Trades, Quotes, and Information Shares

Björn Hagströmer and Albert J. Menkveld

Discussion by Katya Malinova

DeGroote School of Business

McMaster University

HEC-McGill Winter Finance

Ischgl, March 28 2023

Hasbrouck 1995:"One security, many markets: Determining the Contributions to Price Discovery"

- multiple (market) prices

- common random walk efficient price

- innovations in the efficient price attributed to different "markets"

- VECM \(\to\) each market's information share (H95)

- proportion of the variance in the common efficient price innovation that can be explained by innovations in that market's price

Hasbrouck's 1995: "many markets"

- Original paper: truly multiple marketplaces

- Use quotes from these marketplaces and not trade prices because:

- An incredible workhorse tool! \(\to\) over time:

- "One security, many markets" broadly defined (as suggested in Hasbrouck 1995 & including in Joel's own follow-up work)

- multiple prices (bid vs. ask)

- multiple securities (stocks vs. options)

- quotes vs. trades

"a market that happened to have relatively infrequent trades would tend to have last-sale prices that were most obsolete, and therefore least informative."

This paper:

- quantify the "stale price problem"

- solution for when Hasbrouck's 1995 "use quotes only" approach doesn't work

- trades vs. quotes

- "markets" with no continuous quotes

How do the authors resolve the "stale prices" problem?

Step 1: Do not use them!

-

Hasbrouck (1991): "The Summary Informativeness of Stock Trades: An Econometric Analysis."

- single observed security price = an implicit efficient price + noise

- innovations in the efficient price attributed to trades

- VAR \(\to\) proportion of the efficient price innovation variance explained by trades

- predecessor to Hasbrouck (1995) information shares!

- Trade variable = (signed) trade volume

Step 2: Skip directly to "trade information shares"

How do the authors resolve the "stale prices"?

"Marry" Hasbrouck (1991) and Hasbrouck (1995)

- Use the time-t quote to reflect contributions of quotes

- continuously updated between (t-1) and t

- Use signed trade volume to reflect contributions of trades

- summed up over all trade events between (t-1) and t

- GIS = generalized information share = proportion of the variance of the efficient price innovation explained by each series

The first impression ....

The problem has been around for 28+ years!

Finance Academics

But has it?

Are "stale trade prices" a bigger issue now than in 1995?

My (educated?) guess = Yes

- Canonical work (Glisten & Milgrom (1985), Kyle (1985)

- \(\to \)private info impounded by trades

- Limit orders, HFTs

- \(\to\) quote revisions contribution to price discovery more prominent

Understanding information shares of quotes vs trades more relevant!

Are "stale trade prices" a bigger issue now than in 1995?

The markets "sped up"

High resolution is key to identify contributions of each "market"

- Ideal world: independent innovations across markets

- At least high enough resolution for tight bounds on info shares

Trades are relatively more stale at higher resolutions

- More severe H95 info share bias ((?), with caveats)

Quoting "sped up" more than trading

More markets without quotes (e.g., dark pools)

Understanding the role of "event-only" contributions

to price discovery more important

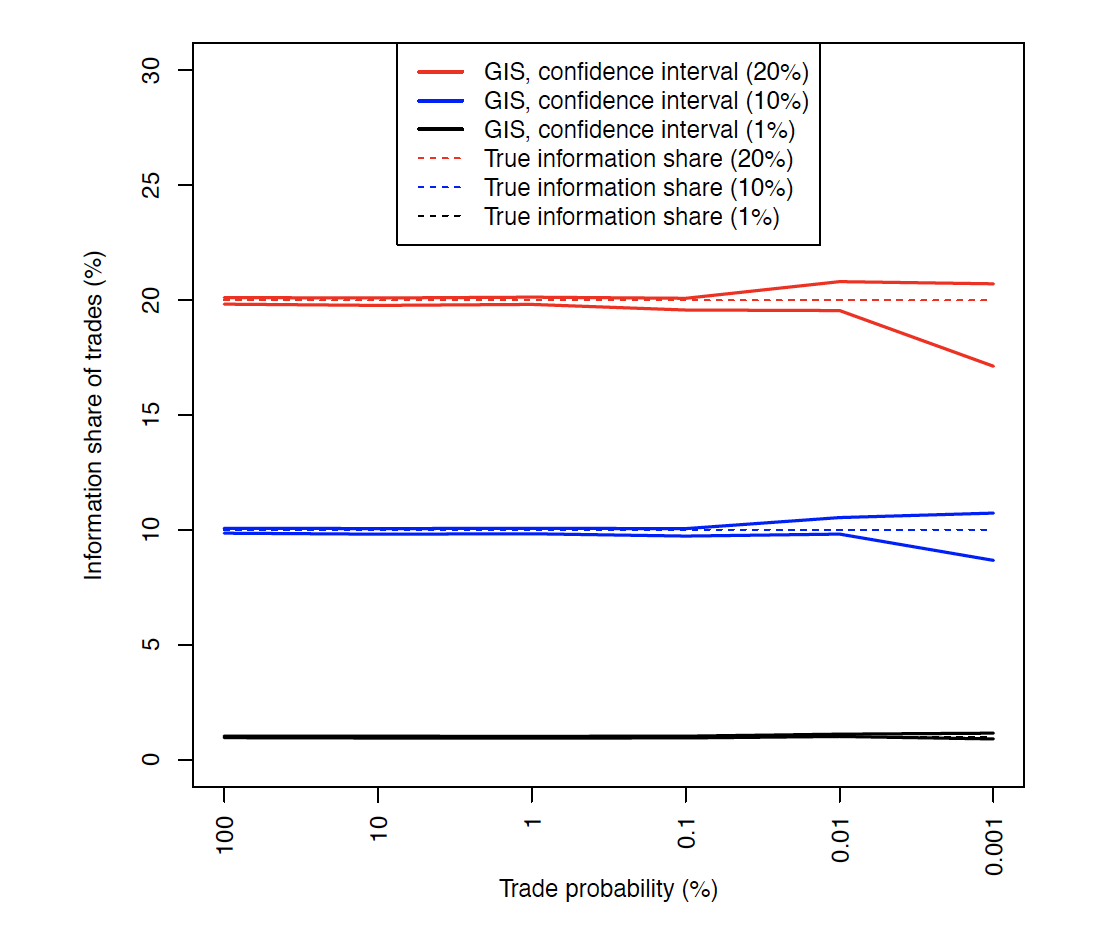

What does the GIS resolve?

- The "staleness" bias

- underestimation of trade information share relative to quote info share

- Additionally: resolves the "small-sample" bias identified by the authors:

- underestimation of trade information share for (very) infrequent trades

Empirically:

- GIS \(\to\) trade info share 40%-ish

- IS \(\to\) trade info share 30%-ish

Empirically:

- GIS \(\to\) dark share vanishes

Authors' interpretation: uninformed are siphoned away from exchanges \(\to\) bad news

Nag: simulate GIS performance for higher trade info shares?

1: What does the H95 measure re: price discovery?

Hasbrouck (1995):

-

the information share measures "who moves first" in the process of price adjustment

- caveat: Putnins (2013): noise plays a role

- nothing in this approach measures in any absolute sense the total information that is impounded in prices

Comerton-Forde & Putnins

- use H95 IS (& other measures)

- overestimate (?) the info shares of dark trades

- low levels of non-block dark trading are benign or even beneficial, block trades harmless

Not immediately obvious that low GIS share of dark = overly toxic lit exchanges

2: Signed Volume

- Signing trades is not easy ...

- Lee-Ready (1991) & Holden and Jacobsen (2014)

- @ a price > the prev millisecond quote midpoint \(\to\) " A BUY"

- Even more challenging for dark midpoint trades:

- A BUY if the dark midpoint price \( >\) the closest previous trade price

- Does this work for matched block trades?

- A BUY if the dark midpoint price \( >\) the closest previous trade price

Do you know how accurate the method is?

Also: accuracy levels across venues?

- Lit vs. dark?

-

As an aside: is all signed volume created equal re: information?

- A single $100K trade

- vs. two (almost) off-setting large trades

3: Data size

The authors: The GIS estimation of that system takes a full week even when relying on parallel processing in state-of-the-art cloud computing services.

Hasbrouck (2021) "Price Discovery in High Resolution": an approach to overcome the estimation challenges at sub -millisecond frequencies

Is there merit for Hasbrouck \(\times\) 3: (1991) + (1995) + (2021)?

Comments courtesy of Referee #2 = ChatGPT:

Explore the potential impact of different trading frequencies on the GIS framework to understand its performance under various market conditions.- Investigate how the GIS framework performs for other asset classes (e.g., bonds, commodities) to assess its applicability across different financial markets.

- Assess the sensitivity of the GIS framework to varying levels of market fragmentation to better understand its performance in diverse market structures.

Compare the GIS framework with alternative econometric models (e.g., state-space models) to further establish its advantages and limitations.

The bot didn't read past the intro

The bot didn't read the Appendix

"Excellent suggestions for future work using HM 2023!"

or: "Write your own paper!"

Summary

-

Excellent paper!

-

Cool new -- yet, close enough to the workhorse classic -- methodology!

-

Read it, use it, cite it!

Nag #4: GIS performance for higher trade info shares?

IS = 30%

empirical estimate for the LSE H95-Info-Share

empirical estimate for the LSE

Generalized Info Share

IS = 40%

tightest confidence interval

IS = 20%

IS = 10%

true info share

@katyamalinova

malinovk@mcmaster.ca

slides.com/kmalinova

https://sites.google.com/site/katyamalinova/