Blockchain Technology in Finance & DeFi (Part 3)

Instructor: Katya Malinova

Course : F741 Winter 2021

Related Development: Libra

The most controversial entrant of them all ...

Partnerships

"new financial infrastructure"

The One the world is talking about

What is Libra and how does it work?

issued by a consortium of firms (e.g., Facebook, Uber) and not for profits (Creative Destruction Lab)

original idea: each coin will be backed by a basket of SIX fiat currencies

idea is conceptually similar to IMF Special Drawing Rights (pegged to USD, EUR, YEN, GBP, YUAN)

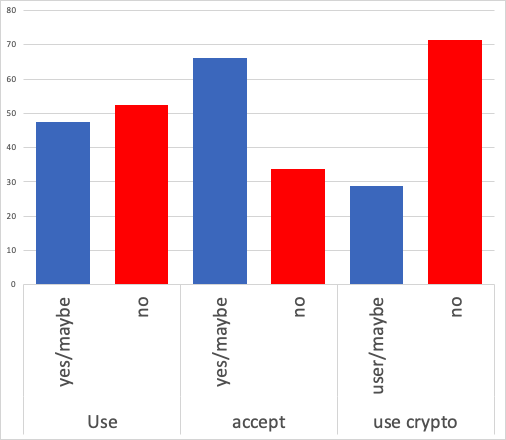

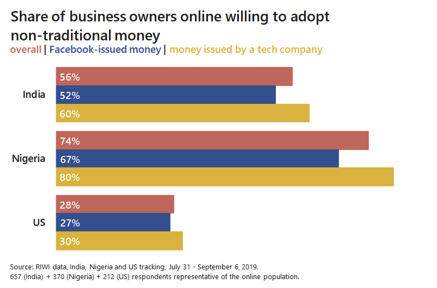

Survey Info on Libra

Would you use Libra/Money issue by Tech Firm?

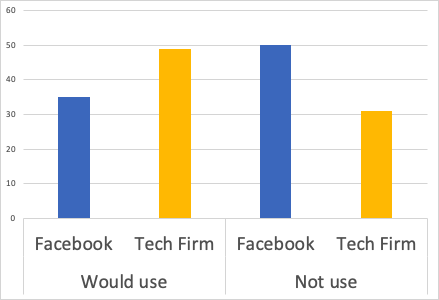

If we ask explicitly for Facebook vs Tech Firm

Scaled to yes/maybe/no. About 20% say: "Need more info"

Source: Will Libra Succeed? Results of a Global Randomized Survey Experiment; by Danielle Goldfarb and Andreas Park

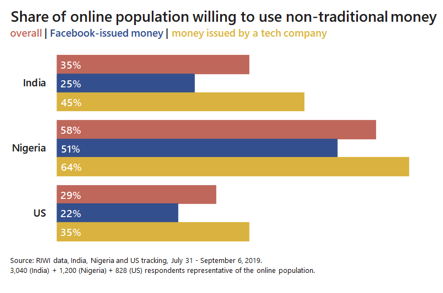

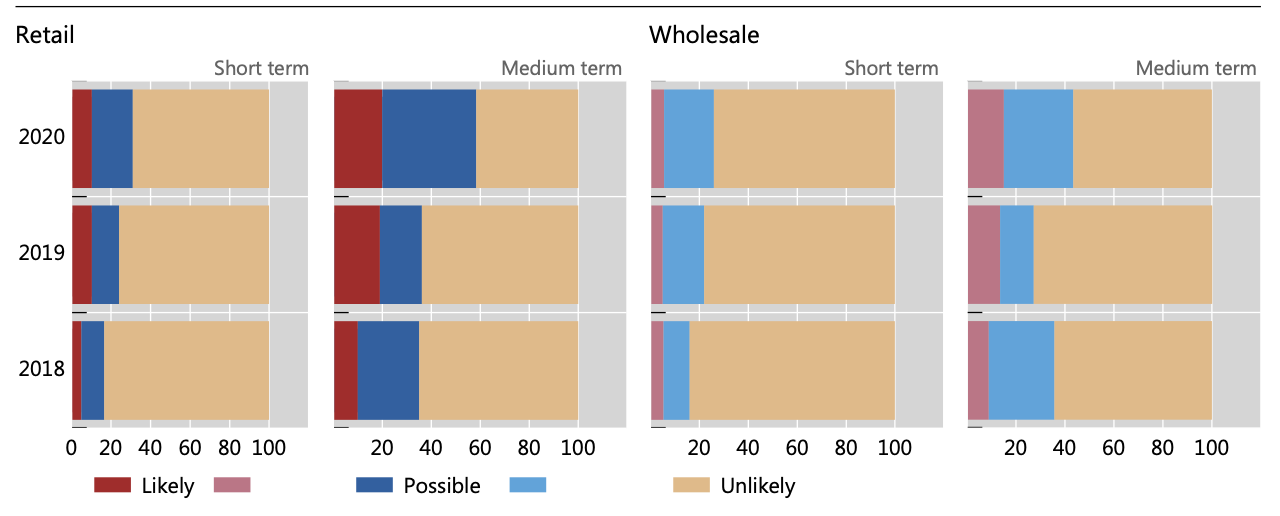

Will people use Libra?

Source: Will Libra Succeed? Results of a Global Randomized Survey Experiment; by Danielle Goldfarb and Andreas Park

Why does BigTech enter the finance game?

They have ZERO interest in becoming a financial institution/bank

\(\rightarrow\) no expertise

\(\rightarrow\) competitive market

\(\rightarrow\) one of the most regulated business environments

My take

They are trying to deal with frictions that impede their business

They aim to collect data which will vastly improve their business

Related Development: Central Bank-Issued Digital Currencies

Newest Developments: CBDC

CBDC = Central Bank issued Digital Currency

not a cryptocurrency \(\to\) just a "normal" liability on central banks balance sheets

-

BIS Jan 2019: "Proceed with caution"

-

BIS Jan 2020: "Impeding Arrival"

-

BIS Jan 2021: "READY, STEADY, GO!"

Is it coming?

players

-

China: in test mode; provinces prep own initiatives, coming next year

-

U.S.: has bigger problems and is always a last mover

-

UK: preparing

-

Canada: contingency planning (Will happen within two years?)

Newest Developments: CBDC

BIS 2020 Survey on CBDC

What's the problem and what should a CBDC look like?

current problems

future concerns

crib sheet

too slow

too expensive

not flexible

lack of competition

disintermediation

by new players (Libra)

data harvesting

with no way out

ineffectiveness

of monetary policy

demise of the Loonie

two-tiered world in Canada

fast

cheap

flexible/programmable

universally accessible

resilient

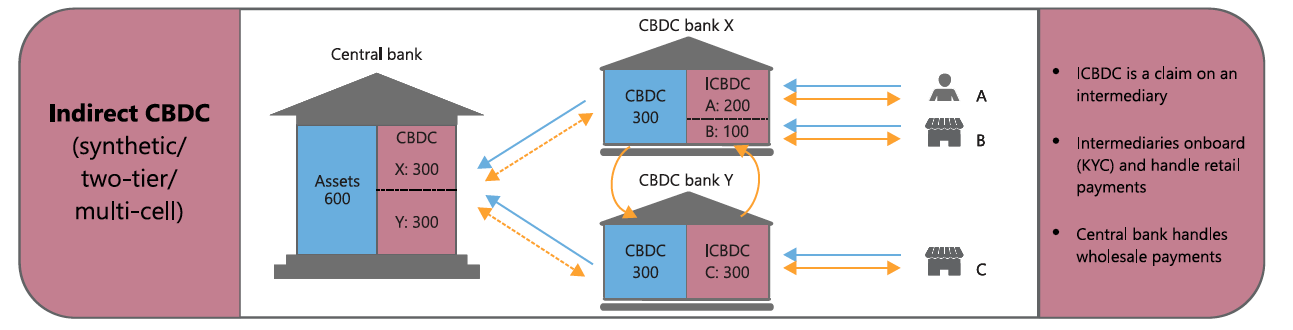

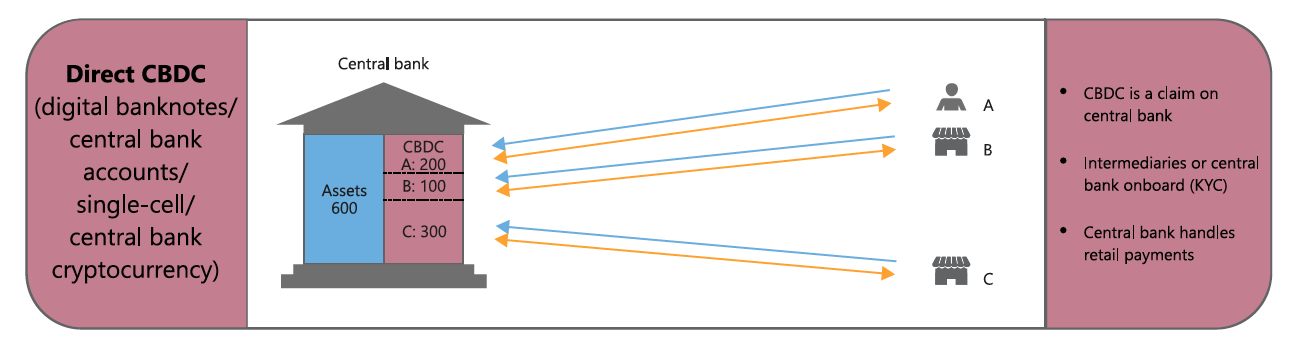

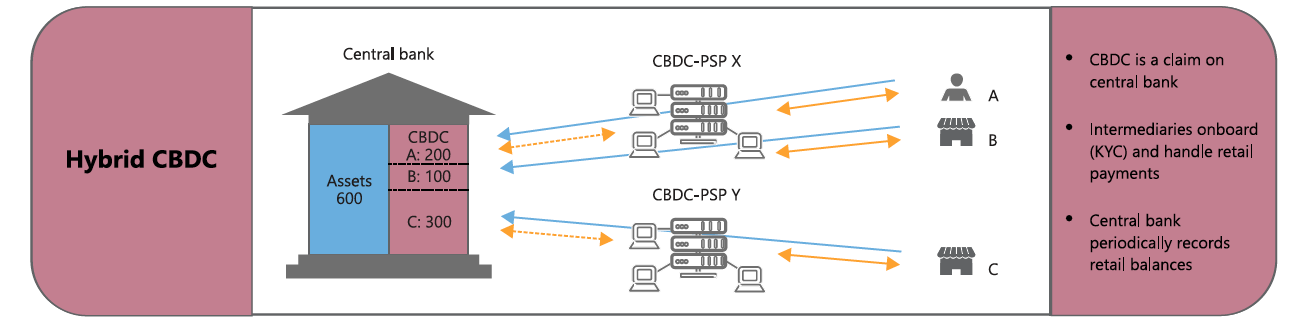

Possible CBDC architectures

Source: BIS Quarterly Review, March 2020

What is "disintermediation"?

two types of money

government:

-

reserves

-

cash

commercial

-

each commercial loan \(\to\) deposit

cash withdrawal

convert commercial money into government money

lowers bank's balance sheet

disintermediation

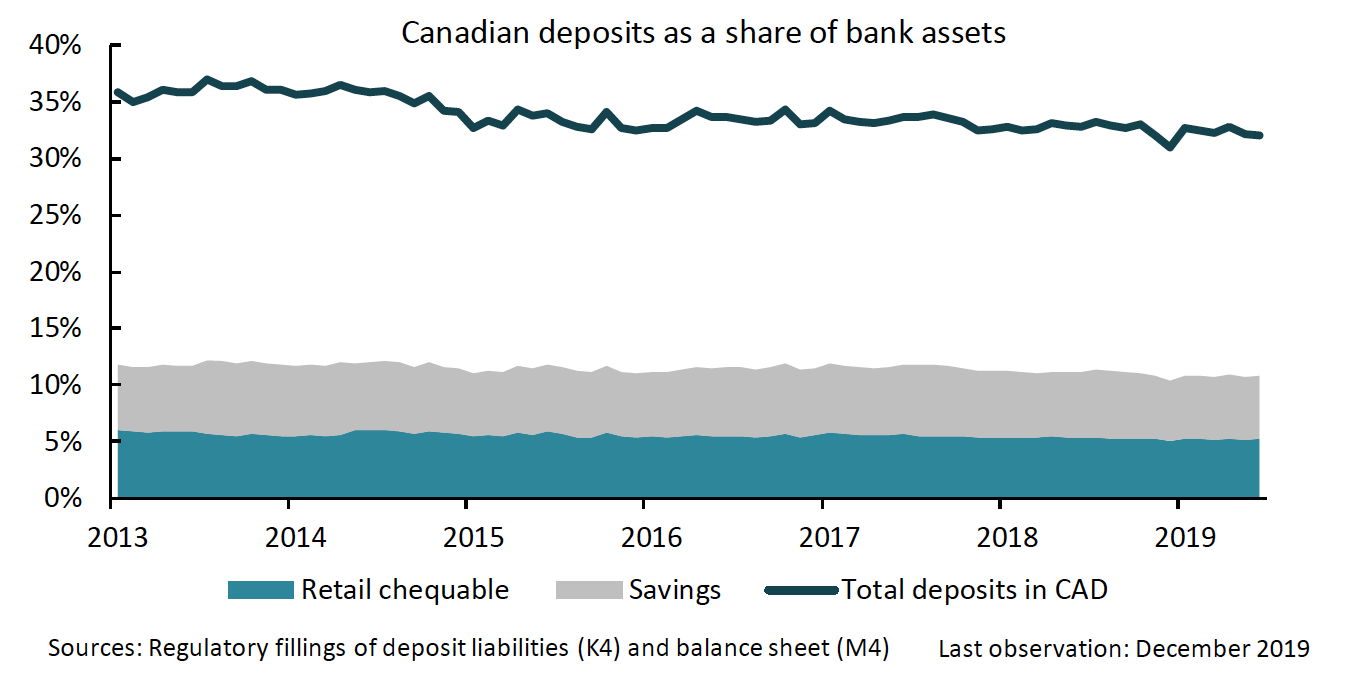

Would a CBDC destabilize the banks?

BoC analysis (August 2020):

- [banks] are well-positioned to absorb potential temporary negative effects on profitability and liquidity

- Banks[can] absorb the shock under plausible adoption scenarios.

- [No] threat to the stability of the financial system or to banks’ competitiveness in terms of ROE.

- banks will maintain healthy liquidity levels, and liquidity could become a concern only in the most extreme scenario.

Questions for the future

What is the economic impact of "tokenizing everything"?

How will it affect investments and investment banking?

Which business opportunities will it enable?

What do tokens and "alternative money" mean for payments?

Conclusion and final thoughts

blockchain is a transformative technology, but won't be used in practice overnight

many conceptual and technological challenges remain, but there are already various areas of application

legal, regulatory, and competitive changes are needed and then the opportunities are endless ...

it will open up the banking world further, foster international competition, and change how we pay and exchange value