The Market Inside the Market: Odd-lot Quotes

Robert P. Bartlett, Justin McCrary & Maureen O’Hara

Discussion by Katya Malinova

DeGroote School of Business

McMaster University

CFMR 2022 (virtual)

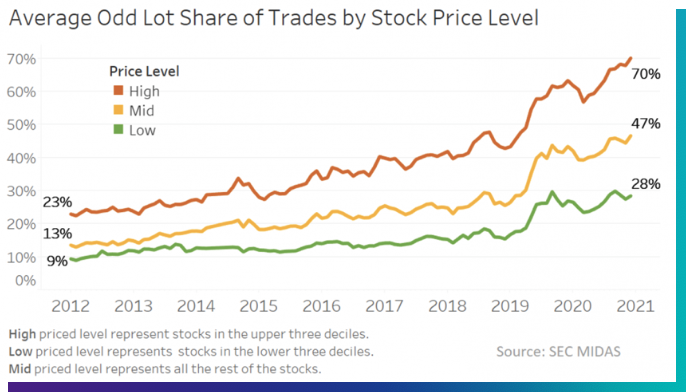

Oddlots: not a small market!

https://www.nasdaq.com/articles/odd-facts-about-odd-lots-2021-04-22

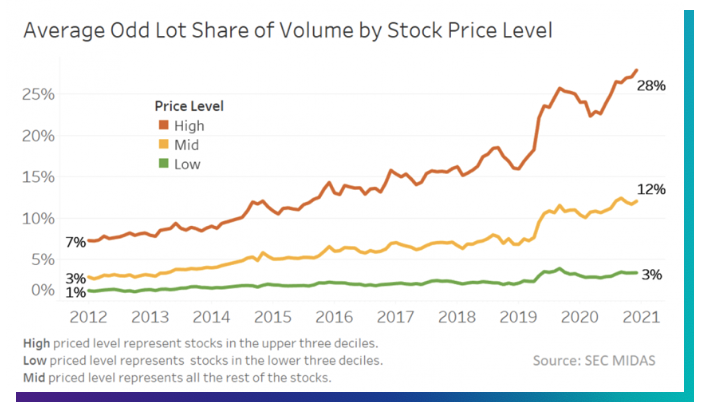

Substantial volume share for mid&high-priced stocks!

https://www.nasdaq.com/articles/odd-facts-about-odd-lots-2021-04-22

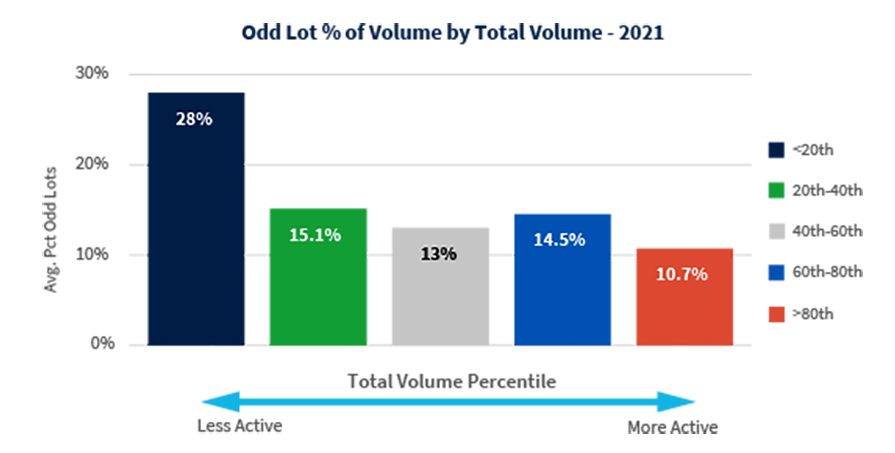

Substantial volume share across different trading volumes!

https://www.cboe.com/insights/posts/an-in-depth-view-into-odd-lots/

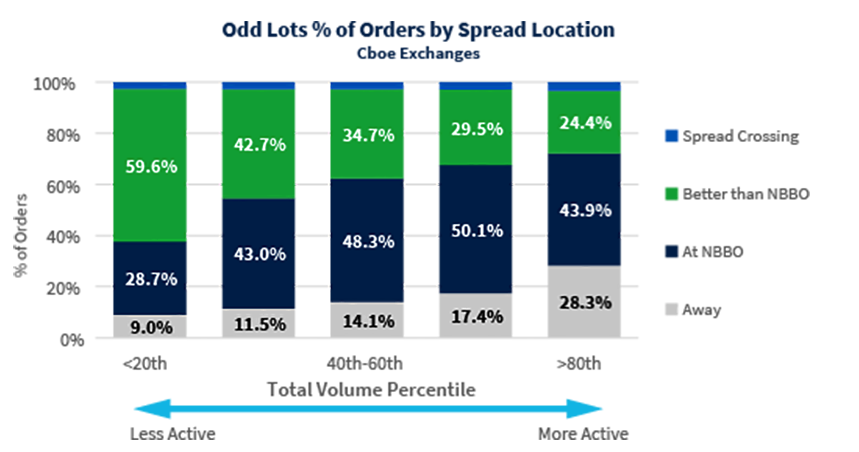

Significant amount of odd lot orders at better than the NBBO prices!

https://www.cboe.com/insights/posts/an-in-depth-view-into-odd-lots/

Key Questions in the Paper:

- How prevalent are the "superior" (relative to the NBBO) odd-lot quotes?

- Is the info in the (invisible on the SIPs) odd-lot quotes valuable?

- Will the Reg NMS II & the new definition of the round lots resolve the odd-lot issues?

- A true market-inside-the-market, esp. for higher-priced stocks!

- Yes, t+ one minute predictability & profitable trading strategy!

- Not really ...

Several issues/questions after reading the paper ...

2. Is there a need for a regulatory intervention?

- Who is disadvantaged by the "market-inside-the-market"?

3. If "yes" to #2, then what type of changes? What else do we need to know?

4. More broadly:

- What is the origin of the round lot sizes, minimum pricing increments, etc.?

- Do we still need to regulate these?

1. Now that we have read the paper, what's next?

- What can/should you do as an investor? As a broker?

Regulatory Response: Round Lot Sizes

- Why 100, 40, 10?

- Convenience for the humans?

- The authors suggest to think of a machine learning approach based on eliminating the info advantage from observing the odd lot data.

- An alternate take:

- Is there any "natural"/equilibrium/stable $-volume trade size?

- What is the distribution of $-trade sizes?

- Do rigid lot sizes create frictions?

- Is there any "natural"/equilibrium/stable $-volume trade size?

Regulatory Response: Round Lots, the SIPs, and Order Protection

- Should the SIPs contain all quotes (incl. odd-lots)?

- Is it feasible?

- Would this eliminate the profitable opportunities?

- Many subscribe to prop data feed & see the odd lots ...

- Many subscribe to prop data feed & see the odd lots ...

- The role of the Order Protection Rule?

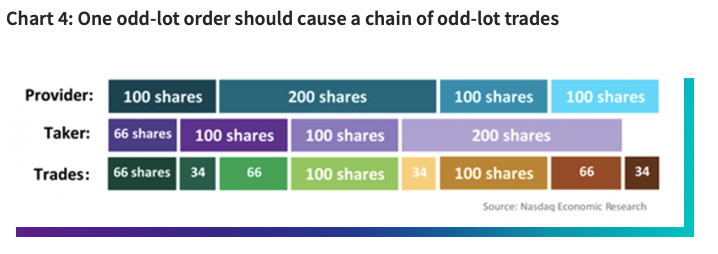

- Post 100 shares, get hit by a 1-share taker, left with 99 unprotected?

- Why such different treatment of 100 vs 99?

- Room for manipulation?

- Should the odd-lot quotes be protected?

- (And can/should we revisit the protection of the round lot ones? ....)

- Post 100 shares, get hit by a 1-share taker, left with 99 unprotected?

Regulatory Response: things to consider

- Are there "too few" odd-lot trades?

- Does the mkt "reset" quotes to round? Why & how? Impact on exec quality?

- The dynamics & the origin of the odd-lot quotes?

- Posted as "odd"? Or "leftover" after odd taker orders?

- Kept or cancelled if "leftover"?

https://www.nasdaq.com/articles/odd-facts-about-odd-lots-2021-04-22

Regulatory Response: things to consider

- Wholesaler pricing for retail:

- Improve over the best quote overall (and not just the NBBO based on the round lots)?

- Improve over the best quote overall (and not just the NBBO based on the round lots)?

- Other NBBO reference pricing? (Dark pools?)

- Prop Feeds Data Costs?

- Other frictions while trading against the odd lot quotes? Settlement costs?

Bigger/bolder picture: can we learn from crypto markets?

- Do fixed lot sizes + min pricing increments create unnecessary frictions?

- Why were they introduced and do we still need them?

- High divisibility on crypto-exchanges and those seem to work fairly well ...

- Same speed limit for all cars ... but

- can we build better, safer, faster roads?

- does regulating the speed limit ever become obsolete?

Interesting paper!

Impressive data!!!!

Fun to read!

Lots of food for thought!

Bottom line

@katyamalinova

malinovk@mcmaster.ca

slides.com/kmalinova

https://sites.google.com/site/katyamalinova/