The Netherlands AS A CONDUIT OFFSHORE FINANCIAL CENTER

Javier Garcia-Bernardo

The University of Amsterdam

May 23nd, 2017

Javier Garcia-Bernardo, Jan Fichtner, Frank Takes, Eelke Heemskerk

Paper: arxiv.org/abs/1703.03016

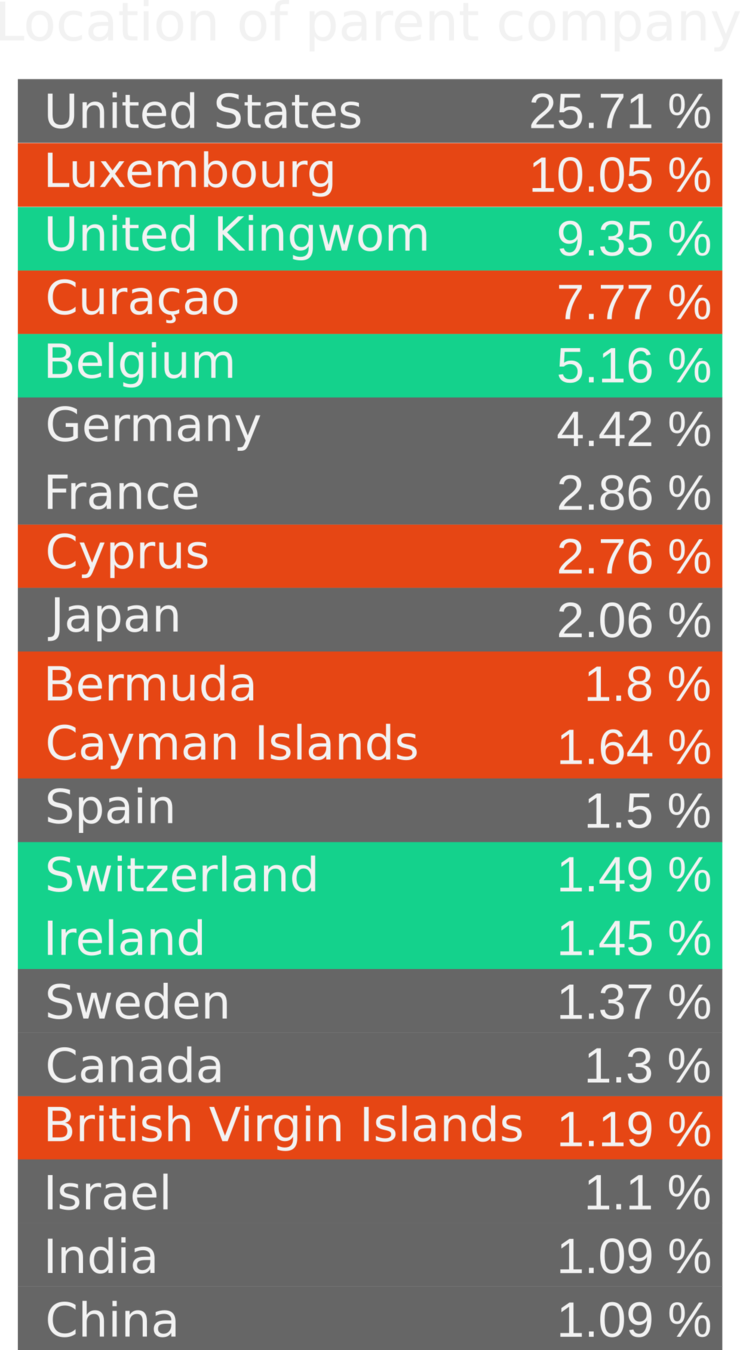

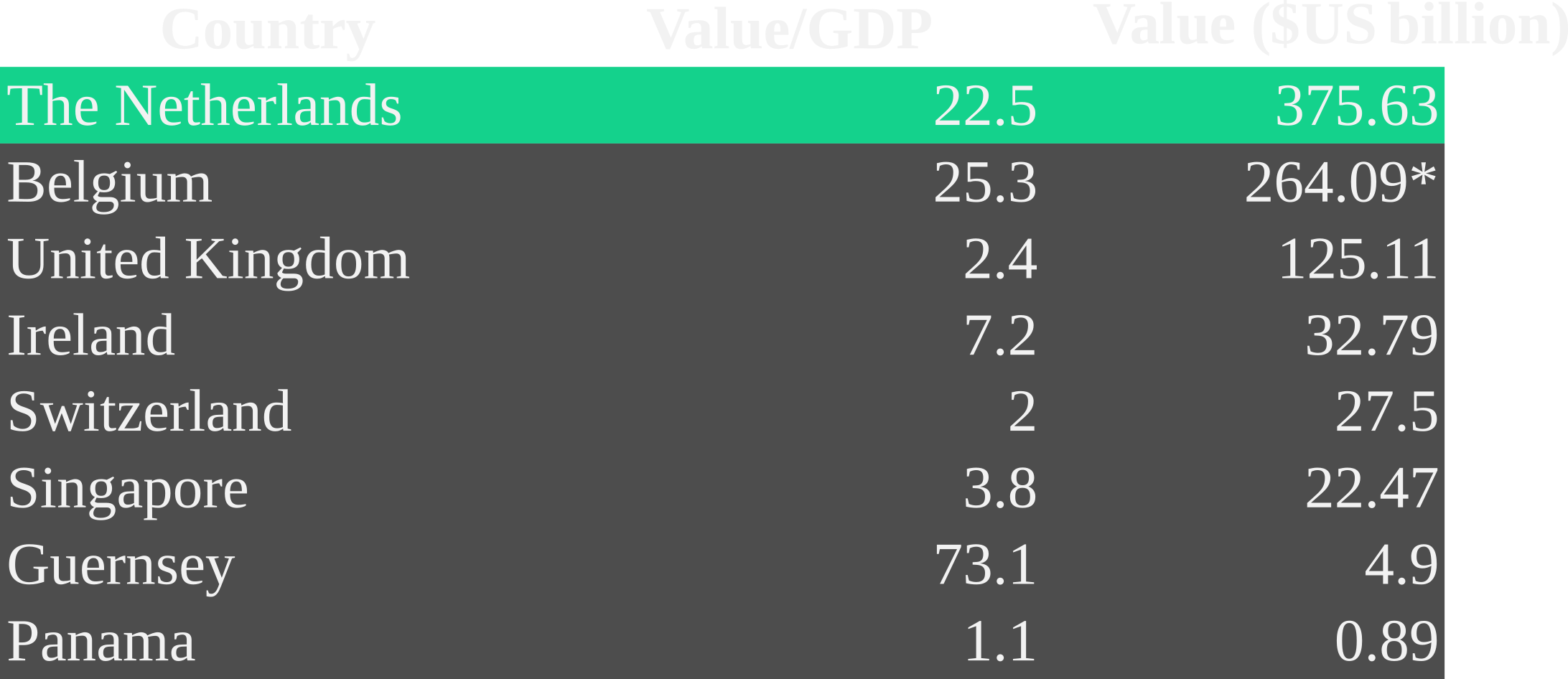

THE NETHERLANDS IS IN THE CENTER OF FOREIGN INVESTMENT

Origin of foreign direct investment in Brazil (Brazilian firms controlled by foreign companies)

Weichenrieder, A. J., & Mintz, J. (2006). What Determines the Use of Holding Companies and Ownership Chains?

IT EMERGED IN THE LAST 30 YEARS

Reasons

- Logistic:

- Located in the heart of Europe.

- Outstanding infrastructure.

- Highly educated and multilingual workforce.

- Developed trust and management services.

- Easy to start Special Purpose Entities (SFIs in NL)

- Beneficial tax regime:

- No withholding taxes for interest and royalties.

- No real withholding tax for dividends.

- Participation exemption.

- Large number of tax treaties.

- Advance Tax Rulings (ATR) and Advance Pricing Agreements (APA)

- Investor protection

- Large number of bilateral investment treaties

- Advanced tax ruling system (increase certainty)

(PwC / EY / DELOITTE / KPMG)

- Examples of SFI are:

- Holding companies of (mainly) foreign companies;

- Finance companies that typically extend loans to foreign group companies and are themselves financed mainly from abroad;

- Royalty companies, film and music rights companies that receive royalties mainly from abroad;

- Reinvoicing companies that are mainly invoiced by foreign entities and invoice other foreign entities.

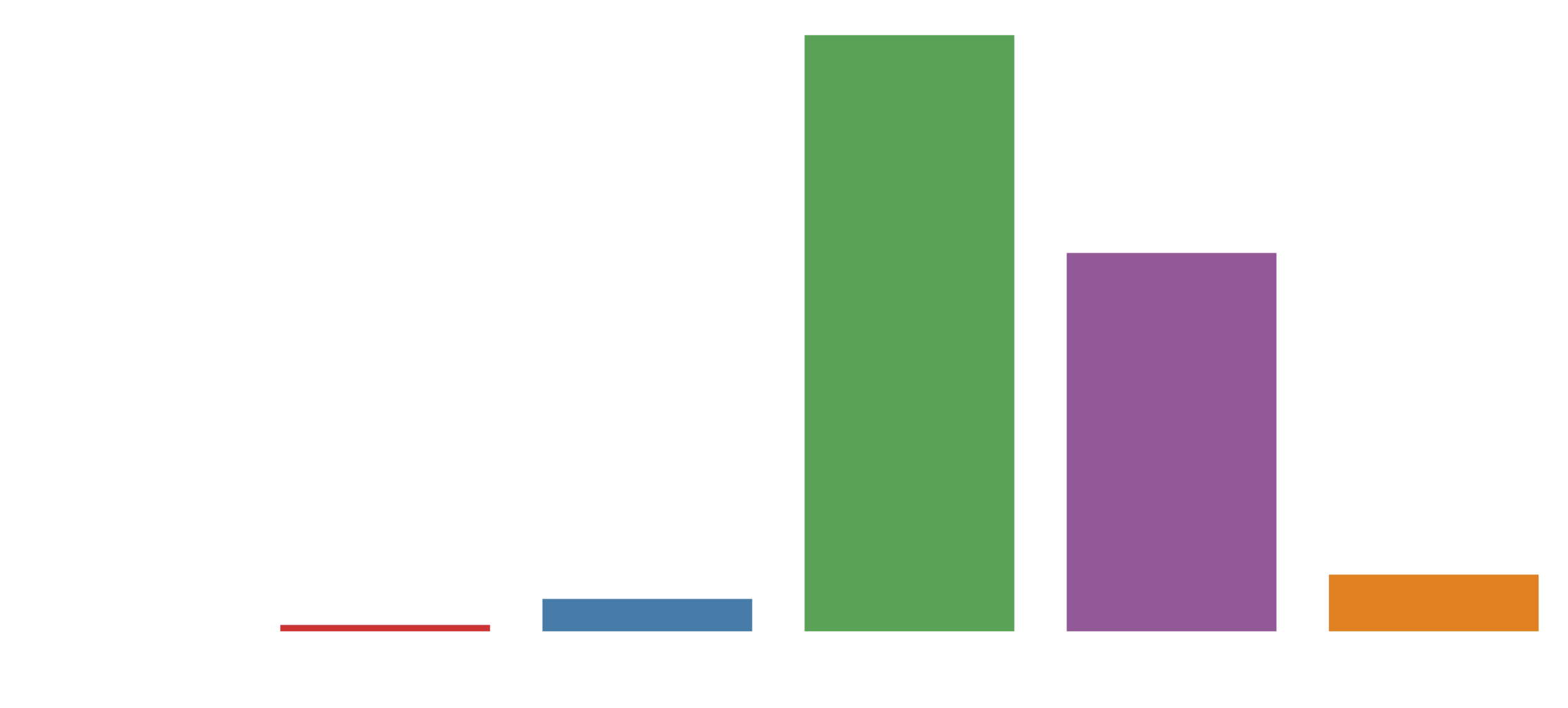

FINANCIAL VEHICLES USED: Special Purpose Entities

(Special Financial Institutions)

Source: De Nederlandsche Bank

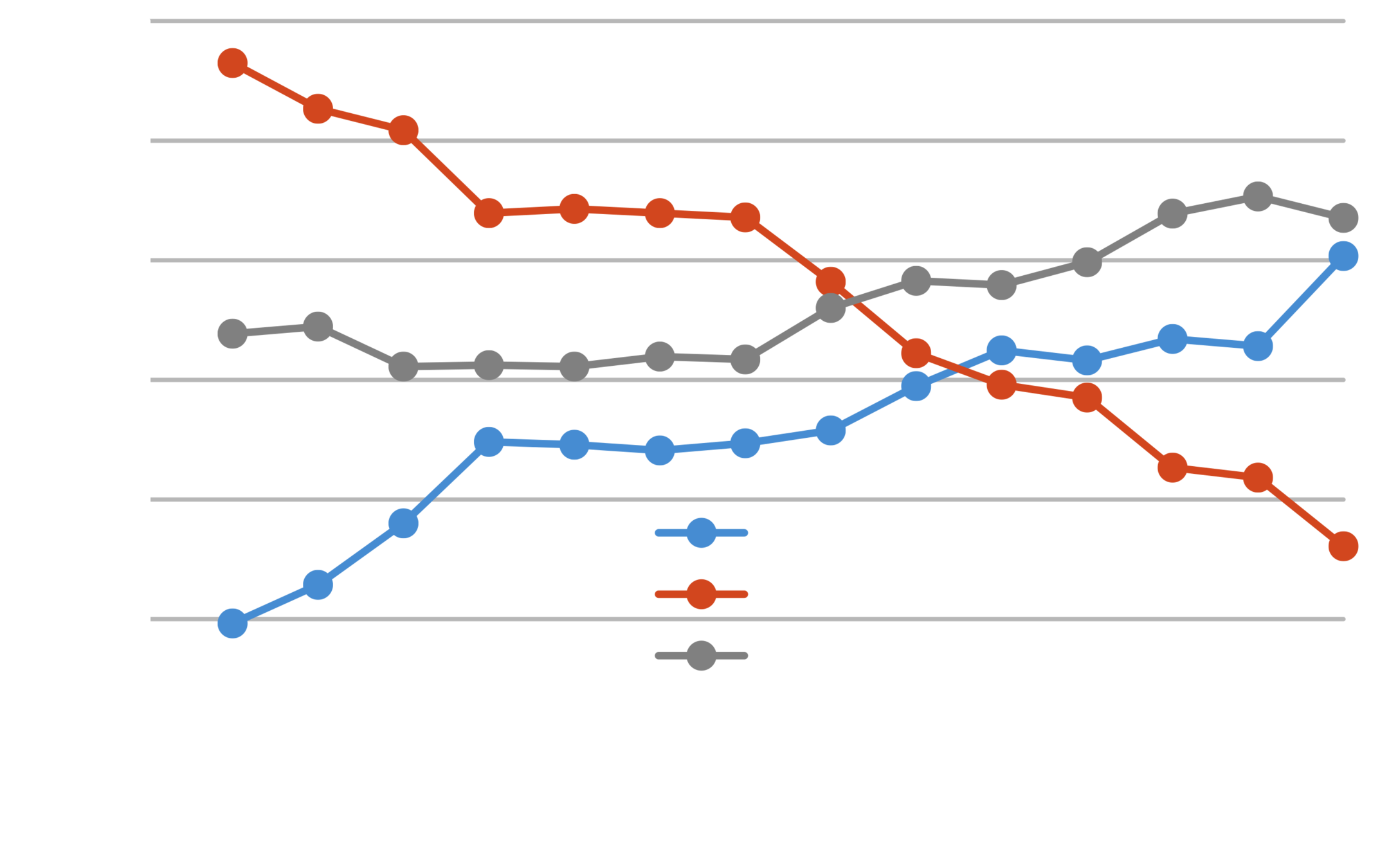

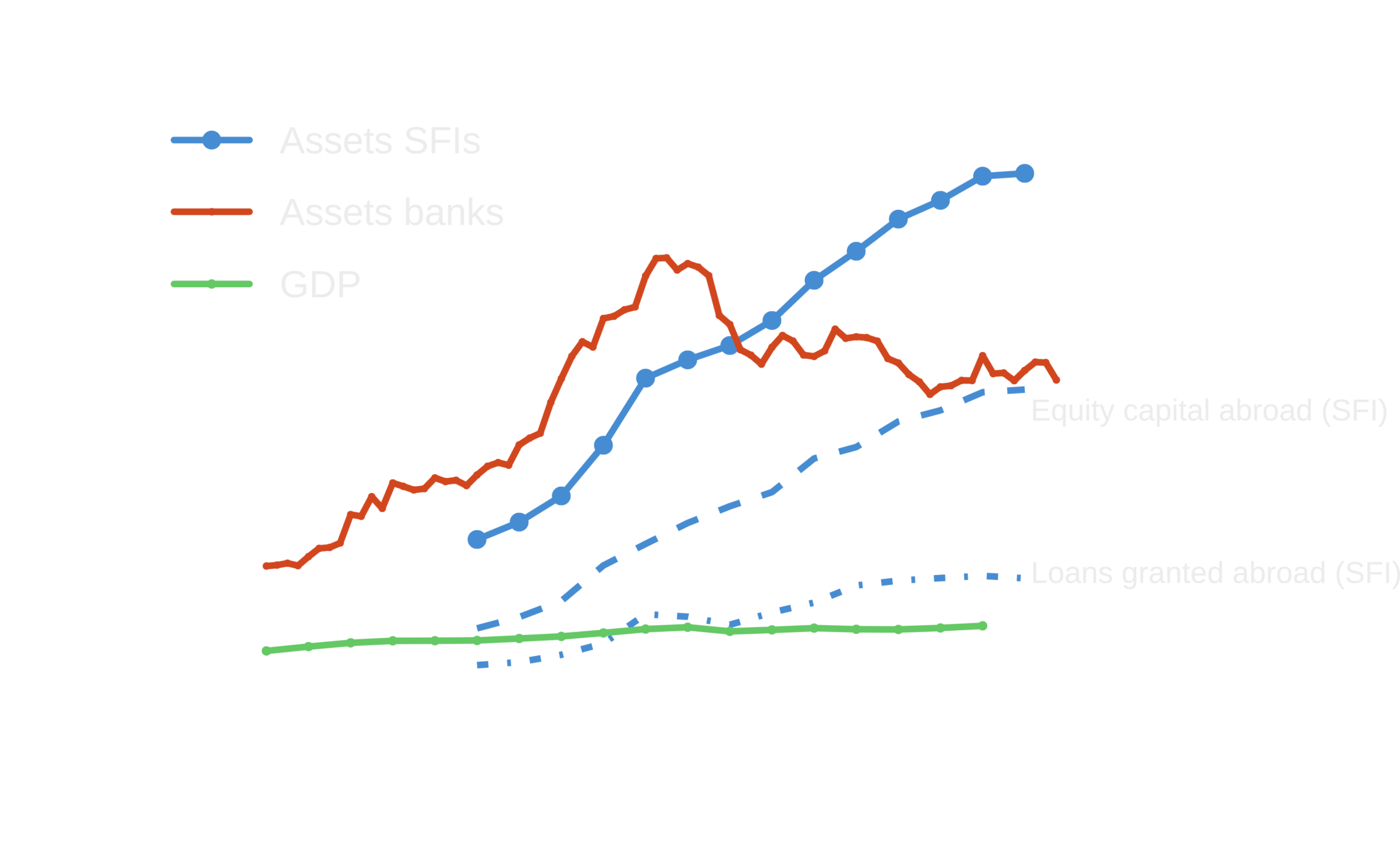

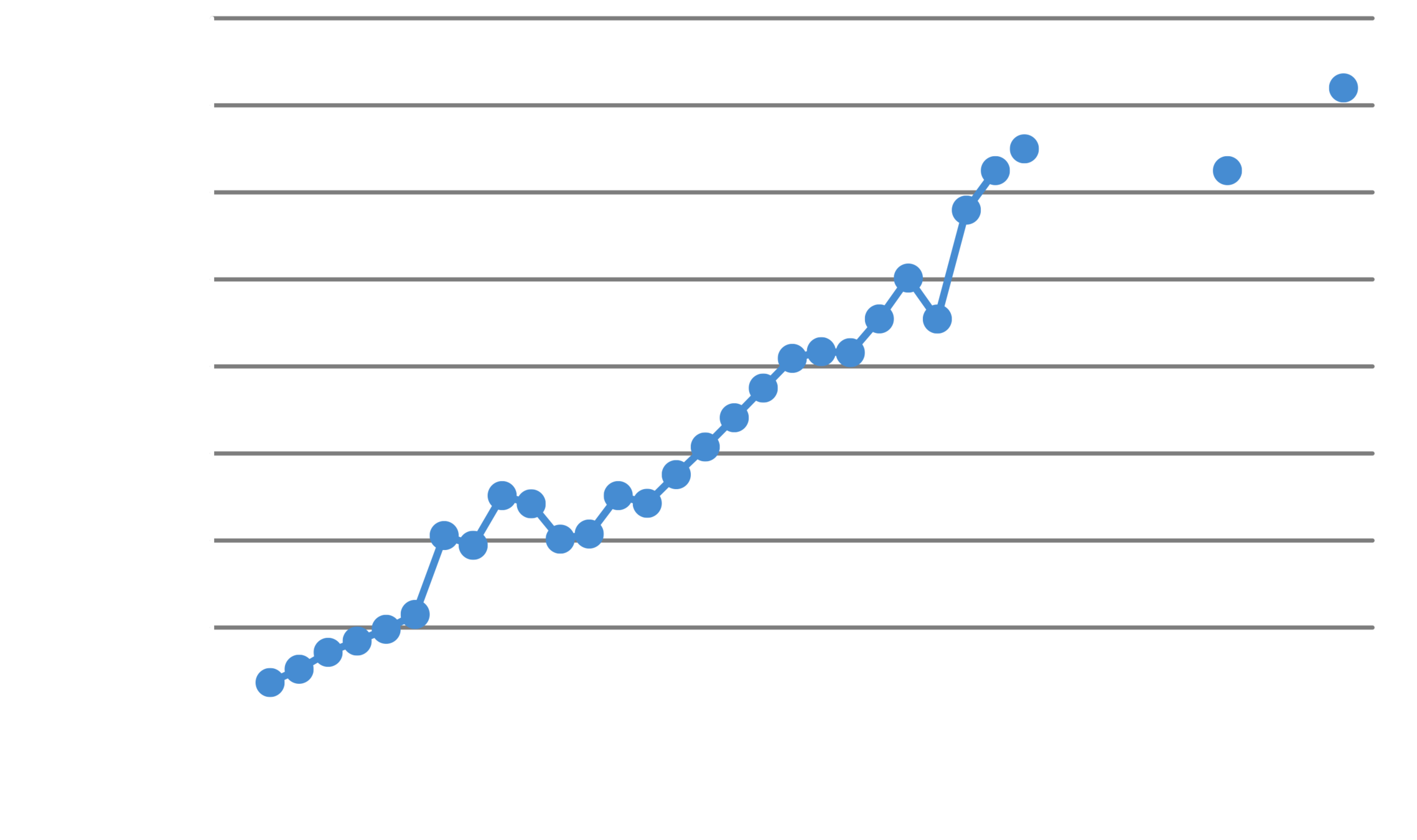

Assets of SFIs

Source: De Nederlandsche Bank

Number of SFIs

Source: De Nederlandsche Bank

Source: Orbis

- Ownership structures reflect tax strategies:

- Dividends: Parent-subsidiary relationship usually required.

- Royalties/Interests need at some point ownership relationships.

-

The size of the Netherlands indicate a structural role in tax planning:

- Companies such as IKEA, Fiat, Ferrari or Qiagen have moved the headquarters to the Netherlands.

- More common: Use Dutch SFIs. Virtually every EU multinational do it.

- Families control their fortune through foundations in the Netherlands.

WHY WE CARE ABOUT SFIs

Around €150 billion are lost by tax avoidance -- equivalent to the total annual expenditure of the EU*.

WHY WE CARE ABOUT SFIs

* Fernandez, R., McGauran, K., & Frederik, J. (2013). Avoiding Tax in Times of Austerity. Energias de Portugal (EDP) and the Role of the Netherlands in Tax Avoidance in Europe.

Tax of Holding: 27.8%

Tax of IKEA: 22.5%

our research

We look at which countries are used disproportionally in transnational ownership chains.

ORBIS

- 200 million companies

- 70 million ownership relationships

- 10 million transnational chains

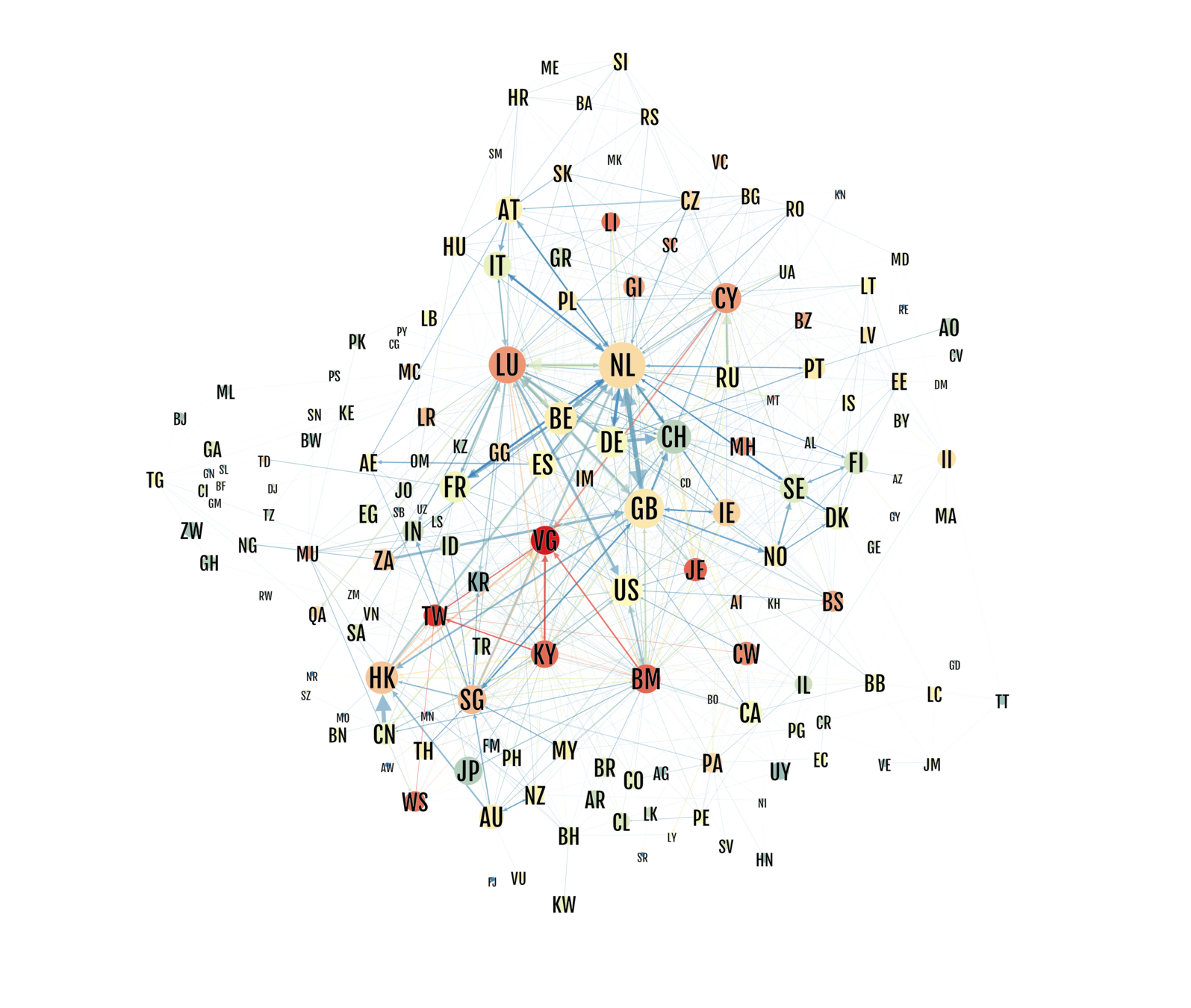

finding 1: sink-OFFshore financial centers

Blue: (Former) Colony/Territory of the United Kingdom

Paradisacal beach in Luxembourg

As of June this year, BVI hosted 430,000 companies: 15 for each of their 28,000 inhabitants. The

finding 1: sink-OFFshore financial centers

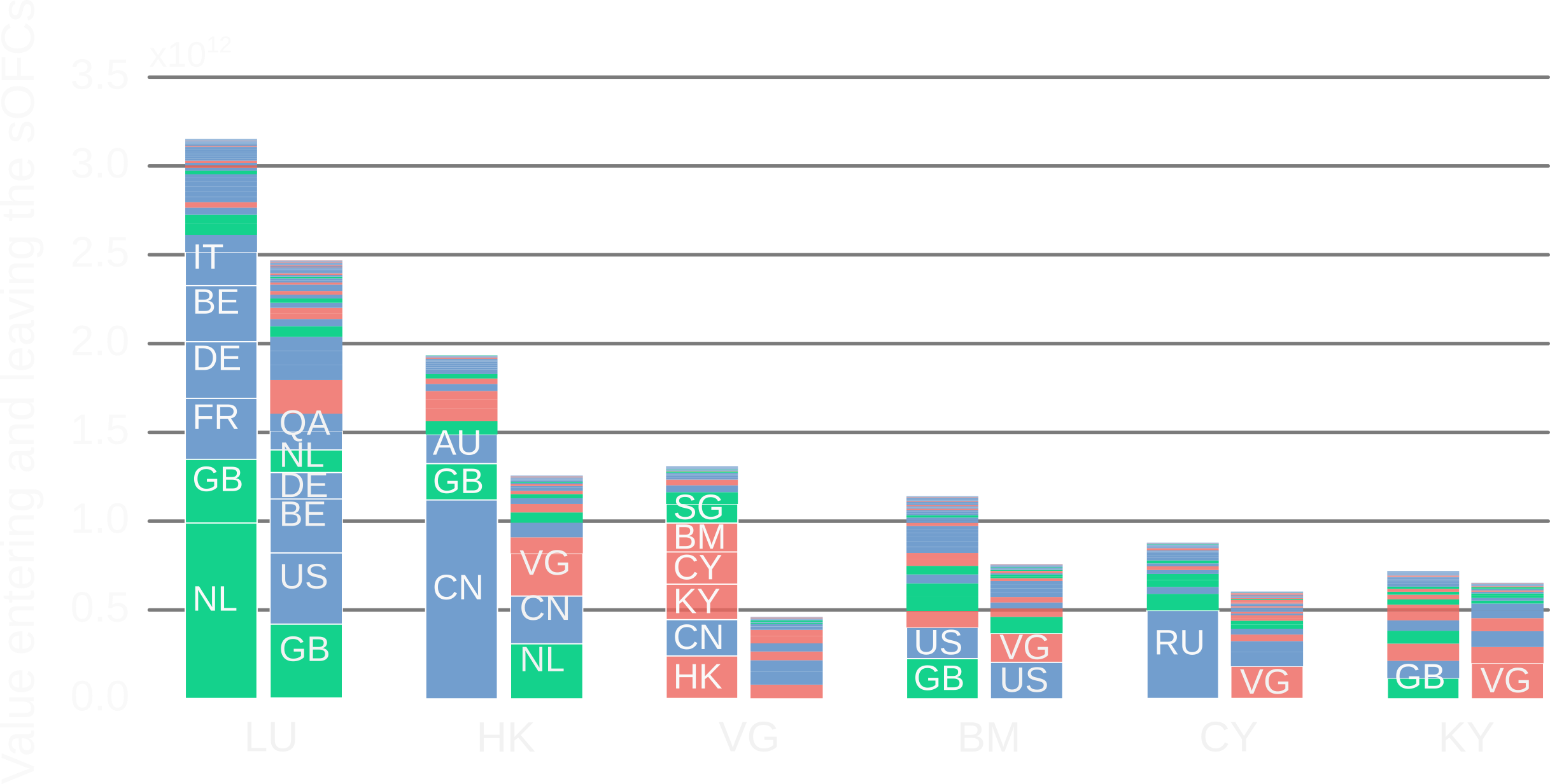

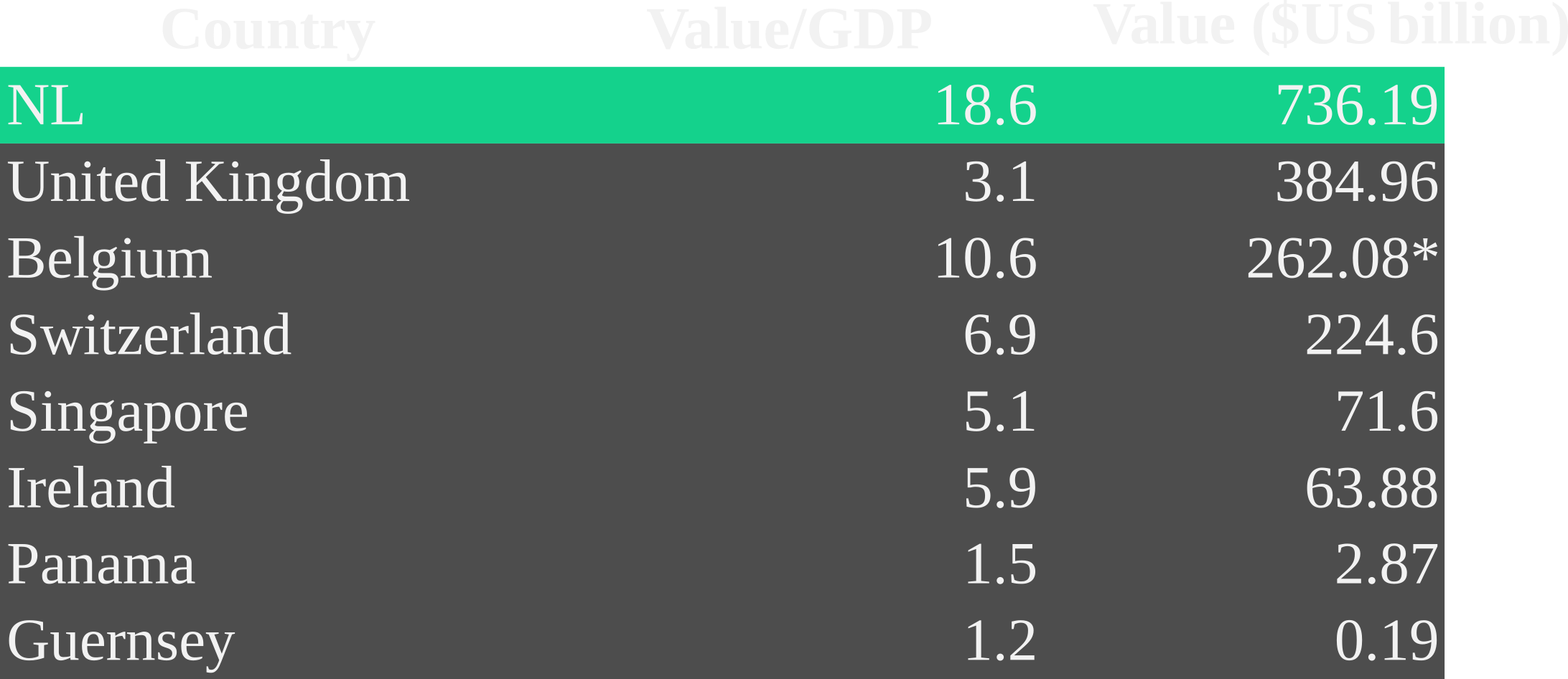

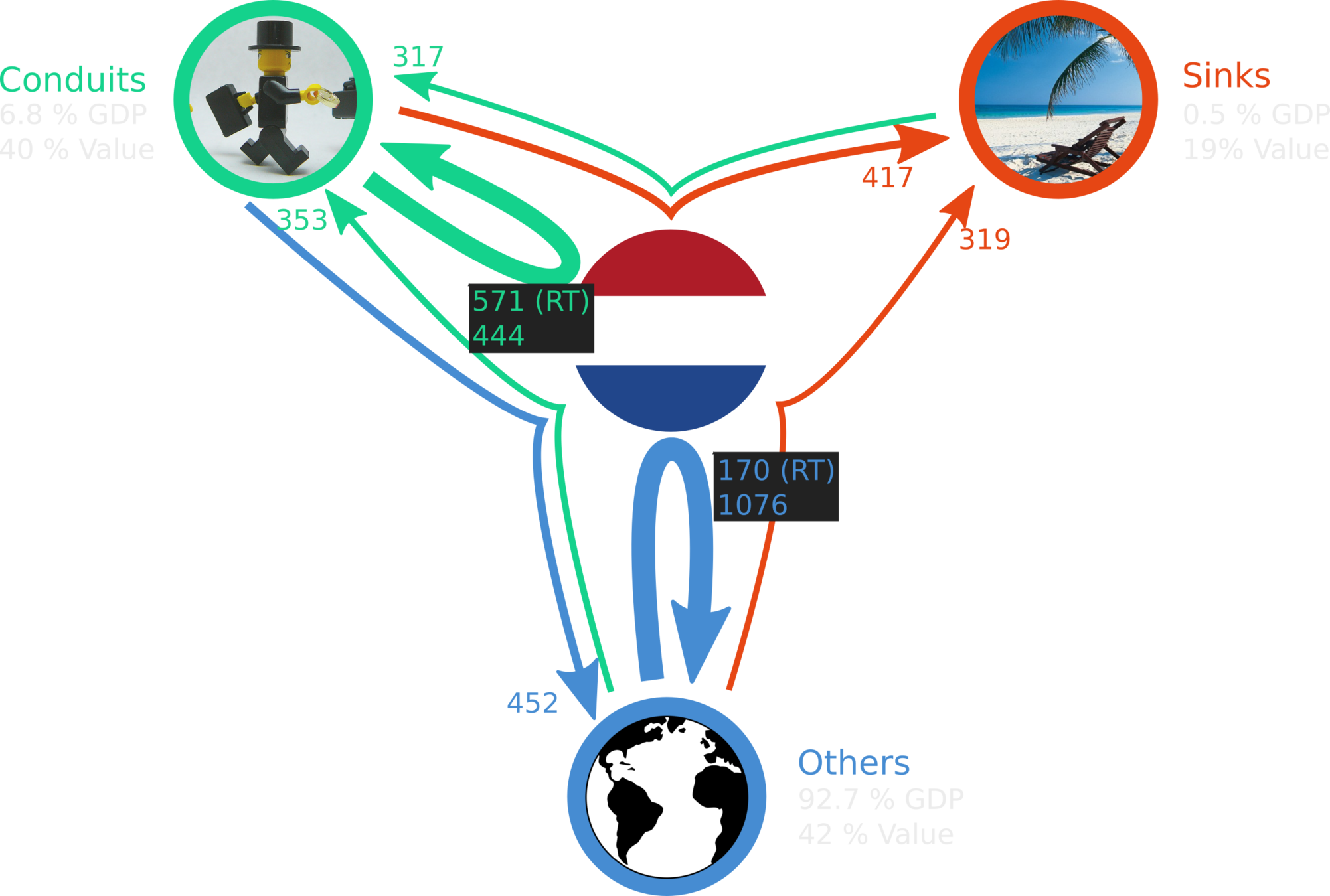

finding 2: conduit-OFFshore financial centers

sink

conduit

other country

finding 2: conduit-OFFshore financial centers

sink

conduit

some country

Round-tripping

what do the numbers actually mean?

what do the numbers actually mean?

23% of all the value flowing to a sink-OFC flows through a Dutch SFI

Chains to:

- Luxembourg: 40% go through the Netherlands

- Cyprus: 30% go through the Netherlands

- Malta: 71% go through the Netherlands

- Curaçao: 90% go through the Netherlands

- Lichtenstein: 30% go through the Netherlands

Node:

- Color: Importance as sink (Blue < Yellow < Red)

- Size: Importance as conduit

Arrow:

- Color: Importance relative to GDP

- Size: Importance

conclusions

- Global situation:

- Sink-OFCs are connected to the United Kingdom (except Luxembourg).

- Conduit-OFCs (NL,GB,IE,CH,SG) are on our doorstep:

- They are specialized geographically and sectorally.

- Can be a point of intervention.

- Dutch situation:

- Dutch SFIs are in the middle of 23% of all corporate structures (and growing).

- SFIs have assets of over 4 trillion (up from 1.5 trillion in 2007).

- SFIs are used to transfer dividends, as well as royalties and interests, especially to Luxembourg.

Paper: arxiv.org/abs/1703.03016

Interactive visualizations: corpnet.uva.nl/ccs2016

Twitter: @uvaCORPNET @javiergb_com

garcia@uva.nl