Understandable Artificial Intelligence

Content

©2019 Economic Data Sciences

- Takeaways From Other Projects

- A.I.'s Ability to Solve These Issues

- EDS Software Solution

- Where EDS is Different

- Tangible Client Benefits

- How We Work

- Two Client Work Examples

Takeaways From Other Projects

©2019 Economic Data Sciences

From our work with other investors, following challenges emerge:

- Get more from less

- Can we make existing resources more efficient?

- 'Fat'-Tail Risk

- How can we manage down markets that hurt performance and can permanently impair capital?

- Balancing risk and opportunities in their many forms

- How can we determine the 'right' trade-off for our investments?

- Beyond attribution

- What drives a manager's investment and style?

The Case for Artificial Intelligence

©2019 Economic Data Sciences

Significant performance improvement when combined with humans

It has a unique ability to make improvements by searching across every known factor to get the best from existing best-practices

56% of institutional investors plan to increase integration of A.I.*

A.I. is best used when combined with humans

A.I. Already Impacts Your Investments

©2019 Economic Data Sciences

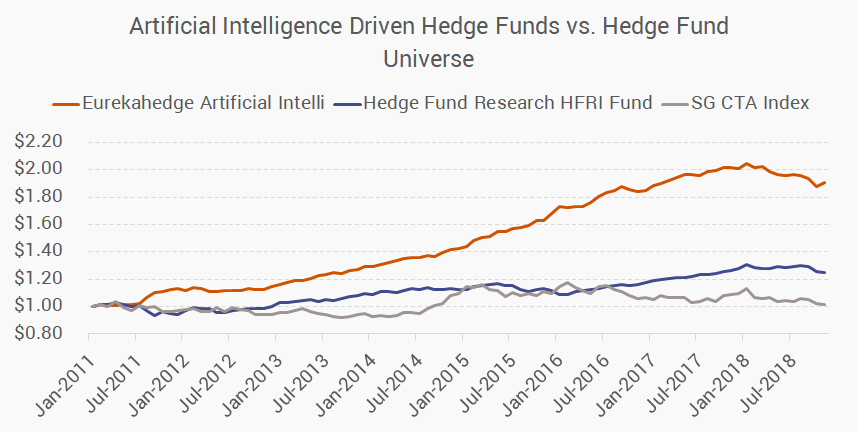

- Market participants are quickly adapting

- 2013 these groups were negatively correlated, in 2018 strongly positive

The observable impact of A.I. in hedge funds is clear*

*Past performance is not a reliable indicator of future results, Yearly performance available in the Appendix

A.I. Is Transformational

©2019 Economic Data Sciences

Using A.I. in financial services has become industry best-practice

- Aug 2017: 20% usage of A.I. or Machine Learning

- Aug 2018: 56% usage

Blackrock Data Science Core

Exploratory programs on machine learning

- A.I. based risk management

- Dynamic factor analysis using A.I.

- A.I. reconciling investment decisions

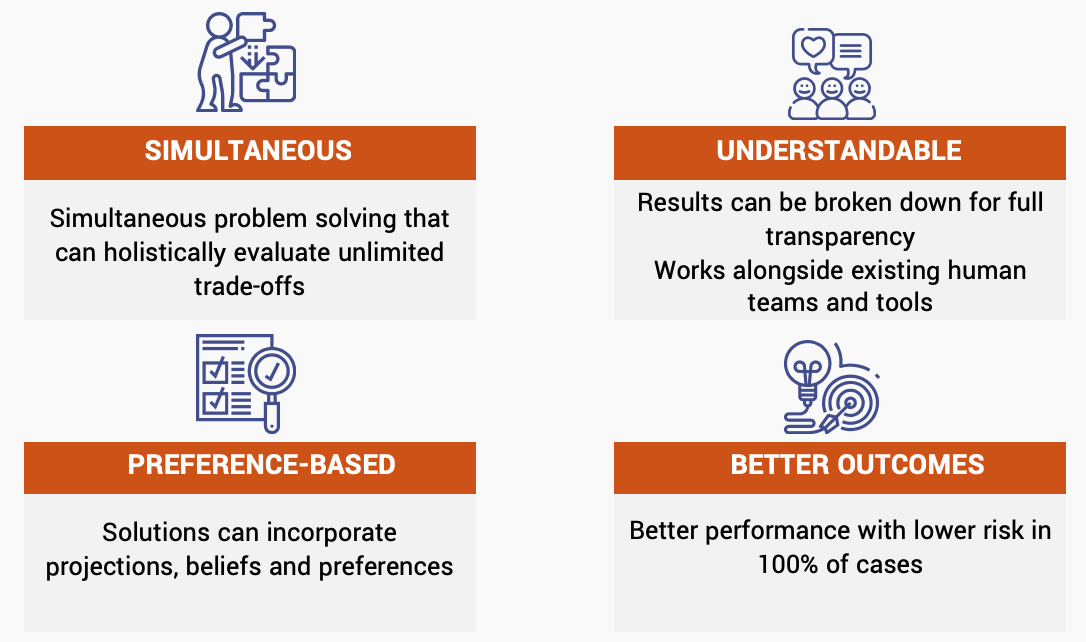

EDS Software Solution - First of its Kind

EDS developed the first software to solve these problems

©2019 Economic Data Sciences

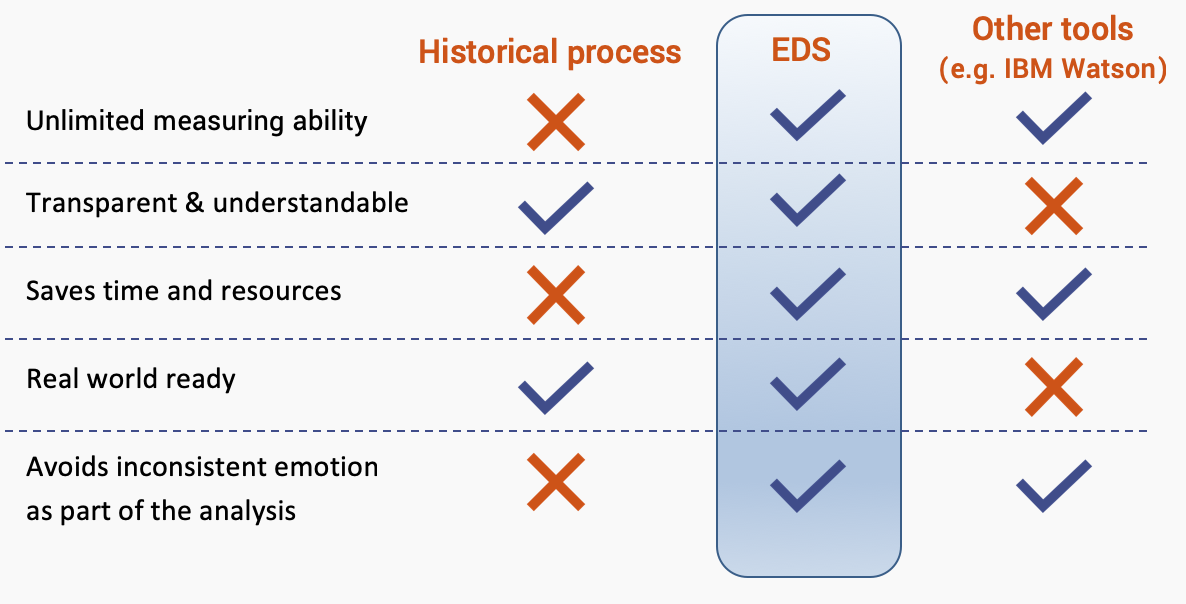

Where EDS Differs

©2019 Economic Data Sciences

EDS improves results across dozens of metrics at the same time

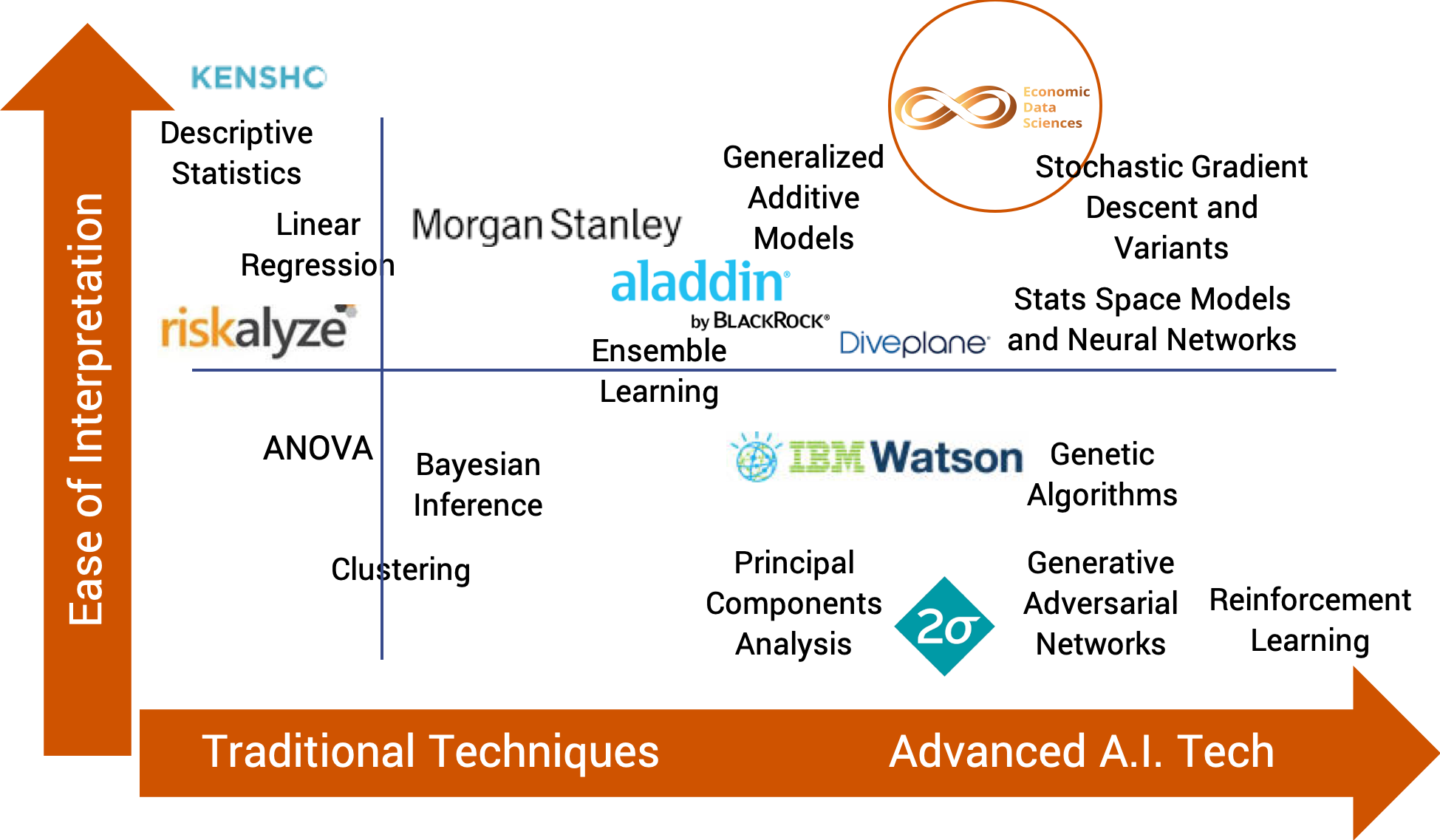

EDS Tech - Best Possible Mix

©2019 Economic Data Sciences

Cutting edge technology with focus on ease of interpretation

Tangible Benefits to Working With EDS

©2019 Economic Data Sciences

EDS analysis has made immediate improvements in 100% of cases

*Past performance is not a reliable indicator of future results

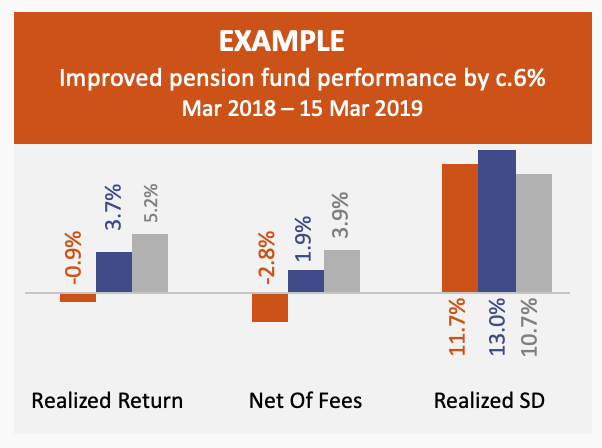

Working With EDS

©2019 Economic Data Sciences

EDS provides 3 possible partner collaborations:

Case Study 1

Portfolio Optimization

Overview

©2019 Economic Data Sciences

EDS was given a sample portfolio by a UK pension fund. Since only the asset weights were known, EDS tool deducted the investors' preferences and proceeded to analyze the holdings

The following preferences were deducted:

- Main focus was return

- Fees and volatility were less critical

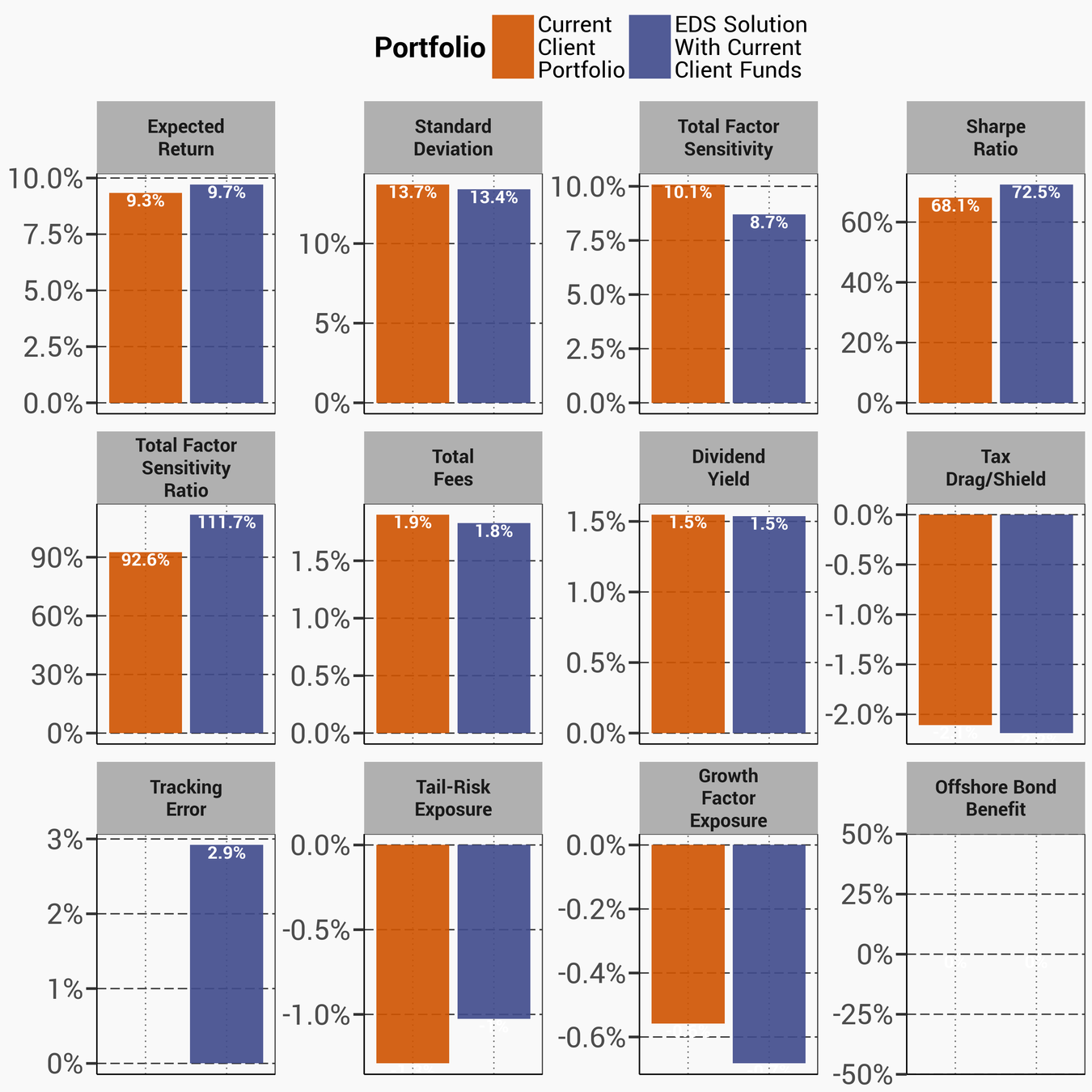

Solution Using Client Universe

Universe included c.40 funds

©2019 Economic Data Sciences

- Higher expected return

- Higher Sharpe Ratio

- Lower volatility

Opening to External Funds

©2019 Economic Data Sciences

-

Expand possible investments beyond existing funds

- Preference remains for approved client funds

- Limit each fund to 20%

- Focus on same preferences as the original portfolio

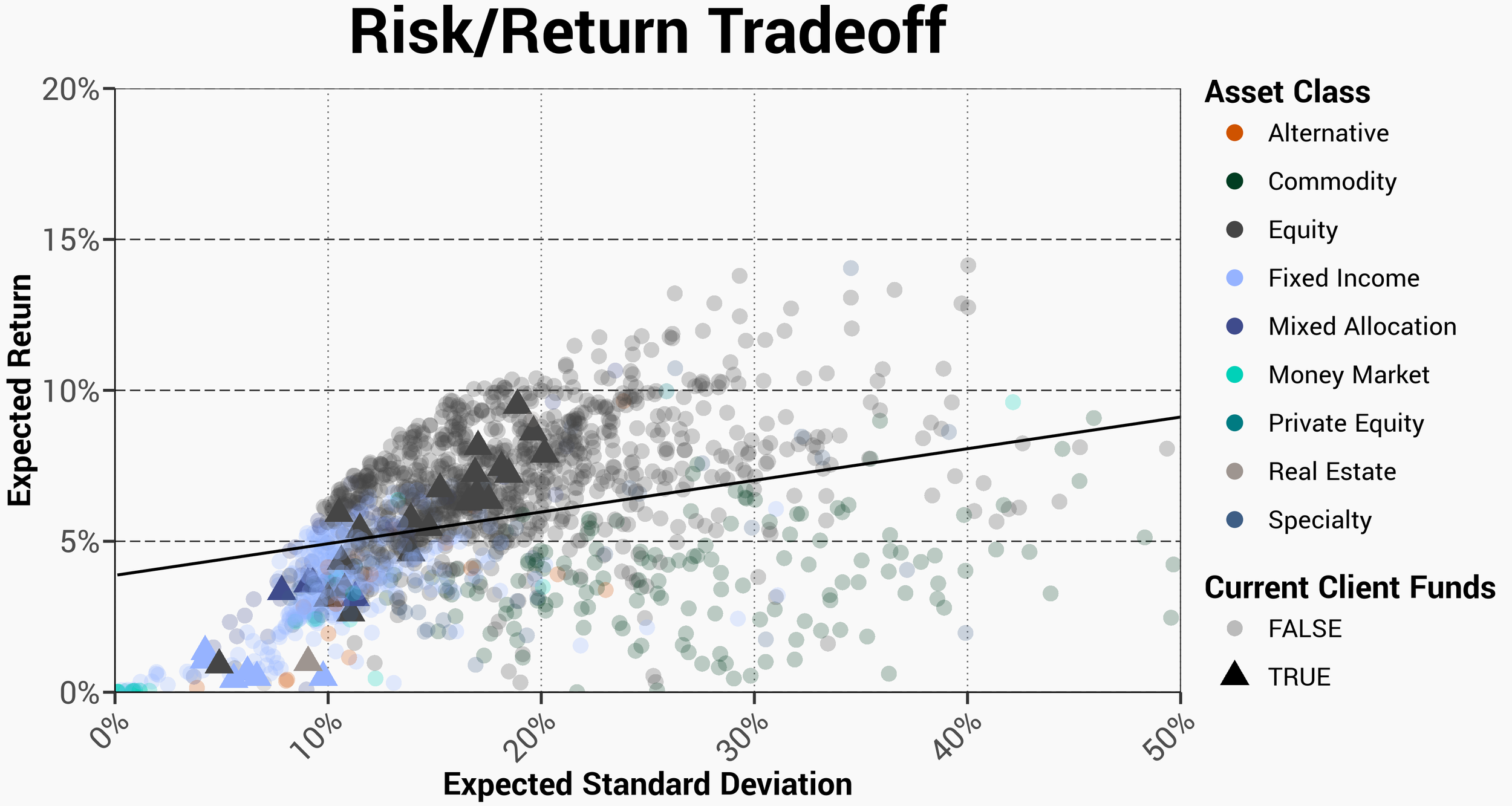

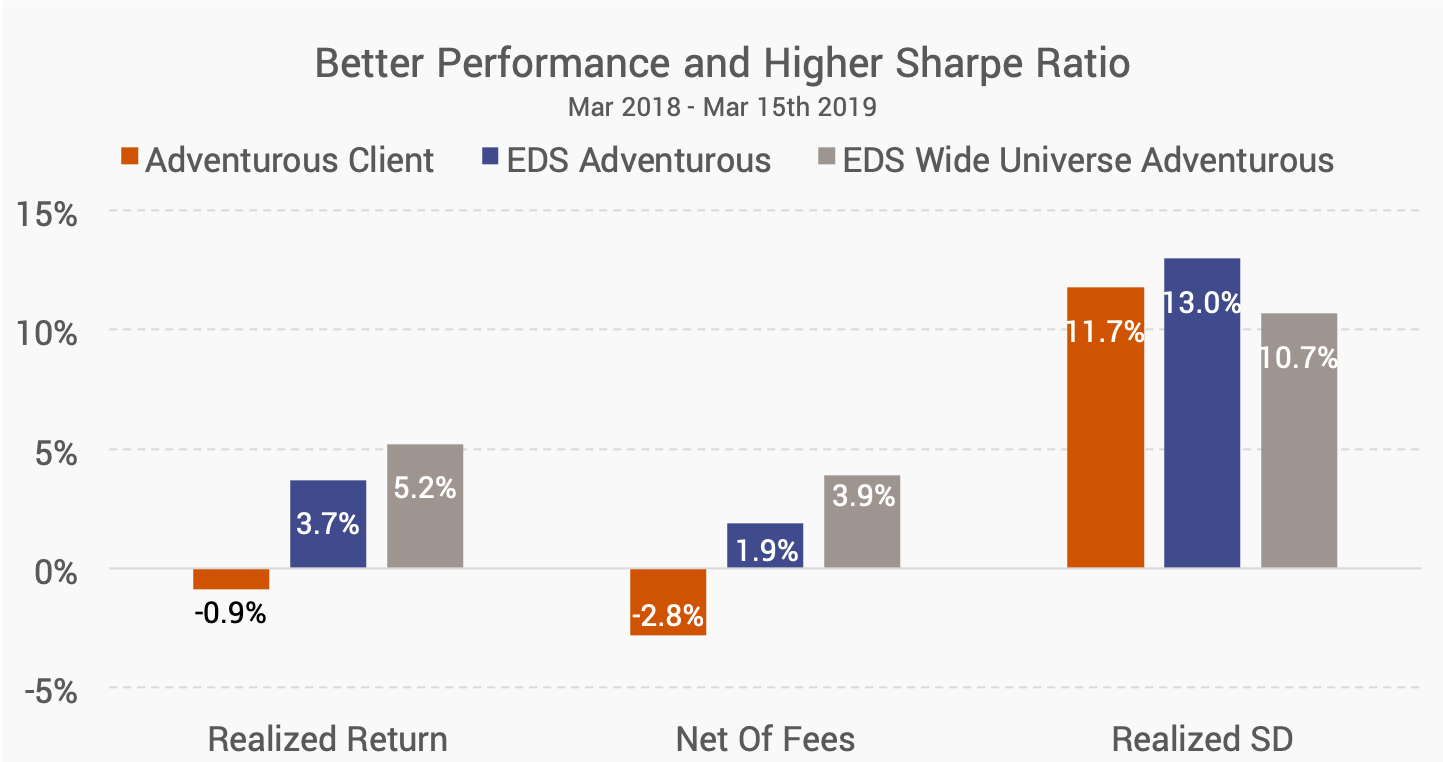

Results - Risk/Return

©2019 Economic Data Sciences

EDS tool reviewed 2,743 potential U.K. funds

- Original portfolio allocation shows good asset selection

- Broader universe allows for more targeted risk taking

- The average mixed allocation fund expects a 6.1% annual return with 13.8% S.D.

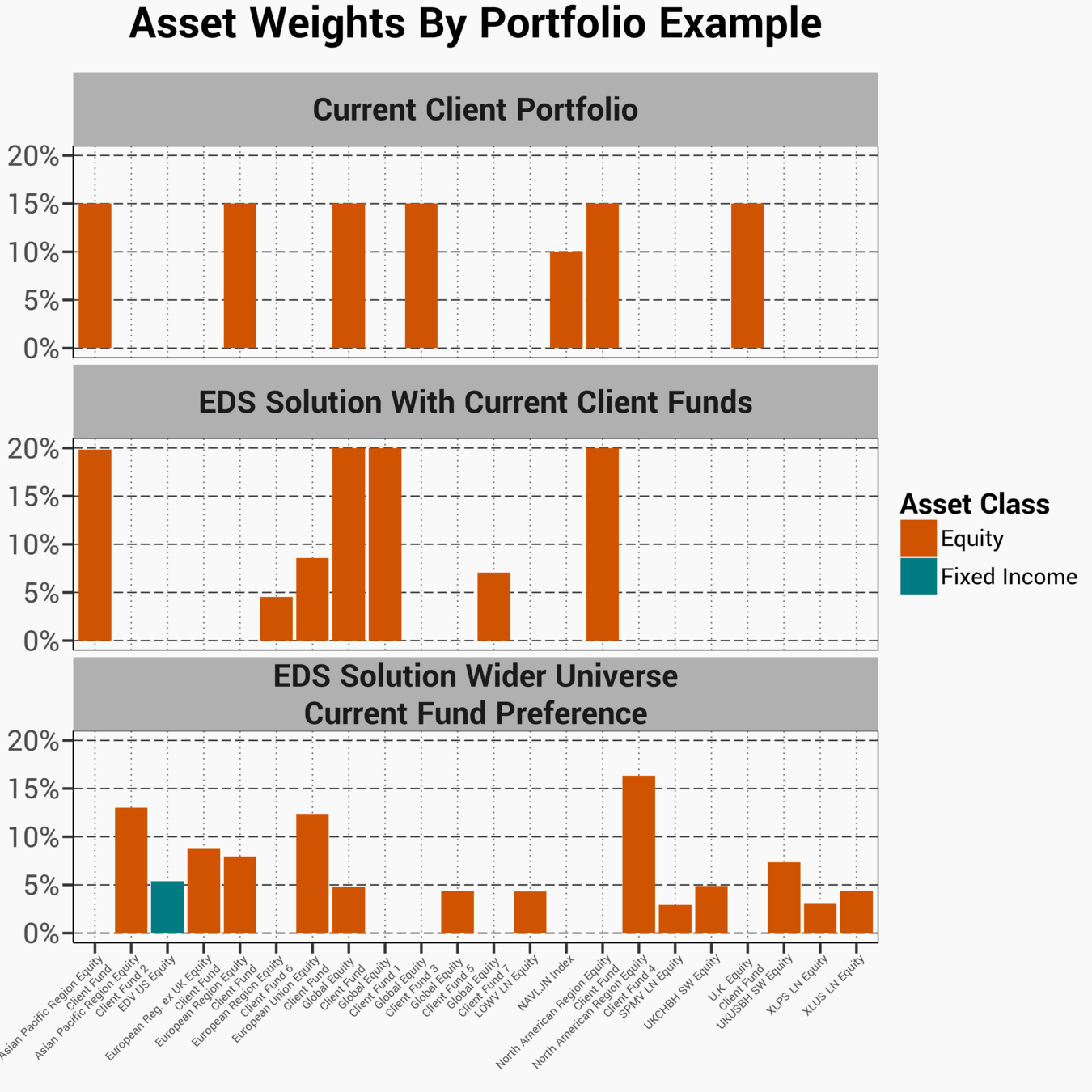

Results Overview - Funds

©2019 Economic Data Sciences

EDS recommended the following holdings

- Each fund is capped at 20%

- 8 additions to original portfolio

- Full flexibility around which funds and how many to include

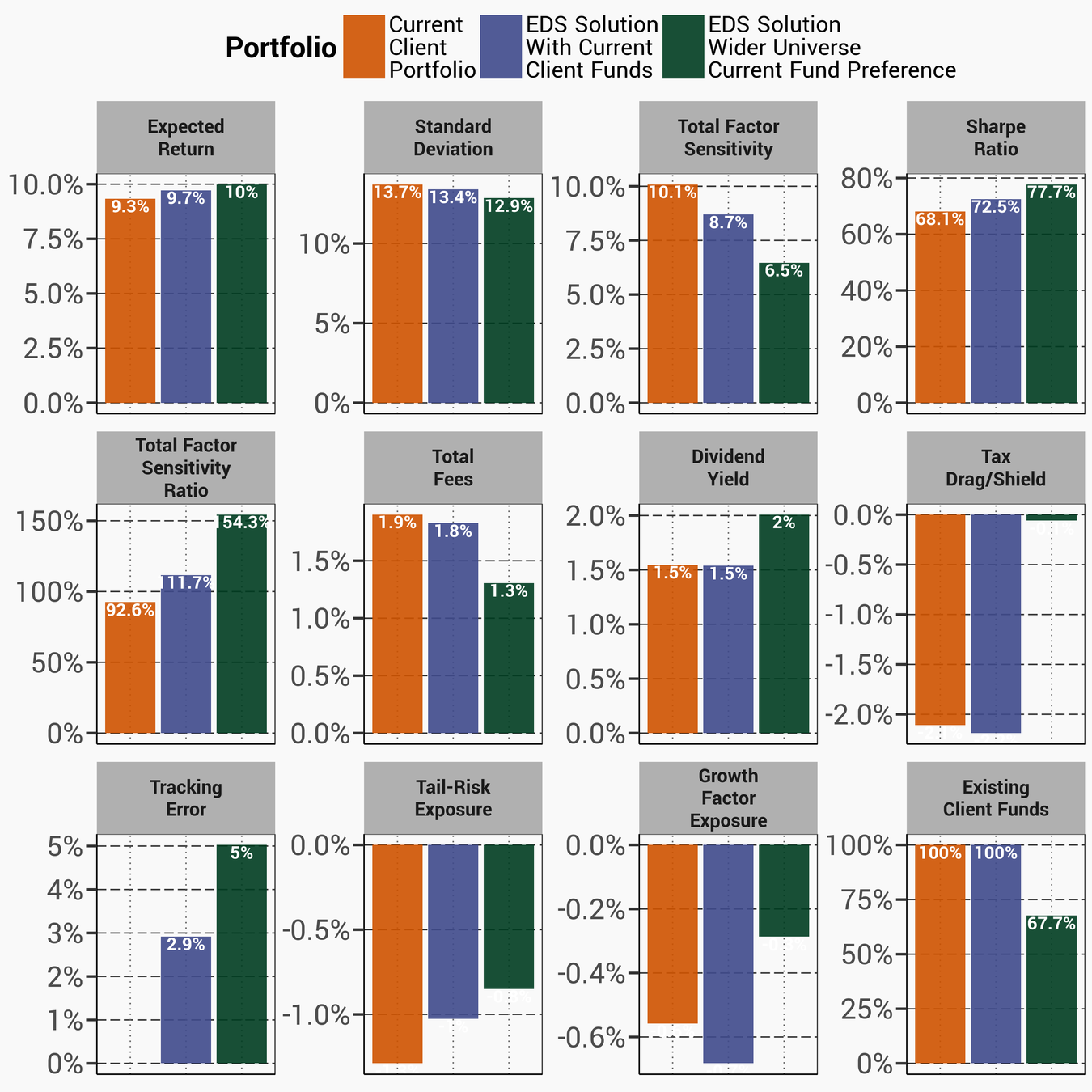

Results Overview

©2019 Economic Data Sciences

Significant projected improvement using EDS tool

-

Higher expected return

- With lower standard deviation

- Lower management fees

- Higher dividend yield

- Client approved funds comprise 68% of the total

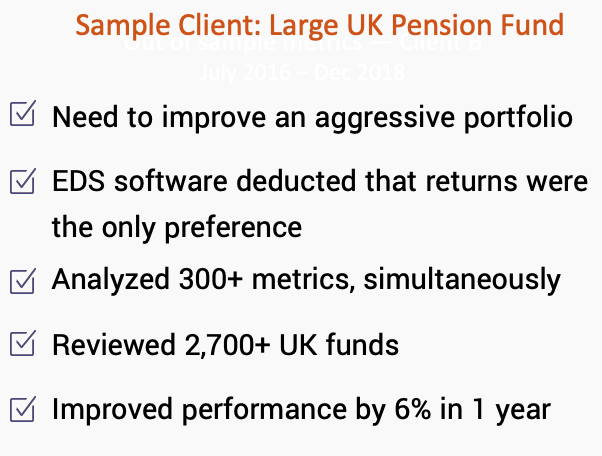

Actual Results Since Recommendation

©2019 Economic Data Sciences

EDS recommendation delivered superior results

*Past performance is not a reliable indicator of future results

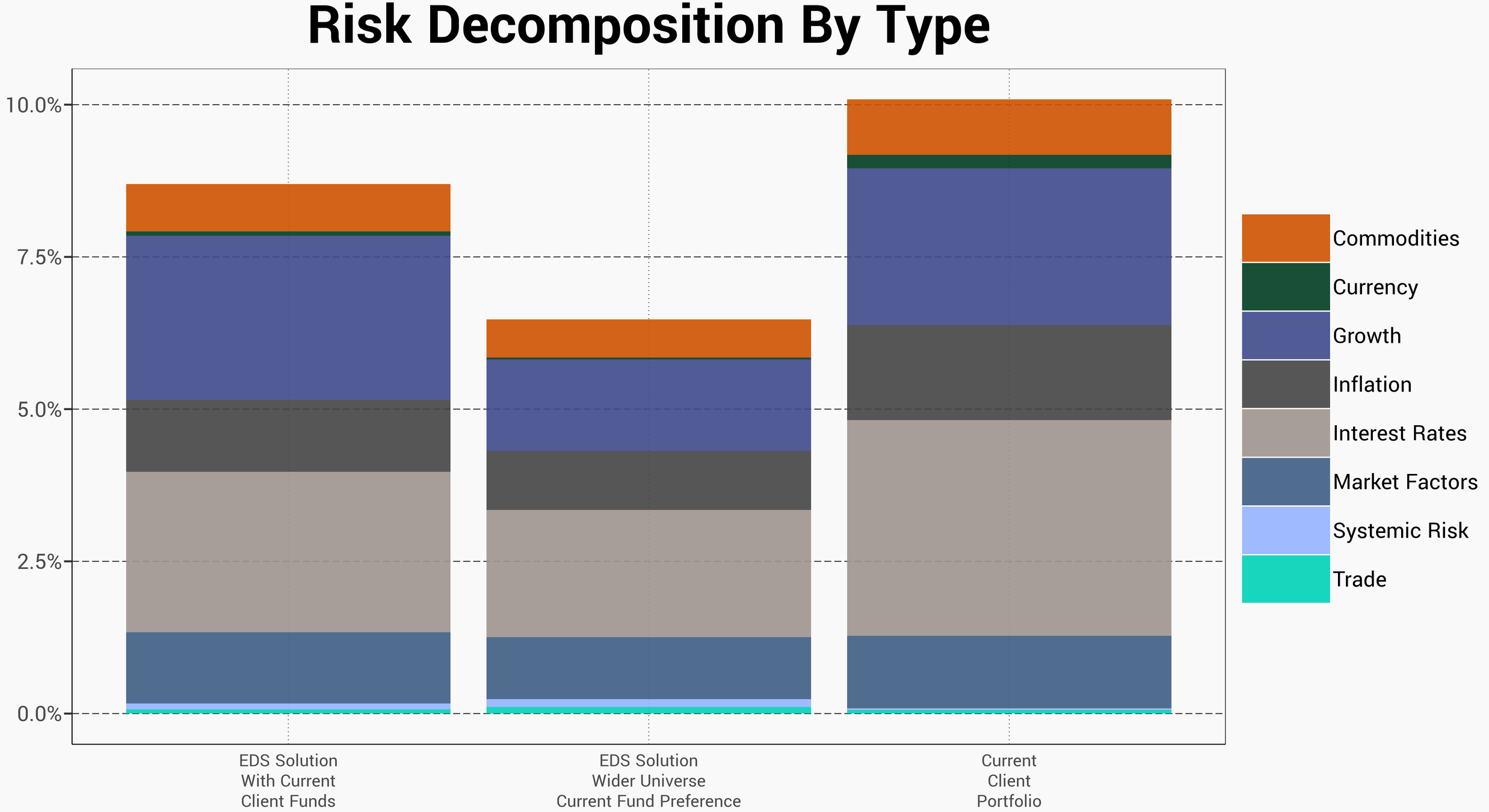

Results Overview - Risk

©2019 Economic Data Sciences

Where do these gains come from?

- Lower risk exposure across most metrics

- Significantly improved factor risk exposure and risk distribution

Case Study 2

Exposure to China vs. downside risk

Overview

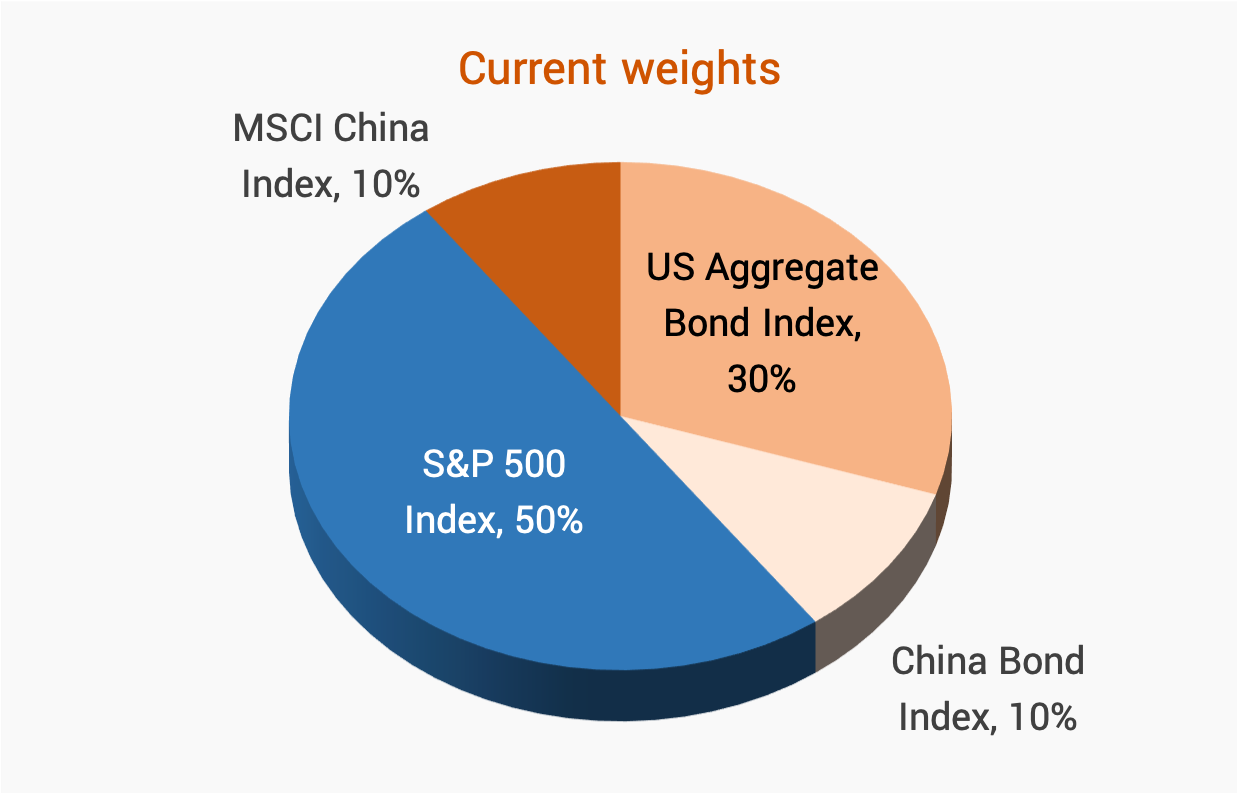

©2019 Economic Data Sciences

Goal: Modify a 60-40 equity-fixed income portfolio to adjust risk

We show how the software iterates through portfolios and provides different options, depending on Client preferences

The Client had several simultaneous goals:

- Increase exposure to China

- Maintain all other factors relatively stable

- We assume Chinese benchmark has 0 tail risk

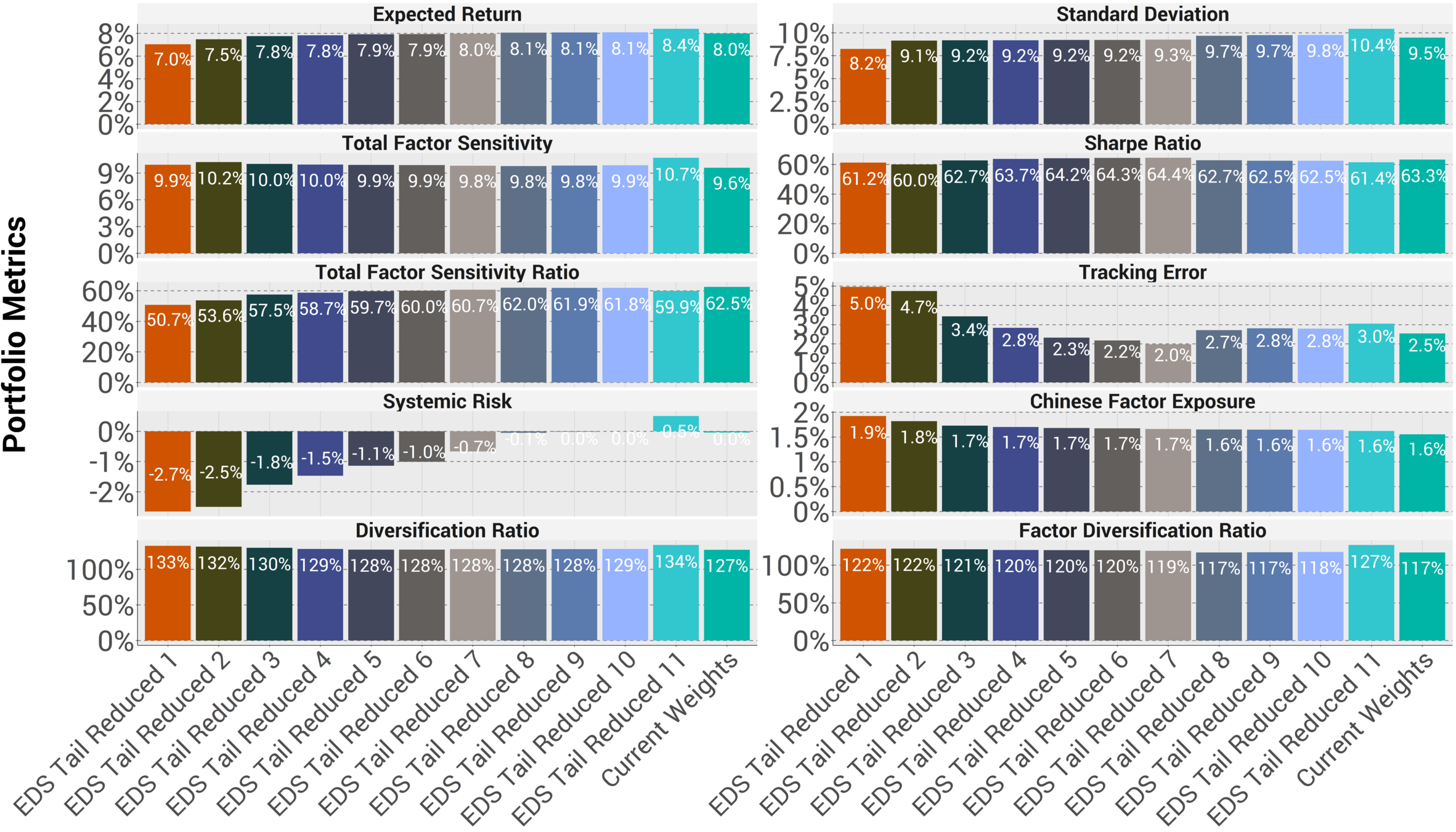

Results - Key Takeaways

©2019 Economic Data Sciences

-

The analysis can be done in reverse as well:

- We tested by how much tail risk would rise

- With a less "generic" initial portfolio, we could do the opposite

- If desired, EDS software can increase hedge to China

- Exposure to China and tail risk are clearly related

- Each solution represents the best trade offs given these parameters

- Results were analyzed using monthly data going back to 2005

Results

©2019 Economic Data Sciences

Increasing exposure to China increase tail risk by 2.7%

List of Funds for 3 Select Portfolios

©2019 Economic Data Sciences

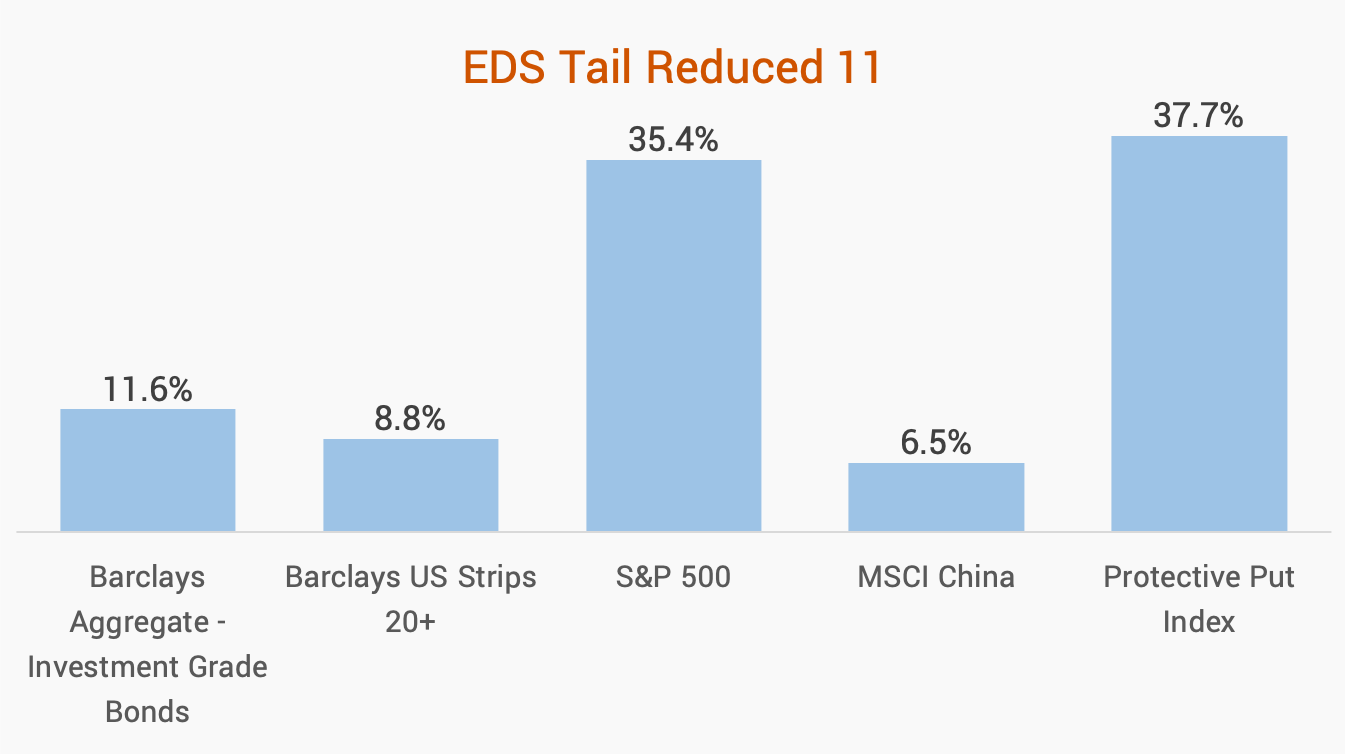

Portfolio 11 had the highest expected return and standard deviation

Number of funds or desired minimum/maximum fund weight can be modified

List of Funds for 3 Select Portfolios

©2019 Economic Data Sciences

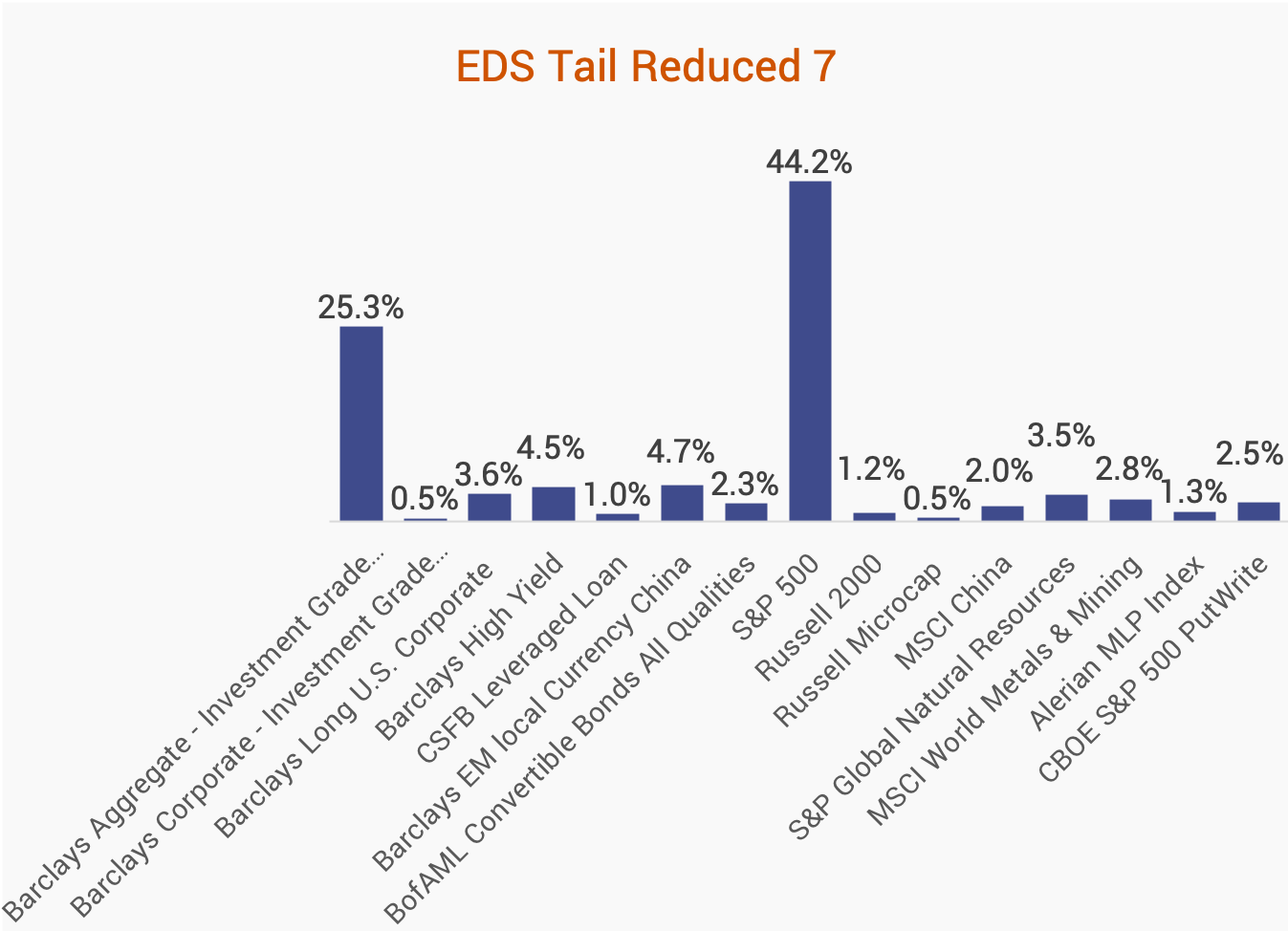

Portfolio 7 had the highest expected Sharpe Ratio

List of Funds for 3 Select Portfolios

©2019 Economic Data Sciences

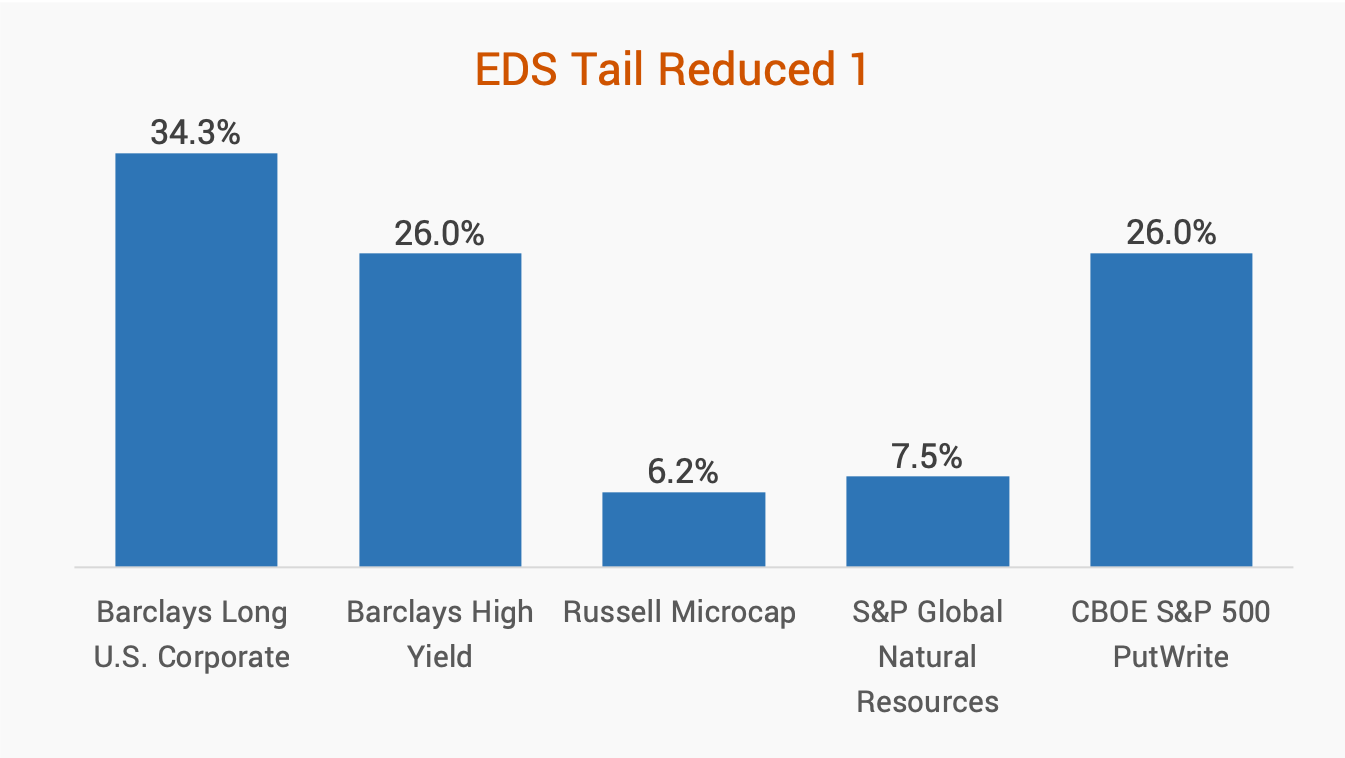

Portfolio 1 had the highest exposure to China

Recommendations

©2019 Economic Data Sciences

- Each portfolio represents optimal solution in its own right

- The "best" portfolio depends entirely on client preferences

- EDS believes that maximizing Sharpe Ratio is preferable, so would recommend portfolio #7

EDS advice based on the data:

Additional Examples

©2019 Economic Data Sciences

-

Finance

-

Big Data simulations

- Across any data-driven industry

- For risk management or forward projections

Disclaimers

©2019 Economic Data Sciences

info@EconomicDataSciences.com