finding illicit financial flowS with network science

Polarization // social networks

Inequality and crime // financial networks

who is the largest investor in spain?

who is the largest investor in brazil?

who is the largest investor in south africa?

why?

Spoiler: Tax avoidance/evasion

professionals

corporate entities

state

PARt 1: The corporations

corporate ownership is complex

Garcia-Bernardo, J., Fichtner, J., Takes, F. W., & Heemskerk, E. M. (2017). Uncovering offshore financial centers: Conduits and sinks in the global corporate ownership network. Scientific Reports, 7(1), 1-10.how do companies organize their corporate structures?

Garcia-Bernardo, J., Fichtner, J., Takes, F. W., & Heemskerk, E. M. (2017). Uncovering offshore financial centers: Conduits and sinks in the global corporate ownership network. Scientific Reports, 7(1), 1-10.

Data provider: Orbis (300M+ companies, 100M+ ownership links)

sinks

15 companies per capita

Garcia-Bernardo, Fichtner, Takes, Heemskerk (2017)

conduits

Work with Valeria Secchini (PhD candidate at COPTAX, Charles University)

modeling corporate structures with higher-order dependencies

First order

Second order

PH

PL

...

Work with Valeria Secchini (PhD candidate at COPTAX, Charles University)

modeling corporate structures with higher-order dependencies

First order

Second order

PH

PL

...

Xu, Jian, Thanuka L. Wickramarathne, and Nitesh V. Chawla. "Representing higher-order dependencies in networks." Science advances 2.5 (2016): e1600028.

Q: Is PH a better representation of the data than PL?

PH

PL

Test: are the two distributions different?

Potential approach: Kullback-Leibler divergence > δ

Problem: overfitting

(high number of false positives)

On realistic synthetic data:

Precision: 7%

Sensitivity: 62%

Our solution: Cross-validation

Find pattern in train dataset, keep if it holds in validation

Results:

Applied to multinational corporations

201 patterns, 80% containing a tax haven

p.

p.

p.

PARt 2: the professionals

- Corporate structures are created by tax professionals:

- Set up the entity

- Provide directors

- Manage the accounts

- In the Netherlands: Trust Industry (trustkantoren)

- 94% of the services are provided to foreign companies

- 250,592 entities in 100 addresses

- Providing trust services requires a license

- But it is expensive + compliance

8150 companies

9.3/window

facilitators are key

How many illegal trust service providers are in the netherlands?

detect them based on their network

Garcia-Bernardo, Javier, Joost Witteman, and Marilou Vlaanderen. "Uncovering the size of the illegal corporate service provider industry in the Netherlands: a network approach." EPJ Data Science 11.1 (2022): 23.Strategy:

- Build network features

- Find similar directors to those from a licensed trust

- Manually annotate a sample

- Robustness test

Results:

Illegal trust service providers:

- 31-51% of total number of trust service providers

- 19-27% of all companies managed

Maybe a better approach: Graph Neural Networks

Andrea Longobucco MSc

https://distill.pub/2021/gnn-intro/

PARt 3: The state

what type of country lose the most from tax avoidance?

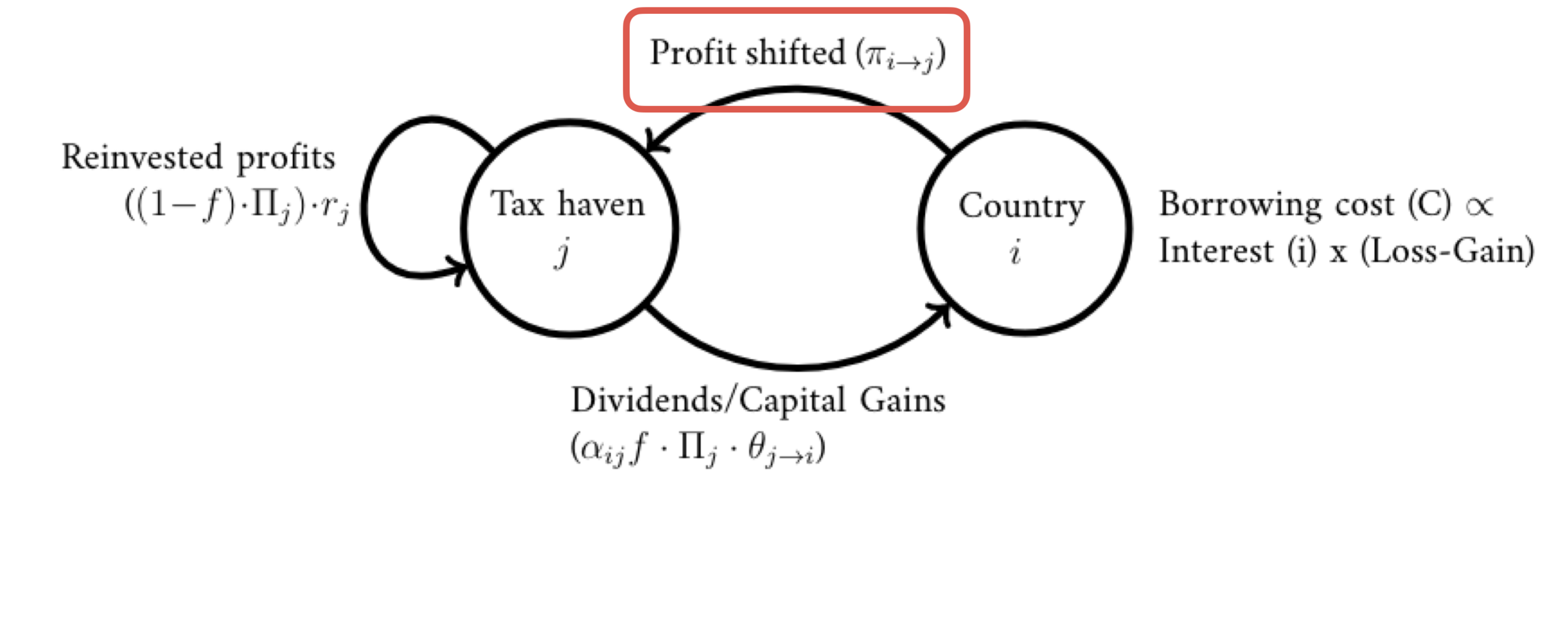

Garcia-Bernardo, Javier, and Petr Janský. "Profit shifting of multinational corporations worldwide." arXiv preprint arXiv:2201.08444 (2022).Garcia-Bernardo, J., Haberly, D., Janský, P., Palanský, M., & Secchini, V. (2022). The indirect costs of corporate tax avoidance exacerbate cross-country inequality (No. 2022/33). WIDER Working Paper.

Garcia-Bernardo, J., Haberly, D., Janský, P., Palanský, M., & Secchini, V. (2022). The indirect costs of corporate tax avoidance exacerbate cross-country inequality (No. 2022/33). WIDER Working Paper.

Garcia-Bernardo, J., Haberly, D., Janský, P., Palanský, M., & Secchini, V. (2022). The indirect costs of corporate tax avoidance exacerbate cross-country inequality (No. 2022/33). WIDER Working Paper.

Garcia-Bernardo, J., Haberly, D., Janský, P., Palanský, M., & Secchini, V. (2022). The indirect costs of corporate tax avoidance exacerbate cross-country inequality (No. 2022/33). WIDER Working Paper.

Garcia-Bernardo, J., Haberly, D., Janský, P., Palanský, M., & Secchini, V. (2022). The indirect costs of corporate tax avoidance exacerbate cross-country inequality (No. 2022/33). WIDER Working Paper.

developing countries lose more

summary

- Wealth inequality is rising

- Tax avoidance is key

- Complex corporate structures are used for it

- Network science tools help us:

- Understand how they organize (higher order dependencies)

- Estimate which countries gain/lose

- Detect facilitators

summary

- Wealth inequality is rising

- Tax avoidance is key

- Complex corporate structures are used for it

- Network science tools help us:

- Understand how companies organize (higher order dependencies)

- Estimate which countries gain/lose

- Detect facilitators

Javier García-Bernardo

javier.gbe@pm.me