategies

"yield aggregator:" push capital where rate of return is highest

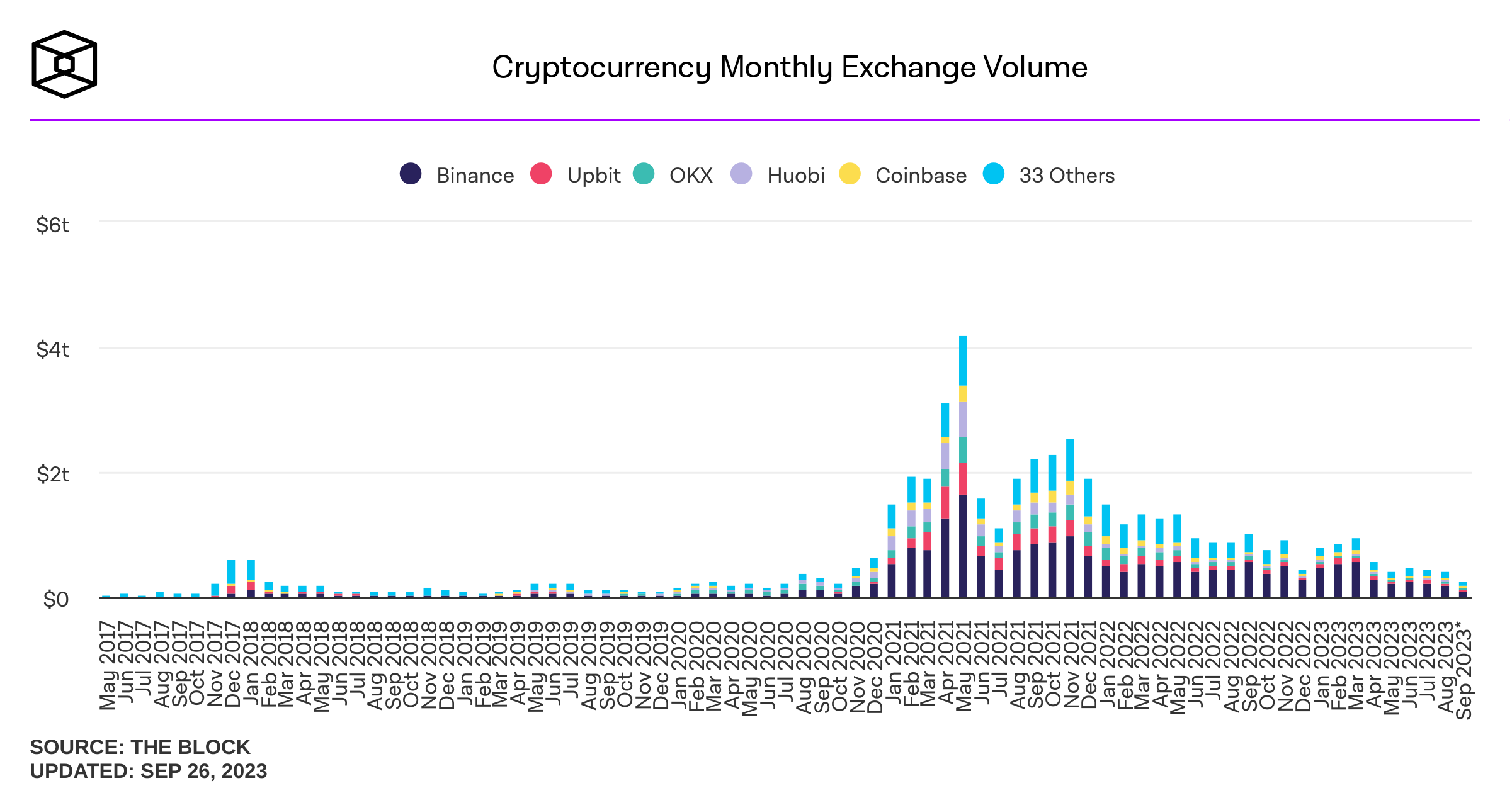

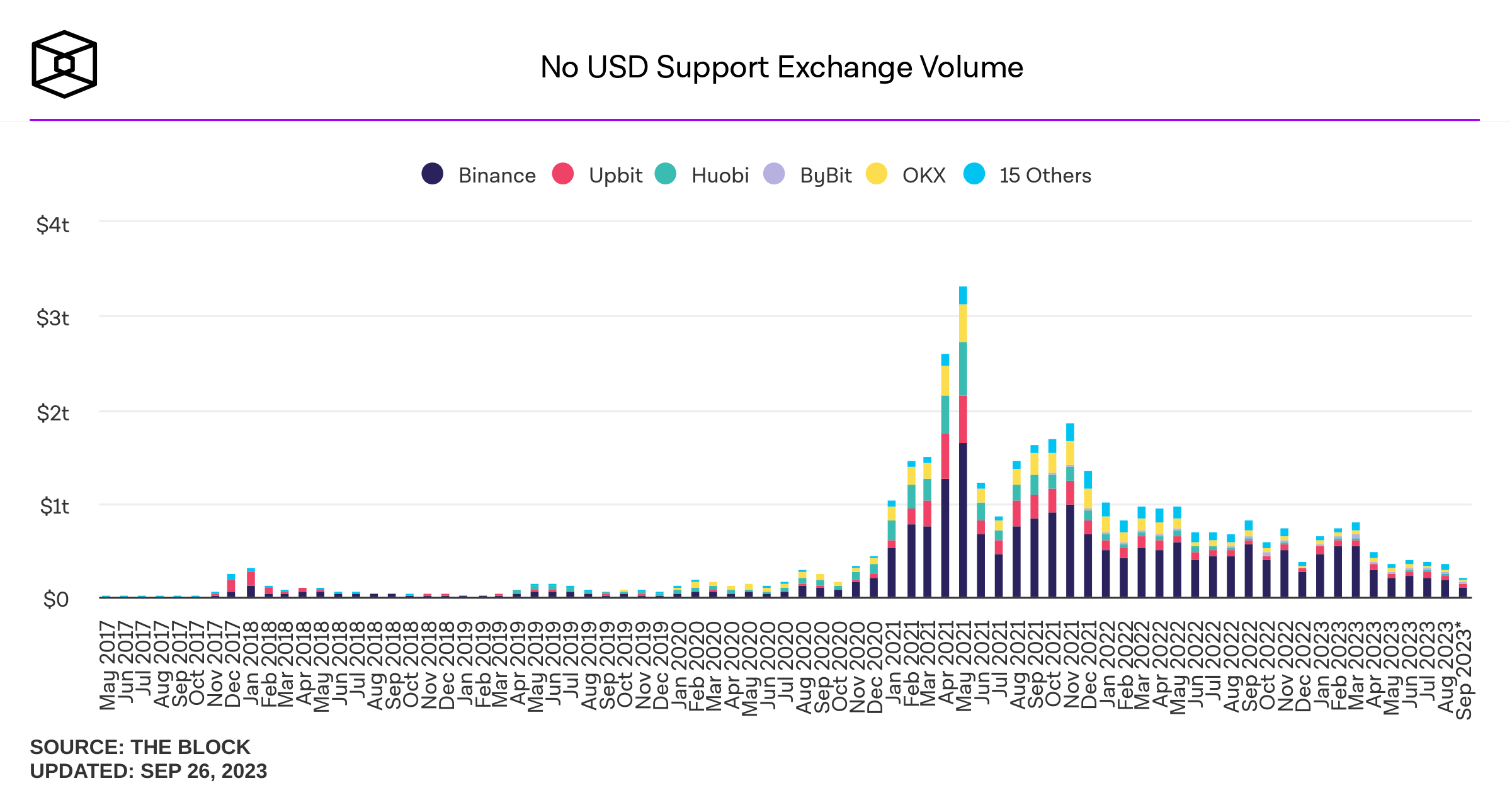

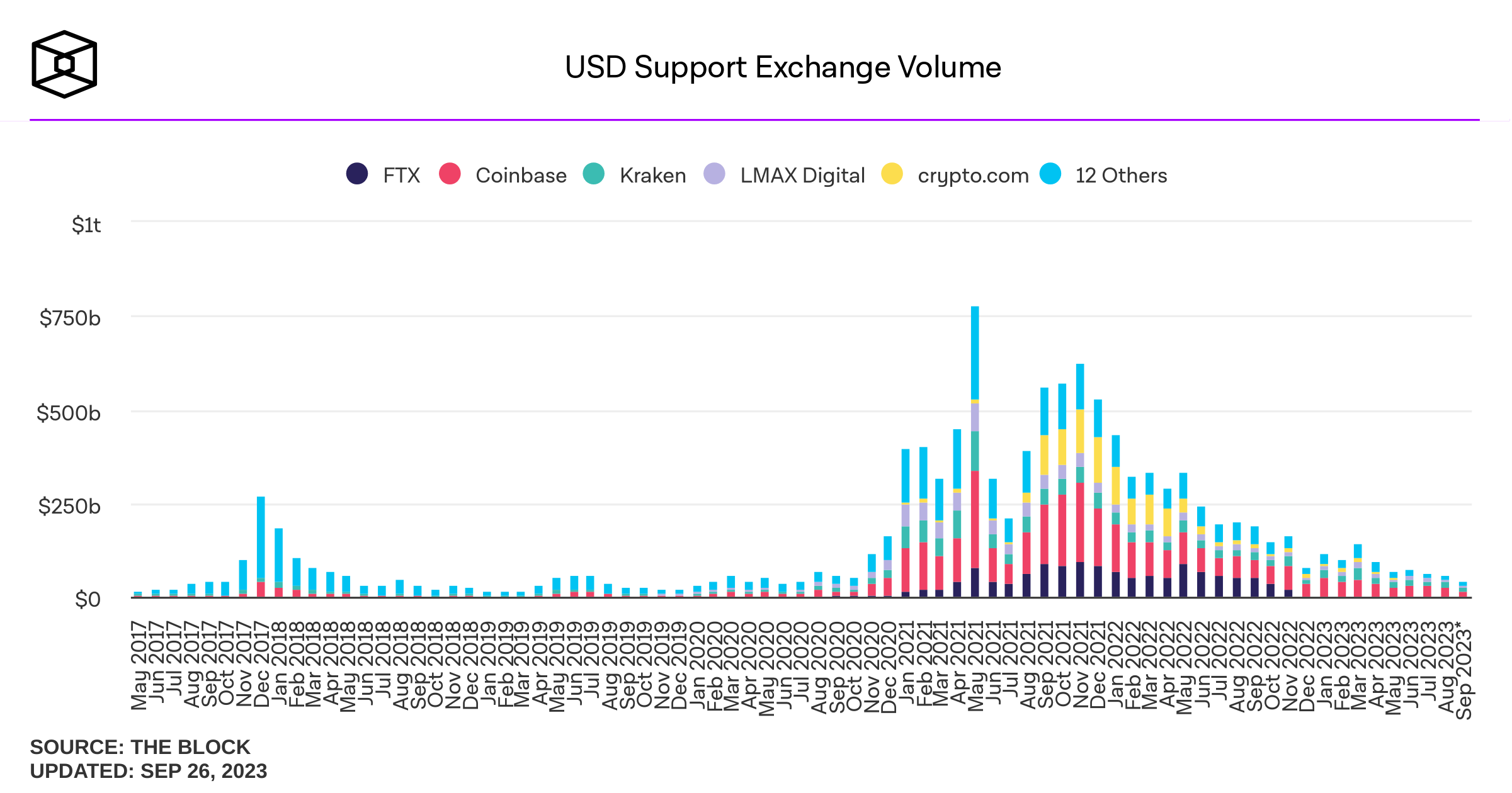

Crypto Trading

Broker

Exchange

Internalizer

Wholeseller

Darkpool

Venue

Settlement

Centralized Trading

Issues and concerns with CEX trading

- No shortage of drama!

- A short list of issues

- expensive arbitrage

- price manipulation

- volume manipulation

- security risk

- Google "Lazarus Group"

- Are they unlicensed securities exchanges?

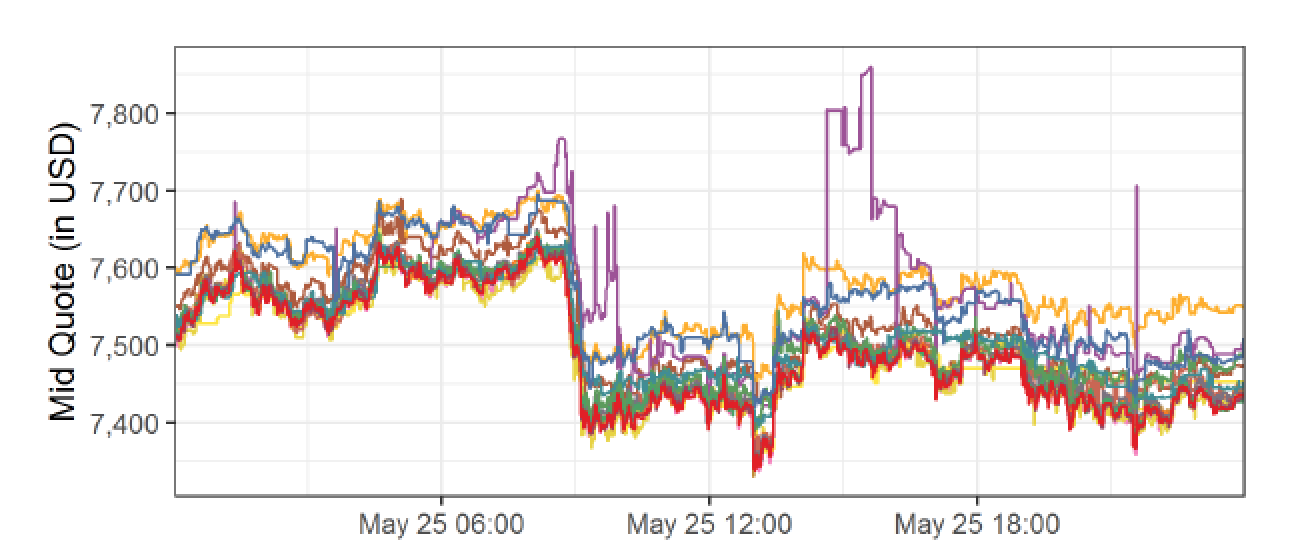

Costly Arbitrage

BTC/USD

ask: 7,600

bid: 7,550

BTC/USD

ask: 7,500

bid: 7,450

buy BTC

sell BTC

move BTC to Kraken

=> arbitrage = commit capital on multiple exchanges

Crypto Wash Trading, Lin William Cong, Xi Li, Ke Tang, Yang Yang

- systematic tests:

- robust statistical and behavioral patterns in trading to detect fake transactions on 29 cryptocurrency exchanges.

- Regulated exchanges are OK

- unregulated exchanges: rampant manipulations

- wash trading on each unregulated exchange:

- on average over 70% of the reported volume

- improve exchange ranking

- temporarily distort prices

Volume Manipulation

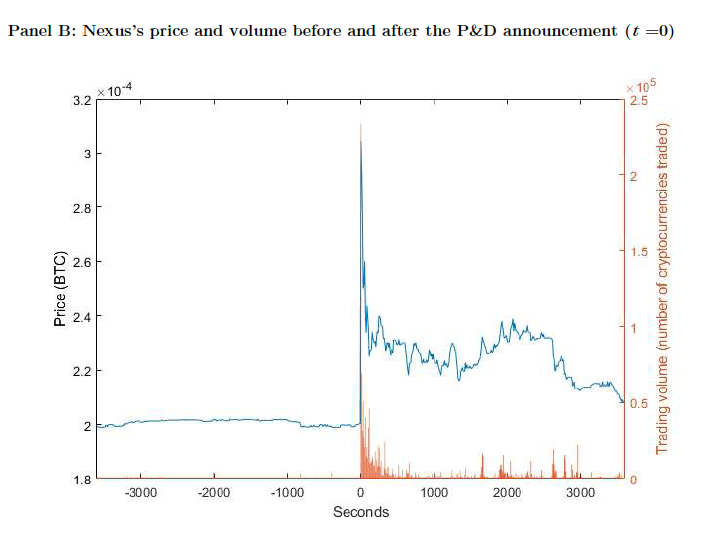

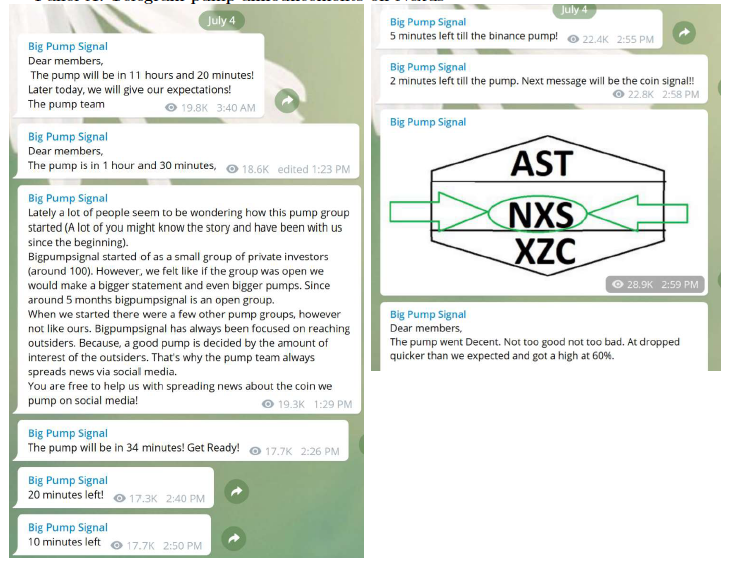

Cryptocurrency Pump-and-Dump Schemes

Tao Li, Donghwa Shin, and Baolian Wang, 2020

What is pump and dump?

arranged via Telegram Channels

Price Manipulation: Pump & Dump

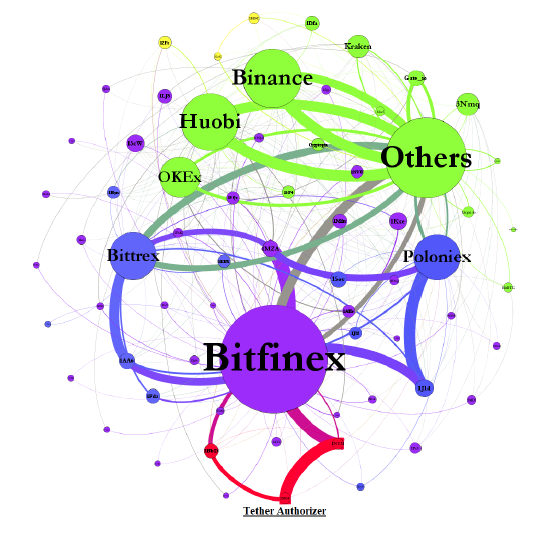

IS BITCOIN REALLY UN-TETHERED? JOHN M. GRIFFIN and AMIN SHAMS

Journal of Finance 2020

- Tether = ‘pushed’

- print an unbacked digital dollar to purchase Bitcoin.

- \(\to\) additional supply of Tether creates unwarranted inflation in Bitcoin price

vs.

- Tether = ‘pulled’

- driven by legitimate demand from investors who use Tether as a medium of exchange

- \(\to\) the price impact of Tether reflects natural market demand

Price Manipulation: Pumping Bitcoin

Price Manipulation: Pumping Bitcoin

Figure 1. Aggregate Flow of Tether between Major Addresses

August 2016

Security Risk

Nov 8

The FTX Implosion

Recurring Core problem

-

QuadrigaCX (Jan/Feb 2019) (OSC report):

- Co-founder and CEO Gerry Cotten sold people crypto he did not have

- "like a Ponzi scheme"

- => Clients collectively lost $169 million

-

FTX (Nov 2022) (according to the CFTC allegations):

- SBF controls both FTX.com and Alameda Research

- "features in the code underlying the FTX trading platform that allowed Alameda to maintain an essentially unlimited line of credit on FTX"

- Allowed Alameda research to bypass the auto-liquidation risk-management process

- => $8 billion of customer funds siphoned via Alameda

In a regulatory vaccum re: custody

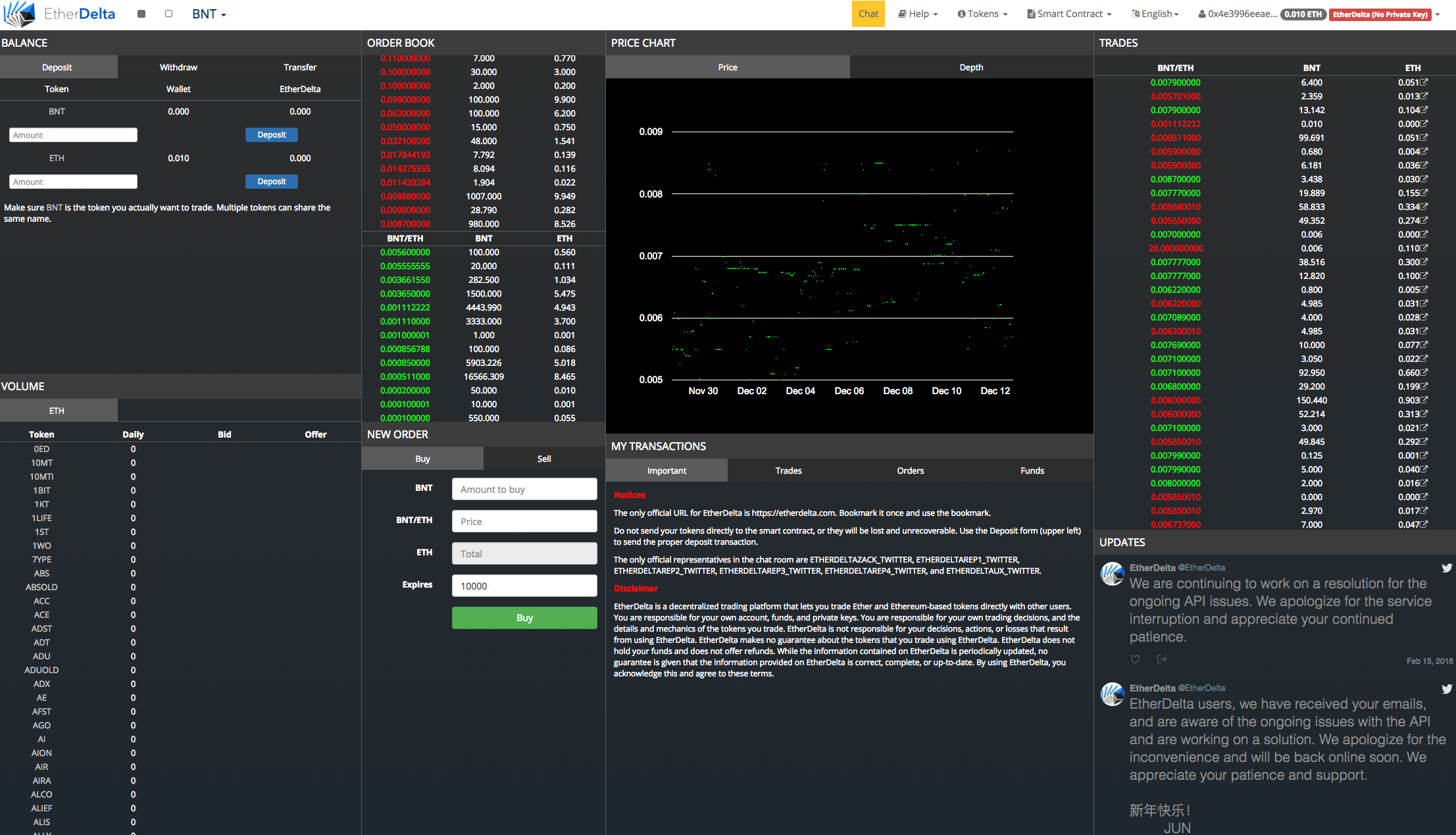

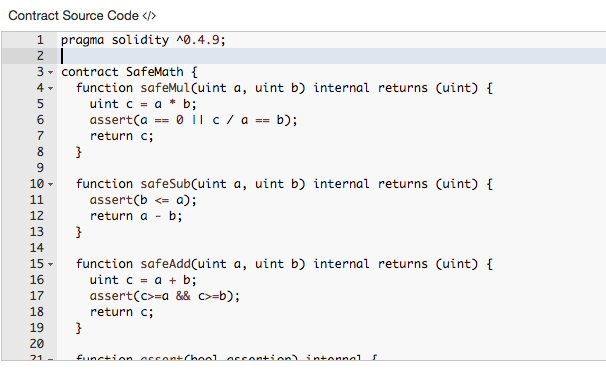

Decentralized Trading

... 300 lines of code ...

First approaches: de-centralized limit order book

Turns out ...

- bad idea

- Why?

- Data-intensive, computation intensive, costly, inefficient

- re-pricing of limit orders is very costly!

Decentralized Exchanges (DEX)

Some background stats on DEcentralized Exchanges (DEX)

decentralized exchange

Key Components

Idea:

- create a way to exchange items on-chain

- fully decentralized

- \(\to\) no single controlling entity, or location, everything runs with smart contracts

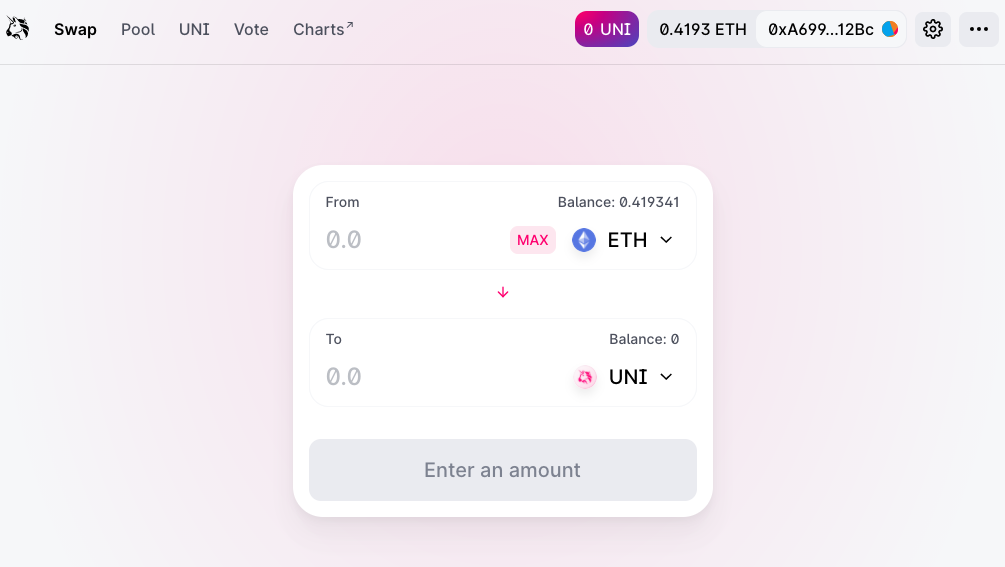

How does it look?

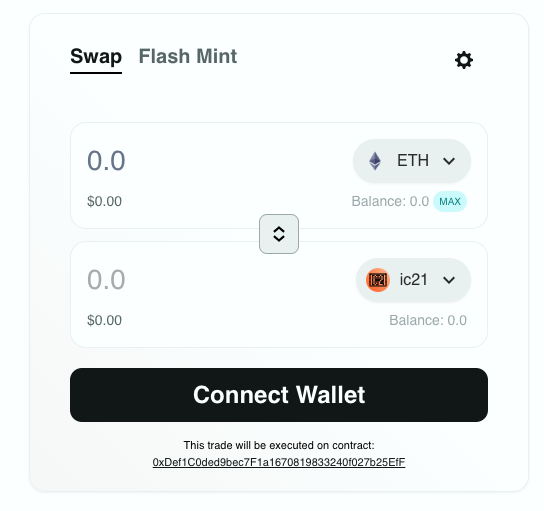

automated market maker

\(\to\) simply connect with MetaMask (or similar wallet)

Application: decentralized trading with automated market makers

New institutions!

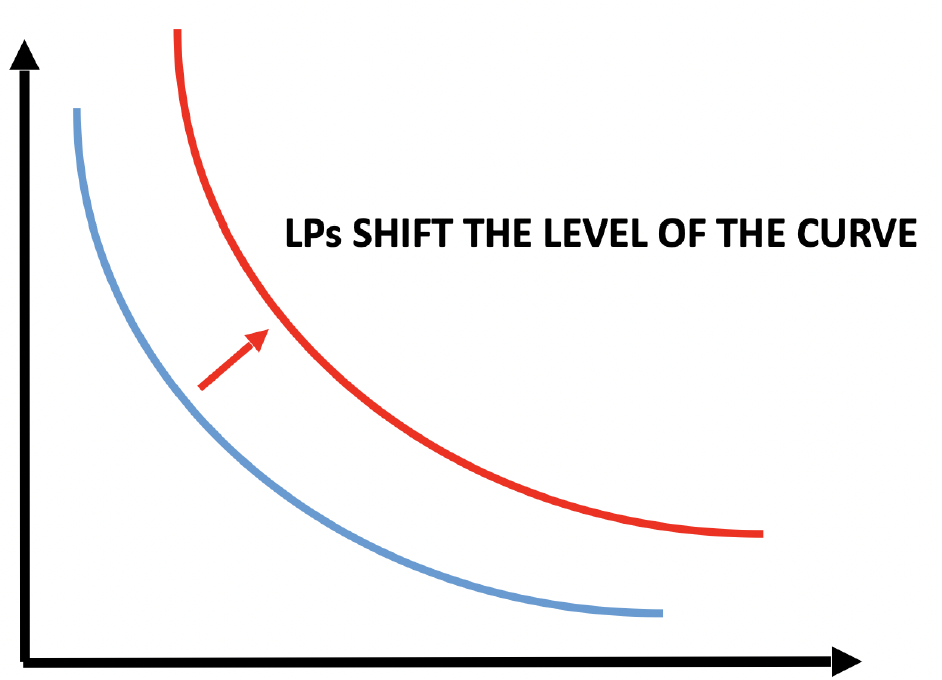

- passive "shared" liquidity provision

- new pricing function

AMM Pricing

- AMMs require liquidity deposits

- Deposits:

- \(a\) units of an asset (e.g. a stock)

- \(c\) units of cash

Key Components

- pooling of liquidity

- pro-rated (for liquidity providers)

- fee income

- risk

- Liquidity providers:

- use existing assets to earn passive income

- Liquidity demanders:

- predicatable price

- continuous trading

- ample liquidity

\(X-Q\)

\(X\)

\(Y+P(Q))\)

\(Y\)

\(c=X\cdot Y\)

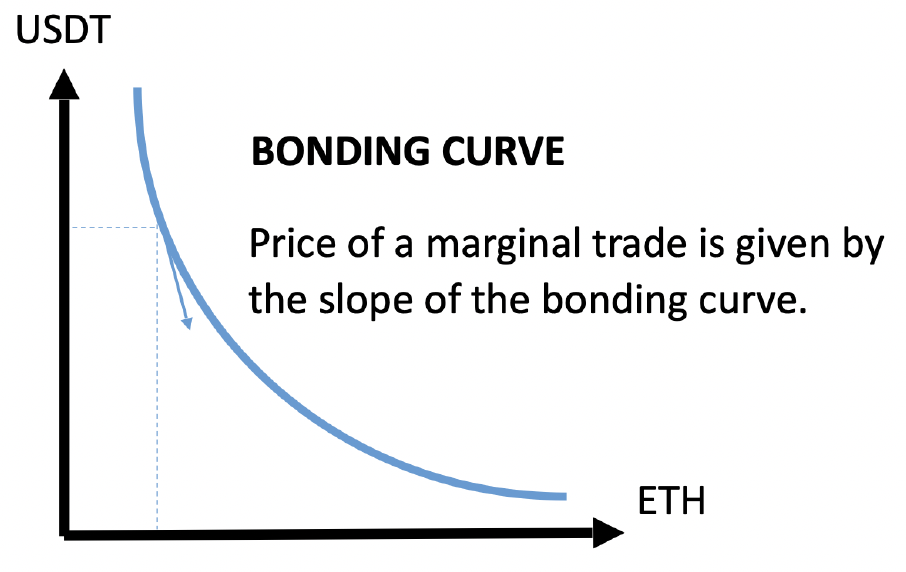

automated market makers Pricing Function

- remove \(Q\) of one token

- must add \(P(Q)\) of other token

- so that liquidity stays invariant \[L(X,Y)=L(X-Q,Y+P(Q))\]

- Common rule: constant product \[X\cdot Y=(X-Q)\cdot (Y+P(Q))\]

How do you organize DEX trading?

automated market maker

Price mechanism:

- risk-neutral "invariance" pricing

- at price, contract (AMM) is indifferent between buying and selling

- \(X=\) contract balance of asset \(A\)

- \(Y=\) contract balance of asset \(B\)

- \(k=\) invariance factor

- key relation \(k=X\times\ Y\)

Prices

- when you want to sell \(x\le X\) you receive \(y\) that maintains invariance.

How do you organize DEX trading? EXAMPLE

automated market maker

invariant \(k=4\times4=16\)

Instantaneous exchange rate:

1 = 1

Contract deposit:

How do you organize DEX trading? EXAMPLE

automated market maker

sell 4 DAI for how many USDC?

1

0.5

=

How do you organize DEX trading? EXAMPLE

automated market maker

invariant \(k=100\times100=10,000\)

Contract deposit:

Problem: large "slippage" (or price impact)

"Deep liquidity" helps minimize this.

\(100\times\)

\(100\times\)

How do you organize DEX trading? EXAMPLE

automated market maker

sell 4 DAI for how many USDC?

\(100\times\)

\(100\times\)

\(3.85\times\)

\(-3.85\times\)

1

0.9625

=

How do you organize DEX trading? EXAMPLE

automated market maker

\(\to\) the more money is in the contracts, the lower the price impact

-

Increase the deposit to 10,000 DAI & USDC:

- \(k=10,000\times10,000=100,000,000\)

- \(~\to\) for \(4\) DAI you get \(10,000-100,000,000/10,004=3.998\) USDC

How do you organize DEX trading? other mechanisms

automated market maker

- anyone can become a liquidity provider when supplying both sides of a pair

- can also establish a new pair

- including creating a brand-new token \(\to\) establish a starting price!

- trades carry a fee \(\to\) paid to liquidity providers (pooled)

- liquidity providers face adverse selection and opportunity costs relative to all other assets \(\to\) fee income must be sufficient

superannoying feature

automated market maker

-

front-running

-

transactions enter mem-pool

-

\(\to\) all visible there

-

arbitrageur make instant-swap trade at higher gas price

-

\(\to\) trade instead of original trade

-

"fix" (not a proper solution): set a max slippage (a range of prices that willing to trade at)

-

Uniswap V3

-

-

Stopped here in lecture 3

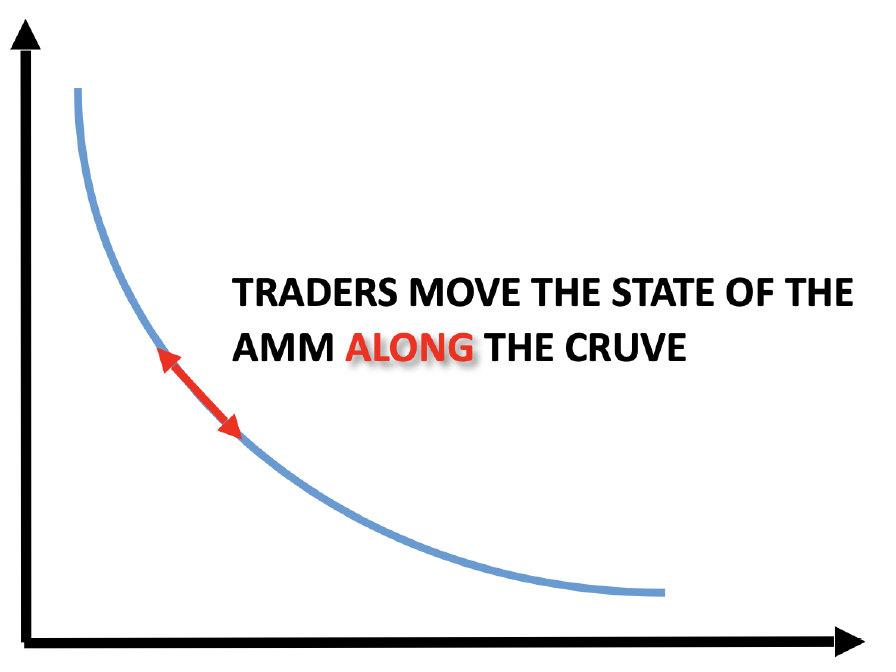

DEX: Quick Recap

Decentralized trading using automated market makers (AMM)

Liquidity providers

Liquidity demander

Liquidity Pool

AMM pricing is mechanical:

- determined by the amounts of deposits

- most common:

- constant product

- #USDC \(\times\) #ETH = const

USDC

Quiz: Quick Recap

Consider a DEX (decentralized exchange) that prices securities according to the constant product rule discussed in lecture. The initial deposits in the liquidity pool are 200 ETH and 300,000 USDC. You want to buy ETH.

Note: buy ETH = sell USDC

After you buy 1 ETH in exchange for y USDC, the pool will have

- 200-1 = 199 ETH

- 300,000 + y USDC

\(\Rightarrow 200 \times 300,000= (300,000 + y) \times (200-1) \)

\(\to y = 1,508\)

Quiz: Quick Recap

After you buy 10 ETH and sell y USDC, the pool will have

- 200-10 = 190 ETH

- 300,000 + y USDC

\(\Rightarrow 200 \times 300,000= (300,000 + y) \times (200-10) \)

\(\to y = 15,789\) -- cost of 10 ETH!

\(\to 1,578.9\) per 1 ETH

Some facts about DEXes

automated market maker

- anyone can become a liquidity provider when supplying both sides of a pair

- can also establish a new pair

- including creating a brand-new token \(\to\) establish a starting price!

- trades carry a fee \(\to\) paid to liquidity providers (pooled)

- liquidity providers face adverse selection and opportunity costs relative to all other assets \(\to\) fee income must be sufficient

superannoying feature

automated market maker

-

front-running

-

transactions enter mem-pool

-

\(\to\) all visible there

-

arbitrageur make instant-swap trade at higher gas price

-

\(\to\) trade instead of original trade

-

"fix" (not a proper solution): set a max slippage (a range of prices that willing to trade at)

-

Uniswap V3

-

-

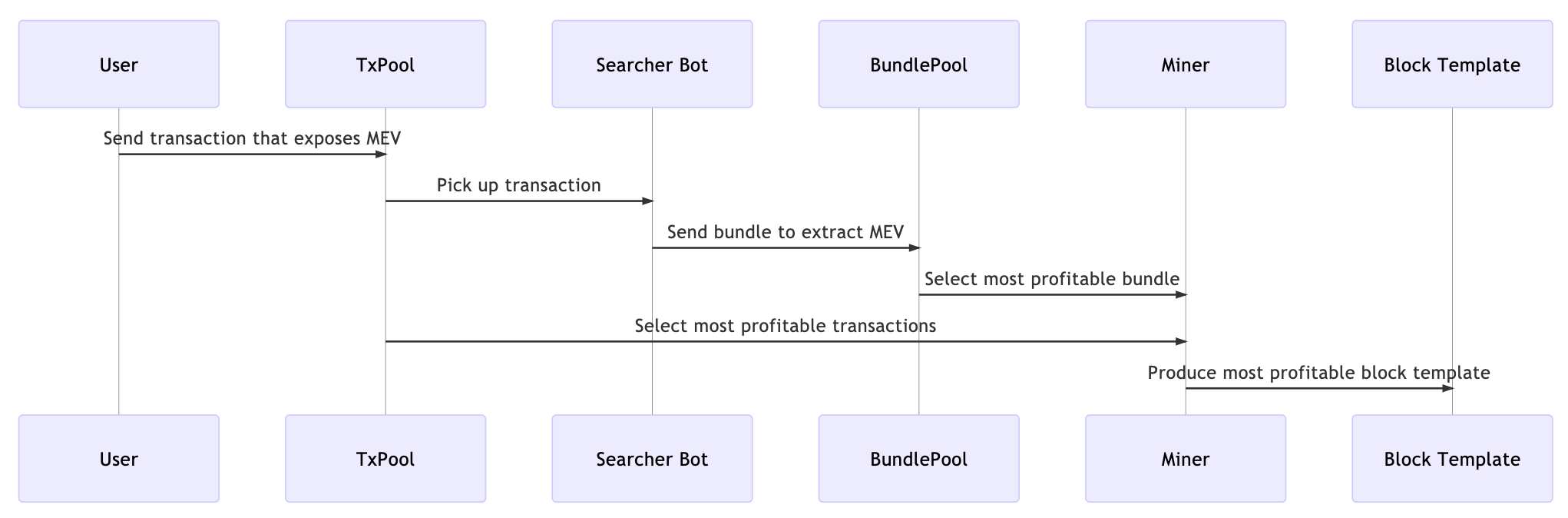

Transaction Processing in DeFi

Transaction Visualization

transactions

decentralized applications

tokens

The

"Mem-Pool"

a

b

c

d

e

f

g

A Simple Overview

a

b

c

d

e

f

g

The reality is more complicated

Consequence 1: Extract Value from Users

"Ethereum is a Dark Forest"

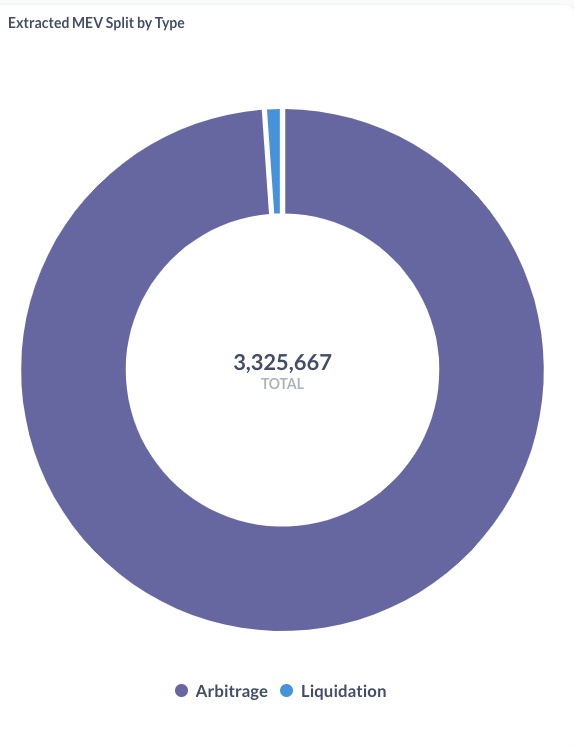

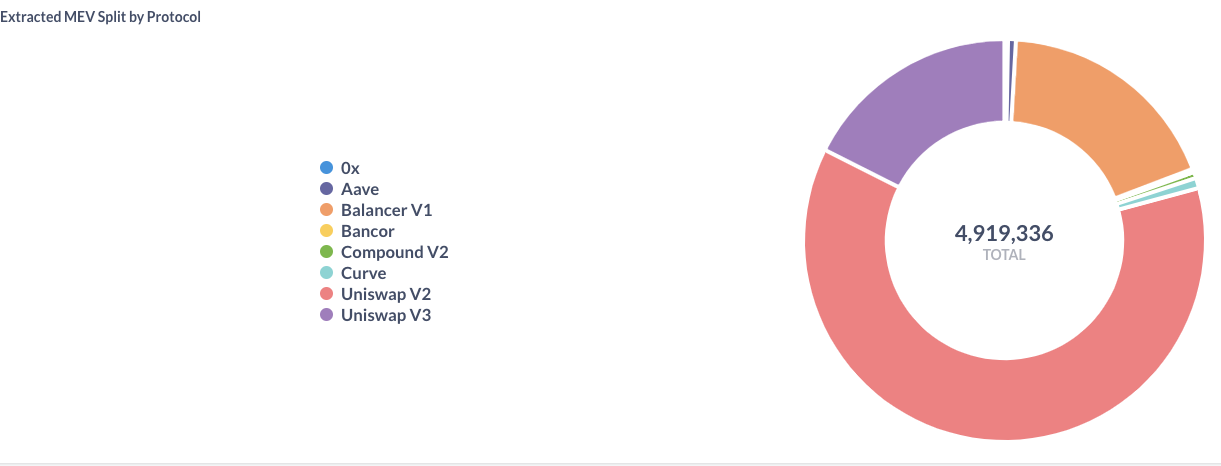

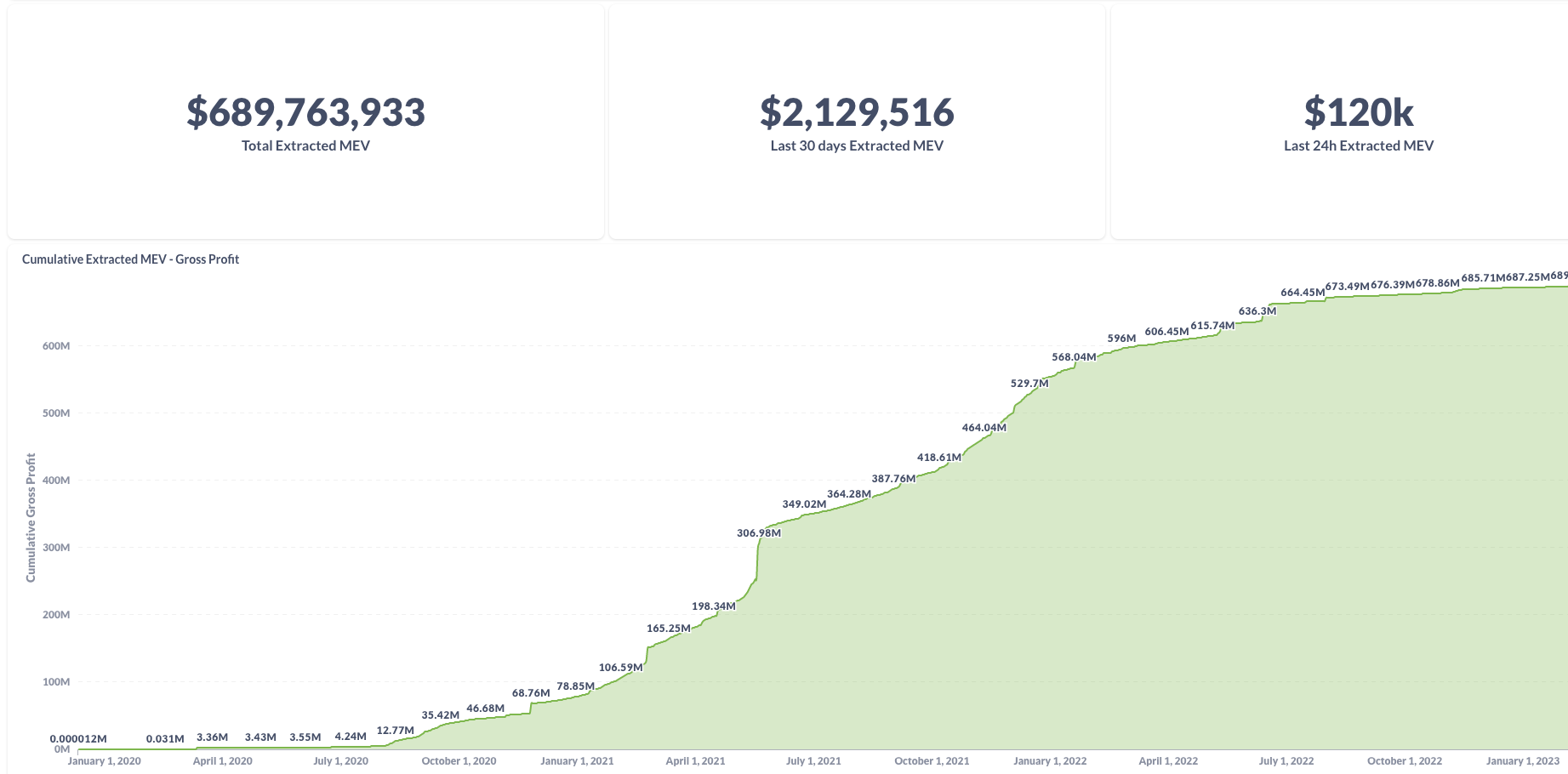

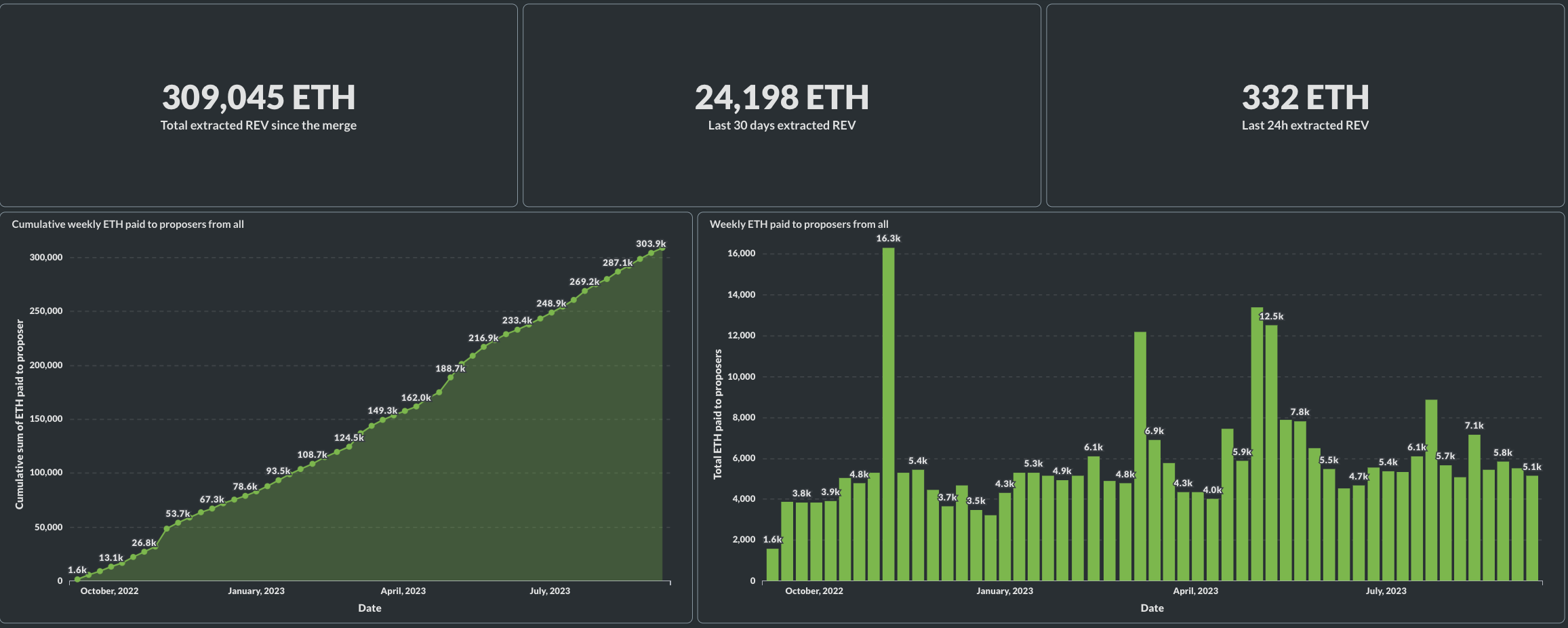

The "dark side": MEV = maximum (formally: miner) extractable value

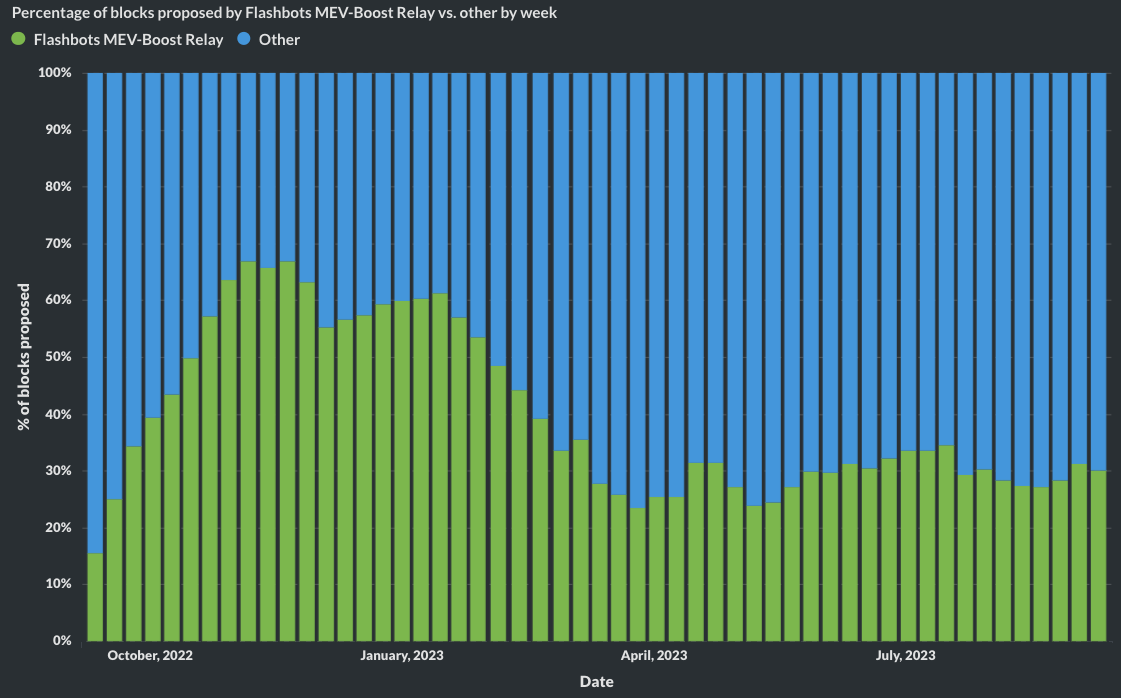

The charts are for pre-merge, see https://transparency.flashbots.net for post-merge stats

Consequence 2: Excess Gas Prices ("Priority Gas Auctions")

- may raise costs for all users without economic benefit

- wastes blockspace

- slows down processing

One resolution:

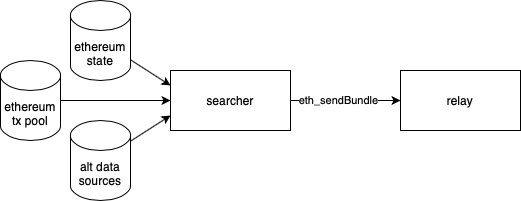

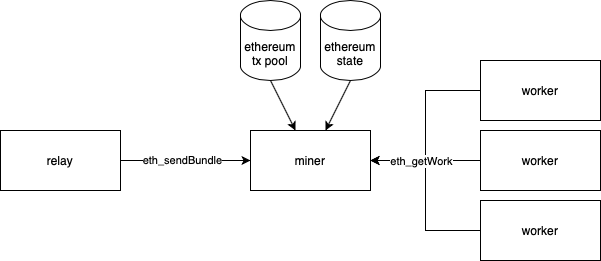

Flashbots Protocol

Idea of Flashbots

- separate user roles

- builders/seekers

- relay

- miners/validators

- eliminate public mempool

- reserve top of blockspace for privately submitted transactions

Flashbots does not prevent MEV!

- "democratize" the access

- the structure helps prevent gas auctions

@katyamalinova

malinovk@mcmaster.ca

slides.com/kmalinova

https://sites.google.com/site/katyamalinova/

Illustration

Transactions Send to Searchers

NB: the relay is a security measure: it has high capacity and can distinguish garbage from real transactions

Bundles come to Miners

NB: miners could still manipulate, front-run etc, but Flashbots monitors them and would cut them off if they misbehave

Is it used?

81% of validators have signed on with Flashbots (>880,000 total)

Does Flashbots Prevent MEV? No!

Does Flashbots Prevent MEV?

- Flashbots "democratizes" MEV

- prevents priority gas auctions

Flashbot 3.0 Transaction Privacy

- under development (as of 2023)

- Idea:

- submit encrypted transactions

- block building based on gas but not content

- decryption only occurs at processing

- But: very tricky problem in a trustless world