Book 2. Quantitative Analysis

FRM Part 1

QA 10. Stationary Time Series

Presented by: Sudhanshu

Module 1. Covariance Stationary

Module 2. Autoregressive (AR) and Moving Average (MA) Models

Module 3. Autoregressive Moving Average (ARMA) Models

Module 1. Covariance Stationary

Topic 1. Covariance Stationarity Conditions

Topic 2. Autocovariance and Autocorrelation Functions

Topic 3. White Noise

Topic 4. Time Series Forecasting

Topic 1. Covariance Stationarity Conditions

-

Time Series: A time series is data collected over regular time periods (e.g., monthly S&P 500 returns, quarterly dividends paid by a company, etc.).

-

Time series data have trends (the component that changes over time), seasonality (systematic change that occur at specific times of the year), and cyclicality (changes occurring over time cycles).

-

The cyclical component is our core focus for this chapter. It can be decomposed into shocks and persistence components.

-

Covariance Stationary Time Series: A time series in which the relationships among its present and past values to remain stable over time.

-

For a time series to be covariance stationary, it must exhibit three properties:

-

Its mean must be stable over time.

-

Its variance must be finite and stable over time.

-

Its covariance structure must be stable over time.

-

-

Covariance Structure: Refers to the covariances among the values of a time series at its various lags.

- A lag (τ) represents a given number of periods apart at which values are observed (e.g., τ=1 for one-period lag).

Practice Questions: Q1

Q1. The conditions for a time series to exhibit covariance stationarity are least likely to include:

A. a stable mean.

B. a finite variance.

C. a finite number of observations.

D. autocovariances that do not depend on time.

Practice Questions: Q1 Answer

Explanation: C is correct.

In theory, a time series can be infinite in length and still be covariance stationary. To be covariance stationary, a time series must have a stable mean, a stable covariance structure (i.e., autocovariances depend only on displacement, not on time), and an infinite variance.

Topic 2. Autocovariance and Autocorrelation Functions

-

Autocovariance Function: The covariance between the current value of a time series and its value τ periods in the past is its autocovariance at lag τ.

- The autocovariances for all τ make up its autocovariance function.

- If a time series is covariance stationary, its autocovariance function is stable over time; it depends on τ but not on the observation time.

-

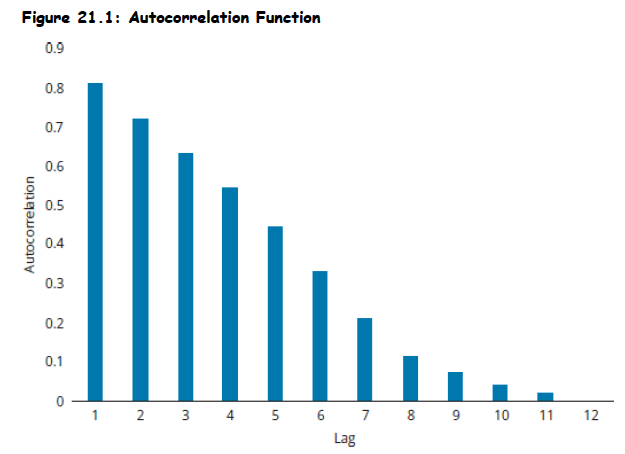

Autocorrelation Function (ACF): To convert an autocovariance function to an ACF, divide the autocovariance at each τ by the variance of the time series.

- This scales autocorrelations between -1 and +1.

- For a covariance stationary series, autocorrelations approach zero as τ gets large.

Practice Questions: Q2

Q2. As the number of lags or displacements becomes large, autocorrelation functions (ACFs) will approach:

A. −1.

B. 0.

C. 0.5.

D. +1.

Practice Questions: Q2 Answer

Explanation: B is correct.

One feature that all ACFs have in common is that autocorrelations approach zero as the number of lags or displacements gets large.

Topic 3. White Noise

- Serially Uncorrelated Time Series: A time series with zero correlation among any of its lagged values.

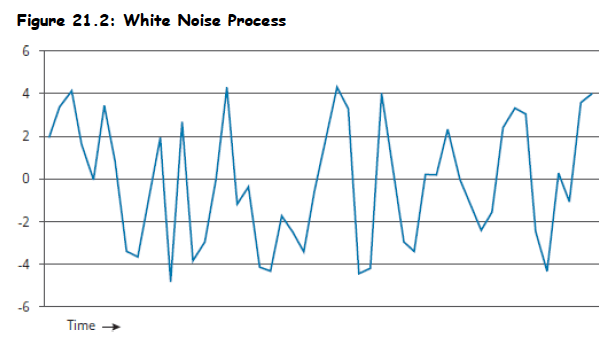

- White Noise (Zero-Mean White Noise): A special type of serially uncorrelated series that has a mean of zero and a constant variance.

- Independent White Noise: A white noise process where observations are independent and uncorrelated.

-

Normal (Gaussian) White Noise: An independent white noise process that also follows a normal distribution.

- All normal white noise processes are independent white noise, but not all independent white noise processes are normally distributed.

- Graphically, a white noise process shows no identifiable patterns.

Practice Questions: Q3

Q3. Which of the following statements about white noise is most accurate?

A. All serially uncorrelated processes are white noise.

B. All Gaussian white noise processes are independent white noise.

C. All independent white noise processes are Gaussian white noise.

D. All serially correlated Gaussian processes are independent white noise.

Practice Questions: Q3 Answer

Explanation: B is correct.

If a white noise process is Gaussian (i.e., normally distributed), it follows that the process is independent white noise. However, the reverse is not true; there can be independent white noise processes that are not normally distributed. Only those serially uncorrelated processes that have a zero mean and constant variance are white noise.

Topic 4. Time Series Forecasting

- Purpose of White Noise: Used to analyze a forecasting model.

-

Model Evaluation: A model's forecast errors should ideally follow a white noise process.

- If errors do not follow white noise, they can be forecasted, implying the model is inaccurate and needs revision (e.g., by adding more lags).

-

Conditional vs. Unconditional Mean and Variance:

- White noise has an unconditional mean of zero and a constant unconditional variance.

- Conditional mean and variance may not be constant; if a relationship exists, it can be used for forecasting.

- For an independent white noise process, the conditional mean equals the unconditional mean, and forecasting based on past values is not possible.

-

Wold's Theorem: Proposes that a covariance stationary process can be modeled as an infinite distributed lag of a white noise process, known as a general linear process.

- where b variables are constants and ϵt is a white noise process.

-

This expression can be applied to any covariance stationary series, it is known as a general linear process.

Module 2. Autoregressive And Moving Average Models

Topic 1. Autoregressive Processes

Topic 2. Estimating Autoregressive Parameters using Yule-Walker Equation

Topic 3. Moving Average (MA) Processes

Topic 4. Lag Operators

Topic 1. Autoregressive Processes

- Most widely applied time series models in finance.

-

First-Order Autoregressive [AR(1)] Process: A variable regressed against itself in lagged form:

- d: intercept term

- yt: time series variable

- yt−1: one-period lagged observation

- ϵt: current random white noise shock (mean 0)

- Φ: coefficient for the lagged observation

- Covariance Stationarity for AR(1): Absolute value of the coefficient on the lagged operator must be less than one (∣Φ∣<1).

- Covariance Stationarity for AR(p): The sum of all coefficients should be less than 1.

-

Long-Run (Unconditional) Mean Reverting Level:

- For an AR(1) series:

- For an AR(p) series:

- This mean reverting level acts as an attractor, drawing the time series toward its mean over time.

- VarianVaVariance for AR(1): Variance of

Practice Questions: Q4

Q4. Which of the following conditions is necessary for an autoregressive (AR) process to be covariance stationary?

A. The value of the lag slope coefficients should add to 1.

B. The value of the lag slope coefficients should all be less than 1.

C. The absolute value of the lag slope coefficients should be less than 1.

D. The sum of the lag slope coefficients should be less than 1.

Practice Questions: Q4 Answer

Explanation: D is correct.

In order for an AR process to be covariance stationary, the sum of each of the slope coeficients should be less than 1.

Topic 2. Estimating Autoregressive Parameters using Yule-Walker Equation

- Forecasters estimate autoregressive parameters by accurately estimating the autocovariance function of the data series:

-

Yule-Walker Equation: Used to solve for the autocorrelations of an AR(1) process.

- for t=0,1,2,...

- Significance: For autoregressive processes, autocorrelation decays geometrically to zero as t increases.

- Example: For , the first-period autocorrelation is , and the second-period autocorrelation is .

- If Φ is negative, the autocorrelation will still decay in absolute value but oscillate between negative and positive numbers.

Topic 3. Moving Average (MA) Processes

- Definition: A linear regression of the current values of a time series against both the current and previous unobserved white noise error terms (random shocks).

- Covariance Stationarity: MA processes are always covariance stationary.

-

First-Order Moving Average [MA(1)] Process:

-

- μ: mean of the time series

- ϵt: current random white noise shock (mean 0)

- ϵt−1: one-period lagged random white noise shock

- θ: coefficient for the lagged random shock

-

- Short-Term Memory: An MA(1) process has short-term memory because it only incorporates what happened one period ago.

- Autocorrelation Cutoff: The autocorrelation is computed using the following formula:

-

For any value beyond the first lagged error term, the autocorrelation will be zero in an MA(1) process. It is one condition of being covariance stationary.

-

A more general form, MA(q), incorporates q lags:

-

Mean of MA(q) is still μ but the variance,

Practice Questions: Q5

Q5. Which of the following statements is a key differentiator between a moving average (MA) representation and an autoregressive (AR) process?

A. An MA representation shows evidence of autocorrelation cutoff.

B. An AR process shows evidence of autocorrelation cutoff.

C. An unadjusted MA process shows evidence of gradual autocorrelation decay.

D. An AR process is never covariance stationary.

Practice Questions: Q5 Answer

Explanation: A is correct.

A key difference between an MA representation and an AR process is that the MA process shows autocorrelation cutoff while an AR process shows a gradual decay in autocorrelations.

Practice Questions: Q6

Q6. Assume in an autoregressive [AR(1)] process that the coefficient for the lagged observation of the variable being estimated is equal to 0.75. According to the Yule-Walker equation, what is the second-period autocorrelation?

A. 0.375.

B. 0.5625.

C. 0.75.

D. 0.866.

Practice Questions: Q6 Answer

Explanation: B is correct.

The coefficient is equal to 0.75, so using the concept derived from the Yule-Walker equation, the first-period autocorrelation is 0.75 (i.e., ), and the second- period autocorrelation is 0.5625.

Topic 4. Lag Operators

- Notation: A commonly used notation in time series modeling (L).

- Function: Shifts the time index back by one period:

-

Properties:

- Shifts the time index back by one period.

- (multiple periods).

- Does not change a constant when applied.

-

Used in lag polynomials to assign weights to past values

- Example: If we have the model

- Using lag operators in this model (known as a lag polynomial), it would be expressed as:

- Lag polynomials can be multiplied.

- Can be inverted if coefficients satisfy certain conditions.

-

Main Purposes:

- An AR process is covariance stationary only if its lag polynomial is invertible.

- Invertibility is used in the Box-Jenkins methodology to select the appropriate time series model.

Practice Questions: Q7

Q7. Which of the following statements is most likely a purpose of the lag operator?

A. A lag operator ensures that the parameter estimates are consistent.

B. An autoregressive (AR) process is covariance stationary only if its lag polynomial is invertible.

C. Lag polynomials can be multiplied.

D. A lag operator ensures that the parameter estimates are unbiased.

Practice Questions: Q7 Answer

Explanation: B is correct.

There are two main purposes of using a lag operator. First, an AR process is covariance stationary only if its lag polynomial is invertible. Second, this invertibility is used in the Box-Jenkins methodology to select the appropriate time series model.

Module 3. Autoregressive Moving Average (ARMA) Models

Topic 1. Autoregressive Moving Average (ARMA) Processes

Topic 2. Application of AR, MA, and ARMA Processes

Topic 3. Sample and Partial Autocorrelations

Topic 4. Testing Autocorrelations

Topic 5. Modeling Seasonality in an ARMA

Topic 1. Autoregressive Moving Average (ARMA) Processes

- Definition: Combines both autoregressive (AR) and moving average (MA) processes to capture richer relationships in a time series.

-

Formula (ARMA(1,1)):

-

- d: intercept term

- yt: time series variable

- Φ: coefficient for lagged observations (yt−1)

- ϵt: current random white noise shock

- θ: coefficient for lagged random shocks (ϵt−1)

-

- Covariance Stationarity: For an ARMA process to be covariance stationary, ∣Φ∣<1.

1 - Autocorrelation Decay: Autocorrelations in an ARMA process will also decay gradually.

-

ARMA(p,q) Model: Represents 'p' lagged operators in the AR portion and 'q' lagged operators in the MA portion.

- Offers the highest possible set of combinations for time series forecasting.

Practice Questions: Q8

Q8. Which of the following statements about an autoregressive moving average (ARMA) process is correct?

I. It involves autocorrelations that decay gradually.

II. It combines the lagged unobservable random shock of the MA process with the observed lagged time series of the AR process.

A. I only.

B. II only.

C. Both I and II.

D. Neither I nor II.

Practice Questions: Q8 Answer

Explanation: C is correct.

The ARMA process is important because its autocorrelations decay gradually and because it captures a more robust picture of a variable being estimated by including both lagged random shocks and lagged observations of the variable being estimated. The ARMA model merges the lagged random shocks from the MA process and the lagged time series variables from the AR process.

Topic 2. Application of AR, MA, and ARMA Processes

-

Model Selection based on Autocorrelations:

- If autocorrelations cut off abruptly: Consider an MA process.

-

If autocorrelations decay gradually: Consider an AR process or an ARMA process.

- Especially if periodic spikes are noticed as they decay (indicating seasonality).

- Model Evaluation: Test various models using regression results.

- AR and ARMA models are generally more robust than pure MA models for real-world data like employment, where autocorrelations decay gradually.

- Forecasting from ARMA Models: Can generate forecasts using the estimated coefficients and past values of the time series and shocks.

Practice Questions: Q9

Q9. Which of the following statements is correct regarding the usefulness of an

autoregressive (AR) process and an autoregressive moving average (ARMA) process when modeling seasonal data?

I. They both include lagged terms and, therefore, can better capture a relationship

in motion.

II. They both specialize in capturing only the random movements in time series data.

A. I only.

B. II only.

C. Both I and II.

D. Neither I nor II

Practice Questions: Q9 Answer

Explanation: A is correct.

Both AR models and ARMA models are good at forecasting with seasonal patterns because they both involve lagged observable variables, which are best for capturing a relationship in motion. It is the moving average representation that is best at capturing only random movements.

Topic 3. Sample and Partial Autocorrelations

- Sample Autocorrelation and Partial Autocorrelation: Calculated using sample data.

- Purpose: Used to validate and improve ARMA models.

- Model Selection: Initially, these statistics guide the analyst in selecting an appropriate model.

-

Goodness of Fit Evaluation: Residual autocorrelations at different lags are computed and tested for statistical significance.

- If the model fits well, none of the residual autocorrelations should be statistically significantly different from zero, indicating the model has captured all information.

Topic 4. Testing Autocorrelations

- Model Specification Checks: Involve examining residual Autocorrelation Function (ACF).

- Goal: All residual autocorrelations should be zero.

- Graphical Examination: Autocorrelations violating the 95% confidence interval around zero indicate the model does not adequately capture underlying patterns.

-

Joint Tests for Residual Autocorrelations:

-

Box-Pierce (BP) Q statistic: A joint test to determine if all residual autocorrelations equal zero versus at least one is not equal to zero.

-

Box-Pierce (BP) Q statistic: A joint test to determine if all residual autocorrelations equal zero versus at least one is not equal to zero.

- Ljung-Box (LB) Q statistic: A version of the BP statistic that works better for smaller samples (T ≤ 100).

-

Where:

- Q is a chi-squared statistic with h degrees of freedom

- T is the sample size

- is the sample autocorrelation at lag i

Practice Questions: Q10

Q10. To test the hypothesis that the autocorrelations of a time series are jointly equal to zero based on a small sample, an analyst should most appropriately calculate:

A. a Ljung-Box (LB) Q-statistic.

B. a Box-Pierce (BP) Q-statistic.

C. either a Ljung-Box (LB) or a Box-Pierce (BP) Q-statistic.

D. neither a Ljung-Box (LB) nor a Box-Pierce (BP) Q-statistic.

Practice Questions: Q10 Answer

Explanation: A is correct.

The LB Q-statistic is appropriate for testing this hypothesis based on a small sample.

Topic 5. Modeling Seasonality in an ARMA

- Seasonality: Recurrence of a pattern at the same time every year (e.g., higher retail sales in Q4).

- Modeling in Pure AR Process: Include a lag corresponding to the seasonality (e.g., 4th lag for quarterly data, 12th for monthly data) in addition to other short-term lags.

- Modeling in Pure MA Process: A similar approach is used.

- ARMA Model with Seasonality Notation: ARMA

- and denote the seasonal component.

- and are restricted to values of 1 or 0 (true or false), where 1 corresponds to the seasonal lag (e.g., 12 for monthly).