Competition in Health Care

BE 608

Start recording

Payment Reform Model Project

- A few people didn't sign up for a group--I assigned them to a group.

- Mutually beneficial swaps are permissible but make any changes soon--the end of the semester is upon us.

- This is under the "People" tab in Canvas.

- Hopefully you have looked into your reform by now and gotten a rough idea of what is going on

As you conduct your research, it would be great if you could send me one or two articles that you found helpful in summarizing the reform so that I can post them for your classmates.

Health Affairs, JAMA, New England Journal of Medicine are great sources, so keep your eyes out for papers in these journals.

Payment Reform Model Project

- Each team should prepare a short (10-12 minutes) presentation summarizing the reform, its goals, and its successes and failures.

- Send me slides by 3pm the last day of class

- I will use a random number generator to select one of the two groups to go for projects with more than one group assigned.

- The second group will discuss the first group's presentation

Homework assignments

- Grades posted

- Class average was about 88% (great job!)

- You can see my comments for you (if I had any) on the canvas assignment tab.

- If you got below ~7 you might want to revisit the lecture notes from lecture 2, or leaf back through your BE 502 or microeconomics notes.

Did your state expand Medicaid under the ACA? Any other reactions to the Affordable Care Act?

Outline

•Recap: How is Health Care Different?—The Case of Hospitals

•Mergers and Consolidation in the Hospital Industry

•Anti-Trust Policy in Health Care: Three Seminal Cases on Hospitals and Recent Anti-Trust Activity in Insurance Markets

•New Forms of Vertical Integration: CVS and Aetna

Health Spending Differences

•“It’s the Prices Stupid,” Reinhardt, Anderson, Hussey and Petrosyan, Health Affairs, 2003

•“Resource Allocation in Health Care: The Allocation of Lifestyles to Providers,” Reinhardt The Milbank Quarterly

“… the allocation of resources in health care is seen to emerge from bargaining over the distribution of economic privilege among members of society.”

“…is the commodity “health care” sufficiently similar to the imaginary widgets, gidgets, gadgets, or gloobs to let a freely competitive

market arbitrate the inevitable conflict over resource allocation…?”

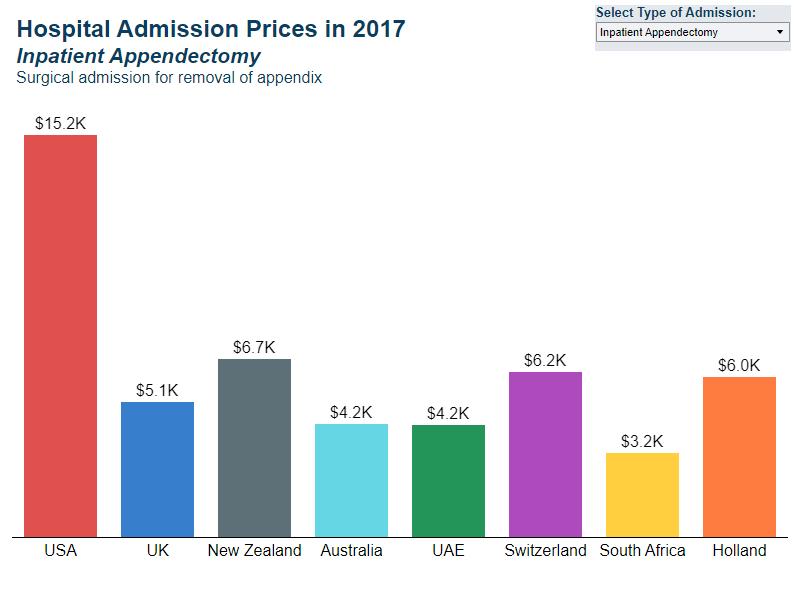

Recap: Hospital Prices in the US

Appendectomy

C-section

Do High Hospital Prices Reflect Market Failure?

How does the hospital market deviate from perfect competition?

How might this explain the higher prices observed in the US?

Why would prices be higher in the US?

Health Care Prices in the US

Negotiate rates

- What leverage does each side have?

Health Care Prices in the US

Negotiate rates

Choose among providers--based on what?

Health Care Prices in the US

Negotiate rates

Choose among providers

Competition among insurers affects mark-up above claims.

Provider Competition

•Competition in markets takes place in 2 stages.

Stage 1: hospitals & insurers negotiate over network inclusion & price.

Stage 2: Hospitals compete for patients (not typically on price).

•Negotiated prices will depend on:

~ importance of provider is to insurer’s network

~ willingness of insurer to steer patients elsewhere

The balance of power has changed over time.

Pre-Managed Care Era

•Fee-for-service indemnity insurance predominated.

~Insurers were passive: little or no negotiating

~Plans covered “all willing providers”, paying “usual, customary and reasonable” fees

•Hospitals competed via a “medical arms race.”

~High tech capital, non-clinical amenities as a signal of quality

~Cost-based reimbursement => excess capacity & incentive for over-use

This led to high spending, spurring the rise of managed care.

Managed Care Revolution

•Insurers began using supply-side strategies to lower costs.

~Aimed at lowering both P and Q

•Utilization review used to control costs by reducing quantities

~Reducing admissions, unnecessary tests and procedures

~Managing care = saying no

•Negotiating lower prices with providers

~Selective contracting: offering volume in return for lower prices

Post-Managed Care "Revolution"

Gains from managed care were not sustained. There were several factors behind the “managed care backlash.”

1.Employers wanted broad networks

2.Provider push-back

3.Provider consolidation

Hospital Mergers and Acquisitions

Source: Kaufman Hall Transactions Data

Number of Hospitals in Health Systems, 2004-2014

Number of Beds and Beds per Population

Benefits and Costs of Mergers

What are potential benefits of mergers?

What are potential costs of mergers?

Trends in Hospital Payments by Payer

Selden et al Health Affairs 2015

Market Concentration and Anti-Trust Enforcement

Mergers increased market concentration, as measured by the Herfindahl-Hirschman Index (HHI).

HHI > 2,500 is considered highly concentrated.

2,500 = 4 equal firms

5,000 = duopoly

10,000 = monopoly

DOJ/FTC Guidelines: in highly concentrated markets, mergers that raise HHI by 100+ points merit scrutiny.

Market Concentration

From Cutler &Scott-Morton’s analysis of 306 Hospital Referral Regions:

•Competition in a “typical” market:

~1980s: 5 major competitor + smaller players.

~2011: 1 dominant system, 2-3 fringe players.

On average, top 3 systems accounted for 77% of admissions.

Market Concentration

Cooper et al. 2019

- 16% of hospital markets are monopolies

- 19% of hospital markets are duopolies

- Only about half have at least 4 players

Prices in monopoly markets are about 12% higher than in markets with 4+ players

Monopoly hospitals are less likely to enter into risk-sharing contracts with insurers

Hospital Anti-Trust

In the past 30+ years, there have been more anti-trust trials in health care than any other industry.

•1984-1994: FTC/DOJ won 5 of 6 merger cases

•1994 – 1999: FTC/DOJ lost 8 consecutive cases

•2002: FTC began retrospective review of consummated mergers

•Since 2005: several mergers successfully challenged, but many go through

-4 hospital mergers blocked in last 2 years

-Anti-trust cases against hospitals with anti-competitive practices (Sutter Health)

Between 2010-2017: 561 successful hospital mergers

General Principles of Antitrust Enforcement

•In all industries, competition benefits consumers

~Lower prices

~Better quality products and services

~Increased choice, selection, convenience and innovation

•The antitrust agencies (FTC and DOJ) challenge mergers that reduce competition sufficiently to harm consumers.

•Actions are grounded in economic analysis.

~Will a merger create market power that will lead to higher prices or lower quality?

Antitrust laws protect competition not competitors.

How did we get here? Three Cases

•Grand Rapids, MI: Butterworth-Blodgett merger, 1996

•Evanston, IL: Evanston Northwestern-Highland Park merger, 2000

- Utah: St. Luke’s acquisition of Saltzer medical group, 2012

Butterworth/Blodgett Merger

The Grand Rapids market, 1995

•Butterworth (529 beds)

•Blodgett (515 beds)

•St. Mary’s (230)

•Metropolitan (238)

Butterworth and Blodgett propose to merge and form

Butterworth/Blodgett Merger

Pre-merger HHI: 2863

Post-merger HHI:5247

The Grand Rapids market, 1995

•Butterworth (529 beds)

•Blodgett (515 beds)

•St. Mary’s (230)

•Metropolitan (238)

Butterworth/Blodgett Merger

•Court accepted FTC’s market definition and HHI analysis

~Agreed that merged entity would have “substantial market power”

•Defendants made two main arguments:

1.Consolidation would produce efficiencies

~Reduce duplication

~Both hospitals were about to make major capital investments

2. Hospitals were non-profit and would not exploit market power

~Efficiencies would be passed on to the community

Hospital Ownership, 2016

Source: CMS

Hospital Markets

What do non-profits maximize?

Hospital Markets

•Possible models of non-profit behavior

~Altruistic, maximizing social benefit?

~For-profits in disguise?

•Neither model fits perfectly, though non-profits look more like for-profits than public hospitals.

~Provide the same (low) amount of charity care

~May have a stronger preference for volume than for-profits

~Charge higher prices when they have market power

Hospital Markets

Court ruled in favor of the defendants

•Spectrum signed a “Community Commitment” promising to limit price increases for 7 years to no more than regional inflation.

•Not clear efficiencies were realized

•Prices did not increase beyond what was promised in the first 7 years, but were increased 12% in the first year after the agreement was lifted.

No guarantee that Spectrum hasn’t exploited market power since

~Spectrum may have competed less vigorously on other dimensions

~Merger led to consolidation in physician market

~Merger may have distorted competition in insurance market (Spectrum owns Priority Health)

Evanston Northwestern/Highland Park Merger

Evanston Northwestern Healthcare

- Evanston Hospital (400 beds)

- Glenbrook Hospital, Glenview IL (125 beds)

Highland Park Hospital (200 beds)

- 14 miles north of Evanston

Merger in 2000 was not challenged by anti-trust agencies.

FTC Retrospective Review

Prospective analysis of mergers is difficult

•Research is limited by a dearth of data on transaction prices.

•Merger effects must be predicted based on theory and simulation models

•Even when models are not sensitive to assumptions, they can be disputed

FTC Retrospective Review

2002: FTC decided to review the results of past mergers

•Analysis could be done using actual transaction prices

•Provides direct evidence on price effects

•Provides a test of the econometric models

Results show large price increases after Evanston/Highland Park and other consummated mergers.

FTC Retrospective Review

Evanston/Highland Park Merger

In 2005, FTC staff challenged the merger.

Their analysis of actual prices showed that average prices paid by managed care companies increased by nearly 50%.

Internal documents and testimony corroborated this.

- Highland Park CEO: “it would be real tough for any of the Fortune 40 companies in this area whose CEOs either use this place or that place to walk from Evanston, Highland Park, Glenbrook and 1,700 of their doctors.”

- Testimony from MCOs: prior to merger, plans could play one hospital off against the other to get lower prices.

Evanston/Highland Park

•Court ruled in favor of the FTC. But, several years after the merger the “eggs could not be unscrambled.”

•Key result: Court accepted FTC’s argument that the relevant market definition is based on Stage 1 negotiations between payers and hospitals, not patients’ choice of hospitals.

•Instead of divestiture, the two hospitals were required to negotiate separately with insurers.

The St. Luke’s/Saltzer Case

St. Luke’s Health System

Largest system in Idaho

- Multiple hospitals

- 600+ employed physicians

- Acquired over 20 PCP practices since January 2008

2012, entered into an agreement to acquire Saltzer Medical Group

The St. Luke’s/Saltzer Case

Saltzer Medical Group

•Largest independent group with 40+ physicians

•Headquartered in Nampa, ID

•Largest group of PCPs in Nampa

Combined entity would have controlled 80% of PCP market

2013: Deal challenged by FTC & Idaho Attorney General

The St. Luke’s/Saltzer Case

How is this different from the previous two examples?

Vertical Consolidation in Health Care

Potential Effects of Vertical Integration

Possible Benefits? Possible Costs?

Potential Effects of Vertical Integration

Benefits:

•Better care coordination

•Administrative scale economies

•Facilitates investment in IT

•Reduced admin burden on providers

Better health outcomes at lower cost

Potential Effects of Vertical Integration

Potential Costs:

•Higher private prices

•Patients diverted to higher-cost hospitals

•Increased Medicare spending due to facility fees

Higher spending without necessarily producing health gains

Physician Prices by Market Share

Source: MedPac, Report to Congress, June 2017

Medicare Spending by Location

Source: Avalere Health, “Medicare Payment Differentials Across Outpatient Settings of Care," Feb. 2016

St Luke’s/Saltzer: The Arguments

Defendants claimed that merger

•was necessary for improved clinical integration and quality-improving investments like electronic health record.

•would lead to savings from improved efficiencies.

•But, internal documents contradicted these arguments

St Luke’s/Saltzer: The Arguments

Government countered that

•Clinical integration could be achieved other ways.

•Past acquisitions of practices had not produced savings.

•Past acquisitions had led to higher negotiated prices.

The Court ruled for the government.

What about the insurer side?

Just four insurance companies--United Healthcare, Aetna, Cigna, and the Blues (Blue Cross and Blue Shield Association)--control almost 90% of the market share of private insurance.

What is good and bad about market concentration in insurance markets?

Insurer Mergers

In 2015, Anthem struck a deal to acquire Cigna.

- This merger would create the largest health insurance company in the United States.

Challenged by DOJ as anti-competitive

Anthem/Cigna

Strongest argument from defense:

- Larger insurance companies needed to compete with ever growing providers.

- Merger will allow Anthem/Cigna to negotiate more favorable rates, that would be passed on to customers.

- Analysis from Anthem showed that merger would allow the new entity to reap $2.4 billion in reduced provider payments--lowering health care costs.

Anthem/Cigna

Government's argument:

- New entity would have substantial market power--making it unlikely that the company would "pass the savings on" to customers.

- Previous merger of Aetna and Prudential in 1999 did result in lower payments from providers--but also led to higher premiums for patients.

Ultimately the court blocked the merger, which was abandoned (after appeal) in 2018.

Humana/Aetna $34 billion merger deal also blocked by courts in 2017.

More Vertical Integration

Insurance companies are not just concerned about negotiating with hospitals. Drug prices have been an increasing portion of medical spending and are likely to increase over time.

A new type of vertical integration proposed between health insurance companies and pharmaceutical benefits management companies (PBMs) :

- $69 billion purchase of Aetna by CVS

- $52 billion Cigna-ExpressScripts merger.

Both passed regulatory hurdles and completed acquisitions in 2018.

Insurance and pharmacy mergers

Most large companies keep prescription drug coverage separate from medical coverage.

- Use larger company, like CVS or ExpressScripts, to negotiate with pharmaceutical companies who naturally have more market power.

- But CVS also gets a cut of the drugs they sell--maybe they don't have an incentive to negotiate that hard? Do they really pass on all of the savings to the insurer?

- Merger hopes to align these incentives.

- Also costs of drugs and cost of other medical care interact--creating "externalities."

- E.g., Medicare plans that have medical and drugs together charge less money for drugs that keep patients out of the hospital (Lavetti and Simon 2017).

Insurance and pharmacy mergers

Deal is good for CVS too:

- Get Aetna patients "in the door" can expand their retail customer base

- Encourage Aetna patients to use their "Minute Clinics"

- Take Minute Clinics beyond just immunizations/acute episodes and into more complex services like chronic condition management.

Possible problems?

Insurance and pharmacy mergers

On the other hand, now that Aetna has "locked in" CVS as a benefits manager--will that give them an unfair edge in the insurance market?

- Aetna's competitors also use CVS to manage their drug plan

- Is CVS/Aetna really going to want to give their competitors good deals?

- Makes it harder for new insurance companies to enter.

- Over time, less competition can mean higher premiums.

The pharmacy market is also totally concentrated--dominated by CVS and Walgreens--will it be good for consumers to give one of these entities even more market power?

State Question!

What do hospital and insurer markets look like in your state?

Has there been a change (e.g. a big merger)?

Was there a policy response (FTC or DOJ law suit or other action by the state)?