Matter

For the Culture

$44.6 billion

In 2017,

$156 per year

of which the average US person over the age of 13 spent

was spent on music,

2

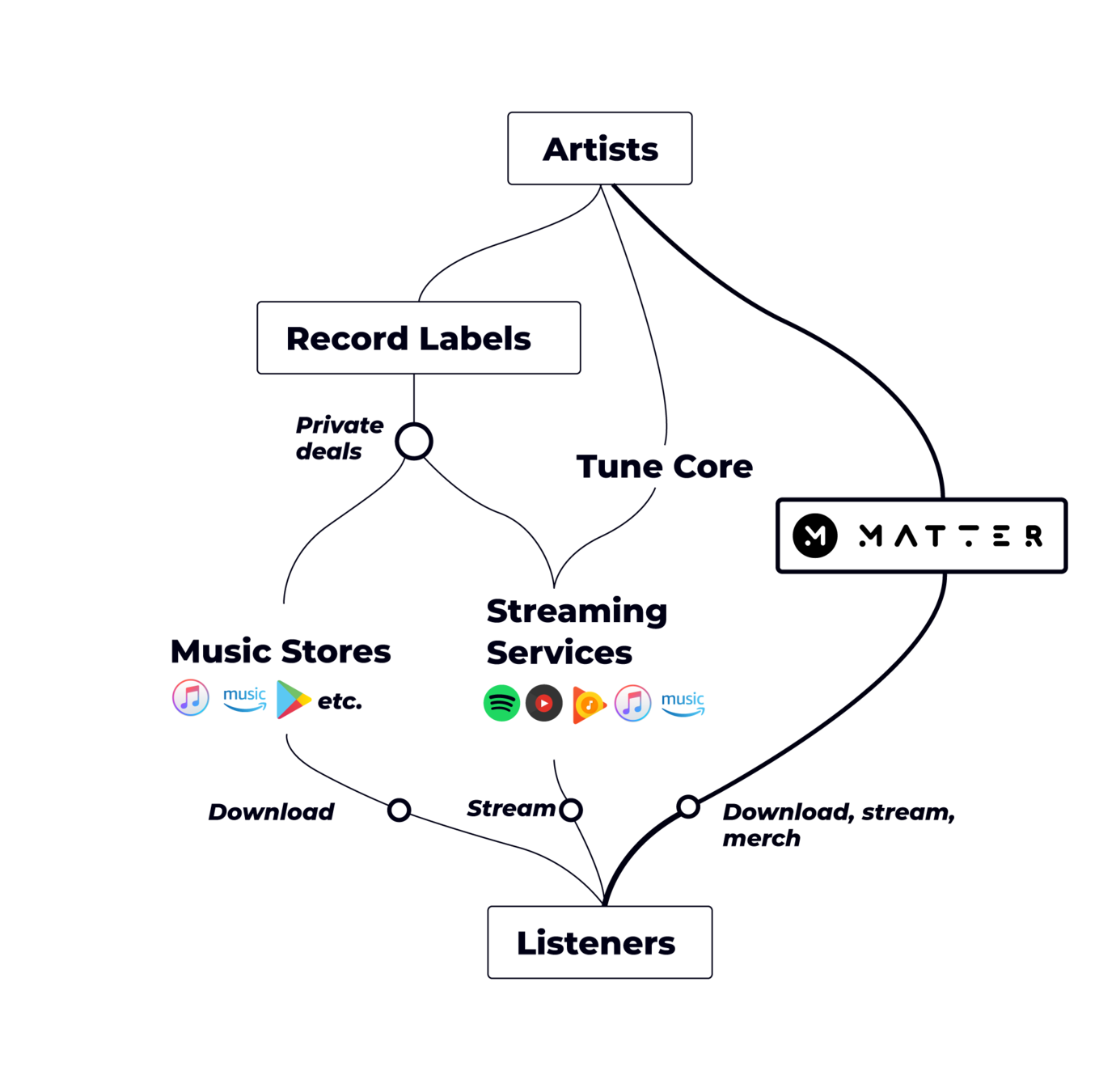

The legacy structures of the industry make profitability impossible.

Spotify and similar music services are obligated to pay record labels to license the music of their artists, which creates a massive obstacle to profitability.

— As a result, they have to find listeners who pay for the platform but use it infrequently to attain profitability.

— This directly competes with their free music platform, which is ad-supported.

Consumer behaviors and music platform demands are unique for everyone. This leads to platform fragmentation and a lack of value capture across all engagement channels.

— No incumbents have successfully pursued strategies to broaden their revenue base.

Incumbents have had little success overcoming structural barriers to profitability

Spotify has only ever had 1 profitable quarter, which they’ve stated was by accident. ³

Sony, Universal, and Warner recently sold their stake in Spotify. ⁴

Soundcloud is a dead platform. ⁵

The community died after artists left because Soundcloud didn't provide monetization.

Radio, once the dominant player, has been eclipsed both culturally and financially. ⁶

Pandora is experiencing a 6% decline in users YoY. ⁷

Meanwhile, only the labels have managed to stay profitable, mostly through a decades long

We are nowhere.

What is the future of music streaming?

Enter: Matter

Our model is scalable and runs more efficiently than incumbents

Matter can actually pay labels and artists more, giving them a massive financial incentive to use Matter’s platform rather than established incumbents.

Our engagement to consumption funnel is frictionless.

By removing vulnerability of COGS for high activity users, Matter is able to capture billions in untapped music market share through its simplistic approach for social and commerce verticals.

Our culture-forward approach provides the best solution for consumers and creators

We’ve been able to build the perfect platform by listening to what people really want. The bands, rappers, producers, engineers, designers, managers, promoters, labels, and fans who have been neglected until now.

Our vision sets us apart

In a world where everything has become a commodity, Matter created a platform where the rarest thing is inherent in the identity of the platform: authenticity.

People desire to be a part of the next big thing, the next cultural wave. By serving the independent artist: the trendsetter, the renegade, the person who lives on the edge of what is possible, we create a relationship between the listener and the artist that pushes the boundaries of what we know.

By focusing on the future and creating a platform that allows people to explore, we create a community that not only works, but has never existed before.

Current platforms created a set of consumer behaviors that accelerated fragmentation. We all have an individualized desire to find something that appeals to us.

Matter disrupts the current industry

Matter built a platform for an underserved market segment that is poised to become much larger.

By making it profitable for the vast majority of creators, no incumbent can directly compete.

In doing so, we eliminated opaque supply chains, rent seeking actors, and exploitative agents.

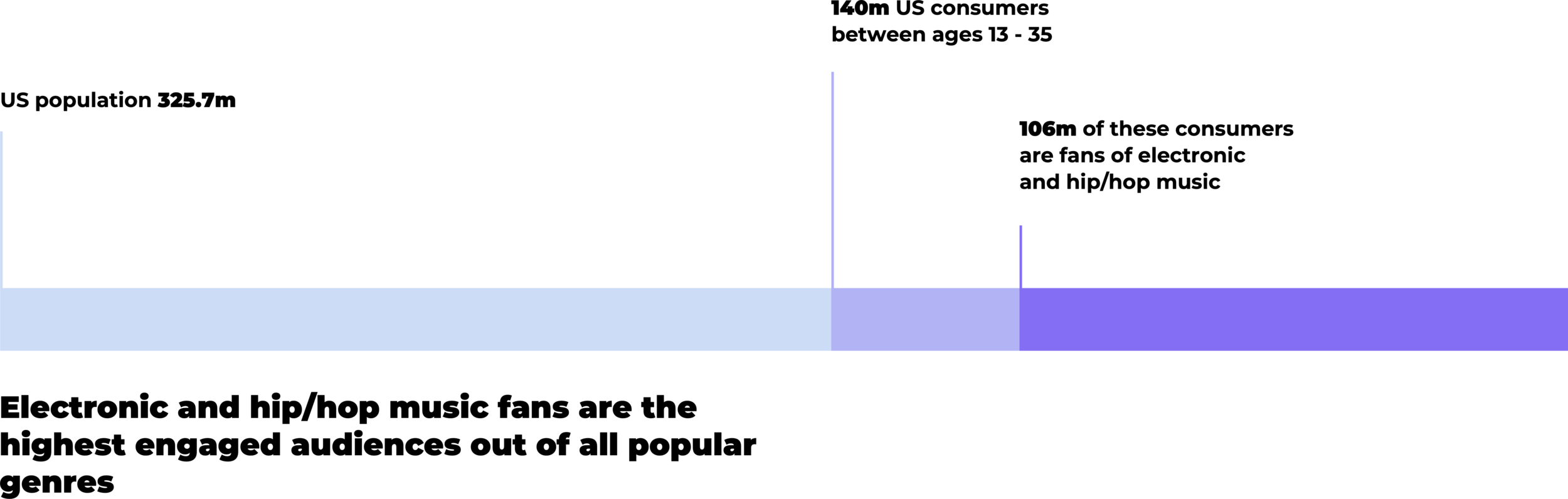

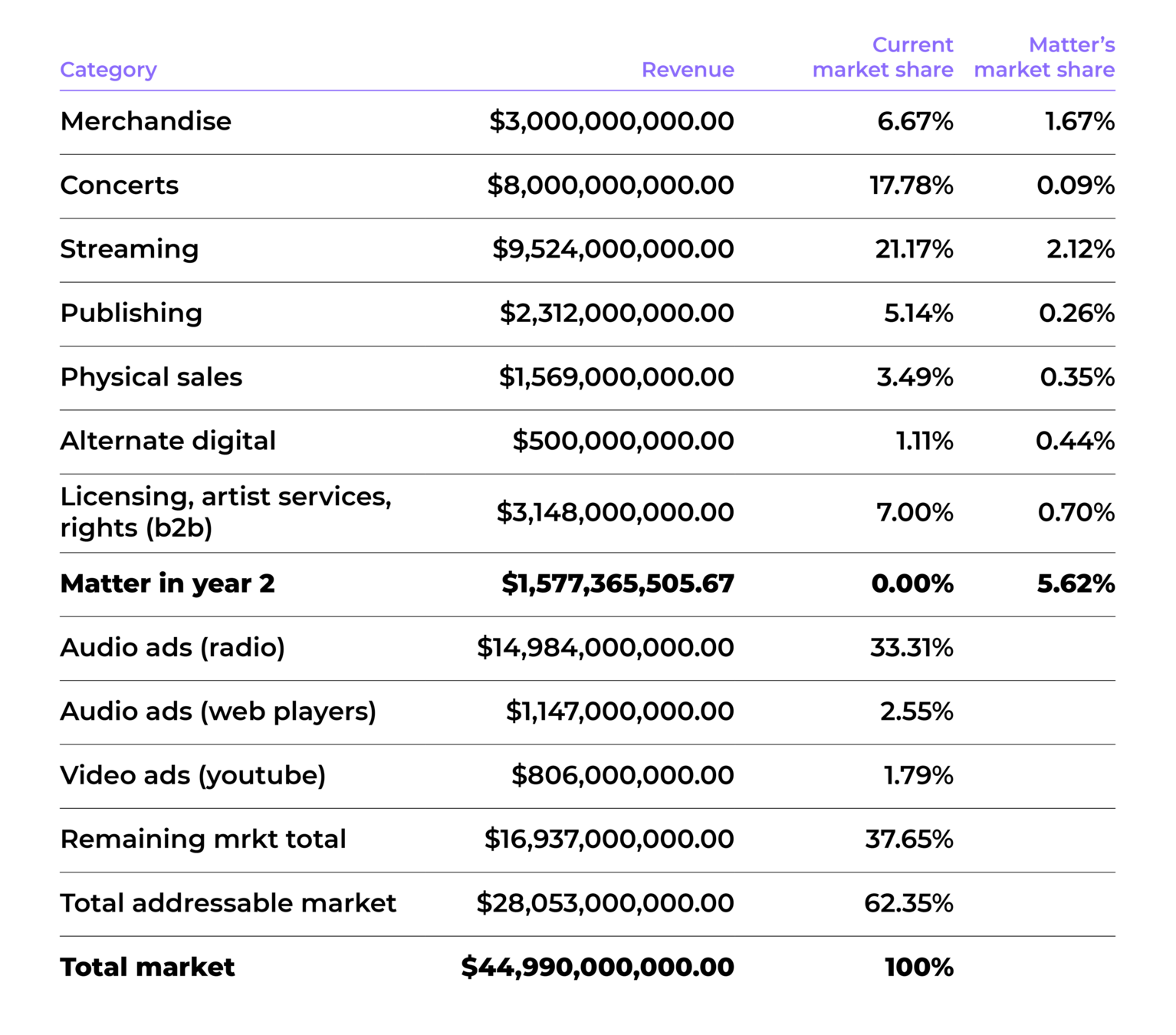

Core Addressable Market

Our initial artist

base has...

30m monthly

streams on Spotify

We are targeting the “stickiest” genres with the highest rates of streaming, engagement, and consumer spending habits:

Hip-Hop/Rap and EDM.

3m followers

on Soundcloud

1.5m followers

on Twitter following

4.5m followers

on Instagram

Artist engagement

Artist base

— 60% US

— 35% European

— 5% other

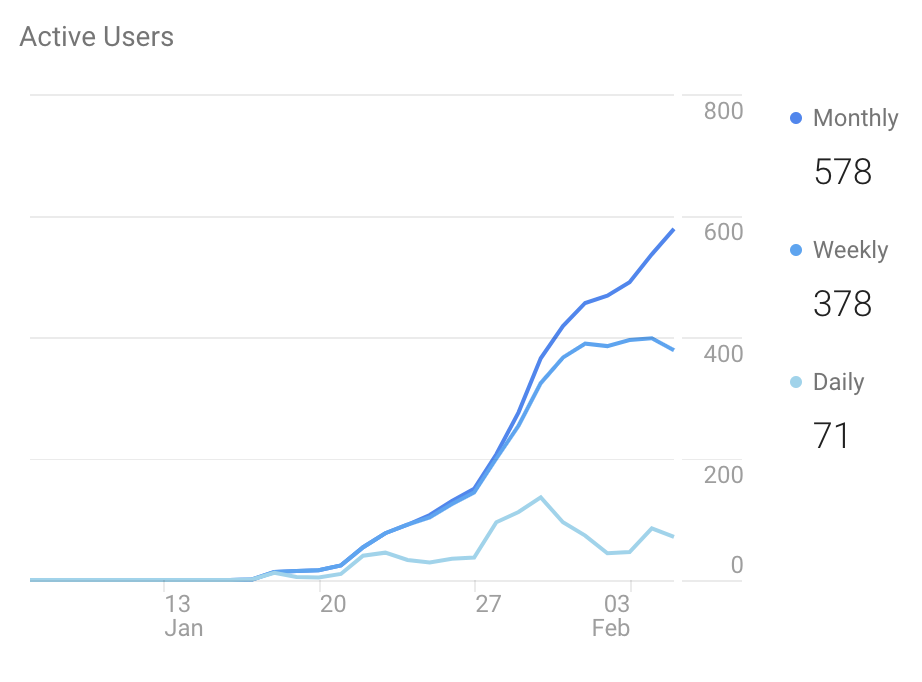

Artist growth on closed Alpha

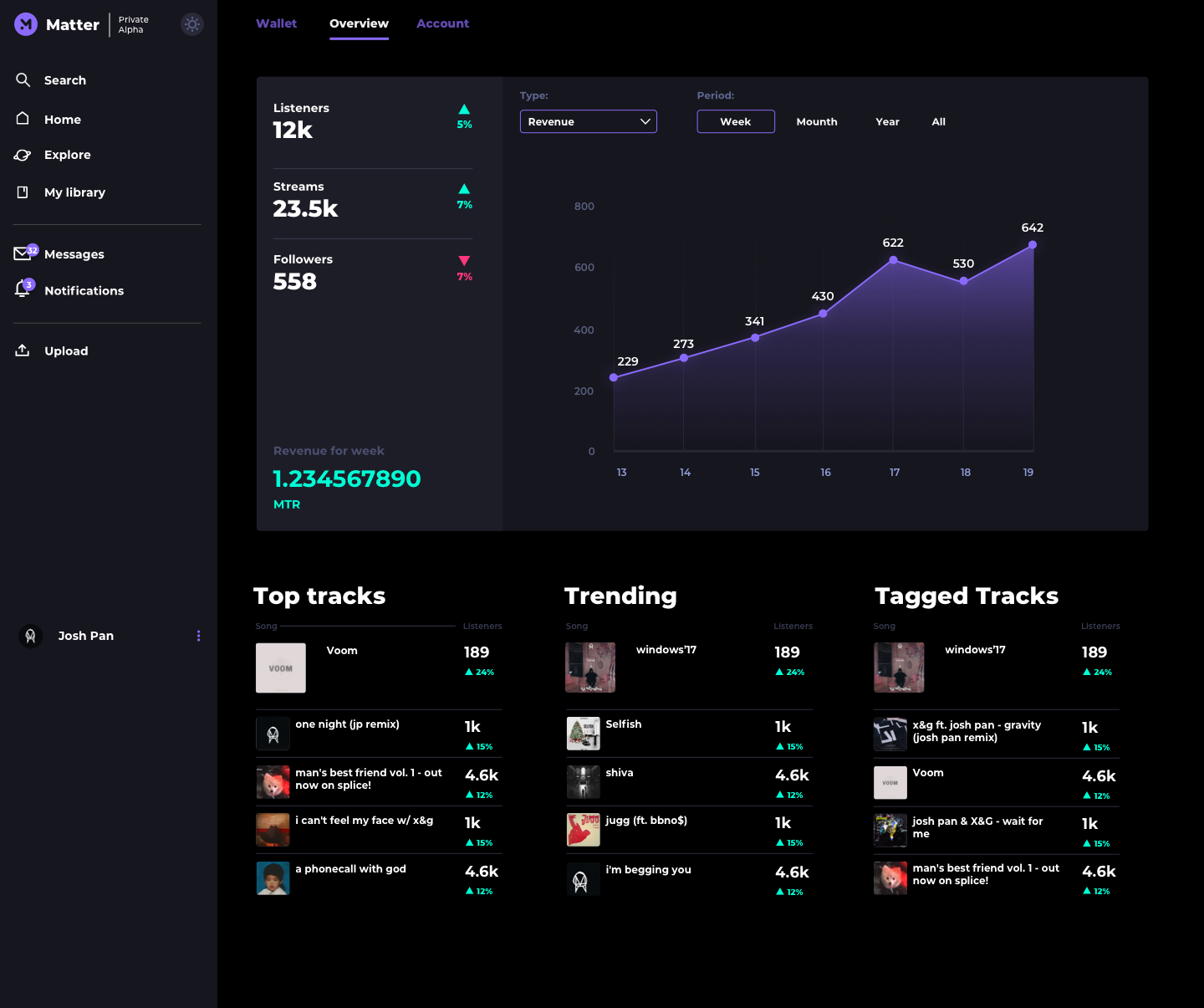

Engagement

— average time spent on platform has been 30% higher than leading competitors

— average pages viewed per session = 29.3

7 day k factor = 1.7 with

only 183 artist invites sent

TAM was based on US statistics, disregarding our strong initial traction in foreign markets

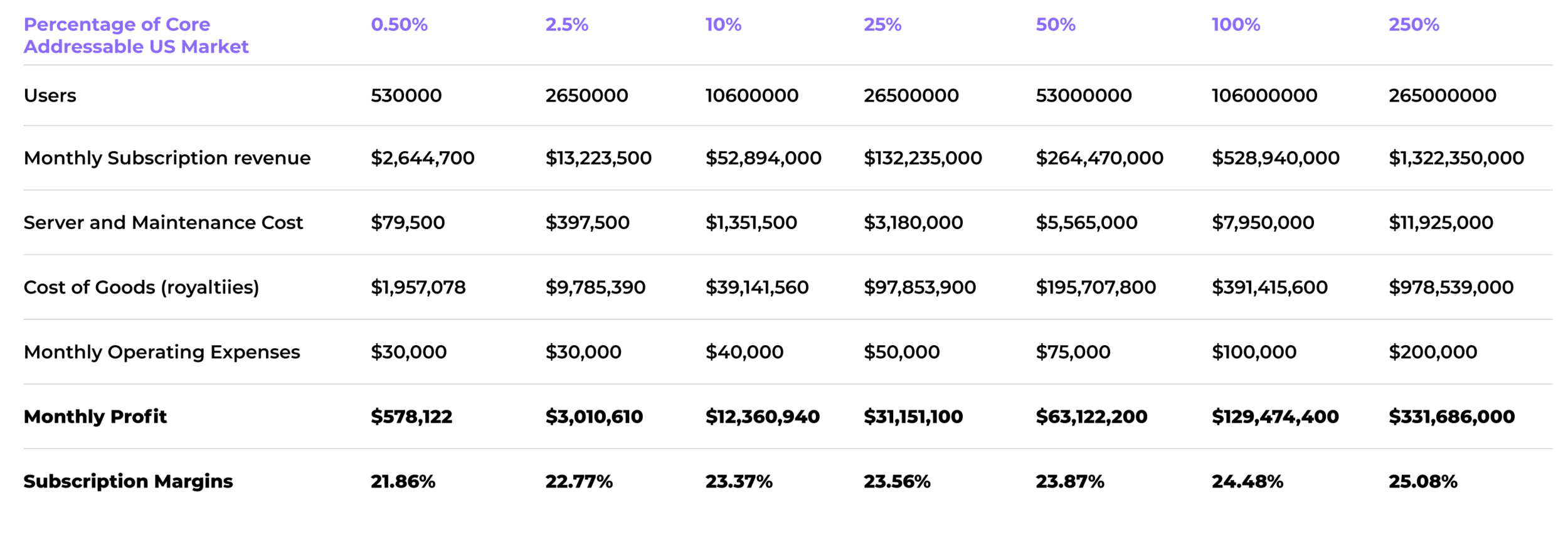

*Break even point = 0.024667% = 26,000 users

0.5% of our core addressable US market represents the conversion of ⅙ the people who follow our initial artists on Soundcloud.

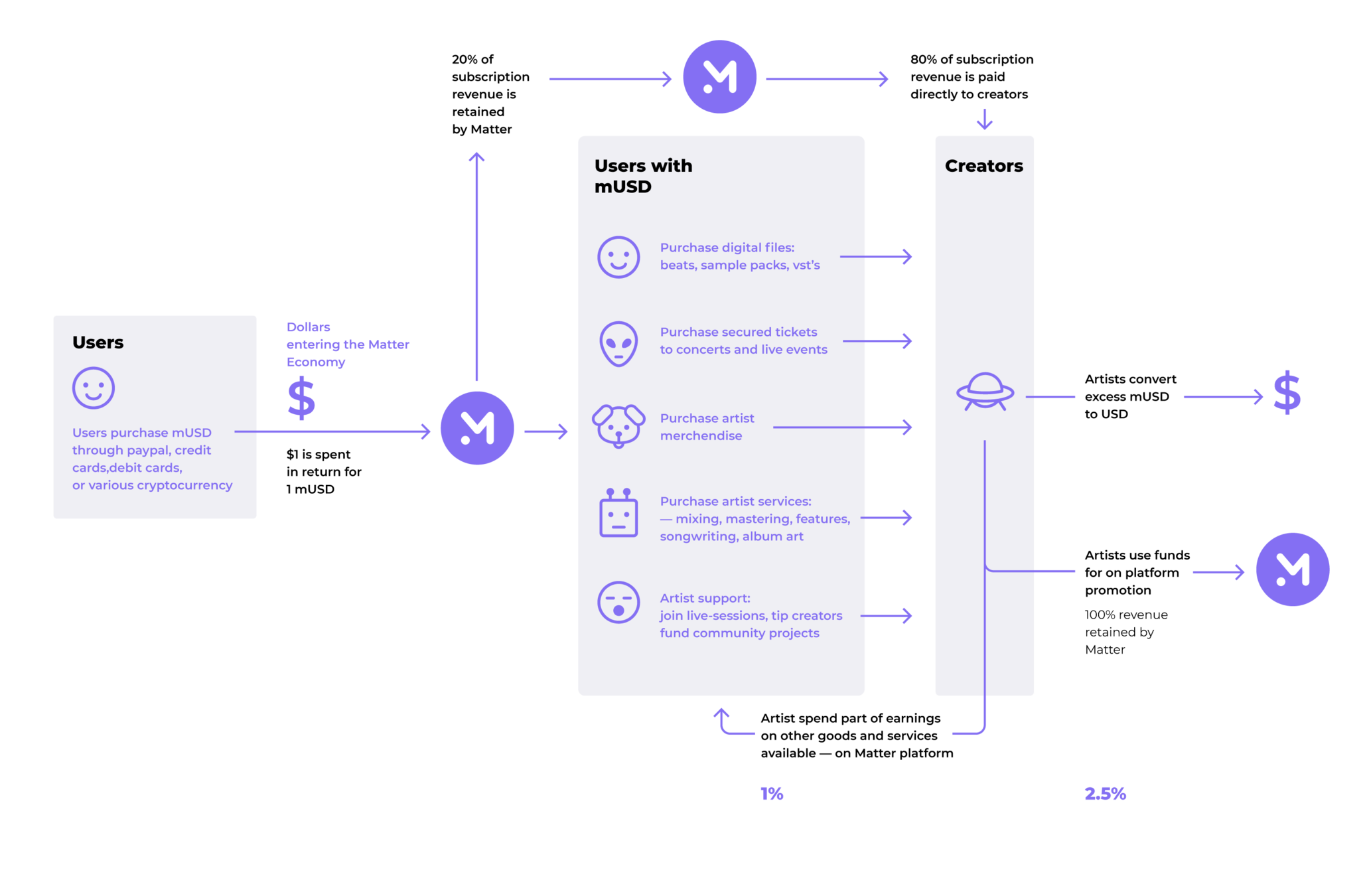

Matter Makes Streaming Profitable

Furthermore, based on the initial artist onboarding and the velocity of new artists signing on to the platform, 2.5% is accomplishable within the first year.

This limited outreach to artists and their participation not only reflects loyalty to the platform, but the scale of the market opportunity and our ability to capitalize.

Profit

Potential

As streaming consumption increases, incumbents are unable to absorb increasing licensing costs.

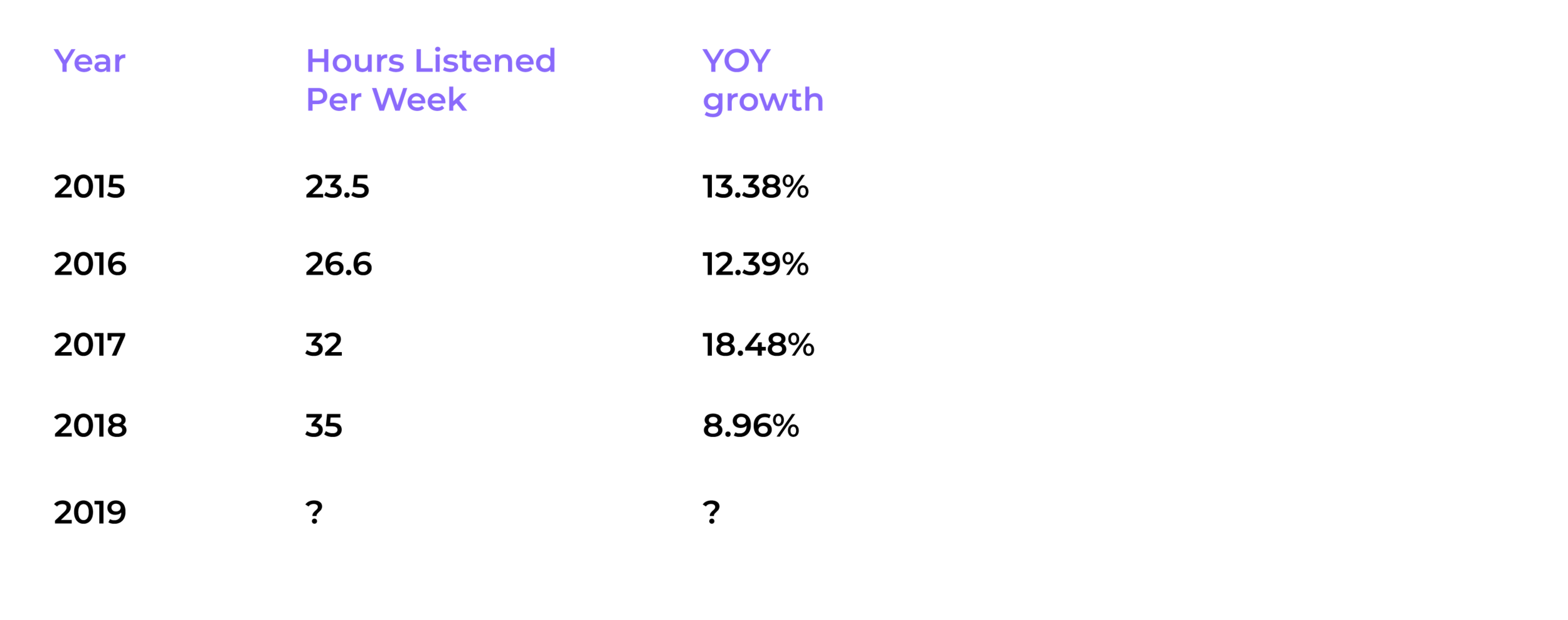

If music consumption trends continue (8.96% YOY), current industry leaders will be vulnerable to a company that can offer a more expansive product with lower price points.

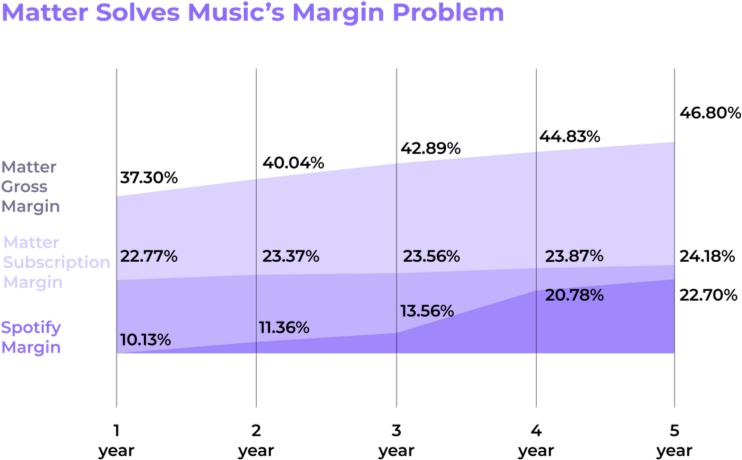

Ignoring SG&A costs and focusing on our most fundamental business activity, we can effectively double the margin's of industry leaders, regardless of product pricing.

Of the 71% of Americans who do not use music streaming, 55% cited high subscription costs as the number one reason.

Available non-core Growth Strategies

We convert high activity users into fuel for what will be the highest volume music commerce market in the world.

Matter’s platform analytics support high daily activity for its users who spend 83 minutes per day listening to music. Because their cost of goods is agnostic to user activity, Matter is able to broaden product scope to make even more money.

Matter’s community-first approach enables the company to enter adjacent verticals, driving platform revenue and

Blockchain driven efficiency

Data Ownership

Transparency

Scalability

Reduced Cost

Servers

Payment Processing

Options

Security

Global Reach

Internet 2.0

Congressional

Support

Our blockchain platform allows best in-class:

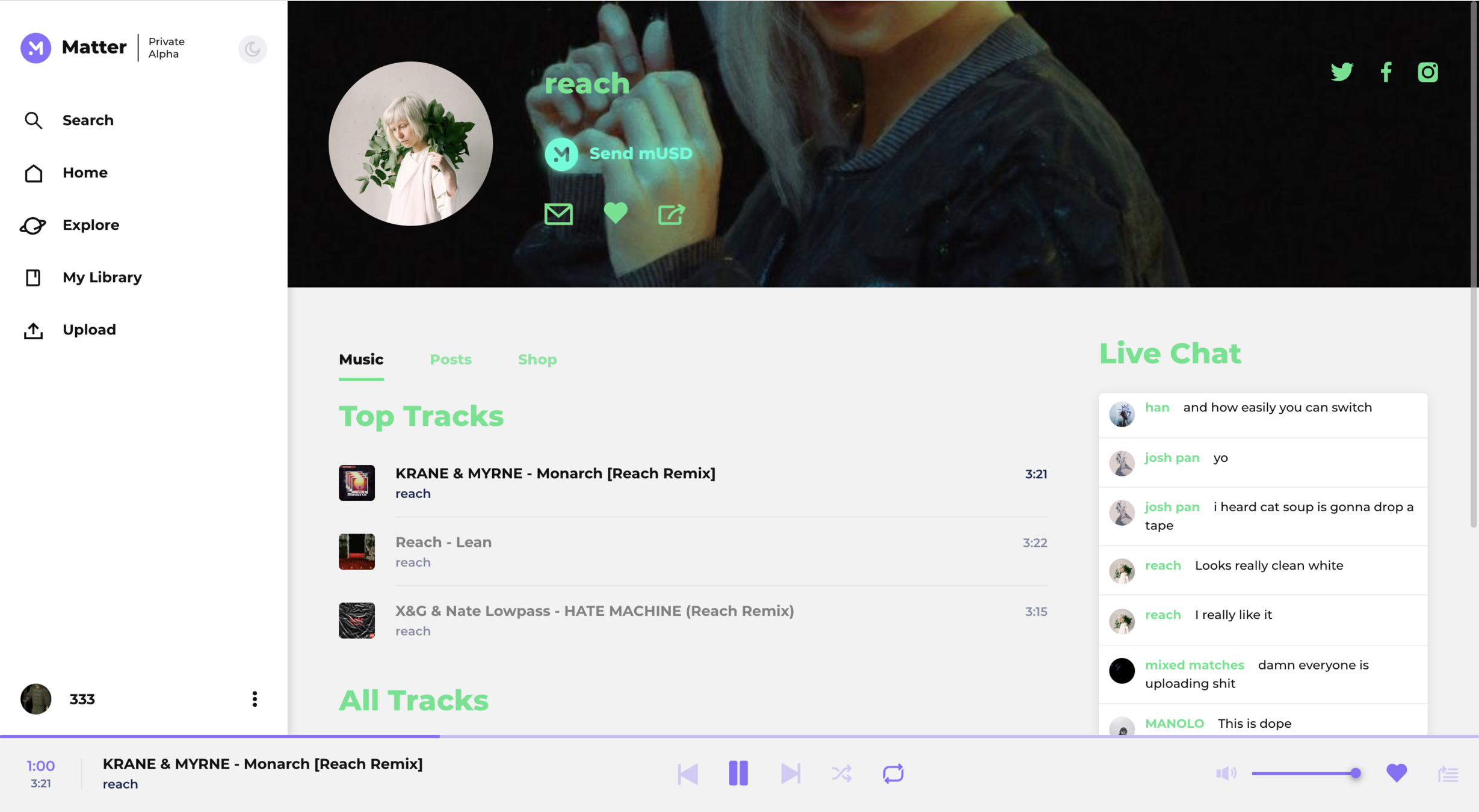

The platform

Here’s the full functionality

Paul Meed: CEO

Created and sold his cryptocurrency trading firm, then got over 5 million streams with his first releases as an independent artist

Ryan Klaus: COO

Team building, organizational development, and sales experience. 1 successful exit

Josh Pan: Creative Director

MBA graduate and active musician signed to OWSLA, a top electronic label founded by Skrillex. Hear his music on EA’s Fifa 19.

Boris Adimov: CTO

Years of experience building and shipping promotional websites, complex services, startups and mobile apps.

Bogdan Kovtun:

VP of Engineering

With over 20,000 career hours spent as a backend developer, he is practically a machine himself

Here’s who we are

Tigran Tumasov:

Product Manager

Exceptional productivity and problem solving skills combined with outside-the-box thinking to design the best possible product

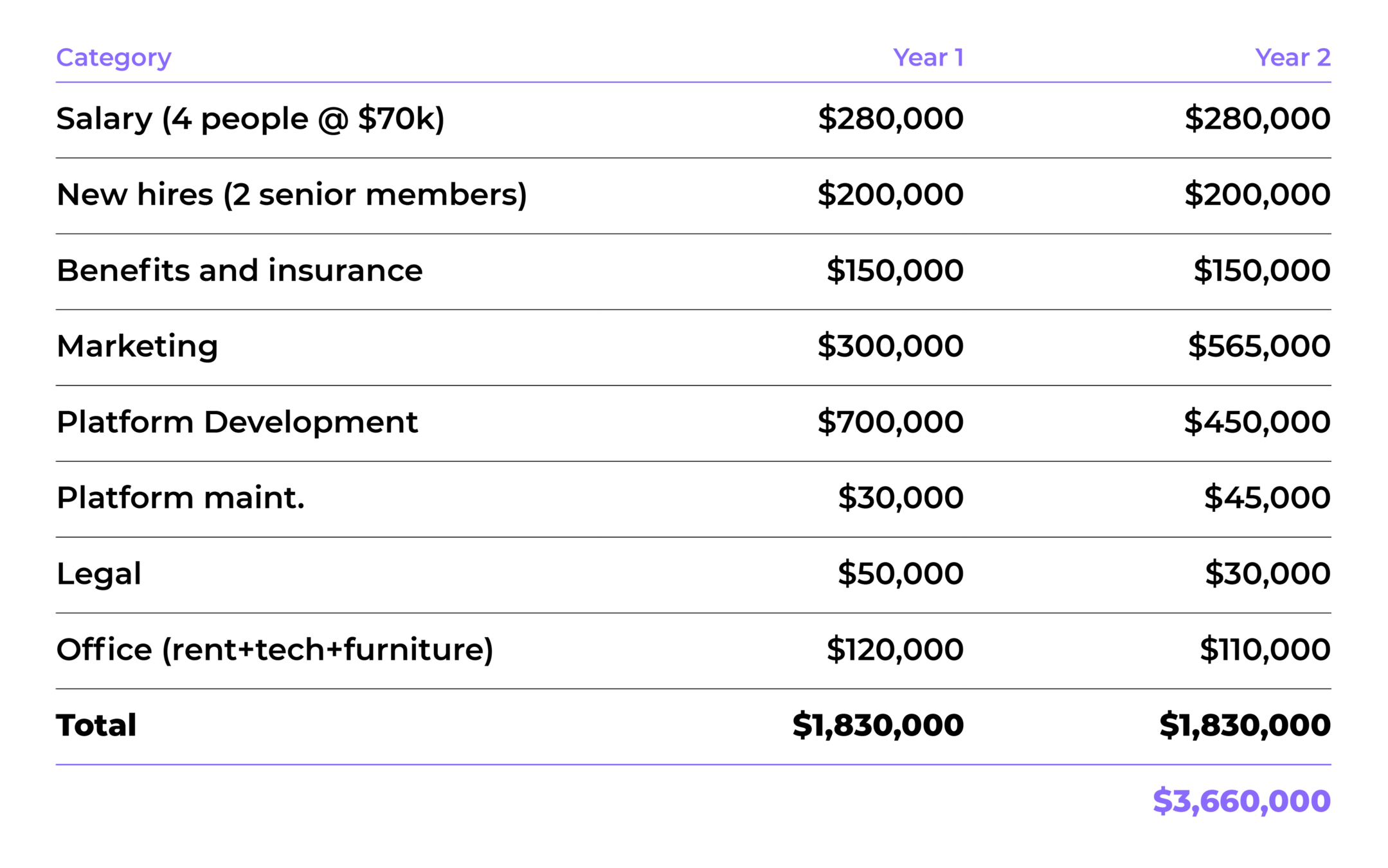

We are raising

$4 million

$4 million brings

Matter past product market fit

— Full time engineering team

— Product Marketing

— Team development

— Office

— 2 strategic hires: VP of music

and Senior UI/UX developer

— Business and liability insurance

Appendix

Citations

1. Winberg, Sampo. “Constantly Evolving Music Business: Stay Independent vs. Sign to a Label: Artist’s Point of View,” n.d., 68.

2. “The Average Person Spends Less Than $15 Per Year on Streaming Music | Digital Trends.” Accessed February 2, 2019. https://www.digitaltrends.com/music/nielsen-streaming-music-spending-news/.

3. “Spotify Just Turned the First Net Profit in Its History (but It’s Not Particularly Happy about It).” Music Business Worldwide, November 1, 2018. https://www.musicbusinessworldwide.com/spotify-just-turned-the-first-net-profit-in-its-history-and-its-not-particularly-happy-about-it/.

4. “Here’s Exactly How Many Shares the Major Labels and Merlin Bought in Spotify - and What Those Stakes Are Worth Now.” Music Business Worldwide, May 14, 2018. https://www.musicbusinessworldwide.com/heres-exactly-how-many-shares-the-major-labels-and-merlin-bought-in-spotify-and-what-we-think-those-stakes-are-worth-now/.

5. “The SoundCloud You Loved Is Doomed | Pitchfork.” Accessed February 2, 2019. https://pitchfork.com/thepitch/the-soundcloud-you-loved-is-doomed/.

7. “Declining Audience, Rising Revenue For Pandora.” Insideradio.com. Accessed February 2, 2019. http://www.insideradio.com/free/declining-audience-rising-revenue-for-pandora/article_f0f129be-9556-11e8-b009-5fa5684f0ca0.html.

8. Kafka, Peter. “Spotify Has Guaranteed to Pay Big Music Labels Billions over the next Two Years.” Recode, June 15, 2017. https://www.recode.net/2017/6/15/15807382/spotify-revenue-2016-financials-guarantee-payment-universal-merlin.

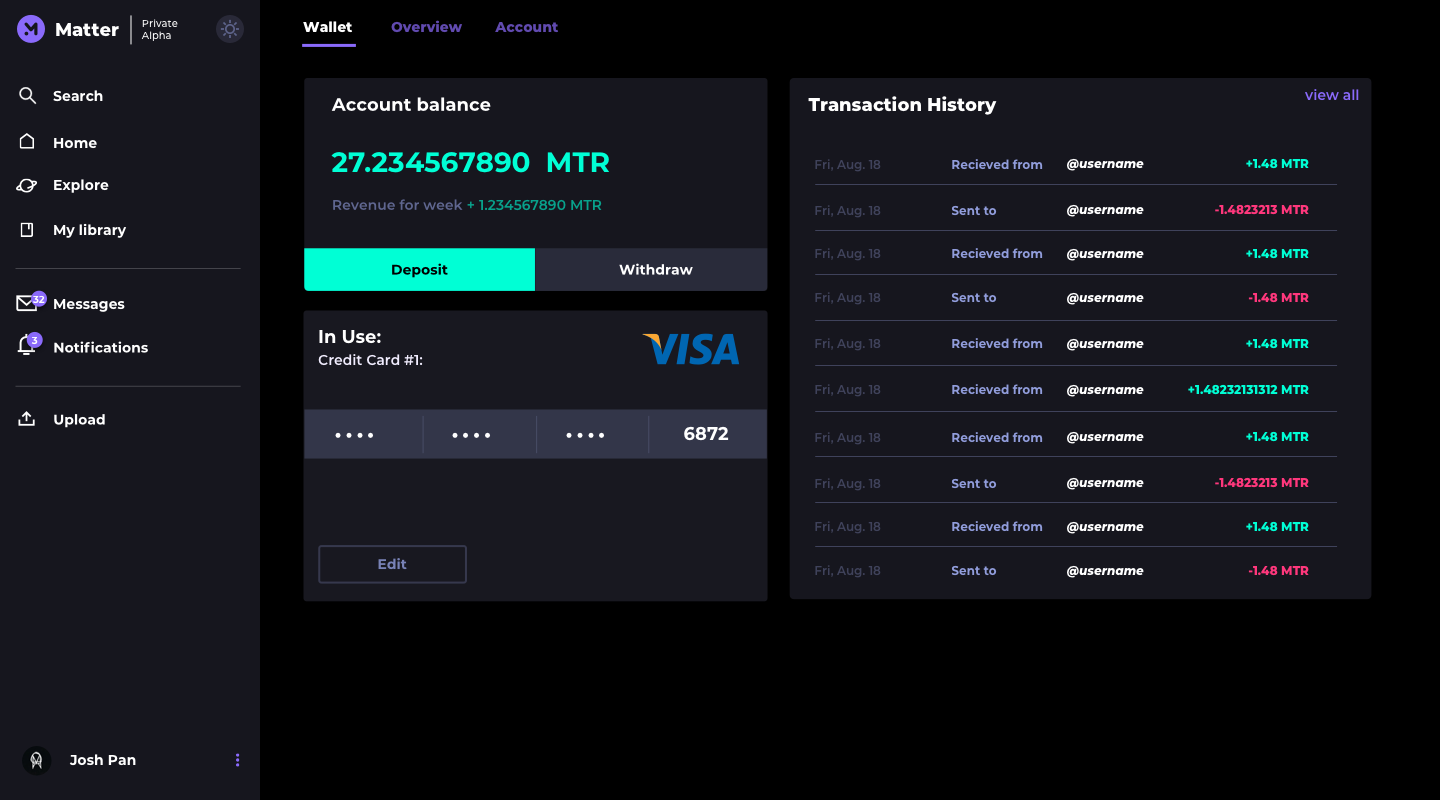

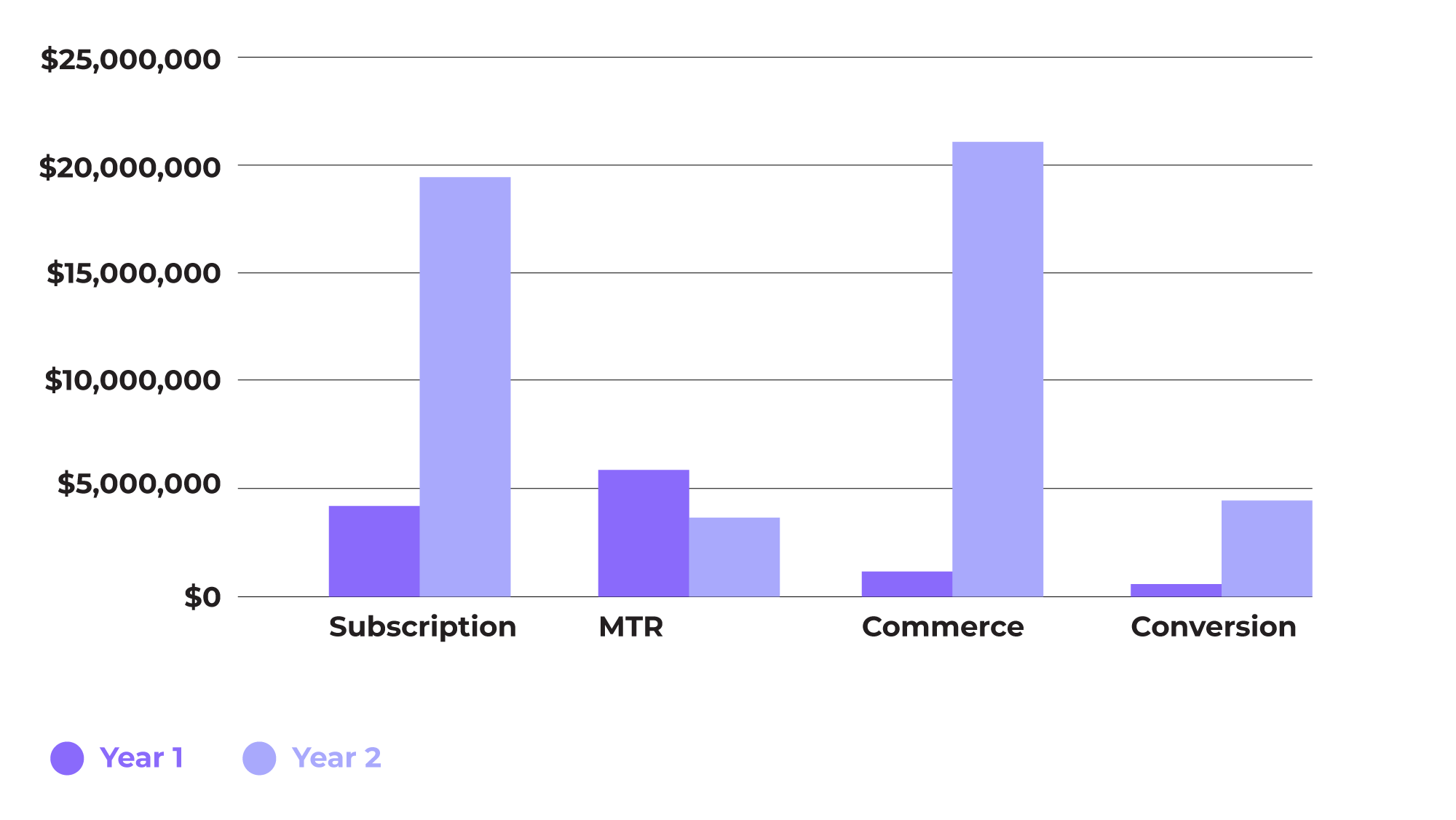

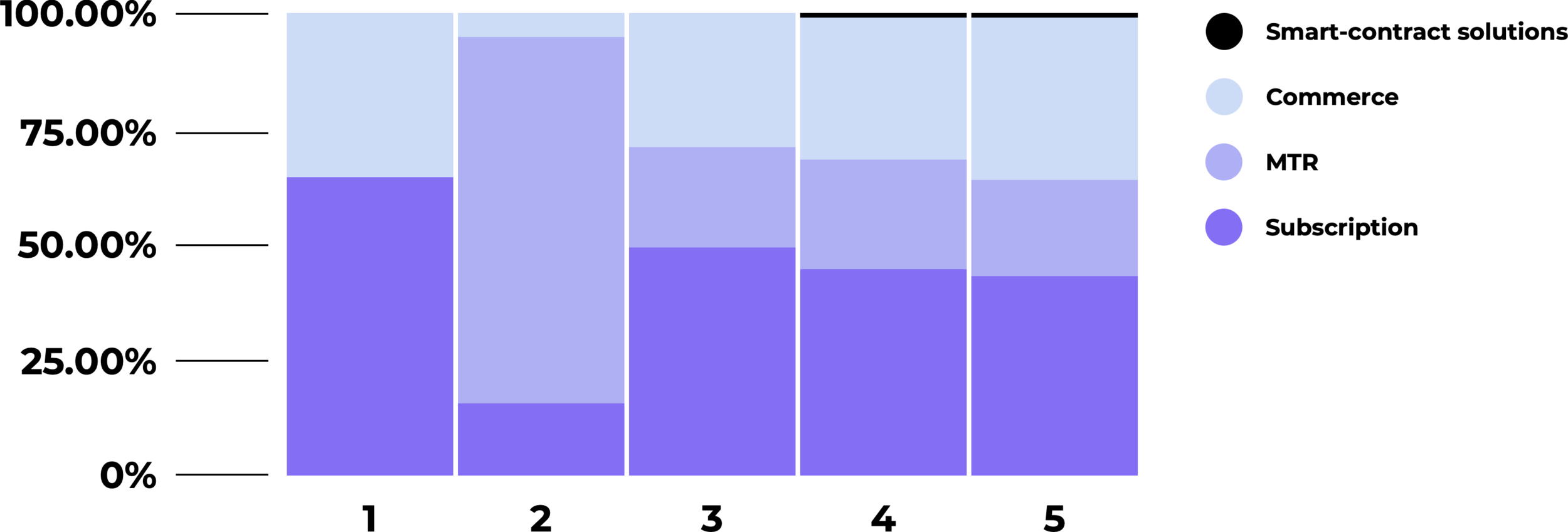

Expected Future

Burn Rate

The

network

enables

revenue

9.25%

2 year revenue forecast

Matter can generate a profit within 3 months because of low overhead cost to implement their model. Long term scalability will be achieved through domination of the music commerce verticals and user preference for a payment method.

ICO plan

Trailing 3 months

(Active UsersHype + Historic NAL) Market timing = Successful Sale

Average ICO Monthly Raise Over Past Year = $1.86 Billion per Month

Token Generation Event = $25m

October:

$720m

November: $530m

December: $690m

The “average” ICO has raised $6.9m

over the past 3 months

The Breakdown

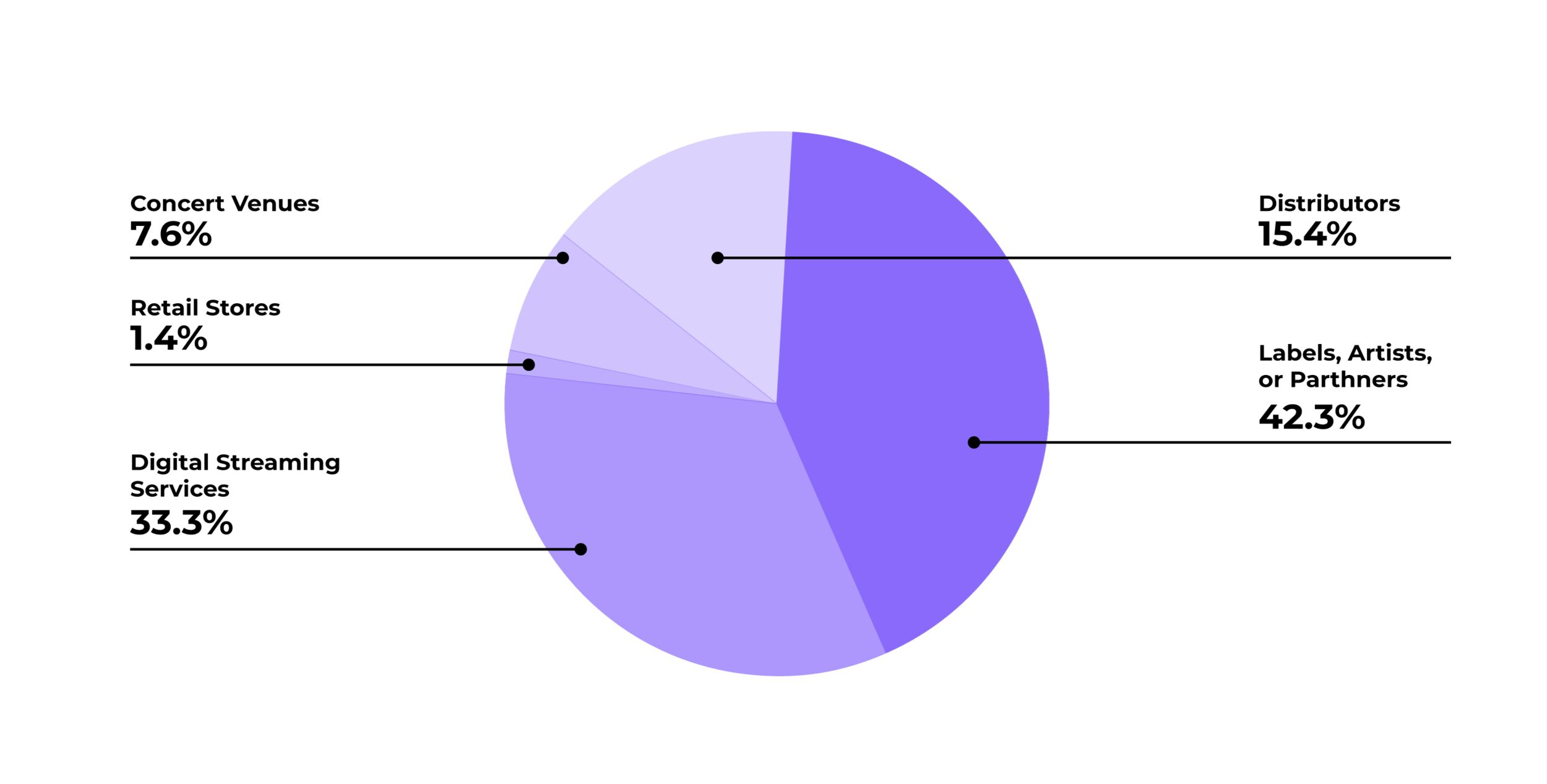

$43,000,000,000 of revenue was generated in 2018,

with over $29b going to non-content creators

Here’s why we are defensible

Artists already onboarded support our pricing model

We are addressing an unaddressed and underrepresented market. Forcing incumbents to abandon current business practices to compete on our terms

Pricing model

— Non fixated payouts

Paradox of high activity platforms is non-linearity of cost of goods vs. subscription revenue

— Reducing several layers of “middlemen”

— Aggregate several industry value props at lower price

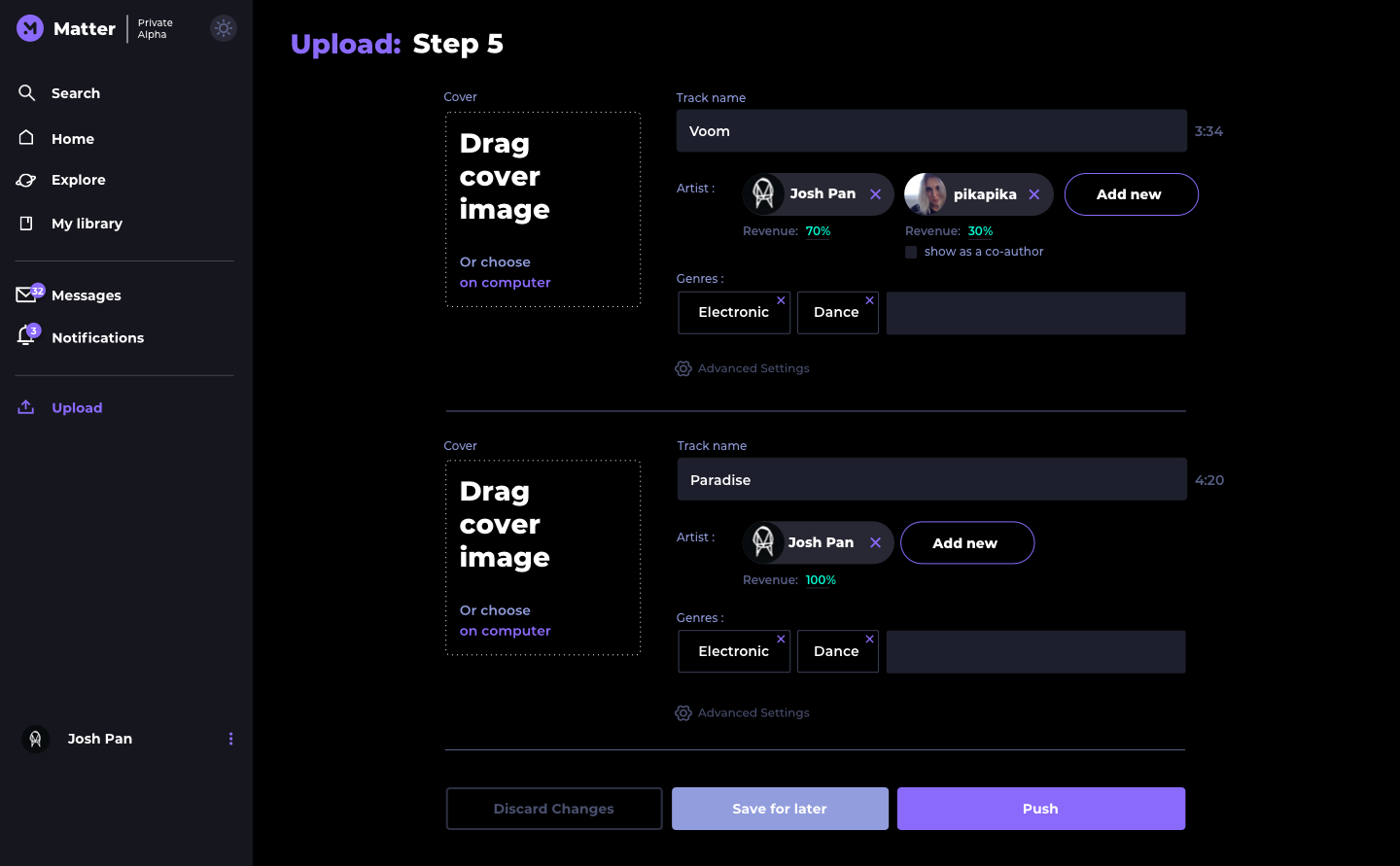

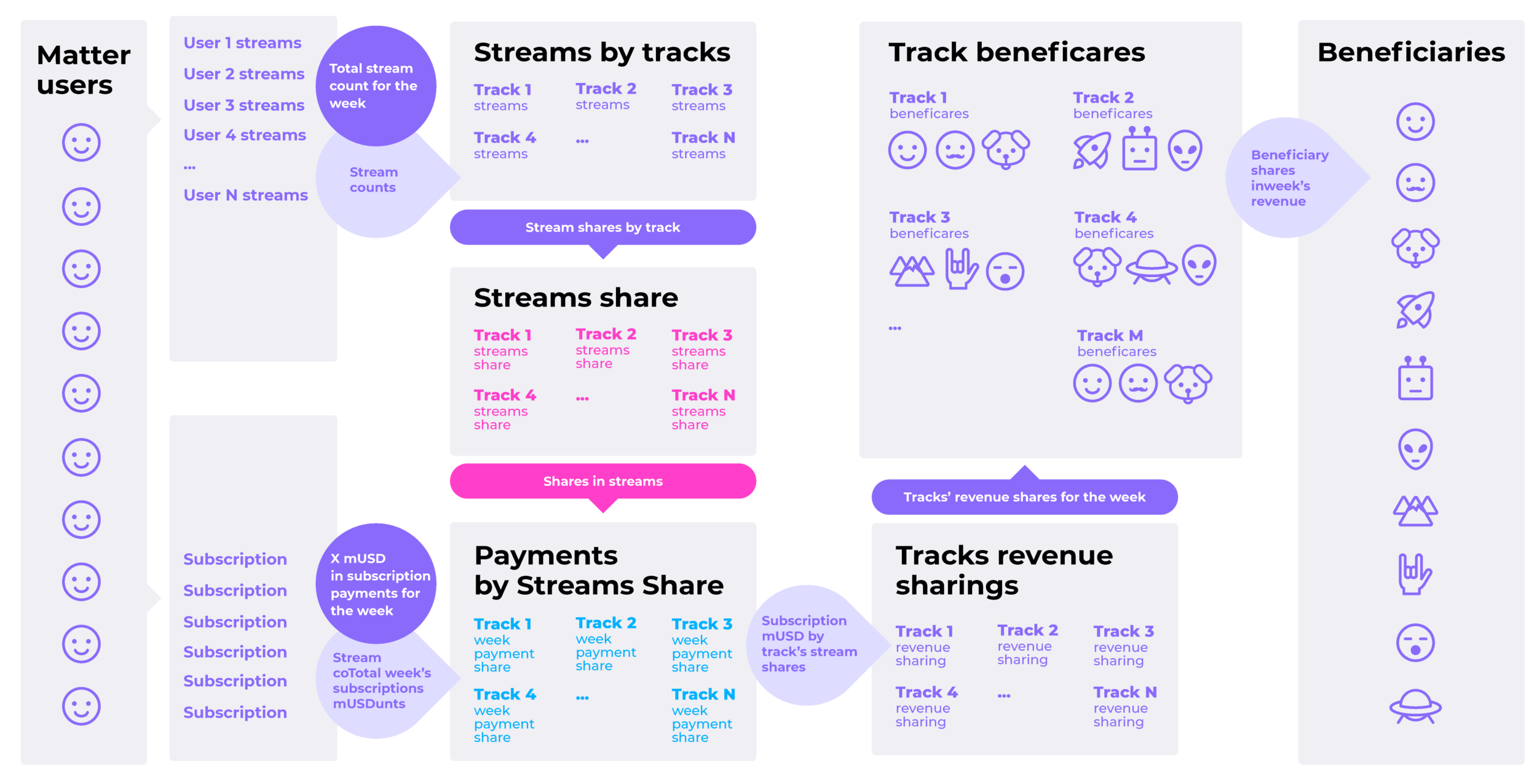

Smart Contract Revenue Distribution

Additional Moats

SEC No Action Letter

Bipartisan Congressional support from:

Key legal authorizations

Patent pending for dual token model

— Unprecedented for blockchain sector.

— Allows to legally ICO to US non-accredited investors

— House Financial Service Committee

— Senate Finance Committee

— Blockchain Caucus

— Music Modernization Act

— Applicable to any entertainment platform that will use blockchain

Competitive

landscape

Our community-first approach enables us to smoothly enter adjacent verticals

Driving platform revenue and increasing monetization opportunities for creators has been heavily requested by the community further establishing a deeper wedge between Matter and its competitors.

Phases

Rounds of funding completed by direct competitors

Spotify

24

Pandora

10

Soundcloud

9

Matter is operationally profitable from streaming alone after capturing 0.026% of their core addressable US market. Matter will not need further rounds of funding in any foreseeable future.

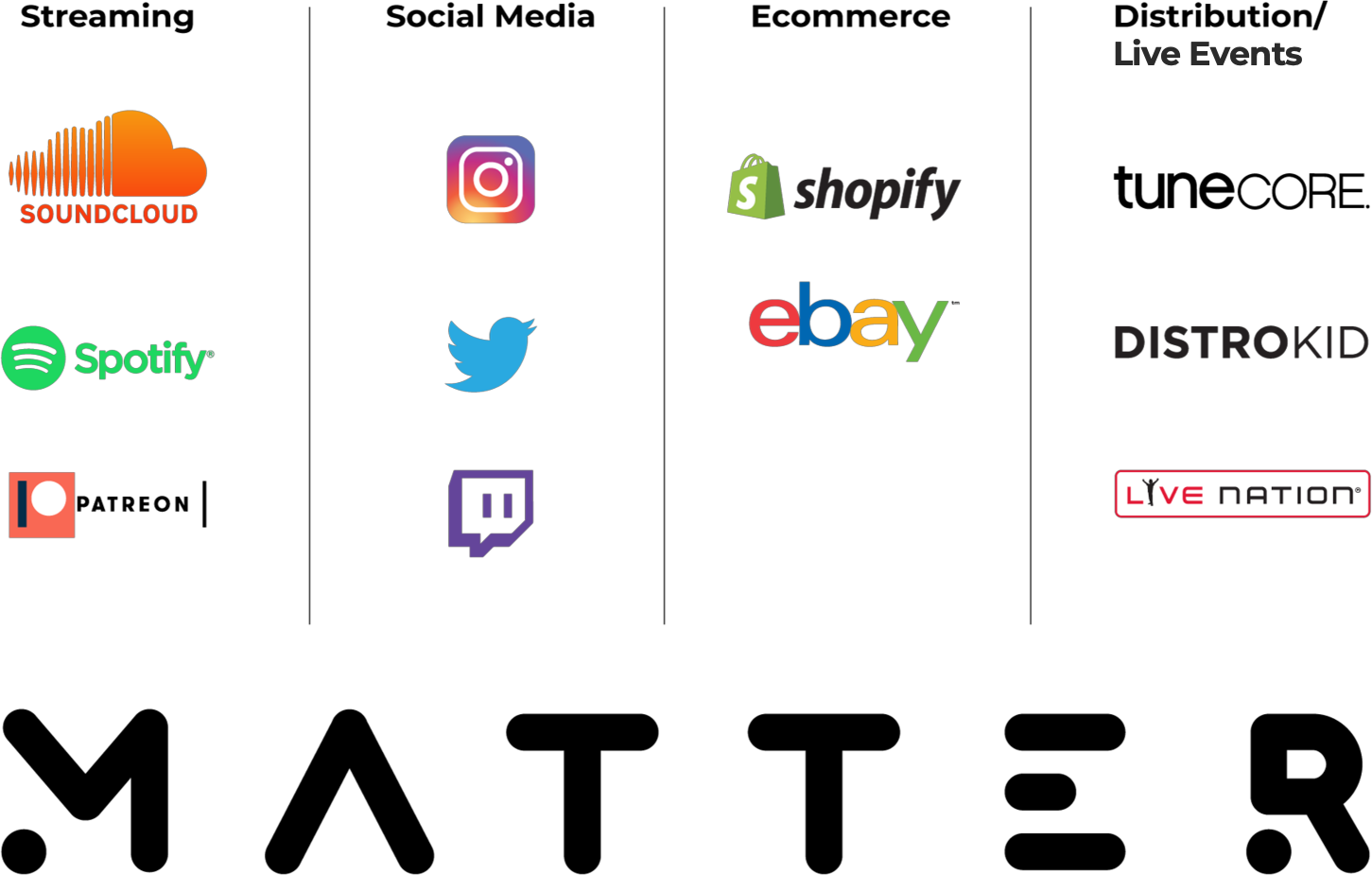

— Gain a following on Soundcloud

— Upload to Spotify to get paid royalties

— Determine splits with your producers on Stem

— Acquire distribution and digital rights on Distrokid

— Announce new releases on Twitter

— Sell merch on Shopify

— Sell beats on Tracktrain

— Sell used gear on Ebay

— Sell tickets through LiveNation

— Show behind the scenes on Instagram

— Receive tips on Patreon

Distribution solutions past publishing

The hub for your digital music career

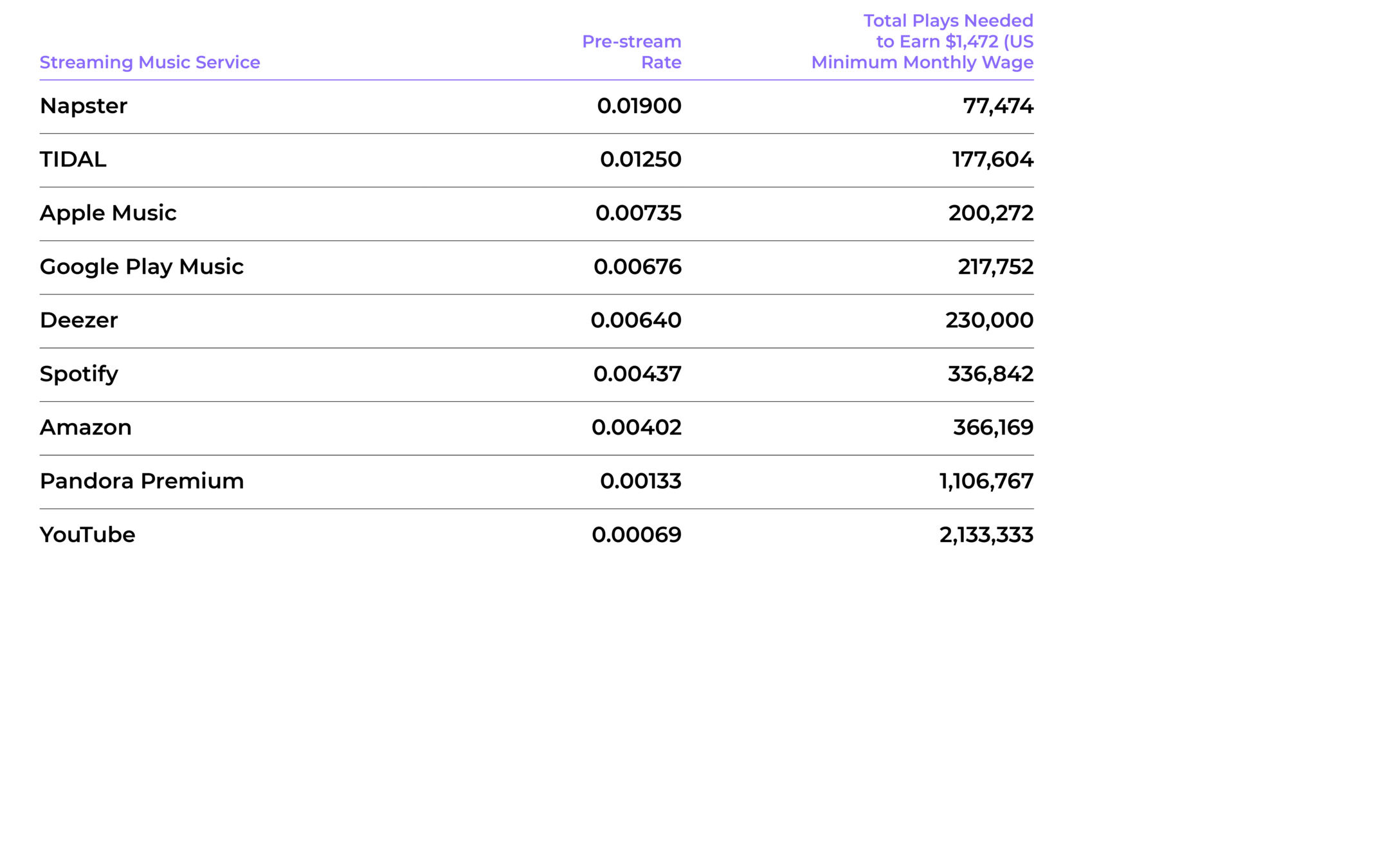

Are you able to earn minimum wage?

With the advent of the digital age, artists have been unable to monetize their work, leading to shocking statistics such as the amount of streams it takes for an artist to earn the minimum wage. Additionally, artists typically only receive distributions every 3-6 months.

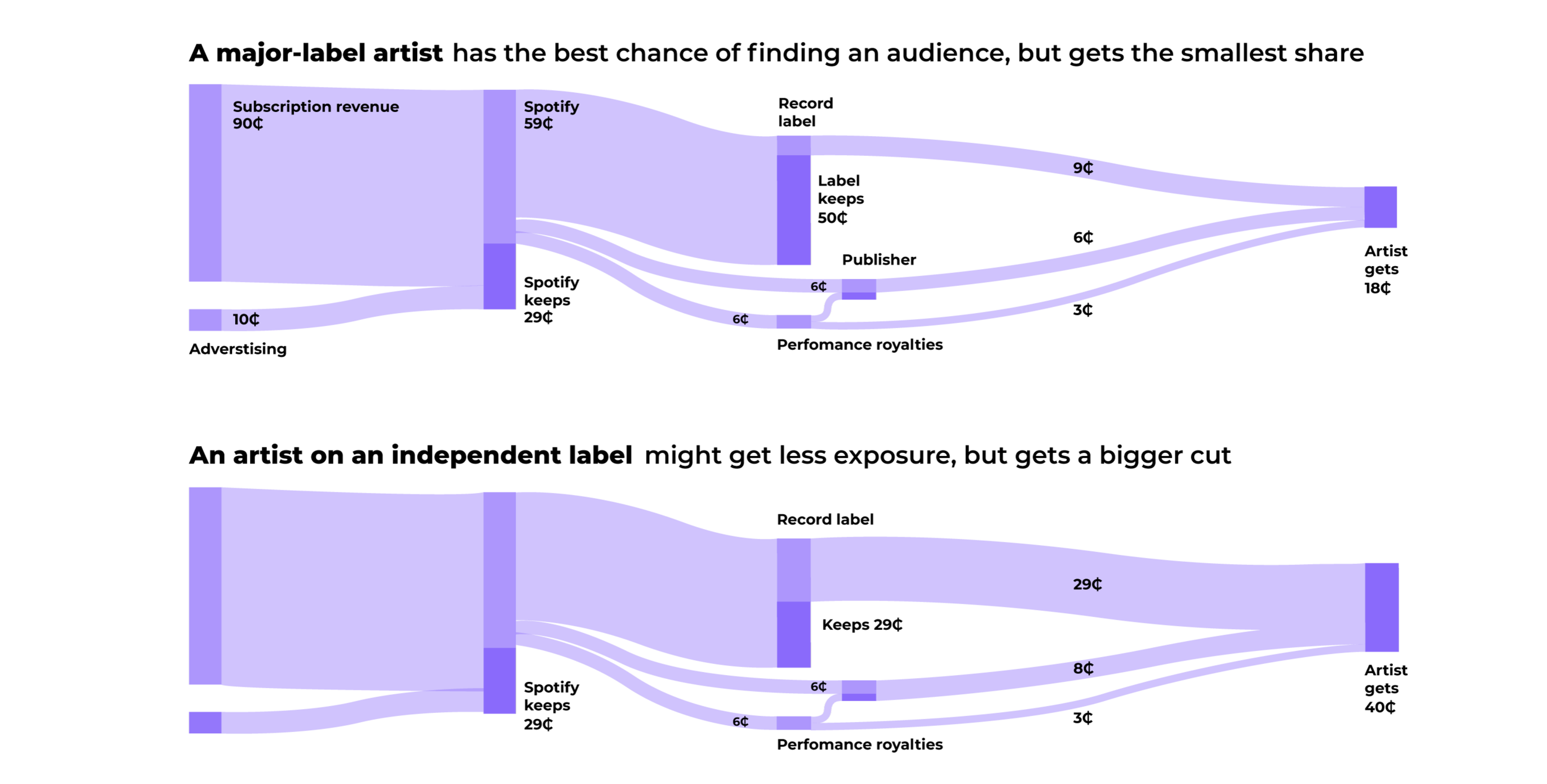

How $1 Flows from Spotify

to Recording Artists

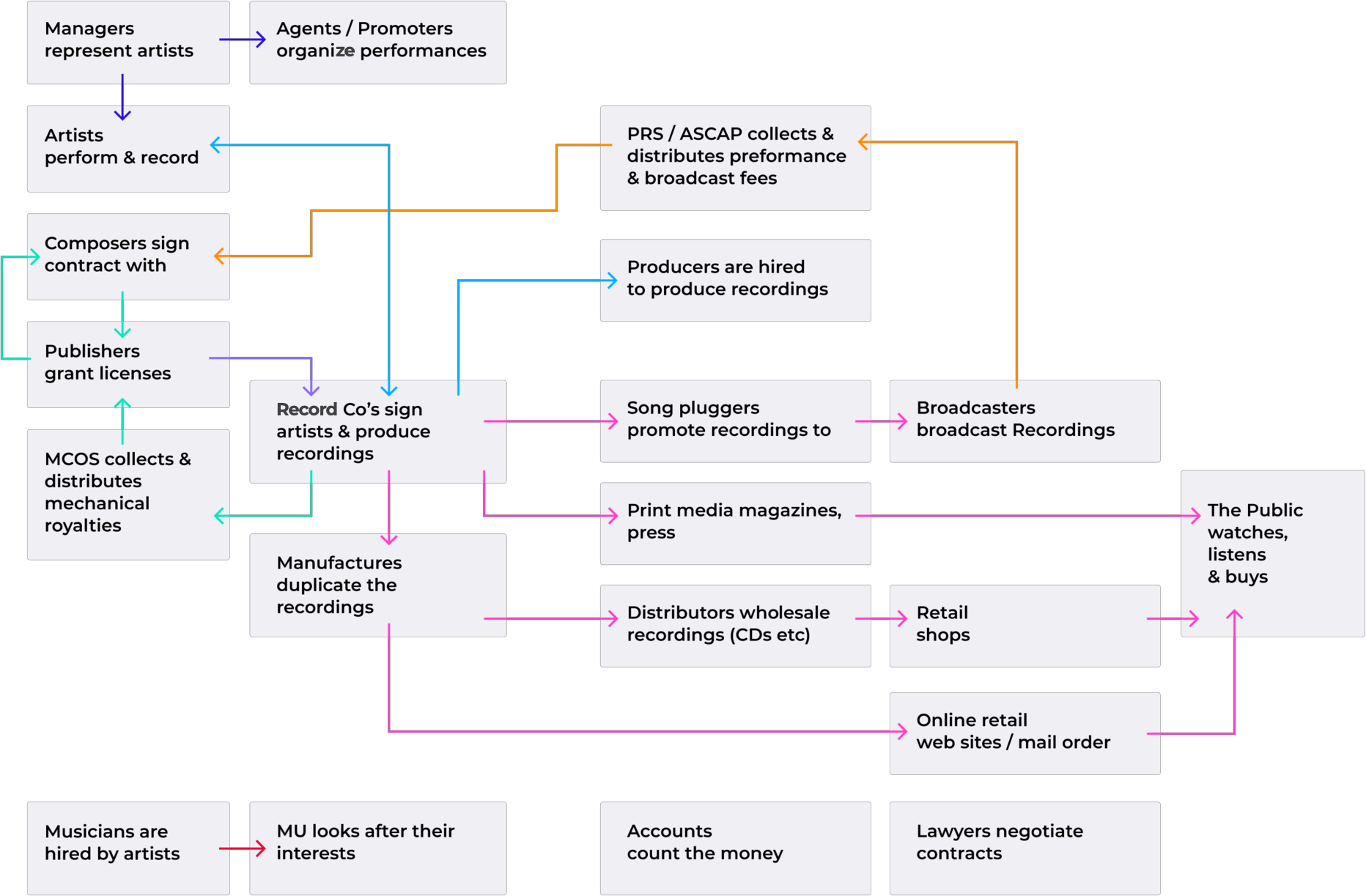

Structure

of the

Industry

The present internal structure of the music industry was born when the radio was king, the record store was queen, and the labels were small and independent.

Principal Organisational

Structures of the Music

Industry

Available non-core Growth Strategies

We convert high activity users into fuel for what will be the highest volume music commerce market in the world.

Matter first focuses on creating a comfortable and community oriented streaming platform because the average American spends 5 hours a day listening to music. Doing so, allows them to solve one of the worst commercial conversion rates across the internet; artists selling goods and services to their fans.

While creators receive a majority of their impressions at the location their content is published, they ultimately fail at driving this traffic to off-platform commerce channels.

Matter provides an opportunity for artists to instantly sell to their biggest fans, while avoiding click falloff. In the marketplace they can offers goods such as merchandise, tickets, beats and and gear. Offers services like mixing, mastering, features, and cover art. Along with limitless 'live sessions' where artists stream exclusive content like behind the production, q&a interviews, intimate acoustic shows, or even a 1 on 1 video lessons.

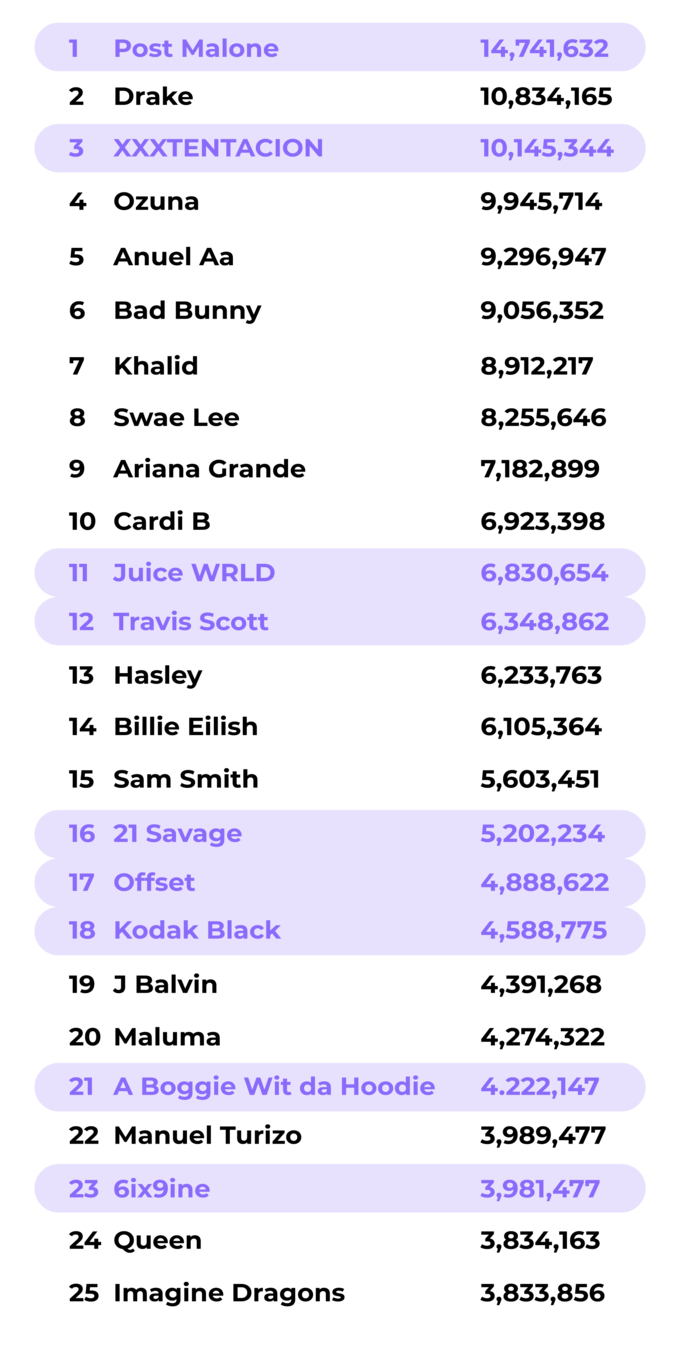

Discovering

talent

Of today’s top 25 artists, 9 have been discovered on Soundcloud. In 2014-2016 Soundcloud was able to provide necessary engagement between artists to propel careers.

Where will the next Post Malone be found? The answer is Matter.

Partners and

Progress

Recording

Academy

Sonic Ark Publishing LLC

6-month Launch Plan

1/15

Private Alpha

1/25

Artist Onboarding

Launch of streaming features