Intro to FinTech

MBA F741

Instructor: Katya Malinova

This slide deck was developed in collaboration with Andreas Park (University of Toronto)

What is FinTech?

Finance

+

Technology

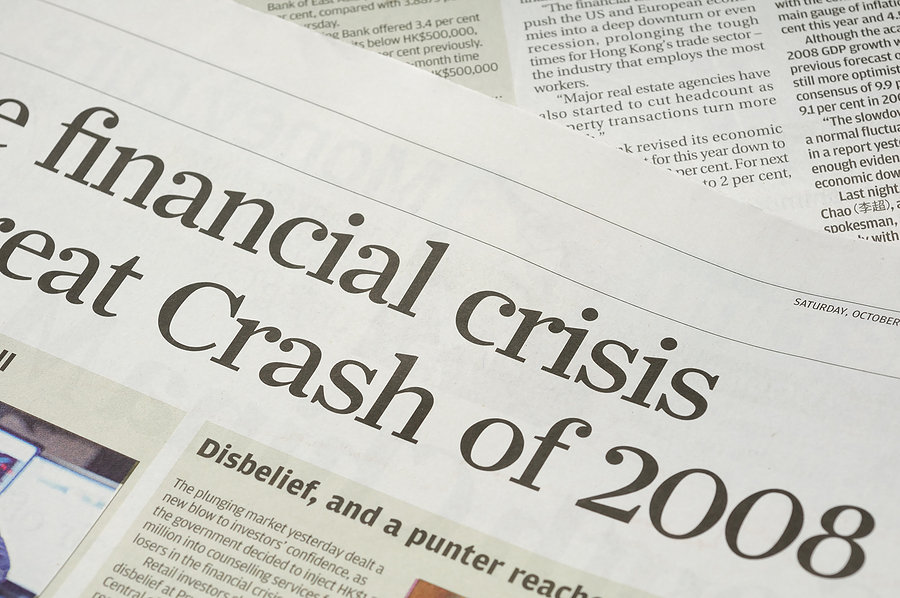

usually post 2008

outside of traditional financial institutions

goal: disrupt existing FIs

this is really squishy ...

The world of Finance as we know it is over

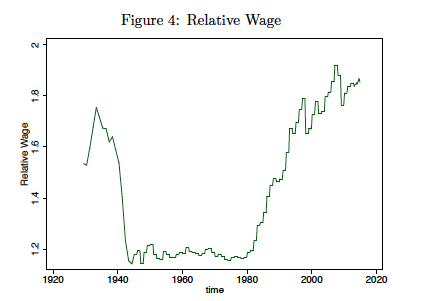

in a nutshell: why people choose to work in finance

relative wage=avg wage in finance/avg rest of economy

Source: Philippon (AER 2015) "Has the U.S. Finance Industry Become Less Efficient?"

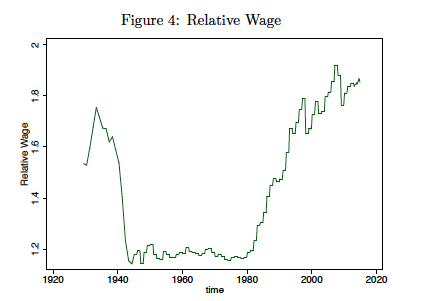

The Growth of Finance as % of GDP

Source: Philippon (AER 2015) "Has the U.S. Finance Industry Become Less Efficient?"

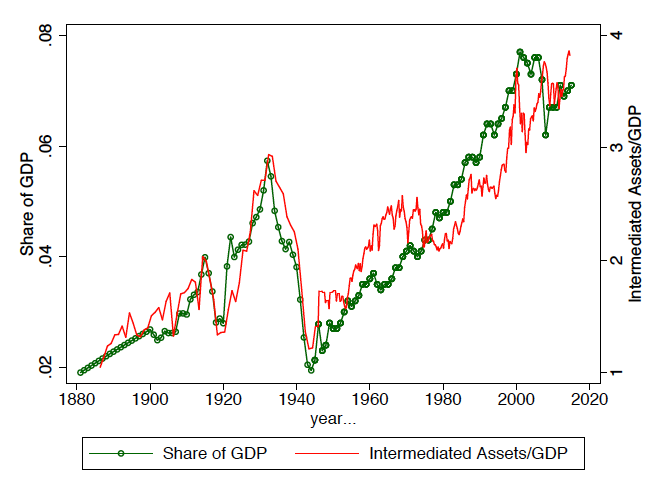

... and unit costs are flat!

Source: Philippon (AER 2015) "Has the U.S. Finance Industry Become Less Efficient?"

Ratio of the income of financial intermediaries to the quantity of intermediated assets

Workers in the Finance Industry benefit greatly from growth of finance

- Philippon and Reshef (QJE 2012):

- 1980: wage financial services=wage other industries

- 2006: financial services=170% x other

-

Goldin & Katz (AER 2008)

- 1969-74: 6% of Harvard grads went to Fin Industry

- 2006: 28%

-

Oyer (JF 2008):

-

wages Stanford GSB grads in finance industry

- 300% of wages in non-finance

-

wages Stanford GSB grads in finance industry

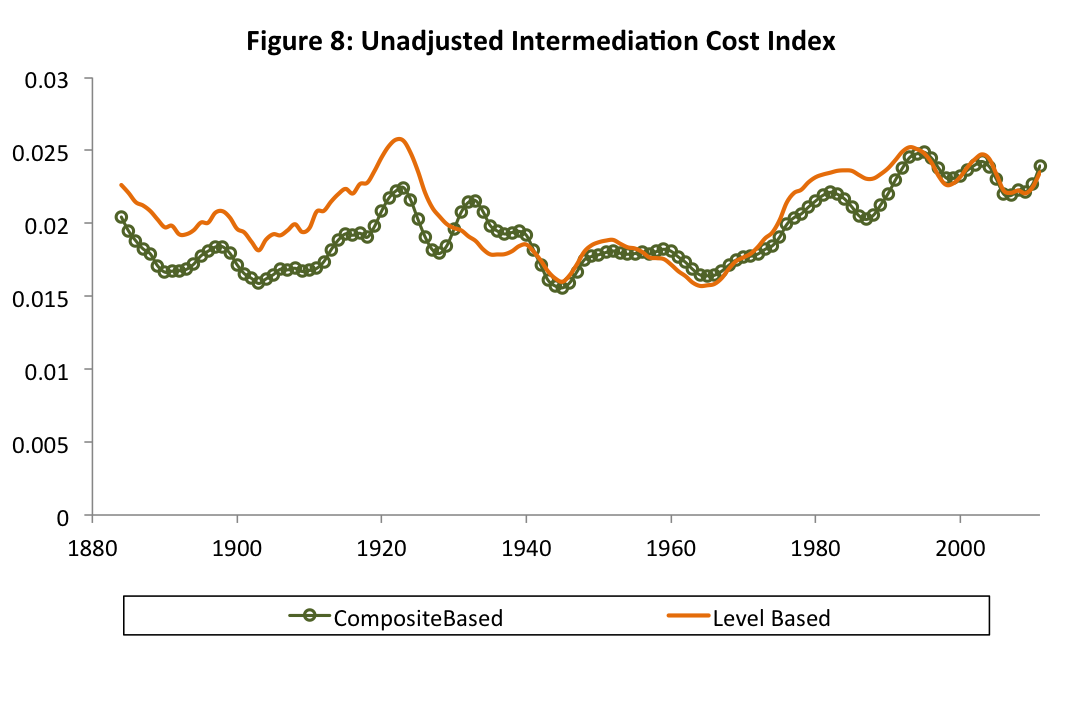

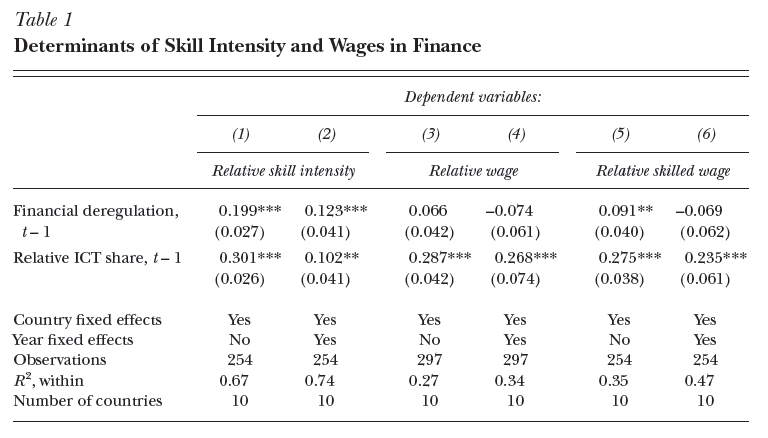

What drives high wages?

Deregulation or complementarity to IT?

Source: Philippon & Reshef (JEP 2013)

What explains high wages?

- High quality?

- Bai, Philippon, Savov (JFE 2013): No, markets haven't become any better/more informative.

- Better allocative efficiency?

- Aguiar and Bils (AER 2015): no improvement in risk sharing.

- No evidence that allocative efficiency has improved (typically measured by "total factor productivity" (TFP)).

- There is a dispute whether growth in finance has actually brought benefit to society ...

And then there's this:

which led to ...

High cost industries with high rents?

What do we know from the long history of capitalism?

Disruptive entry is bound to take place!

Why disruption from outside?

- Financial Industry is self-contained

- for many years, hired a "certain" type of person

- "fixed" set of tech vendors

- access to financial infrastructure essential

- outside disruption difficult

- Technological advances have the capacity to break into the industry

Example: One of the first segments that were disrupted from the outside: equity trading

Technological Innovation has always affected trading ....

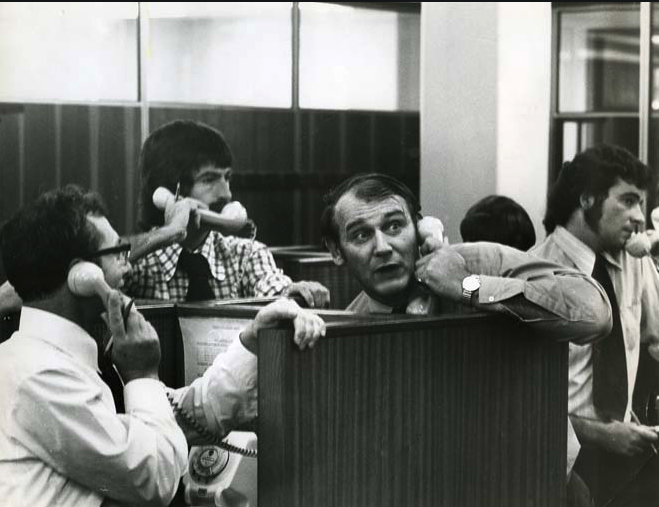

Old days of trading: highly specialized humans

Modern Day Trading

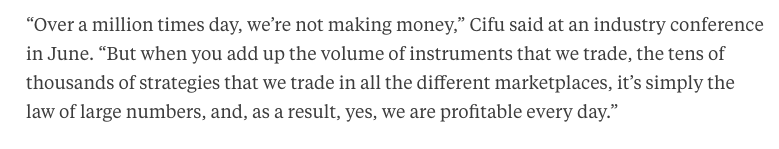

Autonomous Algorithms run the show

Modern Day Trading

Trading floors are more suited for parties and journalists

Modern Day Trading

And the former heart of Wall Street is now in a faceless & glamourless suburb of Mawah, NJ

Why?

- Many trading strategies are more-or-less mechanical/probabilistic

- computers are

- faster,

- cheaper, and

- more reliable

- Computer algos allow much wider scope

Source: Bloomberg News, Feb 20, 2015

Note: The biggest disruptors (the HFTs) came from the outside of the traditional system (kinda).

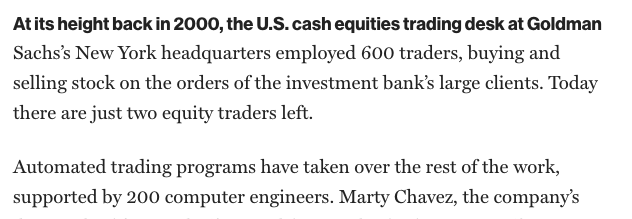

The HR Component

- Old skill-set of an equity trader

- good and fast with numbers

- brash

- strong vocab in profanities

- whatever this koala has...

- New skill set

- programming

- stats/data

- econometrics

- ....

The result?

entire career streams disappear

MIT Technology Review, Feb 07, 2017

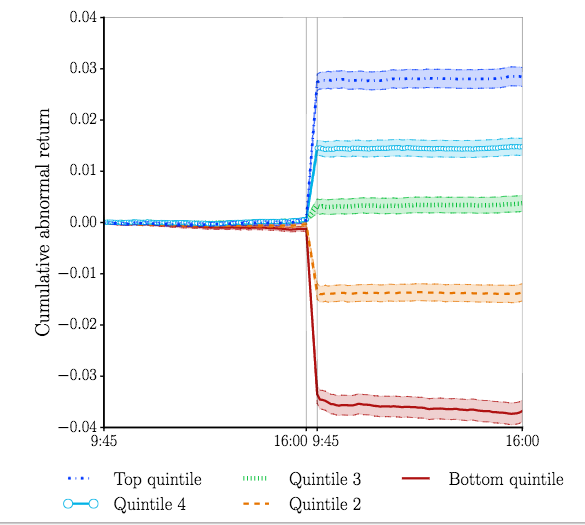

Markets get better: the post earnings announcement drift had been a long-standing puzzle in finance. ... It's gone.

And what's the result?

Source: Martineau (UofT) (WP2017)

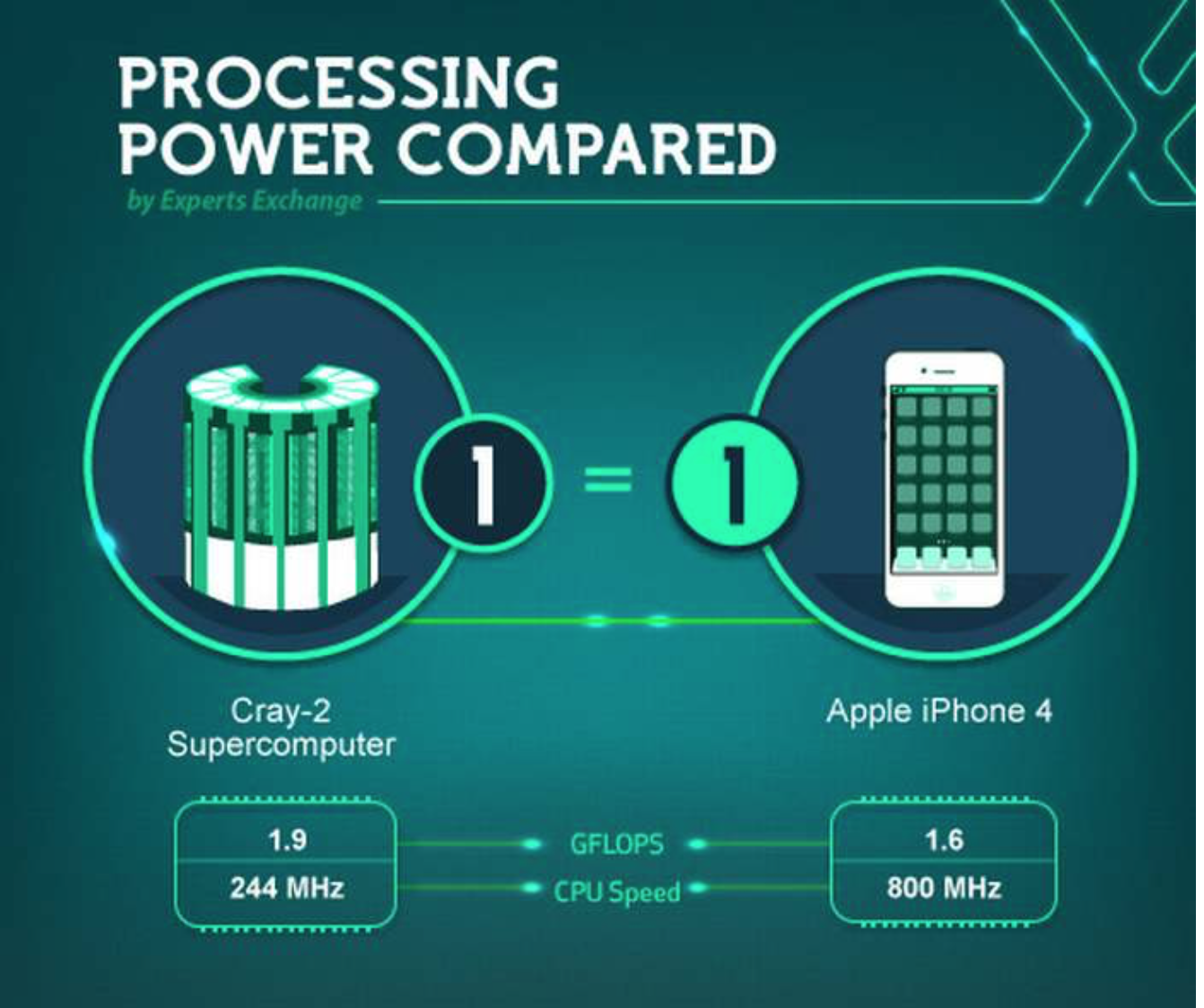

Main Structural Change

Main Structural Change

Main Structural Change

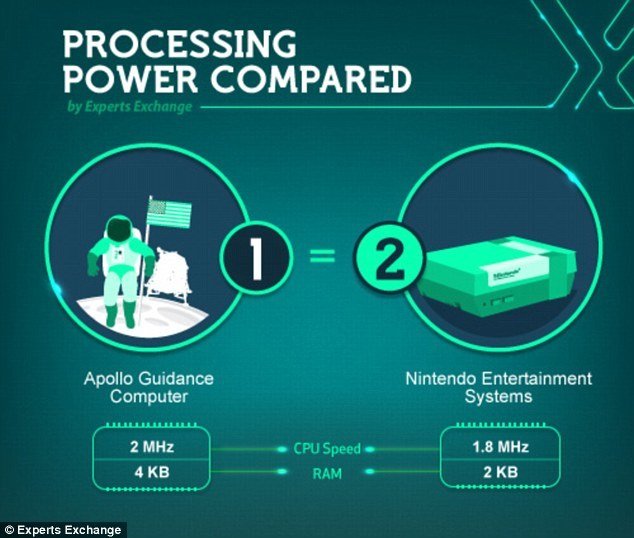

Fastest Computer in 1985!

Main Structural Change

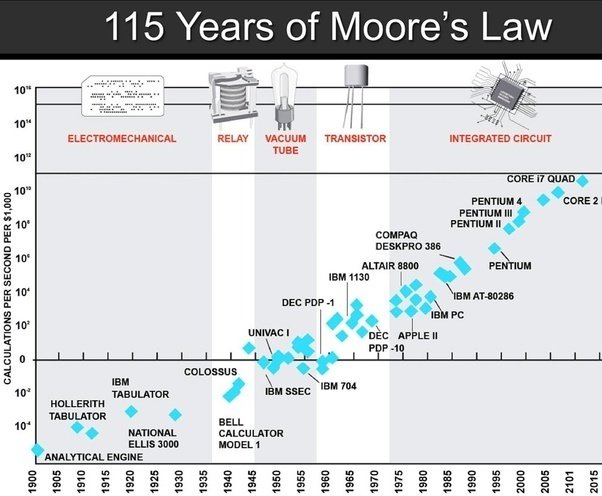

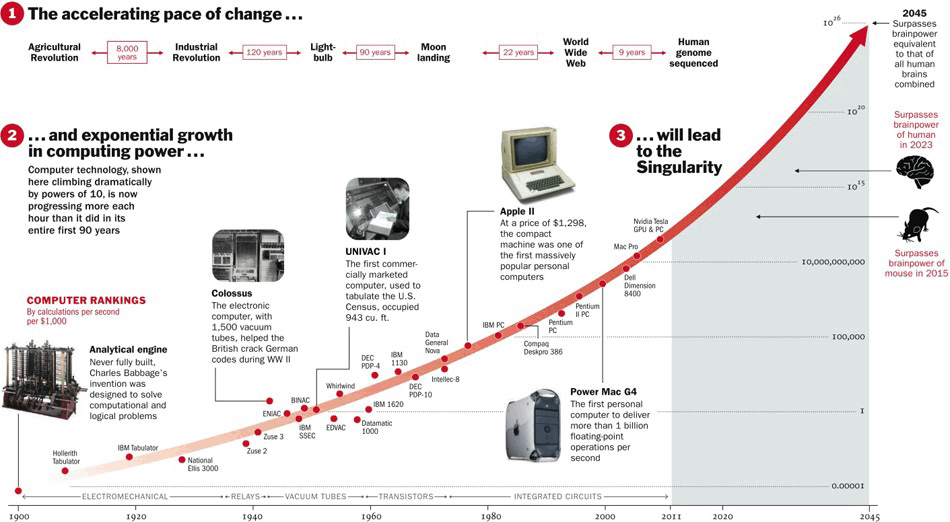

Moore's Law

"the number of transistors per square inch on integrated circuits had doubled every year since their invention."

Moore's Law: the future

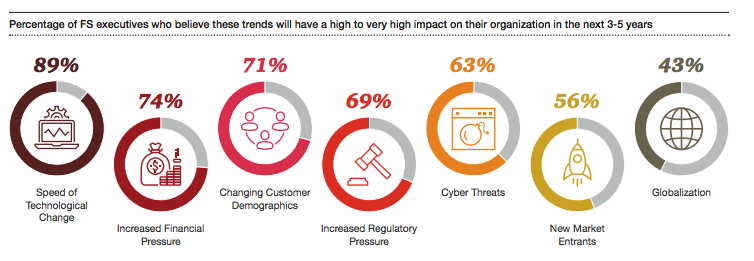

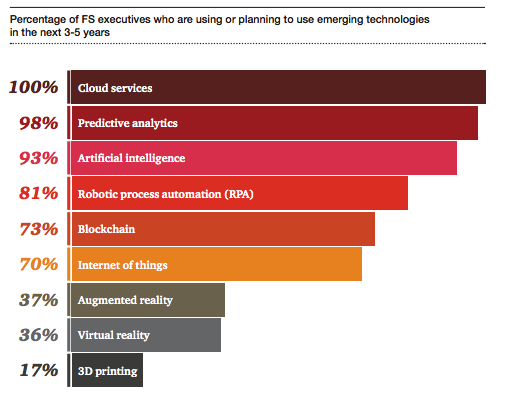

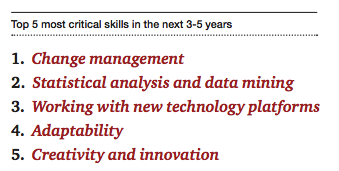

TFSA study on the Future of the Financial Industry

GTA: 800,000 jobs in FI

50% of executives believe that 40% or more of these jobs will change fundamentally over the next 3-5 years

Source: "Unlocking the human opportunity: Future-proof skills to move financial services forward"; PwC report for the Toronto Financial Services Alliance, April 2018

TFSA study on the Future of the Financial Industry

TFSA study on the Future of the Financial Industry

TFSA study on the Future of the Financial Industry

TFSA study on the Future of the Financial Industry

What is FinTech?

Key features

- focus on positive customer experience

- Willingness to apply technology in novel ways.

Approach: Propositions that are

- simpler, seamless

- more convenient,

- more transparent and

- more readily personalized.

based on EY 2017 FinTech report

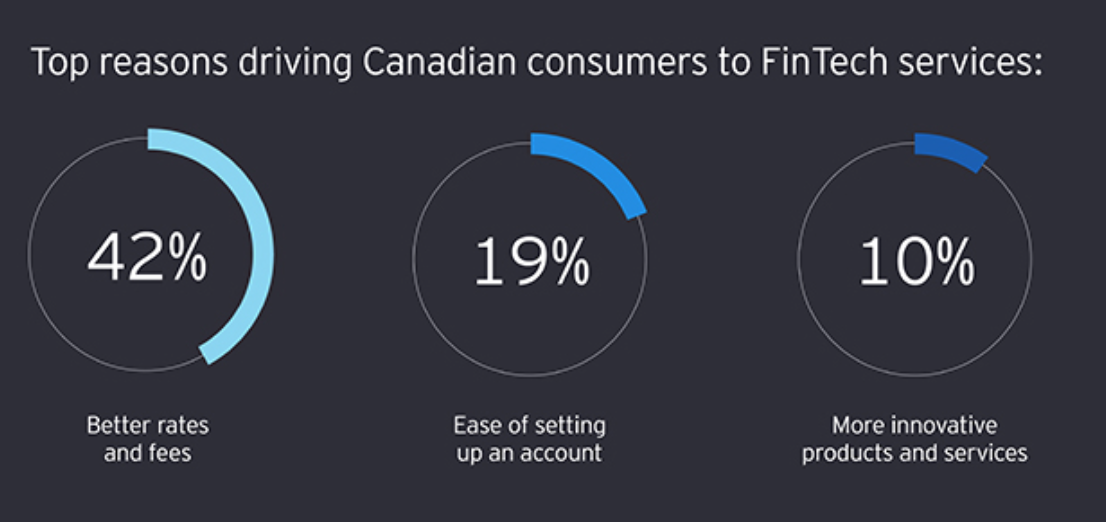

Consequence of FinTech

Impact on incumbents: struggle to deliver the seamless and personalized user experience.

Consequence: ripple effect

-

consumers expect convenience for all financial products and from all service providers

- retail banking,

- wealth management or

- insurance.

based on EY 2017 FinTech report

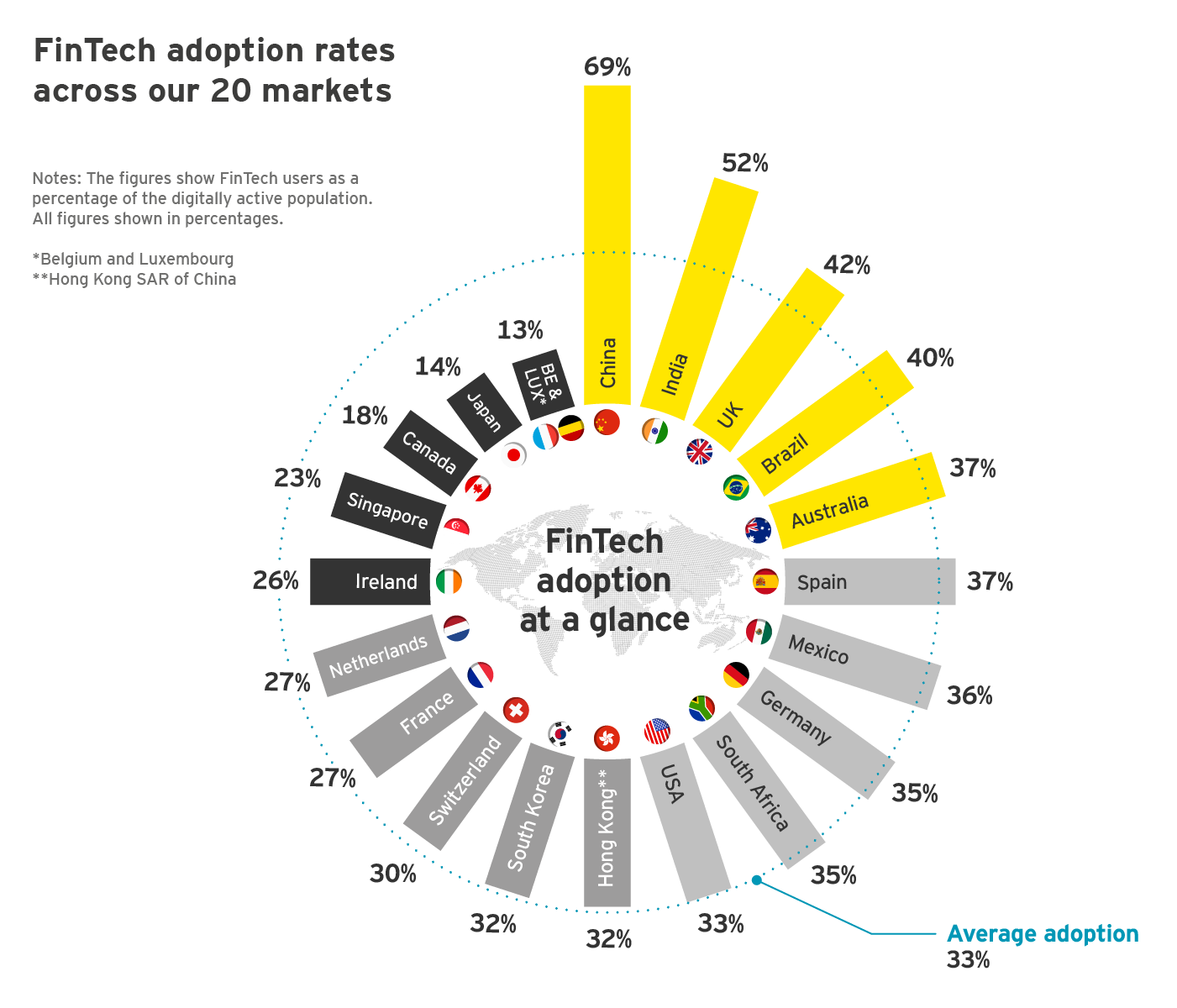

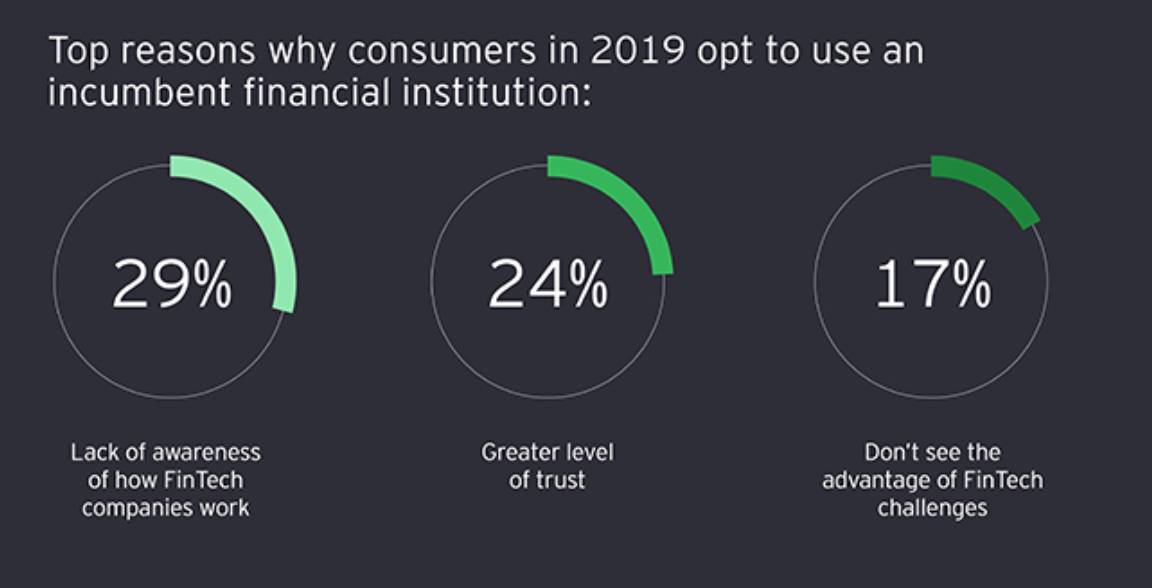

Problem for incumbents

- FIs focus on their needs and wants

- => are not customer-centric

2 years ago many haven't heard of it!

Source: EY FinTech Adoption Index 2017

18%

Obstacles

Source: Philippon (2017)

- non-integrated IT systems

Things are changing ...

- non-integrated IT systems

Things are changing ...

- non-integrated IT systems

Things are changing ...

- non-integrated IT systems

Clayton Christensen: customers don’t buy products; instead, they hire a solution to help them complete a specific job at a specific time.

https://youtu.be/sfGtw2C95Ms

Three types of FinTechs (?)

- Those that start outside of FIs and would like to collaborate with FIs.

- Those that started outside of FIs and now collaborate FIs.

4. Big Tech Firms

3. Those that work to replace or change the financial system as we know it.

Some Core Functions of Financial Institutions/Banks affected by FinTechs

Lending and Borrowing

Wealth Management

Payments

Investment Banking Services

Payments

5% to cab firm and 10-day delay

International remittances: $600B (U.S.) p.a.

all in: 10% fees

Payments

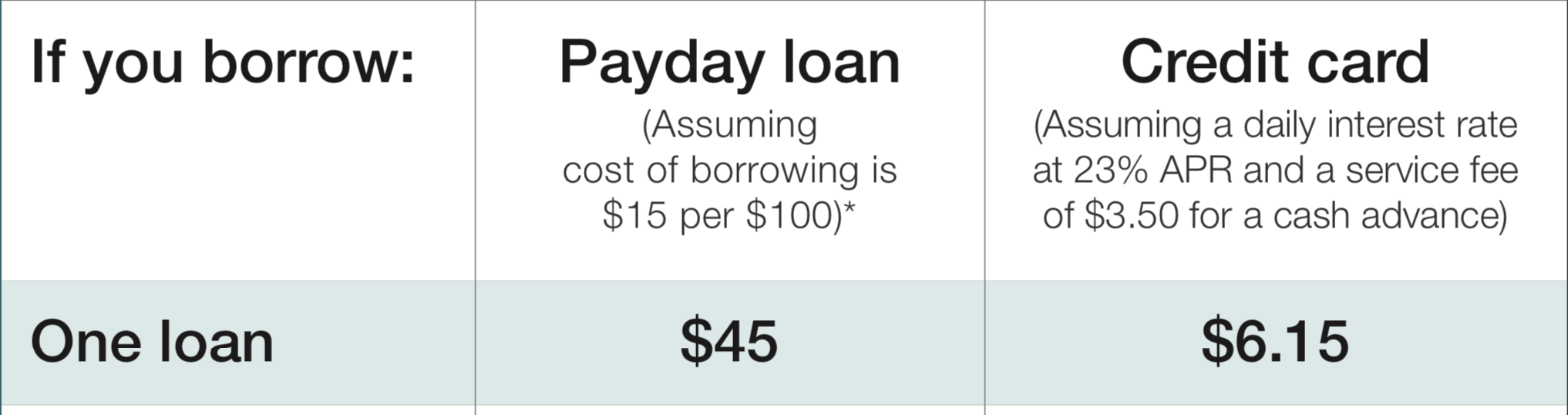

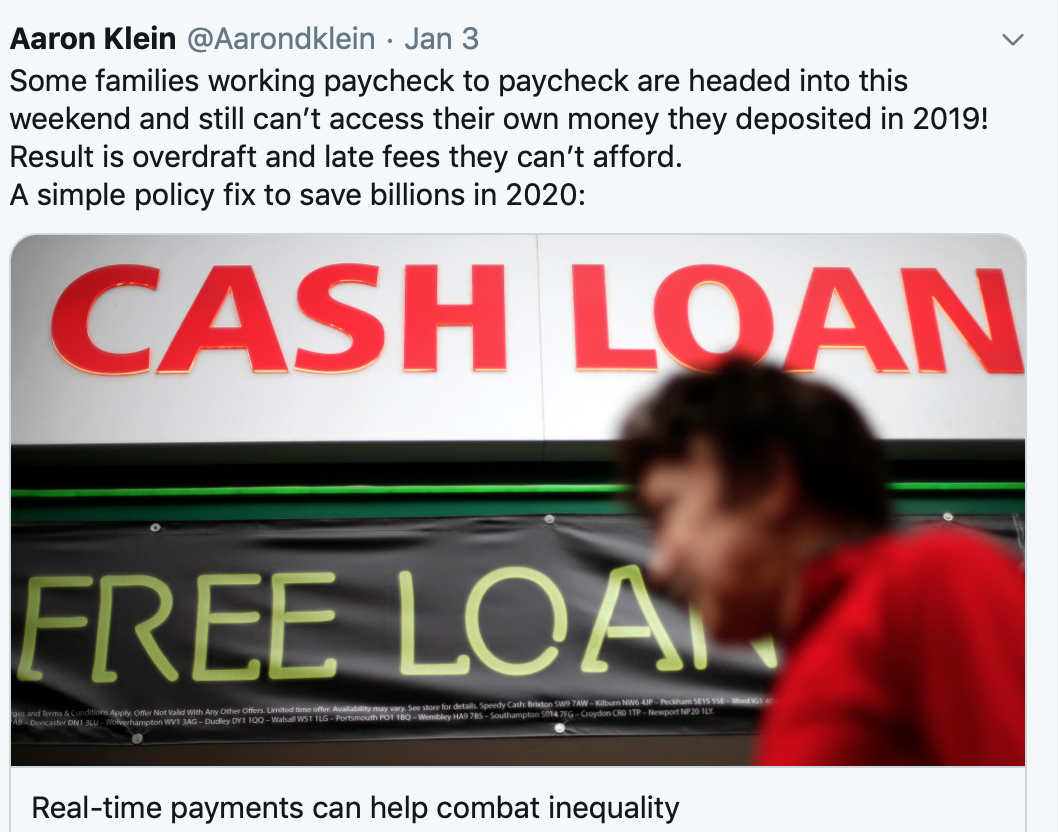

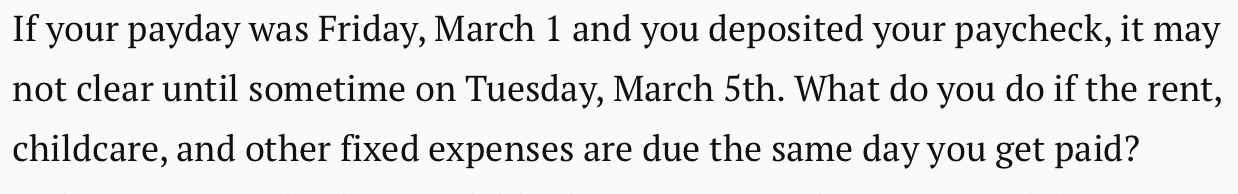

https://www.brookings.edu/opinions/real-time-payments-can-help-combat-inequality/

Importance of Real-Time Payments

Text

https://www.brookings.edu/opinions/real-time-payments-can-help-combat-inequality/

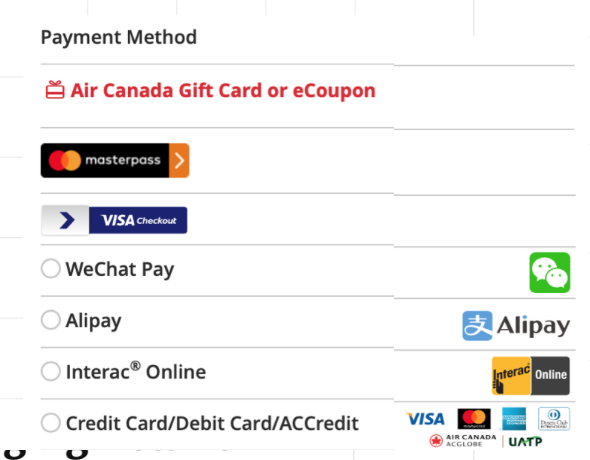

Payments

500M users in India

free international transfers at Interbank rates

used by >60% of total population in Denmark

- 1 billion WeChat users

- >150K in Greater Toronto

Lending and Borrowing

price for loan

effort required to get loan

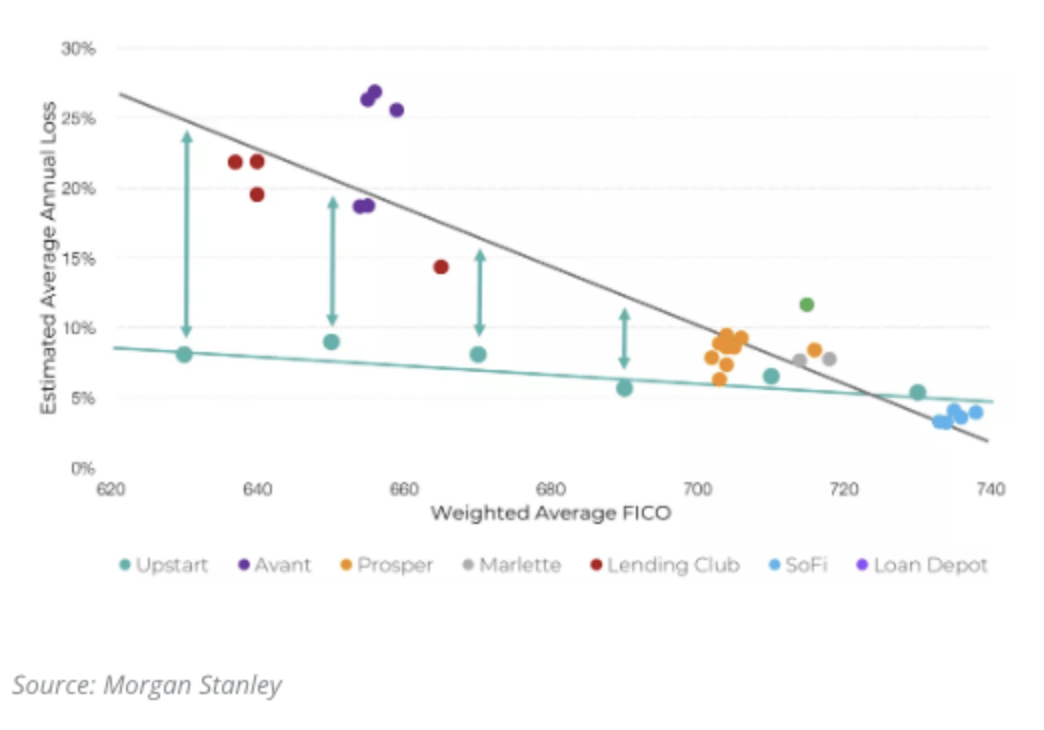

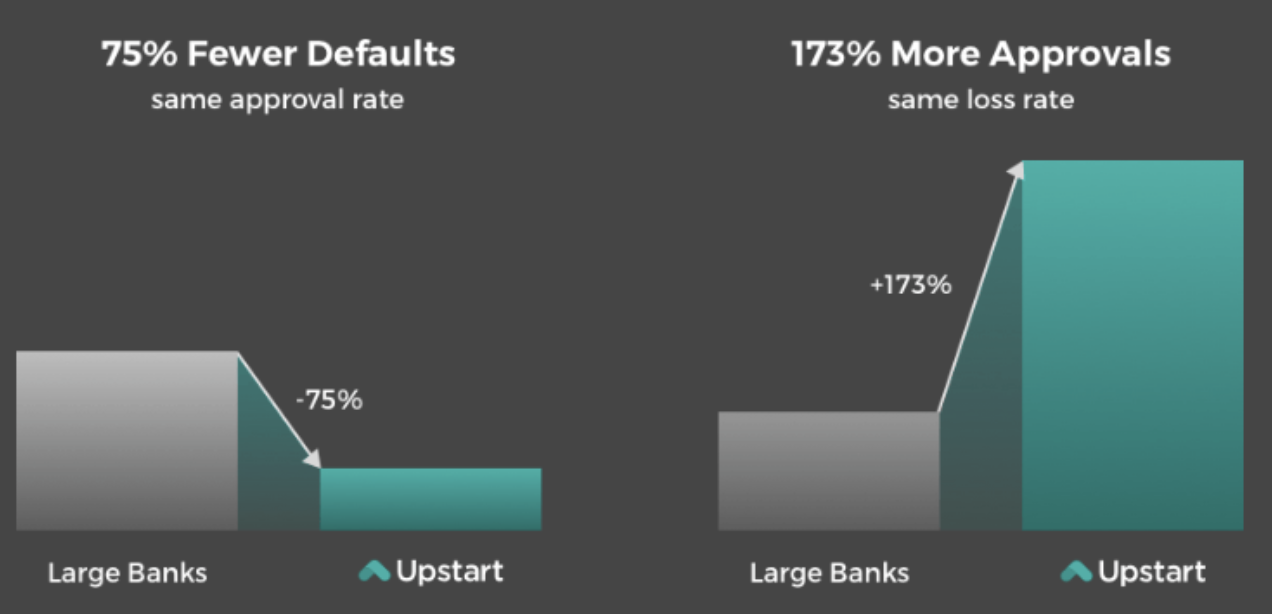

Lower losses than competitors

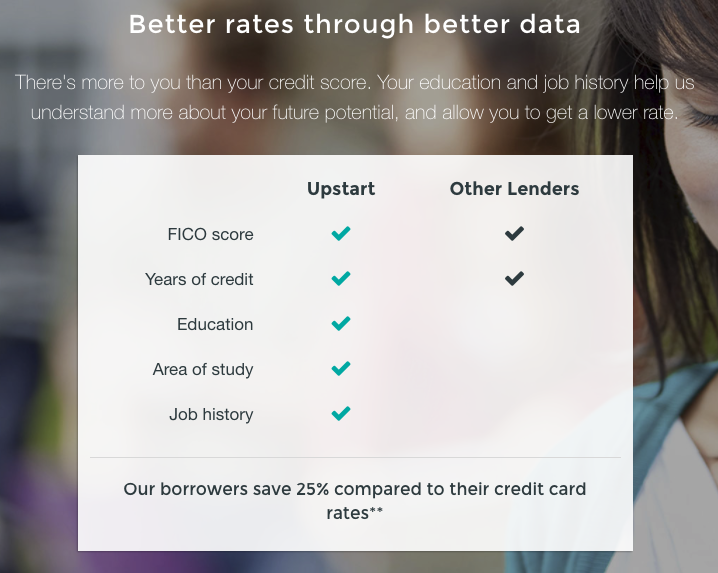

Example: Upstart

Tools?

AI& Machine Learning

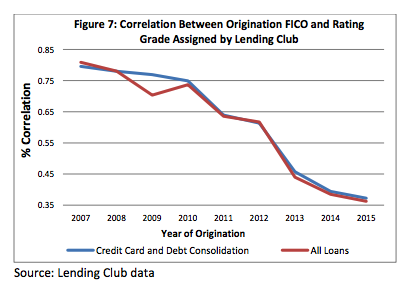

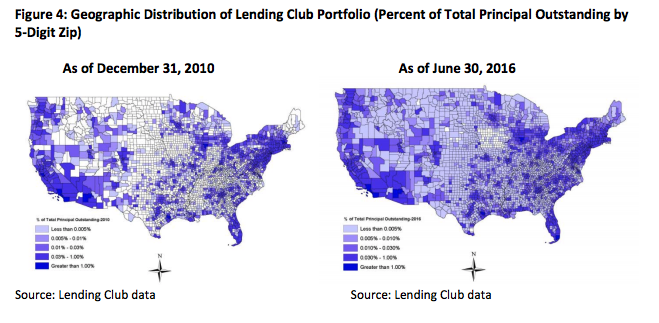

Example: Lending Club

Source: Jagtiani & Lemieux, 2017, Philly Fed Working Paper 17-17

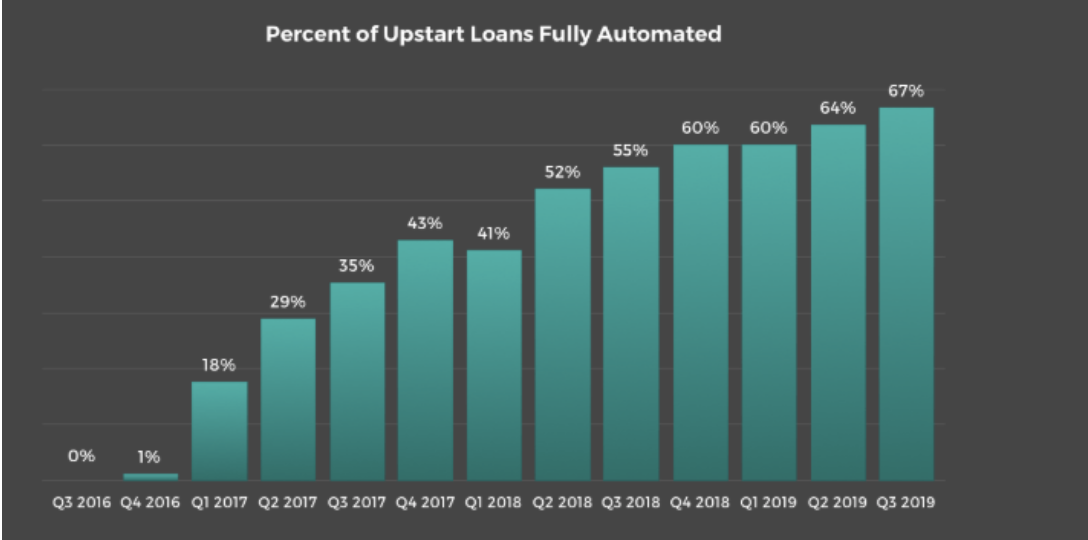

Future: Scalability

Source: Jagtiani & Lemieux, 2017, Philly Fed Working Paper 17-17

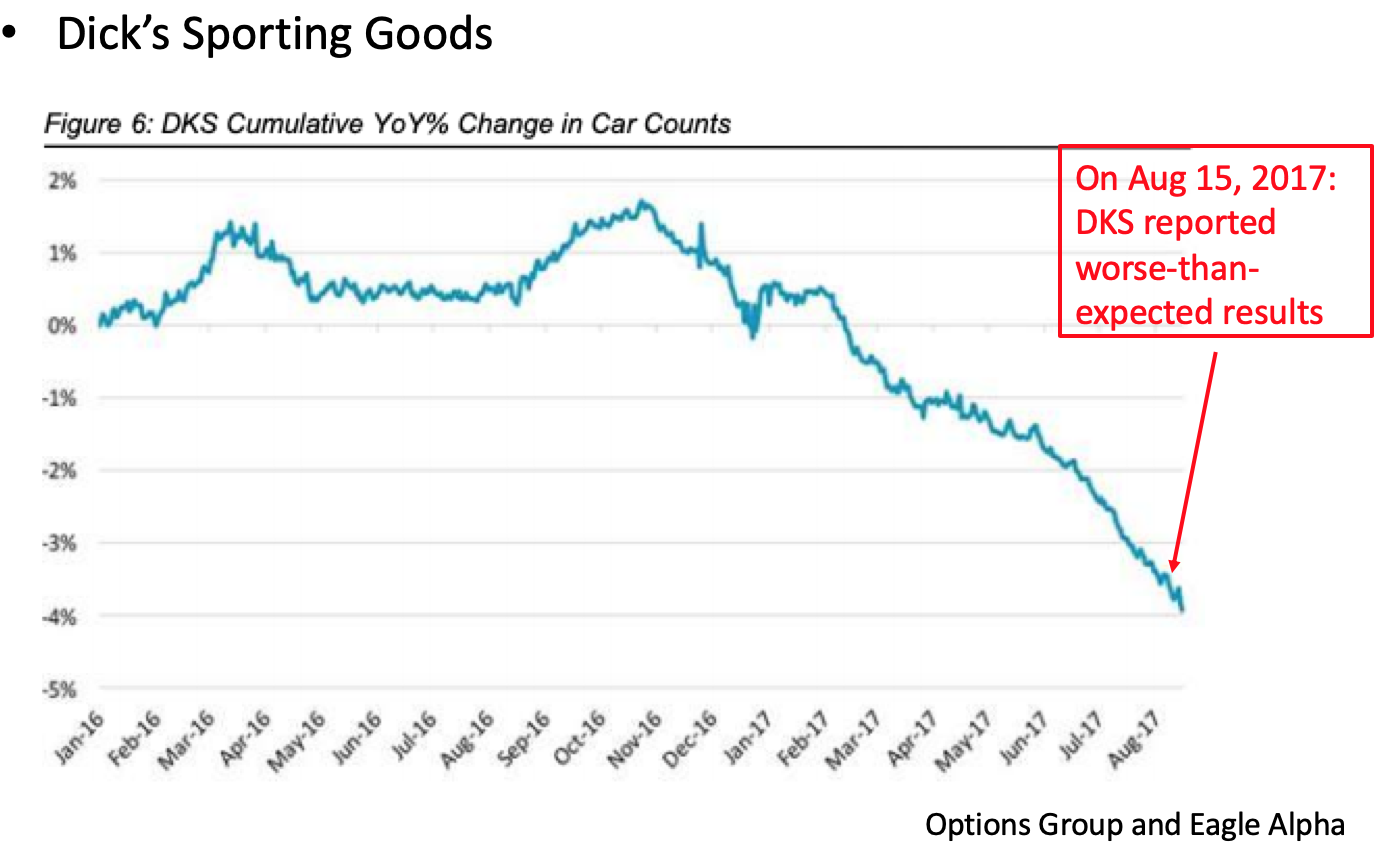

Big Data, Machine Learning, AI

WealthTech

- availability of investment products

- fee transparency

- regulatory changes

- mobile savvy users

some key changes in recent years:

Type 3: Those that want to "blow up the banks"*

*= disintermediate

everything

Nokia's market shares for devices:

- 2007: 49.4%

- 2012: 3%

Little bit of history ....

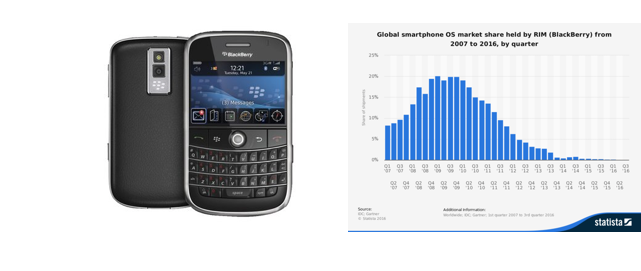

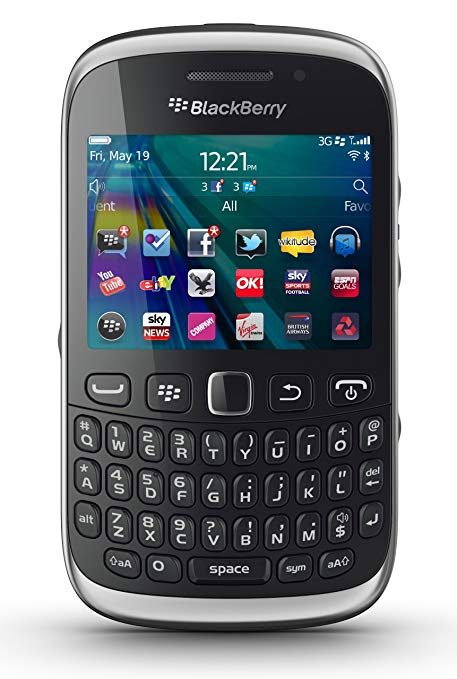

Paid-for vs. valued

- Keyboard

- Security

- Being businessy

- Cool and cutting edge

- Being Canadian

- Independence from desk

What did they pay for?

What do people value?

- Mobile email

- Brand name

- Easy access to branch

- Great product range

- Fair prices

- Great advice

- Latest tech

- Friendly tellers

- Safe-keeping of assets

- Moving money around

As banks move data into "the cloud," why do we need banks?

Blackberry vs. a Generic Bank

Key Insight: Open Platforms provide value