Phase-Type Models in

Life Insurance

Dr Patrick J. Laub @ PARTY, Sibiu

Motivating theory

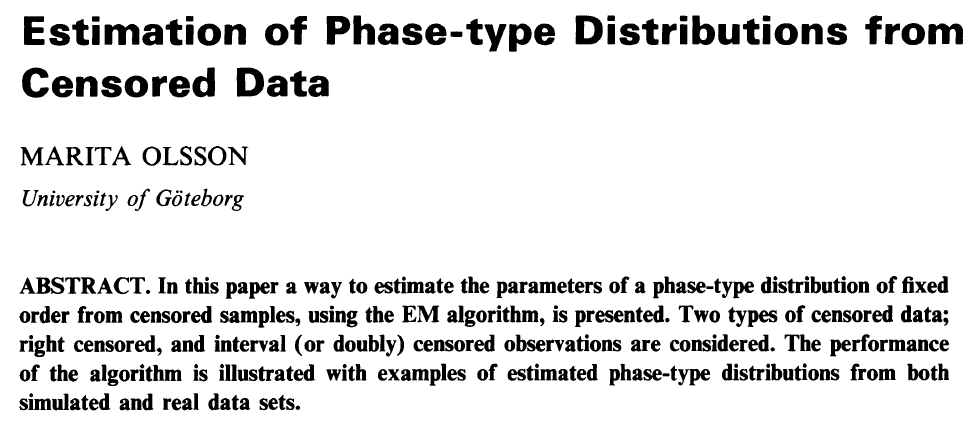

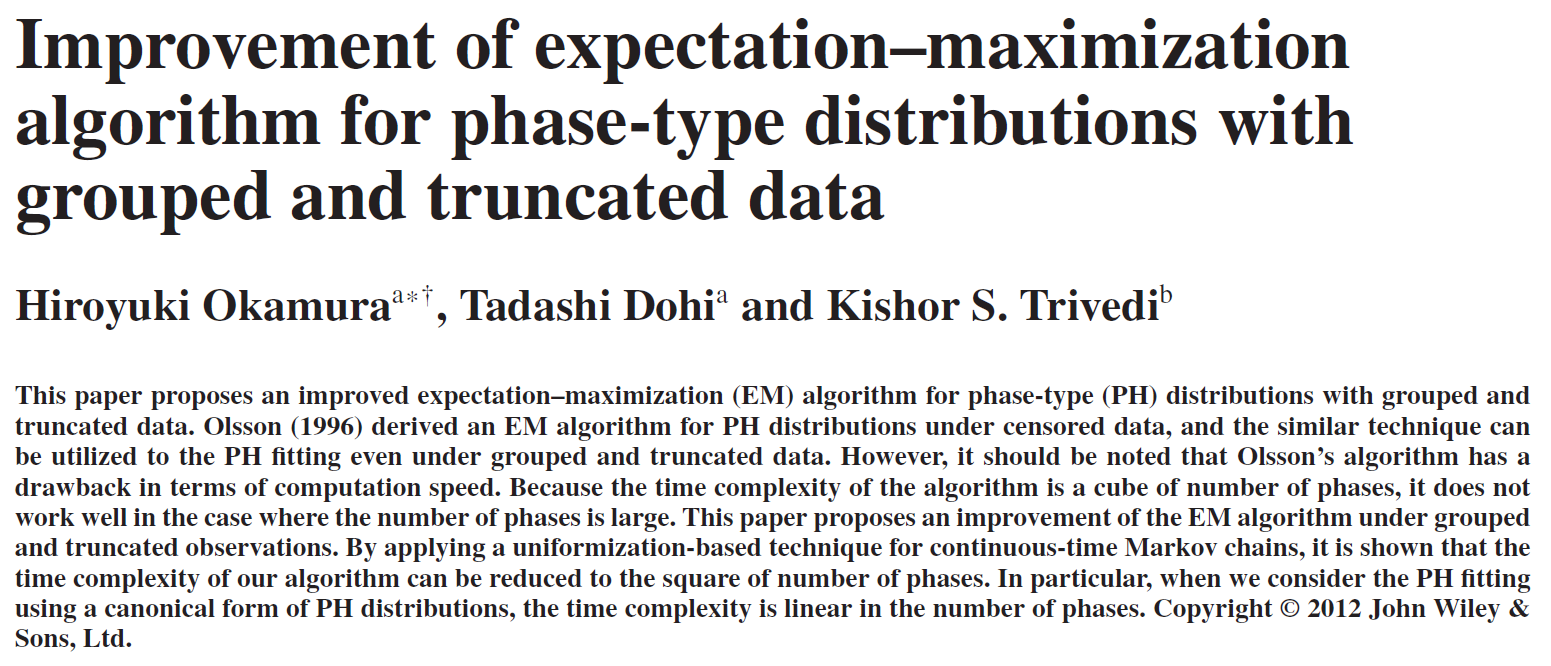

Stochastic Models (2019), 34(4), 1-12.

Can read on https://arxiv.org/pdf/1803.00273.pdf

Guaranteed Minimum Death Benefit

Equity-linked life insurance

High Water Death Benefit

Equity-linked life insurance

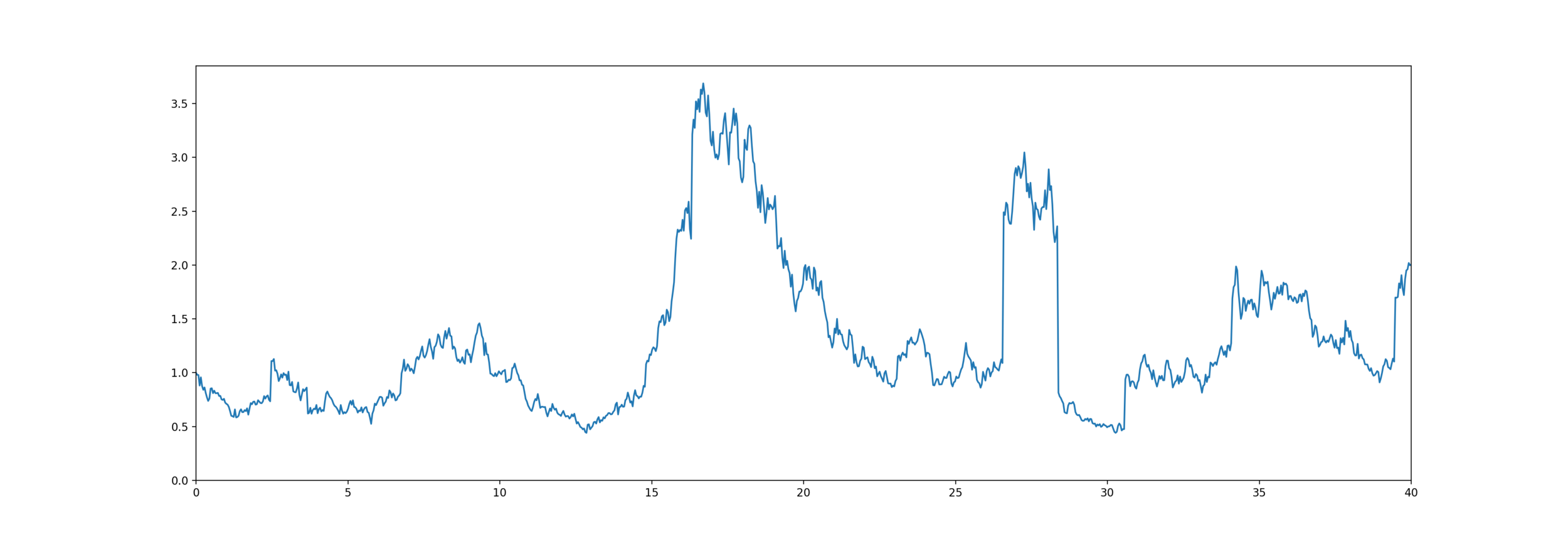

Model for mortality and equity

The customer lives for years,

Equity is an exponential jump diffusion,

Exponential PH-Jump Diffusion

Get some helpful matrices

Use fixed-point approximation

We're starting to some library to do this more generally

Pricing these contracts

Take home messages

- If you really care about equity-linked life insurance, check out our paper

- What are phase-type distributions?

- Why are they cool?

- Strategy: if some maths works when using an exponential distribution, try a phase-type distribution

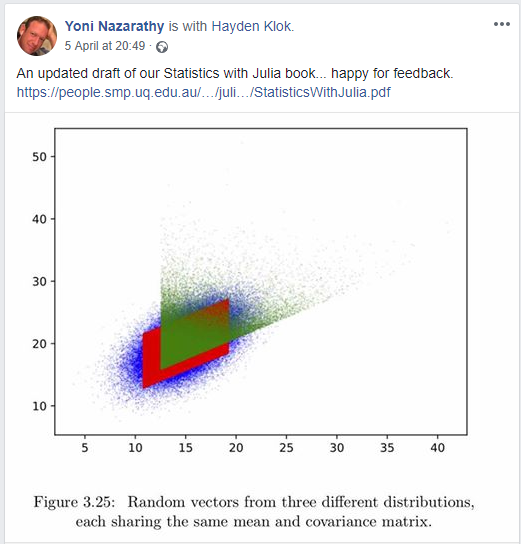

- I have a package to fit them in Julia

- If you've never tried it, check out Julia language.

What are phase-type distributions?

Markov chain State space

Phase-type definition

Markov chain State space

- Initial distribution

- Sub-transition matrix

- Exit rates

Phase-type properties

Matrix exponential

Density and tail

Moments

Laplace transform

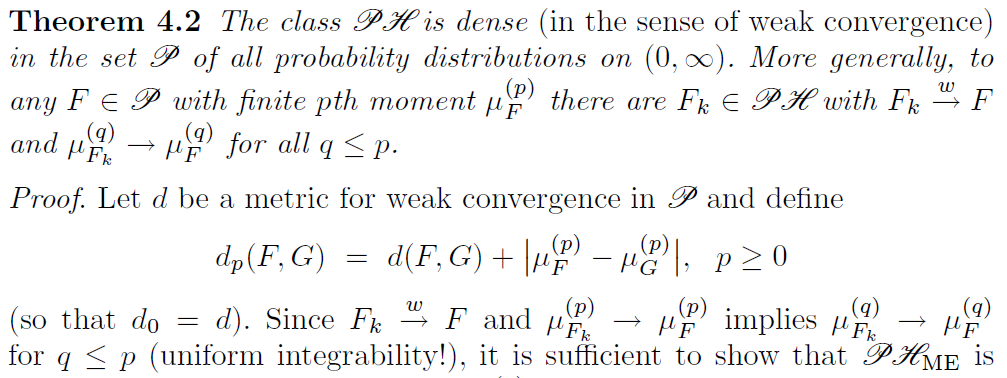

Class of phase-types is dense

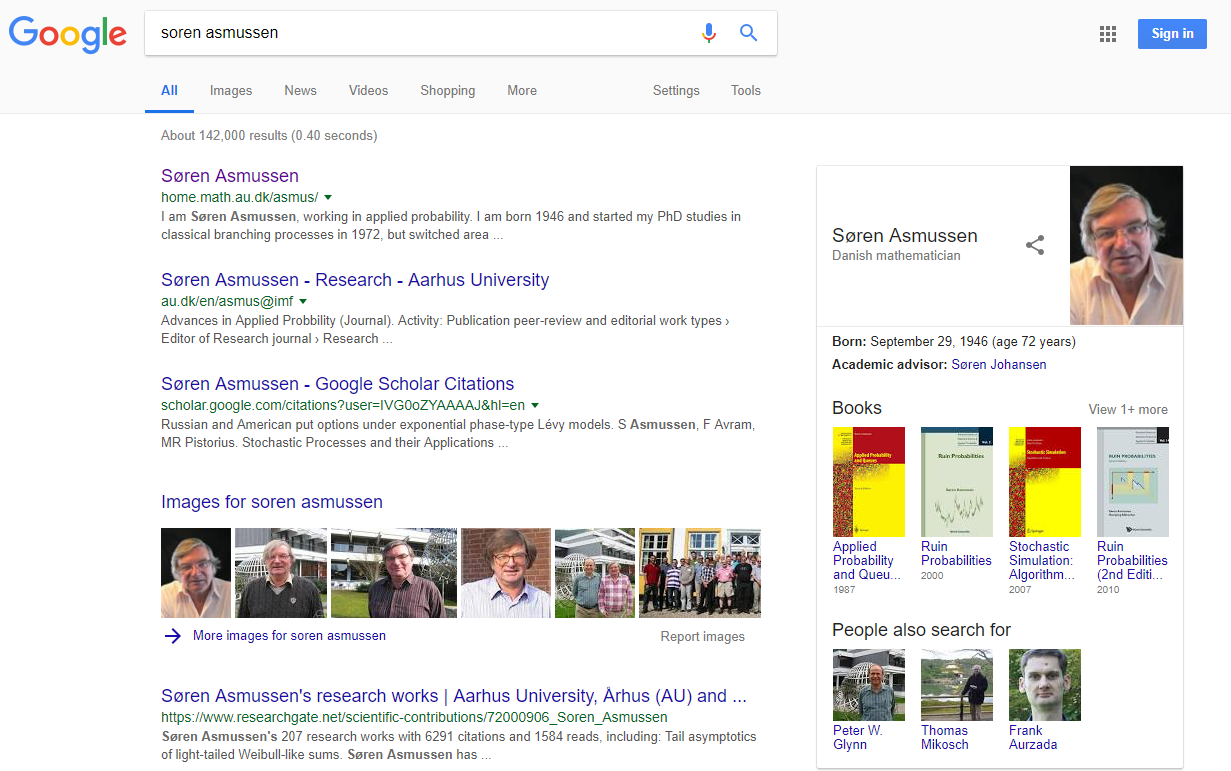

S. Asmussen (2003), Applied Probability and Queues, 2nd Edition, Springer

Phase-type generalises...

- Exponential distribution

- Sums of exponentials (Erlang distribution)

- Mixtures of exponentials (hyperexponential distribution)

More cool properties

Closure under addition, minimum, maximum

... and under conditioning

Two ways to view the phases

As meaningless mathematical artefacts

Choose number of phases to balance accuracy and over-fitting

As states which reflect some part of reality

Choose number of phases to match reality

X.S. Lin & X. Liu (2007) Markov aging process and phase-type law of mortality.

N. Amer. Act J. 11, pp. 92-109

M. Govorun, G. Latouche, & S. Loisel (2015). Phase-type aging modeling for health dependent costs. Insurance: Mathematics and Economics, 62, pp. 173-183.

If it works for exponential distribution, try phase-type

Assume:

- is exponentially distributed

- where is a Brownian motion

Then and are independent and exponentially distributed with rates

Wiener-Hopf Factorisation

-

is an exponential random variable

- is a Lévy process

Doesn't work for non-random time

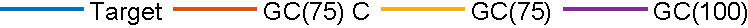

How to fit them?

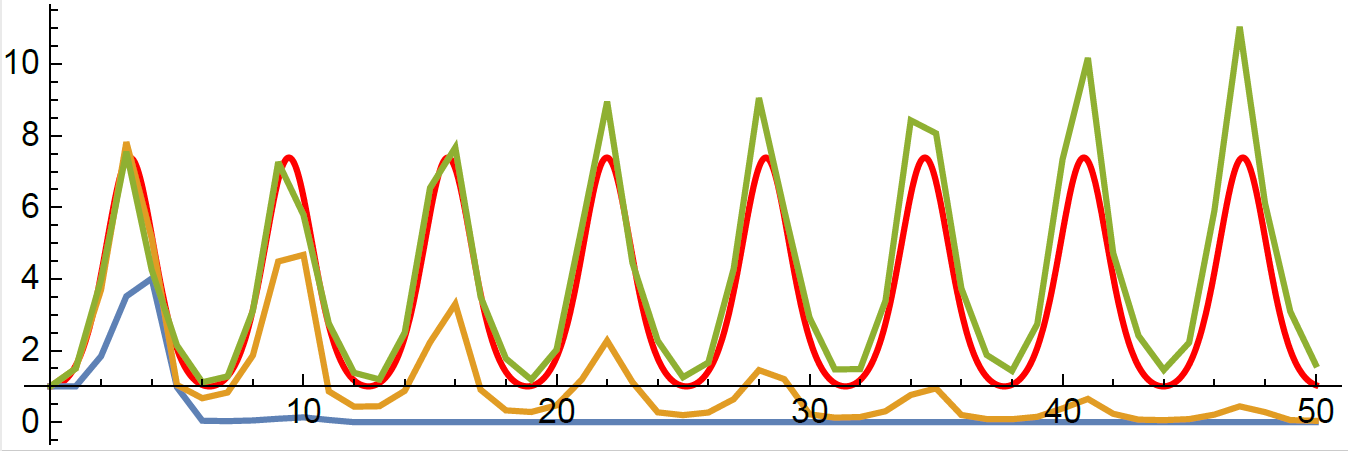

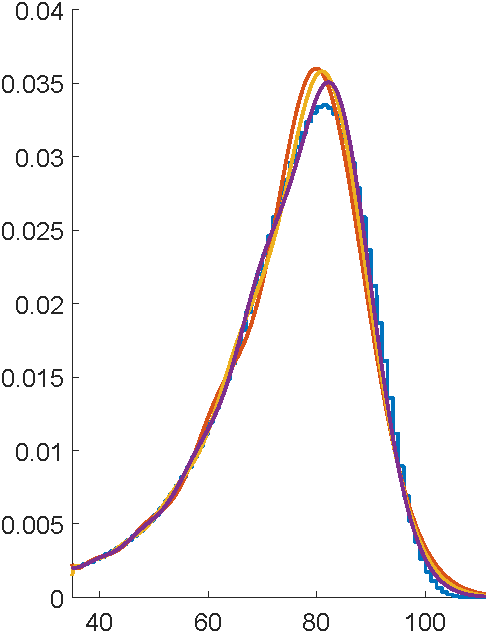

Traditionally, using EM algorithm

Bladt, M., Gonzalez, A. and Lauritzen, S. L. (2003), ‘The estimation of Phase-type related functionals using Markov chain Monte Carlo methods’, Scandinavian Actuarial Journal

Representation is not unique

Also, not easy to tell if any parameters produce a valid distribution

Lots of parameters to fit

- General

- Coxian distribution

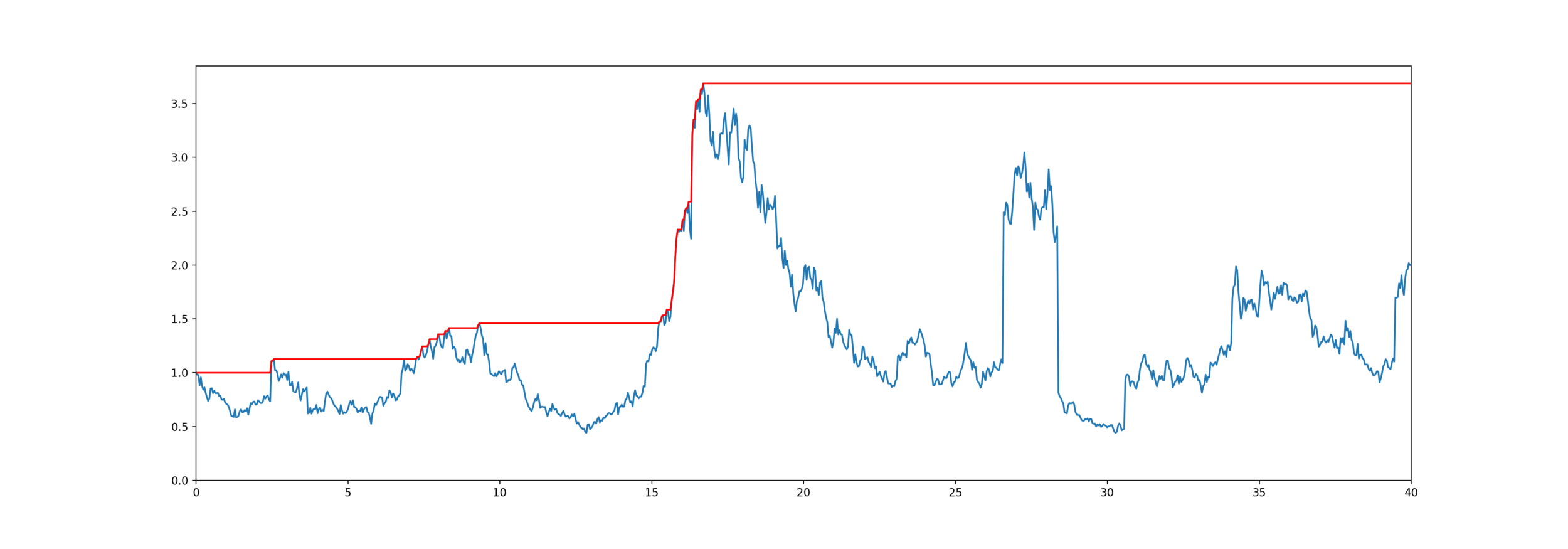

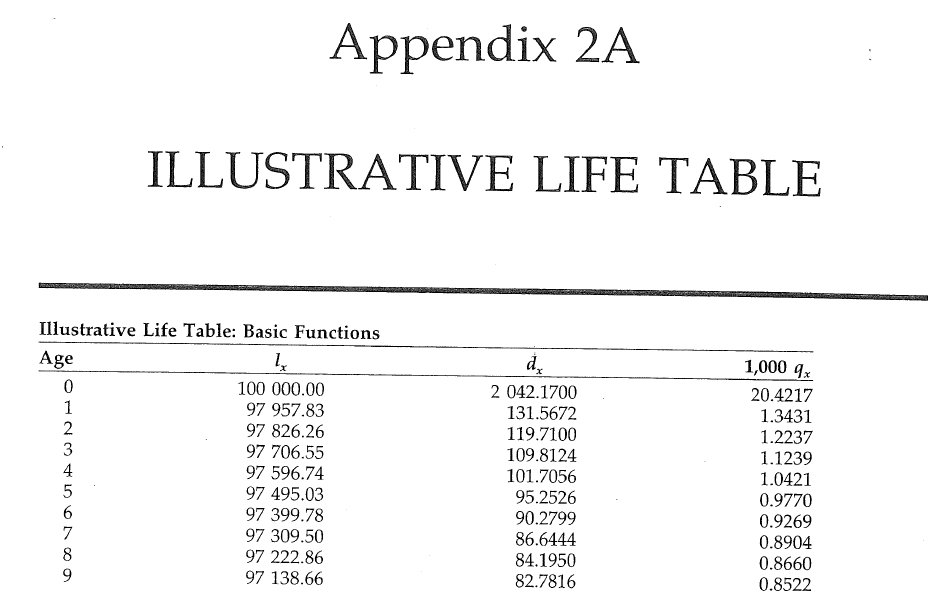

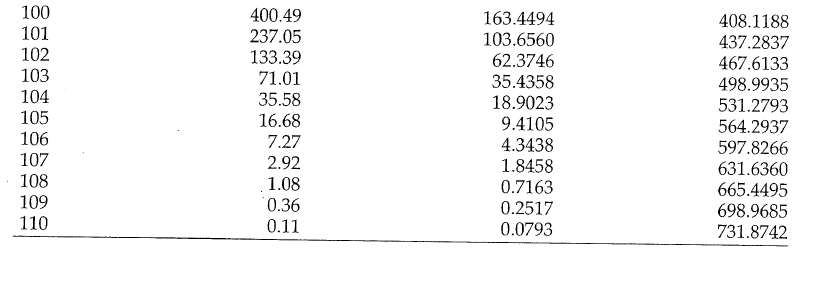

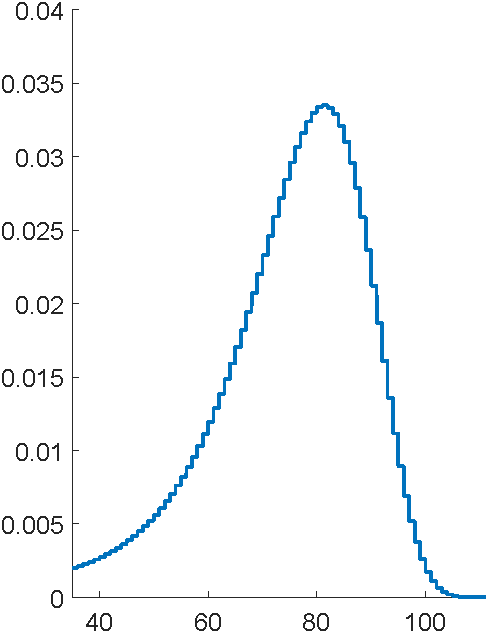

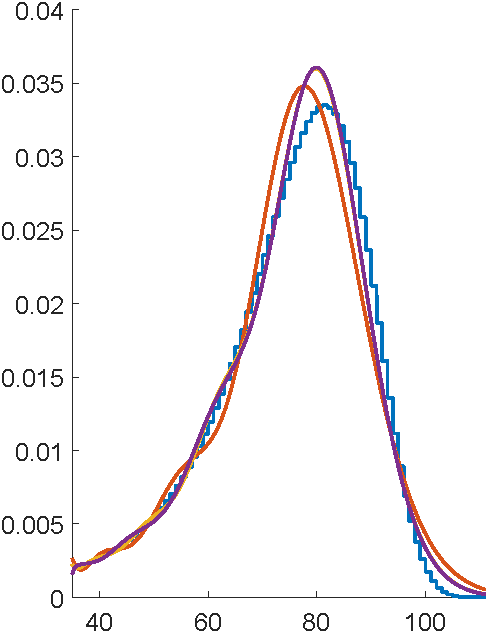

Problem: to model mortality via phase-type

Bowers et al (1997), Actuarial Mathematics, 2nd Edition

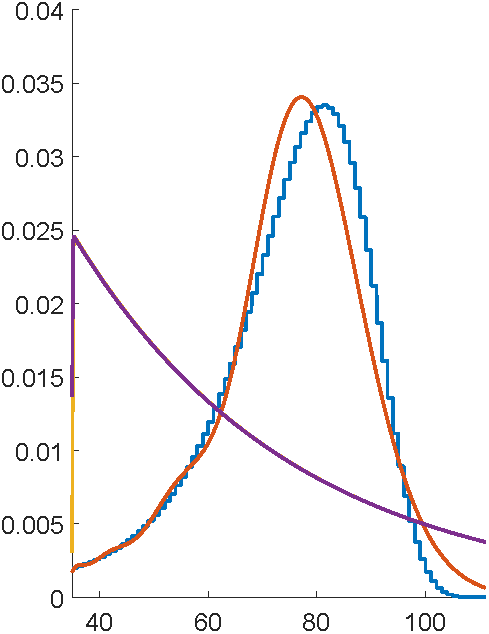

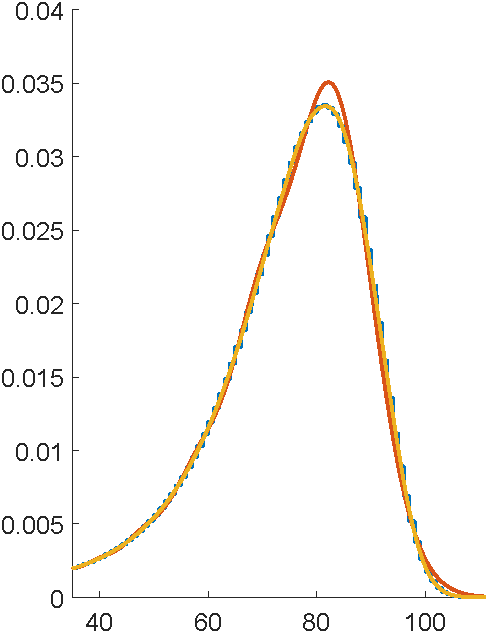

First attempts with EMpht

Why's this so terrible?

"E" step has a bazillion matrix exponential calculations

DE solver going negative

Rewrite in Julia

void rungekutta(int p, double *avector, double *gvector, double *bvector,

double **cmatrix, double dt, double h, double **T, double *t,

double **ka, double **kg, double **kb, double ***kc)

{

int i, j, k, m;

double eps, h2, sum;

i = dt/h;

h2 = dt/(i+1);

init_matrix(ka, 4, p);

init_matrix(kb, 4, p);

init_3dimmatrix(kc, 4, p, p);

if (kg != NULL)

init_matrix(kg, 4, p);

...

for (i=0; i < p; i++) {

avector[i] += (ka[0][i]+2*ka[1][i]+2*ka[2][i]+ka[3][i])/6;

bvector[i] += (kb[0][i]+2*kb[1][i]+2*kb[2][i]+kb[3][i])/6;

for (j=0; j < p; j++)

cmatrix[i][j] +=(kc[0][i][j]+2*kc[1][i][j]+2*kc[2][i][j]+kc[3][i][j])/6;

}

}

}

This function: 116 lines of C, built-in to Julia

Whole program: 1700 lines of C, 300 lines of Julia

# Run the ODE solver.

u0 = zeros(p*p)

pf = ParameterizedFunction(ode_observations!, fit)

prob = ODEProblem(pf, u0, (0.0, maximum(s.obs)))

sol = solve(prob, OwrenZen5())https://github.com/Pat-Laub/EMpht.jl

# Run the ODE solver.

u0 = zeros(p*p)

pf = ParameterizedFunction(ode_observations!, fit)

prob = ODEProblem(pf, u0, (0.0, maximum(s.obs)))

sol = solve(prob, OwrenZen5())

...

u = sol(s.obs[k])

C = reshape(u, p, p)

if minimum(C) < 0

(C,err) = hquadrature(p*p, (x,v) -> c_integrand(x, v, fit, s.obs[k]),

0, s.obs[k], reltol=1e-1, maxevals=500)

C = reshape(C, p, p)

end

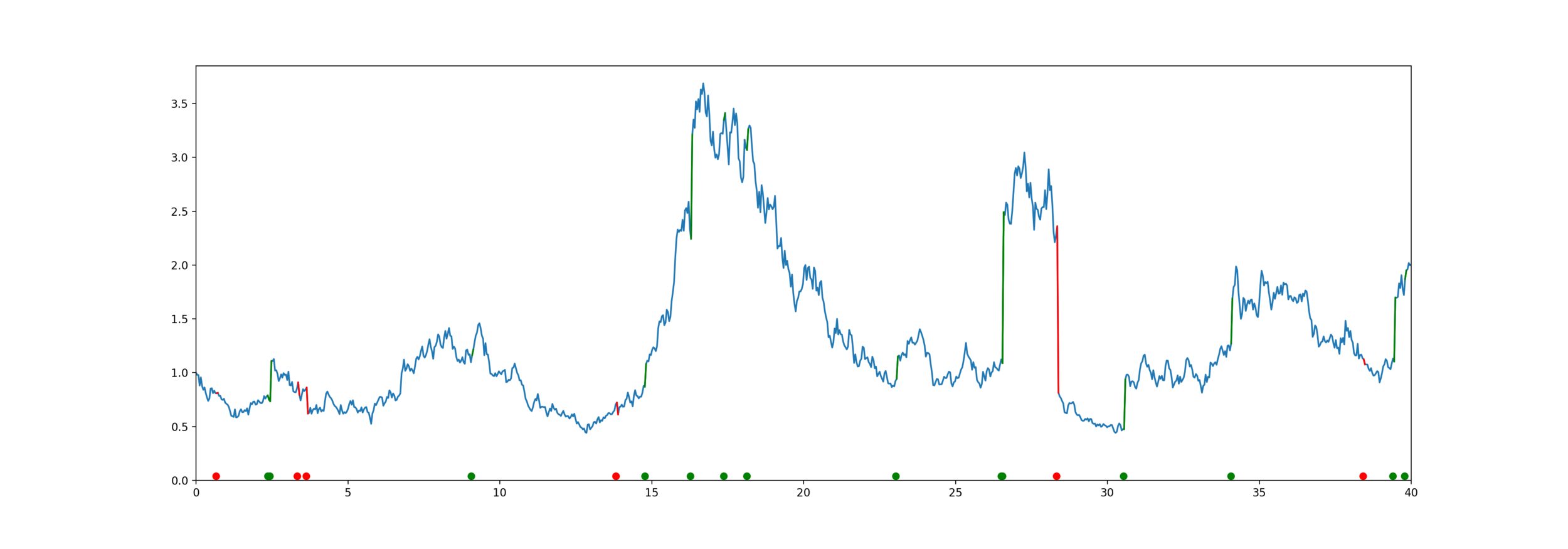

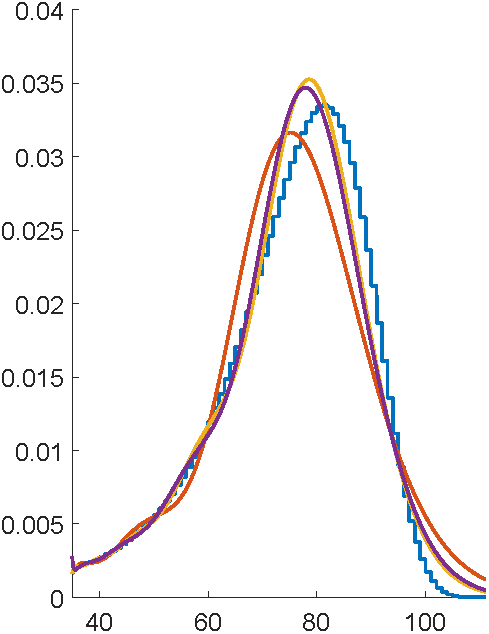

Swap to quadrature in Julia

Swap to quadrature in Julia

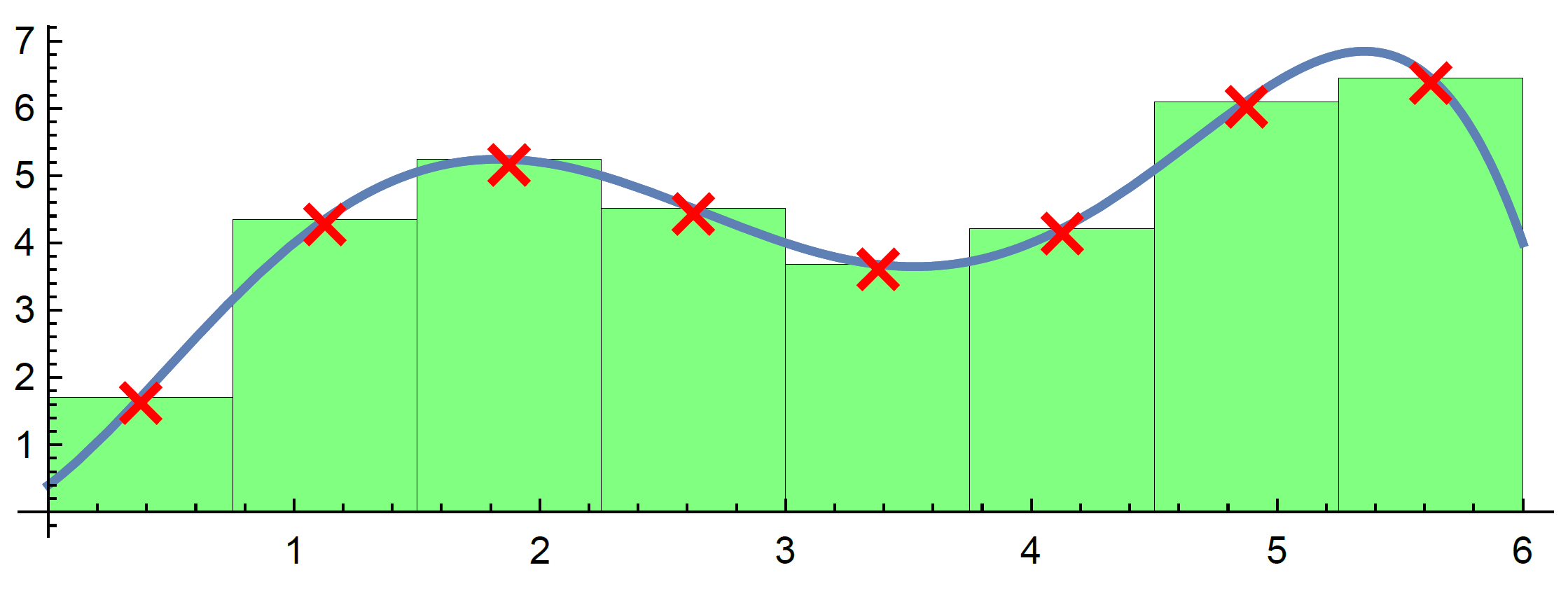

Better starting value

Canonical form 1

Uniformization magic

Et voilà

Contract over a limited horizon

Can use Erlangization so

and phase-type closure under minimums

Payout occurs at death or after fixed duration T, whichever first

Thanks for listening!

Phase-type distributions

Markov chain State space