Delayed Impact of Fair Machine Learning

Lydia T. Liu, Sarah Dean, Esther Rolf, Max Simchowitz, and Moritz Hardt

University of California, Berkeley

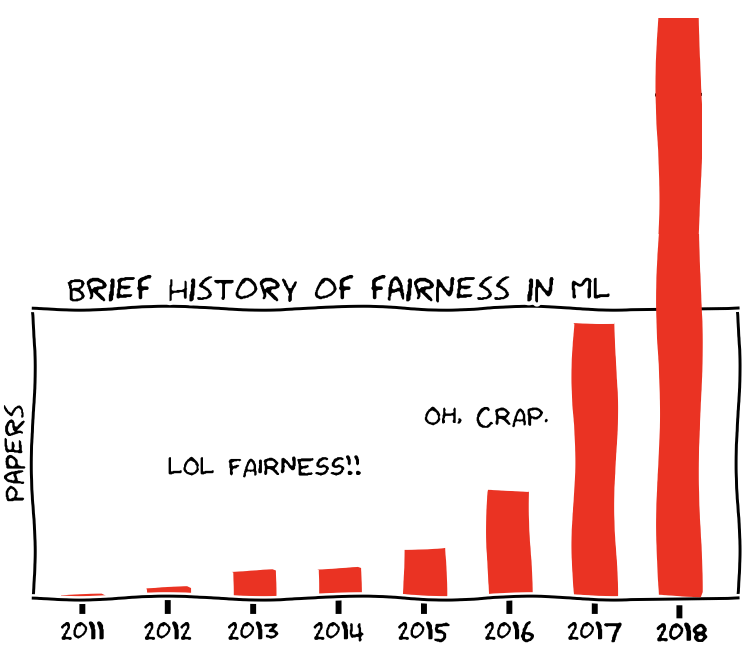

“21 definitions of fairness” [Narayanan 2018]

- Demographic Parity

- Equality of Opportunity

- Predictive value parity

- Group Calibration

. . .

- Many fairness criteria can be achieved individually using efficient algorithms post-processing [e.g. Hardt et al. 2016]; reduction to black-box machine learning [e.g. Dwork et al. 2018; Agarwal et al. 2018]; agnostic learning [e.g. Kearns et al. 2018; Herbert-Johnson et al. 2018]; unconstrained machine learning [Liu et al. 2018b]

- But typically impossible to satisfy simultaneously [e.g. Kleinberg et al. 2016; Chouldechova, 2017]

?

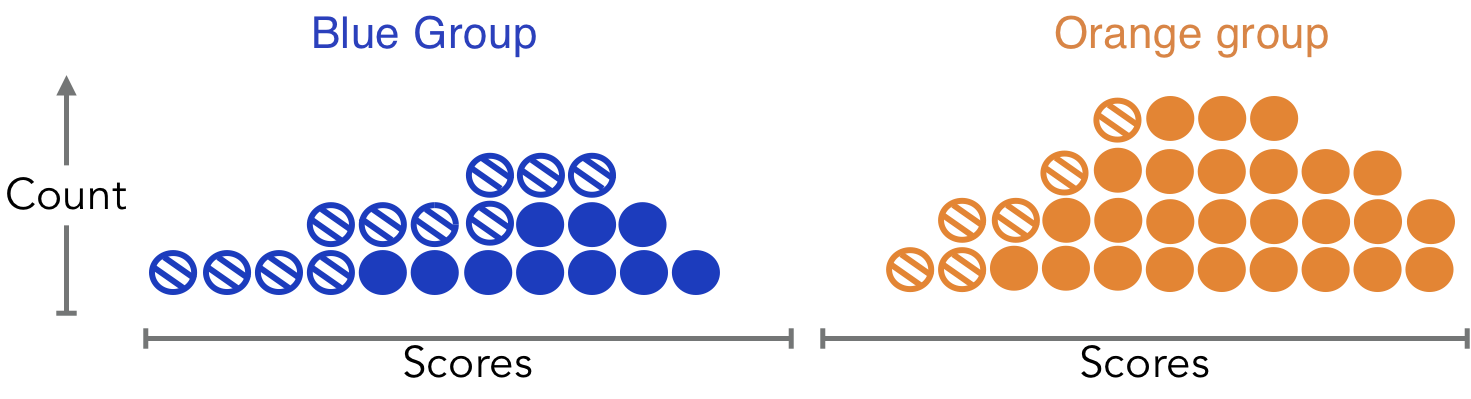

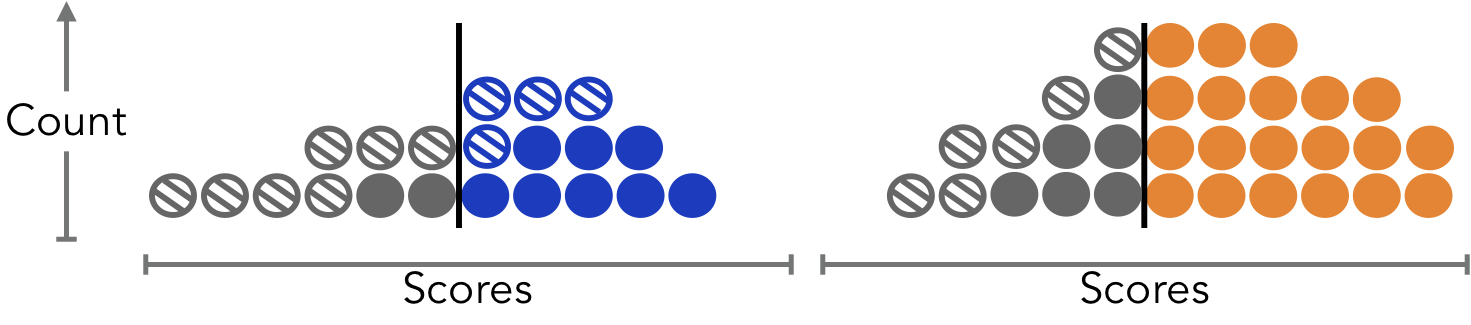

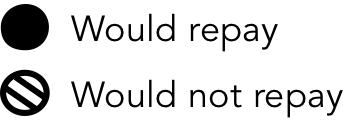

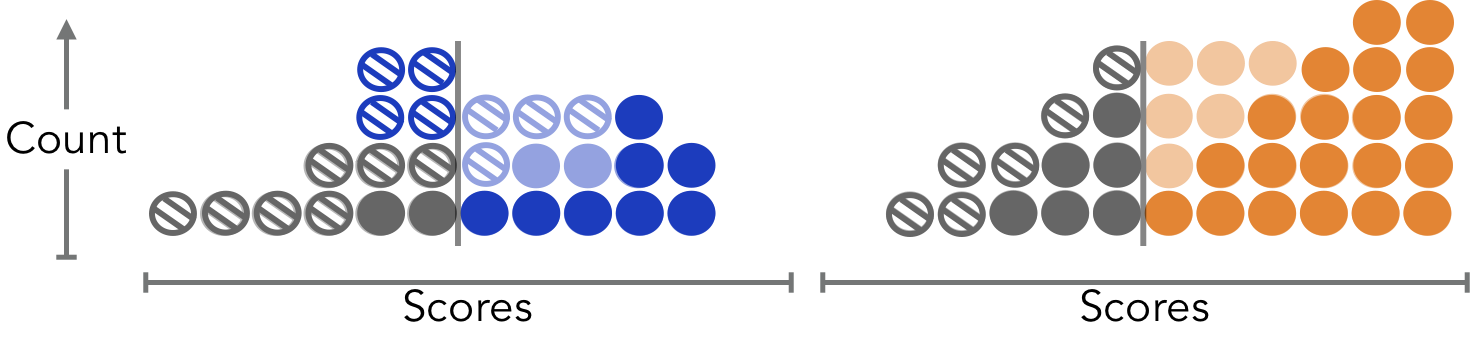

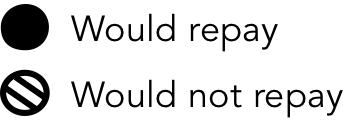

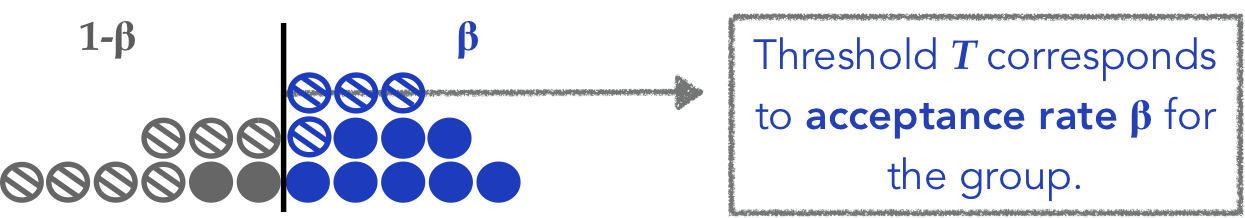

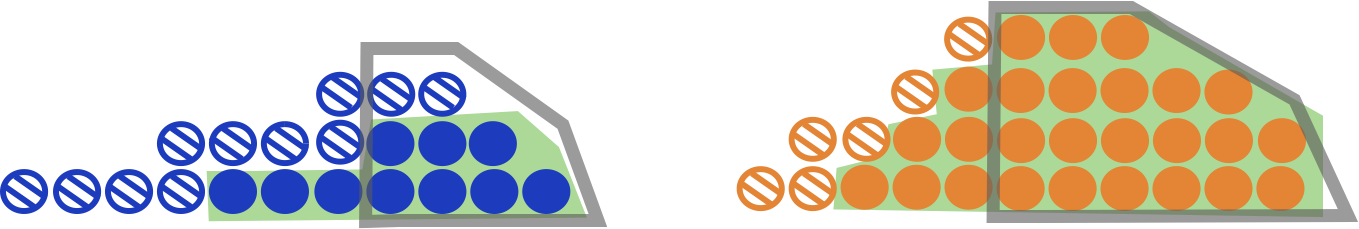

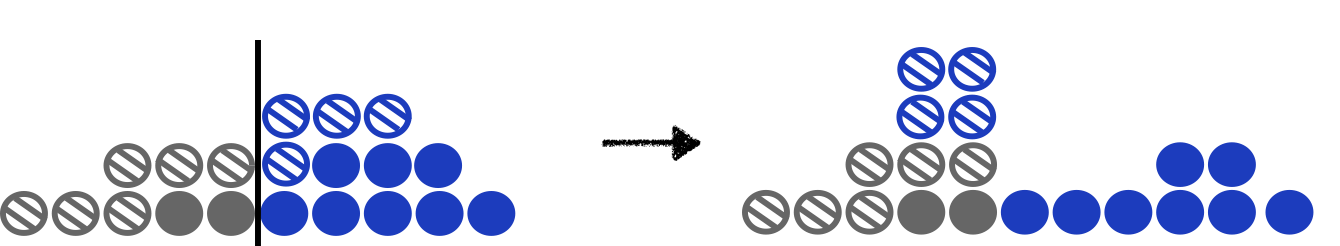

Two groups with different score distributions (e.g. credit scores)

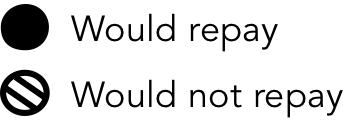

Approve loans according to Demographic Parity.

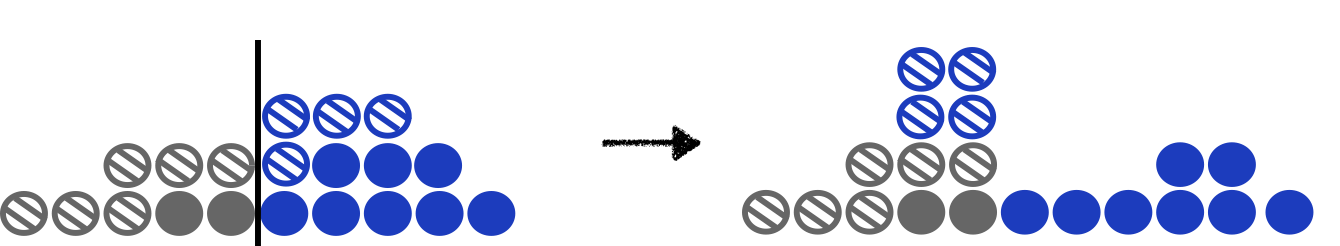

Credit scores change with repayment (+) or default (-).

Harm!

What Happened?

Fairness criteria didn’t seem to help the protected group,

once we considered the impact of loans on scores.

Our Work

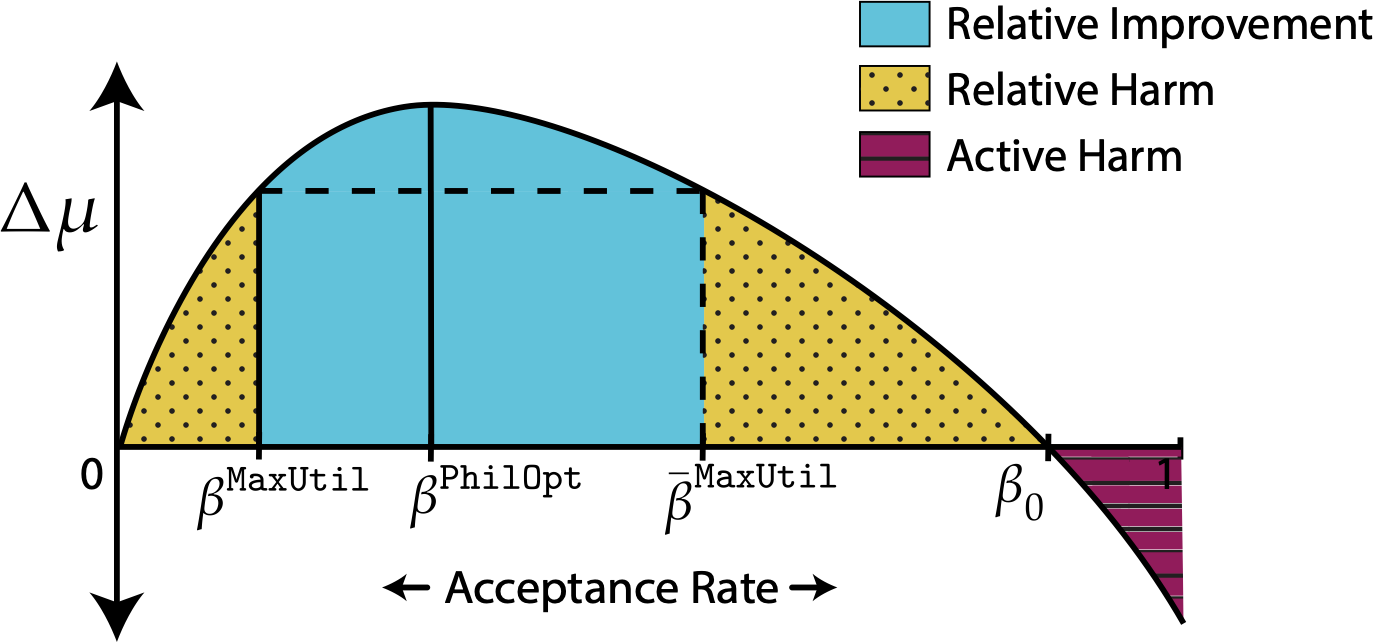

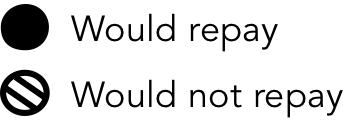

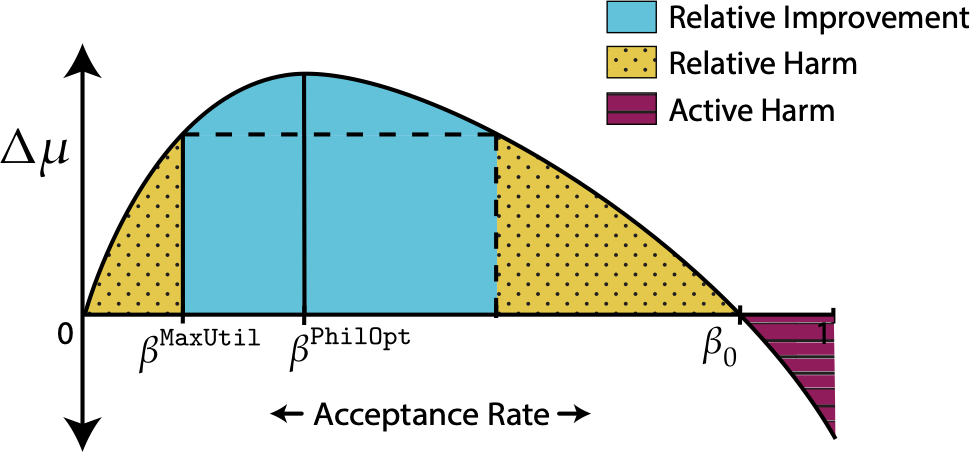

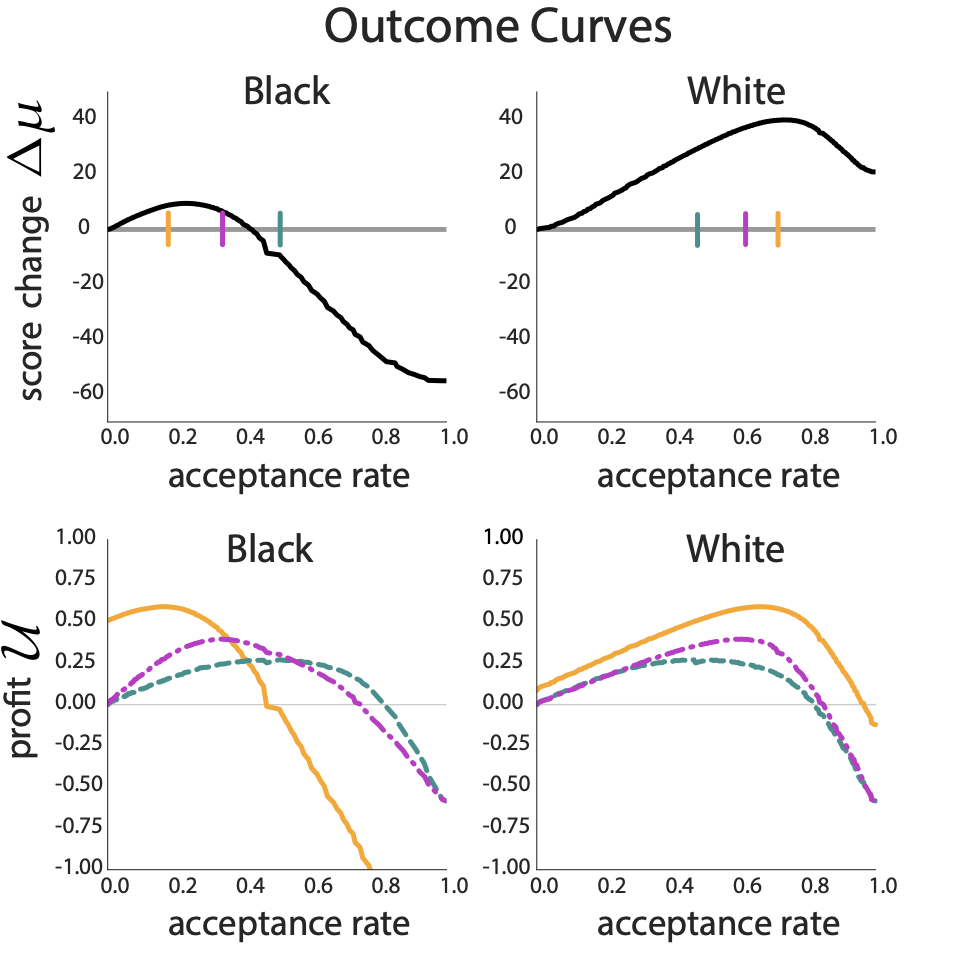

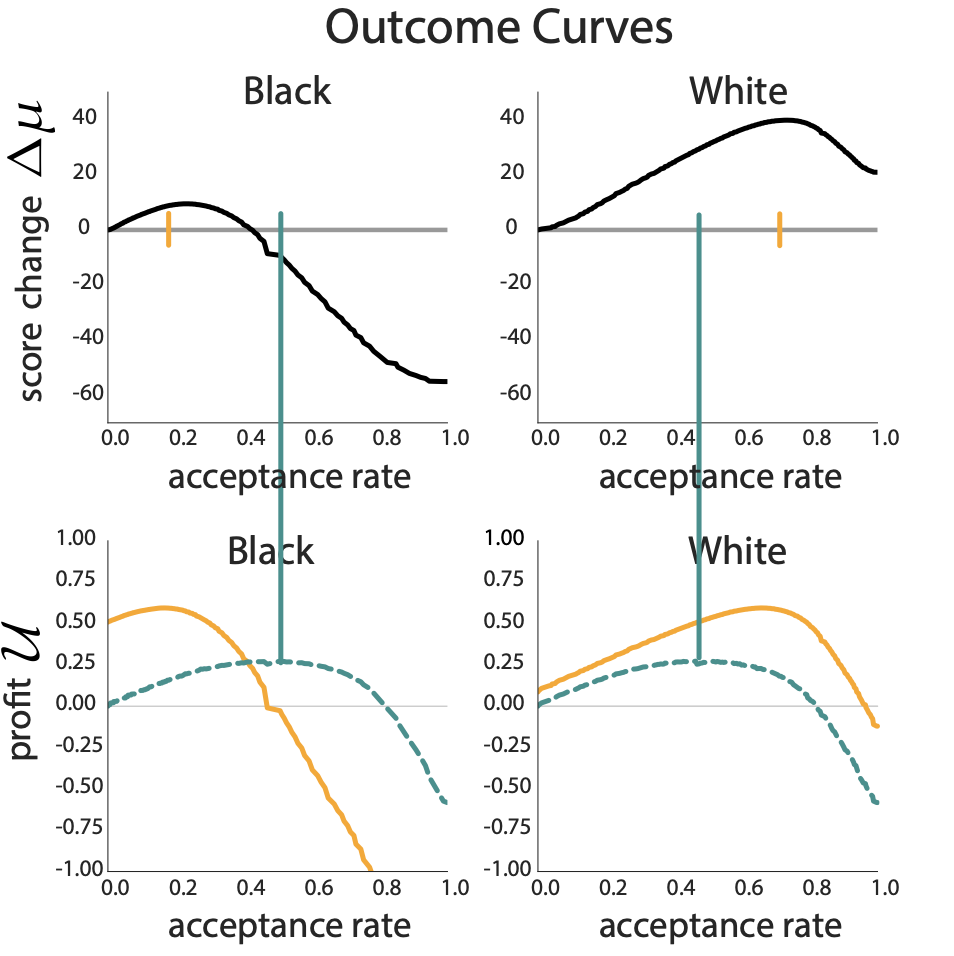

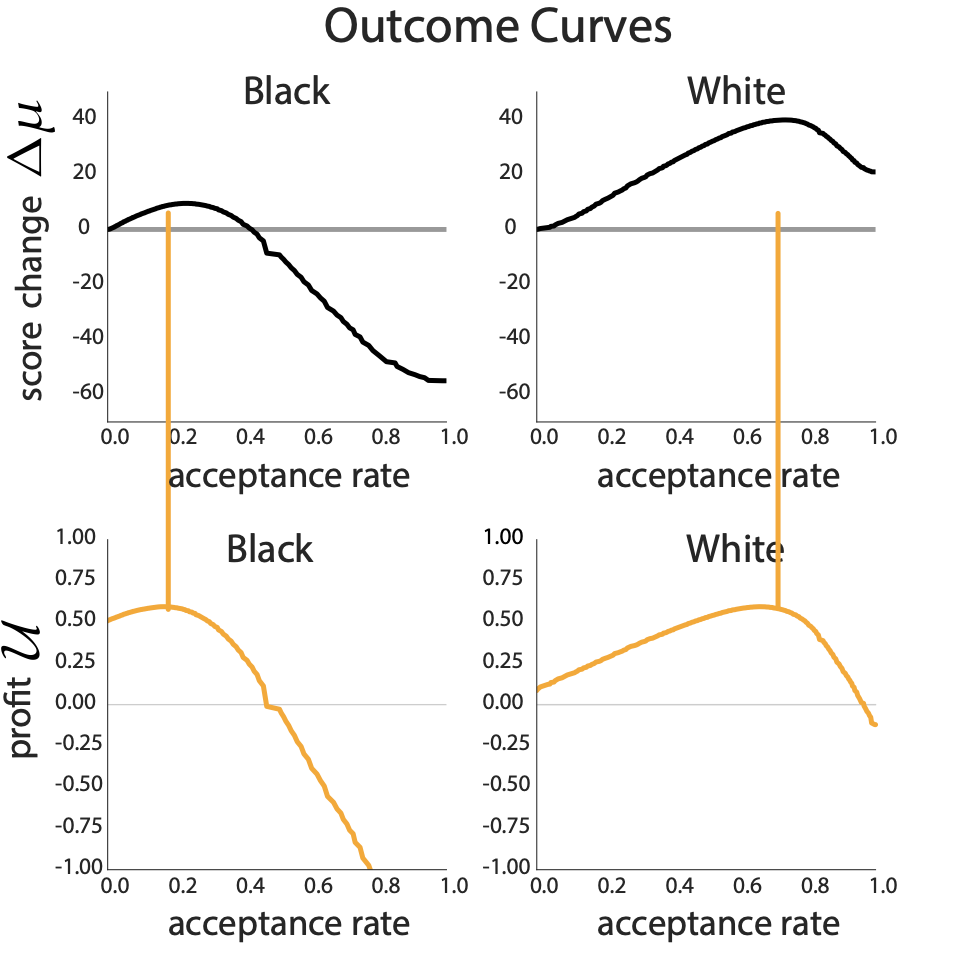

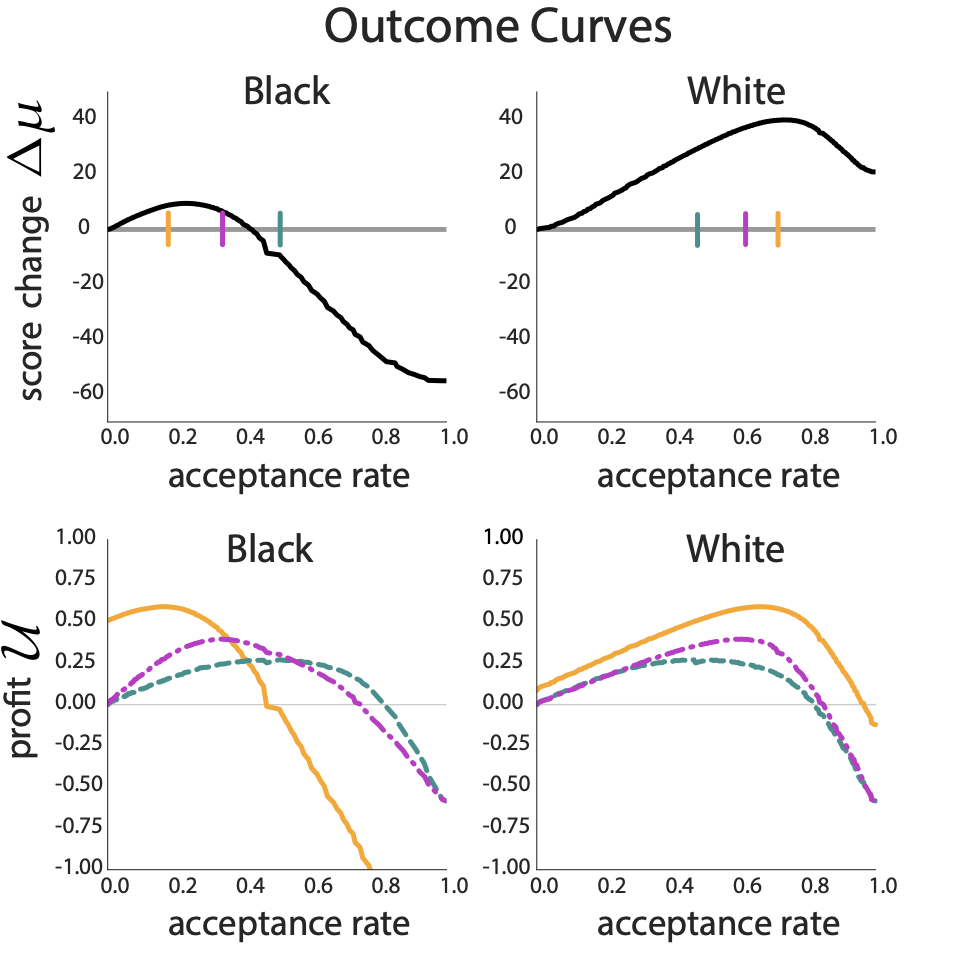

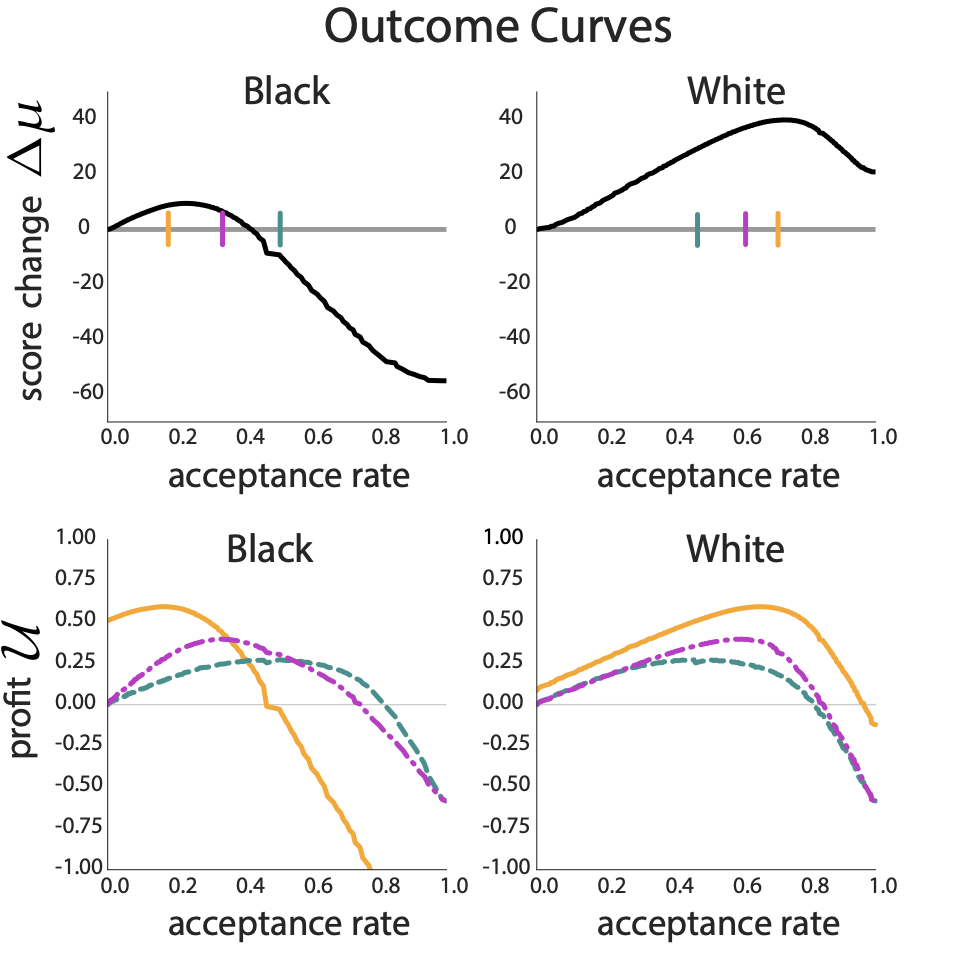

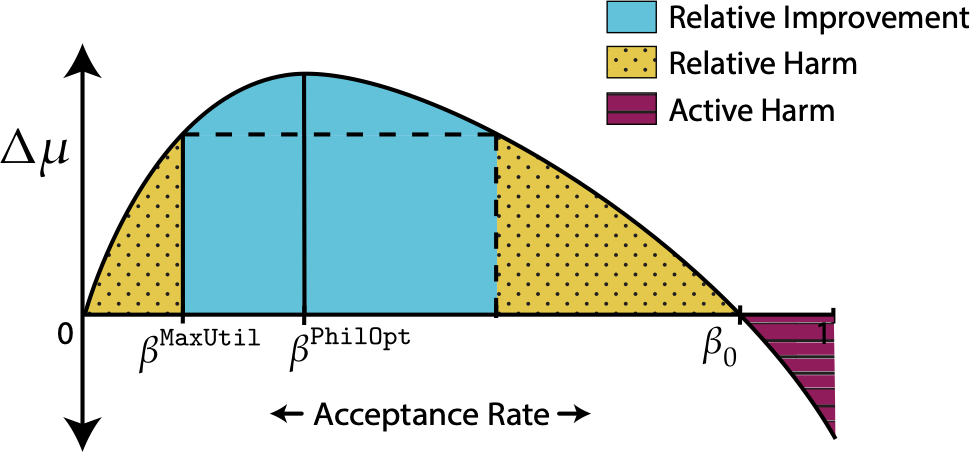

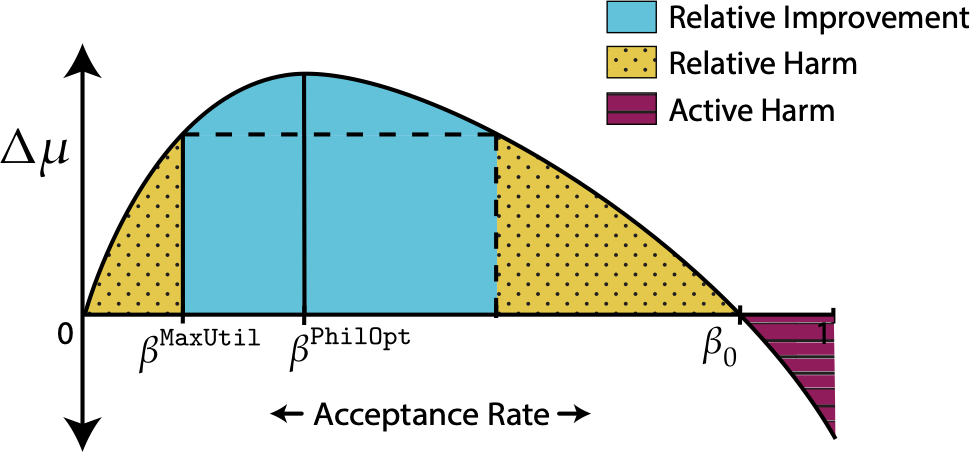

- Introduce the “outcome curve”, a tool for comparing the delayed impact of fairness criteria

- Provide a complete characterization of the delayed impact of different fairness criteria

- Show that fairness constraints may cause harm to groups they intended to protect

Scores and Decisions

Model Delayed Impact

- A score \(R\) is a scalar random variable corresponding to success probability if accepted

- Scores of accepted individuals change depending on their success.

- The average change in score of each group is the delayed impact \(\Delta \mu\)

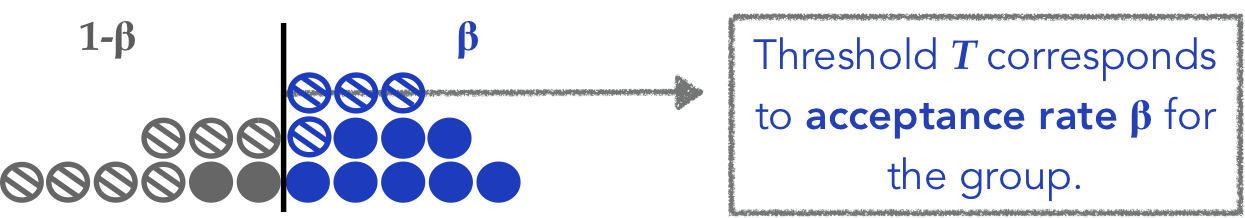

- Institution accepts individuals based on threshold \(T\), chosen to maximize expected utility

Lemma: \(\Delta\mu\) is a concave function of acceptance rate \(\beta\) under mild assumptions.

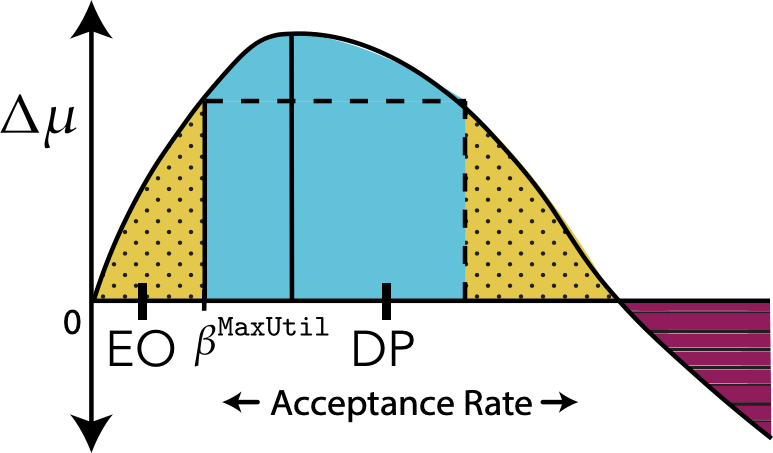

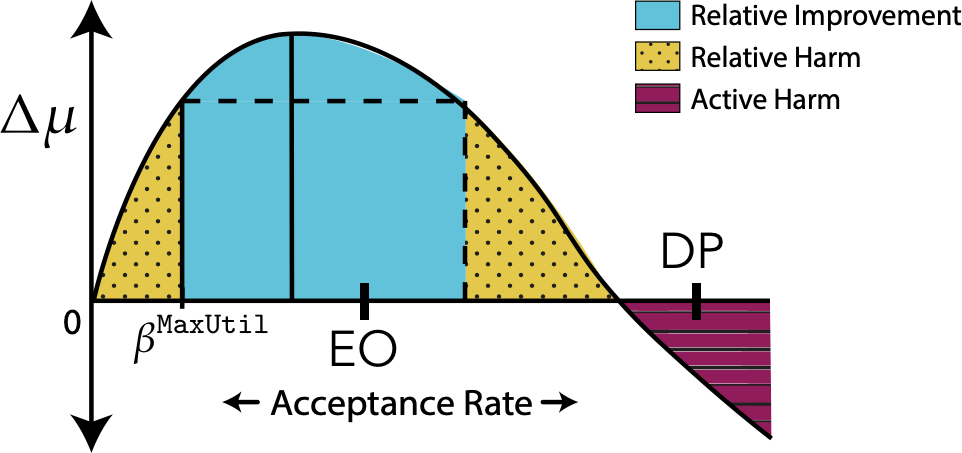

Outcome Curve

average score change

Fairness Constraints

Alternative to unconstrained utility maximization

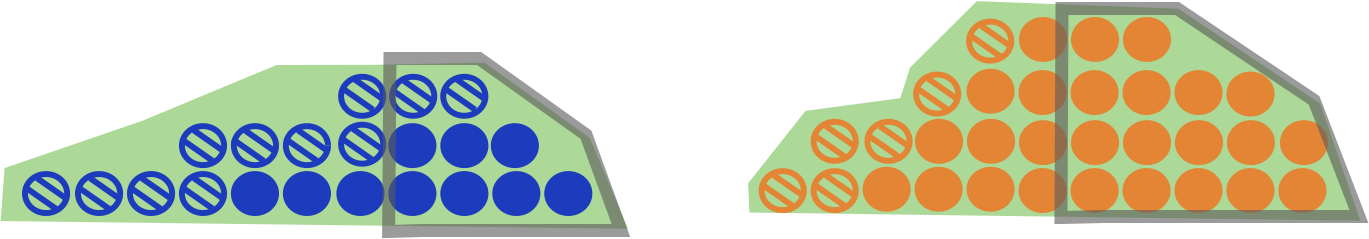

Demographic Parity: Equal Acceptance Rate

Equal Opportunity: Equal True Positive Rates

All outcome regimes are possible

Result 1

Equal opportunity and demographic parity may cause relative improvement, relative harm, or active harm.

Unconstrained utility maximization never causes active harm.

Main Results

Result 2

Demographic parity (DP) may cause active or relative harm by over-acceptance; equal opportunity (EO) doesn't.

Result 3

Equal opportunity may cause relative harm by under-acceptance; demographic parity never under-accepts.

Choice of Fairness Criteria Matters

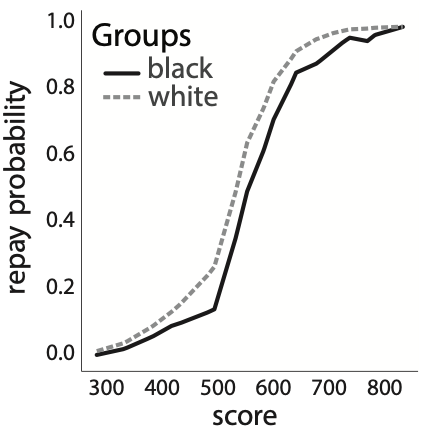

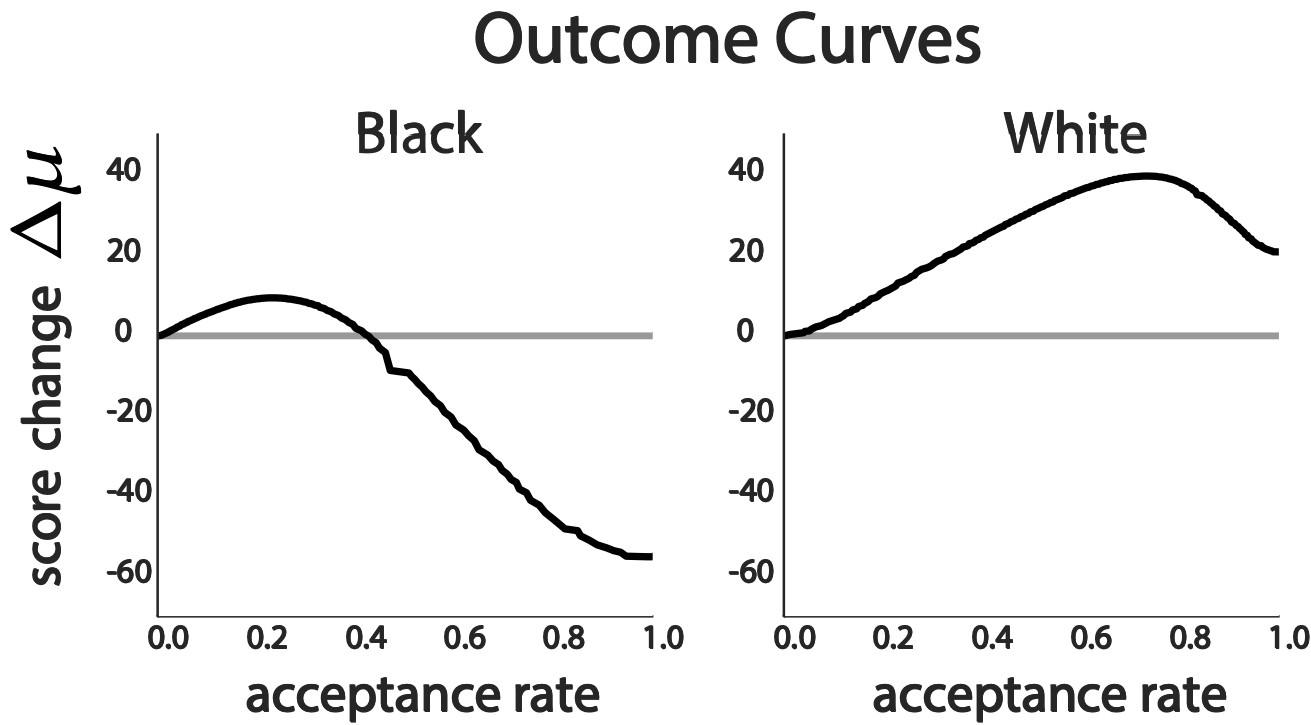

Experiments on FICO Credit Scores

- 300,000+ TransUnion TransRisk scores from 2003

- Estimate score distributions and repayment probabilities

- Model bank’s profit/loss ratio as +1:-4

- Model impact of repayment and default on credit score as +75 and -150

Why the large difference in delayed impact?

Maxima of outcome and utility curves under fairness criteria are more misaligned in the minority black group

Discussion

Future Work

- Outcome curves provide a way to deviate from maximum utility while improving outcomes

- Need for domain-specific models of delayed impact

- Context-sensitive nature of fairness in machine learning

- Measuring and modeling outcomes directly

- Practical tradeoffs of using machine learning for human-centered policies

- Long term dynamics of the distributional outcomes of algorithmic decisions [Hu and Chen 2018; Hashimoto et al. 2018; Mouzannar et al. 2019]

Thank you!

Details in full paper:

https://arxiv.org/abs/1803.04383

Algorithmic decisions are everywhere

- A score \(R\) is a scalar random variable, e.g. credit scores 300-850

- A group has a distribution over scores:

- Scores correspond to success probabilities (e.g. likelihood of repaying a loan) if accepted

- Higher score implies higher probability of success

Score Distribution Within Protected Group

- Institution accepts individuals based on threshold \(T\), chosen to maximize expected utility:

- When there are multiple groups, thresholds can be group-dependent.

Classifiers are Thresholds

\(\mathbb{E}[\mathrm{utility}|T] = \mathbb{E}[\mathrm{reward~from~repayments}|T] - \mathbb{E}[\mathrm{loss~from~defaults}|T]\)

- Scores of accepted individuals change depending on their success.

- The average change in score of each group is the delayed impact:

Model Delayed Impact on Groups

\(R_\mathrm{new} = \begin{cases} R_\mathrm{old}+c_+ &\text{if repaid} \\ R_\mathrm{old}-c_- &\text{if defaulted} \end{cases}\)

\(\Delta \mu = \mathbb{E}[R_\mathrm{new}-R_\mathrm{old}]\)

Measurement Error Increases Potential for Improvement

Result 4

If scores are systematically underestimated in the protected group, then regime of relative improvement is widened

- 300,000+ TransUnion TransRisk scores from 2003

- Scores range from 300 to 850 and are meant to predict default risk

What we did

- Use empirical data labeled by race (“white” and “black”) to estimate group score distributions, repayment probabilities, and relative sizes

- Model the bank’s profit/loss ratio, e.g. +1:-4

- Model the delayed impact of repayment/default on credit score, e.g. +75/-150

- Compute “outcome curves” and delayed impact under different fairness criteria

Experiments on FICO Credit Scores