Nonprofits include:

Political “dark money” groups and activist groups that may as well be political

Unions

Sports leagues

Hospitals and universities

Corporate foundations

Political “dark money” groups and activist groups that may as well be political

Unions

Sports leagues

Hospitals and universities

Corporate foundations

ANNUAL FORM 990S INCLUDE:

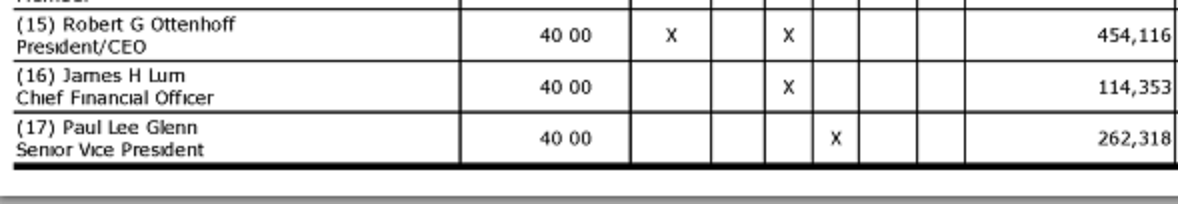

WHO’S ON THEIR BOARD AND TOP STAFF AND HOW MUCH THEY’RE PAID

WHO THEY GIVE GRANTS TO

ANSWERS TO QUESTIONS ABOUT CONFLICT OF INTEREST

HOW MUCH MONEY WENT TO ADMINISTRATION, FUNDRAISING, ETC

WHO’S ON THEIR BOARD AND TOP STAFF AND HOW MUCH THEY’RE PAID

WHO THEY GIVE GRANTS TO

ANSWERS TO QUESTIONS ABOUT CONFLICT OF INTEREST

HOW MUCH MONEY WENT TO ADMINISTRATION, FUNDRAISING, ETC

PREVIOUS OPTIONS

what citizenaudit has

-

Ten years of PDFs for every filer, obtained monthly from the IRS on DVDs and posted online.

- Fully text-searchable. We did optical character recognition (OCR) on many millions of pages.

- Can search within PDFs with CTRL+F

- Staff, board members, vendors, dollar amounts, addresses, grants, answers to questions, anything that’s in the form.

- Download spreadsheets of structured data

Just search... like google.

- Type anything in the box.

- There's a lot of data, so use quotes if you want to match an exact phrase, or if there are numbers involved.

- The first tab "X Nonprofits found" is if you're looking for a given nonprofit's 990

- The second tab, "X Tax Documents found" is if you're looking to learn who funded that nonprofit. This tab is the most interesting--if Nonprofit B mentions Nonprofit A within its 990, that is because Nonprofit B funds Nonprofit A.

Finding funders

- Most novel and important use for CitizenAudit is if you want to find out who's funding a nonprofit.

- Nonprofits don't disclose who gives to them, but they do disclose who they give to.

- It's always been easy to ask for an organization's 990 and read it, but to see who's funding it, you'd basically have to read the grantee section of every other nonprofit in existence's forms. You wouldn't know where to look.

- That's what CitizenAudit does. It should find almost all nonprofit-to-nonprofit grants. This technique won't tell you what companies and individuals are funding nonprofits, unless they're routing it through trusts, etc.

click an org name to go to a profile page

OCR'd text is on there too. CTRL-F can be helpful

Formatting of OCR'd text isn't always very clear, but there are page numbers, so you can click to open the PDF and see the real page. OCR'd text serves as a guide telling you exactly what normal (PDF) docs to look at.

use it for routine backgrounding

- 990s are thorough disclosures. It's a chance to get paper on someone, more than you'll see in limited forms like incorporation documents.

- If you're backgrounding anyone who's been active in the community, there's a decent chance they'll show up. Get in the habit of doing it even when your story has nothing to do with tax-exempt organizations.

- Nonprofits can be shadow/sister organizations to companies and other groups. They can sometimes have almost no real-world presence, but search an address or a person's name and they may have one there.

Addresses and salaries

- Just because it's called a nonprofit doesn't mean people don't get rich

-

Pulling a 990 the traditional way isn't enough because they could be getting paid by other, supposedly unrelated charities

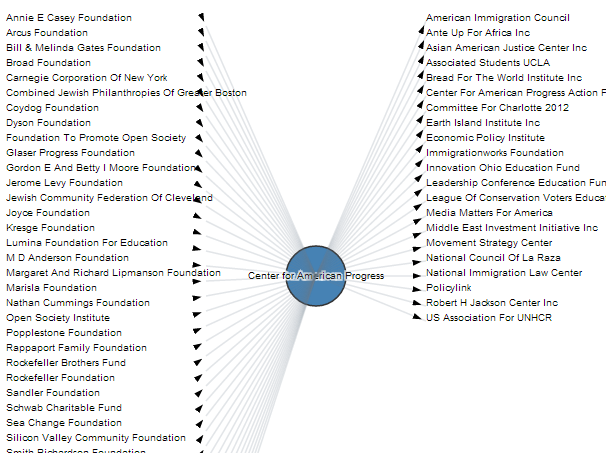

Center for American Progress: Money in, money out

Before, you only had half the picture: money out. With CitizenAudit, you can piece together pass-throughs.

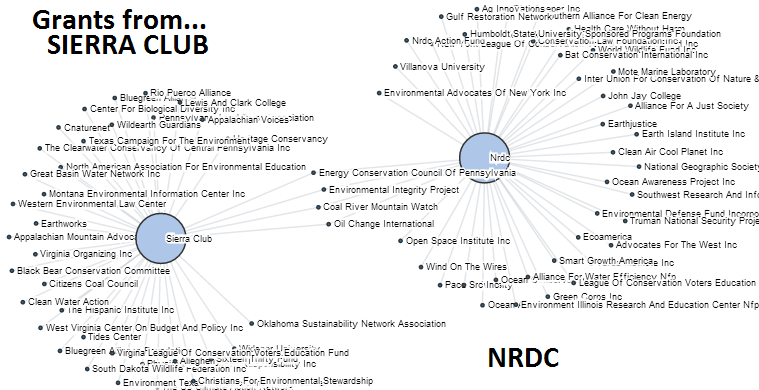

Tangled weBS

FOR SQL people and webdevs

API and CSV

- Pass it an EIN, get back JSON: the structured data from the extracts and the OCR'd text

- 100TB of storage

Subsection code

Described in 501(c)(3)?

Schedule B required?

Political activities?

Lobbying activities?

Subject to proxy tax?

Donor advised funds?

Conservation easements?

Collections of art?

Credit counseling?

Term or permanent endowments?

Land buildings and equipment reported?

Investments in other securities reported?

Program related investments reported?

Other assets reported?

Other liabilities reported?

Separate consolidated financial statement

Separate audited financial statement

Included in consolidated financial statements?

School?

Foreign office?

Foreign activities, etc?

More than $5000 to organizations Part IX, line 3?

More than $5000 to individuals Part IX, line 3?

Professional fundraising?

Fundraising activities?

Gaming?

Hospital?

Hospital audited financial statement included?

Grants to organizations?

Grants to individuals?

Schedule J required?

Tax exempt bonds?

Investment income?

Escrow account?

On behalf of issuer?

Excess benefit transaction?

Prior excess benefit transaction?

Loan to officer or DQP?

Grant to related person?

Business relationship with organization?

Business relationship thru family member?

Officer, etc. of entity with business relationship?

Deductible non-cash contributions?

Deductible contributions of art, etc?

Terminated?

Partial liquidation?

Disregarded entity?

Related entity?

Related organization a controlled entity?

Any transfers to exempt non-charitable org?

Activities conducted thru partnership?

Schedule O completed?

Number forms transmitted with 1096

Number W-2Gs included in 1a

Compliance with backup witholding?

Number of employees

Employment tax returns filed?

Unrelated business income?

Form 990-T filed?

Foreign financial account?

Prohibited tax shelter transaction?

Taxable party notification?

Form 8886-T filed?

Non-deductible contributions?

Non-deduct. disclosure?

Quid pro quo contributions?

Quid pro quo disclosure?

Form 8282 property disposed of?

Number of 8282s filed

Funds to pay premiums?

Premiums paid?

Form 8899 filed?

Form 1098-C filed?

Excess business holdings?

Taxable distributions?

Distribution to donor?

Initiation fees amount

Gross receipts amount

Gross income from members

Gross income from other sources

Form 990 in lieu of 1041?

Tax exempt interest in lieu of 1041

Qualified health plan in multiple states

Qualified health plan reserves required

Qualified health plan reserves on hand

Payments for indoor tanning

Filed Form 720 for tanning

Reportable compensation from organization

Reportable compensation from related orgs

Other compensation

Number individuals greater than $100K

Number of contractors greater than $100K

Total contributions

Program service revenue code 2a

Program service revenue amount 2a

Program service revenue code 2b

Program service revenue amount 2b

Program service revenue code 2c

Program service revenue amount 2c

Program service revenue code 2d

Program service revenue amount 2d

Program service revenue code 2e

Program service revenue amount 2e

Program service revenue amount 2f

Program service revenue

Investment income

Tax-exempt bond proceeds

Royalties

Gross rents -- Real estate

Gross rents -- Personal property

Rental expense -- Real estate

Rental expense -- Personal property

Net rent -- Real estate

Net rent -- Personal property

Net rental income

Gross sales -- Securities

Gross sales -- Other assets

Sales expense -- Securities

Sales expense -- Other assets

Net gain from sales -- Securities

Net gain from sales -- Other assets

Sales of assets

Gross fundraising

Fundraising expenses

Fundraising income

Gross income from gaming

Gaming expenses

Gaming income

Gross sales of inventory

Cost of goods sold (inventory)

Income from sales of inventory

Other revenue code 11a

Other revenue amount 11a

Other revenue code 11b

Other revenue amount 11b

Other revenue code 11c

Other revenue amount 11c

Other revenue amount 11d

Other revenue

Total revenue

Grants to governments/orgs in the US

Grants to individuals in the US

Grants to orgs and individuals outside the US

Benefits paid to or for members

Compensation of current officers, directors, etc

Compensation of disqualified persons

Other salaries and wages

Pension plan contributions

Other employee benefits

Payroll taxes

Management fees

Legal fees

Accounting fees

Lobbying fees

Professional fundraising fees

Investment management feed

Other fees

Advertising and promotion

Office expenses

Information technology

Royalties

Occupancy

Travel

Travel/entertainment expenses to public officials

Conferences, conventions, meetings

Interest expense

Payments to affiliates

Depreciation, depletion, amortization

Insurance

Other expenses 24a

Other expenses 24b

Other expenses 24c

Other expenses 24d

Other expenses 24e

Other expenses 24f

Total functional expenses

Cash -- non-interest bearing -- eoy

Savings and temporary cash investments -- eoy

Pledges and grants receivable -- eoy

Accounts receivable -- eoy

Receivables from officers, directors, etc. -- eoy

Receivables from disqualified persons -- eoy

Notes and loans receivables -- eoy

Inventories for sale or use -- eoy

Prepaid expenses or deferred charges -- eoy

Land, buildings, & equipment (net) -- eoy

Investments in publicly traded securities -- eoy

Investments in other securities -- eoy

Program-related investments -- eoy

Intangible assets -- eoy

Other assets -- eoy

Total assets -- eoy

Accounts payable and accrued expenses -- eoy

Grants payable -- eoy

Deferred revenue -- eoy

Tax-exempt bond liabilities -- eoy

Escrow account liability -- eoy

Payables to officers, directors, etc. -- eoy

Secured mortgages and notes payable -- eoy

Unsecured mortgages and notes payable -- eoy

Other liabilities -- eoy

Total liabilities -- eoy

Unrestricted net assets -- eoy

Temporarily restricted net assets -- eoy

Permanently restricted net assets -- eoy

Retained earnings -- eoy

Permanently restricted net assets -- eoy

Paid-in or capital surplus -- eoy

Total Net Assets -- eoy

Total Liabilities + Net Assets -- eoy

Reason for non-PF status

Number of organizations supported

Sum of amounts of support

Gifts grants membership fees received (170)

Tax revenues levied (170)

Services or facilities furnished by gov (170)

Public support subtotal (170)

Amount support exceeds total (170)

Public support (170)

Public support from line 4 (170)

Gross income from interest etc (170)

Net UBI (170)

Other income (170)

Total support (170)

Gross receipts from related activities (170)

Gifts grants membership fees received (509)

Receipts from admissions merchandise etc (509)

Gross receipts from related activities (509)

Tax revenues levied (509)

Services or facilities furnished by gov (509)

Public support subtotal (509)

Amounts from disqualified persons (509)

Amount support exceeds total (509)

Public support subtotal (509)

Public support (509)

Public support from line 6 (509)

Gross income from interest etc (509)

Net UBI (509)

Subtotal total support (509)

Net income from UBI not in 10b (509)

Other income (509)

Total support (509)

Try it out

- Questions?

- Sample searches I can conduct for you right now?