Intro to FinTech

MBA F741

Instructor: Katya Malinova

Lecture 2

This slide deck was developed in collaboration with Andreas Park (University of Toronto)

What is a blockchain?

Questions we wish to address

What economic problem does it solve?

How does it apply to finance?

How does it work?

Learning Objectives

- most online resources and books are

- either too shallow and written by evangelists

- or too technical and written by & for developers

- or plainly obnoxious and written by crypto-peddlers

- our goal:

- an intro to the concepts and functioning of blockchains

- understanding of key concepts

- ability to assess pros/cons and possible use cases

- identify challenges for applications

- understand regulatory restrictions/implications

Today?

How does it apply to finance?

Will talk about trading and raising funds using blockchain

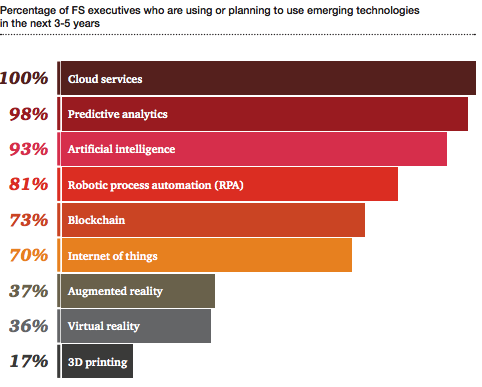

Why should we care?

Why should we care?

Source: "Unlocking the human opportunity: Future-proof skills to move financial services forward"; PwC report for the Toronto Financial Services Alliance, April 2018

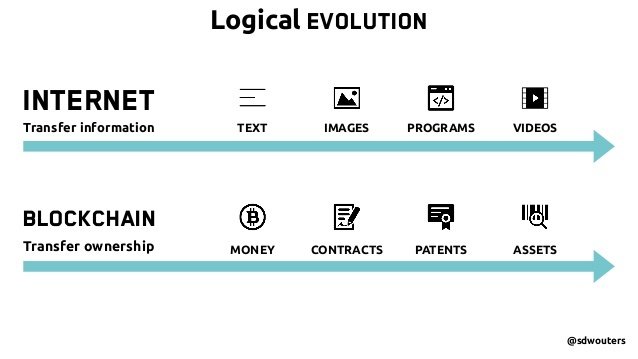

What does a blockchain do?

only the first 1:16 min are relevant

What happened?

exchange needed TRUST

What's needed for trust in anonymous deals?

Authority

Execution

Continuity

Authority

Do you have the item?

Do you have power over it?

A Key Tool: cryptography

Execution

Can we agree that it happened?

Tool:

consensus algorithm

Security

Are the records immutable?

restricted permissions

really difficult to hack

historically:

commerce requires trusted parties

trustworthy people

long-term relationships

reputation

contract

law

premise of blockchain

no trusted parties needed

everything

in code

open to

anyone

platform or network

commerce thrives

How?

Cryptography: only Sue can spend her money

Authority

Execution

Problem: double-spending

How can we trust that

- sale happened and

- $$ only spent once?

Execution

Security

Blockchain?

- Social Media

- eCommerce

- Uber, AirBnB

- ......

- ?????

Detour: Bitcoin vs. Ethereum

first full application of a working public, permissionless blockchain

Bitcoin

Can't do much other than transfer stickers (exception: "coloured coins")

- Ethereum = Blockchain 2.0:

-

"virtual computer" for decentralized code execution

- E.g., an auto-executing escrow code.

- code execution \(\rightarrow\) require computing power

- malicious code could "crash" virtual machine

- \(\to\) pay in Ether for computations (for "gas")

- Ether is not a "better" cryptocurrency

Ethereum = Blockchain 2.0

Sue wants to send Bob money

Illustration of Infrastructure Frictions: money transfers

Version 1: They use the same bank

Change ledger entry locally

Version 2: They use different banks but the banks have a direct relationship

Sue's bank transfers from Sue's account to Bob's bank's account

Bob's bank transfers from its account to Bob's account

Version 3: They use different banks that have no direct relationship

Sue's bank transfers from Sue's account to its own account

Bob's bank transfers from its account to Bob's account

Central Bank

Central bank transfers from Sue's bank's account to Bob's bank's account

International transfers

Sue's bank transfers from Sue's account to its own account

Bob's bank transfers from its account to Bob's account

use the Swift network of correspondent banks

Bottom Line

-

very complex

-

many parties

-

lots of friction

-

expensive

Crazy thought:

Wouldn't it be nice if there was a single ledger?

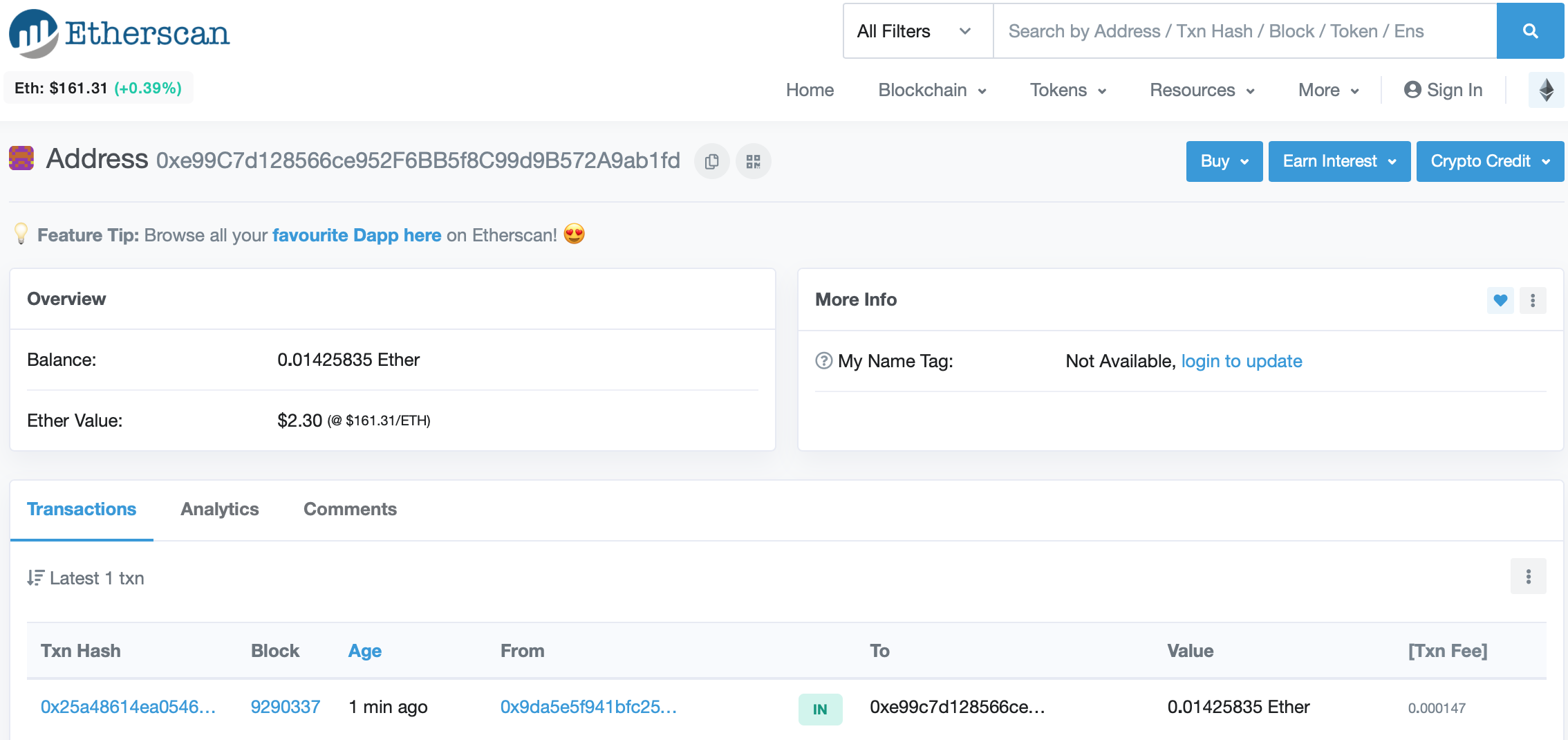

Here follows an in-class demonstration of a transfer

(hopefully!)

Public Information about my address

Detour: how do you get cryptocurrencies

Step 1:

send dollars to (say) coinbase using a bank transfer of a credit card

Step 2:

convert dollars to cryptocurrency at

Step 3:

send crypto to blockchain address

0xa65d00eda4eeb020754c18e021b1bf4e66c9ed90

0xe99C7d128566ce952F6BB5f8C99d9B572A9ab1fd

Below are examples of my three different demo addresses, from: myeitherwallet, Metamask, and Jaxx Liberty.

A glimpse of a stock trade today

Alice wants to sell ABX

Bob wants to buy ABX

sell order

buy order

Clearing House

Stock Exchange

Broker

Broker

3rd party tech

custodian

custodian

record beneficial ownership

central bank for payment

Strongest feature

digital contracts

With Blockchain: single ledger for money and securities

0xA69958C146C18C1A015FDFdC85DF20Ee1BB312Bc

0x91C44E74EbF75bAA81A45dC589443194d2EBa84B

0xA65D00Eda4eEB020754C18e021b1bF4E66C9Ed90

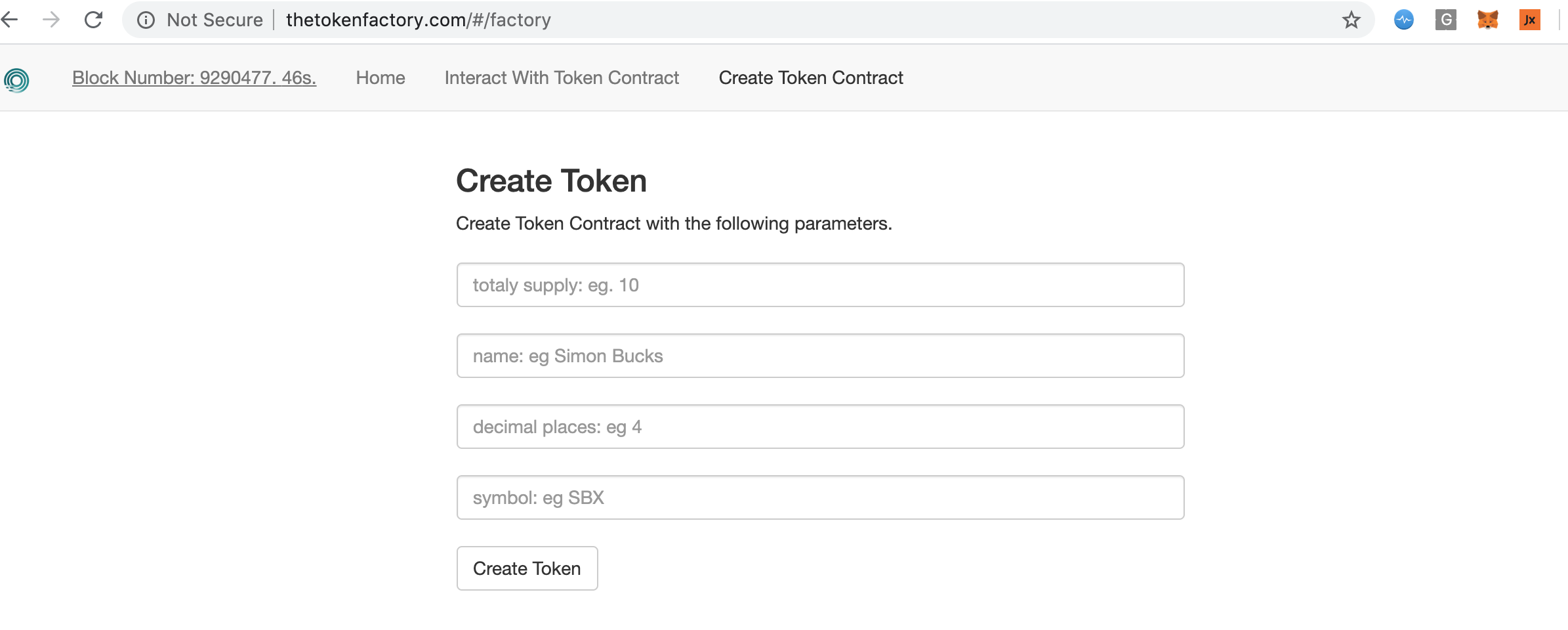

What is a token?

You can create your own token

A coin/token taxonomy by function

-

native to a blockchain for payment

-

examples: Bitcoin, Bitcoin Cash, Ether, Lumens, Cardano

- build on top of or linked to an existing blockchain

- not just for payments ...

Crypto-currency

link to on-chain activities

link to off-chain activities or assets

Stable coins

- blockchain is a value transfer infrastructure

- claims to revenues, cash flows, assets (e.g. real estate)

Three Fallacies for Crypto Economics

crypto assets = traditional equities

crypto trading = traditional trading

crypto entities = traditional firms

Crypto

Exchange

Traditional

Internalizer

Wholeseller

Darkpool

Investor

Venue

Broker

Settlement

Investor

Venue

Settlement

On chain

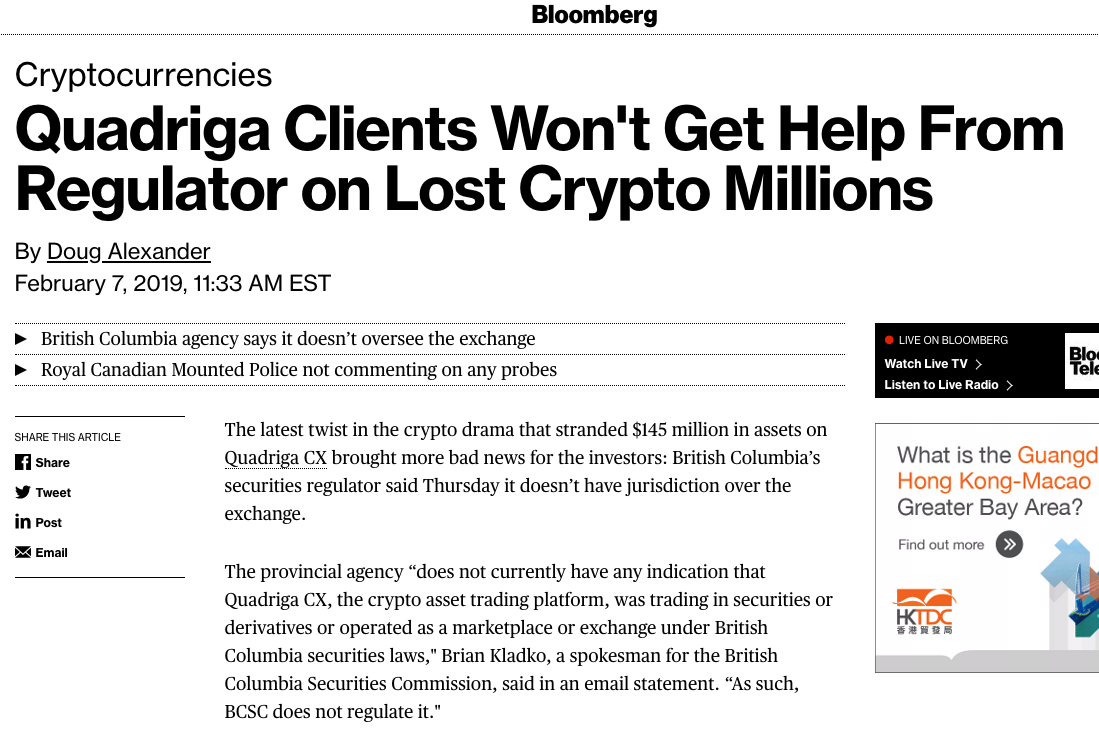

Concerns

arbitrage is either not possible or requires large capital commitment => expensive

exchanges = brokers? => single point of failure

decentralized: totally anonymous => easy price manipulation (e.g. wash trades)

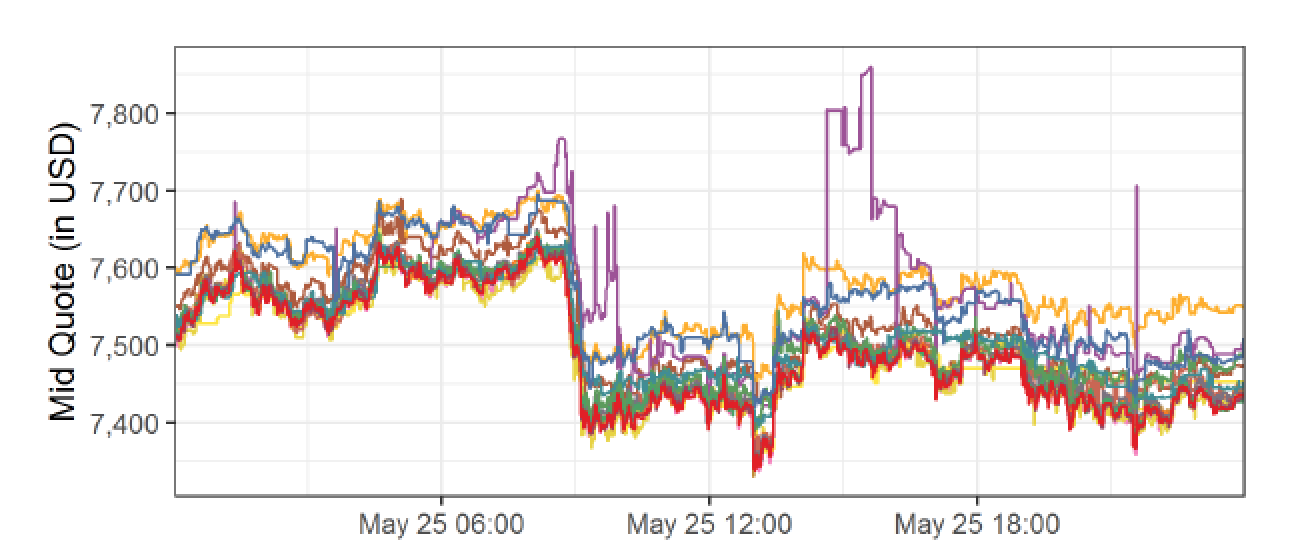

Bitcoin prices in USD, May 25 2018, 17 exchanges

Arbitrage?

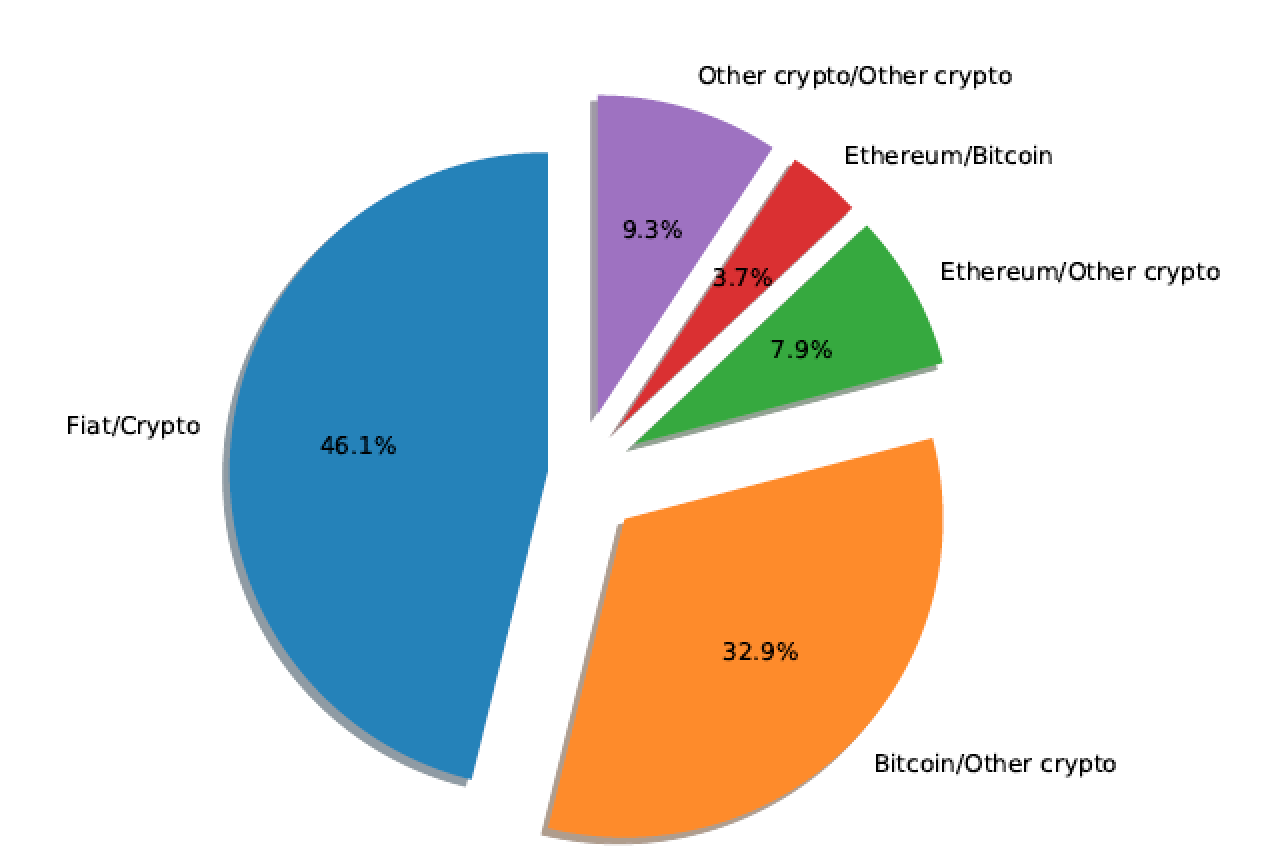

Where does trading occur?

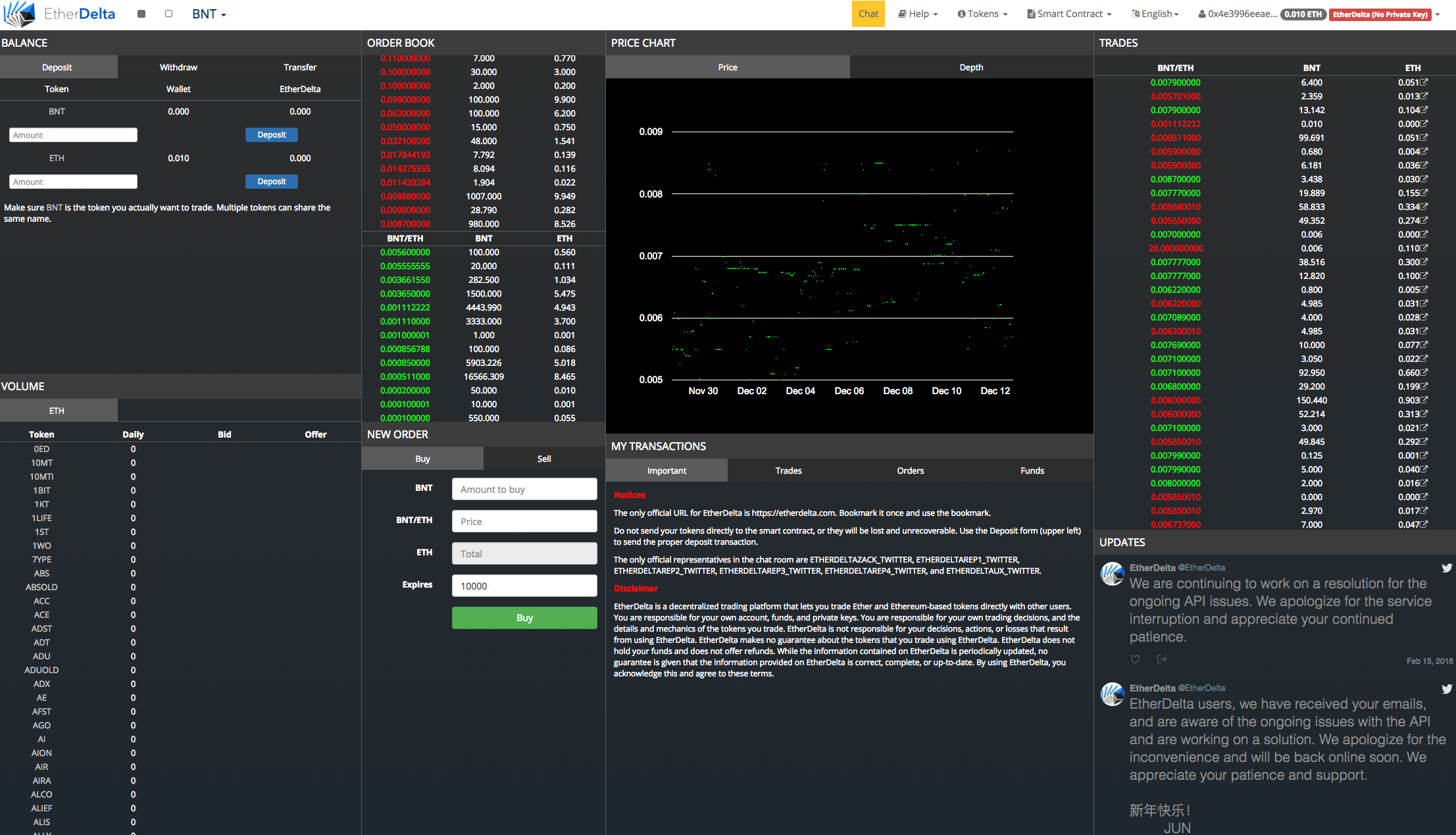

Trading in Crypto Markets

Centralized Exchanges

Alternative Markets/Liquidity Systems

Smart on-chain contracts ("Decentralized Exchanges")

Trading on a Crypto Exchange

trade

Settle on the blockchain for digital "assets"

Wire transfer for fiat

Arbitrage on a Crypto Exchange

BTC/USD

ask: 7,600

bid: 7,550

BTC/USD

ask: 7,500

bid: 7,450

buy low

sell high

Arbitrage on a Crypto Exchange

BTC/USD

ask: 7,600

bid: 7,550

BTC/USD

ask: 7,500

bid: 7,450

buy BTC

sell BTC

move BTC to Kraken

Arbitrage on a Crypto Exchange

Wire: free*; 1-5 days

Credit card: 3.5%

trading fee: 10-25 bps

flat fee in BTC \(\approx\) $4-8

\(\approx\) 10-60 minutes

trading fee: 0-26 bps

35 USD + 0.125%

($5 if >$50,000)

1-3 business days;

possible other fees/delays

Some exchanges allow short selling

What's the result?

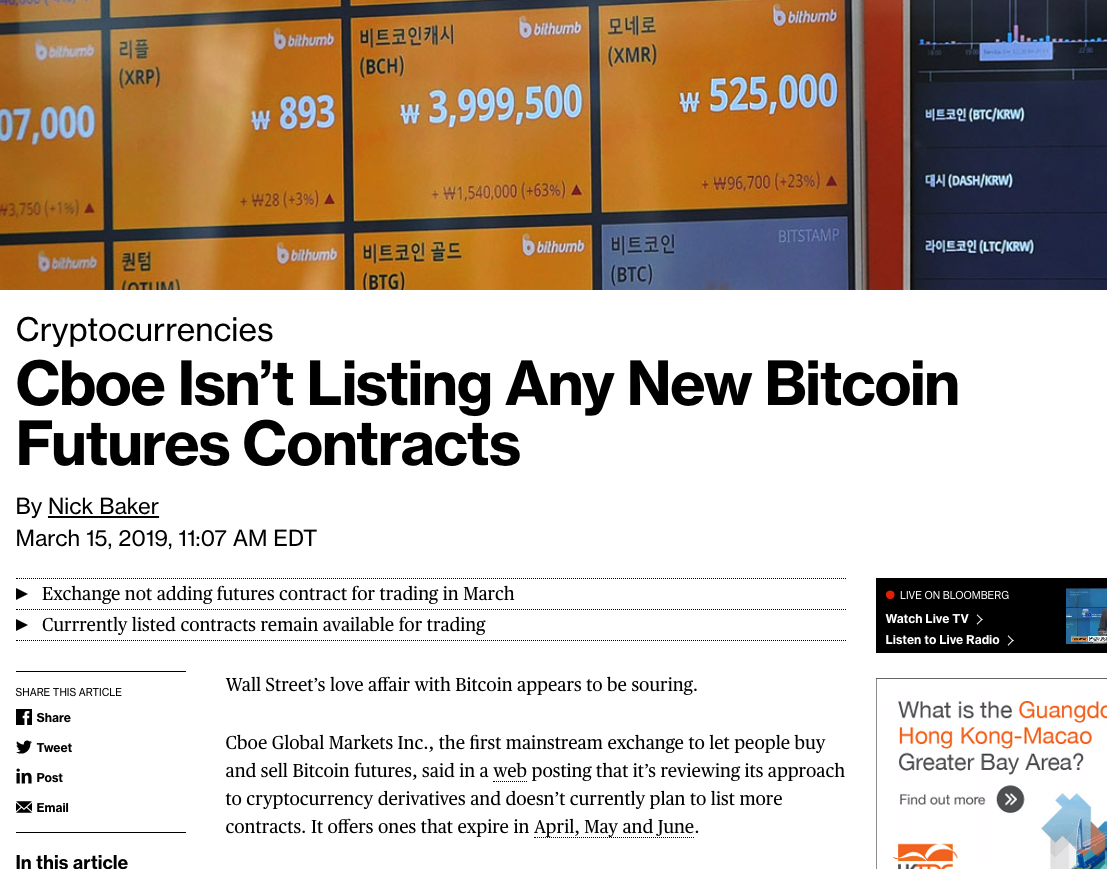

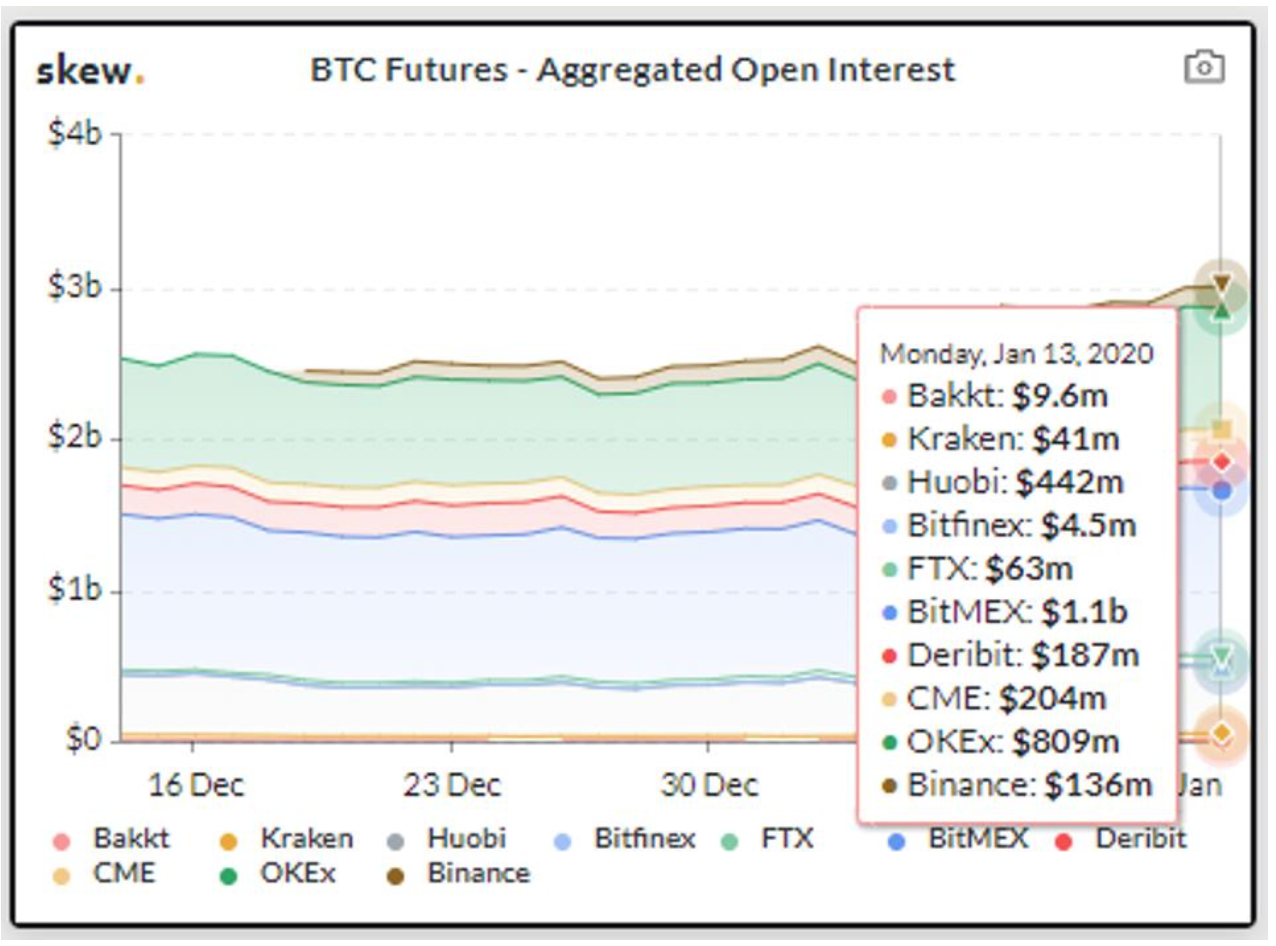

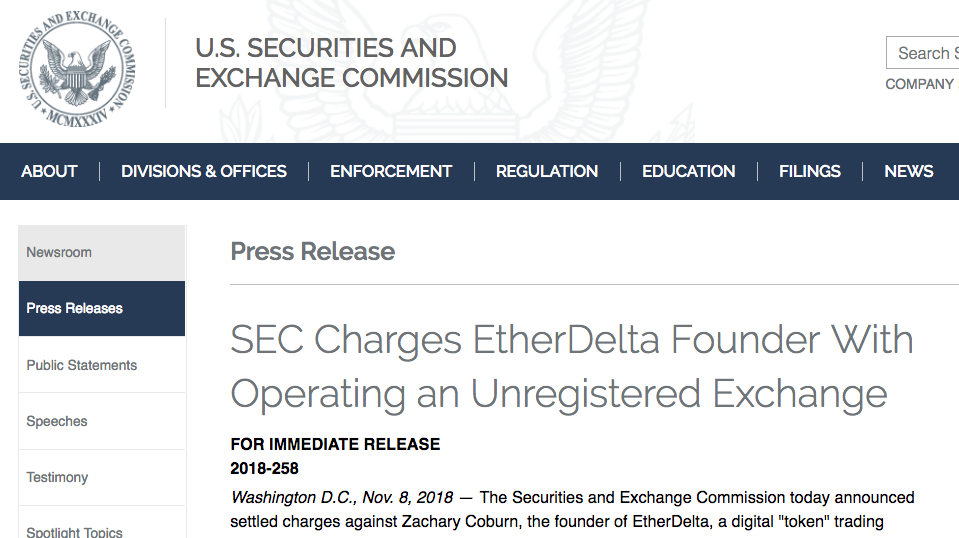

Regulated Exchanges

Derivatives trade mostly offshore! Unregulated(?!)

"Just in"

(Jan 13, 2020)

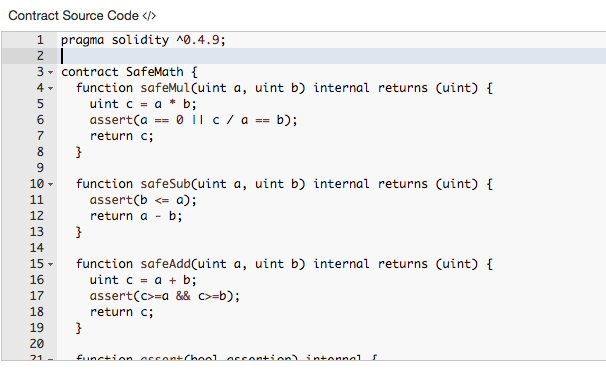

Spirit of Blockchain: Fully decentralized

... 300 lines of code ...

standard trading rules practically impossible to enforce

Crypto exchanges are a security risk

August 2016

Crypto exchanges are a security risk

https://www.forbes.com/sites/jasonbrett/2019/12/19/congress-considers-federal-crypto-regulators-in-new-cryptocurrency-act-of-2020/#7ddcdfd65fcd

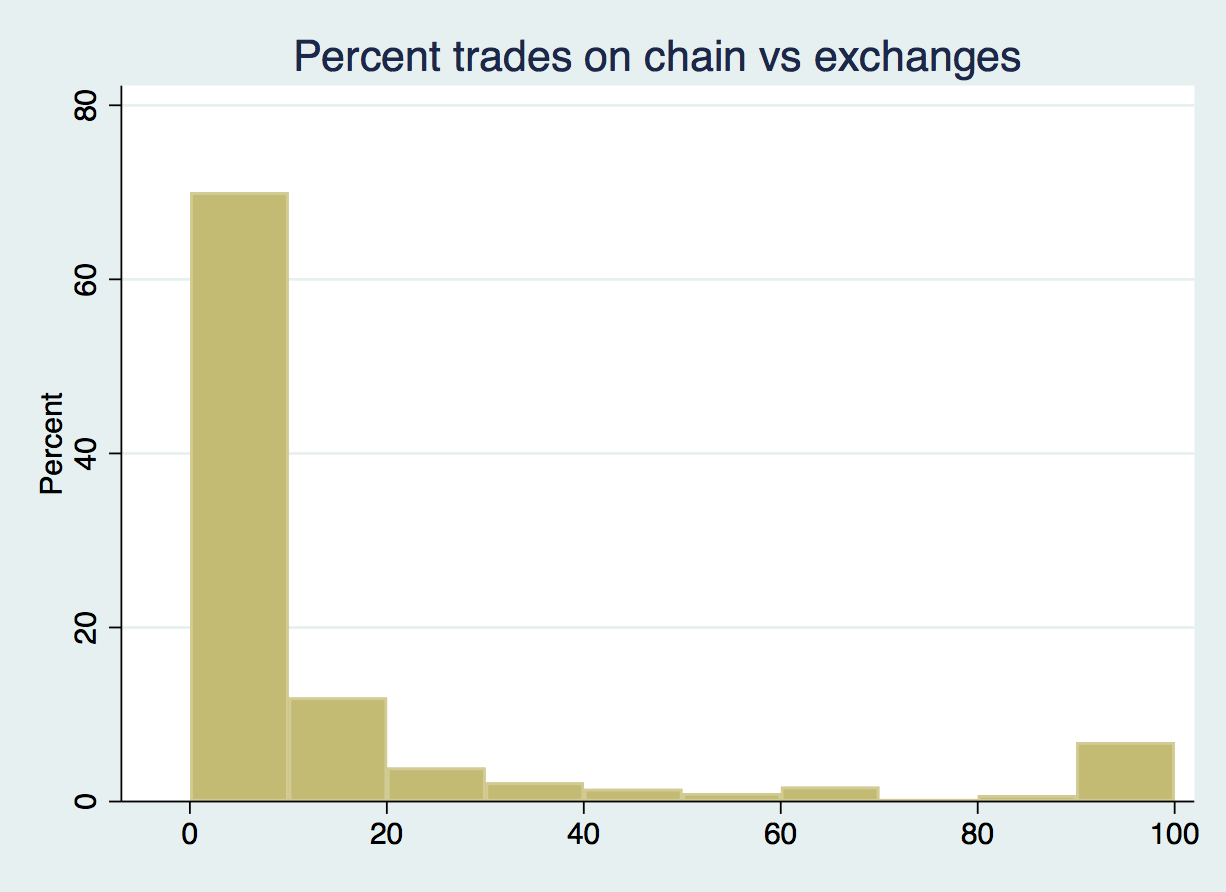

Some trading data

based on Khapko, Malinova, Park, and Zoican (2018)

Distribution of changes in beneficiary ownership

most tokens stay at exchanges and don't get settled on the blockchain

some usage tokens are "in use"

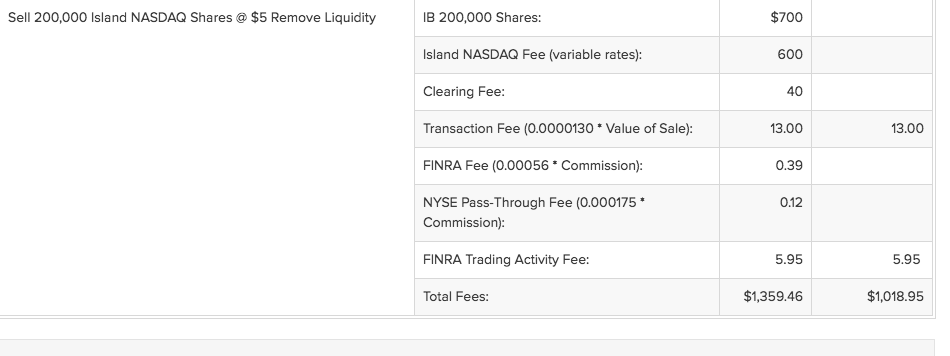

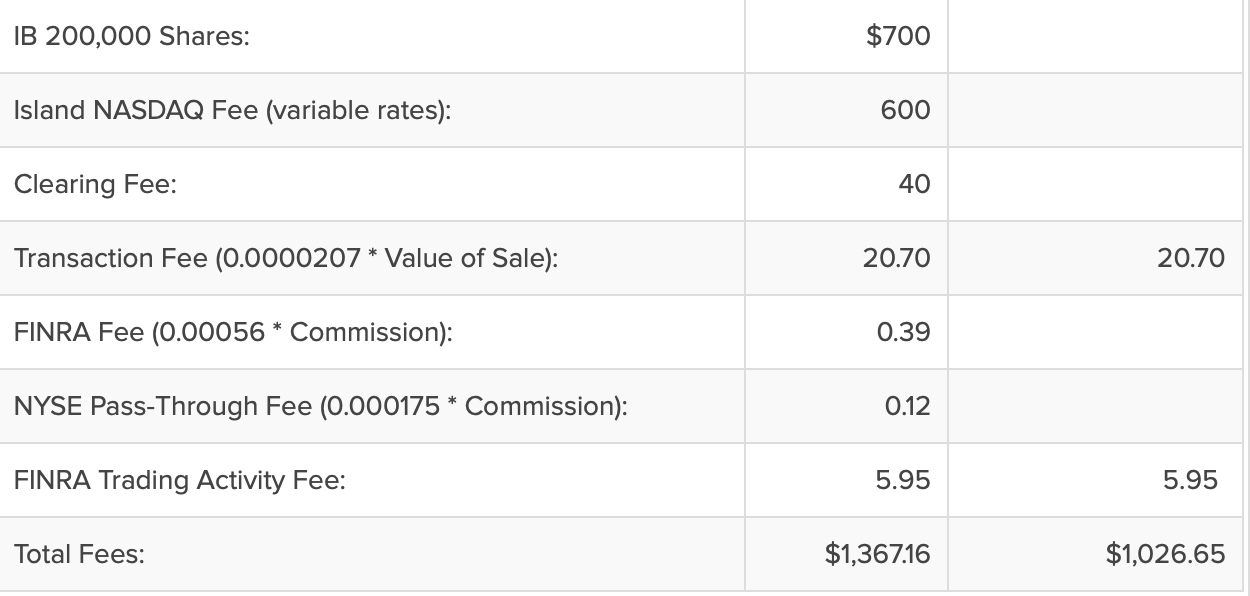

Transactions costs

Source: Interactive Brokers

Broker

Level

crypto exchange fees for $1,000,000 market order

account

wire/in-out

-

25 bps = 2,500 trading fee

-

in/out fee 0.1% - 3%

-

mining fee ($0.25)

$1,000,000 market order