DeFi Review

David Stancel

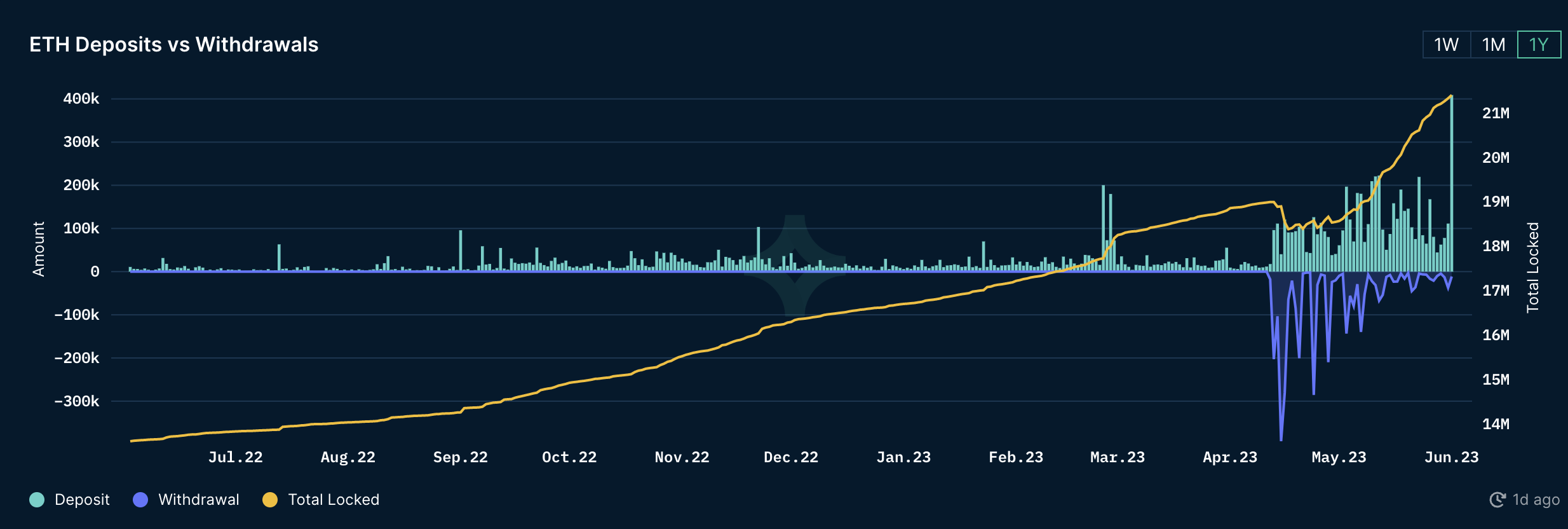

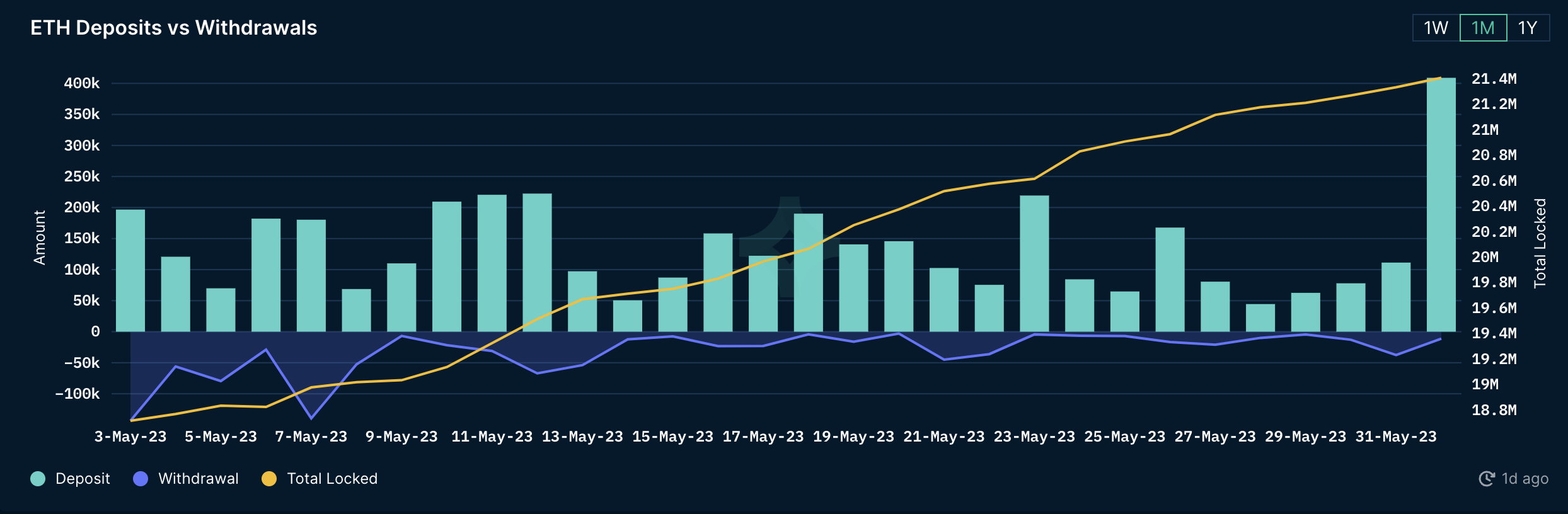

ETH Deposits and Withdrawals

Zoomed In the last 30 days

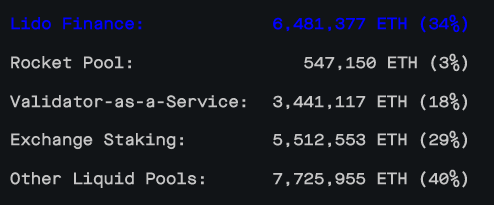

ETH Validators Distribution

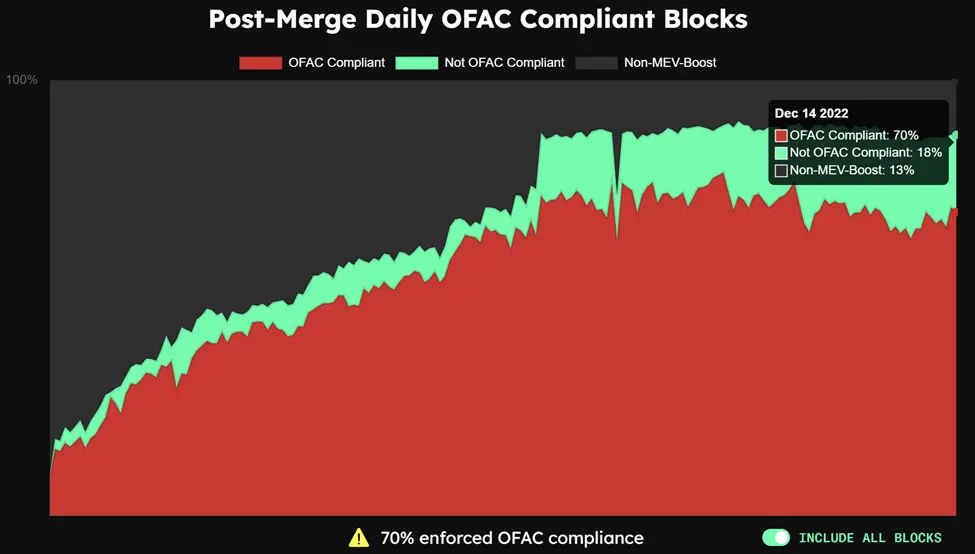

Tornado Cash

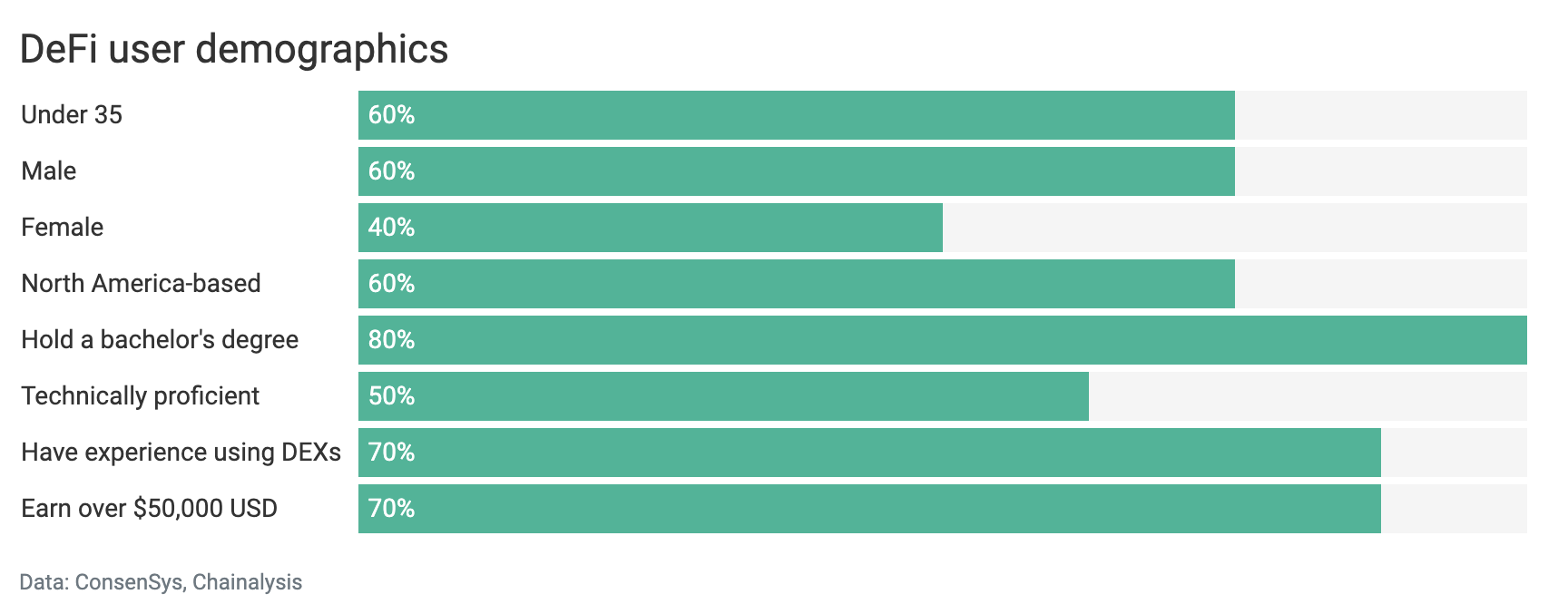

- MetaMask, DeFi’s most popular non-custodial wallet, boasts over 30 million users.

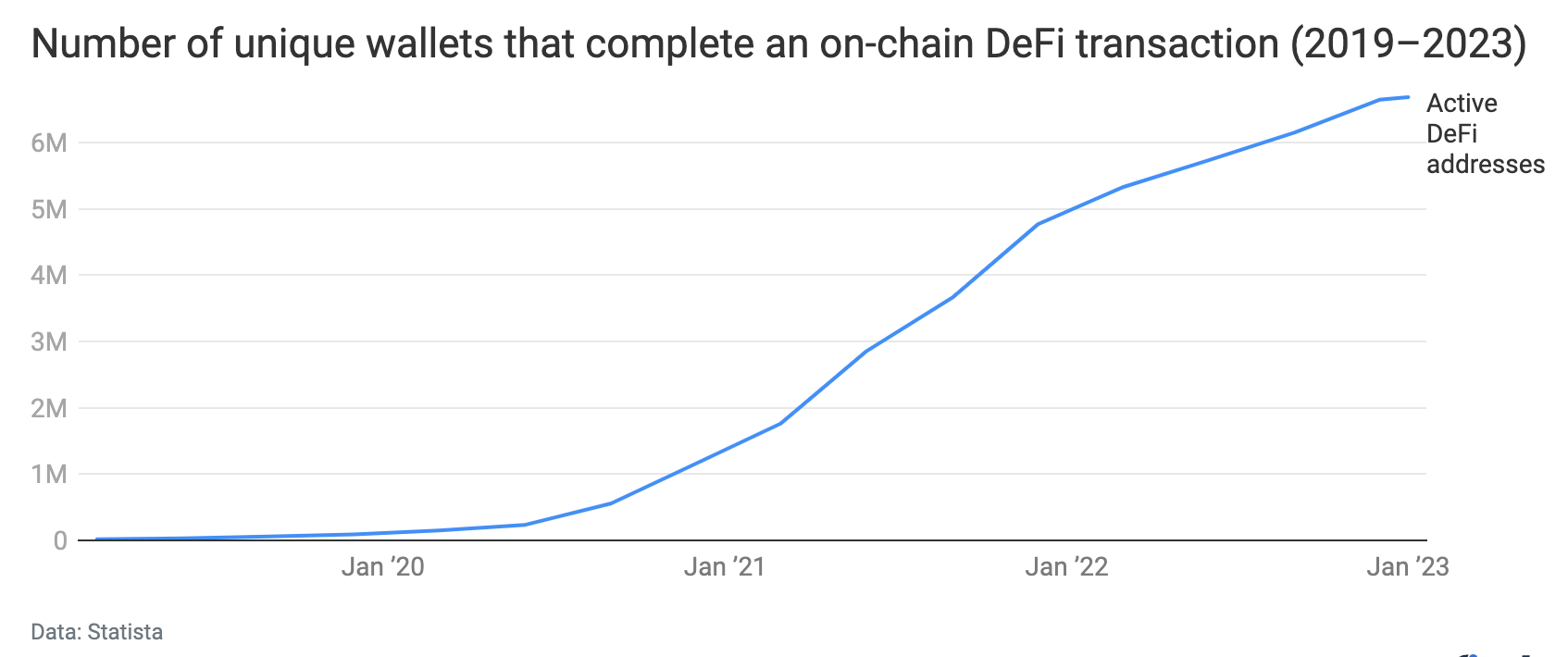

- Unique DeFi users have risen by 40% in 2022. Despite market conditions, DeFi users have gone from 4.7 million at the start of 2022 to more than 6.5 million.

-

Uniswap, Lido, and OpenSea (the three largest Ethereum-based apps) now generate more monthly fees, on a combined basis, larger than the entire Ethereum L1

-

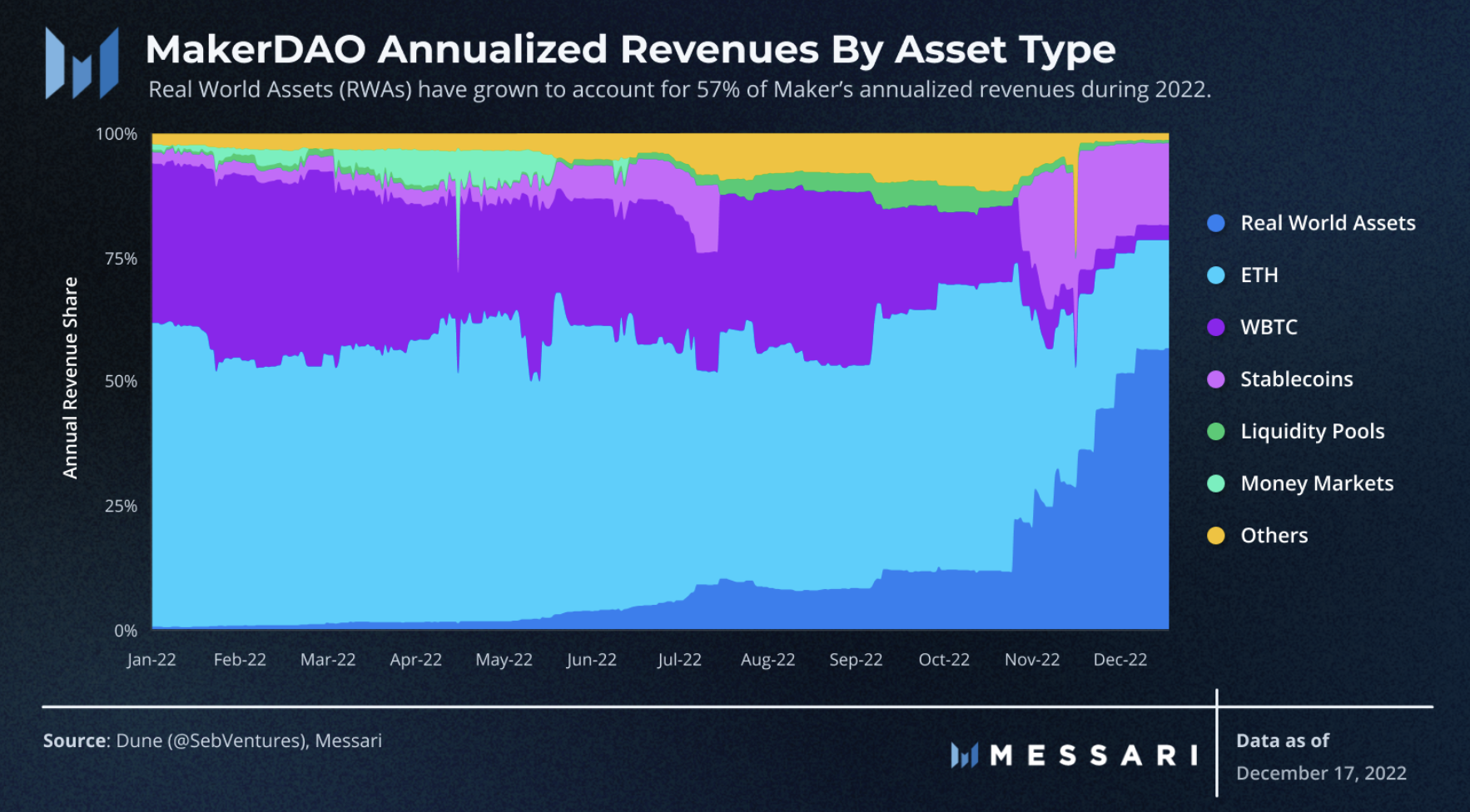

Real-world assets account for 57% of MakerDAO’s total protocol revenue, up from less than 10% in July

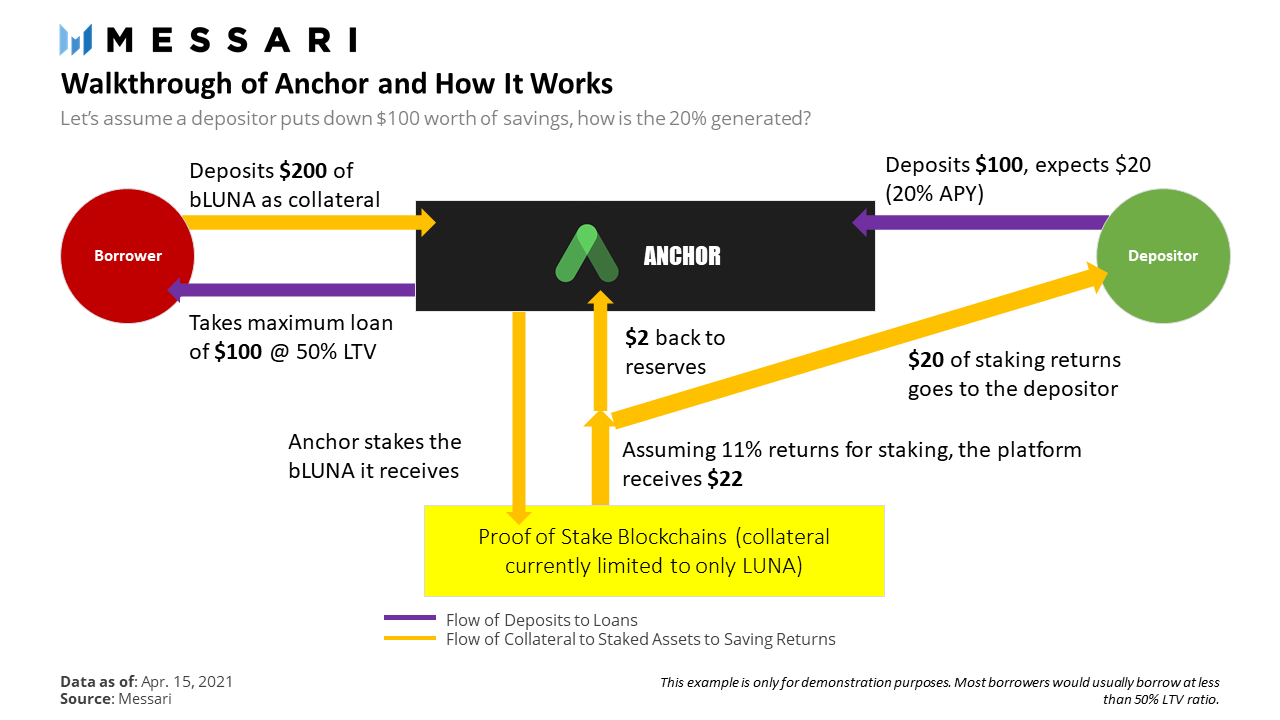

Terra Today

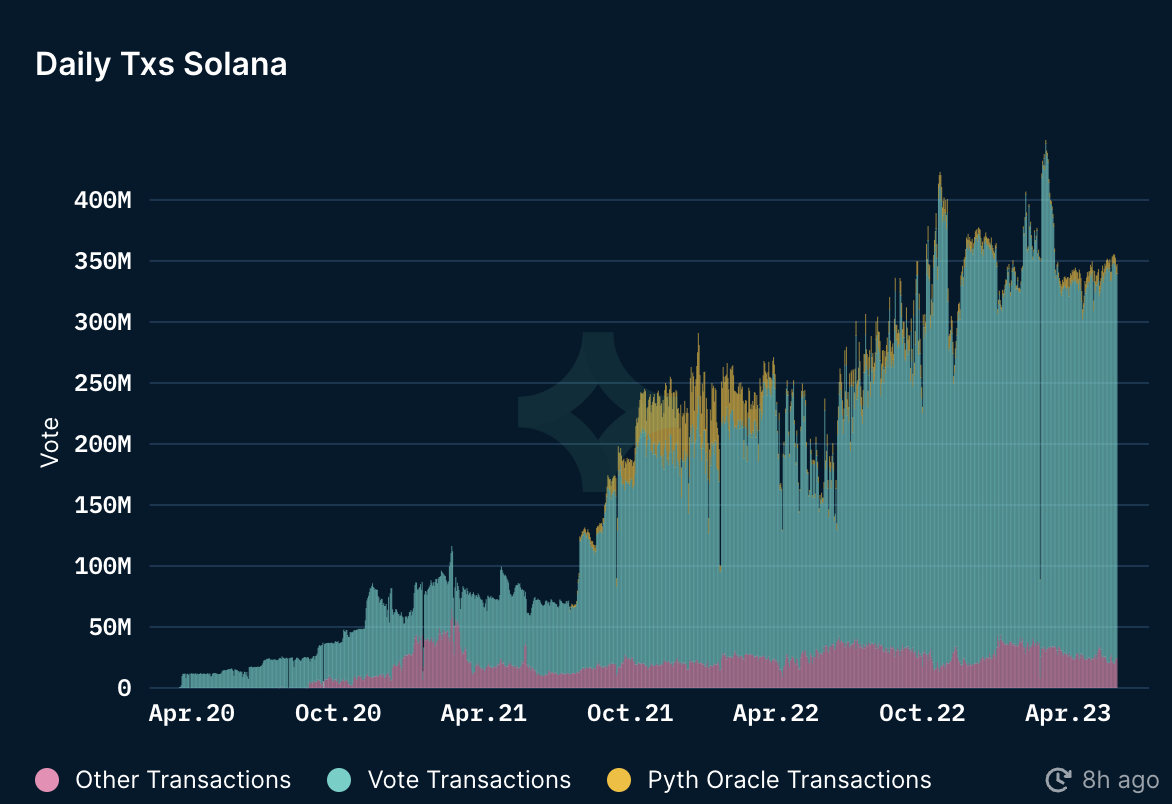

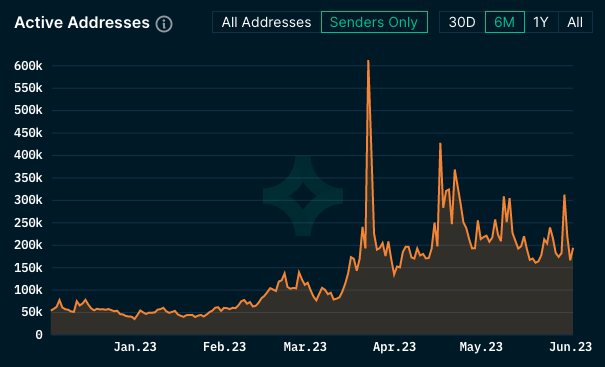

Solana

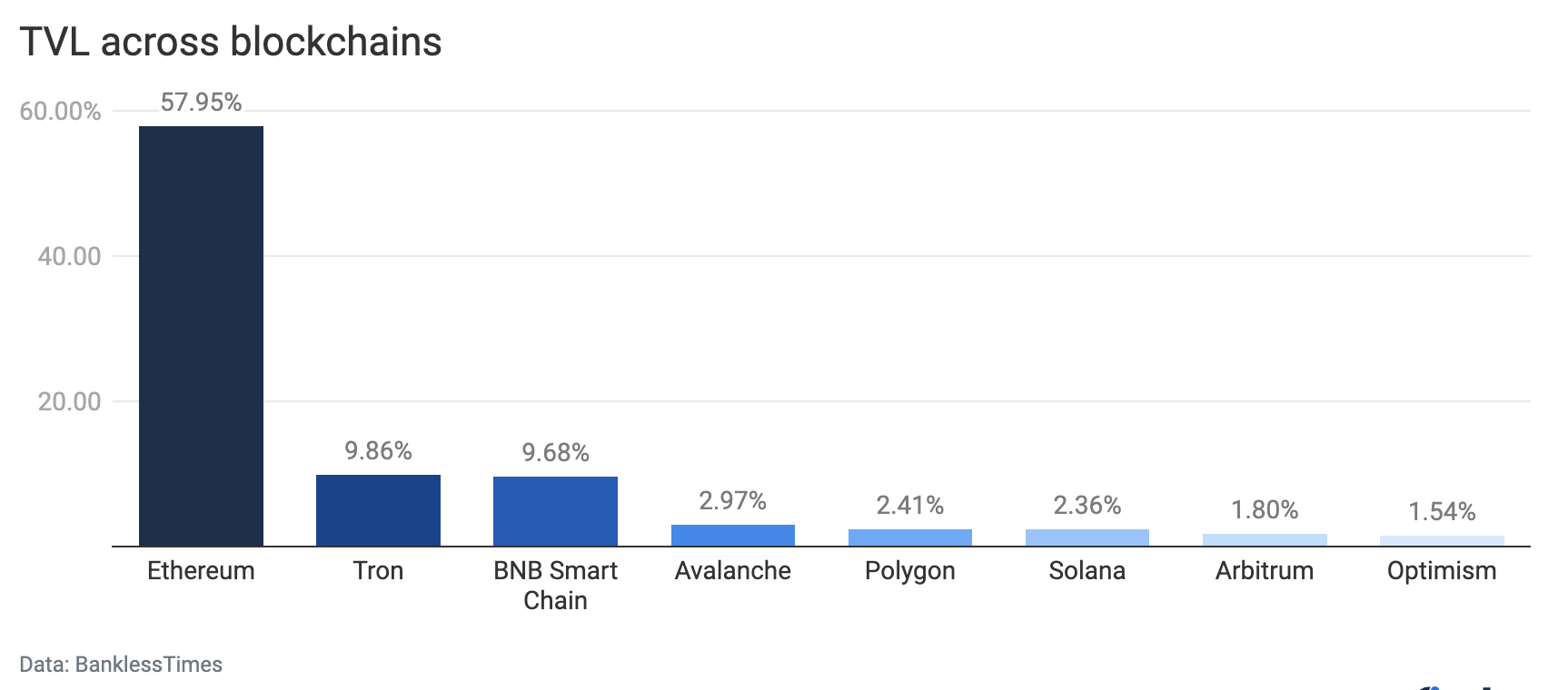

Solana lost the most TVL throughout 2022: Solana’s ecosystem lost 96% of its TVL in dollar terms in 2022. It started the year with $6.68 billion in its ecosystem and ended with $290 million.

The collapse of Alameda Research/FTX played a significant role in the collapse of the ecosystem due to how closely tied Sam Bankman-Fried was to it.

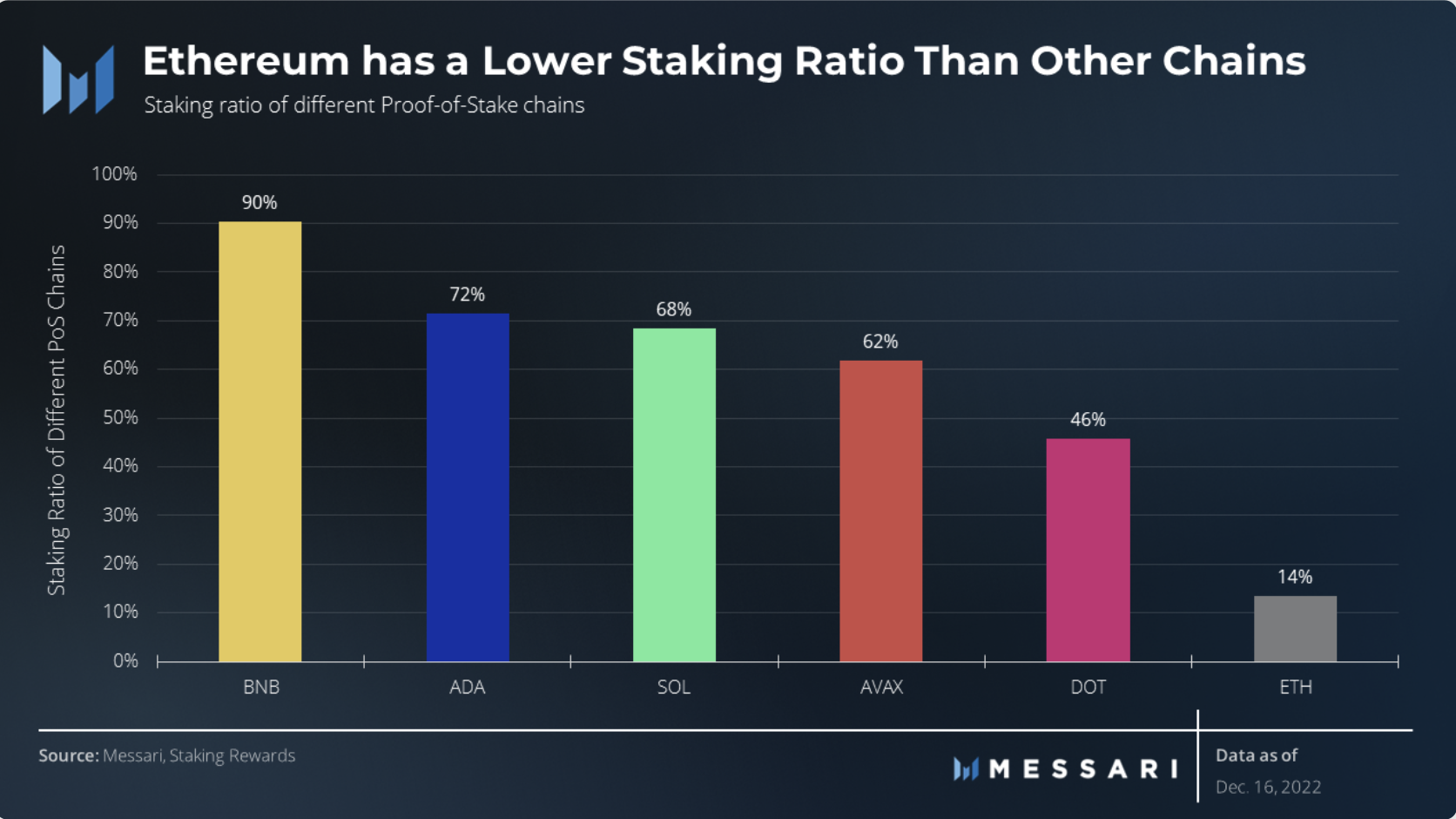

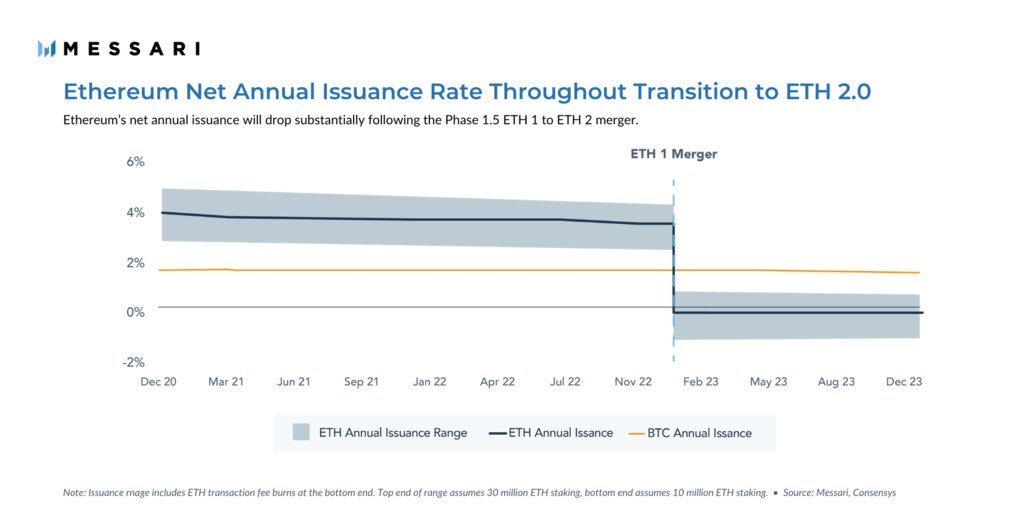

Ethereum

Optimism

Polygon

Arbitrum

TRON

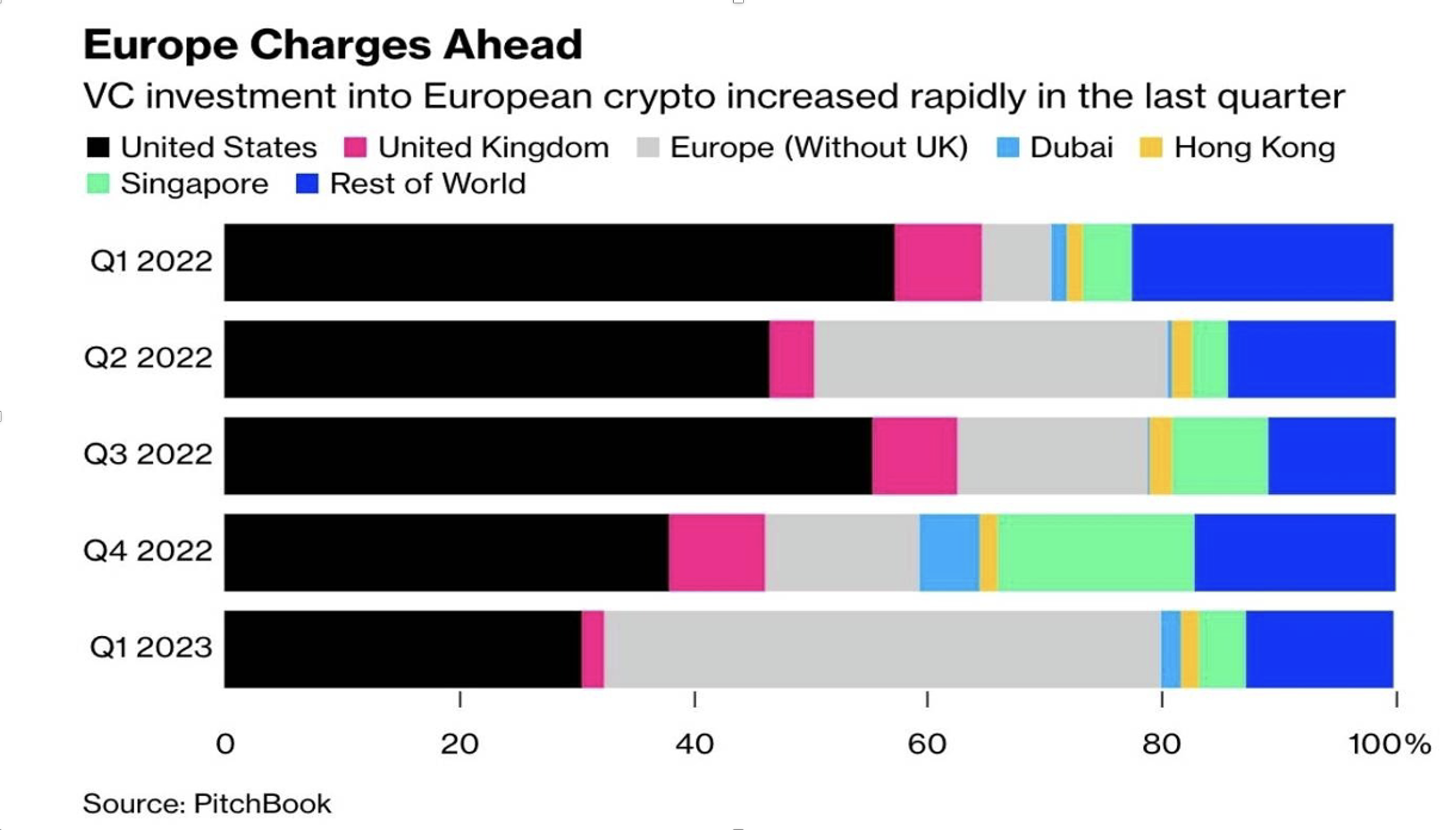

MiCA

https://cryptoautomat.xyz/

Restaking enables staked ETH to be used as cryptoeconomic security for protocols other than Ethereum, in exchange for protocol fees and rewards.

Restaking is available for both natively staked ETH and liquid staked tokens like stETH, rETH, cbETH, and LsETH.

ZkEVMS

Type 1

Fully Ethereum equivalent

do not change any part of the Ethereum system

Type 2

Fully EVM equivalent

Differ in data structure and state trees

Type 2.5

Fully EVM equivalent

except for gas

Gas Costs Inereased for some specific operations

may break some tooling

Type 3

Almost EVM equivalent

few sacrifices to remove features that are difficult to implement in a zkEVM system

Type 4

High-level language equivalent

Contracts written in Solidity/Vyper and compiled in another language used in the zkEVM system.

-

DeFi TVL dropped by 76% throughout 2022.

-

DeFi is expected to expand with a CAGR (Compound Annual Growth Rate) of 42.5% from 2022 to 2030.

-

DeFi’s TVL has increased by 6,900% since 2020.

-

DeFi is expected to gross $231 billion in revenue in 2030.

-

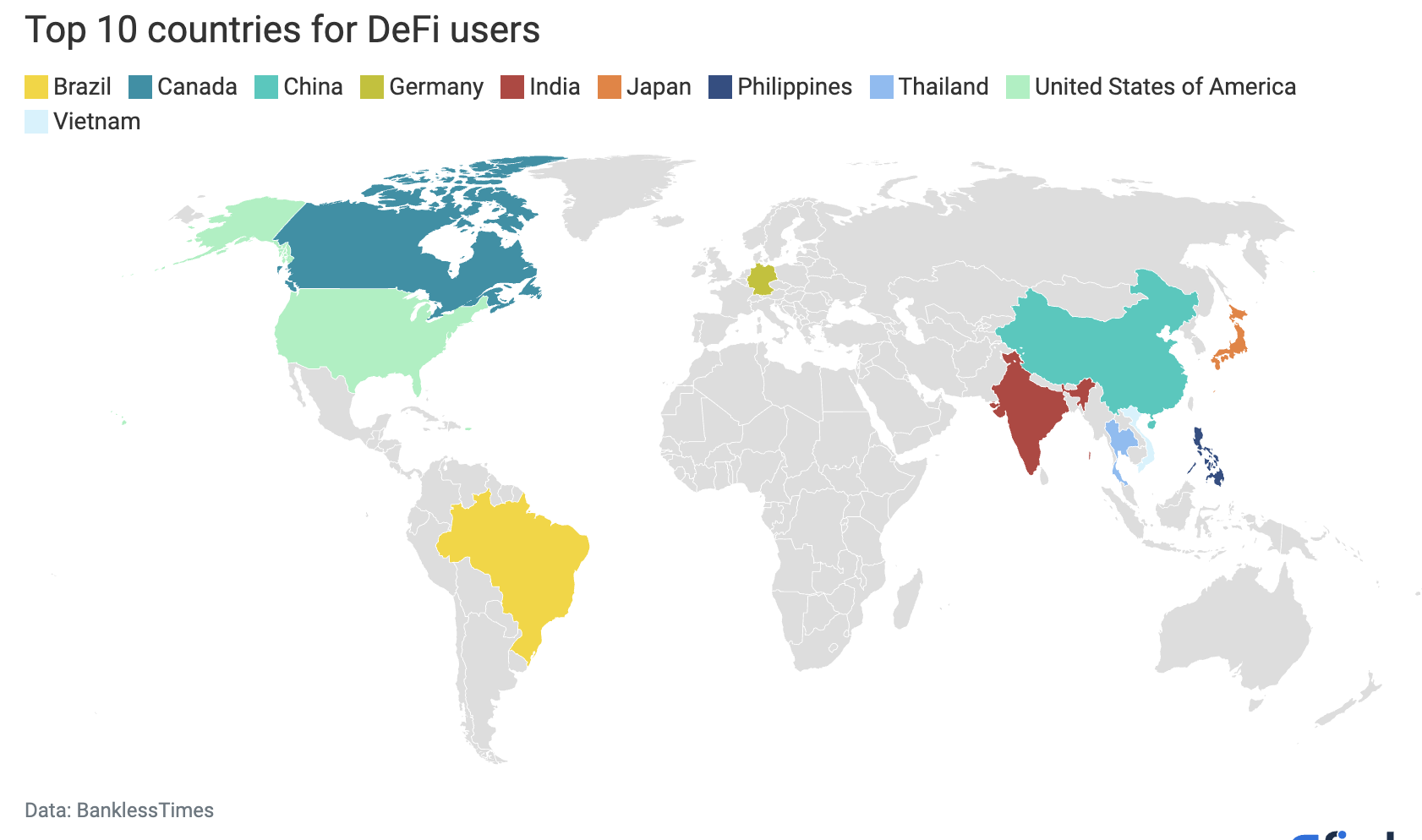

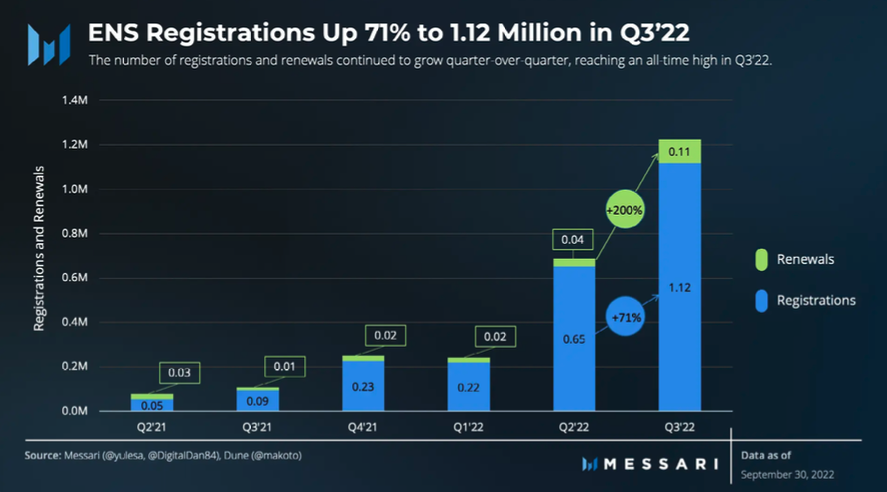

Decentralized exchanges witnessed more than $850 billion in trading volume through 2022 from more than 5.6 million unique wallet addresses.

SUMMARY

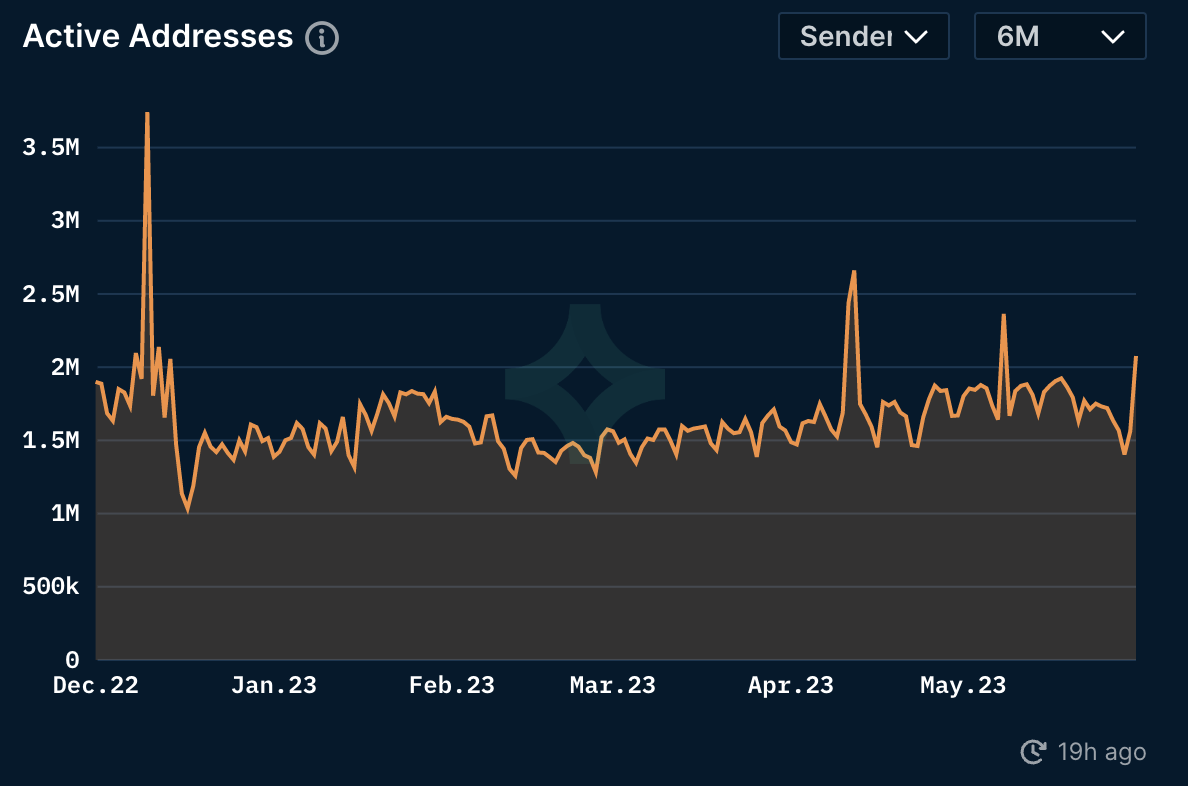

●5M active daily users - 40x growth in the last 2 years

●100M users have self-hosted wallets

●TVL 5X growth in the last 2 years, despite the market meltdown

●Expected to 10X in the next 4 years, 20X in the next 10 years

●Partnerships like Paypal and Metamask will just further foster the adoption

●MiCA will “normalize” crypto assets from late 2024 and include them into the traditional financial services

No Fee Switch

Thank you!

stanceldavid.sk

coinstory.tech