Stripe Banchmark

Wiki:

Pricing

per successful card charge

- No setup, monthly, or hidden fees

- Pay only for what you use

- Real-time fee reporting

Credit & debit cards

ACH and Bitcoin payments

0.8% · $5 cap

ACH and Bitcoin fees are capped at $5—payments above $625 cost $5. We also provide tools to verify customers’ bank accounts at no additional cost. We charge $4 for failed ACH payme

2.9% + 30¢

Withdrawal

Fast, predictable transfers. Once you’re set up, transfers arrive in your bank account on a 2-day rolling basis. Or you can opt to receive transfers weekly or monthly.

Clients

- Mobile Commerce

- On-demand economy

- SaaS

- Nonprofit

- Platform payments

Mobile Commerce

On-demand economy

SaaS

Nonprofit

Platform payments

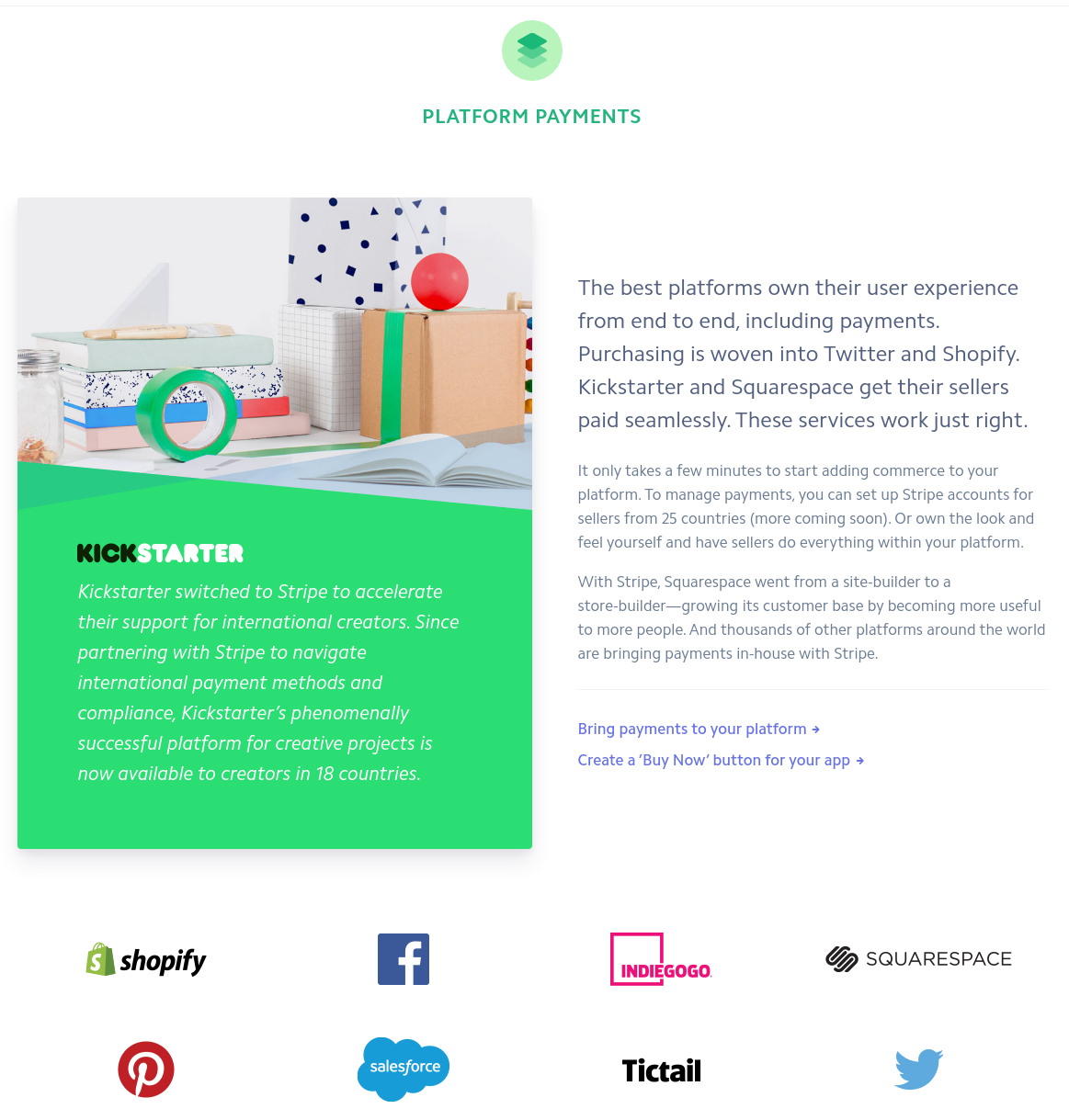

At its core, Stripe’s business model is fueled by using digital technology to capitalize on the wave of e-commerce and marketplace platforms emerging – Stripe differentiates itself from other digital payment processors by building the most beautiful, high-converting payment flows for internet and mobile commerce. Whether the business is a subscription service (i.e., Blue Apron), an on-demand marketplace (i.e., Uber), an e-commerce storefront (i.e., Saks), or a crowdfunding platform (i.e., Kickstarter), Stripe designs APIs that creates the best possible experience for users [2]. The companies listed here are a sample of Stripe’s 100,000+ customers, where, unlike PayPal, users like you and I don’t know we are using Stripe when we pay, and businesses still own the customer experience that is integrated seamlessly onto their websites and mobile apps!

Business Model

As Stripe is not the only fin-tech start-up disrupting payment processing (its biggest competitor is Braintree, which was acquired by PayPal in September 2013), Stripe has had to have a relentless focus on innovating new products to stay ahead of competition [3]:

Operating Model

In September 2016, for marketplace models (i.e., Lyft, InstaCart), Stripe made it possible to send instant payouts to service providers (i.e., drivers, shoppers) on their platform. Unlike traditional bank transfers, payouts are deposited in drivers’ bank accounts within minutes after a ride is completed, allowing Stripe’s customers to be even more nimble in attracting service providers onto their platform who value receiving earnings faster [4]

1

A few months ago, Stripe announced its latest product, Stripe Atlas, that gives entrepreneurs the building blocks to start a global internet business within a couple of days. Atlas helps an entrepreneur incorporate his/her company in the U.S., open a U.S. bank account with Silicon Valley Bank, and start a Stripe account to accept payments from countries around the world [5]. Stripe is working with 100+ accelerators and VC firms to get Atlas in the hands of promising start-ups.

2

In October 2016, Stripe released Radar, which uses advanced machine learning algorithms to learn from Stripe’s global network of businesses to automatically detect and block fraudulent charges in real-time [6].

3

The digital payments business has relatively low barriers to entry and thus has seen a number of entrants. For Stripe to maintain its sustainable competitive differentiation, it must continue to innovate its business model and execute on its operating model. Specifically, Stripe will face margin pressure in the future as competitors try to sell their products for cheaper. Instead of competing on price, Stripe should continue to differentiate itself from competitors by innovating on products that deepen the value proposition for existing and new users. Stripe should also focus its resources on speed-to-market in new emerging countries (Stripe currently operates in 25 countries) to capture market share as these economies open to ecommerce and consumers begin trusting online payment processing [9]. To achieve this success, it will all come down to one thing: as Stripe scales, can it hire and retain the best talent to win in this market?

Looking Forward

Use Cases for PayPal and Stripe

When NOT to use PayPal or Stripe

- Still Proving Concept (prove as viable business)

- Low Sales (sales are under 10,000 a month)

- Supplementing (added PayPal as an option for consumers to pay with)

- Your Sales Volume Exceeds 10k/mo

- Your Business Lies Anywhere on the “High Risk” Spectrum