Javier García-Bernardo

University of Amsterdam

October 2nd, 2018

who is the largest investor in germany?

who is the largest investor in brazil?

who is the largest investor in south africa?

why?

professionals

PEOPLE

corporation

state

PARt 1: The corporations

how corporations structure

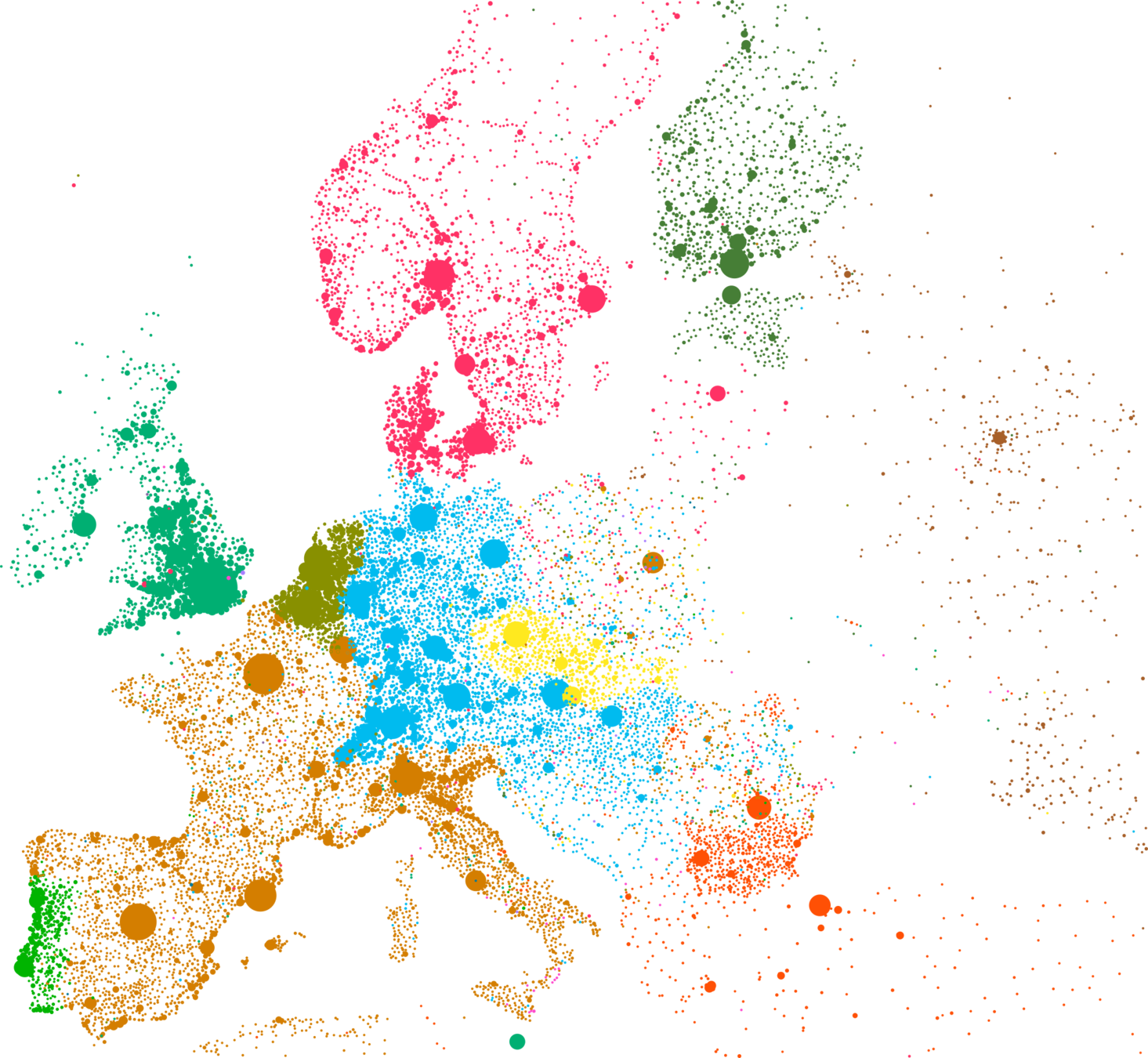

sink-OFFshore financial centers

15 companies per capita

Garcia-Bernardo, J; Fichtner, J; Takes, F W; Heemskerk, E M "Uncovering Offshore Financial Centers: Conduits and Sinks in the Global Corporate Ownership Network "Scientific Reports, 2017.

conduit-OFFshore financial centers

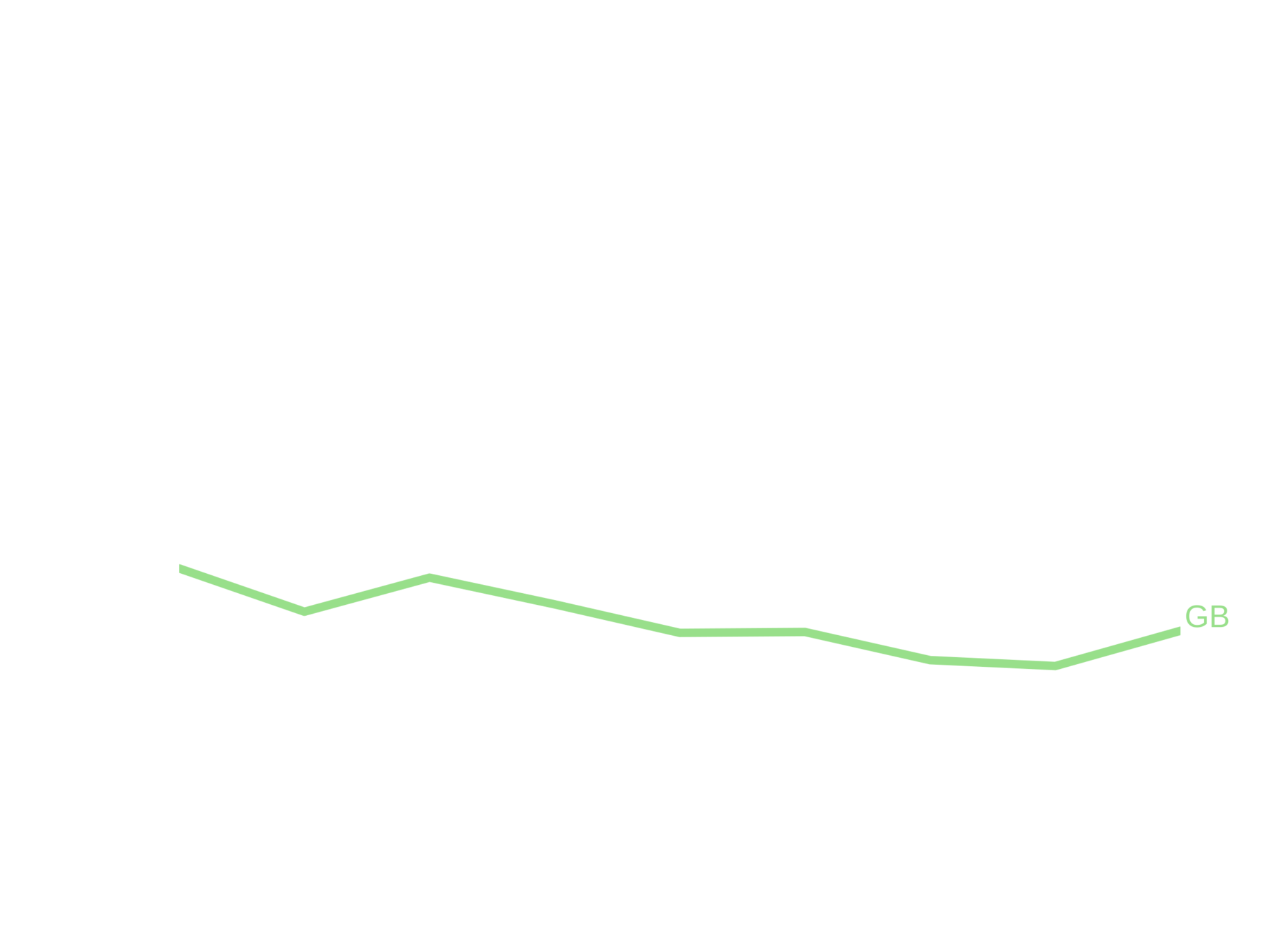

importance of the netherlands

-

23% of all the value flowing to a sink-OFC flows through a Dutch Special Financial Institutions (BFI)

- Percentage of chains that go through the Netherlands and end in:

-

Luxembourg: 40%

-

Cyprus: 30%

-

Malta: 71%

-

Curaçao: 90%

-

Lichtenstein: 30%

-

PARt 2: The state

Reasons

(PwC / EY / DELOITTE / KPMG)

- Logistic:

- Located in the heart of Europe.

- Outstanding infrastructure.

- Highly educated and multilingual workforce.

- Well-developed trust and management services.

- Easy to start Special Purpose Entities (BFIs)

- Beneficial tax regime:

- No withholding taxes for interest and royalties.

- No real withholding tax for intra-group dividends.

- Participation exemption.

- Large number of tax treaties.

- Advance Tax Rulings (ATR) and Advance Pricing Agreements (APA)

- Investor protection

- Large number of bilateral investment treaties

- Advanced tax ruling system (increases certainty)

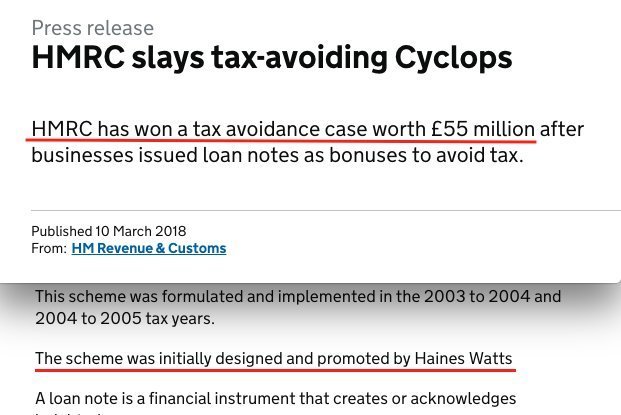

R Leijten (SP) questions to E.D. Wiebes, staatssecretaris van Financiën

vehicle 1: equity holding

- Give security to investors (e.g. investment treaties)

- Funnel dividends tax free (e.g. participation exemption, tax treaties)

- Soon: no dividendbelasting

The Nederlandsche Bank

vehicles 2&3: interest and royalty conduits

Crash course on "tax avoidance" (base erosion / profit shifting)

- Step 1: Sell things in a country

- Step 2: Make intra-group payments to entities in low-tax jurisdictions

- Intellectual property / brand / know-how

- Interest on loans

- Services/goods

Caveat: Arm-length principle: Intra-group payments need to be priced at "market prices"

However: What's the market price of a mermaid on a coffee cup?

vehicle 2: INTEREST holding

- Access to capital markets

- No thin capitalization rules

- No withholding tax on interest

The Nederlandsche Bank

vehicle 2: INTEREST holding

- NL intra-group finance activities:

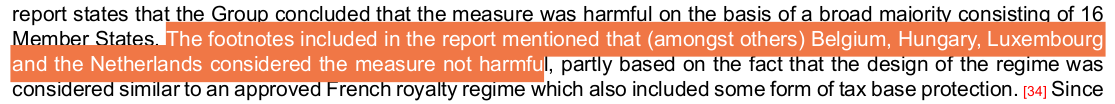

- EU Code of conduct: Harmful (A010 Council 7018/1/03)

- EU state aid: Not assesed

- NL group interest box (5% tax rate)

- Not implemented

- NL International financing activities:

- EU Code of Conduct: Harmful (B004 Countil 7018/1/03)

- EU State Aid rules: State Aid (OJ 2003 L180/52)

- NL informal capital (notional interest deduction):

- EU Code of conduct: Harmful (council 0717/1/03 E004)

- Innovation/patent box: Tax rate 7% (5% until 2017)

- DOES NOT ATTRACT R&D

- No withholding tax on royalties

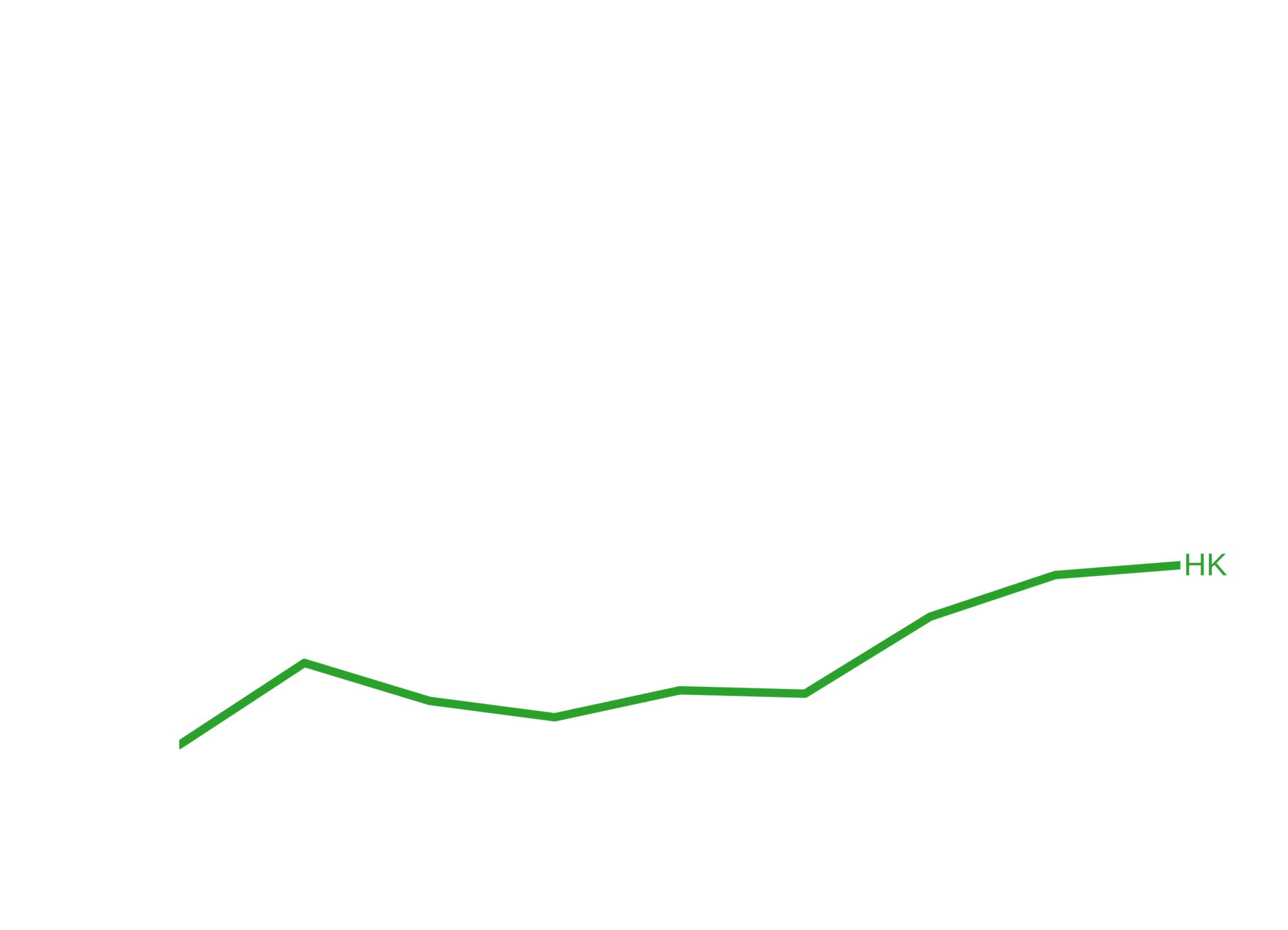

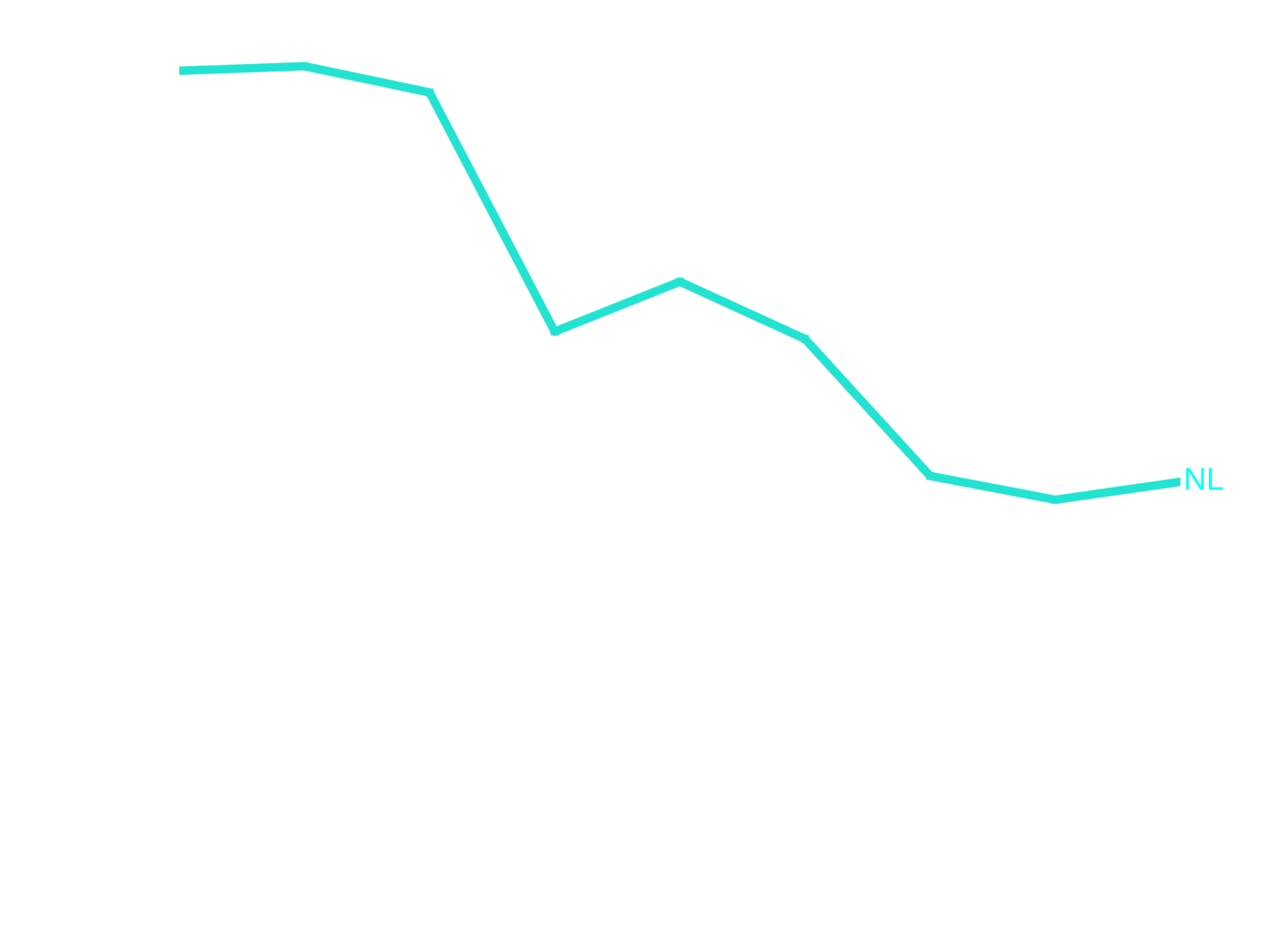

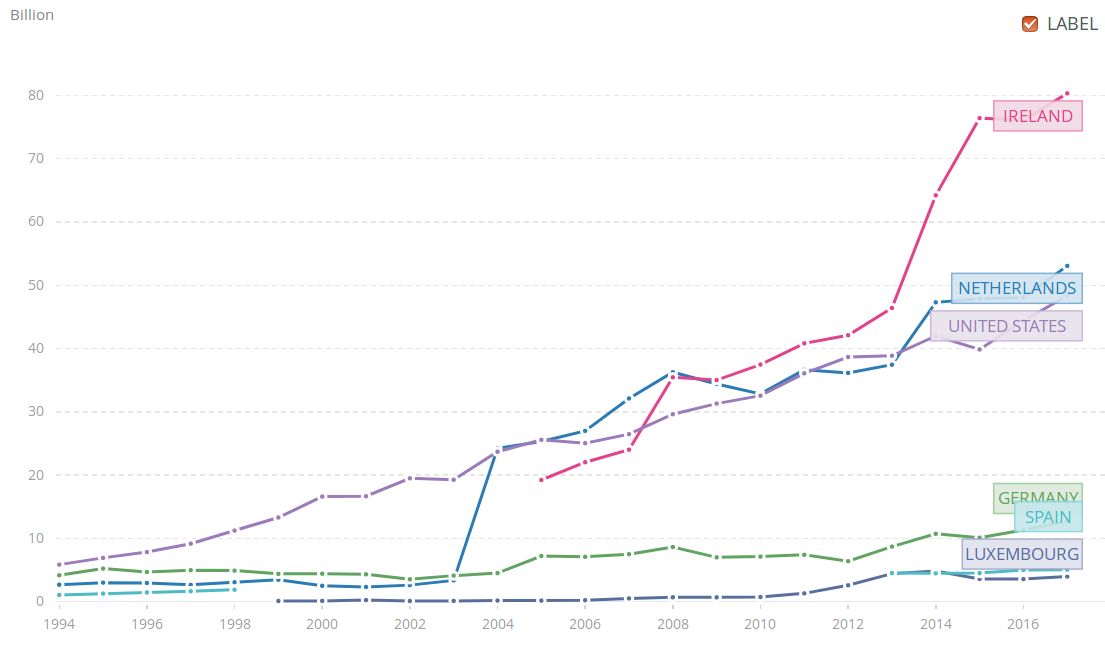

vehicle 3: royalty holding

Payments for the use of intellectual property. Source: World bank data

80

60

40

20

$Billion

1994

2000

2006

2012

2017

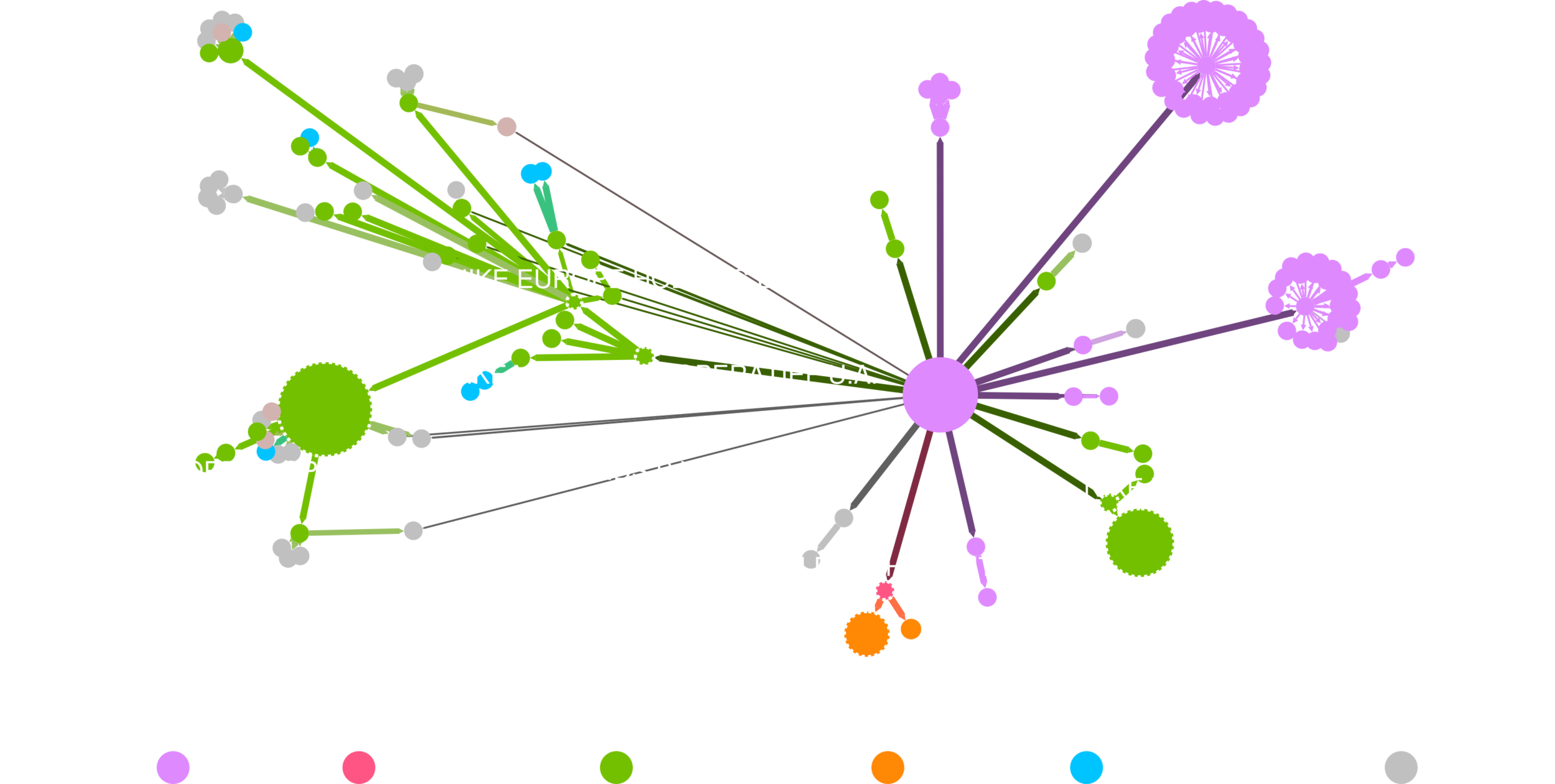

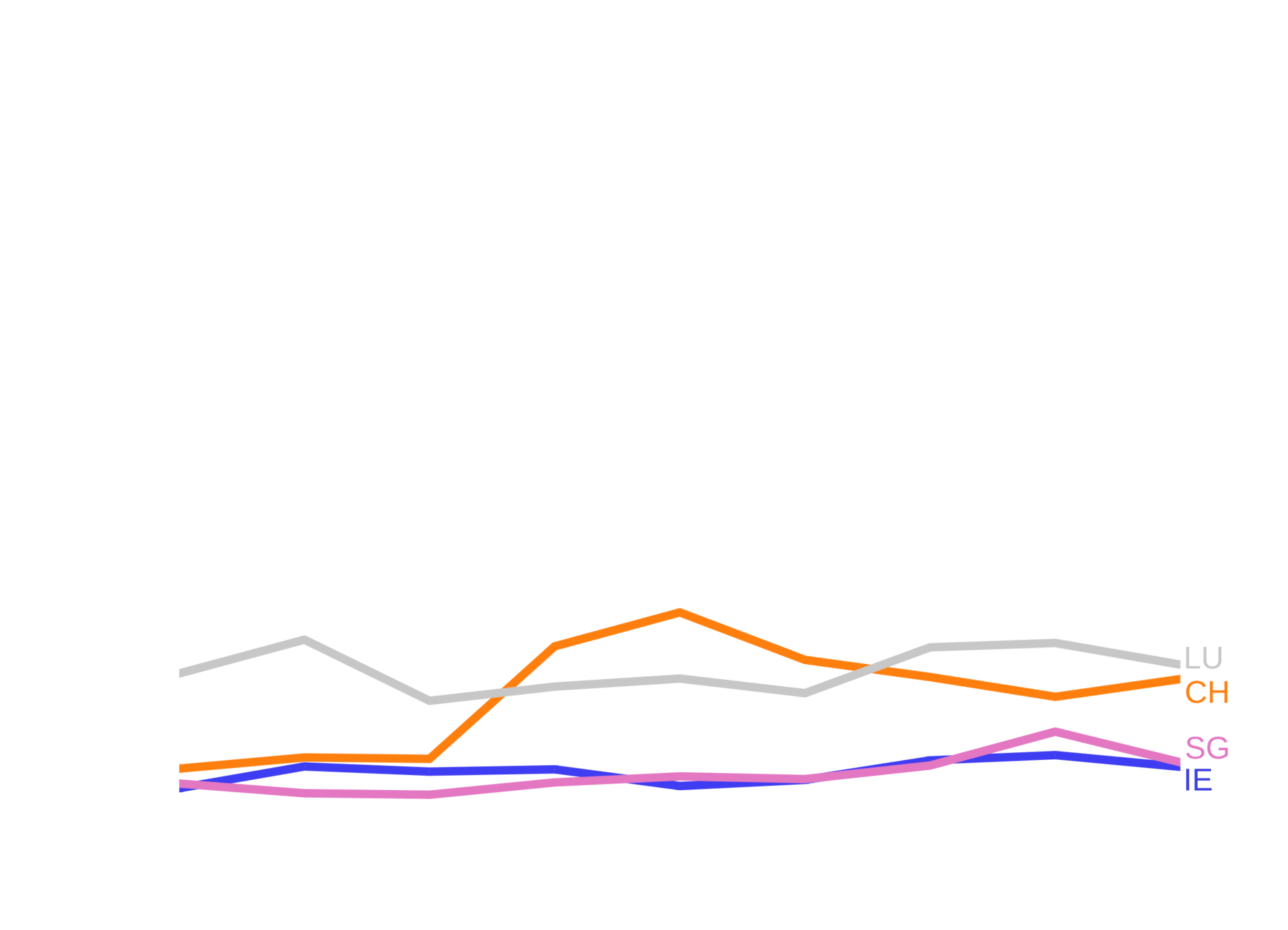

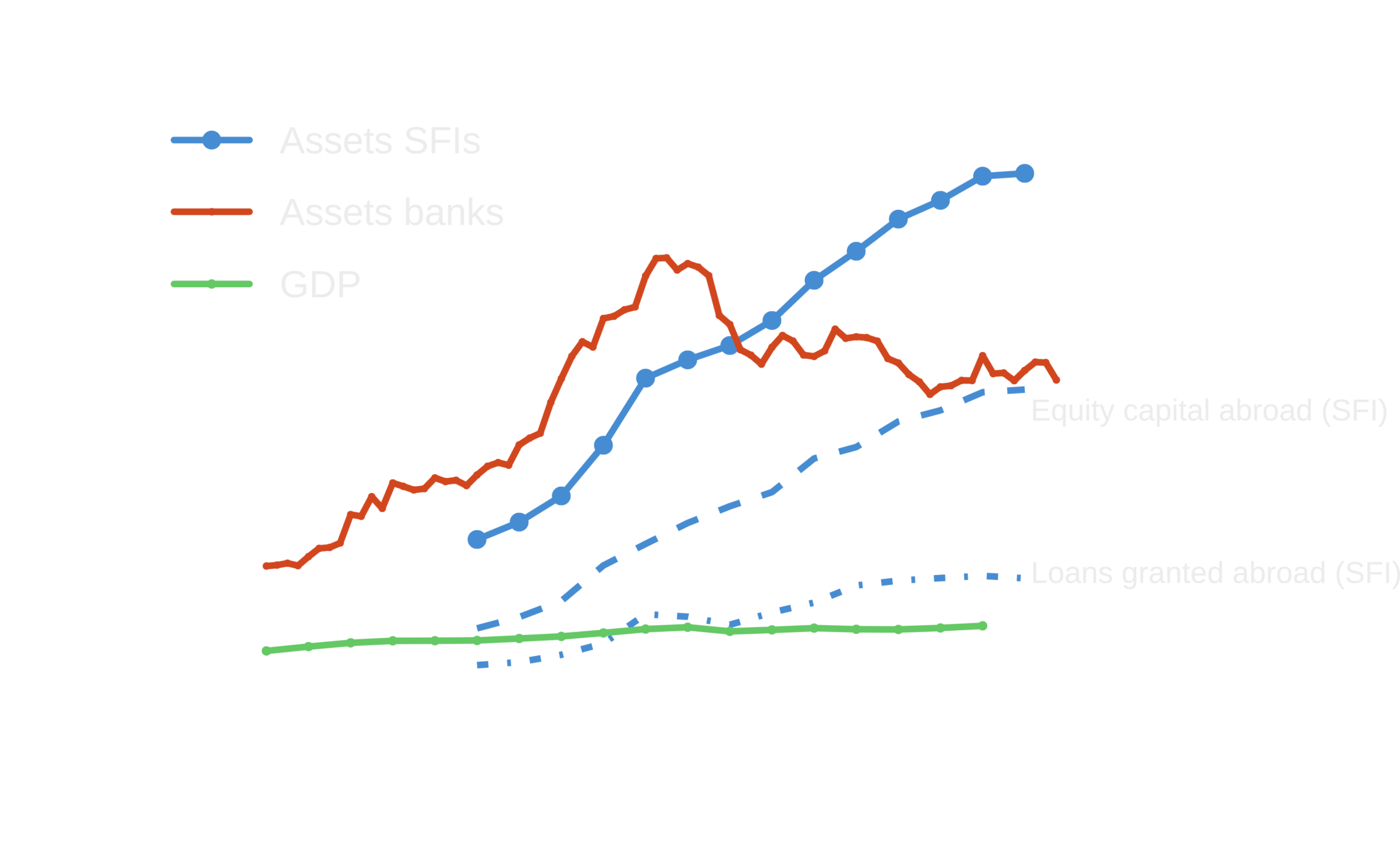

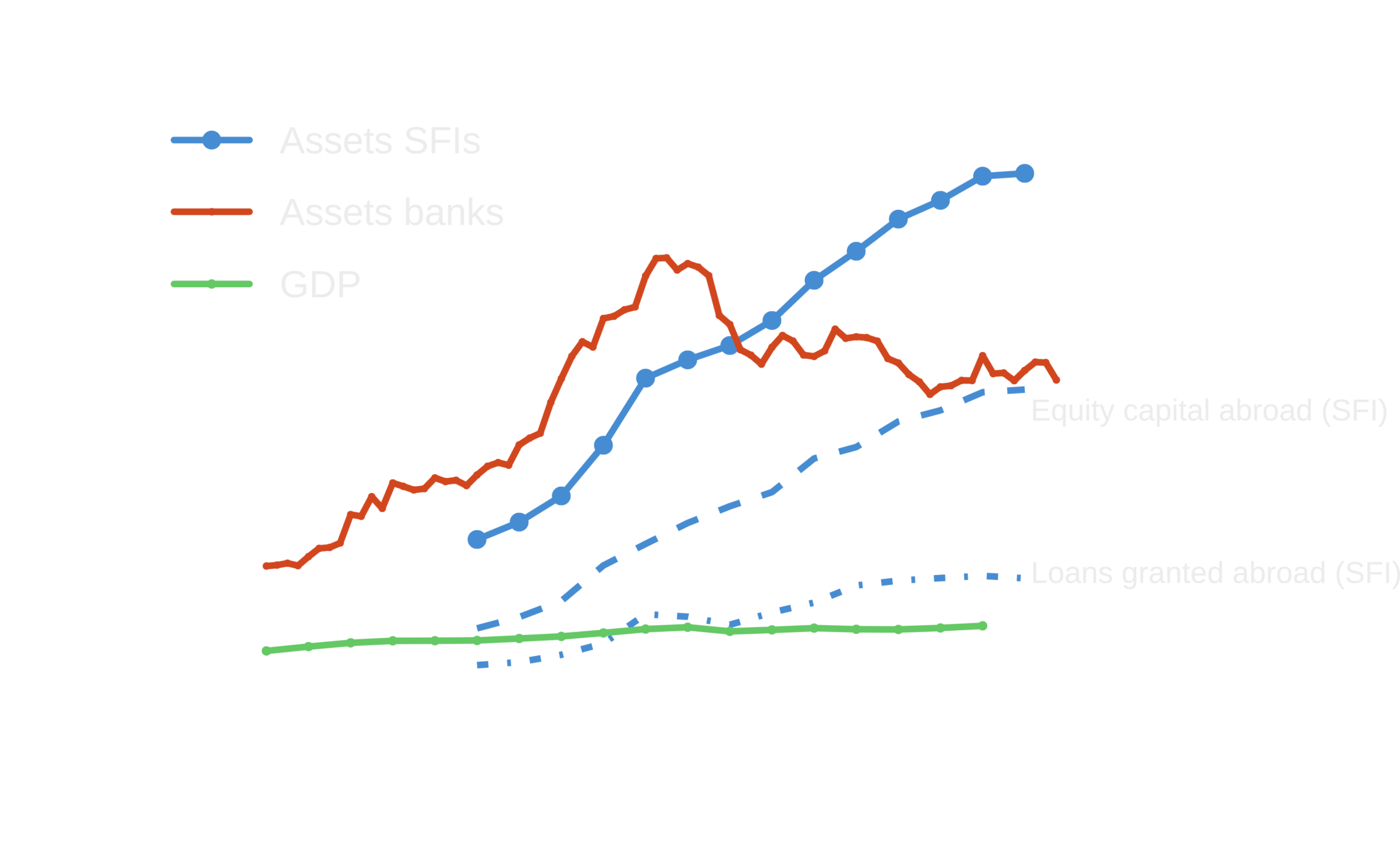

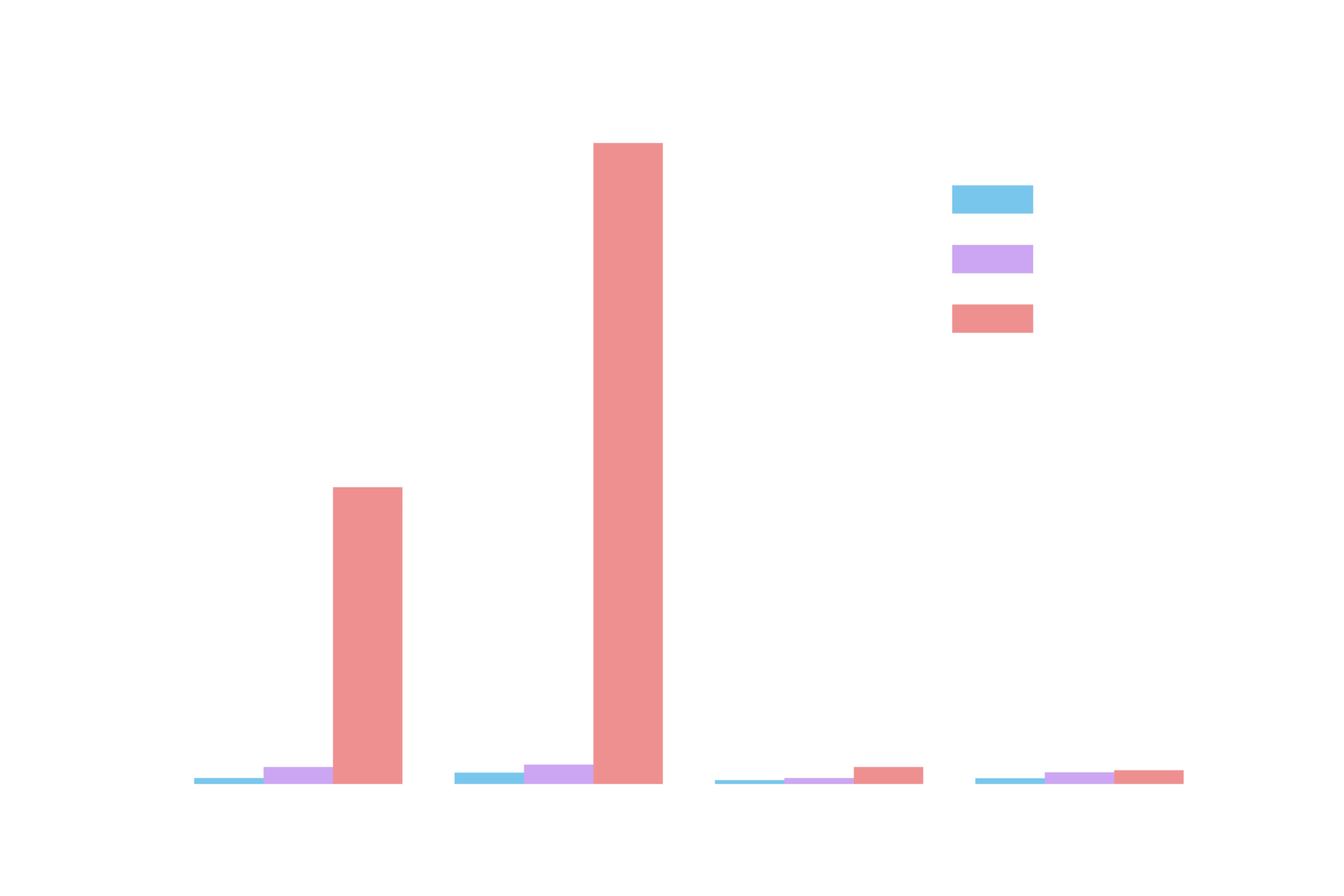

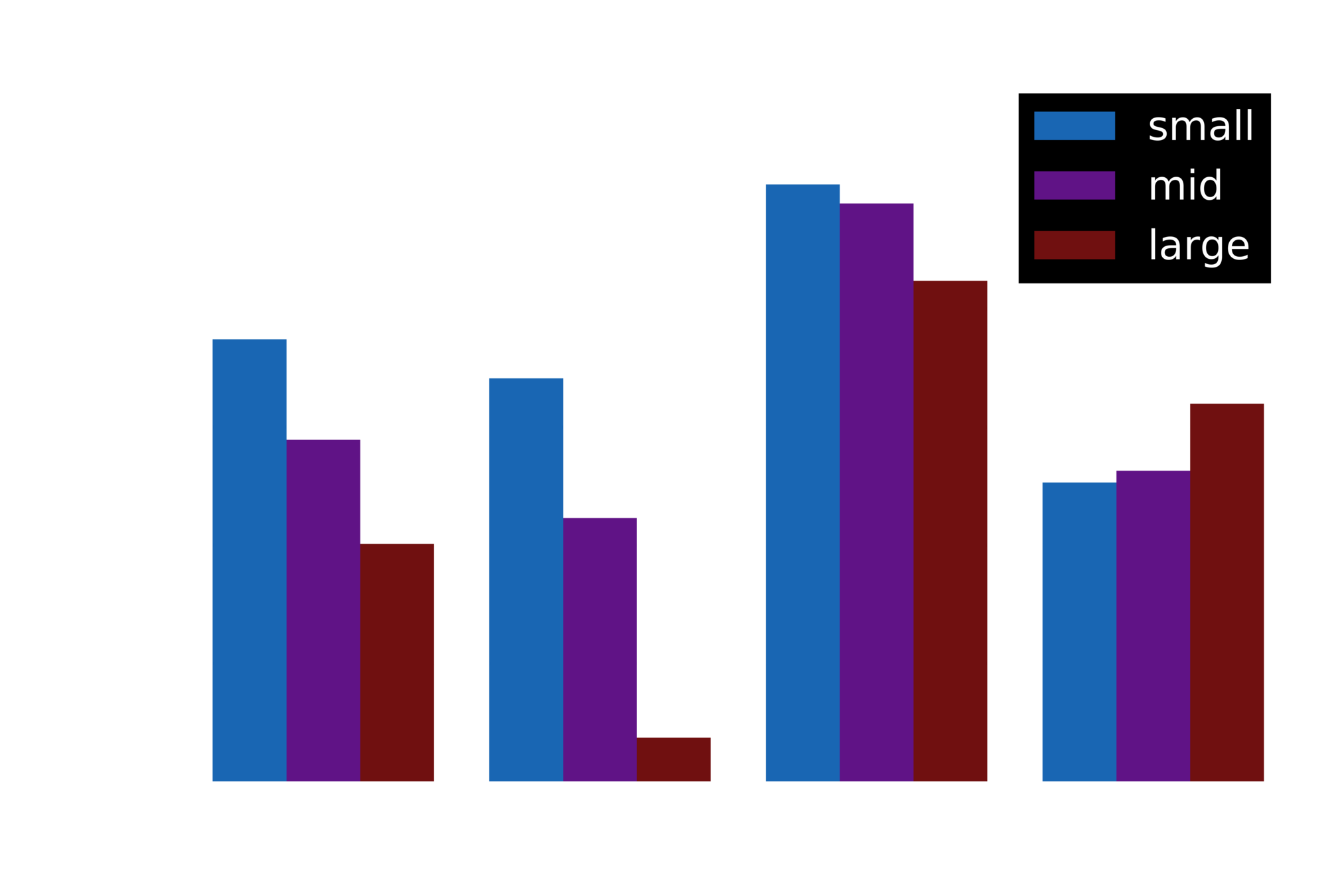

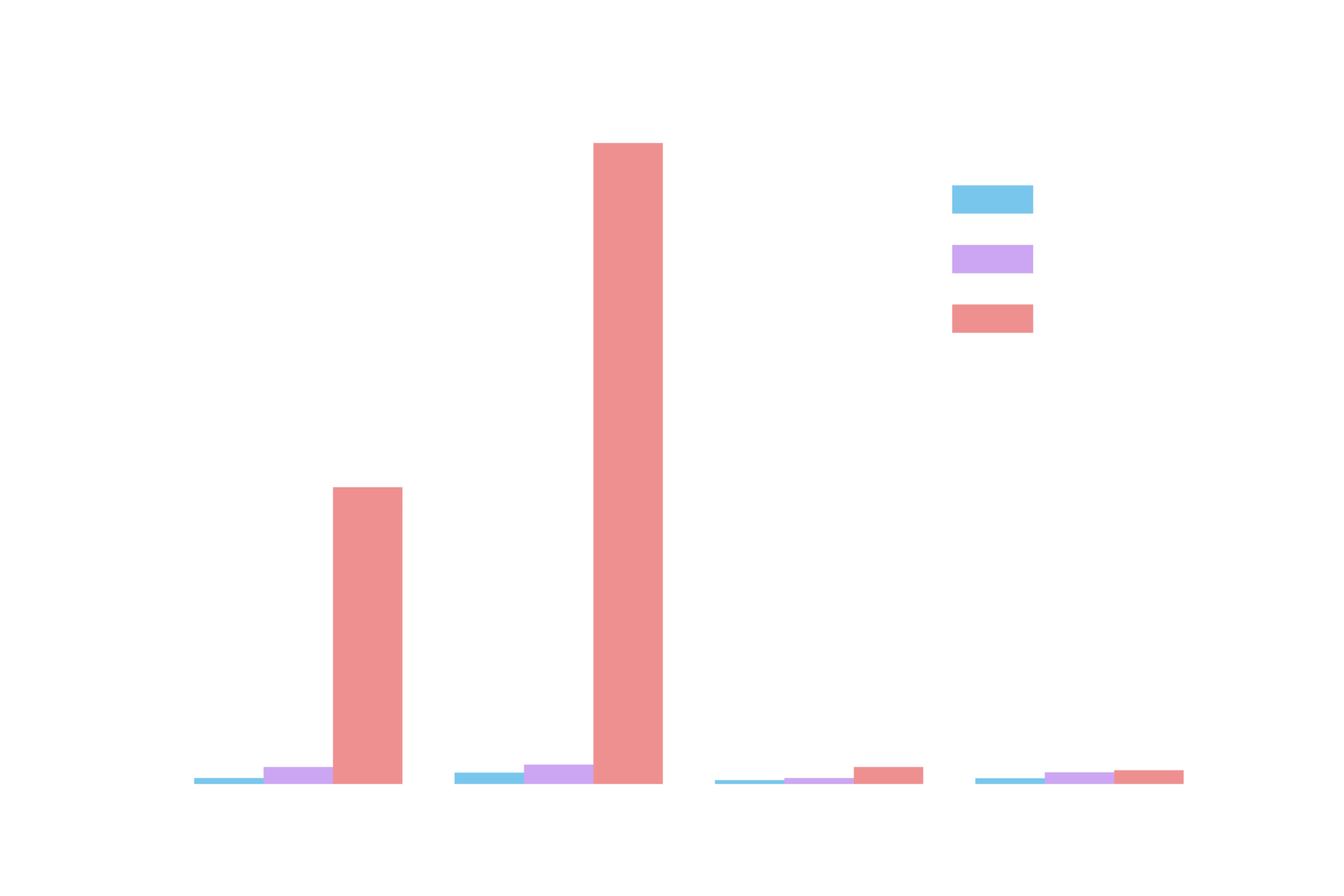

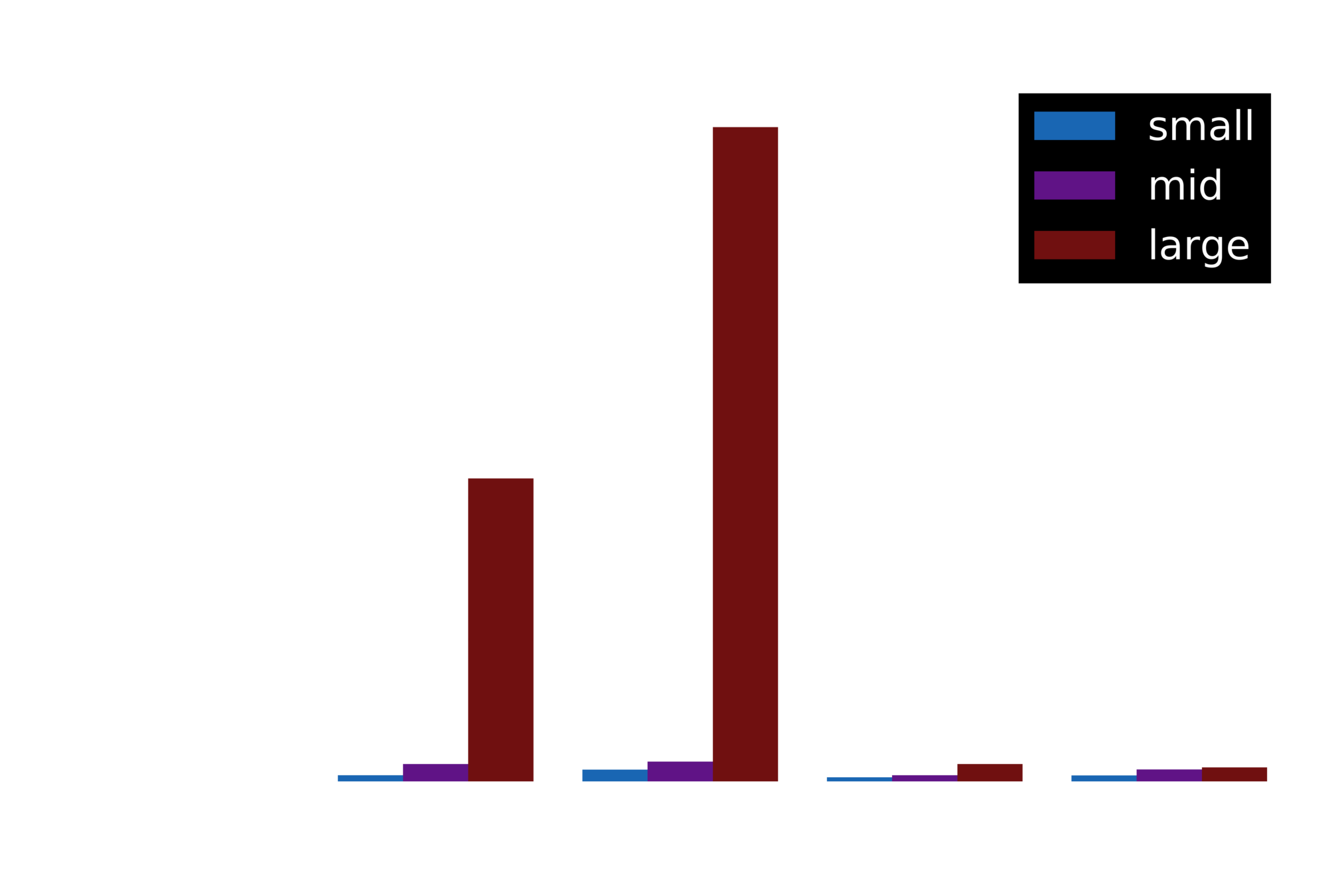

consequences of the use of vehicles

Source: Own calculations, forthcoming paper

consequences of the use of vehicles

Source: Own calculations, forthcoming paper

revenues of companies

Gray: Operating revenue

Orange: Financial revenue

companies paying >10% tax

companies paying <10% tax

who are those companies?

Did they sign an advanced Pricing Agreements?

blanked for privacy reasons

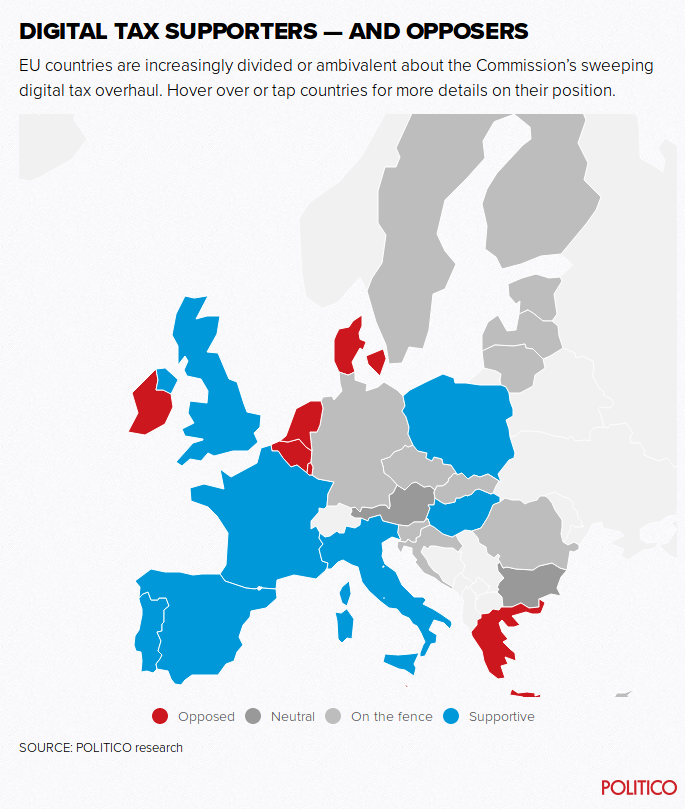

Always a front runner in tax competition

Dividendbelasting

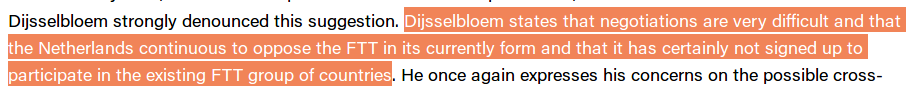

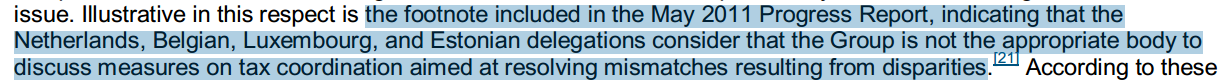

Blocking EU legislation

PARt 3: the professionals

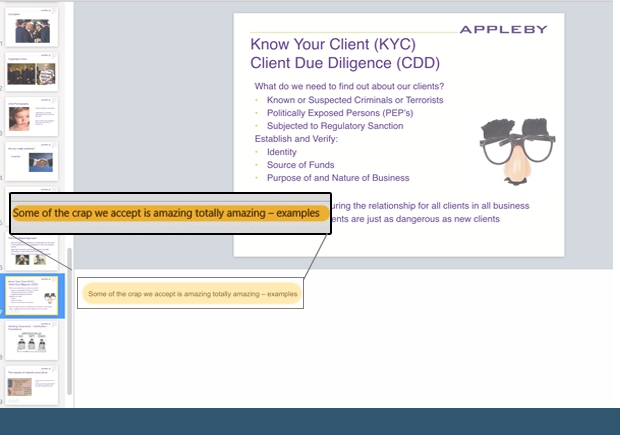

- Corporate structures are complex for two reasons:

- Mergers/acquisitions make them complex (for corporations)

- Are created complex:

- To hedge against failures

- To avoid regulations

- To avoid taxation

- They are created by intermediaries:

- Law/trust firms (Appleby, Mossack Fonseca, Intertrust)

- Accounting/auditor firms (The Big Four)

- There are usually several layers of intermediaries involved.

- In the Netherlands:

-

The Dutch Trust Industry - SEO Economisch Onderzoek

- 94% of the services are to foreign companies

- Tax advice is the main service provided

- 250,592 entities in 100 addresses

- 762,992 entities in 1,000 addresses

-

The Dutch Trust Industry - SEO Economisch Onderzoek

the intermediaries

8150 companies

9.3/window

Source: Internal presentation by the director of compliance (Woods)

- Terrorist financing offences: “We have a current case where we are sitting on about 400K that is definitely tainted and it is not easy to deal with.”

- Set up a trust and accepted money on his behalf “without question.”

consequences: the people

what does the netherlands gain?

The Netherlands is extremely successful at attracting holding companies (assets ~8 times GDP).

Taxes

- 1.5-3 billion / year

Employment

- 3000 of business service professionals

- Some other thousands by headquarters and shared service centers

The benefits are expected to increase in the post-BEPS era

what does the netherlands lose?

Credibility

- e.g. 2009 Obama named the Netherlands as a tax haven

Accelerate the decrease in corporate taxation

- The Netherlands is a front runner in tax cuts

Domestic firms:

- e.g. Average tax rate of mid-size domestic companies: 21.0% (vs 14.5 % for foreign affiliate)

what does the worLD LOSE?

1. rising inequality

Wealthy people have access to better investments and lower taxation

Taxing corporate profits is one of the only ways to tax capital

Source: World Inequality Database

$7M

$200M

$1,500M

1. rising inequality

Source: World Inequality Database

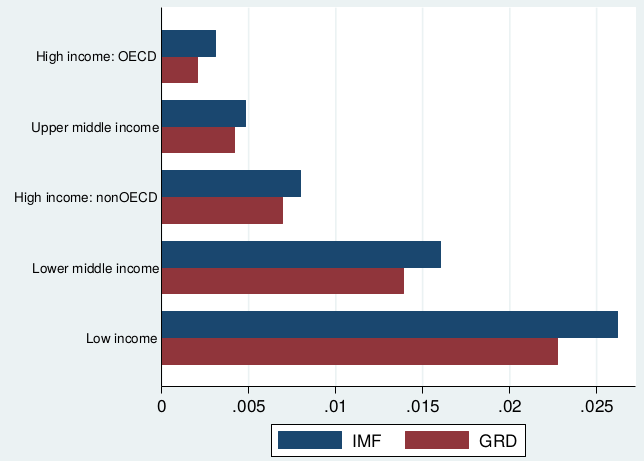

Global distribution of revenue loss from tax avoidance.

Re-estimation and country results Alex Cobham and Petr Janský

2. "aid in Reverse'

- Developing countries may lose more money than it is given in aid

The Netherlands is the largest player because corporations organize their internal structure using Dutch conduits

PART 1

PART 2

PART 3

Corporations use the NL because it provides all the macro-institutional features AND many tax incentives

- Taxing financial revenue differently

- Secrecy in deals with corporations

Intermediary firms design such structures and advise governments about tax reforms

CONSEQUENCES

- As the largest player in corporate structures, the NL enables companies to shift profits away from their origin

- Contributes to inequality (domestic firms, EU, dev. c) - The NL diminishes tax sovereignty of other countries

corpnet.uva.nl

@javiergb_com

@uvaCORPNET

javiergb.com

corpnet@uva.nl

garcia@uva.nl

This presentation: slides.com/jgarciab/svn2018