Applied

Microeconomics

Lecture 17

BE 300

Plan for Today

Value of Innovation--Competition v. Monopoly

Network Effects

Positive and Negative Externalities

Coming Up

Chapter 11 intro and Ch 11.1

Chapter 12 intro and Ch 12.1-12.2

Market Structure & Incentives to Invent

Let's look at two types of markets: perfect competition and monopoly.

•a single inventor is considering investing in R&D in order to achieve a cost-reducing invention of a particular size.

•The inventor is not concerned about competition from other inventors, and enjoys complete protection from imitation.

What are the payoffs to invention in the competitive case and in the monopoly case?

Market Structure & Incentives to Invent

New Product (often from R&D)

New Process lowers production costs

“Minor invention”: costs drops may not be big enough to induce price reductions

“Major invention:” drive out previous (incumbent) tech

Results in price reduction

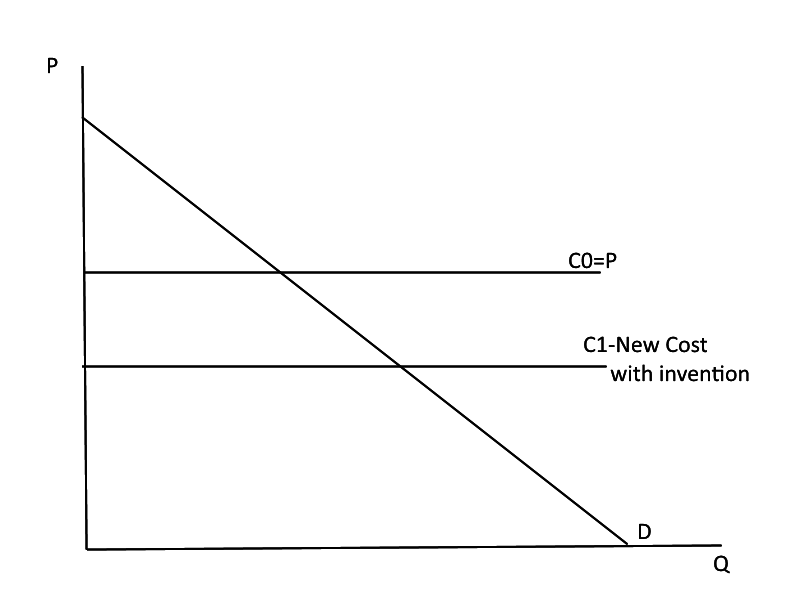

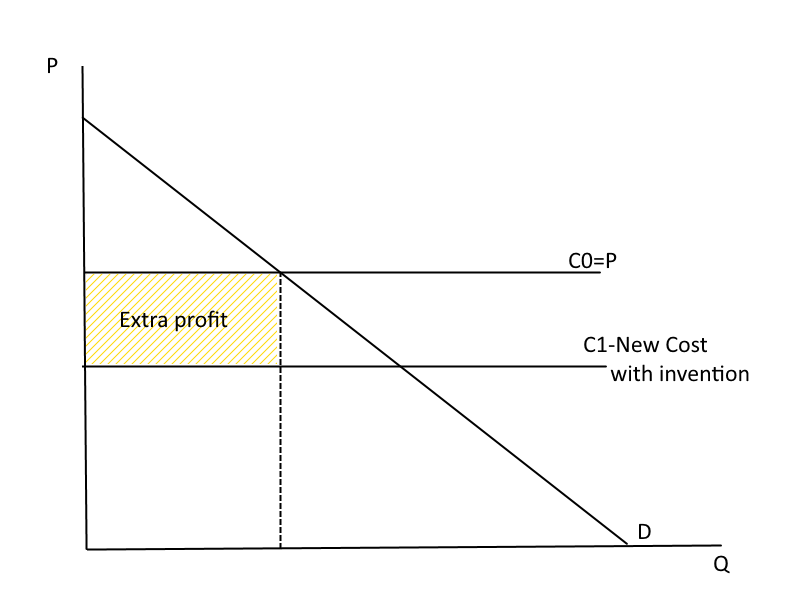

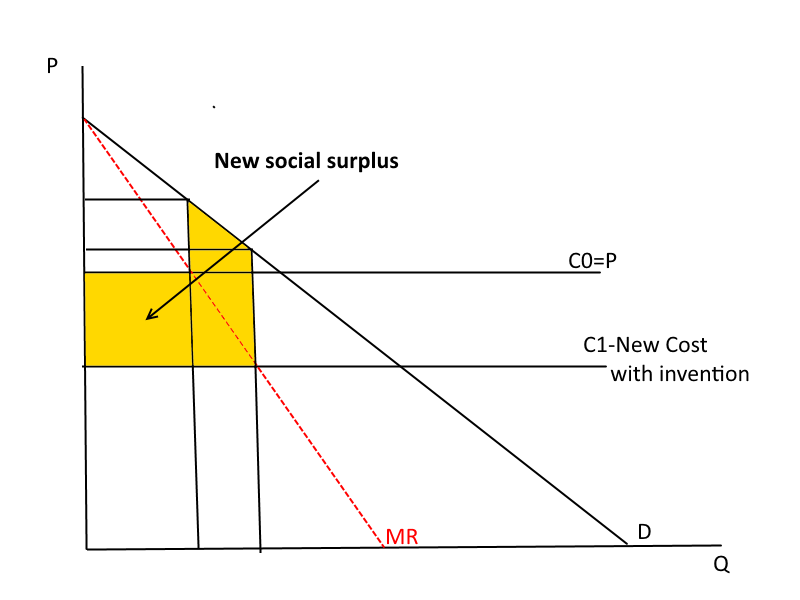

Perfect Competition

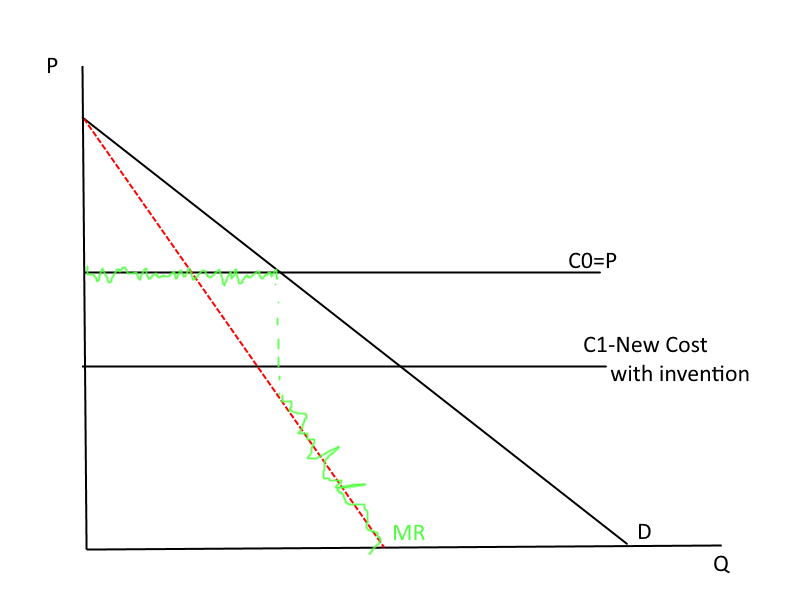

Perfect Competition--everyone else has cost C0, but the innovator has cost C1. What is the advantage to the innovator?

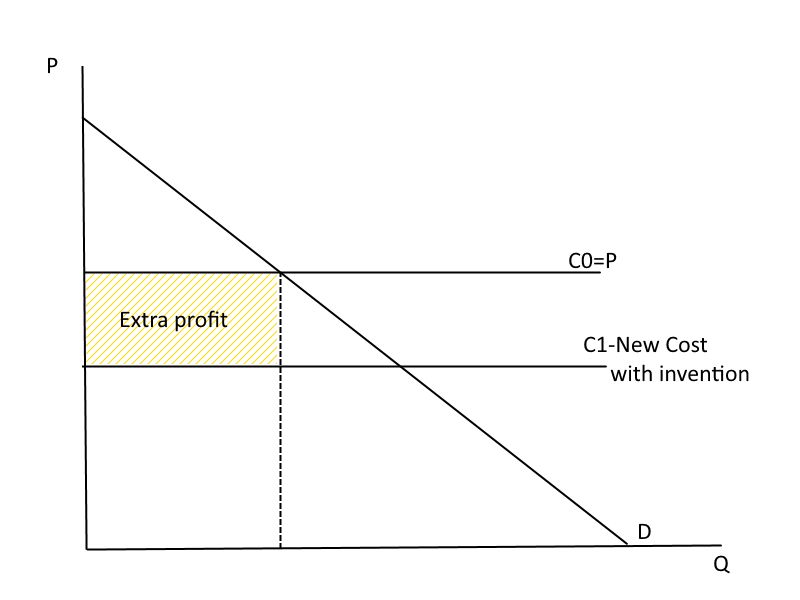

Perfect Competition

Same Q, but lower cost. But wait--why not increase Q?

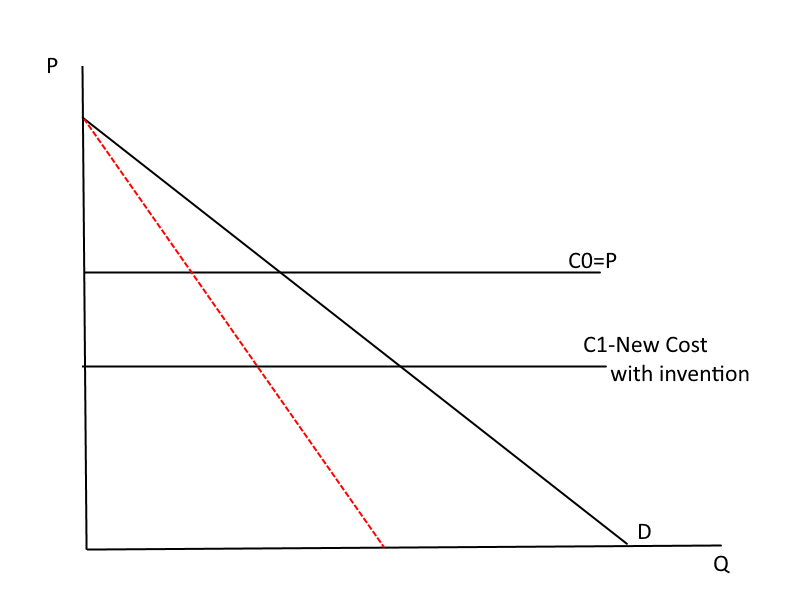

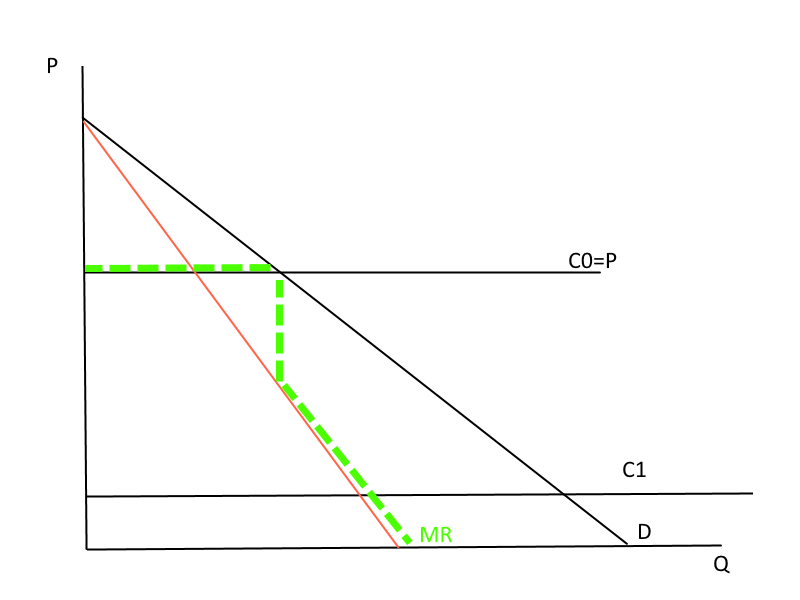

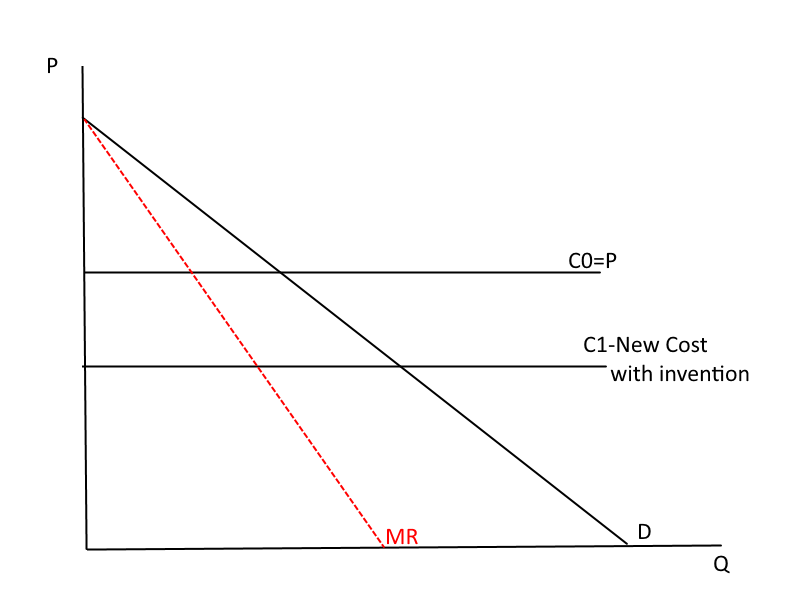

Perfect Competition

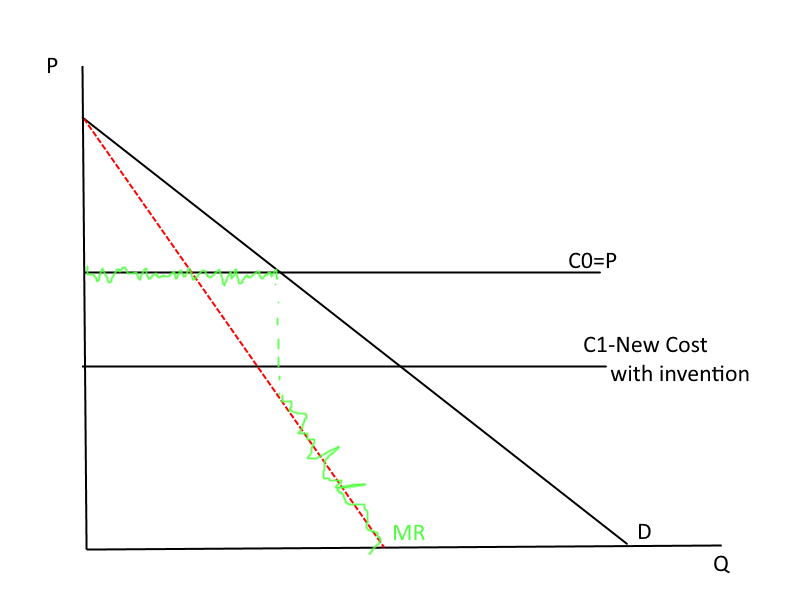

Change in revenue associated with changing the price. Why not charge price where red line = C1?

Perfect Competition

The innovator could sell more by lowering the price--but the MR would be below MC (C1)--so his/her profit is higher if he/she stays at the old quantity and price.

(A Better Picture)

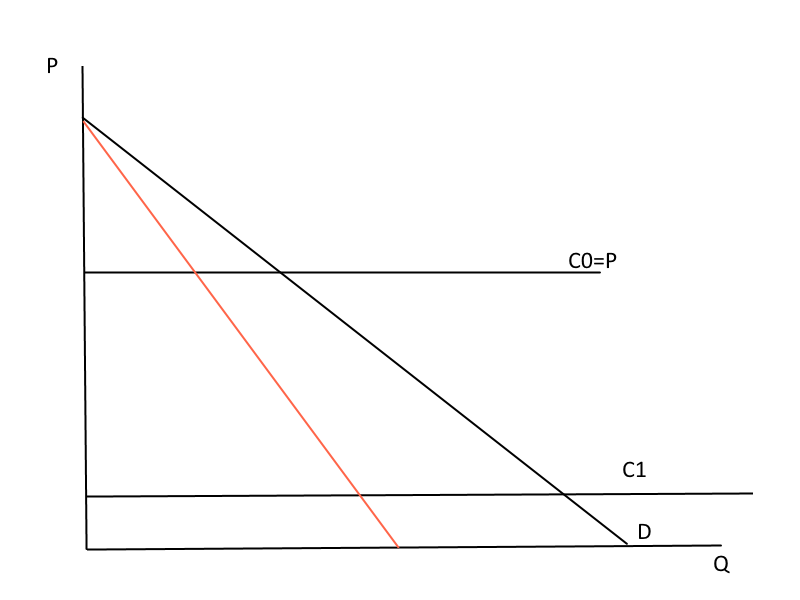

Perfect Competition

Put differently--the innovator does better by remaining in the "perfect competition" world but reaping the benefits of being exceptionally low cost.

Perfect Competition

What if innovation is so extreme that it lowers cost to C1?

Perfect Competition

Now it makes sense to lower price--what will the new price be? What will happen to the rivals?

Perfect Competition

Let's focus on this case for now.

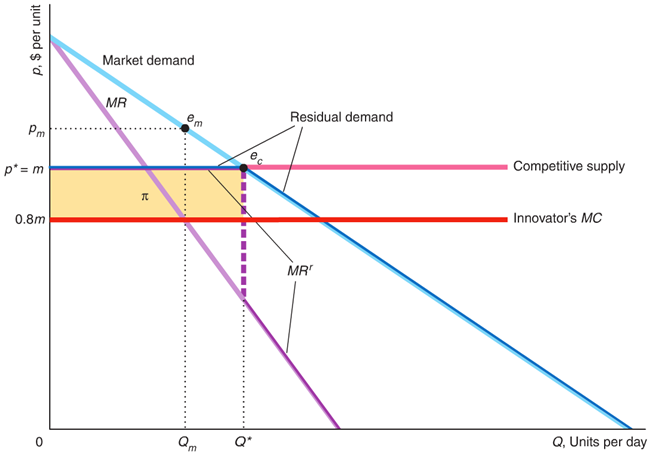

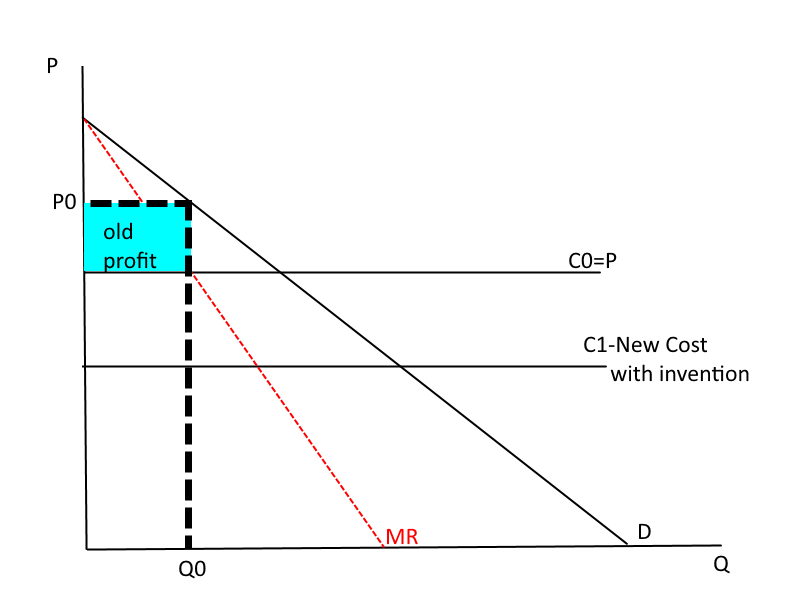

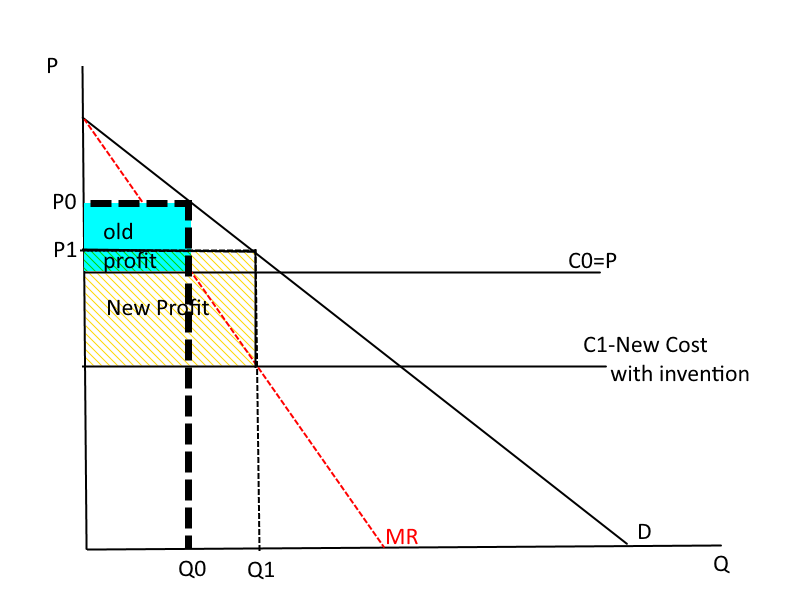

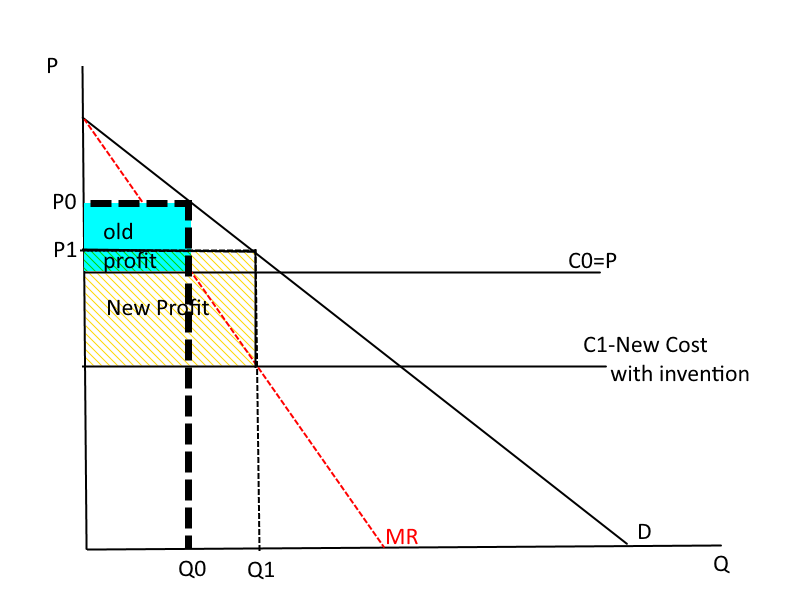

Monopoly

This is the same innovation but for a monopolist. Where was the old price/profit? What is the new price/profit?

Monopoly

Profit before innovation

Monopoly

Profit after innovation. Change in profit is New Profit - Old Profit

Monopoly v Competition

So, who has more to gain from innovation?

Monopoly v Competition

For minor inventions the incentive to invent is greater for the perfectly competitive firm than for the monopoly firm.

Key Result #1:

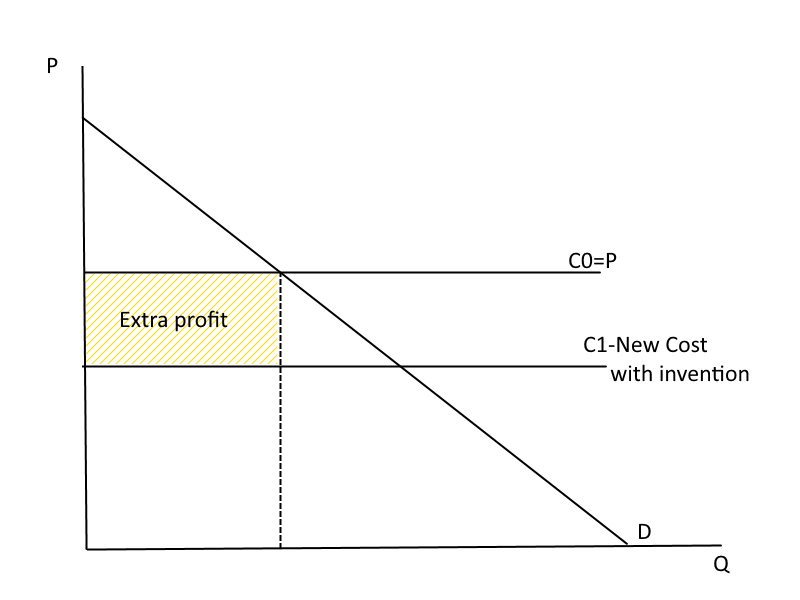

Monopoly v Competition

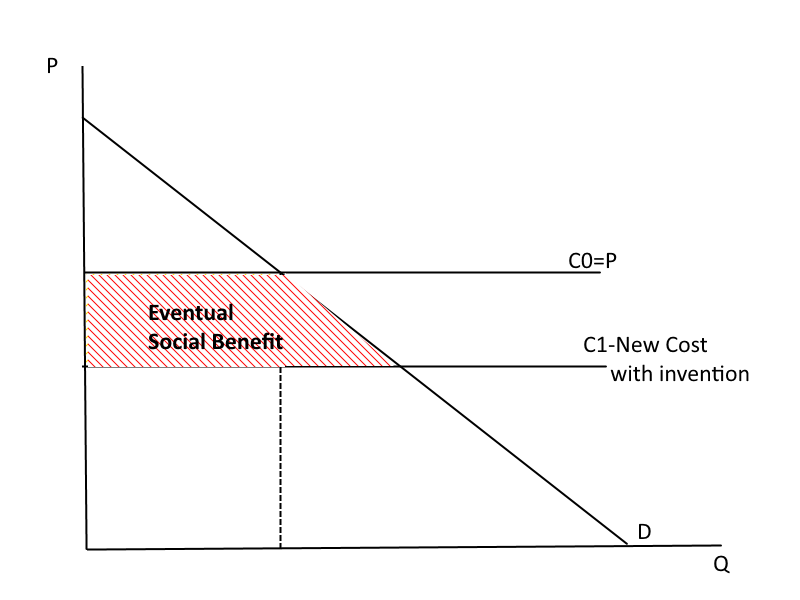

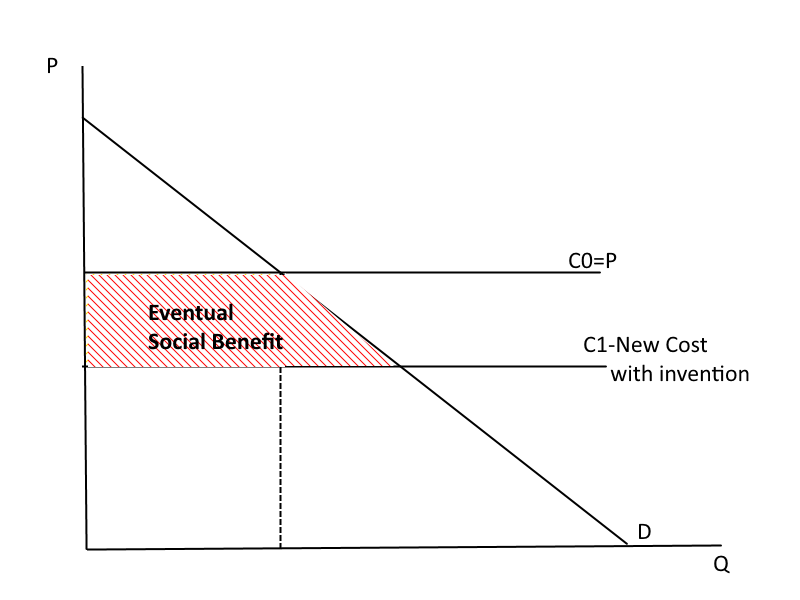

Furthermore, if we think the invention will eventually be made to other firms in the industry (e.g., when the patent expires), the social benefit for an innovation in a competitive market will be:

Monopoly v Competition

Which is larger: the benefit to society, or the benefit to the inventor himself/herself?

Monopoly v Competition

How about with Monopoly?

Monopoly v Competition

Key Result #2:

Some of the new surplus from innovation will always accrue to the consumers, not to the innovator. Social benefit from invention exceeds the incentive to invent both under perfect competition and under monopoly

Practice Problem

Assume the market demand for shoes is Q=100−P and that MC=60. There are two cases:

- C: the industry is organized competitively

- M: the industry is organized as a monopoly

In each case an invention lowers MC to 50.

Assume that there is no rivalry to make the invention:

- C: the inventor has a patent of infinite life

- M: the inventor is the existing monopolist and entry is barred.

Practice Problem

Find the initial price and quantity equilibria in the two cases.

What is the higher profit that the inventor in perfect competition could expect from its lower cost production process?

What is the higher profit that the inventor int he monopoly market can expect from its lower cost production process?

In perfect competition, what would be the increase in total economic surplus if no patent were granted and the invention was immediately copied?

Demand: Q=100-P; Old MC=60, New MC=50

Demand for Consoles

Network Effects

Many network industries exhibit economies of scale, BUT this is not their defining feature in terms of analyzing competition & potential entry

Network effects are present when a product becomes more useful to consumers the more other people there are using it. Each new user joining the network derives private benefits, but also confers external benefits (network externalities) on existing users.

- Direct Networks: physical two-way links (e.g., Telephone, E-mail)

- Indirect or Virtual Networks: apps developed b/c of critical mass (e.g., Hardware/Software (computers, video games)

Network Effects

In an industry with network effects, demand is affected by more than just price, income, perceived quality, etc. It is effected by beliefs about the size of the network.

These beliefs may be come self-fulfilling.

Positive feedback effect: tendency for actions to be self-reinforcing.

What are some industries that exhibit network effects?

Network Effects

Example: eBay

•Sellers want the site that has most potential buyers.

•Buyers want the site that has the most potential sellers.

Network Effects

Can network effects cause market to tip in favor of one supplier?

Perhaps: Suppose one technology gets an early advantage (for whatever reason). Positive feedback effect implies more new users choose this technology. Market tips in favor of a single standard. One firm may dominate the market.

Does this imply that the first-mover wins? In other words, if you build up market share, can you lock in that market? What are some strategies that firms use?

Network Effects

•Things like sign-up fees or two part tariffs (think back to two-part pricing in the EPP case) can help prevent entry because they generate switching costs for consumers.

•These switching costs also can make it hard for an entrant to gain market share, hopefully discouraging entry in the first place

•Frequent purchaser programs can also serve a similar role.

Externalities

•A network effect is a type of positive externality.

One consumer's use of a product increase other consumers' enjoyment of that product.

An externality is a benefit or cost of a market that is not fully captured by consumers (if a benefit) or producers (if a cost).

•Examples of externalities: Air pollution, traffic congestion, global warming, the development of new ideas for which the developer does not receive all the value that he or she creates, beautiful building design, being nice.

Externalities

Positive Externalities Efficiency Problem: generator of benefits does not capture full reward.

Consequence: underproduction (e.g., information provision).

E.g., if Comcast provides faster internet, I enjoy Netflix more. Netflix can extract more money from me as a consumer. However, Comcast (possibly?) will not directly benefit.

Other goods with positive externalities?

Externalities

Public goods generate positive externalities:

~No rivalry in consumption: one person’s use doesn’t reduce the amount available to another

~No way to exclude someone from consuming & benefiting (free-rider problem)

Externalities

•Negative Externality (Spillover Costs): when an action taken by one party imposes costs on another party

~e.g., Textile plant produces waste products that contain a poisonous chemical. If the textile manufacturer disposes of this waste by dumping it into a nearby river, others will be harmed

~Result: Too many textile products are produced relative to the socially desired level (where the socially desired level would take the extra costs into account)

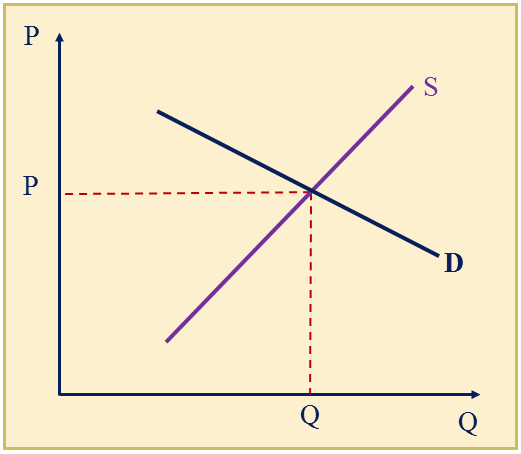

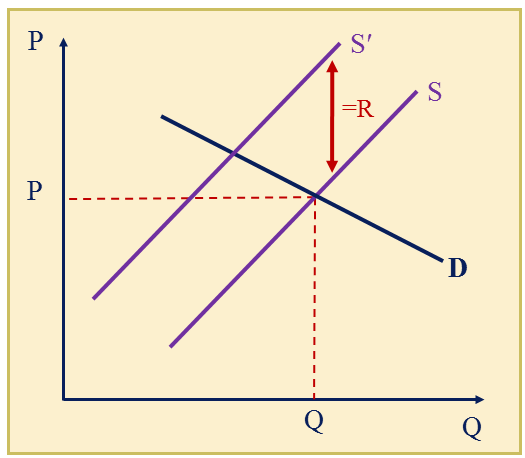

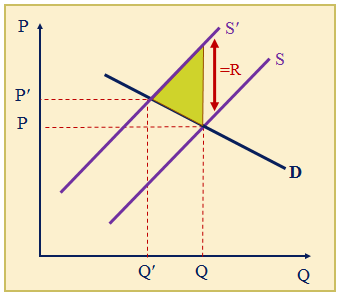

Externalities

Supply curve represents ∑MC for all producers. These are private costs. But suppose there is an external cost to production, R. What is the "real" marginal cost?

Externalities

Suppose production generates pollution = a social cost of R per unit

- the supply curve that includes all costs is S′

Externalities

Private parties would reach Q and P as an outcome. But accounting for the full social cost, Q′ and P′ are optimal, i.e., max social.

Externalities

Charge a price/make sure the producer pays something commensurate with the cost they impose (the externality)

- One possible approach: charge producers an emission fee (= R) per unit of output that approximates the external cost they generate

- Or impose a tax (t = R) on the good that is being produced (note: pay producers a subsidy if they generate a positive externality)

- If set at right level, then get P′ and Q′

Likely problem : what is R?

Externalities

•Government creates a market

•It either auctions off pollution permits (“emissions allowances”) or allocates permits to firms

•After the initial allocation, firms can buy and sell these permits

Enormous benefit: Allows firms, rather than government, to determine the least-cost way of reducing pollution.

What are the problems?

Coase Theorem

Ronald Coase, 1991 Nobel Prize

•Cattle from farm A damages fields of farm B…

•What can we do?

~Put up a fence? Who pays for it?

•Surprise: irrespectively of the allocation of property rights, the fence will be built.

~Efficiency doesn’t suffer

~What does?

Coase Theorem

•Under the assumption of zero transaction costs, the initial allocation of property rights does not affect the final outcome (though it does affect the distribution of welfare).

•There should be some contractable solution that allows one or both parties to internalize the externality, leading us to the socially optimal (efficient) outcome.

•When trade in an externality is possible and there are no transaction costs, bargaining will lead to an efficient outcome, regardless of the initial allocation of property rights.

Coase Theorem: Application

•The upstream factory emits discharges that harm the citizens who live downstream. The economic cost of this pollution to the citizens is $500. The factory can eliminate this pollution through primary treatment at the plant for a cost of $100. The citizens can eliminate this damage by constructing a water purification system for a cost of $300.

•What is the bargaining solution if the citizens have the property rights?

•What is the bargaining solution if the factory has the property rights?

Coase Theorem: Application

•Bargaining with victim-assigned property rights:

~Max offer by company: $100

~Min acceptance by citizens: $300

~Outcome: company installs controls, no cash transfer

•Bargaining with polluter-assigned property rights:

~Max offer by citizens: $300

~Min acceptance by company: $100

~Outcome: citizens pay company

–$100 to install controls

Limitations of Coase Theorem

1.Transactions are “often extremely costly, sufficiently costly at any rate to prevent many transactions that would be carried out in a world in which the pricing system worked without cost.” Coase (1960)

2.Property rights are not always well-defined

~Limited enforcement, due to imperfect information

~Free-riding

2.Competing effects & complex ramifications of externalities

This provides another economic rationale for regulation (and give a reference framework for developing a regulatory policy)

Limitations of Coase Theorem

1.Transactions are “often extremely costly, sufficiently costly at any rate to prevent many transactions that would be carried out in a world in which the pricing system worked without cost.” Coase (1960)

2.Property rights are not always well-defined

~Limited enforcement, due to imperfect information

~Free-riding

2.Competing effects & complex ramifications of externalities

This provides another economic rationale for regulation (and give a reference framework for developing a regulatory policy)