Automated Market Makers

Mick de Graaf

Smart Contracts @ PieDAO🎂

Twitter: @MickdeG010

Program

- Different exchange types

- Orderbook

- Quote Provider

- Reserve

- AMM

- Uniswap

- Balancer

- BTC++

Exhange

a place or organization where shares, currencies, commodities, etc. are bought and sold

Orderbook

Stock Exchanges, Binance, most ZRX relayers

Quote Provider

ShapeShift, Bitonic, Contractors

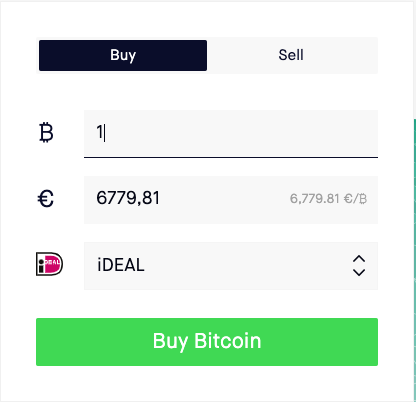

Alice signals that she wants to buy 1Bitcoin.

Bob has liquidity and signals that he is willing to sell 1 BTC at €6779,8. (makes a quote)

Alice agrees, sends the euros and buys 1 BTC

Alice == Buyer Bob == Seller

Reserve

Kyber Reserves, Super Markets

Alice == Buyer Bob == Seller

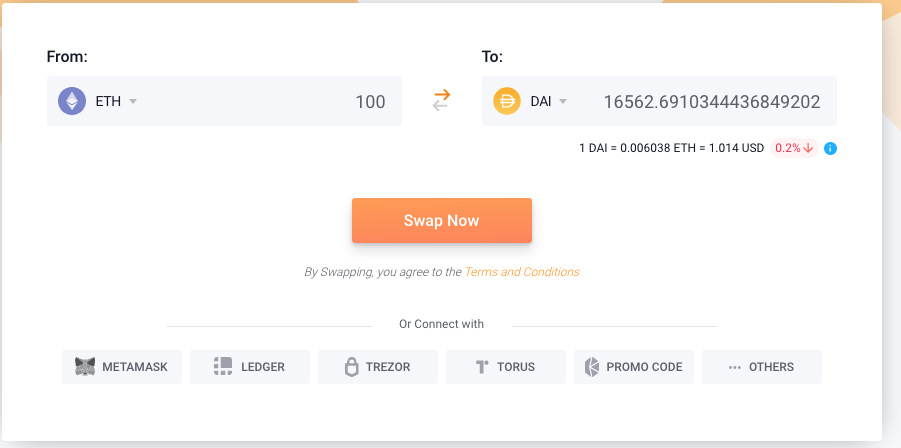

Bob periodically deposits DAI into a smart contract and periodically updates the price of ETH in DAI he likes to receive when selling DAI.

Alice sends 1ETH to the pool and gets 1/BobsPrice

Automated Market Makers

Uniswap, Balancer, Bancor, Curve, Shell Protocol

Characteristics

- Smart Contract Based

- Require no external input

- Use a curve to determine price

- Pool Liquidity from different users

- Share in liquidity pool is tokenised

- Fully onchain

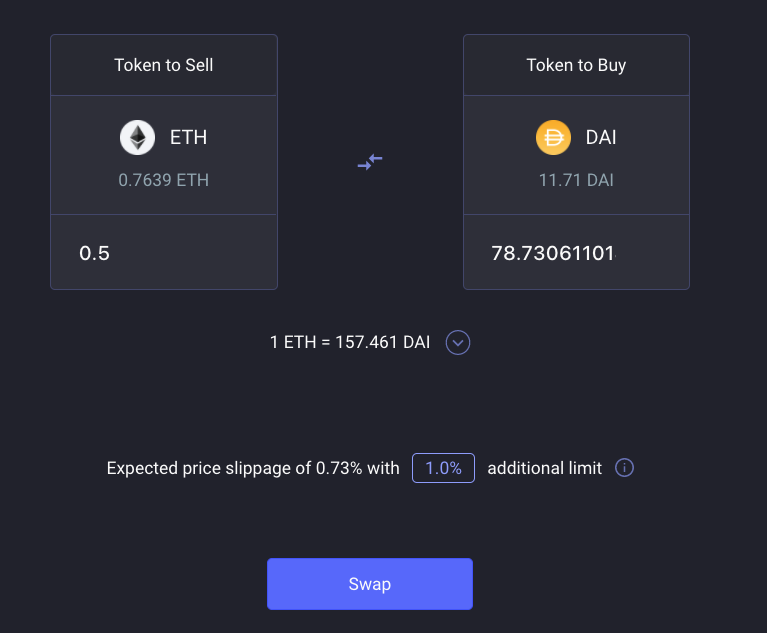

Uniswap

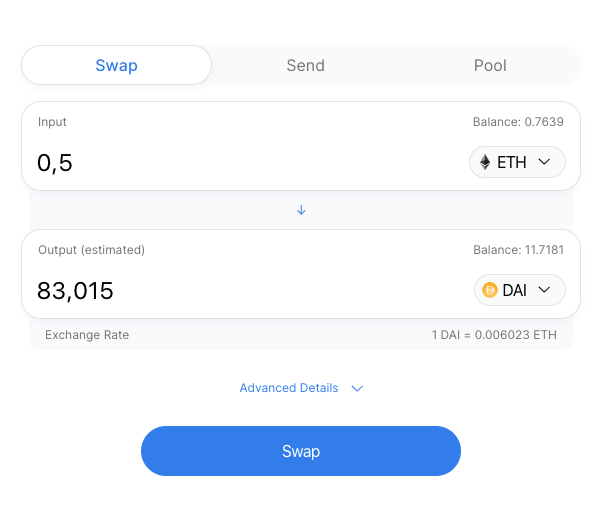

Alice == Buyer Pool == Seller

Alice sends tx to pool with 0.5 ETH

Pool returns 83.015 DAI

In a single transaction!

Pool?

Contract with liquidity of multiple people

Pool Token

LPT = Liquidity Pool Token

aB = Pool asset A balance

bB = Pool asset B balance

1 Liquidity Pool Token

aB / LPT supply

tB / LPT supply

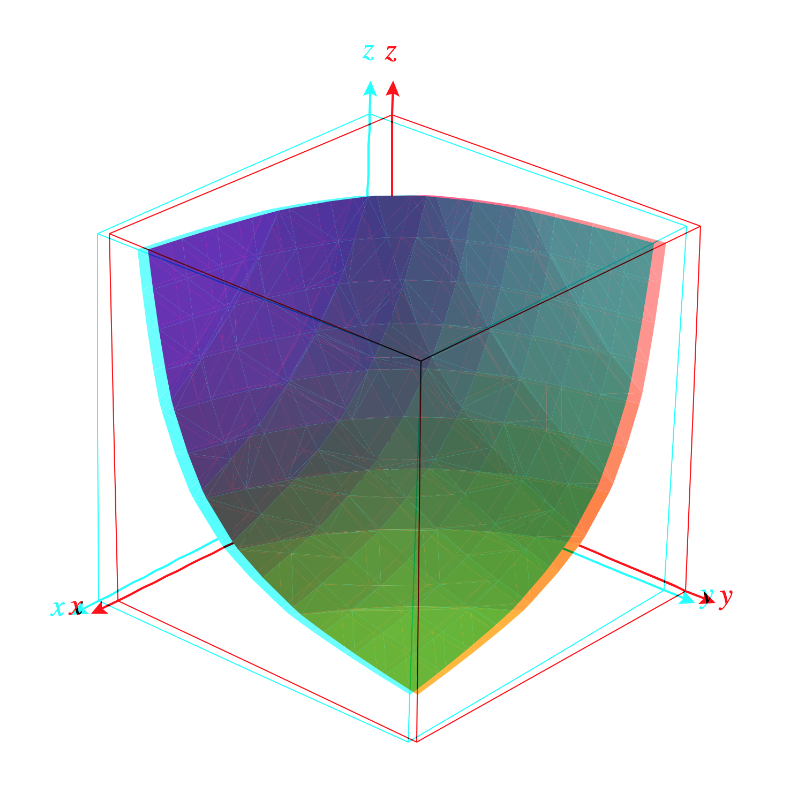

Price Calculation

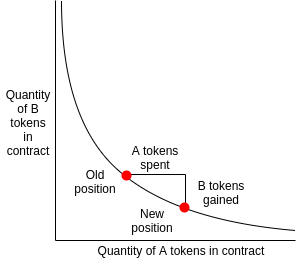

X * Y = K

1 * 1 = 1

2 * 0.5 = 1

aB (X) = Pool asset A balance

bB (Y) = Pool asset B balance

K = Constant

Constant Product Formula

Spot Price == 1 / 1 == 1

Actual Price == K / aB == 1 / 2 == 2

Value Distribution

50/50

TokenA / TokenB

When the prices of the assets fluctuate against each other there will be an arbitrage opportunity. Traders taking advantage of this will restore the 50/50 distribution.

Basically a simple index fund

Fees

0.3% of every trade added to liquidity pool

Balancer

Alice == Buyer Pool == Seller

Alice sends tx to pool with 0.5 ETH

Pool returns 78.73 DAI

In a single transaction!

Much like Uniswap

- Tokenised pool of assets

- Fees generated from swaps

- Constant product formula for prices

- Keeps balanced through arbitrage traders

But Different

Multi Dimensional

Up to 8 tokens in a Pool.

Pool tokens represent proportional share of that 8 tokens.

Custom Weights

(aB / aW) * (bB / bW) * (cB / cW) = K

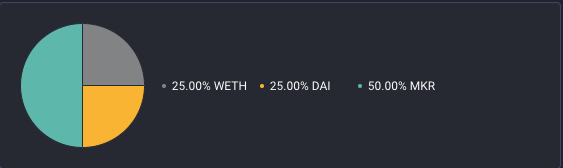

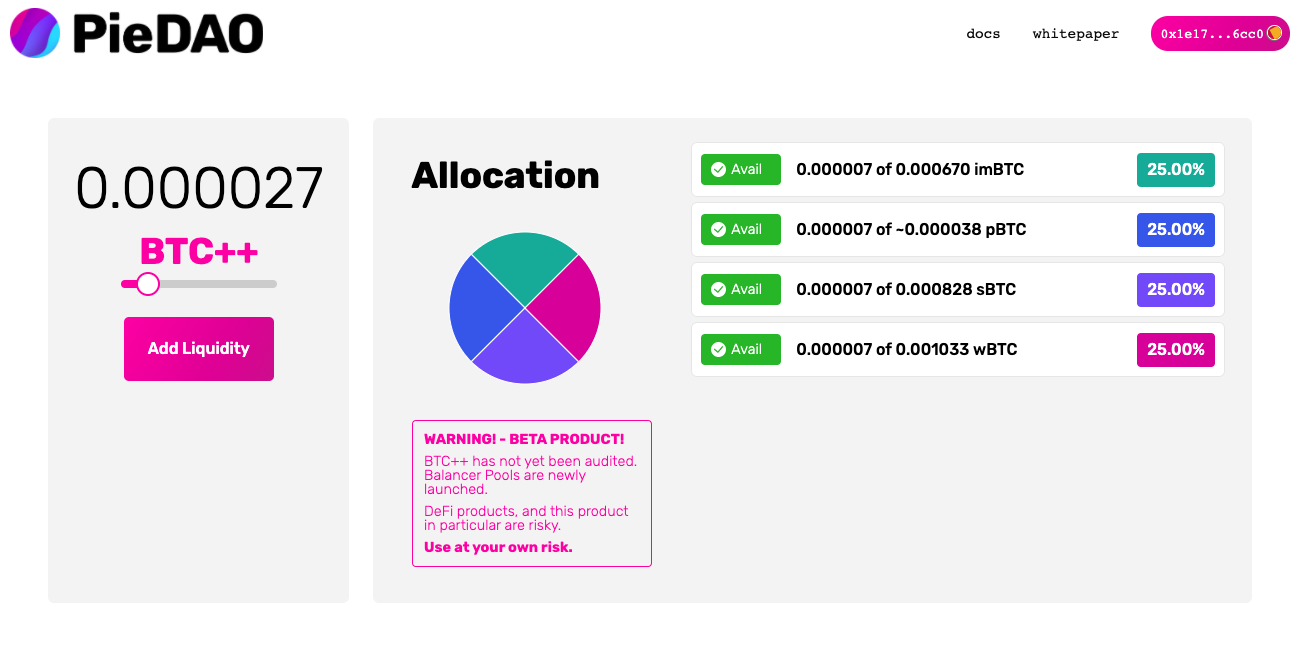

BTC++

Bitcoin on Ethereum Diversified

Allocation

25/25/25/25

sBTC/WBTC/iMBTC/pBTC

Goal

Spread risk of failure of a single asset

Bitcoin exposure on Ethereum

Generate yield for liquidity providers

Underlying Tech

- Balancer Pool

- Aragon DAO

- Smart Pool Manager