Learning from DeFi: Would Automated

Market Makers Improve Equity Trading?

Katya Malinova and Andreas Park

Warwick Business School Gillmore Centre Conference

DeFi & Digital Currencies

The Shard. London 27 & 28 October 2023

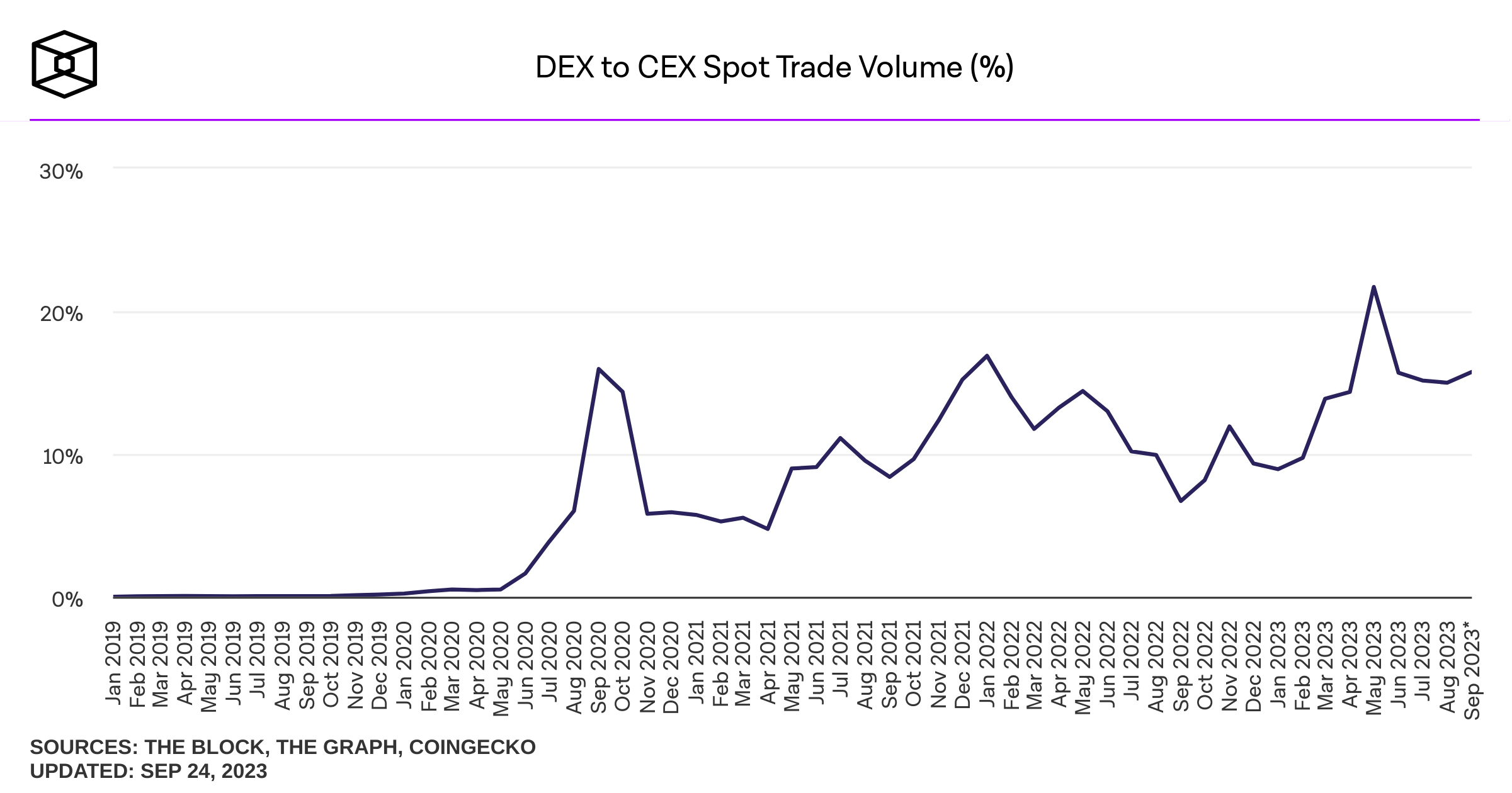

Preliminaries & Some Motivation

- Blockchain: borderless general purpose value and resource management tool

Basic Idea

- DeFi: financial applications that run on blockchains

- \(\Rightarrow\) brought new ideas and tools

- one new market institution: automated market makers

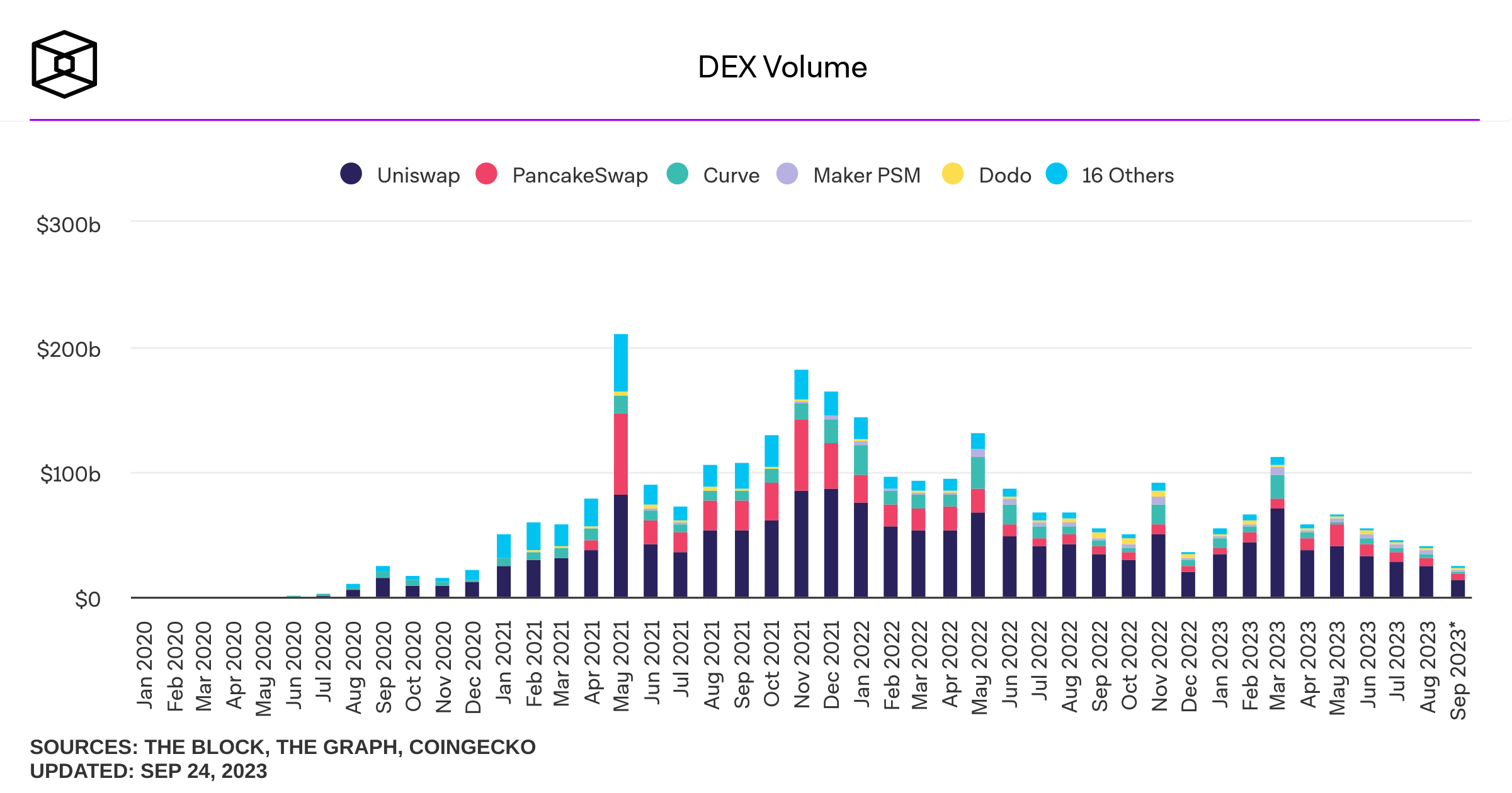

Decentralized trading using automated market makers (AMM)

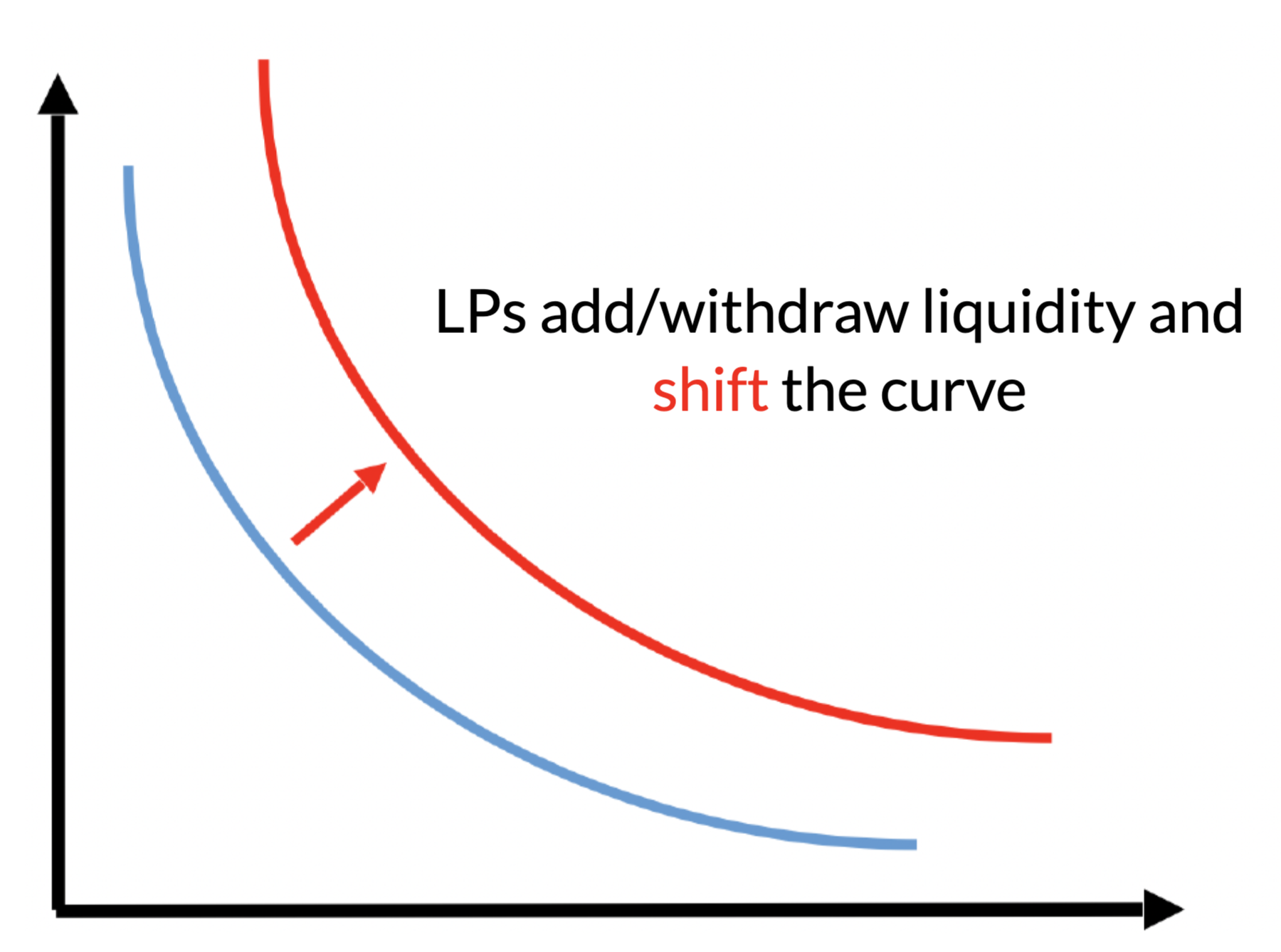

Liquidity providers

Liquidity demander

Liquidity Pool

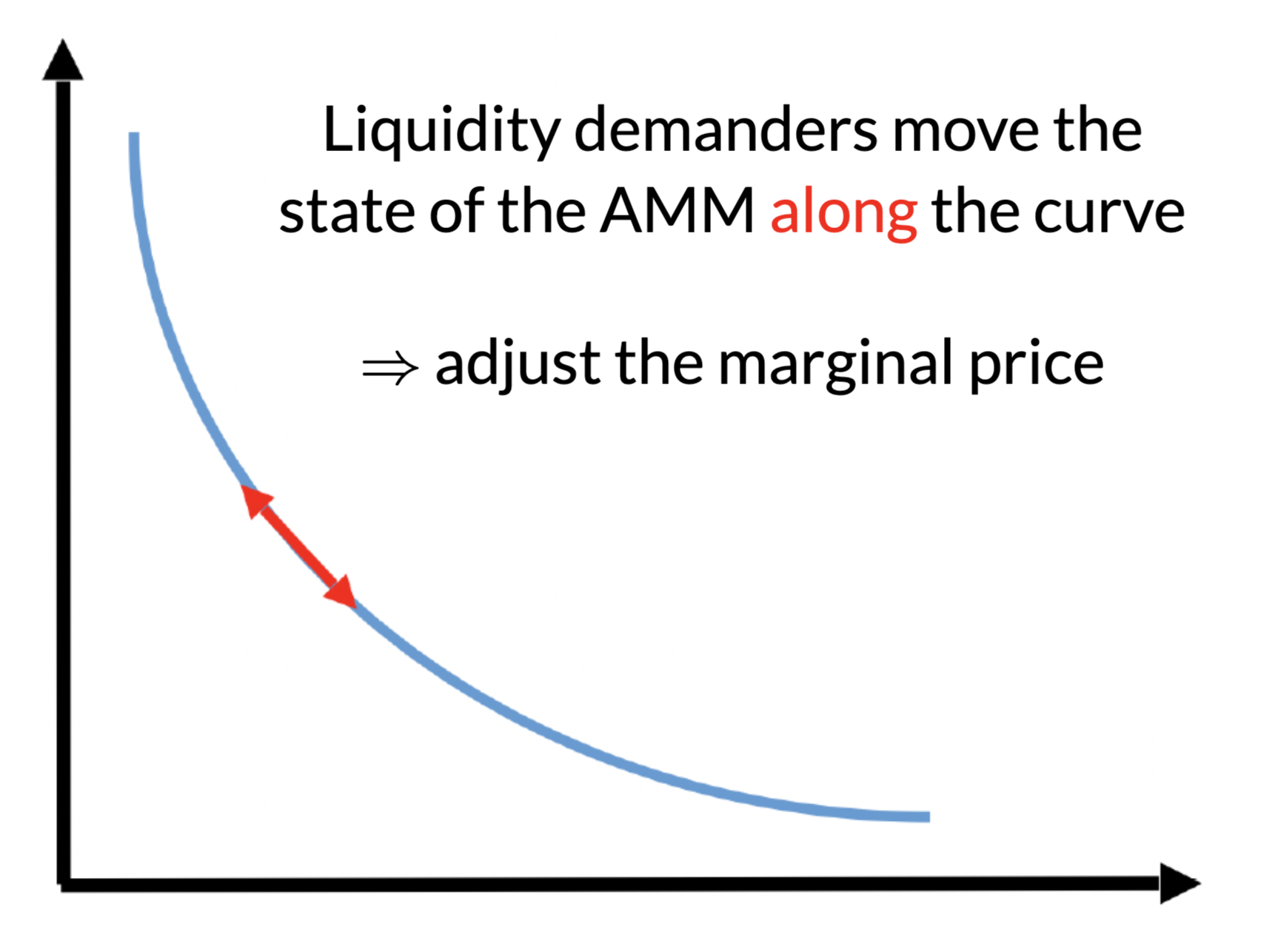

AMM pricing is mechanical:

- determined by the amounts of deposits

- most common:

- constant product

- #USDC \(\times\) #ETH = const

No effect on the marginal price

Key Components

- Our question:

- Can an economically viable AMM be designed for current equity markets?

- Would such an AMM improve current markets?

- Pooling of liquidity!

- Liquidity providers:

- pro-rated

- trading fee income

- risk

- use assets that they own to earn passive (fee) income

- retain exposure to the asset

- pro-rated

- Liquidity demanders:

- predictable price

- continuous trading

- ample liquidity

Liquidity Supply and Demand in an Automated Market Maker

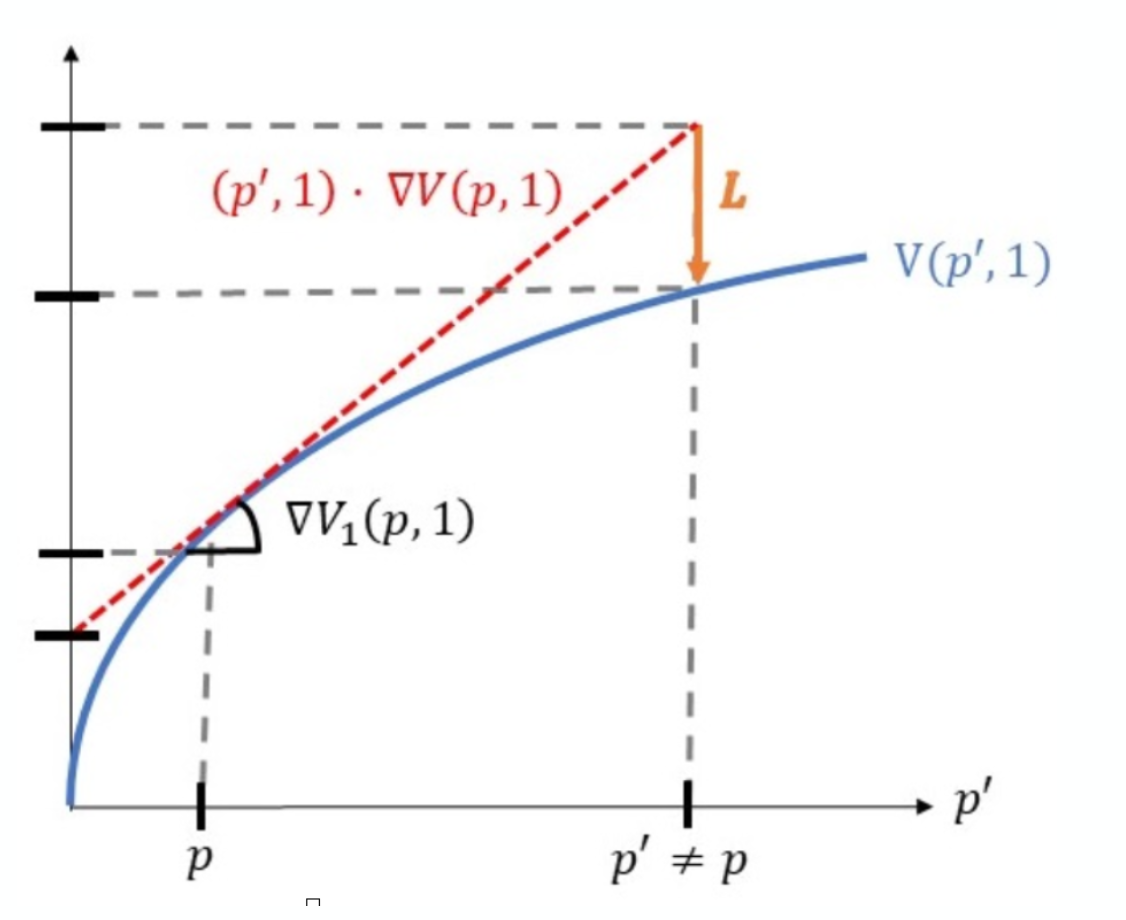

Liquidity providers: positional losses

- Deposit asset & cash when the asset price is \(p\)

- Withdraw at price \(p'\ne p\)

Buy and hold

Provided liquidity

in the pool

- Why?

- adverse selection losses

- arbitrageurs trade to rebalance the pool

- \(\to\) always positional loss relative to a "buy-and-hold"

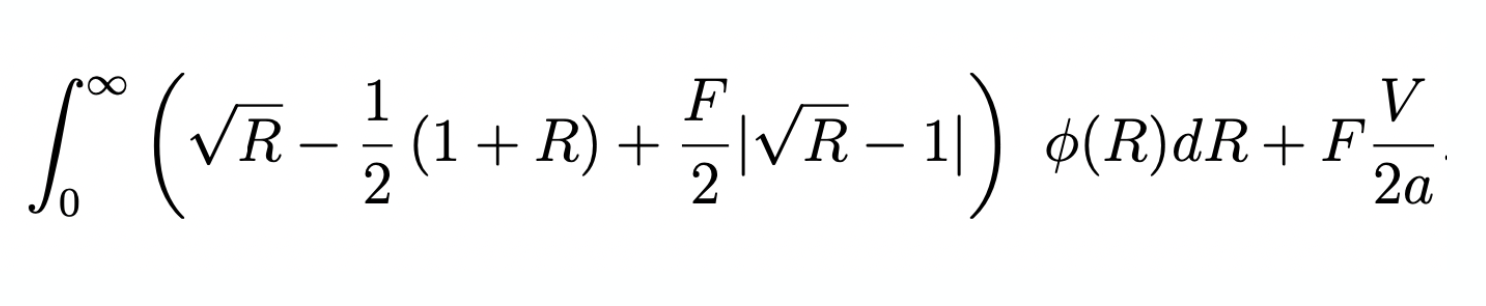

Returns to liquidity providers

- \(R\) = asset return

- F = trading fee

- V = balanced volume

- a = size of the liquidity pool

Similar to Lehar and Parlour (2023), Barbon & Ranaldo (2022).

(incremental) adverse selection loss when the return is \(R\)

fees earned

on informed

fees earned

on balanced flow

for reference:

- If the asset price drops by 10% the incremental loss for liquidity providers is 13 basis points on their deposit

- \(\to\) total loss=-10.13%

- If the asset price rises by 10%, the liquidity provider gains 12 basis points less on the deposit

- \(\to\) total gain =9.88%

For fixed balanced volume \(V\) & fee \(F\):

- Larger pool size \(\to\) smaller shares of the fees

- \(\to \) LP expected return \(\searrow\) in pool size

-

Competitive liquidty provision:

- \(\to\) find the upper-bound on pool size above which LPs lose money

- we characterize this by \(\bar{\alpha}\) - fraction of the asset's market cap to be deposited to the pool

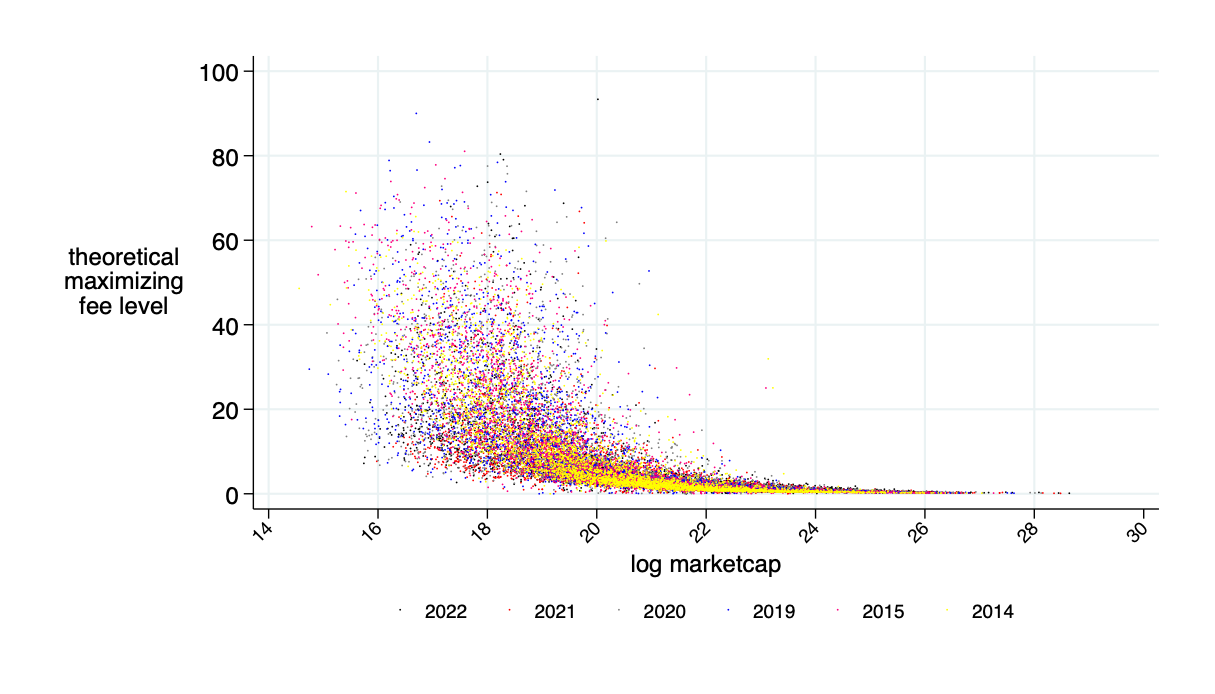

Liquidity Demander's Decision & (optimal) AMM Fees

- Better off with AMM relative to traditional market if

\[\text{AMM price impact} +\text{AMM fee} \le \text{bid-ask spread}.\]

- Two opposing forces when fee \(F\nearrow\)

- more liquidity provision

\(\to\) lower price impact - more fees to pay

- more liquidity provision

Result:

competitive liq provision\(\to\) there exists an optimal (min trading costs) fee \(>0\)

- \(\to\) derive closed form solution for competitive liquidity provision

- depends on return distribution, balanced volume, quantity demanded

Similar to Lehar&Parlour (2023) and Hasbrouck, Riviera, Saleh (2023)

What's next?

- Have:

- equilibrium choices for competitive liquidity provision

- fee that minimizes liquidity demander AMM costs (\(>0\))

- Next:

- Calibrate to stock markets

- AMM Feasible?

- AMM costs at the optimal fee < bid-ask spread?

How we think of the Implementation of an AMM for our Empirical Analysis

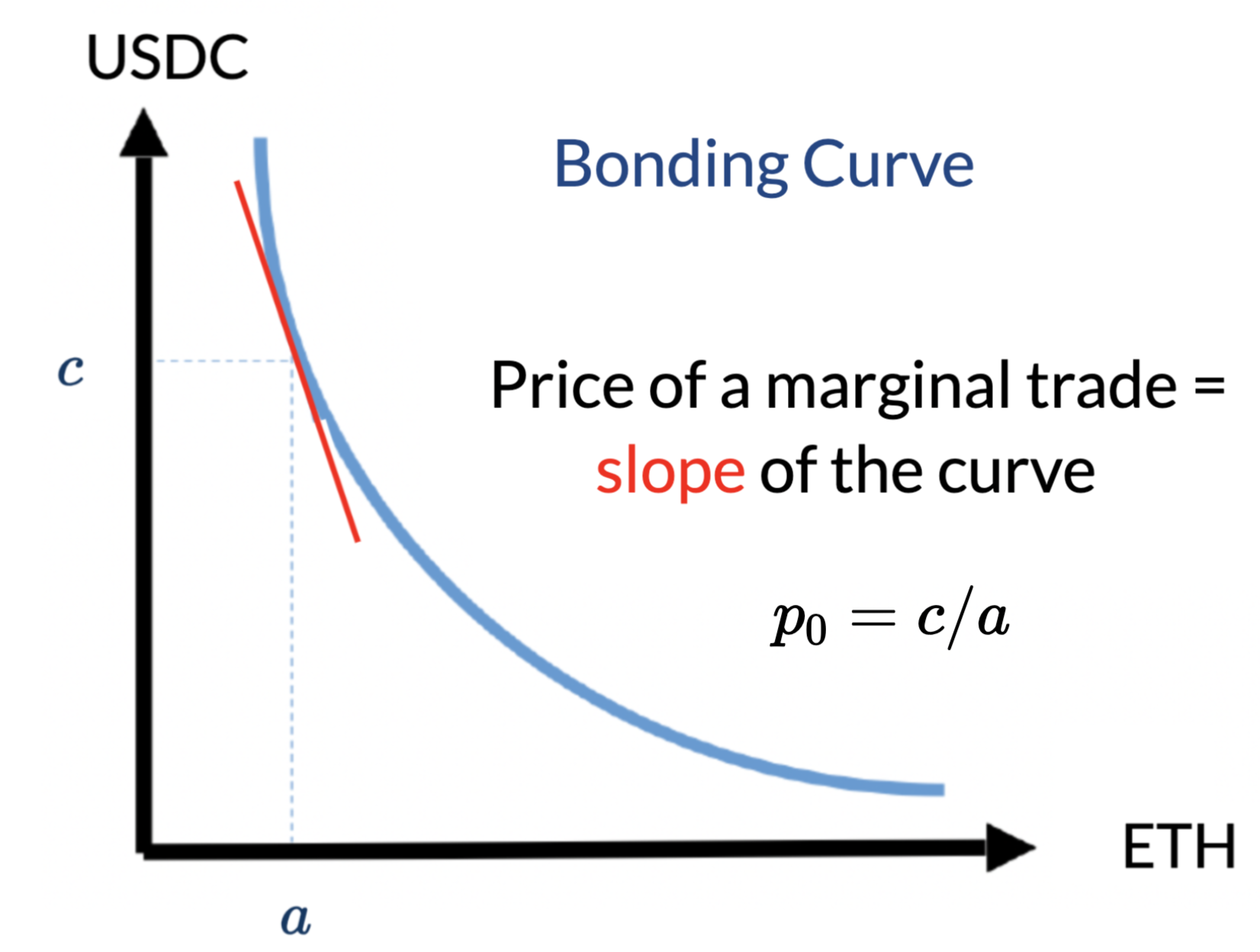

Approach: daily AMM deposits

- AMMs close overnight.

- Market: opening auction \(\to\) \(p_0\)

- Determine: optimal fee; submit liquidity \(a,c\)

at ratio \(p_0=c/a\) until break even \(\alpha=\overline{\alpha}\)

- Liquidity locked for day

- At EOD release deposits and fees

- Back to 1.

Background on Data

Special Consideration 1: What volume?

-

some volume may be intermediated

- with AMMs: no need for intermediation

- \(\to\) intermediated volume could disappear

- \(\to\) use volume/2

- Some caveats, e.g.

- arbitrageur volumes

- larger volume if AMM has lower trading costs

Special Consideration 2: What's \(q\) (the representative order size)?

- use average per day

- take long-run average + 2 std of daily averages

- (also avg \(\times 2\),\(\times 4\), depth)

All displayed data CRSP \(\cap\) WRDS

- CRSP for shares outstanding

- WRDS-computed statistics for

- quoted spreads (results similar for effective)

- volume

- open-to-close returns

- average trade sizes, VWAP

- Time horizon: 2014 - March 2022

- Exclude "tick pilot" period (Oct 2016-Oct 2018)

- All common stocks (not ETFs) (~7550).

- Explicitly not cutting by price or size

- All "boundless" numbers are winsorized at 99%.

Special Consideration 3:

Where to get returns and volume?

- Approach 1: "ad hoc"

- "one-day-back" look

- take yesterday's return and volume when deciding on liquidity provision in AMM

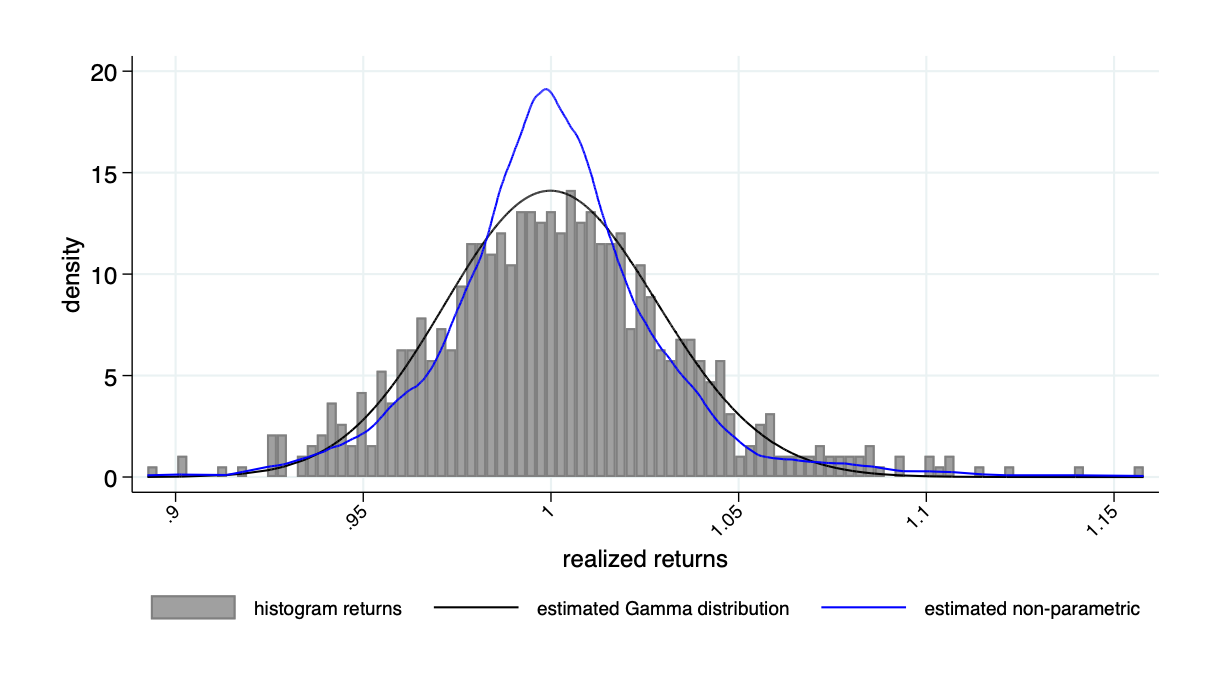

- Approach 2: estimate historical return distribution

AMMs based on historical returns

Return distribution example: Tesla

- average \(F^\pi=11\)bps

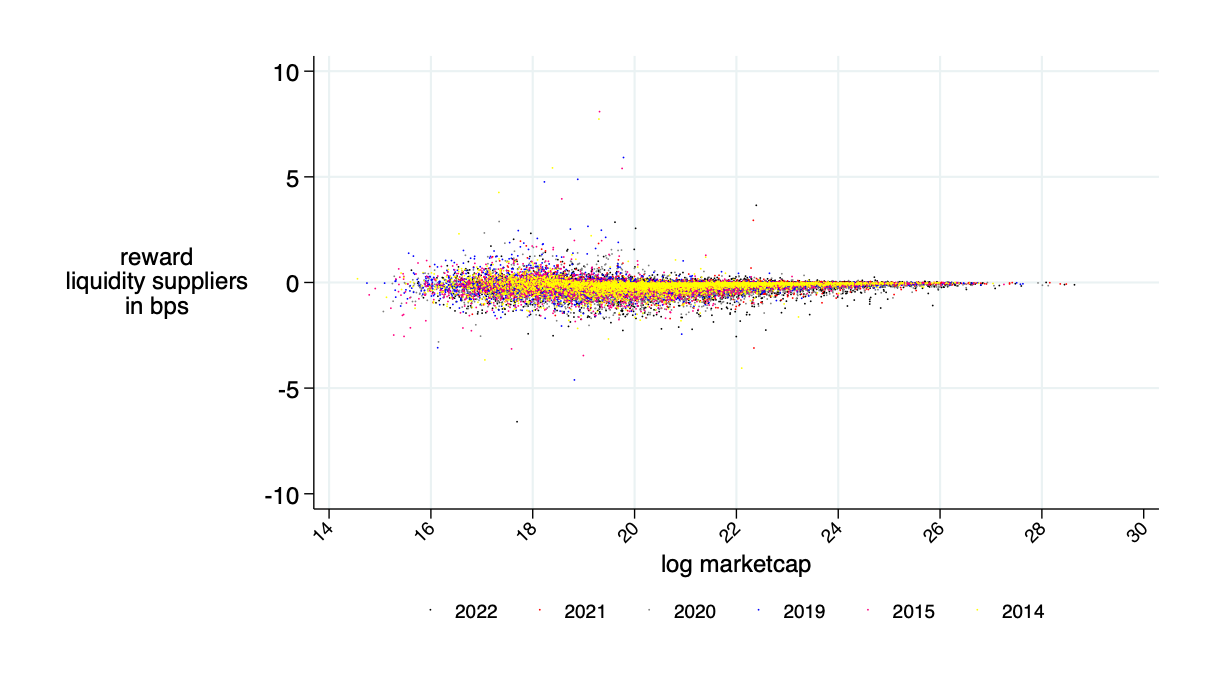

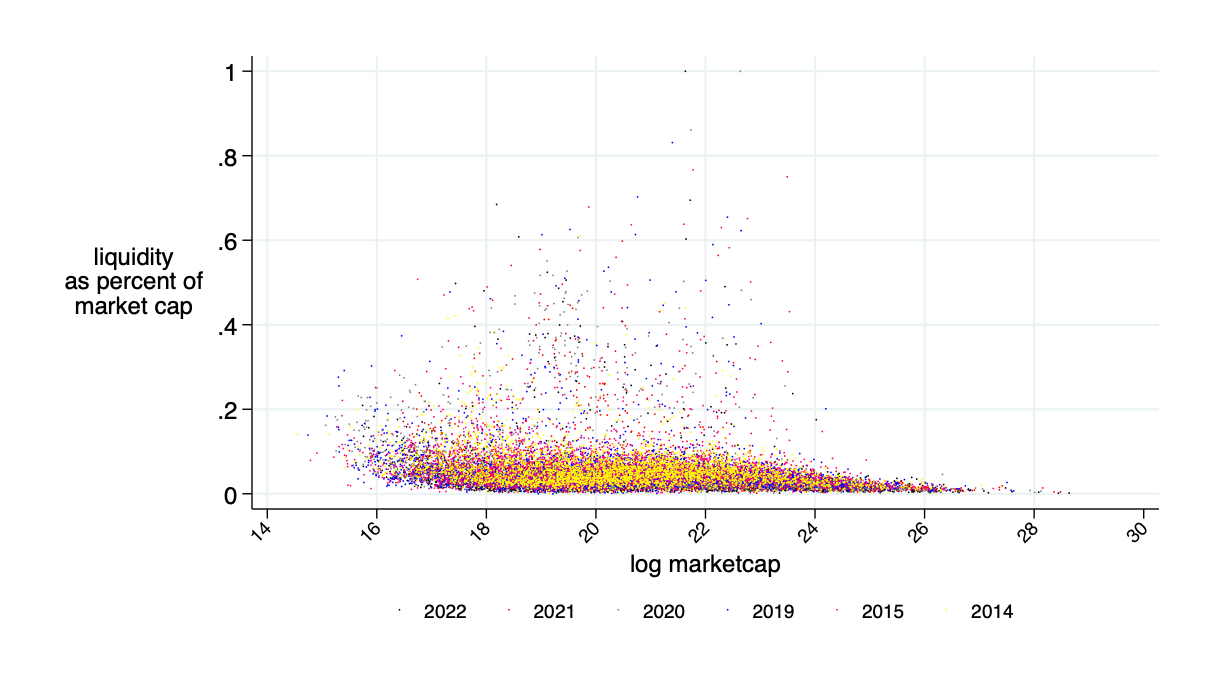

Average of the market cap to be deposited for competitive liquidity provision: \(\bar{\alpha}\approx 2\%\)

almost break even on average (average loss 0.2bps \(\approx0\))

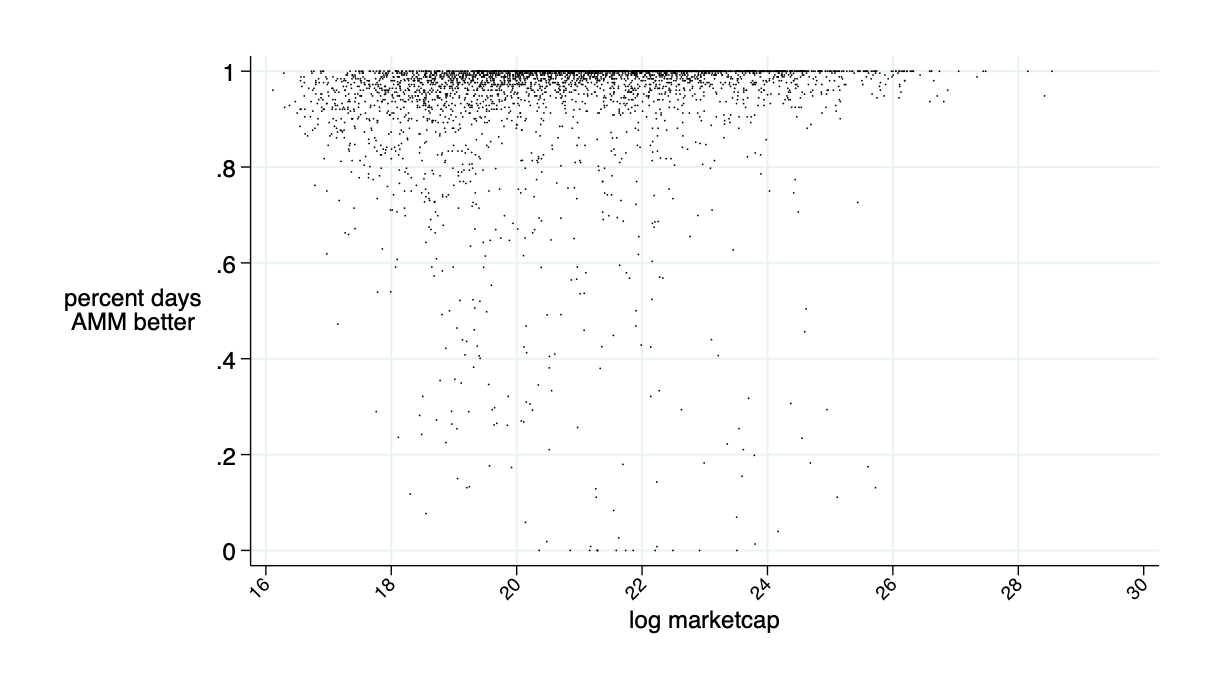

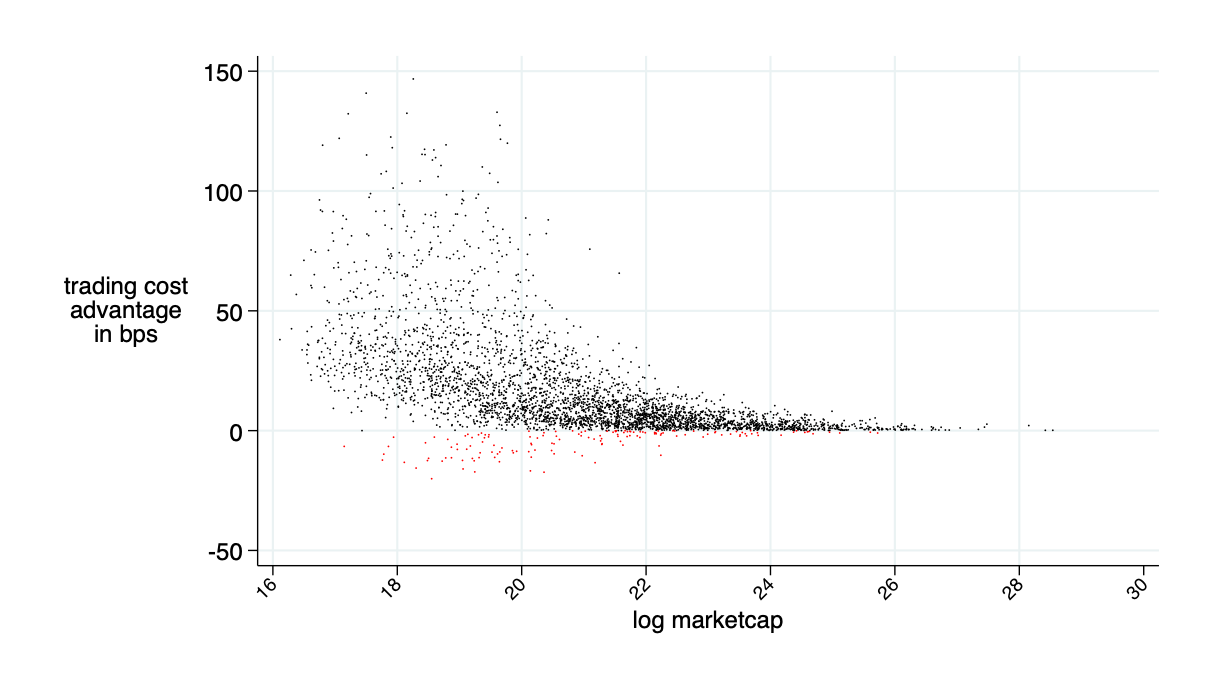

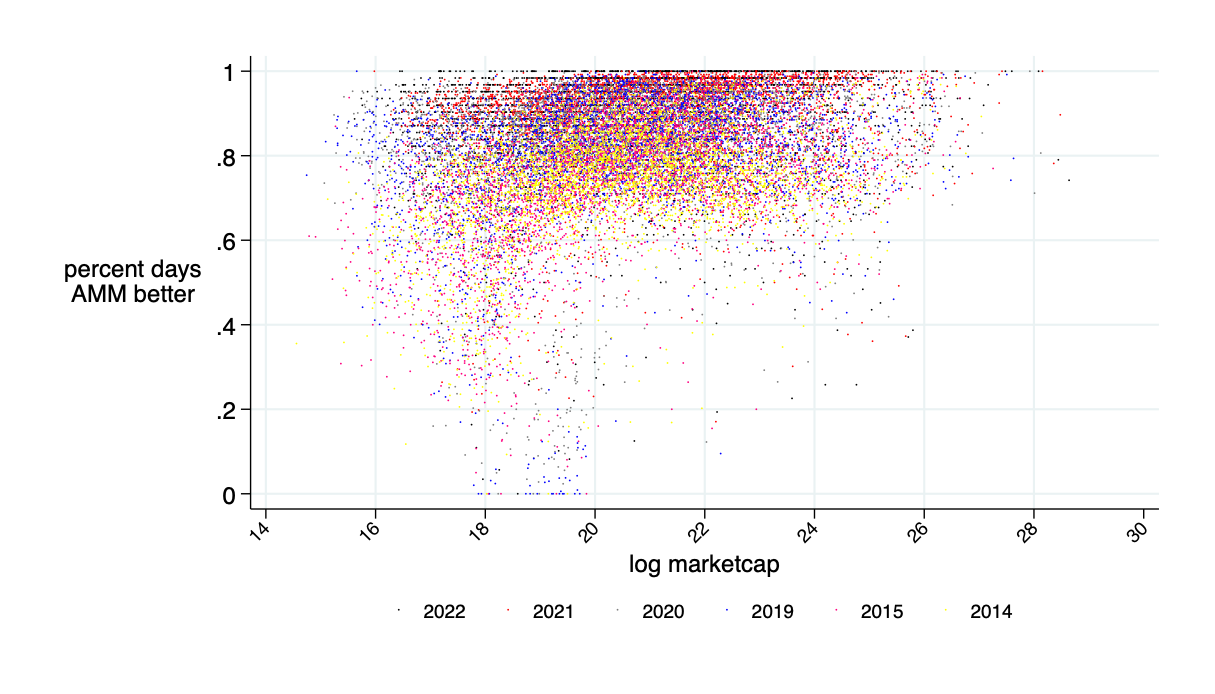

average: 94% of days AMM is cheaper than LOB for liq demanders

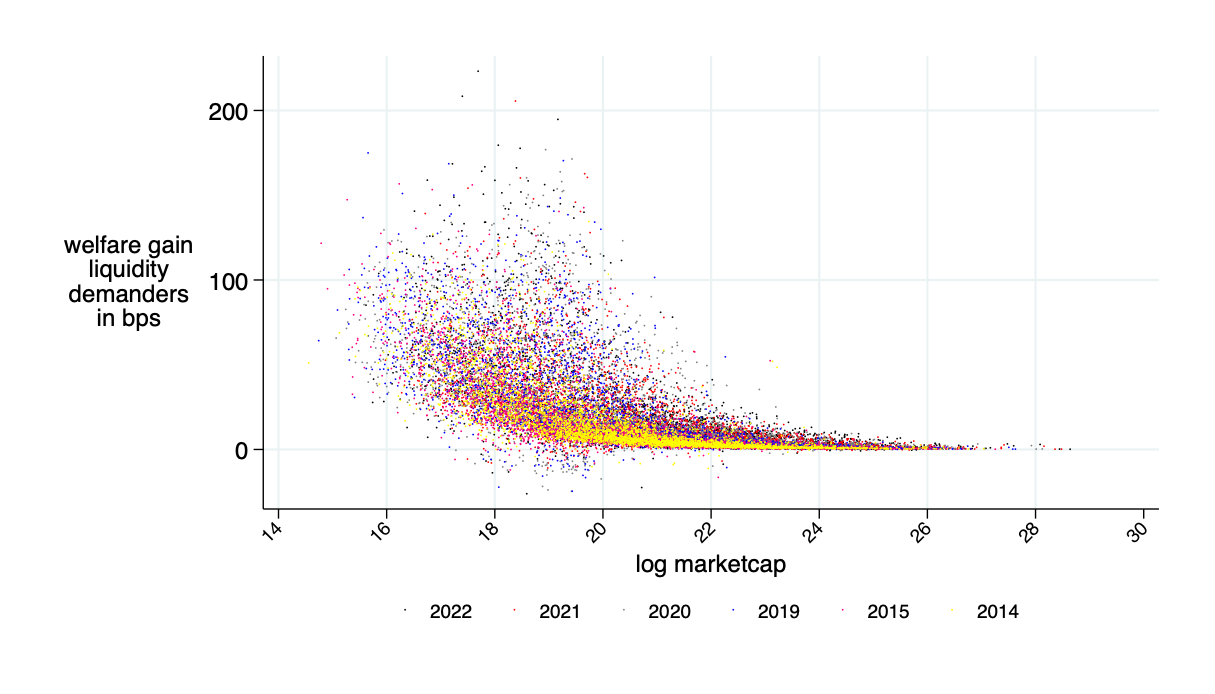

average savings: 16 bps

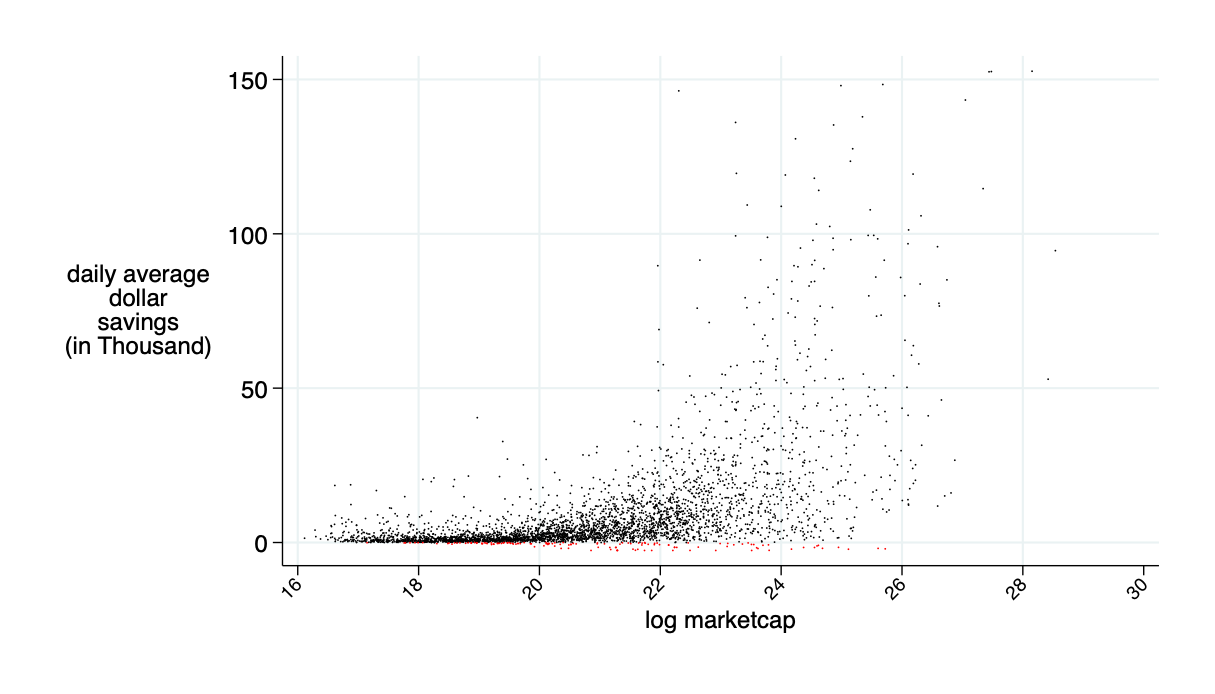

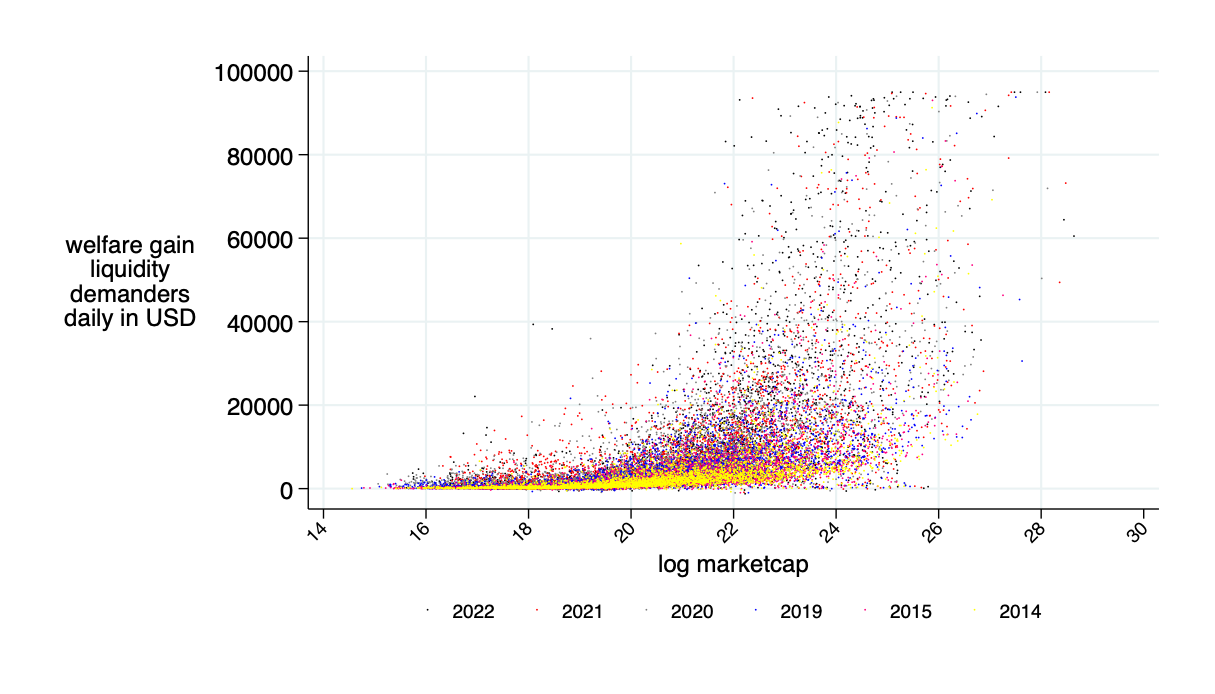

average daily: $9.5K

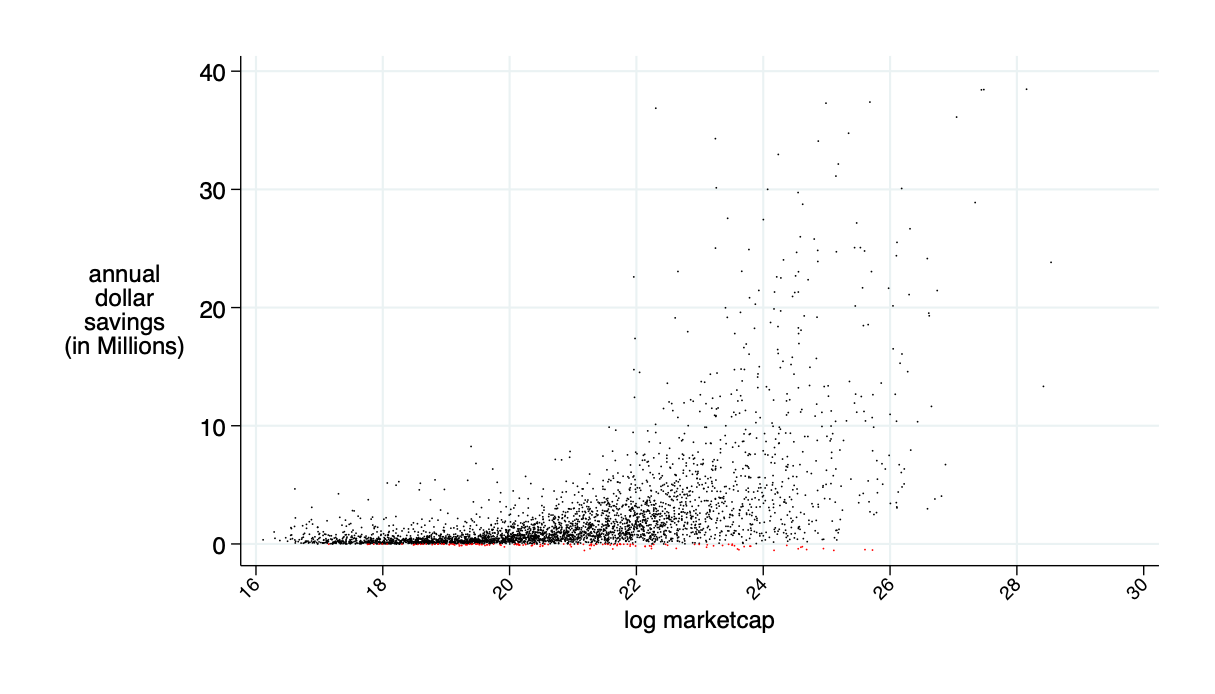

average annual saving: $2.4 million

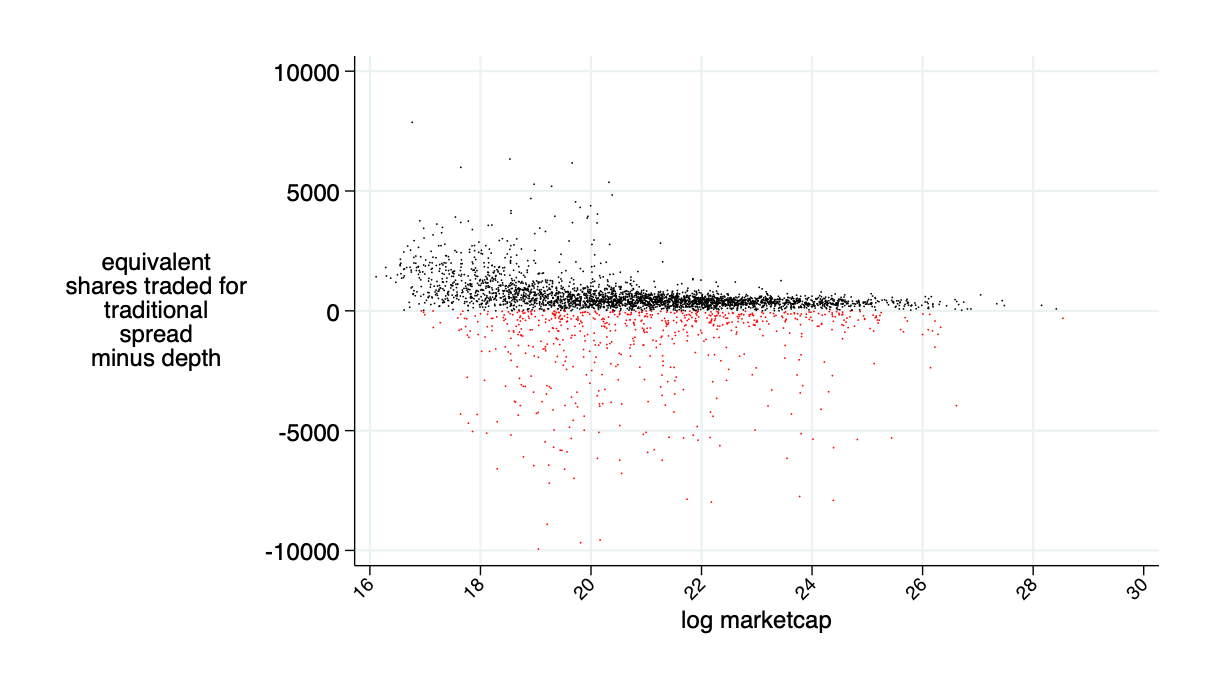

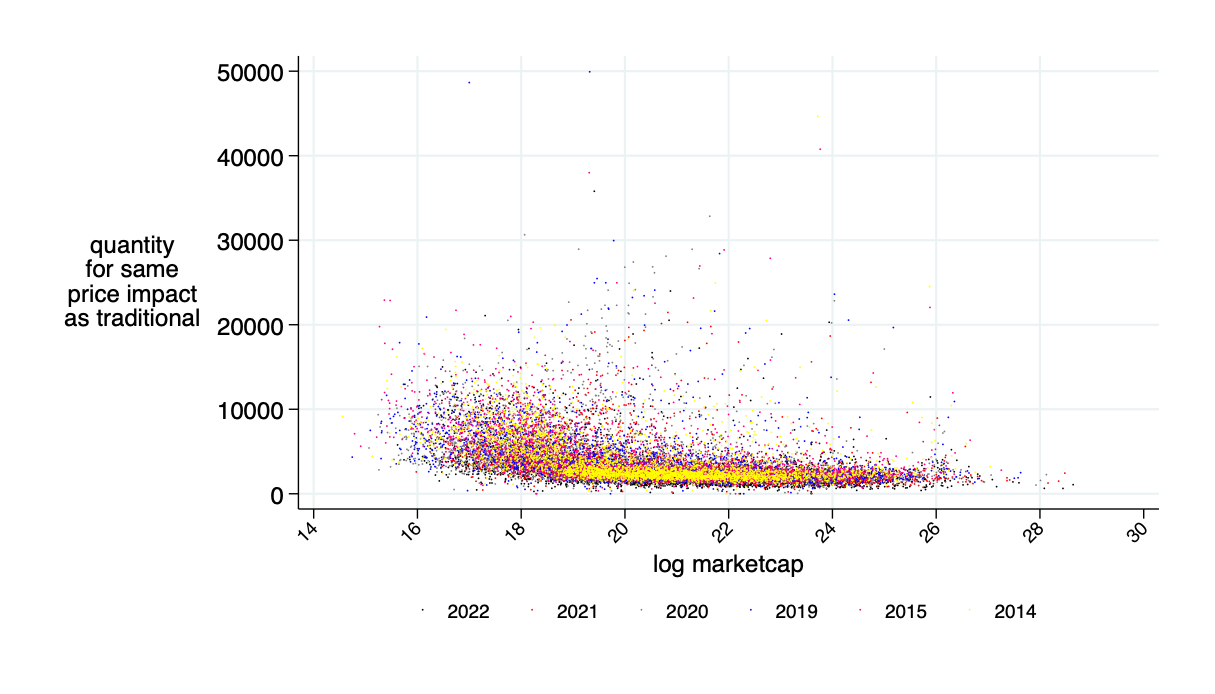

implied "excess depth" on AMM relative to the traditional market

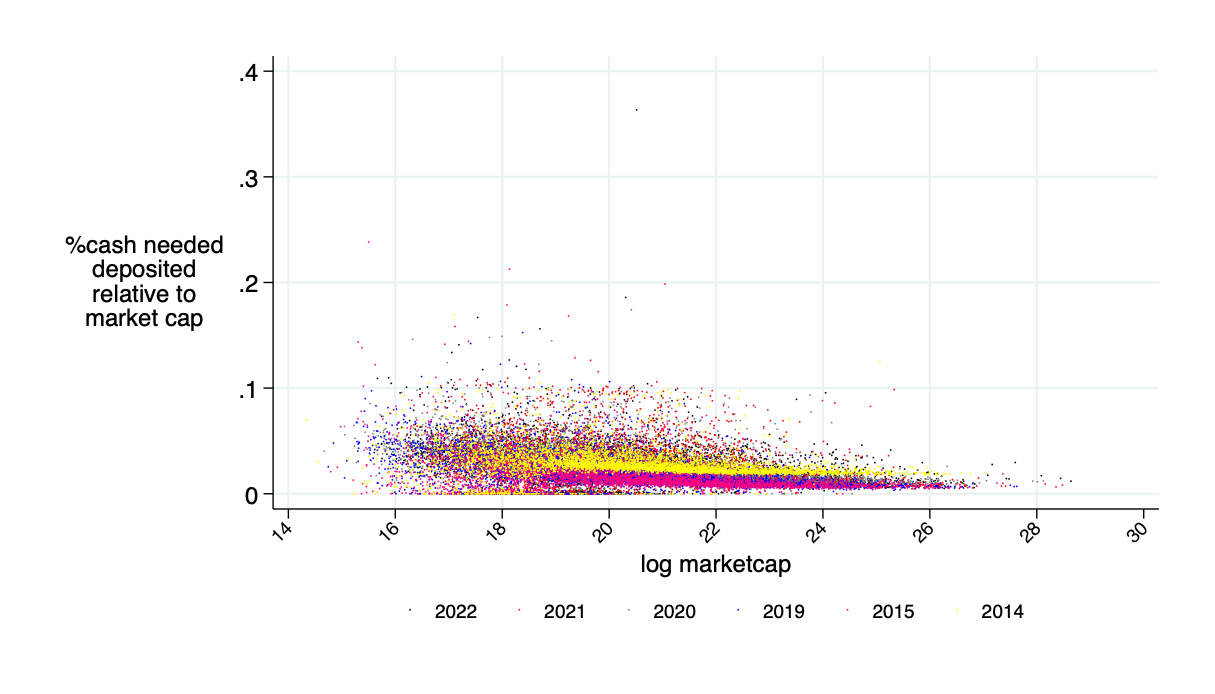

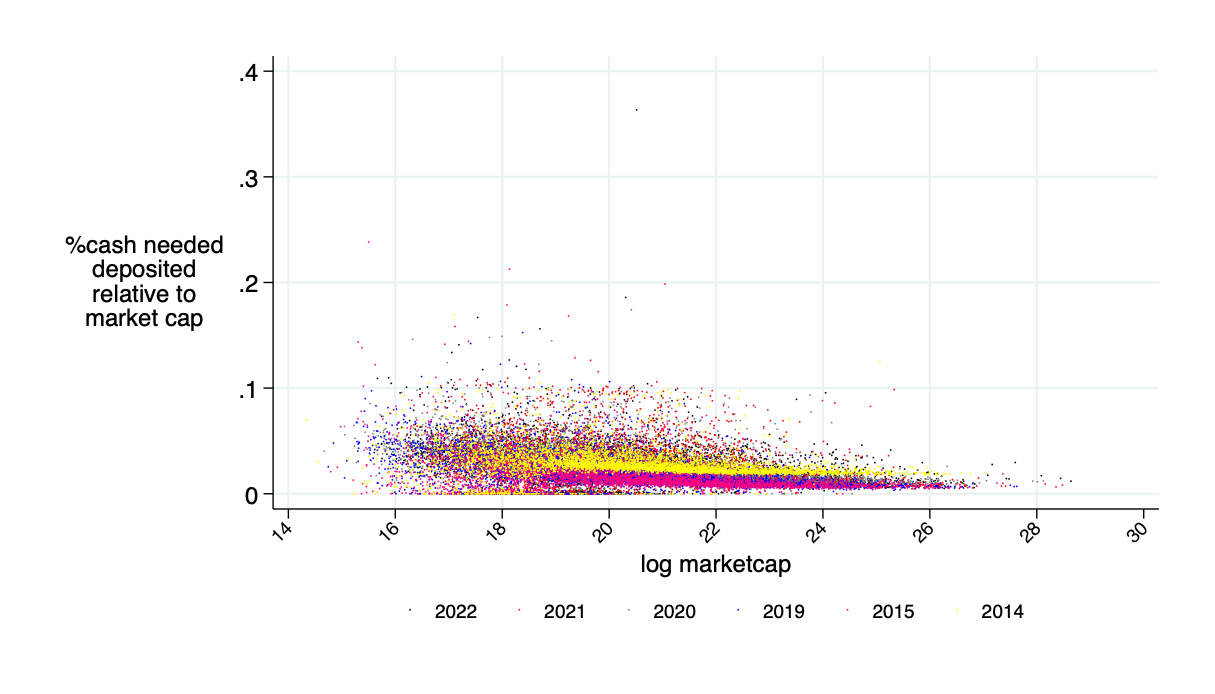

Sidebar: Capital Requirement

Deposit Requirements

- Our approach: measure liquidity provision in % of market cap

- Share-based liquidity provision is not a problem: the shares are just sitting at brokerages.

- But: AMM requires an off-setting cash amount: \(c =a\cdot p(0)\).

- Cash is not free:

- at 6% annual rate, must pay 2bps per day.

- Would need to add to fees

- But: do we need "all that cash"?

- No.

- (hand-waving argument)

- 2nd gen AMMs have liquidity provision "bands": specify price range for which one supplies liquidity

- Here: specify range for \(R\in(\underline{R},\overline{R})\)

- Outside range: don't trade.

- Inside range: "full" liquidity with constant product formula.

- Implication: only need cash and shares to satisfy

in-range liquidity demand.

\(\Rightarrow \) Need about 5% of the value of the shares deposited -- not 100% -- to cover up to a 10% return decline

Summary

- AMMs do not require a blockchain - just a concept

- could be run in the existing world (though there are institutional and regulatory barriers)

- Our question:

- Can an economically viable AMM be designed for current equity markets?

- Would such an AMM improve current markets?

- Answers:

- Yes.

- Massively.

- Source of Savings:

- Liquidity providers \(\not=\) Citadel!

- \(\to\) no (overnight) inventory costs

- \(\to\) use idle capital

- \(\to\) + better risk sharing

@katyamalinova

malinovk@mcmaster.ca

slides.com/kmalinova

https://sites.google.com/site/katyamalinova/

Deposit Requirements

- For return \(R\), the following number of shares change hands: \[q=a\cdot(1-\sqrt{R^{-1}}).\]

- Fraction of share deposit used \[\frac{q}{a}=1-\sqrt{R^{-1}}.\]

- Fraction of cash used \[\frac{\Delta c ("R")}{c}=\frac{1-\sqrt{R^{-1}}}{\sqrt{R^{-1}}}.\]

- Example for \(R=.9\) (max allowed price drop \(=10\%\)) \[\frac{\Delta c ("R")}{c}=-5\%.\]

- \(\Rightarrow\) "real" cash requirements \(\not=\) deposits

\(\Rightarrow \) Need about 5% of the value of the shares deposited -- not 100% -- to cover up to a 10% return decline

An alternative to -10% circuit breaker:

max cash needed based on long-run past average R \(-\) 2 std

Optimally Designed AMMs with

"ad hoc" one-day backward look

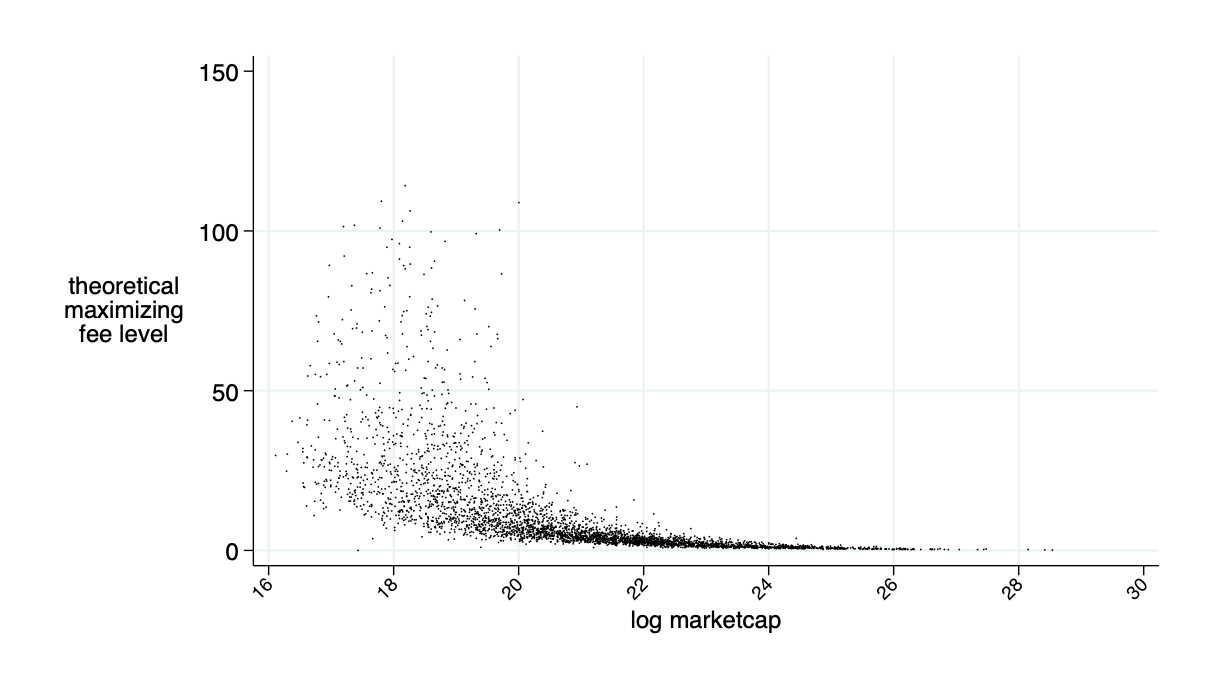

Optimal fee \(F^\pi\)

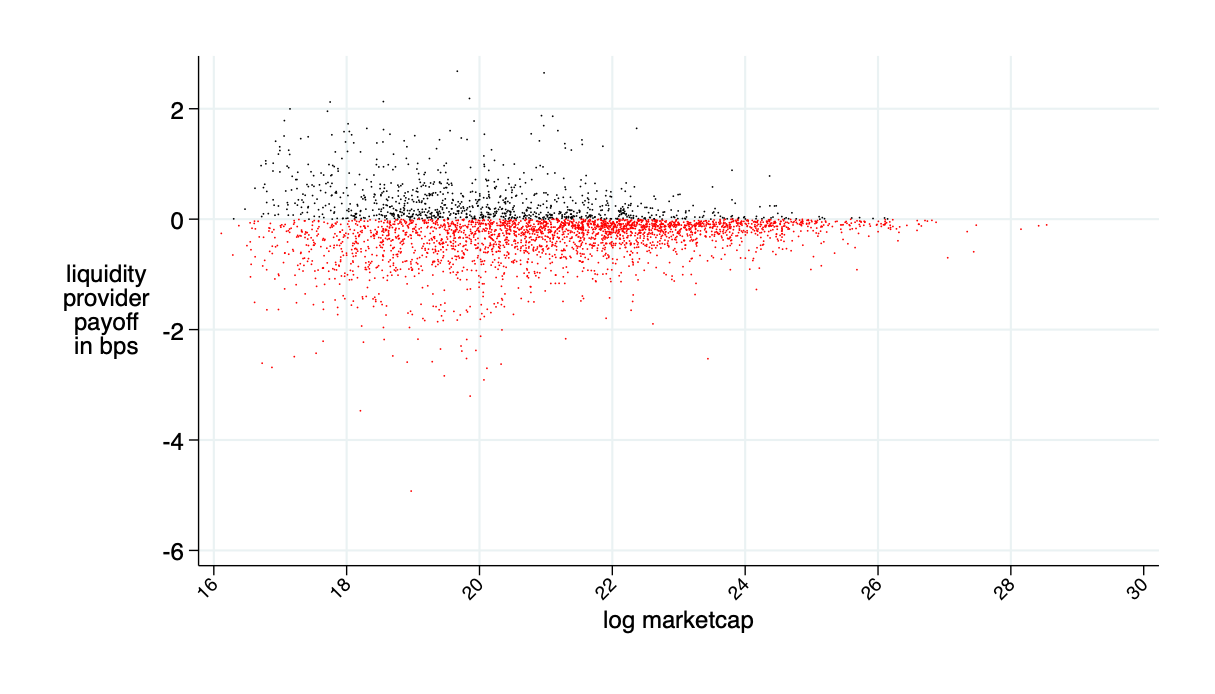

average benefits liquidity provider in bps (average=0)

Insight: Theory is OK - LP's about break even

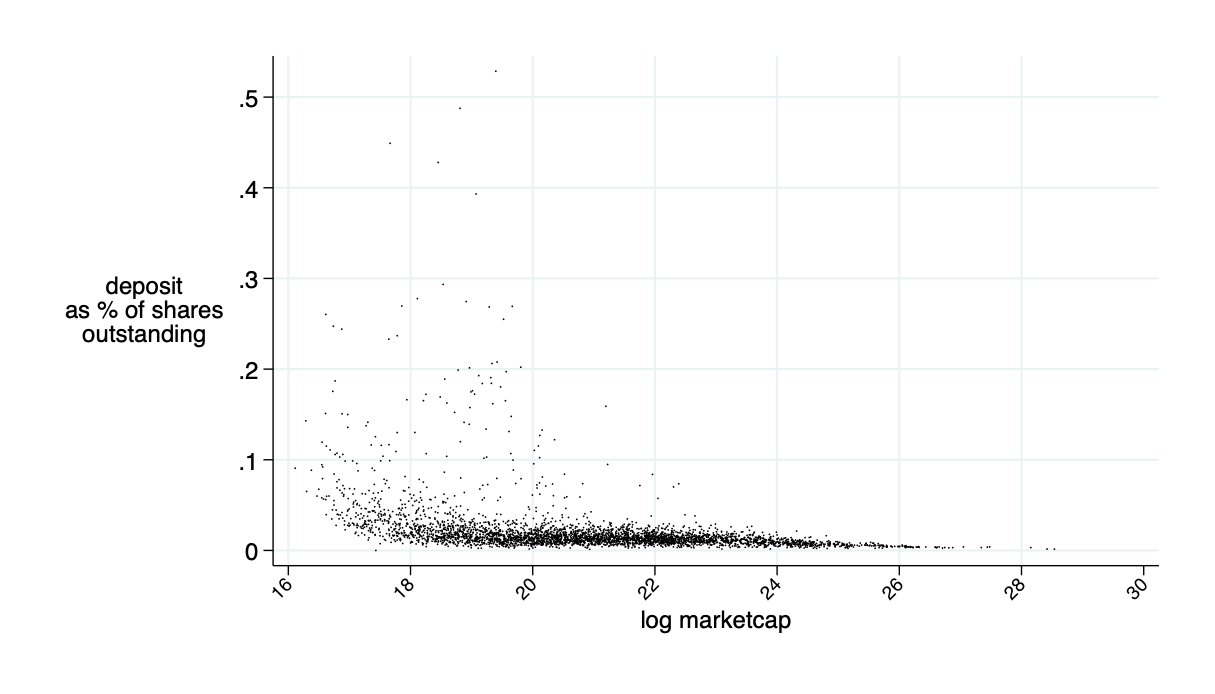

\(\overline{\alpha}\) for \(F=F^\pi\)

Need about 10% of market cap in liquidity deposits to make this work

actually needed cash as fraction of "headline" amount

Only need about 5% of the 10% marketcap amount in cash

AMMs are better on about 85% of trading days

quoted spread minus AMM price impact minus AMM fee (all measured in bps)

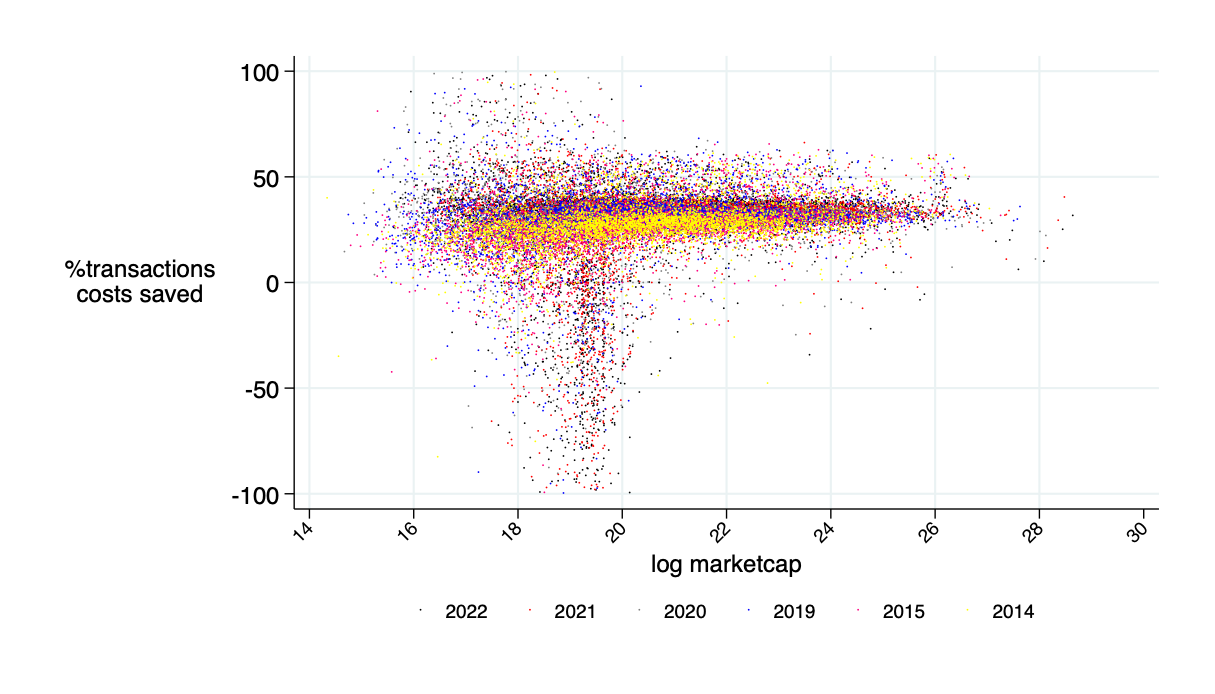

relative savings: what fraction of transactions costs would an AMM save? \(\to\) about 30%

theoretical annual savings in transactions costs is about $15B

Literature

AMM Literature: a booming field

- Theory

-

Lehar and Parlour (2021): for many parametric configurations, investors prefer AMMs over the limit order market.

-

Aoyagi and Ito (2021): co-existence of a centralized exchange and an automated market maker; informed traders react non-monotonically to changes in the risky asset’s volatility

-

Capponi and Jia (2021): price volatility \(\to\) welfare of AMM LPs; conditions for a breakdown of liquidity supply in the automated system; more convex pricing \(\to\) lower arbitrage rents & less trading.

-

Capponi, Jia, and Wang (2022): decision problems of validators, traders, and MEV bots under the Flashbots protocol.

-

Park (2021): properties and conceptual challenges for AMM pricing functions

-

Milionis, Moallemi, Roughgarden, and Zhang (2022): dynamic impermanent loss analysis for under constant product pricing.

-

Hasbrouck, Rivera, and Saleh (2022): higher fee \(\Rightarrow\) higher volume

-

-

Empirics:

-

Lehar and Parlour (2021): price discovery better on AMMs

-

Barbon and Ranaldo (2022): compare the liquidity CEX and DEX; argue that DEX prices are less efficient.

-

@financeUTM

andreas.park@rotman.utoronto.ca

slides.com/ap248

sites.google.com/site/parkandreas/

youtube.com/user/andreaspark2812/