Trading Across Fragmented Markets

Workshop on Frontier Areas in Financial Analytics

May 2019

The Fields Institute

Katya Malinova and Andreas Park

Developments in Equity Trading over the last Decade

-

computerized (equity) trading

- no more phones and human specialists

- electronic access through brokers

- electronic traders: autonomous and fast (high-frequency traders)

- multiple marketplaces

-

regulation that mandates electronic linkage of multiple markets

- U.S. and Canada: protected quotes (or no-trade through rule)

- = market-wide price priority

- U.S. and Canada: protected quotes (or no-trade through rule)

Popular Line of Reasoning

-

traders report that after they submit orders, all hell breaks loose:

-

quotes "fade"/"slide" on other venues

-

"others" get to trade on other venues before them

-

-

=> HFTs and fragmented markets are at fault

What do HFTs do after trades?

- What explains HFTs' reactions (if present)?

- Is there an impact?

- What is the role of fragmentation?

Trading with multiple markets

1,000

Shares at Canadian Offer

300

400

Regular Joe sends buy order to broker

buy 1,500 shares

no trade through => broker must split among three venues

Shares

1-tick off

400

100

2,000

Through the microscope

1,000:

Shares at Canadian Offer

300:

400:

100

100

100

100

100

100

100

- They may not want to trade all that they post.

- will try to cancel quickly

- once their order gets hit or

- once they see trades

- => flurry of cancellations

- will try to cancel quickly

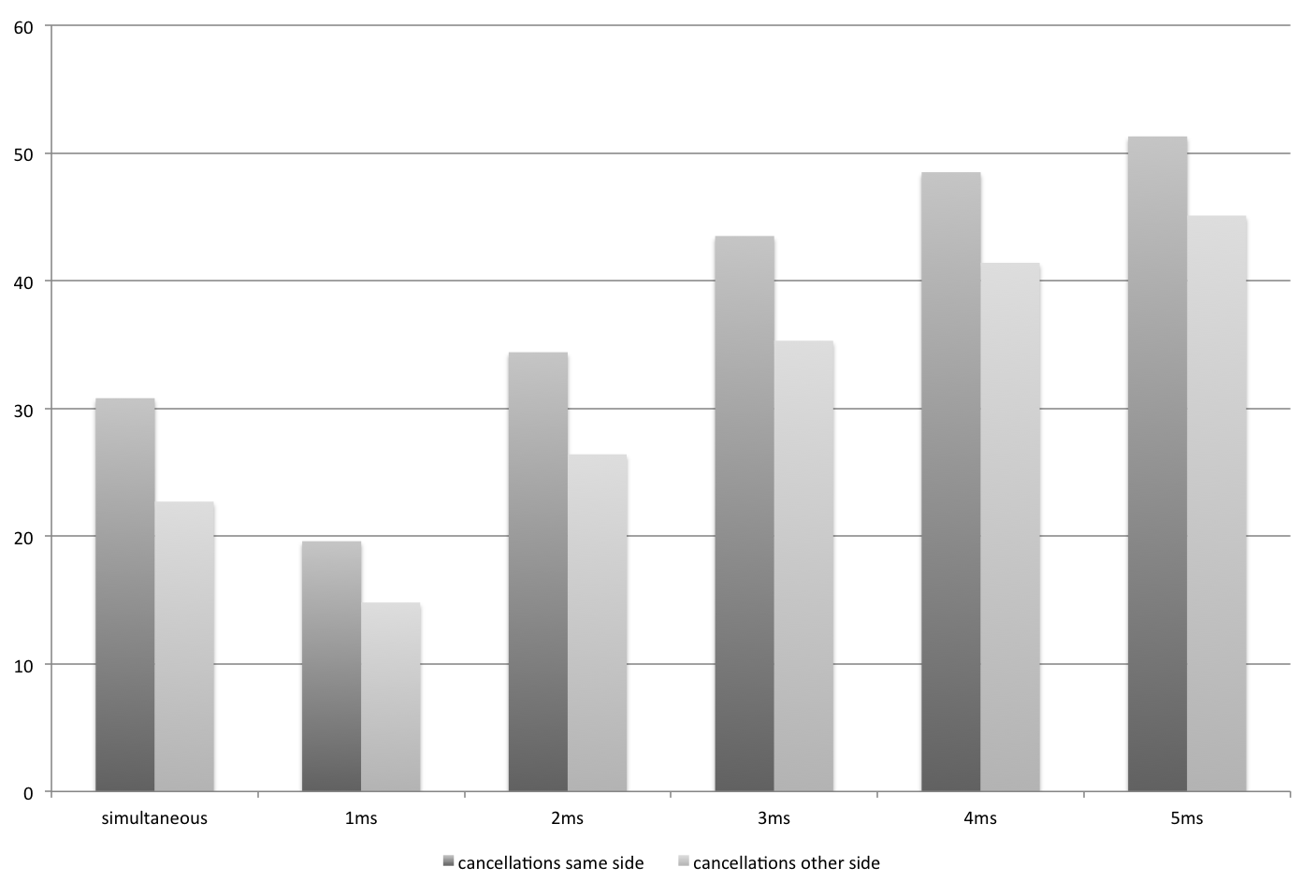

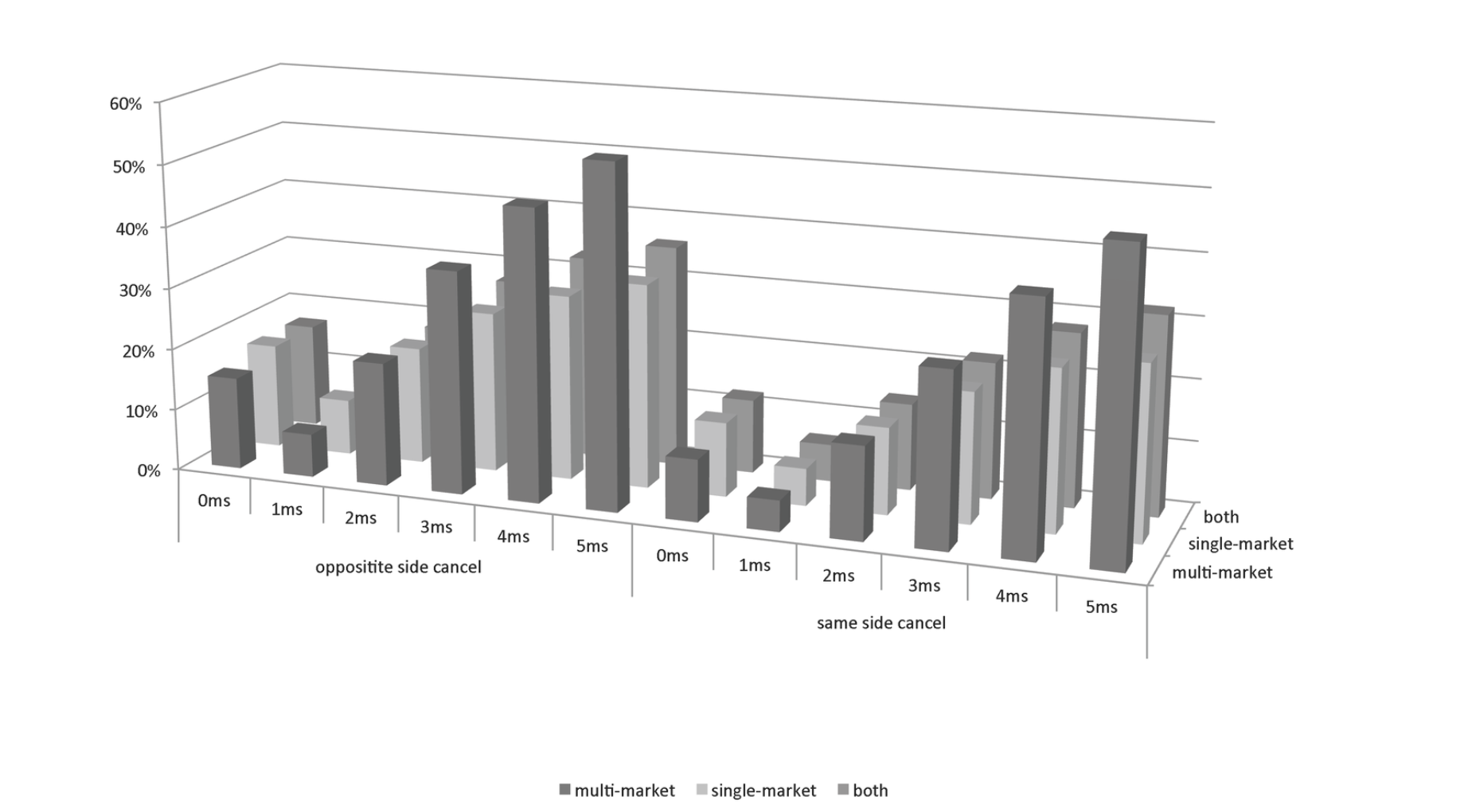

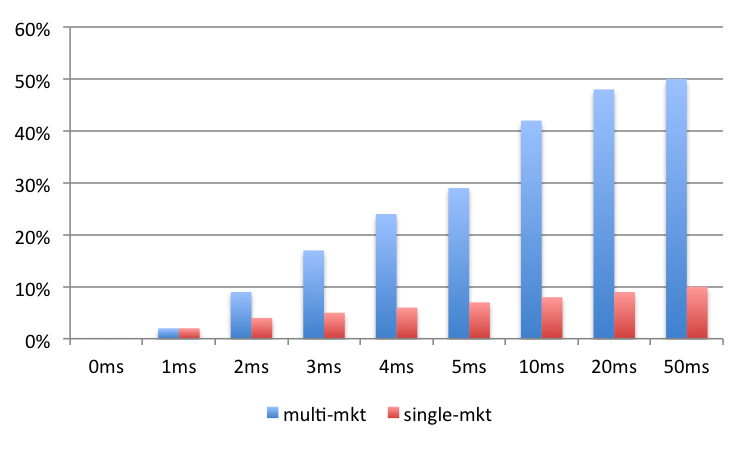

Flurry of HFT Activities after Trades

50% of trades -- by a non-HFT -- are quickly followed by a cancellation -- by an HFT -- on a different venue within 5ms of the trade

Within 50ms: about 70% of trades followed by cancels

And: the reaction is more extreme

after multi-market trades!

Flurry of HFT Activities after Trades

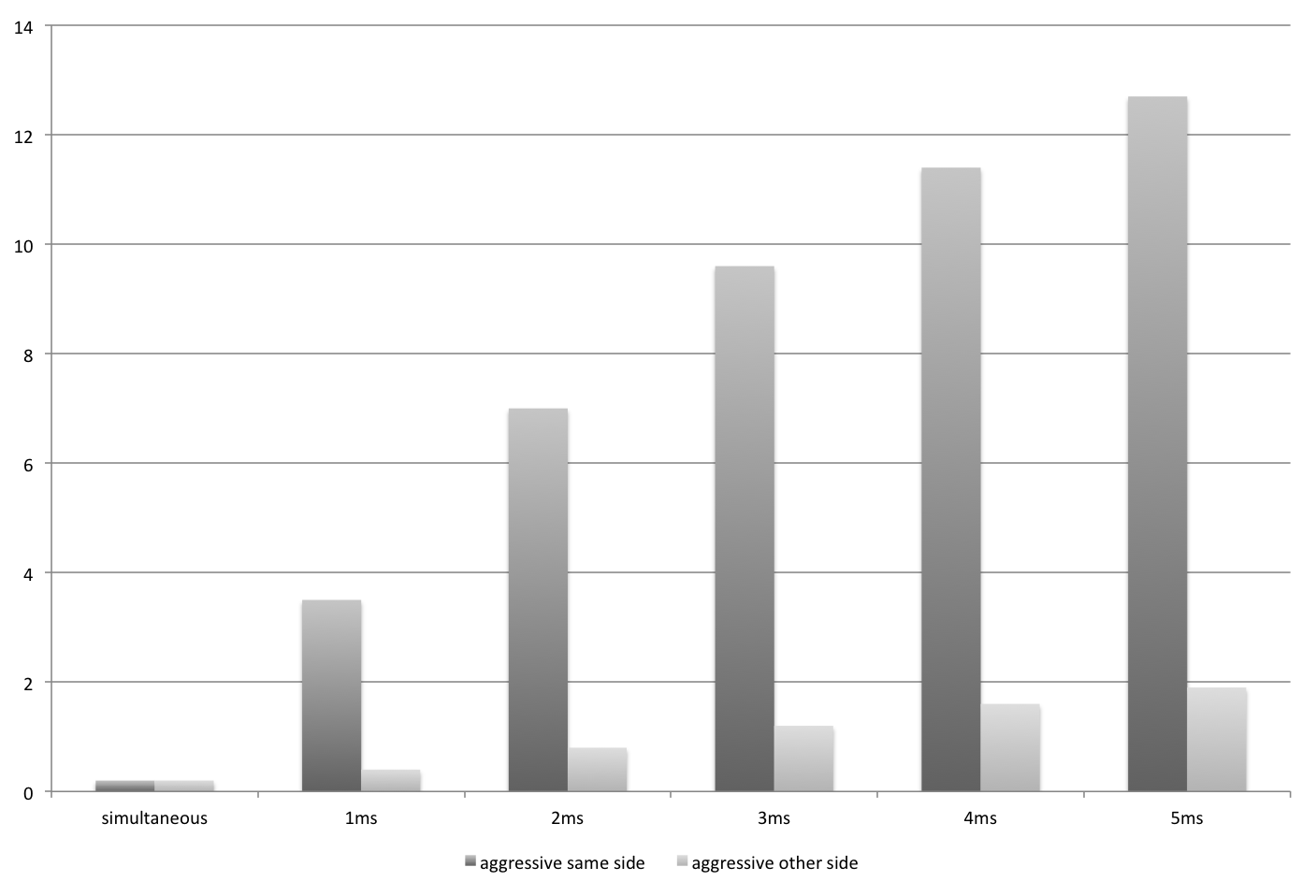

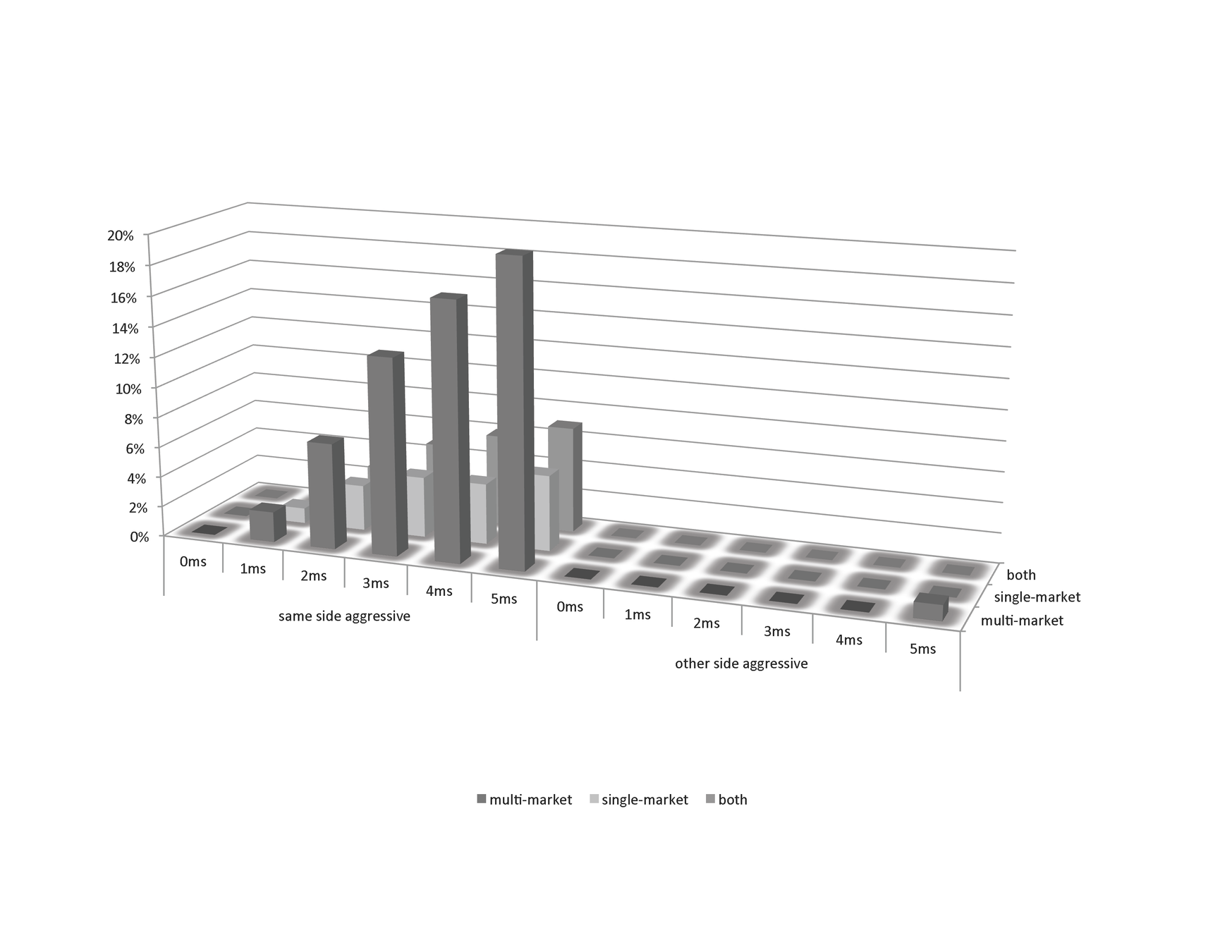

13% of trades -- by a non-HFT -- are followed by an aggressive trade -- by an HFT -- on another venue in the direction of the original trade within 5ms

Within 50ms, 29% of trades are followed

Again: the reaction is more extreme for multi-market trades!

This project's goal:

Characterize this behavior and its impact in fragmented markets

-

Step 1: Characterize/describe fast (HFT) traders’ reaction to trades:

- Do they cancel their orders? (yes)

- Do they submit own aggressive orders? (yes)

- Different reaction to single vs multi-market orders? (yes)

-

Step 2: What explains the different reaction?

-

size?

-

type of trader?

-

information?

-

- Step 3: Does the HFT behavior have an impact on the market?

Not the first to look at fragmented markets

- Long literature, including

- Joel Hasbrouck (e.g., "One Security, Many Markets: Determining the Contributions to Price Discovery", JF 1995)

- O'Hara & Ye (JFE 2011): good for mkt quality

- Degryse, de Jong, van Kervel (2014): visible vs. dark fragmentation

- Bernales, Riarte, Sagade, Valenzuela, Westhei (2017): fragmentation without competition

- most closely related:

- van Kervel (RFS 2015): over-posting exists

- Baldauf & Mollner (WP 2015) (theory): splitting of liquidity across markets

- Brogaard, Riordan, Hendershott (JF 2018): HFT generate price discovery with limit orders, without trading.

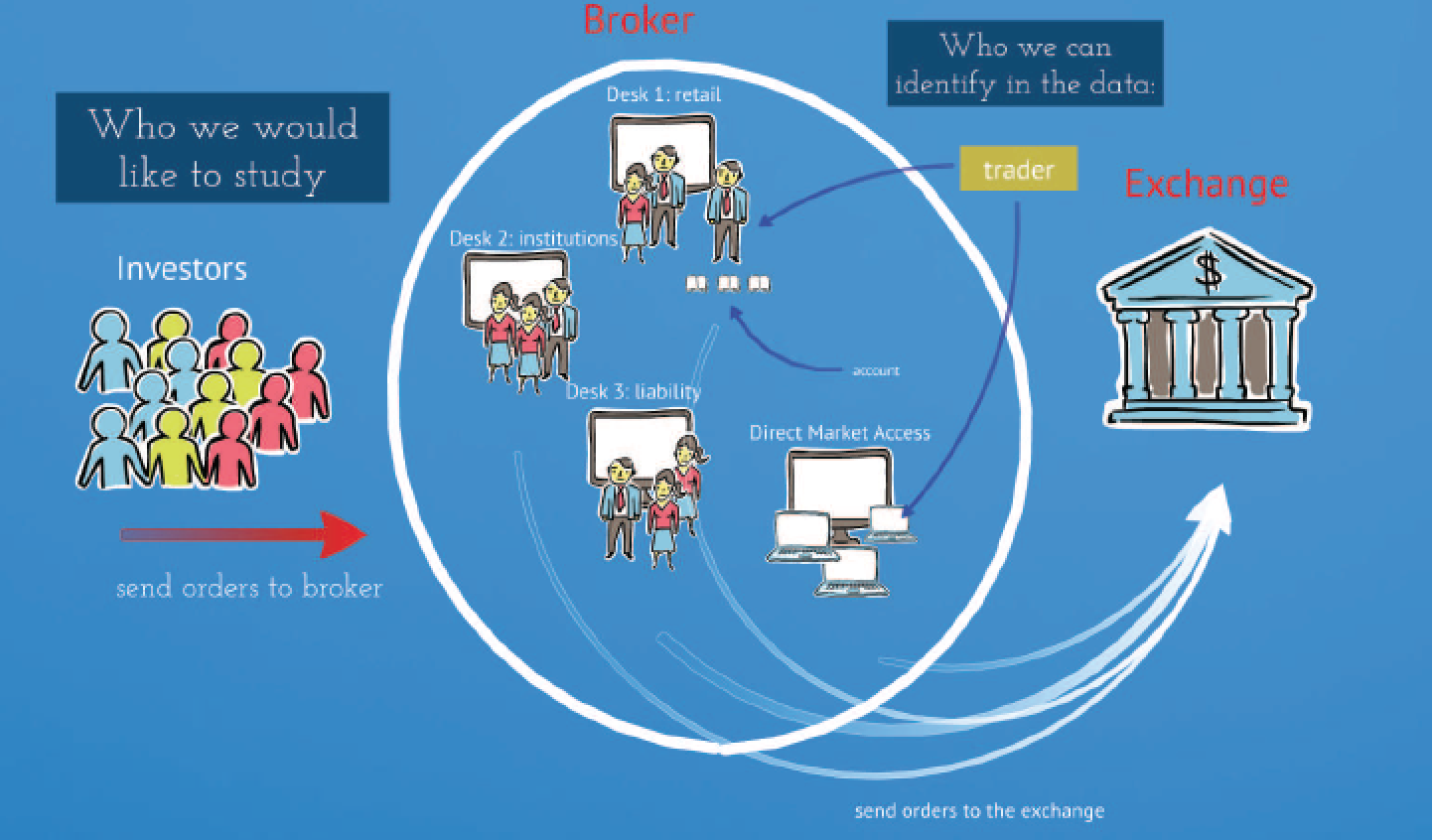

Critical Ingredients

-

Our focus:

-

HFTs in regulation-mandated integrated mkts

-

- What do we need?

- examine HFT? => need trader level info

- impact of mandated multi-mkt? => need trader level data to identify multi-mkt vs single mkt

- examine the impact => need identification

-

proprietary masked trader-level data for all Canadian equity markets (provided by IIROC, the Canadian regulator)

-

use 30 most frequently traded non-crosslisted stocks, March - May, 2013.

-

-

a critical market-organization change that eliminated latency between two of the three main markets (markets A and B) on April 29, 2013 => identification

Data on Investors vs Traders

Identifying Traders

-

Similar to Comerton-Forde, Malinova, Park (2018)

-

Fast traders: Use three criteria (across many securities on many days: 307 securities, Jan& Feb, 2013)

-

regularly submit and cancel orders very quickly

-

median submit-to-cancel times < 250ms.

-

-

submit/cancel most orders very quickly subsequent to someone else’s activity

-

85% of activity within 1ms of someone else.

-

-

react quickly (500ms) to a particular, regular, market-wide news announcement (the market-on-close imbalance).

-

classified: ~82 (out of ~4,900)

-

- Retail: special order type that can only be used by retail

-

Institutions: trade-strings:

- at least 10 distinct orders

- single direction on a day

What is a multi-market trade?

-

same trader ID

- caveat: "trader ID" is not the same as "trader"

- submits marketable order on separate markets within 5 milliseconds

Post-trade Cancellation

- cancellation by fast trader

- within 1,2,...,5 milliseconds

Post-trade Aggressive Order

- in the same direction as the trade

- aggressive by fast trader

- within 1,2,...,5 milliseconds

What should we expect?

- HFT are often voluntary market makers (MMs)

- MMs don’t want to absorb large inventories because of

- capital commitments;

- risk of adverse price movements.

- MM should respond to trades.

-

post on multiple venues => cancel to avoid overtrading

-

learn new info => cancel/reprice existing quotes + "backrunning"

-

accumulate inventory => revert (=trade aggressive with trade)

-

- There is still a question if the reaction

- warranted or

- an over-reaction

- why different for multi-market

-

Trades = information.

- Baldauf and Mollner (2015): only smart trade everywhere

- van Kervel (2015): only sophisticated have access to smart order routers/multiple venues

-

Market makers post everywhere but only want to trade once.

- Cancel existing orders (van Kervel (RFS 2015))

Are multi-market trades different?

- Market making should lead to flurry of activities

- cancellations are to be expected

- aggressive orders can be part of market-making

-

Are the HFT actions merely seamlessly integrating markets?

-

First steps: are there any "in plain sight" differences between single- and multi-market orders?

- Are they submitted by more informed traders?

- Are they larger?

-

First steps: are there any "in plain sight" differences between single- and multi-market orders?

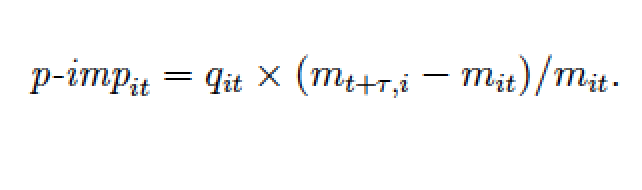

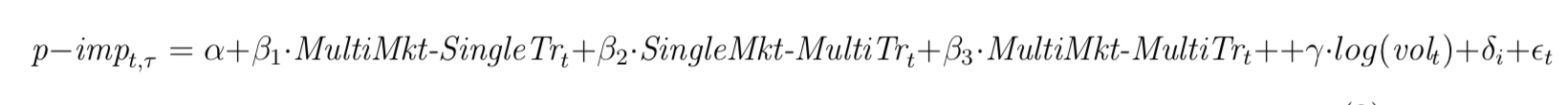

Measure of Interest: Price Impact

- signed difference of the prevailing mid-point of the NBBO bid-ask spread \(\tau\) time units in the future and the mid-point that prevailed at the time of the trade

- \(q_{it}\) = 1 for buyer-initiated and -1 for sells

- \(m_{it}\) = midpoint at time t

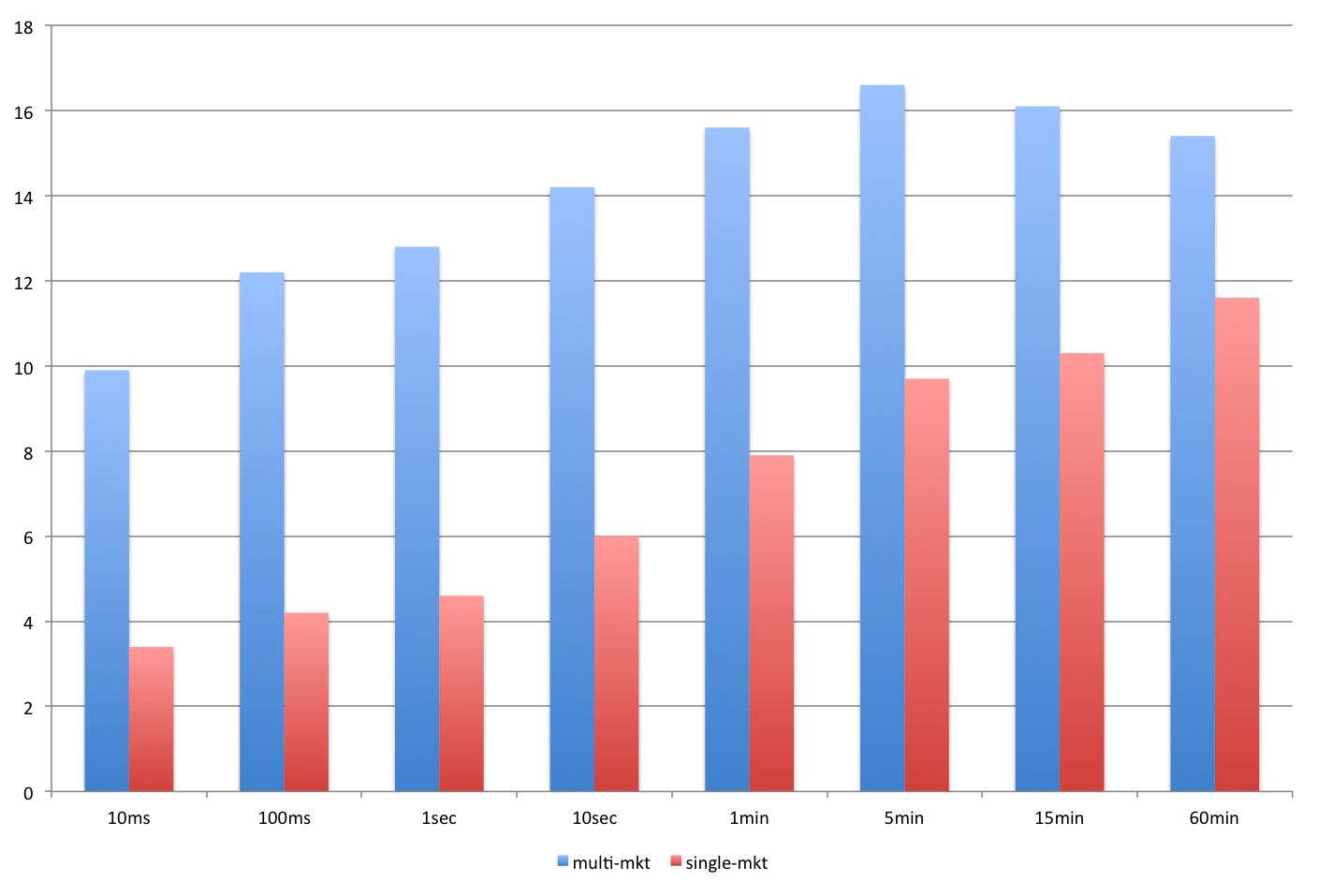

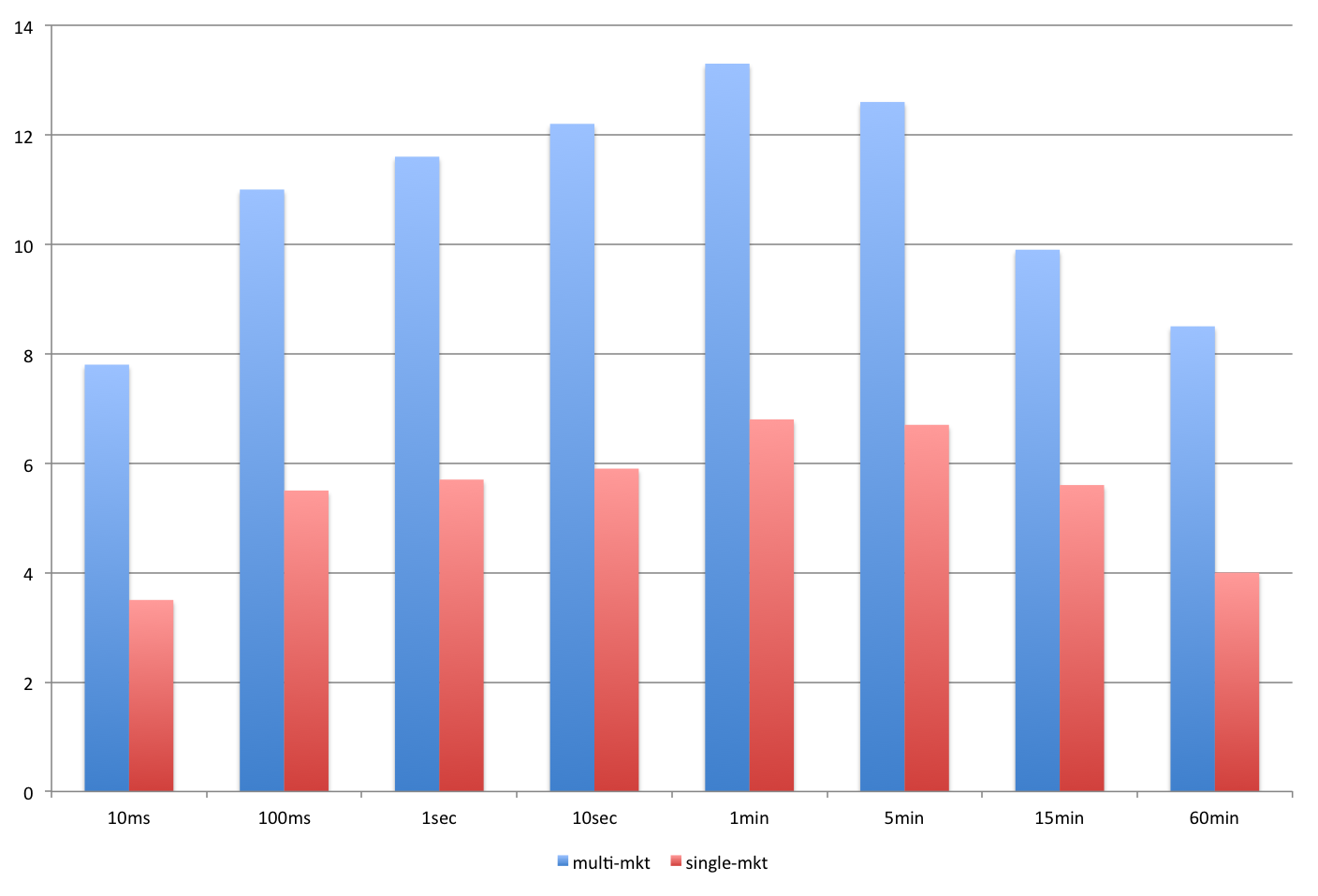

Are multi-market trades more informed?

Simple summary stat: price impact

Naive conclusion: multi-market trades have higher price impact, therefore they are more informed

Consistent with Baldauf & Mollner and van Kervel:

multi-market = smarter

HFTs must react stronger!

End of story?

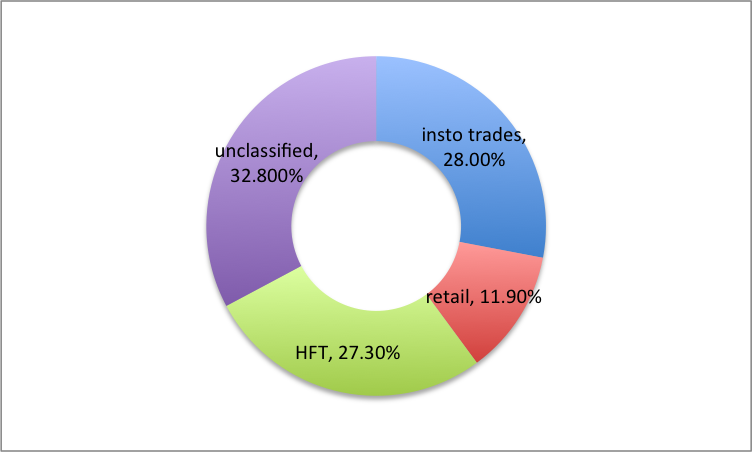

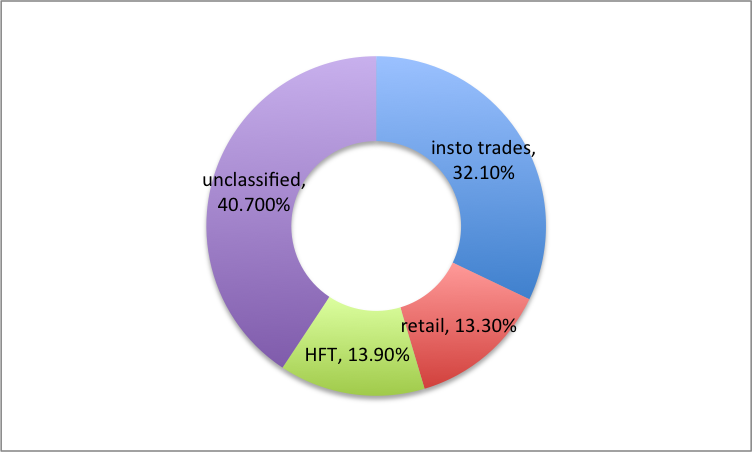

Who trades in multiple markets?

All trades

Multi-market trades

Multi-market trades:

\(\approx\) 32% of total $-value

Price impact for retail trades

Conclusion: If we believe that retail orders are not informed, then the price impacts for single vs. multi-market orders shouldn't look this different.

Reminder:

- Broker SORs may have to split larger orders to obey OPR

- Brokers may want to split larger orders to avoid high costs

Multi-Market

Single Market

vs.

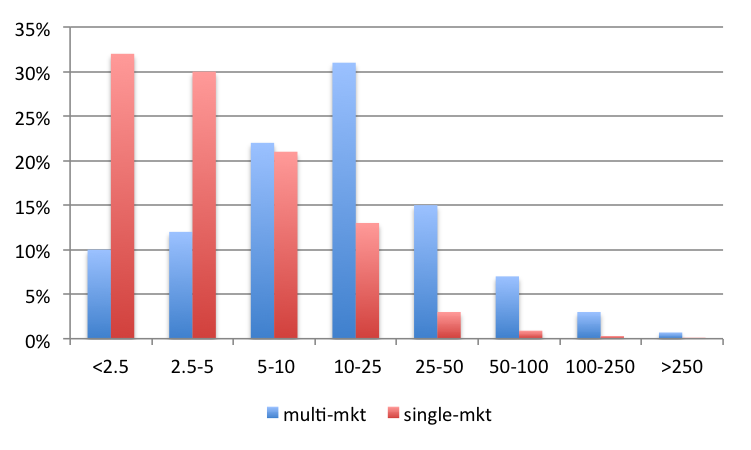

Is it Size?

| trade size | % of all value | % of multimarket value |

|---|---|---|

| 100-200 | 23 | 3 |

| 201-500 | 17 | 11 |

| 501-1,000 | 15 | 15 |

| 1,001 -- 5,000 | 25 | 36 |

| >5,000 | 19 | 36 |

$ value of trades per bucket

$ value of all trades

$ value of multi-mkt trades per bucket

$ value of all multi-mkt trades

Size distribution

Conclusion: multi-mkt orders are larger

Is it size?

Single Market

Multi-Market

Larger size => larger price impact?

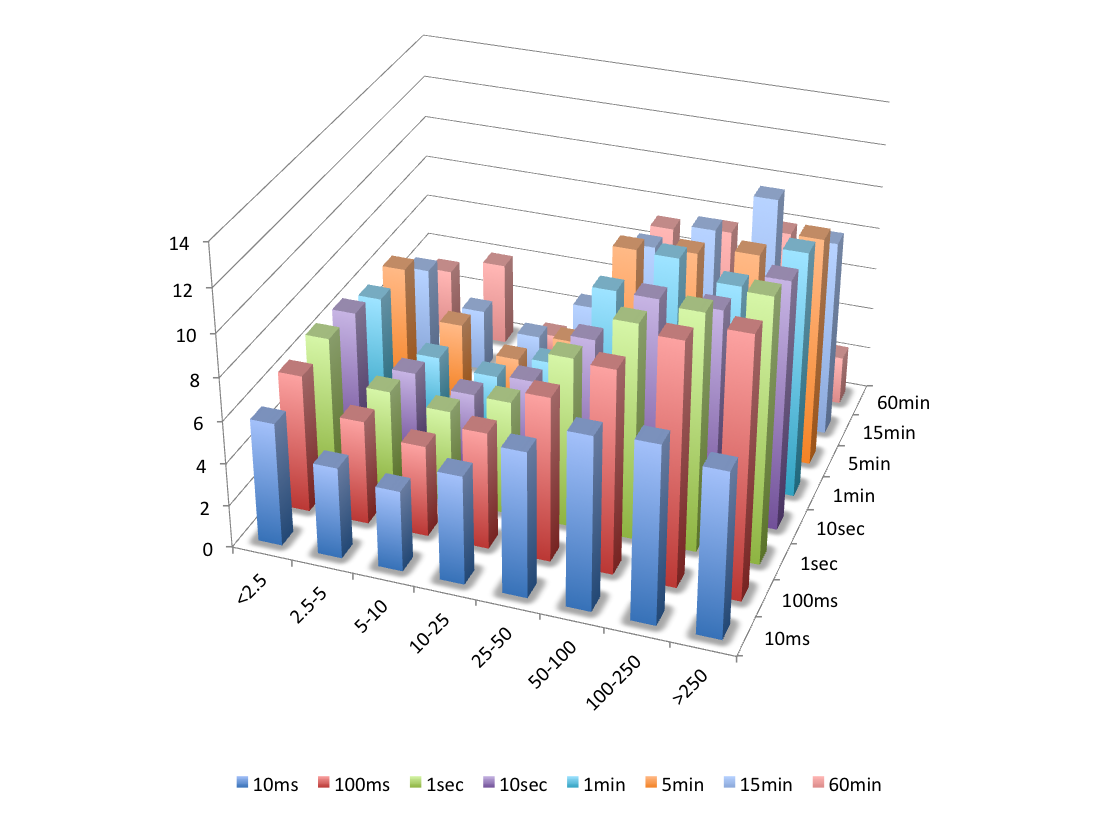

Plotting: price impact multi-mkt minus single-mkt

Conclusion: even for similar size, price impact of multi-market orders is larger.

Is it size?

Could price impact be larger because of the HFT reaction?

Plotting: price impact with HFT reaction minus price impact without HFT reaction

reaction = cancellations

Reaction= trades

Observation: HFT makes your trade look fat

fast aggressive orders(same direction minus opposite direction)

total number of transactions

Conclusion: HFT reaction looks like there is much more activity than warranted by the original trade

Multi-Market

Single Market

Bottom Line

- multi-mkt trades are larger but need not be smarter

- using multi-mkt is/can be regulation requirement

- possibly exchange fee considerations

- retail (brokers) use them regularly

- multi-mkt have larger price impact

- even for retail

- for same size

- multi-mkt with HFT cancellations/aggressive submissions

- have larger price impacts.

- look "bigger"

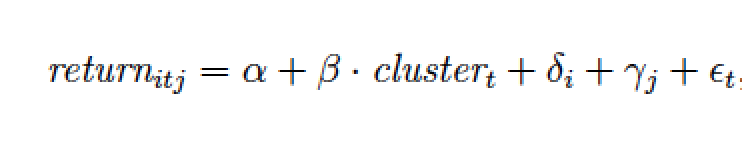

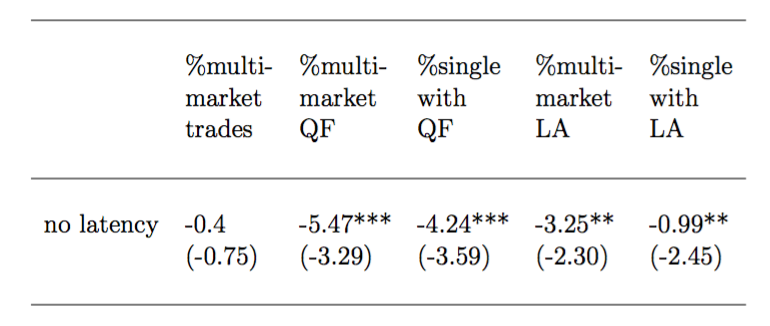

"Trade clusters"

- "Merge" all transactions that occur within a short (10ms) time interval into a "trade cluster", instead of restricting these to be by a single trader

- Average cluster lasts for 3.4ms

- Compare trade clusters :

- with single vs. multiple traders (i.e., where the original trade was followed by others)

- that occur on a single vs. multiple markets

Price Impact of Trade clusters

- Assign all trade clusters into one of the four categories:

| Single Trader | Multi Trader | |

| Single Mkt | ||

| Multi Mkt |

- Estimate a regression over all trades to assess whether following by other other traders & multi-market trading matters for the price impact, controlling for the size

Price Impact in Trade Clusters

| Dummy | Coeff controlling for the vol of the first trade | Coeff controlling for the aggregate cluster volume |

|---|---|---|

| MultiMkt-SingleTrader | 0.645*** | 0.605*** |

| SingleMkt-MultiTrader | 1.919*** | 1.132*** |

| MultiMkt-MultiTrader | 2.095*** | 1.137*** |

- Effects on the price impact 5ms after the trade (in basis points), controlling for the size of the first trade in a cluster or for the aggregate volume of the trade cluster (2 separate regressions):

Who follows the trades and why?

- Over 60% of follow-up trades stem from 14 fast traders

- As a group, these:

- Earn $1.25M on in-cluster trades

- Lose $0.28M on out-of-cluster (active) trades

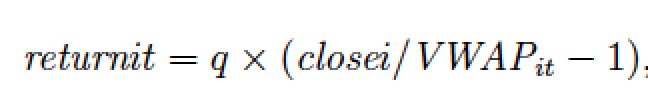

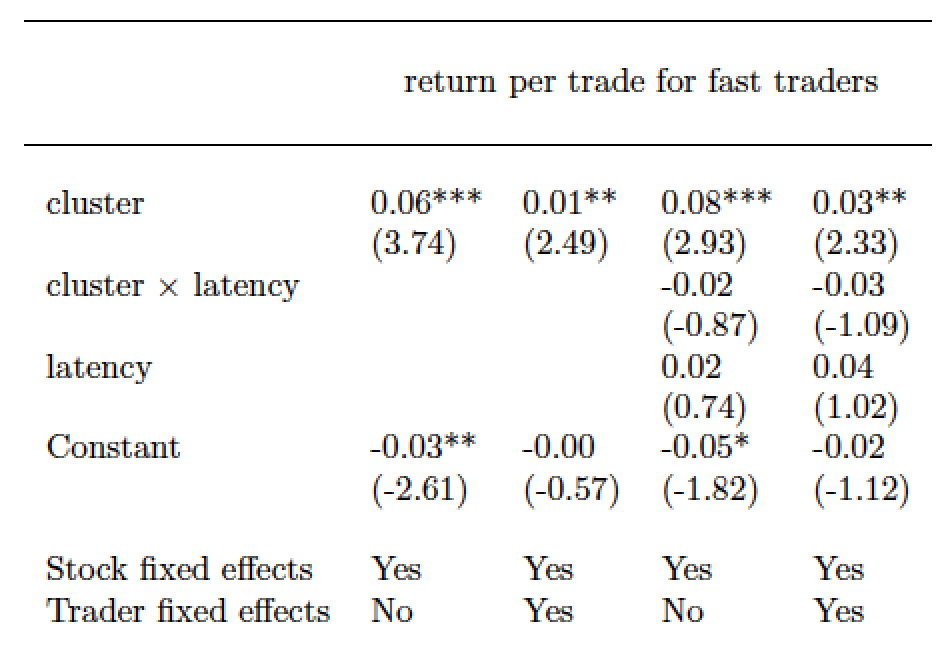

- Compute return per trade, relative to the trade's VWAP and assuming that positions are closed at end-day prices:

- Estimate:

Who follows the trades and why?

Bottom Line

- Price Impacts are higher for

- Trades that execute on multiple markets -- even after controlling for trade size

- Possible explanations: liquidity effects: the choice of whether to go to multiple markets is endogenous

- Trades that are followed by other traders -- again, after controlling for trade size

- This latter effect is even more pronounced for trades that are followed by one of the 14 fast traders

- Trades that execute on multiple markets -- even after controlling for trade size

- Remains unresolved whether followers:

- increase the price impact by making trades look "bigger"

- or follow the trades that are informed ("back running")

The Big Question

-

Is the reaction:

- reacting to information/price discovery

- HFT push prices to the "right" level

- or noise

- HFT reaction obfuscates learning

- reacting to information/price discovery

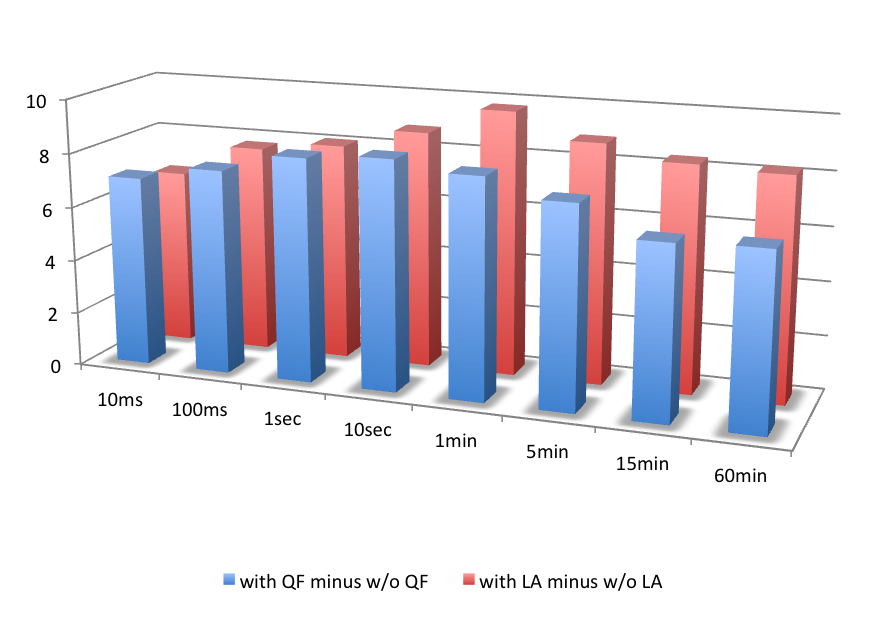

How to identify?

- Idea: if latency between venues disappears:

- non-HFT order flow should remain similar

- if price discovery => HFT can create same level of it.

- "Following" is harder to implement:

- if noise => lower price impacts

- non-HFT order flow should remain similar

How do you make physical latency disappear?

Market A and B move to the same data centre: April 29, 2013

What would we expect?

- if you post on both A and B, you cannot avoid being "hit" on both, i.e. no more outrunning

- depth should decline

- spreads may increase

- fewer post-trade cancellations

- impact on post-trade aggressive trading is unclear

- Notable differences between A and B:

- Market A: lowest take fee/make rebate

- Market B: "big", highest take fee/make rebate

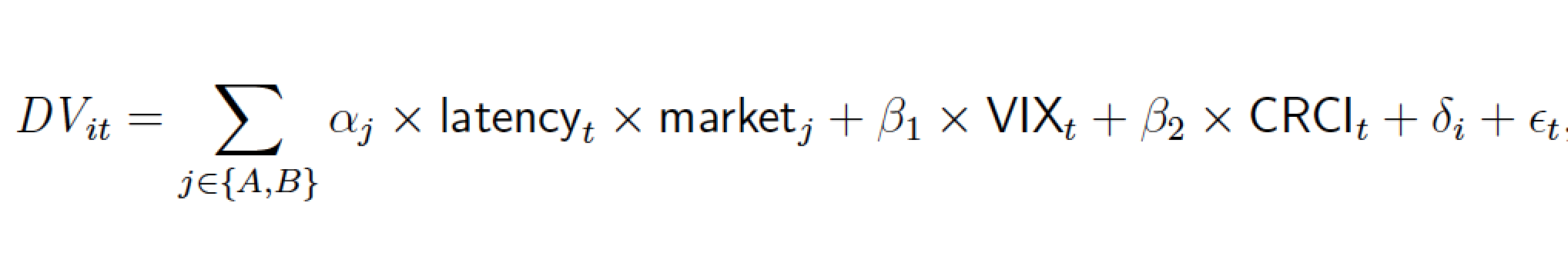

Empirical Strategy

Examine changes in market quality and trader behavior

- before/after (March 1-May 31) and also by market;

- DV dependent variable of interest

- Dummies for the event and the market

- Controls include VIX for volatility & an ETF for the S&P500 GSCI commodity index for the price level

- Security and mkt fixed effects

- Std errors double-clustered by date and security

Changes in Liquidity and fast trading activities

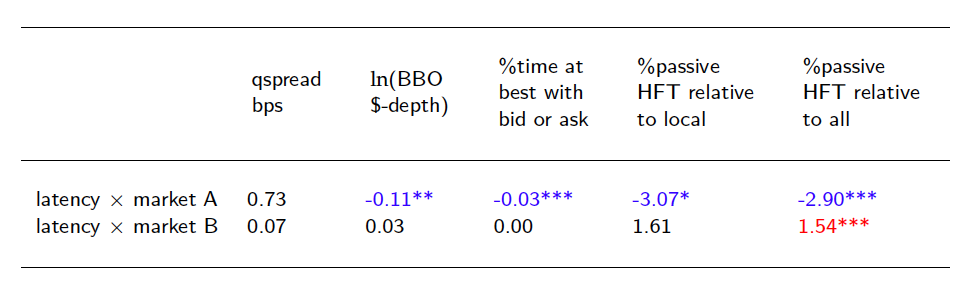

Changes in Responses to Trades

(no)

Untabulated: no significant changes in size or usage of multi-mkt trades

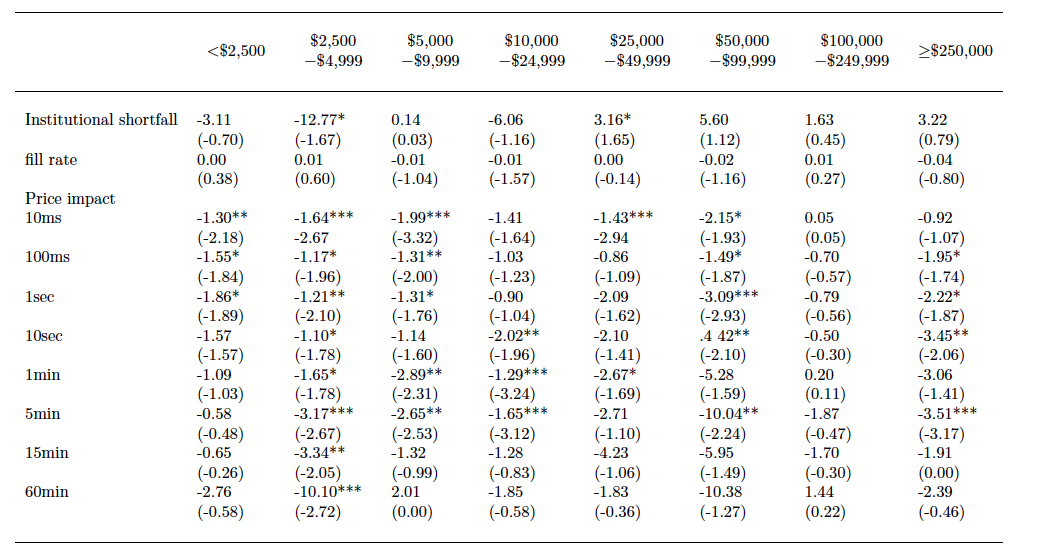

Changes in Price Impacts

Bottom line: price impacts of multi-market orders decline

Difference in differences of multi- vs. single-mkt orders before vs after

Summary and Conclusion

- Multi-market trades are

- common

- often required by regulation

- also performed by choice (and without need?)

- not the sole purview of sophisticated traders

- How do fast traders react to trades?

- Fast traders cancel quotes rapidly and take out (stale?) quotes after trades.

- Stronger reactions to multi-market trades

-

What does HFT behavior do?

- Some evidence that it increases price impact of orders

- indication that in multiple mkts, HFT may obfuscate learning/price discovery

- Some evidence that it increases price impact of orders