Demonetisation In India

A presentation by

Shubham Joshi and Shruti Sharma

What is Demonetisation ?

Demonetisation

- Demonetisation is withdrawal of a particular form of currency from circulation.

- It is the process by which a series of currency will not be legal tender.

- The series of currency will not be acceptable as a valid medium of exchange.

Why Demonetise ?

- to combat hyperinflation.

- to combat corruption and crime (counterfeiting, tax evasion).

- to discourage a cash-dependent economy.

What happened on Demonetisation day in India?

- On 8 November 2016, the Government of India announced the demonetisation of all ₹500 and ₹1000 banknotes i.e. currency notes will be worthless.

- These notes accounted for 86% of the country’s circulating cash.

- Public can deposite can change the currency from the banks and post offides till 30th dec'16.

History of Demontisation in India

| What Happened | YEAR | MONTH | CURRENCY NOTE |

|---|---|---|---|

| Demonetised | 1946 | Jan | ₹1000,₹5000,₹10,000 |

| Ressued | 1954 | --- | ₹1000,₹5000,₹10,000 |

| Demontised | 1978 | Jan | ₹1000,₹5000,₹10,000 |

| New-Denomination | 1987 | Oct | ₹500 |

| Ressued | 2000 | Nov | ₹1000 |

What were the causes of Demonetisation ?

Black Marketing

Corruption

Currency Storage

Fake Currency in Economy

- Drop on stone pelting in Kashmir

- Reduced in moist violence

- ATM looting

Strike on Terrorism

Merits of Demonetisation

Currency demonetization increases deposit base and savings as individuals will deposit more and store less physical currency at home.

Increases Deposit Base & Savings:

With currency demonetization, there happened a movement of currency from individuals to banks and Financial Institutions. The rise in deposit rates put all of this money into circulation. The cost of funds reduce for Banks and the overall lending rates for various trade, business and commerce activities would reduce.

Improves Monetary Transmission & Reduces Lending Rates:

Jan Dhan Yojana accounts have a very high number of dormant or unused accounts. These accounts have suddenly seen a spike in usage, and individuals who’ve had these will finally start using them and it might help them in inculcating banking habits

Direct Boost to The Jan Dhan Yojana

The Government significantly benefit from the additional cash that is pushed into the economy. There has been a much higher collection of income and other taxes by the Government.

Added Support for Government Finances:

Demerits of Demonetisation

- The biggest disadvantage of demonetisation has been the chaos and frenzy it created among common people initially.

- Banks and ATMs witnessed long queues while small businesses suffered temporary financial losses.

Chaos and Frenzy

Another disadvantage is that destruction of old currency units and printing of new currency units involve costs which has to be borne by the government

Operation Costs

Economic Growth Slows Down

Post demonetization growth of Indian Economy slowed down from 9.1% to 5.7% in less than one year. Month-wise GDP growth chart for the period March 2016 to September 2017

Was Demonetisation a Success ?

From the perspective with Opposition Party it was and will always be a major disaster

From the perspective with government

- It was a method to destroy black money.

- It became a way to make informal economy to formal economy.

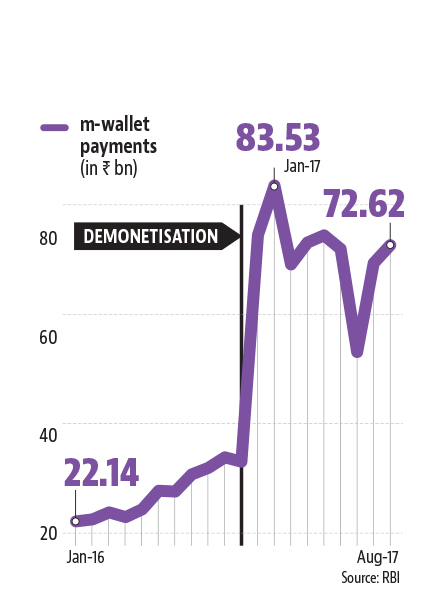

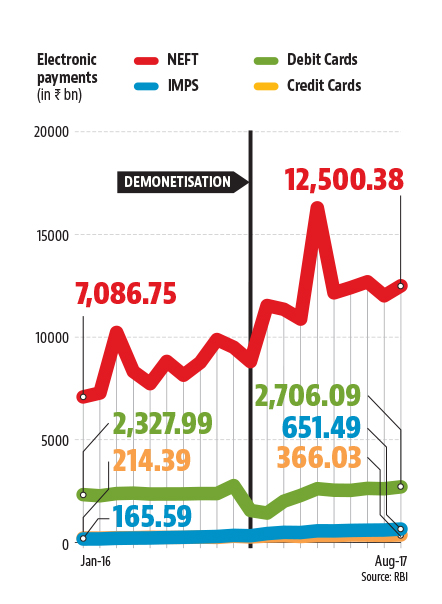

- Finally the mission was to digitalise India

From the perspective of common man

we suffered