Young PETGOV club

Arjan Reurink

Javier Garcia-Bernardo

The great fragmentation of the firm, and the structure of tax competition in the EU

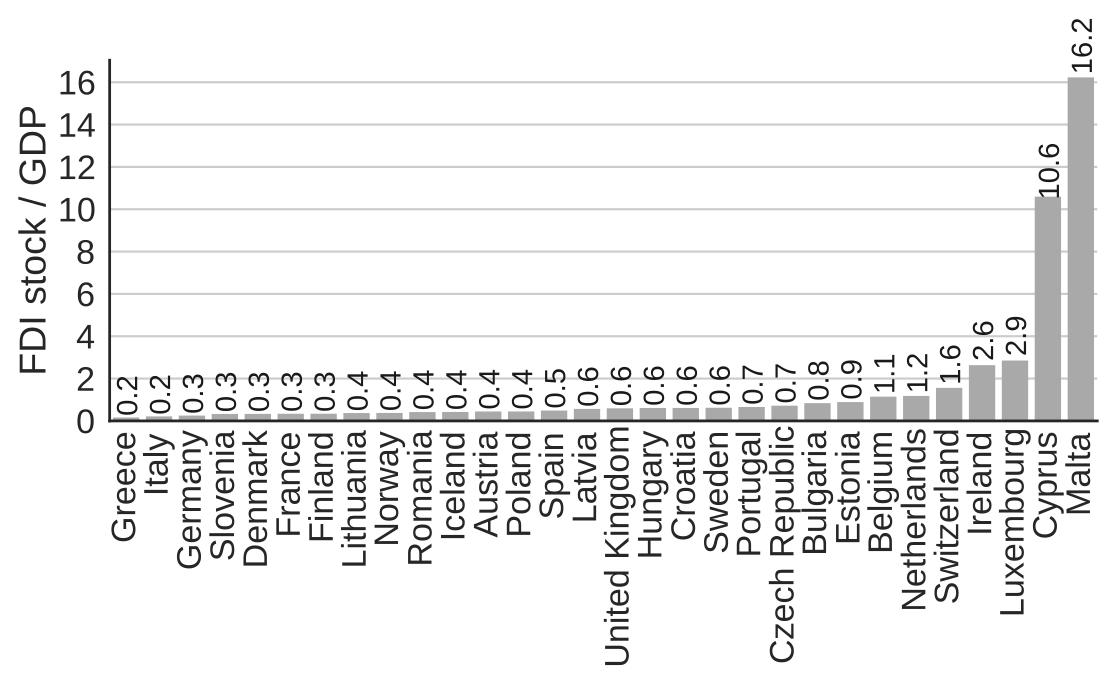

The Race for FDI in Europe

What does it mean that countries compete for FDI?

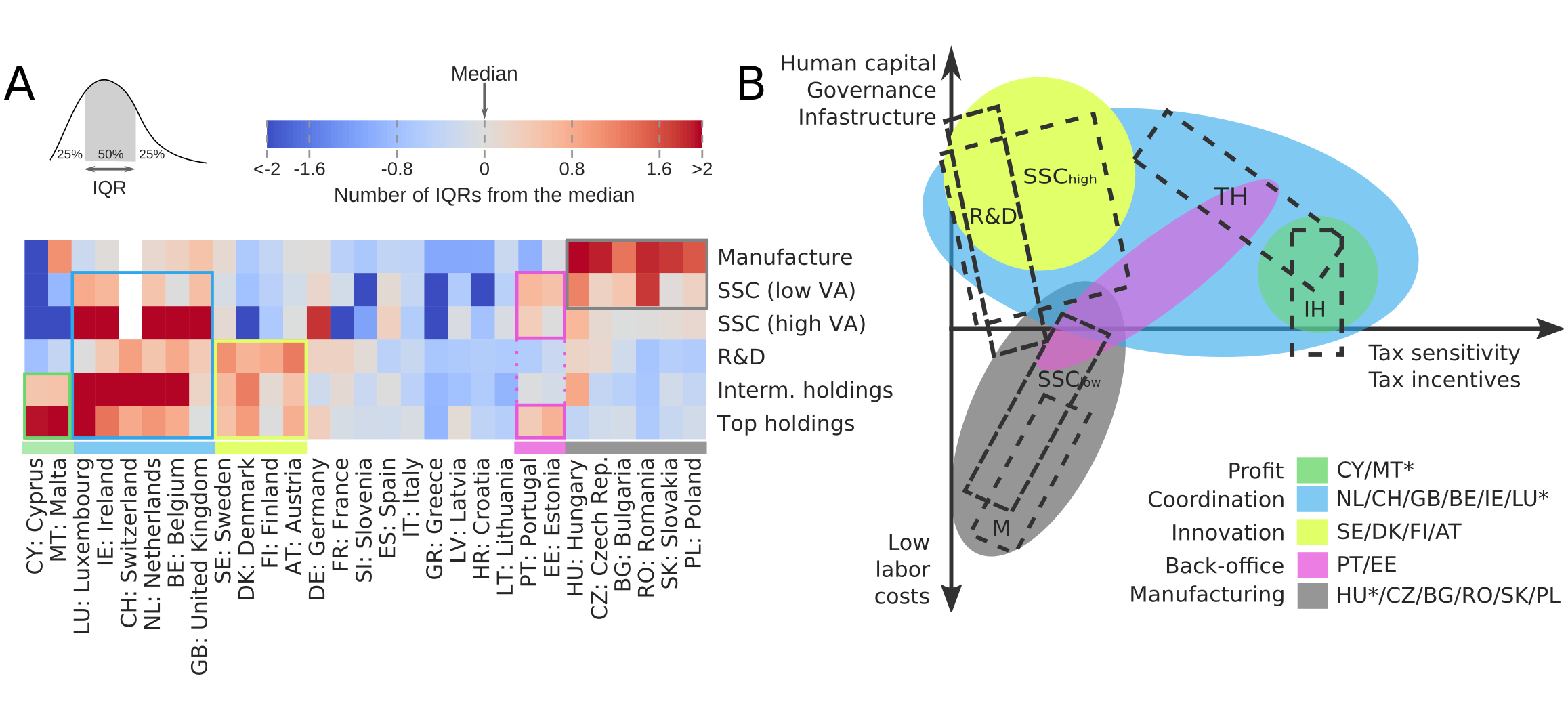

Who competes with whom? → Countries attracting the same categories of foreign investment For what? → Employment and tax revenues How? → Macro-institutional features & tax arrangement

Categories of FDI:

The great fragmentation of the firm

-

Operational level (Optimize value creation):

- Unbundling and geographical dispersion of TNCs’ operational activities

- Gives rise to different types of subsidiaries

-

Legal-functional level (Optimize value capture):

- Unbundling and geographical dispersion of TNCs’ value-creating assets

-

Gives rise to:

- Holding subsidiaries

- Inter-subsidiary relationships (leasing, cost-sharing, financing)

The anatomy of the firm:

Five categories of FDI

- Manufacture

- Shared service centers (Low and high value-adding)

- R&D facilities

- Top holdings

- Intermediate holdings

Results

Color: FDI attraction model Dashed: Ideal-type of country

Blocks: FDI attraction model