Buying the Hype:

Understanding Startup

Stock Options

Jessica Parsons

@verythorough

Documentation engineer at

(We're hiring!)

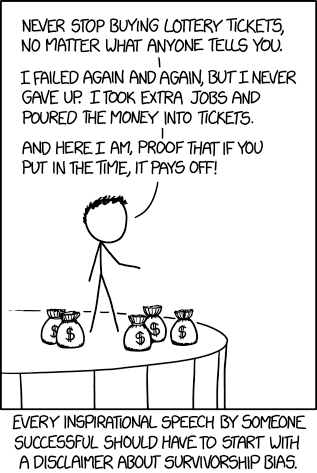

The Dream

The Reality

source: xkcd

The Basics

Defining Terms

Stock Options: An option to buy a certain quantity of stock at a certain price

Grant

Vesting

Exercise

Sale

The Grant

Grant date: date when your grant begins. All other dates calculate from this one.

Strike/exercise price: the price you pay for your shares (usually "fair market value" on the grant date)

Quantity: number of shares you can buy when fully vested

Legally binding agreement of terms for your options

Vesting Schedule

"Four-year monthly vesting with a one-year cliff"

Vested shares

Gradually gives you access to your options

Exercise Terms

# of shares x strike price = cost basis

# of shares x (current fair market value - strike price) =

1000 x $0.10 = $100

1000 x ( $1.00 - $0.10 ) =

bargain element

$900

(This is important for taxes.)

The act of purchasing your actual stock

Sale Terms

# of shares x current market price = gross proceeds

gross proceeds - cost basis = net proceeds

1000 x $2.00 = $2000

$2000 - $100 = $1900*

* $900 of this is the bargain element

The act of selling your stock

The Startup

Buying Private Stock

You can buy and hold, but you have to watch out for...

Can't sell until there's an exit:

acquisition ~ or ~ IPO

Private Company: A company that is not publicly traded (i.e. you can't buy shares on the public stock market)

AMT

Alternative Minimum Tax

Counts the bargain element as income

at exercise

... but it may not apply to you. (It's complicated.)

AMT can be huge

10,000 shares Strike price $0.10 Value at exercise $5

Cost basis = 10,000 x $0.10 = $1000

Bargain element = 10,000 x ($5 - $0.10) =

$49,000

taxable "income"

Waiting for an exit

Schedule limitations

Termination (voluntary or involuntary)

Quit/fire/layoff is usually 90 days

(but some are offering much longer)

Death or disability may have a longer window

(like 12-18 months)

Expiration

10 years after grant date

The Offer

Evaluating an Offer

General Considerations

- Are you taking a cut in salary?

- How much?

- When will you reach market value?

- What stage is the company in?

- How are its prospects?

Evaluating an Offer

Questions to ask the company

- How many shares are being offered?

- What % of the company are the options worth?

- Compare with benchmarks and job listings

- What is the 409a valuation? (estimates your strike price)

- How much has the company raised?

- When do you plan to raise more? How much are you aiming for?

- What are your exit dreams for the company?

Acquisition? IPO? When do you hope this will happen?

Calculating Possible Exits

Dilution and Preferred Shares

Dilution

Your option count stays the same (for this grant), but your percentage will decrease as more investors join

This can mean that if the company sells for $100M

but raised $100M to get there, your shares are worth $0

Preferred Shares

Investors typically have preferred shares, which usually includes liquidation preference, which means investors get back what they put in, first.

Calculating Possible Exits

See what info you can get from the company

- What is the liquidation overhang?

- How much has the company raised?

- Is all of that preferred with liquidation preference?

- Do any investors have multipliers or participation rights? (This amplifies the liquidation overhang.)

Calculating Possible Exits

Generate possible minimums

- How much would the company have to 'sell' for before your stock is worth anything?

- How much before you get back your lost salary?

- How much before it really gets interesting?

How likely is this to happen? How long will it take?

(Be sure to consider future funding in your calculations.)

Find similar companies to compare.

The Negotiation

Negotiation Points

Minimize upfront costs

Early exercise

Buy shares before vesting to eliminate bargain element

10,000 shares Strike price $0.10 Value at exercise $0.10

Cost basis = 10,000 x $0.10 = $1000

Bargain element = 10,000 x ($0.10 - $0.10) = $0

(If you leave before full vesting,

you'll have to sell back unvested shares.)

archival photo, Silicon Valley circa 2015

but don't forget ...

Negotiation Points

Keep your options on the table

Extended exercise period

Keep your options for years after you leave, so you can wait for an exit. Some may scoff, but companies are doing it.

Follow-on stock grants

See if the company has a policy for granting more stock over time, to curb dilution and get options with later expiration.

Accelerated vesting on acquisition

Avoid losing unvested options if the company is acquired (single-trigger) and lays you off (double-trigger).

The Follow-Up

After Accepting

Gotchas to watch out for

Get your grant

This is not your offer letter! It may be months before you get it, especially in a new startup. Try to ensure you get it before the company's valuation goes up.

Look before you leap

Before exercising options (especially buy & hold), make sure you know the tax implications. Get professional help!

After Accepting

Reality Check

Money isn't everything

And stock options may never be money! Remember there are many reasons to join a company.

Satisfaction is perception

Wondering if you could have negotiated a better deal will not bring you more money or happiness. Celebrate what you achieved and move on!

(and new funding rounds are a great time to renegotiate!)

Thank you!