Opt out of the EU

Hacking guide for Global Opportunists how to be free

The current statist world plays a nasty game

- Concept of borders & citizenships with privileges and duties

- permissions to travel, aka visa policies (discrimination based on birthplace)

- military and tax slavery

- Concept of "a permission to stay" - temporary or permanent residency with a lot of duties

- military and tax slavery

- obligatory levies (health and social insurance)

- collective duties (census, full-scale testing)

-

It's a nasty game, so let's play by the rules to win -> to have the most advantages and freedom in your life

The goal

To have the most Freedom = have the best cards in your wallet with privileges but not duties

Do I have the best citizenship and (tax) residency?

Get rid of your:

- EU permanent residence

- EU tax residency

- EU compulsory healthcare insurance

- EU compulsory social insurance

- EU bank account

(EU) citizenship

- Usually, citizenship provides benefits:

- Unless it is associated with global taxation duties (USA, Hungary, Eritrea, Myanmar, Tajikistan)

- Unless it enforces military service (Russia, Belarus, South Korea, Israel, Switzerland, Singapore, Turkey. Greece, Finland, Austria, Norway, Denmark, Brazil, Iran, Armenia, North Korea, Egypt, Thailand, Eritrea, Venezuela, Colombia, Myanmar...)

- Slovak citizenship is a relatively good one:

- Military service is associated with permanent residency (can be easily revoked), not with citizenship

- Slovak citizens cannot have no tax residency (unlike Germans), but this can be easily fixed with the Paraguayan tax residency

- Czech citizens have military services associated with their citizenship and also cannot have no tax residency

Always consider the better citizenship/passport

-

If your citizenship gives you a global tax liability (USA, Hungary)

-

If your citizenship makes you liable to conscription.

-

If your passport prevents you from traveling to most countries

Getting a new citizenship is always a time-consuming or expensive process:

- By naturalization (most easily in Argentina, have to live at least two years in the country, cannot be revoked)

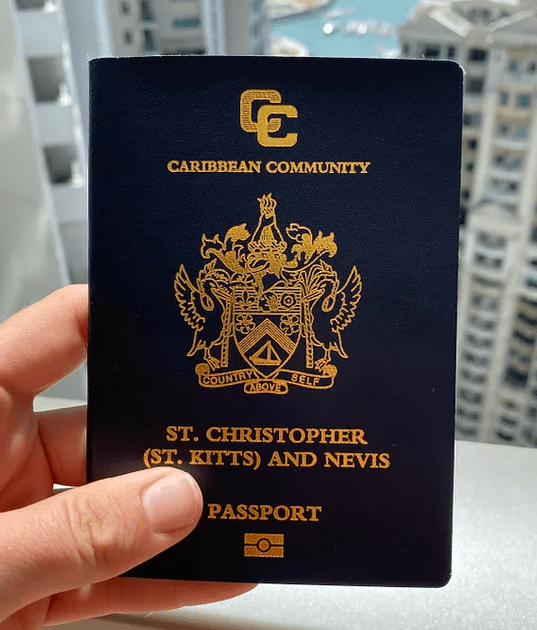

- By investment (St. Kitts & Nevis, Antigua & Barbuda, prices started from 230k USD and it will be just more expensive in the future)

EU residency

-

Usually, you have obligations arising from your temporary or permanent residency.

- Conscription (e.g. Slovak residency)

- Tax duties (if it defines the center of your life interests)

- Obligatory levies (health and social insurance)

- A lot of collective duties (census, full-scale testing.)

- The benefit is usually just a right to stay in the given country and move freely in Shengen (you do not need it if you are the EU citizen)

Consider the better residency:

- When you have a military service associated with the residency (Slovakia)

- When you have tax duties related to residency (in most countries)

- When you have any responsibilities associated with the residency

Getting a new residency is much easier than citizenship:

- Consider countries with no or territorial taxation (Paraguay, Uruguay, Panama, Costa Rica, El Salvador)

- Paraguay is probably the only country where you can get tax residency without living there a majority of the time (if your citizenship requires you to have a tax residency somewhere, then Paraguay is ideal)

International taxation

Pink countries are countries where tax liability is linked to your citizenship, dark blue to your residency where you pay taxes on worldwide income; light blue are countries with territorial taxation (you only pay taxes on local income)

EU tax residency

- If you stay in any EU country for more than 183 days, you are automatically a tax resident of the given country, and it does not matter where else you have tax residency/citizenship, especially if you have it in a zero-tax or territorial taxation country.

- Most good zero-tax or territorial taxation countries do not have a "double tax treaty agreement" with your EU country.

- Therefore, to keep your tax residency solely in Paraguay (Panama, Uruguay), you cannot live anywhere for more than 183 days (tax limit for most countries)

- I use nomadlist.com/@wilder to track my time (one month before I reach the tax limit, I receive the email warning)

- Another option is the chrono.io app (which requires full GPS tracking)

- EU tax residency implies a healthcare / social levies too

EU Tax residency but with no obligation to pay tax

- If you stay in a tax hell country (any EU country) for more than 183 days, you are a tax resident (unless a double tax treaty agreement defines otherwise)

- Not to have tax duties, you cannot have any income as a physical person (no income = no taxes)

- You have to live from fiat or crypto loans

- It's very easy to ask and start living from crypto loans

- Centralized (firefish.io, nexo.com) with the agreement

- Decentralized (aave.com, spark.fi) and top up your crypto card with stablecoins

- Your company can still have a profit and expenses

- Usually, if you do not want to have health / social duties, you have to renounce your permanent residency

EU bank account

- Full reporting inside of the EU (e.g., in Slovakia, police and secret services have full access to all bank accounts without a court order)

- Requires the EU residency

- Requires regular income to have more benefits (e.g. credit cards)

- Usually it is not crypto friendly

If it is possible, stay in Bitcoin/crypto!

- "Using a bank account is a risky thing to do in terms of protecting the privacy of your financial transactions."

- Banks pose the most significant privacy risk for doing business because of their reporting, their capabilities to monitor and freeze transactions

- There are countless stable coins out there, so you can avoid the volatility of cryptocurrencies (or you can use “hedging”). There are also many services that allow you to remain compatible with the “fiat” world and still conveniently pay your suppliers’ invoices by bank transfer

- if you can afford to operate without bank accounts, the number of countries you can do business from increases significantly

Do you really need a bank account?

Do business with your Bitcoin tribe!

OK, sometimes it is not possible - finding a good bank account out of the EU that can be easily opened with no residency & proof of income requirements may be challenging.

The excellent option is the premium SOLO bank account in the Bank of Georgia:

- There is no need to have residency in Georgia or any connection to Georgia (ideal solutions for Paraguayan residents)

- Crypto-friendly (from Georgian crypto exchanges like cryptal.com)

- The best VISA Signature, VISA Platinum, and Mastercard Word Elite, Optionally, the AMEX credit card

- VISA concierge, a SOLO concierge

Other options: Xapo.com (Gibraltar) Dukascopy Bank (Switzerland)

EU company

- Most bureaucratic and regulated company in the world

- High taxes

- A lot of duties

- Fortunately, there are still some places where it can make sense to create an EU company

- Cyprus (12.5% income tax)

- Ireland (12.5% income tax)

- Bulgaria (10% income tax)

- Estonia (20% income tax but only for withdrawn profit)

- The Czech Republic - can be 7% income tax (fixed tax) for profits under 2 million CZK (approx 80k EUR) inside of the country

Unless you do demonstrable business physically in the EU (but online), it rarely pays to have an EU company:

- Use the US LLC (disregarded company)

- Use the UK LLP

- Use the Gibraltarian company

- If you own these companies as a tax resident of a territorial taxation country (like Paraguay), you can achieve 0% total taxation with almost no extra duties

- It can even make sense if you have tax residency in the EU country (stay there the most time) because of less bureacracy

EU Health Insurance

- Firstly, it is not insurance but the health tax

- You may pay 10k EUR yearly but still have no extra/premium services (you still have to pay for your private dental services!)

- No clear contract - you have no idea what your insurance covers.

- It is obligatory; you cannot avoid them with tax residency and income in the given EU country.

- You still have to wait many weeks or months for medical procedures

Pay the best international healthcare insurance

- Select the coverage in the countries you want medical care (the price usually doubles if you opt for the U.S.)

- Define the amount of coverage and the deductible you pay yourself (the higher the deductible, the lower the cost to the insured)

- Do you want to be covered only for expenses immediately during your hospital stay (inpatient), for costs related to tests such as X-rays and MRIs during one-off visits to the hospital (outpatient), or for dental work or regular gynecological examinations?

- The better the program you choose, the more you will pay - health insurance prices can range from $50 to $1,000 per month

- If you are flexible, you can pay cheaper inpatient insurance and use the benefits of health tourism (Kuala Lumpur, Bangkok)

EU Mobile Operator

- There may still be cheaper and better options in the EU than your local mobile operator in your home EU country (look MobiMatter, e.g., Sparks)

- Or

- If you have residency in Paraguay, you can use the Personal Mobile operator that will get you 30 GB for 23 EUR data roaming in all EU countries

- If you want the cheapest global coverage (almost all countries), then PokeFI (2.5 USD/GB)

"OPT-OUT" digital nomad

- Be a solely permanent /tax resident of Paraguay (don't stay in any country except Paraguay for more than six months / don't have anywhere else the center of the interests)

- Use a US LLC company for doing business out of the US

- Stay in crypto to have the most freedom & privacy

- Use a UK/LLP or Gibraltarian company for doing business with US customers

- Use your non-CRS Paraguayan tax residency with personal account:

- Bank of Georgia (premium SOLO bank account)

- XAPO crypto card (Gibraltarian bank account)

- Dukascopy Bank (Swiss bank account)

- Pay global international healthcare insurance

"OPT-OUT" stay at one place (in the EU)

- If you are an EU citizen, you don't need residency in your citizenship country -> cancel your EU residency and all duties related to the residency (healthcare/social insurance, military service, etc)

- If you are living in your country with no residency for more than six months, you are still a tax resident, but it doesn't matter:

- Have no income at all (as a physical person), live from loans (check AAVE, SPARK, .. or companies like Nexo or Firefish)

- Instead of obligatory health insurance, pay global international health care insurance

- Use your Paraguayan driving license instead of your EU driving license