Spoofing in Equilibrium

Basil Williams & Andrzej Skrzypacz

Discussion by Katya Malinova

DeGroote School of Business

McMaster University

WFA 2022

June 2022, Portland OR

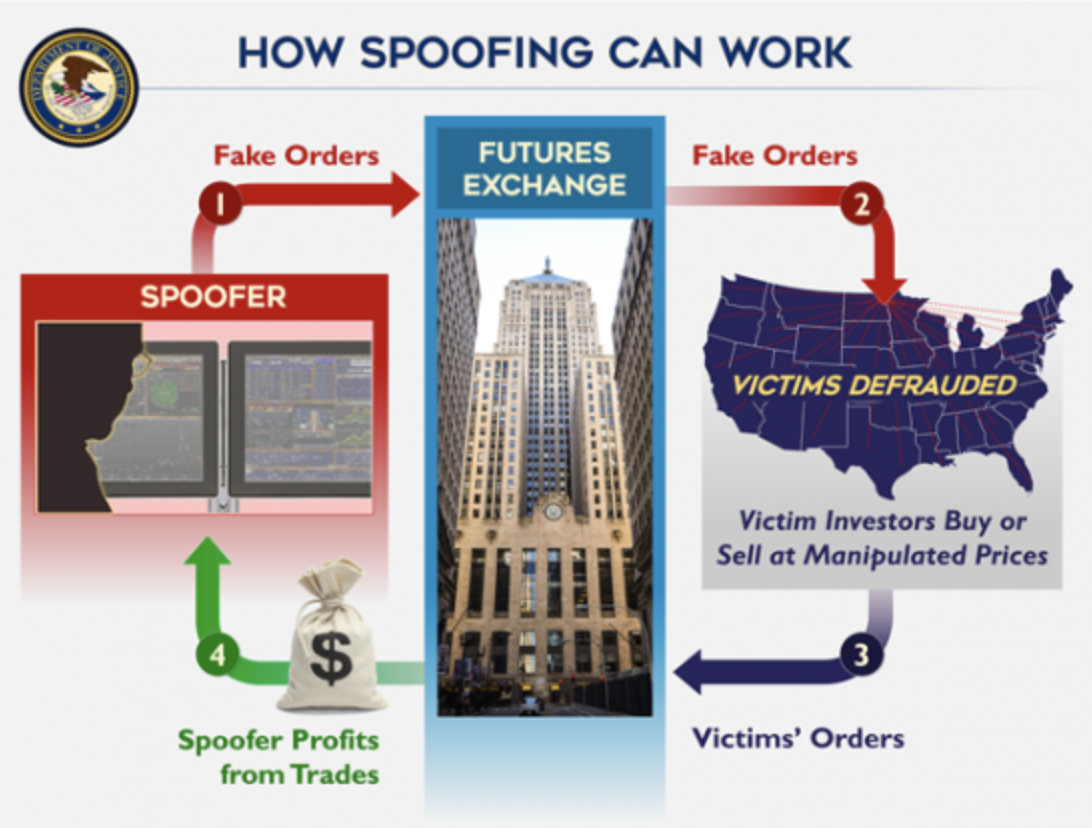

Spoofing: why care now? new? big(ger) problem?

- Not new

- But: was it easier to detect "bluffs" & bad actors on the floor/in the pit?

- SEC filed charges against spoofing in Nov 2001

- violating Securities Act of 1933 and Securities Exchanges Act of 1934

- 6 individuals, collectively pay $43,860.63

- Dodd-Frank: defined spoofing & explicitly illegal in futures in 2010

- enforcement ramped up (?)

BUT: not that many cases made the news!

Little spoofing? Threat of prosecution?

Difficult to catch and/or to prosecute?

As an aside: "Cryptocurrency Pump and Dump Schemes" Li, Shin, Wang (2021)

"bidding or offering with the intent to cancel the bid or offer before execution"

Spoofing: remains difficult to identify

- How to distinguish intent from legitimate cancels?

- Change of mind, new info, ...

- 2014: Michael Coscia

- pre-programmed algorithms

-

2021: Edward Bases and John Pacilio

- online chat

- “I know how to game this stuff.”

- “One can definitely manipulate if you’re aggressive.”

- “If you spoof this it really moves.”

Ideally: need a model/method to address this problem

High legal bar!

This paper

- Cool tractable model to conceptualize spoofing

- Spoofing is an equilibrium outcome

- most prevalent in "moderately" liquid markets

- Predictions on the impact

- slower price discovery

- lower liquidity

- higher volatility

Model: modified Glosten-Milgrom

- Traders: informed or noise, use market orders against MM, trade one unit

MM posts T1 quotes

MM posts T2 quotes

fundamental revealed

T1 Short-term trader: market order

T2 Short-term trader: market order

T1

T2

T1 market order may be cancelled: by the T1 trader or exogenously

Model: modified Glosten-Milgrom

MM posts T1 quotes

MM posts T2 quotes

fundamental revealed

T1

T2

Long term trader (buyer)

market buy

market sell

cancel

Model: modified Glosten-Milgrom

T1

T2

long-term buyer \(\Rightarrow\) E[V| history] = Pr (informed) = \(\alpha\)

\(p=\alpha\)

\(0<p<\alpha\)

market buy

market sell

cancel

market buy

long-term buyer \(\Rightarrow\) E[V| history] =\(\alpha\)

short-term seller + short-term buyer \(\Rightarrow\) E[V| history] =0

- Cool approach & gets the job done!

- tractable model of price manipulation

- But:

- interpretational challenges

- high price impact of spoofing

- What about a stylized limit order book model (with "simple" pricing rules)?

- Kaniel and Liu (2006)

- Brolley and Malinova (2021)

Comment 1: market order cancellations?

- Single parameter describes both the mean and the variance of the fundamental

- Spoofing by a buyer ("fake sells"):

- lower expected value

- \(\to\) mechanically higher variance \(\to\) higher bid-ask spread

- How robust are the liquidity and volatility predictions to richer info structures?

Comment 2: two states of the world

- A single order enough to move the needle

- Sell + cancel = always "bad news"

- what if "cancel" is due to new positive info?

- Long-term trader is a temporal "monopolist"

- only exogenous costs to spoofing

- no competition, no prices moving against you

Comment 3: too "easy" to spoof in the model?

Difficult to draw strong policy/practical implications

E.g., authors: HFTs facilitate spoofing

True: easier to "hide" the cancels

But is it easier to spoof with HFTs?

- Very nice, tractable, parsimonious model to conceptualize spoofing

- Spoofing is an equilibrium outcome

- can't "educate it away"

- Main takeaways for policy? Regulators? Prosecutors?

- Key insights on differentiating price manipulation from legitimate behavior?

To sum up

@katyamalinova

malinovk@mcmaster.ca

slides.com/kmalinova

https://sites.google.com/site/katyamalinova/

https://www.justice.gov/opa/pr/eight-individuals-charged-deceptive-trading-practices-executed-us-commodities-markets