Title Text

Digital currencies & Blockchain

Lecture 9

- Blockchain In Enterprise

- Alternative uses of Blockchain

Content

-

Receipts - Auditable data does not need to be decentralized.

- Receipts + public key cryptography = record of what happened in a way that prevents each party from changing things around later

- signed by the parties involved, plus some sort of third-party auditor may be a cheaper and faster way to add data integrity

-

Central Database with API

- Backup service - $0.25/GB for bandwidth plus $0.25/GB/month for storage vs. 1 satoshi/byte or about $84,000/GB of storage

Alternatives to Blockchain

In fact, of the 231 PoCs Gartner reported on, only 14 have moved into a limited scale live-in production environment, reflecting the immaturity of the market we’re seeing today.

The same report estimates only 10% of these projects will make it to a fully-scaled business model by 2020. Given this predicament, it’s no surprise seeing enterprises employing stricter vetting processes and restricting spending on DLT projects overall.

More:

https://www.gartner.com/doc/3869368/blockchain-trials-industries-market-transition

Blockchain usecases

Virtual Reality

In March 2017 a group of 30 enterprises announced the formation of Ethereum Enterprise Alliance, which has recently grown to more than 200 members, making it probably the largest blockchain consortium today.

EEA’s focus in bringing Ethereum to the enterprise environment, meaning moving from a public, permissionless to a private, permissioned setting, which means it will be easier to provide better support for privacy and performance. There are some plans to support anchoring on the public Ethereum network as a way to securely timestamp the chain state.

Ethereum Enterprise Alliance

Ethereum Enterprise Alliance

- Ease of Publication & Distribution Independent validation

- Immutable Records - Digital fingerprints (hashes) of the individual certificates issued, are placed permanently in a blockchain transaction

- Reduced time to issue Certificates

- Costs of re-issuing certificates in the case the hard copy is lost are minimal

- Ease and instant authentication by interested parties (e.g. employers) even if the application used or the institution’s website no longer exists. Operational costs minimized

https://block.co/

Academic Certificates

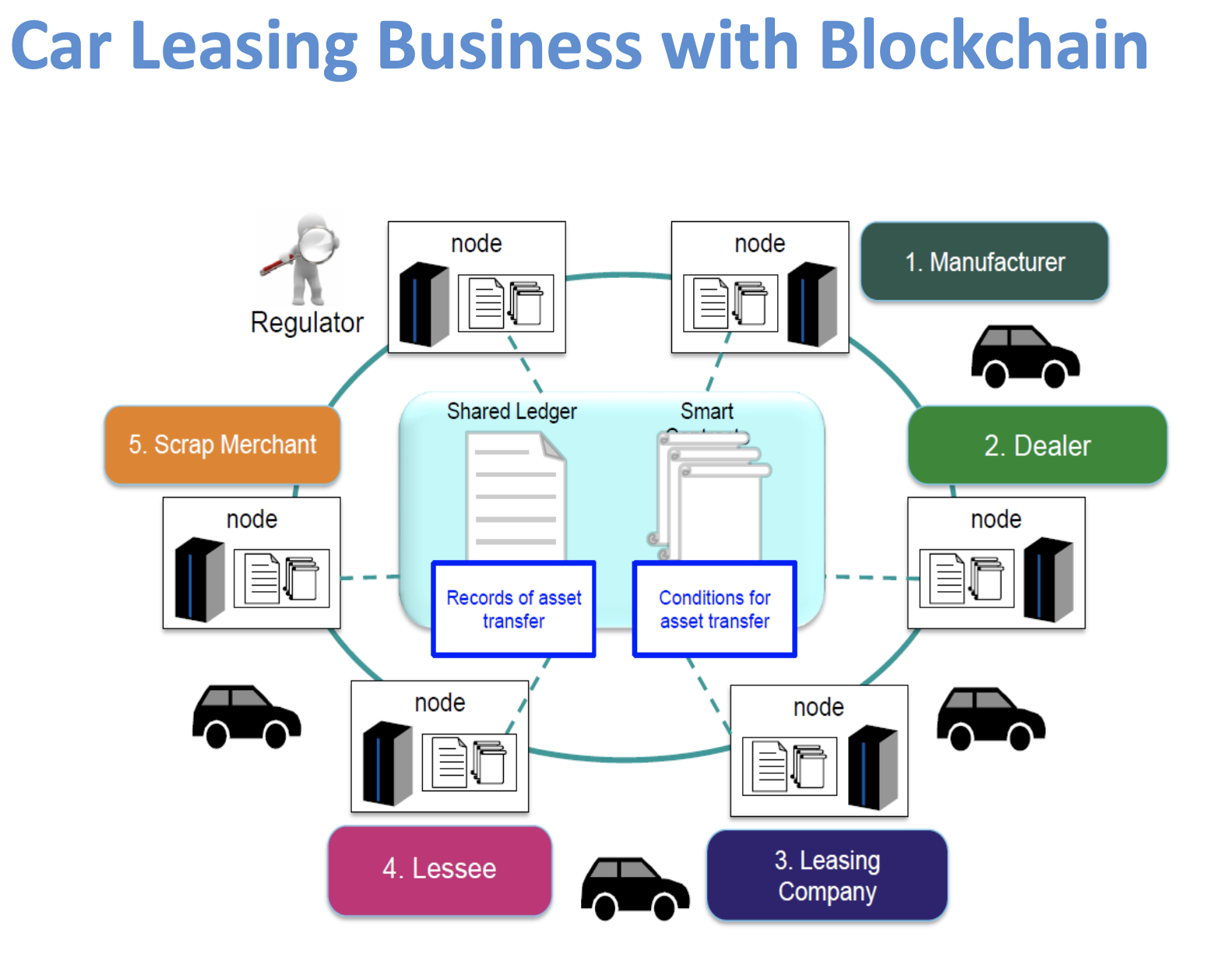

- Digitize Supply Chain Process

- Track the paper trails of shipping containers

- Reduce time spent in transit and shipping process

- Enhance transparency and security of product information exchanged between parties

- Reduce costs and complexity

- Improve stock management

- Reduce fraud and errors on the quality of products

Supply Chain

September 2018, fifteen of the world’s largest banking and commodity companies announced the formation of komgo - a global blockchain-based trade financing platform.

Collaboration between: ABN AMRO, BNP Paribas, Citi, Crédit Agricole Group, Gunvor, ING, Koch Supply & Trading, Macquarie, Mercuria, MUFG Bank, Natixis, Rabobank, Shell, SGS and Société Génerale

While using ETHEREUM, it will launch with two initial products: a KYC process and a Letters of Credit product.

Trade Finance - Komgo

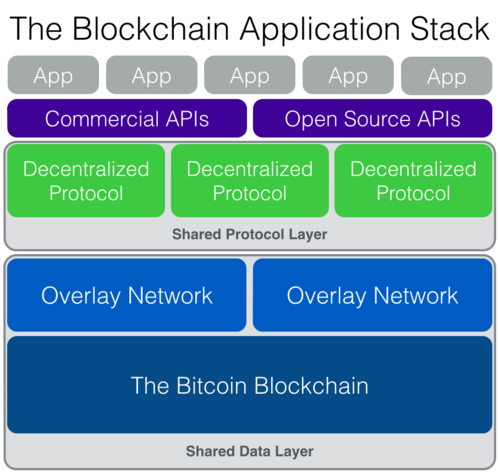

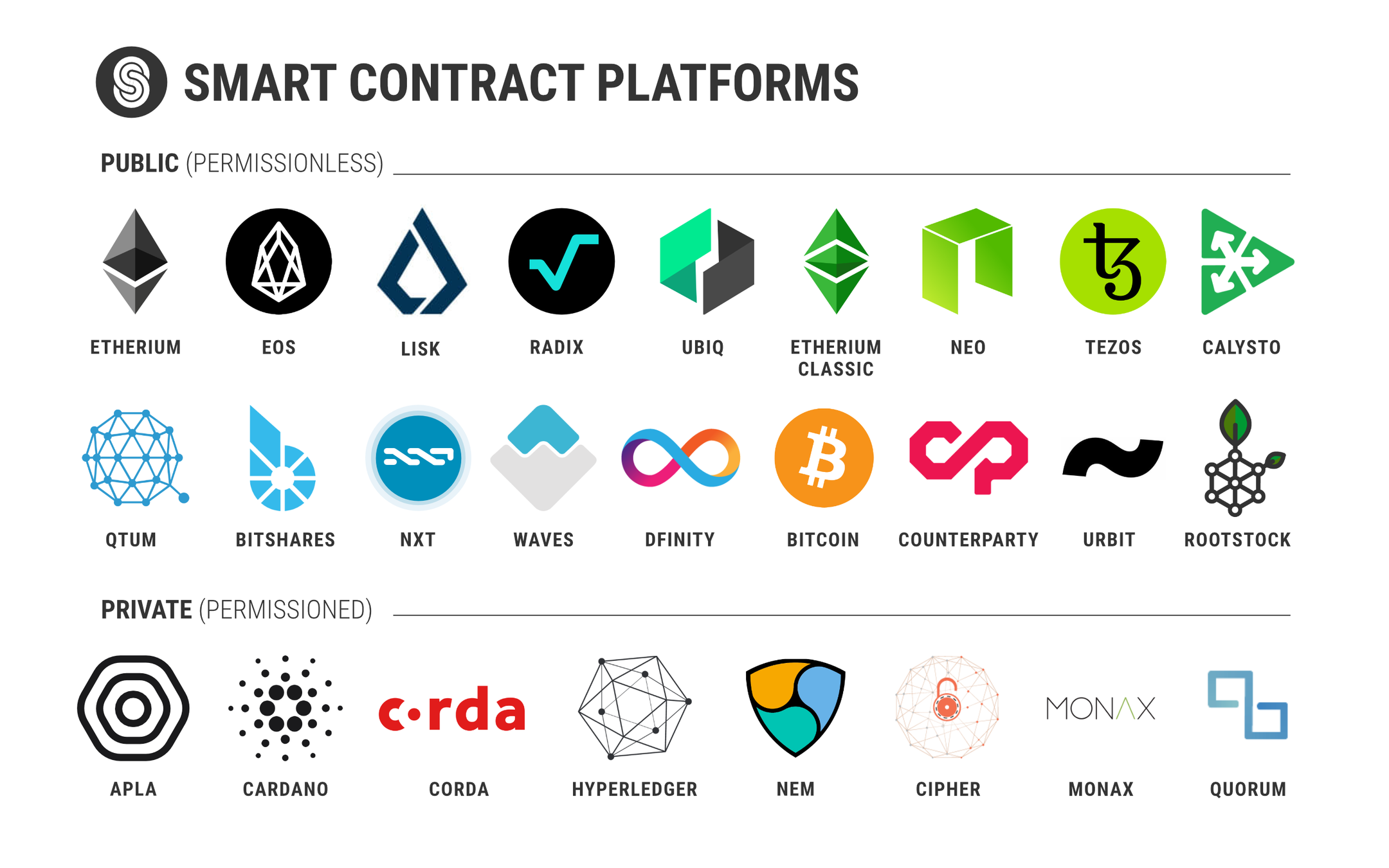

A smart contract is a contractual agreement that is implemented using software. Unlike a traditional contract where parties may seek remedial action through the legal system, a smart contract is self-enforced (possibly also self- executed), depending on whether specific conditions, that are monitored through software, are met. Due to the way the Bitcoin blockchain works, a “layer” can be built upon the existing infrastructure to support smart contracts.

Smart Contracts

Benefits:

- They may automatically enforce power equality of all parties involved

- They protect an individual’s rights by enforcing reasonable expectations for the signee

- They eliminate the possibility of any signatory defaulting on their obligations

Insurance

Industry Applications - EU

-

Official exchange of eDocuments by national administrations

-

Exchange of access to electronic health records

-

eID and cross-border authentication of people and companies

-

Traceability of foodstuffs and pharmaceutical products

-

Validation of academic qualifications

-

Exchange of criminal records at EU level

Colored Coins

- Instead of building other blockchains (sidechains), colored coins allow attaching metadata to bitcoin transactions. These coins now represent other real-world assets which can be traded on the bitcoin blockchain

- The value of such assets (Securities, shares, bonds, cars, documents, smart keys, digital rights etc.) is tied to a real world promise (contract) by the asset issuers that they are willing to redeem digital tokens for these assets

- This concept takes advantage of blockchain immutability and transparency

- Example: Color 1 btc – each satoshi is tied to 1 share of XYZ stock. XYZ stock can be traded on the btc blockchain, not the stock market

- Disadvantage: Real world promise is a contract done outside of blockchain. So trust must be built. If I have 10k satoshis and go to XYZ company to take my shares, they are not forced by the protocol to give me the shares.

- Coins can be tracked. Anyone can color. But a special wallet is needed to check b/ces and distinguish which bitcoins are colored. Colored coins are staying irrelevant because other solutions emerge which do not depend on bitcoin blockchain e.g. ERC 20 Tokens