The Role of the Government in the US Health care system

BE 608

State Question

What is the hospital or insurer market like in your state? Any big mergers and/or antitrust action?

Outline

- How did we get here? (Very brief) history of government health policy in the US

- The Affordable Care Act

- Recent health policy changes

- What's next?

The role of the government

What are some ways the government intervenes in health care markets and what is the rationale?

How did we get here?

How did we get here?

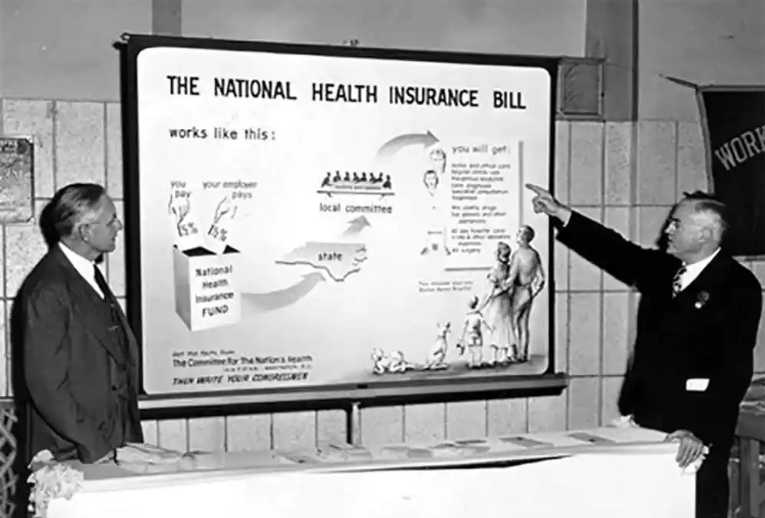

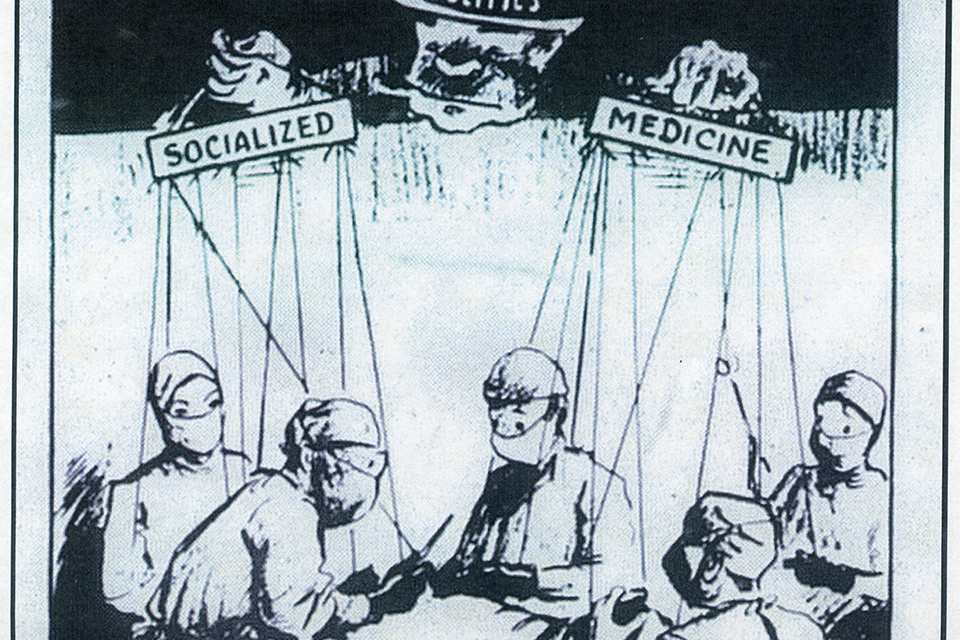

Why did this plan fail in the US?

- Opposition from Southern Democrats who saw the bill as leading to hospital desegregation

- Massive pushback from AMA

- Beginning of cold war and looming fear of socialism

How did we get here?

1940s-1960s

- 1943: War Labor Board decides health benefits do not count as "wages" and are not subject to wartime wage price controls

- Blue Cross/Blue Shield "pre-pay" private insurance starts spreading throughout the country

- Henry Kaiser begins pre-pay health plan for shipyard workers in California

1940: about 9% of population has some form of private insurance through employer

1960: 68% has some form of private insurance

- Elderly, disabled, and unemployed are left out.

How did we get here?

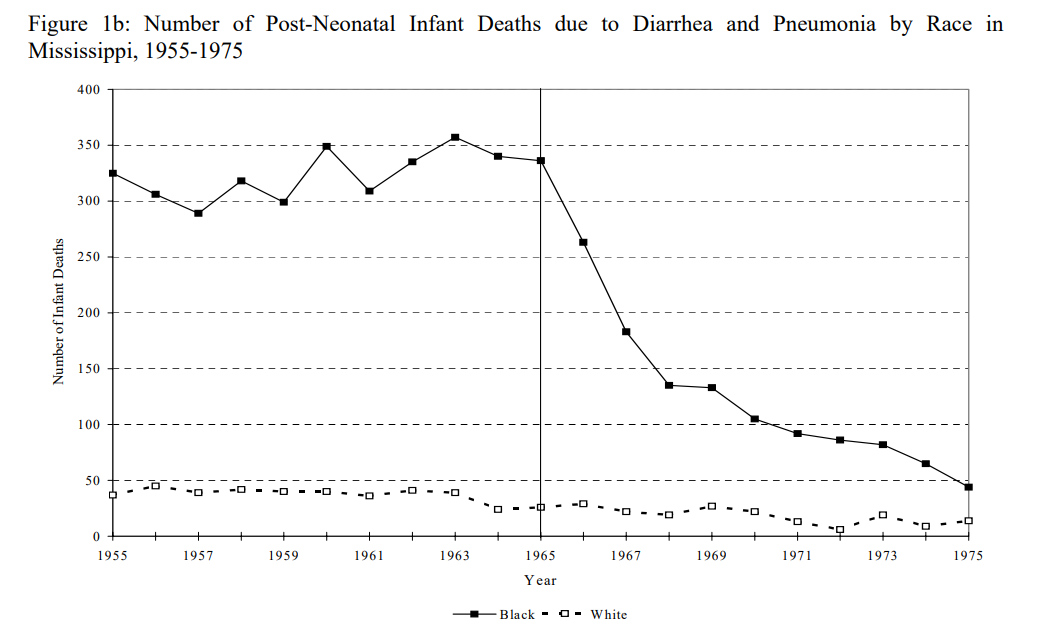

1965: creation of the Medicare/Medicaid programs

Medicare

Covered all elderly

Covered hospital and physician care

Did NOT cover prescription drugs

Federal program

Medicaid

Covered disabled people and single mothers with children but only if very low income

State-federal partnership

This spurred the desegregation of Southern hospitals

1960s-1990s

Medicare expands to include the disabled and those with end stage renal disease (1972)

Medicaid coverage expands to cover all children and pregnant women in households under the federal poverty level, later expands to include pregnant women and children in somewhat higher income households (1990s)

2000s

Medicare adds prescription drug coverage ("Medicare Part D")

Medicare adds the option of using benefits to get private coverage ("Medicare Advantage)

- If beneficiary selects private coverage, that insurance company gets flat rate from government to cover.

- Insurance company may charge premium on top of what it gets from government.

- About half of all people use this private option.

2010: Affordable Care Act--last "big" health policy push

Goals of the ACA

•Expand insurance coverage

•Reduce the growth of health spending

•Strengthen quality incentives

Builds on the existing system of private insurance.

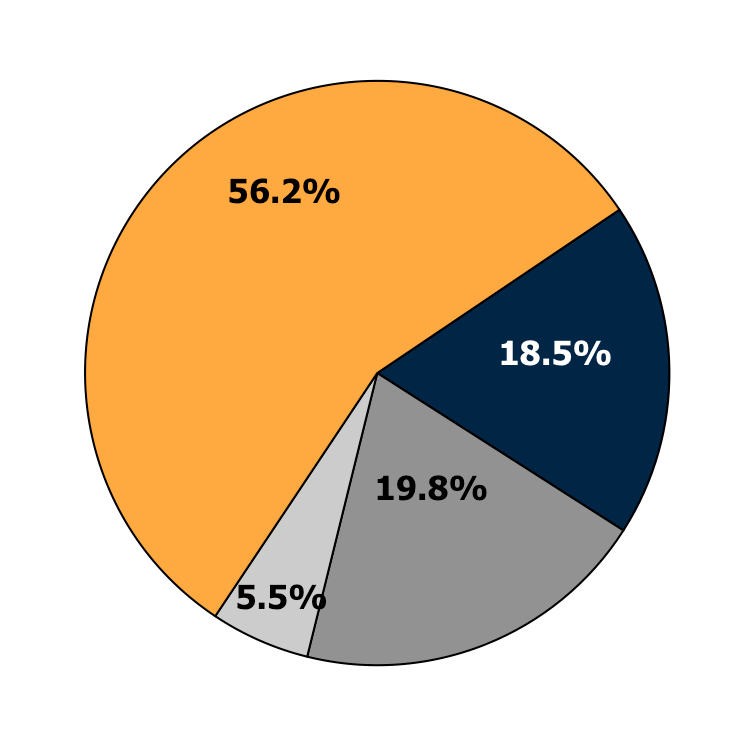

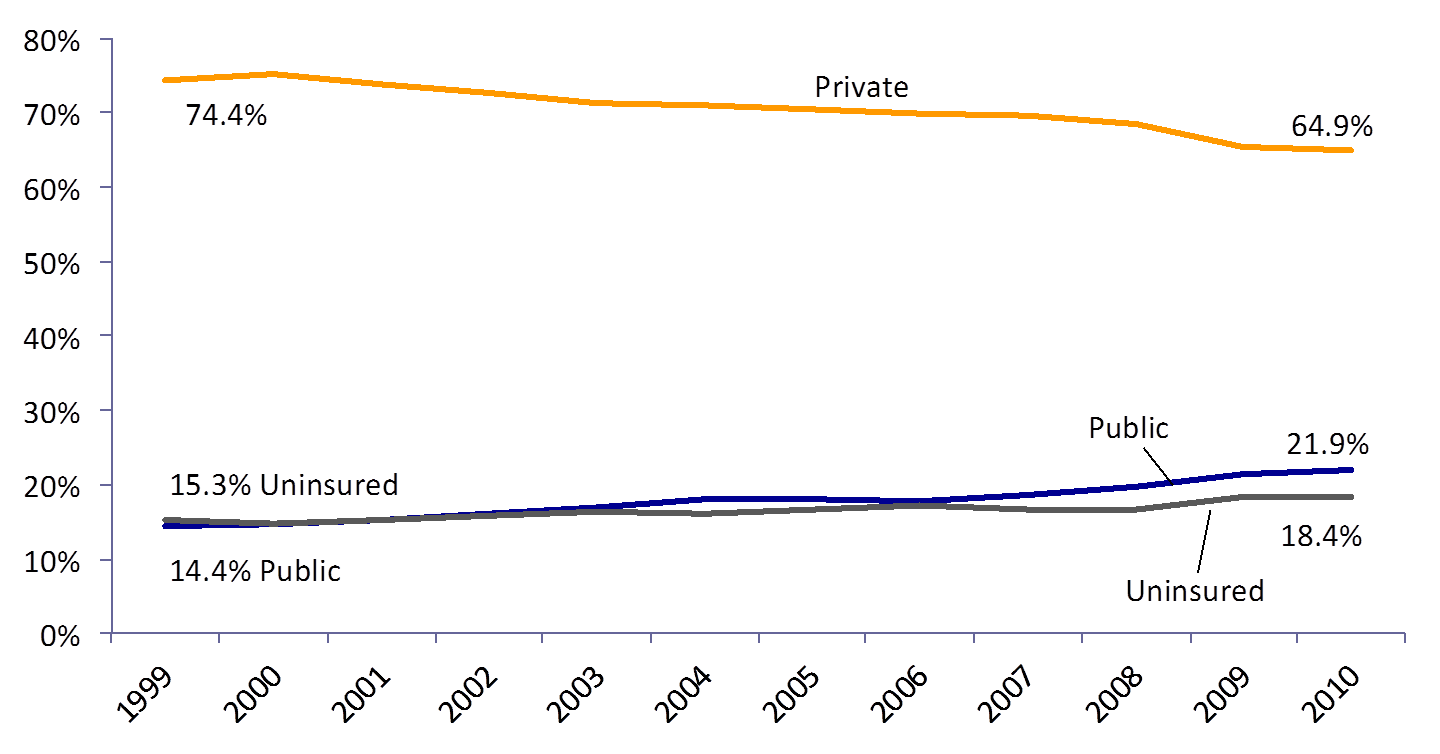

What was Coverage Like Before the ACA?

Employer-Sponsored

Health Insurance

Private Non-Group

Medicaid or other

public programs

Uninsured

Source: 2011 CPS ASEC, Non-Elderly Only

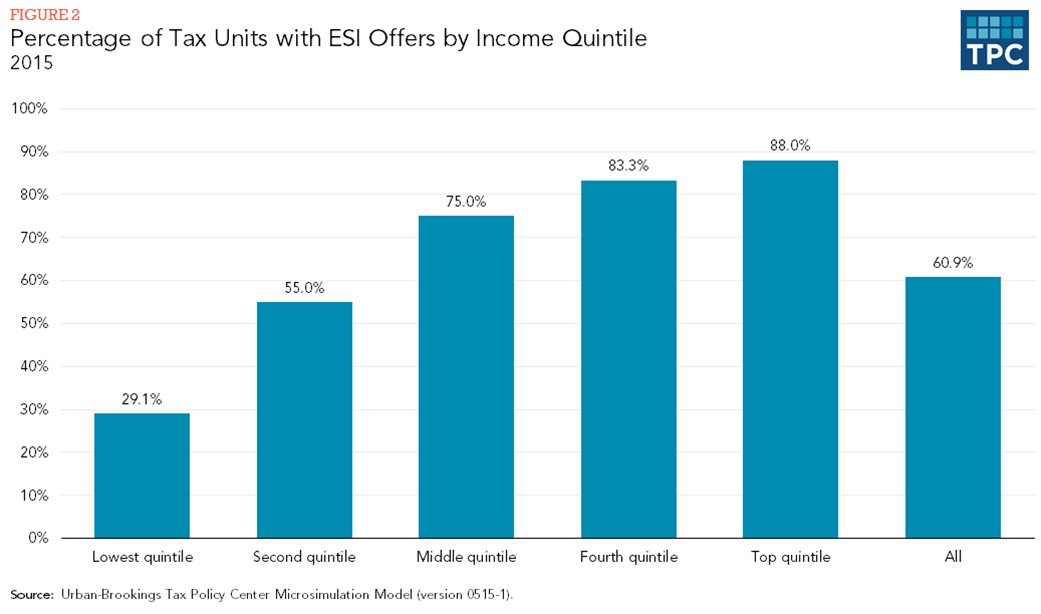

Why is employer sponsored health insurance so popular?

•Should ask: Why do (some) workers prefer to pay for ESI with reduced wages?

•Answer: ESI is a much better deal than individually-purchased coverage. There are three main reasons:

1.Efficient risk-pooling

2.Economies of scale in marketing and administration

3. Substantial tax subsidy

Advantages of ESI are the mirror image of the limitations of the existing individual market.

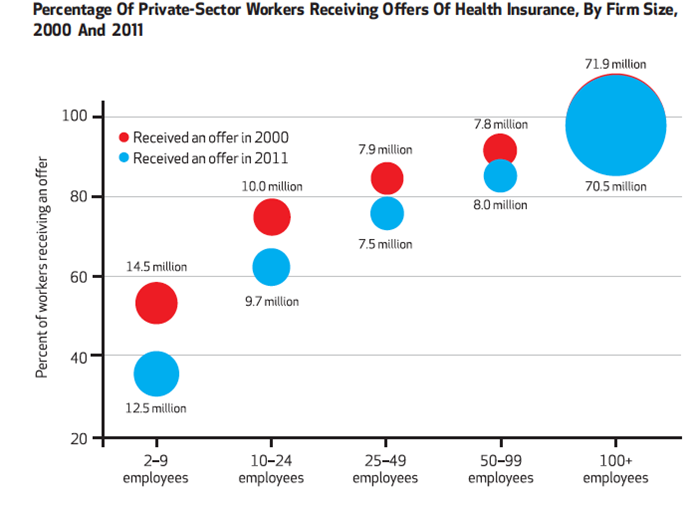

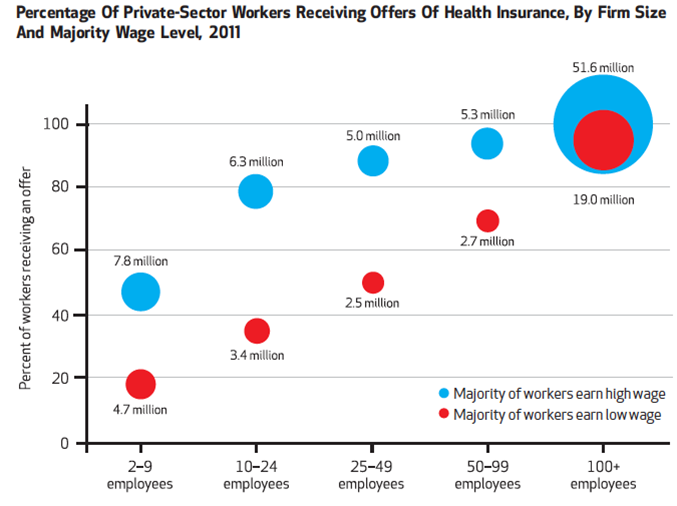

Employer Sponsored Health Insurance

Source: Buchmueller, Carey and Levy Health Affairs 2013

Employer Sponsored Health Insurance

Source: Buchmueller, Carey and Levy Health Affairs 2013

Employer Sponsored Health Insurance

Employer Health Insurance and the Labor Market

The link between health insurance and the workplace (and the lack of other affordable options) can distort worker behavior. The result is various types of “job-lock”:

- Job mobility

- Entrepreneurship

- Weekly hours

- Retirement

Broader labor market trends contributed to reduced access to ESI:

- Declining labor force participation

- Dislocation from technology and trade

- Declining unionization

- The “gig economy”

Declines in Coverage

Source: DeNavas-Walt et al. Income, Poverty and Health Insurance Coverage in the United States: 2011, US Census Bureau (2012)

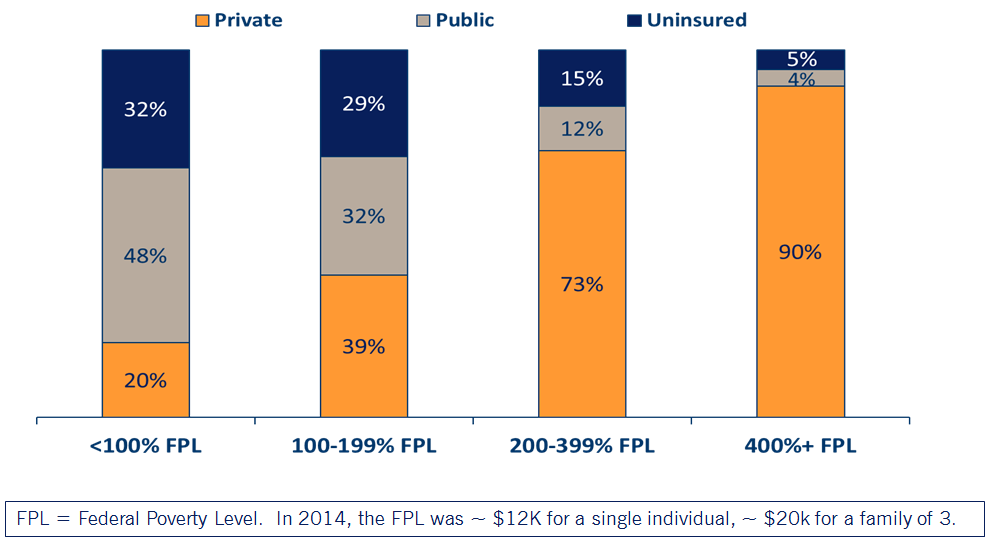

Health Insurance by Income Level

Poverty Line Cheat Sheet

| # in Family | 100% | 138% | 250% | 400% |

|---|---|---|---|---|

| 1 | $12,060 | $16,643 | $30,150 | $48,240 |

| 2 | $16,240 | $22,411 | $40,600 | $64,960 |

| 3 | $20,420 | $28,180 | $51,050 | $81,680 |

| 4 | $24,600 | $33,948 | $61,500 | $94,400 |

ACA Expanded Coverage in 3 Ways

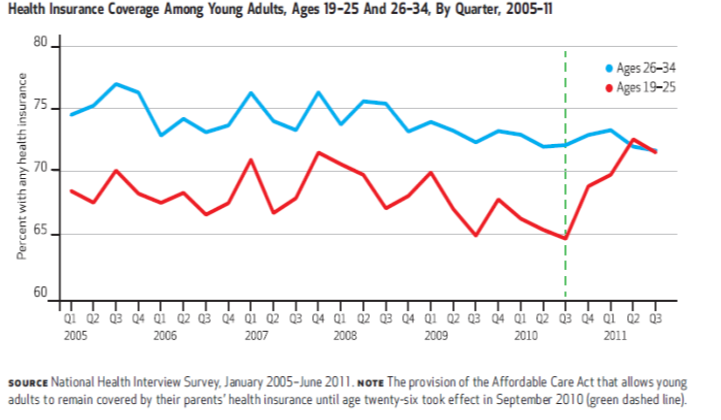

1.Young adults allowed to stay on their parents’ private insurance until age 26 (effective September 2010)

2.Eligibility for Medicaid extended to everyone with incomes below 138% of the Federal Poverty Level (effective Jan 2014*)

3.New tax credits for private insurance for families between 100 and 400% of the Federal Poverty Level (effective Jan 2014)

* Several states elected to expand Medicaid at different times, or not at all!

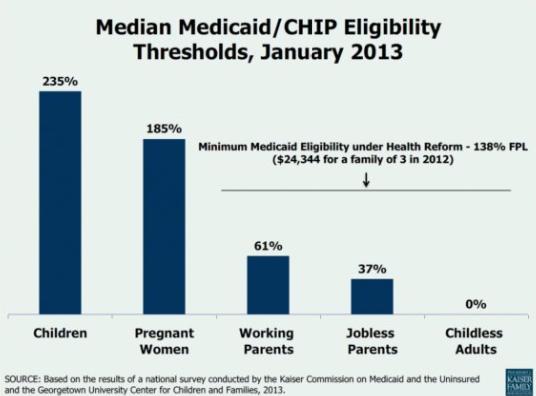

Medicaid Expansion

Medicaid Expansion

How does the government plan to expand Medicaid?

- Federal match assistance percentage (FMAP): States were historically guaranteed at least a 1-to-1 match from federal government.

- Higher match rate for lower income states (highest is MS, 2.8 to 1 in 2015)

- Under ACA, federal government pays 100% of additional costs during 2014-2016, then phases down to 90% by 2020.

- Under the original law, states have to expand Medicaid or risk losing all of their funding

NFIB v Sibelius 2012

High profile supreme court case challenging constitutionality of the ACA:

SCOTUS ruled the threat of losing all Medicaid funding was unconstitutionally coercive, a "gun to the head" as Roberts wrote in his majority opinion.

Because of this ruling, states could opt not to expand Medicaid without risking losing additional funding.

Also gave states some negotiating power to expand on their terms.

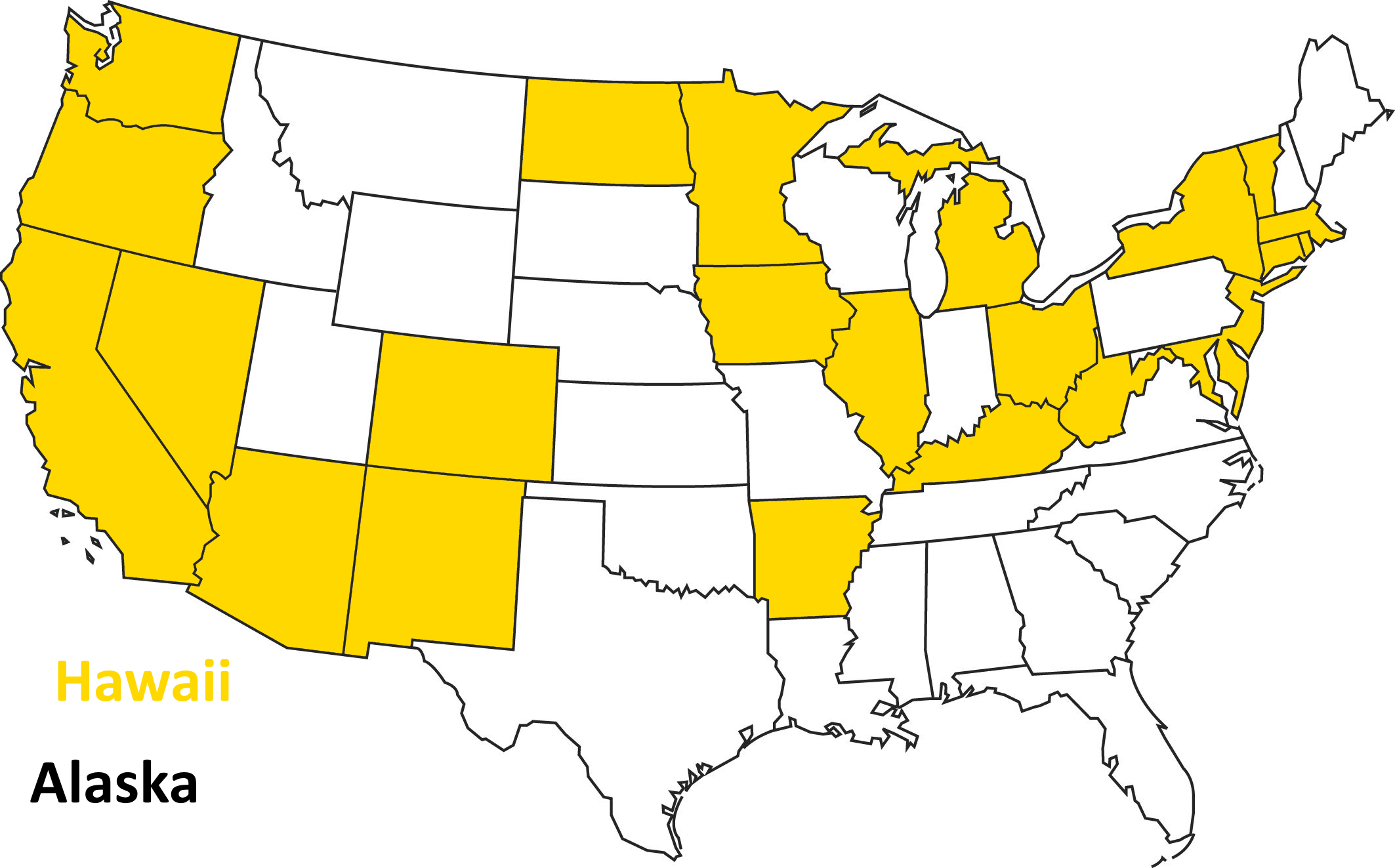

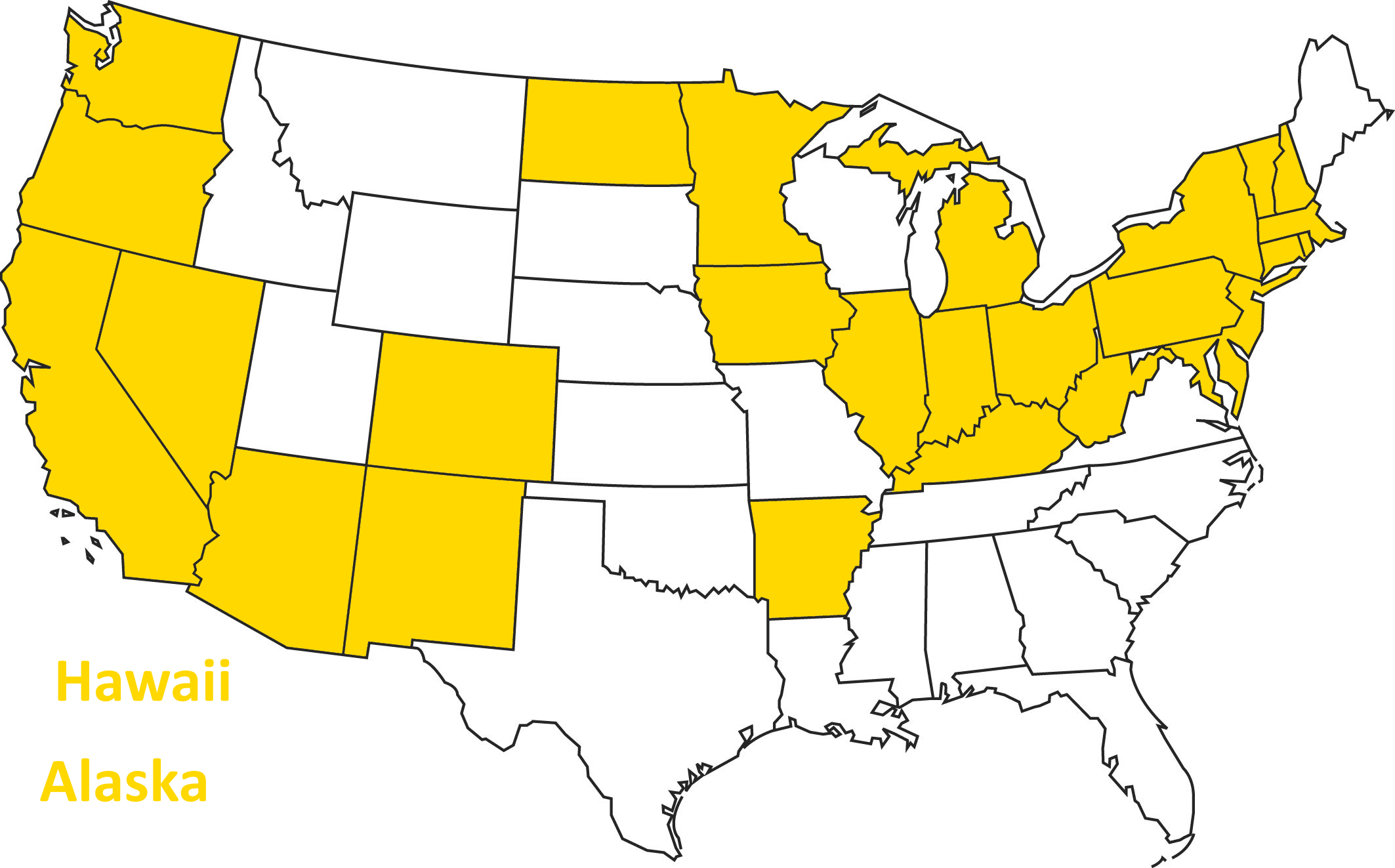

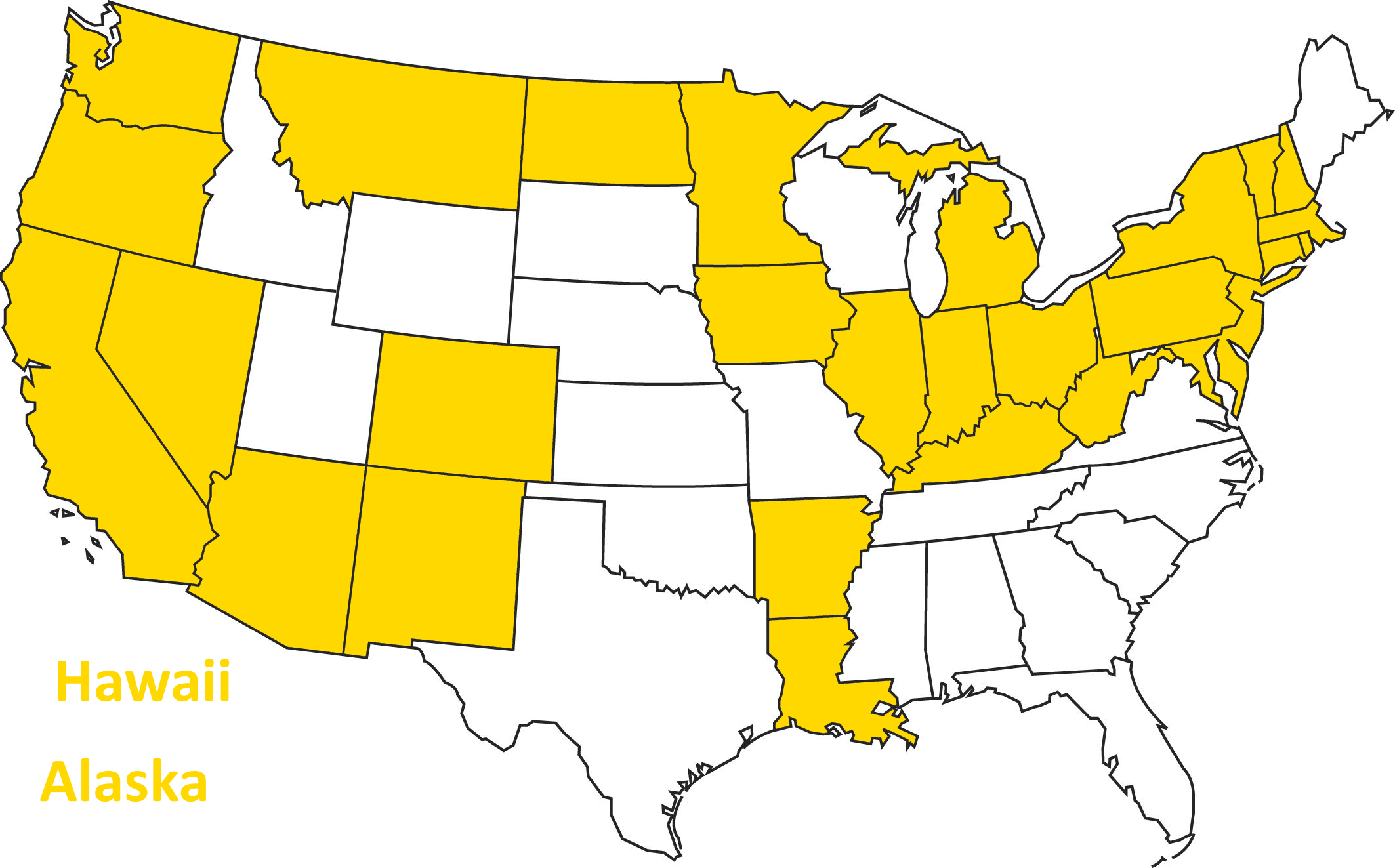

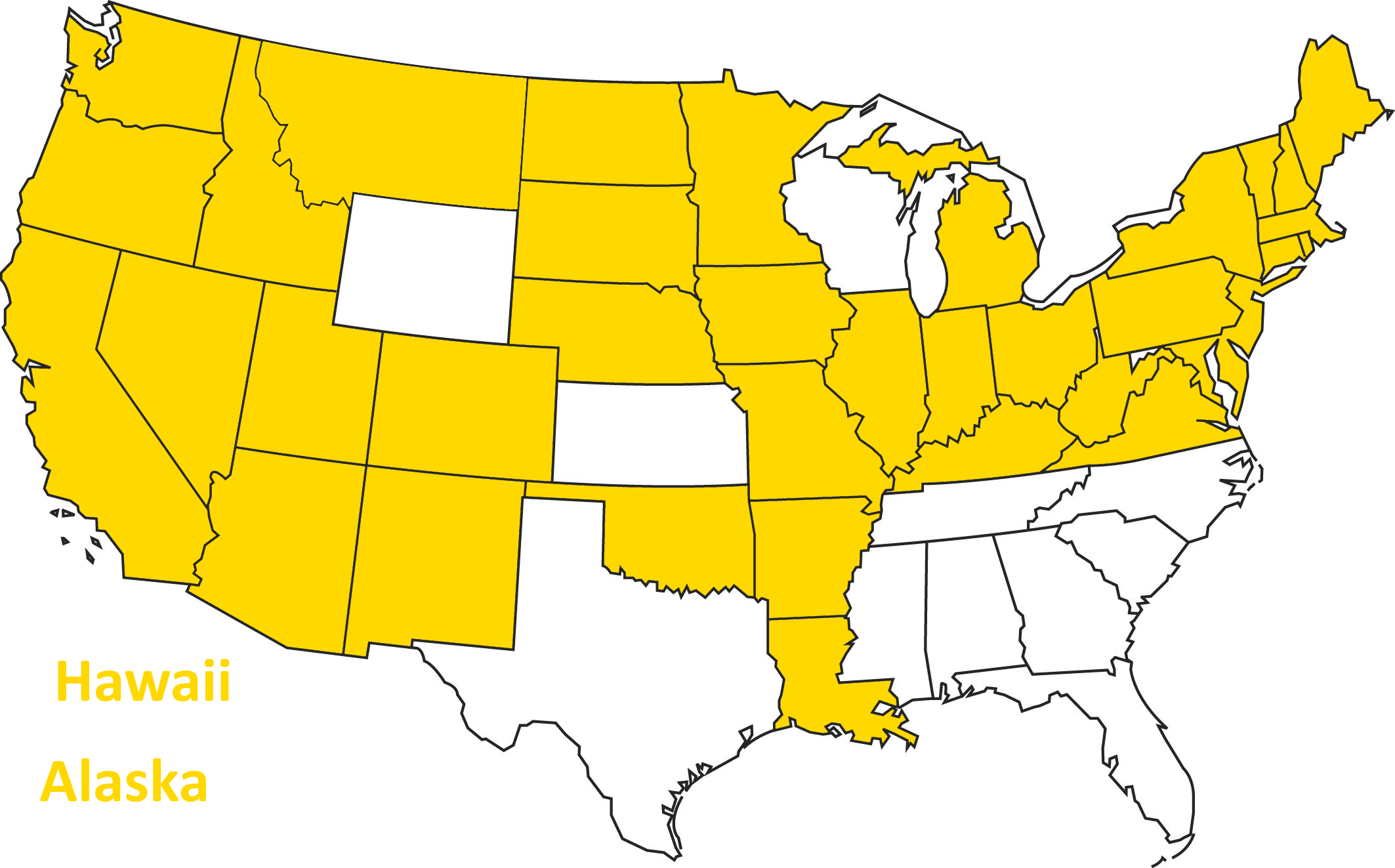

Opted to Expand in 2014

As of 2015...

As of 2017...

As of today...

Medicaid expansion

What are some reasons states might not want to take up the Medicaid expansion?

Private Coverage Provisions

Underwriting reforms:

- "Guaranteed issue": no denials or exclusions for pre-existing conditions

•Adjusted community rating: premiums vary by age, smoking status, but nothing else

-Results in higher premiums for those who are younger, men; lower premiums for older, women

Private Coverage Provisions

Individual mandate -- Now repealed!

Tax penalty for not having insurance (now repealed)

- 2014: max[$95 per adult, 1% of income]

- 2017: max[$695 per adult, 2.5% of income]

- 2018 forward: $0

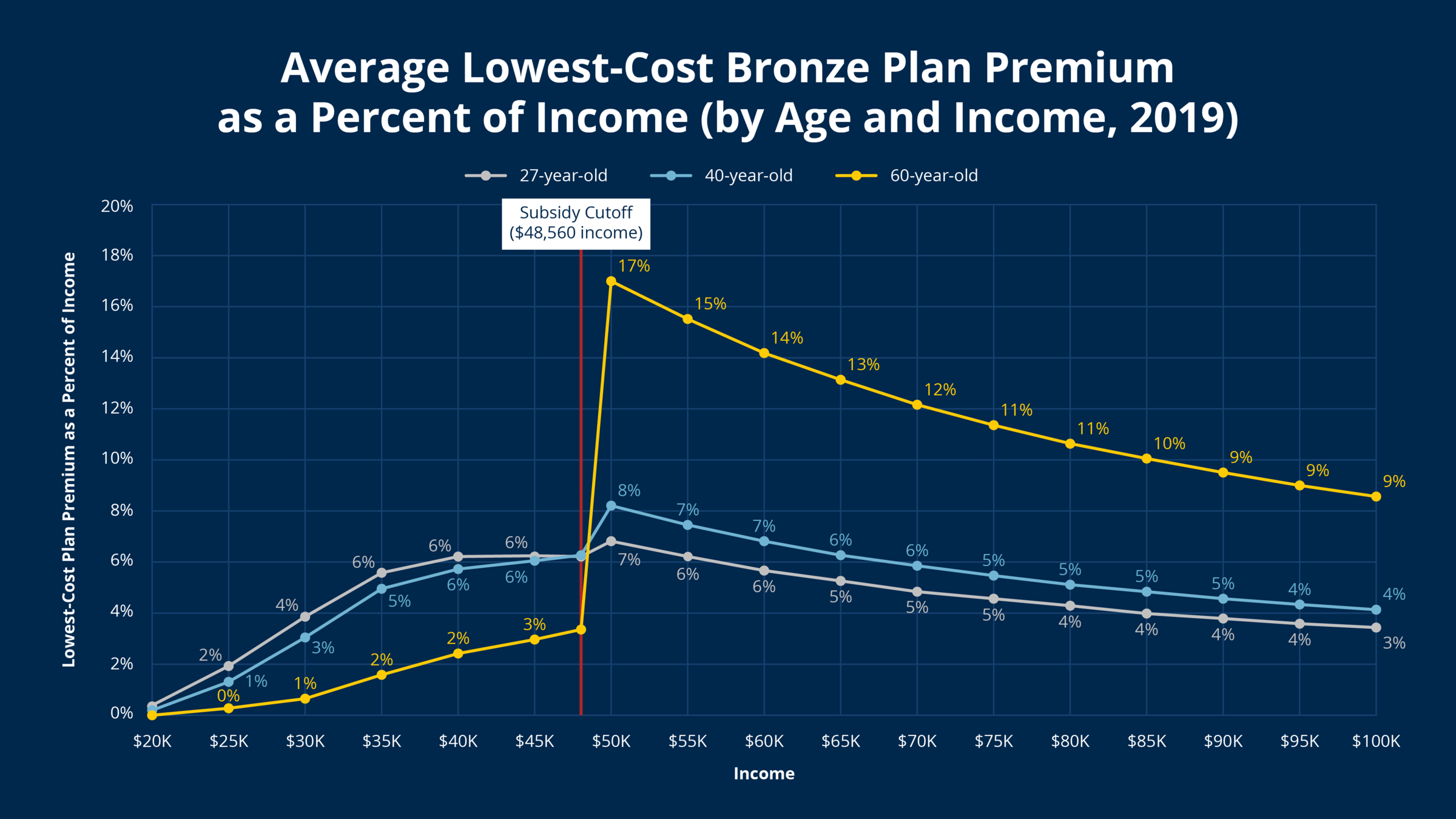

Premium Tax Credits

•Available between 100% and 400% of poverty

•Eligibility limited to people without access to affordable ESI

•Can only be used for coverage in newly established “marketplaces”

Health Insurance "Marketplaces"

The goal: make it easier to shop for health insurance if you don't have coverage through an employer

•Consumers choose from a menu of private plans

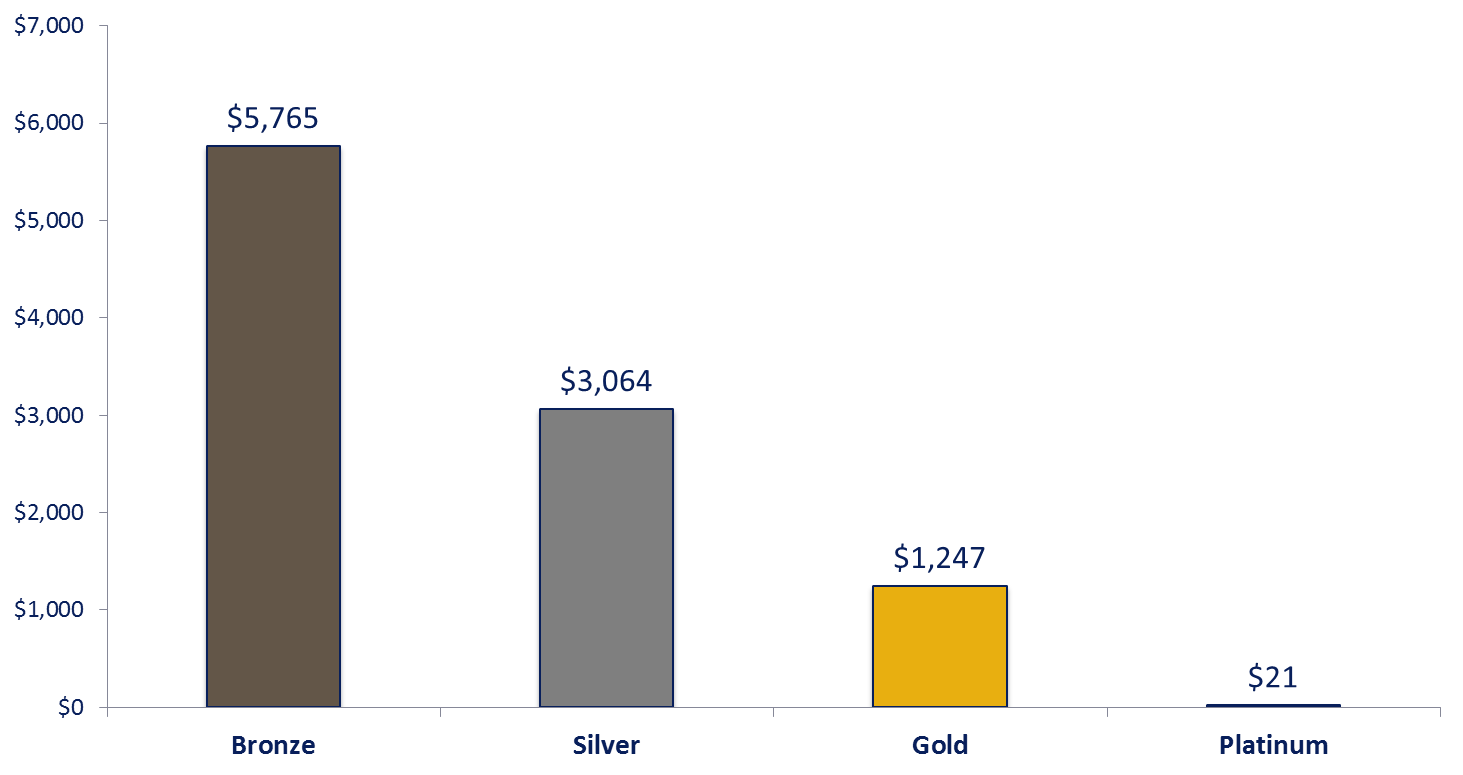

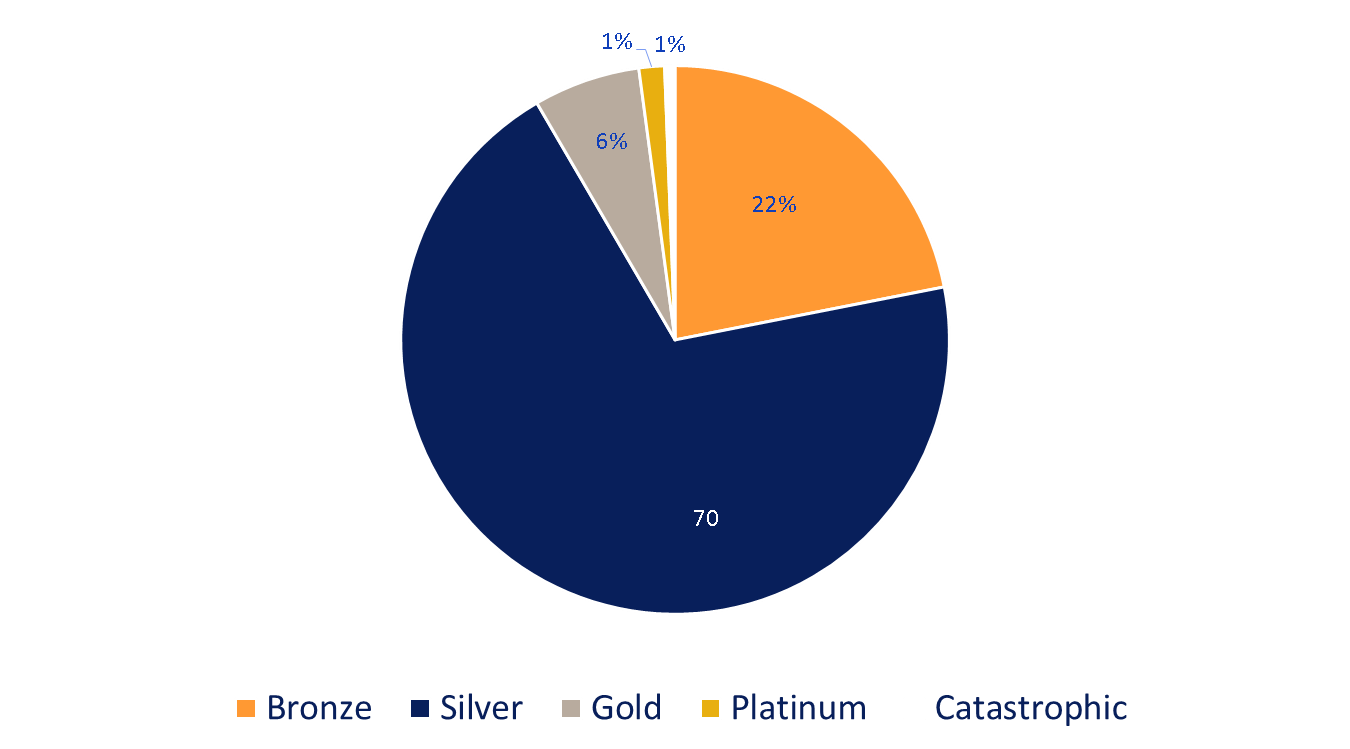

•All plans must offer 10 “essential health benefits” and conform to one of four actuarial value “metal levels.”

•Tax credits are based on consumer income and the premium for the 2nd lowest cost silver plan.

- 100-133 % of FPL: premiums are capped at 2% of income

- 300-400% of FPL: premiums are capped at 9.7% of income

•Low-income enrollees also qualify for cost-sharing reductions.

Health Insurance Marketplaces

Note: if a consumer gets a subsidy, then what the consumer actually pays doesn't actually depend on the price--it depends on the consumer's income.

When prices go up, the consumer doesn't necessarily pay more... (who does?)

Premium for Benchmark Plan

Source: 2018 KFF, note this is net of subsidy

Typical Deductibles

Source: KFF

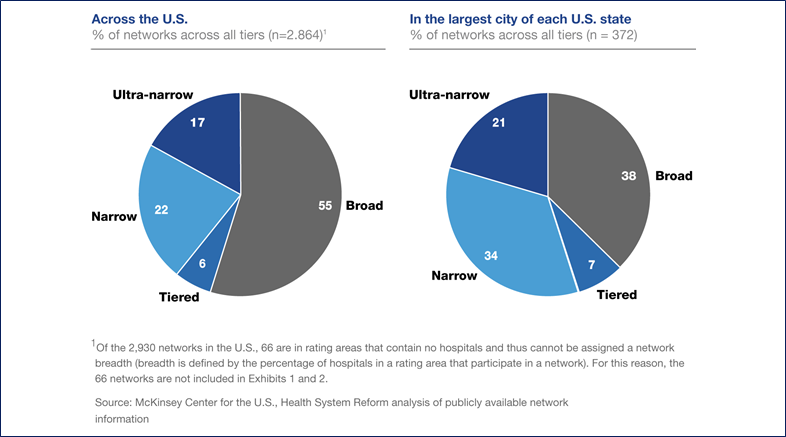

Rise of Narrow Network Plans

•Ultra narrow plans contract with < 30% of hospitals in the market

•Narrow plans contract 30% to 70% of hospitals in the market

•Broad plans contract with > 70% of hospitals in the market

Marketplace Enrollments

Withdrawal of "household name" insurers:

Exits 31 states in 2016/2017; remains partially active in New York, Nevada, and Virginia.

Withdraws entirely (from 13 states) in 2017/2018 transition.

Exits entirely (11 states) in 2017/2018 transition

Marketplace Enrollments

Success of plans with Medicaid managed care experience:

Narrow networks (e.g. So Cal plans exclude UCLA)

600k enrollees

Profitable

1.2 million marketplace enrollees

Low premium, high deductible, narrow network

Dependent Coverage

Dependents can remain on parents' coverage until age 26

- One of the most popular aspects of the bill

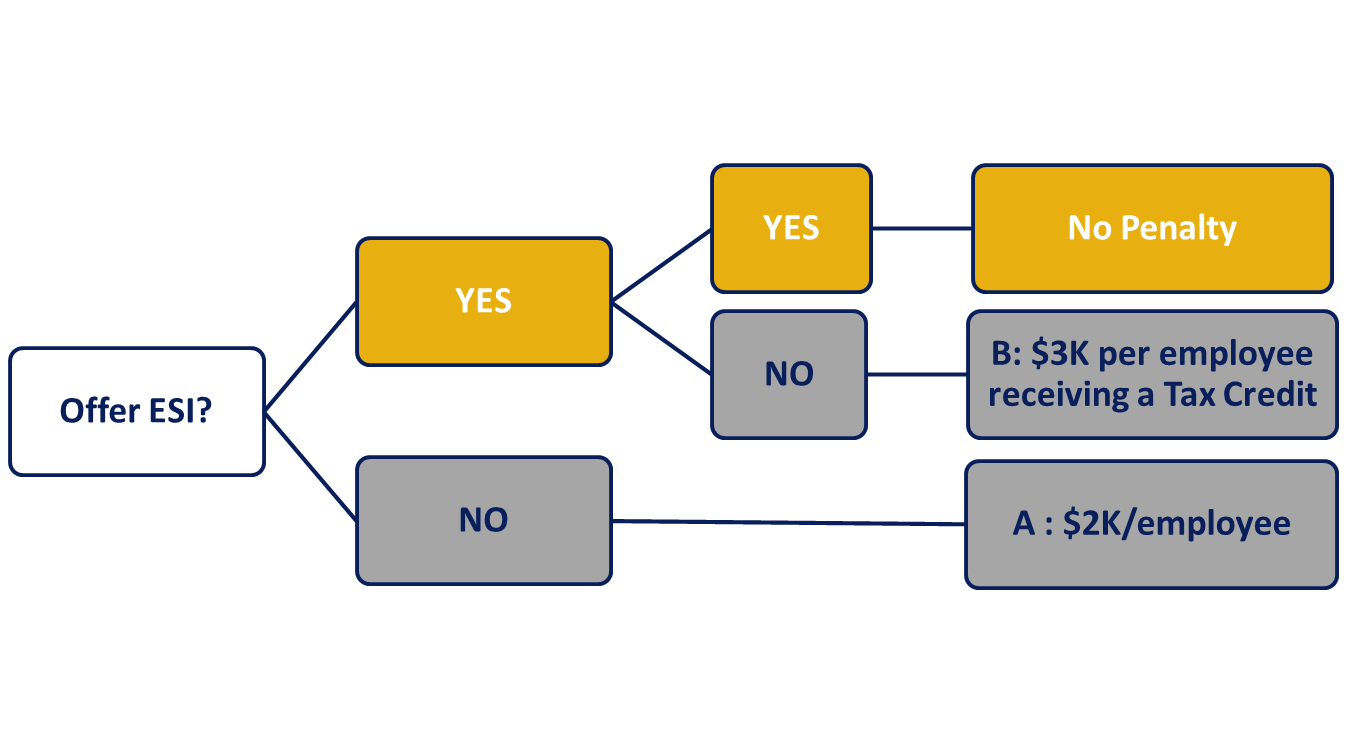

Employer Mandate (50+ FTEs)

•Penalties only apply if 1 or more full-time employee receives a premium tax credit in the exchange.

•Penalties do not apply to first 30 employees

•B penalty is capped at the amount of the A penalty (i.e., $2K/employee)

Costs employees less than 10% of their income? ("Affordable")

(And at least 1 employee used the tax credit)

About ~2 million gain coverage

through dependent mandate

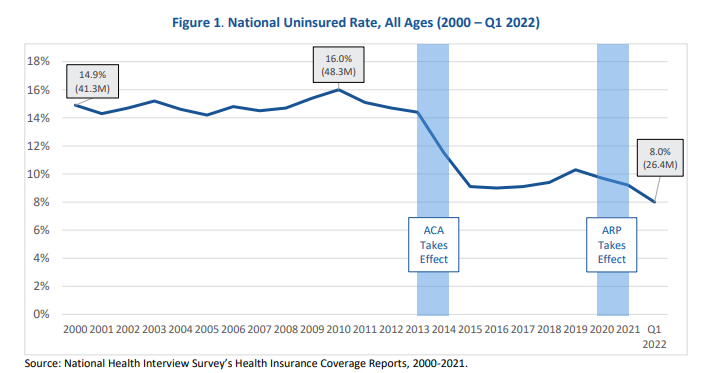

Overall Coverage Gains

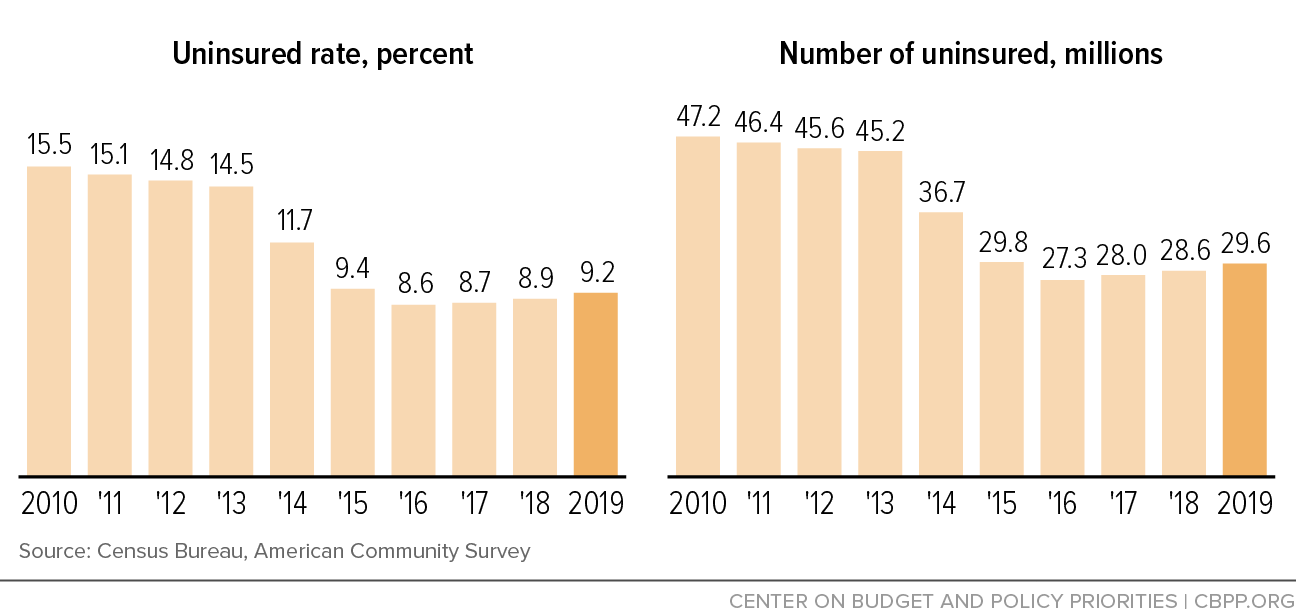

The number of people with insurance increased by more than 25 million between 2010 and 2022--but did not drop to zero!

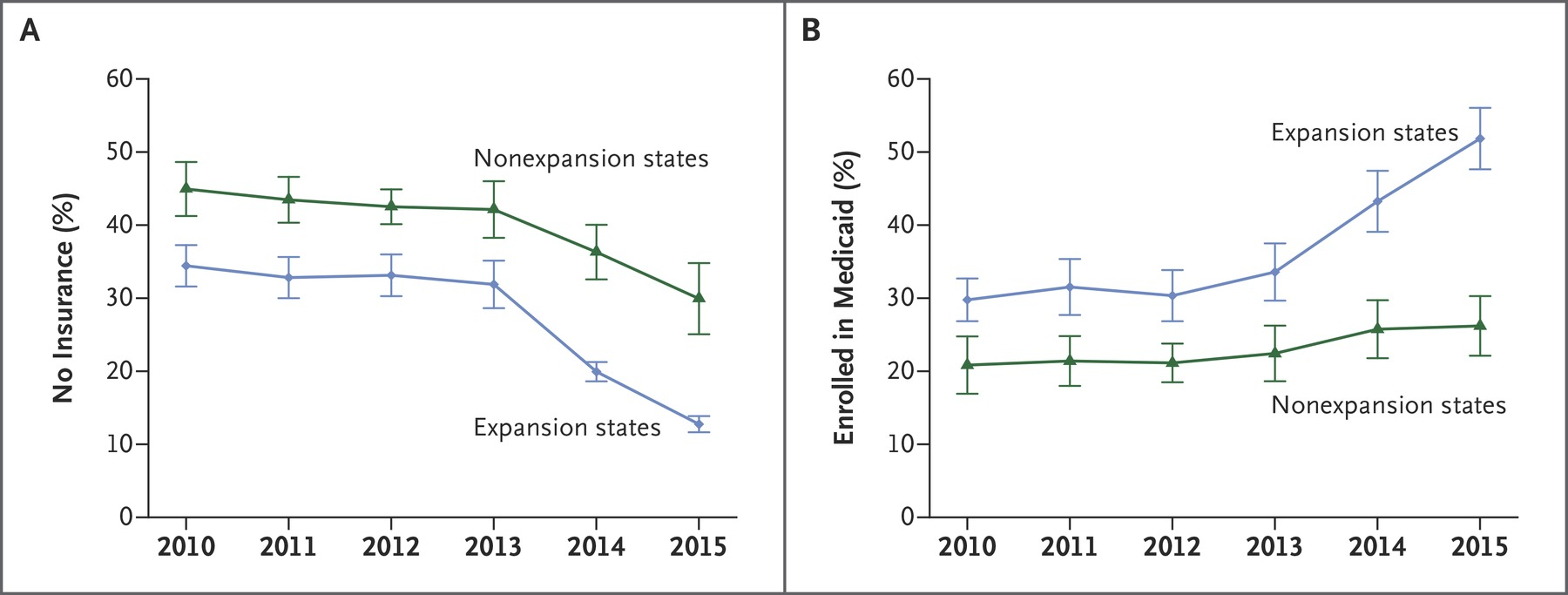

Coverage Gains Largest in states that expanded Medicaid

Sample among low income adults, Miller and Wherry 2016 New England Journal of Medicine

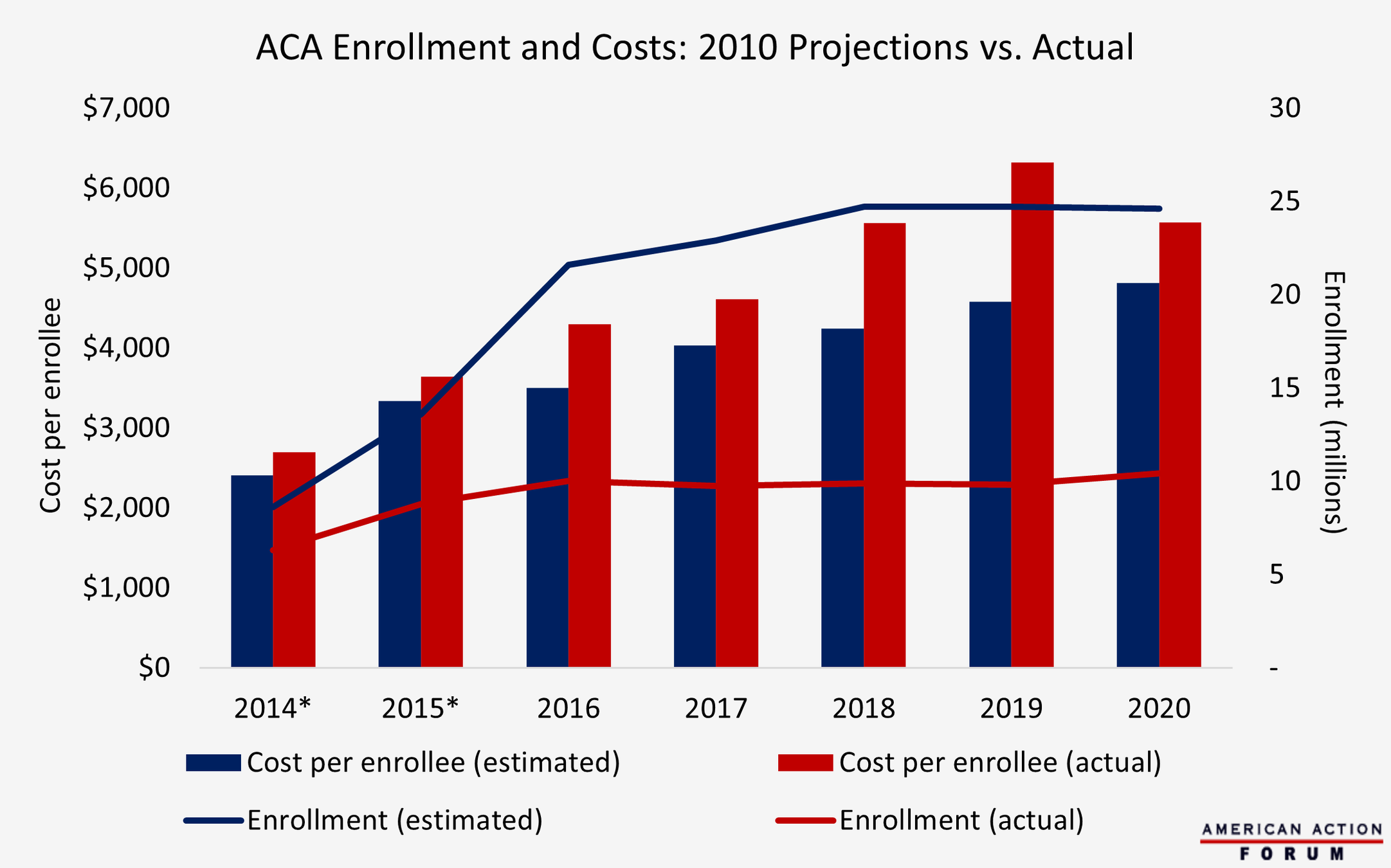

Marketplace Enrollments

Source: American Action Forum (CBO and Healthcare.gov Enrollment Figures)

Enrollment by Plan Type

Source: Healthcare.gov

Significant Premium Volatility

Which price is relevant...?

Recall--the listed premium isn't relevant for 85% of enrollees who are receiving subsidies (capped as % of income).

- For these consumers, net of subsidy premium has declined.

Risk Selection in Marketplaces

•More evidence of adverse selection in non-expansion states (Peng 2017), especially “direct enforcement” states that most strongly resisted the ACA (Kowalski 2016) and states that permitted non-compliant plans to continue to be sold (Lucia and Corlette 2017).

Stabilizing effect of the tax credits--reduces death spiral tendencies.

But for "higher end" products (Platinum plans) death spiral appears to have happened.

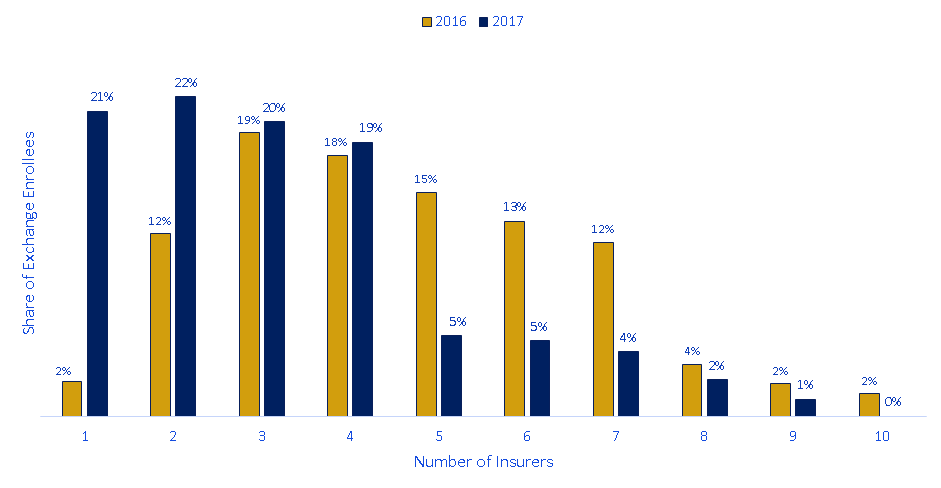

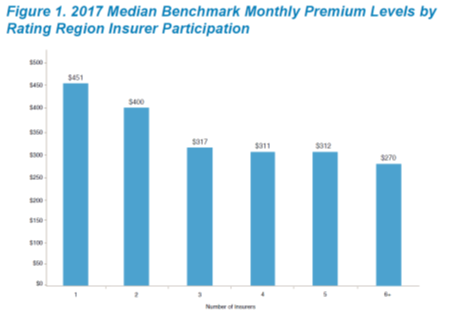

Competition on the Exchanges

About 20% of enrollees have only one insurance company offering plans--far from the "perfect competition" ideal

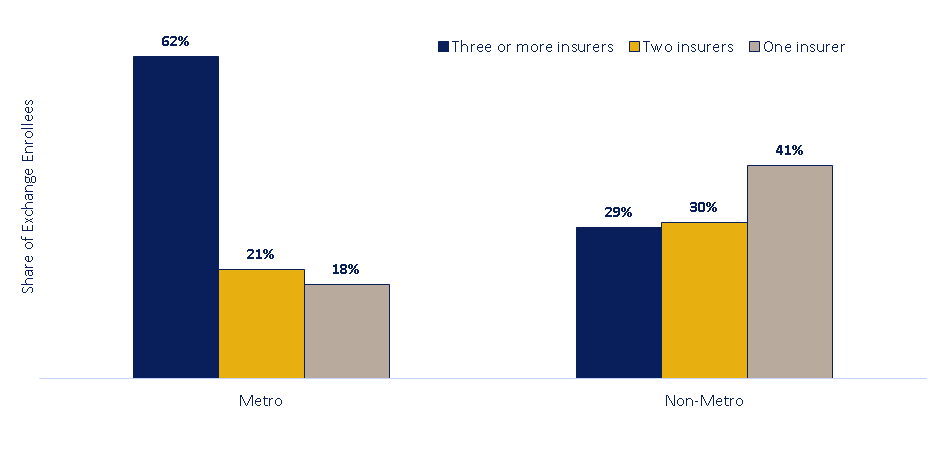

Competition on the Exchanges

This is worse in rural locations

Premiums are lower and more stable in markets with robust competition

Source: Holahan et al, Urban Institute Report, 2017

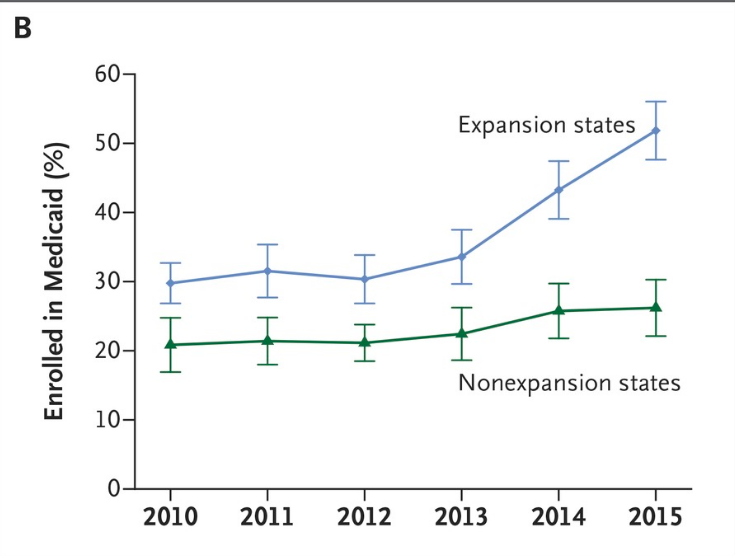

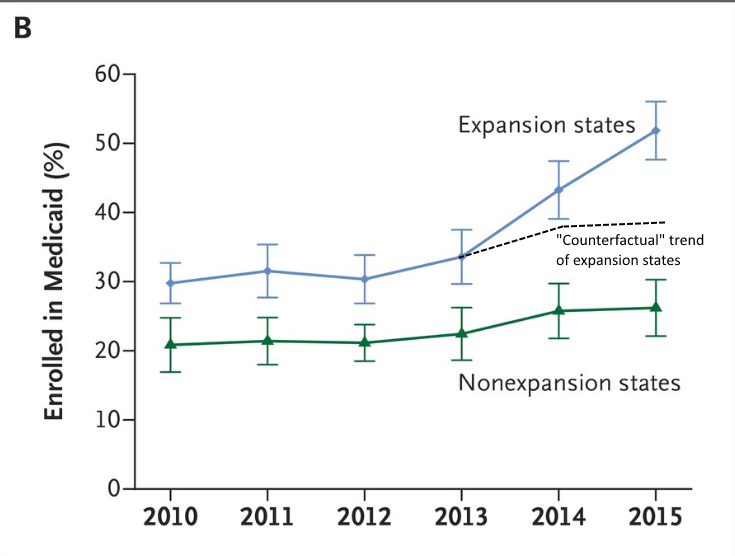

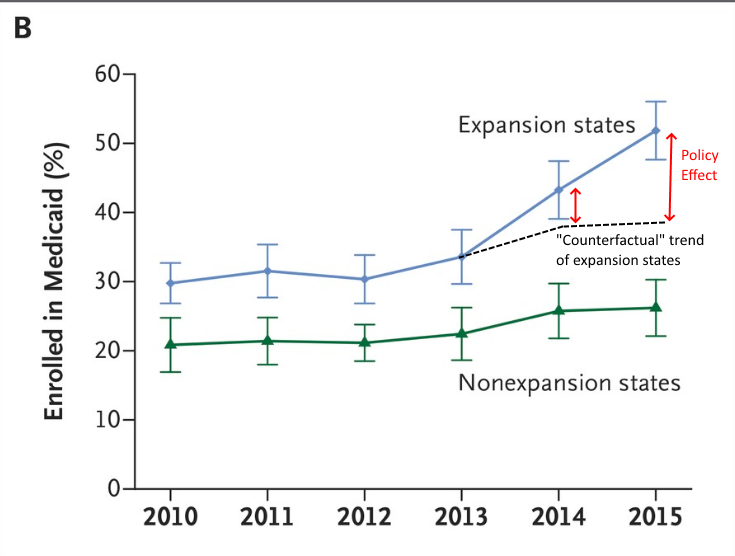

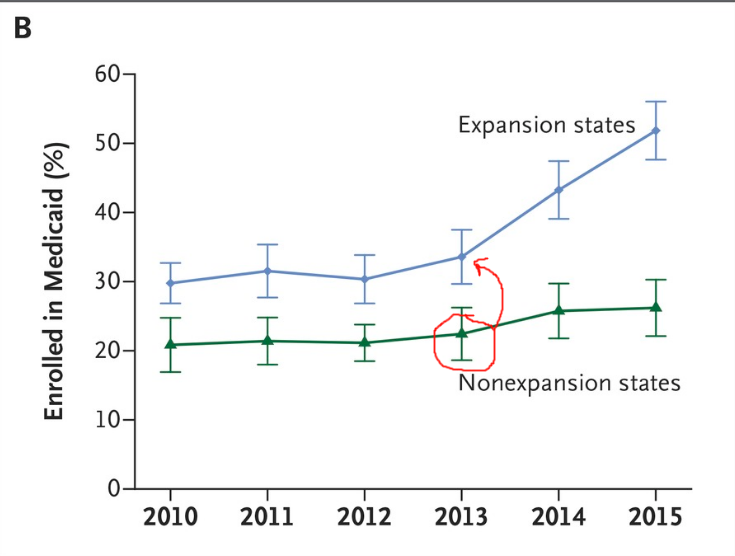

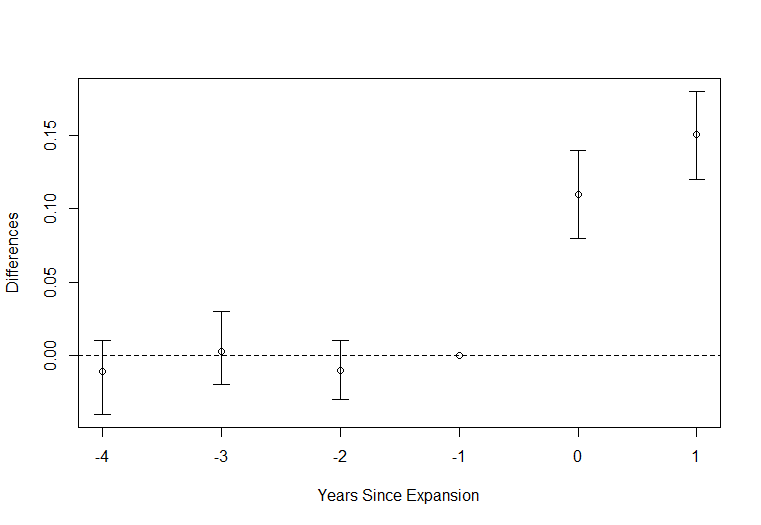

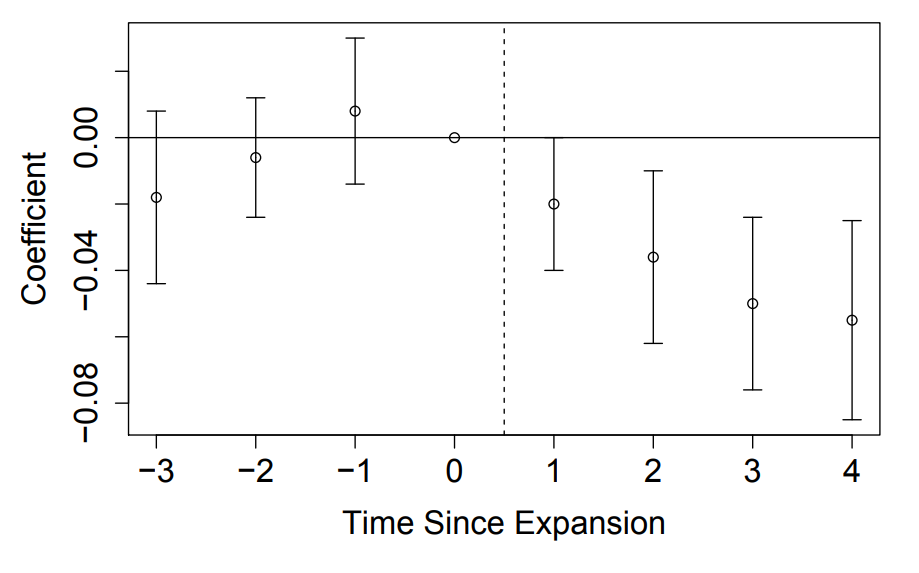

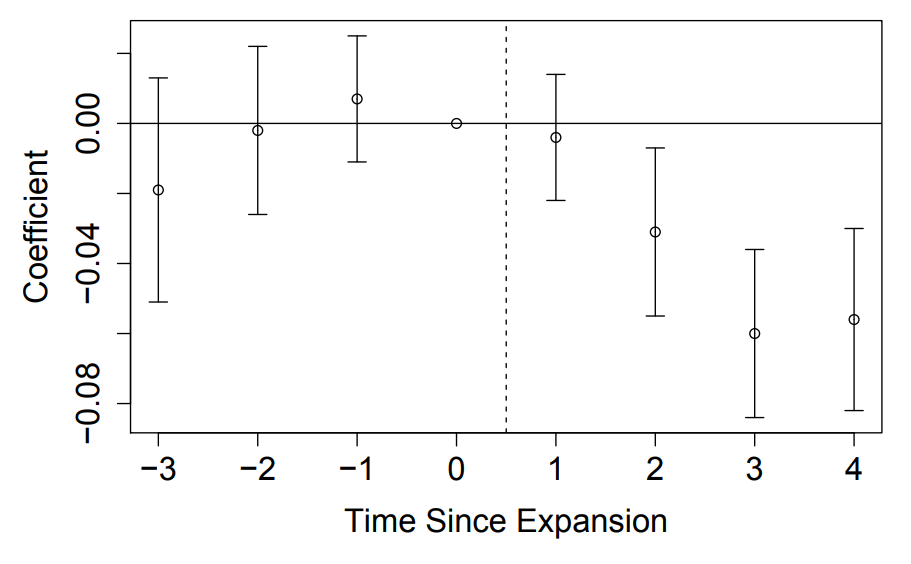

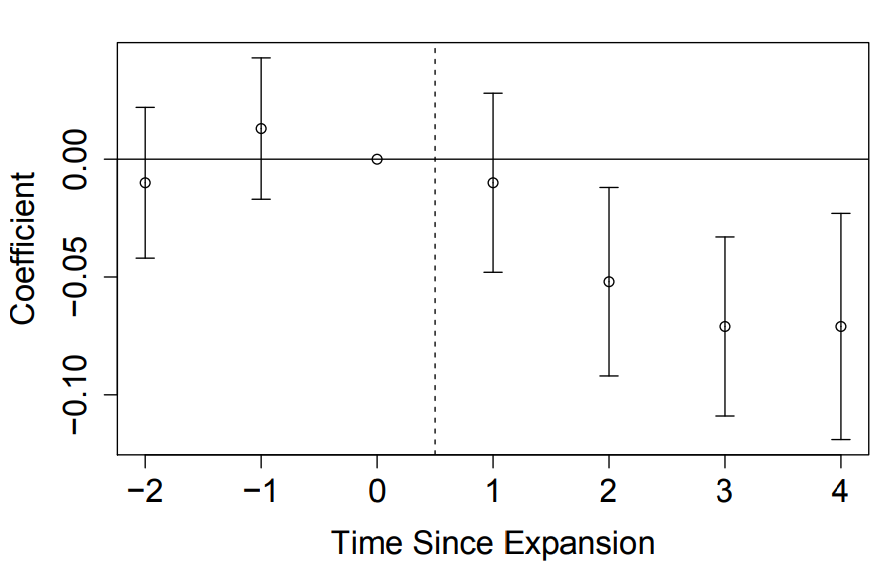

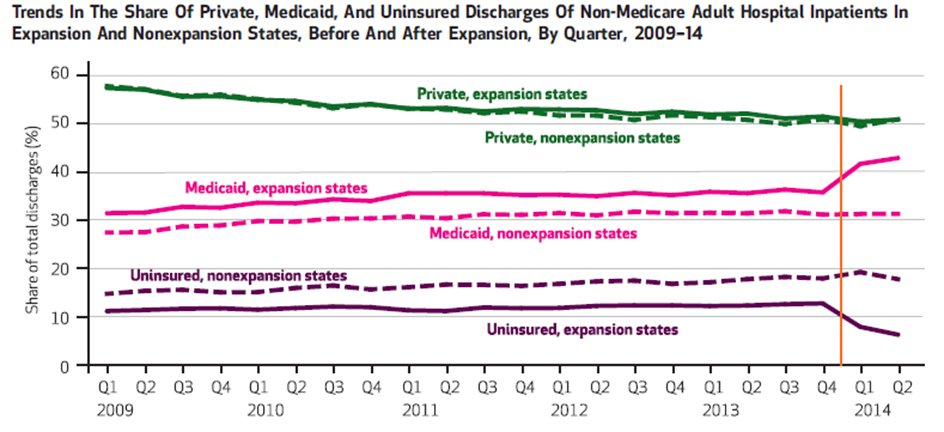

Medicaid Expansions

- Take advantage of non-universal adoption of the Medicaid expansion that resulted from the 2012 Supreme Court decision.

- Use a "difference in differences" quasi-experimental empirical design

Compare changes in outcomes across expansion and non-expansion states.

Expansion states and non-expansion states might be at different levels, but are they on the same trajectory?

Difference in Differences

Let's go back to this figure:

Difference in Differences

Let's go back to this figure:

Difference in Differences

Let's go back to this figure:

Difference in Differences

One way to represent this would be to subtract out the difference in one year (normalize to zero) and then plot the remaining difference.

Difference in Differences

Uninsured

For low income adults--probability of being uninsured went up in expansion states

(Miller and Wherry 2019 AEA P&P)

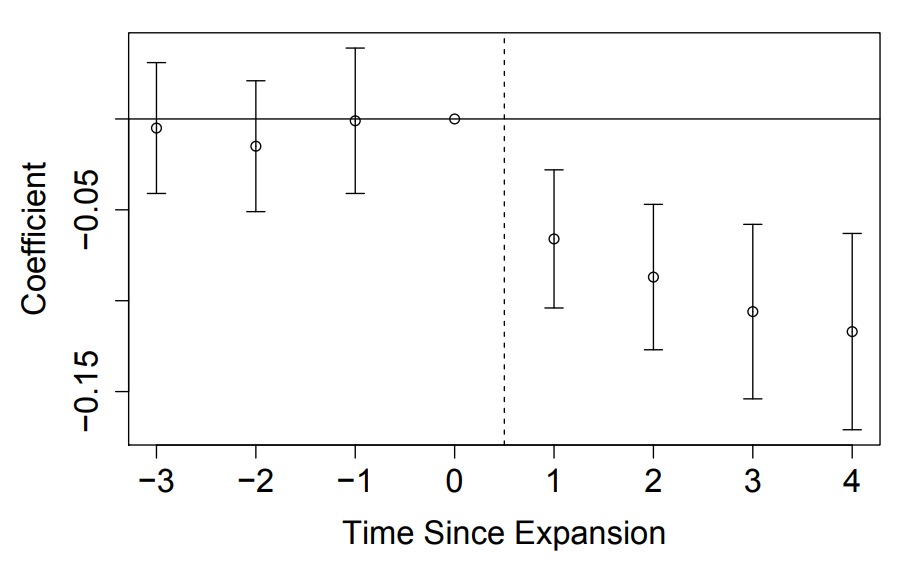

On Medicaid

For low income adults--probability of being on Medicaid went up in expansion states

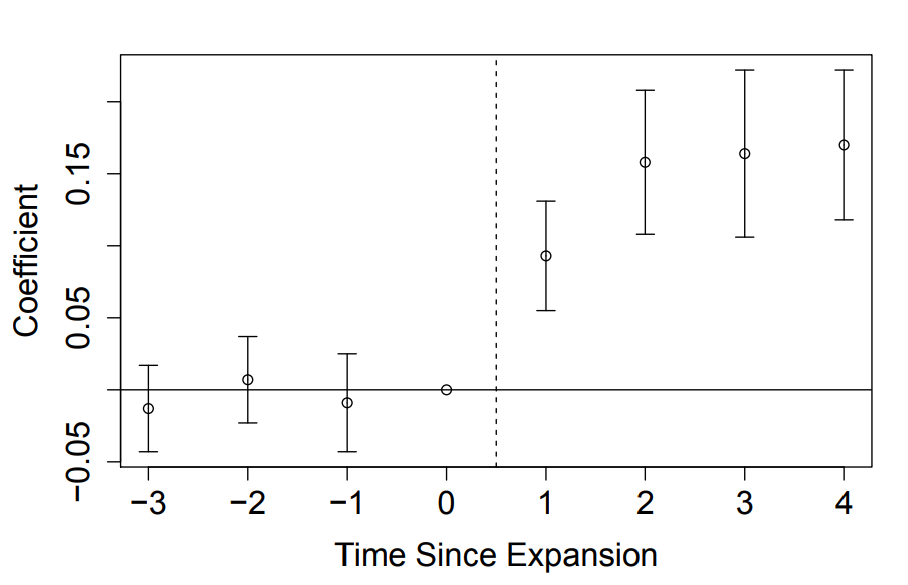

Privately Insured

For low income adults--probability of being privately insured went down in expansion states

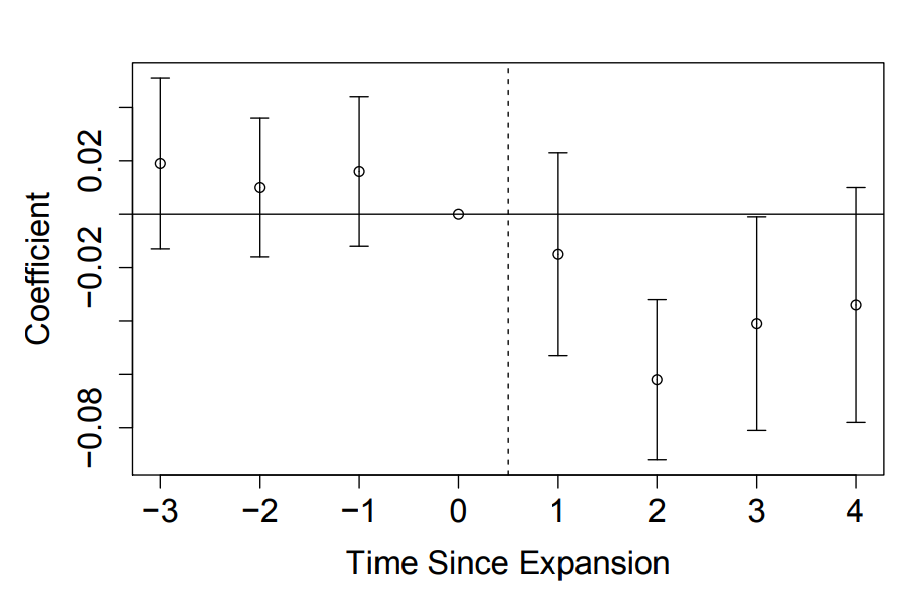

Needed Care but Couldn't Afford it

Delayed Care due to Affordability

Problems Paying Bills

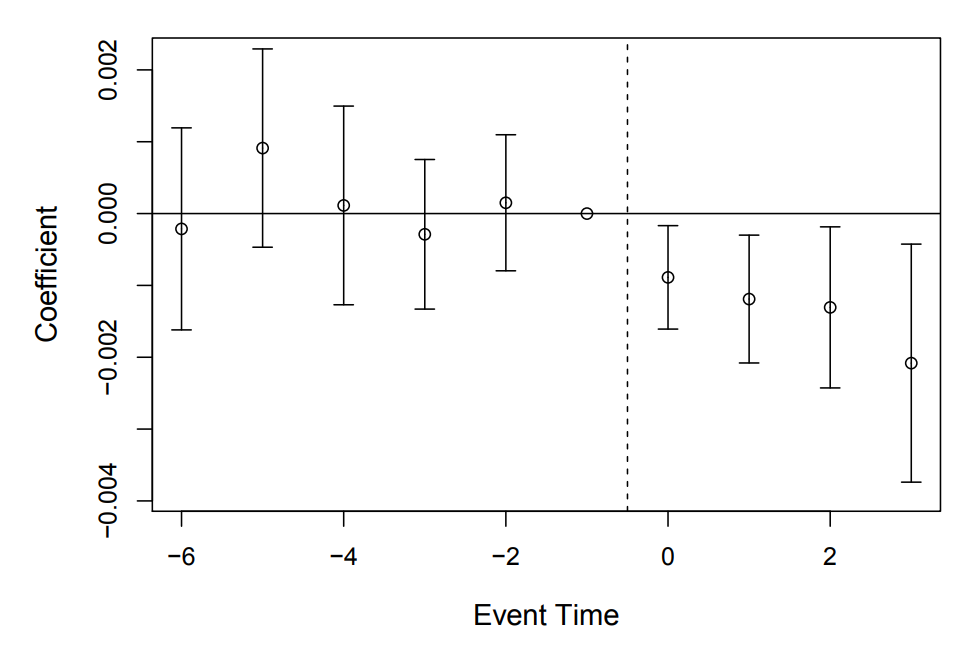

Mortality Effects

Reduction in mortality of about one tenth of a percentage point (about 9.4%). Implies 19,200 fewer deaths from 2014-2017 in expansion states (or ~15k excessive deaths in non-expansion states)

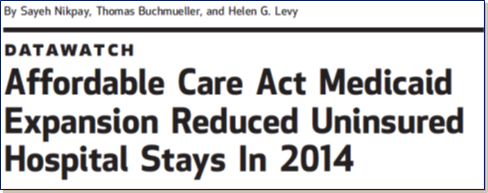

Effect on Providers

Because hospitals must accept all patients regardless of ability to pay, they are “insurers of last resort.”

- Each uninsured person generates an average of $900 in uncompensated care per year.

- 2013: hospitals provided ~$45 billion in uncompensated care

(~6% of expenditures)

Hospitals were advocates for reform and for continued Medicaid expansion.

Medicaid and Hospital Finances

Buchmueller et al. 2019

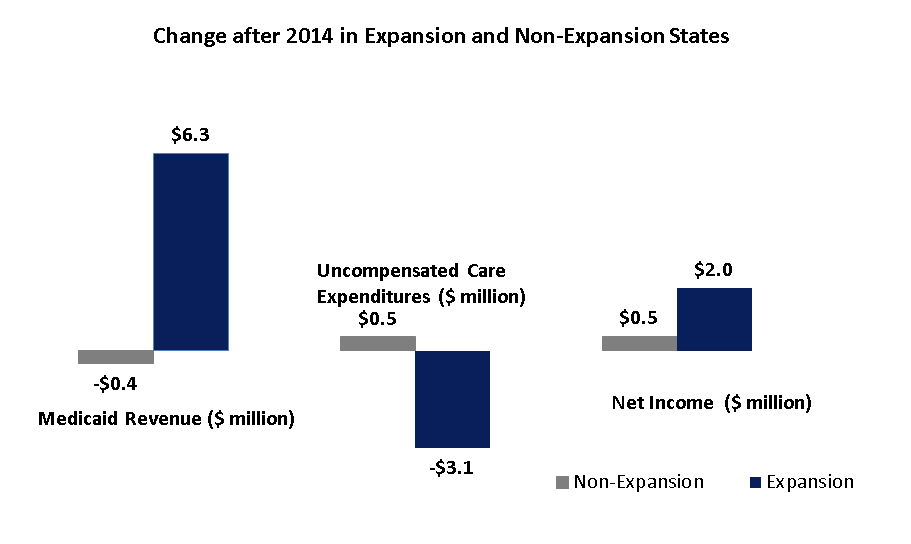

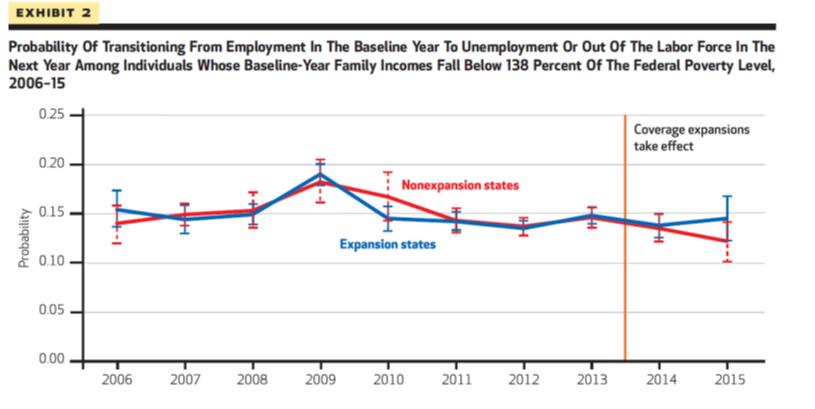

Potential Labor Market Effects

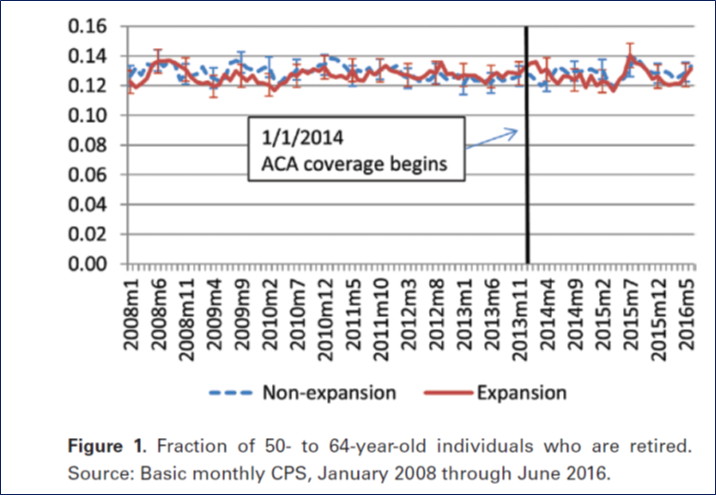

•The CBO projected that the ACA would reduce labor supply by roughly 2%. The largest effect was on retirement.

•Effects on labor supply could represent an improvement in labor market efficiency as job-lock is eased.

•Effects on labor demand may be inefficient if employers are distorting hiring to avoid cost of coverage (especially employers with 50 FTE+ who might get hit with a penalty).

So far, there is little evidence of effects on either supply or demand--this was a surprise to most economists.

Nothing going on with early retirement...

(Levy et al 2017)

Trump Administration Health Policies

Continued growth in Medicaid coverage

- During the Trump administration, 6 states (VA, ID, LA, NE, UT and ME) elected to expand Medicaid.

- Federal government has been much more permissive in issuing waivers, giving states more flexibility:

- Work requirements for Medicaid--but these have been struck down by the courts

- Allow "short term" health plans that don't follow ACA regulations

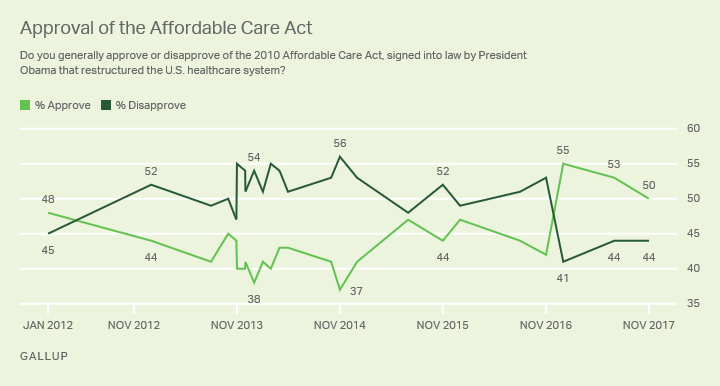

Make Obamacare Great Again

Ironically, more people seem to like the Affordable Care Act after President Trump's election...

Mandate Repeal

To reduce adverse selection, the ACA included an individual mandate to purchase insurance with a penalty if you did not purchase it. This was repealed for tax year 2017.

Appears to not have had that big of an effect:

- Relatively few tax filers paid the penalty: about 12m were "exempted," 6.7 paid penalty

- Some confusion about whether mandate was repealed (about 40% did not know in latest Gallup poll)

- Many enrollees are subsidized, which is larger than the penalty

Short-term plans

A "loop hole" to allow insurance companies to not cover pre-existing conditions or all essential health benefits (e.g., maternity coverage) is to let them offer "short term" plans which are exempt from this regulation.

- Only permitted to cover for 3 months under Obama admin; Trump admin allows them to cover 364 days, renewable 3 years.

- Much cheaper than exchange plans--about 1/3 the cost--but cover less and don't cover pre-existing conditions.

- There is a concern they will pulling healthy people off of the exchanges, setting off a "death spiral."

Coverage

Biden Adminstration

A variety of COVID-related policy made it difficult to untangle what exactly is driving changes in coverage--but higher insurance rate coverage ever reported was in 2022.

- COVID relief bill temporarily eliminated "jump" in premiums that occur once you hit the income cutoff

- Public health emergency meant no kicking people off of health plans, government subsidized coverage for recently uninsured

- Some extensions in Medicaid coverage (e.g. expand coverage beyond 60 days post partum for new mothers)

Biden Adminstration

Inflation Reduction Act: Negotiating drug prices in Medicare

How will this plan work?

What are potential issues that could arise?

What's Next?

What do you think policymakers should consider when it comes to government interventions in health markets in the future?

Future policies?

"Reinsurance"--encourage more insurance companies to offer exchange plans by having the government step in and cover the costs for patients who end up being particularly expensive.

AK, ME, MN, NJ, OR and WI all have applied to start such a program.

Government covers some fraction (e.g., 80%) of claims above some threshold (e.g., $50k)

Not cheap--Alaska has spent $55million on only 17k individuals, and expected costs to scale nationally are estimated to be about $38 billion.

Proposed solutions?

"Public option"/Medicare Buy-In:

Allow enrollees to "buy in" to Medicare at premiums that cover cost.

Medicare pays about 60% of what employer-sponsored insurance pays.

Forces plans to compete with Medicare

- on the plus side, lowers premiums (7-8% according to CBO in 2013)

- on the negative side, may drive some plans from the market and decrease choice.

Proposed solutions?

"Public" Medicare-for-All

Eliminate private insurance and replace it with Medicare.

- Everyone gets covered.

- People like Medicare when they get it.

- Market based solutions (ACA) haven't been as popular as drafters hoped.

- Private insurance is expensive, we could reduce costs by switching to public plan.

- Eliminates choice, less innovative

- Disruptive, providers won't be happy

Proposed solutions?

"Private" Medicare-for-All

Eliminate individual or employer sponsored private insurance and replace it with regulated private plans paid for by the government.

- Could cover everyone.

- Greater choice than "Public" Medicare for all (although potentially still less choice than current system).

Proposed solutions?

Market based approaches:

- Roll back regulations from ACA and allow market to provide greater range of products.

- Roll back Medicaid expansion and focus Medicaid coverage on the very needy or those with high health needs: pregnant women, poor children, disabled, elderly in nursing homes.

- Fewer people might choose to get covered, but those who got covered would have more options--"skimpier" but cheaper plans available might induce some currently uninsured to buy in.

- Pursue other (non-coverage related) policies like tort reform, reducing regulations and restrictions that could potentially lower costs.

- Reduce preferential tax treatment of ESI and replace it with advanceable/refundable credit

Proposed solutions?

Market based approaches:

- Improve price transparency

- CMS issued rule that hospital prices for 300 "shoppable services" must be posted

- This would include what price each insurance company pays

- AHA sued, saying these negotiated rates were confidential

- Judge ruled against AHA--Prices were required to be posted Jan 1, 2021, but many hospitals have not complied

State question:

Did your state expand Medicaid under the ACA?

Any other responses to the ACA you uncovered?